Chapter 1. Overview: Towards a sustainable and inclusive high-income country

After nearly three decades of strong macroeconomic performance and some social improvements, Panama should now embark on a new reform agenda to become a sustainable and inclusive high-income country. This chapter highlights the socio-economic improvements Panama has achieved in recent decades thanks to strong economic growth and consequent poverty reduction. Its growth model is characterised by a dual economy in which a small number of activities, including those related to the Canal and Special Economic Zones (SEZs), have exhibited high productivity growth but limited job creation. This chapter therefore urges greater productivity in sectors that contribute to job formalisation to reduce disparities in income and among regions. As developing these policies requires further resources, taxation system improvements and greater mobilisation of private sector investment through public-private partnerships are needed. This chapter presents the main results of implementing policy actions in the three areas studied in this report: skills and jobs, regional development, and development financing.

Panama has experienced considerable socio-economic progress and improved well-being in recent decades. Gross domestic product (GDP) per capita grew significantly between 2006 and 2016, at an average of 5.5% annually – faster than the average of 1.5% in Latin America and the Caribbean, and 0.7% in Organisation for Economic Co-operation and Development (OECD) countries–, narrowing the gap in GDP per capita with developed countries. Moreover, Panama is on the verge of becoming a high-income economy. In addition, the level of poverty (defined as the share of people living on less than USD 3.20 at purchasing power parity [PPP] per day) dropped by more than half between 2005 and 2016, to 7%. Similarly, extreme poverty, or those living on less than USD 1.90 PPP per day, is only one-fifth what it was in 2005, affecting 2.2% of the population in 2016. Furthermore, Panama performs relatively well in most OECD well-being dimensions compared with countries at the same level of development (OECD, 2017).

Panama’s impressive economic performance and social improvements in the past decade have not been achieved without challenges. Most of the economic growth and improvements in labour productivity are due mainly to investment and commerce, both retail and wholesale. Furthermore, the Canal and, to a lesser extent, the SEZs have played a considerable role in the country’s economic performance, which explains why Panama is often characterised as a dual economy.1 Although the country has a formal sector featuring high wages in specific activities linked to global trade (Bussolo et al., 2012), export capacity and productivity remain low in the rest of the economy, particularly in the industrial and agriculture sectors. In addition, similar to other Latin American economies, the shadow economy has contributed to Panama’s economic performance but its total contribution, which is difficult to assess, has not benefited most of the population or the state. In terms of social welfare, although poverty rates have fallen considerably in the past decade, income inequality has improved very little. The share of income held by the top 10% of the population has been high (close to 40%) since 2005, and many of the people who escaped poverty in recent years remain vulnerable to slipping back into poverty if there is an economic slowdown.

To address these challenges, Panama should embark on a new model of development to promote continuous, sustainable and inclusive growth, and well-being for all citizens. Although Panama is set to become a high-income economy soon, challenges to sustainable and inclusive growth imply that reforms are needed in the process of moving from middle- to high-income status. These include policies to enhance skills and productivity, as well as labour market reforms to promote the creation of formalised jobs. Further, inclusiveness and extending economic benefits to other sectors and across all provinces and comarcas requires improvements in the institutional framework as well as capacity building for a regional development policy. Finally, policies to adjust the tax structure, strengthen tax administration and promote greater private sector involvement through public-private partnerships must be implemented to finance development.

This chapter summarises how Panama should upgrade its drivers of economic growth and improve its social policies to support an inclusive and sustainable high-income country. First, the chapter provides an historical overview of socio-economic development in Panama and the main characteristics of current macroeconomic performance. Second, it presents the main challenges to promote further development. Finally, it highlights from a multidimensional perspective the constraints to boosting inclusiveness and sustainable growth, namely skills and labour market policies, regional development policy and financing for development. This final section summarises the main policy implications and actions to be adopted, and they are analysed in greater depth in subsequent chapters of this review.

