Chapter 3. Co-operative international regulatory co-operation efforts: how Mexico engages internationally on regulatory matters

In a largely globalised and highly integrated world economy, co-ordination between countries on regulatory matters is essential to tackle the challenges that cross borders and achieve a coherent and effective regulatory response at least costs for business and citizens. International regulatory co-operation (IRC) provides the opportunity for countries to develop common regulatory positions and instruments with their peers. This chapter gives an overview of Mexico’s efforts to co-operate internationally on regulatory matters, be it bilaterally, regionally or multilaterally. It highlights the regulatory co-operation efforts that have resulted from high economic incentives, often with high-level political traction as is the case with the High Level Regulatory Cooperation Council, trade agreements, or mutual recognition approaches. The chapter also acknowledges the numerous co-operation efforts undertaken in a variety of different sectors by line ministries and regulators. Often in the form of voluntary Memoranda of Understanding or participation in various different types of international bodies, information about these efforts tends to be more fragmented.

Introduction

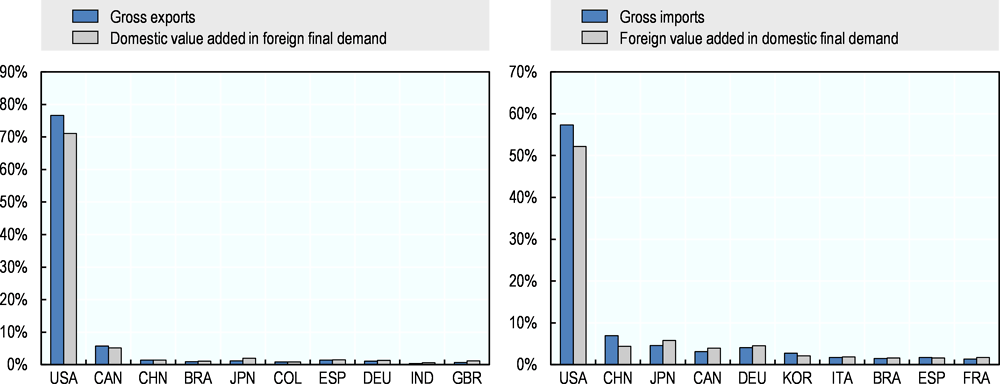

Mexico is a highly open economy, particularly reliant on trade, which represents more than a third of its GDP. Its main destination market and source of imports is the United States, representing over 70% of its exports and around 60% of its imports, both in gross and value added terms. Its other major import and export partners include Canada, People’s Republic of China, Brazil, Japan, Korea, Colombia Germany, Spain, France and Italy, see Figure 3.1.

As a result, trade and economic integration are major considerations driving Mexico’s international co-operation activities. Mexico is very active on the international scene. It shows consistent political resolve to engage internationally, making significant high level political commitments towards regulatory co-operation, be it bilaterally, regionally or multilaterally.

Mexico’s high-level co-operation efforts are particularly driven by its close trade ties with its neighbours of North America, the United States and Canada, with whom it is heavily integrated, particularly in terms of trade and investment flows. In particular, reflecting the significance of economic integration with North America, Mexico has established high level political commitments to regulatory co-operation applicable to a variety of sectors. Mexico and the United States agreed on a High Level Regulatory Cooperation Council, and the Canada, Mexico and the United States together meet regularly within the North American Leaders’ Summit. In addition, Mexico has concluded a number of governmental mutual recognition agreements with Canada and the United States. Recently, Mexico has also started modernising its trade agreements with its major trading partners by including good regulatory practices (GRP) or IRC provisions, namely with modernisation of the NAFTA Agreement, a bilateral agreement with the European Union, as well as an agreement with the MERCOSUR countries. Finally, Mexico also recently signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CP-TPP) with 10 other countries of the Pacific region, including sectoral annexes with specific IRC provisions.

Mexico’s high-level political willingness to co-operate is shared by the regulators themselves, who undertake bilateral co-operation efforts directly with their foreign peers. This collaboration generally goes beyond economic motivations and differs in nature and in geographic scope from the high-level initiatives. Mexican regulators have a broader range of partners across the world, with whom they tend to co-operate on specific themes or sectors. Mexico has a strong “development” strategy with its neighbours from the South American region, with whom it shares its regulatory experience in particular through MoUs. Beyond this, Mexican regulators seek to gain information about regulatory approaches and standards abroad, for instance by signing MoUs with developed countries, from Asia, Europe and North America, or by participating in trans-governmental networks of regulators (TGNs).

Finally, the Mexican government is also very active in its participation in a number of multilateral organisations. Through its Membership in various multilateral bodies, it therefore contributes Mexico’s position to the design and development of international rules and standards, and ensures its perspective and specificity is taken into account in global settings.

From this variety of co-operation efforts at the bilateral, regional and multilateral levels, Mexico has been building long-lasting relationships with a number of partners, particularly in the North and South American region, and has acquired and exported expertise and practices, including through multilateral bodies, via its intense international activity. Nevertheless, there is limited evidence on how effective Mexico’s co-operation efforts have been at improving the Mexican regulatory process. Political will without a more structured approach cannot guarantee implementation. Indeed, a closer look at the agreements signed suggests that many include significant political willingness to co-operate or to exchange information, whereas technical co-operation on regulatory matters remains less frequent.

This chapter highlights on one hand the regulatory co-operation efforts that have resulted from high economic incentives, often with high-level political traction as is the case with the HLRCC, trade agreements, or mutual recognition approaches. On the other hand, the chapter acknowledges the numerous co-operation efforts undertaken in a variety of different sectors by line ministries and regulators. Often in the form of voluntary Memoranda of Understanding or participation in various different types of international bodies, information about these efforts tends to be more fragmented.

High level co-operation initiatives

The Mexican Government is committed at the highest political level to engage in regulatory co-operation with its two neighbours from North America, the United States and Canada. This co-operation follows logically the high level of economic integration and is focused on areas of mutual interest in the region. High-level co-operation has taken the form of the High Level Regulatory Cooperation Council (HLRCC), a commitment to improve co-ordination in regulatory practices between Mexico and the United States, and of regular Leaders’ Summits on selected issues driven by the evolving political context.

While the HLRCC showed limited results to follow-up with high-level commitments, other more informal fora for co-operation have managed to create an impetus for continuous dialogue among regulators. This was the case for example of the North American Leaders’ Summit (NALS) between the Heads of State of Canada, Mexico and the United States or other more specific Ministerial meetings. However, their informal nature may prevent them from guaranteeing continuity in the long term.

High Level Regulatory Cooperation Council between Mexico and the United States

The High Level Regulatory Cooperation Council (HLRCC) was created with a view to develop permanent and lasting co-ordination of regulatory practices, processes, and activities between Mexico and the United States. It represented an important political commitment at the highest levels of the United States and Mexico, mirroring namely a similar initiative between the United States and Canada, the Regulatory Cooperation Council (OECD, 2013[1]). However, after the first work plan 2012-2014, the HLRCC reached a stalemate, without a political agreement for the future.

Background about HLRCC

In May 2010, the President of the United States and Mexico mandated the creation of the High Level Regulatory Cooperation Council, aiming “To increase regulatory transparency; provide early warning of regulations with potential bilateral effects; strengthen the analytic basis of regulations; and help make regulations more compatible”. The HLRCC was developed in parallel with the Regulatory Cooperation Council (RCC) launched by Canada and the United States in February 2011. These Councils opened the way for stronger regulatory co-operation with the United States, as established under Executive Order 13609 on “Promoting International Regulatory Co-operation”.

