Chapter 3. People: Improving citizen well-being in Paraguay1

This chapter focuses on key aspects related to the well-being of citizens in Paraguay. It analyses the country’s performance in terms of poverty and of inequality between people. While poverty has fallen significantly in the past ten years, inequality is persistently high. The chapter goes on to analyse key mechanisms to address inequality in the short and medium terms: employment and labour markets, education and the social protection system.

Improving the well-being of everyone in a sustainable manner is the ultimate development goal. Paraguay has made significant progress in reducing poverty. High economic growth and strengthened social spending have contributed to this achievement. On the other hand, income inequality and inequalities between urban and rural areas remain large. Improving education and labour market outcomes is critical to ensuring that the good economic fortunes of the country benefit all.

This chapter examines performance and the constraints on improving people’s well-being across a number of dimensions. The chapter first examines Paraguay’s performance in terms of poverty and inequality, with special attention paid to territorial inequalities, the income and non-monetary dimensions of which are considerable. The chapter then turns to selected topics of critical importance to the ability of the Paraguayan economy and state to reduce inequality. Promising job opportunities provide an avenue for increasing the incomes of the poor, and while Paraguay has a very good job creation record, the country still faces challenges in generating good-quality jobs in the formal economy. Education is also a key component in ensuring that future generations have more equal opportunities. Paraguay still faces challenges in meeting its objective of universal access to 12 years of education for all students, and this problem is exacerbated by significant gaps in the quality of learning outcomes. Finally, the institutional arrangements and the prevalence of informality lead to a fragmented social protection system.

Paraguay’s growth performance has led to improvements in incomes but inequality remains large

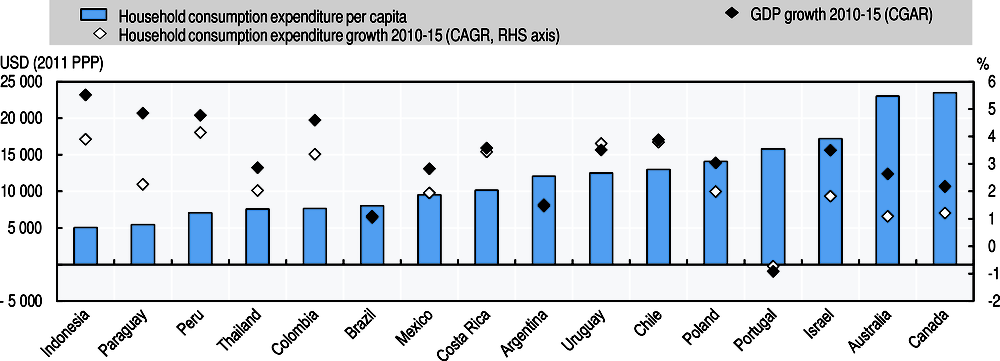

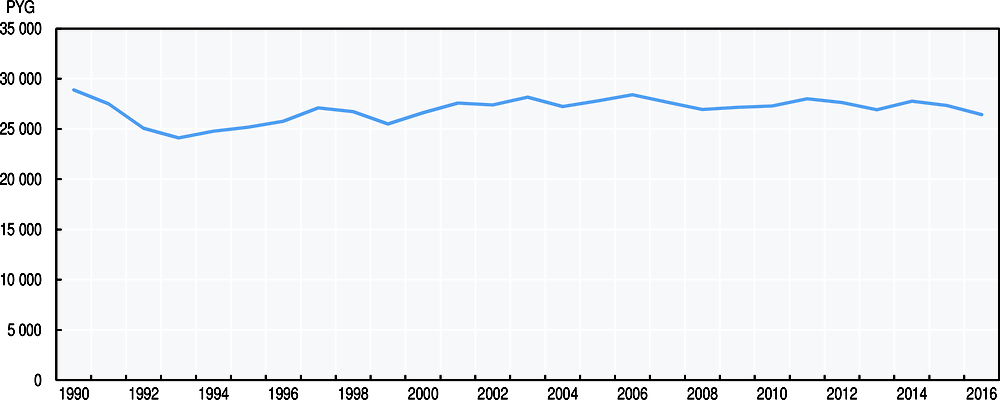

The recent period of economic growth in the country has contributed to raising the living standards of many Paraguayans, including those of the poorest. While household consumption expenditure in Paraguay is among the lowest in the comparison group, the economic performance over the past five years has been very encouraging. This has translated into an adequate growth in household consumption expenditure (2.3% annual in purchasing power parity [PPP] terms), above that of most OECD comparators, but below that of other fast-growing countries in the region and beyond.

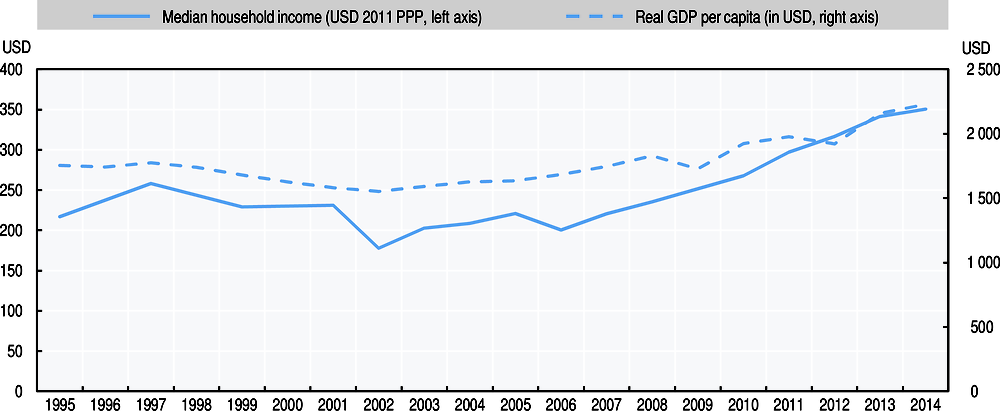

Economic growth has contributed to growth in personal incomes, albeit less than in comparable countries. Incomes started growing in real terms when growth picked up in 2003, but it was only after 2006 that growth in personal incomes accelerated and stabilised. In the period 2007-14 economic growth has been associated more directly with improvements in people’s living standards. While historically the relative disconnect between gross domestic product (GDP) growth and household incomes means that over the whole period, growth did not always benefit consumers as much as it could have, it has an advantage, since macroeconomic volatility did not lead to volatility in median incomes as measured by national household surveys (Figure 3.2).

Inequality has fallen but remains high

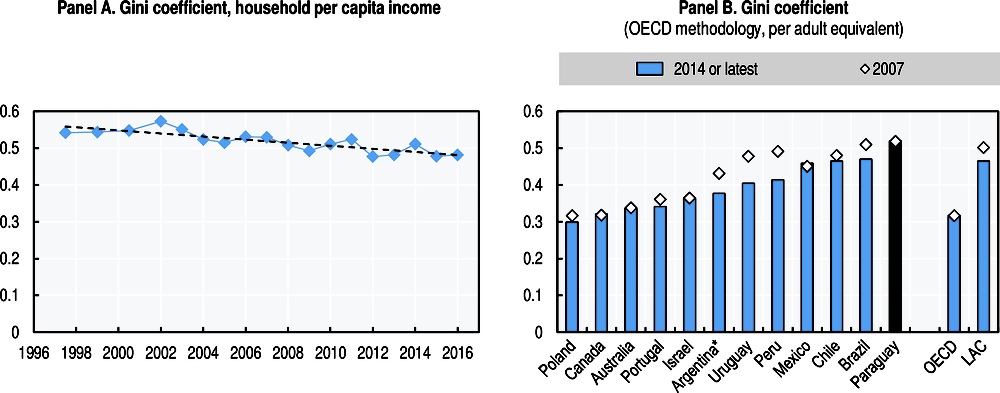

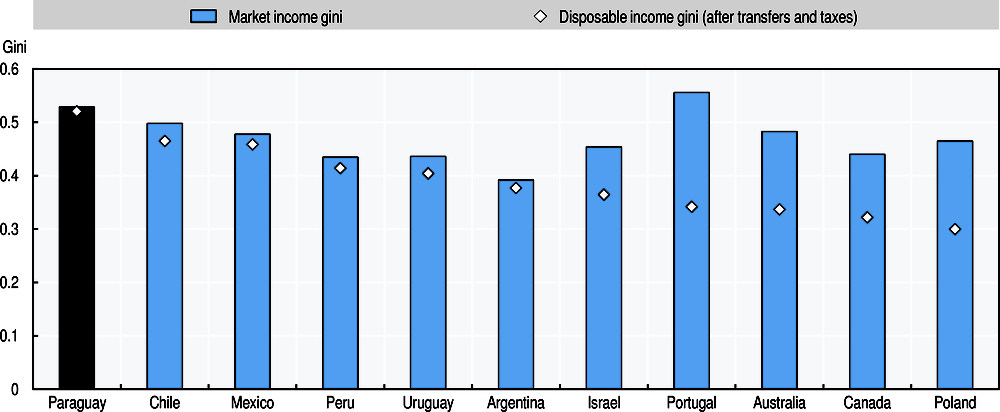

The pattern of income growth in Paraguay has led to a slight fall in the level of income inequality since the turn of the century, with a Gini coefficient dropping from 0.55 in 2000, to 0.48 in 2016, according to national sources. In terms of OECD comparable data, inequality in per capita equivalent disposable income fell from 0.57 in 1999 to 0.52 in 2014. This is a significant fall in inequality as shown by the trend in Panel A of Figure 3.3, even though it is smaller than the fall in inequality observed for the Latin American region as a whole (Figure 3.3, Panel B).

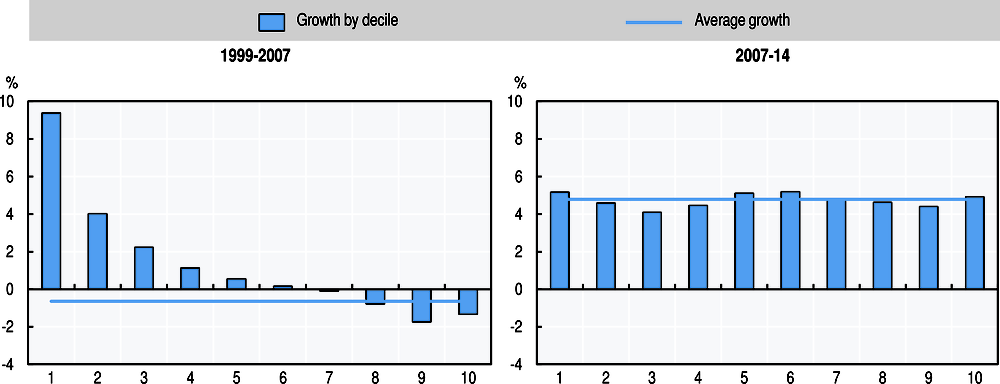

The distributional pattern of growth has changed dramatically since the end of the crisis of the 1990s. Growth was more pro-poor during the period 1999-2007, but at very low average rates; indeed average real growth was slightly negative, at -0.6%. Since 2007, growth has been much stronger and affected all parts of the income distribution almost equally, although the poorest decile benefitted slightly more than average (Figure 3.4, Panel B).

Inequality in Paraguay has a marked geographical component. Income is highest in Asunción, the capital, although the premium over average income fell from over 110% in 2001 to 73% in 2011 (CEDLAS and the World Bank, 2017). On the other hand, the ratio between overall rural and urban incomes was stable between 2001 and 2015, with rural incomes oscillating between a minimum of 55% of urban incomes and a maximum of 70%. Remarkably, urban residents in the Central region, which includes most of Greater Asunción, and the rest of the country’s cities, had similar average incomes 10% above the national average, while those in rural Central had 80% and those in other rural areas 72%, possibly reflecting easier access to market close to Greater Asunción than further inland. The rural to urban gap has been fairly stable since 2002, with rural incomes standing at about 60% of average urban incomes.

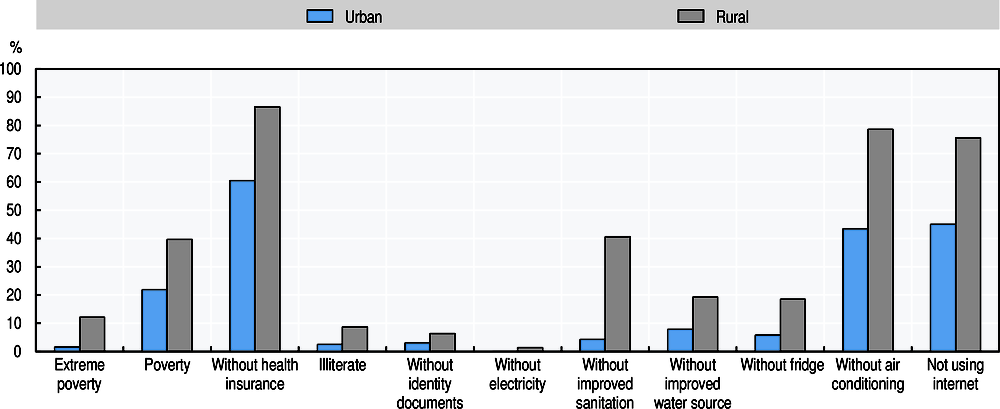

Territorial inequality is an important contributor to inequality and deprivation in Paraguay. Extreme poverty is largely a rural phenomenon, reaching only 1.6% in urban areas, compared to 12.2% in rural areas. As Figure 3.5 shows, levels of monetary and non-monetary deprivation are higher in rural areas, with marked differences in access to water and sanitation. Basic services that require less heavy investment, such as electricity and telephony are more present in rural areas.

