Chapter 14. Kazakhstan

Support to agriculture

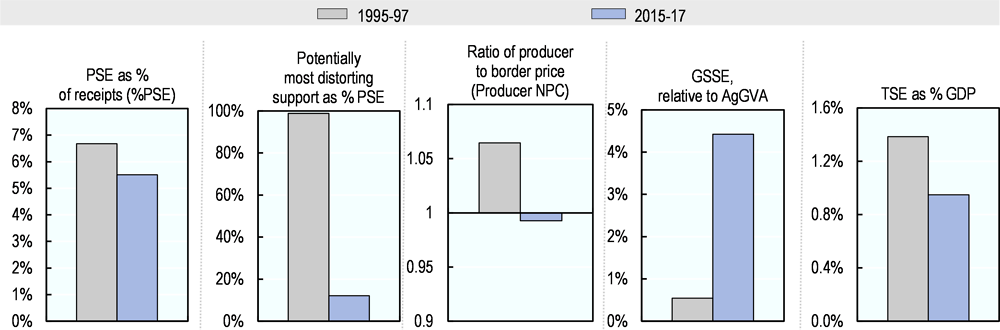

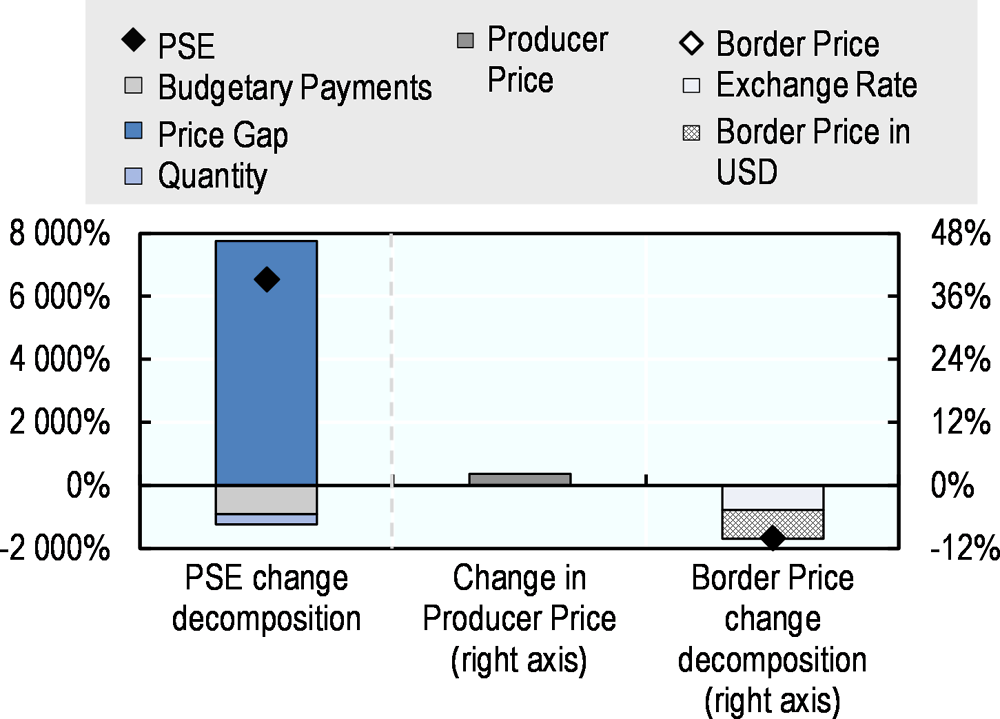

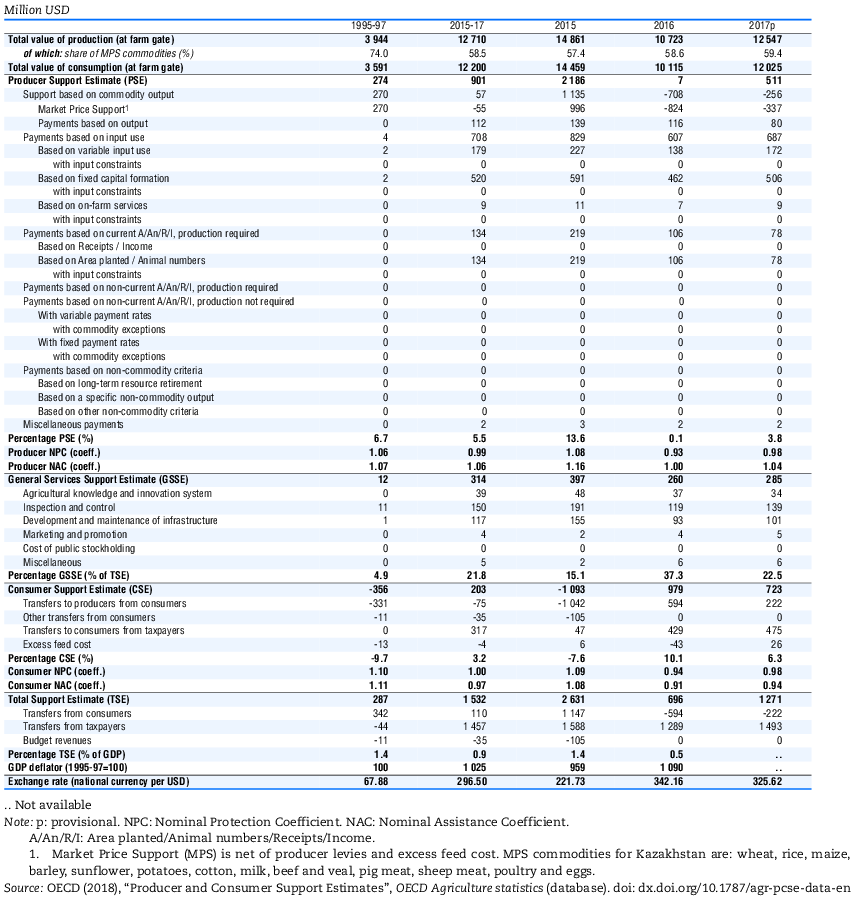

The share of producer support in gross farm income (%PSE) was nearly 6% in 2015-17. In 2017, domestic producer prices remain on average below world levels although to a lesser extent than in 2016, leading to a negative aggregate price support (MPS)1 and an implicit transfer from farmers to consumers as measured by the Consumer Support Estimate. Support to farm investments gains prominence, with its share in budgetary transfers to producers increasing to 60% in 2017 from less than 30% in 2013. On average, total support to agriculture growth is in par with economic growth and its share in the economy (%TSE) is stable. The share of General services to the sector (GSSE) in the TSE is stable at around 22%. Spending on Inspection and control and on development and maintenance of infrastructure together made up more than 80% of the GSSE in the past three years.

Main policy changes

In 2017, Kazakhstan continued the implementation of changes initiated in 2016 to its set of agricultural policy instruments. The total budget for state support was maintained while the number of payment schemes reduced from 65 to 54. Output payments to livestock were reallocated to subsidise feed costs. Larger amounts were attributed to the subsidisation of pedigree livestock, debt rescheduling and interest rates for investments, for micro-credit and for agricultural loans and leasing contracts.

On 1 January 2018, Kazakhstan eliminated the VAT preference to certain agricultural producers and processors as foreseen in its WTO accession protocol of 2015.. Beyond binding the AMS, the de minimis levels and agricultural export subsidies, other commitments include the compliance with the WTO SPS and TBT Agreements, the use of international standards for technical regulations as well as participation in international conformity assessment procedures.

Greater use is made of Information Technologies. Since 2017, applications to KazAgro credit and leasing instruments can also be submitted through an electronic system. Computerised customs procedures are now part of the new Customs Code of the Eurasian Economic Union that came into force in January 2018.

The partial privatisation of KazAgro is delayed as no buyers came forward at auctions in 2017 for the sale of 11 KazAgro subsidiaries.

Assessment and recommendations

-

Between 1995-97 and 2015-17, Kazakhstan’s support to agriculture as measured by the %PSE has decreased and its composition has changed. While market price support is no longer the sole instrument, all farm support requires production and is hence likely to influence farm management decisions, increase pressure on resources and distort markets.

-

An important and growing share of payments support farm level long-term development and productivity. This should have a positive effect on the sector. As from 2014, the formation of fixed capital attracts 50% or more of payments, mostly to livestock pedigree programmes.