The Terms of Reference document adopted in March 2011 instructed the HLRCC to identify sectors for co-operation in line with the following key principles:

-

Making regulations more compatible, increasing simplification, and reducing burdens without compromising public health, public safety, environmental protection, or national security;

-

Increasing regulatory transparency to build national regulatory frameworks designed to achieve higher levels of competitiveness and to promote development;

-

Simplifying regulatory requirements through public involvement;

-

Improving and simplifying regulation by strengthening the analytic basis of regulations;

-

Linking harmonisation and regulatory simplification to improvements in border-crossing and custom procedures; and

-

Increasing technical co-operation, to increase the level of development of their regulatory systems.

The first task of the HLRCC was to elaborate a work plan, which was adopted in February 2012 for the biennium 2012-14. This work plan was developed following a public consultation by both Mexico and the United States. In this context, Mexico received 252 proposals for better regulation among the two countries, with the participation of 79 companies and 26 chambers of commerce.1 The United States received 48 proposals.

The work issued in February 2012 pursued the broad objectives of reducing administrative burdens, aligning regulations and creating new trading opportunities in the region. It focuses on the following seven priority sectors: i) Food safety modernisation, ii) E-certification for plants and plant products, iii) Transportation: commercial motor vehicle safety standards and procedures, iv) Nanotechnology, v) Electronic health record (EHR) certification (E-HEALTH), vi) Offshore oil and gas development standards, vii) Cross-sectoral issue: accreditation of conformity assessment bodies.

These seven sectors reflect broadly the areas raised as priorities during the public consultation.

Achievement of the HLRCC

To date, the HLRCC has involved nine regulators in Mexico (including Ministry of Economy) and 11 in the United States. The Council is presided from the Mexican side by the Vice-minister of Competitiveness and Business Regulation and the Vice-minister of International Trade, and from the United States side by the head of OIRA and of USTR.2

A first progress report was published in August 2013.3 It reported on a number of collaboration efforts and dialogues between US and Mexican regulators and envisaged deliverables to achieve each goal of the first work plan. According to this report, the main outputs of the first work plan consisted in improving US and Mexican mutual understanding of their respective regulations. For example, US and Mexican regulators from different sectors met at several occasions and exchanged views on their respective draft regulations to encourage regulatory coherence (e.g. Consultation of Mexico on draft texts such as Policy Principles on Policy Principles for the U.S. Decision-making Concerning Regulation and Oversight Applications of Nanotechnology and Nanomaterials; Mexican comments to the U.S. Food Safety Modernization Act; U.S. Comments to Mexico’s NOM project on vehicle safety; respective reviews of E-health certification programmes), and workshops held throughout Mexico to facilitate understanding about US regulations (e.g. about FDAs rules and regulations on Food safety).

Despite this positive progress report and the value of the stakeholder engagement platform provided by the HLRCC to help regulators on the two sides of the border identify burdensome regulations and areas for improvement, political support to the HLRCC has stalled. Beyond specific examples mentioned in the progress report, there is some evidence that the work of the HLRCC may not have trickled down to all relevant regulators and that more could be done to link the high-level political commitment to a deeper engagement of regulators. Mexico acknowledged a number of practical challenges that slowed down the implementation of the first work plan. Lack of resources and bureaucratic layers resulted in delays to implement the specific projects. The work stream was not focused around a critical path, dispersing the scope of the work conducted under each working group. The dynamics were not adapted to specific working groups, failing to consider the specificities of each regulator, sector and objective. Finally, there was insufficient co-ordination, resulting in unequal process among the work streams of the HLRCC.

Taking note of these lessons learned and to ensure the effectiveness of the HLRCC going forward, Mexico has highlighted in particular the need to focus priority topics on interests of both countries and industry; to foster more active engagement of regulators; as well as to identify financial, material and human resources. A second work plan proposal was sent by Mexico to the United States in 2015, to which the United States responded in December 2015. In July 2016, in the context of the broader “High Level Economic Dialogue”, the US and Mexican ministers reiterated commitment to work towards a second work plan.4 However, the work plan has remained pending further discussions between the authorities of the two countries.5

North American Leaders’ Summit between Canada, Mexico and the United States

Another high level initiative that Mexico has undertaken with its North American partner countries is the North American Leaders’ Summit (NALS), between the heads of government of Canada, Mexico and the United States. The meeting has been held on nine occasions since 2005 in rotating host countries. Having a broad policy scope, this Leaders’ Summit participates inter alia in setting common policy objectives in the region and aligning their positions in multilateral fora.

While it is not supported by a dedicated secretariat to implement the commitments of the Leaders, some evidence suggests that some of the high-level commitments have trickled down to the regulators’ level, resulting in coherent policy approaches.

The last summit was held in 2016 in Ottawa, Canada. The Leaders’ Statement announced the establishment of a North American Climate, Energy, and Environment Partnership and the launch of an Action Plan that identified activities and deliverables for the Partnership. Five key areas of work were included in the Action Plan: 1) Advancing clean and secure energy; 2) Driving Down Short-Lived Climate Pollutants; 3) Promoting Clean and Efficient Transportation; 4) Protecting Nature and Advancing Science; and 5) Showing Global Leadership in Addressing Climate Change.

The main mechanisms of collaboration for these purposes included joint research, setting common goals and/or targets and develop regulation to achieve them, develop national strategies to reduce pollutants, aligning applicable regulations in specific sectors, encouraging the adoption of international standards or implementation of international commitments more generally, inter alia.

Some concrete commitments included time-bound objectives for regulatory alignment between the three countries. For example in their latest Action Plan, the Leaders’ committed to improving energy efficiency, namely by aligning six energy efficiency standards or test procedures for equipment by the end of 2017, and a total of 10 standards or test procedures by the end of 2019. To date, four regulations on energy efficiency have been harmonised and further discussions are still on-going, demonstrating that there is follow-up to this commitment of the three Leaders. This concrete “top-down” commitment was made in parallel to informal discussions taking place between energy regulators of the three countries as a result of a “bottom-up” demand, from their respective industry representatives. As a result, it is likely that the combination of both a high-level impetus and an industry-led demand proved to be a positive combination to ensure effective results of IRC.

Another concrete output implementing the Leaders’ commitments of this is the North American Plan for Animal and Pandemic Influenza (NAPAPI) launched at the 2012 NALS. This was the result of renewed commitments by Leaders since 2005 to address the threat of avian and pandemic influenza. In particular, the three Leaders agreed to a continued and deepened co-operation on pandemic influenza preparedness, including enhancing public health capabilities and facilitating routine and efficient information sharing among the three countries. Such commitments at various Leaders Summits resulted in close dialogue between senior policy makers, health, agriculture and security experts as well as representatives of foreign affairs, ultimately delivering the NAPAPI. This collaborative policy framework sets a co-ordinated trilateral emergency response to pandemic influenza, aimed at complementing national emergency management plans in each of the three countries and builds upon the core principles of the International Partnership on Avian and Pandemic Influenza, the standards and guidelines of the World Organisation for Animal Health (OIE) and of the World Health Organization (WHO) – including the IHR (2005).6

Ministerial-level meetings

A number of meetings are convened at the ministerial level to provide impetus for co-operation in specific sectors. This is particularly the case for example in the energy sector, where regular ministerial level meetings have facilitated the bilateral/trilateral collaboration between energy regulators in Canada, Mexico and the United States on energy efficiency standards harmonisation. These meetings take place for instance in the context of the North America Energy Working Group, the Clean Energy and Climate Change Task Group and, more recently, the North America Energy Ministerial. Thanks to regular meetings of these groups, the regulators have also developed a close working relationship, and continue collaboration despite variations in high-level political priorities.

