7. Decarbonisation support: a comparison with Germany

This chapter reviews policy instruments aimed at reducing greenhouse gas emissions in German industry and compares the German and Dutch policy landscapes. The German policy mix focuses strongly on energy efficiency and on recycling. Compared with the Netherlands, the German government is more reluctant to develop biomass and CCS. Germany’s innovation funding policies strongly focus on fundamental research and CAPEX support, while the Netherlands provide greater support to demonstration projects and deployment. As a consequence, high operational costs are still a major barrier for large-scale investments in Germany.

This chapter reviews policy instruments aimed at reducing greenhouse gas emissions in German industry and compares the German and Dutch policy landscapes. It offers fact sheets of relevant policies, an assessment of the policy mix and a comparison with the Netherlands. Emphasis is placed on the carbon intensive industry sectors in Germany, with a particular focus on policies supporting technology innovation and diffusion in the following fields: hydrogen (including blue and green hydrogen), electrification of industrial heat (and the corresponding development of renewable energy to attain zero net emissions), carbon capture and storage (CCS), bio-based materials, recycling of materials (notably metals and plastics).

The fact sheets below review decarbonisation policies geared towards the industry sector. Other related and cross-cutting policies and targets upon which the industrial transition also depends indirectly are discussed in the next section. Examples are support regimes for renewable energies to decarbonise electricity supply, the building of necessary infrastructure like a hydrogen transport network or the availability of green hydrogen.

The 27 policies reviewed in this chapter are listed below:

National and sectoral greenhouse gas (GHG) reduction targets

Technology development, demonstration and market introduction programmes aimed at industry decarbonisation

18. Federal support for energy efficiency in the economy - grant and loan

20. The Kreditanstalt für Wiederaufbau (KfW) Energy Efficiency Programme: Low-interest loans for energy efficiency projects

22. Federal funding for energy efficiency in the economy - funding competition

24. Energy audit obligation for large companies (implementation of Article 8 EU Energy Efficiency Directive)

25. Minimum energy performance standards – EU Ecodesign Directive

7.1.1. Targets

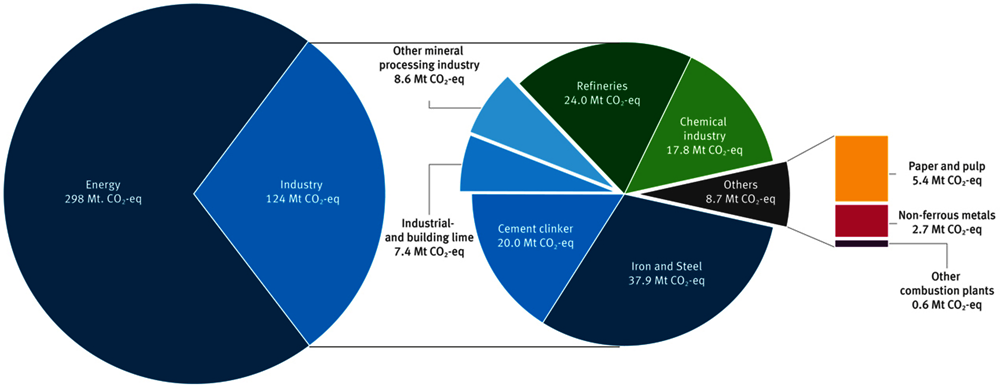

The Climate Action Plan 2050,1 adopted by the German Government in November 2016 affirms the target of the Paris Agreement to achieve CO2-neutrality by mid-century, contains concrete actions to achieve the target and defines milestones for the year 2030 at a sectoral level. For the industry sector it sets a target of 49-51% GHG reduction compared to 1990. To achieve the sectoral target, substantial efforts on mitigation technologies are needed including large-scale investments in decarbonisation technologies, as presented in Figure 7.1. The targets were further strengthened through the climate protection law, which went into force in December 2019. It defines a (linear) path for emission reduction in all sectors towards the 2030 milestone and requires additional policy action, if the monitored emissions fall short of the minimum path in a certain year.

7.1.3. Technology development, demonstration and market introduction programmes aiming at industry decarbonisation

7.1.6. Energy efficiency

In the following, measures addressing energy efficiency improvement are briefly summarised to provide a complete overview. While some of the programmes also address topics beyond energy efficiency like renewable energies or material efficiency, the main focus of these programmes is clearly on energy efficiency.

18) Federal support for energy efficiency in the economy (grant and loan)

The programme represents a reorganisation of a number of previously individual support programmes. The programmes for the promotion of highly efficient cross-sectional technologies (e.g. electric motors), the Waste Heat Directive, the promotion of energy-efficient and climate-friendly production processes, the promotion of energy management systems and the promotion of renewable process heat in the Market Incentive Programme expired in December 2018 at the latest. They were relaunched as a joint promotion package with adapted promotion conditions and rates of support in January 2019. The programmes were bundled in the form of four modules and their application procedures were aligned. The aim of the restructuring is to offer an integrated energy efficiency support package for the industry, to reduce obstacles in the application process and to eliminate overlaps between programmes.

