Chapter 16. Boosting labour market performance in emerging economies

This chapter uses the Jobs Strategy framework to discuss how emerging economies can confront the dual challenge of low productivity and inclusiveness in a context of widespread informality. Pervasive informality implies that large parts of the workforce do not have access to social insurance or basic regulatory protections. It also limits the ability of the government to collect taxes and hence the resources at its disposal to confront the challenge of promoting inclusive growth. A comprehensive approach is needed that simultaneously promotes formality and reaches out to the most vulnerable.

Introduction

Promoting inclusive growth is a major policy challenge in emerging economies. Compared with the typical OECD economy, emerging economies generally exhibit much lower standards of living and higher levels of inequality. In addition, emerging economies also have to face up to pervasive labour informality. Widespread informality implies that large parts of the workforce are effectively beyond the reach of the government and do not have access to social insurance or regulatory protections. Moreover, informality limits the ability of the government to collect taxes and hence the resources at its disposal to promote inclusive growth.

This chapter uses the Jobs Strategy framework to discuss how emerging economies can enhance labour market performance, and more specifically, confront the dual challenge of low productivity and low inclusiveness, in a context of widespread informality. To this end, it focuses on emerging economies that have a link with the OECD, namely Argentina, Brazil, Chile, China, Colombia, Costa Rica, India, Indonesia, Mexico, Kazakhstan, Peru, the Russian Federation, South Africa, Thailand, Tunisia, and Turkey. Given the enormous diversity in this group of countries in terms of income, size, demography, and institutions, the nature of the challenges and the most appropriate policy responses may differ substantially and can only partially be reflected given the scope of this chapter.

The issues discussed in the chapter may not only be of interest to policy-makers in emerging economies, but also to those in more advanced economies. The advent of the platform economy, and associated rise in self-employment, has raised difficult questions about differences in regulatory treatment between dependent employees and self-employed. Emerging economies have been struggling with similar issues for a long time due to the importance of informal work. In recent years, this has resulted in the development of innovative social protection schemes that provide interesting insights also for more advanced economies.

The chapter is organised as follows. Section 16.1 describes the dual challenge of low productivity and inclusiveness in a context of pervasive informality. Section 16.2 discusses the role of policies and institutions for promoting productivity and formality, while Section 16.3 discusses how policies and institutions can promote inclusiveness without undermining formality. The final section concludes.

16.1. Key challenges

The emerging economies considered in this chapter share a dual challenge of (1) low productivity and (2) low labour market inclusiveness. For both these challenges, curbing informality plays a key role.

Economic development is lagging

Economic development is much lower in emerging economies than in the typical OECD country. The gap in gross domestic product (GDP) per capita between emerging economies and the OECD average varies between 40% (Turkey) and 87% (India) (Figure 16.1, Panel A). In other words, the average income in emerging economies is roughly two to ten times lower than that in the average OECD country.

Low economic development mainly reflects lagging productivity. Across the covered emerging economies, labour productivity is between 84% (India) and 18% (Turkey) below the OECD average (Figure 16.1, Panel A). All countries except Argentina, Mexico, and Turkey have experienced productivity convergence during the last few decades, as productivity growth has exceeded the OECD average (Figure 16.1, Panel B). However, the degree of productivity convergence has varied substantially, with particularly fast convergence in the East and Central Asian countries considered here.

To promote productivity in emerging economies, improvements are needed across the board in all firms, but particularly at the bottom of the productivity distribution. Compared with more advanced economies, the distribution of productivity across firms tends to be more dispersed, with a long fat tail of low-productivity firms (Bloom et al., 2010[1]; Levy and López-Calva, 2016[2]; Bento and Restuccia, 2017[3]). Low-productivity work typically reflects the abundance of people with poor basic skills and the demand for low-quality goods and services by these same workers and their families (La Porta and Shleifer, 2014[4]).

In addition to boosting productivity, promoting economic development also requires raising employment, and particularly labour force participation. Bringing employment rates to OECD levels would reduce the gap in GDP per capita between emerging economies and the OECD on average by four to five percentage points (Figure 16.1, Panel A). This mainly requires boosting labour force participation, particularly among women (see Box 16.1). Unemployment tends to be less of an issue.1 This is in part related to the fact that most workers can ill afford being unemployed for extended periods of time since unemployment benefit systems generally have low coverage or are non-existent (OECD, 2015[5]).

Jobs tend to be of poor quality and inclusiveness is low

A second key policy priority is to promote inclusiveness by ensuring that the gains from productivity growth are broadly shared and by protecting vulnerable workers against financial hardship and social exclusion. This requires supporting job quality, tackling excessive inequalities and eliminating extreme poverty.

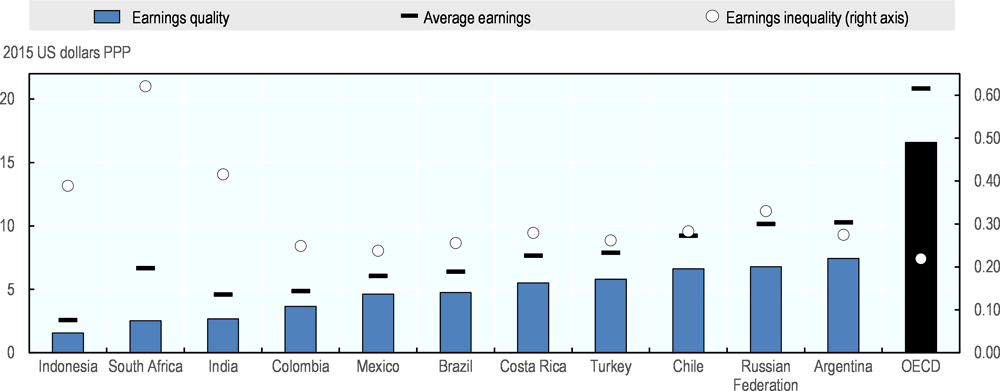

Job quality is a major concern in emerging economies. Lower earnings quality compared to the OECD average reflects both substantially lower average earnings and higher levels of earnings inequality (Figure 16.2). To an important extent, this results from the low levels and wide dispersion of productivity as discussed above. Workers in emerging economies also tend to be more vulnerable to labour market risks than their counterparts in more advanced economies (OECD, 2015[6]). In most emerging economies, this primarily reflects the risk of falling into extreme low pay.2 The quality of the working environment is also generally lower in emerging economies compared with OECD countries. One indication of this is the higher incidence of working very long hours (OECD, 2015[6]).3

Gender gaps in labour force participation and education have shrunk, but progress is uneven

Over the past three decades, women throughout the emerging world have been catching up with men in a number of labour market outcomes. One of the most notable improvements has been an unprecedented increase in female labour force participation, but progress has been very uneven across emerging economies. The most significant improvements have been recorded in Latin America, particularly in Chile and Costa Rica, where the participation gap has fallen by 1 percentage point per year since the mid-1999s. The largest gaps remain in Tunisia, India, and Indonesia. Low-skilled women from poor families, however, continue to face substantial participation gaps throughout the world.

Gender gaps in educational attainments have also generally been shrinking in recent decades. Enrolment rates in primary and secondary education are almost identical for boys and girls, and in many countries women are now attending tertiary education more frequently than men. The most remarkable improvements have been recorded in Tunisia, China, Turkey, Indonesia, and India. However, girls’ educational performance lags behind in mathematics and often in science, which, in conjunction with biased social norms regarding gender roles, results in a lower share of girls to study and work in STEM-related fields (science, technology, engineering, and mathematics). Average improvements in school attainment also hide the fact that girls from poorer families are still much less likely to be enrolled in school at all levels of education. Closing these remaining gaps in education is an important policy objective.

Women continue to hold worse jobs than men

Women tend to have lower-quality jobs than men in emerging economies. The sectors and occupations where women most typically work tend to be less productive and pay lower wages. This is related to the fact that women are more likely to have informal jobs than men. Moreover, a large share of working women (often the majority) are self-employed, and they typically own smaller, less successful, and more often informal businesses than men. Credit constraints, as well as gaps in financial literacy and business-related knowledge, are among the key drivers of gender gaps in entrepreneurship. As a result, the gender pay gap in emerging economies is even larger than in OECD countries. Most worryingly, wide gender pay gaps persist when comparing workers with the same level of education and in similar jobs. Women in emerging economies also have less secure jobs, facing higher risks of both unemployment and extreme low pay (OECD, 2015[6]).

