Executive summary

The economy has been hit hard

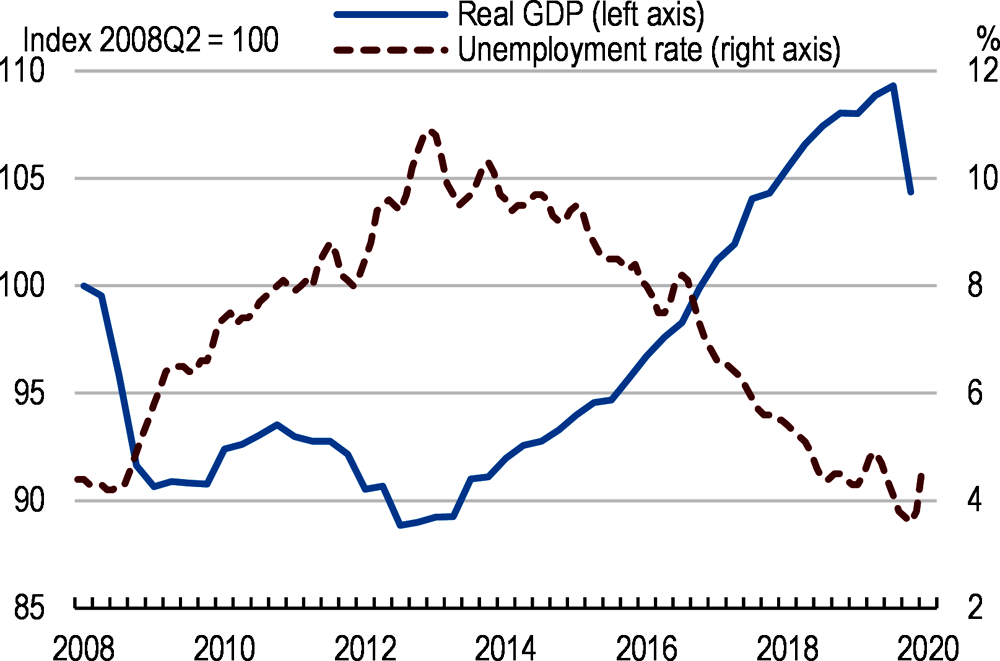

The coronavirus pandemic hit the economy hard. Containment measures cut many service activities, while manufacturing was hit by failing foreign demand (Figure 1). The moderate rise in unemployment reflects measures to support jobs and incomes. The downturn comes after a long period of high growth that had supported higher living standards, improved labour market inclusiveness, and fostered faster income convergence.

A fragile pick-up in activity is underway. Output plunged in the first half of 2020, which could happen again if new outbreaks occur (Table 1, Figure 3). Many services are slowly recovering, while sectors sensitive to foreign demand and international supply chains will continue to operate at low capacities. The economy is projected to gradually recover with the lifting of restrictions, releasing pent-up demand of, notably, durable goods and business investments. Following this initial boost to growth, the economy is projected to enter a more stable growth path with unemployment gradually receding towards pre-crisis levels. If an outbreak occurs at end-2020, a second contraction will follow, leading to higher long-term unemployment and more bankruptcies, and resulting in larger shares of underutilised resources. In both cases, the main risks are large increases in the number of bankruptcies and higher-than-expected unemployment, reducing the economy’s ability to bounce back. On the upside, growth would be faster if foreign demand rebounds faster than projected, especially if international supply chains are restored rapidly.

Crisis-related fiscal measures amount to nearly 4½ per cent of GDP, focussing on providing income support for workers, while buttressing businesses. Moreover, banks have to defer liabilities by 12 months for crisis-affected solvent businesses, while the government has issued guarantees of up 4½ per cent of GDP. In addition, the government is implementing stimulus, amounting to one per cent of GDP.

The economy may need continued support. With the fading of the health crisis, containment measures are being phased out and associated fiscal measures set to be terminated. The transition to a strong recovery remains fragile and may necessitate support to avoid scarring of long-term economic growth.

Long-term fiscal sustainability is at risk from ageing-related spending. The old-age dependency ratio nearly doubles to 60% in the coming decades with a smaller and older workforce. If the pandemic comes back in the autumn, the public debt-to-GDP ratio could reach 87½ percent in 2021. At the same time, pension and other ageing-related spending are rising, adding to the challenges of securing fiscal sustainability. By 2055, such spending is projected to increase more than in almost any other European country. If not countered, the public debt-to-GDP ratio will continue to rise.

The pension system needs to prepare for population ageing

The deficit in the public pension system is projected to triple. With current rules, future pensioners will spend more time in retirement than almost anywhere else. At the same time, the shrinking working age population impacts negatively on revenues. As a consequence, the current large intergenerational transfers would need to increase further to cover the system’s financing gap.