In the new funding programme "Federal funding for energy efficiency in the economy", funding is possible in four selectable and combinable modules:

Module 1: Cross-cutting technologies (e.g. electric motors, pumps, fans)

Module 3: Reflective surfaces, sensor technology and energy management software

Module 4: Energy-related optimisation of plants and processes.

The extent to which technologies and measures to increase material efficiency in Modules 1, 3 and 4 can also be promoted more intensively is being examined, provided that they demonstrably support the achievement of the relevant funding objectives. These activities also relate to the German Resource Efficiency Programme III (promoting material and energy-efficient production processes).

It is expected that the EUR 300 million budget for the programme set for 2020 will also apply to subsequent years.

19) Energy audits in SMEs

Small and medium-sized enterprises (SMEs) are offered the support of qualified energy consulting within the framework of the BMWi programme "Energy Consulting for SMEs" (Directive on the Promotion of Energy Consulting for SMEs of 11.10.2017, BAnz AT 07.11.2017 B1, [EBM)]). Qualified energy consultants identify potentials for energy saving and make concrete proposals for energy-efficiency measures for the respective company. The proposed measures can be used, for example, to create concepts for waste heat utilisation. The directive complies with the EU requirements for energy audits according to the EU Energy Efficiency Directive (2012/27/EU). The programme is administered by the Federal Office of Economics and Export Control (BAFA). The maximum funding amount per audit is EUR 6 000.

Identified energy-efficiency measures should also include material efficiency with the aim of saving energy in industrial processes. Corresponding training courses for auditors to identify material and resource efficiency measures are recognised. These activities also serve the implementation of measure 29 of the German Resource Efficiency Programme III, which aims, among other things, to improve the co-ordination of the content and structure of consulting services on material and energy efficiency and to avoid duplication of consulting services.

20) KfW Energy Efficiency Programme: Low-interest loans for energy efficiency projects

With the KfW Energy Efficiency Programme, the KfW grants low-interest loans to commercial enterprises for the implementation of energy efficiency measures. The programme promotes energy-efficient production facilities/processes including cross-sectional technologies with a relatively highest energy-saving potential. As the programme was further developed, both a new entry-level standard (10% savings) and a new premium standard (30% savings) were introduced. Thus, the funding intensity is aligned to the amount of energy savings, regardless of the size of the company. Projects with premium standard receive particularly favourable conditions. The improved funding conditions became effective in July 2015. By 2019, 219 commitments were made with a funding volume of EUR 974 million. The programme is financed from KfW's own funds.

21) Pilotprogramm "Einsparzähler" (Savings meter)

The pilot programme "Einsparzähler" aims to foster innovations in digitalisation to improve energy efficiency. Funding is available to companies that want to test and demonstrate innovative digital systems and related business models. The companies will receive funding of up to EUR 2 million. Within the pilot projects, energy consumption data must be metered precisely and assigned to individual devices or systems (groups). The current funding announcement "Pilotprogramm Einsparmeter" of the BMWi is dated 18 February 2019 (BAnz AT 21.02.2019). It is limited until 31 December 2022 and replaces the funding announcement "Pilotprogramme Einsparzähler" of 20 May 2016. BAFA is the granting authority. The pilot projects to date have achieved energy savings in the private household, commercial, trade, services, industry and transport sectors.

22) Federal funding for energy efficiency in the economy - funding competition

The programme promotes the implementation of energy efficiency projects in companies in a competitive process that is open to all actors, sectors and technologies with the objective to finance projects with the best cost/use-efficiency. The programme supports investment measures to optimise the energy efficiency of industrial and commercial plants and processes that contribute to increasing energy efficiency or reducing fossil energy consumption in companies, including measures for the provision of process heat from renewable energies and energy audits. This programme is a further development of the "Promotion of electricity savings within the framework of competitive tenders" programme introduced in 2016 with a budget of EUR 35 million for 2020.

23) Energy efficiency networks for businesses

Energy Efficiency Networks (EEN) are networks of companies that set common energy efficiency and CO2 reduction targets and want to learn from each other. After a successful pilot phase of the EEN concept, the German government has decided in 2014 to implement EEN as a main pillar of the National Energy Efficiency Action Plan. Up to 500 new networks should be established by 2020. For this purpose, a voluntary agreement "Initiative Energy Efficiency Networks" on the introduction of EEN was signed in 2014 between the Federal Government (BMWi and BMU) and 22 business associations and organisations.. Based on the agreement extended in September 2020, 300-350 additional networks are to be created by 2025.

Companies participating in networks need to conduct an energy audit at company level and set a savings target at network level based on individual company targets. The networks are supported by a qualified energy consultant. The implemented measures are recorded in the context of an annual monitoring. As of 10 September 2020, 282 networks were established.

24) Energy audit obligation for large companies (implementation of Article 8 EU Energy Efficiency Directive)

"Large" companies are obliged to conduct energy audits as required by Article 8, Paragraph 4-7 of the EU Energy Efficiency Directive (2012/27/EU; EED). The energy audits should be carried out by qualified and/or accredited experts. The directive requires that the first energy audit be conducted by 5 December 2015 at the latest. In order to implement these requirements, the Energy Services Act (EDL-G) has been amended accordingly with effect from 22 April 2015. According to this, large companies (non-SMEs, i.e. companies that do not fall under the European Commission's definition of SMEs [<250 employees or turnover <EUR 50 million or annual balance sheet total < EUR 43 million]) are obliged to have carried out an energy audit according to DIN EN 16247-1 by 5 December 2015 and thereafter a further audit at least every four years. Companies that have an energy management system certified according to DIN EN ISO 50001 or an EMAS environmental management system are exempt from the obligation to conduct energy audits.