Ministerial-level meetings result in concrete outputs particularly when they address issues that originated from industry demand. This is the case namely in the area of energy efficiency, where four technical regulations have been harmonised between Canada and the United States: “Minimum energy performance standards” (MEPS) and test procedures were harmonised for domestic refrigerators and freezers, for three-phase motors, in room-type air-conditioning, and in external power supplies.7

Industry representatives frequently inform their national energy regulators of the unnecessary costs of regulatory divergences and the benefits that a harmonised standard would have. In this context, the four harmonised regulations were considered by the three regulators through regular informal exchanges of experiences and technical workshops about the existing regulatory frameworks in Canada (NRCan), Mexico (CONUEE) and the United States (Department of Energy). After agreement on the type of harmonisation to pursue (regulation, test procedure, or both), the regulator of each country pursued their domestic regulatory procedure to introduce the regulation into their domestic legal framework. In the case of Mexico, the four harmonised regulations resulted in NOMs. Beyond these four harmonised regulations, close dialogue with the private sector maintains the energy regulators informed of regulations in other countries and encourages them to take foreign regulations into consideration when developing their own.

IRC in trade agreements

Within a large majority of its trade agreements, Mexico has included provisions to encourage good regulatory practices (GRPs). A few provisions also encourage international regulatory co-operation more directly. In particular, Mexico and its negotiating partners have included detailed regulatory components in sectoral chapters, annexed to the Technical Obstacle to Trade chapters in its recent trade agreements (i.e., CPTPP; Pacific Alliance, EU-Mexico Free Trade Agreement, NAFTA, among others). The information flow between trade and regulatory authorities has been increasingly fluid, with regulators invited to most recent trade negotiations.

Overview of Mexico’s trade agreements

Mexico has trade agreements with its major (import and export) trading partners, except with China and Korea (Table 3.2). It also has an active strategy to further integrate regional markets, through recent or ongoing negotiations. In addition to its existing trade agreements, Mexico has recently concluded or is still undergoing, trade negotiations with a number of countries beyond its traditional partners. This is the case with the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CP-TPP) and the Pacific Alliance for instance. Finally, Mexico is also in the process of modernising the trade agreement it has with the European Union, as well as the NAFTA with Canada and the United States.

Due to the successive conclusions of bilateral and regional agreements, Mexico even has several agreements with certain countries. With Colombia and Chile, for instance, Mexico is linked through three agreements: a bilateral agreement, concluded in 1995 and 1999 respectively, the Pacific Alliance, as well as the CP-TPP.

GRP and IRC in trade agreements

Mexico considers trade facilitation and reducing unnecessary barriers to trade as important objectives of their IRC and regulatory improvement efforts, as seen in Chapter 2. In turn, trade agreements can also serve as an avenue to encourage IRC, in a wide range of policy areas such as competition policy, anti-corruption, and specific goods and services sectors. By ensuring and maintaining the principle of non-discrimination in domestic regulations and putting great emphasis on designing least-trade restrictive regulations, trade agreements can contribute to more coherence and convergence in regulatory matters. Trade agreements are therefore increasingly seen as a portal to foster IRC through different mechanisms that promote transparency and encourage parties to the agreements to initiate co-operation (OECD, 2017[2]).

Over time, Mexico has increasingly incorporated provisions concerning regulatory practices and co-operation in its trade agreements, following the broader global trend in trade negotiations. In particular, all of Mexico’s trade agreements have included some sort of provisions related to good regulatory practices (GRPs), ranging from transparency, risk assessment, the adoption of international standards, and enabling international regulatory co-operation, for instance by encouraging equivalence of rules, mutual recognition of conformity assessment, or creating special Committees to enable regulatory co-operation, particular on TBT and SPS. Such provisions are included either in the general text of the Agreement, within horizontal or thematic chapters, or in sectoral annexes, as described below.

Typically, all Mexico’s trade agreements since 1990 have included some forms of regulatory transparency provisions, from publication of laws to notification of draft and/or adopted measures directly to trading partners. Most agreements include a horizontal transparency chapter, setting a broader requirement for a transparent and predictable policy environment for traders (e.g. NAFTA; Mexico-Colombia; etc.) In addition, transparency provisions are included throughout the agreements in specific chapters. Transparency for regulatory purposes is most common in the specific chapters on SPS or TBT in line with the WTO, with equivalent or slightly more detailed notification requirements of SPS and TBT measures. Some agreements also include transparency obligations for all measures relating to trade in goods (e.g. Mexico-Costa Rica; or Mexico-Uruguay) or services (e.g. Mexico-Japan), for a number of sector-specific measures such as telecommunications (e.g. Mexico-Nicaragua), financial services (e.g. Mexico-Peru) or automobile (e.g. Mexico-Colombia).

Building on regulatory transparency, regulators may be encouraged to conduct consultations early on in the rule-making process, particularly on SPS measures (e.g. Mexico-Costa Rica). Many trade agreements also envisage the establishment of a specific TBT or SPS Committee in which government officials and regulatory agencies from both parties can meet to discuss respective draft regulations or trade-restrictive measures (e.g. Mexico-Nicaragua, Mexico-Bolivia, Mexico-Japan). Finally, certain trade agreements include specific provisions allowing foreign stakeholders to participate in domestic stakeholder engagement procedures to the same extent as national stakeholders (e.g. Mexico-Costa Rica; Mexico-Chile; Mexico-Uruguay; NAFTA).

Among the agreements currently in force, only the Pacific Alliance has a horizontal chapter on GRPs per se (Box 3.1). The text of the CPTPP included a horizontal Chapter on Regulatory Coherence, which was agreed on but is not yet operational.8 Going forward, Mexico has an active strategy to include a more horizontal approach to GRPs in trade agreements. The strategy in this regard is led by the Ministry of Economy, with expert inputs from the COFEMER. In particular, four trade agreements under negotiation potentially include a horizontal chapter on GRPs:

-

Partial Scope agreement with Brazil.

-

The Free Trade Agreement between Mexico and the European Union.

-

The renegotiated version of the NAFTA.

-

Partial Scope Agreement with Argentina.

Other provisions in Mexico’s trade agreements have aimed more directly at reducing unnecessary regulatory divergences. For instance, commitments to adopt international standards are commonly included in SPS and TBT Chapters, with specific bodies listed, going beyond the WTO SPS Agreement (e.g. NAFTA; Mexico-Colombia Trade Agreement). Overall, Mexico’s trade agreements frequently set up an enabling environment for regulators to exchange throughout their regulatory process. Most agreements encourage collaboration to achieve equivalence of rules, and particularly of technical regulations (e.g. ALADI Agreement on TBT) or SPS measures, for instance with dialogue starting from common work plans for SPS measures (e.g. Mexico-Costa Rica, El Salvador, Guatemala, Honduras and Nicaragua Free Trade Agreement).

A number of provisions also recognise the burdens imposed on trade by conformity assessment procedures and include an engagement to make conformity assessment procedures compatible as much as possible or to accredit conformity assessment bodies of other parties without discrimination (e.g. NAFTA, TLCUEM, AP, CPTPP). Among possible means to reduce burdens resulting from conformity assessment, agreements include commitments of the parties to embark in negotiations of mutual recognition agreements (e.g. Mexico-Peru) and participation in regional or international bodies such as the Inter-American Accreditation Co-operation (IAAC) (cf. for e.g. ALADI Agreement on TBT).

The Pacific Alliance was established in April 2011, as a regional integration initiative between Chile, Colombia, Mexico and Peru to strengthen integration between these economies and create a trade hub with facilitated exchanges with the Asian-Pacific region. After the definition of institutional foundations of the Pacific Alliance in a Framework Agreement, the parties launched the negotiation of a trade agreement, the “Additional Protocol to the Framework Agreement”, which entered into force on 1 May 2016.

The negotiations of the Additional Protocol have involved extensive consultations with the private sector from the very early stages of negotiations to identify Technical Obstacles to Trade, and throughout the various stages of negotiation. In particular, the private sector has actively contributed to the trade negotiations from a “side room”, ensuring them a more efficient way to conduct consultations through the negotiation process.

