Chapter 2. Responding to business needs: Fostering a doing-business enabling framework in Latvia

This chapter presents and discusses the current organisational and procedural arrangements deployed by the government to pursue administrative simplification and promote an increasingly business-friendly environment in Latvia. By placing specific focus on procedures regulated by the Latvian Commercial Law, the chapter seeks to identify actions that could further facilitate doing business based on evidential validation drawn from the Chapter 3 related to costs associated with administrative procedures.

The legal and regulatory framework for conducting business in Latvia

The general legal and policy framework

The Latvian Commercial Law is at the centre of founding, operating and closing businesses in Latvia. It applies to sole traders, partnerships (in particular, general and limited partnerships) and companies (in particular, private and public companies). The Commercial Law establishes the rules for starting a business, registration requirements, organisational and financial management, the relationship between members, adaptions and restructurings, and the liquidation of a commercial entity. In its application to commercial reality the Commercial Law works in conjunction with, and refers to, other laws such as the Law on the Enterprise Registry,1 the Law on Annual Financial Statements and Consolidated Financial Statements2 and the Law on Electronic Documents.3

The Commercial Law was adopted on 13 April 2000 and has since been amended several times. The number of amendments is particularly high since 2011 and it is not unusual to see up to four amendments per year as, for example, in 2013. Historically, the Commercial Law was built on the experience of its German counterpart, the Handelsgesetzbuch of 1897.4 This is still visible in both the structure and specific provisions of the law. The Latvian Commercial Law deviates insofar as it integrates the rules concerning private and public companies into one formal law. As a result, the Commercial Law contains a section on general rules applying to all company forms and more specific rules applying to private and public companies only.

The country’s accession to the European Union (EU) in 2004 proved to have a high impact on the regulation of businesses in Latvia. The Commercial Law reflects the European Union’s acquis to commercial and company law. A certain degree of harmonisation and cross-border compatibility strengthened the international dimension of Latvian commercial and company law. The standardisation effect of the EU directives is particularly felt with regard to public companies, while the Latvian legislation is little constrained by EU law with regard to private companies.

The Law on Judicial Power regulates the judicial system in Latvia.5 It introduced a three-tier courts system and laid down basic principles maintaining judicial independence. The procedures for hearing cases are outlined in the Civil Procedure Law,6 the Criminal Procedural Law7 and the Administrative Procedure Law.8 In Latvia the Constitutional Court operates as an independent institution examining laws’ conformity with the Constitution. Latvia is reforming the judicial map and consolidating small district city court areas within the jurisdiction of regional courts (OECD, 2017). The reform aims to improve the efficiency of the court system through the equalisation of the length of the proceedings, ensuring equal practices before the court and redistribution of judges’ posts.

In parallel, the government adopted a range of regulatory policies and frameworks to encourage a sound business environment and economic development. The National Development Plan 2014-2020 is the highest level strategic mid-term document currently in force, approved by the Saeima in December 2012 (Government of Latvia, 2012). It includes, among other things, a list of regulatory policy-related priorities focusing mostly on impact assessment, administrative burden reduction and regulatory simplification as well as the better engagement of stakeholders.

The National Development Plan complements the National Reform Programme of Latvia in the implementation of the “EU 2020” Strategy,9 of which one of the key policy action lines of Latvia’s national economy is the improvement of its business environment, envisaging the simplification of administrative procedures, the elimination of administrative costs and burden, and the implementation of e-services for the performers of economic activities.

In 2016, the government set the overall goal of placing Latvia among the top 20 economies in the World Bank’s “Doing Business” rating and among the top 40 economies in the Global Competitiveness Index in 2018.10

While the regulatory policy of the Latvian government is not consolidated in a single, overarching document, several individual elements of the better regulation agenda are spelt out in strategies and programmatic documents at both governmental and ministerial level – a number of which are presented in the various sections of this chapter. The institutional stakeholders responsible for the implementation of the different aspects of the commercial and regulatory policy framework are highlighted in Box 2.1.

Responsibility for commercial and regulatory policy in the Latvian government is allocated among several institutional stakeholders, as follows.

The State Chancellery

At the centre of government, the State Chancellery is in charge of several elements of the better regulation agenda. The Chancellery’s main tasks include activities to mainstream and upgrade regulatory impact analysis (RIA), such as extending the scope of impacts to be assessed and revising the RIA Handbook. The Chancellery is also actively promoting capacity building on RIA, with the implementation, moreover, of two pilot exercises to test possible methodologies and procedures.

The Chancellery is also responsible for the development of a new Public Administration Reform Plan, which will cover initiatives related to both reducing administrative burdens and the Open Government Partnership. With regard to cutting red tape, the Chancellery launched a website via which stakeholders and citizens can report cases for potential simplification and internal surveys on regulation-inside-government bottlenecks (notably in relation to data sharing).

The Ministry of Justice

In Latvia, the Ministry of Justice plays a critical role in setting a commercial framework and providing a range of services to business. It provides the other public administration institutions with methodological assistance in the development of draft regulations. It is the body co-ordinating and overseeing the transposition of EU legislation into national legislation. It is, moreover, directly responsible for the elaboration and implementation of policies related to, among other things, state law, administrative law, civil law, commercial law, thereby having a direct impact on economic activities.

The Ministry of Economy

The Ministry of Economy’s main involvement in the Latvian better regulation agenda concerns the simplification of the regulatory framework for business. On the basis of sustained and close dialogue with businesses and entrepreneurs, since 1999 the ministry has managed the related “Action Plan for the Improvement of the Business Environment”, which over the years listed several hundreds of measures to relieve business from disproportionate administrative barriers. The ministry is also responsible for reducing the number of licenses and permits and for progressively shifting from an ex ante authorisation regime to an ex post, risk-based inspection system.

The Ministry of Environmental Protection and Regional Development

The Ministry of Environmental Protection and Regional Development is the leading state authority for e-government and the information society, working also at the regional and local levels. Within the ministry, the Public Services Department deals with the planning of electronic services (such as e-identity, e-documents and e-signature) as well as with the related infrastructure. The same department is also in charge of the implementation of the one-stop-shop principle. The technical aspects of information and communication technology (ICT) development and management are managed by the Electronic Government Department.