The housing deficit is a key aspect of territorial inequalities

Access to decent housing and infrastructure is s fundamental element of material well-being and one where territorial inequalities are large in Paraguay. SENAVITAT (Secretaría Nacional de la Vivienda y el Hábitat), the national housing authority, estimates the housing deficit to concern over 800 000 housing units, or 73% of the total. Within that deficit, 13% corresponds to needs for new housing (on the basis of overcrowding or the presence of multiple households in a single house). The rest of the deficit is qualitative, and represents chiefly needs for improvements to housing, in particular to access to piped water and to the public sanitation grid, which only covers 10% of the population.

In spite of the development of the construction sector, needs remain significant. Overall, SENAVITAT estimated a need to build just under 100 000 dwellings on the basis of the 2002 census (SENAVITAT, 2016). That figure was projected to reach 190 330 by 2020 (SENAVITAT, 2012). The need for housing is also reflected in the extent of informal settlements, which according to estimates, number over 1 000 in the Central department alone (which includes areas surrounding the capital Asunción). In addition to the large estimated needs for the poor, there are difficulties for the lower middle classes (in the 1 to 3 minimum-wage band) in accessing housing, because construction firms concentrate on the higher end of the market and because of the difficulties in access to credit for those households.

Public intervention in housing is largely focused on construction of housing units. SENAVITAT has built 20 299 dwellings since 2013, benefitting 80 000 people and has reached the capacity to generate 10 000 units a year since 2015, of which about 90% go to families in extreme poverty. This is the result of a significant increase in public expenditure in housing and community services after 2011. Financial commitments towards housing from SENAVITAT more than doubled in real terms between 2011 and 2016 when they reached just under 600 million PYG. According to the law that governs access to the national fund for social housing (FONAVIS) (Law No 3637), households with a total income below one minimum wage can receive a 95% subsidy on the acquisition of a dwelling. The state also grants subsidised long-term loans for the acquisition of housing through the Agencia Financiera de Desarrollo (AFD) to creditworthy households through the Micasa and Mi Primera Casa programmes. However, these tend to reach higher income individuals able to pay. Law No 3909 of 2010, which created the current housing authority, SENAVITAT, gives it regulatory functions, but SENAVITAT has largely focused on construction in the past. Recent interventions have increasingly aimed at incorporating a more holistic approach to housing construction, by ensuring that not only utilities but also community services, are available to new dwellers, in particular in larger projects like the San Francisco neighbourhood in Asunción (SENAVITAT, 2017).

Weaknesses in the land administration and management system present difficulties for the housing sector. Most construction programmes require families to own the land where construction is planned, but inconsistencies in land administration instances (the Public Register and the Cadastre) and the spread of informal settlements make this condition difficult to meet. There are a number of government interventions to address this problem, mostly through ex post regularisation of land tenure. Among them, the Tekoha programme, implemented by the SAS (Secretaría de Acción Social), grants property rights to beneficiaries through the regularisation and sale of land. The programme has widened its scope, serving 22 693 families by February 2017, although it remains small compared to the size of other social programmes and the potential size of the problem.

Poverty reduction accelerated but has stalled in recent years

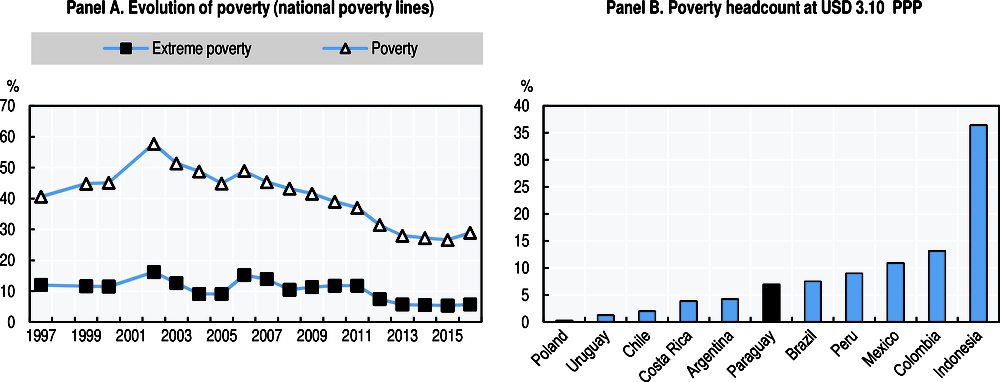

Paraguay has managed significantly to reduce poverty and extreme poverty since the turn of the century. The poverty headcount fell from 45% in 2007 to 27% in 2015 according to the national poverty line;2 and extreme poverty from 14% to 5.4% in the same period (DGEEC, 2017). The fall in poverty has been continuous since the 2002 crisis, but has slowed in recent years. The pattern is identical if other poverty lines are used. On the basis of the World Bank moderate poverty line, set at USD 3.10 in 2011 PPP, poverty fell from 18% in 2001 to 7% in 2014. The stagnation in poverty rates is a cause for concern, given the still relatively rapid growth in population. Indeed, the absolute number of poor and extreme poor in the country is estimated to have increased between 2015 and 2016 on the basis of an improved methodology.

The fall in poverty has been largely driven by growth in incomes across the population rather than by increased redistribution. This is suggested by the growth incidence curves in Figure 3.4. Given that poverty occupied the first four deciles until the mid-2000s, rapid growth across the distribution was a stronger force than the very progressive but low-growth pattern of the early 2000s. Correspondingly, if the evolution of poverty is decomposed into a growth and a distribution component, all the fall in poverty can be attributed to growth, given the increase in inequality during the period (ECLAC, 2016).

Macroeconomic stabilisation played a major role in sustaining the fall in poverty. The World Bank (2015) found that poverty levels prior to the fall in poverty of the first half of the decade were very sensitive to food prices. This explains the increase in poverty and extreme poverty in 2006-07 when the increase in food prices was more than double the general rate of inflation. It is worth noting that the food consumer price index (CPI) for Asunción is used to update the extreme poverty line, so that actual food affordability in other parts of the country may vary, depending in particular on the quality of market integration.

Paraguay’s tax and expenditure system only has modest effects on inequality and poverty

Taxes and public transfers in Paraguay have a very small effect on income inequality. Of the group of benchmark countries with comparable data from the OECD Income Distribution Database, Paraguay is not only the country with the highest level of inequality in disposable income, but also the one where the tax and transfer system has the lowest incidence in the distribution (-1.6%, compared to -7% in Uruguay and a maximum of -38% in Portugal). The data for Paraguay in Figure 3.7 do not account for the redistributive effect of social security contributions; as such, they understate market income inequality relative to other countries, and possibly understate distribution. The reliance on indirect taxes and flat tax rates explains the low impact of taxes on the income distribution. Giménez et al (2017) estimate a total effect of direct taxes corresponding to 0.13% of market income inequality.

Public transfers in Paraguay do have an impact on poverty. The Tekoporã conditional cash transfer (CCT) and the social pension (Adulto Mayor) lead, respectively, to falls in the moderate poverty rate of 0.3 and 1.1 percentage points, (Giménez et al, 2017). There are several other programmes which effect direct transfers to households, although their impact cannot be assessed through the same methodology in the absence of identifiable benefits in national household surveys. They include Abrazo, a programme to fight child labour, which focused originally on children working on the streets but as of 2015 covered over 3 000 families, and provided conditional cash transfers to 2 000 of them and to 7 700 children.3 They also include programmes aimed at supporting households’ productive activities, in particular in smallholder agriculture. Of these, the programme of direct purchase of smallholder agricultural produce by the Ministry of Agriculture is noteworthy as it provides preferential access to certain public purchases (including for school meals).

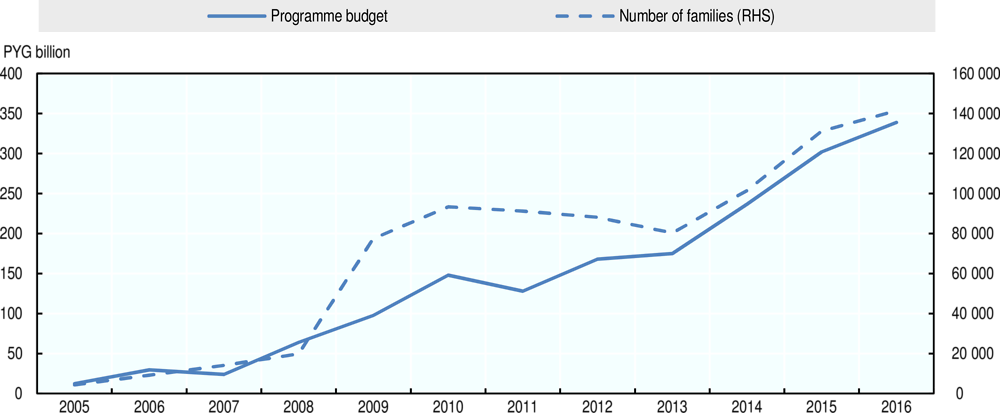

The conditional cash transfer programme Tekoporã is one of the cornerstones of Paraguay’s poverty agenda. The Tekoporã programme has grown considerably since its creation in 2005, in particular under the Lugo presidency and under the current administration. In December 2016, the programme covered 685 578 people, about the same as the number of extreme poor in the country. Tekoporã was evaluated in 2016 by Rossi (2016). The programme has significant impact in terms of health and education outcomes. Programme participants are 8% more likely to have vaccination cards, and attend school 13% more often than non-participants. The programme also leads to increases in the use of health services, with an increase in 25% of prenatal controls. Effects on health and education contribute to reducing the inter-generational transmission of poverty. However, the programme’s poverty impact is relatively modest. Giménez et al. (2017) estimate that after accounting for Tekoporã transfers, poverty and extreme poverty fall by less than one percentage point (0.3 and 0.7 percentage points respectively). The falls in the poverty gap are larger (1.2 percentage points for both). This is due to limitations in both the size of the transfer and the coverage of the programme. The programme is targeted on the basis of a quality of life index, which can explain in part that, when compared to household income alone, Giménez et al. (2017) find it only covers 30% of households in the first income decile and 20% of households in the second income decile. This is a low figure by international standards, although it is an improvement on the results of a similar study that estimated that in 2010 only 24% of the extreme poor received direct transfers (Higgins et al, 2013).4 Moreover, the size of transfers is relatively modest: Rossi (2016) notes that the average participant household received each month about 60% of the cost of a basic food basket for one person. The programme therefore would need to grow further in coverage and generosity to have a larger impact on monetary poverty. The evaluation also highlights a number of possible improvements in process that would contribute to its efficiency (Rossi, 2016).

The administration is responding to the stagnation in the fall of poverty by innovating its approach to targeting and delivering anti-poverty programmes. On the one hand, programmes are being extended beyond cash transfers to include a productive investment component (Tenonderã and Familia por Familia). Given the rate of poverty in rural areas, the effectiveness of the new approaches will hinge on the success of policies to increase productivity in smallholder agriculture. The Tenonderã programme is the largest of such initiatives. The programme provides grants for productive activities chosen by the beneficiary household (the majority choose small livestock raising) along with capacity-building in social, life and business skills. It can be seen as a graduation programme from the CCT Tekoporã, as it targets households who have been in the CCT programme for three years. Tenonderã and Familia por Familia target poor farmers, often with subsistence production, which is a different population than the established smallholders most likely to receive assistance from the Ministry of Agriculture. Tenonderã initiated operations in 2014 and covered 11 540 households by the end of 2016 (SAS, 2016) for a budget of 13 billion guaraní (PYG), about 3% the size of Tekoporã. On the other hand, new programmes are extending the range of personal and social support that accompanies recipients, which is already a feature of Tekoporã, to include financial literacy and life skills, and piloting new ways of implementing them (under the pilot methodology Familia por familia).

The administration is also responding to the persistence of poverty by increasing its institutional capacity. The Sembrando Oportunidades programme, led by the STP, in the national anti-poverty programme. It seeks to co-ordinate the action of multiple agencies and programmes to deliver better livelihoods for the poor. Among other elements, it introduces a single targeting instrument and has a strong focus on productive inclusion through agriculture. Familia por Familia is one intervention of the programme. The programme also includes the development of a monitoring framework and tool, which is linked to the budget and to the PND and allows geolocalised monitoring of interventions.

Employment and labour outcomes: The challenge of informality and job quality

Paraguay is undergoing a demographic transition and has a major opportunity to accelerate growth and strive for a more equal society, but also faces the challenge of creating high-quality jobs for large cohorts of young entrants into the labour market.

