Chapter 16. Malaysia

SME policy has recently become a pillar of Malaysia’s push to achieve higher-income status. Accordingly, its main policy priority is productivity enhancement. It broadly adopts the “service delivery” approach to SME policy, providing services, particularly finance, to help SMEs increase their competitiveness.

Overview

Economic structure and development priorities

Economic structure

Malaysia, an upper middle-income country on the path towards high income graduation, is one of ASEAN’s richest and most globally integrated economies.1 It has the sixth largest population in ASEAN, standing at 31.7 million people in 2016 (ASEC, 2016[1]). It has the fourth greatest land mass and is rich in tin, petroleum, timber, copper, iron ore, natural gas and bauxite. Since the 1970s it has transformed from a mainly agricultural and mining-based economy to an economy based predominantly on industry (accounting for 36.8% of GDP and 27.5% of private-sector employment in 2016) and services (accounting for 56.2% of GDP and 61.1% of private-sector employment in 2016) (World Bank, 2016[2]; ILO, 2016[3]). The production of palm oil remains important for the Malaysian economy, accounting for 43.1% of agricultural GDP in 2016 (DOSM, 2017[4]).2

Like many economies in the region, Malaysia has followed a growth model that relies in part on international expansion. Over a 30-year period, the country’s export base expanded by more than 20 percentage points, from less than 50% of GDP in 1980 to more than 70% by 2010. These exports have also become increasingly sophisticated. Following the collapse of rubber and tin prices in the early 1980s, Malaysia shifted its support for the commodities sector to crude oil, natural gas and palm oil, and at the same time worked on diversifying the country away from commodities through development of its manufacturing industry. Its success in developing its electronics and electronic parts industry is particularly impressive, and this specialisation has facilitated the country's integration into regional and global value chains.3 Today, machines and mineral products constitute the greatest share of goods exported by Malaysia, accounting for 42% and 15% of total exported goods respectively.4 Its five most exported products in 2016 were integrated circuits (13.9%), refined petroleum (5.9%), palm oil (4.9%), semiconductor devices (4.3%) and computers (4.2%) (MIT, 2016[5]). The diversification process has also changed the composition of the country’s trading relationships. Export to traditional partners, particularly European commodity importers, has steadily lost ground in favour of regional partnerships, particularly those in the ASEAN Economic Community and with China. Other ASEAN countries absorb 30% of Malaysian exports, of which half is absorbed by Singapore alone. China (13%), the United States (11%) and Japan (8.3%) are also important export partners (MIT, 2016[5]).

In conjunction with its strong growth performance, Malaysia scores well on poverty reduction and human development indicators. Today just 0.6% of the population lives below the poverty line, and the country ranks high on the UN’s Human Development Index, at 59th globally and 3rd in ASEAN.5 It counts a high adult literacy rate, with 93% of the country’s population being literate in 2010 (UNESCO, 2016[6]). Its unemployment rate is also low, averaging 3% over 2012-2016. Unemployment is higher among young people. Around 11% of individuals aged 15-24 are not in employment, education or training (NEET) – 8% among males and 15% among females (ILO, 2016[3]).

Moving forward, Malaysia is now looking to join the high-income bracket by 2020. The outlook for this looks promising. The country continues to exhibit robust growth underpinned by solid macroeconomic fundamentals, and the World Bank forecasts that it should join the high-income bracket between 2020 and 2024 (World Bank, 2017[7]). Average annualised GDP growth of 5.3% (2012-2016) was achieved while maintaining a fiscal deficit below 3% of GDP and a stock of public debt at 54.9% of GDP (IMF estimates, 2017). Malaysia has continued to boost domestic consumption, and at the same time it maintains a relatively strong external position. It holds a current account surplus of around 2.4% of GDP, adequate levels of foreign currency reserves (covering around six months of imports) and a strongly positive trade balance (equal to 25.3% of GDP in 2017) (IMF, 2017[8]). Intensifying measures to implement structural reforms in order to boost productivity and inclusiveness will increase the resilience of Malaysia’s strong growth rate over the medium term (OECD, 2016[9]). The country also remains notably more vulnerable to a slowdown in global commodity prices than many of its income-group and regional peers. Despite marked success at diversifying its economy, 19.2% of exports were agricultural and mining goods in 2015, and 21.5% of government revenue was still oil-related (OECD, 2016[9]).

Reform priorities

Many of the country’s long-term economic policies are geared towards Malaysia’s goal of joining the high-income country bracket by 2020. These measures are outlined in the 11th Malaysia Plan (2016-2020), the country’s main socio-economic strategic planning document and the final strategic document to fall under the country’s Vision 2020 strategy launched in 1991. The plan identifies “six strategic thrusts” and “six game changers” for achieving the strategic thrusts (Table 16.2).

The plan aims to achieve average GDP growth of 5%-6% per year over 2016- 2020 in order to increase per capita income from its current position, USD 9 860 in 2016,6 to the higher-income country threshold of USD 12 735 in 2016.7 In addition it aims to increase:

-

labour productivity to MYR 92 300 (Malaysian ringgit) in 2020, from MYR 77 100 in 2015

-

GNI per capita to MYR 54 100 in 2020

-

average monthly household income to MYR 10 540 in 2020, from MYR 6 141 in 2014

-

the share of employee compensation in GDP to at least 40% in 2020, from 34.8% in 2015

-

the Malaysian Well-being Index (MWI), an indicator of improvement in the well-being of the Malaysian people, by 1.7% per annum.

To achieve this, it places high priority on measures to increase total factor productivity (TFP), innovation and inclusion. In particular, it aims to accelerate TFP growth through education and training programmes and policies, and investment in key infrastructure and information and communications technology (ICT). It also commits to increasing private-sector investment in order to modernise key economic sectors, and it calls for the country’s federal government to ensure the stability of its programmes, balancing its fiscal position by 2020 by strengthening its tax base and improving the decision-making process of fund allocation for proposed government programmes (11th Malaysia Plan, 2016). The plan builds on the country’s New Economic Model (NEM), which was launched in early 2010, and the One Malaysia concept, which was introduced the same year. The NEM outlines a path for achieving Vision 2020 by encouraging public and private investment, particularly in infrastructure and the development of services, and for realising productivity gains through innovation and increased export sophistication.

Private sector development and enterprise structure

Business environment trends

Malaysia consistently scores as one of the region’s top performers on business environment indicators. The country boasts world-class infrastructure, a multilingual workforce (with over half the population proficient in English) and a stable financial sector. Firms benefit from broadly low fixed operating costs (notably electricity and rental costs), and the government provides information to would-be investors on the costs of starting and running a business.8 Malaysia is the region’s third largest recipient of FDI, after Singapore and Viet Nam, absorbing 12% of the region’s total.

A number of reforms have been implemented over recent years to enhance the business environment. To address swelling and outdated regulations, the country has been undergoing a comprehensive process of regulatory reform since 2006. One significant milestone of this process was the introduction of a new Companies Act in 2016, which superseded a previous version from 1965. The act introduced simplified rules over company incorporation; modernised rules on share capital management, restructuring and insolvency; reinforced the importance of audit and financial reporting; and introduced new rules for effective corporate governance. To facilitate economic transformation, Malaysia has embarked upon a number of big-ticket infrastructure development projects and has intensified its efforts to attract international investment.

Yet some constraints to doing business remain. These include issues with corruption, foreign currency regulations and difficulties accessing finance. While bribes and irregular payments in return for services are not generally widespread, they are used by some companies “to get things done”. There are particular integrity risks surrounding public procurement, where connections and gifts have often played an important role in securing contracts. In addition, foreign currency restrictions apply to Malaysian residents, which may hinder exporters. Under these rules, no resident is able to buy, borrow, sell or lend foreign currency, or to make any payment in Malaysian ringgit to a non-resident. Many firms in Malaysia also report difficulties in accessing finance, though a range of public programmes have been implemented to address this. Finally, a number of taxes on enterprises were introduced in 2016 and 2017 that were designed to shore up public finances but proved unpopular. They included a goods and service tax and a withholding tax, the former of which was dismantled following the 2018 general election (honouring a campaign pledge).

SME sector

There are around 920 624 registered enterprises operating in Malaysia, of which 75.3% are micro enterprises, 20.9% are small, 2.2% are medium-sized and 1.5% are large. SMEs account for of 65.3% of employment and 36.6% of GDP.

