copy the linklink copied!Chapter 2. Context and description of the current Peruvian pension system

This chapter describes the Peruvian pension system and the context in which it has developed and currently exists. It first describes the current macroeconomic and demographic contexts, and the challenges that the pension system faces. The chapter summarises the main reforms and initiatives that have led to the structure of the current pension system. It then describes the structure and rules of the current pension system in order to provide a basic understanding of how it operates and a reference for subsequent chapters.

copy the linklink copied!2.1. Macroeconomic and demographic context

The macroeconomic situation in Peru, compared with other countries in the region that have implemented an individual account-based pension system in Latin America - Chile and Colombia - as well as the OECD average, is relatively similar. Peru has GDP and productivity growth on par or higher than Chile, and well over the OECD average Table 2.1. Long-term interest rates are comparable to its Latin American counterparts. Government deficit and debt are also comparable to Chile’s, while inflation and wage growth are somewhat lower than Chile’s, with inflation being higher than wage growth in both countries. Compared to the other jurisdictions shown in the table, Peru has very high employment and labour force participation ratios.

Between 2007 and 2016 there has been very little change in the overall employment rate in Peru, which has remained around 70% throughout the period. However, there is some variation across different age groups and by gender, as shown in Table 2.2. The male employment rate is around 30% higher than that for women, at 78% in 2016 compared to 60% for women. The employment rate among ages 60-64 has increased significantly since 2001, going from under 60% to over 75% currently. Across the OECD the employment rate for 55 to 64 year olds is 60%, showing that the employment rate in Peru is at a relatively high level for older workers.

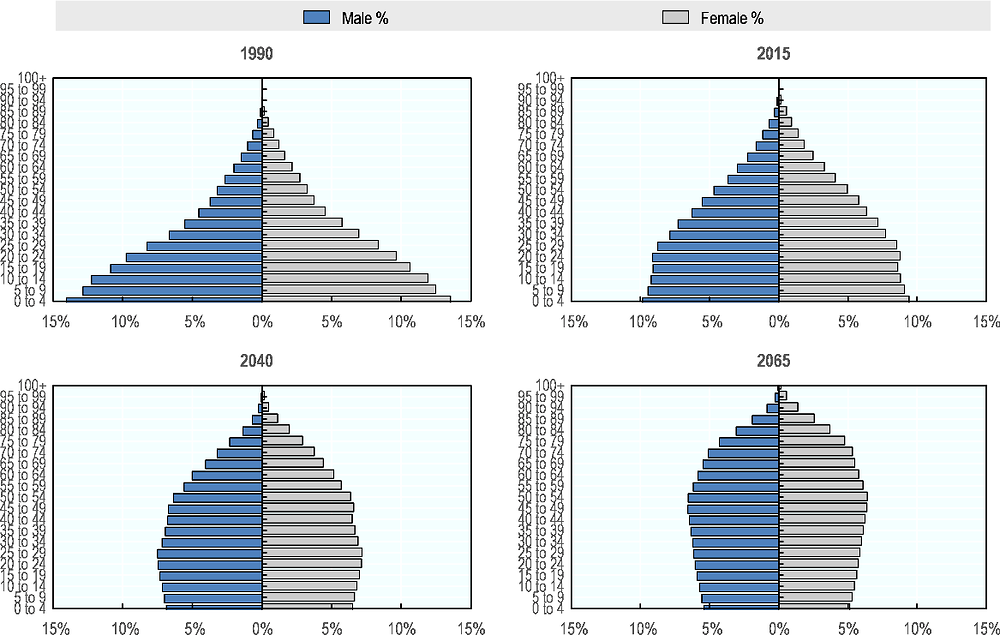

Peru, like most countries in the world, has a rapidly ageing population driven by increases in life expectancy combined with lower fertility rates, which will lead to a change in the overall population structure (Figure 2.1). In 1990 just under 15% of the population was under the age of 5, but this age group is currently around 10% and will represent less than 5% by 2060. Over the same time period, the fertility rate has fallen from around 4.0 in 1990 to 2.4 currently, and is projected to be around 1.8 by the middle of the century, well below the replacement level of 2.1.

Conversely, the proportion of individuals aged 65 and over and therefore of pension age is rising rapidly. In 1990, only 4% of the population were aged 65 and over, reaching 6.5% in 2015 and forecast to increase to 13.5% by 2040 and 22.5% by 2065.

This increase in the elderly population is largely the result of the large estimated increases in life expectancy at birth, which currently stands at 75.4 in Peru, according to the latest UN estimates. By 2060, life expectancy at birth is expected to increase to 83.8, over eight years higher than the current level.

Whilst not all of the increase in life expectancy will be relevant to the pension system, as not all individuals survive until age 65, forecasts suggest that the life expectancy at age 65 will still increase by over four years, from 18 years currently to 22.2 years in 2060.

copy the linklink copied!2.2. The Peruvian pension system: reforms and current structure

2.2.1. Historical background

The Peruvian Pension system was overhauled in 1992 with the Decree Law 25897, which created the Private Pension Fund Administration System (SPP) with the aim of addressing the financial sustainability concerns of the existing pay-as-you-go scheme (SNP) and contributing to the development and strengthening of the social pension system. This system of privatised individual accounts followed the Chilean model that was introduced a decade earlier. However, unlike Chile, Peru retained the public scheme to operate in parallel with the SPP, and affiliates of the SNP were given the choice to switch to the SPP. Rights accumulated under the SNP for members who chose to join the SPP were granted in the form of Recognition Bonds provided when the member retires.

