Chapter 11. Social enterprises and inclusive SMEs

Introduction

The ASEAN Economic Community (AEC) has increasingly pursued an inclusiveness agenda as it steps up integration efforts, attempting to reduce subnational and regional income disparities and thereby to spread the gains of enhanced economic integration. In particular, it advocates for policies to stimulate entrepreneurship among commonly marginalised groups. This commitment is demonstrated under the equitable pillar of the AEC Blueprint, which highlights the value of targeting poverty alleviation and protecting vulnerable segments of the population through business creation and self-employment (ASEAN, 2012[1]).

Inclusive entrepreneurship policies aim to address any market failures that prevent an individual from setting up and operating a business based on an aspect of their identity. The aspects covered in this Index are gender (“inclusive entrepreneurship policies for women”), age (“inclusive entrepreneurship policies for youth”), and handicaps (“inclusive entrepreneurship policies for persons with disabilities”). Such policies aim to level the playing field for entrepreneurship.

As another instrument for boosting inclusion, the concept of the social enterprise1 is gaining popularity worldwide as a market-friendly alternative to cost-intensive social policy programmes. Advocates argue that civil society can address social problems in innovative new ways that also include social enterprises. Social entrepreneurship has been shown to assist resource-constrained governments in tackling socio-economic problems such as poverty, disease and access to education and work, and in dealing with disabilities (Seelos, Ganly and Mair, 2006[2]; OECD, 2014[3]). Policies to stimulate social entrepreneurship are progressively becoming popular across the OECD, as well as in high-income AMS such as Singapore. For the purposes of this publication, the OECD has considered a relatively wide definition of social enterprise and has integrated initiatives such as inclusive businesses and co-operatives into the analysis.

Assessment framework

The framework used to assess policy under Dimension 8 comprises two sub-dimensions: one on social enterprises and the other on inclusive SMEs. Each sub-dimension has three thematic blocks spanning the breadth of the policy cycle: i) planning and design; ii) implementation; and iii) monitoring and evaluation.

Sub-dimension 8.1 assesses the maturity of the ecosystem for social enterprises and the depth of policies to facilitate their creation and operation. In particular, the indicators look at whether the country has a formal definition for a social enterprise, whether national strategies or legislation are in place, the existence of national social enterprise registries and whether one agency has a clear responsibility for this policy area. The assessment attempts to get a picture of the full range of actors operating in this space, including those from the private sector and from civil society. On a more programmatic level, it looks at whether the country runs awareness-raising activities on social enterprise and whether support instruments are in place, with an indication of their budgetary allocation to provide a sense of scale. The assessment takes into account funding from government, donors, civil society and private initiatives. Within this sub-dimension, the highest weight is given to implementation activities, followed by planning and design, and then monitoring and evaluation.

In the assessment, a social enterprise is defined as a vehicle that “involves private activity conducted in the public interest, organised with an entrepreneurial strategy, but whose main purpose is not the maximisation of profit but the attainment of certain economic and social goals, and which has the capacity for bringing innovative solutions to the problems of social exclusion and unemployment.” For purposes of comparison, and given the novelty of these enterprises globally, including in OECD countries, a variety of socially oriented ventures in ASEAN countries – such as co-operatives, inclusive business initiatives and associations – were counted as a “social enterprises” in the implementation and monitoring and evaluation blocks. In the planning and design block, however, the assessment followed the definition of a social enterprise stated above.

Sub-dimension 8.2, on inclusive SMEs, looks at the policies and activities in place to level the playing field for entrepreneurship among three target groups: women, youth and persons with disabilities (PWD). Given varying policy priorities across ASEAN Member States (AMS), interventions for each target group were assessed individually. Indicators included whether such policies were covered under a strategic plan, the mechanisms for co-ordination across different government agencies, the availability of data, the existence of dedicated training programmes and business networking facilities, and financial support programmes. As in sub-dimension 8.1, the greatest weight was assigned to implementation activities, followed by planning and design, and then monitoring and evaluation.

Although sub-dimension 8.2 focuses on entrepreneurship policies, other labour-market policies, such as programmes to boost employability, were also considered in the assessment. The rationale was that entrepreneurship policies are often considered to complement employability measures, and that therefore policies to boost inclusive entrepreneurship can be assessed in relation to broader labour-market policies.

Dimension 8 intersects with areas reviewed elsewhere in this report: the “business development services” sub-dimension in Dimension 1, and the “entrepreneurial skills” sub-dimension in Dimension 7. Given the novelty of social enterprise activities, both in the region and globally, sub-dimension 8.1 was assigned a weight of 25%. The remaining 75% was assigned to the larger policy area covered in sub-dimension 8.2. Taking this sub-dimension as a whole, inclusive entrepreneurship policies for women and youth were each assigned a weight of 35% (given the importance of these policies for the region, as evidenced by their inclusion in the SAP SMED action lines), while those for PWD received 30%.