Malaysian SMEs are principally found in the service sector (89.2% of all SMEs). Aside from services, 5.3% of SMEs operate in the manufacturing sector, 4.3% in the construction sector, and just 1.1% in the agricultural and 0.1% in the mining and quarrying sectors. Roughly 53.6% of registered SMEs are located in four of Malaysia’s 13 provinces: Selangor (19.8%), WP Kuala Lumpur (14.7%), Johor (10.8%) and Perak (8.3%). Selangor is Malaysia’s richest (measured by GDP) and most populated state, WP Kuala Lumpur is the second richest state, Johor is the second most populated and fourth richest state, and Perak is the fifth most populated and seventh richest state. Interestingly, Sarawak and Sabah account for a lower share of SMEs (6.7% and 6.2% respectively) than Perak, despite having a greater GDP and population. Rich in natural resources, both of these state economies are highly dependent on the export of primary commodities.

SME policy

SME policy in Malaysia has traditionally had both social and economic objectives. It first became noticeably present on the policy agenda in 1971 with the introduction of the New Economic Policy (NEP), which aimed to improve economic opportunities for the country’s ethnic Malay (Bumiputera) population, as well as to engage in economic interventionism and to accelerate development through industrialisation. The intensity of SME policies increased after the development of Malaysia’s Industrial Master Plans (IMPs), particularly IMP 2 (2000-05) and IMP3 (2006-20). These plans gave SME policy a greater role in boosting economic competitiveness and innovation, as well as economy-wide productivity. Via the SME Masterplan (2012-2020), which was launched in July 2012, SME policy thereafter became an important component in Malaysia’s strategies to achieve high-income status by 2020.

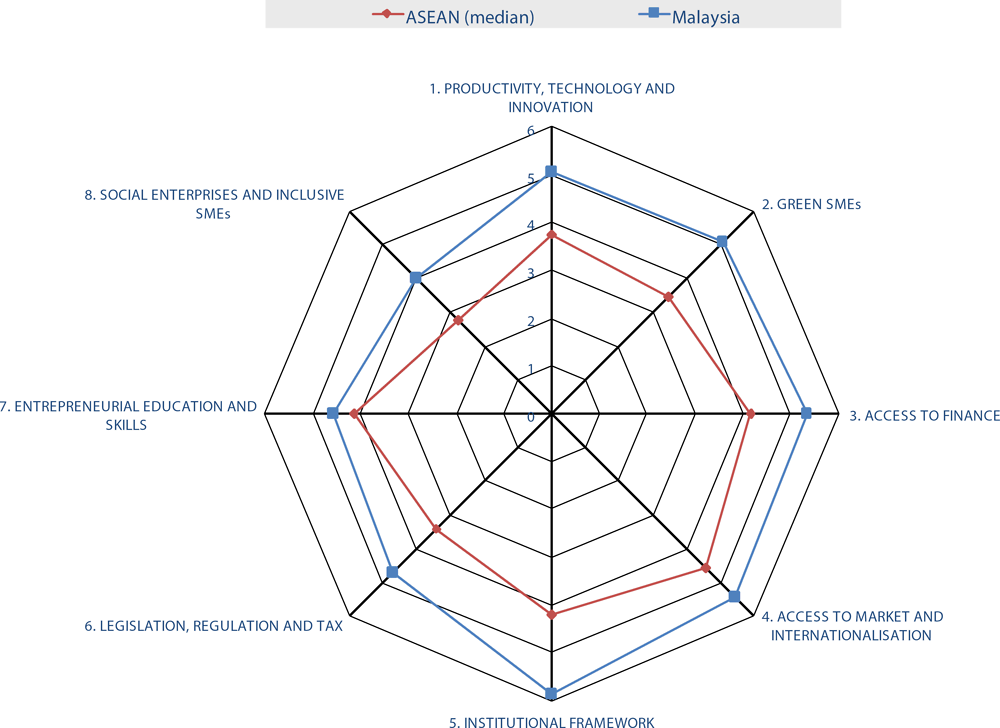

2018 ASPI results

Strengthening the institutional, regulatory and operational environment (Dimensions 5 and 6)

Malaysia has an advanced institutional framework for the development of SME policy, and this is reflected in its Dimension 5 score of 5.86. It has an SME agency, SME Corp. Malaysia, and an SME policy co-ordination body that is chaired by the country’s prime minister. It produces annual action plans that are indexed to a longer-term strategy for SME development, the SME Masterplan (2012-2020), which is itself in line with the country’s broader plan for socioeconomic development, Vision 2020. To frame its SME policies, Malaysia issued a revised SME definition on 1 January 2014 and undertook a periodic census of SMEs in 2005, 2011 and 2016.

In the area of legislation, regulation and tax, Malaysia’s Dimension 6 score of 4.71 reflects the fact that the country has been conducting a programme of regulatory reform since 2007 as part of its efforts to reach high-income status through increased innovation and productivity. A Special Task Force to Facilitate Business (PEMUDAH) was set up that year as a platform to facilitate closer public-private dialogue and to illuminate and address any major policy barriers to doing business (MPC, 2016[10]). These efforts intensified with the implementation of the 10th Malaysia Plan in 2011, and responsibility for regulatory reform was assigned to the Malaysia Productivity Corporation (MPC). Today the MPC acts as a secretariat for both PEMUDAH, which is responsible for reviewing and enhancing existing regulations, and the National Development Planning Committee (NDPC), which is responsible for socialising the use of good regulatory practices throughout the public administration. Malaysia’s overall high performance on business environment indices reflects these reforms. On company registration and the payment of tax, however, Malaysia continues to score relatively low, largely due to the time required for these activities. Enhancing e-governance platforms could help to improve performance. Malaysia recently introduced platforms for the e-filing of tax and online payment of social security and pension contributions.

Framework for strategic planning, design and co-ordination of SME policy

The elaboration of SME policy in Malaysia is handled by the National SME Development Council (NSDC). The NSDC was established in 2004, with meetings scheduled to take place at least twice a year, usually in June and December. The body is chaired by the prime minister; those attending include relevant ministers involved in SME development, the chief secretary to the government, the director-general of the country’s Economic Planning Unit (EPU) and the governor of Bank Negara Malaysia (BNM). The NSDC plays a strategy, co-ordination and advocacy role in the development of SME policy. As indicated in Table 16.3, it is tasked with formulating broad policies and strategies for SME development; reviewing the roles and responsibilities of implementing ministries and agencies; playing a co-ordination role in the implementation of programmes, policies and action plans; overseeing engagement with the private sector; and advocating for the development of Bumiputera SMEs across all sectors of the economy (SME Corp., 2018[11]). Policies and programmes set by the NSDC are implemented by relevant ministries and agencies.

SME Corp. Malaysia acts as secretariat for the NSDC. It has been operational since 2009 under the Ministry of International Trade and Industry (MITI). An earlier specialised SME agency, the Small and Medium Industries Development Corporation (SMIDEC), began operating under MITI in 1996. SMIDEC was rebranded and restructured as SME Corp. upon expanding its functions to become the Central Co-ordinating Agency (CCA) for SME development, assuming the secretariat role of the NSDC which was previously held by Bank Negara Malaysia. At this time the agency established state-level branches to help implement SME policies and programmes, and today it employs more than 300 staff. SME Corp. supports the NSDC in policy elaboration, policy and programme implementation, and monitoring and evaluation. It also provides informational, advisory and business support programmes and services to SMEs through its SME Hub and state-level branches. It enhances policy coherence by including representatives of both the private sector and other government ministries and agencies on its governance board, though the latter are significantly more represented than the former.

The main strategic document is the SME Masterplan (2012-2020), which outlines the long-term strategy for SME policy in Malaysia. The Masterplan covers 32 initiatives including six High Impact Programmes (HIPS) and 26 supporting measures. It was developed with input from private-sector stakeholders and has measurable targets to be reached by 2020.