Three different Recognition Bonds were offered to affiliates who switched from the SNP to the SPP and who had contributed to the SNP at least 48 months over the ten years prior to the date of one of the Recognition Bonds:

-

the 1992 Bond recognises contributions through December 1992;

-

the 1996 Bond recognises contributions through December 1996;

-

the 2001 Bond recognises the contributions made up to January 2001.

The value of rights transferred through the Recognition Bond is based on the product of the number of months of contributions and the average of the last 12 wages, multiplied by a factor of 0.1831.1 The value of the bond was subject to a maximum nominal value of PEN 60 000 at December 1992, and its value is updated according to the Consumer Prices Index for Metropolitan Lima. As of June 2018, the present value of Recognition Bonds outstanding totalled PEN 3.7 billion, representing 0.5% of GDP.

In 2001, the Law No. 27617 restructured the SNP and imposed a gradual reduction in the benefits offered by the public system. It also allowed members who had switched to the SPP to continue to be entitled to a minimum pension.

In 2012, the Law No. 29903 introduced a major reform of the SPP. The main objectives of this reform were to:

-

improve competition among the AFPs with the introduction of a tender mechanism for new affiliates;

-

improve the value and transparency of the disability and survival insurance through the introduction of a tender mechanism;

-

align the incentives of the AFPs with those of their members by changing the fee structure from charges based on remuneration to charges based on assets under management;

-

simplify the administrative process to join the SPP;

-

increase the coverage of the pension system by mandating the participation of self-employed workers.

However, the requirement that the self-employed contribute was reversed soon after its implementation, and all contributions were refunded if requested.

In 2013, the government expanded a programme targeting extreme old-age poverty in certain regions to cover everyone in Peru over the age of 65 who does not receive a pension from the contributory pillar. The programme, known as Pensión 65, provides modest benefits of PEN 250 every other month. The number of beneficiaries of this programme has grown to over 500 000.

In 2016, Law No. 30425 allowed members to take 95.5% of their savings in the SPP as a lump sum at retirement. Up until 2016, savings accumulated with the AFP had to either be withdrawn gradually throughout retirement according to a formula that takes into account gender, age and family status or be used to purchase a life annuity product with an insurer. Allowing a lump-sum pay-out has nearly eliminated the payment of pensions from the system, as over 95% of retirees now take their pension savings as a lump sum.

In 2017, the Ministry of Economy and Finance created a Working Group called the Social Protection Commission to assess the functioning of the social protection systems and to propose economic reforms. The Commission was made up of a group of independent technical professions and academics. Their final report, published in September 2017, suggested proposals to reform the pension, health and unemployment schemes in Peru. With respect to the pension system, the main proposals were to:

-

implement a basic universal pension, initially in the form of a means tested subsidy;

-

make participation in the SPP mandatory for all;

-

establish a centralised entity to take over administration of the system and provide information and advice to members;

-

subsidise contributions for low income and young members;

-

promote an efficient and simple annuity market, with the default pay-out being a traditional life annuity.

In May 2019, the government created a Council with representatives from the Ministry of the Economy, Ministry of Labour, the Pension Normalisation Office (ONP) and the pension and insurance regulator (SBS) that will evaluate the pension system within 180 days. The objectives of this Council are to evaluate the pension system with a focus on fiscal sustainability, adequacy of pensions, demographic trends, universal coverage, and early retirement regimes. Decree 175-2019-EF established the procedures to be followed by the Council.

2.2.2. Description of the current pension system

The Peruvian pension system has a non-contributory safety-net and an earnings-related contributory component. The non-contributory pension provides a modest benefit to individuals in extreme poverty that do not have access to a contributory pension. The earnings-related pension, mandatory for all formal workers, is made up of a public PAYG system and a private system of funded individual accounts. Workers must choose whether to contribute to the public or to the private system. Although contributions are not mandatory for self-employed workers, they can voluntarily choose to contribute to either system. Several special contributory pension schemes also exist for workers in specific occupations, but many of these have been closed to new entrants. Workers affiliated with the private system may also make additional voluntary contributions to their pension accounts.

Non-contributory benefits for the elderly are provided through the programme Pensión 65, which was established in 2011and provides a flat benefit to the elderly in extreme poverty. The programme is not integrated with the rest of the pension system and is managed separately by the Ministry of Development and Social Inclusion (MIDIS). However, MIDIS does coordinate with the SBS and the ONP to verify that beneficiaries of Pensión 65 do not belong to the SPP or SNP and have not received any benefits.

The public and private contributory pension systems are not complementary, but rather they operate in parallel, and all formal workers in Peru are required to contribute to one or the other. The public system is a PAYG defined benefit pension system managed by the public sector (Sistema Nacional de Pensiones, SNP). The private system is an individual defined contribution pension system managed by the private sector (Sistema Privado de Pensiones, SPP). Individuals are allowed to switch from the SNP to the SPP at any time, but they may not switch back to the SNP. There are also special schemes for certain occupations that are managed separately, for example for the military and for civil servants.