-

The debt restructuring programme initiated in 2013 absorbs higher budgets every year. Any future allocation of public funds and productive resources would be improved by increasing farmers' co-responsibility and a more active use of bankruptcy procedures.

-

Support conditional on compliance with administratively specified requirements should be evaluated in light of desired outcomes.

-

Increased subsidies for fertiliser and chemicals inputs and for the use of industrial feed should be assessed in light of their potential negative environmental impact. Furthermore there is a risk of subsidy leakage to the input industry. Current efforts to streamline support to fewer measures and more transparent attribution conditions should be continued.

-

The sector’s long term productivity should be strengthened by giving producers access to land ownership and long-term rent, by enabling them to better manage market and climate-related risks and by creating incentives for a more efficient and sustainable use of natural resources. Farm decision-making and performance could be improved by developing a national system of extension services.

-

A number of infrastructure projects are underway that have the potential to reduce weaknesses in the transport and market infrastructure, facilitate farmers’ access to domestic and international markets and improve water and land management. The focus on infrastructural development needs to be maintained.

-

Kazakhstan’s emission reduction target of 15% by 2030 relative to the 1990 levels (25% conditional on international investments to access low carbon technologies) covers all sectors including agriculture. An agriculture-specific target or reduction plan, however, has not been defined. It therefore remains unclear whether, to what degree and how agricultural emissions will be reduced.

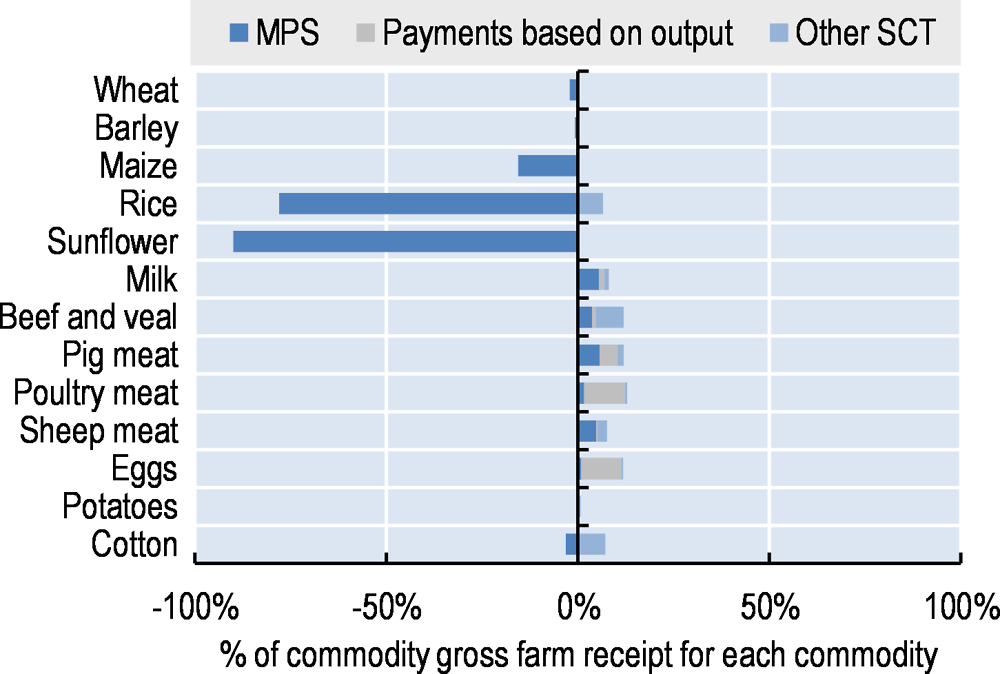

Support to agricultural producers as measured by the %PSE was estimated to less than 6% of gross farm receipts on average in 2015-17. In 1995-97 nearly all (99%) support was potentially most distorting (support based on output and variable input use – without input constraints). This share has gone down to 12% on average in 2015-17. Domestic prices were lower than world prices for crop products and higher than world prices for livestock commodities, resulting in average prices received by farmers at 1% below world prices. Support to general services (GSSE) represents 4% of agricultural value added in the most recent period, an increase from less than 1% in 1995-97. This reflects the setting up of basic services including pest and disease inspection and control as well as institutional and market infrastructures. Total support to agriculture (TSE) as % of GDP was stable at about 1.4%. The share of GSSE in TSE increased from 5% in 1995-97 to 22% in 2015-17. In 2017, the MPS was less negative than in 2016, driven by price changes on domestic and world markets. Reflecting individual commodity price gaps, SCTs were strongly negative for rice and sunflower and slightly positive for livestock products.