The State Regional Development Agency (SRDA) operates under the supervision of the ministry. Originally tasked with administrating programmes for entrepreneurs in specially supported territories and implementing various state and EU Structural Fund-financed local municipality support programmes, SRDA’s current main task is to provide e-services for governmental and municipal institutions.1

Cross-Sectoral Coordination Centre

Under the umbrella of the Prime Minister of Latvia, the Cross-Sectoral Coordination Centre (CSCC)’s main role is to supervise and co-ordinate development planning by allowing for cross-level co-operation in the decision-making process. In this respect, the CSCC is entrusted with developing and monitoring the implementation of the National Development Plan of Latvia for 2014-2020, the Sustainable Development Strategy of Latvia until 2030 and the national development programmes pertaining to the country’s involvement in the European Union. Moreover, the CSCC is in charge of co-ordinating the corporate governance of state-owned enterprises (SOEs) operating in a partially centralised SOE governance co-ordination model.

← 1. See www.vraa.gov.lv/en/about_us/

Source: Information gathered by the OECD from government sources during the OECD fact-finding mission, October 2017; Latvia - Cross-Sectoral Coordination Centre, website.

The Commercial Law: A facilitative commercial framework for all

Businesses consulted for this report expressed their general satisfaction with the Latvian Commercial Law. The legal forms of businesses offered and their general design provides a reliable framework as the basis for their commercial activity. The stakeholders also expressed their general satisfaction with the public services involved in operationalising the Commercial Law and its associated substantive and procedural laws and institutions, such as the Enterprise Registry, the State Land Service and Land Registry offices and Patent Office (see below).

One of the issues mentioned by stakeholders concerns the spirit of application of the Commercial Law and its related laws. It is felt that state institutions such as courts and public services take a rather restrictive approach in commercial reality. Where, for example, the Commercial Law does not provide a rule for a specific issue, the state institutions’ starting point may not always be the stakeholders’ freedom to privately create rights and obligations as they see fit. Instead courts and public services conclude, at times, that when a matter is not regulated, it is not allowed. This is thought to contradict the history of the Commercial Law, which was enacted to facilitate business and which should view prohibition as the exception and not as the starting point. At least two solutions were proposed by stakeholders:

First, by establishing an enabling culture by principles of interpretation, where for instance the higher courts, in particular the Supreme Court, could contribute to a more facilitative interpretation of the law in their judgement. Second, the legislature could support this cultural change by selected intervention where practice and courts do not achieve facilitative solutions.

An issue for further discussion might be bringing state enterprises and institutions with a commercial function, such as certain ports by way of example, within the general framework of Commercial Law if not already the case. This might unleash the beneficial effects of a facilitative Commercial Law in two ways. The established structures of the Commercial Law – for example the organisational rules of private and public companies – could be an efficient backbone to organise such enterprises and institutions.11 Further, private enterprises might find a levelled playing field with state-owned enterprises, contributing to a higher efficiency of the Latvian economy. To give an example, the Port of Hamburg is legally organised as a public company (Hamburger Hafen und Logistik Aktiengesellschaft). This contributes to a successful governance structure and allowed for a part-privatisation by way of publicly offering the shares on the Frankfurt Stock Exchange in 2007 (with the state keeping a majority share).12

Adapting to modern forms of business

Stakeholders strongly highlighted the need to adapt the Commercial Law to modern forms of business. According to them, the law did not follow all modern developments, resulting in gaps in the law. One example is the provision of a reliable framework for modern forms of business finance, including but not limited to start-up funding and crowdfunding. At times, however, very specific new rules were added to the Commercial Law such as those on leasing and franchising in 2008. Consequently, the Commercial Law today presents itself as a mix of general rules, more specific rules and a number of gaps compared to modern business reality. Stakeholders emphasised that this should not necessarily be understood as a general call for hard law regulation. Instead, soft law and self-regulation could be considered as alternatives (Box 2.2). An approach to law reform that is more based on thorough research and economic impact assessments was called for. This was seen to be more beneficial in the end than regulation based on anecdotal calls from stakeholders.

A general policy for selecting the types of rules for a modern commercial law framework ensures the right regulatory mix, whereby the regulatory instruments used are compatible and enhance each other if combined. According to the OECD Guiding Principles for Regulatory Quality and Performance adopted by the OECD Council in 2005, regulatory mix fosters “innovation though market incentives and goal-based approaches” and is in line with “competition, trade investment-facilitating principles at domestic and international levels.” Such a general policy therefore prevents combinations of methods that are incompatible and allows for an informed and improved policy outcome involving a mix of the following regulatory instruments :

-

mandatory statutory law

-

non-mandatory statutory law

-

ministerial orders

-

soft law (such as a corporate governance code)

-

self-regulation by commercial actors

-

freedom of contract.

Note: For more information on the regulatory mix (with examples from mediation), see International Finance Corporation (2016).

Source: International Finance Corporation (2016); Cunningham, N. and Sinclair, D. (1999); OECD Guiding Principles for Regulatory Quality and Performance.

Toward legal certainty and the predictability of the Commercial Law

Consultation

This report is a testament to the Ministry of Justice’s articulate consultation culture, similar to that found in many other OECD countries (Box 2.3). Involving stakeholders systematically and inclusively brings a number of advantages. It provides legislative bodies with a full picture of the regulatory challenge and, in particular, exposes conflicts of interest between groups of stakeholders that need consideration. It also improves acceptance and compliance with reform projects. If all stakeholders are involved at an early stage, their acceptance of the resulting laws is higher even if their wishes are not met as they may deem the process fair. Early involvement also raises awareness within the relevant groups. This has the positive effect of a quicker adoption of the mandated changes by both public and private actors.

The Australian government established the Business Consultation website to improve dialogue between business and government. The website provides state departments and agencies with an opportunity to consult business-related policy or regulation with various stakeholders. Businesses, individuals, industry associations and non-profit organisations can register and participate in the consultation processes. The government conducts public or direct consultations. A public consultation is available to all parties interested while a direct one is private and sent to selected stakeholders. The website aims to reduce the regulatory burden on Australian business and deliver better outcomes by consulting early in the policy development process.

Many other OECD member countries (e.g. France, Greece, Luxembourg, Portugal, and Spain) consult social partners and civil society including business groups through the Economic and Social Councils. For instance, in Portugal the Conselho Económico e Social (CSE) was created in 1991 based on provisions of the Constitution. Its mission is to advise the government, promote the involvement of economic and social players in the government’s decision-making process, and provide a forum for dialogue between social partners and other civil society organisations. In the course of this work the CSE draws up opinions on draft legislation and economic policy programmes submitted to it by the government or on its own initiative. Members include representatives of the government, workers’ and employers’ organisations, the autonomous regions and municipalities, as well as representatives of civil society (such as professionals, researchers and universities, consumer and environment associations, universities).

Source: Australia - Government Initiative Business Consultation (n.d.); OECD (2010).