Both the public and private systems provide benefits in the form of 1) retirement pensions; 2) disability pensions; and, 3) survivor pensions for spouses, dependent children and dependent parents. In addition, individuals working in hazardous or arduous occupations are covered for disability and survival insurance under the Complementary Insurance for Risky Occupations (Seguro Complementario de Trabajo de Riesgo, SCTR) scheme. The legal retirement age is 65 under both systems, but several options for individuals to retire early also exist.

copy the linklink copied!2.3. Non-contributory pension for the elderly

Pensión 65, established in 2011 through the Decree 081-2011-PCM, is a non-contributory and independent component of the pension system providing a benefit to individuals aged 65 and over who do not receive a contributory pension and are living in extreme poverty. Extreme poverty is defined as having income below PEN 183 per month (USD 55) based on an indicator of Social Economic Levels (NSE) established by the Household Targeting System (Sistema de Focalización de Hogares, SISFOH). The programme was an extension of a pilot programme that provided a basic benefit to individuals in extreme poverty from the age of 75 in the regions of Apurimac, Ayacucho, Huancavelica and Lima Metropolitana. Pensión 65 lowered the eligibility age to 65 and initially expanded coverage to six regions before covering all regions. Benefits are flat rate, at PEN 250 every two months.

Additionally, recipients are entitled to free care in public health facilities and are eligible for the Integral Health Insurance Programme (Seguro Integral de Salud, SIS). The number of claimants has been increasing over recent years as shown in Table 2.3, and currently nearly 24% of individuals over the age of 65 benefit from the programme. Total annual expenditure on benefits is around 0.11% of GDP.

copy the linklink copied!2.4. The pay-as-you-go national pension system

The pay-as-you-go national pension system (Sistema Nacional de Pensiones, SNP) is administered by the Pension Normalisation Office (Oficina de Normalizacion Previsional, ONP). Workers affiliated with this system are required to contribute 13% of their salary on 12 of the 14 wages paid per year.2 Pensions are paid 14 times per year.

To qualify for a retirement pension, the individual, or couple combined, must contribute at least 20 years. Benefits are calculated on the average of the final 60 monthly wages. The targeted replacement rate depends on the age of the individual at the time of the implementation of the law that restructured the SNP in 2001 (Table 2.4). For the youngest cohort of individuals born in 1972 or later, the first 20 years of contributions entitles them to a replacement rate of 30%, whereas those born before 1947 would expect a replacement rate of 50%. Each additional year of contributions for the oldest cohort entitles the individual to an additional 4% salary replacement and for all other cohorts an additional 2%. The maximum monthly pension benefit is PEN 857.36 (USD 254 or 62.5% of average wage and 92% of the minimum wage), and the system guarantees a minimum pension benefit of PEN 500 (USD 148 or 36% of average wage and 54% of the minimum wage), increased from PEN 415 in June 2019.

The proportion of individuals over 65 receiving benefits from the SNP has been decreasing, even if the numbers have been increasing in absolute terms. The number of male beneficiaries within the SNP system has remained steady over the last ten years, only increasing by 8%, compared to a 34% increase albeit from a low level for women (Table 2.5). During this time the population aged over 65 increased from 1.66 million to 2.30 million, i.e. a 39% increase (United Nations, 2017[1]). This means that 16% of people older than 65 received a SNP benefit in 2017 against 19% in 2007.

2.4.1. Early retirement

The legal retirement age is 65 for both men and women. Early retirement is possible from age 55 with at least 30 years of contributions for men or from age 50 with at least 25 years of contributions for women. The number of years of required contributions is reduced to 20 years for both men and women under special circumstances, such as collective lay-off from employment.

The early-retirement pension is permanently reduced by 4% for each year that the pension is taken before the normal retirement age of 65, subject to the floor of the minimum pension of PEN 500.

2.4.2. Disability pensions

Disability pensions are paid if an affiliate has a mental or physical disability that prevents them from earning more than one-third of the salary that an equivalent worker could receive. The number of individuals receiving disability pensions by gender is shown in Table 2.6. To qualify for benefits in the event that the disability resulted from a work-related accident or occupational disease, the individual must be contributing to the system at the time the disability occurred. If the individual was not contributing to the system at that time, and whatever the cause of the disability, the individual can still qualify for a benefit if one of the following conditions are met:

-

having contributed between 3 and 15 years prior to the disability, with at least 12 months of contributions made in the 36 months prior to the month in which the disability occurred;

-

having contributed less than 3 years, with at least half of the contributions made within the last 36 months;

-

having contributed for at least 15 years.

The disability pension pays 50% of the reference salary - average monthly earnings in the last 12 months - plus 1% for each full year of additional contribution beyond three years, subject to a floor of PEN 500 paid 14 times per year. For non-work related disabilities, individuals can still qualify for a benefit if they contributed between one and three years prior to the disability, with at least 12 months of contributions made in the 36 months prior to the month in which the disability occurred. Benefits are one-sixth of the wage for each full year of contribution.

Disability pensions are not necessarily paid indefinitely, as individuals who are eligible for a retirement pension from age 65 can transfer to a retirement pension. Movement to a retirement pension is possible earlier if the retirement pension is higher than the disability pension, more than 20 years of contributions have been made, and the individual is aged at least 55 years for men and 50 years for women.

2.4.3. Survivor pensions

In the case of death of the affiliate, survivor pensions may be paid to the surviving spouse, children, and/or dependent parents. To qualify for the spousal pension, the surviving male spouse must be over the age of 60 or disabled and must have been economically dependent on the affiliate. These conditions do not apply to surviving female spouses, and with women also living longer on average the number of women claiming survivor benefits is nearly 20 times the number of men (Table 2.7). Benefits for survivor pensioners are equal to 50% of the retirement pension that the affiliate would have been entitled to, subject to a minimum benefit of PEN 350.