A key driver of gender inequality in emerging economies continues to be the uneven distribution of household and family care between men and women. Action is required to promote flexible work arrangements, make parental leave more effective, and fight gender discrimination.

Source: This box has been prepared by Paolo Falco (OECD) based on OECD (2016[7]), “Closing gender gaps in the labour markets of emerging economies: The unfinished job”, in OECD Employment Outlook 2016, https://doi.org/10.1787/empl_outlook-2016-8-en.

Labour market inclusiveness in emerging economies tends to be low (see Chapter 3). The low-income rate, i.e. the share of persons in households with a disposable income of less than half the median, tends to be high. While on average across the OECD, about one-in-ten people live in poor households, this ratio ranges from one-in-four in China to one-in-eight in the Russian Federation across emerging economies. Elevated low-income rates reflect both high pay inequality and high rates of inactivity among disadvantaged groups, such as youth and older workers with low skills. Income inequalities between men and women also remain large (Box 16.1).

At the same time, considerable progress has been made in eradicating extreme poverty rates in most emerging economies, although it remains a pressing policy concern in some. The percentage of the population living on less than USD 1.90 per day in 2011 purchasing power parity (PPP), the international extreme poverty line as used by the World Bank, is around 20% in India and South Africa, and remains between 3% and 7% in Brazil, Peru, Colombia, and Indonesia. Extreme poverty rates went down in all countries during the last few decades. Progress has been particularly impressive in China and Indonesia, where extreme poverty rates went down from around 45% in the mid-90s to 1% (China) and 7% (Indonesia) now (World Bank, 2016[8]).

Informality is pervasive

Weak productivity and limited inclusiveness are for an important part related to informality, where workers and firms are partially or fully outside the remit of regulation and do not contribute to social insurance.

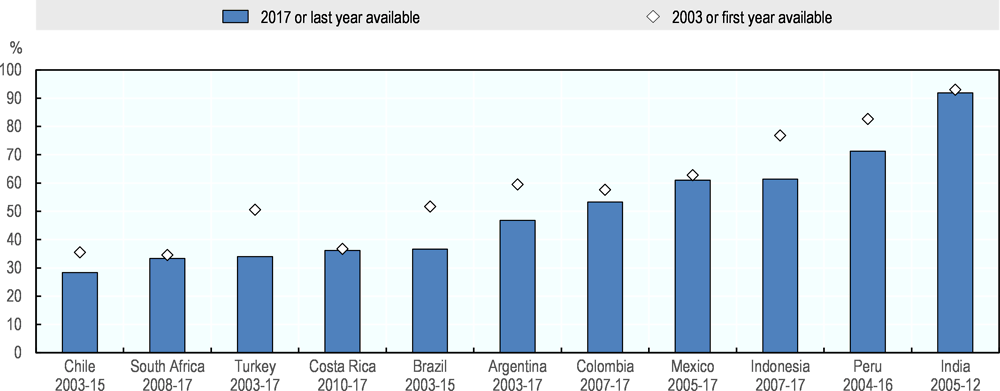

Informal employment is persistently high among emerging economies, albeit with significant cross-country variation (Figure 16.3). Among the countries considered, informality rates range from about 30% in Chile to around 90% in India. Informality is common among very different groups of workers, including own-account workers, family workers and self-employed, but also unregistered wage employees in formal or informal firms (OECD, 2009[9]). In some cases, it reflects a subsistence strategy in the absence of opportunities for formal wage employment, while in others, it reflects a voluntary choice as workers opt out of formality to avoid having to pay social security contributions and taxes (Perry et al., 2007[10]; Meghir, Narita and Robin, 2015[11]).

Informality rates went down in all the emerging economies considered here, but only slowly. Informality tends to shrink as an economy develops. However, this is not an automatic process, as informality depends on many different factors, including the ability of successful formal firms to attract suitable workers (Díaz et al., 2018[12]). Moreover, rapid population growth, especially among the poor, can slow formalisation, as it sustains the supply of low-skilled informal workers and the demand for low-quality goods (La Porta and Shleifer, 2014[4]).4

High and persistent informal employment represents a major policy concern and greatly complicates the challenge of promoting strong productivity growth and more inclusive labour markets.

-

Informality is associated with low productivity and hinders productivity growth. Informal firms are highly overrepresented in the bottom of the size and productivity distribution (Hsieh and Klenow, 2009[13]; Li and Rama, 2015[14]; OECD, 2018[15]). Informal firms tends to be small since this allows them to stay under the radar of enforcement agencies and minimise the risk of detection. However, this also tends to hold down productivity growth as it prevents them from reaching an efficient scale of production and limits their access to credit. Moreover, informality can provide a source of unfair competition to formal firms and thereby weaken incentives for formal-sector development.5

-

Informality is closely related to low labour market inclusiveness, not least because large portions of the workforce are left unprotected from statutory or collectively agreed labour standards as well as social insurance.6 Moreover, mobility rates between informal and formal employment tend to be relatively low, suggesting that the job-quality gap associated with informal work can be highly persistent over time (Bosch and Esteban-Pretel, 2012[16]; Cruces, Ham and Viollaz, 2012[17]; OECD, 2015[6]).7 Finally, persons from groups associated with a weaker labour market position, such as low-skilled youth, women or older workers, are much more likely to work informally than others (OECD, 2008[18]).

-

Informality limits the capacity of the state to collect taxes and hence the resources that can be used to promote inclusive growth, through for example public investment in infrastructure and education and the development of labour market programmes (Besley and Persson, 2014[19]). It also limits the degree of redistribution that can be achieved through the taxes-and-benefits system.

In sum, promoting labour market performance in emerging economies requires confronting the dual challenge of low productivity, on the one hand, and low labour market inclusiveness, on the other. While these challenges are not too different from those faced by more advanced economies (Chapter 2), the context is very different due to the presence of pervasive informality. This greatly limits the reach of employment and social policies and the financial resources available for government action. Any strategy for promoting better labour market performance in emerging economies should therefore take account of the importance of informality.

16.2. Promoting productivity growth and tackling informality

Tackling informality requires a comprehensive strategy that simultaneously addresses all the main factors that drive it. Past experience suggests that narrow reforms that focus on only one specific element affecting formality tend to have only modest effects (Bruhn and McKenzie, 2014[20]). A comprehensive approach to tackling informality should focus on the following elements: i) the development of relevant skills and their efficient use in the labour market; ii) lowering the costs of formality while enhancing its benefits; iii) improving the efficiency of enforcement.

Attaining a skilled workforce and reducing skill mismatch

A skilled workforce is a major determinant of economic and labour market performance (Gennaioli et al., 2013[21]). Differences in human capital account for about half of the difference in GDP per capita between Latin-American countries and OECD countries (Hanushek and Woessmann, 2012[22]). The importance of a skilled workforce reflects both the greater likelihood that skilled workers are employed, as well as their tendency to be more productive in their jobs. Skills also facilitate the dissemination of productivity-enhancing technologies and can thereby help lagging firms to catch up with the technological frontier.

Skill development is also very important for reducing informality. For example, in Colombia, skill upgrading explains two thirds of the reduction in informality from 70% in 2007 to 62% in 2017 (IMF, 2018[23]).8 Formal work necessitates higher productivity and more skilled workers to compensate for the costs of social security contributions, personal income taxes and complying with regulatory requirements. It is therefore not surprising that low-skilled workers are overrepresented in informal work and typically have weak prospects of moving to formal work (OECD, 2015[24]; Cruces, Ham and Viollaz, 2012[17]).

Improving educational enrolment and the quality of education

While emerging economies have made impressive progress in expanding coverage of basic education, enrolment rates of secondary and tertiary education need to be improved to promote the further upskilling of the workforce.9 In addition, the overall quality of the educational system requires further attention. According to the Programme for International Student Assessment (PISA), the average level of skills among high-school students in emerging economies remains well below the OECD average and improvements over time have been modest.

Poor educational outcomes can be ameliorated by ensuring that sufficient financial resources are available for public spending on education, by enhancing the collection of taxes and addressing informality. Governments in emerging economies tend to spend less as a share of GDP on education than OECD countries. This reflects lower public spending overall rather than a lower spending priority for education, since emerging economies tend to devote a larger share of their public budget to education than more advanced economies.