Stakeholders expressed their content with the sincere openness of the Latvian state institutions in considering their regulatory concerns and including them in drafting commercial reform laws. Some stakeholders, however, felt that the inclusion of stakeholders’ views could be more systematic and organised. In addition, some stakeholders expressed that there might be an overemphasis on listening to the voices of entrepreneurs while other stakeholders such as judges and academics might receive less consideration.

Pace of reform and uncertainty

Modern governments, in particular in the European Union, face the challenge of finding the right balance between speedy reactions to reform needs and avoiding overburdening institutions and actors with a hectic rhythm of reform. This challenge finds its roots in multiple causes. To name a few: the European Union adds a second source of reform needs in addition to national reform initiatives; moreover, information technology (IT) and globalisation have accelerated change in the business world, which needs to be reflected in the underlying law.

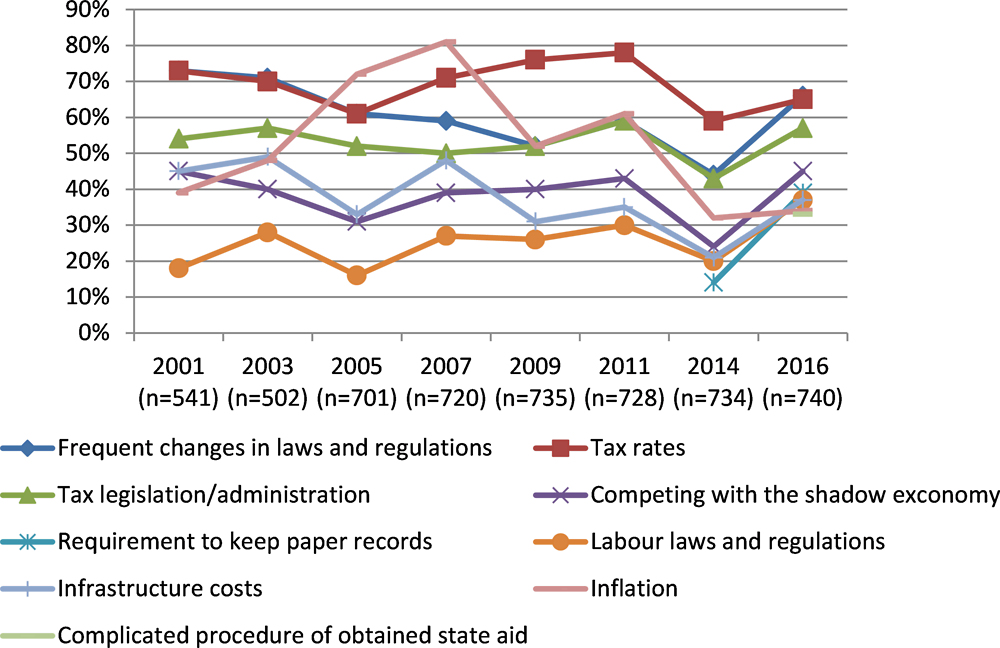

As described above, the Commercial Law is at the centre of founding, operating and closing businesses in Latvia as well as addressing any related disputes. While going in the right direction, there is a widespread feeling from state institutions such as courts and services as well as from entrepreneurs that the hectic rhythm of law or regulation reforms is difficult to follow. In 2016, the most commonly mentioned obstacle impeding business growth was “frequent changes in laws and regulations” (mentioned by 66% of respondents) (Figure 2.1). This can have an impact on legal stability and predictability, hindering business development. Some small and medium-sized enterprises (SMEs) that do not have legal resources may also feel overwhelmed and have trouble keeping up to date.

A possible solution might be to collect reform amendments and enact reform packages in less hasty waves. In addition, while there are initiatives to communicate laws and regulations in understandable language to businesses, there seems to be room for improvement. Improving further the communication of reform packages, in particular explaining their key measures and principles, might make it easier for those concerned to digest the new information. Currently, Latvian law and essential websites are not consistently available for foreign investors in an up-to-date and English version. Some stakeholders suggested that allowing accounting and employment documents to be provided in English, which currently seems prohibited, would increase the attractiveness of Latvia as a place for foreign investment.

Access to law and legal information in a globalised world

Entrepreneurs and managers praised recent initiatives to communicate laws and regulations in accessible language. As mentioned above, widening the horizon in order to attract more international investment might be a strong reason to extend these measures further and consider the needs of investors from outside of Latvia. A core initiative could be to make Latvian law and essential websites consistently available for foreign investors in an up-to-date English version. In some countries, e.g. Estonia, all current Estonian laws are available in a consolidated English version, the English version being informative only. In the United Kingdom, information is provided based on business lifecycle events (Box 2.4). A point for discussion would be whether stakeholders should have the option to choose another language such as English to be the legally relevant language for company, accounting and employment documents. The guiding question would be whether the expected advantages of more international investment and improved cross-border co-operation would outweigh the public cost of providing this option.

Many countries design and organise information systems and explain business law by way of practical topics. For instance, the UK web portal, gov.uk, provides information on government services, including a bookmark for business and the self-employed (see below). The Irish portal helps to identify the main regulations which affect businesses and provides links to the relevant agencies and their guidance, tools and contact points.

The formal requirements for businesses: Reduction and coherence

Notaries and electronic means of identification

Many stakeholders raised the issue of reducing the formal requirements regarding documents to be submitted to the Enterprise Registry. This concerns namely Sections 9, 10, 25, 187 and 327 of the Commercial Law. In particular, a larger number of stakeholders called for a reduction or even abolition of the need to provide documents in notarised form. Other stakeholders, in particular sworn notaries,13 raised reasons to keep such requirements or to reshape them and make them fit for the future. Reducing formal requirements should not be seen in isolation: attempts to reduce costs for businesses need to be considered against the background of introducing electronic forms of documents and identification as well as against the background of the practical readiness of such electronic solutions (see Chapter 2). Further, reform of the formal requirements should happen with a clear vision of the purpose such rules will serve and under consideration of the institutions that will administer the requirements. It is suggested that the reduction of formal requirements and the introduction of electronic solutions provide immense potential to reduce costs and create benefits for businesses. However, relevant reform calls for a measured and integrated manner. Care needs to be taken to include all stakeholders. Against this background, the following text concentrates on principles and core issues.