Analysis

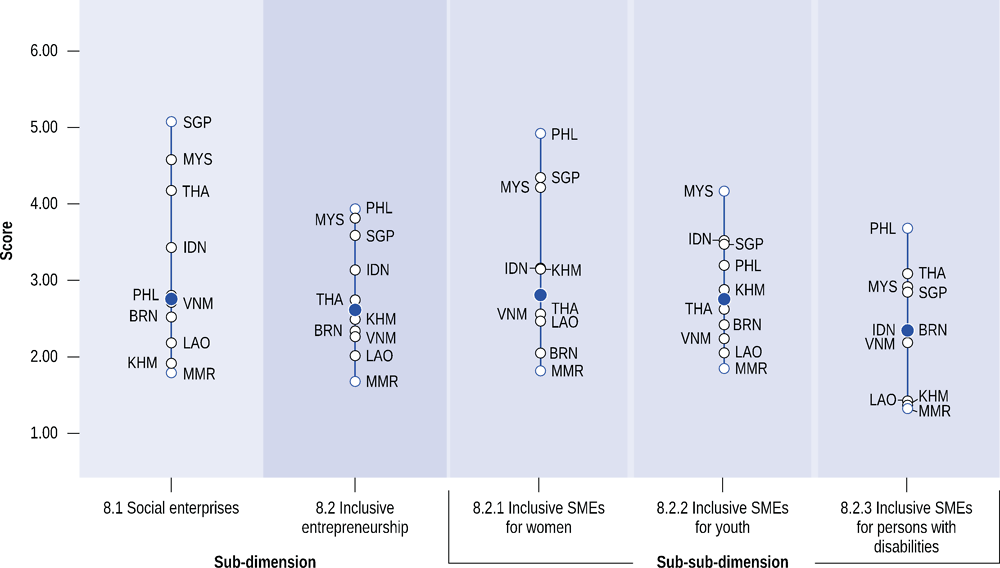

The overall assessment results for each sub-dimension are presented in Figure 11.2. The graphic also presents scores for the three target groups analysed in sub-dimension 8.2 on inclusive SMEs.

Analysing the results, the spread is highest in sub-dimension 8.1 on social enterprises, possibly because it is a relatively new policy area and some countries might need time to develop relevant policies. In sub-dimension 8.2 on inclusive SMEs, women’s entrepreneurship shows the highest spread, reflecting the fact that several countries are outliers with more advanced policy measures. Interestingly, women’s entrepreneurship is the sub-group where countries have achieved the most progress overall.

Sub-dimension 8.1: Social enterprises

This sub-dimension examines planning and design for social enterprise policy and its implementation, monitoring and evaluation. The first thematic block, on planning and design, includes indicators relating to the availability in each country of formal and shared definitions of social entrepreneurship, a formal law or policy covering this area and the referencing of social enterprises in national strategies. The second block covers implementation of policies for enhancing social entrepreneurship, including the budget, dedicated instruments and implementation agencies. The third block assesses monitoring and evaluation mechanisms at a national level.

The median score for the region as a whole on this sub-dimension is 2.74, indicating that policies to promote social entrepreneurship are at an early stage of development. This is consistent with the fact that it is a relatively new area for policy makers, as is also the case in many OECD countries. Social entrepreneurship has received much more attention in ASEAN over the last decade. In some countries, social entrepreneurship is promoted as a key policy response to gaps in socio-economic well-being, and it is included in key policy documents. There is little official statistical data, but based on data received from a number of countries, the vast majority of social enterprises are in an early or seed stage of development and could be considered as SMEs based on size and the challenges they face.

Planning and design: AMS are making progress on policy for social ventures

AMS have a history of supporting the development of co-operatives, associations, non-governmental organisations (NGOs), not-for-profit organisations and foundations. Over the last decade, ASEAN governments have gone further, making progress in designing dedicated policies for the promotion of social ventures. This is reflected by a relatively high median score of 3.58 in the planning and design thematic block. In many cases, the governments have integrated social enterprises into national development strategies. In Thailand, Malaysia and Singapore, they have designed specific action plans for social entrepreneurship promotion. Many AMS have also created dedicated initiatives to promote inclusive business (IB). For example, the Philippines selected IB models as a preferred area for investments for 2017-2019, and it has established an IB promotion programme.

As for defining a social enterprise, however, only Thailand, Viet Nam, Malaysia and Singapore have a formal set of characteristics or definition. A definition is important for bringing clarity to the nature, missions and activities of social enterprises, and forms part of the legal framework that in turn grants social enterprises the recognition and visibility needed to thrive; conversely, inaccurate definitions can be harmful to social enterprises by causing confusion or failing to capture the full spectrum of vehicles that qualify as social enterprises in a given context (OECD, 2017a[4]). Among the AMS, Thailand and Viet Nam have a clear formal definition. In Philippines, the Senate is working on a bill that integrates a shared definition for social enterprise, but the document is still in the proposal stage. Other countries are without a formal definition for social enterprises, although they do have definitions related to co-operatives, associations, foundations and NGOs, whose activities closely adhere to social entrepreneurship. In some cases there is a shared working definition, though not formally approved. For example in Malaysia, although there is no formal definition, the government has developed a guidebook, MaGIC SE 101, which provides a shared working definition for government institutions that serves as a basis for social enterprise accreditation.

Only a few ASEAN countries have an institution with a clear mandate covering the area of social enterprises. The mandate is often shared among several institutions, such as the Ministry of Social Affairs or Social Services. Singapore and Thailand have a dedicated committee in place for promoting social enterprise. In the Philippines, there is a proposal to create a Social Entrepreneurship Development Council. A number countries do not have a dedicated institution to promote social enterprise, but they do have institutions in place tasked with providing policy support to co-operatives, NGOs, foundations and other social organisations. Other countries do not yet have a dedicated institution in place, but ministries or agencies responsible for social affairs or enterprise development carry out ad hoc activities. In Brunei Darussalam, a number of activities are carried out by the Ministry of Culture, Youth and Sports (MCYS) and Darussalam Enterprise (DARe), and the Legislative Council has expressed an interest in further developing the policy framework for social enterprise.

Several countries have designed dedicated policies for promoting social entrepreneurship, among them Thailand (Social Entrepreneurship Promotion Action Plan for 2011-16 and part of the 12th National Economic and Social Development Plan for 2017-21) and Malaysia (Malaysia Social Entrepreneurship Blueprint for 2015-18). Social enterprises are mentioned in the national strategic documents of Cambodia and Singapore. In the remaining AMS, national strategic documents do not specifically mention social enterprises, but they strive to promote social inclusion through provisions for other organisations involved in inclusive businesses.

