Chapter 3. Peer-learning for bolder social protection in Korea

This chapter looks at the social protection measures applied in OECD countries. The analysis benchmarks common types of income support and activation measures for unemployment, temporary work incapacity and other types of poverty risk. It highlights lessons for Korea based on the commonalities and differences among the measures implemented across the OECD, focusing on several of their operational features. The discussion, in particular, looks at the coverage conditions such measures entail; the duration and scope of the support they provide; the active features they embody; and the supporting policies through which they are implemented.

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

Learning from international experience

The Korean approach to social protection policy

Korea’s social protection measures are considerably young compared with those in many other OECD countries. Policy makers have an incredibly rich pool of international experience from which to draw ideas, insights and warnings. Lessons of this kind have already helped Korea to introduce effective social protection measures and deliver on many of its economic, social and labour market goals.

Social protection measures in Korea have consistently been introduced with a characteristic “cautiousness” on the part of policy makers. With each new measure put in place, both formal coverage and the level of support have tended to start from a very modest base. Afterwards – once any behavioural effects were observed and the necessary implementation channels established – incremental reforms to each measure created new coverage opportunities and expanded the support on offer.

Korea’s cautiousness in this area has probably contributed much to its strong activation climate; sustained employment outcomes; and unprecedentedly low levels of long-term unemployment. Nevertheless, Korea’s cautious approach to social policy-making also underpins its biggest remaining weaknesses. Three leading challenges stand out in this respect: large pockets of jobseekers still remain outside the coverage of income and employment support measures; workers undergoing sickness have no guarantee of support and are commonly dismissed from their jobs, impeding their recovery and rehabilitation; while other needy groups – including low-income workers – often gain too little support or miss out on it altogether. Bolder policy actions may be necessary to address the issues on each of these remaining fronts.

The lessons developed among Korea’s peers within the OECD offer key solutions and guidance to embolden policy makers. The purpose of this chapter is to explore such lessons for the enrichment of Korea’s social protection environment. The analysis outlines a range of assertive, innovative and bold policy actions Korea might consider to decisively address its remaining social protection challenges.

Benchmarking OECD countries’ approaches

The present chapter’s analysis establishes a number of benchmarks relating to OECD countries’ social protection measures and supporting institutions. Drawing on the diverse array of approaches, measures and conditions developed, the analysis highlights the potential merits, drawbacks and pitfalls they represent for Korea.

The discussion targets the central themes already developed in Chapter 2:

-

Addressing the remaining coverage gaps of Korea’s Employment Insurance (EI), the analysis looks at the equivalent eligibility, entitlement and behavioural conditions other countries use. The discussion points out viable ways of tackling some of EI’s most prominent omissions.

-

Addressing the relatively narrow scope of the income support offered under EI, the analysis compares how other OECD countries calculate unemployment benefits. The discussion highlights the positive role non-contributory measures can play as a secondary “tier” of income support and the future part Korea’s Employment Success Package Programme (ESPP) might choose to play.

-

Addressing the current lack of social protection for workers undergoing sickness in Korea, the analysis looks into the types of policies and measures used elsewhere. It points out potential avenues for Korea.

-

Addressing poverty and in-work poverty, the analysis compares Korea’s Basic Livelihood Security Programme (BLSP) and Earned Income Tax Credit (EITC) with parallel measures used in other OECD countries. The discussion looks into the relevant coverage conditions in each case and, in particular, the different features making up the means tests they apply.

The following three sections of this chapter compare and review OECD countries’ social protection measures targeting the working-age population under three specific circumstances: in unemployment; through a temporary period of work incapacity; and otherwise under a risk of poverty. Each discussion compares the coverage conditions such measures entail; the scope of support they provide; the active features they involve; and the supporting policies integral to their implementation, drawing out potential best practices for Korea. A short concluding section reiterates the main messages.

Protections for unemployed persons in OECD countries

Unemployment insurance and unemployment assistance

Social protection measures for unemployment commonly seek to balance two competing objectives. On the one hand, they seek to compensate unemployed persons for all or part of their previous earnings. For individual jobseekers, this enables a degree of support in maintaining work capacity and providing for dependents during the unemployment spell. For the broader economy, it entails an automatic stabilising effect on earnings volatility to help smooth consumption, on aggregate (Rejda, 1966[1]; OECD, 2011[2]; Di Maggio and Kermani, 2016[3]). On the other hand, social protection measures for unemployed persons seek to promote jobseekers’ transitions into work. For individual jobseekers, this enables a livelihood, self-sufficiency and fulfilment through work. For the broader economy, achieving such transitions both swiftly and robustly enlarges the workforce, bolsters skills development and increases fiscal gains.