For historical reasons, Latvia involves notaries in the formal procedure of submitting documents to the Enterprise Registry. Latvian law, however, developed quite a specific way in which notaries are involved by the Commercial Law. According to Section 9(1) Sentence 4 of the Commercial Law, if the signature of a person must be notarised, there are three alternative options to comply with this requirement: 1) certification by a sworn notary; 2) certification by an official of the Enterprise Registry; or 3) a secure electronic signature if it is a document in electronic form. This rule gives businesses a choice, in particular between certification by a sworn notary or by an official of the register. Compared to the officials of the Enterprise Registry (state notaries), sworn notaries apply stricter rules.14 This leads to more substantive checks by sworn notaries, but it also makes the procedure more cumbersome for users. As a result, it is more attractive for applicants to go to the state notaries/officials in the Enterprise Registry rather than the sworn notaries, since the requirements before the state notaries/officials in the Enterprise Registry are lower.

Compared to other jurisdictions that involve notaries in commercial law matters (e.g. Germany), the function of notaries in Latvian commercial matters is quite limited. Latvian commercial law does not require notaries to check the legal substance of events or documents to be registered. Rather the function of notaries is generally limited to certifying the identity of persons acting in the relevant matter. Consequently, essential acts of notaries are: 1) determining the person’s identity (comparing the person, the ID card and the register of people);15 2) checking the validity of documents;16 3) verifying the capacity of persons to act; 4) in cases of representation checking the authorisation (based on the power of attorney and register entries, e.g. Registry of revoked power of attorneys). For example, a notary can be involved in checking a person’s identity when registering a business or in certifying the identity of persons party to a share transfer. The sworn notaries representatives involved in the stakeholder interviews estimated that 85% to 90% of their work relates to certifying identities, while the remaining time covers work dealing with the substance of legal acts.

By contrast, in Germany, another country with a history of notarial involvement in commercial law matters, notaries are more involved in checking the substance matter of documents to be registered. They are, for example, more substantively involved in verifying the articles of association and share transfer contracts. It is noted, though, that German law does not provide for alternatives to notarial certification as does Latvian law. Rather, where notaries are to be involved, there is no other optional form.

English law, on the other hand, does not rely on notaries to certify commercial documents to be registered. Instead, the relevant functions are achieved by a combination of prescribed forms, the involvement of the companies and the relevant register (Companies House). The fact that jurisdictions such as the English administer the same functions without notarial certification can raise the question that unnecessary costs are borne by Latvian businesses without achieving a corresponding advantage.

In recent times, notarial involvement in commercial matters came under additional pressure by electronic means of identification in procedural matters. E-signatures, e-identities and other electronic forms offer a cost-efficient way to identify actors. In addition, these forms of identification correspond with the transfer of registers from paper-based to IT-based organisation (see below).

Against this background, two different opinions emerged in the stakeholder interviews. On the one hand, various stakeholders believed that some or all of the provisions requiring notarised certification in the Commercial Law could be abolished. This was often tied with the suggestion to improve and widen the use of electronic means for identification under the Commercial Law. In particular, it was thought that if e-signatures or e-identities ensured identification, notarial identification was not necessary any longer. This was connected with the suggestion to use e-identification not only for communication with public services such as the Enterprise Registry, but also for other types of communication such as business-to-business (B2B) communication. The idea of having a proper company e-address was supported in this context. It was added that fraud prevention by way of analysing electronic data delivers stronger results than the visual checks carried out by notaries. Overall, simplifying the registration process for one-person companies was also seen as necessary.

On the other hand, sworn notaries maintained that their involvement is still required in the interest of fraud prevention. They argued that electronic means of identification are vulnerable to abuse because no one checks whether the relevant electronic device is operated by the person who pretends to operate it. In addition, sworn notaries argued that one of the reasons why businesses register in Estonia rather than in Latvia is the fact that Estonian notaries are more substantially involved in checking documents, thus lending more credibility to the Estonian registration system. Since no formal risk management system is currently in place in the Latvian state administration to carry out ex post controls on the submitted documentation, the notarisation requirement serves as an ex ante filter. At the same time, given that notaries verify and certify the validity of the signature and identity without performing a substantive check of documents signed casts doubts on the effectiveness of the measure to prevent crime.

Latvian sworn notaries are preparing themselves for the future: they are currently investing in IT systems such that certification can be done at a distance (e.g. facial recognition using video conferencing), supported by recent law reform aimed at facilitating notarial services. Foreign investors in particular might benefit from these changes. In the opinion of the sworn notaries, the legislature should focus on what and why notaries should be involved in, and limit the powers of institutions involved in the same process, i.e. sworn and state notaries.17 As part of the next steps it will be important to consider the associated costs (or, conversely, the associated potential benefits) associated with notarisation (also based on the burden analysis developed further below; Chapter 3 addresses the possible simplification of the registration procedure by streamlining notarisation).

Administrative simplification for business development

In Latvia, initiatives aimed at simplifying the regulatory and administrative framework have traditionally been driven by a business-oriented rationale. Improving the business environment is an ongoing reform endeavour by the Latvian government.

Contrary to most OECD countries, Latvia has not carried out a larger programme on ex post measurement of administrative burdens. The Latvian government has rather opted for a more qualitative approach based on a sustained and systematic dialogue with stakeholders. The approach seems to be delivering tangible results, contributing to steadily improving the country’s performance over the past few years. The approach is also generally viewed positively by the representatives of the private sector and the public administration bodies.

Besides the direct inputs from the affected stakeholders, priority simplification measures are identified on the basis of Latvia’s ranking in the World Bank’s Doing Business Indicators and the World Economic Forum’s Global Competitiveness Index, which are permanent target benchmarks of the Government Declaration and the National Development Plan for 2014-2020 for the achievement of an excellent business environment. The government also intends to benchmark its progress through the European Innovation Scoreboard as of 2018.

The Action Plan for Improvement of the Business Environment

The longest standing and arguably most significant initiative undertaken by the government to ease doing business in Latvia is the Action Plan for Improvement of the Business Environment (the “Action Plan”), elaborated yearly since 1999 by the Ministry of Economy in co-operation with stakeholders: the National Economic Council, the Foreign Investors Council in Latvia, the Latvian Chamber of Commerce and Industry, and the Employers’ Confederation of Latvia.

The Action Plan lists concrete measures aimed at eliminating excessive regulatory burdens in all areas related to running a business. Over the years, several hundreds of such measures were identified and introduced as a part of the plan.