The text of this Additional Protocol is the most detailed of Mexico’s trade agreements in terms of international regulator co-operation. This aims to increase trading opportunities with other countries of the Pacific Alliance and more broadly to further increase integration in the Latin American region.

IRC in Sectoral Annexes to the Framework Agreement of the Pacific Alliance

The parties to the Pacific Alliance negotiations adopted a substantive strategy to strengthen regulatory co-operation in the Sectoral Annexes: with the “Regulatory Co-operation Pathway”, the four economies selected initiatives of common interest to all of them with the aim to eliminate unnecessary obstacles to trade. To date, the parties have negotiated/ are negotiating additional annexes to the Additional Protocol in the areas of pharmaceutical products, cosmetics products, organics products, food supplements, and medical devices. Further sectoral chapters are under consideration. Specific working groups are set up to implement these annexes, and the TBT Committee of the Pacific Alliance monitors this implementation. These working groups are composed of relevant regulators and a representative from the Ministry of Economy or Commerce of each Party.

Chapter 15 bis on Regulatory Improvement, Annex 4 to First Protocol Modifying Additional Protocol of Framework Agreement of the Pacific Alliance

At the Paracas Summit of July 2015, the Heads of State of Chile, Colombia, Mexico and Peru agreed on the First Protocol Modifying Additional Protocol of Framework Agreement of the Pacific Alliance. This Protocol included namely Chapter 15 bis on Regulatory Improvement (Mejora Regulatoria).

It defines GRPs as the international good regulatory practices in the process of planning, development, adoption, implementation and revision of regulatory measures in view of facilitating the achievement of national public policy objectives; and as the efforts conducted by governments to improve regulatory co-operation in view of achieving such public policy objectives and to facilitate international trade, investment, economic growth and employment.

Overall, parties agree to establishing and/or maintaining a body to ensure co-ordination of regulatory improvement efforts across government; to conducting RIAs; to consider foreign and international measures when developing new regulation; to transparency and access to regulations; to forward planning. The Chapter establishes a Committee on Regulatory Improvement to ensure the implementation of the Chapter and identify future priorities on regulatory improvement in the Pacific Alliance, for instance sectorial initiatives of regulatory co-operation. The Committee will take stock of the events on international GPRs and of the Parties’ efforts related to regulatory improvement, in view of considering the necessary update of Chapter 15 bis.

Source: www.sice.oas.org/tpd/pacific_alliance/pacific_alliance_s.asp and www.acuerdoscomerciales.gob.pe/images/stories/alianza/docs/anexo_4_6_7_15.pdf.

Regulatory provisions of trade agreements in practice

To fulfil intended objectives of regulatory coherence among trading partners, the regulatory provisions in trade agreements require follow-up by domestic regulators, either by a change in their procedures or practices, an active dialogue with their foreign peers or through the setting up of a specific institutional framework for co-operation.

A number of regulatory practices committed to in its trade agreements are already part of the domestic regulatory process. For instance, Mexico already has publication requirements of laws and regulations, opens its stakeholder consultations to all stakeholders, including foreign stakeholders, as part of its commitment to regulatory improvement overseen by the COFEMER. Trade agreements merely reaffirm Mexico’s commitment in this area and may promote such disciplines in countries (in particular in Latin America) where they are less embedded into the domestic rule-making. Negotiations of NAFTA may change this dynamic, given the high-level of commitment and implementation of all partners to GRPs.

Beyond the existing disciplines of regulatory improvement, the notification provisions promoted by trade agreements may be the ones which have resulted in most concrete dialogue and exchange of information on regulatory matters. Thanks to the already well established notification procedure to the WTO, the Mexican Ministry of Economy has in place well-functioning domestic procedures to make the best of these provisions in bilateral and regional trade agreements as well. However, even though some notifications are more detailed than in WTO agreements, the notifications to FTA partners are not publically available. The benefits of these notifications are therefore much more limited than notifications to the WTO: they result in information to the trade authorities of the partner country directly, but not necessarily in the information of all stakeholders in the partner countries as is the case thanks to the public WTO information management system.

Evidence on implementation of GRP and IRC provisions in trade agreements by regulators themselves is difficult to obtain. In line with international practice so far (OECD, 2017[2]) the majority of these provisions in force to date contain best endeavour language, confirming the parties’ willingness to promote regulatory coherence to reduce trade costs, without committing to do so through legally binding provisions. In addition, monitoring of their implementation is rarely done. As a result, evidence on their impacts on Mexican regulator’s activity remains limited today, as is the case for most countries. This may change with more recently negotiated FTAs, which have ambitious sectoral provisions but have not yet entered into force.9

Mutual recognition agreements and arrangements

Mexico has actively developed a variety of mutual recognition approaches, both governmental and non-governmental; on goods and services; unilateral, bilateral and multilateral. It is one of the few countries to have a centralised authority that keeps track of existing governmental recognition efforts. However, Mexico faces challenges in establishing the quality conformity assessment infrastructure, which constitute the backbone of well-functioning MRAs. As a result, it is not clear how intensely MRAs are used, which may explain Mexico’s difficulty to show their results. Indeed, not unique to the country, there is limited evidence on the implementation / use of recognition to facilitate market entry and on the trade and other impacts of these agreements.

The institutional framework for MRAs in Mexico

The institutional framework behind mutual recognition is an important component of concluding and implementing effective recognition agreements. In Mexico, a central body has an oversight function over mutual recognition, whereas a single independent body – the Mexican Accreditation Entity (EMA) ensures the accreditation of all Conformity Assessment Bodies in Mexico, which comprise testing laboratories, calibration laboratories, medical laboratories, inspection bodies and certification bodies, Proficiency Testing Providers and the Greenhouse Gas Emissions Verification / Validation Bodies.

The General Bureau of Standards (DGN) within the Ministry of Economy oversees the conclusion of Mutual Recognition Agreements (MRAs) and Arrangements (MLAs). The texts of the MRAs are therefore negotiated by the Ministry of Economy and the relevant authorities. COFEMER assesses the cost-benefit of the MRAs that are concluded by public entities.10 It does not however oversee the arrangements concluded directly between private bodies.

Thanks to this broad oversight by the Ministry of Economy, Mexico has a general overview of the agreements that have been concluded and their implementation, as well as of the areas where further recognition agreements may still be necessary. This access to information about the agreements concluded is not however published in a central source, leaving scope for improving information among regulators and conformity assessment bodies about the agreements and their potential and actual benefits.

Overview of recognition efforts in Mexico

Mexico makes use of mutual recognition of conformity assessment procedures in several sectors, particularly important for its goods and services trade. It therefore has experience with different forms of mutual recognition defined in OECD (2016), as reflected in Figure 3.2.

Based on information collected from previous OECD surveys and interviews, Mexico has developed:

-

Unilateral recognition efforts of specific measures

-

4 bilateral governmental MRAs with its NAFTA partners

-

30 arrangements between conformity assessment bodies in the sector of electronic products/electrical appliances

-

7 MRAs on professional qualifications (healthcare, law, engineering, architecture, accountability/ auditing, and in the training and certification of seafarers)

-

Multilateral recognition in APEC.

Unilateral recognition

Mexico engages in selected efforts to unilaterally recognise the conformity assessment procedures of other countries. This seems to be done in selected sectors by regulators’ own initiative, when justified by the subject matter. It is the case for instance in the area of pharmaceutical products, in which Mexico recognises the certificates for innovative medical products emitted by the United States, Canada, Australia, Japan and Switzerland for example, to speed up their market entry.

Bilateral MRAs between governments

Mexico has developed a total of five governmental MRAs, with the United States and Canada, for tequila, tyres, telecommunications and food safety.