Three decades of socio-economic progress in Panama

Following the economic and political crisis at the end of the 1980s, macroeconomic performance considerably improved in the 1990s. Political unrest, with citizens demanding an end to 21 years of dictatorship and corruption, coupled with an economic crisis (GDP per capita decreased by 1.7% between 1985 and 1990, and by more than 15% in 1988 alone), led to the removal of Manuel Antonio Noriega from power in 1989 (Chaikin, 2013; OECD, 2017). In the 1990s a stable macroeconomic framework, based upon improved debt sustainability, saw average annual economic growth reach 5.5%. This contributed to a reduction of extreme poverty (defined as living on less than USD 1.90 per day, 2011 PPP) by close to 8 percentage points during the 1990s, to less than 15% at the end of the decade.

The socio-economic gains exhibited in the 1990s have accelerated since the beginning of the 21st century. As a result of the Torrijos-Carter treaties, signed in 1977 and progressively implemented until 1999, revenues from the Canal have become a key source of income to Panama. Panama’s adhesion to the World Trade Organisation (WTO) at the end of 1997 has seen the country benefit from increased global trade. Over the last ten years, levels of investment in Panama have been higher than OECD and Latin American averages. In the period 2006-16, GDP per capita grew an average of 5.5% annually (vs. 3.3% in the 1990s), thereby helping to reduce the GDP per capita gap with high-income countries. Similarly, extreme poverty continued to decline dramatically and is only one-fifth that observed in 2005, encompassing 2.2% of the population in 2016. Finally, the OECD well-being framework shows that Panama is doing relatively well compared to countries with similar levels of development, particularly in areas such as social connections, life evaluations, life expectancy and, more generally, material conditions. For instance, more than three out of four Panamanians report being satisfied with their living standards (OECD, 2017).

Current challenges reveal that new engines for sustainable and inclusive growth are needed

The favourable macroeconomic performance of the past decade, which has been a key driver of the recent social progress, has lost impetus in the past few years. The Dominican Republic and Panama are leading Latin American economies in terms of annual economic growth. According to both the Economic Commission for Latin America and the Caribbean (ECLAC) (2018) and the International Monetary Fund (IMF) (2018), GDP is expected to grow at 5.6% in Panama for 2018, well above the projections for the region (2.2% and 2.0% according to both institutions, respectively). However, annual GDP per capita growth has declined since 2012, from 9.9% in 2011 to 3.2% in 2016, and labour productivity remains well below OECD countries (Figure 1.1). Less promising economic conditions have impacts beyond GDP. Indeed, the effect of growth, rather than reducing inequalities, was responsible for most of the reduction in poverty of recent decades.

Furthermore, dynamic growth in recent decades has been concentrated in only a few activities and regions, benefitting only a small proportion of the population. Gains in GDP growth and labour productivity growth in recent decades were in part the result of a dual economy. The Canal and to a lesser extent the SEZs have played a considerable role in Panama’s economic performance. In contrast, other regions and sectors, in particular the industrial and agricultural sectors, exhibited low levels of export capacity and productivity. In that context, the lack of co-ordination among public institutions to deliver an effective national strategy for development remains a concern in Panama (OECD, 2017). In addition, estimates show that the shadow economy has been important in Panama, as in other Latin American economies. This includes the production of goods and services that are deliberately concealed from public authorities to avoid payment of taxes, social security contributions or certain administrative procedures (Schneider, Buehn and Montenegro, 2010). While shadow economy activities are reflected in the state of the official economy, such as the GDP per capita, they are not considered in state revenues thereby affecting the quality and quantity of publicly provided goods and services for all citizens.