The Action Plan currently being implemented, issued in February 2017, seeks to achieve “simple and high-quality services in business: more e-services”. In particular, Action Lines 2.1. and 3.11. explicitly cover Starting a business and Smart public administration and its e-services, respectively – two set of reforms directly addressed in this chapter. Overall, the Action Plan includes 46 measures, reflecting the following paradigms:

-

observing the one-stop-shop principle

-

implementing the “Consult First” principle, especially at the stage of starting a business

-

simple and qualitative state public e-services – even more active integration of e-solutions (digitalisation)

-

introducing business-environment-friendly infrastructure development services, including introducing and observing reasonable deadlines ensuring the importance of safety and quality requirements

-

simplifying administrative requirements, especially in the field of taxes and accounting, and reducing the bureaucratic burden

-

strengthening the legitimate expectations in the regulatory framework, especially in matters of protection of rights of investors and insolvency.18

The Action Plan issued in February 2017 includes the following main objectives:

Starting a business

-

Transition to the company’s registration online only starting from 2018

-

Reducing the standard costs for company’s e-registration to EUR 100

-

Dealing with construction permits

-

Providing all construction co-ordination processes digitally only not later than in 2020

-

Implementing the silent consent principle in the process of co-ordination of construction intention

-

Improving the insurance system in the construction field.

Protecting investors

-

Reviewing the stock option framework, granting shareholders the right to waive the pre-emptive right if new shares are issued, simplified reorganisation process, etc.

Resolving insolvency

-

Creation of a monitoring system of insolvency proceedings that could indicate main problem areas.

Efficient public administration and e-services

-

Integration of the “Consult First” principle in the government’s work

-

Improving the business section of the Public Administration Service Portal (www.latvija.lv)

-

Providing at least 20 new e-services on the Public Administration Service Portal over three years

-

Providing roadmaps for new entrepreneurs

-

Implementing the silent consent principle in several certification proceedings, as well as in other procedures.

Paying taxes

-

Ensuring the use of a single account for all tax payments.

Source: Latvia - Ministry of Economy.

The measures fall under the portfolio and responsibilities of several ministries. The implementation of the Action Plan and the respect of the targets and deadlines defined therein is hence decentralised, with rather soft co-ordination and oversight powers entrusted to the Ministry of Economy. In case of significant delays and lack of progress, political discussions take place at the ministerial level.

To date, ministries have not yet fully deployed quantification methodologies such as the Standard Cost Model (or equivalent), grounding their simplification programmes on qualitative assessments and perception surveys. One established source of information in this respect is the portal Let’s Share Burden Together!, which offers citizens and businesses the opportunity to report excessive administrative burdens and submit proposals for simplification (OECD, 2016).19 The reports submitted through the website are considered by the State Chancellery, which decides whether or not to organise a follow-up or not, in co-ordination with the responsible state body. In the future, the portal will be also used as a platform to conduct more targeted sector- and policy-specific opinion surveys on administrative burden and bureaucracy.20

In addition, every other year a business survey, “The Impact of Administrative Procedures on Business Environment” is conducted to collect inputs from the stakeholders on perceived barriers to doing business and on trends further to the simplification agenda.

The Draft Public Administration Reform Plan 2020

Most recently, and in the wake of implementing the National Development Plan 2014-2020, a Draft Public Administration Reform Plan 2020 (“PA Reform Plan”) was announced at the State Secretaries Meeting of 27 July 2017, and is currently being finalised.21 The Public Administration Reform Plan will complement the Ministry of Economy Action Plan for Improvement of the Business Environment. It was drawn up in light of the ever-increasing public demand for the efficiency and competitiveness of public administration, the simplification of processes and the reduction of administrative burdens.

The programme for reforms outlined in the PA Reform Plan takes account of the processes, functions and human resources available in the Latvian public administration. It grounds future actions on the three dimensions of “economy” (investing less), “utility” (investing proportionally, taking account of the benefits) and “efficiency” (investing smartly). The resulting initiatives are not supposed to increase state budget expenditures. Rather, reforms should be carried forward thanks to innovative solutions that rationalise Latvia’s administrative regime.

In the PA Reform Plan, the Latvian government identifies a number of recurring structural challenges, including:22

-

The public administration and human resource development policy is currently not sufficiently flexible and is incapable of adapting to the rapidly changing environment and public interest.

-

The allocation of responsibilities and tasks to discharge administrative functions is not efficient and does not sufficiently leverage synergies and economies of scale, causing significant internal administrative burden and consumption of human resources.

-

The system does not stimulate individual responsibility. Performance appraisals could be further grounded on a clearly defined reporting system with established criteria. Remunerations in the public administration, moreover, are not competitive and contribute to a negative public image of the public administration and a continuous flow of senior management into the private sector.

To tackle these challenges, the PA Reform Plan sets up ten reform directions, which should be implemented over a period of three years and are intended to be the basis for changing the culture of the state administration. Among the reform priorities, the government seeks to introduce a “zero bureaucracy” approach, facilitating the transition to a small and analytical public administration with streamlined supervisory and control functions (Box 2.6).

Priority Action 8 of the Draft Public Administration Reform Plan 2020 seeks to leverage better regulation policy and strengthen efficiency and effectiveness audits to minimise administrative burdens. Abiding by the principles of “regulating as little as possible” and “intervening only where necessary”, the government seeks to promote a transparent, evidence-based decision-making process by engaging more with the public and being more responsive.

Regular online public surveys on “Reducing burden together” are expected to identify areas of disproportionate bureaucracy affecting businesses and citizens. The proposed creation of a “Zero Bureaucracy” project team should contribute to developing effective simplification solutions. Initiatives already launched on inter-institutional administrative bottlenecks will continue operating, with a view to reducing the frequency of different administrative procedures and reporting.

State administration managers also play an important role in reducing administrative burdens and supporting internal audit function. Implementing horizontal audits and switching from compliance to performance reviews should help improve efficiency and economy.

Source: Latvia - Draft Public Administration Plan 2020, p. 28.

“Consult First”

One of the most visible, innovative and successful measures implemented in the framework story of the government’s administrative simplification programme is the so-called “Consult First” project signed in June 2017. Explicitly drawing from OECD guidance,23 this initiative led by the Minister of Economy is a co-operation between 22 state market surveillance and enforcement bodies24 as well as business associations including representatives of the Latvian Employers’ Confederation, the Latvian Chamber of Commerce and Industry, the Latvian Traders Association and the Association of Latvian Food Traders.

It aims to encourage a “client-oriented” approach to promote self-assessment and advice on compliance and conformity correction, prior to proceeding to established sanctions. The “Consult First” principle aims to provide advice first, before sanctioning businesses, to some extent. Legal rules that are considered essential will still be enforced without prior advice. In order to ensure uniform application of the “Consult First” principle, the Ministry of Economy introduced specific guidelines to the enforcement authorities, and linkages are envisaged with revised performance appraisals and capacity-building programmes. Consultations and communication are thereby put at the forefront of the dialogue with businesses, limiting recourse to fines to severe and recidivist cases.