-

Agreement between the Office of the United States Trade Representative and the Ministry of Economy of the United Mexican States on Trade in Tequila (2006)

-

Agreement between the Government of the United Mexican States and the Government of the United States on the certification of tyres

-

Mutual Recognition Agreement between the Government of the United Mexican States and the Government of the United States for Conformity Assessment of Telecommunications Equipment (2011)

-

Mutual Recognition Agreement between the Government of the United Mexican States and the Government of Canada for Conformity Assessment of Telecommunications Equipment (2012)

-

Mutual Recognition Agreement between the Ministry of Agriculture, Livestock, Rural Development, Fisheries and Food (Secretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación, SAGARPA), United States Department of Agriculture (USDA), and the Canadian Food Inspection Agency (CFIA) (2017)

These MRAs include provisions envisaging the creation of joint bodies responsible for monitoring the application by the parties of the agreement, as well as periodic reporting obligations (e.g. Box 3.2).

The MRA on Tequila between the United States and Mexico establishes a Working Group on Tequila which monitors the implementation and administration of the MRA, has period reporting obligations, and includes an enforcement procedure. The working group monitors implementation namely through ongoing dialogue between authorities of both countries and exchange of statistical information on trade in tequila. Ultimately, the WG is encouraged to also consult with non-governmental authorities, including industry representatives, to obtain information about implementation of the MRA. To ensure regular reporting, the importers from both Canada and the United States are required to provide quarterly reports documenting the use of bulk Tequila. Finally, when concerned with incidents of alleged non-compliance with the MRA, the Mexican Ministry of Economy may submit an enquiry or complaint to USTR. USTR will review or investigate the issue and if appropriate, take the necessary action.

In practice, however, there are challenges in the implementation of these MRAs. The MRA on tyres is no longer operational because the Mexican NOM which served as its basis is no longer in force. Implementation of the two MRAs on telecommunications was delayed because of a Constitutional reform in the sector of telecommunications. The two agreements are currently in force, though implementation has recently been initiated only between the United States and Mexico. In practice, the United States National Institute of Standards and Technology (NIST) has opened the possibility for US testing laboratories to seek recognition by IFT under the terms of the MRA.11 Three US laboratories have been recognised by the IFT to date.12 Mexico and Canada are still in the course of settling procedural details before the agreement can be fully implemented.13

Other attempts to develop governmental MRAs seem to have stalled. For example, Mexico has encountered most difficulty in establishing MRAs in the electric and electronic sectors due to the specific technical features of the industry.14

Finally, a number of provisions encouraging mutual recognition are embedded in bilateral trade agreements concluded by Mexico. Nevertheless, evidence on their implementation remains limited.

Recognition of professional qualifications

Mexico has 7 bilateral agreements concluded for the mutual recognition of professional qualifications, with Latin American countries, Spain, Singapore and China. These are in the sectors of healthcare, law, engineering, architecture, accountability/ auditing. In addition, it has a number of MoUs in which it recognises foreign qualifications regarding the training and certification of seafarers. In addition, Mexico has a number of MoUs with countries recognising unilaterally the qualifications of seafarers.

The agreements on recognition of the training and certification of seafarers establish an automatic recognition of professional qualifications on the basis of the regulation I/10 of the International Convention on Standards of Training, Certification and Watchkeeping for Seafarers (STCW Convention). There are three countries with which Mexico has agreed on mutual recognition of the training and certification of seafarers (e.g. Singapore, Spain, Panama). In practice, it has done so through two separate MoUs – recognising separately the qualification of Mexican seafarers on foreign ships in one MoU, or those of foreign seafarers on Mexican ships in another MoU.

In addition, Mexico has also concluded 8 MoUs with foreign countries in which the recognition is unilateral. Six of these MoUs include recognition by the other country of the qualification of seafarers originating from Mexico exclusively (e.g. Barbados, Cyprus,15 Indonesia, Isle of Man, Belgium, Luxembourg). Two of these MoUs include recognition from Mexico of the qualifications in another country (Vanuatu, Marshall Islands).

All MRAs related to education are subject to Cost/ Benefit Analysis. Some of the MRAs regarding education set up a specific body to ensure information exchange, define the terms and procedures for the professional qualification recognition process, summon participants to meetings, give information on the application and implementation of the MRAs. Other MRAs, namely on the training and certification of seafarers, agree on setting up a contact point for review and compliance.

Arrangements between conformity assessment bodies

As of 2014, Mexican conformity assessment bodies had 30 co-operative non-governmental arrangements with foreign bodies (see Annex B). A large majority of these are between private bodies in the sector of electronic products/electrical appliances. This is also the sector in which there is most developed conformity assessment infrastructure.

Mutual recognition of inspection schemes

There is also anecdotal evidence of mutual recognition initiatives in the downstream phase of the rule-making cycle, in particular among inspection authorities. In particular, an agreement has recently been concluded directly between the inspection agencies of Mexico, United States and Canada, in the area of food safety. It aims to ensure continuous communication between veterinary services in the three countries to guarantee fair and open trade of meat, poultry and eggs (Box 3.3).

In January 2017, the National Service of Food and Agriculture Health, Safety and Quality (SENASICA) of the United Mexican States, the Food and Inspection Agency (CFIA) of Canada, and the Food Safety Inspection Service (FSIS) of the United States signed terms of reference for the Operational Relationship in the trade of meat, poultry and egg products.

The terms of reference set out protocols for the three countries to audit one another and outline provisions regarding equivalency, which will enhance market access. Overall, it aims to strengthen the trilateral, scientific and technical relationship, as well as the capacity of the agencies to address issues that arise concerning trade in meat, poultry and egg products.

This agreement implies the mutual recognition of the Meat Products Inspection Systems of the three countries, which represents for Mexico to maintain markets for domestic companies interested in consolidating their products in the United States and Canada.

In addition, the renewal and modernisation of the document introduced new elements to optimise communication between the authorities, speed up the inspection of products at the border and establish the procedures to deal with border rejections. For instance, the terms of reference explore the use of electronic certification as a tool to facilitate the trilateral trade.

Source: SENASICA answer to OECD questionnaire, November 2017.

Like for government-to-government agreements, Mexican certification bodies have a number of arrangements with bodies from Canada and the United States (3 with Canadian bodies, 7 with US bodies). Nevertheless, it also has a significant number of agreements with bodies in China (5). This is significant, as it confirms the need for co-operation at the technical level, despite lack of impetus from the political level. Indeed, Mexico has not engaged in governmental recognition agreements, trade agreements or high-level political co-operation with China.

These arrangements are underpinned by regional and multilateral platforms of accreditation bodies that promote a quality infrastructure system. Mexico, represented by the Mexican Accreditation Entity (EMA) is a member of both International Laboratories Accreditation Commission (ILAC) and International Accreditation Forum (IAF) at the multilateral level. EMA is also a member of the regional pillars of the accreditation system: Inter-american Accreditation Cooperation (Cooperación InterAmericana de Acreditación, IAAC); Pacific Accreditation Cooperation (Cooperación de Acreditación del Pacífico, PAC); Asia Pacific Laboratory Accreditation Cooperation (Cooperación de Acreditación de Laboratorios de Asia-Pacífico, APLAC). It also participates in specific fora, as those related to the OECD Good Laboratory Practices and the Mutual Acceptance of Data, as well as the joint ILAC/World Anti-doping Agency (WADA). As such EMA’s accreditation services have received recognition from all of these bodies.

Multilateral MRAs

Other attempts at multilateral MRAs have remained unsuccessful so far. For example, the APEC TEL MRA, which aimed to recognise conformity assessment of telecommunications equipment throughout APEC Economies, is not operational. The MRA was first concluded in 1999, and reformed in 2010. It includes a reporting mechanism within APEC that monitors the implementation of the MRA in all signatory countries. However, the Agreement has never been formally ratified by Mexico.