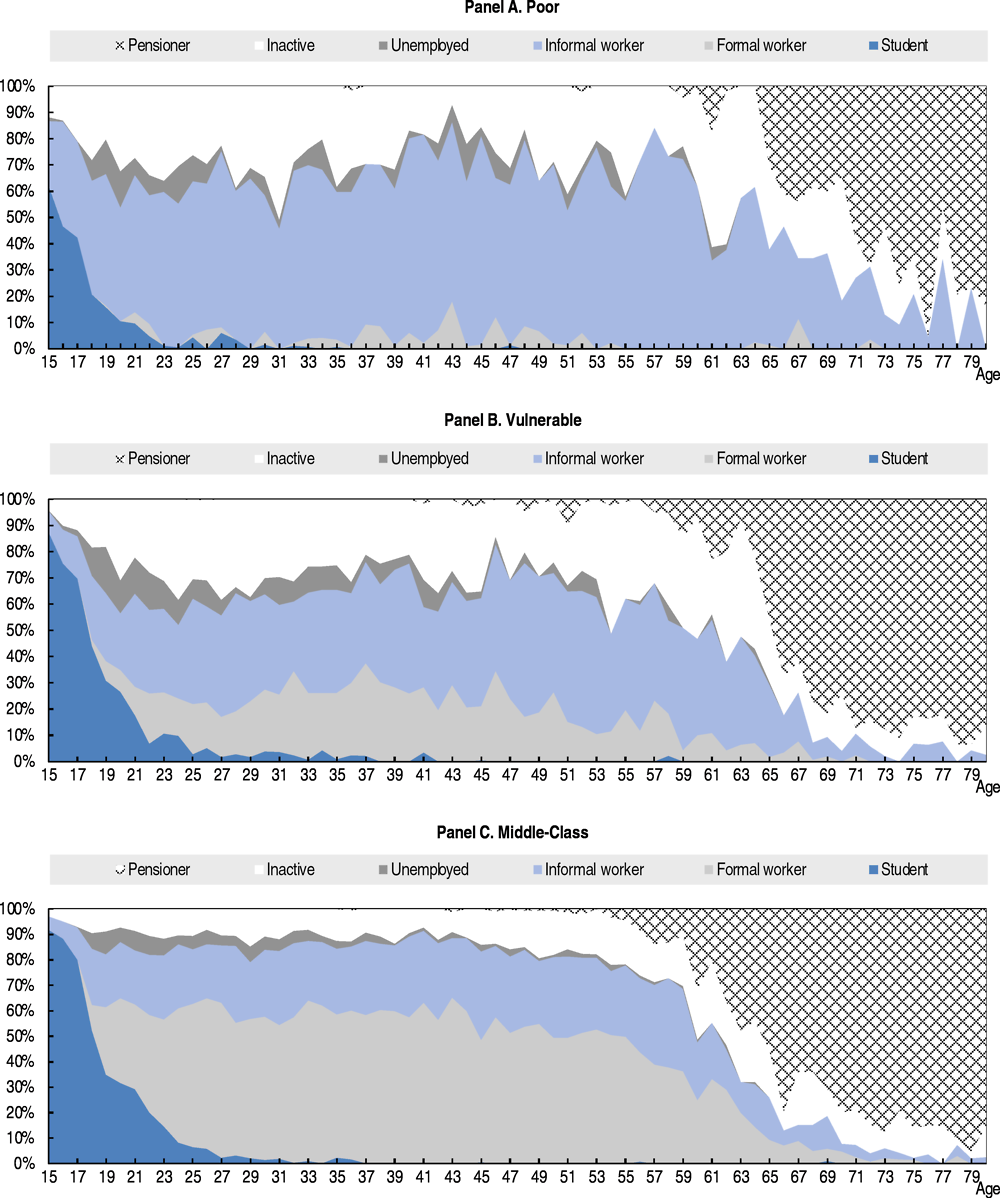

Consequently, despite the reduction of poverty in the past decades, spatial and income disparities remain in Panama. While the share of the population living in poverty has declined considerably, significant inequalities continue to exist. The Gini coefficient declined very little and, similar to other economies in the region, it remains high at close to 0.48 (vs. 0.32 in OECD economies). Informality (workers are considered informal if they do not have the right to a pension when retired) also persists, accounting for more than one-third of non-agricultural employment. The large proportion of unprotected own-account or low-skill informal jobs on the one hand, and the high-skill formal jobs on the other, have resulted in a dual labour market that mirrors Panama’s dual economy. The former group is largely comprised of the poorer classes, but also contains members of the vulnerable middle classes, which risk sinking into poverty and represent one-third of the population (Figure 1.2). Finally, there is a large gap in terms of well-being outcomes across provinces and comarcas. Residents of comarcas are much more likely to live in poverty and report lower levels of satisfaction with their living conditions, and they are also at greater risk of having informal jobs. However, low outcomes in material and living conditions are also evident in some provinces as well, generally those that are rural, and regardless of whether they have a high percentage of indigenous inhabitants.