Children of a deceased affiliate will qualify for a pension if they are disabled, under the age of 18, or under the age of 21 if they have continued studying. Benefits equal up to 50% of the retirement pension that the affiliate would have been entitled to, subject to a minimum benefit of PEN 270.

If there remains a balance of the pension entitlement of the deceased member after paying the widow and orphan pensions, a survivor pension may also be paid to the dependent mother or father over the age of 55 and 60, respectively, or if the parent is disabled. Benefits for each parent are equal to 20% of the retirement pension that the affiliate would have been entitled to, subject to a minimum benefit of PEN 270.

On top of pension entitlements, special bonuses are paid to individuals meeting certain criteria. For example, bonuses are paid to individuals aged 80 and over, disabled pensioners who need permanent care, and widows aged 70 and over.

Survivor pension payments cease if the widow(er) remarries or if a disabled widower is assessed as being able to work. Upon remarriage a lump-sum of 12 times the spouse’s pension is paid.

2.4.4. Reserve fund

A consolidated reserve fund (RCF) was established in 1996 to help improve the financial viability of the system. Its objective is to support pensions paid by the ONP, the payment of Recognition Bonds and pension payments for the Cedula Viva scheme for civil servants. It was created with money from the privatization of public enterprises. The resources of the RCF come from the actuarial reserves of public pension schemes administered by the ONP, public treasury contributions, net investment returns, contributions for Pension Assistance and other transfers coming from the private sector and national and international cooperation. Table 2.8 shows the increase in the value of the fund from the end of 2001 to the end of 2017.

The RCF manages four types of funds:

-

Funds with actuarial reserves belonging to privatized or liquidated public companies

-

Recognition Bonds Fund

-

RCF-D.L 19990 Funds

-

Solidarity Contribution for Pension Assistance Funds (RCF-DL 28046)

The RCF Board of Directors is responsible for its portfolio policies and guidelines. The Board is made up of the Minister of Economy and Finance, the Head of the ONP, the General Manager of the Central Bank of Peru, and two representatives of pensioners nominated by the National Labour Council and appointed by executive power through a ministerial resolution endorsed by the Minister of Economy and Finance.

In January 2017, the Board approved an update of the RCF regulatory documents within the Strategic Asset Allocation (SAA) framework that contains parameters and investment limits in order to provide some flexibility around the investment management of the fund. Table 2.9 shows the investment limits and asset allocation for the RCF as of December 2017.

Portfolio management is done through direct investments made by the Technical Secretariat at the ONP and mandates by portfolio managers. The Technical Secretariat periodically examines new investment practices and evaluates them for the RCF portfolio management.

The Investment Committee is responsible for making decisions within the SAA framework. Members of the Committee are the Head of the ONP, the General Manager of the ONP, the Investment Director, the Head of the Risk Management Office, and the Head of the Institutional Control Body.

copy the linklink copied!2.5. Special regimes

Within the Peruvian pension system there are a number of occupations that either still have special schemes, or they had special schemes which have now been closed for new entrants but there is an associated legacy cost.

There are several other contributory pension arrangements for specialised populations covering approximately 2.4% of the active and 15% of the retired population. These populations include the following occupations:

-

Civil Servants (closed to new entrants)

-

Police and military personnel

-

Fishermen

In addition, there are a number of special regimes within the SNP system, with different retirement ages in particular for certain occupational groups, namely:

-

Journalists

-

Leather industry workers

-

Housekeepers

-

Pilots and co-pilots

-

Maritime workers

-

Civil construction workers

-

Mining, metallurgy and iron and steel industry workers

2.5.1. Civil Service scheme (Cédula Viva)

The Law Decree No. 20530 (Cédula Viva), promulgated on February 27, 1974, established a special regimen for civil servants in which a worker acquired the right to a pension equal to 100% of the remuneration after 12.5/15 years of contributions for females/males respectively, regardless of age. Pension benefits were indexed to wage increases. Contribution rates were set at 6%.

In December 2005, the Government established the New Rules of the Pension System of the Law Decree No. 20530 (Law No. 28449) to close the regime. Former employees of Government institutions who contributed under the Law Decree No. 20530 at the date of the reform established by law No. 28389 could qualify to be in this regime.

To qualify for benefits under the new system, men were required to have between 5 and 30 years of service, and women between 12.5 and 25 years of service, otherwise they could opt into the SNP or the SPP and receive recognition bonds for the benefits they had already accumulated. Contributions under the new regime were increased to 13%.

In terms of benefits, men could receive 3.33% of the average pensionable remuneration received over the last twelve months for each year of service, and women could receive 4% per year of service. If pensionable remuneration had increased by 50% or more over the last 60 months or between 30% and 50% over the last 36 months, the pension would be adjusted considering the average of the pensionable remuneration received over the last 60 or 36 months, respectively, or the higher of the two cases.

There is no specific formula for the indexation of pensions, rather the Budgetary offices decide by how much they will be indexed based on the money available, inflation and economic growth up to a maximum limit of adjustment of two times the tax unit established by the tax agency for the year.

2.5.2. Police and military personnel (Caja de Pensiones Militar Policial, CPMP)

The Military and Police pension scheme was established as a defined benefit pension plan in 1972. Contributions were set at only 12%, well below the level of 19% needed to fund the promised benefits of 100% replacement of the final salary after 30 years of contributions. The scheme was closed in 2011 due to the resulting deficit, and now relies on transfers from the Ministry of Finance to fund the pension benefits.

