Annex A. Methodology

Methodology for measurement

The Standard Cost Model

The measurement conducted by the OECD and presented in this report (see Chapter 3) refers to costs borne by entrepreneurs and businesses in Latvia when complying with requirements and obligations that are contained in legal instruments, such as the Commercial Law. In particular, the purpose of the quantification exercise was to measure exclusively the administrative burdens imposed on businesses by the selected formalities mentioned above. Accordingly, the measurement does not provide evidence of other types of compliance costs borne by private entities, nor of the costs that affect the public authorities involved in the formalities.1

The measurement is largely based on the Standard Cost Model (SCM), a cost assessment methodology originally developed in the Netherlands and which is widely used in several OECD countries since the late 1990s.2 Annex Box A.1. presents the main concepts and elements of the SCM. Several countries have made adaptations to the methodology, mainly reflecting the specific domestic policy drivers underlying the cost measurements. For the purpose of this exercise, the OECD maintained the main features and parameters of the classical SCM approach, adapting them to the Latvian conditions and previous experiences with such measurements.

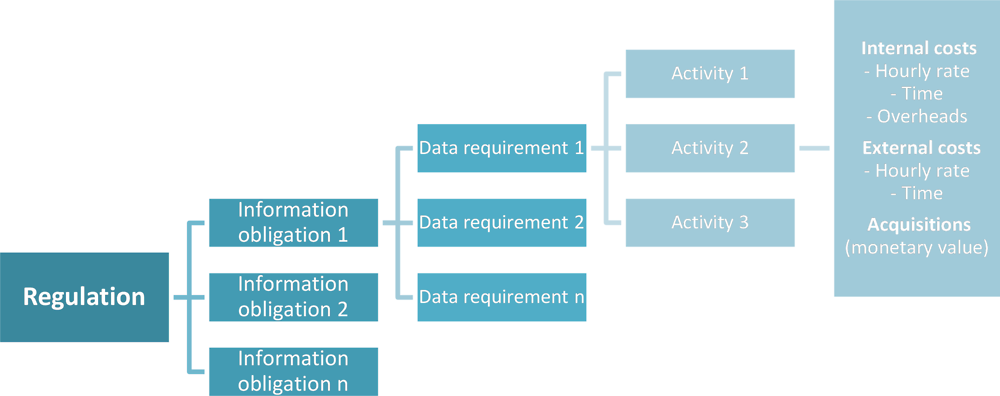

According to the International Standard Cost Model (SCM) Manual, the method is a way of breaking down a regulation into a range of manageable components that can be measured. The SCM does not focus on the policy objectives of each regulation. As such, the measurement focuses only on the administrative steps that must be undertaken in order to comply with regulation and not whether the regulation itself is reasonable or not.

The basic unit of measurement is an information obligation (IO). IOs are the requirements arising from regulation to provide information and data to the public authorities or third parties. IOs can only be completed if some specific administrative activities are undertaken by the economic operator. The SCM estimates the costs of completing each activity. The SCM basic formula is the following:

Cost per administrative activity = Price x Time x Quantity (population x frequency)

The rationale underlying the SCM is represented in the following figure:

Methodological approach and data sources

The OECD proceeded to a tiered approach to the identification and measurement of the administrative costs associated with the three selected formalities:

-

In close collaboration with the Latvian Enterprise Registry, the OECD thoroughly reviewed the relevant laws, implementing regulations and administrative acts regulating the procedures, and conducted a comprehensive mapping of what businesses have to comply with.

-

The Enterprise Registry also provided detailed information on the various forms that must be filled in by businesses and administrative fees associated with each procedural step. An integral part of the mapping exercise was also the identification of all checks that the Registry carries out once the businesses submit their application and information dossiers, as well as the conditions under which the Registry grants a positive response or a request for amendment.

The SCM is a methodology that relies heavily on first-hand information provided by the users of the formalities. To that end, the OECD subsequently tested the “theoretical” information obtained from the mapping exercise through direct interviews with businesses. The interviews took place on site and over the phone or Skype, when entrepreneurs or their representatives visited the Enterprise Registry to complete the paperwork. Interviews were also undertaken with law firms that help businesses go through the procedures.

Assumptions and limitations

The cost calculation process rests on a few assumptions. In particular, the OECD relied on the formulas and standard values that the Latvian institutions are expected to use when performing such measurements. Typically, this occurs during the process of elaborating a regulatory impact analysis (RIA).

Provisions regulating the ex ante impact assessment system and methodological guidance are set out in the related Cabinet Instruction of 2009.3 The Instruction stipulates how the measurement of administrative costs should be made. By administrative costs are meant costs that result from information obligation or storing duties provisions. They should be obtained using the following formula: C = (f x l) x (n x b), where:

-

C = Information provision/storing costs

-

F = Financial resources required (costs per hour of work)

-

I = Time to prepare information

-

N = Number of people subject to duty

-

B = Frequency per year

The costs per hour of work (F) were estimated using the information gathered by the Central Statistical Bureau of Latvia, in relation to the hourly labour costs of administrative and support service activities in 2016.4 In the framework of the OECD measurement exercise, the costs per hour of business to handle administrative activities was set at EUR 8.10 per hour.