Therefore, Panama needs to invest in new engines of inclusive and sustainable growth. Panama is on the verge of becoming a high-income country, but overcoming the middle-income trap (MIT) will require a set of public policies designed to improve labour productivity across all sectors. Following the experiences of other countries that have tackled the MIT, improvements in the quality of education, governance, rule of law, the taxation system and liquidity in the equity market are some of the main domains that should be prioritised (Melguizo, Nieto-Parra, Perea and Perez, 2017). These policies should contribute to expand labour productivity to other activities beyond the Canal, the SEZs and the construction sector, but also consolidate the middle class and promote formal jobs. In that context, better institutional capacity to deliver public services to citizens is fundamental to move towards further inclusive development. Taking into consideration the regional disparities, a national strategy, in partnership with sub-national actors, should be delivered to enhance regional development.

The multidimensional approach of this review supports Panama’s vision of becoming an inclusive and sustainable high-income economy. The entire process of the OECD’s Multidimensional Country Review (MDCR) aims to close the gap in the design and implementation of policies for development. Therefore, this review supports Panama by formulating national development strategies that take into account the development objectives and the means available for implementing public policy to promote equitable, inclusive, and sustainable economic growth that advances national aspirations and improves the well-being of all citizens. The first volume of the MDCR of Panama described economic development in the country since the 1980s and provided an in-depth assessment of the Panamanian economy and its institutional framework as well as state of well-being today. It also identified the main constraints to sustainable and inclusive development, and proposed topics for further analysis in the second phase of the MDCR. A participatory workshop held in October 2017 with policy makers, civil society representatives and participants from the private sector discussed topics identified as fundamental to boost inclusive development (Box 1.1). The results of the workshop were considered when recommendations and the analysis presented in this review were drawn up.

This review is composed of three distinct phases:

-

The first phase aimed to identify the main constraints to achieving sustainable and equitable improvements in well-being and economic growth. That report, entitled “Initial Assessment”, was the first volume and was launched in October 2017.

-

This second phase further analyses the key constraints identified in the first report to the formulation of policy recommendations that can be integrated into the development strategy of Panama. This second volume is entitled “In-depth Analysis and Recommendations”.

-

The final phase of the MDCR will provide support for the implementation of these recommendations. As for other Latin American economies, this final phase is particularly relevant in Panama given the complexity of both the political economy and the policy-making process to make reform happen (Dayton-Johnson, Londono and Nieto-Parra, 2011). The third volume is entitled “From Analysis to Action”.

For each phase, in addition to the publication of a report, a series of workshops was organised. The policy recommendations in this volume are informed by the participatory work stream of the MDCR of Panama. A workshop entitled “Opportunities for the future in Panama: Territorial inclusion, formal jobs, financing” was held in Panama City on 12 October 2017. The workshop brought together thirty-five participants from the administration, the private sector and civil society to discuss policy options to respond to the three main challenges identified in the first phase of the MDCR of Panama (OECD, 2017).

Based on the governmental learning methodology, workshop participants selected key topics to concentrate on in a prioritisation exercise and formed thematic groups to discuss (i) territorial development, (ii) sustainability, (iii) capacities and human capital, (iv) financing development, (v) co-operation and social dialogue, (vi) formal jobs and (vii) state capacity. Each of these groups then identified policy solutions to Panama’s most pressing development problems. On the basis of policy proposals from the OECD team and from participants, the workshop participants discussed, and suggested additions and amendments to, the policy recommendations that are included in each chapter of this review.

Volume 2 of the MDCR presents in-depth analysis of, and outlines recommendations for, the three topics identified in Volume 1 as key constraints to inclusive development in Panama:

-

building better skills and creating formal jobs for all Panamanians (Chapter 2)

-

strengthening regional development policy to boost inclusive growth (Chapter 3)

-

improving the taxation system and promoting the private sector’s involvement to support financing for development (Chapter 4).