Fiscal constraints highlight the importance of making spending more effective. This can be done by promoting early childhood education, in particular among children in poor households since this increases the motivation for further study and its effectiveness (Heckman, 2006[25]; Kugler et al., 2018[26]). Other cost-effective measures include providing information about school quality and returns to schooling, promoting teacher quality, and using digital technologies in the provision of education services (Ganimian et al., 2016[27]; World Bank, 2018[28]).

Tackling pervasive skill mismatch

While improving the supply of skills is critical, it is equally important that the skills provided by the education system correspond to the skills that are required by firms and that the labour market matches workers to jobs in which they can put their skills to their best possible use. Skill mismatches prevent firms and workers from reaching their full potential, resulting in lower productivity, wages and job satisfaction (Mcgowan and Andrews, 2015[29]; OECD, 2017[30]). Moreover, mismatches lower the returns to education, and therefore, the incentives for workers to invest in education (Levy and López-Calva, 2016[2]).

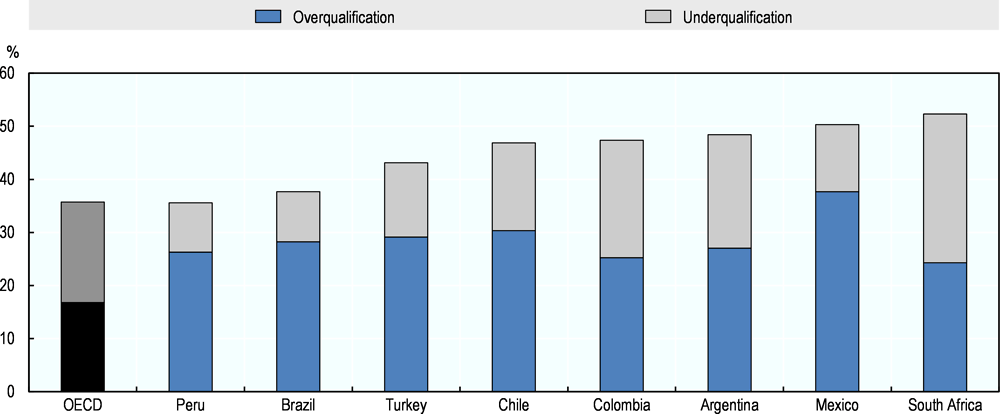

Skill mismatch tends to be high in emerging economies. In each of the emerging economies for which suitable data are available, skill mismatch exceeds the average level in the OECD (Figure 16.4). Moreover, with the exception of South Africa, overqualification tends to be relatively more important than underqualification, in contrast to OECD countries where underqualification tends to be somewhat more important on average.

Skill mismatch can be reduced by ensuring that the educational system provides the skills needed by employers, the labour market allows for an efficient matching between workers and firms and worker skills are fully used in the workplace.

To ensure that students leave the educational systems with the skills required by formal employers, it is essential to strengthen the links between the world of education and the world of work. One promising way of doing this is by combining classroom learning with workplace training, including through the use of apprenticeships. This not only promotes skill acquisition and ensures that training programmes correspond to employer needs, but also provides youth with valuable work experience in formal firms (OECD, 2015[24]). The Colombian Jovenes en Acción programme, for instance, which combines classroom training with an internship in the formal sector, increased the probability of working formally and raised earnings up to ten years after programme completion (Attanasio et al., 2015[31]; OECD, 2016[32]).

Reducing skill mismatch also requires an efficient matching of worker skills with firm needs. This requires good information about the skills of workers and the available job opportunities. Skills accreditation programmes, such as the Recognition of Prior Learning programme in South Africa (OECD, 2017[33]), can help providing better information about worker skills, while information about job vacancies can be disseminated through online platforms or the public employment services, including towards disadvantaged groups. Efficient skills matching also requires that workers can easily move across jobs and firms can adjust their workforce in line with emerging challenges and opportunities. Among other things, this requires sufficiently flexible product markets and employment protection regulations, coupled with effective employment and social policies that support workers rather than their jobs (see discussion below).

Another way of reducing mismatch is to promote the use of skills in the workplace by investing in the competences of entrepreneurs and promoting the use of high performance management and work practices (Bloom et al., 2013[34]; Bloom et al., 2018[35]). This is also likely to support formal-sector development since better skilled managers can deal more easily with the administrative processes that come with formality.10 Moreover, high-performance management and work practices are likely to be more effective in formal firms since they tend to be part of a long-term strategy based on stable employer-employee relationships.

Lowering the costs of formality while enhancing its benefits

Promoting productivity growth crucially requires a business-friendly environment in which formal jobs can flourish. This includes a legal system that enforces property rights and contracts in a fair and timely manner (Quatraro and Vivarelli, 2015[36]). Having the legal power to demand that contracts are upheld is a major advantage of being in the formal sector and should be guaranteed by the government. An effective judiciary is also key for productivity growth, as it allows formal firms to access credit, reduces uncertainty to foreign investors, and supports the participation in global value chains (Perry et al., 2007[10]).

In many emerging economies, stringent product market rules hold back competition, productivity growth and the creation of formal jobs (Koske et al., 2015[37]). Barriers to entrepreneurship, trade and investment tend to be considerably higher in emerging economies than in more advanced OECD countries. They tend to protect incumbents against competition from outsiders by imposing high administrative hurdles to potential entrants. State control, as reflected by high shares of public ownership in the market sector, also tends to be more important. Pro-competitive reforms can promote productivity growth by: improving the operational efficiency of firms and the efficient allocation of resources (OECD, 2016[38]); enhancing institutional quality by reducing the scope for rent-seeking behaviour and corruption (Rijkers, Arouri and Baghdadi, 2016[39]); and fostering formal-sector job creation by reducing the administrative costs of registering or running a business.

Labour taxes should be kept moderate as they can represent a substantial cost for the creation of formal jobs, particularly of low-skilled ones (Cano-Urbina, 2015[40]; Bosch and Esteban-Pretel, 2012[16]; Frölich et al., 2014[41]). While labour tax rates tend to be similar or lower on average than in OECD countries, they tend to be much higher for low-wage workers (OECD, 2015[5]). This reflects a much greater reliance on social security contributions, which tend to be proportional to income, as opposed to personal income taxes, which tend to be more progressive. This has potentially important implications not only for labour market inclusiveness, but also the attractiveness of being formal. To the extent that there is a strong link at the individual level between social security contributions and entitlements, a significant labour tax wedge may not have important implications for the choice between working formally or informally. However, incentives to work formally tend to be weakened if: i) social security has a significant redistributive component, ii) the social security system does not provide value for money due to poor management; or iii) workers do not value entitlements because they are short-sighted.11 To strengthen the incentives of working formally, one possibility could be to reinforce the link between entitlements and contributions. Another is to promote incentives for formality among low-wage workers by making labour taxes more progressive. This can be achieved through the use of exemptions from social security contributions for low-wage workers or by relying more strongly on general taxation, including progressive personal income taxes.

Labour market regulation has traditionally been a popular instrument for governments in emerging economies to ensure adequate working conditions, but it should be used carefully to avoid unnecessarily adding to the cost of formal employment. While the design of occupational and safety regulations should be driven primarily by considerations over the wellbeing of workers rather than their costs to firms, this is less obvious in other regulatory areas. Indeed, employment protection regulations and statutory minimum wages could be considerably lightened in certain emerging economies, provided that effective social-assistance and unemployment-insurance systems are in place.12 Such an approach is likely to increase the attractiveness of formality to firms by reducing payroll and dismissal costs, while at the same time provide more effective protection to workers and their families (see Section 16.3).

Enhancing compliance through enforcement, social dialogue and social norms

Tackling informality also requires enhancing compliance with regulations through an effective judiciary, well equipped labour inspectorates and the involvement of the social partners. Compliance can also be enhanced through the establishment of social norms that promote a responsible business conduct.

The effective enforcement of labour, tax and social security regulations is essential for combatting informal employment. In most emerging economies, this requires additional resources for labour inspectorates since labour inspectors tend to be few and their training insufficient.13 At the same time, limited resources can often be used more efficiently by applying risk-assessment methods to target non-complying firms and workers, such as small firms and firms in the service sector (OECD, 2008[18]). To avoid the risk that enforcement further worsens the position of already vulnerable workers in the labour market (Ulyssea, 2010[42]; Ulyssea, 2018[43]; Almeida and Carneiro, 2012[44]), it should not be overly harsh, by balancing sanctions in case of non-compliance with technical assistance to help workers and firms navigate administrative processes.

