copy the linklink copied!Latvia

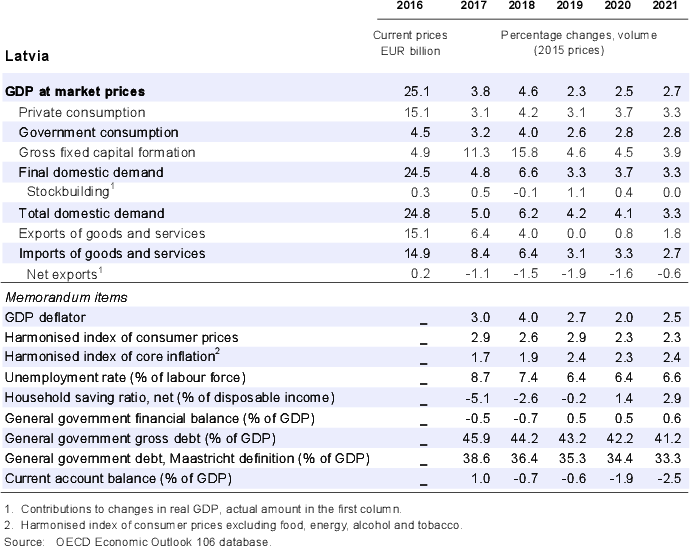

Economic growth slowed in the first half of 2019 and is projected to remain moderate. Weak world trade will be a drag on growth, while investment growth will ease to a more sustainable pace following an exceptional surge in the disbursement of EU funds. Private consumption will continue to play a key role in maintaining growth, supported by the strong labour market. Inflation will gradually decrease towards 2%.

The strong fiscal position, alongside already low interest rates, leaves room for the government to take a bigger role in supporting growth if the effects of the trade downturn are more serious than projected and flow through to the labour market. Higher investment in skills and research would drive further improvements in efficiency and the quality of living. Continuing to reduce informality would help to finance these investments.

Strong growth is set to moderate

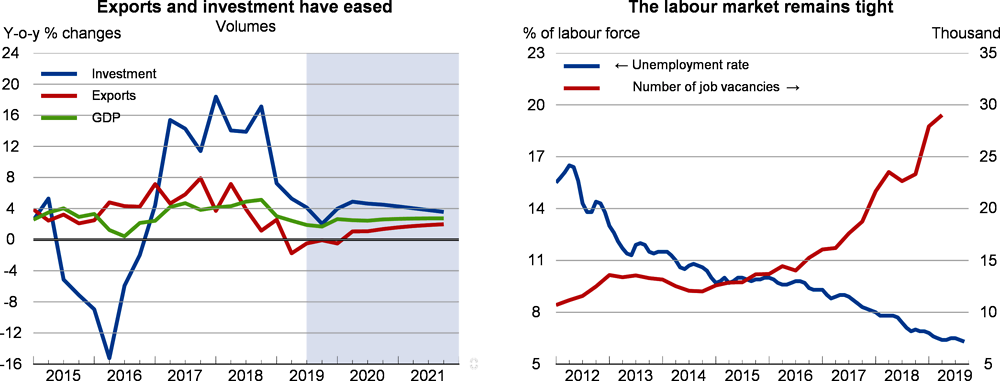

GDP growth slowed to about 2.5% in the first half of 2019, with a sharp fall in export and investment growth. Domestic demand continues to be robust, as the employment rate and wages increase. The unemployment rate has fallen further, to 6.4%. Vacancies continue to grow and nominal wages keep rising at a pace of about 8% per year, fuelled by productivity advances and rising skill shortages. Wage growth has contributed to the continuing strength of private consumption and to rising labour costs, with effects on competitiveness tempered by similar increases in Estonia and Lithuania. Despite rapid wage growth, inflation is stable at around 3%.

Strengthening productivity growth is essential as the population declines

The fiscal position remains strong: government debt is decreasing and currently is at the relatively low level of about 35% of GDP according to the Maastricht definition. The primary budget balance is projected to remain in surplus, in spite of slowing growth. The fiscal stance will remain broadly neutral. This leaves room for tax cuts or higher government spending if the trade downturn leads to a rise in unemployment. Accommodative ECB monetary policy is supporting growth through low borrowing costs.

Stronger productivity growth is necessary to continue the convergence to GDP per capita levels in Western Europe despite demographic headwinds stemming from ageing and emigration. This will require higher investment in skills and research, as well as greater competition, particularly in sectors where state-owned or municipal enterprises have wide influence. Aligning vocational and tertiary education more closely with labour market needs, and developing a rental housing market would help address skill mismatches. Supporting access to long-term finance and helping municipalities to build more affordable rental apartments would help to develop the rental market. Additionally, the government should continue to implement measures to decrease high poverty among elderly people.

The global slowdown will further hurt growth

Economic growth will further slow in 2020, before recovering gradually in 2021. Export growth will stay low as global trade remains weak. EU structural funds will continue to support investment, but should return to a more sustainable pace. Wage growth will stay high as skill shortages persist and productivity is increasing. However, it will slow as weaker investment decreases employment demand and no minimum wage increase hike is expected. Wage growth will support robust private consumption. Even so, the projected slowdown of wages and output growth will gradually decrease private consumption growth, as well as inflation.

Latvia faces risks from global trade uncertainty, particularly where it affects key trading partners, notably Germany and the United Kingdom. Trade risks will be intensified if rapid wage increases are not matched by productivity growth, threatening the competitiveness of domestic firms. On the other hand, rising incomes could strengthen consumption more than expected, leading to a more sustained pick-up in domestic business confidence and investment.

Metadata, Legal and Rights

https://doi.org/10.1787/9b89401b-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.