The overview of the main findings and policy actions for these three topics follows. In-depth policy recommendations are covered specifically in each of the following chapters of the report.

Building better skills and creating formal jobs for all Panamanians

Informality remains high in Panama and is a challenge for social inclusion and productivity. Although Panama’s economic growth has served to create more than half a million jobs since 2003, informality remains higher than in other countries with similar levels of GDP per capita such as Argentina, Turkey and Uruguay. In 2016, informality still affected around 40% of non-agriculture workers and almost 50% of workers overall. Informality poses a double threat: large losses for workers in the form of low savings and inadequate social protection, as well as a lack of upskilling; and low productivity and loss of fiscal revenues for firms and the wider economy.

Inequalities in the labour market start early, highlighting the need for better access for all Panamanians to quality education and skills. Young workers from poor or vulnerable families are more likely to have informal jobs than those from the middle class. Youth from these households leave school earlier than their peers in better-off households, and when employed they work mainly in informal jobs. At age 15, six out of ten youths living in poor households are in school; at age 30, however, nine out of ten are informal workers or inactive. In vulnerable households, six out of ten young people aged 30 are working in the informal sector or inactive. This shows that informality especially affects those in the lowest quintiles of the income distribution and thus a certain degree of labour market segmentation exists in Panama, making the transition from school to work a particularly relevant stage in young people’s careers and futures.

Furthermore, the dual economy has translated into a dual employment market, which in turn largely explains income inequality in the country. On one hand, Panama has a strong and productive modern tradeable service sector – mainly financial intermediation and trade, logistics and communications activities surrounding the Canal and the SEZs – which steered the country’s recent economic growth. These sectors are skills intensive but create relatively little employment. On the other hand, the less productive services sector, the agricultural sector and in some measure the manufacturing sector, in which own-account workers and micro-productive units have proliferated, offer subsistence and informal jobs to most workers.

To promote better skills and better jobs for all Panamanians, certain policy actions should be taken into account (the policy recommendations are developed in depth in Chapter 2):

-

Create better conditions for productive development by including formalisation as a key item in a national development strategy and a well-co-ordinated approach to increasing economic diversification in agro-industry and upgrading existing services.

-

Develop better and relevant skills by increasing the access to and quality of secondary and technical education, as well as strengthening active labour market policies such as training programmes with effective participation of the private sector, in particular for young people.

-

Increase the incentives to be formally employed and mitigate the pervasive impact of informality by developing an integrated pension system, by providing alternative schemes to incorporate independent workers, domestic workers and temporary agricultural workers in the social security system and also by communicating the benefits of formality and the risks of informality.

-

Generate incentives for employers to formalise workers by partially subsidising the social contributions of vulnerable workers, or by establishing a simpler scheme to determine minimum wages.

-

Supervise and enforce labour laws by increasing efforts to supervise informal workers in formal firms.

-

Boost the formalisation of small and medium enterprises (SMEs) and independent workers by reducing red tape and administrative costs associated with formal status.

Strengthening regional development policy to boost inclusive growth

Regional development is a lever to help Panama continue on its growth trajectory and achieve more inclusive socio-economic outcomes. Regional disparities across provinces and comarcas in terms of productivity, social cohesion and well-being outcomes are persistent in the country. In improving strategic planning and implementation frameworks, well-being and economic prosperity can be better promoted in the key multisector policy area of regional development. The state should therefore invest effectively in regions, including the lower-performing ones, to encourage sustainable growth in Panama.

There is a pressing need to define and implement a strategic approach to regional development in order to help mitigate the risk of ad hoc growth in some areas of Panama. Projections indicate that the greatest population growth is expected in some of the least advantaged territories, where quality of life and well-being outcomes are already low, particularly in the comarcas, Bocas del Toro, and Los Santos. In addition, Panama City is also expected to grow significantly and the challenge will be to ensure adequate infrastructure, housing, amenities, and public service delivery capacity to keep up with growing demand, while also maintaining or improving quality of life. While appropriate spatial and land-use planning are fundamental to meeting the challenges represented by such growth, they complement and contribute to a regional development policy; they do not replace it.