Contextual information

Kazakhstan has the ninth largest land area in the world and is one of the least densely populated countries. It has the second-highest per-capita availability of arable land in the world. The country is an upper middle-income economy.

Although lower than in 1995, the share of trade in GDP rebounded from 21% in 2015 to 23% in 2016. Kazakhstan is an exporter of mineral fuels and its share of trade in GDP is substantially higher than the corresponding value for all countries analysed in the report. Agriculture contributes about 5% of GDP and employs 18% of the country’s working age population. The farm structure is dualistic: large-scale and often highly integrated operations dominate the grain sector, while around 76% of beef and 80% of milk is produced by rural households.

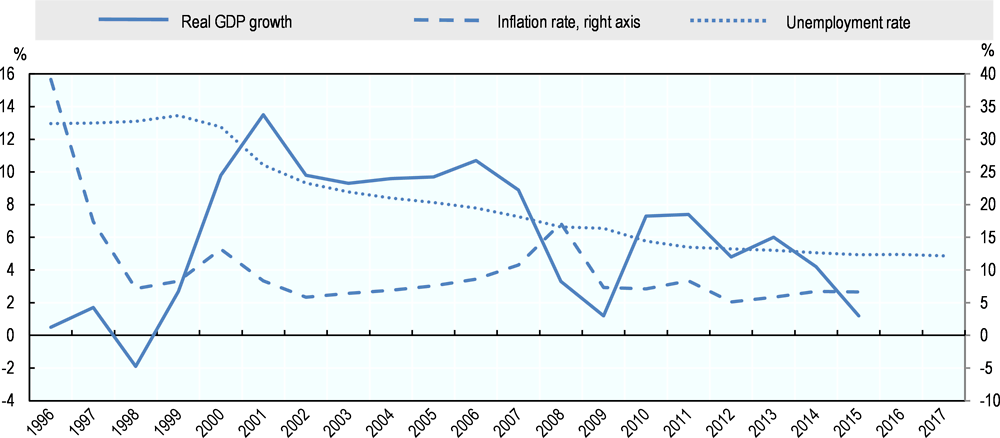

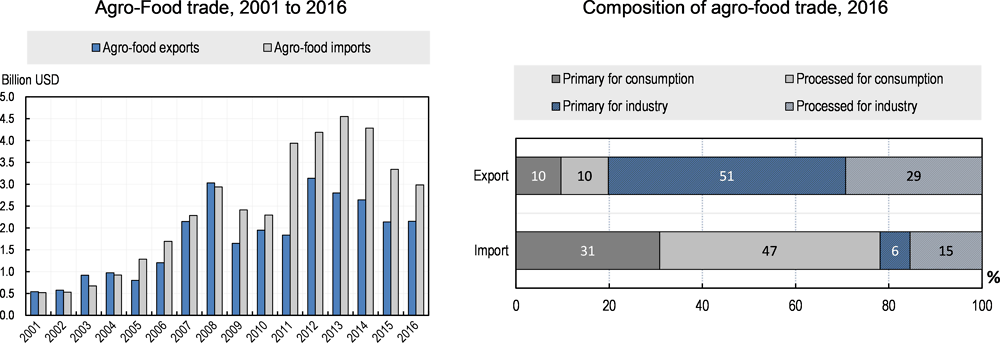

GDP growth slowed down to 1.2%, in 2015 from 6% in 2013 and 4% in 2014.2 The rate of inflation has stabilised at around 6.7% in 2014 and 2015. Unemployment has been on a steady decline and reached its lowest level in 2016 at 4.9%. Kazakhstan is a net agro-food importer since the mid-2000s while one of the world’s largest wheat exporters. More than 60% of agro-food exports are in primary commodities, of which 84% go to processing. While more than 60% of agro-food imports are in processed commodities, of which 75% are for final consumption.