Since the area of social entrepreneurship is relatively new, few countries have developed registries of social enterprises. Information was available only from registries in Malaysia, Thailand and Singapore. Registries form an essential aspect of the monitoring and evaluation framework and can greatly aid in sectorial mapping and data collection for improved policy making. Accreditation systems support the setting of standards and help to maintain and reinforce formal criteria for social entrepreneurship within a country. In addition, online registries can allow networking among social entrepreneurs.

The Republic of Korea’s government has taken an active role in building a comprehensive ecosystem for the social economy. The Social Enterprise Promotion Act (SEPA) was enacted in 2006 to facilitate new employment and provide qualified social services for the local economy. Following SEPA, the Second Social Enterprise Promotion Plan (2013-2017) was adopted in 2012 to increase the sustainability of social enterprises and spread enterprise values. Diverse types of social enterprises exist based on the SEPA and can take the legal form of a corporation or association under the Civil Law, a company under the Commercial Act, or a non-profit private organisation (SEPA Act, Article 8).

Unlike many other countries where social enterprises emerge from the voluntary efforts of civil society, social entities in Korea receive substantial focused support from the government to develop the social enterprises sector (Kim and Moon, 2017[5]). The Ministry of Employment and Labour certifies social enterprises through the Korea Social Enterprise Promotion Agency (KoSEA), which is the chief agency responsible for the execution of policy programmes (SEPA Act, Article 20). A range of institutional support to social enterprises is provided through operational support (including specialised advice and information), management support (including management consulting and accounting programme support), financial assistance (including tax benefits and funding for insurance) and educational support (including academic programmes for raising professional social entrepreneurs).

As a result of implementing the SEPA, there was a dramatic increase in the number of certified social enterprises. The total number of active social enterprises rose from 55 in 2007 to 1 460 by 2015. Furthermore, networks of social enterprises were expanding in many regions of the country instead of being concentrated in metropolitan areas. This success is attributed to the government’s effective mobilisation of the necessary budget and the creation of an effective institutional arrangement for collaborative partnerships with the private sector and local governments (Kim and Moon, 2017[5]). Policy makers, newly established social enterprises, consumers, the co-operative sector and civil organisations have become increasingly aware of the importance of the voluntary efforts of citizens for nurturing the social economy (Jang, 2013[6]).

Implementation: Governments could collaborate more with private initiatives

The second thematic block, on the implementation of social enterprise policy, analyses data on government budgets for promoting social entrepreneurship and identifies good-practice initiatives focused on awareness raising, financial support, skills development and market access. The region’s median score for this block is 2.88, but scores vary widely from country to country, indicating that government support for implementation of social enterprise policy is limited and not available in all countries.

While budgets to support co-operatives and NGOs have been mobilised in all ten AMS, support instruments specifically for social enterprises have been put in place in only three countries: Malaysia, Thailand and Singapore. Malaysia has created a dedicated Social Entrepreneurship Unit within the Malaysia Global Innovation and Creativity Centre (MaGIC), and in 2015 mobilised a budget of MYR 20 million (Malaysian ringgit), or about USD 5.1 million, to finance the unit and its activities, including awards, seed funds and capacity-building programmes. Thailand provided a budget of THB 105 million (Thai baht), or about USD 3.3 million, for the period 2011-16 to finance activities for promoting social entrepreneurship. The Thai social entrepreneurship system is currently in transition, but budgetary support is expected to continue. Singapore’s government, in partnership with the sponsor community, has committed a fund of SGD 30 million (Singapore dollars), or about USD 22.8 million, including investment and grants, to support social enterprises for the period 2015-20. Substantial budgets have also been put in place across the region by a community of donors, foundations, social impact investors and private initiatives, among them the British Council, DBS Foundation, LGT Impact Ventures and Impact Hub. Overall, the number of players providing finance to social ventures and social enterprises in ASEAN has been growing rapidly, adding to donor budgets and government support.

Two countries, Malaysia and Singapore, have well-structured implementation agencies for social innovation. In Malaysia, this role is carried out by the Social Entrepreneurship Unit within MaGIC. Other institutions, such as the National Innovation Agency and the Agency of Youth and Sports, are also involved in implementing social innovation. MaGIC offers financial grants, skills development and market access support through its Global Accelerator Programme and other initiatives. In Singapore, a Social Enterprise Association and a Social Enterprise Development Centre serve as focal points for the sector. Set up in 2015, the Singapore Centre for Social Enterprise, known as raiSE, has implemented initiatives that provide skills development, mentoring support and funding in the form of grants and capital investment. Thailand formerly had a dedicated Thai Social Enterprise Office that supported social enterprises with skills development through intermediaries. It ceased to exist in 2016, but the Department of Social Development and Welfare was due to take over its function from August 2017. The operating modalities and budget for this new situation were not clear at the time of publication.

Other AMS are at an earlier stage, but are beginning to implement some initiatives in this field. In Indonesia, the government is supporting social venture initiatives through its KUBE programme, and the Ministry of Youth and Sports is promoting social entrepreneurship among young people via business-plan competitions. In Brunei Darussalam, Universiti Brunei Darussalam has embedded a module on social enterprise into its Discovery Year programme. This module is called the Community Incubation Programme, and it aims to promote a mind-set for social enterprise among young people.

Across ASEAN, an increased number of intermediaries are offering business-related services to ventures pursuing social goals. Cambodia, Indonesia, Malaysia, Thailand, Singapore, Philippines and Viet Nam have seen a rise in such private-led initiatives. International networks such as Ashoka, Impact Hub, the Spark project and UnLtd are present in several countries and have played an important role in creating awareness and providing support services to social ventures. In Cambodia, Myanmar, Lao PDR, and Viet Nam, donors like the British Council and the United Nations Development Programme (UNDP) play a substantial role in promoting social entrepreneurship initiatives. In Viet Nam, a Centre for Social Entrepreneurship Development has helped more than 100 social ventures thanks to initial support from the Netherlands Development Organisation.