Scope of SME policy

Malaysia’s SME definition was reviewed in 2013, and a new, simplified version came into effect in January 2014. The revised version distinguishes between micro, small and medium-sized enterprises. It maintains the same criteria as the previous version (employment and annual sales turnover), but with increased thresholds to reflect changes in the economy. Only full-time employees are counted. Under the definition, a firm is classified as an SME if it meets either of the criteria (employment or turnover). Its size category is determined by the smallest category it fits under either of the criteria. The definition distinguishes among sectors: i) manufacturing; and ii) services and others. Under the new definition, all SMEs must be registered entities with the Companies Commission of Malaysia (SSM) or other equivalent bodies, such as respective authorities in Sabah and Sarawak, and respective statutory bodies or professional service providers. Companies that cannot be classified as SMEs are those listed on the main board of the country’s stock exchange and their subsidiaries, and subsidiaries of multinational corporations (MNCs), government-linked companies (GLCs) or state-owned enterprises. After elaborating the new definition, SME Corp. issued guidelines to all government agencies instructing them to use only this definition. It now appears to be used consistently among government agencies and financial institutions.

Malaysia has a residual informal economy that may be excluded from SME policies. Employment in the informal sector reached 1.4 million in 2015, an increase of 6% over the previous year, with non-agricultural employment in the informal sector standing at 11.4% in 2015, up from 11.2% in 2013 (DOSM, 2016[12]). Most non-agricultural informal employment is in the services sector, namely wholesale and retail trade and repair of motor vehicles and motorcycles (63%), followed by construction (20.6%) and manufacturing (15.9%). The government is committed to tackling the issue, and it conducts surveys on the topic. However, associated measures predominantly focus on improving the ease of business registration, mostly via the country’s High-Impact Programme 1 (HIP 1) under the SME Masterplan. Other initiatives aimed at decreasing informality include measures to improve connectivity within East Malaysia and with Peninsular Malaysia; HIP 6, on inclusive innovation; measures to ease market access for SMEs in Sabah and Sarawak; and an initiative to review the country’s tax regime in order to eliminate any elements that may reduce incentives for SME development.

Development of legislation and regulatory policies affecting SMEs

The government has been working since 2007 to inculcate good regulatory practices. In 2013, a circular entitled National Policy on the Design and Implementation of Regulations instructed all federal ministries and agencies to undertake good regulatory practices in the development of new and existing regulations. This included requirements to conduct public-private consultations (PPCs) in order to provide information on the development of business-related regulation; to undertake regulatory impact analysis; and to complete regulatory impact statements. Handbooks were issued to provide guidance to government officials on realising good regulatory practices, among them the Best Practice Regulation Handbook, which advises regulators to consider the impact of new regulations on SMEs, the number of SMEs that will be affected and whether the overall impact on SMEs will be proportional to the impact on other businesses or groups. Moving forward, policy makers could work to increase the transparency of these procedures. A list of ongoing PPCs is not currently available online. At present, policy makers pick the participants for such consultations and not all interested parties are able to participate, which may reduce their representativeness. The government is aware of this and is currently working to increase transparency, for instance by developing a single website to list PPCs. Records of PPC outcomes are kept by respective regulators, and more could be done to increase transparency here.

Company registration and ease of filing tax

Malaysia ranks relatively low globally on indices of the ease of starting a business and paying tax. In the World Bank’s 2018 Doing Business report, it ranked 111th out of 190 countries on “starting a business” and 73rd out of 190 countries on the “ease of filing tax”. This is largely due to the time needed to complete these transactions. According to Doing Business, the preparation, filing and payment of taxes takes 188 hours in Malaysia, while company registration takes 18 days for men and 19 days for women.

Still, the country has made considerable progress over the last 15 years. The Special Task Force to Facilitate Business (PEMUDAH), the entity responsible for reviewing existing business-related regulation, is also responsible for improving business licensing procedures. The Malaysian Administrative Modernisation and Management Planning Unit (MAMPU) is responsible for implementing HIP 1, on the integration of business registration and licensing. Malaysia has made progress on developing electronic platforms for registration and licensing. In 2016, the MalaysiaBiz Portal, an information portal for business licensing, went live as a quick win of HIP 1, and it is expected to be operational by the end of 2020 as a single gateway for firms to register and apply for licenses. At the time of assessment, E-lodgement, a platform for the electronic filing of company and business statutory documents, had recently gone live.9 Malaysian companies required multiple company identification numbers, which contributed to the time it took to register. E-lodgement has been subsequently discontinued as the Malaysia Corporate Identity Number (MyCoID) has been scaled up.10 The MYCOID is a single company identification number which can be used to register and transact with different government agencies. It is issued upon incorporation by the Companies Commission of Malaysia (SSM). The authorities were working on further developing MYCOID, and expect this process to be complete by 2020.

E-governance facilities

One of the government’s main paths for enhancing the ease of regulatory compliance is through the development of e-governance platforms, as described above. MAMPU is also responsible for the e-government flagship, which was launched in 1997. This programme identified seven priority e-government applications for development as part of a broader push to modernise and enhance public service delivery.11

Facilitating SME access to finance (Dimension 3)

Malaysia has a well-developed financial sector according to global indicators. It is ranked 16th for financial sector development by the World Economic Forum (WEF, 2017[13]) and 20th for ease of getting credit by the World Bank (World Bank, 2017[14]). The economy has a high level of financial intermediation. Domestic credit to the private sector, a proxy measure of this, stood at 123.9% of GDP in 2016, notably above the 80-100% mark beyond which finance may have a negative effect on economic growth (Berkes, Panizza and Arcand, 2012[15]). Financial institutions, in particular banks and development financial institutions, constitute the main source of SME financing. They provided 96% of financing facilities available to the sector in 2017 (SME Corp., 2017[16]). Financial institutions have also progressively increased their engagement with SMEs. The share of SME financing in total business financing grew from 43.8% in 2015 to 50.7% in 2017 (SME Corp., 2017[16]). Malaysia’s Dimension 3 score of 5.35 reflects these findings.

This credit growth is partially the result of a concerted effort over the past 17 years to boost financial sector development, particularly as concerns SME financing. Bank Negara Malaysia (BNM),12 the country’s central bank, played a pivotal role in driving and implementing SME development policies from 2003 to 2010, until the establishment of SME Corp.13 In building a comprehensive SME financing ecosystem, the BNM developed a number of initiatives and put in place key infrastructure such as the Credit Guarantee Corporation, a credit bureau and credit application support schemes for SMEs (Table 16.5).

Malaysia continues to allocate the bulk of its SME development budget to enhancing access to finance. In 2017, for instance, 88.3% of public funding for SME development went to SME financing programmes. At present, such programmes predominantly target the growth of innovative new sectors, financial inclusion and support for Bumiputera enterprise. This generally echoes the government’s broader economic development priorities. SME financing programmes in 2017 aimed to reach 393 162 SME beneficiaries. (SME Corp., 2017[16]).

Legal, regulatory and institutional framework

Malaysia has strong framework conditions for supplying finance. Facilities to assess and hedge against credit risk are generally available and well functional. A dual credit reporting system has been in place since 2008, and it provides high credit information coverage14 as well as value-added services such as credit scoring. The country has an SME-specialised credit bureau15, Credit Bureau Malaysia (CBM).16 Financial institutions can use contracting elements such as securitisation to mitigate credit risk. Clear rules over perfection and priority are generally in place, and both immovable and movable asset registers are functional and regularly updated. Malaysia has worked to improve the legal framework governing insolvency since the last assessment. Its bankruptcy law, enacted in 1967, has been amended; the new law took effect in October 2017. Going forward, financial institutions may still face lack of clarity in the secured transaction framework for lending to unincorporated entities, and this may particularly affect SMEs. The introduction of a Personal Property Security Act (PPSA), along the lines of those enacted in other common-law countries, could help to eliminate these uncertainties. The government has undertaken research and consultations to assess the feasibility of this reform. In addition, measures could be introduced to centralise the movable assets register and make it notice based, which would increase clarity over the ownership of collateralised assets and the order of priority in the event of insolvency.