This approach is highly welcomed by businesses and serves as a useful addition to the repertoire of state agencies dealing with businesses. Stakeholders proposed two points to further improve the “Consult First” principle. First, stakeholders asked whether further clarity in terms of what is key (immediate enforcement) and what is non-key (consult first) can be achieved. Second, stakeholders suggested establishing the “Consult First” initiative as a right for businesses as opposed to a discretionary remedy of the state agency. Further analysis is needed to assess the impact of such requests.

The Latvian “Consult First” project did not require amendments to the existing legal base. It will be implemented following two main pillars, outlined in the Ministry of Economy’s guidelines:

-

The first refers to the “efficiency of the surveillance activities”, and includes drawing up the authority strategy for effective surveillance; establishing key performance indicators (KPI); following a risk-based approach in surveillance activities; and gearing the activities towards the new overarching objective, namely to achieve compliance.

-

The second set of measures is about instilling a “client-based approach in regulatory practice”. This includes organising the provision of information and advice; the deployment of appropriate methods to explain the applicable requirements (including IT solutions); considering specifically the needs of new businesses; developing a service-oriented culture within the authority; and running client satisfaction evaluations of the work and achievements.

Criteria will be drawn up to evaluate progress among the authorities with regard to introducing the principle in their daily work. The first results of the evaluation are expected in 2018. The authorities will be ranked according to their compliance with the guidelines, and recommendations for improvement will be made for the following year.

The “Consult First” project is expected to run until 2020, when a comprehensive evaluation will be carried out. Albeit at its early stage, a number of success factors can already be identified, which make the Latvian experience with this innovative approach an international good practice. They include:

-

the strong political backing given to the project by the Prime Minister, making it a government flagship initiative

-

the shared ownership of the project, triggered not least by the fact that good practices already developed in some inspectorates were leveraged and consolidated in the elaboration of the general approach (bottom-up and horizontal approach to reform design) as well as thanks to the intense consultation with business representatives (participatory approach)

-

the comprehensive (whole-of-government) nature of the project, which touches upon various dimensions: from incentives included in the civil service reform (amendments of relevant KPIs to evaluation inspectors) to partnerships with the Public Administration School to launch new, dedicated capacity programmes), as well as – as it is envisaged – other levels of government with the future involvement of the Latvian municipalities

-

the very constructive and responsible attitude taken by the private sector, which did not limit itself to sheer complaining but contributed to ideas and improvements on their end

-

drawing lessons from international experiences with reforming enforcement governance and deploying mechanisms to stimulate compliance, thanks also to the good practices shared by the OECD.

Source: See https://em.gov.lv/files/ministrija/konsultevispirms/2017-06-15_10_05_37_KV_Vadlinijas_FINAL_MAKETS_14.06.2017.pdf.

Further reform initiatives

The government also envisages launching additional initiatives that may be conducive to making further progress on administrative simplification for improving the business environment, primarily under the leadership and co-ordination of the State Chancellery. Among such initiatives are:

-

Newly established, dedicated Labs, which should help investigate ways to enhance ethics in the public administration, and embed results-oriented and performance management practices.

-

An Entrepreneurship Project, to be carried out as of 2018 in conjunction with the Latvian Public Administration School, which aims to diffuse end user and entrepreneur-centred approaches to decision making among Latvian regulators.25

-

In the framework of the European Structural and Investment Funds (ESIF) project, a single portal26 as of 2020 to elaborate and co-ordinate legal acts within the executive branch. The portal will also include the “Public Participation” e-service, which will publish white and green papers to gather opinions from civil society and the public sector; announce stakeholder engagement activities, and consolidate inputs and feedback received in various consultation rounds.

An evidence-based regulatory process

As mentioned in the previous section, Latvia put less emphasis on quantifying administrative burdens during stock-taking simplification reviews than in the process of elaborating new regulatory interventions. Measuring administrative burdens stemming from new regulations is increasingly becoming a standard part of the ex ante impact assessment process.

Far from being exhaustive, the review of initiatives for evidence-based decision-making outlined in this section especially focuses on the synergies with other efforts to simplify the administrative regime in Latvia and reduce burdens.

The regulatory impact assessment system

In Latvia, the obligation to conduct a regulatory impact assessment (RIA) and the necessary arrangements for the underlying system are set out in a Cabinet Instruction of December 2009.27 That legal base includes the methodology of quantifying and monetising administrative costs. Such an assessment is to be carried out in cases in which the draft legal act has negative administrative impacts. The instruction defines “administrative costs” as those costs that result from information obligation provision or storing duties.

The Cabinet of Ministers adopted amendments to Instruction No. 19 in June 2017, which entered into force as of 1 January 2018.28 They provide for a series of new assessments to be conducted as a part of the RIA, including expected impact on small and medium-sized enterprises (SMEs), micro enterprises and start-ups. Moreover, the analysis of impacts on the environment, competition, health and non-governmental organisations (NGOs) will have to be included in the initial impact assessment, together with statements on the compliance requirements. If a new public service is created or redesigned, the RIA must include an analysis of delivery channels and an assessment of the impact on existing or future information and communication technology (ICT) systems.

These and other amendments will be added to a revised version of the existing Handbook on Draft Legislative Act Initial Impact Assessment, elaborated by the State Chancellery.29 The handbook is complemented by a Guide on Enhanced Standard Cost Model. Furthermore, specific training for policy officials on the new RIA requirements is envisaged by the end of 2017.

To consolidate all necessary information on the RIA system for government initiatives, the State Chancellery published a dedicated section of the electronic Guidebook on Drafting Legislative Acts, which includes downloadable forms and the relevant guidance materials.30

Ex post reviews of regulatory stock

Similar to several OECD countries, no systemic programme is in place in Latvia on ex post reviews of existing regulations. Reviews of regulations are part of the development planning system, and should in principle be conducted as a part of the regulatory process. However, to date such evaluations have tended to be carried out on an ad hoc basis or in particular areas or for particular types of legal acts, for example, with the aim of identifying obsolete legal provisions. Setting up inter-institutional working groups for such reviews is a regular practice.