There is also a spectrum of impact finance and investment opportunities in Southeast Asia, with varying levels of risk accompanying the potential for financial return and social impact. Impact investment is more advanced in countries with developed financial systems (Singapore, Malaysia), but growing numbers of impact investors can be found across ASEAN, among them LGT Impact Ventures and the Insitor Seed Fund. In Singapore, the DBS Foundation set up a USD 50 million fund in 2014 to champion social entrepreneurship. In Malaysia, the Social Outcome Fund was launched with MYR 3 million in 2017 to finance social intervention projects. The Stock Exchange of Thailand is considering the establishment of a Stock Change Market for Social Enterprises. Despite these initiatives, the impact investment market is still nascent and fragmented in the region, and most social enterprises are still in demand of early-stage seed funding.

Monitoring and evaluation: National assessment of societal impact is rare

The third block has a median score of 1.99, indicating that monitoring and evaluation of social enterprise policy are not yet common in the region. Only a few AMS are developing key performance indicators (KPIs), gathering data on KPIs and integrating findings into the policy development cycle. In many countries, programmes funded by the government or donors were monitored but the findings from this process were not available.

However, a number of AMS have taken initiatives to evaluate not only the economic impact of measures supporting social ventures, but also their societal impact. Initiatives include the Payment by Results programme in Malaysia, the SE quality index in Philippines and the Social Value Toolkit in Singapore.

Sub-dimension 8.2: Inclusive SMEs

This sub-dimension looks at institutional structures, programmes, initiatives and monitoring and evaluation mechanisms for advancing inclusive entrepreneurship for three groups: women, youth and persons with disabilities. The first thematic block, on policy planning and design, assesses the framing of entrepreneurship for the target groups in national strategies and co-ordination mechanisms among relevant actors. The second block, on implementation, examines the budgets allocated for entrepreneurial activities, as well as the quality and variety of support available to target-group entrepreneurs in terms of finance, training, promotion and market access. The final block assesses monitoring and evaluation mechanisms vis-à-vis programmes and strategies, paying particular attention to the use of KPIs.

The ASEAN region counts numerous initiatives to engage women, youth and PWD in entrepreneurship. This social approach developed in response to labour-market challenges and the objectives of alleviating poverty, promoting social inclusion and moving towards gender equality. Nevertheless, while support activities may be gaining ground in AMS, especially for women and youth, a comprehensive structural approach is largely lacking within the region, although this varies from country to country according to national priorities for the three target groups. On the regional level, inclusive entrepreneurship is at an early stage of development, evidenced by the sub-dimension 8.2 score of 2.56. In many AMS, existing initiatives for entrepreneurs from the target groups have yet to be matched by coherent policies and strategic documents, which are needed for full support.

The results suggest that that policy implementation could benefit from a more co-ordinated, structured approach. For each of the target groups, about half of the ASEAN Member States have national strategies or action plans to promote entrepreneurship. Although women’s economic empowerment is consistently mentioned as an aim in national strategies, there are still few explicit strategies to promote women’s entrepreneurship, and women remain largely absent from MSME strategies. For youth, who receive considerable support from youth associations, strategies and support are not always co-ordinated among the many actors involved (youth ministries, SME agencies, educational institutions, etc.). Support for youth can also tend to cluster around start-up activities, leaving out young entrepreneurs with ventures in the growth stage. For PWD, many initiatives have focused on access to finance. A more holistic approach may be needed, such as matching financial support with the skills required to start and run a successful business, and awareness raising that reinforces the feasibility of self-employment as a viable option.

As noted above, interventions for each target group have been assessed individually in view of the varying policy priorities across AMS.

Inclusive entrepreneurship policies for women

Women face unique challenges and barriers to entrepreneurship: social pressures, limited access to finance, lack of business-related knowledge and skills, and limited access to business networks and networking activities. These issues merit targeted and regularised entrepreneurial programmes (OECD, 2017a[4]).

Planning and design: Explicit strategies on women’s entrepreneurship are needed

Advancing women’s entrepreneurship and economic activity is widely acknowledged as a general aim in national strategies across the region, and all AMS have agencies and co-ordination mechanisms for enhancing women’s economic empowerment. ASEAN also has a number of regional platforms for issues related to women and women’s entrepreneurship, among them an ASEAN Committee on Women and an ASEAN Women Entrepreneurship Network. However, women are still largely absent from strategic documents on SMEs, and few countries have clear, explicit strategies for advancing women’s entrepreneurship. The regional median score of 3.62 for planning and design reflects the fact that, although institutional structures are in place, gaps remain in the policy framework.

Women’s entrepreneurship policies and implementation in AMS are generally handled by the country’s ministry for women or social and family affairs, meaning that the ASEAN countries take a gender mainstreaming approach to women’s entrepreneurship development (OECD, 2017a[4]). The Philippines is the only ASEAN country where implementation is formally handled by the lead SME agency, the Department of Trade and Industry.

All AMS engage various agencies in implementation, including the lead SME agency, women’s associations and the private sector. For example, in Cambodia and Lao PDR, a women’s business association is formally involved in the co-ordination structure for implementation of entrepreneurial activities. This multi-stakeholder approach and the active involvement of the women’s business community can be an important avenue to meeting the needs of women entrepreneurs and identifying the main hurdles they face for successful start-up and operation of a business. There may also be segments of women, such as low-income women or single mothers, who are more disadvantaged than others in entrepreneurship. This is recognised in Malaysia, which has an action plan for single mothers who are entrepreneurs.

