Chapter 13. Nurturing labour market resilience

Labour market developments following the global financial crisis of 2008-09 differed starkly across countries. This partly reflects cross-country differences in the size and the nature of the underlying economic shocks. However, cross-country differences in labour market resilience, i.e. an economy's capacity to limit fluctuations in employment and to ensure a rapid rebound, also played a role. This chapter discusses how counter-cyclical macroeconomic policies, state-dependent employment and social policies as well as structural policies can strengthen labour market resilience.

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

Introduction

The global financial crisis of 2008-09 and the slow pace of the subsequent recovery in many countries has highlighted the importance of labour market resilience, i.e. limiting fluctuations in employment and ensuring a quick rebound in the wake of economic shocks. Labour market resilience is crucial not only to limit short-term social costs but also to support labour market and economic performance in the medium to long term. In particular, resilient labour markets reduce the degree to which increases in cyclical unemployment translate into structural unemployment, lower labour force participation and lower wage growth.

Labour market resilience in the wake of the Great Recession has differed widely across countries, which partly reflects differences in the size and the nature of the initial economic shock. In a number of countries, including Germany and Japan, employment losses were limited and short-lived, with employment back around pre-crisis levels within 2-3 years. In some other countries, such as a number of Southern European countries, employment losses were large and more persistent. While some countries experienced only transitory declines in external demand, others were additionally hit by financial, sovereign debt and balance of payments crises. For instance, Germany and Japan only experienced deep but short-lived declines in exports, whereas a number of euro area countries, such as Greece, Italy and Spain, were additionally hit by banking crises, sovereign debt crises and sudden capital flow reversals.

Yet cross-country differences in labour market resilience also reflect differences in macroeconomic policy as well as structural policy and institutional settings. The monetary and fiscal policy response to the initial economic shock differed widely across countries, contributing to cross-country differences in the size and the duration of output losses (OECD, 2010[1]). Even when accounting for cross-country differences in output losses, there were large cross-country differences in labour market outcomes. In some countries, the labour market adjusted to the fall in aggregate demand mainly through the employment margin whereas in others the number of hours worked or wages declined. To some extent, these differences in margins of adjustment reflect structural policy and institutions (OECD, 2017[2]).

The remainder of the chapter is structured as follows. Section 13.1 documents labour market resilience across OECD countries and Section 13.2 discusses the role of public policies and institutions.

13.1. Labour market resilience during and after the crisis of 2008-09

Labour market resilience in this chapter is defined as the capacity of the labour market to limit persistent deviations in employment from pre-crisis trends in the aftermath of adverse output shocks (i.e. recessions).1 This definition encompasses the avoidance of excessive fluctuations in labour market outcomes as well as the swiftness of the rebound.

There were large differences in output developments across OECD countries in the wake of the economic and financial crisis (Figure 13.1, Panel A). In countries with annualised output per capita losses of 12% or more, including Estonia, Greece and Latvia, cumulative losses over the period 2008-15 amount to at least a year of lost income. Several other countries either were little affected by the Great Recession (e.g. Israel) or partially made up for output losses relative to trend in the wake of the Great Recession through above-trend growth in later years (e.g. Germany).

Differences in output developments – which reflected differences in the nature and the size of the initial economic shock and differences in the macroeconomic policy response – accounted for around half of the differences in labour market resilience. Countries with large deviations of output per capita from pre-crisis trends such as Greece, Spain and Ireland, which were hit by major banking, sovereign debt and balance of payment crises, typically experienced large deviations of unemployment from the pre-crisis rate (Figure 13.1, Panel B). The opposite was true for countries with small deviations of output per capita from the pre-crisis trend, such as Germany and Japan that experienced transitory declines in external demand. However, differences in output developments cannot fully account for differences in labour market developments, suggesting that policies and institutions that affect the different margins of labour market adjustment also played a role (OECD, 2017[3]).

13.2. Policy lessons from the global crisis

This section discusses the lessons from the global crisis for macro-economic policies, state-contingent employment and social policies and structural labour market policies.

The role of macroeconomic policies

By stabilising inflation and aggregate demand, monetary policy plays an important role in stabilising the labour market and preventing hysteresis in the wake of aggregate shocks. Monetary policy can be deployed immediately, with rapid effects on real interest rates and aggregate demand (Ramey, 2016[4]). Even when short-term interest rates cannot be reduced further during large economic downturns, monetary easing can be provided by unconventional measures that directly affect longer-term interest rates, such as quantitative easing and forward guidance. Risks to financial stability arising from the consequent increases in asset prices can be limited by financial regulation, including micro- and macro-prudential measures such as well-designed bank stress tests and adequate capital ratios. To further limit such risks, monetary support needs to be gradually scaled back as economic conditions normalise.