A new scheme was established in 2012 that modified the benefit formula to provide a 55% replacement rate of the last five years of salary for 30 years of contributions, pro-rated for fewer years of contributions. The new scheme maintained the level of contributions at 12%, split equally between affiliates and the state. However, since January 2018 contributions to the new fund have been increased to the equilibrium level of 19% for new entrants into the scheme, with 13% paid by affiliates and 6% paid by the state.

As of December 2018 the technical reserve for the old CPMP system was PEN 52.9 billion, around 7% of GDP (CPMP annual report), and the annual deficit amounted to PEN 633.8 million, around 0.1% GDP. The new fund had a technical reserve of PEN 1.6 billion.

2.5.3. Fishermen (Regimen Especial de Pensiones por los Trabajadores Pesqueros, REP)

The current system REP applies from 2013, after replacing the previous system Caja de Beneficios y Seguridad Social del Pescador (CBSSP).

Fishermen contribute 8% of their insurable earnings and ship operators (the employer) contribute another 5%. Insurable earnings include all earnings and in-kind payments (e.g. captured fisheries) and cannot be lower than the minimum wage.

Eligibility to a pension requires:

-

Being 55+ years old;

-

Being registered as fisherman and able to prove 25 years working as a fisherman;

-

375 weeks of contributions;

-

Not being affiliated to another pension system.

Pension benefits are equal to 24.6% of average insurable earnings from the last 5 years (the same as for workers from old system, CBSSP, who are eligible for REP). Maximum monthly pension of PEN 660 applies in 2018 and pensions are paid 14 times per year. The maximum amount of pension is reviewed every two years and can be increased.

Pensioners and workers eligible for a pension under the old system (CBSSP) are entitled to a special pension named Transferencia Directa al Expescador (TDEP) which cannot be combined with any other public pension or social assistance. The maximum pension is PEN 660 per month with 14 payments per year.

2.5.4. Journalists

Eligibility to a pension is based on both an age requirement and number of years of contributions depending on when eligibility to a pension was achieved. The retirement age is 55 for men and 50 for women.

If the age requirement was met before 18 December 1992, then men need to have made 15 years of contributions and women 13 years. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.2% for each complete additional year of contribution for men and 1.5% for women.

If the age requirement was met after 18 December 1992 then 20 years of contributions are required for both men and women. The benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

In both scenarios reference earnings are defined depending on the number of years of contributions. For 30 or more years of contributions, earnings during the last 36 consecutive months are divided by 36. For 25 to 30 years of contributions earnings during the last 48 consecutive months are divided by 48, and for 20 to 25 years of contributions earnings during the last 60 consecutive months are divided by 60.

2.5.5. Leather industry workers

Eligibility to a pension is based on both an age requirement and number of years of contributions depending on when eligibility to a pension was achieved. The retirement age is 55 for men and 50 for women.

If the age requirement was met before 18 December 1992 then men need to have made 15 years of contributions, and 13 years for women. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.2% for each complete additional year of contribution for men and 1.5% for women.

If the age requirement was met after 18 December 1992 then 20 years of contributions are required for both men and women, of which 15 and 13 years need to be as leather workers for men and women respectively. The benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

In both scenarios reference earnings are defined depending on the number of years of contributions. For 30 or more years of contributions, earnings during the last 36 consecutive months are divided by 36. For 25 to 30 years of contributions earnings during the last 48 consecutive months are divided by 48, and for 20 to 25 years of contributions earnings during the last 60 consecutive months are divided by 60.

2.5.6. Housekeepers

Eligibility to a pension is based on both an age requirement and number of years of contributions depending on when eligibility to a pension was achieved. The benefit is only paid to women and the retirement age is 55.

If the age requirement was met before 18 December 1992 then five years of contributions are required. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.5% for each complete additional year of contribution.

If the age requirement was met after 18 December 1992 then 20 years of contributions are required. The benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

In both scenarios reference earnings are defined depending on the number of years of contributions. For 30 or more years of contributions, earnings during the last 36 consecutive months are divided by 36. For 25 to 30 years of contributions earnings during the last 48 consecutive months are divided by 48, and for 20 to 25 years of contributions earnings during the last 60 consecutive months are divided by 60.

2.5.7. Pilots and co-pilots

Eligibility to a pension is based on both an age requirement and number of years of contributions depending on when eligibility to a pension was achieved. The retirement age is 55 for men and 50 for women.

If the age requirement was met before 18 December 1992 then men need to have made 15 years of contributions, and 13 years for women. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.2% for each complete additional year of contribution for men and 1.5% for women.

If the age requirement was met after 18 December 1992 then 20 years of contributions are required for both men and women. The benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

In both scenarios reference earnings are defined depending on the number of years of contributions. For 30 or more years of contributions, earnings during the last 36 consecutive months are divided by 36. For 25 to 30 years of contributions earnings during the last 48 consecutive months are divided by 48, and for 20 to 25 years of contributions earnings during the last 60 consecutive months are divided by 60.

2.5.8. Maritime workers

Eligibility to a pension is based on both an age requirement and number of years of contributions depending on when eligibility to a pension was achieved. The retirement age is 55 for men and 50 for women.

