Chapter 2. Towards a more prosperous and competitive Hidalgo

In response to the new signs of opportunity for tackling Hidalgo’s economic challenge, the newly elected executive of the state of Hidalgo implemented in 2016 some reforms to reignite Hidalgo’s economy. Most of this chapter analyses the steps taken, their implementation and, where possible, the results that can already be observed. It highlights the lessons and benchmarks that can be learnt from Hidalgo’s experience, and formulates some assessments and recommendations for Hidalgo based on the experiences of other OECD members.

Key findings

-

1. Conditions may be right for the establishment of a more prosperous and competitive Hidalgo. Road infrastructure improvements that facilitated the state’s accessibility together with a surge of modern economic reforms have attracted foreign investments and are opening the way to a potential wave of opportunity for Hidalgo’s economy. However, policy must aim to improve enabling factors to attain a sustained economic growth in the long run.

-

2. Hidalgo is less focused on tradable activities than the national average. The state shows, however, a higher concentration in the manufacturing sector with little prominence of other tradable sectors, such as information activities.

-

3. The foreign direct investment in Hidalgo is more diverse in origin than at the national level. With a lower prominence of United States investment than at the national level, Hidalgo has the opportunity to build a position within a relatively more “global” industrial value chain.

-

4. Hidalgo could further benefit from the consolidation of Mexico within the global value chains (GVC). Its link with the foreign market is mainly driven by intermediate products, rather than final high-value-added products.

-

5. Hidalgo has hence untapped opportunities to increase its transition towards tradable and productive activities in the service sector such as information or logistics. In terms of manufacturing, the state can increase productivity in subsectors with large workforce such as the textile and food industries.

-

6. Hidalgo’s economic development policy is based on a well-thought-out plan that aims to improve the current business environment, promote new local and foreign investment and support innovation in specific strategic sectors.

-

7. The implementation of the state’s economic development plan can better link the competitive advantages with local realities, especially in northern municipalities. As Hidalgo is faced with a highly imbalanced distribution of its economic activity, the economic plan should be implemented with a place-based approach to reduce such a divide.

Enabling factors

-

1. The south part of Hidalgo is well connected through physical infrastructure. However, northern municipalities lack paved roads, rail and port connections. The whole territory lags behind in terms of information and communications technology (ICT) infrastructure. This issue has however been set as a high priority for the new administration.

-

2. The entrepreneurial support policy in Hidalgo lacks a strategic view aligned with the economic plan and that integrates funding mechanisms, soft assistance programmes, incubators and new foreign direct investment (FDI) investments. A strategic view will also strengthen the approach to entrepreneurship policy as an instrument to achieve broader socio-economic goals rather than just a key element for science and technology priorities.

-

3. Basic education in Hidalgo performs well both in coverage and quality. However, there is a mismatch between graduates from higher education and the local labour market, which translates into a lack of highly skilled workforce for local firms. In addition, incentives for strengthening the link between higher education institutions and private firms is deficient, which represent a bottleneck for a more dynamic innovation system.

-

4. Hidalgo is lacking a holistic innovation policy that goes beyond science and technology and sets strategic priorities. The innovation performance of Hidalgo in the national and international context is relatively poor and has not improved over time.

-

5. The new law of public-private partnerships (PPPs) in Hidalgo goes in the right direction to provide a sound legal PPP framework. It can further benefit from establishing a clear strategy to co-ordinate PPP projects across the level of governments.

-

6. Informal business represents the vast majority of the economic entities in Hidalgo (85%), which affects its economic growth through a systematic under-optimisation of local human and business capital. This phenomenon is largely explained by structural problems in the economy, but specific measures targeted to microfirms and in co-ordination with the federal government can contribute to reducing it.

Implementation of policy complementarities

-

1. Hidalgo’s economic strategy aims to mobilise the new strategic sectors and improve the state’s competitiveness by focusing on four main factors: cost, quality, innovation and value creation. However, to address the productivity challenge over time, the economic strategy of the state requires an incremental approach strategy to improve key enabling factors: infrastructure, human capital, business ecosystem, innovation as well as integrated regional policy.

-

2. Hidalgo’s economic strategy aims to promote clusters around the five strategic sectors. The policy approach requires a better integration within the whole-innovation strategy for the state.

-

3. The flagship industries that have been chosen for Hidalgo’s special economic zone (SEZ) depend on the existing industrial base already in place in the area. It should benefit from a clearer strategy to measure outcomes and complement the socio-economic and institutional conditions of the state.

Introduction

The state of Hidalgo has long experienced economic stagnation, although since the 2008-09 international crisis the economy has been gaining strength. Recent changes in the business ecosystem, regulation and investment conditions have given new momentum to the state’s economy.

Over the last decade, Hidalgo had only managed to make some slow gradual improvements in terms of gross domestic product (GDP) per capita. Between 2003 and 2014, GDP per capita grew somewhat above the national average in Hidalgo, slowly closing up the gap with national standards. Notwithstanding this, in 2014, the state of Hidalgo contributed to only 1% of Mexico’s national gross value added (GVA) and generated 1.6% of national employment (INEGI). This is despite the state accounting for 2.2% of the country’s working-age population (2015). Of this GVA, total investments registered that year amounted to 3.6% of the state’s value-added, a participation lower than that observed at the national level of 9.2%. In 2014, gross fixed capital formation, which captures increased (productive) investments in assets and inputs, totalled MXN 1 128 million, 2.06% of the value added generated in Hidalgo, also lower than that registered at the national level of 9.03%.

Despite this scenario, Hidalgo’s current administration has recently managed to consolidate important investment projects in strategic sectors such as the electric automobile industry and food industry. These recent changes have been accompanied by the introduction of a new approach to stimulate the state’s economic development.

In response to the new signs of opportunity for tackling Hidalgo’s economic challenge, the new administration of the state of Hidalgo implemented in 2016 some reforms to reignite Hidalgo’s economy. Most of this chapter analyses the steps taken, their implementation, and where possible, the results that can already be observed. It highlights the lessons and benchmarks that can be learnt from Hidalgo’s experience, and formulates some assessments and recommendations for Hidalgo, based on the experiences of other OECD member countries.

This chapter is organised around three main sections. The first examines the current challenges and opportunities of Hidalgo’s productive system as well as the main economic policies undertaken by the current administration. The second looks at the enabling factors needed to boost productivity over the medium and long term. Finally, the third focuses on governance responses including policies and strategies to support development in the state of Hidalgo.

Hidalgo’s productive system and the new economic strategy

Regional productive fabric

The type of economic structure and its level of diversification can determine the economic outcome of a region. OECD regions that are undergoing a catching-up process in their stages of economic development are characterised by a high level of diversification and greater share of concentration in tradable activities. Tradable activities typically include manufacturing, some service sectors, resource extraction and utilities (OECD, 2016[1]) (see Box 2.1). Tradable sectors are those goods and services that are exported to other regions or countries either as final or intermediate goods. Productivity in tradable activities tends to be larger than non-tradable activities across OECD countries and regions. Therefore, they are key activities for lagging regions such as Hidalgo to develop in order to catch up to its productivity frontier to other regions.

Furthermore, high-productivity in non-tradable activities requires of economies of agglomeration, which are still underdeveloped in Hidalgo (see Chapter 3). It is to no surprise that Hidalgo’s labour productivity in the non-tradable service sector is 2.6 times lower than in the tradable sector (Chapter 1). In this sense, integration into global value chains (GVC) also matter for productivity and sophistication of production (OECD, 2017[2]).

Hidalgo’s economic history is largely characterised by the mining sector. Mining of different metals, including silver and gold in the Pachuca/Real del Monte region, had dominated the state’s economy since the colonial era. Hidalgo’s first important source of post-colonial FDI came in 1824 from British direct investment in the region’s mining sector following Mexico’s War of Independence. This British investment contributed to the introduction to Hidalgo’s mining industry of steam-powered machinery and many different modern technologies for the time (Randall, 1972[3]). Following a significant slowdown in the mining industry that started in the 1950s, which deteriorated Hidalgo’s economy and welfare, efforts were undertaken to shift the state’s economy from mining and agriculture to manufacturing. Of the manufacturing industries that have historically taken hold in Hidalgo, the state’s textile industry has been an important engine of economic development.

Hidalgo has a relatively diversified economic structure. According to the index of specialisation (i.e. measures how specialised the state’s productive structure is with respect to the national average), Hidalgo has a lower level of specialisation (0.31, where 1 means over-representation of sectors) than the average of Mexican states (0.38) (see Chapter 1).

Hidalgo is slightly less concentrated on tradable activities (35.7% of GVA) than the national average (37.7%) (See Table 2.1). Most of the tradable sector in Hidalgo is concentrated in manufacturing activities (58% of tradable activities), followed by non-manufacturing industry (i.e. energy) (17%). Other tradable sectors such as financial services or information have less prominence as a value-added activities in Hidalgo’s economy and present one of the biggest productivity gaps with the national level (see Table 2.1).

Overall, Hidalgo’s economic structure shows a higher share of manufacturing activities (20.6% of GVA) than the national average (16.1%). The largest contributor to manufacturing in the state is the subsector of production and refinery of petroleum (43%), which not only lacks the capacity of job creation (employs 5% of the labour force working in the manufacturing industry) but is concentrated in a small number of companies (8 establishments).

Other relevant subsectors in manufacturing are the textile industry (8% of manufacturing) and the food and beverage (7%). While they add a lower value to the manufacturing sector, they employ most of the labour-working population in the sector (26% and 22% respectively).

-

In terms of textile, Mexico is the sixth supplier of clothing to the United States due in great measure to its proximity, low cost and high-quality suppliers of fibre, textile and clothing. In recent years, Mexico and Hidalgo have been gaining attractiveness to many Asian suppliers of textile due to increasing labour costs in Asia and shortening of textile supply chains. It benefits Hidalgo since the state leads the country in the preparation and spinning of textile fibres and yarn manufacturing, and ranks fourth nationally in the manufacture of fabrics (Álvarez Guevara, 2014[4]). The textile industry has a relatively high number of economic units (over 8 000, mostly small and medium-sized enterprises [SMEs]) and is highly linked with an extensive network of family-based informal sewing workshops. It generates sources of employment, yet not always formal, particularly for people with limited economic resources.

Other sectors of relevance in the state are:

-

The energy sector of Hidalgo is the 5th largest producer of electricity in Mexico with an installed generation capacity of 2 386.60 megawatts (MW). Its geographic location is a competitive advantage due to its proximity to regions characterised by high consumption of energy. As an energy supplier, Hidalgo receives the raw material for its transformation in fuel and mainly delivery the electricity to the centre of the country. It has also an important potential for developing renewable energies, in particular, solar and wind energy.