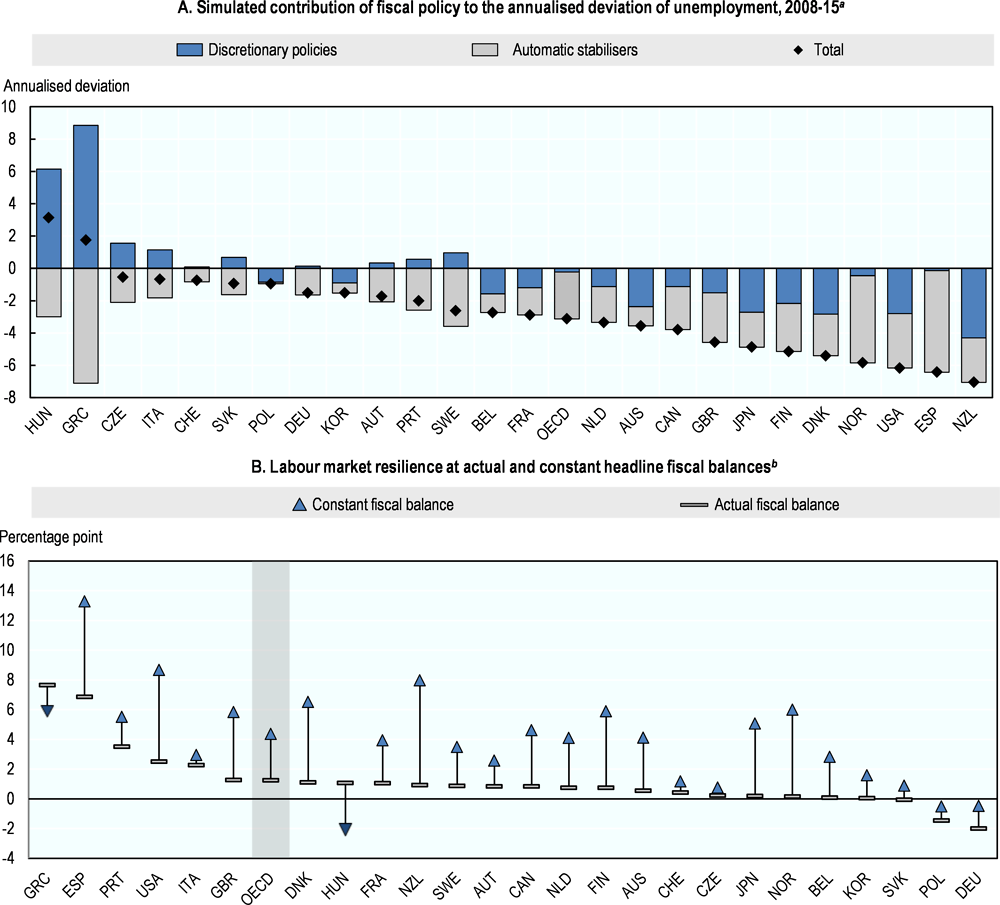

The monetary policy response needs to be accompanied by counter-cyclical fiscal policy to be effective, especially in a context of persistently low inflation and low nominal interest rates (OECD, 2016[5]). Persistently low inflation over the past decade despite prolonged, very accommodative, monetary policy suggests that monetary policy cannot bear the burden of stabilisation alone. Fiscal policy can help to mitigate shocks via the so-called automatic stabilisers and through the use of discretionary measures. During the Great Recession, fiscal policy contributed significantly to labour market resilience. Recent analysis suggests that fiscal policy reduced the annualised deviation of unemployment from the pre-crisis NAIRU during the period 2008-15 from over 4 to about 1 percentage point for the OECD as a whole (OECD, 2017[2]), although there were marked differences across countries (Figure 13.2).

The automatic fiscal stabilisers need to be allowed to operate and could be strengthened in a number of countries by making expenditure on social and labour market programmes, such as unemployment insurance and active labour market programmes, more contingent on aggregate economic conditions (see below). During deep economic downturns, the automatic fiscal stabilisers can be complemented with timely and high-quality discretionary measures – preferably with a focus on measures such as public investment that both add to demand and raise the long-term growth potential of the economy. Lags in the implementation of such discretionary measures can to some extent be addressed by identifying projects well before the economic downturn so that a pool of rapidly implementable projects is available when it is most needed (OECD, 2015[6]).

Fiscal policy is particularly effective during economic downturns and when initial levels of public debt are low (Auerbach and Gorodnichenko, 2012[7]; Auerbach and Gorodnichenko, 2013[8]; Ilzetzki, Mendoza and Végh, 2013[9]). Collective action across economies would bring additional gains (OECD, 2016[5]). At the same time, public debt needs to be kept at prudent levels during economic upturns to enhance the space available for fiscal support during downturns (OECD, 2010[1]). In this light, counter-cyclical fiscal rules that have sufficient flexibility to permit temporary fiscal support during large downturns but require building fiscal buffers during upturns are preferable to rules with a narrow focus on the headline fiscal balance or government debt.

The role of state-dependent employment and social policies

Employment and social policies are partly needs-driven and thus contain an element of state-dependency. A key question is to what extent it is desirable to further increase their responsiveness to changes in the business cycle, so as to both enhance their effectiveness during economic downturns and strengthen automatic fiscal stabilisation. This sub-section discusses the role of short-time work schemes for preserving jobs in times of crisis, the role of unemployment benefit schemes for consumption smoothing and supporting aggregate demand and the role of activation policies for helping people who lose their jobs return to work.