Job creation has been adequate, sustained by growth in the services sector

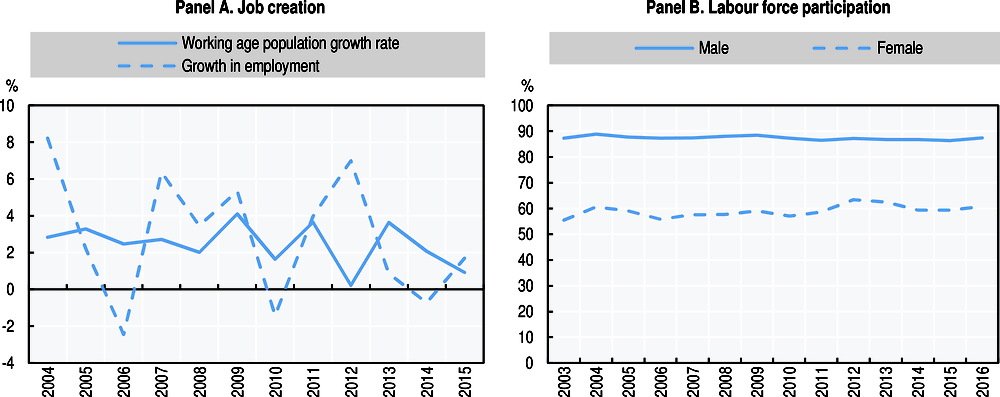

Net job creation over the medium term has been good, overtaking the rapid growth in the working age population (2.5% p.a, in 2003-15). Job creation, as measured by the main household survey, the Encuesta Permanente de Hogares (EPH), is markedly volatile.5 This volatility corresponds to the volatility of activity in the various sectors, not only in agriculture, where climatic conditions can influence labour demand, but also in the secondary sector. This is partly due to the importance of agro-industrial activities in Paraguay.6

Women’s labour force participation seems to be particularly responsive to economic conditions (Figure 3.9, Panel B), significantly more so than for men. Given that unemployment is low, this suggests that women exit the labour market in lean years and re-enter in boom years.

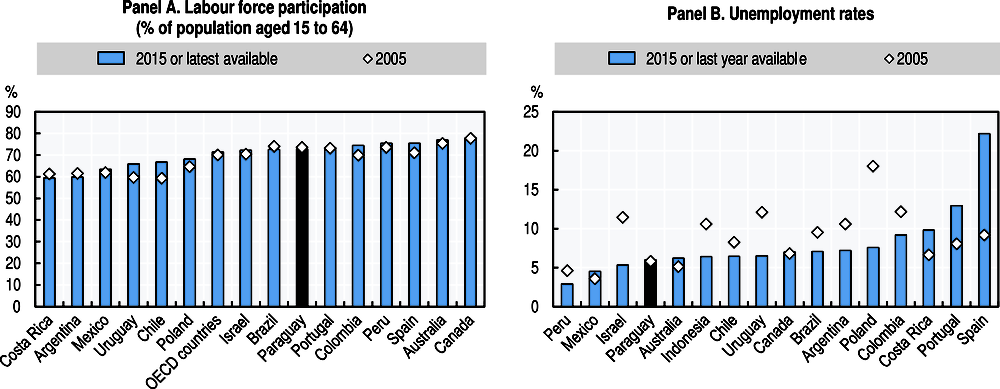

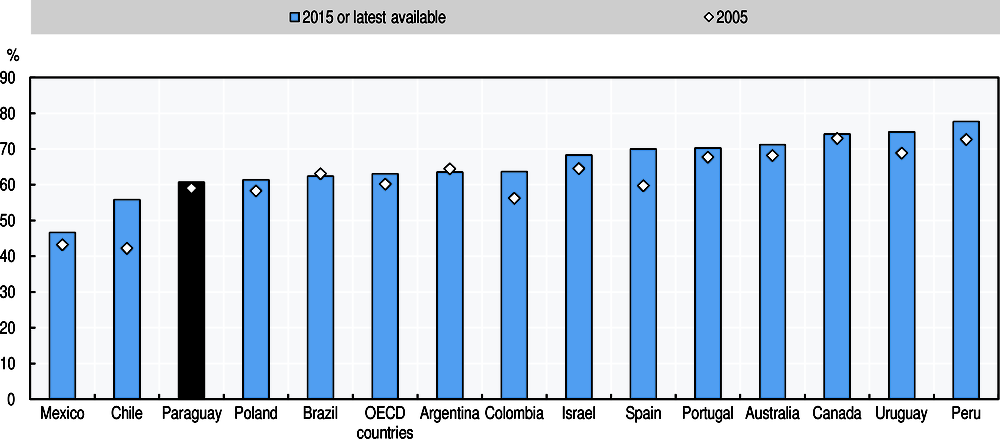

Unemployment is low and labour force participation remains stable. Labour force participation in Paraguay was 70.5% for the age group over 15 years old in 2016, stable compared to 2005 figures.7 This figure is slightly below the average of labour force participation rates for the OECD (71.3% in 2015) but in line with other countries of the region. When a wide age group is considered, including older citizens, measured labour force participation is lower than for the 15 to 64 group, as would be expected, although a third of people over 65 are still active in the labour market. In 2016, unemployment concerned only 6% of the labour force and most of the persons remain unemployed for a short period of time (less than three months). Around 6.0% of the unemployed (about 10 000 people) were looking for a job for more than two years.

The participation of women in the labour force is low. Only 50% of women (and 61% of women aged 15 to 64) are active in the labour market, one of the lowest rates among the benchmark countries. This rate increases with the level of education but there is still some margin for improvement at the country level. As many as 57% of employed women among salaried workers are working in agricultural activities in the economy (CEDLAS and the World Bank, 2017). In this regard, Paraguay may want to consider reviewing how countries have implemented 2013 Recommendation of the OECD Council on Gender Equality in Education, Employment and Entrepreneurship (OECD, 2013a).

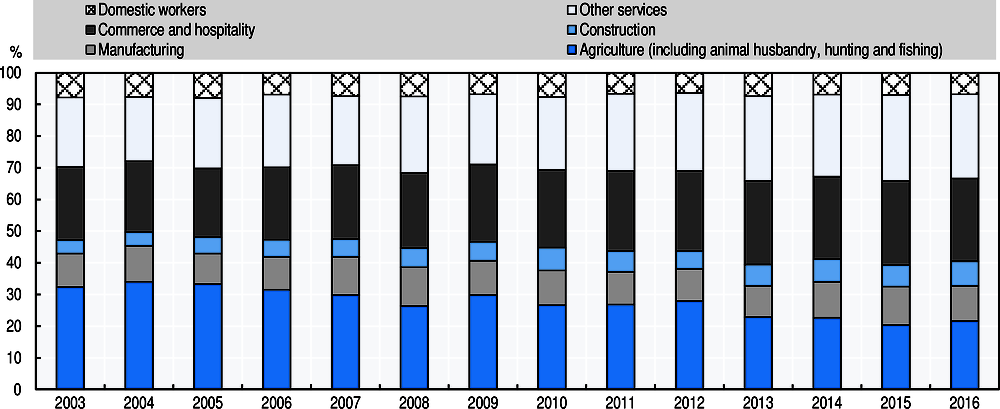

The structure of employment across the economy shows a slow but regular decline in the primary sector. From 2006 to 2016, the proportion of people working in the agricultural sector declined by ten percentage points, compensated for by job increases in hospitality and commercial services (+3.3 percentage points), in construction (+2.2 percentage points) and in other services, including financial services, real estate and community and personal services (+3.6 percentage points) (Figure 3.12). Manufacturing employment has stayed, in relative terms, around a modest 10% of total employment. Changes have been more rapid in rural areas. If 90% of those working in the primary sector live in rural areas, the reverse is not true for the secondary and tertiary sectors. One-third of the jobs in the secondary sector are now located in rural areas, highlighting the growing importance of the agro-business industry in the country. Even if the number of people working in the secondary sector remains higher in urban areas, it increased significantly in rural areas between 2003 and 2015 (+ 71%).

Job quality remains a major issue

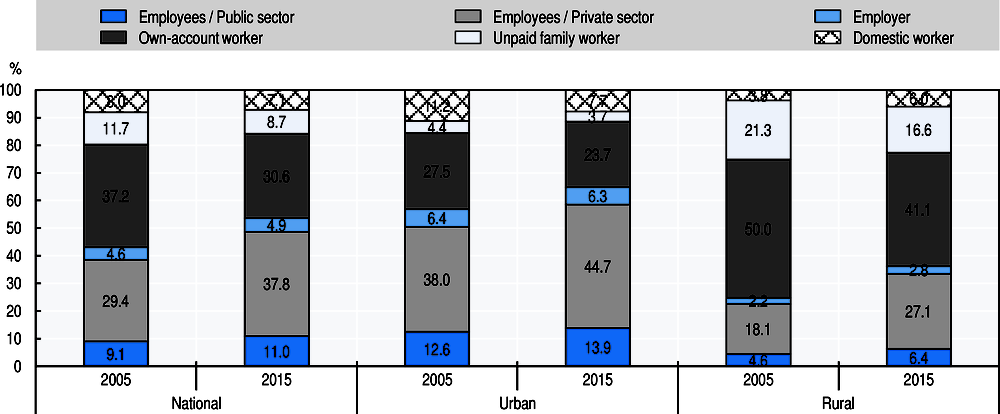

Job quality remains an issue for many workers. Despite some changes in the employment structure over the last decade, domestic workers, unpaid family workers and own-account workers account for 46% of employment and almost two thirds of jobs in rural areas.

Salaried work has increased

The past few years have seen a slow but regular increase in salaried work. In 2014, almost half the working population were salaried (Figure 3.13). The increases in both public sector (by 40% over the 2010-15 period) and private sector jobs have contributed to this trend. Between 2002 and 2013, more than 1 million salaried jobs were created in the country, two-thirds of them in the private sector. This regular increase in salaried work concerns all the country. In urban areas, this increase is led by the growing number of jobs in the tertiary sector (+865 000 between 2002 and 2015). In rural areas, the increase in salaried work can be partially explained by the formalisation of work in the secondary sector.

Public employment has also grown significantly in the past ten years. The human resource management capacity of the Paraguayan state has grown significantly in recent years, but consolidated data on public employment for the early 2000s are patchy and a lack of complete information means it is not possible to examine the evolution of public employment from administrative data. Survey data (Figure 3.13) show that public and private salaried employment grew at a rate of 5.4% per annum between 2002 and 2015, compared to 3% for total employment. Thanks to an improvement in reporting, data provided by the Secretaría de la Función Pública (SFP) on public employment now cover 365 reporting institutions out of 409 registered institutions, accounting for 297 891 public employees as of 2016 (SFP, 2017).

Informality is a major challenge for job quality

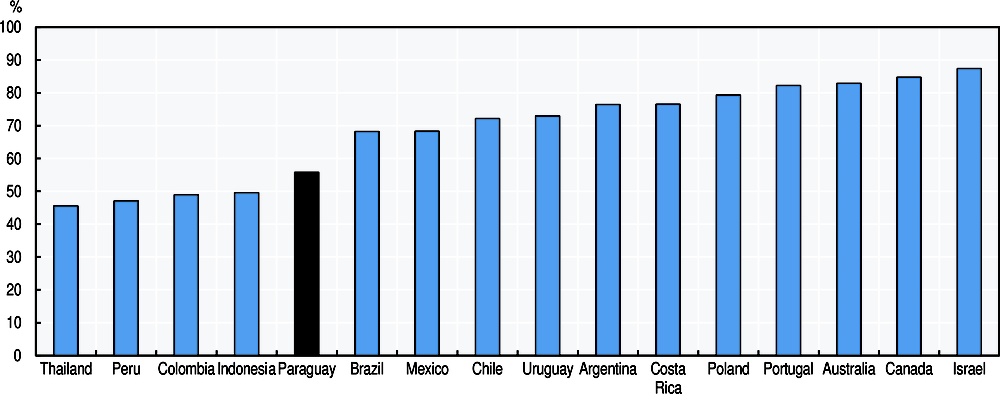

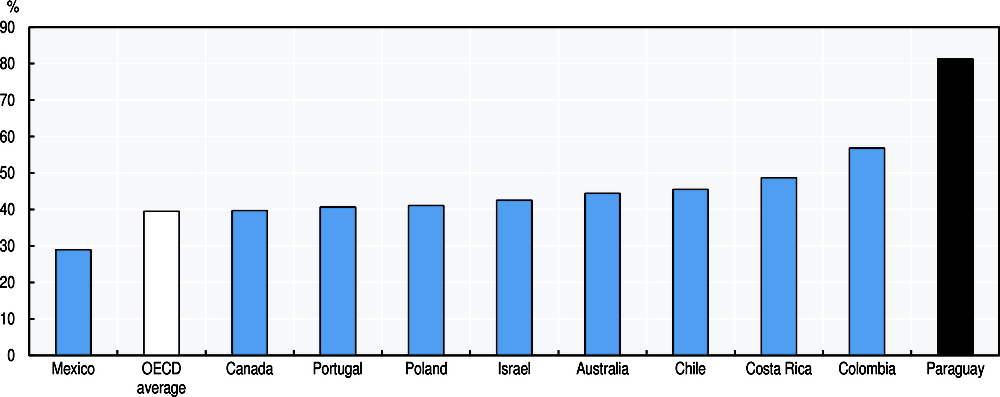

In 2015, informal employment in Paraguay concerned 64% of workers outside agriculture. This represents a high level of informality compared to benchmark countries but still lower than informal rates in Indonesia and Peru. Informal employment is a job-based concept and encompasses all persons whose main jobs lack basic social or legal protections or employment benefits and may be found in the formal sector, informal sector or households. In Paraguay, informal employment includes unpaid family workers (by definition), most domestic workers, and most of those working as own-account workers (77% of them are informal, [DGEEC, 2016]).