Consideration should be given to strengthening the normative and institutional frameworks supporting regional development. Currently, there is no overarching strategy to guide regional development in the long term, nor is there an explicit regional development policy to serve as a road map in the medium term. The implementation of regional development initiatives is spread across line ministries, with each territory introducing and executing its sectoral objectives and plans. At the national level, regional development is consequently fragmented and sector-driven, with limited effectiveness and a lack of concrete results. At the sub-national level, newly introduced District Strategic Plans (Planes Estratégicos Distritales) combine development and land-use planning, and are designed with the Strategic Government Plan 2015-2019 (Plan Estratégico de Gobierno) and the National Strategic Plan 2030 (Plan Estratégico Nacional con Visión de Estado-Panamá: 2030) in mind.

To design and implement a regional development agenda for all provinces, comarcas and municipalities, certain policy actions should be taken into account (the policy recommendations are developed in depth in Chapter 3):

-

Strengthen multilevel governance practices to better support regional development by adjusting normative and institutional frameworks for regional development and building sub-national, especially municipal, capacity and resources. Inspiration could be drawn from practices in Finland and Slovenia (legal frameworks), the United Kingdom (White Papers), Sweden (state strategies), France (state-region planning contracts) and New Zealand (regional growth programmes).

-

Support a “new paradigm” approach to regional development. Several actions are required: (i) develop a national regional development policy that clearly articulates national territorial development objectives and priorities; (ii) introduce provincial and comarca regional development plans; (iii) create regional development funding mechanisms; (iv) build performance measurement systems; and (v) consider stronger partnerships between the public and private sectors when launching future regional development agencies. Countries such as Colombia, France, Ireland, Mexico and Sweden are good examples of these practices since they have taken diverse approaches to formalising their regional development strategies.

-

Enhance horizontal and vertical co-ordination capacity by creating a high-level interministerial body and a dedicated unit for regional development policy. This presupposes the need to build vertical dialogue mechanisms and promote intermunicipal co-operation. Sweden’s Forum for Sustainable Regional Growth and Attractiveness offers a successful example of vertical co-ordination, and countries such as Chile, Greece, Iceland, the Netherlands, New Zealand and Ukraine have mechanisms to support intermunicipal co-operation.

Improving the taxation system and mobilising private sector investment to support financing for development

Panama’s total tax revenues have remained stagnant during the last two decades. At 16.6% of GDP in 2015, total taxes and social security contributions in Panama remain well below those of the OECD (34.3% of GDP) and Latin American and Caribbean countries (22.7% of GDP) (OECD/ECLAC/CIAT/IDB, 2018). However, revenues from the Canal and other public enterprises have partially compensated for low levels of revenue intake.

Improving the prospects of tax revenue collection would provide a stable long-term source of income to finance inclusive growth. To ensure financing for development in Panama, citizens’ willingness to pay taxes – known as “tax morale” – is fundamental (OECD/CAF/ECLAC, 2018). Revenues can be increased by improving tax collection instead of raising rates. This is particularly evident for indirect taxes. Furthermore, Panama provides a wide array of tax benefits that affect the system’s efficiency by potentially providing incentives to firms within sectors that would not be profitable in the absence of tax expenditures. Moreover, exemptions, deductions and other special treatments affect both the vertical and horizontal equity of the tax system. Finally, evasion and fraud linked to the weak institutional capacity of the tax administration office affect tax collection in Panama.

Better private sector involvement, through public-private partnerships, is an additional source of effective financing for development; Panama therefore needs to update its current legislation on public-private partnerships. In 2011, a law proposal was withdrawn at the Congress, and the 1988 law regulating concession projects, including roads and airports, is outdated. The establishment of sound regulatory and institutional frameworks for public-private partnerships should promote sustainable investment projects for development in Panama.

To implement a policy framework that effectively increases financing for development in Panama, certain policy actions should be taken into account (the policy recommendations are developed in depth in Chapter 4):

-

Ensure macroeconomic stability and bolster international creditworthiness by establishing an independent fiscal council to promote compliance, transparency and accountability within the fiscal framework.

