copy the linklink copied!25. Latvia

This country profile highlights current inclusive entrepreneurship policy issues and recent developments in Latvia. It also benchmarks key self-employment and entrepreneurship indicators for women, youth, seniors and immigrants against the European Union average.

copy the linklink copied!Key trends

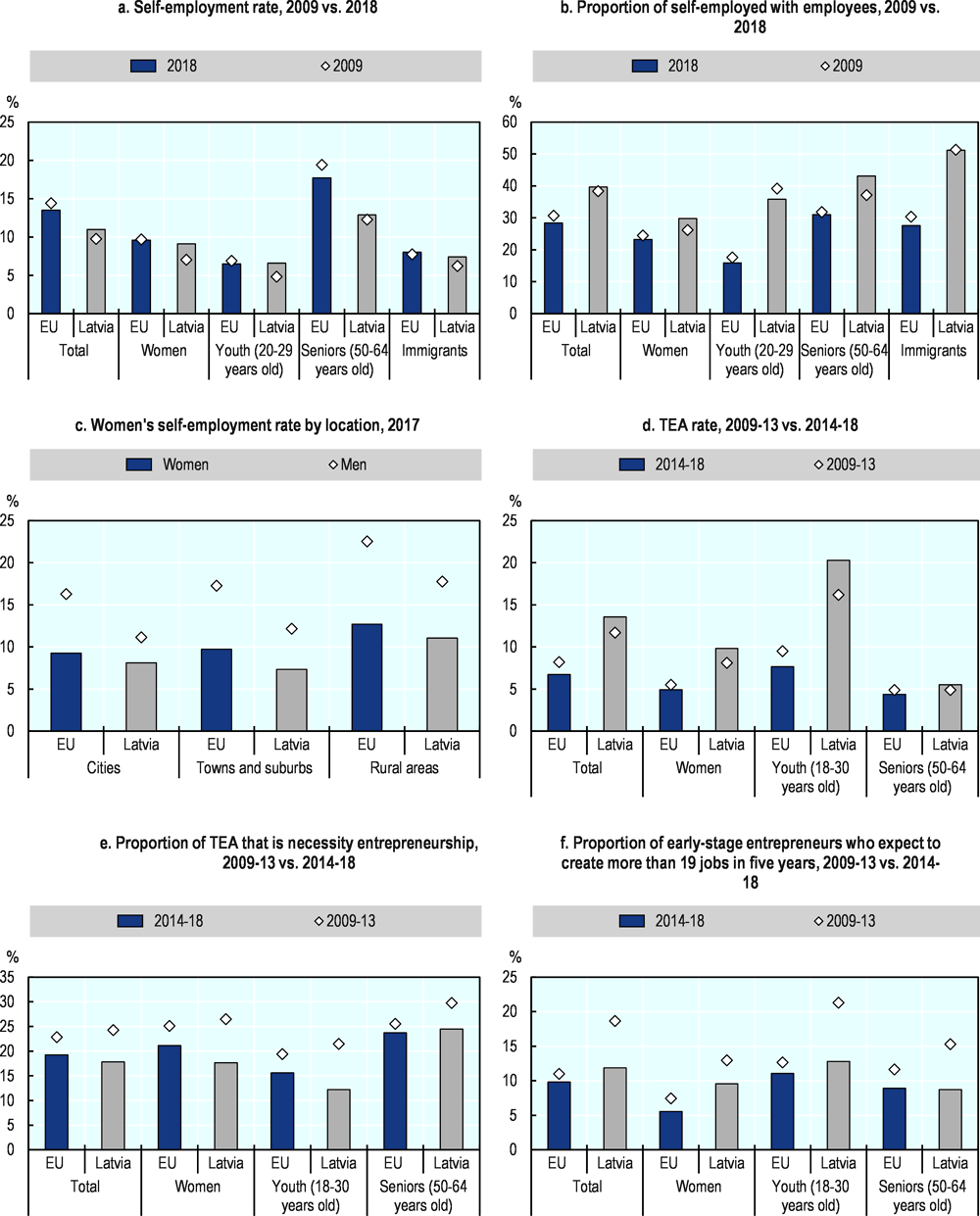

Self-employment rates for women (9.1% vs. 9.6%), youth (6.6% vs. 6.5%) and immigrants (7.4% vs. 8.0%) were approximately equal to the European Union (EU) averages, while the rate for seniors was below (12.2% vs. 17.7%). Relative to 2009, the self-employment rates for these groups increased slightly. Similarly, the proportions of women, youth and seniors involved in starting and managing new businesses increased over the past decade. Relative to the EU average, new women, youth and senior entrepreneurs were slightly more likely to expect to create at least 19 jobs over the next five years. However, this proportion has declined over the past decade.

copy the linklink copied!Hot issue

The Ministry of Environmental Protection and Regional Development created four Special Economic Zones (SEZ) – Riga Free Port, Ventspils Free Port, Liepaja Special Economic Zone and Rezekne Special Economic Zone. A fifth SEZ was created in 2017 for Latgale. The aim of these SEZ is to promote regional development and promote entrepreneurship activities in the regions. While the benefits vary slightly across the regions, entrepreneurs and firms can receive tax rebates and reduce administrative requirements. Discussions are ongoing in some of the regions to expand the relief measures to also include support wage costs and leasing of assets, and to expand the sectors covered.

copy the linklink copied!Recent policy developments

New amendments to the Micro-enterprise Tax Law came into force on 1 January 2017. The respective amendments reduce the tax rate to 12% for enterprises with turnover less than EUR 7 000 per year and to 15% for enterprises with turnover between EUR 7 001 to EUR 100 000. This regime also reduces the mandatory State Social Insurance payments. This reduced tax burden is expected to provide an incentive for business creation and improve the conditions for very small businesses.

This profile is based on a recent country assessment report, which can be found at: www.oecd.org/cfe/leed/inclusive-entrepreneurship.htm.

Metadata, Legal and Rights

https://doi.org/10.1787/3ed84801-en

© OECD/European Union 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.