If the age requirement was met before 18 December 1992 then men need to have made 15 years of contributions, and 13 years for women. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.2% for each complete additional year of contribution for men and 1.5% for women.

If the age requirement was met after 18 December 1992 then 20 years of contributions are required for both men and women. The benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

In both scenarios reference earnings are defined depending on the number of years of contributions. For 30 or more years of contributions, earnings during the last 36 consecutive months are divided by 36. For 25 to 30 years of contributions earnings during the last 48 consecutive months are divided by 48, and for 20 to 25 years of contributions earnings during the last 60 consecutive months are divided by 60.

2.5.9. Civil construction workers

Eligibility to a pension is based on both an age requirement and number of years of contributions depending on when eligibility to a pension was achieved. The retirement age is 55 for both men and women.

If the age requirement was met before 18 December 1992 then 15 years of contributions were required. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.2% for each complete additional year of contribution for men and 1.5% for women.

If the age requirement was met after 18 December 1992 then 20 years of contributions are required. The benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

In both scenarios reference earnings are defined depending on the number of years of contributions. For 30 or more years of contributions, earnings during the last 36 consecutive months are divided by 36. For 25 to 30 years of contributions earnings during the last 48 consecutive months are divided by 48, and for 20 to 25 years of contributions earnings during the last 60 consecutive months are divided by 60.

2.5.10. Mining, metallurgy and iron and steel industry workers

Eligibility to a pension is based on both an age requirement and number of years of contributions depending on when eligibility to a pension was achieved. The retirement age depends on the type of mining undertaken.

In all cases reference earnings are defined depending on the number of years of contributions. For 30 or more years of contributions, earnings during the last 36 consecutive months are divided by 36. For 25 to 30 years of contributions earnings during the last 48 consecutive months are divided by 48, and for 20 to 25 years of contributions earnings during the last 60 consecutive months are divided by 60.

Underground

If working underground the age requirement is 45 years and if this was met before 18 December 1992 then 10 years of contributions were required for a proportional pension and 20 years for a full pension, with at least 10 years in mining. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.2% for each complete additional year of contribution for men and 1.5% for women.

If the age requirement was met after 18 December 1992 then the benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

Open pit

The age requirement is 50 years and if this was met before 18 December 1992 then 10 years of total contributions were required for a proportional pension and 25 years for a full pension, with at least 10 years in mining. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.2% for each complete additional year of contribution for men and 1.5% for women.

If the age requirement was met after 18 December 1992 then 20 years of contributions were required for a proportional pension and 25 years for a full pension (10 years must be working in the open pit mine). The benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

Mining, Metallurgical and Steel Centres

The age requirement is 50-55 years and if this was met before 18 December 1992 then 15 years of total contributions were required for a proportional pension and 30 years for a full pension, with at least 15 years in mining. The benefit is 50% of reference earnings for the first five years of contributions, increased by 1.2% for each complete additional year of contribution for men and 1.5% for women.

If the age requirement was met after 18 December 1992 then 20 years of contributions were required for a proportional pension and 30 years for a full pension (15 years must be working in mining). The benefit is 50% of reference earnings for 20 years of contributions, increased by 4% for each additional year of contribution up to a maximum of 100% of reference earnings.

copy the linklink copied!2.6. The funded private pension system

The funded private pension system (Sistema Privado de Pensiones, SPP) is a fully funded defined contribution system with individual accounts. The SPP is regulated and supervised by the Superintendence of Banks, Insurance and AFP (Superintendencia de Banca, Seguros y AFP, SBS). The pension fund administrators (Administradoras de Fondos de Pensiones, AFPs) manage the assets for the individual accounts. There are currently only four AFPs operating in the market: Habitat, Integra, Prima and Profuturo. Prima is the AFP with the largest number of affiliates, and Habitat the fewest as they are the most recent player to enter the market (Table 2.10).

The distribution of assets across the AFPs differs slightly from the distribution of members, with Integra having the largest amount of assets under management at 38% of the market (Figure 2.2). Habitat manages only 5% of assets, as even if they currently have a larger market share of affiliates, they have had less time to accumulate comparable levels of assets.

Contributions to the SPP are comprised of two main components: 1) deposits into the retirement savings account, amounting to 10% of the wage; and 2) a premium for disability and survival insurance, set at 1.36% of the wage in 2018, subject to a ceiling for premiums and benefits of PEN 9 489.04. In addition, the AFPs charge affiliates a management fee that is either calculated as a percentage of wages and paid on top of contributions or calculated as a percentage of assets under management (AUM) and deducted from the individual’s account accumulated since May 2013.

2.6.1. Retirement savings accounts

Mandatory contributions to the individual’s retirement savings account are 10% of monthly salary, with no contributions required from the two additional salaries paid in July and December.3 The contribution level was decreased to 8% in 1995, but increased back to 10% in 2006. The contribution level established must be set so as to provide the SPP’s affiliates with an adequate replacement rate on average when taking into account expected investment returns and life expectancy. According to Law 29903, since 2013 the SBS is required to review contribution levels every seven years. Any change in contribution rate will require an amendment by law that must have the prior opinion of the Ministry of Economy and Finance and the SBS. In addition, this decision must be reviewed by a qualified external party who wins a public bidding process and who will propose any needed modifications in the legislation.