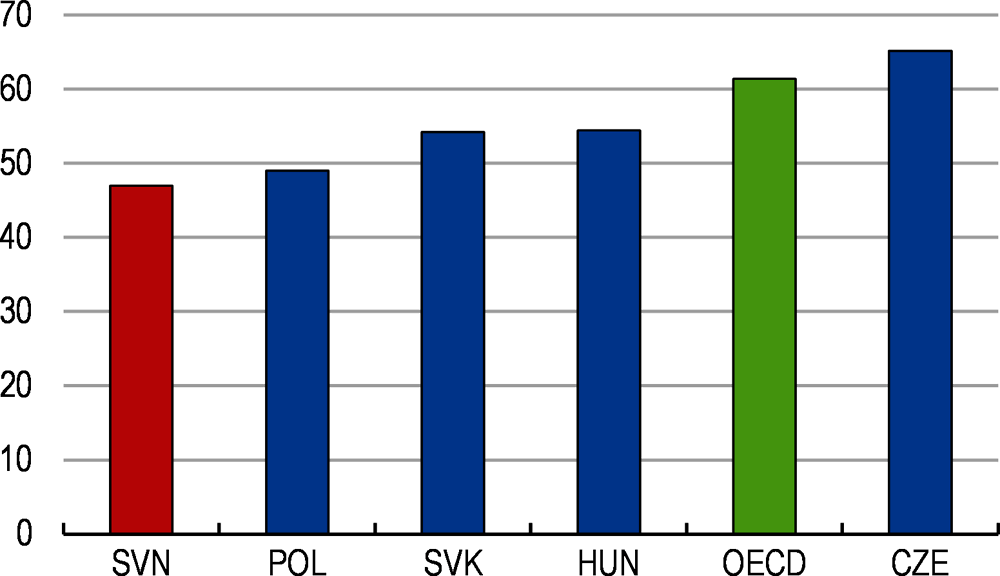

Pension reform has aimed at addressing rising life expectancy. In 2013, a pension reform to prolong working lives introduced a minimum pension age of 60 for workers with a full contribution period of 40 years and a statutory age of 65 for all. Nonetheless, the effective retirement age remains among the lowest in the OECD.

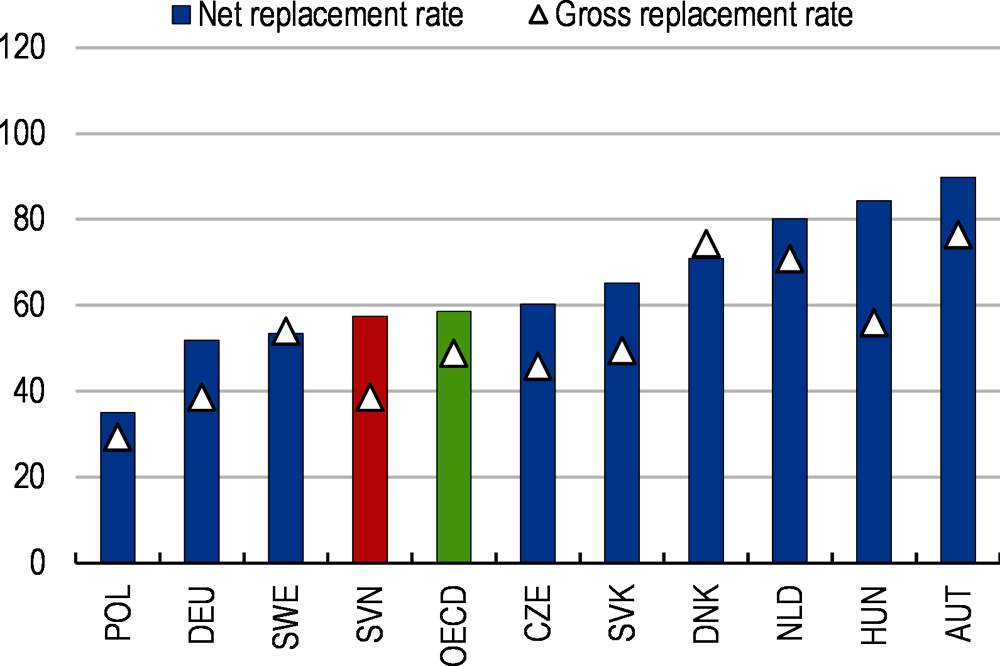

The state pension system is redistributive, reflecting policy measures, such as a minimum pension and an effective limit on pension benefits, and population characteristics, such as differences in life expectancy. This leads to large transfers between contributors within the system, eroding work and savings incentives, and from younger to older generations. Moreover, pension contribution rates are relatively high, while net replacement rates are at par with the OECD average (Figure 2). Recent reform is increasing replacement rates. Many pensioners have short contribution periods and low-income bases, leading to low pension benefit for most and old-age poverty for many.

Later retirement would bolster sustainability. There is low, although increasing, take-up of the bonus/malus system, which has higher rewards for retiring up to three years later than penalties for retiring up to five years earlier. The system is applicable anytime between the minimum and statutory retirement age, reducing actuarial fairness. Special retirement regimes allow early retirement for workers with full work capacity.

The second pillar is underdeveloped. The voluntary second pillar system has many, mostly higher income, contributors. However, contributions are low as generous tax advantages are applied to low levels of contributions. Thus, accumulated funds are very low, rendering the pillar ineffective in providing additional pension income.