As part of the amendment in 2019, a threshold of 500 MWh total energy consumption was introduced. Below this threshold, a simplified energy audit can be carried out through a declaration of energy consumption and energy costs to the BAFA.

25) Minimum energy performance standards – EU Ecodesign Directive

All energy-related products are potentially covered by the EU Ecodesign Directive (2009/125), which sets general and specific requirements for 27 product groups, some of which are relevant for the industry (e.g. electric motors, industrial fans and ventilation units, water pumps or professional refrigerating appliances). Compliance is monitored through both physical and documentary checks as products are placed on the market.

Looking forward, the EU Ecodesign Directive includes opt-in material-related requirements regarding reparability, durability and recyclability but these have not been implemented to any significant extent.

This section discusses the effectiveness of the overall policy mix to induce the low-carbon transition in the heavy industry in Germany, with a particular focus on the following technologies:

7.2.1. Decarbonisation technology developments

In recent years, the German policy mix has been extended by several instruments aiming at the development and large-scale market introduction of decarbonisation technologies in heavy industries. Five instruments can be particularly mentioned in this category (numbers refer to the list in the previous section and are used for the analysis):

6) Programme CO2 Avoidance and Use in Basic Industries: Under preparation (effective 2 January 2021)

8) National Hydrogen Strategy: IPCEI "Hydrogen for industrial production"

9) EU ETS Innovation Fund: further development of the NER300 programme.

While all instruments aim at decarbonisation of heavy industry, they differ substantially in technology focus (Table 7.2). The EU Innovation Fund shows the broadest technology coverage and even includes switch to new low-carbon products. While the Decarbonisation Programme was first planned to only address process-related emissions, it was finally published with a broader technology scope. However, downstream activities like material efficiency or recycling are out of scope. The Programme for CO2 avoidance was still under preparation and not finally published as of January 2021. It is currently intended to address CCS/CCU as well as transport technologies. The IPCEI for hydrogen and the CCfD Pilot both aim at building large-scale industrial installations using hydrogen (green or blue) to replace fossil fuels. Overall, the programmes show a relatively complete technology coverage for the major decarbonisation options: hydrogen, electrification and CCS/CCU.

The three programmes CO2 Avoidance and Use, Hydrogen CCfDs and IPCEI for Hydrogen mainly target large-scale industrial plants, while the Decarbonisation Programme and the EU Innovation Fund are also open for smaller demonstration projects.

The potential impact of these programmes can be estimated based on the available budget. This is summarised in Table 7.3 for the time horizon foreseen in the programmes' current planning. However, it is likely that the programmes continue beyond the currently planned time horizon, which will substantially increase the total budgets available until 2030.

The total budget of the programmes sums up to about EUR 5 billion, cumulated over the respective planned time horizon of the individual programmes, which ends between 2025 and 2030. The first programmes started to accept applications in 2020 (EU Innovation Fund and Decarbonisation Programme). However, it is likely that most of the programmes will run longer than today's budget planning indicates. More specifically, a continuation of the programmes on the currently planned level towards 2030 would increase the total cumulated budget to EUR 12 billion.

From the total budget of about EUR 5 billion, about EUR 4 billion are directed exclusively towards CAPEX funding, EUR 550 million address OPEX (CCfDs) and EUR 800 million are more flexible (EU Innovation Fund). The total CAPEX funding seems a relevant amount, when compared to costs of industrial scale projects like a new DRI steel plant (EUR 0,4 billion invested for DRI+Electric Arc Furnace (EAF) plant of 1 Mt/y of crude steel production), a cement clinker kiln equipped with carbon capture (EUR 0.15 billion invested for 1 Mt/y clinker production). Thus, the estimated budgets are sufficient to support financing of several industrial-scale installations.

However, while the CAPEX funding seems substantial, the available funding for OPEX seems rather insufficient to close the gap between the traditional fossil-based processes and low-carbon production processes. Operational costs of low-carbon production processes can outweigh capital expenditures in these technologies within a few years, especially at low or exempted carbon prices, compromising the business case for low-carbon installations. In particular, hydrogen-based technologies show very high OPEX costs compared to fossil fuel alternatives. Assuming an emission quota price increase of about EUR 30 on average and hydrogen costs of EUR 150 per MWh, the OPEX cost gap is often several times higher than CAPEX costs for technologies like DRI steelmaking or the use of hydrogen for methanol/ethylene production. On the other side, assuming electricity costs of EUR 40 per MWh (today's tariff for very large electricity consumers) direct electrification options like electric glass melting might become cost-competitive without additional OPEX funding. CCS also requires comparably little OPEX funding.