-

The agriculture, fisheries and forestry sector represented 3.7% of Hidalgo’s GVA in 2015, although employs 18% of Hidalgo’s working population. Most agriculture in Hidalgo (98.8%) is performed by small- or medium-sized farms and productive units. The state is the first producer of barley and alfalfa and it ranks among the top producers of maguey (wild agave) and corn in the country (see Chapter 3 for details concerning agriculture in Hidalgo).

-

The service sector in Hidalgo is mostly concentrated in non-tradable activities (65% of the service sector’s GVA is repairs, food sale, accommodation, healthcare and education). In fact, distributive trade, repairs and food services represent the most important sector in Hidalgo’s economy (25.5% of GVA). As mentioned before, the non-tradable services sector has a particularly low productivity. This ongoing concentration in low productivity services limits the room for added value activities in the state (Chapter 1).

Drivers of growth vary across levels of development. The barriers to growth that regions must overcome vary widely across regions and levels of development. Successful performance, therefore, requires a place-based approach, rather than “one-size-fits-all” economy policy. Several characteristics could be associated with a stronger regional catching-up process. OECD (2016[1]) classified regions with respect to their productivity growth in 3 groups and analysed the growth pattern from 2000 to 2013:

-

Frontier regions (regions with the highest GDP per worker and 10% of national employment).

-

Catching-up regions (regions growing faster than frontier).

-

Diverging regions (regions falling behind).

The study found that several characteristics could be associated with a stronger regional catching-up process. Population density could also determine the capacity of a given region to benefit from the diffusion of technology, in particular in the service sectors. Another element is the level of education of the regional workforce. Research and development expenses should be a factor promoting the adoption of innovations. Finally, the quality of regional and local governments should contribute to the adoption of good policies and investment choices

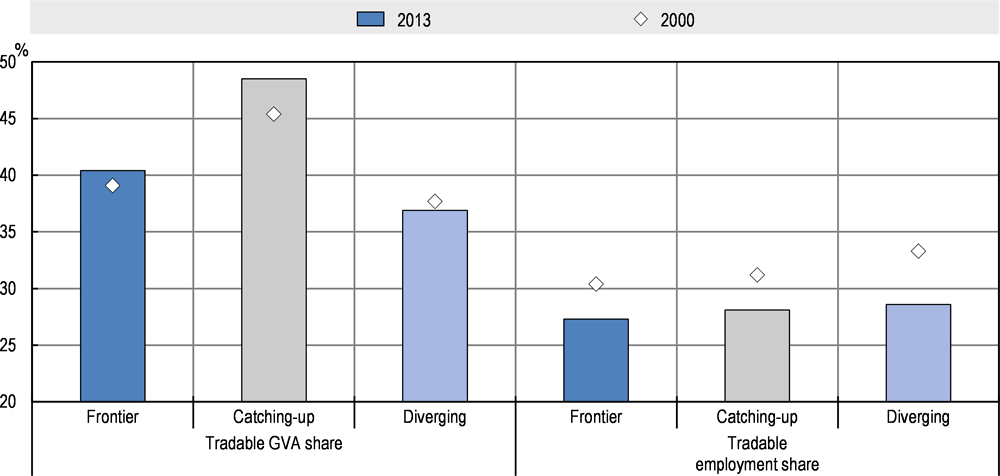

In particular, the tradable share in gross value-added (GVA) is (statistically significantly) higher in catching-up regions (Figure 2.1). The tradable sector allows greater opportunities to catch up through “unconditional convergence”, meaning convergence to the global frontier is less dependent on a country’s particularities or institutional weaknesses. Tradable services and resource extraction are the elements of the tradable sector that account for most of the difference in the catching-up and diverging regions. The contributions to GVA from tradable services and from resource extraction (i.e. mining and drilling) in catching-up regions exceed the contributions in diverging regions, tradable services by about 5 percentage points and resource extraction by even more in 2013.

Overall several characteristics of the tradable sector give rise to its special role for economies. First, it tends to be an innovative and dynamic sector, which adapts to and pushes the technological frontier. Second, manufacturing has traditionally employed not only the highly skilled, but also a large number of medium- and low-skilled workers at relatively high wages, which sets it apart from other high-productivity sectors such as mining or finance. Third, the growth and success of the tradable sector are not limited by the size of the local market, which decouples its growth, to a certain degree, from the rest of the economy (Rodrik, 2016[6]).

Hidalgo’s FDI has surged in recent years and is becoming more diversified

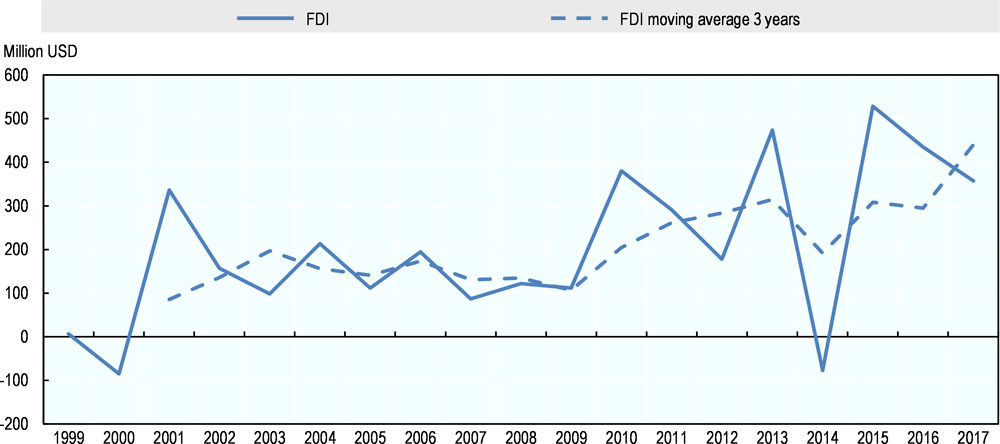

Hidalgo has ranked 25th place out of all the Mexican states in terms of foreign direct investment (FDI) attraction over the last 10 years to 2017 (INEGI). It underlines the historic low capacity of Hidalgo to attract FDI when compared to other Mexican regions. Fluctuations in its annual FDI figures have been high from year to year, responding to exceptionalities in investments (see Chapter 1). Hidalgo’s FDI strategy has traditionally followed a case-by-case approach and often one-off investments.

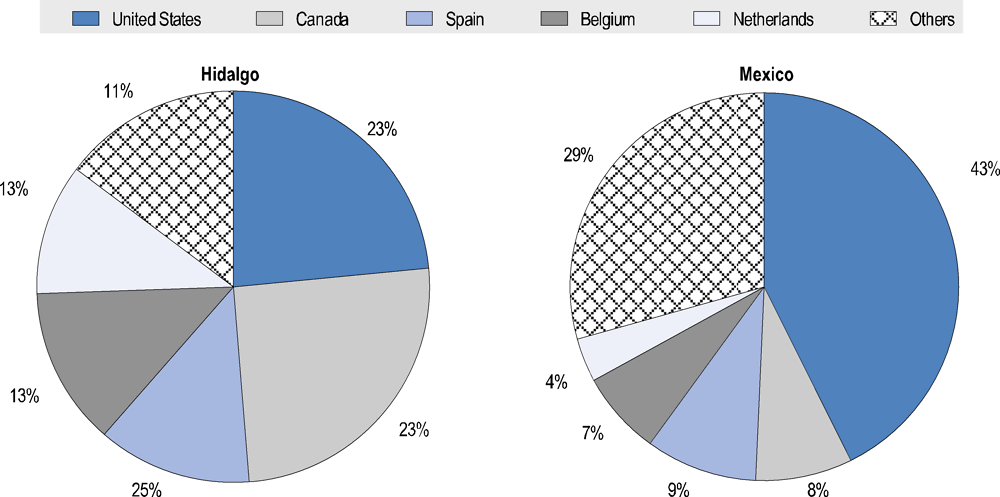

This trend, however, appears to be reversing in recent years. Since 2014, FDI in Hidalgo has increased (Figure 2.2) with a relatively greater dispersion in origins than the national level (Figure 2.3). The importance of investment from the United States is much less dominant in Hidalgo (23% of the FDI between 2008 and 2017) than at the national level (43%) (Secretary of Economic Development of Hidalgo, 2016[7]). The lower reliance is partially explained by its low initial level of FDI and by the efforts of the current administration to diversify its foreign investments. In terms of allocation, most of the FDI has been allocated to manufacturing, transport and warehousing (see Chapter 1).

Global value chain (GVC)

GVCs are often complex networks involving multi-directional flows of material inputs, services and personnel, ownership of assets via foreign direct investment (FDI) in a cross-border context, enforcement of contracts and standards, encompassing transfer of technology and protection of intellectual property (IP).

Improving the GVC linkages of local industry has many benefits. It entails importing competition and accelerating the reallocation of domestic resources towards the most competitive firms. It also facilitates the diffusion of knowledge spill-overs from suppliers or foreign direct investment (FDI). Through improved GVC participation, local industries tend to gain access to new markets that contribute to better optimise local human capital, competitive advantages and natural resource endowments that contribute to greater economic growth.

Many Mexican industries have increased their importance within the GVC. The country’s policy has favoured foreign trade and investment through various agreements; 12 free trade agreements have been signed with 46 countries (OECD, 2017[2]). Mexico is gradually evolving into a global manufacturing hub. Following the North American Free Trade Agreement (NAFTA), Mexico’s strategic location, low unit labour costs and increasingly adept labour force helped the country consolidate its position within the GVC (i.e. some Asian suppliers are using Mexico as an entrance point to North American markets). Mexico initially had benefited from its integration in GVCs mostly as an assembler of manufactured inputs. However, in recent years, it has moved up the GVC to increasingly producing domestic content. This means that more domestic value-added is present in Mexico’s exports (with the automobile sector leading the way and producing more cars with higher value-added [luxury cars] and with less imported content) (OECD, 2017[2]).

With the rising strains in the international trade environment, existing trade agreements have been afflicted by increased uncertainty. Given Mexico’s trade openness, any retreat from trade agreements directly impacts its exports and investments. In part, because of Mexico’s success in establishing its position within the GVCs, Mexico could lose substantial market share with trading partners, triggering a significant deceleration in output, depending on the size of the trade flows affected (OECD, 2017[2]). Without turning its back on the position that Mexico has built and made for itself within the North American industrial value chain, there is also a logical need to expand the scope of its industrial influence that would reduce its dependence on an increasingly domineering partner at its northern border.

Hidalgo has not benefited as much as many of its neighbouring states from the consolidation of Mexico within the GVC. This may be due to past policy circumstances, but also to the relative isolation of Hidalgo. The state was historically perceived as a place where people and goods could go to, but not go through in terms of connectivity. This condition was dramatically changed in 2009 with the construction of the Arco Norte that circumvents the capital city and is now a key aspect of Hidalgo’s attractiveness (see section on connectivity and infrastructure later in this chapter).