There is an auction system in place to assign new entrants into the SPP. New entrants are enrolled to contribute to the AFP winning the last auction. Every two years since 2012, AFPs can participate in an auction mechanism and bid on the fees charged for the management and investment of the individual accounts. The winning AFP to receives all new entrants into the SPP. After a period of 24 months, affiliates are free to change to a different AFP. However, the affiliate can switch to another AFP after only 180 days if the return net of fees is lower than the market average

The AFPs have collaborated to establish a centralised system, AFPnet, that collects contributions and centralises other common administrative tasks. Employers are obliged to manage the payments of affiliates’ contributions to the AFPs through this system.

AFPs are required to offer four different investment funds with varying risk profiles. The default fund for new affiliates is the Mixed Fund (Fund 2), which can have up to 45% investment in equities. Individuals below the age of 60 can choose to invest in the Growth Fund (Fund 3), which can invest up to 80% in equities. AFPs are required to automatically transfer the affiliate’s investment to the Capital Preservation Fund (Fund 1) when they reach age 60, unless the affiliate requests in writing to stay in Fund 0 or Fund 2. This fund can invest up to 10% in equities. The Super Conservative Fund (Fund 0), introduced in 2016, is now required for individuals age 65 and over until they make a decision regarding how they will withdraw assets from their account, unless they provide a written request to stay in Fund 1 or Fund 2.

AFPs are required to guarantee a minimum return to members that is calculated on a monthly basis. The guarantee varies by fund and references the average real returns for the fund across all AFPs over 36 months. AFPs are required to hold a reserve fund to cover the guarantee, which is currently calculated as 0.9% of assets under management. In addition, AFPs are required to obtain a letter of credit from a bank equal to at least 0.5% of the assets under management to guarantee additional risks that AFP´s reserve is not sufficient to finance the minimum guarantee for the affiliates´ accounts.

Since the second half of 2016, affiliates have been allowed to withdraw 25% of the balance in their accounts to buy a first property.

2.6.2. Asset management fees

There are currently two types of fees that members can be charged: a fee based on salaries or a mixed fee based on both salaries and assets under management (AUM). This is due to the reforms in 2012 that changed the structure of the commission payments to AFPs, moving from a fee based on contributions as a percentage of salary towards a fee based on assets under management (AUM). Existing members could choose whether to keep paying the fee based on their salary, or gradually transition to the fee based on AUM with an implementation planned over 10 years. The fee based on AUM applies only to the balance accumulated from contributions made since June 2013, and the fee charged on contributions is subject to a maximum level that declines over the ten year implementation period. The SBS provided information and a calculator on its website to help individuals make the decision of whether or not to switch. New members since February 2013 pay the fee based on AUM.

2.6.3. Disability and survivor insurance

Affiliates can receive a disability pension in the event of temporary or permanent, total or partial disability before retirement age. In the case of total disability, where the worker loses 66% of their capacity to work, the pension paid is 70% of the average of the last 48 wages. In the case of partial disability, where the worker loses between 50% and 66% of their capacity, the pension benefits are 50% of the average of the last 48 wages.

In the case of death of an affiliate, a pension is paid to children, surviving spouses and/or dependent parents. The benefit levels, as a percentage of monthly wage, are as follows:

-

42% for the spouse or partner with no children

-

35% for the spouse or partner with children

-

14% for children under 18 or disabled

-

14% each for a father and/or mother older than 55 and 50, respectively, that is economically dependent on the affiliate

Insurance companies provide the disability/survivor insurance. There are currently seven insurance companies operating in the market. The premium charged for this insurance in 2018 was 1.36% of the worker’s wage up to the maximum insurable wage.4 According to the last auction in December 2018, the new premium will be 1.35%. The pension is financed with the balance from the individual’s account, and the insurer provides an additional contribution to top off the balance to finance the level of pension benefit.

In addition to the insurance companies, disability and survivor pensions are also serviced by captive insurance companies of the AFPs established under the Temporary Regime. The Temporary Regime was opened in 2004, and sought to give an initial boost to the pension insurance market by facilitating the entry of companies into this market over time. In the case of a claim, the same company provided the insurance and the payments. It is now a runoff portfolio of survivor and disability annuities. Now the company receiving the premium contributes the additional contribution to top up the assets to a level sufficient to fund the annuity, and pays the total premium to a second long-term insurance company who provides the payments.

Until 2013, each AFP negotiated an individual contract with an insurance company to provide disability and survivor insurance to its members. Law 29903, which became effective in October 2013, established the collective insurance scheme SISCO (Seguro Colectiva para la administracion de los riesgos de invalidez, sobrevivencia y gastos de sepelio). Under this joint administration scheme, insurance companies that win the bid to provide the insurance operate as co-insurers for the disability and survivor coverage, paying a fixed percentage of the claims representing the percentage of the market that they won in the bidding process. This process has eliminated the variability in the cost of AFPs coming from the provision of the insurance, increased the transparency of the management of the insurance and the claims, and mitigated the potential conflicts of interest of companies belonging to the same financial group.

Figure 2.3 shows that the average insurance premium charged increased significantly from 2008 until the introduction of SISCO in 2013, following which the premium decreased before more recently returning to previous levels. Nevertheless, this increase followed a period where the claims ratio was near 100%, implying little margin for the insurers to cover their expenses, so an increase in premium would be expected. Although claims ratios fell in 2016 and 2017, they rebounded in 2018 with a claims ratio over 100%.