In summary, the recent introduction of specific programmes aimed at the development and industrial upscaling of key technology solutions for industry decarbonisation can be regarded as central milestones in establishing a policy mix for the transformation of the German industry sector towards GHG neutrality. The foreseen overall budgets are relevant and the technology scope covers the most important options. However, with the current regulatory frame (energy prices, hydrogen production costs and EU ETS), the budgets are most likely not sufficient to close the OPEX gap and make hydrogen-based technologies cost-competitive with today’s fossil fuel-based technologies. Approaches to close this gap can include an ambitious minimum price path in the EU-ETS, higher budgets for CCfDs - if the instrument is working - or a supply-side approach that makes (green) hydrogen available at lower prices to industrial consumers. In addition, the creation of lead markets could generate higher product prices.

7.2.2. Material efficiency and circular economy

The relevance of material efficiency and the circular economy for achieving national and EU climate goals is well established.9 In this context, increasing material efficiency is considered desirable to trigger the decarbonisation of the German industrial sector, although the implementation of material-based strategies does not necessarily mean a reduction in emissions due to, e.g. higher energy demand. Consequently, these strategies and the related policies need further assessment and evaluation against adequate targets, which lies beyond the scope of this report.

The German policy mix addressing material efficiency and circular economy is framed by the German Resource Efficiency Programme ProgRess III and comprises legislative as well as financing instruments. The implemented legislation in Germany is mostly a one-to-one implementation of the EU Waste Framework Directive and hence, the EU Circular Economy Action Plan. On a few aspects, the national legislation goes beyond the EU requirements. The financing instruments, with a total budget of EUR 490 million from 2018 to 2024, are mostly focussed on the funding of R&D projects in construction and plastics. An exception is the r+Impuls funding guideline, which helps bring technologies to the market. Similar for decarbonisation technology support, the funding of CAPEX is more common during the implementation phase. In general, the effectiveness of these policies is questionable since the aim of the German Resource Efficiency Programme Progress II of doubling the resource productivity from 1994 to 2020 is expected to be missed. Nevertheless, recycling quotas defined by the relevant legislation have been achieved.

The Circular Economy Act defines recycling as the recovery of waste for the original or other purposes excluding energetic recovery, which therefore includes the preparation for recycling and the storage of waste. The calculation of recycling rates is obtained from an input-based method, which consists of comparing the input of the recycling processes with the total quantity of waste. In practice, the input that is actually recycled varies widely from 10% to 90%. In particular, incorrect sorting leads to the energetic recovery and disposal of the remaining quantities. The relevant waste types and the associated recycling rates are shown in Figure 7.3. While packaging stands out due to a high and increasing recycling rate, the rate for other waste has been decreasing since 2010.

The much-discussed plastic waste recycling rate is about 47% in 2017 and 2019.10 Even though this information is used frequently, e.g. by the Parliament, the Environment Agency or the plastic packaging industry association,11 its accuracy is questioned because the input-based calculation method does not consider losses during recycling. Additionally, exported waste is considered to be recycled even though the actual implementation is not tracked.12 To overcome these challenges the recycled share of plastic processing is proposed as an indicator. This key figure compares plastic products from recycling with the total amount of processed plastics in Germany. Consequently, exported recycled plastics and quality losses during recycling are not considered. In Germany, recycled plastics are typically used in the construction sector, in agriculture and for the production of packaging. In 2017 the recycling share was about 12% and in 2019 about 14%. Historical data are not available for comparison.13

A similar approach calculating the share of secondary pre-materials is used for aluminium, copper and steel recycling as shown in Figure 7.4. The shares of secondary aluminium, copper and steel scrap are more or less constant over time. The highest share of recycled material is used for aluminium production.

The challenges of the input-based calculation method of recycling rates have been considered in the amendment of the EU Waste Framework Directive in 2018.14 The new rules require an output-based calculation method, so that the output of the recycling plants is accounted for in the calculation. Hence the losses are taken into account. The required recycling quotas were lowered accordingly in the Circular Economy Act. Due to the newly introduced output-based calculation method the recycling rates shown in the preceding sections cannot be compared with the recycling quotas directly. A transfer of input-based recycling rates for residential waste in 2015 has shown, however, that the output-based recycling rates are significantly lower (input-based recycling rate for residential waste in 2015: 67%; output-based recycling rate for residential waste in 2015: 36-40%). In practice, a share depending on the specific waste type of the input material is used for energetic recovery.15 Compared to the current legislation the quotas would consequently not be fulfilled. Nevertheless, the actual recycling rates for the relevant time period are not yet available. Hence, an assessment of the effectiveness of the policy mix from this perspective is currently not possible.

Recent Faunhofer-ISI work evaluates the ability of the policy mix to facilitate the circular economy innovation system in Germany (Gandenberger, 2021[1]). The conclusion is that ProgRess III does not enable the transformation from a linear to a circular economy for two reasons: non-existent markets for secondary products and insufficient financial resources for innovations. Therefore, ProgRess III would not achieve its objectives as framing for the circular economy. Recent amendments to the legislative framework and especially the Packaging Act, as well as further emerging technologies and innovations, are not considered in this evaluation. Two major approaches in this context are the chemical recycling of plastics and the transformation to a bioeconomy. In 2020 the National Bioeconomy Strategy was published by the German Government. The strategy includes general objectives and action fields focussing on the potential assessment and (inter-)national collaboration. The use of biogenic materials in industry is also mentioned, but limited by land availability.16 The topic was additionally mentioned in ProgRess III, part of FONA4 and to a smaller extent considered in funding guidelines. Nevertheless, the topic is less present in the societal and political discourse about industry decarbonisation - in contrast to chemical recycling of plastics.