Informality is prevalent across many sectors of the economy. Although it is significantly lower among public employees, by the criteria of the household survey just over 60 000 public employees were informally employed in 2016. This corresponds to public employees under contract (as opposed to civil servants), whose labour relationship is governed by the Civil code (Art. 5 of Law 1626/00). Informal employment is high for those working in the private sector (65%). In terms of sectoral distribution, the construction and commerce sectors also present high levels of informal jobs (respectively, 89% and 72% in 2016). Informality is higher among young (below age 24) and older workers (above age 60), women, the less educated and those working in rural areas. For instance, 79.4% of the jobs occupied by women in rural areas were informal in 2014.

Informality has fallen in recent years. It dropped from 69.2% of non-agricultural employment to 64.3% between 2010 and 2015. Given the fall in agricultural employment, which is largely unprotected, this in fact understates the rate of formalisation in the economy.

Earnings

A considerable proportion of workers earn less than the national minimum wage. In the public sector, 9.6% of workers earned less than the minimum wage in 2016, but this share rises to 44.5% of workers in the private sector. Half of informal employees earn less than the minimum wage, even when domestic workers are excluded. These proportions have registered a decrease over the past five years, (by eight and seven percentage points for public sector employees and private sector employees respectively), but remain substantial in the light of the level of development of the country. Moreover, the minimum wage fell in real terms by over 2% during the period, which diminishes the impact on workers’ purchasing power.

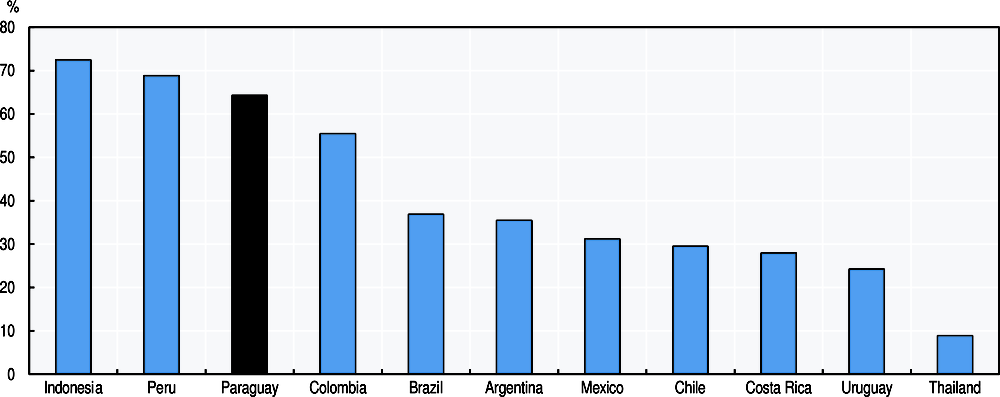

The minimum wage has not changed much in real terms over the past 25 years. In 2015 it was estimated at USD 342 (PYG 1 964 507). In real terms, the minimum wage stood in early 2017 at a similar level to that of 1991. The general wage index has only gained 12 percentage points over the increase in the consumer price index (CPI) in the past 13 years, a very modest evolution in the face of rapid growth. Moreover, there are very large differences in labour earnings between rural and urban areas (the gap is about 43% in monthly labour earnings).

The minimum wage in Paraguay is very high by international comparison. OECD data compare minimum wages to average or median wages of the relevant population (salaried workers). In Figure 3.17, minimum wages are compared to mean monthly wages of salaried workers according to the labour force survey, which covers the greater Asunción area and is therefore not representative. Even then, the minimum wage stood at 81% of the mean wage, far above comparator countries. The minimum wage is also high relative to the country’s level of development. It is of the same order of magnitude as GDP per capita. The only country in the comparison group that comes close to having such a high minimum wage relative to its economy is Costa Rica, where the minimum wage is 64% of GDP per capita.

Working time

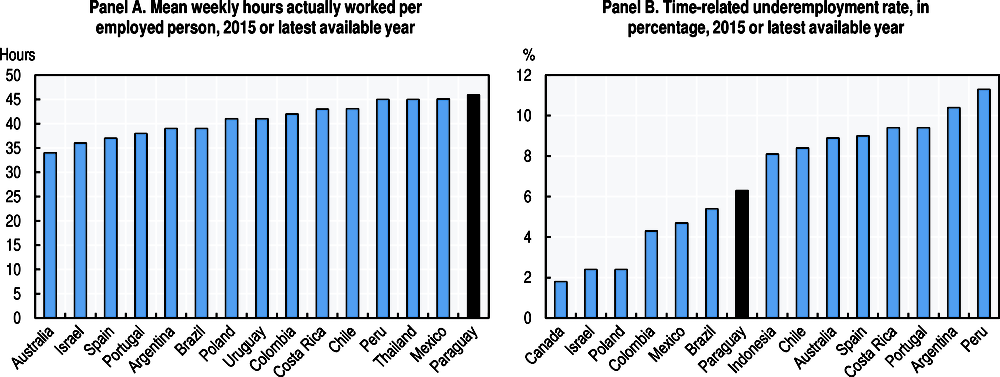

Most Paraguayans work long hours. National data show that more than half of workers work more than 45 hours a week. Only 28% work fewer than 39 hours a week (DGEEC ECE [Encuesta Continua de Empleo], 2016). Compared to benchmark countries, the number of weekly hours worked per employed person is highest in Paraguay (46 hours a week).

Underemployment is a significant issue in Paraguay although measures are very imperfect. Indeed, the level of time-related underemployment appears high given relatively long average hours. This can partly be explained by the very high level of the minimum wage. Underemployment is defined as a situation where a worker either is working fewer hours than they would like (visible underemployment) or one where their labour earnings are not sufficient to meet a standard, usually the minimum wage (invisible underemployment). The high level of the minimum wage in Paraguay both relative to the country’s economy and its labour market, makes this a high bar to reach. In Paraguay so-called invisible underemployment is twice as prevalent as invisible underemployment.

The insertion of the young in the labour market is a major challenge

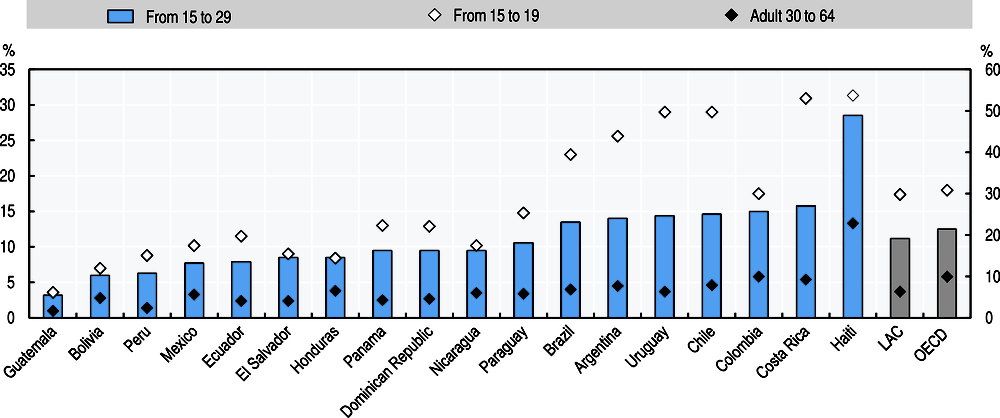

In spite of the low unemployment rate, unemployment in Paraguay for the young is triple that of prime-age adults. The 15-to-29 age group faces an 11% unemployment rate, similar to that of the Latin American region as a whole (Figure 3.19). Compared to the rest of the region, however, young Paraguayans are less likely to remain idle. The share of 15-29 year-olds who are not in employment, education or training (NEET) is 17.2%, below the level of ten years ago and three percentage points below the average for the region.

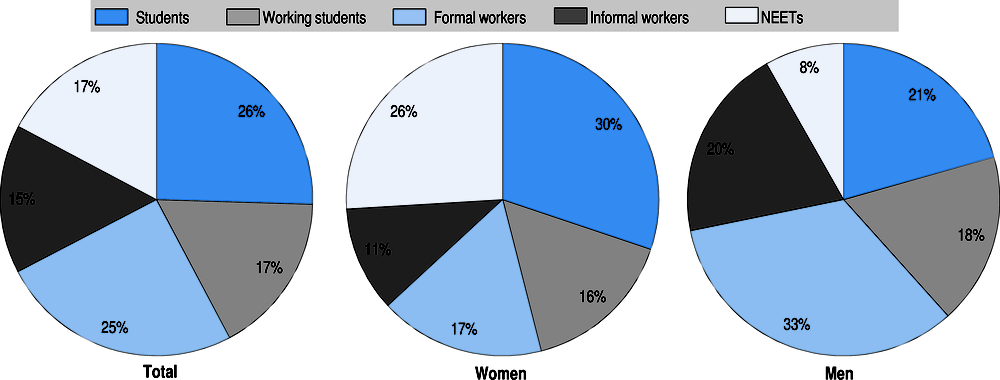

Gender gaps in employment performance emerge early in Paraguay. Young women are more likely to continue studying, as shown also in education outcomes (see next section). However, they are much more likely not to be in employment, education or training. They are also more likely to be unemployed if they are looking for a job (14% compared to 8% for young men) (OECD/CAF/ECLAC, 2016). Conversely, young men are much more likely to work informally. Informality rates for the 20-24 group are significantly higher than average (73% compared to 63% for the whole labour force)

Analysis of school-to-work transitions in Paraguay suggests that informality is not a deliberate choice of the young. In other countries in the region where informality is high, a substantial proportion of the young exit school and enter informality: in Mexico, 20% of males do. By contrast, in Paraguay, only a small proportion of school leavers, aged between 15 and 29, enters informal work directly in the year after leaving school (7%), and a higher proportion than in other countries goes to formal work. However, larger shares of young men and women leave school and become inactive or unemployed8 (OECD/CAF/ECLAC, 2016).

Child labour also remains an issue. Paraguay and the ILO estimate that almost half of five to 17 year-olds in rural areas work, including 42% of those under the legal age to work, which in Paraguay is 14 years (ILO/DGEEC, 2016). Significant proportions of children and adolescents in rural areas undertake dangerous tasks. For those above the legal minimum age, jobs are almost entirely informal – a formalisation of traditional apprenticeships would go some way towards incorporating young school leavers into the social protection system.

The role of labour market institutions and policies

Paraguay’s labour market institutions are relatively weak. The Ministry of Labour was created in 2013. Before that the functions of the ministry were performed by the Ministry of Justice, with mainly an enforcement function, and a limited one at that. Active labour market policies under the ministry are currently focused on the young as well as on women. This is justifiable in the light of the issues regarding their incorporation into the labour market, all the more so as this generation is much better educated than the previous one. Indeed, 60% of 25 to 29-year olds have completed secondary education and 17.3% tertiary education, compared to 36.6% and 12.5% of adults, respectively. In both these indicators, young Paraguayans have overtaken the regional average.

Collective bargaining is weak, given the relatively small share of workers that is unionised (4.9% according to the ILO). The Ministry of Labour has directed efforts to the modernisation of the system of registration of trade unions. There has been less progress in easing the obstacles to freedom of association and union activity. In particular, the lack of effective protection of workers against anti-union discrimination has been pointed out repeatedly by the ILO’s Committee of Experts on the Application of Conventions and Recommendations (CEACR) as a weakness of Paraguayan labour law (Lachi, 2014). Social dialogue received a new impetus in 2014 with the creation of areas for dialogue in the form of tripartite thematic discussion tables and a consultative council, which have led to noteworthy results, including consensus on the reform of the system for minimum wage adjustments and on the creation of a social security system for microentrepreneurs, as well as key agreements at the sectoral level (MTESS, 2017). Enforcement functions in the ministry are under-resourced. The labour inspectorate only has 31 inspectors, and the first recruitment on the basis of competitive examination took place in 2015, with the intention of professionalising the service. This compels any enforcement activity to be targeted, rather than systemic.

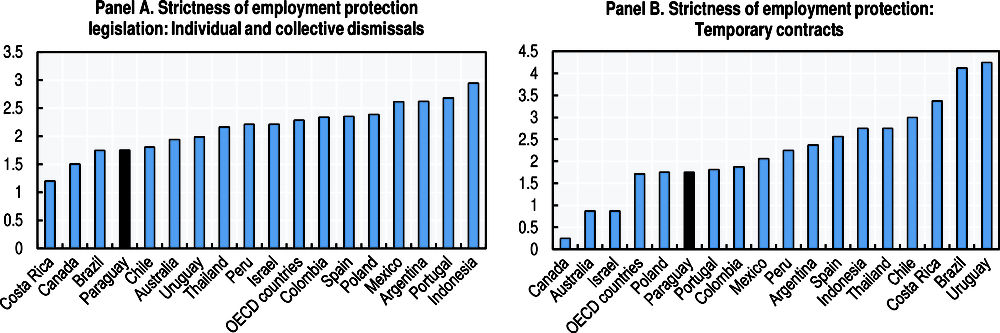

Employment protection is relatively low and unlikely to cause limited mobility in the labour market. Traditionally, employment protection legislation (EPL) is designed to protect jobs and have only a limited impact on employment and unemployment rates (OECD, 2013b). However, it can affect job creation and labour mobility. The OECD has developed a framework for measuring EPL that assesses the strictness of the procedures and costs involved in dismissing individuals or groups of workers and those involved in hiring workers on fixed-term or temporary work agency contracts. This analytical framework is based on 21 indicators that measure from zero (not strict at all) to six (very strict) the strictness of the legislation. Paraguay scores 1.75 out of 6 regarding the strictness of EPL for individual and collective dismissals, a low score which can be explained by the fact that there is no additional procedure for collective dismissals. Regarding legislation for temporary work contracts, Paraguay also displays legislation that favours employers.

