5.5. Financial reporting

Accounting standards used by governments can provide differing figures, which in turn can result in varying estimates of their fiscal position. Governments use two main types of accounting basis: cash flow and accruals. Cash budgeting recognises transactions only when the related cash is received or paid. Although a cash flow basis can be manipulated to reflect a more favourable fiscal position, as revenue collection is accelerated and payments are differed, this form of accounting is essential for fiscal management and the ability of governments to easily monitor the effect of government finances in the economy.

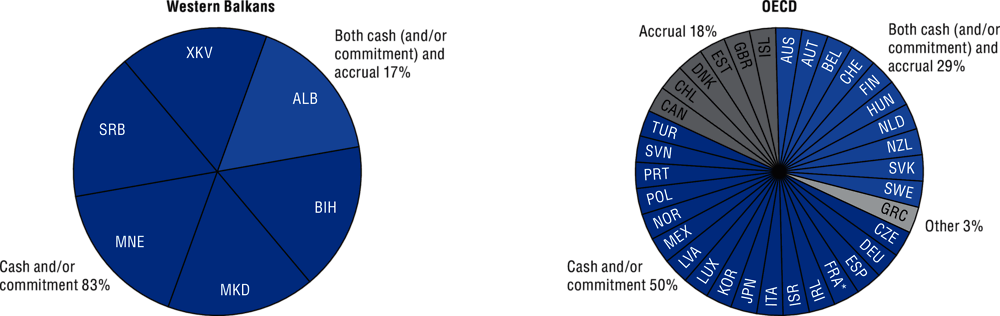

Accrual accounting is a system of accounting in which transactions and other flows between institutional units are recognised when economic value is transferred, increased, or lost, regardless of the timing of the related cash receipts or payments. Accrual budgeting entails planning that includes revenues and expenses in the budget of the year in which the underlying economic events are expected to occur. While a budget reported in accruals could display a more accurate image of reality it requires sophisticated accounting systems and may be subject to uncertainty making it harder to put place. Almost all Western Balkans considered in this report prepare their budget on a cash basis including commitments. Albania is the only country that indicated that the budget is prepared in both cash and accruals. Only a handful of OECD countries, some of which have the most sophisticated budgeting systems in the world, prepare the budget exclusively on an accrual basis while about a third used a modified cash basis or other combined accounting method.

The budget is arguably the government’s key policy document as it contains important information regarding government policies and priorities, in both the short and medium term. The budget also provides a glimpse into the country’s finances, and may disclose information on governments’ expectations for economic performance. Consolidating the results of the budget exercise entails receiving information from the different spending units about their execution levels. In turn, depending on their frequency, ‘in-year reports’ of budget execution could contribute to raising public managers’ awareness of potential risks stemming from budget overruns (or the opposite) as well as informing citizens of how governments are using public resources.

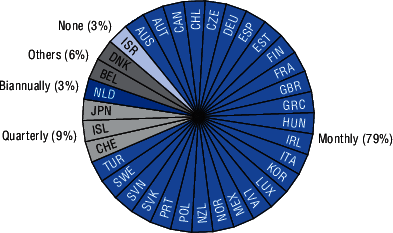

Quarterly reports are the most common type of in-year reporting for different bodies in the Western Balkan region. For example, in Kosovo all government bodies are obliged to submit a report every three months. This is similar in Albania and Serbia, with the exception of state-owned enterprises (SOEs) in the former and local and regional governments in the latter. North Macedonia and Montenegro publish monthly reports for ministries and social security funds. In about 80% of OECD countries all reports are produced on a monthly basis.

Data were collected through the 2019 Survey for the Western Balkans on Budget Practices and Procedures. The survey was completed in 2019 in the Western Balkans – Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia and Serbia. The data for Bosnia and Herzegovina, reflects the consolidated response submitted by the State level, based on individual responses received from different levels of administration – the State level, the Entities and Brcko District. Data for OECD countries are derived from the 2018 OECD Budget Practices and Procedures Survey. Respondents were predominantly senior budget officials. Unless specified otherwise, responses refer to central/federal government

A modified cash basis is a combination of cash and accrual accounting methods. In this case, the cash basis is used for short-term elements on the balance sheet, and the accrual basis is used for long-term elements.

The consolidated central government annual report is the government’s main accounting document. It demonstrates government compliance with the level of expenditure and revenue authorised by congress/parliament, and is normally audited by the country’s supreme audit institution. The report generally includes any in-year adjustment to the budget, comparative information with results from the previous years, a discussion of the government’s financial assets and liabilities, and non-financial information such as the attainment of pre-established performance targets.

Further reading

van Helden, J. and C. Reichard (2018), “Cash or accruals for budgeting? Why some governments in Europe changed their budgeting mode and others not”, OECD Journal on Budgeting, vol. 18/1, https://doi.org/10.1787/budget-18-5j8l804pq0g8.

C. Irwin, T. (2015), “The whole elephant: A proposal for integrating cash, accrual, and sustainability-gap accounts”, OECD Journal on Budgeting, vol. 14/3, https://doi.org/10.1787/budget-14-5jrw6591hns1.

Khan, A. (2013), Accrual Budgeting: Opportunities and Challenges, Public Financial Management and its Emerging Architecture pp 339-363, International Monetary Fund. Washington D.C

Figure notes

Data for the United States are not available. On data for Israel, see https://doi.org/10.1787/888932315602.

5.9 In France, the State budget is prepared on cash/commitment basis, but the social security budget is prepared on an accrual basis. In Greece, the budget is prepared on a modified cash basis.

This document, as well as any data and map included herein, are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. Extracts from publications may be subject to additional disclaimers, which are set out in the complete version of the publication, available at the link provided.

https://doi.org/10.1787/a8c72f1b-en

© OECD 2020

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.