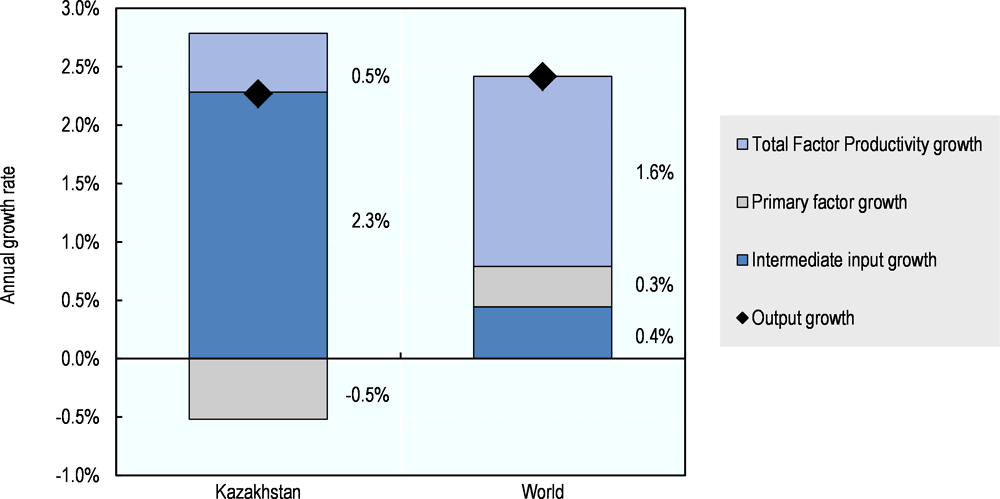

The average annual TFP growth rate of 0.5% between 2005 and 2014, underscores the remaining gap to achieve the world average of 1.6%. Output grew by 2.3% per year, reflecting the intermediate inputs growth, while the primary factors use decline offset the TFP growth. Agriculture’s share of energy use declined considerably between 1991-2000 and 2005-14 when it was equal to the OECD average. Agriculture’s share of GHG emissions also fell during the period while it remained above the OECD average, a comparison that should be qualified by the higher contribution of agriculture to the country’s GDP than the OECD average. The share of irrigated land remains low at 1%.

Description of policy developments

Main policy instruments

Since 2017, the State Programme of Agro Industrial Complex Development for 2017-2021 (hereafter, the 2021 State Programme) defines the agricultural policy framework in Kazakhstan. It replaced the Programme for the Development of Agro Industrial Complex for 2013-20 (Agribusiness 2020) that had been in place since 2013.

Major principles from the previous programme are maintained, namely 1) financial rehabilitation of the sector; 2) subsidies and other budgetary support to the sector; 3) development of phyto-sanitary and veterinary systems; 4) enhancement of state regulation (development of information systems, agrochemical services, seed testing, technical regulation, state inspections and control and other public services). Nonetheless, the 2021 State Programme announced a stronger emphasis on the development of, and support to, individual household plots and small farms, agricultural producer co-operatives and agriculture supporting services and infrastructure such as agricultural machinery, agrichemicals, taxation, trade infrastructure and certification. In addition, some input subsidies including on seed, fertiliser and pesticides were also to be increased. Since the implementation of Agribusiness 2020, sub national budgets subsidise a larger share of agricultural policy instruments.

Kazakhstan is a party to the Paris Agreement on Climate Change. Through its Intended Nationally Determined Contribution, Kazakhstan set an economy-wide target to reduce its total GHG emissions by 15% in 2030 compared to 1990, over a period starting in 2021. This target covers all emissions including from agriculture. A more ambitious target of 25% reduction has also been identified conditional on international investments to access low carbon technologies. Specific targets or reduction plans for the agricultural sector have not been defined.

Kazakhstan applies a range of border and domestic price intervention instruments. Border measures are in large part implemented within the Customs Union of the Eurasian Economic Union (EAEU) and include Tariff Rate Quotas (TRQs) and non-tariff measures. TRQs apply to imports of beef of lower grade and poultry products.