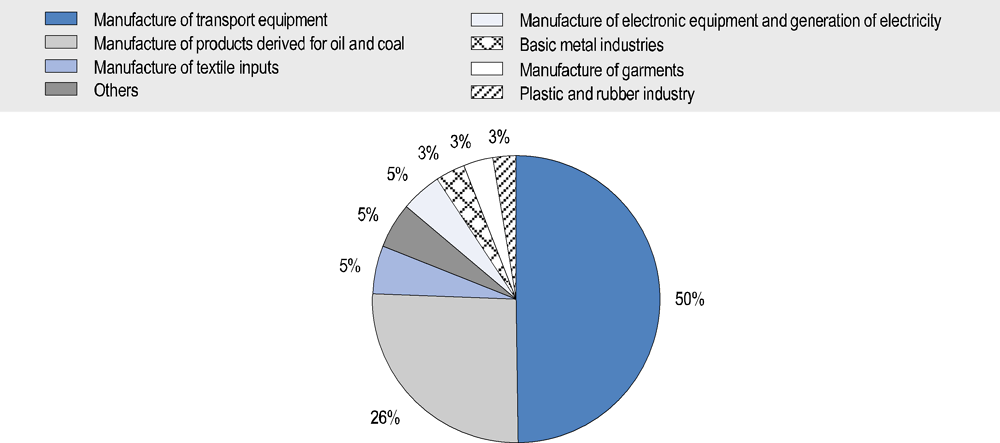

There is an important potential to develop the participation of Hidalgo’s businesses within the foreign market. Hidalgo’s economy has seen exports represent only a very marginal proportion of its business. Hidalgo is the 13th state with the lowest level of exports in the country (0.5% of national exports value). In 2016, transport equipment, mainly auto-parts, represented most of the exports (50%), followed by products derived from oil and coal (26%) and textile industry, mainly textile inputs (5%). Agro-industry exports, found inside others products, represented 1.5% of exports (Figure 2.4).

As seen in Figure 2.4, Hidalgo’s linkages with external markets are mainly driven by its manufacturing sector; particularly intermediate products (transport equipment, i.e. auto parts, petroleum derivative products and textile inputs). It underlines that the participation of Hidalgo in GVC tends to be more as a supplier of inputs to other markets rather than a producer of final products.

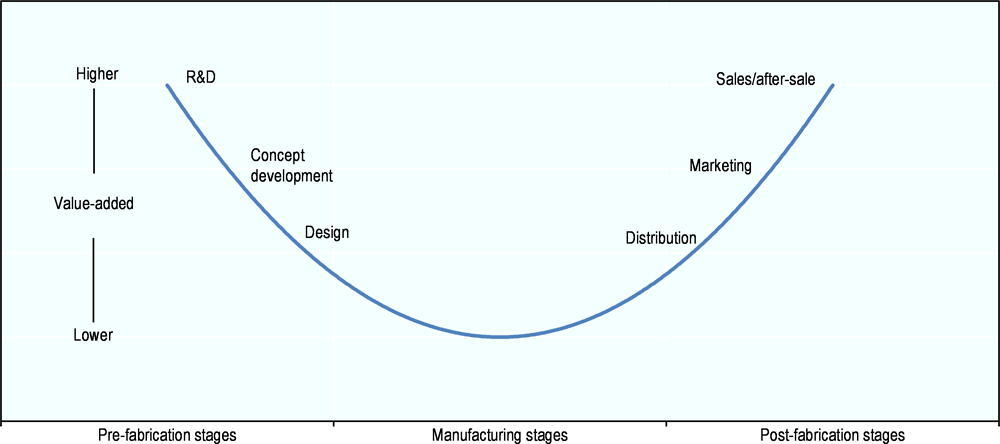

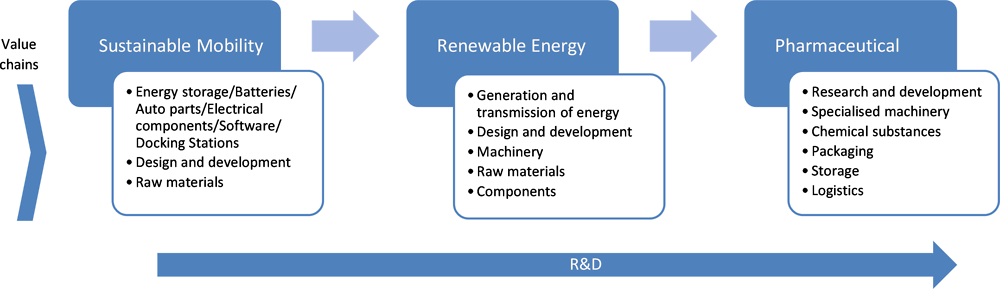

Globalisation has brought an increased competition to the tradable sector and especially to manufacturing. In this context, Hidalgo cannot base its economic growth in intermediate, standardised manufacturing products, but needs to move up into flexible and customised-oriented production. To create larger value in GVCs, Hidalgo should increase the ratio of domestic value added to its exports. The highest value-added activities in GVCs can be often found in pre-fabrication activities (research and development (R&D,) branding development, design) and in post-fabrication activities (marketing, promotion and after-sales services). This phenomenon is known as the smile curve (OECD, 2017[2]) (Figure 2.5).

Hidalgo can then encourage firms to integrate shop-floor production with product development (design) and sales. This particularly applies to the textile industry, which has a vast production base but lacks branding and marketing skills. Furthermore, a higher support to R&D investments and concept development can spur high-value activities in the state. It is especially needed since Hidalgo has decreased its number of R&D outputs (from 0.8 patents per million inhabitants in 2002 to 0.5 in 2015), lagging far behind the national average (see Chapter 1). The state can also co-ordinate along with federal government a better link between established national firms that export their products (i.e. the refinery) with local suppliers.

Additionally, Hidalgo has the potential to link other sectors with foreign markets by trying to diversify its composition of exports. Supporting exports from other tradable sectors, such as agriculture and services, will generate a greater presence in foreign markets. A larger interconnection with foreign markets not only diversifies the outlets for Hidalgo’s products but also favours Hidalgo’s visibility and that of its firms, which could potentially help to open up and better consolidate the state’s position within GVCs. Hidalgo also has the opportunity to build a position within a relatively more global industrial value chain. Not having locked itself into an overwhelming dependence on North American industry means that Hidalgo has the possibility to more strategically diversify its international industrial linkages.

There are hence untapped opportunities for Hidalgo to transition towards tradable and productive activities in the service sector such as logistics or information. In terms of manufacturing, the state can increase productivity in subsectors that employ a large workforce and have the potential to build locally different stages of the productive chain such as textile and food industry. However, Hidalgo should bear in mind the risks associated with the very rapid evolution of GVCs. A GVC can experiences changes in response to global factors including trade restrictions or technological change. Therefore, opportunities linked to GVCs should not be analysed as static but rather as constantly moving targets that need very careful diagnoses and well-designed strategies. Overall, the allocation strategy on economic sectors should be based on the analysis of the state’s position within the global value chains.

Hidalgo’s competitive advantages and endowments

Hidalgo’s existing competitive advantages, which include its safety, environment, connectivity, low business cost and result-driven governance are very much in line with making the state an attractive place for people, ideas, investments and businesses.

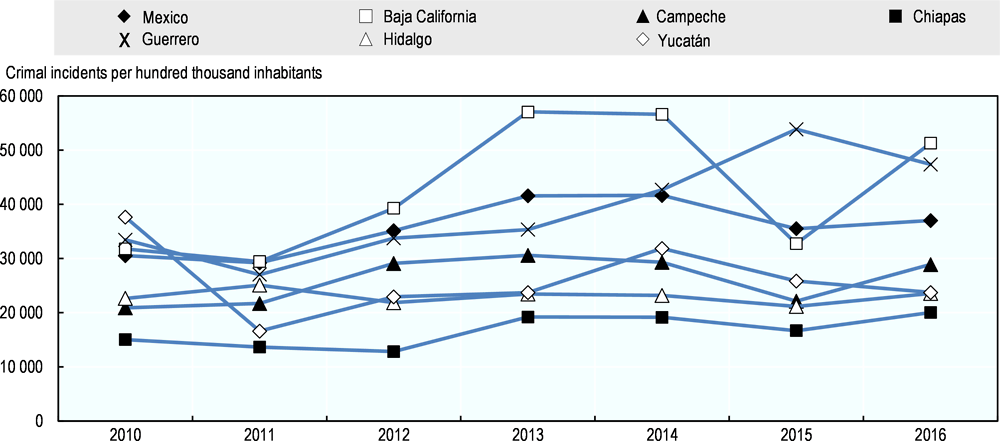

Safety

Many new foreign investors in Hidalgo have selected the state due to its relative safety and low level of conflict when compared to most other Mexican states. Because of the often-difficult social conflicts and illicit conduct plaguing many regions of Mexico, and the consequent negative external reputation that has emerged, many foreign investors and firms may be reluctant to do business in Mexico, despite its potential benefits. A place like Hidalgo, that offers relative safety for its tangible and human resources, forms an attractive oasis in the midst of an otherwise complicated and risk-ridden business environment. Greater visibility and promotion of this fact would most likely attract investment in even greater numbers. Hidalgo’s public administration needs to keep the efforts and resources in maintaining and further developing safety as one of the state’s main competitive advantages for attracting FDI.

Similarly, the state has been faced with relatively low levels of labour conflicts in the past. This is also seen by external investors as a point of attractiveness for Hidalgo, albeit one that will require wise and proactive action by local administrations in collaboration with the private sector, neighbouring states and labour organisations. At the moment, on average, the wages and compensations offered to Hidalgo’s labour market fall below those found in comparable jobs of neighbouring states (Figure 2.6). As the state’s economic development plan achieves its results and the demand for labour increases, conditions for workers will need to quickly adjust to the national averages if labour conflicts are to be avoided.