The 2018 European Strategy for Plastics discusses chemical recycling as a promising option for the recycling of plastic waste. Chemical recycling summarises different technology options for the depolymerisation of plastic as preparation for recovery.17 In accordance with the EU Waste Framework Directive and the national Circular Economy Act, chemical recycling contributes to the recycling quota achievement. In contrast, according to the German Packaging Act, chemical recycling is classified as recovery and not as recycling - just like the energetic recovery. Consequently, it can contribute to the recovery quota defined in the Packaging Act (90%) but not to the recycling quota (65%). Chemical recycling can thus substitute energetic use prospectively.

The Federal Ministry for the Environment, Nature Conservation and Nuclear Safety currently supports this legislative design. On the one hand, chemical recycling is perceived less ecologically reasonable due the high process energy demands. On the other hand, the incentives induced by the Packaging Act shall be ensured and risks avoided for extended sorting and recycling capacities. Thus chemical recycling is assessed exclusively as an alternative to the energetic recovery of contaminated plastic waste if economically and ecologically feasible.18 A comparable position is taken by the Federal Environment Agency. However, it emphasises the need for further research to assess economic and ecologic advantages of chemical recycling.19 Especially the liberal opposition party is challenging the position of the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety and thereby the Federal Government against the backdrop of the intensification of the recycling quotas and technology openness.20

While environmental organisations such as the Nature and Biodiversity Conservation Union and Greenpeace support the current position of the Federal Government,21 the national and the European chemical industry associations are pointing to barriers for technology development.22 The legislative demands of the environmental organisations include the delimitation of chemical recycling to processes which again produce plastic and the inclusion of chemical recycling in the waste hierarchy between recycling and energetic recovery. On the contrary, the industry associations demand the full classification of chemical recycling as recycling. The development of this discourse will have an influence on the decarbonisation of the industry - even if the direction has not yet been determined.

In a nutshell, the German policy mix in the field of material efficiency and circular economy does not currently seem to have a strong impact on industry decarbonisation. In the evaluation of the innovation system for circular economy, Gandenberger (2021[1]) proposes dynamic standards for the use of secondary materials to create markets as well as product design standards enabling repair and recycling. He underlines the importance of accompanying measures to establish new business models.23 Similar aspects have also been identified at the international level (IRP, 2020[2]). Particularly, steel and cement but also plastics, paper, glass and metals are relevant and should be targeted directly.24 Technologies such as chemical recycling of plastics but also an increased share of secondary steel as well as an increased cement/concrete recycling are key solutions for the decarbonisation of the industry. Downgrading of materials should be avoided widely. Also the use of alternative or bio-based materials in the construction sector can have a significant impact. Additionally, an overall policy strategy focussing on decarbonisation via material efficiency and circular economy would benefit from co-ordinating the efforts on the national and the EU levels.

7.2.3. Overall assessment

An overall assessment of the policy mix and possible ways forward to make it more effective for decarbonisation are laid out below. Table 7.4 offers an overview of all policies in scope and their respective technology focus.

Traditionally, the policy mix to decarbonise the industry sector in Germany focused strongly on energy efficiency support policies like audit schemes or grants of efficiency improvement projects. These mostly addressed SMEs and lighter industries. A second major traditional pillar of the policy mix are regulations for recycling and the sorted collection of consumer waste. This resulted in high recycling rates for products like paper or glass. The main policy addressing decarbonisation in the heavy industry was for a long-time the EU ETS. Energy taxes and the EEG-levy are relevant mainly for small companies, while large energy consumers receive large tax exemptions.

GHG reduction targets have also evolved over the past decade. The Climate Action Plan 2050,25 adopted by the German Government in November 2016 sets out concrete actions to achieve the target of the Paris Agreement to achieve CO2-neutrality by mid-century and defines milestones for the year 2030 at the sectoral level. For the industry sector it sets a target of 49-51% GHG reduction compared to 1990. To achieve the sectoral target, substantial efforts on mitigation technologies are needed, including large-scale investments in decarbonisation technologies. The targets were further strengthened through the climate protection law, which went into force in December 2019. It defines a (linear) path for emission reduction in all sector towards the 2030 milestone and requires additional policy action, if the monitored emissions fall short of the minimum path in a certain year. Overall, the sectoral target and the clear commitment to GHG neutrality by 2050 have facilitated activities to decarbonise industry from private, but also public actors, as it becomes obvious that the industry sector also needs to reduce emissions drastically to achieve the overall reduction target.

Two important milestones for the industrial transition were the publication of the Hydrogen Strategy (June 2020) and the Climate Action Programme 203026 (October 2019). Among others, they initiate several major technology development programmes (see policy fact sheets) providing investment support for the industrial-scale market-introduction of decarbonisation technologies in heavy industry sectors.