Collective bargaining and social dialogue can play a key role in ensuring that labour market regulations and labour standards are upheld. Trade unions as well as other forms of collective worker representation are well placed to raise instances of non-compliance and provide a voice to workers. However, unionisation rates tend to be very low in emerging economies (OECD, 2018[45]). This partly reflects the fact that the rights of freedom of association and collective bargaining are often not well respected. Governments should make greater efforts to protect these rights and to promote constructive social dialogue more generally.

Social norms can contribute to compliance with labour laws by promoting the responsible business conduct of firms. The OECD Guidelines for Multinational Enterprises are the most encompassing government-supported instrument to promote the responsibility of employers for the quality of employment conditions and industrial relations in their business operations and supply chains (see Chapter 7). Among other things, they commit governments to encourage multinational enterprises to contribute to the effective abolition of child and forced labour, tackle discrimination, promote the right of worker representation, enhance health and safety in the workplace, and mitigate the adverse effects of collective layoffs.

16.3. Protecting workers

Productivity growth is a necessary but not a sufficient condition for broadly shared increases in living standards. It is equally important that vulnerable workers are protected against financial hardship and social exclusion by effective social protection systems.14 When considering different options for strengthening social protection due consideration should be given to the possible effects of taxes and benefits on work incentives, notably those for formal work.

Strengthening social protection

Social protection in emerging economies is generally much weaker than in more advanced OECD countries. It is also largely focused on formal workers, leaving an important share of the population vulnerable to poverty and economic shocks.

Weak social protection in part reflects low social spending. Overall public social expenditure as a share of GDP falls well short of the average level in the OECD, and is even half that level in some emerging economies (OECD, 2016[46]). This is partly related to the pervasiveness of informality and the constraints that this places on the ability to collect taxes. Given the difficulty of expanding the budget for public social expenditures in the short-term, a strong targeting of social expenditures towards the most vulnerable is needed (OECD, 2015[5]).

However, contributory social insurance programmes account for the bulk of public social expenditures in emerging economies, while their coverage, by definition, is limited to formal workers (OECD, 2010[47]).15 As a result, the impact of social insurance benefits on the income distribution tends to be regressive, whereas such benefits typically have a strong inequality-reducing effect in more advanced economies (Causa and Hermansen, 2017[48]). Even among formal workers, the effectiveness of social insurance tends to be limited due to the combination of patchy coverage, and low levels of benefits or, in some countries, the complete absence of key programmes such as unemployment insurance.

Non-contributory social assistance benefits can make a potentially important contribution to alleviating financial hardship in emerging economies since they can be targeted at those who need it most, including informal workers. In practice, however, the effectiveness of social assistance in rolling back poverty is often limited, due to a combination of insufficient resources, resulting in benefits that are not sufficiently high to lift families out of poverty, as well as poor targeting, due to the difficulty of means-testing in emerging economies.16

Strengthening labour market inclusiveness requires reinforcing social assistance in countries where informality remains pervasive and existing programmes are not sufficiently effective in addressing financial hardship. Strengthening social insurance is also important to protect formal workers against labour market risks and to avoid that adverse career events drive people into informality.

Protecting the most vulnerable against financial hardship

Various approaches to social assistance have emerged

The principal objective of social assistance is to reduce poverty, tackle social exclusion and promote economic development by focusing on poor segments of the population irrespective of their labour market status. During the past twenty years, there has been a proliferation of large-scale, and sometimes innovative, cash transfers (CT) programmes in emerging economies.17 One can differentiate three broad classes (Barrientos, 2016[49]):

-

Unconditional cash transfers (UCT), usually targeted to poor households with older household members. Examples of UCTs beyond old-age pensions include the Chinese Di Bao system which seeks to provide a guaranteed minimum income for all households and South Africa’s Child Support Grant which provides income support to caregivers of children. UCT programmes do not impose any conditions beyond being below the income (or wealth) threshold.

-

Conditional cash transfers (CCT) programmes, which provide income support to poor household that comply with certain behavioural requirements in relation to education or health (e.g. school attendance, vaccinations, health clinic visits). Apart from reducing poverty, CCTs also seek to promote equal opportunities and long-term economic growth by investing in the education and health of children. Examples include Bolsa Familia in Brazil – currently the largest CCT in operation worldwide – and Prospera in Mexico (formerly known as Oportunidades).

-

Integrated anti-poverty programmes, which combine income support to the poor with interventions that seek to address the structural causes of poverty. This recognises the need for a comprehensive approach to tackling the often multiple barriers to durably moving out of poverty.18 The best known example is Chile Solidario which combines income support with personal counselling and access to social services (e.g. education, employment, healthcare, housing and justice).

Cash transfers do not need to entail negative employment effects

CTs typically play a significant effect in reducing financial hardship among benefit recipients. The evidence suggests that households receiving social benefits have higher incomes and increase their consumption (Bastagli et al., 2016[50]). This means that the effect of benefit receipt is not fully offset by adverse effects on work incentives and that benefits play a potentially important role in alleviating liquidity constraints (Banerjee et al., 2017[51]).

However, CTs tend to have modest effects on reducing poverty and inequality. This reflects a combination of low benefit generosity – benefits typically do not exceed 20% of the average wage (OECD, 2011[52])19 – and poor targeting due to the use of proxy-means tests (OECD, 2010[47]). Inaccurate targeting tends to give rise to significant errors of exclusion, i.e. eligible households who not receive income support, in some cases well over 50% of potential beneficiaries, implying that financial hardship in many cases remains unaddressed. Errors of inclusion, i.e. non-eligible households who receive benefits, tend to be smaller, but remain far from negligible, raising important questions about the efficiency of public spending (OECD, 2010[47]; Soares, Ribas and Osório, 2010[53]; Golan, Sicular and Umapathi, 2017[54]; Larrañaga, Contreras and Ruiz-Tagle, 2012[55]).

CTs in emerging economies typically do not generate strong negative employment effects for a number of reasons (OECD, 2011[52]; Banerjee et al., 2017[51]; Banerjee et al., 2017[51]).20 First, benefit recipiency is not conditional on labour market status, as tends to be the case in more advanced OECD countries. CTs are typically seen as a complement to subsistence incomes rather than a response to joblessness. This means that joblessness is generally not a condition for eligibility.21 Second, the use of crude and infrequent means tests to determine initial and continued benefit eligibility for CTs in emerging economies implies that additional income is not immediately taxed away as a result of benefit withdrawal. Third, levels of transfers are generally low and recipient households are typically very poor.22 This means that work incentives are likely to remain relatively strong. There may even be positive labour market effects when benefits alleviate financial barriers to labour force participation among very poor households.23

While loose means tests and low benefits limit potentially adverse labour market effects, they also limit the effectiveness of CTs in reducing poverty. One way of increasing policy effectiveness without inducing significant labour market effects may be to make use of graduated benefits which only gradually decline as income rises (OECD, 2011[52]). The main drawback of such an approach is that it would require a shift from proxy-means tests towards means-tests based on regular income declarations, which are more demanding in terms of administrative capacity and may be costly to operate. Given the difficulties involved with targeting, an alternative option could be to move towards a universal basic income (UBI), i.e. an unconditional benefit for everyone irrespective of income or labour market status. While this would address the issue of horizontal equity that results from inaccurate targeting, benefits would be too low to significantly alleviate financial hardship among the poor without substantial additional fiscal resources (Hanna and Olken, 2018[56]).

Address poverty at it roots and promote long-term labour market outcomes

Conditional cash transfers can make a potentially important contribution to the inter-generational transmission of poverty and long-term labour market outcomes through their impact on education and health. The evidence shows positive effects of varying extents on school attendance, child nutrition and height for age (Narayan et al., 2018[57]). Evidence on long-term labour market effects remains scarce as children among recipient households are only starting to make their way to the labour market now, but typically point to small positive effects (Millán et al., 2019[58]; Kugler and Rojas, 2018[59]; Behrman, Parker and Todd, 2011[60]). However, CCT programmes have been criticised for falling short of their promises as a result of a weak enforcement of conditionality and poor-quality education and health services (OECD, 2011[52]; Fiszbein et al., 2009[61]).