Short-time work schemes preserve jobs in times of crisis, but can become an obstacle to structural change in good times

An important lesson from the global crisis is the positive role of well-designed short-time work programmes in mitigating the unemployment costs of deep economic downturns. Short-time work (STW) programmes are public schemes that are intended to preserve jobs at firms temporarily experiencing low demand by encouraging work-sharing, while also providing income-support to workers whose hours are reduced due to a shortened workweek or temporary lay-offs. A crucial aspect of all STW schemes is that the contract of an employee with the firm is maintained during the period of STW or the suspension of work. The main purpose of STW schemes is to avoid “excessive” layoffs, that is, the permanent dismissal of workers during an economic downturn whose jobs would be viable in the longer-term. In an environment where firms are risk-neutral and they can fully insure their employees, excessive layoffs are effectively ruled out (Burdett and Wright, 1989[10]). However, in an environment where firms are financially constrained, as during a credit crunch, a well-designed STW scheme may help to increase welfare (Braun and Brügemann, 2014[11]). Moreover, STW schemes may also help to improve equity by sharing the burden of adjustment more equally across the workforce (OECD, 2009[12]).

Twenty-five OECD countries operated a STW programme during the global financial crisis, with considerable variation in their institutional design (Hijzen and Venn, 2011[13]). Institutional differences relate to the range of permissible hours reductions (“work-sharing requirements”), the conditions for employers and workers that must be met to participate (“eligibility requirements”), the actions firms and workers are expected to take during (or after) participation (“conditionality or behavioural requirements”) and the way the costs of short-time work are shared between governments, firms and workers (“generosity”). The challenge for policy makers is to design short-time work schemes that strike the right balance between ensuring adequate take-up and maintaining cost-effectiveness. The latter depends on the importance of deadweight effects, i.e. subsidies paid to preserve jobs that would have been retained anyway, and displacement effects, i.e. subsidies paid to preserve jobs that are unviable even in the long-run, slowing the process of reallocation.

There is now considerable evidence that short-time work helped preserving jobs in the aftermath of the global financial crisis (Hijzen and Martin, 2013[14]; Hijzen and Venn, 2011[13]; Cahuc and Carcillo, 2011[15]; Boeri and Bruecker, 2011[16]). The largest impact was observed in Germany, Italy and Japan (Figure 13.3). Results based on firm-level data typically yield more mixed results due to the difficulty of accounting for selection into short-time work programmes (Bellmann, Gerner and Upward, 2012[17]; Boeri and Bruecker, 2011[16]; Calavrezo, Duhautois and Walkowiak, 2010[18]). When a credible research design is available, firm-level studies confirm the positive role of short-time work on employment in the early phase of the crisis (Cahuc, Kramarz and Nevoux, 2018[19]). Yet the continued use of STW during the recovery is also likely to have exerted a negative influence on the strength of the recovery by limiting job creation and output growth (Hijzen and Martin, 2013[14]; Cahuc, Kramarz and Nevoux, 2018[19]). Their use should therefore be cut back during good times to avoid that that they undermine the efficient reallocation of resources and thereby productivity growth.

To ensure that short-time work schemes can be deployed rapidly, it is desirable to design them when business conditions are normal. Short-time work schemes that were introduced from scratch in response to the 2008-09 recession typically had only limited take-up and therefore not much of an impact, while schemes that pre-dated the 2008-09 crisis typically had higher levels of take-up (OECD, 2010[20]). This may reflect firms’ lack of familiarity with new schemes or simply the fact that that they became operational too late when the need for them had largely subsided. Evidence for France suggests that programme familiarity is indeed a very important determinant of take-up (Cahuc, Kramarz and Nevoux, 2018[19]). This highlights the importance of providing clear and easily accessible information on the modalities of their use.

Another possibility may be to establish a dormant state-contingent scheme which can be triggered in times of crisis. Sweden, which did not have a public short-time work scheme during the crisis, adopted such a scheme in 2013. It can be triggered in the event of a deep economic crisis with the agreement of the government and the social partners and is strictly time-limited (Ibsen, 2013[21]). The advantage of this dormant scheme is that it can be scaled up more quickly than entirely new schemes. Moreover, the strong presence of the social partners in Swedish workplaces is likely to greatly facilitate its roll-out.2

The institutional design of short-time work schemes can also help ensure that such schemes are mainly used in times of crisis and phased out rapidly when the economy recovers. One option is to temporarily relax eligibility and conditionality conditions or increase the generosity of public subsidies during times of crisis, while tightening conditions and reducing generosity in good times. Most countries with a short-time work scheme in place before the crisis took measures to temporarily increase their attractiveness (OECD, 2009[12]). Other measures that can help to ensure that the use of short-time work is temporary are to limit the maximum duration for which short-time work subsidies are available and to target them at firms with temporary difficulties. More generally, firms should be required to share the cost of short-time work, which is the case in about half the countries with a short-time work scheme in place (Hijzen and Venn, 2011[13]), so that they only have incentives to participate if they genuinely want to preserve jobs and expect the situation to improve..