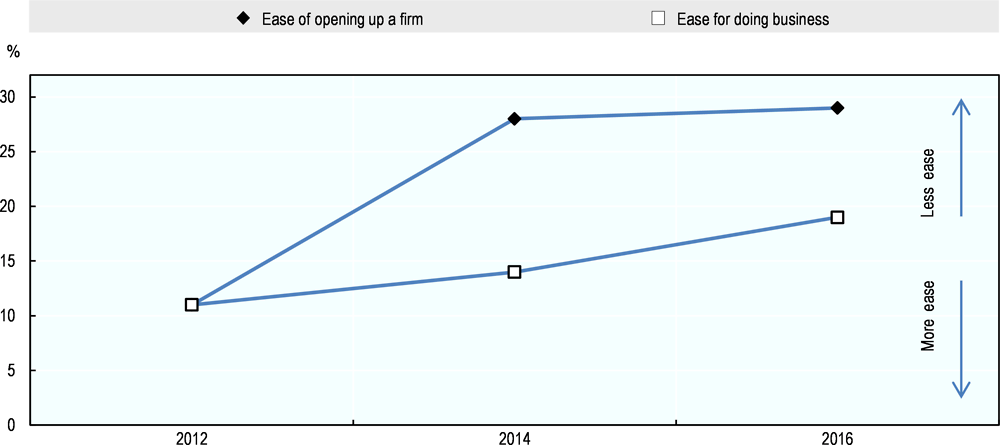

Results driven governance

Much has been done by Hidalgo’s current state administration (2016-22) to create a supportive business environment for FDI. Until 2016, for the general citizen, entrepreneur or investor, the ease of doing business was deteriorating in comparison to the rest of Mexico (Figure 2.7). As described in chapter 4, the state of Hidalgo is now working on creating a conducive business environment by implementing an administrative simplification strategy. Steps have therefore been taken to improve the relevant regulatory framework. Similarly, legislation has been adopted that obliges the state administration and that of the state’s 84 municipalities to improve regulations in ways that will make things more agile for business (see Chapter 4). This is seen as the first steps towards the eradication of excessive bureaucracy and corruption linked to business activities. These measures are meant to streamline and reduce transaction costs associated with doing business in Hidalgo.

These are important steps forward for amplifying Hidalgo’s attractiveness but they are still mostly aimed at large FDI business interests. The efforts to improve Hidalgo’s business environment and create a fertile eco-system for the attraction, creation and growth of businesses should further include ventures of all sizes and origins beyond those perceived as strategic. Moreover, the state should hence seek for a wider political consensus on the implemented reforms, involving other political parties, the private sector, civil society and relevant stakeholders, to attain a long-term stability of the recent reforms beyond political cycles.

Environment

Hidalgo benefits from a relatively better quality of its environment (see Chapter 1). This can potentially make Hidalgo a better place to live and establish a business. Although certain specific industrial areas in the south of Hidalgo are struggling with air and water contamination issues (see Chapter 3), overall the state of Hidalgo enjoys low levels of environmental contamination, especially compared to the Mexico City Metropolitan Area.

The environmental virtues of Hidalgo stand to become increasingly important as a source of comparative advantage. This advantage will stem from the growing importance that environmental concerns will suppose for quality living standards and eventually the location decisions of individuals and businesses. High human capital employees tend to be especially attracted to places where they can have high-quality standards of living. This is key if Hidalgo is to establish and grow a knowledge-intensive economic base for the state. Similarly, environmental conditions are likely to deteriorate in the metropolitan area of Mexico’s capital city (Ibarrarán, 2011[13]). This can potentially accentuate the comparative attractiveness of Hidalgo resulting from the quality of its environment.

Northern Hidalgo is especially endowed by the quality of its natural and environmental conditions. Such attractiveness can be strategic for industries such as tourism. Hidalgo must strike a good balance between exploiting the advantages that the environmental conditions can offer, without spoiling these attributes in the process.

Connectivity

Hidalgo lies in close proximity to the national capital and to the State of Mexico, which represents Mexico’s main economic and population hub. The southern part of the state falls within the Mexico City Metropolitan Area and modern road and rail networks connect the State’s southern municipalities with the nation’s capital. The Arco Norte highway is an important transport artery passing through the southern limits of Hidalgo. The highway circumvents the Mexico Valley and its very congested metropolitan area, allowing travellers and transporters to bypass the city and important delays. The Arco Norte was inaugurated in 2009 and amplified in 2018. It offers Hidalgo State a road connection with Mexico’s main north-south axis and a means of disenclavement that avoids the congested metropolitan area. Businesses and their road-freight can now reach the United States much more easily. The road system also allows easy access to Mexico’s western and eastern naval ports without the need for passing through the capital.

The southern part of the state is also well served by an extensive rail network that connects the state to the main north-south as well as east-west axes. This rail infrastructure is adequate for cargo, general logistics as well as passenger transport.

The state’s connectivity is less developed and would require attention in the northern half of Hidalgo, located in the more topographically arduous Sierra Madre Oriental region. Similar to the issue of accessibility in northern Hidalgo already discussed in Chapter 1, the transport connectivity in this region, both road and rail, is deficient. This scarcity comes in terms of both inter-municipal connectivity as well as poor connections with the capital and the regional economic centres, especially those to the east in the neighbouring state of Veracruz where naval ports that could be strategic for the development of northern Hidalgo are located.

Low business cost

The cost of doing business in Hidalgo can be relatively more economical. In comparison to the cost of establishing and doing business in another part of the Mexico City Metropolitan Area, Hidalgo offers several cost-saving advantages. The potential cost advantages of the state come from the connectivity of the state (in the south) with the Mexico City area, as well as easy connections with the Atlantic and Pacific port areas that avoid the congested Mexico City area. Hidalgo also falls on Mexico’s main north-south road and rail axes. This allows for logistical savings relative to more peripheral, less connected states, or those that are unable to avoid the delays and costs of going through the capital’s intense traffic.

Industrial real estate is also another source of cost advantage. Land and real estate in Hidalgo, particularly industrial real estate, is relatively less expensive than comparable sites in the capital’s greater metropolitan area. This can suppose important savings for businesses establishing their offices and operations in Hidalgo.

Labour costs and wages tend to be lower in Hidalgo. This potentially reflects the lower cost of living in Hidalgo as compared to the Mexico City area. However, the administration must resist the temptation of using Hidalgo’s current low labour costs as a point of attractiveness. Using labour costs as a point of attraction would only contribute to entering a race to the bottom, where neither Hidalgo’s workforce nor its industry would end up benefiting in the long-run. Not only would this strategy likely result in labour conflicts that would harm Hidalgo’s reputation and image amongst potential FDI, but the benefits of building a high human capital labour force would be forgone. Encouraging investments in Hidalgo’s labour force and greater human capital development will potentially increase the overall value added of doing business in Hidalgo.

Hidalgo’s existing competitive advantages – safety, results-driven governance, environment, connectivity and low business cost – can constitute important differentiated assets for the state’s economic development if well integrated within Hidalgo’s strategy for the future. The state’s competitive advantages, however, have to be carefully maintained. These strategic strengths should be further enforced and protected, eventually making them core competencies for the state’s economic strategy. A solid territorial development strategy should be based on its assets and potential, both emerging from its competitive advantages. Out of all potential competitive advantages, Hidalgo should focus on those that offer the greatest strategic value in terms of exclusiveness, market relevance and sustainability of the competitive advantage that comes from being difficult or very costly for other regions to duplicate or imitate.

Apart from the said competitive advantages, the proximity to the capital and the availability of vacant industrial infrastructure currently form the main existing endowments of the state. The lack of clear tangible, human or natural endowments for business means that regulatory and policy measures will need to be the principal tools used to amplify local competitive advantages and implement the state’s economic strategy. A strategic incremental approach that measures progress in each stage can be a good tool to promote its competitive advantages. The resources and capabilities that form the basis of Hidalgo’s competitiveness are dynamic in nature. This means that they change over time and can build these up, pushing capacity limits and allowing for new more valuable advantages. From an incremental strategic point of view, Hidalgo should envision a clear path of resource and capability development, so as to build on its value-adding advantages and strengthen its attractiveness for FDI.

Hidalgo’s economic strategy

The development experience across several OECD countries has shown that strategic planning can be important to the development process. Countries and regions at certain levels of economic development can benefit from planning especially in the provision of basic public services and those that are essential for growth and diversification, such as schooling, infrastructure and creating the right framework for investments in innovation. Effective strategic planning can help solve co-ordination issues, externality issues, reduce asymmetries of information, socialise part of the costs of discovery, contribute to the better functioning of markets and create new markets where there are none (OECD, 2016[14]).

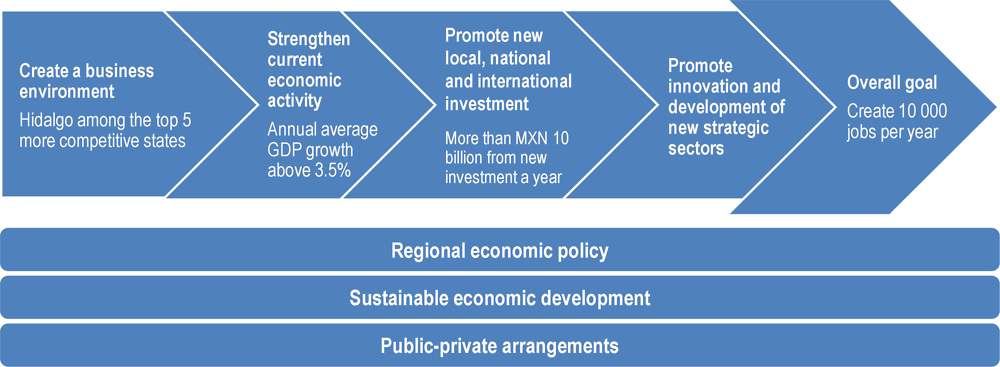

Hidalgo has given itself a competitive new economic strategy (Figure 2.8). The state government, which took office in 2016, quickly put in place its economic strategy that falls under the responsibility of the state administration’s Secretariat of Economic Development. This ambitious strategy came as a marked contrast to that of previous administrations, which had a less proactive stance on actions to stimulate and guide the local state economy.

Hidalgo’s Economic Strategy is supported by three key actions (a regional economic policy with sustainable development and joint work with the private sector) and built around four main guiding action pillars (Secretary of Economic Development of Hidalgo, 2016[7]):

-

1. Create a conducive business environment: Generate an institutional framework that promotes existing economic activity, facilitates the opening and operation of businesses and promotes productivity as well as competition.

-

2. Strengthen existing economic activity: To consolidate current and future economic vocations, fostering the competitiveness of companies and their inclusion in global markets.

-

3. Promote new local, national and foreign investments: Strengthen and create better conditions for attracting investment in infrastructure, connectivity, human talent, skilled labour, quality of life, legal certainty and security.

-

4. Promote entrepreneurship, innovation and development of new strategic sectors: To promote an economy based on innovation, technology, knowledge and high-impact entrepreneurship, aimed at the new sectors of the global economy.

The economic strategy identified by some ambitious goals. Each action pillar is linked to a specific and measurable target:

-

1. Hidalgo aims to be ranked amongst the top five competitive states in Mexico.

-

2. Its average annual GDP growth is set at 3.5%.

-

3. FDI should reach MXN 10 billion of investment per year.

-

4. It should develop new clusters in four sectors.

-

5. Ten thousand new workers should be formally employed per year.

The last objective has emerged from the assessment of the level of growth required to optimise Hidalgo’s local human capital generation. Out of the approximate 16 000 new graduates coming out of Hidalgo’s higher education system every year, it is calculated that some 10 000 of them either do not find adequate employment or have to leave the state to find a job. The annual objectives set by the state are meant to absorb the local human capital and create durable economic growth for Hidalgo.