Despite this recent amendment, the policy mix is in several aspects not sufficient to put the industrial transition on track towards decarbonisation by 2050. These mainly relate to the fact that it does not provide a clear and robust perspective for the competitive operation of large-scale low-carbon plants in the medium term (towards 2025/2030). Here, policy initiatives could address the following issues:

Technology development programmes currently focus on CAPEX support and lack OPEX support, which is particularly important for hydrogen-based technologies in the short and medium term. Expanding the pilot CCfD programme - if successful - can be a way forward. Alternatively, the supply of hydrogen at lower costs could also reduce this OPEX gap.

Lead markets for green products that allow for a price-premium on products made from CO2-neutral basic materials, like a car made from CO2-neutral steel or a building from CO2-neutral concrete, do not exist. Among others, public procurement could close this gap and induce niche markets.

The EUA price in the ETS is too low to make key decarbonisation technologies like hydrogen, electrification or CCU/CCS cost-competitive and lacks a clear perspective that allows considering increasing CO2-prices in cost-benefit assessments for new investments. A minimum CO2-price path could solve both issues and provide a clear perspective for low-carbon investments towards cost-competitiveness.

Furthermore, the huge amounts of CO2-neutral energy carriers required to operate CO2-neutral industrial-scale plants (electricity, hydrogen, green gas) are not yet available. Even more, there is still a huge uncertainty by when and if such energy carriers will be sufficiently provided at a competitive price. For companies to make investments worth of several hundred million euros, the supply of such critical energy carriers needs to be ensured. This also includes the local availability of e.g. hydrogen and the needed infrastructure for generation/import and transport. For instance, investors in large-scale DRI-steel plants need to know if there will be access to a hydrogen network at a certain date in the future and if hydrogen is a strategic part of Germany's industry decarbonisation strategy. Thus, the industry policy mix also links to infrastructure planning.

In some sectors, process emissions cannot be mitigated by switching energy carriers or process routes. Cement and limestone production are the most prominent and relevant examples. Deep decarbonisation of these sectors most likely requires CCS or CCU. While the Programme for CO2 Avoidance and Use in Basic Industries is currently being implemented, there is still a huge uncertainty for investors due to the public opposition towards CO2 storage in Germany. Although this opposition was initially directed towards CCS for coal-fired power plants, it is not evident that the public opinion can distinguish CCS for process-related emissions. For CCU, a major challenge will be to find uses with a long-term storage - substantial R&D is still needed.

Another area where the current policy mix needs amendment to come on track towards industry decarbonisation is the entire field of material efficiency and circular economy along the industrial value chains down to the end-user sectors. CO2-prices are not included in the prices of most end-consumer products. Consequently, CO2 is not factored into investment decisions when for example materials are used to construct buildings or cars.

Circular Economy policies still show a rather traditional focus on the collection and recycling of waste. While some improvements were made (e.g. including stricter regulations on commercial waste), particularly materials with a very high emission intensity still show very low shares of secondary production routes. Circular economy policies can more effectively contribute to decarbonisation if amended in the following directions:

Stronger focus on circularity of plastics products in order to close carbon cycles by including chemical recycling and avoid downgrading.

Further replacing primary steel production by secondary production is a very effective decarbonisation measure, but would require improved collection of steel scrap and also use secondary steel for high-quality products, e.g. in the automobile industry.

Development and use of alternative materials to decarbonise the construction sector and especially concrete production.

These goals require the creating of markets for recycled products and implementation of uniform product standards on the national and the European level.