-

Enhance the tax system’s efficiency by adopting a methodology to measure and report tax expenditures on an annual basis; by ending subsidisation of otherwise unprofitable businesses or firms; and by expanding the tax base by scaling back tax benefits provided to consolidated industries within SEZs.

-

Promote higher equity and the redistributive power of the tax system by for instance expanding currently exempted services in the value-added tax base or by expanding the personal income tax base to include the currently exempted “13th wage” (a bonus paid at the end of the year), since those that earn more benefit the most.

-

Modernise the tax administration by integrating critical processes to improve efficiency and reduce administrative costs, or by continuing the development of electronic invoicing to encourage compliance by fighting fraud and tax evasion.

-

Adopt and implement new norms for public-private partnerships with sound regulatory and institutional frameworks. These include the creation of a public-private partnerships unit, transparent and competitive auction processes, effective and efficient participation of citizens in the grant process for environmental and social licences, the execution of land permits, and fiscal accounting for public-private partnerships to avoid using concessions as an option for fiscal space.

References

Bussolo, M. et al. (2012), “Distributional effects of the Panama Canal expansion”, Economia, Vol. 13/1, Brookings Institution Press, Washington, DC, pp. 79-129, www.jstor.org/stable/41756783.

Chaikin, D. (2013), “Controlling corruption by heads of government and political elites”, in Larmour, P. and N. Wolanin (eds.), Corruption and Anti-Corruption, ANU Press, pp. 97-118, http://www.jstor.org/stable/j.ctt2tt19f.9.

Dayton-Johnson, J., J. Londono and S. Nieto-Parra (2011), “The process of reform in Latin America: A review essay”, OECD Development Centre Working Papers, No. 304, OECD Publishing, Paris, https://doi.org/10.1787/5kg3mkvfcjxv-en.

ECLAC (2018), “Actualización de proyecciones de crecimiento de América Latina y el Caribe en 2018”, April 2018, Economic Commission for Latin America and the Caribbean, https://www.ce Panamanian Balboa.org/sites/default/files/pr/files/tabla-proyecciones_crecimiento_abril-2018_esp.pdf.

IMF (2018), World Economic Outlook (database), International Monetary Fund, https://www.imf.org/external/pubs/ft/weo/2018/01/weodata/index.aspx (accessed April 2018).

Melguizo A., S. Nieto-Parra, J. R. Perea and J. Perez (2017), “No sympathy for the devil! Policy priorities to overcome the middle-income trap in Latin America”, OECD Development Centre Working Papers, No. 340, OECD Publishing, Paris, https://doi.org/10.1787/26b78724-en.

OECD/CAF/ECLAC (2018), Latin American Economic Outlook 2018: Rethinking Institutions for Development, OECD Publishing, Paris, https://doi.org/10.1787/leo-2018-en.

OECD/ECLAC/CIAT/IDB (2018), Revenue Statistics in Latin America and the Caribbean 2018, OECD Publishing, Paris, https://doi.org/10.1787/rev_lat_car-2018-en-fr.

OECD (2017), Multi-dimensional Review of Panama: Volume 1. Initial Assessment, OECD Development Pathways, OECD Publishing, Paris, https://doi.org/10.1787/9789264278547-en.

Schneider, F., A. Buehn and C.E. Montenegro (2010), “New estimates for the shadow economies all over the world”, International Economic Journal, Vol. 24/4, Taylor & Francis, pp. 443-461.

World Bank (2018), World Development Indicators (database), https://data.worldbank.org/products/wdi (accessed February 2018).

Note

← 1. There are three major SEZs, each one serving a distinct purpose. The Colon Free Trade Zone (CFZ), the pioneering SEZ, specialises in re-exporting and manufacturing for exports. The more recent Panamá Pacífico is a residential and industrial zone that seeks to attract multinational headquarters, service companies and high-value-added manufacturing firms, among others. Finally, the City of Knowledge is orientated towards knowledge-intensive enterprises, privileging innovative enterprises, research institutions and international organisations.