A growing awareness of the need for a comprehensive approach to tackle the social problems that drive poverty and enhance the long-term effectiveness of CCTs has contributed to the development of integrated anti-poverty programmes that combine income support with a range of social services. While evaluations of Chile Solidario during its initial period of operation suggest that the programme did not yield significant employment effects (Carneiro, Galasso and Ginja, 2018[62]; Galasso, 2011[63]; Larrañaga, Contreras and Ruiz-Tagle, 2012[55]), the programme has been redesigned to enhance its effectiveness and similar programmes have been developed elsewhere. For example, in Argentina Seguro de Capacitacion y Empleo (SCE) was established in 2006 to provide employment services to recipients of the CCT Plan Jefes. Evaluation results suggest that this increased formal employment and wages (López Mourelo and Escudero, 2017[64]). In Mexico, Prospera, which replaced Oportunidades in 2014, systematically registers benefit recipients with the public employment services to support poor households in getting a foothold in the labour market (OECD, 2017[65]).

Protecting formal workers against the consequences of job loss

Even though social assistance can provide an important backstop for displaced workers, it is also important that effective income support policies are available for workers who are displaced from formal jobs to provide them with the necessary time and resources to search for a new formal job and to avoid that they are pushed into informal work.

Support for displaced workers tends to be job-oriented

Income support to formal-sector job losers generally takes two forms: unemployment insurance (UI) and severance pay (SP). UI represents a worker-oriented approach to job displacement by alleviating the impact of job loss on consumption during the period of unemployment and to provide workers with the means to search for a suitable job. By contrast, SP represents a more job-oriented approach in the sense that it tends to reduce the risk of unemployment directly through the use of a firing penalty.24 Moreover, UI represents a collective approach based on the pooling of risks across individuals and firms. This reduces the cost of insurance and allows for redistribution. By contrast, SP provides a more individualised approach, as firms are held directly responsible for the costs of their layoff behaviour. 25

Severance pay represents the main source of income support to job losers in emerging economies, in contrast to more advanced OECD economies where unemployment insurance tends to be much more important. As an illustration, Figure 16.5 juxtaposes the value of income support during the first year of unemployment that is available to eligible job losers from either UI or SP.26 In the emerging economies considered here, except South Africa and the Russian Federation, SP represents the main source of income support. Some emerging economies do not have a universal UI system at all and, where it exists, coverage tends to be very low, particularly among the most vulnerable, as a result of strict eligibility requirements or short maximum durations. By contrast, in all non-emerging OECD economies except Lithuania, the value of income support from UI exceeds (or equals) that from SP. They all have universal UI systems in place, while about half do not impose any mandatory SP requirements.

The importance of SP in emerging economies reflects to an important extent legal traditions (Botero et al., 2004[66]), but is also related to the difficulty of providing UI effectively in a context of widespread informality and weak administrative capacity. Workers at low risk of job loss may opt out of the system by working informally (“adverse selection”). Moreover, benefit recipients often have the possibility of working informally while receiving benefits, reducing incentives to look actively for another formal job (“moral hazard”).

Because of the difficulties in providing UI in a context of widespread informality, employment protection has sometimes been considered as a low-cost alternative to unemployment insurance in emerging economies (Heckman and Pages, 2004[67]). However, the emphasis on job security rules is unlikely to be ideal for providing effective protection to formal-sector job losers, nor for promoting formal-sector development and productivity.Despite being a legal requirement, in practice severance payments are rarely made in emerging economies due to widespread non-compliance, particularly in the case of vulnerable workers with a weak bargaining position (World Bank, 2019[68]).There is a risk, moreover, that overly strict employment protection rules push workers from low-skilled jobs into informal ones (Betcherman, 2015[69]). Finally, strict employment protection hampers the efficient allocation of resources, and hence productivity growth.

Strengthening unemployment insurance for workers

To provide more effective support to displaced workers from formal jobs, UI systems should be designed or redesigned so as to minimise the unintended effects of benefit receipt on incentives to work formally, while maximising support to cash-strapped job losers in their search for quality work in a context of widespread informality and significant administrative constraints. This can be achieved by giving individuals more responsibility for the cost of unemployment benefits through the use of individual unemployment saving accounts (IUSA), collective UI schemes with limited benefit generosity, or a combination of the two.

IUSAs provide self-insurance against the risk of unemployment based on mandatory savings by the employee, employer, or both. They preserve strong work incentives, as unemployed workers can make withdrawals from their own personal savings accounts under certain modalities to support their income and assist them in their job-search. IUSAs can also strengthen incentives for working formally since social security contributions are less likely to be perceived as a tax on labour and more likely as a delayed payment. The main drawback of IUSA systems relates to their potential to provide adequate protection to vulnerable workers due to the lack of risk pooling; i.e. those most likely to exhaust their accounts as a result of frequent and/or long-lasting spells of unemployment.

A second possibility is to complement IUSAs with a small collective UI system to provide income support to job losers who have no or insufficient savings in their individual savings accounts. Such a scheme was introduced in Chile in 2001. While benefits from the collective fund were found to increase unemployment durations more than those from IUSAs, consistent with weaker work incentives (Hartley, van Ours and Vodopivec, 2011[70]), this could also reflect the role of benefits for alleviating liquidity constraints that prevent cash-strapped unemployed persons from searching for a job that fits their skills (OECD, 2011[52]; Chetty, 2008[71]).

A third option is to make use of a collective UI system only, with benefit schedules that are designed to ensure strong work incentives. The main advantage of this approach is that it allows for (more) risk-pooling and redistribution than is possible with no or only a limited collective component. Preserving strong work incentives in a context of weak administrative capacity may require, at least initially, benefits with relatively low replacement rates and short durations. Addressing liquidity constraints that lead to sub-optimal job choices furthermore may require targeting benefits towards job losers with limited resources. This could be achieved by offering flat benefit schedules, as in China, or means-tested replacement rates, as in Brazil.27

Gradually develop public employment services

Efforts to strengthen collective unemployment insurance schemes should be accompanied by investments in employment policies to minimise the risk of benefit dependency, facilitate the return to work and limit skills mismatch.

The role of the public employment services depends on the specific features of the UI system. In countries with a relatively short maximum duration of benefits, such as Brazil, activation may be light, by mainly focusing on the administration of initial benefit eligibility and the provision of job-brokering services. In countries where benefits are available for a relatively long duration, such as China and the Russian Federation, the public employment services may need to play a more important role, including by monitoring and enforcing continued eligibility and engaging in the development of individual action plans.

While investing in public employment services is important, it is equally important to tread cautiously and complement investments in the PES with investments in administrative capacity. The evidence on the effectiveness of more elaborate employment programmes, including training, is not encouraging (Kluve, 2016[72]; McKenzie, 2017[73]; Hirshleifer et al., 2016[74]). While to some extent this may reflect the role of insufficient treatment intensity related to limited resources, weak administrative capacity related to, for instance the coordination of benefit administration and re-employment services, is also likely to play an important role.

Conclusions

This chapter uses the Jobs Strategy framework to discuss how emerging economies can confront the dual challenge of low productivity and inclusiveness in a context of widespread informality. Informality complicates this dual challenge by holding back productivity growth, leaving large parts of the workforce without social insurance and basic regulatory protection, and by limiting fiscal space to invest in measures that can support inclusive growth. The main message of this chapter is that governments in emerging economies should concentrate more directly on workers by providing them with the skills to succeed in the labour market and protecting the most vulnerable against financial hardship. The current focus on the protection of well-paid formal jobs through the combination of rigid product market regulations, strict employment protection rules and high minimum wages risks being counterproductive, with adverse consequences for productivity, formality and inclusiveness. More specifically, the chapter provides the following messages:

-

Invest in skills. Investing in skills is critical for raising productivity, reducing inequality and promoting formal employment. More needs to be done to ensure that education is accessible and affordable to everyone, including children from disadvantaged backgrounds. The quality of educational systems deserves particular attention since too many students enter the labour market without the skills that are needed in formal jobs. Poor-quality education not only does little to enhance career prospects in the formal sector, it also represents a waste of financial resources and time and can lead to false expectations, particularly among the young, with potentially important consequences for trust in public institutions.