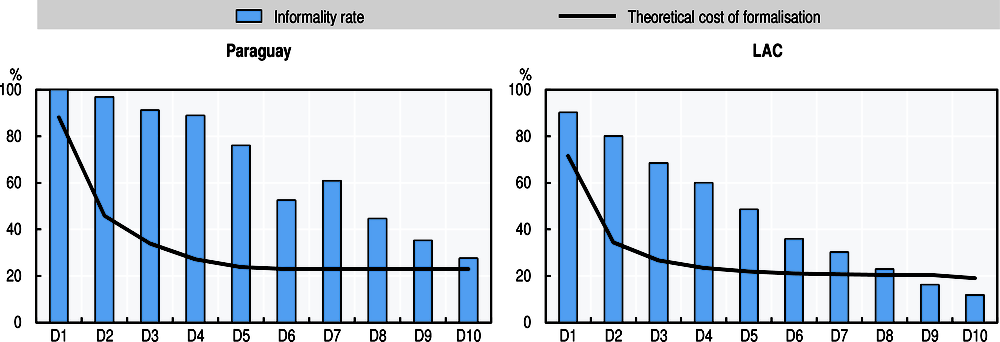

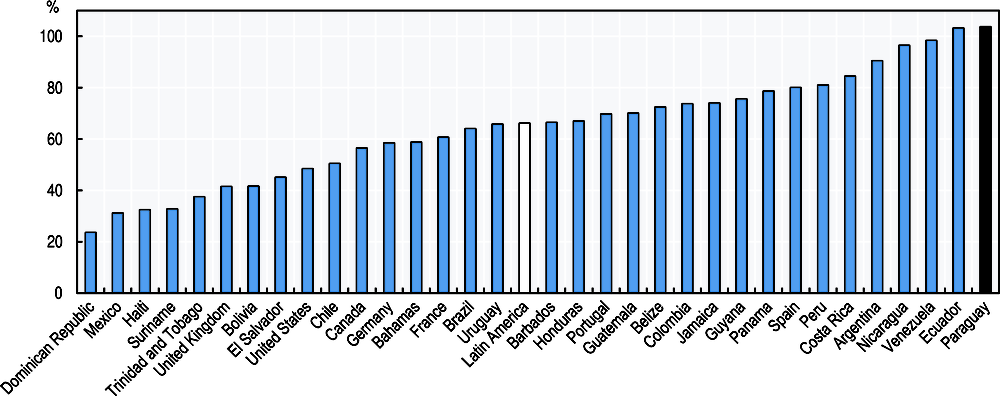

On the other hand, the combination of contribution rules and high minimum wages makes formalisation costly for employees. Higher theoretical formalisation costs are associated with higher levels of informality among wage-earning workers in Paraguay and Latin America. Theoretical formalisation costs measure the cost for a worker to join social security programmes given required income thresholds and minimum contribution levels, expressed as a proportion of their current earnings. Individuals at the lower end of the income distribution are therefore more likely to be informal because of higher costs. In the case of Paraguay, poor workers at the lowest end of the income distribution would have to forego 88% of their wages to join social security programmes, which is higher than the theoretical cost for a poor worker in Latin American countries (72% of the worker’s wage) (Figure 3.22).

Despite recent improvements in initial education, Paraguay faces a significant skills shortage. The training system is relatively small, which makes it insufficient to address this challenge. The reach of the national training system (SINAFOCAL) and the public training organisation (SNPP) is too small to provide training to a large section of the population. SINAFOCAL oversees the training system as a whole (including SNPP and private providers of training). It estimates that a quarter of adults over 25 had received training during their careers by 2014, of which a large fraction (39%) in the five years preceding the survey. In contrast, in OECD countries, 50% of adults participate in formal or informal training over a given year, and 10% do so in the formal education system (Education at a Glance [OECD, 2016]). By contrast, SNPP provides training to about 5% of the active population (181 529 workers were trained in 2016, for an estimated active population of about 3.5 million people, [SNPP, 2016]). The training system is being developed, with a four-fold increase in the budget of SNPP in the past eight years.

Education outcomes have improved but reforms are unfinished

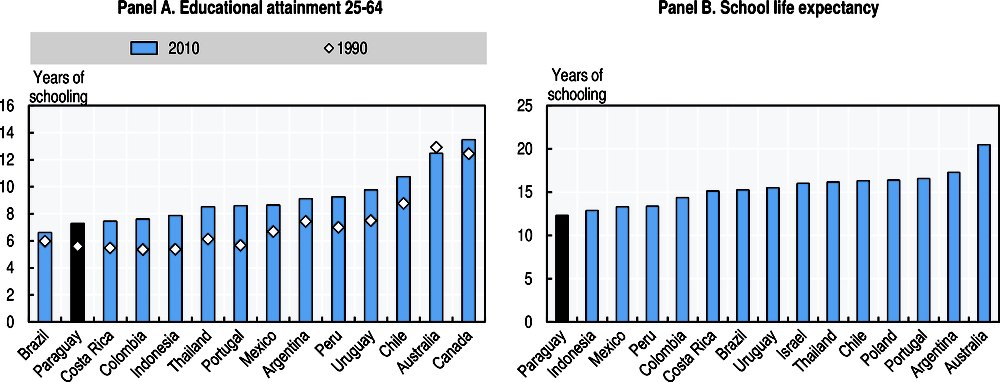

Educational attainment in Paraguay is low in spite of recent improvements. The country lagged significantly behind the benchmark countries in 1990. In 2010, the average educational attainment of a working age Paraguayan over 25 was 7.3 years according to international databases (Cohen and Leker, 2014) and 7.7 years according to national survey data,9 below the level of most benchmark countries and significantly below the level of attainment corresponding to compulsory education. Since 1990, there has been considerable progress: indeed, average educational attainment for the 20-24-year-old cohort was estimated to be 10.9 years in 2010 by Cohen and Leker (2014) and 10.2 on the basis of survey data, a very significant progress over the same cohort 20 years before, and on a par with a number of Latin American benchmarking countries (Colombia, Brazil, Mexico).

Despite recent progress, the prospects for future catch-up in educational attainment remain uncertain. Indeed, school life expectancy, which measures the expected educational attainment of today’s entrants to the education system, is the lowest in the group of comparator countries (Figure 3.23, Panel B).

School enrolment and student retention are still problematic in some areas

The 2010 reform that made education compulsory and free from pre-school to end of secondary school is a landmark of Paraguay’s development ambition with respect to its education system. The system is structured into four main blocks: initial education covers all pre-primary education, of which only the year of pre-school (age 5) is compulsory, basic education consists of three three-year cycles of which the first two make up primary education (and correspond to level 1 of the International Standard Classification of Education [ISCED]) and the third makes up lower secondary (corresponding to ISCED level 2). Finally, middle education is a 3-year cycle corresponding to ISCED level 3 (upper secondary education).

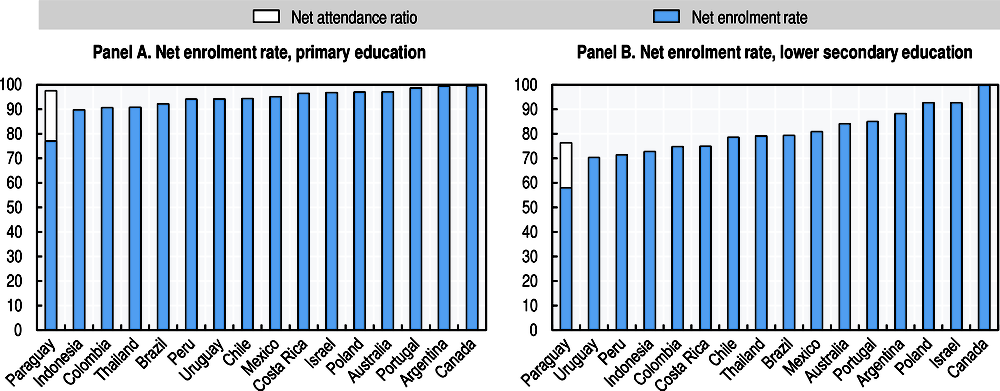

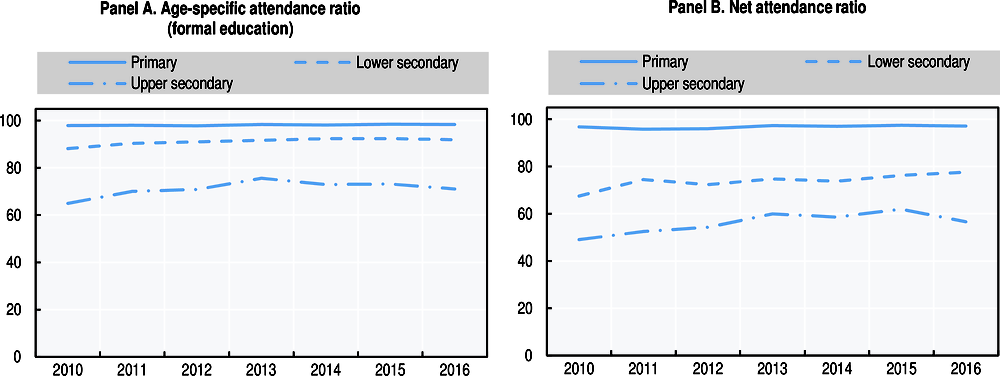

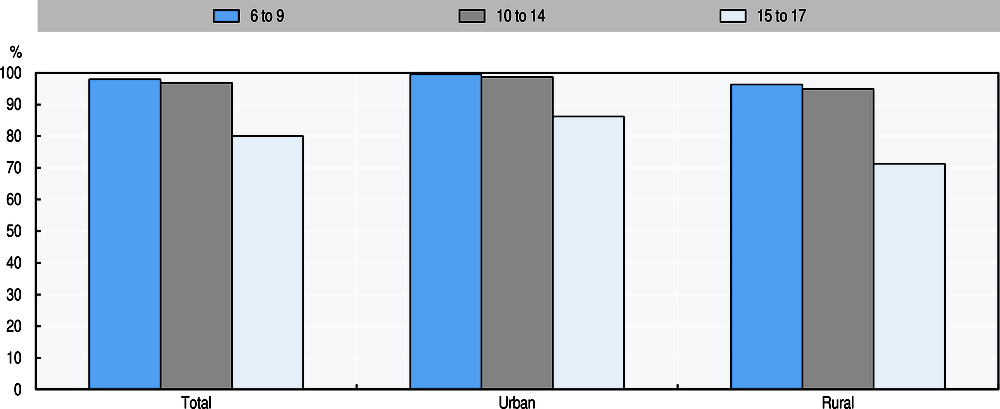

Weaknesses in the production of education statistics hamper the analysis of access to education across cycles as well as that of its evolution over time. Available data on access to education present a mixed picture and are inconsistent across sources. Enrolment rate data as made available by the Ministry of Education and Culture (MEC) situate Paraguay at the bottom of the group of comparator countries (Figure 3.24) and show declining net and gross enrolment rates for primary education. However, falling net enrolment rates in primary education reflect both falling numbers of enrolled students and population estimates that find the corresponding cohort to be growing slowly (between 0.2% and 0.3%). The Ministry of Education and MEC (2014) note that the falls in enrolment rates are due to overestimates in the population projections for the age group.10 Enrolment rates are also at odds with data from household surveys, which indicate that 98% of six to nine year olds and 97% of ten to 14 year-olds attend school (DGEEC, 2015).11 The Ministry of Education is currently working to improve its capacity to generate primary information on access to education through the improvement of its information system, in particular of the unified registry of students.

Combining the available administrative data with survey data allows to draw comparative perspectives and to establish a diagnostic. Available survey data do not include information on enrolment by grade, but include information on attendance and on the last grade completed. The survey is carried out during the end of the school year, which can also potentially lead to differences in how answers are given to questions on current enrolment. Unfortunately, data available over time are not representative of the whole country, as the main household survey (the Encuesta Permanente de Hogares, EPH) did not cover two of the country’s departments (1.1% of the population as of 2012) or its indigenous areas (1.8% of the population as of 2012) until the most recent iterations. Elías, Walder and Sosa (2016) note that estimates from the survey lead to estimates of the population of students that are 9% higher than shown by administrative records in the Ministry of Education. For this reason, the analysis in this chapter relies on proportion estimates alone, which excludes any estimates of proxies for gross enrolment rates. Age-specific attendance ratios were estimated to reflect the likelihood that children of specific age-groups are enrolled in formal education (including special education programmes for the disabled but excluding adult education). Similarly, net attendance ratios were calculated to reflect that likelihood that children are attending the cycle of education that corresponds to their age.