Further, also to the recognition within the Saeima of the need for more systematic evaluation of the implementation of laws, the Cabinet of Ministers adopted a Conceptual Report on “Implementation of Ex Post Evaluation” in August 2016,31 with the aim to improve the oversight of efficient implementation of regulations. Implementing that commitment, the State Chancellery conducted two pilot projects throughout 2017 in co-operation with the Saeima and relevant line ministries – namely an ex post evaluation of the Law on Volunteers Work and one of the Regulation on Public Administration Employees Performance Evaluation System. On the basis of that experience, the Chancellery will elaborate a methodology for post-implementation regulatory reviews in 2018.

The Digital Agenda and e-Government Strategy

The Digital Agenda and e-Government Strategy are traditionally powerful drivers for administrative simplification in Latvia. Over the years, efforts were made at the central level to develop and mainstream ICT in the public administration, not least through the transposition of European Union legislation in the field.

The current National e-Government Strategy32 dates back to early 2013, when the Cabinet of Ministers approved a Concept of the Organisational Model of Public ICT Management, on the basis of which the government framed public ICT strategies, principles and scenarios for the effective co-ordination of the public ICT’s development and maintenance through partly centralised and partly sectoral management.

The Cabinet’s Information Society Development Guidelines for 2014-2020 of October 2013 were elaborated to ensure continuity of policies in the previous strategic period and to determine the ICT priorities for the EU Structural Funds Programming period until 2020.

At present, the e-government landscape nonetheless remains relatively heterogeneous, with different initiatives managed by, and targeting, various actors within the state administration. Some providers of public services are not directly bound by the government agenda for statutory or budgetary grounds. As a result, the Ministry of Environmental Protection and Regional Development deploys both soft and harder approaches to advance the digitalisation of public administration, relying on high-level political dialogue, memoranda of understanding, as well as more binding Cabinet resolutions. Particular attention is currently put on ensuring a smooth, paperless co-ordination, sharing data across the public administration, and better data management systems. Initiatives related to the one-stop shops, the provision of services and the deployment of e-signature are also part and parcel of the e-government strategies (see Chapter 2). A series of co-operative agreements are also signed with relevant NGOs on matters such as the development of digital skills; Latvia’s e-Index; and digital transformation.33

Towards a simplified, business-friendlier administration: Governance implications for Latvia

An effective agenda for administrative simplification with untapped potential

Overall, Latvia appears to be on a good reform track, reflecting a strong political commitment to rendering the economy more competitive.

Latvia is developing and advancing many reforms to develop a sound business climate, including pursuing administrative simplification and digitalisation; reviewing its legal framework for commercial activities; and increasing businesses’ accessibility to public services, especially through digital means.

While this is also partly the result of complying with EU legislation and policies, it is undeniable that the government set the explicit goal of matching the top world performers in terms of facilitating doing business and stimulating entrepreneurship. The inclusion of targets related to improvement in Latvia’s ranking according to established OECD and other international indicators (e.g. World Bank’s Doing Business) in government decisions confirms such commitment and increases accountability, while at the same time allowing the government to sustain its reform momentum over time and across several areas of intervention.

Progress is acknowledged and there is general appreciation by private sector stakeholders of the government’s work on easing doing business in the country. Both the substance and means to achieve such progress are an asset.

Most of the non-governmental stakeholders met by the OECD (among whom there were representatives of business, trade and professional associations as well as individual entrepreneurs) held a favourable opinion of the progress made by the government in simplifying business procedures and stimulating paperless interactions with the public administration. The sustained and constructive dialogue nurtured by the government with the business community regarding inputs and co-design reforms was also particularly appreciated. The positive climate for reform is confirmed by the acknowledgement of the government of the generally constructive and responsible attitude taken by business in collaborating on the reform programme – an attitude which in turn has encouraged responsiveness and commitment to institutional learning.

There are, in other words, very good framework conditions in place for further reform actions in Latvia. Both the reformers within the public administration and among the reform beneficiaries enjoy a high level of credibility and trust. The approach to reforms also appears to be seen as an asset. With regard to administrative simplification measures at least, it is consensual and participatory, where the responsibilities of all parties involved in the reform endeavour are recognised and leveraged. In this respect, the lack of systematic quantification and measurement efforts by the government to guide the direction of the simplification initiative does not seem to be considered negatively by either party.

Despite the fact that the project itself is still in its early stages of implementation, the approach taken to elaborating the “Consult First” project may be considered the epitome of the Latvian model to reform. It well illustrates the willingness between several actors to enter into constructive dialogue; to listen to the challenges and the constraints faced by both regulators and the regulated; to share good practices and leverage ideas; and to seek a comprehensive scope of application of the innovative solution reached.

The scope of the reforms appears to be quite wide and comprehensive, although challenges remain in relation to the strategic co-ordination, monitoring, accountability and communication of the reform.

As highlighted above, the remit of measures undertaken to simplify and digitalise the public administration encompasses most of the typical areas covered by regulatory policies in OECD countries. Also in terms of ensuring an evidence-based regulatory process, arrangements and guidance are in place that reflect international standards. More generally, regulatory policy elements are embedded in the government’s strategic documents and rules of procedure.

Nonetheless, no single, formal, whole-of-government document spells out the regulatory policy of the government. This may hamper the overall effectiveness of the Latvian better regulation agenda, if it prevents the elaboration and implementation of a strategic vision of the reforms. Such a risk may emerge also in light of the relatively dispersed allocation of responsibilities for individual parts of the regulatory reform. In the case of administrative simplification, for instance, leadership, design and management of parallel reform dossiers are spread between the State Chancellery, the Ministry of Justice, the Ministry of Economics, and the Ministry of Environmental Protection and Regional Development, as a minimum.

The lack of standing, institutionalised mechanisms for co-ordination is coupled with a relatively soft power that those ministries can deploy to ensure compliance with the reform targets and deadlines across the state administration. Political discussion at ministerial level must often compensate for failing to formally enforce reform programmes. While it allows for a less hierarchical and potentially more co-operative attitude towards administrative simplification, this approach may not prove the quickest and most effective approach to delivering change.

A further consequence that appears to result from the lack of a centralised policy and a more cohesive leadership to the reform is the rather weak accountability that line ministries appear to enjoy when implementing administrative simplification programmes. To date, neither a regulatory policy in general, or individual reform initiatives in particular, are systematically evaluated in terms of performance against the agreed pace and scope of the reforms. Communication of such progress to the public is also not regular or comprehensive.

References

Business Regulation (n.d.), “Making it Easier for Business”, www.businessregulation.ie/ (accessed 11 May 2018).

Cunningham, N. and Sinclair, D. (1999), 'Regulatory Pluralism: Designing Policy Mixes for Environmental Protection', Blackwell Publishers Ltd, Law & Policy, Vol. 21, No. 1, January 1999.