In the area of equity financing, Malaysia has a relatively deep and liquid stock market. Stock market capitalisation amounted to 135% of nominal GDP by December 2017. In 1997, the MESDAQ Market was launched to attract listings of technology-based and high growth companies. In 2009 this was transformed into the ACE Market, an alternative market for emerging companies of all sizes and sectors to raise capital. Recognising the importance of SMEs to the economy, and in order to complement existing listing platforms with a more SME-friendly financing solution, Bursa Malaysia launched its Leading Entrepreneur Accelerator Platform, or LEAP Market, in July 2017. Given the higher risk involved, only experienced investors and high net-worth individuals or entities can invest in LEAP companies, and Malaysia’s largest institutional investor funds have suggested they may abstain from investing in the market. Also, certain policies may discourage listing. They include, for example, a requirement that an enterprise be able to demonstrate 12.5% Bumiputera ownership in order to be eligible to list publically. This amount is down from 30% in 2008. Programmes are now being developed to encourage more firms to list on the LEAP Market. For instance, on 30 March 2018, the prime minister announced a budget of MYR 50 million to encourage at least 100 Bumiputera companies to list on the LEAP Market. This would finance a cash reimbursement to reduce the cost of listing for companies that successfully list between 2019 and 2024. Again, however, this specifically targets Bumiputera-owned firms.

Sources of external finance for MSMEs

Malaysia has a good range of financial products available to SMEs, the most common being credit-based loan products provided by banks. Collateral requirements are relatively low (54.6% of the loan), though interest rates increased 160 basis points between 2013 and 2015, standing at 7.4% in 2015 (OECD, 2017[17]).17 Public programmes to encourage bank lending to SMEs mainly take the form of refinancing schemes and guarantees.18 BNM has specialised funds for SME lending targeting new entrepreneurs, the primary agriculture sector; micro enterprises and firms without collateral. Guarantees are provided through Credit Guarantee Corporation Berhad (CGC) and the Syarikat Jaminan Pembiayaan Perniagaan Berhad (SJPP). In addition to incentive schemes, Malaysia has also established a dedicated bank for SMEs, the SME Bank.

The CGC is the larger of Malaysia’s two guarantee schemes. Since its creation in 1972, it has provided SMEs with around 441 598 financing packages, valued at over MYR 63.7 billion as of December 2017. It traditionally provided individual guarantees and since 2015 has also begun providing portfolio guarantees to speed up the approval and disbursement of guaranteed loans. The CGC provides advisory services for SMEs and assists them in building up a credit history. CBM, Malaysia’s SME-oriented credit bureau, is a subsidiary of the CGC, which is itself a subsidiary of BNM, home of the country’s public credit registry. The CGC has dedicated guarantee programmes for certain types of SMEs, such as women-owned entities, via BizMula-i and BizWanita-I, and Bumiputera-owned entities, via the BizJamin Bumi scheme. Both the CGC and SJPP are evaluated by BNM every two years, though neither has private-sector representatives on its governance board.

Microfinance has traditionally been accessed through Amanah Ikhtiar Malaysia, a non-governmental organisation (NGO) that was founded in 1987 and that provides microfinancing primarily to women for income-generating activities. By June 2016, this entity had provided 3.7 million loans amounting to MYR 15.7 billion (SME Corp., 2017[16]). Today microfinance is predominantly provided by commercial and development finance institutions, partially the result of a sustained effort by BNM to promote and support the extension of microfinance products. This effort has included the implementation of a comprehensive regulatory framework for microfinance by BNM (2006); the development of a range of microfinance products by BNM for disbursal by three state-owned banks (Skim Pembiayaan Mikro, since 2006); and the extension of a credit line for banks to provide loans of up to MYR 50 000 without collateral (the BNM’s Fund for SMEs). Over the last ten years, 216 944 microenterprises have benefited from loans totalling MYR 3.5 billion that were provided by ten financial institutions under this scheme. Total financing outstanding from the scheme stood at MYR 931.9 million at the end of December 2017 (SME Corp., 2017[16]). Two public microfinance financial institutions have also been established: the Economic Fund for National Entrepreneurs (TEKUN), under the Ministry of Agriculture and Agro-based Industry, and Yayasan Usaha Maju, under the Ministry of Finance.

Asset-based loan products are also available in Malaysia, but they appear to be used at a lower scale than venture and growth capital products. In 2017, the volume of leasing and factoring finance, two of the most common types of asset-based financing, was MYR 1.28 billion, compared to MYR 2.45 billion for venture and growth capital.

High-growth firms can access private equity and venture capital (PE/VC) financing. As of 31 December 2016, 103 venture capital and six private equity firms were registered and operating in the country, and over that year they had invested in 376 companies, with new investments totalling MYR 570 million, bringing total cumulative PE/VC investments in the country to MYR 2.9 billion in 2016.19 The majority of venture capital investment in 2016 went to the life sciences sector – mainly to early-stage firms, which received 61% of total investment. The government is a key driver of the PE/VC industry in Malaysia, with 47.7% of venture capital funds coming from sovereign wealth funds and government investment companies (BNM, 2017[18]).20 The government has also partnered with private investors to boost early stage financing. HIP 3, the SME Investment Programme, commits to co-fund early-stage debt, equity or hybrid investments in high-potential SMEs. In 2017, a total of MYR 20 million was allocated under the programme (SME Corp., 2017[16]).

Enhancing access to market and internationalisation (Dimension 4)

Malaysia has a strong and long-standing commitment to foster the internationalisation of its SMEs. It recognises the need to create opportunities for SMEs by exposing them to larger potential buyers and suppliers. Its continuous drive to help SMEs to go global is reflected in its high score of 5.4 for Dimension 4.

Export promotion

In Malaysia’s SME Masterplan 2012–2020, expediting SMEs’ exposure to the global market is one of the six High Impact Programmes. Although various ministries and government agencies collaborate to support SME export, it is the Malaysia External Trade Development Corporation (MATRADE) that acts as the country’s main export promotion agency, particularly for manufactured and semi-manufactured products. MATRADE offers a wide range of assistance and programmes in collaboration with other government agencies. The agency undertakes market intelligence activities and makes its comprehensive database on international markets and existing Free Trade Agreements (FTAs) available on its website. SMEs may apply to the agency’s Market Development Grant (MDG) programme for a reimbursable grant of up to MYR 200 000 for their participation in international trade fairs, trade missions or international conferences. To help Malaysian SMEs transition from domestic selling to exporting, MATRADE also conducts numerous training programmes, most of which are free of charge. Interested applicants may register online.

To address co-ordination issues among implementing agencies, MATRADE established an Integrated Centre for Export in 2015 that brings together MITI, the Ministry of Agriculture and Agro-based Industry, the Ministry of Health, SME Corp., the Royal Malaysian Customs Department, Export-Import (EXIM) Bank, and SME Bank. MATRADE issues an annual report on its performance as part of the monitoring and evaluation of its programmes.

Integration in GVCs

Various government initiatives support the integration of Malaysian SMEs into global value chains (GVCs). The Industrial Master Plan 3 (IMP) (2006–2020) includes a strategy for enhancing collaboration between Malaysian firms, including SMEs, and GLCs, MNCs based in Malaysia and Malaysian firms with overseas-based MNCs.

SME Corp. implements the Industrial Linkage Programme and the Vendor Development Programme to help local SMEs create linkages with and receive assistance from large companies and MNCs in major industries. The co-ordinating agency also runs the Business Linkage Programme, which creates opportunities through business matching sessions during annual flagship events and other platforms. As of 31 December 2016, the programme had generated a total of MYR 714.7 million in potential sales through 481 sessions involving 443 SMEs.21 Other programmes include industry-specific initiatives, like the Global Value Chain-SME for the Automotive Sector Project proposed by the Philippines and Malaysia at the APEC Automotive Dialogue session in Manila in 2015, and business matching sessions conducted by the Muda Agriculture Development Authority.

Use of E-commerce

Recognising the importance of a strong e-commerce basis for SME development in the future, Malaysia has set up a legal framework and policy interventions for e-commerce to grow. The Electronic Commerce Act 2006 serves as the legal framework for e-commerce; the Payment Systems Act 2003 provides regulations on e-payment; and the Consumer Protection (Electronic Trade Transactions) Regulations 2012 cover consumer protection issues. Malaysia established a National E-commerce Council comprising 25 agencies and ministries to design and implement a National E-commerce Strategic Roadmap, which was launched by the prime minister in 2016. Via the roadmap, Malaysia aims to double its e-commerce growth rate and reach a GDP contribution of MYR 211 billion by 2020.