-

Strengthen social protection. In emerging economies, social protection tends to be weak and mainly focused on formal workers. More should be done to protect poor families against financial hardship while addressing the roots of poverty. This requires investing in comprehensive social assistance systems in combination with employment, social and health services that tackle barriers to the gainful employment of working-age adults and promote the long-term labour market prospects of children. A better targeting of benefits to poor households would further increase policy effectiveness, but may also weaken work incentives. Benefit dependency can be avoided by allowing for benefit schedules that gradually decline with additional income. Similarly, to promote formal employment among low-wage workers, the financing of social insurance systems could be made more progressive or the importance of general taxation increased. In the longer term, a more integrated approach to social protection could be envisaged that provides social assistance and social insurance in a unified framework.

-

Provide more flexible product and labour markets. Compared with OECD standards, product market regulations, employment protection rules and statutory minimum wages in emerging economies tend to be relatively strict, while at the same time leave large parts of the economy unregulated. This undermines productivity growth, formal sector development and, in the case of product market regulations, also institutional quality by increasing the scope for regulatory capture and corruption. Rather than relying on strict regulations, more attention should be given to addressing poverty through social assistance and supporting workers who have been displaced from formal jobs through unemployment insurance. At the same time, to promote a good environment for firms and adequate labour standards for workers, governments should enhance compliance with existing labour and product market regulations through an effective judiciary, well-equipped labour inspectorates and constructive social dialogue.

References

[44] Almeida, R. and P. Carneiro (2012), “Enforcement of Labor Regulation and Informality”, American Economic Journal: Applied Economics, Vol. 4/3, pp. 64-89, https://doi.org/10.1257/app.4.3.64.

[31] Attanasio, O. et al. (2015), “Long Term Impacts of Vouchers for Vocational Training: Experimental Evidence for Colombia”, NBER Working Paper, No. 21390, https://doi.org/10.3386/w21390.

[51] Banerjee, A. et al. (2017), “Debunking the Stereotype of the Lazy Welfare Recipient: Evidence from Cash Transfer Programs”, The World Bank Research Observer, Vol. 32/2, pp. 155-184, https://doi.org/10.1093/wbro/lkx002.

[49] Barrientos, A. (2016), Social Assistance In Developing Countries, Cambridge University Press, http://admin.cambridge.org/sb/academic/subjects/politics-international-relations/political-economy/social-assistance-developing-countries (accessed on 23 August 2018).

[50] Bastagli, F. et al. (2016), Cash Transfers: What Does The Evidence Say? A Rigorous Review Of Programme Impact And Of The Role Of Design And Implementation Features, Overseas Development Institute, http://www.odi.org/sites/odi.org.uk/files/resource-documents/10749.pdf (accessed on 05 September 2018).

[60] Behrman, J., S. Parker and P. Todd (2011), “Do Conditional Cash Transfers for Schooling Generate Lasting Benefits?”, Journal of Human Resources, Vol. 46/1, pp. 93-122, https://doi.org/10.3368/jhr.46.1.93.

[3] Bento, P. and D. Restuccia (2017), “Misallocation, Establishment Size, and Productivity”, American Economic Journal: Macroeconomics, Vol. 9/3, pp. 267-303, https://doi.org/10.1257/mac.20150281.

[19] Besley, T. and T. Persson (2014), “Why Do Developing Countries Tax So Little?”, Journal of Economic Perspectives, Vol. 28/4, pp. 99-120, https://doi.org/10.1257/jep.28.4.99.

[69] Betcherman, G. (2015), “Labor Market Regulations: What do we know about their Impacts in Developing Countries?”, The World Bank Research Observer, Vol. 30/1, pp. 124-153, https://doi.org/10.1093/wbro/lku005.

[34] Bloom, N. et al. (2013), “Does Management Matter? Evidence from India”, The Quarterly Journal of Economics, Vol. 128/1, pp. 1-51, https://doi.org/10.1093/qje/qjs044.

[1] Bloom, N. et al. (2010), “Why Do Firms in Developing Countries Have Low Productivity?”, American Economic Review: Papers & Proceedings, Vol. 100/2, pp. 619-623, https://doi.org/10.1257/aer.100.2.619.

[35] Bloom, N. et al. (2018), “Do Management Interventions Last? Evidence from India”, World Bank Policy Research Working Papers, No. 8339, https://doi.org/10.1596/1813-9450-8339.

[16] Bosch, M. and J. Esteban-Pretel (2012), “Job Creation And Job Destruction In The Presence Of Informal Markets”, Journal of Development Economics, Vol. 98/2, pp. 270-286, https://doi.org/10.1016/J.JDEVECO.2011.08.004.

[66] Botero, J. et al. (2004), “The Regulation of Labor”, The Quarterly Journal of Economics, Vol. 119/4, pp. 1339-1382, https://doi.org/10.1162/0033553042476215.

[20] Bruhn, M. and D. McKenzie (2014), “Entry Regulation and the Formalization of Microenterprises in Developing Countries”, The World Bank Research Observer, Vol. 29/2, pp. 186-201, https://doi.org/10.1093/wbro/lku002.

[40] Cano-Urbina, J. (2015), “The Role Of The Informal Sector In The Early Careers Of Less-Educated Workers”, Journal of Development Economics, Vol. 112, pp. 33-55, https://doi.org/10.1016/J.JDEVECO.2014.10.002.

[62] Carneiro, P., E. Galasso and R. Ginja (2018), “Tackling Social Exclusion: Evidence from Chile”, Unpublished, http://www.ucl.ac.uk/~uctppca/cs_jan12_2018.pdf (accessed on 29 August 2018).

[48] Causa, O. and M. Hermansen (2017), “Income Redistribution Through Taxes And Transfers Across Oecd Countries”, OECD Economics Department Working Papers, No. 1453, https://doi.org/10.1787/bc7569c6-en.

[71] Chetty, R. (2008), “Moral Hazard versus Liquidity and Optimal Unemployment Insurance”, Journal of Political Economy, Vol. 116/2, pp. 173-234, https://doi.org/10.1086/588585.

[75] Cingano, F. (2014), “Trends in Income Inequality and its Impact on Economic Growth”, OECD Social, Employment and Migration Working Papers, No. 163, OECD Publishing, Paris, https://doi.org/10.1787/5jxrjncwxv6j-en.

[17] Cruces, G., A. Ham and M. Viollaz (2012), “Scarring Effects Of Youth Unemployment And Informality Evidence From Brazil”, Unpublished, http://conference.iza.org/conference_files/worldb2012/viollaz_m8017.pdf (accessed on 05 September 2018).

[12] Díaz, J. et al. (2018), “Pathways to Formalization: Going beyond the Formality Dichotomy”, No. 11750, IZA, http://www.iza.org (accessed on 15 September 2018).

[61] Fiszbein, A. et al. (2009), Conditional Cash Transfers Reducing Present And Future Poverty, World Bank.

[41] Frölich, M. et al. (eds.) (2014), Social Insurance, Informality, And Labor Markets : How To Protect Workers While Creating Good Jobs, Oxford University Press.

[63] Galasso, E. (2011), “Alleviating Extreme Poverty In Chile: The Short Term Effects Of Chile Solidario”, Estudios de Economía, Vol. 38/1, pp. 101-127, https://scielo.conicyt.cl/pdf/ede/v38n1/art05.pdf (accessed on 29 August 2018).

[27] Ganimian, A. et al. (2016), “Improving Education in Developing Countries: Lessons From Rigorous Impact Evaluations”, Review of Educational Research, Vol. 86/3, pp. 719-755, https://doi.org/10.3102/0034654315627499.

[78] Garganta, S. and L. Gasparini (2015), “The Impact Of A Social Program On Labor Informality: The Case Of Auh In Argentina”, Journal of Development Economics, Vol. 115, pp. 99-110, https://doi.org/10.1016/J.JDEVECO.2015.02.004.

[21] Gennaioli, N. et al. (2013), “Human Capital and Regional Development”, The Quarterly Journal of Economics, Vol. 128/1, pp. 105-164, https://doi.org/10.1093/qje/qjs050.

[54] Golan, J., T. Sicular and N. Umapathi (2017), “Unconditional Cash Transfers in China: Who Benefits from the Rural Minimum Living Standard Guarantee (Dibao) Program?”, World Development, Vol. 93, pp. 316-336, https://doi.org/10.1016/J.WORLDDEV.2016.12.011.