Income-support policies are crucial for alleviating financial hardship among job losers and supporting aggregate demand

The crisis of 2008-09 served as a tough “stress test” for social safety nets in OECD countries. The recession drove unemployment rates sharply higher and particularly the number of long-term or very long-term unemployed. The increase in the share of unemployed workers experiencing long spells of one year or more has been most pronounced in a number of countries that were particularly hard hit by the crisis (e.g. Ireland, the United States and Spain). The rise in long-term unemployment raises the risk that an increasing share of unemployed people exhaust their benefit entitlements. Moreover, in countries with dual labour markets, job losses are likely to be concentrated on workers with flexible work arrangements (e.g. temporary contracts, temporary agency workers, own-account workers), who are less likely to be eligible to unemployment insurance benefits, either because they do not meet minimum contribution requirements or because they are formally excluded. Minimum contribution requirements may also be too high for unemployed youth and other recent labour market entrants without recent work experience.

The effectiveness of social safety nets in supporting the incomes of the unemployed and in providing a stabilising response to the decline in aggregate demand therefore is likely to differ importantly across countries (Price, Dang and Botev, 2015[22]; OECD, 2010[20]). Countries with universal systems of means-tested benefits (e.g. Australia, New Zealand and the United Kingdom) in principle provide income support to all job-losers suffering from financial hardship, but can involve large falls in incomes and weak automatic stabilisers. Countries with comprehensive two-tier systems of unemployment insurance and social assistance (e.g. Denmark, Norway and Sweden) provide the most effective support for the unemployed and tend to have strong automatic stabilisers. However, generous income support systems also carry the risk of undermining work incentives if not properly embedded in an effective activation strategy based on a rigorous mutual obligations framework.

To strengthen unemployment benefits’ impact on short-term stabilisation, while limiting their effects on work incentives, there may be a case for temporarily increasing generosity during downturns. Costs of unemployment insurance in terms of reduced work incentives and benefits in terms of consumption smoothing vary over the business cycle (see Chapter 9). During economic slumps, aggregate consumption can drop dramatically in the absence of sufficient benefits, while the behavioural costs of insurance is limited by the lack of job opportunities. Inversely, during economic booms, these behavioural costs can be large if generous benefits prevent too many people from accepting job offers (Schmieder, von Wachter and Bender, 2012[23]; Kroft and Notowidigdo, 2016[24]; Mitman and Rabinovich, 2015[25]).3

Consistent with the argument for state-contingent unemployment insurance, the majority of OECD countries took additional measures in response to the 2008-09 crisis to strengthen social safety nets for the unemployed. These typically focused on addressing coverage gaps by temporarily relaxing eligibility rules or extending the maximum duration of unemployment benefits. A number of countries, including Canada, Chile and the United States, have (semi-) automatic rules that temporarily increase the maximum duration of unemployment benefits when the unemployment rate exceeds a threshold. In order to facilitate a return to work, extensions in maximum duration of unemployment benefits should be accompanied with an intensification of activation measures, in particular where activation systems are currently underdeveloped. As discussed below, since scaling up activation systems temporarily is not straightforward, the risks in terms of more persistent unemployment in the case of large extensions needs to be weighed carefully.

Unemployment benefits need to be combined with effective activation policies within a strictly enforced mutual obligations framework by which government support is conditional on benefit recipients’ active job search and/or participation in programmes that promote their job prospects (Chapter 9). While the number of job opportunities is depressed in times of crisis, it is important to maintain as much as possible the mutual-obligations approach. It is equally important that access to early retirement and disability benefits is not relaxed. Failing to maintain the integrity of the mutual-obligations approach or alleviating pressures on the labour market by moving unemployed people in disability and early retirement can have long-lasting effects on the effective supply of labour, with serious consequences for economic growth and the sustainability of public finances. For instance, looser job search requirements in unemployment insurance and relaxed health criteria for disability insurance have been found to have lowered effective retirement ages in the aftermath of past recessions (OECD, 2009[12]).

To maintain effective re-employment and training support to all unemployed jobseekers , public employment services need to scale up their capacity significantly during deep recessions (OECD, 2009[12]). Increasing capacity requires additional financial resources. This would also help to strengthen the counter-cyclicality of fiscal policy. However, in practice financial resources on active labour market policies only respond modestly to changes in the number of clients (Box 13.1). A particularly effective way of increasing spending on activation during downturns would be to base such increases on pre-defined rules. In Australia, Denmark and Switzerland, for instance, spending on activation is adjusted according to the government's official unemployment forecasts (OECD, 2009[12]). However, scaling up capacity is not just a matter of financial resources; it also requires recruiting additional staff and extending programme capacity. A key question is whether this can be done quickly enough and whether service quality can be maintained in the process. One possible way of alleviating capacity constraints may be to involve private providers in the delivery of re--employment and training services. However, the challenge of doing so effectively should not be underestimated, since it can take several years to fine-tune and requires rigorous performance management by the public authorities (OECD, 2005[26]).