Health services will be subject to ageing-induced changes in demand

The health care system responded fast and effectively to the health crisis. Moreover, its efficiency compares favourably with peers. Nonetheless, structural problems in the sector raise cost, quality and safety concerns. This is a particular concern as ageing leads to different and higher demand for health and long-term care services.

Existing price instruments in the health sector are ineffective in allocating scarce resources. Co-payments play a limited role in directing demand for health services. The effective use of general practitioners is hampered by payment systems that are not cost-reflective, leading to a high number of referrals to specialists and emergency units. In the hospital sector, allocation of resources is hampered by out-of-date reimbursement rates, soft budget constraints, non-transparent remuneration of doctors and a prevalence of small general hospitals. The guidance of patients through the health system is hindered by a lack of information exchange between providers and uniform care pathways.

The underdeveloped long-term care system is poorly prepared for ageing. Low long-term care spending covers 11½ per cent of the older population, well below perceived needs. The supply of long-term care is fragmented, with different legislation and eligibility criteria. Moreover, most is provided by public institutions, reducing supply flexibility.

Labour market institutions must prepare for a smaller and older work force

To avoid a rise in long-term unemployment as a result of the current crisis, it is important that active labour market policies focus on the hard-to-employ job-seekers by providing adequate job search support and skills upgrading. Such job-seekers are mostly older, low-skilled and long-term unemployed (Figure 3). Moreover, ageing is making labour shortages more permanent, requiring better labour utilisation and allocation to sustain growth. In particular, digital transformation and other new technologies bring new opportunities for individuals and the economy, which can only be realised through continued skills upgrading.

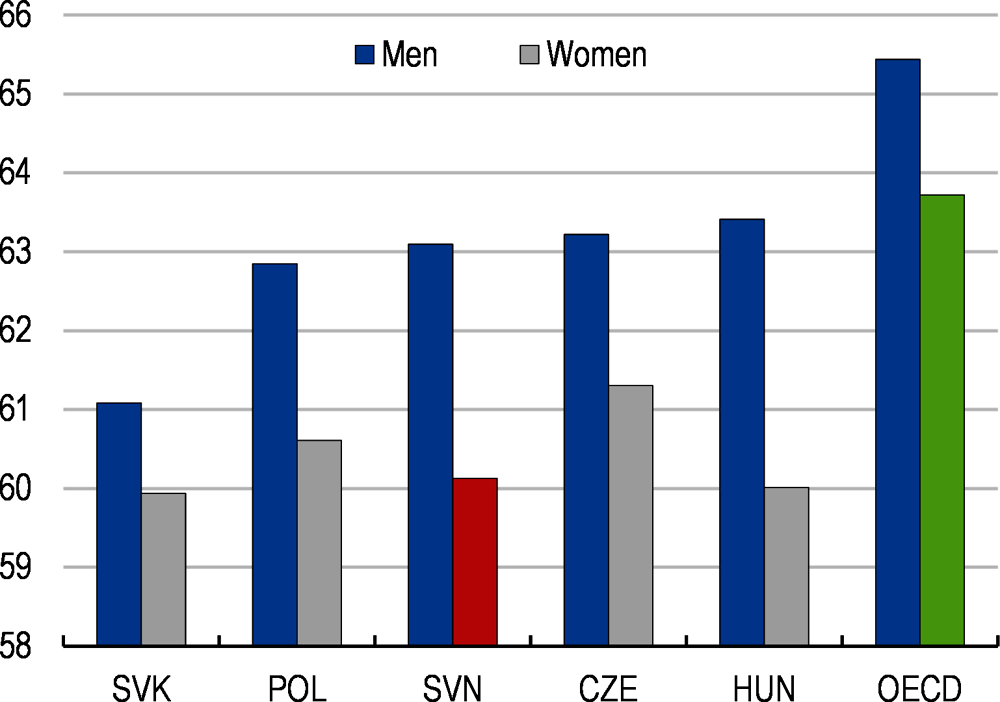

Older workers are often leaving the labour market early. The effective retirement age is among the lowest in the OECD. In addition, many older workers use the unemployment, disability and social assistance systems as pathways into early retirement (Figure 4). Another concern is that many older workers lack life-long learning incentives, hampering their ability to adjust to changing work places and new technologies.

Many unemployed workers lack search and work incentives. Many low-skilled workers have few incentives to enter employment or increase work efforts as their associated income gains are eroded by high taxes and benefit withdrawal.

Re-skilling and upgrading skills are essential for improving employment prospects. Many of the hard-to-employ job-seekers are not receiving sufficient training to enable them to gain a foothold in the labour market. In addition, there is limited participation in adult education among the low-skilled and low-paid workers, hindering job and occupational mobility.

The wage determination process has led to a compressed wage structure. Future growth will increasingly rely on improving labour allocation to bolster productivity. This requires better incentives for individual workers to improve their productivity or move to higher productivity jobs.

Workers’ geographical mobility is low, hampering labour reallocation. The small private rental segment is based on short-term contracts, rendering it unattractive as a longer-term solution. The rigid housing market has contributed to widespread commuting by car. This, together with widespread use of old heating boilers, contributes to emissions of CO2 and small particles.