2.6.4. Retirement age

The legal retirement age is 65 for both men and women. Nevertheless, several pathways to early retirement also exist: regular early retirement, retirement due to terminal illness or cancer, and retirement for the unemployed. Individuals who were in the SNP before the SPP are still entitled to the early retirement benefits that the SNP offered as well as the minimum pension if they meet the eligibility requirements.

Regular early retirement can be taken by females aged 50 and males aged 55 if they have accumulated assets sufficient to provide a replacement rate of 40% of the average salary. Congress passed a new version of this law in May 2019 that reduced the period over which the replacement rate is assessed to 120 months from ten years, and limited the amount of voluntary contributions to 20% of savings with the requirement that they remained in the account for at least a year. It also eliminates the minimum requirement for contribution density.

Early retirement can also be taken if the individual has a terminal illness or cancer and is not eligible for a disability pension.

Several temporary special retirement schemes for individuals who are unemployed (Jubilación Anticipada por Desempleo, REJA) have been introduced since 2002. The last regime was introduced in 2009 with an original expiration foreseen in 2013, but it was extended until December 31, 2018. It allowed males to retire at age 55 and females at age 50 if they had been unemployed for a consecutive period of at least 12 months and if the calculated pension was at least as high as the level of the minimum wage. If it was below that level, a lump sum of up to 50% of pension contributions and the corresponding investment returns on these contributions could be taken. Once individuals retire and access their pension account, they are allowed to return to work and are no longer required to pay contributions from their salary. Compared to previous REJA regimes, the last one significantly relaxed the requirements for the level of pension needed to qualify and reduced the minimum age for women. In May 2019, Congress passed a new version of the law that imposes a limit on the amount of income that an individual can earn as a self-employed worker during the unemployment period to qualify for retirement under the regime. The new law also removes the requirement that the account finances a pension at the minimum wage.

2.6.5. Pay-out from the retirement savings accounts

At retirement, individuals can choose to receive their pension in one of three ways, or in some combination:

-

Leave their assets invested with the AFP and take a programmed withdrawal, calculated taking into account their balance, age, gender and family

-

Transfer their assets to an insurance company to purchase a life annuity

-

Take 95.5% of their assets as a lump-sum, with the remaining 4.5% transferred to EsSalud to finance their health coverage (since April 2016)

Over 95% of individuals retiring now take the lump-sum option. Regardless of the option taken, 4.5% of the pension benefit will go to EsSalud to finance health benefits.

Individuals having switched to the SPP from the SNP who had their accrued rights transferred via a Recognition Bond receive its value paid to their account at retirement.

copy the linklink copied!2.7. Workers in risky occupations

Two regimes exist with respect to how contributions and benefits are defined for risky occupations within the SPP for construction and mining.

For the extraordinary regime, the state provides a supplemental bonus to increase the pension to the level that would have been obtained in the SNP. To qualify for this regime, workers must have worked in the risky occupation for a minimum number of years and have at least 20 years of contributions to the pension system. Depending on the type and duration of the occupation, they can then retire from age 40 to 50.5

For the generic regime, supplementary contributions are co-financed with the employer. In mining, an additional contribution of 4% is shared equally between the employee and employer, and the retirement age can be advanced by two years for every 36 months of contributions. For those working in civil construction, additional contributions are 2% shared equally between the employee and employer, and the retirement age can be advanced by one year for every 36 months of contributions. If the employee switched from the SNP to the SPP before 2003 there is an additional bonus provided.

Employers of those in risky occupations must provide their employees with supplementary labour insurance (SCTR) that provides additional health, disability and survivor coverage to complement that provided under the SNP or the SPP. Employers can obtain this insurance either with the ONP/EsSalud or with a private insurance company.

copy the linklink copied!2.8. Voluntary pension savings

Individuals affiliated with the SPP are allowed to have two types of voluntary contributions that are managed by the AFP: a savings account for the purpose of a pension and a savings account with no foreseen purpose. Voluntary contributions to a pension account are subject to the same withdrawal and taxation rules as mandatory contributions. Individuals who have been affiliated with the SPP for at least five years can also make voluntary contributions to a savings account, from which they can withdraw their funds at any time, though withdrawals are not tax exempt.6 Administration fees for voluntary contributions differ from those charged to mandatory contributions, and charges vary by fund as a percentage of assets under management. Individuals can have a voluntary savings account with no foreseen purpose with a different AFP than the one that manages their mandatory contributions.

Individuals affiliated with the SNP are not currently allowed to have a voluntary account with the AFP.

References

[1] United Nations (2017), World Population Prospects: The 2017 Revision.

Notes

← 1. Defined in the D.S. 180/94/EF.

← 2. Labour regulation requires that formal employees receive 14 salaries per year.

← 3. Since 2015, mandatory contributions were reduced from 14 to 12 contributions per year. Law 30334 established the exemption of payments on the bonuses of the National Holidays and Christmas.

← 4. The insurable wage as of December 2018 was PEN 9 489.04. This reference is updated on a quarterly basis to account for inflation, and it serves as a cap for the premiums and benefits for disability, survivorship and funeral expense insurance.

← 5. As of December 1999, the affiliates who have reached the following ages, which vary according to the productive activity performed: underground metallic mines: 40 years; directly extractive: 45 years; metallurgical and steel mining production centres: 45 to 50 years, depending on the time of exposure to risk, which vary from 7 to 2 years respectively; civil construction: 50 years.

← 6. Prior to 2017, withdrawals were limited to three time per year.

Metadata, Legal and Rights

https://doi.org/10.1787/e80b4071-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.