In 2017, the government launched a Digital Free Trade Zone (DFTZ) through the Malaysia Digital Economy Corporation (MDEC) and Alibaba Group.22 The DFTZ is expected to ease SMEs’ transition as exporters and to position Malaysia as a regional hub for e-commerce logistics and the preferred gateway for global marketplaces in ASEAN. It provides an e-fulfilment hub to help SMEs export their goods and an e-services platform that offers SMEs market access to global customers and suppliers. A sum of MYR 83.5 million was allocated in 2018 for the construction of the first phase of development of a regional e-commerce and logistics hub in Aeropolis, attached to the Kuala Lumpur International Airport, as a part of the DFTZ initiative (MOF, 2017[19]). An additional MYR 100 million was earmarked to expand various programmes under the MDEC, such as eLadang, which aims to encourage farmers to tap into the latest smart farming technologies and big data analytics, and eUsahawan, which works to enhance new businesses’ growth via online sales.

Quality standards

Malaysian initiatives to support SME compliance with quality standards are executed by various ministries and agencies. The National Standards Compliance Programme (NCSP), managed by the Department of Standards Malaysia, aims to bridge all initiatives and information on standards compliance. The NSCP’s one-stop centre for SMEs is located at SME Corp.’s One-Referral Centre. Initiatives to help SMEs comply with standards include the Lean Production System (LPS) programme, run by MITI through the Malaysia Automotive Institute (MAI). It aims to help SME factories and workshops in the automotive sector to transition from traditional to LPS management in order to become world-class vendors. Another initiative is Program Pembangunan Produk, run by the Ministry of Domestic Trade, Co-operatives and Consumerism, which helps SMEs to improve the packaging and shelf life of their products in order to meet the standards of hypermarkets and supermarkets.

SIRIM Berhad, a leading certification body, runs initiatives in co-ordination with the Ministry of Science, Technology and Innovation (MOSTI), for example the GroomBig programme to help SMEs become competitive, resilient and sustainable, and a vendor development programme to help SMEs in the automotive sector to become export-ready companies. Quality certification services in Malaysia are mainly provided under the Accreditation Body Certification scheme, which is under the purview of the Department of Standards Malaysia. Quality certification services are administered by non-governmental or non-profit accreditation bodies in some sectors, for example health care, which is certified by the Malaysian Society for Quality in Health, and the auditing of financial services, which is conducted by the Institute of Internal Auditors Malaysia.

Trade facilitation

Malaysia garnered a moderately high score in the OECD Trade Facilitation Indicators (TFI) of the 2018 ASPI.23 This can be attributed in part to its initiatives and infrastructure for cross-border trading. In 2012, it launched a trade facilitation portal called myTRADELINK (http://www.mytradelink.gov.my/) to connect trading communities with the relevant government agencies and businesses involved in global trade and logistics and to serve as the country’s national single window (NSW). It features a trade-related data repository that includes a directory of industry players and agencies, trade regulations, and permit-issuing agencies. Small and medium enterprises and other traders can use myTRADELINK to prepare, submit, apply for and get approval on all required trade documents online, eliminating the need for manual transactions. SMEs are given a special discount rate when using ePermit and e-Preferential Certificate of Origin services provided by myTRADELINK through the Dagang Net Technologies Sdn Bhd website (http://www.dagangnet.com). Related training for new users is also available. In line with the myTRADELINK initiative, the Royal Malaysian Customs Department launched a new customs online system in 2016 for declaration, payment and clearance. The system, called Ubiquitous Customs (uCustoms), is an upgraded NSW (Tamrin, 2017[20]) that will replace myTRADELINK once it is fully operational.

Other initiatives for facilitating SME cross-border trade have also emerged. In December 2107, MATRADE and China launched the China-ASEAN SME Trade Promotion Platform to facilitate Malaysian SME exports to China. Meanwhile, the new Digital Free Trade Zone frees Malaysian consumers from paying any duties on purchases of less than MYR 1 200 made via e-commerce companies in the zone; manufactured or semi-finished goods imported through the DFTZ will also be duty free. This provides SMEs with an indirect opportunity to grow by cutting the costs incurred from purchasing from abroad, but it also potentially creates tougher competition with larger firms that enjoy similar benefits, particularly in manufacturing sectors. Likewise, the Authorised Economic Operator (AEO) programme run by Malaysian customs has no specific allowances for SMEs, although volume traded is not a criterion for AEO qualification.

Boosting productivity, innovation and adoption of new technologies (Dimension 1 and 2)

Malaysia has long recognised the importance of investing in innovation, as evidenced by overall gross expenditure (1.1% of GDP) and business spending (0.7% of GDP) on research and development (R&D), which is high for its income level. The country is seen as a strong performer in the region. However, its labour productivity growth in the past 15 years has been below that of regional competitors. It has also been held back by a declining share of skilled workers in the labour force and insufficient technology diffusion and innovation (OECD, 2016). Malaysian policy makers have put in place a number of policies specifically focused on the promotion of innovation and productivity, with a particular emphasis on SMEs. Its score of 5.06 ranks it as an advanced country in Dimension 1; its policies on productivity and productive agglomerations and clusters appearing to be particularly advanced. In the area of SME greening, Malaysia’s Dimension 2 score of 5.08 reflects the fact that it is among the pioneer countries in this area.

Productivity measures

The Malaysia Productivity Blueprint (MPB) specifies productivity enhancement strategies at the national, sector and enterprise levels. Drafted in line with the 11th Malaysia Plan 2016-2020, the MPB defines five key strategic thrusts for raising productivity: i) building the workforce of the future; ii) driving digitalisation and innovation; iii) making industry accountable for productivity; iv) forging a robust ecosystem; and v) securing a strong implementation mechanism. The strategy emphasises the role of SMEs in driving digitalisation and innovation to boost productivity. Likewise, the 11th Malaysia Plan specifies dynamic SMEs as a focus area for re-engineering economic growth. The National Productivity Council takes the leadership role and carries out strategic oversight of productivity enhancement programmes and policies at the national level for both large enterprises and SMEs. Advisory and policy support is carried out by the Economic Planning Unit under the Prime Minister’s Department.

Execution of the MPB is funded through at least 89 programmes, with an allocation of MYR 9.5 billion for the 2017-2020 period. These programmes may be drawn on by firms in a new nexus of six productivity sectors launched in November 2017. It aims to boost productivity in the agro-food, ICT, machinery and equipment, private health care, professional services and tourism sectors. Monitoring is emphasised, especially at the initial stages as each sector builds capability and returns on investments. The Delivery Management Office (Malaysia Productivity Corporation and MITI) is responsible for co-ordinating, monitoring and evaluating the implementation of productivity strategies by both public- and private-sector players. Public-private dialogues on productivity are conducted on a regular basis. Key performance indicators (KPIs) on SME productivity, such as labour productivity, are regularly monitored, and total factor productivity is collected regularly at the national level.

Business development services

Both the SME Masterplan 2012-2020 and the 11th Malaysia Plan provide a strategic framework for business development services (BSD). SME Corp. formulates and co-ordinates the implementation of SME development programmes, but other agencies are also involved in the development and implementation of BDS, including the Malaysian Global Innovation and Creativity Centre (MaGIC) and the Malaysia Digital Economy Corporation (MDEC).

These institutions have put programmes in place to help SMEs gather information and obtain necessary skills and training. For example, through SME Corp.’s SME Hub, formerly known as One Referral Centre, SMEs can access relevant information online and offline, such as information on how and where to get support depending on their size, level of development and sector-specific needs. The SME Corp. portal provides opportunities for SMEs to communicate with their peers, meet the private-sector providers and find out about upcoming events. Co-financing mechanisms for BDS – services for logistics, travel, marketing, etc. – are available through SME Corp., the PUNB financial institution, the Facilitation Fund and the Malaysian Technology Development Corporation, with 60% typically provided by the agency in question and 40% by entrepreneurs. There is a plan to introduce a Business Development Voucher Programme that would provide matching grants to assist entrepreneurs in modernising their facilities, exploring new markets and improving their business processes. Two initiatives worth mentioning include the Global Acceleration and Innovation Network (GAIN) and the Digital Hub. The GAIN programme supported 150 tech SMEs with market access, funding capital, business and technical competencies, and leadership. The Digital Hub provides start-ups with high-speed broadband and fibre optic connectivity, funding (both private and government) and facilitation opportunities, and intellectual property (IP) protection.

Regular monitoring is in place through a monthly reporting mechanism. The government also uses annual and quarterly industry reporting.