Spending on active labour market programmes (ALMPs) responded only weakly to the rise in unemployment following the Great Recession (Figure 13.4). A 1% increase in the number of unemployed was associated with a 0.4% increase in active labour market spending. While this was almost twice as high as during previous crisis episodes, the less than proportional increase in spending still resulted in a sharp decline in resources per jobseeker. According to OECD (2012[27]), the value of resources per unemployed person declined by 20% between 2007 and 2010 on average across the OECD. A more significant increase is likely to be necessary to preserve the mutual-obligations ethos of activation regimes. This is particularly important in countries with relatively generous unemployment benefits and a strong emphasis on activation policies to maintain work incentives as well as in countries where the generosity of unemployment benefits is low, but has been temporarily extended in response to the increase in needs following the crisis.

Linking budgets for spending on labour market programmes to labour market conditions raises a number of practical policy questions about implementation, including whether changes should be adopted on an ad hoc or automatic basis. Automatic rules may provide an effective instrument to make ALMP spending more responsive to the business cycle by allowing for a timelier, more predictable, and more transparent response. However, automatic rules also have their drawbacks. They involve an element of rigidity in the way policy responds to changing circumstances, since they are inherently informed by past events and could thus prove to be sub-optimal in new circumstances. An alternative could be semi-automatic mechanisms that trigger a policy adjustment under pre-specified conditions, but that allow for policy discretion in the design of the adjustment. A number of OECD countries already have automatic or quasi-automatic rules to make active labour market spending more responsive to labour market conditions, including Australia, Denmark and Switzerland.

A particular difficulty is that it may be not be straightforward to translate funding increases into higher capacity in the short run.1 Countries with more generous benefits, and that rely more heavily on the mutual-obligations approach, probably have the strongest incentives in maintaining resources per unemployed approximately constant during periods of high cyclical unemployment. Moreover, these are more likely to be countries that have the necessary infrastructure in place to translate funding increases into increased capacity quickly, while maintaining service quality. The difficulty of scaling up the capacity for labour market programmes may explain why spending on hiring subsidies (“employment incentives”), which are easy to expand, increased more strongly than spending on other categories of active labour market spending.

1 This may explain why the presence of automatic rules for active labour market spending did little to stem the decline in resources available per unemployed jobseeker during the crisis.

During economic downturns, the focus of active labour market policies may need to shift from core job-search assistance to training. As labour demand declines, the caseload of public employment services counsellors increases while fewer job opportunities become available, which can make a focus on placing unemployed people in jobs less effective. Moreover, recessions reduce the opportunity cost of time spent in training (Lechner and Wunsch, 2009[28]) and often speed up structural change, thereby raising the need for workers to acquire new skills and change occupations. Therefore, during economic downturns, active labour market policies may need to focus on assigning workers to appropriate training schemes. These programmes should preferably be designed and evaluated well before the crisis hits in order to take medium- and long-term labour market needs into account. As a last resort, public employment schemes may provide a way of keeping hard-to-place job seekers connected to the labour market (Gregg and Layard, 2009[29]) although the evidence suggests that such programmes are costly and have had little success in getting workers permanent jobs in the open labour market.

There is also a case for supporting job creation by temporarily scaling up employment subsidies during economic downturns (OECD, 2010[20]). These can take the form of stock subsidies, such as reductions in social security contributions, or explicit subsidies to new hires (gross hiring subsidies) or only to new hires associated with net job creation (net hiring subsidies). Stock subsidies can help boost employment, but they are expensive and involve deadweight losses by subsidising jobs that would have existed without the subsidy. Gross hiring subsidies entail smaller deadweight losses and are thus more cost effective, but they risk being “gamed” by businesses that raise labour turnover rather than net hiring to pocket the subsidy. Recent empirical evidence from France and the United States suggests that temporary gross hiring subsidies can be a cost-effective way of supporting employment during recessions, but that effectiveness may rapidly decline during economic upturns as the subsidies may push up wages rather than employment (Cahuc, Carcillo and Le Barbanchon, 2018[30]; Neumark and Grijalva, 2017[31]). The most cost-effective way of subsidising employment during downturns are net hiring subsidies, the drawback being that such schemes are complex, and typically difficult to administer for governments as well as firms (contributing to low take-up).

The role of structural policies and institutions

Structural policies can play an important role in shaping the way the labour market responds to economic downturns, including the way the cost of adjustment is shared between firms and workers as well as between different groups of workers. This sub-section focuses mainly on the role of collective bargaining and employment protection legislation, but also touches briefly on the role of several other structural policies and institutions.

Collective bargaining can help adjusting to temporary shocks by facilitating working time reductions

Well-designed collective bargaining systems can promote labour market resilience by facilitating adjustments in wages and working time. Working time adjustments have a much greater potential for shock absorption than wage adjustments, but are only effective in the context of temporary shocks.4

Coordination between bargaining units (firms and/or industries) can promote good labour market outcomes by providing room for adjustment to changes in macro-economic conditions (OECD, 2017[2]). Countries with effective wage coordination include those with predominantly sector-level bargaining, notably the Nordic countries, Austria, Germany, the Netherlands and Switzerland as well as Japan. One way to achieve effective coordination is peak-level bargaining based on the presence of national confederations of unions and employers that provide guidance to bargaining parties at lower levels. Another possibility is pattern bargaining where a leading sector sets the targets – usually the manufacturing sector exposed to international trade – and others follow. A precondition for a well-functioning co-ordination of wage bargaining is to have strong and representative employer and employee organisations (OECD, 2018[32]). Wage co-ordination requires a high level of trust in and between the social partners, the availability of objective and shared information on the labour market situation, as well as well-functioning mediation bodies (Ibsen, 2016[33]).