Together, the available data suggest that enrolment in basic education remains a significant challenge in Paraguay, especially in secondary education. In the case of primary education, net enrolment rates calculated on the basis of administrative data and survey data offer conflicting results. Net enrolment rates based on administrative data are very low compared to benchmark countries. In contrast, survey data suggest that schooling is close to universal for children of primary school age, with 98% of children in school and about 1% entering school with delay. In the case of lower secondary education, and despite the gap between administrative and survey data, the picture is more consistent. In both cases, participation in school has increased slightly (the coverage gap is 8% on the basis of survey data), whilst significant progress has been made in increasing the number of students who are at the right grade for their age.

Compulsory education in Paraguay begins at the age of five, which leads to a relatively high pre-school enrolment for that age group. Attendance at pre-school is compulsory and has been free when provided in public schools since 2010. In contrast, the supply of early childhood education for children before the age of five is meagre. At 60%, the net enrolment rate for pre-school (age five) is low but in the range of benchmark countries. However, given the low supply of early childhood education, overall pre-primary (including all education before age six) enrolment remains at the bottom of the range of benchmark countries. After focusing on pre-school (with an objective of reaching universal enrolment by 2024), the Ministry of Education is currently expanding the supply of pre-primary education.

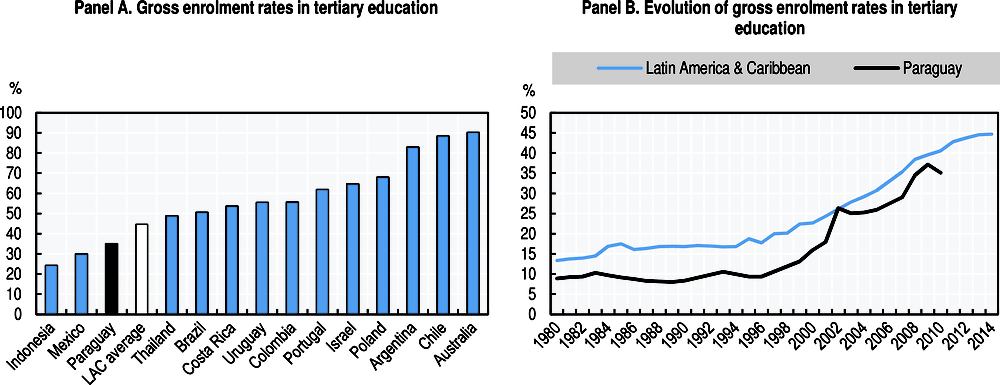

In terms of coverage, most progress has been made in secondary and tertiary education. Gross enrolment rates in secondary education have increased by 10 points to 62% over the past ten years. Moreover, a significant part of this increase has been in vocational upper secondary schooling, which increased from 9% to 15% of the age group between 2000 and 2012. In tertiary education, Paraguay has followed in the footsteps of the region with a rapid increase in access to tertiary education, although gross enrolment rates (at 35% in 2010) remain low compared to benchmark countries.

Paraguay has had success in lowering the high repetition rates and in increasing completion rates for basic education (from primary to lower secondary). According to UNESCO (2017) data, repeaters were 4% of primary students in 2007, compared to 8% in 2001, although the rate did not evolve significantly between 2007 and 2012. The cohort entering education in 2007 had a significantly higher chance (56%) of completing nine years of education than that entering formal education in 2002 (48%). The bulk of the improvement happened for cohorts entering school between 2005 and 2007, which explains why it is not yet visible for completion rates at 12 years of education.

Together, available data sources suggest that the main challenges in access to schooling are in pre-primary and upper secondary school, although observers point to deficiencies in lower secondary schooling in some areas (Elias, Walder and Sosa, 2016). A significant challenge remains to retain students until they have completed nine years of formal schooling (Basic Education in the Paraguayan system) and even more so to retain them until they have completed 12 years of formal schooling. Lowering dropout rates requires also addressing shortcomings in learning outcomes and in late enrolment, which requires not only material, but also organisational and pedagogical actions.

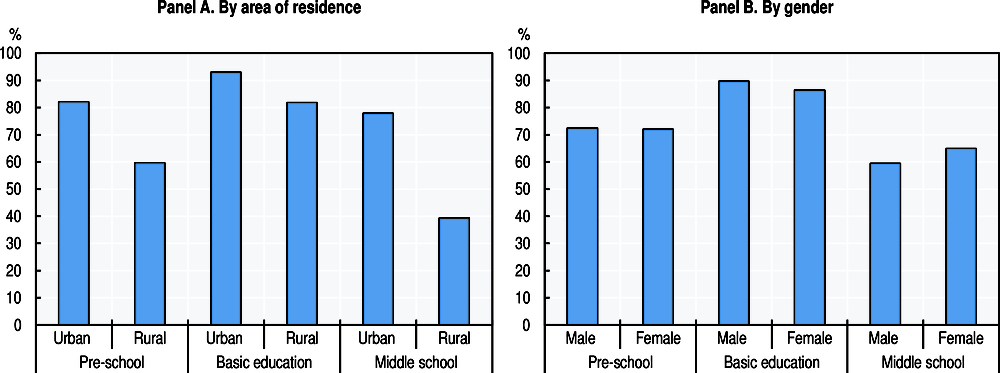

Education and skills can play a major role in sustaining the fall in inequality

Educational outcomes are very unequal between rural and urban areas and particularly low in indigenous areas. Gaps are especially large in pre-school, where gross enrolment rates were 17% higher in urban areas in 2015, and in middle school, where the gap between urban and rural areas was 41% (data provided by MEC, based on administrative records). The gaps are even higher in indigenous areas, where enrolment in lower secondary school was 22% in 2008 (compared to 57% in rural and 102% in urban areas) and enrolment in upper secondary school was 5% in the same year (MEC, 2014).

A remarkable feature of access to school in Paraguay is that gender equality prevails throughout the school system. Differences in enrolment rates between girls and boys in 2015 were 0.4% for pre-primary education, 3.3% (in favour of boys) for basic education and 4.5% (in favour of girls) for middle school (upper secondary education) according to data provided by MEC, based on administrative records.

The challenge of increasing quality in education

Paraguay faces a significant challenge to improve learning outcomes in primary and secondary education. The national education evaluation authority (Sistema Nacional de Evaluación del Proceso Educativo, SNEPE) monitors education quality with regular evaluations in grades 3, 6 and 9, corresponding to the end of each of the three cycles of basic education. Students are classified according to four levels of competency, with the highest level (level 4) corresponding to the expected proficiency and corresponding to the capacities established in the national curriculum. An allowance is made to measure those that score below the first level.12 According to the most recent available results, 78% of grade 3 students scored at level 2 or below in mathematics proficiency. Similarly, 74% of children in grade 3 scored at level 2 or below in communication.

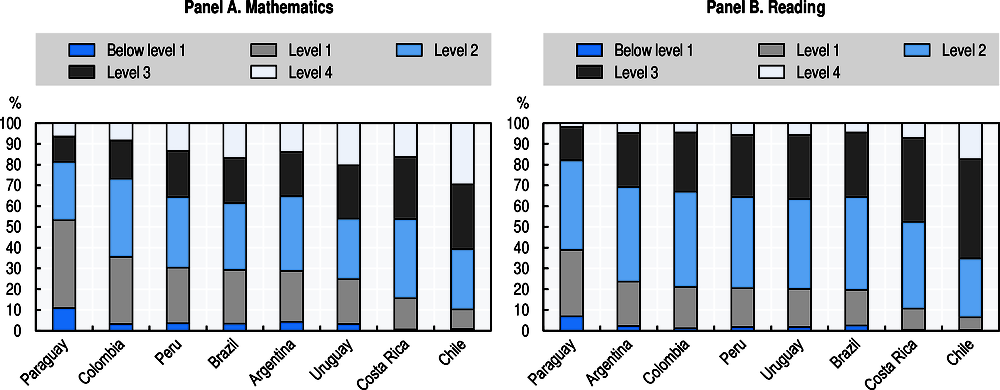

In internationally comparable evaluations, Paraguay scores well below comparator countries in terms of learning outcomes. In UNESCO’s Third Regional Comparative and Explanatory Study (TERCE) (UNESCO, 2015), 83% of Paraguayan children in grade 3 scored at level 2 or lower in mathematics, and 77% scored in level 2 or lower in reading. TERCE follows a similar proficiency classification as the national SNEPE tests, and results are qualitatively similar. While TERCE is only available for Latin American countries, it is worth noting that the Latin American comparator countries in Figure 3.29 participate in the Programme for International Student Assessment (PISA). PISA average proficiency scores for these countries rank them in an almost identical order as their TERCE scores, with the highest, Chile, scoring 67 points below the OECD average (OECD, 2015a). Paraguay is part of PISA for Development (see Box 3.1) and the first results allowing a comparison of learning outcomes among 15 year olds will be available in 2018.

Paraguay is taking part in the OECD’s PISA for Development project (PISA-D), which was designed to enable greater PISA participation by low and middle-income countries by extending the PISA test instruments to a wider range of performance levels, developing contextual questionnaires and data-collection instruments effectively to capture the diverse situations in low and middle-income countries, and establishing methods and approaches to include out-of-school young people in the assessments.

PISA-D builds capacity for managing and using the results of large-scale student learning assessment and using the results to support policy dialogue and decision making in participating countries and promotes peer-to-peer learning by bringing together countries already participating in PISA with PISA-D countries. The OECD and PISA-D countries will work collaboratively in the preparation and dissemination of a national report for each country, and in facilitating the resulting national policy dialogue. The in-school results will be published in December 2018 and the out-of-school results in December 2019.

Participating countries have each established a national centre and nominated a national project manager to ensure appropriate infrastructure and resources are in place to implement the assessment in accordance with the PISA technical standards. In Paraguay the national centre is located within the directorate for evaluation of educational quality (DECE), attached to the directorate-general for education planning. DECE is currently in the process of being incorporated into the national institute of educational assessment, which is in the process of being formed. The Paraguayan team has excelled in their implementation of the study, complying with every deadline and technical standard.

National assessments find that, at higher grades, there are fewer students at the lowest proficiency levels, but there are also fewer at the highest level. In mathematics 18% of students do not reach level 1 in grade 3, compared to 11% in grade 6 and 9% in grade 9 (MEC, SNEPE). However, by grade 9 as many as 52% of students in the cohort had left school in 2010, when the test was administered. The pattern can partly be explained by higher dropout rates among students struggling at school. However, the proportion of students achieving level 4 was also lower at higher grades, with only 2% in grade 9, compared to 9% in grade 3 in 2010.

Inequalities in learning outcomes are most pronounced between public and private establishments and to a lesser degree between rural and urban areas. As with enrolment rates, gender gaps in test performance are small. In mathematics, 78.2% of boys in grade 3 score at level 2 or below, compared to 77.7% of girls. The gap is also small in 9th grade at 0.6 percentage points. However, the gap between public and private education institutions is large, eight percentage points in grade 3, growing to 12 in 9th grade.

A significant difference in performance between urban and rural areas comes from language differences. In 2010 SNEPE applied the communication and language questionnaire in grades 3, 6 and 9, but it was only applied in both official languages (Spanish and Guaraní) in grade 6. The results show that performance in Spanish was better in urban areas while performance in Guaraní was better in rural areas.

The geographic gap is particularly large in secondary school. In mathematics, the gap in performance in grade 3 is small (0.8 percentage point difference in level 2 or below), but it is significant in grade 9 (almost five percentage points). Moreover, while on average 65% of urban students complete secondary school at the expected age only 36% of rural students do (World Bank, 2015).

Resources for education in Paraguay

Paraguay faces significant gaps in social infrastructure, including in education. A detailed analysis of gaps in school infrastructure carried out by the World Bank based on 2008 data found that a substantial proportion of schools, especially in urban areas, suffered from lack of space (Wodon, 2016). The same study found major differences between urban and rural schools in terms of basic amenities, with only half of rural schools having sanitation or toilets compared to 80% of urban schools. Wodon (2016) also noted that the fall in education expenditure left little space to fill this gap. As a response, Paraguay has significantly increased expenditure on education, and the MEC is implementing an updated prioritisation process to manage resources. Among other things, the process aims to encourage larger, better-equipped schools, including in rural areas.

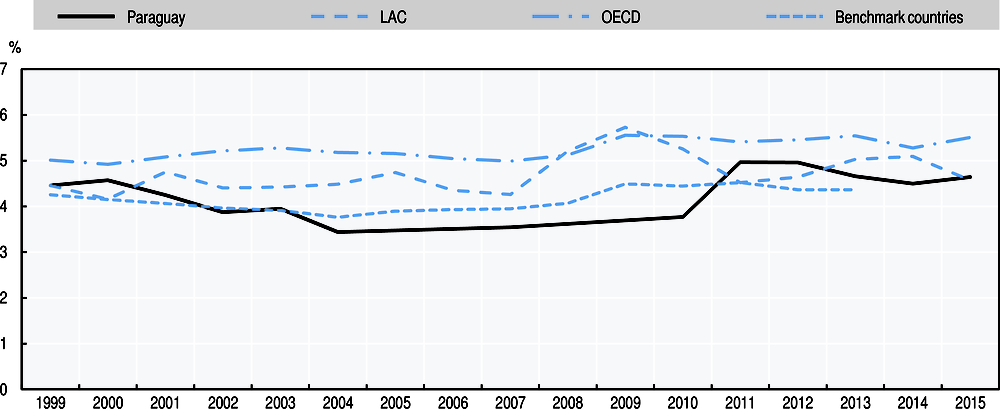

The country has significantly increased public funding for education in the past decades. The crisis of the late 1990s and early 2000s coincided with a major fall in spending on public education. Education expenditure as a share of GDP has since recovered to 4.6%, a level that is comparable to the regional average and the average of benchmark countries, although it remains almost a percentage point below the OECD average.