Government of Latvia (2012), “National Development Plan of Latvia for 2014–2020”, Cross-Sectoral Coordination Centre (CCSC), www.pkc.gov.lv/images/NAP2020%20dokumenti/NDP2020_English_Final.pdf.

International Finance Corporation (2016), “Making Mediation Law”, Mediation Series, http://documents.worldbank.org/curated/en/899611503551941578/pdf/119067-WP-REV-11-9-2017-15-33-48-MakingMedLaw.pdf.

Ireland – Department of Business, Enterprise and Innovation, website, Business Regulation, “Making it Easier for Business”, www.businessregulation.ie/ (accessed 11 May 2018).

Latvia - Cross-Sectoral Coordination Centre, website, https://www.pkc.gov.lv/en/about-us (accessed 23 April 2018).

Latvia - Ministry of Economy (2016), “The impact of administrative procedures on business environment”.

OECD (2017), Corporate Governance in Latvia, OECD Publishing, Paris, https://doi.org/10.1787/9789264268180-en.

OECD (2016), “Latvia”, in The Governance of Inclusive Growth: An Overview of Country Initiatives, OECD Publishing, Paris, https://doi.org/10.1787/9789264265189-25-en.

OECD (2014), Regulatory Enforcement and Inspections, OECD Publishing, Paris, https://doi.org/10.1787/9789264208117-en.

OECD (2010), Better Regulation in Europe: Portugal 2010, OECD Publishing, Paris, https://doi.org/10.1787/9789264084575-en.

UK - gov.uk (n.d.), “Business and self-employed”, webpage, www.gov.uk/browse/business (accessed 11 May 2018).

Notes

← 1. Adopted on 20 November 1990.

← 2. Adopted on 22 October 2015

← 3. Adopted on 31 October 2002.

← 4. Adopted on 10 May 1897.

← 5. Adopted on 15 December 1992.

← 6. Adopted on 14 October 1998.

← 7. Adopted on 21 April 2005.

← 8. Adopted on 25 October 2001.

← 9. Approved by the CoM Protocol No. 64, Paragraph 57, on 16 November 2010.

← 10. See “Strengthening the national economy”, Task 34.1 of the Declaration on the implementation of intended activities of the CoM headed by Māris Kučinskis (approved by Decree No. 275 of 3 May 2016).

← 11. Refer to the OECD Guidelines on Corporate Governance of State-Owned Enterprises (2015 edition), Recommendation II.A (p. 18): “Governments should simplify and standardise the legal forms under which SOEs operate. Their operational practices should follow commonly accepted corporate norms”; the annotation on p. 34 adds: “When standardising the legal form of SOEs, governments should base themselves as much as possible on corporate law that is equally applicable to privately owned companies and avoid creating a specific legal form, or granting SOEs a privileged status or special protection, when this is not absolutely necessary for achieving the public policy objectives imposed on the enterprise.”

← 12. For further information on the corporate governance of the Hamburg harbour – organised as a listed public company, see https://hhla.de/en/investor-relations/corporate-governance/overview.html.

← 13. Although in their tasks they perform equivalent functions as sworn notaries (for instance certifying signatures of natural persons), state notaries are not sworn notaries. State notaries are public officials and their activities are regulated by the State Civil Service Law. They perform the functions specified in the regulatory enactments regulating the scope of the Register of Enterprises. Sworn notaries, by contrast, are officers belonging to the court system and may operate commercially. Their functions are laid down in the Law on the Notaries. Both sworn notaries and state notaries can certify signatures of natural persons on documents that must be submitted to the Enterprise Registry.

← 14. While sworn notaries have to follow the Commercial Law, the Notariate Law and the Prevention of Anti-Money Laundering Law, officials of the Enterprise Registry only have to comply with the Commercial Law.

← 15. Including verifications in the National Register of persons wanted by the police or in national and international sanction lists.

← 16. For example, in Registry of Invalid documents.

← 17. Sworn notaries suggested moving the focus from the formal involvement of notaries towards checking the content of notarised statements provided to the Enterprise Registry and share transfer, especially in light of anti-money-laundering policies.

← 18. See the Action Plan for Improvement of the Business Environment, February 2017, p. 4.

← 19. See also www.mazaksslogs.gov.lv. The State Chancellery administers a related mobile phone application, called Football, with the same objectives of receiving complaints about excessive bureaucracy and ideas for its streamlining.

← 20. Such development forms part of the Draft Open Government Partnership National Action Plan 2017–2019 and the Draft Public Administration Reform Plan 2020, under the direction of “Moving Towards Zero Bureaucracy”.

← 21. As of September 2017; draft available at http://tap.mk.gov.lv/doc/2017_07/MKPl_240717_VPRP2020.803.pdf.

← 22. See the Draft Public Administration Plan 2020, p. 12.

← 23. The specific guidance is OECD (2014), Regulatory Enforcement and Inspections, OECD Publishing, Paris, https://doi.org/10.1787/9789264208117-en.

← 24. Among them are the largest Latvian enforcement authorities, including the State Revenue Service; the State Environmental Service; the Consumer Rights Protection Centre; the Insolvency Administration; the State Agency of Medicines; the Nature Conservation Agency; and the Cross-sector Coordination Centre.

← 25. Six modules are foreseen under the project, covering issues related to the regulatory environment; less regulation and administrative burden reduction; communication with entrepreneurs and monitoring and enforcement; public service delivery; competition; and sustainable entrepreneurship.

← 26. The portal, which will be located at www.gov.lv, will serve as a web platform for both state and municipal institutions.

← 27. See Cabinet Instruction No. 19 on Rules for Completing the Initial Impact Assessment of a Draft Legal Act, available at https://likumi.lv/doc.php?id=203061.

← 28. The related Cabinet Instruction 4/2017 is available at http://tap.mk.gov.lv/doc/2017_06/MKinstr_07042017_Anot_groz.1253.docx.

← 29. The two sets of methodological and analytical guidelines mentioned can be found at www.mk.gov.lv/sites/default/files/editor/metodika_gala1.pdf and www.mk.gov.lv/sites/default/files/editor/3_1_as_metrgr_psim_e-vide1_final.pdf

← 30. See https://tai.mk.gov.lv/anotacija.

← 31. See http://polsis.mk.gov.lv/documents/5677.

← 32. See http://www.varam.gov.lv/eng/darbibas_ve-IDi/e_gov/?doc=13317.

← 33. The related Cooperation Memoranda with NGOs can be found at www.varam.gov.lv/lat/lidzd/Sad_nvo/?doc=14926.