Another example of how countries with predominantly sector-level bargaining can enhance labour market resilience is by providing flexibility within the framework of sector-level agreements at the firm level to allow for adjustments in working time and wages under certain conditions, including through the use of opt-out clauses in the case of economic hardship. An example of such mechanisms is Germany, where sectoral wage agreements provide room for employer-initiated reductions in working time. These agreements typically specify a band around the standard working week, within which employers can vary working hours while maintaining hourly pay (OECD, 2010[20]). This is intended to provide employers with an improved ability to adapt to temporary variations in product demand while providing a high level of employment security. According to Bach et al. (2009[34]), such employer-initiated reductions in working time accounted for approximately 40% of the reduction in working time during the recession of 2008-09. Similar arrangements also played an important role in limiting job losses in Sweden (Ibsen, 2013[21]).

To avoid excessive job losses and weak job recoveries employment protection rules need to be balanced across contract types

An adequate level of employment protection provisions for regular workers can promote labour market resilience by preserving job matches that are at risk of being suppressed but are viable in the medium term. However, excessively strict employment protection risks becoming counter-productive by increasing incentives for the use of temporary contracts in good times that are also easier to terminate in a downturn (Blanchard and Landier, 2002[35]; Boeri, 2011[36]; Cahuc, Charlot and Malherbet, 2016[37]). This can amplify job cuts in the wake of economic downturns and slow the creation of jobs associated with regular contracts in a recovery (OECD, 2012[27]; 2017[2]).5

The challenge for public policy is to design employment protection that strikes the right balance between preserving viable job matches while avoiding labour market segmentation (Chapters 7 and 10). This could be achieved by avoiding excessively high levels of advance notice and ordinary severance pay for workers on regular contracts. Judicial uncertainty related to layoffs of workers on regular contracts could be reduced by defining unfair dismissals narrowly, focusing on false reasons, reasons unrelated to work, discrimination and prohibited grounds. At the same time, there may be room to tighten the regulations governing the use of temporary contracts while strengthening enforcement.

Non-labour market structural policies

Structural policies beyond the labour market can support labour market resilience by limiting output fluctuations, thereby reducing the burden on macroeconomic policies (OECD, 2017[38]). A sound legal and judicial infrastructure based on high-quality institutions enhances both growth and resilience, including by promoting the diversification of funding sources away from the banking sector and towards capital markets. By contrast, financial market liberalisation and capital openness tend to raise growth but also tend increases the risk of banking and currency crises, which may to some extent be mitigated by effective and coordinated prudential financial policies.

Conclusion

This chapter has highlighted that labour market resilience plays a key role in limiting the social costs of economic downturns and the extent to which cyclical changes in employment adversely affect labour market and economic performance in the medium to long term. It has emphasised that counter-cyclical monetary and fiscal policies can be highly effective in cushioning the impact of adverse economic shocks on labour market outcomes, but that a forceful policy response during downturns requires building up fiscal buffers during upturns. A number of structural policies and institutions can help containing fluctuations in employment and promoting a rapid rebound. Adequate social benefits do not only support people who lose their jobs during downturns, but also contribute to stabilising aggregate demand. Active labour market policies can promote a rapid return to work as economic conditions normalise, while short-time work schemes can prevent people from losing their jobs in the first place by promoting adjustments in hours worked rather than employment. A level of employment protection for regular workers that limits labour market segmentation can limit large employment losses for non-regular workers during downturns and can promote the creation of regular jobs during the recovery.

If well designed, policies and institutions that enhance labour market resilience are also conducive to good structural labour market outcomes. As a matter of fact, countries with highly resilient labour markets typically also performed well in terms of low average pre-crisis unemployment rates (OECD, 2012[27]). Vigorous counter-cyclical macroeconomic policies can help countries prevent becoming stuck in low-growth traps characterised by weak investment, high unemployment, as well as low wage and productivity growth (OECD, 2016[5]). Unemployment benefits with broad coverage that provide workers with sufficient financial resources and time to look for a job that matches their skills do not necessarily reduce work incentives, especially during periods of depressed aggregate demand. If combined with adequate activation measures in a strictly enforced mutual obligations framework, such benefits can even contribute to more productive job matches. Well-designed short-term work schemes can prevent productive job matches from being dissolved, thereby preserving workers' skills and labour productivity in the medium term. Similarly, a level of employment protection for regular workers that prevents labour market segmentation can promote labour productivity, including by strengthening incentives to invest in workers' skills (Bassanini, Nunziata and Venn, 2009[39]).

References

[8] Auerbach, A. and Y. Gorodnichenko (2013), “Fiscal Mulpliers in Recession and Expansion”, in Alesina, A. and F. Giavazzi (eds.), Fiscal Policy after the Financial Crisis, University of Chicago Press, https://www.nber.org/chapters/c12634.