Productive agglomerations and cluster enhancement

The 11th Malaysia Plan calls for industrial cluster promotion programmes, particularly for intensifying research, development and commercialisation efforts. Priority sectors include knowledge-based clusters; the automotive, aeronautics and petrochemical industries; tourism; palm-oil downstream processing; and energy-intensive industries including aluminium, steel and glass. A cluster-based approach that vertically integrates production, quality control, processing and marketing is being promoted to encourage participation of co-operatives and associations in agro-food and industrial commodities along the supply chain. Malaysia also has several science parks, including cybercity/cybercentres, digital hubs and start-up community centres.

Malaysia offers a wide range of tax incentives to promote investments by foreign and local investors in selected industry sectors or promoted areas, such as operational headquarters, international procurement centres, regional distribution centres and treasury management centres. A ten-year income tax exemption is granted to developers or managers in industrial parks or free zones. While tax incentives are available for a wide range of companies, participation in product R&D by local enterprises is generally low, even in Penang, the country’s most developed technology cluster region. Initiatives that help SMEs move to cluster zones include rental of incubators, a technology and business incubation programme, and business matching with technology entrepreneurs. The Penang SME Centre and the Penang Science Council are examples of effective public-private co-operation. Public-private partnerships and other collaborative efforts have led to a number of spin-offs and the creation of new enterprises by former employees of multinational enterprises. Malaysia Digital Economy Corporation and SME Corp. regularly monitor their own cluster development programmes. Under HIP, a quarterly performance report is submitted to the NSDC. However, independent evaluation of the cluster programmes is still limited, and cluster KPIs are not SME specific.

Malaysia has the highest score among AMS in the 2014 FIL rate of the Economic Research Institution for ASEAN and East Asia (ERIA), at 94%, up from 83% in 2011. However, while more open in the manufacturing sector, Malaysia is more restrictive on land and natural resources.

Technological innovation

Malaysia has used a range of policy instruments to advance its science, technology and innovation (STI) capabilities and has invested much in education and research. However, the country lacks a stand-alone innovation policy, and there is a continued need to strengthen the innovation capabilities of Malaysian businesses – especially the smaller firms, which are less inclined to undertake R&D or innovation. Malaysia’s approach to innovation is embedded in strategic documents including the SME Masterplan 2012-2020 and the 11th Malaysia Plan. Ministries, agencies and advisory committees and councils are engaged in STI-related policy making, funding and implementation, each with its own strategic framework and policy instruments. Policy co-ordination on innovation is handled by an inter-governmental body, the National Innovation Council, while the National Innovation Agency Malaysia is a statutory body responsible for stimulating and developing the country’s innovation ecosystem. Although efforts have been made to create a simplified architecture for STI governance, the multitude of institutional actors with overlapping responsibilities has made policy implementation a difficult task.

Malaysia’s IP legal system is in line with international standards, and the country is a signatory of many international IP treaties. The agency dealing with voluntary copyright notification is the Intellectual Property Corporation of Malaysia.

Considerable effort has been devoted to attracting and supporting business R&D activities, particularly in the high and medium technology sectors. Measures to promote industrial R&D and innovation include fiscal incentives, support for consortia and clusters, public-private partnerships and the promotion of science-industry linkages and knowledge transfer. Recent initiatives to provide SMEs with external technological and managerial expertise recognise that collaboration with experienced academics or industrial experts is beneficial to SMEs, especially those with low innovation capabilities. Examples include Steinbeis Foundation Malaysia, a SIRIM-Fraunhofer partnership and the Ministry of Higher Education’s Public-Private Research Network. SME Corp. oversees 29 programmes on innovation promotion and an innovation/technology commercialisation platform. This includes its InnoCERT certification programme aimed at fostering innovative enterprise by harnessing and intensifying home-grown innovations and R&D. The programme facilitates access to financial incentives and wider market opportunities and assists certified companies with business matching with international companies, MNCs and GLCs. The government offers financing schemes through HIP 6 for inclusive innovation, focused on three areas: i) innovators/entrepreneurs (up to MYR 200 000); ii) licensing (up to MYR 50 000); and iii) community enablement (up to MYR 50 000).

Public research institutes play an important role in Malaysia’s innovation system through their applied research, technology transfer and information services. However, they have seen their R&D funding fluctuate widely, and their research and technology transfer capacity remains underdeveloped. The country offers a wide array of infrastructure for SMEs including science and technology parks, incubators and innovation centres. An example is Technology Park Malaysia, with more than 3 000 technology-driven companies using its space, equipment and infrastructure, and support services.

Monitoring is implemented on a yearly basis as part of the Annual SME Integrated Plan of Action report. The NSDC monitors national performance indicators that measure the performance of SME innovation policies. However, evaluation of the effectiveness of incentives and grant instruments focused on innovation is limited.

Environmental policies targeting SMEs

Malaysia is among the most advanced countries in ASEAN in terms of environmental policies targeting SMEs. Its policies are included in two national-level strategies: the 11th Malaysia Plan and the Malaysia Green Technology Plan (KeTTHA 2017), which helps operationalise the National Green Technology Policy (KeTTHA 2009). While targeted at the economy as a whole, these strategies contain provisions specifically aimed at SMEs and set out actions and targets. The 11th Malaysia Plan’s sixth strategic area, Pursuing Green Growth for Sustainability and Resilience, aims to develop a market for green products through public-sector green procurement, with a target of 20% of government procurement meeting green standards by 2020. The KeTTHA 2017 supports SMEs involved in green manufacturing, and sets targets for 2020, 2025 and 2030.

These policy goals are supported by different initiatives, notably the MyHIJAU SME & Entrepreneur Development Programme, which helps SMEs adopt green practices. The programme facilitates capacity building for SMEs to help them obtain green label certification. It provides an integrated approach to working with other bodies, such as green certification organisations and private-sector organisations like the SSM, and encourages the greening of corporate supply chains. The aim is to encourage greener practices by partnering a green procurement strategy with policies that support SME greening.

Incentives and instruments for green SMEs

Malaysia’s financial incentives and support schemes for green SMEs include tax incentives on investments in green technology, funds for SMEs and entrepreneurs (the Small and Medium Industries 2 Fund and the New Entrepreneurs Fund), and the Green Technology Financing Scheme, a credit guarantee scheme to facilitate the uptake of energy-efficient technology by SMEs.

Malaysia also offers enterprises support for developing environmental management systems through the ISO 14001 and ISO 50001 standards, but these are complex systems that are aimed at larger enterprises and may be difficult for SMEs to achieve. In terms of regulatory incentives, more could be done to structure the regulatory system to address SMEs specifically in order to encourage them to reach or exceed compliant levels.

Stimulating entrepreneurship and human capital development (Dimensions 7 and 8)

Malaysia has one of the most advanced policy frameworks in the region for the development of skills to boost entrepreneurial success and the promotion of entrepreneurship that is social and inclusive. Its Dimension 7 score, on policies to promote entrepreneurial education and skills is 4.58, compared to a regional median of 4.27. In Dimension 8 on policies to promote social and inclusive entrepreneurship it scores 4.00, compared to a regional median of 2.77. This indicates that policies have been put in place and that initiatives are currently being implemented. Its policies in these two areas are tailored to different demographic groups.

Entrepreneurial education

Under Malaysia’s Education Blueprint 2013-2025, entrepreneurship values are integrated into leadership skills, one of six key attributes taught to students at all education levels. Entrepreneurship elements are included in the revised standard curriculum for the primary and secondary levels, along with creativity and innovation elements. Through its Junior Vocational Education programme, Malaysia has expanded vocational education to begin at the lower-secondary level, and it has also and strengthened its existing Vocational College programme at the upper secondary level. However, the national education blueprint does not clearly define how entrepreneurship is to be taught in formal education.

Nevertheless, Malaysia has put strong emphasis on fostering entrepreneurship in higher education and connecting it with existing businesses, especially SMEs. In 2008, SME Corp. and the Ministry of Higher Education initiated an SME-University Internship Programme to be adopted at all public universities. Malaysia also implements the ASEAN Consulting-based Learning for ASEAN SMEs programme at Universiti Kebangsaan Malaysia. Universities offer various degrees in entrepreneurship, for example bachelor and master degrees at the University of Malaysia Kelantan. Malaysia stands out as the only ASEAN country with a mechanism for monitoring entrepreneurial learning in universities. The monitoring is conducted through the Malaysian Qualification Agency.