Intervention on domestic markets is twofold. The State Commission for the Modernisation of the Economy decides intervention purchases of grains to support domestic producer prices. At the same time, a system of consumption price stabilisation is in place for 29 commodities.3 Intervention is funded by local budgets and responds to local conditions. Purchase occurs after harvest at market prices and commodities are stored before they are released at below market prices later in the year.

Area payments apply to “priority crops”4 while the livestock sector is supported by headage and output payments. Large commercial livestock producers receive most of the output payments. Pedigree support is also in place for all types of livestock; 65% of this support goes to beef cattle.

The Agribusiness 2020 programme substantially increased mineral fertiliser subsidies. Subsidies apply also to the purchase of high quality seeds. The largest share of support to the livestock sector is distributed through pedigree support. Other forms of support to livestock are silage and fodder subsidies, support to artificial insemination and to the purchase of young cattle for feedlots.

Administered prices apply to diesel fuel sold to agricultural producers; total volumes to be supplied at these prices during the sowing and harvesting periods are pre-determined as well.

Investment subsidy budgets have increased and, together with concessional credit, they represent principal forms of support. Concessional credit is delivered through numerous channels. Loans are provided at reduced interest rates by several credit agencies under the umbrella of the state company KazAgro Holding. Interest rates on agricultural loans and leasing contracts are subsidised by up to 7% and 5% per annum for contracts in KZT and USD, respectively. Concessional credits are granted both for short-term and investment loans. Primary producers also benefit from concessional leasing of machinery, which is additionally exempt from Value Added Tax (VAT). Along with agricultural producers, food processors benefit from concessional credit and leasing of machinery and equipment from credit agencies of KazAgro Holding. In addition to support through state-controlled institutions, interest subsidies on loans taken in private banks and direct subsidies to interest rates and leasing fees are also available for loans or leasing provided by commercial banks and companies.

A restructuring of overdue farm loans, known as the Programme of Financial Rehabilitation, began in 2013. Prior to the implementation of this programme, bad and sub-standard loans represented 42% of all credit portfolios of the state holding KazAgro and over one-half of the total agricultural credit portfolios in commercial banks. The programme offers substantial interest concessions, with repayment schemes of overdue loans prolonged for up to nine years. The interest rate on restructured loans is subsidised by up to 7% and 5% per annum, on loans in KZT and USD, respectively. Furthermore, there is also a write-off of fines and penalties on overdue loans. Large scale crop producers are the main beneficiaries of the programme which also concerns livestock-specialised producers, food processors and other businesses not belonging to primary agriculture. Resources underlying these mechanisms have increased substantially through time. They are mainly drawn through emissions of state securities and directed to provide liquidity to KazAgro credit agencies and commercial banks that implement debt restructuring.

The 2021 State Programme foresees measures to improve the financial discipline of farms undergoing debt restructuring procedures. Farms with delays in loan repayment over 90 calendar days would be excluded from the financial rehabilitation programme.

The regional specialisation scheme for Kazakhstan approved in 2014 recommends the types of agricultural production for each country region considering climatic and market conditions and infrastructure availability. Compliance with the scheme has been mandatory up to 2017 for producers seeking support payments and access to concessional credit.

Investment subsidies for new operations or the expansion of existing operations is an important support measure applied since 2014. In contrast to interest subsidies on investment loans, which reduce farmers’ credit costs, this support covers a share of investment project costs and is provided through a complex approval system. It applies to eighteen “priority sectors” conditioned on compliance with a number of technical specifications and regulatory rules and has to be approved by regional authorities and in some circumstances also by the Ministry of Agriculture.

Five business taxes apply in Kazakhstan. These include property tax, social tax, VAT, profit tax, and tax on vehicles. Agricultural enterprises and individual farms benefit from special tax regimes with substantial concessions. For example, corporate and family farms enjoy a 70% discount on all five taxes. Other VAT preferences also apply to agricultural producers and processors. A practice of a 100% subsidisation of VAT to primary processors and procurement organisations on agricultural products procured from individual farms is in place since January 2016. The land tax has applied from 2015 and has since seen a five-fold increase in its basis rates.

Individual farms of less than 3 500 hectares are eligible for a Single Land Tax, which is set as a percentage of the cadastre value of land owned or used and replaces the land tax and the five business taxes mentioned above. Since 2015 individual farms have to pay a 10% income tax for physical persons on the income above KZT 150 million (USD 0.4 million).