Recognition in practice

In Mexico, recognition is more frequently concluded through arrangements between conformity assessment bodies themselves than at the governmental level. This reflects broader practice among OECD countries. Indeed, MRAs are perceived by regulators and the administration costly to develop and to maintain. MRAs are generally perceived as requiring countries to have pre-established a solid conformity assessment infrastructure that ensure confidence in conformity assessment results. In addition, MRAs are seen as costly and challenging to negotiate and maintain (Correia de Brito, Kauffmann and Pelkmans, 2016[3]). In Mexico, both challenges seem to prevent Mexico from fully benefitting from mutual recognition.

On one hand, the conformity assessment infrastructure is still insufficient to demonstrate conformity with Mexican regulations. This discrepancy between conformity assessment infrastructure and the NOMs developed was highlighted by several stakeholders as a priority to address. According to EMA’s responses to OECD questionnaire, only around 30% of NOMs today have an accredited body in Mexico that may assess conformity with the relevant NOM. As of January 2018, out of 768 NOMs in force, 510 required a conformity assessment, and of these only 278 have accredited bodies in place capable of assessing their implementation.

The shortcomings in Mexico’s conformity assessment infrastructure may be explained by several factors. For example, lack of sufficient resources in testing laboratories make it difficult for them to fulfil the necessary requirements to become accredited. The costs of accreditation services imposed by EMA are among the lowest in comparison with international practice, particularly for verification units and laboratories, but lack of awareness about the benefits of accreditation provides little incentive to invest in the lasting infrastructure and human capital to fulfil EMA’s requirements. Some NOMs may not be entirely up to date with latest technologies. Certain public entities conduct conformity assessment themselves, allegedly presenting risks of partiality.

To improve the conformity assessment infrastructure, EMA engages in awareness raising efforts with conformity assessment bodies and the DGN, encouraging the development of new conformity assessment bodies throughout Mexico. EMA’s objective is to increase the infrastructure of accredited bodies by 10% each year, covering at least 25 new norms. This objective was reached in the last two years.

On the other hand, the very negotiation and operationalising of MRAs remains rare. Indeed, perhaps partly explained also by the insufficient conformity assessment infrastructure, the number of MRAs negotiated remains very limited. The conclusion of only five MRAs between governmental authorities, despite a central authority with a mandate to conclude such agreements (DGN) suggests a difficulty to achieve a negotiated agreement with truly mutual benefits for Mexico and its foreign trading partners. In addition, such agreements only exist with Canada and the United States, the two major co-operation partners of Mexico. The costs of concluding governmental MRAs may indeed be justified by the important gains in trade flows with Canada and the United States, whereas this is not necessarily the case with other countries.

The 30 MLAs concluded by Mexican conformity assessment bodies with foreign counterparts for the mere sector of electronics/ electrical appliances suggests that agreements at the technical level are easier to achieve, and are perceived as a useful tool by conformity assessment bodies themselves. This being said, the presence of such agreements in one same sector is an indication that the Mexican conformity assessment infrastructure in the area of electronics/ electrical appliances has managed to gain confidence of foreign partners.

Exchange of information and experiences between regulators

Beyond the regulatory co-operation initiatives that pursue objectives of economic integration, notably in the North American region, Mexican regulators also co-operate directly with their foreign peers. They do so mostly at their own initiative with the use of Memoranda of Understanding (MoUs), to exchange information and experiences and extend the evidence-basis for their regulatory activity. These agreements constitute important political statements of co-operation. In practice, the extent to which these agreements lead to greater regulatory coherence across jurisdictions is difficult to assess and depends on sectors and policy areas.

MoUs in the wider spectrum of international agreements

MoUs are voluntary agreements concluded directly between Mexican authorities with foreign peers or international organisations. Most commonly, MoUs have merely broad and best endeavour language, without creating specific legal obligations.

Overall, MoUs serve as a flexible tool that may be concluded by Mexican regulatory authorities directly on issues under their scope of responsibilities, without need of oversight by central government. The conclusion of MoUs with international organisations may function in a similar manner as those with foreign regulators, but may supporting information sharing or capacity building on international rules or standards, as for example for the MoU between Mexico and the IMO on marine transportation.

Although MoUs remain the co-operation tool most made use of by regulators in Mexico, other legal tools exist for regulators to co-operate with their peers, either more formal and with further legal effects, such as interinstitutional agreements, or even more flexible and informal, such as “work plans” (see Box 3.4). For example, SENASICA concluded a work plan with Chile’s Ministry of Agriculture,16 which formally establishes an electronic certification system on which the certificates issued by both authorities are shared to facilitate trade in food products.

The Ministry of Foreign Affairs (SRE) must be consulted prior to the conclusion of binding agreements, treaties or interinstitutional agreements. This is not a requirement for voluntary MoUs. However, although no legal obligation exists, the SRE is frequently consulted prior to the conclusion of non-binding MoUs. In such a case the SRE verifies that the language remains non-binding and under the responsibility of the given authority, and issues an opinion on the viability of entering into the agreement between a governmental entity and its homologous entity in another government.

The Ministry of Foreign Affairs distinguishes explicitly two forms of international agreements: international treaties and interinstitutional agreements. The difference between the two is related to the process followed for their conclusion and their scope of application. Practice has also seen emerge a number of additional more flexible tools through which authorities co-operate with their foreign peers, such as Memoranda of Understanding and Work Plans.

International treaties are concluded by the President of the Republic of Mexico, or an authority having received specific powers from the President. They must be approved by Congress and published in the Official Gazette of the Federation. Upon this publication, they take the character of supreme law of the Mexican Republic, as long as they comply with the Constitution.

The category of interinstitutional agreements was created by the LCT to reflect common practice in Mexico and other countries. They are concluded directly by a dependency or decentralised agency of the public federal, state or municipal administration, with one or more foreign governmental bodies or intergovernmental organisations. These agreements are legally binding but do not constitute supreme law of the Mexican Republic, and are neither approved by congress nor published in the Official Gazette. These agreements must remain under the exclusive attributions of the authorities concluding them.

Memoranda of Understanding (MoU) are voluntary agreements concluded directly between Mexican authorities with foreign peers or international organisations. The qualification of MoU does not preclude of a specific legal effect. Indeed, MoUs may be voluntary or binding, and their legal effect depends on the language used in the text of the agreement.

Work plan: joint working documents concluded at a technical level together between regulatory authorities in Mexico and their foreign peers.

Source: Author’s own development based on interviews and Guide on the conclusion of international treaties and interinstitutional agreements according to the Ley on the Celebration of Treaties by Ministry of Foreign Affair www.economia-snci.gob.mx/sicait/5.0/doctos/guia.pdf.

In addition, the SRE consults COFEMER on the respect of better regulation disciplines in international agreements. In practice, the opinion of COFEMER remains mostly a formality, without an in-depth scrutiny of the process of the international agreements. Indeed, out of the 179 opinions emitted by the COFEMER regarding international agreements, none is a negative opinion. Authorities concluding MoUs are therefore free to include any sort of provisions they consider necessary, as long as they remain under the scope of their competencies and do not create new attributions or obligations for themselves.

Information about MoUs

Information on the existing MoUs remains scattered among all authorities concluding them, and their content is largely focused on exchange of information and experience. As a result, the evidence on their number, level of implementation and impact remains limited.

The SRE is required to “register” agreements in an internal registry. However, this comprehensive registry has not been published to date. The SRE also makes all binding international treaties accessible on its website, in a searchable format.17 However, it does not include the interinstitutional agreements or the MoUs. There is therefore no central information portal for the interinstitutional agreements or MoUs concluded by individual regulators, and it is difficult to present an exhaustive picture of all such agreements concluded.