[56] Hanna, R. and B. Olken (2018), “Universal Basic Incomes vs. Targeted Transfers: Anti-Poverty Programs in Developing Countries”, NBER Working Paper, No. 24939, http://www.nber.org/data-appendix/w24939 (accessed on 27 August 2018).

[22] Hanushek, E. and L. Woessmann (2012), “Schooling, educational achievement, and the Latin American growth puzzle”, Journal of Development Economics, Vol. 99/2, pp. 497-512, https://doi.org/10.1016/J.JDEVECO.2012.06.004.

[70] Hartley, G., J. van Ours and M. Vodopivec (2011), “Incentive Effects Of Unemployment Insurance Savings Accounts: Evidence From Chile”, Labour Economics, Vol. 18/6, pp. 798-809, https://doi.org/10.1016/j.labeco.2011.06.011.

[25] Heckman, J. (2006), “Skill Formation And The Economics Of Investing In Disadvantaged Children”, Science, Vol. 312/5782, pp. 1900-1902, https://doi.org/10.1126/science.1128898.

[67] Heckman, J. and C. Pages (2004), Law and Employment, University of Chicago Press, https://doi.org/10.7208/chicago/9780226322858.001.0001.

[74] Hirshleifer, S. et al. (2016), “The Impact of Vocational Training for the Unemployed: Experimental Evidence from Turkey”, The Economic Journal, Vol. 126/597, pp. 2115-2146, https://doi.org/10.1111/ecoj.12211.

[13] Hsieh, C. and P. Klenow (2009), “Misallocation and Manufacturing TFP in China and India”, Quarterly Journal of Economics, Vol. 124/4, pp. 1403-1448, https://doi.org/10.1162/qjec.2009.124.4.1403.

[23] IMF (2018), “Colombia : Selected Issues”, IMF Staff Country Reports No. 18/129, https://www.imf.org/en/Publications/CR/Issues/2018/05/29/Colombia-Selected-Issues-45899 (accessed on 05 September 2018).

[72] Kluve, J. (2016), “A Review of the Effectiveness of Active Labour Market Programmes with a Focus on Latin America and the Caribbean”, ILO Research Department Working Paper, No. 9, https://www.ilo.org/wcmsp5/groups/public/@dgreports/@inst/documents/publication/wcms_459117.pdf (accessed on 23 August 2018).

[37] Koske, I. et al. (2015), “The 2013 Update of the OECD's Database on Product Market Regulation: Policy Insights for OECD and Non-OECD Countries”, OECD Economics Department Working Papers, No. 1200, http://www.oecd.org/eco/workingpapers (accessed on 05 September 2018).

[26] Kugler, A. et al. (2018), “Long-Term Direct and Spillover Effects of Vocational Training: Experimental Evidence from Colombia 1”, Unpublished, https://lacer.lacea.org/bitstream/handle/123456789/61291/lacea2016_effects_vocational_training.pdf?sequence=1 (accessed on 18 September 2018).

[59] Kugler, A. and I. Rojas (2018), “Do CCTs Improve Employment and Earnings in the Very Long-Term? Evidence from Mexico”, NBER Working Paper, https://doi.org/10.3386/w24248.

[4] La Porta, R. and A. Shleifer (2014), “Informality and Development”, Journal of Economic Perspectives, Vol. 28/3, pp. 109-126, https://doi.org/10.1257/jep.28.3.109.

[55] Larrañaga, O., D. Contreras and J. Ruiz-Tagle (2012), “Impact Evaluation of Chile Solidario: Lessons and Policy Recommendations”, Journal of Latin American Studies, Vol. 44/02, pp. 347-372, https://doi.org/10.1017/S0022216X12000053.

[77] Lazear, E. (1990), “Job Security Provisions and Employment”, The Quarterly Journal of Economics, Vol. 105/3, p. 699, https://doi.org/10.2307/2937895.

[2] Levy, S. and L. López-Calva (2016), “Labor Earnings, Misallocation, and the Returns to Education in Mexico”, IDB Working Paper, No. IDB-WP-671, https://doi.org/10.2139/ssrn.2956686.

[14] Li, Y. and M. Rama (2015), “Firm Dynamics, Productivity Growth, and Job Creation in Developing Countries: The Role of Micro- and Small Enterprises”, The World Bank Research Observer, Vol. 30/1, pp. 3-38, https://doi.org/10.1093/wbro/lkv002.

[64] López Mourelo, E. and V. Escudero (2017), “Effectiveness of Active Labor Market Tools in Conditional Cash Transfers Programs: Evidence for Argentina”, World Development, Vol. 94, pp. 422-447, https://doi.org/10.1016/J.WORLDDEV.2017.02.006.

[29] Mcgowan, M. and D. Andrews (2015), “Skill Mismatch and Public Policy in OECD Countries”, OECD Economics Department Working Paper Series, No. 1210, https://www.oecd.org/eco/growth/Skill-mismatch-and-public-policy-in-OECD-countries.pdf (accessed on 06 June 2018).

[73] McKenzie, D. (2017), “How Effective Are Active Labor Market Policies in Developing Countries? A Critical Review of Recent Evidence”, The World Bank Research Observer, Vol. 32/2, pp. 127-154, https://doi.org/10.1093/wbro/lkx001.

[11] Meghir, C., R. Narita and J. Robin (2015), “Wages and Informality in Developing Countries”, American Economic Review, Vol. 105/4, pp. 1509-1546, https://doi.org/10.1257/aer.20121110.

[58] Millán, T. et al. (2019), “Long-Term Impacts of Conditional Cash Transfers: Review of the Evidence”, The World Bank Research Observer, https://www.parisschoolofeconomics.eu/docs/macours-karen/molina-et-al-long-term-impacts-of-cct-review-of-the-evidence-2018july09.pdf (accessed on 05 September 2018).

[57] Narayan, A. et al. (2018), Fair Progress? Economic Mobility across Generations around the World, World Bank Group, Washington DC, https://openknowledge.worldbank.org/bitstream/handle/10986/28428/211210ov.pdf?sequence=9 (accessed on 05 July 2018).

[15] OECD (2018), OECD Compendium of Productivity Indicators 2018, OECD Publishing, Paris, https://doi.org/10.1787/pdtvy-2018-en.

[45] OECD (2018), “The Role Of Collective Bargaining Systems For Good Labour Market Performance”, in OECD Employment Outlook 2018, OECD Publishing, https://doi.org/10.1787/empl_outlook-2018-7-en.

[65] OECD (2017), Building an Inclusive Mexico: Policies and Good Governance for Gender Equality, OECD Publishing, Paris, https://www.oecd-ilibrary.org/docserver/9789264265493-en.pdf?expires=1537261648&id=id&accname=ocid84004878&checksum=97B84377ADE61F755D216EB204B5949B (accessed on 18 September 2018).

[33] OECD (2017), Getting Skills Right: South Africa, Getting Skills Right, OECD Publishing, Paris, https://doi.org/10.1787/9789264278745-en.

[30] OECD (2017), OECD Skills Outlook 2017: Skills and Global Value Chains, OECD Publishing, Paris, https://doi.org/10.1787/9789264273351-en.

[7] OECD (2016), Closing gender gaps in the labour markets of emerging economies: The unfinished job, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2016-8-en.

[32] OECD (2016), OECD Reviews of Labour Market and Social Policies: Colombia 2016, OECD Publishing, https://doi.org/10.1787/9789264244825-en.

[46] OECD (2016), Society at a Glance 2016: OECD Social Indicators, OECD Publishing, Paris, https://doi.org/10.1787/9789264261488-en.

[38] OECD (2016), The Future Of Productivity, OECD Publishing, https://www.oecd.org/eco/OECD-2015-The-future-of-productivity-book.pdf (accessed on 06 June 2018).

[24] OECD (2015), “Enhancing Job Quality In Emerging Economies”, in OECD Employment Outlook 2015, OECD Publishing, https://doi.org/10.1787/empl_outlook-2015-en (accessed on 24 August 2018).

[5] OECD (2015), In It Together: Why Less Inequality Benefits All, OECD Publishing, Paris, https://doi.org/10.1787/9789264235120-en.

[6] OECD (2015), OECD Employment Outlook 2015, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2015-en.

[52] OECD (2011), The Labour Market Effects of Social Protection Systems in Emerging Economies, OECD Publishing, https://doi.org/10.1787/empl_outlook-2011-en (accessed on 23 August 2018).