Hidalgo’s state and municipal administrations are working to improve the first pillar –create a conducive business environment – by gaining credibility and moving up standardised international rankings. It includes the World Bank Doing Business in Mexico report. The ranking has not been very favourable to Hidalgo in the past, motivating the current administration to directly address those aspects that can allow the state to make progress in the ranking and in this way signal credibility towards potential foreign investors. There is an initial working programme with Pachuca so as to identify unnecessary government procedures, timings and steps.

A full revision of its regulatory framework has already been undertaken (more on this in Chapter 4). In April 2017 a constitutional reform was approved, making regulatory improvements mandatory for all state and municipal governments of Hidalgo. In the same month, the Law of Regulatory Improvement (Ley de Mejora Regulatoria) was approved. It gives the state, among other business facilitation measures, a one-stop shop system for all government procedures and sanction mechanisms (more on this in Chapter 4). This law has been described by the Federal Commission for Regulatory Improvement as Mexico’s most advanced, mainly due to its one-stop shop system.

In addition, the government of Hidalgo has been approving a package of laws that will further enhance the state’s business environment. These include: the Law of Productive Alliances for Investment to attract more investment; the Law for the Promotion of Economic Development to facilitate the establishment of new economic units; and the Law to Promote Hidalgo’s Sustainable Energy Development. The latter aims to increase Hidalgo’s competitiveness by encouraging, promoting and regulating sustainable energy development. The law also serves to grant legal certainty to investors that participate in the optimal use of energy infrastructure and promote energy efficiency.

As for the second pillar – strengthen current economic activity – the state has been conducting programmes to support first employment with apprenticeship schemes and promote local SMEs and entrepreneurs (the programmes will be discussed in detail in the second section of this chapter). Other sectors where the economic strategy is being implemented include:

-

In the manufacturing sector, the sectorial plan for economic development has identified that business from the largest productive sectors (metal-mechanic, agro-industrial, textile) should adopt better design management practices and develop new products through technological innovations that allow them to create higher value added in the manufacturing process.

-

As for the energy industry, the government has a plan to consolidate Hidalgo as the most important state for transformation, storage and transit of energy products. It is contemplating infrastructure projects focusing on the construction of gas pipelines and promoting renewable energy projects (solar and wind).

-

In services, the state aims to increase the industrial parks located in the southern municipalities. To do so, it has invested in the maintenance of installations and enabling new zones to build industrial parks.

-

In the agriculture sector, Hidalgo’s administration is actively working to modernise and increase the value added of Hidalgo’s farming operations. In this sense, through a co-ordinated effort, the Secretary of Agriculture supports the state’s farmers to migrate towards contract farming schemes. Such a system will help local farmers to play a better role within the local value chain of Hidalgo’s food and beverage industries.

Finally, for the pillar “Increasing new foreign and local investment”, SEDECO has established three strategic priorities with concrete actions (Table 2.2). The strategy aims to set an attractive economic environment with competitive conditions for business creation as well as direct support and follow-up to potential investors with an adaptation of regulatory framework and promotional campaigns.

In a co-ordination effort to align the strategic goals across the territory, SEDECO conducted a co-ordinated territorial agenda among state and municipalities. It involved meeting with municipalities to identify their needs and productive infrastructure in place. The goal is to attract private investment at the local level based on the potential assets of each municipality and encourage municipal governments to focus on business attention and monitoring of investments. SEDECO hence identified 26 areas and 40 warehouses with industrial potential.

According to the economic strategic plan, on the fourth pillar “Promote and develop new strategic sectors”, the plan aims to boost four strategic sectors pertaining to energy, agro-industry, sustainable electric mobility and chemical-pharmaceutical. Hidalgo’s economic strategy aims to promote investment, entrepreneurship and innovation within these specific industries.

These sectors were chosen as a strategy to boost high-value-added sectors that increase the quality of jobs and wages in the state. The selection of these sectors was based on the following:

-

Energy was selected with the aim of boosting the renewable energy industry in the state by addressing the state’s potential of affordable land in a location not suitable for agriculture with favourable sunlight exposition. An American solar energy company has started a project in the municipality of Nopala. It aims to start operation during the first semester of 2019. The energy will be supplied to the national energy network. Another project of wind energy is in the first phase in the municipality of Huichapan, an area known for its favourable winds It is expected to have a production capacity of 120 MW.

-

Agro-industry responds to the expected link that can be made between the agriculture sector and the new beverage and agri-food companies arriving to the state.

-

Boosting electric mobility in order to make Hidalgo a destination for the manufacture of hybrid and electric vehicles. It aims to benefit from the closeness to Mexico City and its potential demand for these types of vehicle and leverage on the arrival of a new foreign automotive company as an anchor to develop the sector.

-

The pharmaceutical sector can use as a leverage the existing pharmaceutical companies that have established themselves in the state’s industrial parks. Pisa Industrial Pharmaceutics has invested in a manufacturing site for veterinary products in the Atilaquia Industrial Park (close to Tula). Likewise, the Mexican pharmaceutical company Quimpharma invested MXN 102 million in the industrial park Tepeji del Río.

To mobilise these new sectors and the broader economic base, the current administration (Secretary of Economic Development of Hidalgo, 2016[7]) has identified four factors as the main focus to improve Hidalgo’s regional competitiveness:

-

1. Costs: According to the state administration, many firms that decide to locate to and remain in Hidalgo may do so in order to benefit from the relative cost advantages that the state offers or can eventually come to offer. The administration is, therefore, working in order to amplify and consolidate these cost-saving opportunities for Hidalgo’s firms and industries. The cost advantages of the state are said to come from the state’s connectivity (in the south) with the Mexico City area, allowing for logistical savings relative to more peripheral states. Industrial real estate and land is also another source of cost advantage as it is relatively less expensive than comparable sites in the capital’s greater metropolitan area. Additionally, joint efforts are being conducted by the state administration to consolidate the local productive value chains in order to build a business ecosystem that offers cheaper locally available inputs for entrepreneurs. In the words of the state administration, the cost advantages for firms are not meant to come from labour savings.

-

2. Quality: The state and local administrations are working with local firms in order to get them to achieve recognisable quality standards and certifications. This is especially important to promote export market expansion amongst local producers. Developing an eco-system of quality supplier and complimentary industries can also become a point of attractiveness for potential investors and entrepreneurs, especially those that compete on the differentiation of their goods and services, which are much more likely to be compatible with the high value-added economic structure that Hidalgo wants to give itself.

-

3. Innovation: Efforts are being implemented in order to stimulate innovation, especially within industries deemed strategic for their knowledge generation and intensity. These industries are more likely to generate spill-overs that can encourage greater value added throughout the local economy.

-

4. Value creation: This aspect is closely linked to innovation and perceived as a natural outcome of sector-specific promotion policy. There is a need for greater specification of the character of the value required for Hidalgo.

Positive results are being generated

Some positive results are visible, particularly with respect to the creation of jobs and the attraction of FDI. During the 2 years of the strategy (second half of 2016-first half of 2018), more than 30 new investment projects have occurred in the state, amounting to over MXN 30 billion. Overall, the FDI in Hidalgo grew 73% between 2017 and 2018, above the growth at the national level (19%) (Secretary of Economic Development of Hidalgo, 2018[15]). This influx of new investments has led to a rise in the state’s employment. During the first half of 2018, Hidalgo registered the 2nd highest growth rate of formal jobs (6.5%) across Mexico (3.3%).

Some examples of the sectors in which some of these new investments were made include: the beverage industry (Modelo), the food industry (MUNSA and BIMBO), the construction industry (GICSA) (estimated of MXN 1.9 billion), the electrical automobile industry (JAC) (estimated of MXN 4.4 billion and 5 000 jobs).

The recent foreign investments are thus an important opportunity for Hidalgo to attain a more sustainable development growth across the territory. The strategic economic plan has called for a diversified and strong economic activity. Much of this improvement in the economic environment will have to rely on the correct integration of the FDI with the local assets, business and human capital. To do so, an incremental strategic approach is needed where short-term results can be capitalised in a sustainable manner in the future. Such a strategy has to be built upon the development of a right ecosystem of enabling factors to boost productivity in the long term.

Enabling factors for Hidalgo’s competitiveness and prosperity

The different pillars of Hidalgo’s economic strategy are all set to improve productivity in the state. However, addressing this productivity challenge to attain a sustainable outcome over time will require a strategic and integrated approach to investing in key enabling factors. The specific enabling factors for regional growth have been identified through the observation by the OECD of many regional economies throughout a diverse set of countries (OECD, 2009[17]). Although there is no magic solution that fits all contexts, some common elements do emerge in regions where the public administration has been able to steer their economy to more prosperous and sustainable levels. These common elements, referred to as enabling factors, include infrastructure, human capital, business ecosystem, and innovation as well as integrated regional policy (see Box.2.2). These factors are interdependent and regional growth requires a full set of them to be present simultaneously in order to have any real effectiveness over a sustainable and inclusive growth.

According to OECD findings, greater growth occurs when regions are able to mobilise their own local assets and resources, rather than depend on public sector support (OECD, 2009[17]). Hidalgo’s government should promote growth accordingly. Fostering growth, even in regions of the state that are lagging economically, is in the interest of Hidalgo as it contributes to the state’s output without hindering growth opportunities elsewhere. It also helps to better attenuate several social and agglomeration related challenges that can hamper development efforts.

OECD analysis of the key determinants of regional growth, the length of time needed for these factors to generate growth and the most successful combinations of factors lead to several suggestions for effective regional policies:

-

Provide infrastructure as part of an integrated regional approach. The analysis suggests that infrastructure alone has no impact on regional growth unless regions are endowed with adequate levels of human capital and innovation. In other words, infrastructure is a necessary, but insufficient, condition for growth. The analysis also reveals that it takes about three years for infrastructure to positively influence growth.

-

Invest in human capital. Regions with well-educated populations will grow. Investments in tertiary education take about three years to have a positive impact on regional growth.

-

Emphasise innovation and research and development. Investments in R&D have a positive effect on patent activity in all categories, as do R&D expenditures by businesses, the public sector, higher education institutions and the private non-profit sector. However, innovation is a longer-term process and appears to have a positive influence on regional growth only after five years. The analysis suggests that as capital and talent agglomerate, they tend to positively influence growth in neighbouring regions. However, innovation remains a highly localised element.

-

Focus on integrated regional policies. Agglomeration economies are partly responsible for regional growth. Sources of growth from within regions, such as human capital and innovation, are more important than a region’s physical distance from markets. Although a region with good accessibility to markets has an added advantage, its growth depends on the presence of human capital, innovation, infrastructure and economies of agglomeration. Regions perform well when local actors in a regional innovation system can communicate easily with each other. Indeed, one region’s performance strongly influences neighbouring regions, suggesting that inter-regional trade and inter-regional linkages play an important role in regional growth.