Not only has the amount of education spending changed, but so also has its composition, through the earmarking of part of the royalties obtained from the binational hydropower plant of Itaipú to education and supporting expenditure. Created in 2012, the Fondo Nacional de Inversión Pública y de Desarrollo (FONACIDE) is a budgetary fund that channels resources within a set of quotas established by law. Of the resources 30% are attributed to a fund for education and research (Fondo para la Excelencia de la Educacion y la Investigación [FEEI]) and 25% to local governments, which have to spend at least 50% of this transfer on education infrastructure and 30% on school meals programmes (Decree 9966/2012, Art. 13). If these two elements are compounded, FONACIDE therefore dedicates 50% of the resources it receives to education. In 2016 FONACIDE received USD 369 million (PYG 2.1 trn). By comparison, the total investment budget for the Ministry of Education in 2015 was PYG 426 billion or USD 72 million.

Limited absorptive capacity hinders the potential impact of increases in education finance. Despite the significant sums earmarked, there are significant hurdles in the way of putting these resources to good use. In 2015, only a fraction of the funds had been transferred to the FEEI or municipalities (10% of transfers, or 5.4% of income had gone to the FEEI, 38% to local governments). In 2016, transfers were much closer to those mandated by law, with 26% going to municipal and departmental governments (including specific transfers for compensation mandated by law). However, the execution rates of these funds are low (Molinier, 2016). The FEEI only committed 30% of its allocation in 2015 and 28% in 2016 (Contraloría General de la República, 2016, 2017).

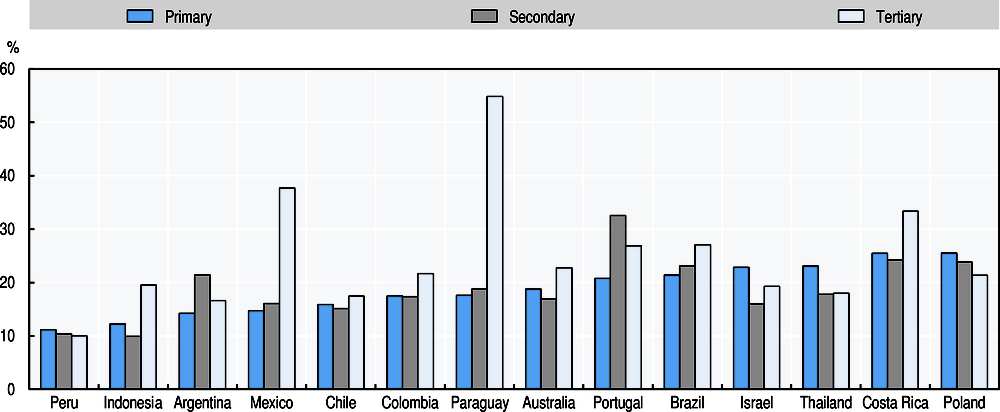

Expenditure per student is similar in primary and secondary education, but much higher than the benchmark countries in tertiary education. Moreover, while public expenditure in all other levels of education is progressive in Paraguay, public expenditure in tertiary education is regressive (in an absolute sense) (Giménez et al. 2017). The recovery in the share of public expenditure on education and the increase in real public expenditure in education during the 2010-15 period (48%) have allowed the country to attain levels comparable to those of benchmark countries in primary and secondary education. Paraguay stands out because of the amount of resources dedicated to tertiary education: it spends 55% of GDP per capita per student in tertiary education out of the public purse. This is particularly striking given that the increase in tertiary enrolment was largely realised in private institutions, where expenditure per student is, at 19% of GDP per capita, comparable to those in OECD countries from the benchmark group (CONACYT, 2016). Public expenditure on tertiary education in Paraguay is an order of magnitude above the level spent by benchmark countries, only comparable to Mexico. This pattern is partly explained by the fact that a significant share in expenditure by the Universidad Nacional de Asunción (UNA), the main public university in Paraguay, is in fact devoted to the provision of health services by the Hospital de Clínicas, the university’s teaching hospital, and one of the largest hospitals in the country (Molinier, 2016). However, the budget of the entire faculty of medicine of the UNA is only 12.6% of total expenditure in tertiary education as reported by the Ministry of Education and Science. While this constitutes significant bias in the data reported in Figure 3.31, expenditure per student would still be much higher than in benchmark countries if it the whole of the faculty of medicine’s budget were deducted from expenditure in tertiary education.

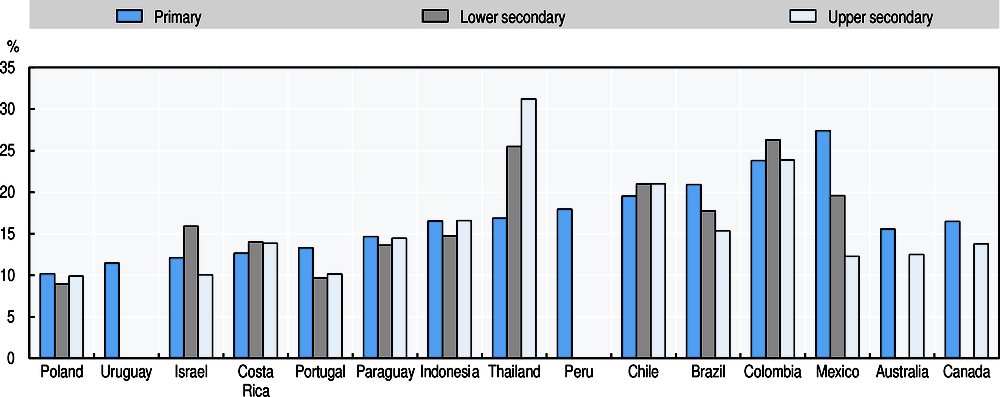

Paraguay has sufficient human resources in education but needs to increase the prevalence of qualifications to ensure quality. Figure 3.32 shows that pupil/teacher ratios for basic and secondary education are similar and in line with those of benchmark countries. Indeed, there was a significant increase in the number of centres for teacher training and the number of candidates trained in the first half of the 2000s. The oversupply of would-be teachers led to a moratorium in new entries to training cycles in 2006-13. On the other hand, given the relatively recent implementation of the framework for competitive entry into teaching, there remain gaps in teacher training (PREAL, 2012). Of all primary teachers 13.4% do not hold the appropriate qualification,13 double the proportion of Colombian teachers. The figure for pre-primary is significantly higher, at 54%, which poses questions regarding the potential benefits of that cycle. A significant effort is therefore being put into on-the-job training for teachers.

The creation of a sizeable scholarship programme in 2015 for study abroad has the potential to contribute to human capital formation and the quality of education in the country. With the aim of improving higher education teacher training and enhancing the supply of qualified labour for science, technology and innovation in the country, the Programa Nacional de Becas de Posgrados en el Exterior Don Carlos Antonio López (BECAL) provides postgraduate scholarships for Paraguayans to study in top universities abroad in science and technology, selected areas for innovation and in education sciences. By March 2017, the programme had financed 790 scholarships, with a sizeable budget (20.6 million USD over the first two years, equivalent to 8% of total annual public expenditure in tertiary education in 2015) (FEEI, 2017). The internationalisation of students follows successful experiences from other countries, like Chile’s Becas Chile Programme, or Kazakhstan’s Bolashak, where similar programmes have transformed key areas of the private and public sectors through the accumulation of skills and the creation of transnational networks.

The social protection system is highly fragmented and limits the efficiency of social service delivery

The social protection system in Paraguay is highly fragmented. The main social insurance institution is the Instituto de Prevision Social (IPS), which provides pensions, health insurance and coverage of labour risks to employees of most private firms. Beyond workers covered primarily by the IPS, the various social security functions are delivered by a multiplicity of institutions. There are separate pension funds for public employees, for the financial sector, for municipal workers, for parliamentarians, and supplementary pension funds for workers at certain major state-owned companies (ANDE, Itaipú) and private pension funds for co-operatives and others. The IPS provides work accident insurance for the majority of those workers that are insured as there are no alternative providers. Social assistance is delivered by a multiplicity of public entities, and consists mostly of income support, as basic health coverage is universal, a function that is carried out by the Ministry of Health.

Social security coverage is low and fragmented

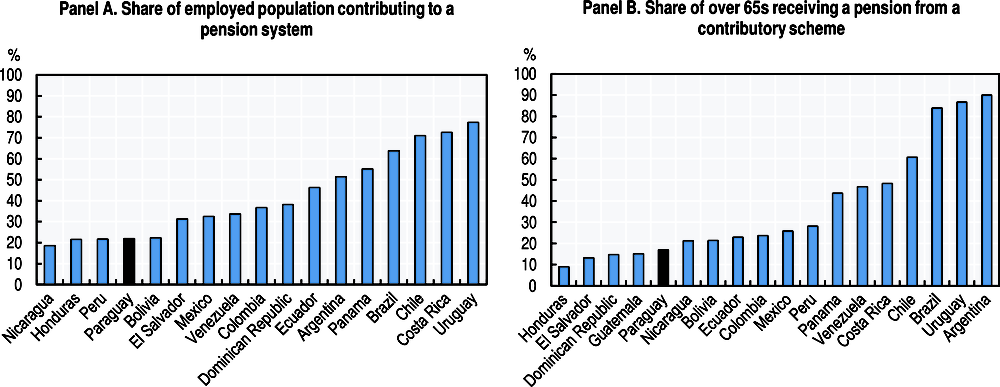

Social security coverage is low compared to the rest of Latin America despite recent improvements in coverage. Only 22% of the employed population contribute to a pension system (Figure 3.33) and only 29% report having medical cover. There has been a recent increase in coverage rates, with health raising from 22.7% to 28% between 2010 and 2015, and falling to 25.9% in 2016. Coverage by the pension system has followed a similar trajectory.

The low coverage reflects informality in the labour market but also institutional features of the design of the social protection system. Indeed, pension and health insurance coverage are voluntary for the self-employed and stay-at-home mothers, who, since 201314 can be affiliates of the pension branch of the IPS. The pension system was also opened to domestic workers, who previously could only pay into the health insurance component of the IPS. However, coverage in those groups is minimal: 363 own-account workers and employers according to the IPS,15 and 22% of domestic workers according to IPS data. Beyond informality and the limitations with respect to independent workers, limitations also exist in the public sector, where so-called contract workers are not required to contribute to the pension system (and largely do not, which explains why only 80.7% of public employees are covered). Low coverage is also a reflection of lack of enforcement.

The pension system is a defined-benefit scheme, and the IPS pension (which covers dependent workers in the private sector) is very generous for those who receive a pension, although relatively rigid. The net replacement rates16 calculated by the OECD pension model, place Paraguay as the country with the most generous pension system in Latin America. Indeed, the OECD pension model estimates replacement rates above 100 per cent, compared to the OECD average of 63% (for a full-career average earner, OECD, 2015b). This results from high gross replacement rates and the low coverage of the personal income tax. However, this generosity is only for the few. When the necessary contribution density to attain a minimal pension is taken into account, only 4.6% of the active population have sufficient density and only 12.6% are expected to have a pension in the future (Navarro and Ortiz, 2014). A large number of contributors, who through breaks in their careers or transitions between formal and informal work, will not reach the minimum number of annuities, are effectively subsidising a very generous system for the few that will ultimately receive pensions.

The multiplicity of regimes and pension schemes in Paraguay contributes to inequality in benefits. Different pension regimes have significantly different contribution rates and in some cases, like the multiple regimes under the Caja Fiscal which covers state employees, even when they have the same contribution rates, they have different retirement rules, minimum contributions and replacement rates. A framework is in place (Ley 3856, 2009) to allow would-be pensioners to claim pro-rated benefits when they have transited from one scheme to the other.

The multiplicity of regimes also poses financing problems. Not all regimes are equally sound financially. While the IPS has reserves to face short and medium-term liabilities, the Caja Fiscal, which covers state employees is estimated to face an implicit deficit of 40 to 50% of GDP in presented discounted value (Larraín, Viteri and Zucal, 2013). Some regimes have had to resort to emergency reform or recapitalisation to avoid becoming financially unsound. Another issue in financing is the use and placement of pension reserves. The sector is not regulated and funds can make risky investments, which if unsuccessful may jeopardise the scheme, and increase the potential hidden liability that the state has to face if future older citizens are left without a pension.

A fragmented health system and high out-of-pocket payments sustain inequalities

The health system is also fragmented between various providers of insurance and services. The system is mixed, with a public and a private subsector. The Ministry of Health and Social Welfare (Ministerio de Salud y Bienestar Social, MSPBS) administers the public component and provides services directly. The public health sector also includes the health services of the social security institute (IPS), the hospital of the national university of Asunción, the military and police health services and health services provision by the secretariat for disabled persons (Secretaria Nacional por los Derechos Humanos de las Personas con Discapacidad – SENADIS), the Dirección de Beneficencia y Ayuda Social (DIBEN, directorate for charity and social assistance, dependent on the presidency), local government, and by the health services of the firms managing the binational hydroelectric power plans. Employees in the private sector who are affiliated to the IPS also receive health services from the IPS. The private sector is constituted by private health insurance providers and private providers of, pre-paid plans and health services.