[47] OECD (2010), The Global Crisis in Emerging Economies: The Jobs Impact and Policy Response, OECD Publishing, http://www.oecd.org/els/emp/48806694.pdf (accessed on 23 August 2018).

[9] OECD (2009), Is Informal Normal? Towards More and Better Jobs in Developing Countries, OECD Publishing, http://www.oecd.org/dev/inclusivesocietiesanddevelopment/isinformalnormaltowardsmoreandbetterjobsindevelopingcountries.htm (accessed on 05 September 2018).

[18] OECD (2008), “Declaring Work Or Staying Underground: Informal Employment In Seven OECD Countries”, in OECD Employment Outlook 2008, OECD Publishing, http://www.oecd.org/els/emp/oecdemploymentoutlook2008.htm (accessed on 05 September 2018).

[10] Perry, G. et al. (2007), Informality, World Bank, https://doi.org/10.1596/978-0-8213-7092-6.

[36] Quatraro, F. and M. Vivarelli (2015), “Drivers of Entrepreneurship and Post-entry Performance of Newborn Firms in Developing Countries”, The World Bank Research Observer, Vol. 30/2, pp. 277-305, https://doi.org/10.1093/wbro/lku012.

[39] Rijkers, B., H. Arouri and L. Baghdadi (2016), “Are Politically Connected Firms More Likely to Evade Taxes? Evidence from Tunisia”, The World Bank Economic Review, Vol. 30/Supplement_1, p. lhw018, https://doi.org/10.1093/wber/lhw018.

[53] Soares, F., R. Ribas and R. Osório (2010), “Evaluating The Impact Of Brazil'S Bolsa Família: Cash Transfer Programs In Comparative Perspective”, Latin American Research Review, Vol. 45/2, pp. 173-190, http://pdfs.semanticscholar.org/6ddd/6db8c49fe528a9a3d718e880ccb01b0e34c43.pdf.

[43] Ulyssea, G. (2018), “Firms, Informality, and Development: Theory and Evidence from Brazil”, American Economic Review, Vol. 108/8, pp. 2015-2047, https://doi.org/10.1257/aer.20141745.

[42] Ulyssea, G. (2010), “Regulation of Entry, Labor Market Institutions and the Informal Sector”, Journal of Development Economics, Vol. 91/1, pp. 87-99, https://doi.org/10.1016/J.JDEVECO.2009.07.001.

[76] UNESCO (2018), UNESCO Data, http://uis.unesco.org/node/334718 (accessed on 05 September 2018).

[68] World Bank (2019), World Development Report 2019: The Changing Nature of Work, World Bank, http://www.worldbank.org/en/publication/wdr2019 (accessed on 05 September 2018).

[28] World Bank (2018), World Development Report 2018: Learning to Realize Education’s Promise, World Bank, http://www.worldbank.org/en/publication/wdr2018 (accessed on 05 September 2018).

[8] World Bank (2016), Poverty and Shared Prosperity 2016: Taking on Inequality, World Bank, Washington DC, https://openknowledge.worldbank.org/bitstream/handle/10986/25078/9781464809583.pdf (accessed on 05 September 2018).

Notes

← 1. The main exception is South Africa where about 1 in 4 active persons are unemployed (OECD, 2015[6]).

← 2. In a number of emerging economies, such as urban China, urban Colombia and Peru, high shares of fixed-term work among wage employees further add to vulnerability (OECD, 2015[24]).

← 3. Apart from reflecting a poor quality of the working environment, this could also reflect the role of low hourly wages for the need to put in long working hours to make a decent living.

← 4. The average annual change in formality rates shown here correlate negatively with the compound annual growth rate in real GDP per capita (-0.5) and positively with population growth (0.2).

← 5. On average across the emerging economies considered here, competition from the informal sector is reported as the biggest obstacle faced by formal firms (World Bank Enterprise Surveys, http://www.enterprisesurveys.org/)

← 6. More specifically, informality tends to be associated with i) lower wages, reflecting both low worker productivity and the absence of binding wage floors; ii) less secure work, due to a higher risk of job loss and the lack of social protection; and iii) a lower quality of the work environment, related to poor health and safety, long working hours and limited training opportunities (OECD, 2015[24]).

← 7. In China and Colombia, most outflows from informal jobs are to unemployment and inactivity, implying that informal work does not work well as a stepping stone to formal work (OECD, 2015[24]).

← 8. Also almost half of the regional variation in informality can be attributed to access to good quality higher education (IMF, 2018[23]).

← 9. Net enrolment rates in secondary and tertiary education are generally well below the OECD average in emerging economies, in particular in South Africa and Indonesia (UNESCO, 2018[77]).

← 10. Managers in formal firms much more often have a college degree than their counterparts in informal firms (La Porta and Shleifer, 2014[4]).

← 11. Providing informal workers with subsidised access to certain aspects of social security could also weaken incentives for formal work. For example, the provision of health insurance to informal workers in Colombia and Mexico has spurred an intense debate about its effects on formality (OECD, 2011[52]).

← 12. De jure minimum wage relative to the median wage is relatively high in emerging economies such as Colombia, Turkey, Costa Rica, and Chile (see Chapter 8).

← 13. The number of labour inspectors per 10 000 workers in emerging economies for the 10 countries for which there is data lies between 0.2 (Mexico) and 0.6 (South Africa), except for Chile (1.7) which is the only country above the average of 0.9 for 25 OECD countries (ILOSTAT, https://www.ilo.org/ilostat).

← 14. This is not just a social concern, but also has implications for efficiency. Financial hardship may generate liquidity constraints that impede effective job search, with adverse consequences for labour force participation and skill mismatches (OECD, 2011[52]). It may also reduce investments in human capital, with negative consequences for economic growth in the long-term (Cingano, 2014[76]).

← 15. This largely reflects the role of contributory schemes for health and pensions, while contributory schemes for unemployment, disability and sickness tend to be considerably smaller, if present at all.

← 16. Public spending on social assistance ranges from less than 1% in Thailand, Costa Rica, Tunisia, China, and Indonesia, to 3-4% of GDP in Colombia, South Africa, and Chile (World Bank ASPIRE, datatopics.worldbank.org/aspire).

← 17. For the countries for which data are available, on average about 70% of social assistance is spent on cash transfers including social pensions, and about 30% on in-kind transfers and subsidised public services, with large differences across countries (World Bank ASPIRE, datatopics.worldbank.org/aspire).

← 18. The approach is similar in spirit as the OECD activation strategy in relation to joblessness (see Chapter 9).

← 19. UCT programmes targeted at the elderly often are considerably more generous than other CT programmes.

← 20. There are social assistance programmes that target unregistered workers, which creates incentives to remain or become informal. An example is the introduction of the Argentinian child allowance scheme, Asignación Universal por Hijo (AUH), whose introduction led to large negative effects on labour market formalisation among programme beneficiaries (Garganta and Gasparini, 2015[79]).

← 21. The increasing emphasis on social assistance to working families in OECD countries could be seen as convergence to the practice in emerging economies (see Chapter 10).

← 22. In programmes with more generous (and less targeted) benefits, negative employment effects tend to be more important. OECD evidence indicates that the South African Old Age Pension, covering more than 80% of the elderly population offering twice the median per capita income, reduced employed in households with an OAP recipient (OECD, 2011[52]).

← 23. For example, OECD evidence in the context of South African Child Support Grant suggests that benefits can promote labour force participation among mothers with young children in very poor households (OECD, 2011[52]).

← 24. In a perfectly competitive labour market, mandated severance pay between employer and employee in the case of dismissal has no impact on dismissal behaviour since its costs will be fully offset by lower wages (Lazear, 1990[78]). However, this is unlikely to be the case in practice due to the presence of wage rigidities and financial market imperfections. Moreover, severance pay tends to come with other aspects of employment protection such as the complexity of dismissal procedures and the definition of unfair dismissal that affect layoff behaviour.

← 25. By increasing firing costs for employers, SP may help to reduce “excessive turnover” of workers whose job matches have temporarily become unprofitable and it can strengthen incentives to invest in firm-specific human capital. See Chapter 7 for further details.

← 26. Note that the figure only takes account of the generosity of income support and not of actually receiving income support which may have important implications in practice.

← 27. Declining benefit schedules as in the Russian Federation can also contribute to maintaining good work incentives over the unemployment spell.