7.3.1. Overall

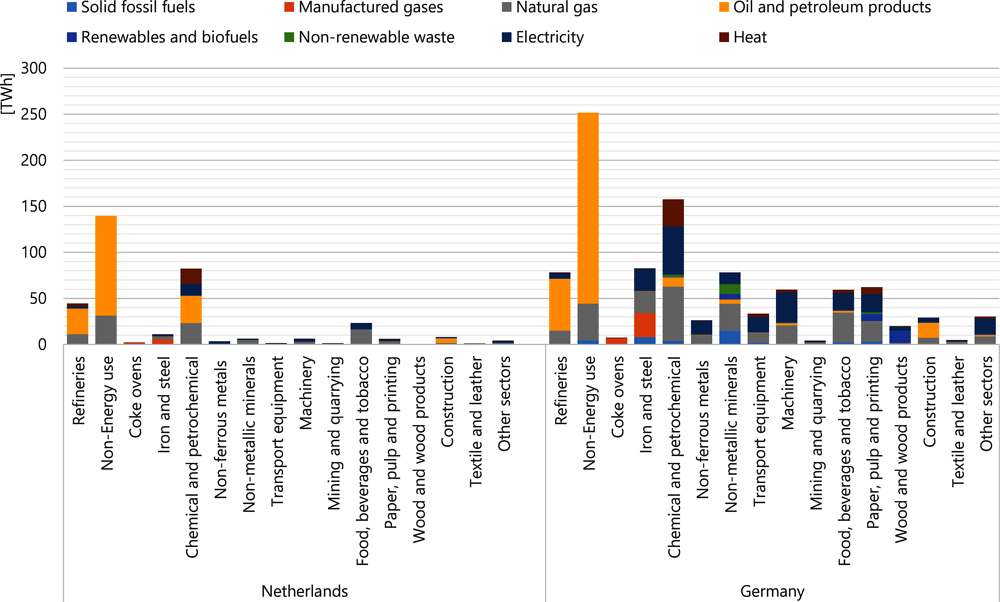

Major differences are explained by structural differences in the industrial production between the two countries. Energy consumption by industrial sector is a useful indicator to illustrate such structural differences. Figure 7.5 compares the industrial energy demand of Germany with the Netherlands by 2019. The high relative importance of refineries and the chemical industry including feedstock use of energy carriers in the Netherlands stands out. While in Germany, the chemical and refineries industries are also important, energy demand is more equally spread across many sectors. The steel and cement production are highly important in Germany and disproportionately contribute to emissions due to their use of CO2-intensive energy carriers and process-related emissions. SME-dominated sectors like transport equipment, machinery, food, paper and others show a high contribution to the overall energy demand in Germany.

Major differences in the policy mix between the Netherlands and Germany include:

Sectoral focus

The chemicals and refineries sectors play an important role in the Netherlands, which explains the important role of hydrogen and bio-based materials.

The German policy mix has a broader sectoral focus and relies less on bio-based materials. It reflects a high importance of the primary steel production as a major expected buyer of green hydrogen. Further SMEs are particularly addressed by several energy-efficiency policies, reflecting the strong SME basis in the German industry.

Infrastructure

The built-up of hydrogen infrastructure is a central requirement for the large-scale roll-out of hydrogen based processes. Here, the current approach taken by Germany is mainly to finance hydrogen infrastructure on project basis (e.g. via IPCEIs). Currently, a strong public role in co-ordinating, planning and operating such infrastructure cannot be observed.

CCS

In Germany, CCS (for power plants) has experienced strong public opposition and storage of CO2 is even forbidden in several states. Still, the Government realises the need for CCS (or CCU) to decarbonise the large cement industry. Accordingly, an innovation funding programme with a total budget of about EUR 500 million (cumulated until 2025) for CCS and CCU is currently being prepared to support large-scale demonstration projects.

Hydrogen-based solutions: OPEX competitiveness gap

In Germany, innovation funding policies strongly focus on CAPEX support and high operational costs are still a major barrier for large-scale investments. However, as part of the Hydrogen Strategy, a pilot programme for Carbon Contracts for Difference addressing green hydrogen use has been implemented. The foreseen budget, however, would need to be extended significantly if the entire industry should benefit.

Biomass and bio-based materials

While the German Industry Association sees a very large role in biomass as a relatively low-cost energy carrier to decarbonise industrial process heating, the Government is more reluctant and the Ministry for the Environment even rather opposes the expansion of biomass use for process heating and other uses. Main arguments are low-costs and CO2-neutrality on the one hand and on the other, scarcity and competition of biomass potentially needed in many sectors.

7.3.2. Material efficiency and circular economy

The differences and commonalities between the national decarbonisation policies of Germany and the Netherlands can also be identified for specific policy areas such as material efficiency and circular economy. In general, both countries are relying on the given EU framework for product standards. Similar to the Netherlands, Germany has implemented rules for sustainable public procurement by establishing an obligation to give preference to sustainable products. In contrast to these similar legislative instruments and hence similar weaknesses of the policy mix, the financing instruments vary to some extent. In the Netherlands, support is mostly provided via broader policy tools addressing multiple areas as shown in Table 7.5. Consequently, the three major aspects of the policy mix for the industry decarbonisation in the Netherlands identified in this report also apply to the policy tools relevant in the field of material efficiency and circular economy.

Firstly, the financial instruments at the national level in the Netherlands are focussing on demonstration projects rather than on fundamental research. In contrast, the policies in Germany have a stronger focus on R&D projects and fundamental research. Secondly, within R&D the policy tools in the Netherlands - and also in Germany, the policy instruments are mainly untargeted and thereby potentially ineffective on the deployment of radically new technologies. The third aspect considers the large number of R&D policy tools in the Netherlands, with little individual funding potentially leading to a high administrative burden but also a tailored funding. In contrast, the German policy tools comprise larger budgets and hence a lower administrative burden.

Besides these general aspects, the policy mix for circular economy and material efficiency are characterised by more specific differences and commonalities. The application of financial instruments in this field in Germany is usually implemented as subsidies while the Netherlands also includes tax allowances and subsidised loans for a more diverse policy design (Table 7.5). Also the target areas of the financial instruments vary. Even though both countries usually do not implement technology specific tools, the funding programmes in Germany are typically sector specific (construction or plastics). Besides the broader policy tools in the Netherlands without sector focus, the Circular economy Implementation Programme presented in 2019 addressed five sectors in particular (biomass and food, plastics, manufacturing industry, construction and consumer good). Both countries provide measures targeting larger companies, SMEs and knowledge institutions, whereas the Germany policy mix for material efficiency and circular economy focuses more intensely on partnerships between knowledge institutions and companies.