Nonetheless, many countries have yet to identify women’s entrepreneurship as a separate intervention point. Only four ASEAN countries have clear and explicit strategies for women’s entrepreneurship accompanied by targets and areas for intervention like access to finance, market access and product development support. In Viet Nam, the National Strategy on Gender Equality 2011-20 seeks to change norms in the labour force by encouraging new enterprise creation by women, with a target of raising the share of women-owned SMEs to 35% or higher by 2020. Lao PDR has a National Strategy for the Enhancement of Women SMEs. In Cambodia and the Philippines, women’s entrepreneurship is referenced across multiple strategic documents on gender equality and national development. The remaining ASEAN countries have an action plan or a strategic document that highlights women’s economic participation through career development and employment, with no specific mention of women entrepreneurs or areas of intervention. (Singapore does not have a specific strategy, as barriers to entrepreneurship for women have been assessed as being very low.)

Overall, women entrepreneurs are absent from SME strategy documents across the region except in the Philippines and Viet Nam. Specific strategies for women’s entrepreneurship send a strong signal, especially in countries where women are at a significant disadvantage in entrepreneurship. The absence of clear commitments in the form of stand-alone strategies, or placement in national development and SME strategies in particular, inhibits the mobilisation of resources.

Implementation: AMS could gear up support for women’s entrepreneurship

Women entrepreneurs in ASEAN have access to general SME support activities provided by governments, and uptake of these services is relatively high in countries like Malaysia and Singapore. But the score for implementation of women’s entrepreneurship activities on a regional level is 2.63, indicating that while programmes exist, they are at an early stage of development and at a low level of intensity.

There are numerous examples of business development support services, incubators and mentoring programmes specifically targeted towards women. Several countries have market-access support programmes in the form of trade promotion exclusively for women, among them Cambodia, Indonesia, Malaysia, the Philippines and Viet Nam. This is a positive development in helping women’s businesses to scale up, especially in industries with high export-growth potential. Some countries also have training programmes focused on ICT skills for women entrepreneurs or programmes that ensure nationwide accessibility, for example the network of Women’s Development Centres across 14 provinces in Cambodia.

The nature of targeted opportunities available for women entrepreneurs varies across AMS. Where the implementation of entrepreneurship programmes is handled by a women’s ministry, entrepreneurship policy appears more likely to be used as a tool for poverty reduction and livelihood creation than for meeting the needs of women entrepreneurs who already have skills or of women-owned enterprises with high-growth potential (OECD, 2017a[4]). Priority is often given to developing the entrepreneurial capacity of women who are at a greater disadvantage than others. In Indonesia, activities focus on empowering women in co-operatives who are already beneficiaries of conditional cash-transfer programmes. In the Philippines, the GREAT Women Project (Box 11.2) targets low-income women micro entrepreneurs across the country.

The Philippines’ GREAT Women Project 2 aims to improve the economic empowerment of women micro entrepreneurs and their workers. The project, whose full name is Gender-Responsive Economic Actions for the Transformation of Women, is a cross-cutting initiative carried out by several government agencies, including Philippines Commission on Women (the lead implementer) and the Department of Trade and Industry. The project offers technical assistance to 12 000 women micro entrepreneurs and to numerous national and local government agencies by delivering gender-responsive business development support services. Its activities are designed to increase the competitiveness and sustainability of women’s micro enterprises and to improve the enabling environment for women’s economic empowerment.

The GREAT Women Project 2 has helped women micro entrepreneurs across priority sectors identified in the national development plan. It links the women with mentors to help them refine business ideas, provides access to finance and facilitates access to domestic and export markets. The project has been able to increase the profitability of beneficiaries’ businesses, helping them to move up the value chain and scale up by linking them with existing SMEs under a gender-responsive value chain approach.

The project illustrates the success and value of a government-wide gender mainstreaming initiative in which the women’s agency is involved in all areas of project implementation. This kind of cross-cutting work is enabled by the inclusion of gender as an intervention pillar in the national MSME development plan. What should also be underlined is the project’s ecosystem approach to overcoming disadvantages faced by women micro entrepreneurs via interventions in the areas of governance and capacity development.

Monitoring and evaluation: Gender-disaggregated data and KPIs are needed

Monitoring and evaluation of women’s entrepreneurship policies and activities in the region focus predominantly on programmes and training. The regional median score on this block was just 1.83. Gender-disaggregated information is available only in Indonesia, Malaysia, Philippines and Singapore. Lack of such data impedes the systematic analysis of barriers to women’s entrepreneurship and can inhibit the creation of better, evidence-based policies and programmes. It should be noted, however, that without specific entrepreneurship strategies for women with clear KPIs, the means for monitoring the advancement of women’s entrepreneurship is understandably limited.

Inclusive entrepreneurship policies for youth

Engaging youth through entrepreneurship can help to achieve inclusive growth, especially since the formal labour market may not provide enough opportunities for all in countries where the workforce is young (UN, 2014[7]). The chances of young entrepreneurs running productive and performing businesses that are able to create decent jobs, as opposed to subsistence businesses, can be significantly increased when young people are drawn towards entrepreneurship for opportunity reasons rather than pure necessity. This is where entrepreneurial education has been shown to be an important building block for the economic impact and success rate of youth entrepreneurship (OECD, 2017b[8]).

Planning and design: Quick progress is possible on youth entrepreneurship

The regional median of 2.00 on planning and design for youth entrepreneurship indicates that this is still a nascent policy area. Youth constitute an important segment of the population in ASEAN economies, and youth employment will continue to be a pertinent policy area, as will identifying the role of the youth in economic growth. But while several AMS have a dedicated strategy for youth employment, few highlight youth entrepreneurship in policy documents. Some do – for instance in Thailand, the promotion of youth entrepreneurship2 is highlighted under the 4th SME Master Plan. In Singapore, there is no dedicated youth policy, since policy makers regard young people as having equal access to the labour market and support schemes for entrepreneurship.