Source: OECD (2009[17]), How Regions Grow: Trends and Analysis, https://doi.org/10.1787/9789264039469-en.

Overall, focusing on enabling factors across the territory is especially meaningful for a state such as Hidalgo. It faces a highly imbalanced distribution of its economic activity (with a north-south divide that leads to greater private sector concentration in the southern municipalities (see Chapter 1). Such a north-south divide is not only economic but rather multifaceted in nature. In fact, the state has a marked cultural divide, where the north has a much greater proportion of the rural indigenous population. This is coupled with an important geographical and topological divide, where the southern half of the state is situated within the Eje Neovolcanico topographical region shared with Mexico City Valley, whereas the northern half of Hidalgo State is characterised by the mountainous topographical region of the Sierra Madre Oriental. This has obvious consequences on the accessibility and connectivity of northern Hidalgo (poor access to markets, lacks local proximity service provision and a deficient availability of many basic amenities).

Given that Hidalgo’s current economic strategy stands to have a disproportionate impact in the south, it is important to plan for future pockets of agglomeration in the southern municipalities, promote a feasible and adaptable development plan in the north and a plan linking the northern and southern geographies. The north will need its own development strategy based on bottom-up endogenous processes. Pre-emptive measures aimed at boosting economic activity in northern Hidalgo, as well as complementary measures facilitating the integration of newcomers in southern Hidalgo, should play a greater role within the state’s economic strategy. These are not only predictable social consequences of the state’s economic development efforts, but they can have significant economic and strategic consequences if they come to negatively affect the existing safety that characterises the state.

In general, the enabling factors are instrumental for the state to reduce the strong divide present in the state while addressing the main bottlenecks for productivity and to unlock opportunities for growth in different areas.

Access to market: Infrastructure

Infrastructure is a necessary driver for productivity growth and well-being in OECD regions (OECD, 2012), although it is not a sufficient condition. It improves accessibility with local, national and international foreign markets, facilitates public service delivery and reduces the cost of the flow of technology and the movement of labour. Investments on infrastructure in isolation, however, do not automatically lead to higher levels of development. To be effective, they need to be co-ordinated with other enabling factors for development, in particular education, innovation and a well-functioning business environment.

Particularly in Hidalgo, investing in quality infrastructure and accessibility is not only a matter of economic outcome but is directly linked with the need to improve well-being and reduce the current north-south divide in the region.

Hidalgo’s northern territories and settlement areas are predominantly rural in nature. They also have a strong interrelation to southern urban settlements in the region due to strong interlinkages in commercial, labour, educational, medical or even leisure-related activities. Similarly, although to a lesser extent, residents of the state’s urban areas also have strong linkages with the north travelling for tourism, visiting family and the homestead, or for buying certain goods and services that are unavailable in the south. The main obstacle to further valorise these interrelations is the lack of adequate road and inexistent passenger rail connections between Hidalgo’s north and south.

Infrastructure has been improving in Hidalgo, albeit skewed towards the south

Road network

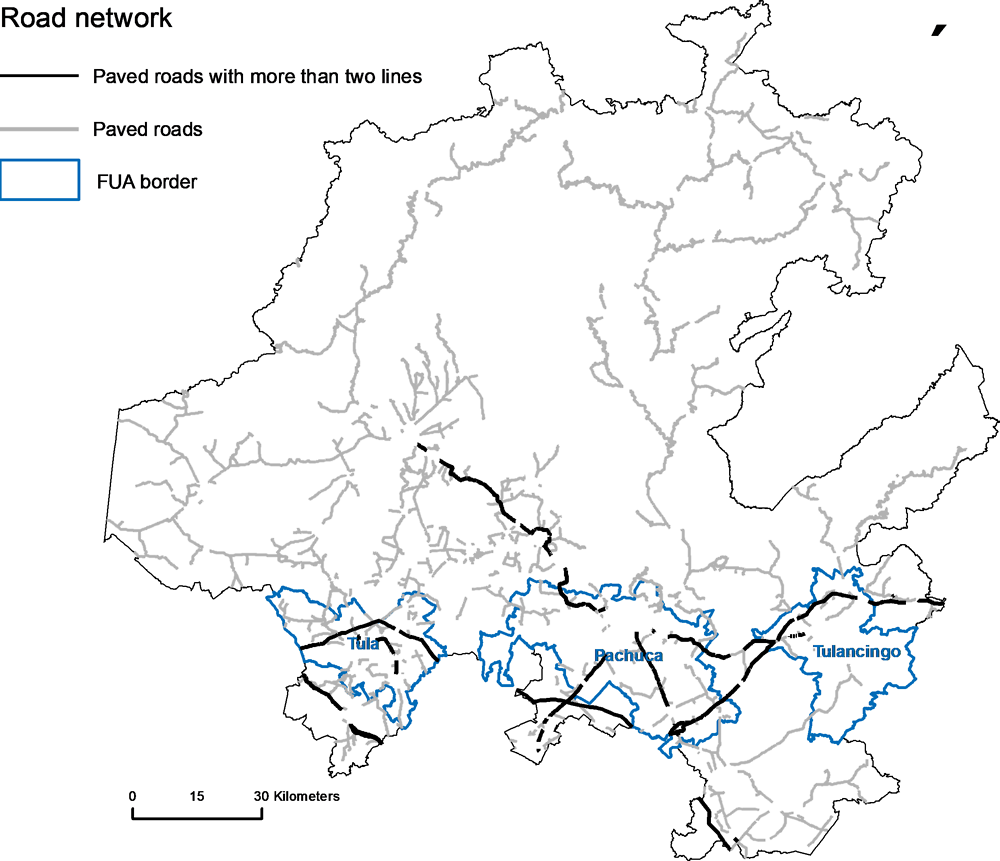

The quality and structure of the road network in Hidalgo underline the unequal conditions between southern and northern municipalities. Road network in the state is composed mainly of unpaved rural roads with most of the paved and modern roads located in the south of the state (Figure 2.9). Hidalgo has a high road density relative to its land area (0.6 km of road per km² vs 0.3 km of road/km² across Mexican states). However, the share of unpaved roads is higher (62%), than the average of Mexican states (53%) (INEGI, 2016[18]). Rural roads account for more than half of the network (51%), which is above the average of the country (43%). The federal roads, the most modern roads, account for just 7% of the network, far below the share across Mexican states (17%).

The most important road development has been the Arco Norte highway that crosses the south of the state. The inauguration of this highway in 2009 brought Hidalgo out of its enclavement. Local population and industry can now circumvent the very congested Mexico Valley to reach the main national road networks, including the main north-south trade routes that link Mexico to the United States, and ports in both the west linking Hidalgo to the Pacific Ocean and east with the Gulf of Mexico. This allows for important time and cost savings, and allows the state to now be strategically situated from a logistical standpoint in the centre of Mexico.

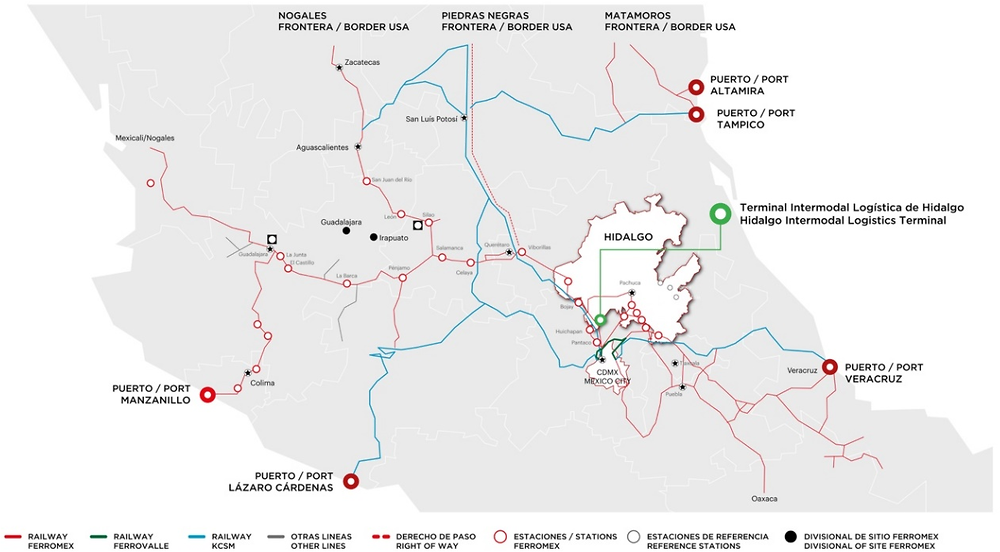

Rail network and access to ports

Overall, Hidalgo is well connected to the national rail network and benefits by its favourable geographic closeness to key national ports (Figure 2.10). With 865 kilometres of railways, it is the 15th state with the largest rail network in the country. The closest seaport to Hidalgo’s capital city, Pachuca, is that of Tuxpan in the neighbouring state of Veracruz. This port is situated at barely two hours’ distance by road from Pachuca. It is also one of the closest ports to Mexico’s national capital, and the connection between both requires crossing the state of Hidalgo. This is important for Hidalgo as the port of Tuxpan is Mexico’s largest receptor of petrol and supplies 96% of all the petroleum consumed in the Mexico City Valley. The port recently completed an expansion phase that has added a new terminal to its capacity infrastructure. Estimated annual capacity of the port in 2018 is of 700 000 TEU (20 feet containers) and 100 000 cars. The relative proximity of Hidalgo to the port will give the state some clear logistical advantages that can help its attractiveness and competitiveness for certain industries and investments.