[7] Auerbach, A. and Y. Gorodnichenko (2012), “Measuring the Output Responses to Fiscal Policy”, American Economic Journal: Economic Policy, Vol. 4/2, pp. 1-27, https://doi.org/10.1257/pol.4.2.1.

[34] Bach, H. et al. (2009), IAB Kurzbericht Die Krise wird deutliche Spuren hinterlassen Rezession überwunden?, http://doku.iab.de/kurzber/2009/kb2009.pdf.

[39] Bassanini, A., L. Nunziata and D. Venn (2009), “Job protection legislation and productivity growth in OECD countries”, Economic Policy, Vol. 24/58, pp. 349-402, https://doi.org/10.1111/j.1468-0327.2009.00221.x.

[17] Bellmann, L., H. Gerner and R. Upward (2012), “The Response of German Establishments to the 2008-2009 Economic Crisis”, OECD Social, Employment and Migration Working Papers, No. 137, https://doi.org/10.1787/5k8x7gwmb3jc-en.

[35] Blanchard, O. and A. Landier (2002), “The Perverse Effects of Partial Labour Market Reform: Fixed-Term Contracts in France”, The Economic Journal, Vol. 112/480, pp. 214-244, https://www.jstor.org/stable/pdf/798373.

[36] Boeri, T. (2011), “Institutional Reforms and Dualism in European Labor Markets”, Handbook of Labor Economics, Vol. 4, pp. 1173-1236, https://doi.org/10.1016/S0169-7218(11)02411-7.

[16] Boeri, T. and H. Bruecker (2011), “Short-time work benefits revisited: some lessons from the Great Recession”, Economic Policy, Vol. 26/68, pp. 697-765, https://doi.org/10.1111/j.1468-0327.2011.271.x.

[11] Braun, H. and B. Brügemann (2014), “Welfare Effects of Short-Time Compensation”, IZA Discussion Paper, No. 8597, http://ftp.iza.org/dp8597.pdf.

[10] Burdett, K. and R. Wright (1989), “Unemployment Insurance and Short-Time Compensation: The Effects on Layoffs, Hours per Worker, and Wages”, Journal of Political Economy, Vol. 97/6, pp. 1479-1496, https://doi.org/10.1086/261664.

[15] Cahuc, P. and S. Carcillo (2011), “Is Short-Time Work a Good Method to Keep Unemployment Down?”, Nordic Economic Policy Review, Vol. 1/1, pp. 133-165, http://ftp.iza.org/dp5430.pdf.

[30] Cahuc, P., S. Carcillo and T. Le Barbanchon (2018), “The Effectiveness of Hiring Credits”, The Review of Economic Studies, https://doi.org/10.1093/restud/rdy011.

[37] Cahuc, P., O. Charlot and F. Malherbet (2016), “Explaining the spread of temporary jobs and its impact on labor turnover”, International Economic Review, Vol. 57/2, pp. 533-572, https://doi.org/10.1111/iere.12167.

[19] Cahuc, P., F. Kramarz and S. Nevoux (2018), “When Short-Time Work Works”, IZA Disucssion Paper, No. 11673, http://ftp.iza.org/dp11673.pdf.

[18] Calavrezo, O., R. Duhautois and E. Walkowiak (2010), Short-Time Compensation and Establishment Exit: An Empirical Analysis with French Data, http://repec.iza.org/dp4989.pdf.

[29] Gregg, P. and R. Layard (2009), A Job Guarantee, http://cep.lse.ac.uk/textonly/_new/staff/layard/pdf/001JGProposal-16-03-09.pdf.

[42] Hagedorn, M., I. Manovskii and K. Mitman (2015), “The Impact of Unemployment Benefit Extensions on Employment: The 2014 Employment Miracle?”, NBER Working Papers, No. 20884, http://www.nber.org/papers/w20884.pdf.

[14] Hijzen, A. and S. Martin (2013), “The role of short-time work schemes during the global financial crisis1 and early recovery: a cross-country analysis”, IZA Journal of Labor Policy, Vol. 2/1, p. 5, https://doi.org/10.1186/2193-9004-2-5.

[13] Hijzen, A. and D. Venn (2011), “The Role of Short-Time Work Schemes during the 2008-09 Recession”, OECD Social, Employment and Migration Working Papers, No. 115, OECD Publishing, Paris, https://doi.org/10.1787/5kgkd0bbwvxp-en.

[33] Ibsen, C. (2016), “The Role of Mediation Institutions in Sweden and Denmark after Centralized Bargaining”, British Journal of Industrial Relations, Vol. 54/2, pp. 285-310, https://doi.org/10.1111/bjir.12142.

[21] Ibsen, C. (2013), Short-time work in Sweden, http://www.eurofound.europa.eu/eiro/2012/03/articles/se1203019i.htm.

[9] Ilzetzki, E., E. Mendoza and C. Végh (2013), “How big (small?) are fiscal multipliers?”, Journal of Monetary Economics, Vol. 60/2, pp. 239-254, https://doi.org/10.1016/j.jmoneco.2012.10.011.