Many AMS recognise that youth entrepreneurship can be a policy tool for addressing youth employment, social inclusion of disadvantaged youth and informality within the labour market. They also recognise that young people can create high-growth business ventures that may contribute to economic growth through innovation and job creation. Five AMS have dedicated policies for youth entrepreneurship. These include Cambodia’s National Policy on Youth Development, in which entrepreneurship is a strategic area; Indonesia’s Grand Design for Youth Entrepreneurship Development; Philippines Youth Development Plan; and Thailand’s Youth and Children Development Plan 2017-21, which identifies entrepreneurship as means of engaging youth outside the formal labour market. In Malaysia, youth entrepreneurship figures in several strategic documents, including the Malaysia Youth Strategy and the national development plan.

The scope is broad for youth entrepreneurship at the national level. Ministries of youth, industry, employment, social affairs and education all have a role in shaping entrepreneurial policies and programmes (OECD, 2016[9]). Within ASEAN, youth entrepreneurship falls under a youth ministry, and there is some co-ordination with education ministries, social affairs ministries and youth associations.

Implementation: Start-up support for youth entrepreneurs is strong in AMS

The regional median for implementation of youth entrepreneurship policy is 3.12. This indicates that initiatives targeting young entrepreneurs exist, even if dedicated strategies do not. Young entrepreneurs in ASEAN have access to numerous forms of support, such as training in managerial skills, incubators, business competitions and coaching activities. In addition to government-backed training schemes, there is high involvement of universities, the private sector and associations. This situation reflects the unique dynamics and broad set of actors on youth entrepreneurship in ASEAN compared to the region’s entrepreneurship initiatives for women and PWD.

Although the environment for youth entrepreneurship is relatively vibrant, activities are sometimes ad hoc in nature and not necessarily co-ordinated. Given the scarcity of clear guiding documents on youth entrepreneurship and the multiplicity of actors involved, there can be inconsistencies, duplication and gaps in support. Most support appears to centre on start-up activities for would-be youth entrepreneurs or early-stage enterprises run by youth. The region’s focus on start-up activities is a positive development, especially in countries where youth entrepreneurial activities are at a very early stage of development. Support includes seed grants and interventions to expedite the regulatory process. Among AMS, many of the largest initiatives for youth have focused on business creation, for example Startup SG initiatives in Singapore, the STEPS (Supporting Talent, Entrepreneurial Potential and Success) project in Lao PDR, the Youth Start-Up Programme 2016-21 in Viet Nam and the YES (Youth Entrepreneurship Support) project in Philippines.

Some countries have shown a preference for supporting young entrepreneurs looking to build technology-based start-ups or engage in innovation activities. In Indonesia, for example, seed investment grants go towards tech-based enterprises. Specifically targeting tech-based enterprises can provide much needed policy support to encourage movement into this industry. However, too much focus could crowd out other promising ventures and limit the impact of youth entrepreneurship in the long run. High performing and high-growth ventures that can create jobs and foster innovation are not exclusively tech-based.

The capacity to deliver targeted training sessions varies significantly across AMS. Countries with stronger activities for promoting the development of entrepreneurial skills (sub-dimension 7.2) tend to perform better on implementation of youth entrepreneurship policy. They are more able to provide targeted entrepreneurial and managerial skills training for youth because general SME training schemes and business development services already exist.

In addition to youth ministries and universities, youth associations and youth councils play a vital role in supporting young entrepreneurs in the region through access to finance, competitions, networking opportunities, mentoring and incubators. Governments are empowering and giving formal mandates to youth associations to carry out entrepreneurial activities. In Cambodia and Viet Nam, youth associations are the main bodies delivering support. The Young Entrepreneurs Association of Cambodia, a volunteer-driven non-profit organisation, is taking the lead in facilitating peer-to-peer learning and enlarging the social capital of young entrepreneurs. In a joint initiative with a women’s association, it is also intervening in the regulatory landscape to expedite the start-up process – a rare example of a blended initiative that targets regulatory barriers faced by both women and youth. Meanwhile, the Viet Nam Youth League’s Youth Start-Up Programme 2016-21 is being conducted in co-ordination with banks, large businesses and organisations.

Monitoring and evaluation: Programmes are assessed, but national impact is not

The regional score on monitoring and evaluation is 2.52. Given that few countries have strategic documents on youth entrepreneurship, monitoring and evaluation are rarely in place on a national level. Rather, monitoring and evaluation are conducted on a programme level by the different actors. At present only Indonesia and Malaysia have statistical data on self-employment and business creation for youth.

Cambodia’s new Business Information Centre (BIC) is helping to foster a vibrant entrepreneurial ecosystem and to ensure that young entrepreneurs embark successfully by making the start-up process easier and resolving information asymmetries. The centre was launched in 2017 when the Young Entrepreneurs Association of Cambodia teamed up with the Cambodian Women Entrepreneurs Association, the Cambodia Chamber of Commerce and the Mekong Business Initiative.

The BIC is an online, open platform for SME support services. It aims to be a one-stop resource for up-to-date information on business laws and regulations, opportunities and business support services, including information on training sessions, a database of financial support services, tailored industry market insights and an SME activity calendar. The initiative is designed to clear obstacles to business incorporation and formalisation by helping to remove barriers that demotivate potential and early-stage entrepreneurs from regulatory compliance.

The BIC represents a prime example of successful blending of women and youth entrepreneurship policies when clear, shared disadvantages between target groups have been identified. The centre took shape after a needs assessment found that the regulatory environment and information asymmetries – for business support services in particular –were pertinent policy areas for both youth and women entrepreneurs.