Following a recent report by the supreme federal auditor, the SRE has been asked to make all international agreements concluded in the past three years public, including interinstitutional agreements, to comply with Mexico’s transparency law. The SRE intends to do so for the interinstitutional agreements to which the SRE is party, which are currently accessible on demand.18 In parallel, dependencies and decentralised agencies have been asked to make public the interinstitutional agreements concluded directly by them to comply with Mexico’s transparency law. However, this only includes agreements that are legally binding. MoUs which are of voluntary nature are not covered by this recommendation.

A number of MoUs are made publically available by the signatory authorities, directly on their websites. This is the case for example of the SCT Department on Maritime Transport, which has a specific webpage on the MoUs it has concluded.19

The SRE does not gather information about the implementation, which fall outside its sphere of competence. The regulatory agencies concluding the MoUs are free to monitor the implementation of the MoUs they conclude. In practice, it seems that they rarely do so. As a result, very little information is available about the co-operation that takes place as a result of MoUs.

Trends and scope of Mexico’s MoUs

The content of MoUs undertaken by Mexican regulatory authorities may vary, but they generally aim to share information, experience and build capacity of both parties. They usually provide for willingness to co-operate, exchange information and constitute an important pillar to enhance trust between regulators and develop common views on regulatory matters. However, these co-operation tools do not guarantee regulatory coherence, let alone convergence.

Several authorities within central government frequently conclude MoUs on matters under their scope of responsibility. These may be on regulatory improvement or oversight, as is the case of COFEMER, or on the harmonisation of standards, in the case of the DGN.

COFEMER has concluded co-operation agreements to share experience and build capacity more broadly with regards to regulatory improvement, namely with Canada, Costa Rica, the Dominican Republic, El Salvador, Chile, China, Colombia, Indonesia, Panama, and the Province of Buenos Aires, Argentina. These agreements focus mainly on training activities in matter of good regulatory practices. More specifically, they aim to strengthen the practices of administrative simplification, improve the institutional framework of regulatory reform (including the design of oversight bodies), share methodologies on regulatory impact evaluation, advice on the implementation of a public consultation process of regulations, advice on the design of online systems which gather information on regulations and procedures. They are often concluded for a limited number of years with a sunset clause, and include a specific work plan and the possibility to renew them for a new period of the same length. These work plans consider the following elements: specific objectives and activities, work schedule, responsibilities of each part, and indicators and evaluating mechanisms.

Beyond these general trends, the MoU concluded between COFEMER and the Treasury Board Secretariat of Canada in early 2018 includes a specific provision on IRC, confirming the parties’ intention to share information, lessons learnt and best practices on international regulatory co-operation with each other, and to explore opportunities to advance bilateral regulatory co-operation and regulatory alignment. The agreement provides for annual meetings at senior official’s level, and the establishment of a work plan.

The DGN from the Ministry of Economy has a number of broad MoUs that enable information exchange and technical co-operation with other countries, and aim to achieve greater harmonisation of standards. Today, DGN has 18 MoUs in force with Germany (DIN, PTB), Bolivia (Ibnorca), Brasil (ABNT), Canada (SCC, UL), China (SIS, SAC), Colombia (Icontec), Costa Rica (Inteco), Ecuador (Inen), United States (ASTM, IEEE, ATM, UL), Peru (Inacal), Dominican Republic (Indocal). In addition, they are in the process of negotiating MoUs with authorities from Chile (INN), Cuba (ONN), Thailand (TISI) and European Union (CEN CENELEC).

Beyond COFEMER and DGN, sectoral regulators also conclude MoUs frequently in their respective areas of expertise (Box 3.5 provides a number of examples). In certain sectors, demand from the industry’s side may be a driver for the conclusion of MoUs with substantive provisions and engagement towards regulatory coherence. This is the case for example for a MoU concluded in the Gulf of Mexico in view of having similar environmental protection requirements applicable throughout the Gulf of Mexico (see Box 3.5).

Mexico’s National Agency for Industrial Safety and Environmental protection of the Hydrocarbons Sector (ASEA) and the US Bureau of Safety and Environmental enforcement (BSEE) signed an MoU in October 2016 with the aim of establishing a framework for co-operation related to the elaboration, oversight and enforcement of safety and environmental regulations for development of offshore hydrocarbon resources. It was concluded in response to demand from industry representatives operating in the Gulf of Mexico. The scope of the co-operation covers mutual regulatory approaches and processes, the development of industry standards, quality assurance and certification programmes, among others. To co-operate in these areas, the MoU envisages that the regulators exchange information periodically, conduct joint studies and research, provide staff exchanges and participate as observes in each other’s activities, and exchange best practices, lessons learned and sharing of expertise. In addition, ASEA has asked BSEE to review its draft regulation on deep waters. However, this exchange of regulation is not systematic but depends on specific needs and topics. BSEE has not shared draft regulations with ASEA to date.

MoU signed by the North American Electric Reliability Corporation (US), the Energy Regulatory Commission (CRE) and the National Centre for Energy Control of Mexico (CENACE)

The MoU establishes a collaborative mechanism for identification, assessment and prevention of reliability risks to strengthen grid security, resiliency and reliability. The MoU provides for co-operation through meetings, capacity building, internships and joint research. It has resulted in reinforced relationships between the three regulatory agencies and common understanding of similar challenges. In addition, a specific provision encourages CRE and CENACE, to adopt the standard already developed by the US regulator, NERC, and to participate as much as possible in NERC’s processes to develop and enforce reliability standards, which it conducts as the Electric Reliability Organization (ERO) in the United States.

Agreement on collaboration, joint publication and licencing concluded between Underwriters Laboratories Inc. (“UL”) and the Mexican Bureau of Standards of the Ministry of Economy (“DGN”)

This agreement aims to foster regulatory coherence more directly, between Mexico, Canada and/or the United States. It pursues this namely through two avenues: on one hand, through the acceptance, translation or use of UL standards in Mexico when DGN considers it relevant, and on the other hand through joint development of new standards at the North American level for use by Mexico, the United States and Canada. To achieve these objectives, the MoU envisages the creation of technical committees composed of staff from the UL, DGN and other entities of interest and encourage participation of UL and DGN staff in each others’ respective standardisation committees. UL and DGN grant each other access to their respective standards database. In addition, it envisages various forms of joint standards, either with a shared label, shared title or shared publication. The parties agree to share the status of activities related to the agreement every six months.

Source: Author’s development based on interviews, response to questionnaire and publically available information.

Experience in implementing MoUs

To date, the examples of documented MoUs suggest that they tend to establish a rather unilateral learning process, with one country building capacity of the other country, instead of a mutual undertaking. In this sense, Mexican regulators tend to use MoUs either with developing countries to support them in building capacity (e.g. MoUs of COFEMER on GRPs; DGN MoUs with Costa Rica, Bolivia, Dominican Republic, Peru, Ecuador or Brazil), or with other emerging or developed countries whose experience they benefit from when regulating in Mexico (e.g. MoU of ASEA and BSEE, or between NERC, CRE and CENACE; DGN MoUs with Germany, Spain, United States, Canada and China).

Still, anecdotal evidence suggests that a few MoUs concluded with specific objectives in mind have resulted in concrete examples of regulatory coherence. The most significant outcomes of MoUs seem to be increased capacity, access to information or joint commitment towards harmonised standards.

Improved capacity

The frequent meetings, staff exchanges and capacity building efforts result in some cases in uptake of similar practices in both countries. In particular, other developing countries have learned from Mexico’s experience, and thus reproduced similar practices in their domestic framework.

COFEMER has concluded specific agreements with different authorities to share its experience on regulatory improvement. These have helped enhance the disciplines of regulatory improvement notably in the Latin American region.