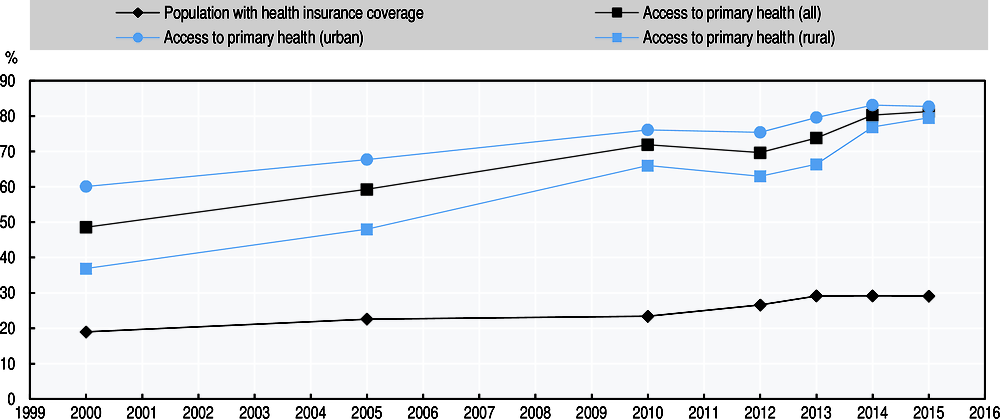

Access has increased in recent years but given the high levels of informality and non-compliance, health insurance prevalence is low in Paraguay (29% for the whole country, only 14% in rural areas). Affordability is an important factor: about half of the uninsured (1.7 million people) say they do not have health insurance because it is too expensive. It should be noted that since 2008 health services provided by the MSPBS network have been free. This was the culmination of a process started in 2000 with free attention to pregnant women and children under five, then extended progressively to other groups and to other services (including vaccines and essential medicines). The system has also been extended to include family health units (unidades de salud de la familia, USF) which are meant to respond to most health needs in a given territory. They are the basic means to provide health service in remote areas. Each USF comprises a doctor, nurse or obstetrician, nurse auxiliaries and community workers. There are currently about 800 USFs in the country. The social security institute covers 21% of the population (salaried workers in the private sector and of autonomous public entities, teachers and a minority of insured independent workers and domestic workers). Other insurers (public and private) cover 8% of the population. This leaves over 70% of the population who are only covered by the free services provided by the Ministry of Health (MSPBS).

The universality in basic health provision and the geographical extension of services seem adequate, although challenges remain, especially in terms of equal access. Progress in access to health services has been notable, especially in rural areas. While only 37% of rural dwellers felt they had access to a medical consultation in 2000, 76% of them had access in 2014 (Benítez, 2017). The increase in access to health has resulted mainly from closing the gap between rural and urban dwellers. According to survey data, only a minority of people who were sick or had an accident did not consult a health professional because of inaccessibility of service (only 2% of those not seeking attention, DGEEC, 2015). In spite of this increase in effective service, two key sources of inequality remain. First, the depth of coverage varies significantly across insurance and service providers, with the IPS covering more pathologies and treatments than many other insurance schemes. Both the IPS and the Ministry of Health have health establishments able to offer services covering a range of complexity across the country. The USFs are the main entry point to the country’s health system, however, and only exist in the Ministry of Health’s system. Second, mortality patterns suggest that certain areas are behind the national curve in the epidemiological transition. Indeed, deaths from communicable diseases have fallen significantly in the past 15 years, but remain a major cause of death in more isolated regions (especially Boquerón and Alto Paraguay) (Casalí and Velásquez, 2016).

Fragmentation can also lead to financing issues because of the lack of patient referral and costing agreements. In particular IPS and MSPBS provision is financed through separate channels but the broader coverage of the MSPBS facilities can lead IPS-insured patients to consult at other facilities. International experience shows that parallel systems can deliver results in terms of coverage but can also generate inefficiencies in staffing, equipment and financial flows. The Ministry of Health is currently implementing a model of integrated health networks to make advances in universal coverage while creating better links between providers at the local and national level.

Despite these advances, health is largely financed by households in Paraguay. Public expenditure in health has increased notably since the mid-2000s, reaching 4.2% of GDP in 2014, but households still finance a sizeable proportion of expenditure on health (Casalí and Velasquez, 2016). This is due in part to out-of-pocket payments, which the WHO estimated were as high as 49% in 2014, among the highest in the Latin American region. According to Giménez (2012), this is largely due (for about half of the out-of-pocket expenditure) to the cost of drugs, followed by studies and finally hospitalisation. Since the elimination of user fees in 2008, access to free drugs has reached an increasing proportion of the population (over 50% of those in the first three quintiles). However, Benitez (2017) finds that out-of-pocket payments for health services still represent 10% of income for the poorest quintile, as opposed to 4% for the richest quintile, thereby sustaining inequalities.

Fragmentation and the need for institutionalisation in social protection

Throughout the social protection system – income support, pensions and health – there is fragmentation and a disconnect between providers that can generate inefficiencies and adverse incentives. Indeed, with minimum contributions for pensions relatively difficult to meet, workers closer to retirement age are likely to forego formal employment altogether, since they have access to health services via the MSPBS and would not receive a pension from IPS if they contributed.

Institutional and operational responsibilities for social assistance overlap. Action in favour of the population in poverty is largely based around programmes, rather than being rights-based, except for health services. As a result, there are multiple agencies (SAS, STP, SENAVITAT, SNNA among them) with their own methods for identifying beneficiaries, including different proxy means tests. The Secretaría Tecnica de Planificación (STP) has recently prepared a targeting instrument (Ficha social) that is destined to encompass targeting processes for multiple programmes. This effort is part of the push for a co-ordinated poverty reduction programme under the umbrella programme Sembrando Oportunidades. However, certain programmes still use their legacy instruments (e.g. that used by the CCT programme Tekoporã). Systematic enrolment is the exception rather than the rule. While the social cabinet of the presidency holds an integrated social information system (SIIS) which covers 95 social programmes, it contains programme information, rather than a unified roster of beneficiaries. Legacy attributions sometimes seem to clash with mandates: for example, the Secretaria de Accion social (SAS), which manages the main conditional cash transfer programme (Tekoporã), also manages a programme aimed at facilitating access to public services by legalising the ownership of land (which it owns) in the favour of beneficiaries. At the same time, the knowledge and mandate for urban development and housing rests with the SENAVITAT. Co-ordination between agencies and ministries is perceived to have improved across government programmes. In the field of urban development, where interventions from a large number of agencies are needed, there is still need for a co-ordinated budget planning process that can contribute to optimising public expenditure in territories.

Co-ordination between institutions seems to work through ad hoc interfaces, but certain problems will require it to be institutionalised. In the field of poverty reduction, the national poverty reduction programme Sembrando Oportunidades establishes a number of mechanisms from targeting to intervention and monitoring to increase co-ordination and provide an integrated approach. In particular, addressing informality will require that better linkages are created between active labour market policies offered by the labour ministry and the national training system, and the social security and fiscal institutions. There has been progress in this respect, as the IPS can now share information with a view to enforcing declaration and payment obligations, which was prohibited by law in the past. Beyond enforcement functions, programme and policy design also require good institutional links to be effective.

References

Alaimo, V. and W. Tapia (2014), “Perspectivas del mercado de trabajo y las pensiones en Paraguay” [Perspectives on the labour market and pensions in Paraguay], Nota técnica #772, Unidad de Mercados Laborales y Seguridad Social, Banco Interamericano de Desarrollo.

BCP (2017), Anexo Estadístico del Informe Económico [Statistical annex to the economic report], Banco Central del Paraguay, Asunción, https://www.bcp.gov.py/anexo-estadistico-del-informe-economico-i365 (consulted August 2017).

Benítez, G. (2017), “Paraguay: distribución del Gasto en Salud y Gastos de Bolsillo” [Paraguay: distribution of health expenditure and out-of-pocket expenditure], CADEP, Observatorio Fiscal, June.

Casalí, P and M. Velásquez (2016), Paraguay, Panorama de la protección social: diseño, cobertura y financiamiento [Paraguay, panorama of social protection: design, coverage and financing], International Labour Organization, Santiago.

CEDLAS and the World Bank (2017), Socio-Economic Database for Latin America and the Caribbean, CEDLAS (Centre for Distributive, Labor and Social Issues in Latin America, Universidad Nacional de La Plata, Argentina) and the World Bank, http://sedlac.econo.unlp.edu.ar/eng/.

Cohen, D. and L. Leker (2014), “Health and Education: Another Look with the Proper Data”, CEPR Discussion Paper No. DP9940, available at https://ssrn.com/abstract=2444963.

Cohen, D. and M. Soto (2007), “Growth and human capital: good data, good results”, Journal of Economic Growth, Springer, Vol. 12(1), pages 51-76, March.

CONACYT (2016), Estadísticas e indicadores de ciencia y tecnología de Paraguay 2014/15 [Statistics and indicators for science and technology in Paraguay 2014/15], Consejo Nacional de Ciencia y Tecnología (CONACYT), Asunción.

Contraloría General de la República (2017) Informe sobre la rendición de cuentas de la ejecución de los programas y proyectos financiados con recursos del FONACIDE al 31 de diciembre de 2016 [Report on the execution of programmes and projects financed with FONACIDE resources to 31 December 2016], Comptroller-General of the Republic, Asunción, March.

Contraloría General de la República (2016), Informe sobre la rendición de cuentas de la ejecución de los programas y proyectos financiados con recursos del FONACIDE al 31 de diciembre de 2015 [Report on the execution of programmes and projects financed with FONACIDE resources to 31 December 2015], Comptroller-General of the Republic, Asunción, March.

DGEEC (2017a), “DGEEC presentó nueva serie de pobreza y pobreza extrema” [DGEEC presents new series for poverty and extreme poverty], website of the Dirección General de Estadística, Encuesta y Censos, Paraguay, available at www.dgeec.gov.py/news/DGEEC-PRESENTO-NUEVA-SERIE-DE-POBREZA-Y-POBREZA-EXTREMA.php.

DGEEC (2017b), Encuesta Permanente de Hogares [Permanent Household Survey] (database), Dirección General de Estadística, Encuestas y Censos, Fernando de la Mora, http://www.dgeec.gov.py/microdatos/index.php, accessed August 2017.

DGEEC (2016), “Empleo informal: Encuesta Permanente de Hogares EPH 2010-2014” [Informal employment: Permanent Household Survey EPH 2010-2014], Dirección General de Estadística, Encuestas y Censos, Fernando de la Mora.

DGEEC (2015), Principales Resultados. Encuesta Permanente de Hogares 2015 [Main results: Permanent Household Survey 2015], Dirección General de Estadística, Encuestas y Censos, http://www.dgeec.gov.py/Publicaciones/Biblioteca/resultado%20eph2015/PUBLICACIONES%20EPH%202015%2008-05-17.pdf.

ECLAC (2016), Panorama Social de América Latina 2015 (Social Panorama of Latin America 2015), United Nations Economic Commission for Latin America and the Caribbean, Santiago.

Elías, R., G. Walder, and D. Sosa (2016), Perfiles de la exclusión educativa en la República de Paraguay [Profile of educational exclusión in the Republic of Paraguay], Investigación para el desarrollo and UNICEF, Asunción.

FEEI (2017), Informe de avance: Programa Nacional de Becas “Don Carlos Antonio López” [Progress Report: National Scholarship Programme Don Carlos Antonio López], Fondo para la Excelencia de la Educación y la Investigación, 31 March 2017.

Giménez, E. (2012), “Introducción al sector salud en Paraguay: Una aproximación conceptual y metodológica para el análisis sectorial” [Introduction to the health sector in Paraguay: a conceptual and methodological approach to sector analysis], Instituto Desarrollo, Asunción.

Giménez, L. et al (2017), “Paraguay: Análisis del Sistema fiscal y su impacto en la pobreza y la equidad” [Paraguay, Analysis of the fiscal system and its impact on poverty and equity], Documento de trabajo, Ministerio de Hacienda, Secretaría Técnica de Planificación del Desarrollo Económico y Social, CEQ Institute and the World Bank.

Higgins, S. et al. (2013), “Social spending, taxes and income distribution in Paraguay”, CEQ Working Paper No. 11, CEQ Institute, Tulane University, www.commitmentoequity.org/publications_files/Paraguay/CEQWPNo11%20Paraguay%20Nov%202013.pdf.

ILO (2016), ILOSTAT (database), International Labour Organization, Geneva http://www.ilo.org/ilostat/.

ILO/DGEEC (2016), Trabajo infantil y adolescente en el sector rural agrícola, pecuario, forestal y de pesca o piscicultura en Paraguay: Encuesta de Actividades de Niños, Niñas y Adolescentes [Child and adolescent labour in the rural agricultural, livestock, forestry, fisheries and piscicultural sectors in Paraguay: Survey of activities of children and adolescents], International Labour Office and Dirección General de Estadística, Encuestas y Censos del Paraguay, Asunción.