The initiative also stands out for its stakeholder involvement, which demonstrates the leading role that associations can play in entrepreneurial policy by illuminating and pushing forward the particular needs of entrepreneurs among their constituents. The BIC was born from feedback collected from SMEs through the associations and the needs assessment phase of documenting and evaluating business registration and licensing processes, with special attention paid to gaps between formal and actual processes.

Source: YEAC (2017), “Business Information Centre to expedite business growth in Cambodia,” https://yeacambodia.org/content_news_events/detailNewsEvent/375.

Inclusive entrepreneurship policies for persons with disabilities

Creating a basis for inclusive employment practices for persons with disabilities is an important step towards rectifying labour-market disadvantages and social exclusion. Much can also be done on the strategy level to promote and empower PWD as business owners. Self-employment can provide an important avenue for greater labour-market participation, especially for people with disabilities who are subject to greater prejudice by employers or in contexts where discrimination is frequently reported (Halabisky, 2014[10]). Nonetheless, there are limitations to PWD entrepreneurship, which may not be a feasible option for people with severe or multiple disabilities (Halabisky, 2014[10]).

Planning and design: Policies focus on employment rather than entrepreneurship

Planning and design of inclusive policy for PWD mostly focuses on entrepreneurship from an employment perspective. Emphasis on the ability of PWD to become successful business owners is still in the early stages in AMS. Nearly all AMS have laws and action plans to protect and enhance work and employment prospects for PWD. These include legislature prohibiting job discrimination, provisions for vocational training, job-placement and career-support services, and regulatory incentives for hiring. In Cambodia, a government sub-decree3 incentivises the employment of persons with disabilities by introducing tax exemptions for foreign enterprises based on factors including the percentage of disabled workers they employ. In Thailand, the government operates a national hotline to help PWD to find decent work through job-matching services. In the Philippines, the Department of Trade and Industry’s PWD Economic Empowerment Framework outlines three intervention areas for integrating PWD into the labour market: enterprise level assistance, enabling environment and policy advocacy.

The only countries with strategic documents that clearly frame and advance entrepreneurship for PWD are Brunei Darussalam, Malaysia, the Philippines and Thailand. Without a structural approach, it is difficult to overcome the unique barriers and challenges faced by PWD in starting and operating a successful business. Given that each country has a clear focal point for PWD entrepreneurship, the foundations for implementing future strategies are already in place.

Implementation: Entrepreneurship initiatives for PWD remain small in scale

Despite the attention given to career and employment support for persons with disabilities, there has not been much concerted, national-scale activity towards promoting self-employment among PWD. Malaysia and the Philippines engage in awareness-raising activities through information campaigns, but awareness-raising efforts around entrepreneurship for PWD are limited elsewhere. The private sector, NGOs and donors participate in small-scale efforts in some countries.

The region counts very few training and assistance schemes specifically targeted towards PWD entrepreneurs. Donors, NGOs and the private sector are involved in such efforts in Indonesia, Lao PDR, Myanmar, Singapore and Viet Nam. Each AMS has at least one initiative in place. On a regional level, interventions like entrepreneurial training, mentoring, coaching and advisory support remain small in scale, with minor budgetary support, and concentrate on providing basic business development services. The low regional median for this thematic block is not entirely unusual given the target group.

Within ASEAN, Malaysia is the only country to offer an array of support activities, ranging from start-up support to export-market access and ICT training. These services are offered by the main SME agency in co-ordination with other agencies. Other countries, like Brunei Darussalam and Lao PDR, have established dedicated training centres. One consideration going forward is physical access to training and business development centres, which can pose a challenge for individuals with disabilities. A solution can be found in online training, which is provided to PWD entrepreneurs in Singapore and Malaysia.

Access to start-up capital is a main barrier to entrepreneurship for PWD. Efforts are underway in the region to address access to finance for PWD entrepreneurs through special financial instruments. In Brunei Darussalam, Malaysia and Thailand, PWD can take out loans to start a business without the need for collateral or a guarantor. This is done through microcredit facilities, mainstream banks and a special government fund. In Viet Nam, PWD may take out loans with preferential interest rates through the Viet Nam Bank for Social Policies.

The availability of special financing instruments is not in itself a guarantee that PWD entrepreneurs will be able to start and operate a business successfully. PWD may lack the necessary skills due to difficulties in accessing education and/or work and entrepreneurial experience in the labour market. Access to finance should therefore be linked to provision of the necessary business knowledge and skills. One example of this is Thailand’s Fund for the Empowerment of Persons with Disabilities.

Monitoring and evaluation: The region scores poorly on national assessment

Monitoring and evaluation of PWD entrepreneurship is mainly conducted at the level of programmes and training. The lack of national strategies available for monitoring helps explain the low regional median score of 1.69. Most countries have employment data on PWD, and Indonesia, Malaysia, Philippines and Thailand have national statistical data on the self-employment activities of PWD. This is an important step for addressing the needs of those PWD who have already embarked upon entrepreneurial activities.