The MoU concluded between COFEMER and the Technical and Planning Secretariat of the Presidency of El Salvador has a concrete work plan for the period 2017-2018, with allocations of responsibilities and monitoring of implementation of the MoU. The substance of the agreement remains focused on capacity building on regulatory improvement. The implementation of the agreement has resulted in El Salvador’s learning from Mexican regulatory improvement practices. For example, several technical visits of Mexico to El Salvador contributed to design and create the National Agency of Regulatory Improvement of El Salvador (Organismo de Mejora Regulatoria, OMR) which was created on 10 November 2015, as an oversight body that has taken into consideration many institutional characteristics similar to those of COFEMER. In 2017, the work activities focused on promoting the Simplifica Program (which aimed to generate strategies for simplified formalities) and generate a Register for Formalities in El Salvador. In 2018, COFEMER has supported El Salvador in its efforts to create a general law on Better Regulation in El Salvador, by participating in the different activities with the President and ministerial authorities.

Regarding the International Co-operation Fund Mexico-Chile, currently, the COFEMER is working with the Servicio Agrícola y Ganadero (SAG) from Chile with the objective to show all the better regulatory tools implemented in Mexico and try to implement the tools in the SAG. The project has the objective to work together with SAG in 18 months in different activities such as workshops, conferences, and a technical short missions in Australia and New Zealand for understanding the policy, institutions, and the tools that are applied in that countries. In that context, in January 2017 the COFEMER and the SAG developed the first Workshop on Good Regulatory Practices in Santiago de Chile and in February 2018 development the second Workshop in the same matter in Mexico City. The outcome of this project is to create a specific area in SAG in charge of the design and the implementation of the better regulation policy in that agency.

In relation to the collaboration between the COFEMER and the Planning Department of Colombia and the Legal and Technical Secretariat from the Municipality of Buenos Aires, these institutions had development a strong agenda for the next months with the purpose to share experiences about Regulatory Impact Assessment, methodologies to measurement the cost-benefit analysis to regulations and promote the better regulation strategies with that institutions. Additionally, the COFEMER and Panama work together in the methodology about the simplification of building permits focused on reduced the requirements to obtain permits in that sector.

Source: Information provided by COFEMER.

For example, the MoU signed between the COFEMER and El Salvador triggered many technical visits of officials from El Salvador to the COFEMER’s offices and to experts of COFEMER to El Salvador with the aim to advise them in the area of regulatory reform policy implementation. This contributed to the design and creation of the National Agency of Regulatory Improvement of El Salvador (see Box 3.6).

Access to information

An important factor to encourage regulatory coherence is to obtain information about the standards or regulations in other countries, or the evidence used to establish them.

MoUs with standardising bodies in particular have resulted in access to useful information, whether scientific evidence or access to standards. Indeed, such agreements tend to incorporate concrete provisions to access information about technical specification standards, which are not always otherwise publically available (see MoU between UL and DGN, in Box 3.5). The implementation of such a concrete provision is also easily verifiable: access to the standards database is granted and can therefore be consulted systematically by personnel of respective authorities.

Such access to information may contribute towards coherent and ultimately harmonised standards.

Coherence of regulations or standards

The harmonisation, i.e. the complete alignment of rules across borders, or adoption of identical measures is an ambitious goal requiring close collaboration and aligned objectives. It is therefore rarely an explicit objective of MoUs. However, MoUs may result in coherent or harmonised standards when the exchange of information is truly effective, and when the MoUs contain joint standardisation provisions. This is particularly the case in MoUs by DGN, which aim to foster harmonisation.

The MoU between DGN and UL concluded in October 2017 (Box 3.5) enables access to information on standards of both authorities, as mentioned above. On this basis, DGN has engaged to base its new standards on existing UL standards and in so doing, include specific language referring to the original UL. While it is still early to observe any new standards, this requirement will offer a tool to track the number of standards which have been developed thanks to information gained through the MoU.

More specifically, this MoU between DGN and UL has also resulted in joint standard-setting. Indeed, UL and DGN are currently developing a number of joint standards on fire safety services as well as on tubes, within their respective standardisation processes. These parallel processes aim to achieve harmonised standards in both countries.

These harmonised standards, if adopted, will remain voluntary standards, NMX in the case of Mexico.

Mexico’s active strategy to engage at the multilateral level

Mexico is very dynamic in international fora, both at the state and regulator’s level. As such, it has the opportunity to hold regular dialogue with a broad range of countries, well beyond its natural partners. With the participation of the Ministry of Foreign Affairs in international bodies, Mexico has the possibility of advancing the government’s perspective to the multilateral debate, contributing to shaping multilateral rules and standards. In particular in standard-setting bodies, the Mexican Ministry of Economy (DGN) makes specific efforts to represent the specific needs and priorities of Latin American countries that have been discussed in regional platforms. With the participation of line ministries or regulators in the different organisations and in the development of international rules and standards, they can gain further ownership about the very rules and standards they are then asked to adopt within domestic regulations.

Given the wealth of international standard setting organisations, the country nevertheless faces resource constraint to support its participation and ensure a government-wide strategy is well represented throughout all organisations. A strategic approach involves identifying the critical areas of priority for Mexico, good internal co-ordination between the Ministry of Foreign Affairs and line ministries and leveraging regional platforms to influence decision making in international fora.

Representation of Mexico in international bodies

Mexico in international organisations

International organisations (IOs) play a critical role to support national regulators in their efforts to put scarce resources together, and co-ordinate their regulatory objectives, rules and procedures when useful. They do so by offering platforms for continuous dialogue and the development of common standards, legal instruments, mutual recognition frameworks, best practices and guidance. Beyond standard-setting, they facilitate the comparability of approaches and practices, consistent application and capacity building in countries with a less developed regulatory culture (OECD, 2016[4]).

Mexico is a member of many international organisations that set international norms and standards, such as the OECD, the WTO, the IMO or the ISO (already mentioned previously), but also the Food and Agriculture Organisation (FAO), the World Health Organisation (WHO), the Organisation for Animal Health (OIE), the UN Economic Commission for Latin America and the Caribbean (UNECLAC), and the International Telecommunication Union (ITU), amongst others.

The Ministry of Foreign Affairs (SRE) in principle centralises participation in different international bodies. To do so, it has specific units in charge of monitoring activity in selected IOs, and it accredits each person travelling to participate in IO meetings. It does not, however, have a consolidated list of all international organisations in which Mexico participates.

In defining Mexico’s foreign policy, the SRE is responsible for co-ordinating, fostering and ensuring the co-ordination of actions of the Mexican public administration abroad (art. 28 I LFPA). As such, its attributions with regards to the conclusion of international treaties grant the SRE oversight over a large range of activities conducted by regulatory agencies, mainly when these are supported by the conclusion of binding treaties or interinstitutional agreements, or formalised by participation in an international organisation. However, its role remains confined to a legal verification process, either about the legality of international agreements or about the accreditation of authorities participation in international organisations.

Beyond the SRE, specific regulatory agencies participate in the IOs in their area of specialty (Table 3.3). They co-ordinate with the SRE to inform them about their upcoming participation and the results thereof, but maintain autonomy to defend their position in the organisations corresponding to their area of specialty.

The DGN participates on behalf of the Ministry of Economy in all IOs related to standardisation and metrology (cf. art. 4 LFMN). In this capacity, DGN plays an active role representing Mexico’s position in international standardisation bodies, and through that, also putting forward the position of developed and emerging economies from the Latin American region. This is for instance the case for the Codex Alimentarius, where the DGN is a regional representative for Latin America, as well as in ISO, where Mexico is part of the Council. In ISO, Mexico also participates in the Spanish Translation Management Group, which plays an important role in terms of dissemination of standards in Spanish-speaking countries. Indeed, the translation management group determines the list of standards to be translated to Spanish, based on market needs in their countries, and region.

Mexico in trans-governmental networks of regulators