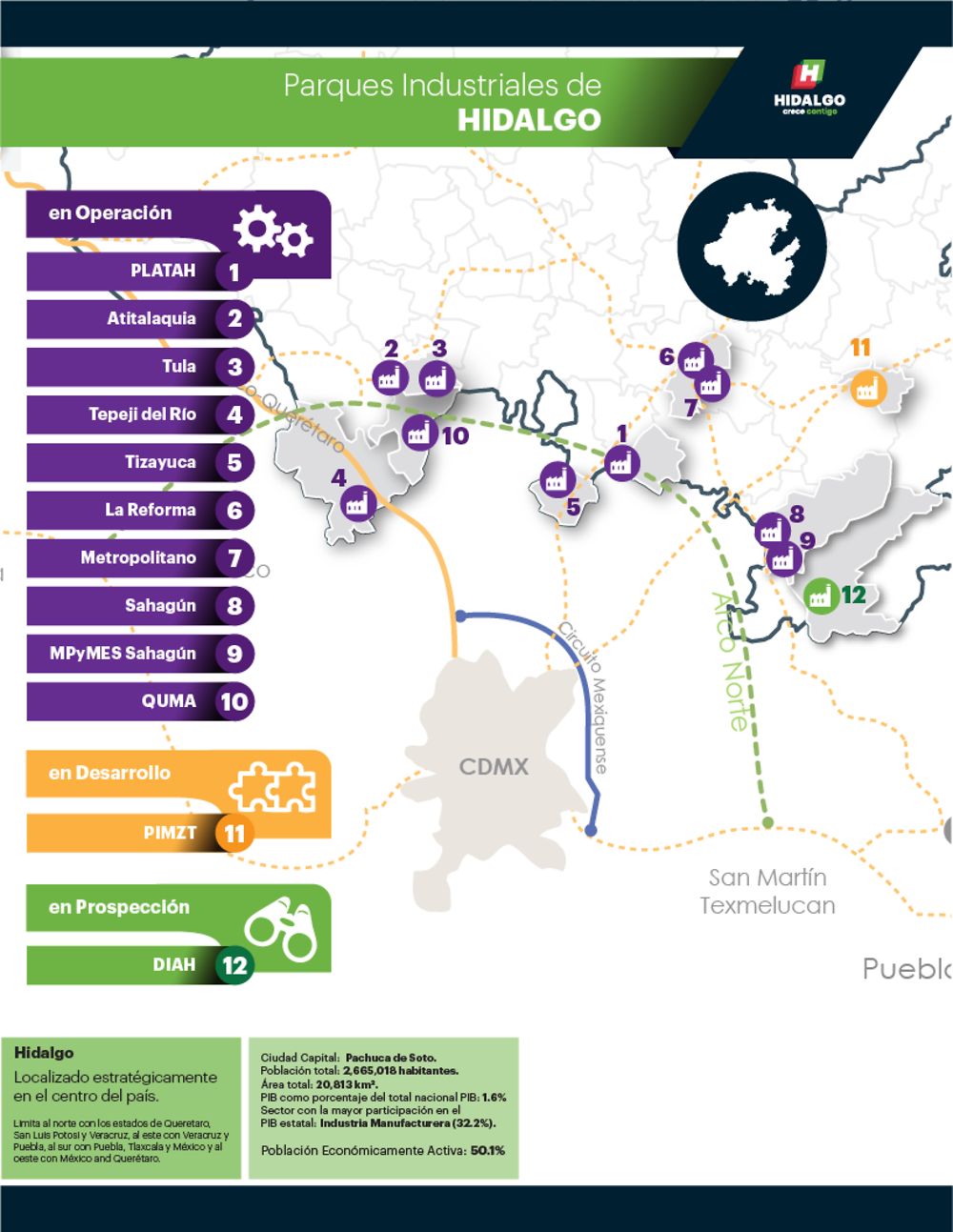

Industrial parks and logistics

In Hidalgo, there are ten industrial parks located in the south of the state, near Arco Norte (see Box 2.3). Each of these is meant to lay down favourable conditions for the spontaneous development of an industrial cluster. All have the basic services required for industrial operations, such as electricity, water supply, drainage infrastructure and telecommunications. Some of Hidalgo’s industrial parks are also equipped with facilities for the supply of natural gas and rail services. Each of these industrial parks has a pre-defined vocation focused on high value-added industries for the operation of industrial plants and distribution centres. Some additional parks are also being built through private investment such as the industrial park of the Altiplano. However, only one park fulfils international standards and most of the key important parks are located just in the south of the state (Figure 2.11). There is hence a need for further modernisation and efforts in following international certifications.

Hidalgo has ten main industrial parks, all located in the south of the state:

-

1. PLATAH. Logistics, food, industrial equipment and industrial kitchens.

Characteristics: Surface: 312 ha.; 119 lots.

-

2. Atitalaquia. Food sector, logistics, construction, technological innovation.

Characteristics: Surface: 229 ha.; 70 lots.

-

3. Tula. Petrochemical, plastic, pharmaceutical and construction.

Characteristics: Surface: 97 ha.; 114 lots.

-

4. Tepeji del Río. Food, beverages, textiles, clothing, chemicals and logistics.

Characteristics: Surface: 518.2 ha.; 266 lots.

-

5. Tizayuca. Petrochemical, food and beverages, textile-confection, construction, metalworking, logistics.

Characteristics: Surface: 300 ha.; 314 lots.

-

6. La Reforma. Food, beverages, construction and distribution.

Characteristics: Surface: 34.95 ha.; 50 lots.

-

7. Metropolitano. Automotive, textile and clothing.

Characteristics: Surface: 49.38 ha.; 27 lots.

-

8. Sahagún. Automotive, metalworking.

Characteristics: Area: 50.20 ha.; 30 lots.

-

9. MPyMes Sahagún. Metalworking.

Characteristics: Surface: 9 ha.; 45 lots.

-

10. QUMA. Industrial, commercial and logistics.

Characteristics: Surface: 72 ha.; 42 lots.

The state is giving itself the adequate logistic infrastructure. Hidalgo is in the process of establishing the Terminal Intermodal Logística de Hidalgo (TILH), which is an inland intermodal logistics centre with an annual capacity of 200 000 TEU, as well as a new logistics park (Zona de Actividad Logística de Hidalgo – ZALH). This dry port and logistics centre is the product of collaboration between Hidalgo’s state administration, Hidalgo’s corporate alliance Corporativo UNNE (leader of Mexico’s logistic sector) and the Hong-Kong-based firm Hutchison Port Holding. This infrastructure will help consolidate Hidalgo’s position as a logistical leader for central Mexican freight and cargo.

Energy

Hidalgo is an important player in terms of energy infrastructure for the country. It produces 43% of the hydropower in the country’s central region and it is the 5th biggest electricity producer in the country (9.4% of electricity in Mexico) with 25 electric stations across the state. The Tula-Tepeji region, in the southwest of the state, houses the Miguel Hidalgo refinery, the biggest Mexican refinery in the country. The state has three gas pipelines that all cross thorough of the southern municipalities and provide the energy to the industrial parks’ network. Hidalgo is also building its first solar farm and has important potential in wind energy.

ICT infrastructure

Virtual connectivity is also important for Hidalgo. In 2017, 67% of households in Hidalgo lacked an Internet connection, a higher percentage than the national average of 49.1% (Chapter 1). As with most other infrastructure in Hidalgo, the distribution of Internet connectivity is largely marked by the north-south divide, with several municipalities of southern Hidalgo having Internet coverage levels of up to half of all households. This contrasts strongly with many municipalities of the north, where in some case less than 1% of local households has an Internet connection. It can be expected that Internet access and use by businesses in Hidalgo follows roughly the same patterns as the overall population.

The government is aiming to improve infrastructure, but challenges remain

The state has set the strategy to enhance and modernise the road network with the support of the federal government. It includes designing a programme to evaluate the status of the network, improve existent roads and develop a project portfolio of roadways. In this regard, two important projects, co-financed by the federal government stand out:

-

The expansion of the Pachuca-Mexico City highway from two to four-lanes.

-

The expansion and modernisation of the road that connects Huejutla in the north with Pachuca into a four-lane highway.

The Huejutla-Pachuca road is particularly important for attaining an inclusive growth in the state. The completion of this initiative will benefit eight municipalities and allow their rural areas to not only increase the trade with urban centres but also receive public services more efficient. However, due to budget cuts and ongoing negotiation at the national level, the road has experienced delays keeping the project at its very early construction phase.

There is also an active plan, promoted by the state administration, to further develop and deploy the fibre across Hidalgo’s territory and reach 100% Internet connectivity. For this, the state launched the strategy Hidalgo for Universal Coverage in Telecommunications which involves a regulation on telecommunications to guide and clarify rules on broadband investments that was approved in mid-2018. This will give much higher levels of connectivity and access to public services (telemedicine and tele-education are also contemplated in the strategy), particularly to municipalities in the north. It will also allow small producers a better access to market and potentially make important advances in terms of innovation. As part of the strategy, the government of Hidalgo will make available more than 3 700 public buildings for the private sector to install fibre optic, antennas and radio bases that will help to bring Internet and mobile communications to increase coverage. So far, the state government has generated some initial results like the optical fibre metropolitan ring (investment of MXN 60 million), the increase of access to the Internet in 300 public buildings and the creation of 200 digital access centres (Government of Hidalgo, 2018[21]).

Availability of good Internet is crucial for business, but availability does not automatically suppose high connectivity. Many communities of the north lack the basic tools and training to make good use of the added connectivity. Connecting the state, especially low-density populated areas, will need to be accompanied by programmes and measures to help Hidalgo’s population and businesses make the optimal use of this connectivity for the prosperity and well-being. Examples of community engagement to support the provision of fibre optical networks in rural areas of Sweden and the United Kingdom can be used as a guide for Hidalgo (Box 2.4).

In terms of road network, the state should make further efforts to improve the quality of roads, especially rural roads (e.g. increase paved roads). In addition, a strategy to improve the resilience of its road network is needed. Natural events have been underlined as a major problem to preserve good quality infrastructure in the state. It has a stock of more than 500 km of roads affected by floods. This kind of impact on the infrastructure not only implies a lack of communication for certain localities but also increases the risk and reduces the time to commute.

Although the traditional priority for Hidalgo in terms of infrastructure investments has centred on enhancing linkages with Mexico City, better connections with neighbouring states, international markets and between northern and central municipalities will improve the accessibility of the whole territory. Linking northern municipalities with the ports of the gulf can unlock most of their economic opportunities and boost the internationalisation of local business. It can also further exploit the geographic proximity to some port. Huejutla, alike other northern municipalities, are closer to some ports like Tuxpan (152 km distance) or Tampico (167 km distance) than to the capital of the state Pachuca (221 km). For doing so, improving the co-ordination with neighbouring states and federal government is needed in terms of infrastructural planning and development for both passenger and freight transport (Chapter 4). Notably, Hidalgo should:

-

Explore mechanism of co-ordination with neighbouring states to develop infrastructure projects that benefit northern municipalities with roads, secondary roads and railways. It may thereafter generate further advantage of its geographic location by increasing its trading relations with the other states (e.g. San Luis de Potosi or Veracruz).

-

Promote a co-ordinated development of modern infrastructure connectivity between the north part of the state with the ports of the Gulf (Chapter 4 further develops the co-ordination mechanisms for this).

-

Strengthen the connection between municipalities in the centre of the state with Huejutla or other poles of growth in the north.

As an increasing amount of economic and social activity is undertaken over communication networks it becomes more challenging to be restricted to low-capacity broadband when living in some rural or remote areas. Given that most countries have regions that are sparsely populated, it raises the question of how to improve broadband access in these areas.