The way forward

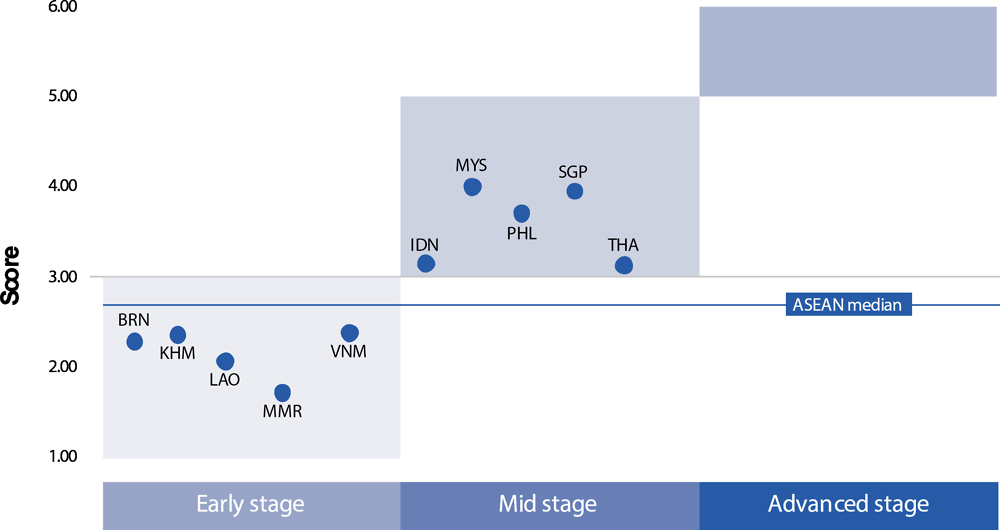

Figure 11.3 presents scores for Dimension 8: Social enterprises and inclusive SMEs.

ASEAN Member States have clearly made efforts to promote social ventures and inclusive entrepreneurship for women, youth and PWD, but policies and systems vary significantly. Areas of focus and approaches to the roll-out of initiatives differ based on each country’s specificity. Half of the AMS fall in the mid-stage category and half in the early stage.

Social and inclusive entrepreneurship policies have started to be applied relatively recently, and there is scope for developing them further. In social entrepreneurship, apart from Singapore, Malaysia and Thailand, AMS are in the early stage of policy development and implementation. A structural approach is largely absent for the promotion of inclusive entrepreneurship for the three target groups: women, youth and PWD. For each of these groups, about half of ASEAN countries have national strategies or action plans. By developing a more structural approach, governments could improve co-ordination and minimise overlaps, inconsistencies and gaps in support activities, both among government agencies and with external actors. This is particularly relevant in the case of women, for whom there are few explicit strategies to promote entrepreneurship and who remain largely absent from MSME strategies.

Policy makers might wish to focus their attention on the following areas:

References

[1] ASEAN (2012), ASEAN Framework for Equitable Economic Development: Guilding Principles for Inclusive and Sustainable Growth, http://asean.org/?static_post=the-asean-framework-for-equitable-economic-development.

[11] EC (2011), “Social Business Initiative: Creating a favourable climate for social enterprises, key stakeholders in the social economy and innovation”, EC COM(2011) 682 final, https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52011DC0682&from=EN.

[10] Halabisky, D. (2014), Entrepreneurial Activities in Europe - Entrepreneurship for People with Disabilities, OECD Publishing, Paris, https://doi.org/10.1787/5jxrcmkcxjq4-en.

[6] Jang, J. (2013), “Emerging dual legal frameworks of social enterprise in South Korea: Backgrounds and prospects”, EMES-SOCENT Conference Selected Papers No. LG13-10, https://www.iap-socent.be/sites/default/files/Jang%20ECSP-LG13-10.pdf.

[5] Kim, T. and M. Moon (2017), “Using social enterprises for social policy in South Korea: Do funding and management affect social and economic performance?”, Public Administration and Development, Vol. 37/1, pp. 15-27, https://doi.org/10.1002/pad.1783.

[9] OECD (2016), “Entrepreneurship can bring disadvantaged youth into the labour market”, in Job Creation and Local Economic Development 2016, OECD Publishing, Paris, https://doi.org/10.1787/9789264261976-en.

[3] OECD (2014), “Job creation in the social economy and social entrepreneurship”, in Job Creation and Local Economic Development, OECD Publishing, Paris, https://doi.org/10.1787/9789264215009-12-en.

[4] OECD (2017a), Strengthening Women's Entrepreneurship in ASEAN: Towards Increasing Women's Participation in Economic Activity, OECD Publishing, Paris, http://www.oecd.org/southest-asia/regional-programme/Strengthening_Womens_Entrepreneurship_ASEAN.pdf.

[8] OECD (2017b), Unlocking the Potential of Youth Entrepreneurship in Developing Countries: From Subsistence to Performance, OECD Publishing, Paris, https://doi.org/10.1787/9789264277830-en.

[13] OECD/EU (2017), Boosting Social Enterprise Development: Good Practice Compendium, OECD Publishing, Paris, https://doi.org/10.1787/9789264268500-en.

[2] Seelos, C., K. Ganly and J. Mair (2006), “Social entrepreneurs directly contribute to global development goals”, in Mair, J., J. Robinson and K. Hockerts (eds.), Social Entrepreneurship, Palgrave Macmillan, London, https://doi.org/10.1057/9780230625655_15.

[7] UN (2014), “Entrepreneuship for development”, Report of the Secretary-General for the Session of the UN General Assembly, http://unctad.org/meetings/en/SessionalDocuments/a69d320_en.pdf.

[12] YEAC (2017), “Business Information Centre to expedite business growth in Cambodia”, YEAC News, https://yeacambodia.org/content_news_events/detailNewsEvent/375.

Notes

← 1. Precise definitions vary, but a social enterprise can be broadly defined as “an operator in the social economy whose main objective is to have a social impact rather than make a profit for their owners or shareholders. It operates by providing goods and services for the market in an entrepreneurial and innovative fashion and uses its profits primarily to achieve social objectives. It is managed in an open and responsible manner and, in particular, involves employees, consumers and stakeholders affected by its commercial activities” (EC, 2011[12]); (OECD, 2017c[13]). Social enterprises are not the only form of social venture, but they are the form covered by this assessment because they have the legal status of a company and are often SMEs.

← 2. Wherein “youth” are specifically understood as those enrolled in schools and universities.

← 3. Government Sub-Decree on Investments 1999 (No. 88/ANK/BK).