copy the linklink copied!Japan

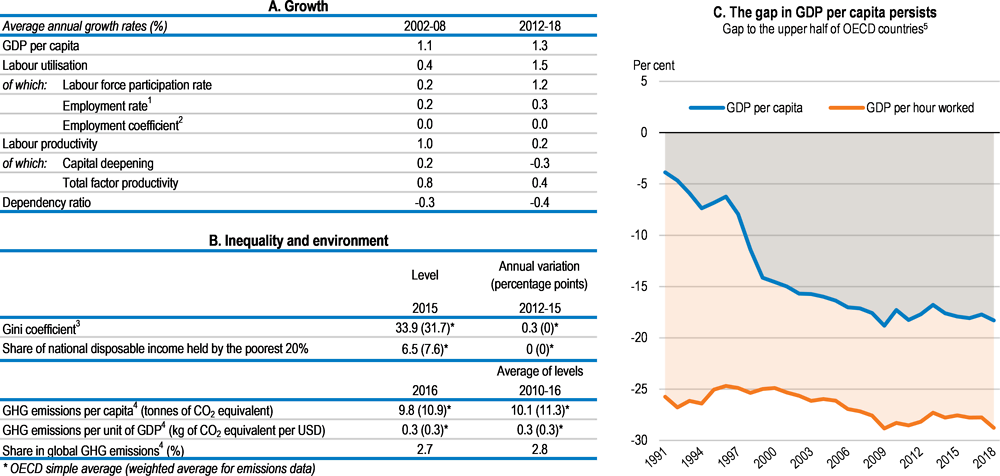

Per capita income remains nearly 20% below the upper half of OECD countries, reflecting low labour productivity and widening gaps between leading and lagging firms. Despite a falling working-age population, a rising participation rate among women and older persons is boosting labour inputs.

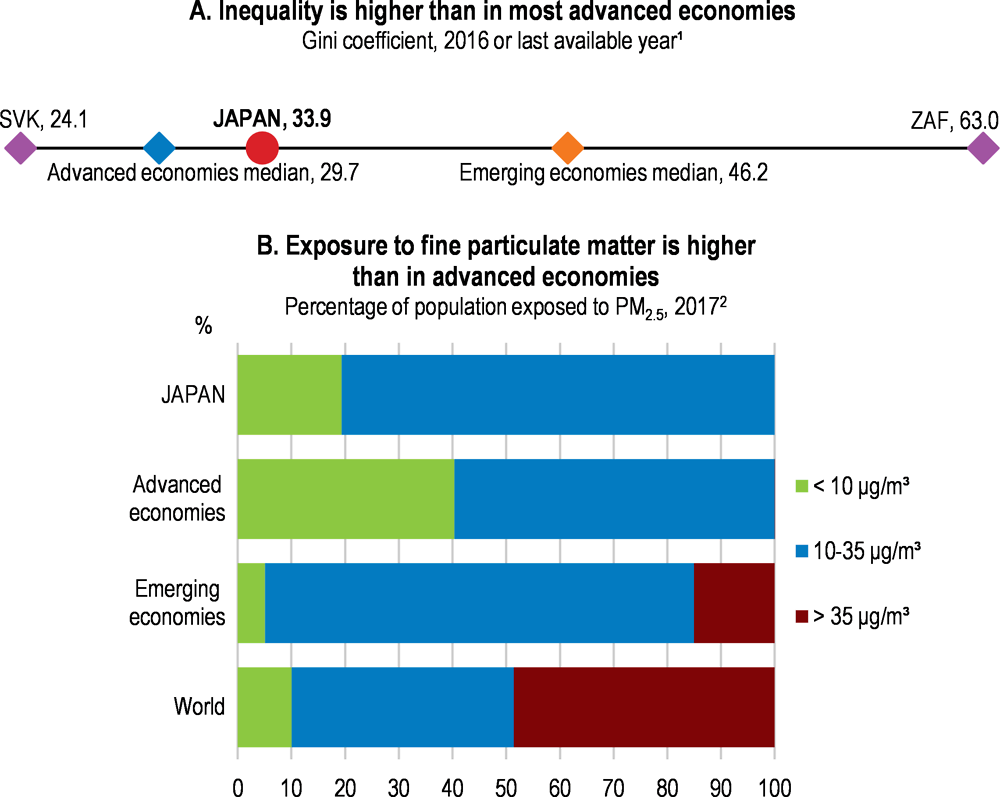

Income inequality, as measured by the Gini coefficient, is above the OECD average, reflecting entrenched labour market dualism and the weak redistributive effect of the tax and social welfare system on the working-age population. Greenhouse gas emissions per capita are slightly below the OECD average while exposure to air pollution is above levels in other advanced economies.

The government has addressed some of the priorities in Going for Growth 2017. The 2017 plan to expand childcare capacity is supporting female employment and free early childhood education and care (ECEC) for children aged 3-5 will be provided from 2019. Legislation to reduce overtime work and improve the treatment of non-regular workers will be fully enforced by 2023.

Narrowing the productivity gap requires enhancing product market competition and the competitiveness of SMEs. Barriers to trade and investment inflows should be reduced to deepen Japan’s integration in the global economy. Further promotion of employment of women and older persons and the integration of foreign workers are essential to mitigate the impact of population ageing. Greater use of environmentally-related taxes would help achieve environmental goals.

Japan: Going for Growth 2019 priorities

Ease entry barriers and raise productivity of the service sector and SMEs. Product market regulations limit competition and investment in services, reducing productivity.

-

Actions taken: Regulatory sandboxes and grants and tax incentives for SME investment in information and communication technologies were introduced in 2018. Participation in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the EU-Japan Economic Partnership Agreement will strengthen competition in services.