[24] Kroft, K. and M. Notowidigdo (2016), “Should Unemployment Insurance Vary with the Unemployment Rate? Theory and Evidence”, The Review of Economic Studies, Vol. 83/3, pp. 1092-1124, https://doi.org/10.1093/restud/rdw009.

[41] Landais, C. (2015), “Assessing the welfare effects of unemployment benefits using the regression kink design”, American Economic Journal: Economic Policy, Vol. 7/4, https://doi.org/10.1257/pol.20130248.

[43] Landais, C., P. Michaillat and E. Saez (2018), “A Macroeconomic Approach to Optimal Unemployment Insurance: Theory”, American Economy Journal: Economic Policy, Vol. 10/2, pp. 152-81, https://doi.org/10.1257/pol.20150088.

[28] Lechner, M. and C. Wunsch (2009), “Are Training Programs More Effective When Unemployment Is High?”, Journal of Labor Economics, Vol. 27/4, pp. 653-692, https://doi.org/10.1086/644976.

[25] Mitman, K. and S. Rabinovich (2015), “Optimal unemployment insurance in an equilibrium business-cycle model”, Journal of Monetary Economics, Vol. 71, pp. 99-118, https://doi.org/10.1016/j.jmoneco.2014.11.009.

[31] Neumark, D. and D. Grijalva (2017), “The employment effects of state hiring credits”, ILR Review, Vol. 70/5, pp. 1111-1145, https://doi.org/10.1177/0019793916683930.

[32] OECD (2018), OECD Employment Outlook 2018, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2018-en.

[3] OECD (2017), “Labour market resilience: The role of structural and macroeconomic policies”, in OECD Employment Outlook 2017, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2017-6-en.

[2] OECD (2017), OECD Employment Outlook 2017, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2017-en.

[38] OECD (2017), “Resilience in a time of high debt”, in OECD Economic Outlook, Volume 2017 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/eco_outlook-v2017-2-3-en.

[5] OECD (2016), OECD Economic Outlook, Volume 2016 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/eco_outlook-v2016-2-en.

[6] OECD (2015), OECD Economic Outlook, Volume 2015 Issue 1, OECD Publishing, Paris, https://doi.org/10.1787/eco_outlook-v2015-1-en.

[27] OECD (2012), OECD Employment Outlook 2012, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2012-en.

[1] OECD (2010), OECD Economic Outlook, Volume 2010 Issue 1, OECD Publishing, Paris, https://doi.org/10.1787/eco_outlook-v2010-1-en.

[20] OECD (2010), OECD Employment Outlook 2010: Moving Beyond the Jobs Crisis, http://www.oecd.org/employment/emp/48806664.pdf (accessed on 25 October 2018).

[12] OECD (2009), OECD Employment Outlook 2009: Tackling the Jobs Crisis, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2009-en.

[26] OECD (2005), OECD Employment Outlook 2005, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2005-en.

[22] Price, R., T. Dang and J. Botev (2015), “Adjusting fiscal balances for the business cycle: New tax and expenditure elasticity estimates for OECD countries”, OECD Economics Department Working Papers, No. 1275, OECD Publishing, Paris, https://doi.org/10.1787/5jrp1g3282d7-en.

[4] Ramey, V. (2016), Macroeconomic Shocks and Their Propagation, National Bureau of Economic Research, Cambridge, MA, https://doi.org/10.3386/w21978.

[23] Schmieder, J., T. von Wachter and S. Bender (2012), “The Effects of Extended Unemployment Insurance Over the Business Cycle: Evidence from Regression Discontinuity Estimates Over 20 Years”, The Quarterly Journal of Economics, Vol. 127/2, pp. 701-752, https://doi.org/10.1093/qje/qjs010.

[40] Sutherland, D. and P. Hoeller (2013), “Growth-promoting Policies and Macroeconomic Stability”, OECD Economics Department Working Papers, No. 1091, OECD Publishing, Paris, https://doi.org/10.1787/5k3xqsz7c8d2-en.

Notes

← 1. The analysis does not distinguish between the sources of output fluctuations (e.g. demand, supply or financial shocks).

← 2. Apart from being familiar with the modalities of the public short-time work schemes, the social partners also have gained useful experience during the crisis with the use of private short-time work arrangements that do not rely on public subsidies (Ibsen, 2013[21]). These private arrangements are made possible through the use of hard-ship clauses in sectoral collective agreements.

← 3. This argument does also imply that the aggregate elasticity of benefit extensions on unemployment is smaller than its elasticity for individuals due to the competition for jobs between job seekers (Landais, 2015[41]; Landais, Michaillat and Saez, 2018[43]). However, whether this is the case has been the subject of some controversy in the literature (Hagedorn, Manovskii and Mitman, 2015[42]).

← 4. By contrast, permanent shocks typically require that aggregate wages adjust in line with aggregate productivity.

← 5. Similarly, Sutherland and Hoeller (2013[40]) show that strict employment protection provisions for regular workers are associated with higher persistence of recessions and lower productivity growth, which partly reflects adverse effects on resource reallocation and skill matching.