A Law on Agricultural Cooperation that came into effect on 1 January 2016 facilitates the creation and operation of producer co-operatives and qualifies them as eligible for the 70% discount on the five business taxes mentioned above, for credit concessions, for investment subsidies and for a subsidy covering 50% of auditing costs. From 2017, agricultural co-operatives have a preferential access to investment subsidies to establish milk-collection and animal-slaughter points, and fruits, vegetable and potato warehouse facilities.

Harnessing Information Technologies is part of Kazakhstan’s longer term strategy to simplify, ease control and improve the transparency and effectiveness of government support to agriculture. An electronic system of subsidy payments is under construction. Applicants to KazAgro credit and leasing can apply electronically. Electronic systems of warehouse receipts and for the provision of investment subsidies are planned. A national land cadastre database is under construction.

The production of organic food is regulated and the legal, economic, social and organisational frameworks required for the development of organic farming in the country are under review.

Changes in the organisation and structure of the state company KazAgro Holding were announced in 2015 which concern: i) the partial privatisation of three KazAgro subsidiary companies;5 and ii) the optimisation of the holding structure and specialisation of its subsidiary companies on the provision of specific support programmes. The Agricultural Credit Corporation (ACC) would specialise on funding commercial banks, credit co-operatives, micro-finance organisations and leasing companies, the Fund of Financial Support of Agriculture (FFSA) would serve small and medium agribusiness and agricultural co-operation, and KazAgroFinance would focus on the leasing of machinery and equipment and no longer provide credits.

The President’s Edict dated 6 May 2016 imposed a moratorium until 31 December 2021 on the foreseen introduction of private ownership of agricultural land and on the extension of the maximum period of agricultural land rent to foreign entities from 10 to 25 years.

The Law on Pasture Land sets procedures for granting the use of pastures within and beyond boundaries of urban and rural settlements, and within regional administrative units.

Several infrastructure projects are under construction that may ease constraints to agricultural development in Kazakhstan in general and agro-food export capacity in particular. Among other components, expenditure on general national programme for the development of transport infrastructure “Nurly Zhol” envisages the expansion of the railway network to facilitate access to the Persian Gulf region. The programme was started in 2016 and is expected to increase grain exports by up to 8-10 million tonnes per year and open opportunities for other agro-food exports.

Domestic policy developments in 2017-18

The intervention purchase of 2 million tonnes of grade 3 wheat at KZT 42 000 (USD 131) per tonne was decided in December 2017. To implement the intervention, KazAgro’s subsidiary Food Corporation is to receive KZT 8.3 billion (USD 25 million) from the State reserve and a loan of KZT 60 billion (USD 187 million) from the State Social Insurance Fund.

The implementation of the 2021 State Programme began in 2017. Adjustments to the existing policy instruments were made and more are foreseen as the Programme is rolled out.

Adjustments to the “priority crops” area payments scheme continued. A number of crops no longer qualify,6 while greenhouse vegetables (both in industrial businesses and farmhouses) and drip-irrigated cotton are newly included. This scheme also covers maize and rice, oilseeds, sugar beet, forage crops, horticultural crops under specific growing conditions and cotton. While the overall budget for area payments has been reduced, the earmarked spending for sugar beet, cotton, silage sunflower and maize has been substantially increased.

Payments to livestock production underwent major changes in 2017. Output payments decreased by more than 30% on average and most payments per head of livestock were reallocated to subsidise feed costs. The per-head subsidy to young cattle for feedlots, however, was maintained and increased seven-fold.

Since 2017, the regional specialisation scheme for Kazakhstan is no longer mandatory for producers seeking support payments and access to concessional credit.

The cost of restructuring overdue farm loans weighs increasingly on government spending and the programme reached KZT 26 billion (USD 81 million) in 2017. This is approximately 15% of the PSE on average, the second largest agricultural budget spending item.

Application to KazAgro credit and leasing underwent simplification and an electronic application system is in place since June 2017. Technical and regulatory requirements for investments subsidies s were also simplified.

The transition period for replacing value-added tax preferences for domestic producers and processors in agriculture to a WTO compatible subsidy mechanism came to an end on 1 January 2018 (WTO, 2015). Preferences were eliminated, however information on the new replacement system is not available.