-

Recommendations: Boost business dynamism by reforming the insolvency framework and expanding access to entrepreneurial training and finance. Extend the reforms in the National Strategic Special Zones nationwide. Reduce entry barriers, while lowering restrictions on service imports and inward FDI.

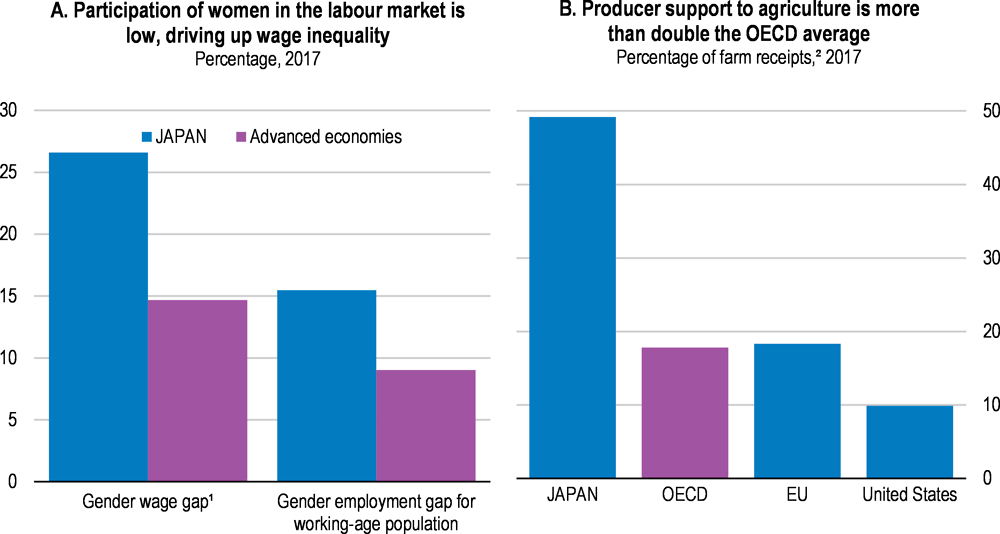

Reduce producer support and increase efficiency of the agricultural sector. Support for agricultural producers, which is more than double the OECD average, is concentrated in the potentially most distorting form and raises prices for consumers.

-

Actions taken: The production quota and direct payments for table rice were abolished in 2018. A 2018 law allows more flexible use of farmland, including for vegetable production, and facilitates the leasing of communal farmland even when some owners are difficult to locate. The duration of leases of such farmlands based on majority agreement was lengthened from five to 20 years.

-

Recommendations: Reduce commodity-specific agricultural subsidies and delink them from production. Promote greater efficiency through further consolidation of farmland by lifting obstacles to transactions, liberalising the regulations on the ownership of farmland by non-agricultural corporations and addressing the issue of unidentified landowners.

Improve the efficiency of the tax system. The tax system, which has a high corporate tax rate, a narrow personal income tax base, and the third-lowest standard VAT rate among OECD countries, lowers Japan’s growth potential.

-

Actions taken: The corporate income tax rate, which was the highest in the OECD in fiscal year 2013, was cut further to 29.74% in 2018. The planned hike in the consumption tax rate to 10% in 2015 has been delayed until 2019 and will be accompanied by the introduction of multiple rates. To make the personal income tax more neutral to diverse workstyles, employment income and basic deductions are to be modified from 2020.

-

Recommendations: Set a schedule of small annual increases in the consumption tax rate that would raise it toward the 19% OECD average. Further lower the corporate tax rate, while raising taxes on capital gains and dividends. Broaden the personal income tax base by scaling back deductions that primarily benefit high-income households. Increase environmentally-related taxes to achieve environmental goals and boost revenue.

Strengthen policies to support the labour force participation of all available talents. Japan is facing the most rapid population ageing in the OECD area, while the share of foreign workers is one of the lowest in the OECD, which makes its working age population shrink.

-

Actions taken: A plan was launched in 2017 to expand childcare capacity by 320 thousand children by 2020. Free early childhood education and care for children aged 3-5 is to be provided from October 2019, financed by part of the revenue from the scheduled consumption tax hike. Spousal deductions of the personal income tax were modified in 2018 to reduce labour supply distortions. Recent legislation introduced limits on overtime work, enforced by legal sanctions, and aims to reduce discrimination against non-regular workers.

-

Recommendations: Encourage the labour force participation of women and older persons by; i) further expanding access to affordable, high-quality childcare: ii) abolishing the right of firms to set a mandatory retirement age: iii) encouraging a shift to flexible employment and wage systems based on ability rather than seniority; iv) breaking down labour market dualism, in part by reducing effective employment protection for regular workers; and v) reducing labour supply distortions in the tax and transfer system. Promote employment of foreign skilled professionals and foreign workers in sectors with severe labour shortages.

1Promote green growth. Increased dependence on fossil fuels after the Fukushima accident in 2011 makes it difficult to meet greenhouse gas emission targets. To ensure sustainability of resources and improve environmental quality, accelerating efforts to achieve the greenhouse gas emission targets and scaling up the mitigation ambition beyond current targets is a priority.

-

Recommendations: Accelerate deployment of renewable energy sources by addressing potential barriers, in part by following through on the electricity sector reform launched in 2015. Implement the 2019 strategy to achieve the 2050 long-term climate goal through the decarbonisation of the economy. Encourage green finance and investment.

Note

← 1. New policy priorities identified in Going for Growth 2019 (with respect to Going for Growth 2017). No action can be reported for new priorities.

Metadata, Legal and Rights

https://doi.org/10.1787/aec5b059-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.