Entrepreneurial skills

Malaysia has no specific mechanisms for conducting background studies on entrepreneurship skills among SMEs as a basis for policy design, other than SME Corp.’s annual report on the SME and Entrepreneurship Development Programme. Nonetheless, initiatives to promote entrepreneurial skills among SMEs are being executed by various ministries and government agencies. Examples include the INSKEN Business Scale Up Programme, run by the Prime Minister’s Department, which aims to provide comprehensive training in entrepreneurial skills to scale up 500 companies, and the Young Entrepreneur Programme, offered by SME Bank Group, which provides young would-be entrepreneurs with basic skills for starting and growing a business. SME Corp.’s Bumiputera Youth Entrepreneurship programme (TUBE) is also a key national initiative for fostering entrepreneurial spirit among youth.

MaGIC is another notable initiative to nurture entrepreneurial skills among SMEs and new entrepreneurs. It aims to build a sustainable entrepreneurship ecosystem through training and incubator programmes designed for early-stage start-ups, small businesses and aspiring entrepreneurs. MaGIC programmes include the Pre-Accelerator Bootcamp for aspiring entrepreneurs and start-ups; the Corporate Entrepreneurship Responsibility programme to introduce quality business practices to entrepreneurs; and the Educ8 programme, which delivers innovation-based courses for entrepreneurs nationwide.

In promoting entrepreneurship, Malaysia pays special attention to vulnerable populations The National Dual Training System, implemented by the Department of Skills Development under the Ministry of Human Resources, was mandated in 2016 to register 4 000 apprentices in its training sessions for school leavers and the unemployed. The I-KIT programme, implemented by the Department for Women’s Development under the Ministry of Women, Family and Community Development, aims to provide intensive skills training and entrepreneurship assistance to low-income single mothers. In 2016, MYR 750 000 was allocated for I-KIT. Further details on SME-related programmes for women, youth and persons with disabilities (PWD) are provided below under Dimension 8 on social enterprises and inclusive SMEs.

Social entrepreneurship

Social entrepreneurship has recently become a significant agenda item for enhancing socio-economic well-being in Malaysia. The country was recognised by the Thomson Reuters Foundation pool as one of the top ten countries for social entrepreneurs in 2016 (JOSTIP, 2017). An estimated 120 Malaysian enterprises currently self-identify as social enterprises and are registered with the SSM. This does not include organisations registered with the Registrar of Societies or Registrar of Co-operatives. Malaysia has no formal definition of a social enterprise (SE), but there is a definition in the SE 101 Guidebook developed by MaGIC. As in other countries in the region, there is no specific legal structure for social enterprises, which can be incorporated as private limited companies, enterprises or associations.

Social entrepreneurship and social innovation were included in the 11th Malaysia Plan’s list of game-changer approaches for the country. A dedicated Social Entrepreneurship Unit was set up at MaGIC in 2013 to promote development of the social enterprise sector. The unit, which developed a Social Enterprise Blueprint, has since been dissolved. MaGIC is considered the main institution for policy co-ordination and implementation. Other institutions also undertake activities relevant to social entrepreneurship, among them the National Innovation Agency (AIM) and the Institute for Youth Research.

Private initiatives and academia play a part in Malaysia’s ecosystem for promoting social entrepreneurship. A fund of MYR 20 million was allocated for MaGIC to finance social enterprises, with a target of increasing their number to 1 000 by 2018. The government has developed a number of instruments in partnership with academia and private sector, including workshops, a social enterprise boot-camp and the Amplify Award, which grants growth funds. Through the Global Accelerator Programme and in partnership with the private sector (ImpactHub, MyHarapan, Scope Group), new social entrepreneurs can get access to skills development, market-access support and financial grants. AIM and MaGIC created an impact assessment toolkit, IDEA Mark, which offers preferential treatment in public procurement to companies that have been certified as impact-driven ventures. Several universities conduct research on social entrepreneurship issues, among them Universiti Putra Malaysia and the National University of Malaysia. At least two organisations provide seed funds to social enterprises: Scope Group (under the UnLtd Malaysia programme) and Social Enterprise Ventures (under MyHarapan, as investments). The Social Outcome Fund was launched in 2017 with MYR 3 million to finance social intervention projects by social purpose organisations.

Inclusive entrepreneurship

Inclusive entrepreneurship is at an intermediate stage of policy development in Malaysia. It is one of the few countries in ASEAN to offer a package of services for each of the target groups (women, youth and PWD), from business skills training to market access and special financing schemes. Barriers common to the target groups are being addressed to a degree. SME Corp. handles most implementation activities – a good-practice example of mainstreaming the concerns of disadvantaged groups into the general SME sphere. The ability to employ a multiple-stakeholder, co-ordinated approach stems from clear strategic documents and focal points for women, youth and PWD.

Support activities differ for each of the target groups. Policies for women tend to focus on subsistence entrepreneurship, those for youth on start-up and growth activities, and those for PWD on refining and expanding existing services. As women are reported to face few barriers to accessing the general SME support services offered by SME Corp., other support for women’s entrepreneurship has taken a welfare approach. It focuses on business start-up activities aimed at providing a sustainable source of income to disadvantaged women, especially low-income women and single mothers. Examples are the I-KIT and I-KeuNITA programmes, led by the Ministry of Women’s Development in co-ordination with relevant social ministries. Malaysia has placed great emphasis on cultivating youth entrepreneurs. This is evidenced by their mention in multiple strategic documents, as well as media promotion, and is underlined by the country’s strong performance in Dimension 7 on entrepreneurial education and skills. Start-up and growth support for youth entrepreneurs includes incubators like TUBE and export-market access under MATRADE. As for PWD, there is a strong desire to expand employment opportunities via entrepreneurship and economic empowerment programmes. Efforts have focused on taking existing financial assistance to PWD beyond start-up support, primarily by lending to businesses ready to scale up and by providing more disability-sensitive business assistance schemes.

The way forward

Strengthening the institutional, regulatory and operational environment

Malaysia has taken steps to strengthen the institutional, regulatory and operational environment for SMEs and SME policy in recent years, and it has now achieved a near- perfect score for its SME policy framework. Nevertheless, further steps could be taken to improve the legal and regulatory environment for SMEs. To build on previous work, Malaysia could:

Legislation, regulation and tax

-

Increase the transparency of public-private consultations. Transparency is important to ensure that PPCs are representative and accountable, particularly for the amendment of key regulations. For key legislative and regulatory amendments, two rounds of consultation could be considered, similar to the procedures in Singapore. Under this process, the topic is discussed with the public prior to the development of a public consultation document that outlines the context for the proposed amendment, potential issues and focus areas for comment, as well as the options being considered. This document is then discussed with key stakeholders.

-

Further streamline the requirements for starting a business. Malaysia has created relatively streamlined requirements for launching a business, but some bottlenecks remain. Registering for goods and services tax, for instance, currently takes 14 days. Easing these bottlenecks through further streamlining would be helpful.

Facilitating SME access to finance

Malaysia’s SME policy commits a substantial share of funding to the development of SME financing, and the country possesses a well-developed financial sector. To further build on previous efforts, Malaysia could:

-

Implement reforms to enhance the secured transaction framework. Financial institutions may continue to face uncertainties in the secured transaction framework for lending to unincorporated entities. The introduction of a PPSA regime could help to eliminate these uncertainties.

Enhancing access to market and internationalisation

Malaysia has advanced with initiatives to promote more seamless cross-border trading and help local SMEs to go global. This can be built upon through the following actions:

-

Better define trade facilitation support for SMEs. There should be clear programmes specifically aimed at facilitating cross-border trading for SMEs to put them in a better position to compete with larger companies. Small and medium enterprises typically have less capability and resources to absorb information about and deal with foreign trading procedures. Merely disseminating information and guidelines for traders is not sufficient for expanding SMEs’ capacities to go global. However, clearer definition of trade facilitation support should not be confused with protective measures towards SMEs, which could be counterproductive for growth.