While auctions were held twice in 2017 for the sale of shares of 11 subsidiaries of KazAgro, no buyers came forward and no progress was achieved on the privatisation plan adopted in 2015.

Trade policy developments in 2017-18

Trade policy reforms are underway in Kazakhstan, mostly driven by the country’s commitments to the Eurasian Economic Union and to the WTO.

Kazakhstan is a participant to the Treaty on the Eurasian Economic Union (EAEU) since its establishment in 2015. This body unifies five countries – Armenia, Belarus, Kazakhstan, Kyrgyzstan and the Russian Federation. Custom procedures between the signatories are simplified and mostly carried out electronically. Beyond free trade and common customs territory, the EAEU guarantees the free movement of labour and capital and sets a common framework for economic policies in its member-states. On 1 January 2018, the Treaty approving the EAEU Unified Customs Code came into force.

Kazakhstan’s border measures are implemented within the Customs Union of the EAEU and a number of national competences in the area of custom regulations are transferred to the EAEU, including SPS and technical regulations.

In 2017-18, EAEU related developments concerned veterinary control and surveillance, seeds circulation and the creation of EAEU common seed register, traceability of goods, product safety, and other issues.

As a member of the EAEU, efforts to harmonise veterinary and phytosanitary standards are on-going with several export destinations, including China, Iran and Saudi Arabia. Future harmonisation negotiations are planned with Israel, Kuwait, Malaysia, Japan, South Korea and the European Union. The harmonisation of veterinary requirements relates to beef, sheep and camels, to varieties of honey and to fish. The harmonisation of phytosanitary requirements relates to flax, beans, peas, safflower, melon seeds, alfalfa and oil cake.

Kazakhstan is a member of the WTO since November 2015. As part of its accession protocol to the WTO, Kazakhstan agreed to a number of commitments, some specific to agricultural trade. These include the compliance with the WTO SPS and TBT Agreements, the use of international standards for technical regulations as well as participation in international conformity assessment procedures. The average final bound rate of Kazakhstan’s agricultural import tariffs is 9.7% compared to the non-agricultural of 6.0% (WTO, 2018).

A TRQ of 21 000 tonnes applies to imports of fresh, chilled or frozen beef and a 140 000 tonnes TRQ applies to fresh, chilled, or frozen poultry, the latter includes a TRQ of 128 000 tonnes for certain frozen bone-in chicken parts, and another one of 12 000 tonnes for remaining poultry items. Bound rates for in-quota tariffs for these TRQs are set at 15%. Bound rates for over-quota imports are set at 40% and no less than EUR 0.65 (USD 0.80) per kilogramme for poultry products. The tariff on pig meat was reduced from 65% to 30% and is set to decline to 25% by 2020.

Currently, a Register of Exporting Companies is in place for primary agro-food companies that have fulfilled the veterinary and phyto sanitary requirements for exports to China. In December 2017, five lamb exporting businesses were registered.

References

WTO (2018), Kazakhstan Tariff profile, http://stat.wto.org/TariffProfiles/KZ_e.htm.

WTO (2015), Overview of Kazakhstan’s accession protocol commitments, https://www.wto.org/english/news_e/news15_e/kazakhannex_e.pdf.

Notes

← 1. Wider price distortions at individual commodity levels offset each other in the aggregate measurement.

← 2. 2015 is the latest year available for real GDP growth and the inflation rate.

← 3. Intervention varies depending on local conditions. It is implemented for flour (grade 1 and extra class), buckwheat, millet, oats, sugar, rice, potatoes, onions, carrots, beets, peas, cabbage, milk, butter, yoghurt, cheese, curd, beef, lamb, poultry meat, eggs, manna groats, pearl barley, pasta, sunflower-seed oil, oil 49% spread, tea and salt.

← 4. Cereals, maize, millet and rice, oilseeds, sugar beet, forage crops, horticultural crops, cotton, vineyards and potatoes.

← 5. KazAgroFinance, KazAgroProduct and KazAgroMarketing.

← 6. Basic payments to cereals, maize and millet were eliminated; maize, sugar beet, cotton and potatoes under drip irrigation; vegetables and melon and vineyards are no longer listed.