There is a growing “grassroots movement” in Sweden to extend optical network fibre coverage to rural villages. There are around 1 000 small village fibre networks in Sweden, in addition to the 190 municipal networks, which on average connect 150 households. These networks are primarily operated as co-operatives, in combination with public funding and connection fees paid by end-users. People in these communities also participate through volunteering their labour or equipment as well as rights of way in the case of the landowners. The incumbent telecommunication operator, as well as other companies, provides various toolkits and services for the deployment of village fibre networks in order to safeguard that these networks meet industry requirements. As the deployment cost per access in rural areas can be as much as four times what it cost in urban areas, such development may not attract commercial players and rely on such collaborative approaches. Aside from any public funding, Sweden’s experience suggests that village networks require local initiatives and commitment as well as leadership through the development of local broadband plans and strategies. They also require co-ordination with authorities to handle a variety of regulatory and legal issues and demand competency on how to build and maintain broadband networks. The most decisive factor is that people in these areas of Sweden are prepared to use their resources and contribute with several thousand hours of work to make a village network a reality.

In the United Kingdom, Community Broadband Scotland is engaging with remote and rural communities in order to support residents to develop their own community-led broadband solutions. Examples of ongoing projects include those in Ewes Valley (Dumfries and Galloway), Tomintoul and Glenlivet (Moray), which are inland mountain communities located within the Moray area of the Cairngorm National Park. Another example of a larger project can be found in Canada and the small Alberta town of Olds with a population of 8 500, which has built its own fibre network through the town’s non-profit economic development called O-net. The network is being deployed to all households in the town with a number of positive effects reported for the community.

Sources: OECD (Forthcoming[22]), Territorial Reviews: Småland-Blekinge 2019 Monitoring progress and special focus on migrant integration

Education, human capital and skills

Human capital is a critical factor influencing regional growth and development throughout all types of OECD regions (OECD, 2017[23]). A skilled human capital is at the essence of regional development and competitiveness by building a learning society that is able to absorb as well as create knowledge, drive innovation and facilitate local adaptability to changing labour demands and technology. Human capital endowment is paramount to boosting productivity growth in the region.

Improved human capital also helps to stimulate social cohesion and well-being because of access to better jobs and potential quality of life enhancements. Analysis by the OECD has shown that, overall, reducing the proportion of the people in a region with very low skills seems to matter more than increasing the share with very high skill levels (OECD, 2017[23]).

Mexico scores below the OECD average in all 3 domains of OECD Programme for International Student Assessment (PISA) 2015: science (416 vs. 493), mathematics (408 vs. 490) and reading (423 vs. 493). Educational attainment in Mexico is indeed a challenge with severe consequences for the national economic development, particularly in relation to tackling informality (see Chapter 1).

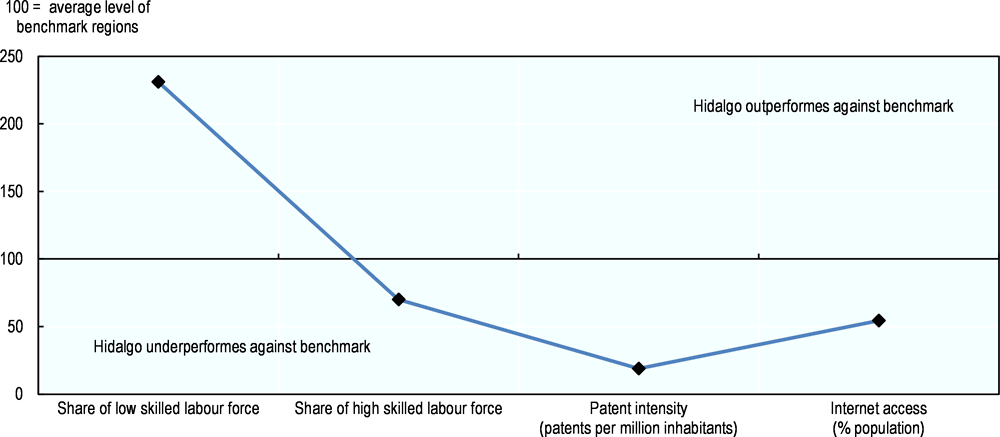

In this sense, if Hidalgo wants to reach the aims set in its strategic plan in terms of economic transformation towards a higher-value economy, first and foremost, Hidalgo will need to build and optimise its human capital endowment. Its current workforce is mostly low-skilled, as only a small percentage of students who start basic education (10.1% in 2016/17) move on to pursue higher education.

Hidalgo has strong basic education but weak incentives for students to pursue higher education

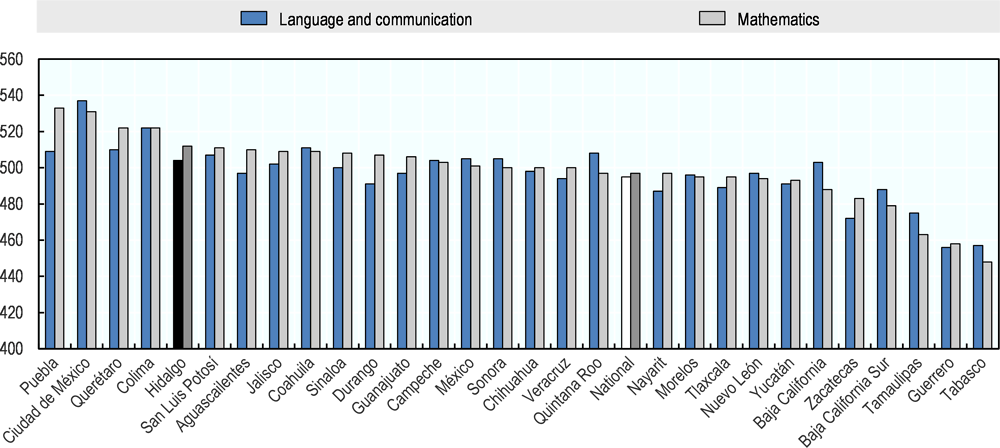

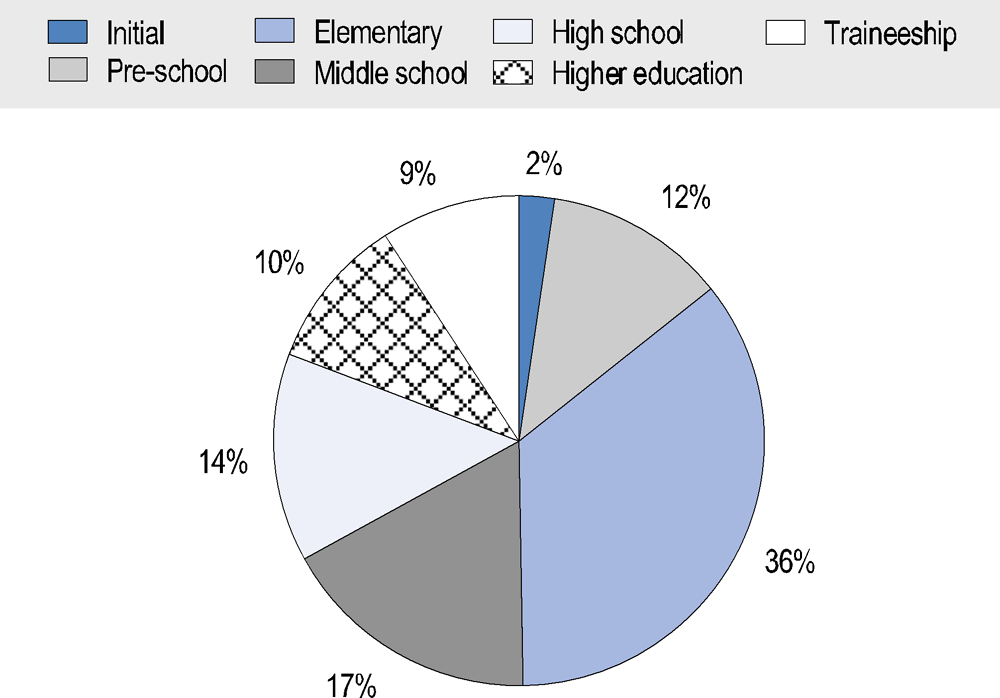

In the current educational context of Hidalgo, the state’s strength is in the basic level of education, both in coverage and quality. During the 2016/17 school year, coverage in basic education level reached 100% (in elementary and middle school) and dropout rates were very low (0% and 9% respectively). In the 2017 national education evaluation PLANEA for middle school (which is comprised within the basic education: pre-school, elementary and middle school), Hidalgo registered a positive performance. In mathematics, Hidalgo (512) scored above the national average (497) and in language and communication Hidalgo (504) is closer to the national average (495) (Figure 2.12).

High school enrolment has nearly doubled since 2007 (41.7%). The growth rate has been more significant in the technological high school track (50.2%) than in the general one. In comparison to the national average of students that pursued the technological high school track in 2016/17 (36.3%), Hidalgo’s proportion of high school students on the same track was higher (42.5%). This high school track could potentially turn into a pipeline of middle-skilled workers for the formal private sector.

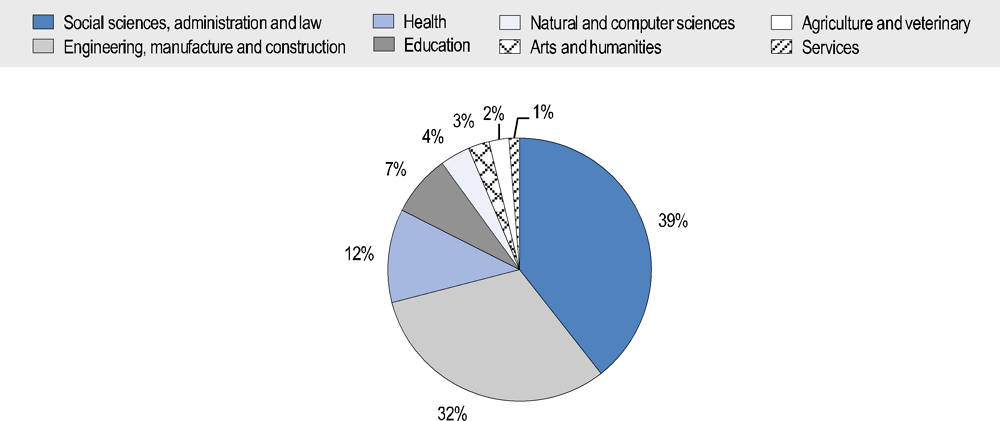

Despite these advances, Hidalgo faces a more challenging situation when it comes to high school and higher education where coverage is low and dropout levels high. Higher education in Hidalgo has a low coverage (see Figure 2.13) and faces challenges to provide incentives for high school students to continue with higher studies. While dropout in high school is a national phenomenon, Hidalgo’s dropout rates (13.7%) are above the national average (12.8% in 2016/17). There is great diversity among Mexican states, for example, Durango (17.3%), Morelos (17%) and Campeche (16.6%) have large dropout rates; while Querétaro (10.7%) and Jalisco (2.7%) experience low dropout levels. High dropout rates in Hidalgo can be related to existing poverty levels (see Chapter 1) and are also a symptom of the mismatch between the offer provided by the state’s higher education institutions and the demands of the local industry.