-

Streamline trade facilitation to avoid inefficiencies. The process of streamlining the various channels and initiatives on trade facilitation needs to be completed soon to avoid inefficiencies and economic costs arising from potential overlapping functions and unclear benefit mechanisms. Expediting the completion of DFTZ development has great potential to help the streamlining process. The integration into DFTZ of SME-specific packages on e-customs and e-commerce initiatives and the AEO programme can lever up its role of supporting SMEs in trading across borders.

-

Strengthen the monitoring and evaluation of GVC integration programmes. Malaysia has a strong commitment to promote SME linkages with larger companies and MNCs. Enforcement of a stronger and more transparent monitoring and evaluation system for such programmes would allow the public to appreciate the notable growth in the number of SMEs involved in global production networks and to understand the government’s contribution to the process. It could potentially drive both large companies/MNCs and SMEs to participate in government GVC integration programmes and, in turn, strengthen these programmes’ spillover effects.

-

Integrate service quality certification into SME quality standards policies. As service sectors continue to grow globally, it is important to embed service quality certification elements in policies in order to ensure that SMEs remain competitive domestically and internationally.

Boosting productivity, innovation and adoption of new technologies

Productivity, technology and innovation

-

Provide clear mandates for the agencies dealing with innovation. A number of institutions deal with policy making, co-ordination and implementation of research, innovation promotion and SME support structures. Institutional governance deficiencies undermine the coherence of innovation policy and make it difficult for SMEs to understand which organisation they should consult in the first instance. Streamlining governance by providing a clear mandate for each agency dealing with innovation would be helpful.

-

Develop the infrastructure available for SMEs at the local level. Malaysia’s business support services tend to be concentrated in urban areas. To spread the benefits of such services throughout the country, measures could be taken to increase the number of local business support centres operating in rural areas. The aim would be to provide better access to information, expertise, equipment and even space, as well as support with company registration. These activities should be aligned and in co-operation with both established and new organisations and initiatives (SME Corp, AIM, Steinbeis Foundation Malaysia, PPRN, SIRIM-Fraunhofer).

-

Further develop evaluation of initiatives to promote productivity. Malaysia could reinforce its mechanisms for evaluating instruments and programmes that promote productivity by developing indicators that not only focus on outputs but also evaluate the impact of its policy measures (outcome). Ideally the evaluation mechanism would analyse the entire ecosystem to ensure that it does not have gaps. Independent evaluation of the existing policy instruments could help policy makers adjust the programmes to create higher impact at lower cost.

Environmental policies and SMEs

-

Provide a clear mandate for the greening of SMEs to a single agency. Although Malaysia has embarked on an ambitious approach for greening its SMEs, policies are derived from different plans and responsibility is spread over different agencies. It could be beneficial to consolidate the various green policies under a broader policy for SME support, or to assign responsibility for coordinating these policies to a single government entity. The creation of a dedicated agency or department with a clear mandate could make this task easier.

-

Develop a monitoring and evaluation system. Steps could be taken to strengthen the monitoring and evaluation of policy implementation in the area of SME greening. This could be done by integrating dedicated KPIs into the policy documents, by providing a clear timeline, and by ensuring regular monitoring of the KPIs.

-

Develop an environmental regulatory system to spur SME performance. SMEs could be encouraged to improve their environmental performance through the creation of a rule-based system that targets higher risk activities and supports self-reporting.

-

Regularly monitor the results of government green procurement. This would help both to ensure the effectiveness of green procurement initiatives and to identify areas where there are not yet options for procuring green products.

Stimulating entrepreneurship and human capital development

Malaysia has developed substantial initiatives to promote entrepreneurial skills. Those initiatives are channelled through various agencies’ programmes and activities and can be enhanced through the following actions:

Entrepreneurial education and skills

-

Set up a one-stop information centre. The centre should have a repository of all available programmes and assistance related to the promotion of entrepreneurial skills and should be able to direct interested participants to the appropriate implementing agencies. At present, several programmes offer similar benefits and have similar target groups. Information on the available initiatives from varied agencies should be collated and categorised by key characteristics and target groups. This would help SMEs or aspiring entrepreneurs better understand the available programmes and determine which are most appropriate for their immediate needs and interests.

-

Strengthen programmes and assistance for the unemployed and school leavers. For the sake of inclusion, these vulnerable groups should also be entitled to programmes that can help develop their entrepreneurial mindset and skills so that they can positively contribute to the economy.

-

Develop more concrete measures to deliver entrepreneurial learning in schools. The current national education blueprint calls for every student to possess an entrepreneurial mindset, but the document has no clear guidelines on how to deliver lessons on entrepreneurship. Without such guidelines, it is up to schools decide on the depth and extent of their lessons on the topic. This makes it difficult to measure the effectiveness of entrepreneurial learning.

Social and inclusive entrepreneurship

-

Develop a clear definition or set of criteria for social enterprise. The lack of a legal definition of a social enterprise has been a persistent source of confusion. Although social enterprises are often falsely perceived as charities, they are in fact profit-making businesses, but with a strong social and environmental purpose.

-

Clearly define the SE governance structure. Malaysia’s previous governance structure to promote social entrepreneurship has ceased to exist and no clear alternatives have been proposed. Any new policy documents should define clear responsibilities for social entrepreneurship policy development and policy implementation and should identify national priority areas.

-

Further promote collaboration with the private sector and academia. Many relevant initiatives have been undertaken by private players and academia. In order to ensure better co-ordination and ways of collaboration, it might be beneficial to create a co-ordination council for social impact that would meet on a regular basis.

-

Further promote development of the impact finance sphere. A side effect of Malaysia’s speedy development and its transition to becoming a high-income nation is that funding of local NGOs from international donors has all but dried up. Through the development of a social impact finance ecosystem, social impact ventures could gain easier access to growth finance.

References

[1] ASEC (2016), AMS: Selected Basic Indicators, https://data.aseanstats.org/.

[15] Berkes, E., U. Panizza and J. Arcand (2012), “Too much finance?”, IMF Working Paper 12/161, https://doi.org/10.5089/9781475504668.001.

[18] BNM (2017), Security Commission (SC) Annual Report 2017: Venture Capital, https://www.sc.com.my/wp-content/uploads/eng/html/resources/annual/ar2017_eng/5_SCAR_2017_Part_5.pdf.

[4] DOSM (2017), Selected Agricultural Indicators: Malaysia 2017, https://www.dosm.gov.my.

[12] DOSM (2016), Informal Sector Work Force Survey Report: Malaysia, 2015, https://www.dosm.gov.my/v1/index.php?r=column/pdfPrev&id=UUFsUEJnNGFhcDE1TndNUlg4OEZCQT09.

[3] ILO (2016), Key Indicators of the Labour Market, http://www.ilo.org/ilostat.

[8] IMF (2017), World Economic Outlook Database, October 2017, https://www.imf.org/external/pubs/ft/weo/2017/02/weodata/weoselgr.aspx.

[5] MIT (2016), Observatory of Economic Complexity, https://atlas.media.mit.edu/en/.

[19] MOF (2017), Touchpoints: 2018 Budget, Ministry of Finance of Malaysia, https://www.pmo.gov.my/bajet2018/TouchpointsBudget2018.pdf.

[10] MPC (2016), PEMUDAH: Annual Report 2016, http://www.mpc.gov.my/pemudah-app/wp-content/uploads/sites/23/2017/07/PEMUDAH_ANNUAL-REPORT-2016.compressed-1.pdf.

[17] OECD (2017), Financing SMEs and Entrepreneurs 2017: An OECD Scoreboard, OECD Publishing, Paris, https://doi.org/10.1787/fin_sme_ent-2017-en.

[9] OECD (2016), OECD Economic Surveys: Malaysia 2016: Economic Assessment, OECD Publishing, Paris, https://doi.org/10.1787/eco_surveys-mys-2016-en.

[11] SME Corp. (2018), “National SME Development Council (NSDC): The highest policy-making body for the development of SMEs In Malaysia”, SMEinfo, https://smeinfo.com.my/nsdc (accessed on 2 February 2018).

[16] SME Corp. (2017), “SME and entrepreneurship development programmes in 2017”, in SME Annual Report 2016/2017, http://smecorp.gov.my/images/SMEAR/Chapter5.pdf.

[20] Tamrin, S. (2017), “Customs to use new information system from January 1”, The Sun Daily, http://www.thesundaily.my/news/1580144.

[6] UNESCO (2016), Education 1 Dataset, http://data.uis.unesco.org/.