The number of businesses subject to the three procedures analysed was obtained by official data from the Enterprise Registry. Table A A.1 outlines the distribution of cases in more detail. For the purpose of the measurement, only the positive decisions were taken into consideration.5

A number of issues in which caution should be exercised regarding this measurement exercise include:

-

While the selected procedures have their legal bases in the Commercial Law, over the years the Enterprise Registry progressively streamlined each of them in order to ease doing business and encourage entrepreneurship. Simplification measures have affected various procedural dimensions, such as the number of interactions and direct visits to the Registry; the compilation of forms and preparatory documents to be presented; the availability of state notaries directly at the Enterprise Registry to notarise signatures, etc. As a result, the requirements established in the law do not necessarily reflect the practice. This discrepancy is not directly explicit in the calculations, which measure the actual costs borne by the businesses. Possible future measures for legal simplification should take this caveat into account when considering the evidence from this measurement exercise.

-

The Enterprise Registry offers the possibility to accelerate the procedure, in particular for the registration process, with additional payment. This “fast-track” registration was not taken into consideration for the measurement, as it is not considered common practice, but rather an exception to the normal procedure.

-

On the basis of the discussions and interviews held by the OECD, it appears that in most cases applications for registering a company (both an individual merchant and an LLC with decreased capital) refer to legal addresses, for which the agreement of the owner is required. As a consequence, the calculations made by the OECD included the specific step of seeking and including the written consent in the application dossier.

-

It was also assumed that documents were presented in Latvian, since this is what the Register requires. If a document is issued in a foreign language, applicants must provide a translation certified by a notary. The additional time and costs that such an operation implies were not considered in the cost measurement.

-

A further assumption refers to the notarisation process. Applicants have the option to have recourse to a sworn notary for the recognition of signatures, or directly to a state notary at the Enterprise Registry. Since most of the applicants interviewed by the OECD indicated that they opted for the state notary procedure (see above), the measurement of the costs refers to this latter scenario. For the calculations, the assumption was that the time to get the appointment with the state notary was 24 hours and the cost per notarised signature was EUR 9, which is cheaper than doing it outside the institution.

The data collection for the calculations comes from direct interviews. Since it was not possible to organise focus groups for this purpose, the methodology relied on structured interviews with people familiar with the process (either businesses themselves or law firms providing support to businesses). Three entrepreneurs were interviewed for the procedure involving the registration of an individual merchant, nine for the registration of an LLC with decreased capital and ten lawyers shared their views while doing the merger by acquisition of two companies.

It shall also be noted that the OECD considered measuring opportunity costs linked to the procedure, notably in the case of the reorganisation of companies through merger by acquisition. Including opportunity costs highlights the potential impact of the waiting time. The opportunity cost measures the foregone benefits due to the impossibility to operate the desired economic activity. It was calculated through the rate of return and investments opportunities in the country.

The classical SCM methodology does not foresee the inclusion of opportunity costs for the waiting time. It only focuses on the time dedicated to the administrative activities required to comply with the information obligations. In case a given procedure generates delays or when no clear deadlines exist, waiting time may become a substantial source of costs, rendering the calculation of opportunity costs significant. In the particular case of the Latvian procedure for reorganisation through merger by acquisition, businesses continue operating during the time they need to wait (Stages 1 and 2 of the procedure). However, since the merger cannot take place in practice, businesses might miss possibilities to operate under the reorganised statutes (this might prevent them from expanding their economic activity or force them to postpone decisions that might have brought a benefit to the companies). The OECD measurement therefore provides results from the quantification of cost both with and without opportunity costs in relation to the reorganisation procedure.

Notes

← 1. For insights on the cost typology, see OECD (2014), OECD Regulatory Compliance Cost Assessment Guidance, OECD Publishing, Paris, https://doi.org/10.1787/9789264209657-en.

← 2. See OECD (2010), Why is Administrative Simplification So Complicated? Looking Beyond 2010, OECD Publishing, Paris, https://doi.org/10.1787/9789264089754-en.

← 3. See the Cabinet Instruction No 19 on “Rules for Completing the Initial Impact Assessment of a Draft Legal Act” of 15 December 2009.

← 4. Hourly labour costs are total quarterly (annual) labour costs divided by the number of actually worked hours of all employees within a quarter (year).

← 5. As a result, the actual costs borne by businesses undergoing the three selected procedures might be higher than those outlined in this report, since negative decisions also generate costs in terms of delays or duplicated procedures.