The two emerging technologies described above – chemical recycling and bioeconomy – are promoted more specifically in the Netherlands than in Germany. Especially the bioeconomy is of high relevance for the refinery and the chemical sector in the Netherlands. For the same structural reason, chemical recycling of plastics is also part of the Dutch policy mix. A roadmap for the implementation of chemical recycling of plastics has been established in the Netherlands. Based on a comparable legislative policy mix, it seems that the Dutch financing policy mix enables more targeted actions in the field of material efficiency and circular economy. Nevertheless, both countries lack specific product design standards.

References

[1] Gandenberger, C. (2021), “Innovationen für die Circular Economy - Aktueller Stand und Perspektiven: Ein Beitrag zur Weiterentwicklung der deutschen Umweltinnovationspolitik”, Umwelt, Innovation, Beschaftigung, No. 2021/01, Fraunhofer-ISI, Karlsruhe.

[2] IRP (2020), Resource Efficiency and Climate Change: Material Efficiency Strategies for a Low-Carbon Future. A Report of the International Resource Panel., United Nations Environment Programme, Nairobi, https://doi.org/10.5281/zenodo.3542681.

Notes

← 1. Climate Action Plan 2050 – Principles and goals of the German government's climate policy (bmu.de).

← 2. https://www.umweltbundesamt.de/publikationen/effiziente-ausgestaltung-der-integration and http://publica.fraunhofer.de/dokumente/N-599450.html.

← 3. https://www.bundesanzeiger.de/pub/publication/sPdNMCSoJMQCRSvn4qr/content/sPdNMCSoJMQCRSvn4qr/BAnz%20AT%2015.01.2021%20B5.pdf?inline.

← 4. https://www.bmu.de/themen/forschung-foerderung/foerderung/foerdermoeglichkeiten/details/31/.

← 5. https://www.klimaschutz-industrie.de/fileadmin/user_upload/KEI_download_pdf/20200709_Hinweisblatt_Foerderprogramm_Foerderfenster.pdf.https://www.klimaschutz-industrie.de/fileadmin/user_upload/KEI_download_pdf/20200709_Hinweisblatt_Foerderprogramm_Foerderfenster.pdf

← 6. https://dipbt.bundestag.de/dip21/btd/19/236/1923624.pdf (2020-01-13).

← 7. https://www.bmwi.de/Redaktion/DE/Downloads/I/ipcei-bekanntmachung-interessenbekundungsverfahren.pdf?__blob=publicationFile&v=16.

← 8. Available at: https://www.bmwi.de/Redaktion/DE/FAQ/IPCEI/faq-ipcei.html (2020-01-13).

← 9. For instance, increasing material efficiency in residential buildings and light duty vehicles constitutes is a key opportunity to achieve the aspirations of the Paris Agreement (IRP, 2020[2]).

← 10. https://www.conversio-gmbh.com/res/Kurzfassung_Stoffstrombild_2017_190918.pdf and https://www.conversio-gmbh.com/res/Kurzfassung_Stoffstrombild_2019.pdf.

← 11. http://dipbt.bundestag.de/doc/btd/19/046/1904634.pdf https://www.umweltbundesamt.de/daten/ressourcen-abfall/verwertung-entsorgung-ausgewaehlter-abfallarten/kunststoffabfaelle#kunststoffe-produktion-verwendung-und-verwertung and https://kunststoffverpackungen.de/wp-content/uploads/2020/11/IK-Jahresbericht-2020-online.pdf.

← 12. https://www.gruene-bundestag.de/themen/umwelt/deutschland-ist-nicht-recyclingweltmeister, https://www.sueddeutsche.de/wirtschaft/plastik-dm-rossmann-recycling-1.4552045 and https://www.nabu.de/umwelt-und-ressourcen/abfall-und-recycling/26205.html.

← 13. https://www.conversio-gmbh.com/res/Kurzfassung_Stoffstrombild_2017_190918.pdf.

← 14. https://www.umweltbundesamt.de/indikator-recycling-von-siedlungsabfaellen#wie-ist-die-entwicklung-zu-bewerten.

← 15. https://www.vivis.de/wp-content/uploads/EaA15/2018_EaA_059-078_Obermeier.

← 16. Nationale Bioökonomiestrategie – Zusammenfassung (bmbf.de).

← 17. Chemisches Recycling von gemischten Kunststoffabfällen als ergänzender Recyclingpfad zur Erhöhung der Recyclingquote | SpringerLink.

← 18. 2020_EaA_065-070_Janz.pdf (vivis.de).

← 19. Chemisches Recycling (umweltbundesamt.de).

← 20. Drucksache 19/20175 (bundestag.de) Drucksache 19/21432 (bundestag.de).

← 21. Chemisches Recycling von Kunststoffen - NABU Das Wegwerf-Prinzip | Greenpeace.

← 22. VCI-Vorlage (bayerische-chemieverbaende.de).

← 23. Innovationen für die Circular Economy - Aktueller Stand und Perspektiven: Ein Beitrag zur Weiterentwicklung der deutschen Umweltinnovationspolitik (umweltbundesamt.de).

← 24. Resource Efficiency and Climate Change | Resource Panel.

← 25. Climate Action Plan 2050 – Principles and goals of the German government's climate policy (bmu.de).

← 26. Klimaschutzprogramm 2030 der Bundesregierung zur Umsetzung des Klimaschutzplans 2050.