Functioning labour markets rely, to a considerable degree, on the fine balance achieved between these two competing goals. Changes in the coverage or calculation of unemployment benefits must thus be careful always to consider how they might alter the balance and, hence, work incentives.

Every OECD country targets support towards unemployed persons under certain circumstances. Two types of measures stand out in particular:

-

Unemployment insurance benefits offer income support to jobseekers on a contributory basis. Most are conditional on evidence of jobseekers’ work history and, in any case, on their job-seeking behaviour. Virtually all are limited over a fixed period of time. Coverage is compulsory for most salaried workers in virtually every OECD country and increasingly open to others. Korea’s EI belongs to this category of measures.

-

Unemployment assistance benefits offer income support to jobseekers who either exhaust their entitlement under an insurance-type measure or never contribute to one in the first place (including, in many cases, new labour market entrants). Entitlement is usually restricted through a means test. Such measures exist in a number of OECD countries as second-tier unemployment benefits and, in some cases and for most non-salaried workers, as the first or only tier. Korea’s ESPP broadly falls into this category of measures.

The discussion below elaborates on the many ways in which OECD countries currently apply such measures: the conditions of coverage they entail; the scope of support they provide; and their active features.

Eligibility, entitlement and job-seeking behaviour

Unemployment benefit measures in OECD countries typically restrict coverage through conditions applied at three distinct stages: they determine who is eligible to contribute into the common fund, while still in work (if the measure is contributory); who is entitled to start claiming its benefits, in case of unemployment; and whose job-seeking behaviour is adequate, once the claim period is underway. Conditions applied at these three respective stages are referred to throughout this chapter as “eligibility conditions”, “entitlement conditions” and “behavioural conditions”.1

Coverage is restricted for a variety of groups under Korea’s EI benefit (Yoo, 2013[4]). “Blind spots” of this kind exist, to some extent, in every OECD country. Most countries limit unemployment insurance coverage for two main groups of workers in particular: non-salaried workers (own-account workers, employers and contributing family workers) and some categories of non-regular salaried workers (including certain groups of non-typical workers and part-time workers with short or irregular time commitments).

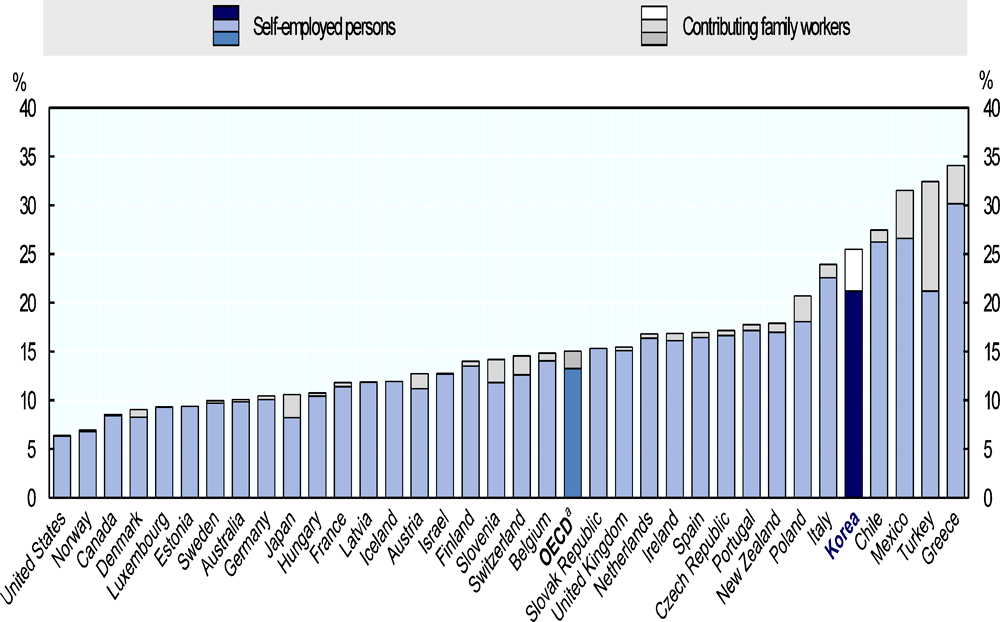

While many OECD countries maintain common blind spots for these groups, the impact this has on Korea’s labour market is greater, since both groups feature more in Korea’s labour market than elsewhere. Korea has among the highest rates of self-employment and contributing family work in the OECD (Figure 3.1) and an elevated share of non-regular workers among salaried employees.

Note: All data are for 2016 except Latvia (2015).

a. Weighted average of the 35 OECD countries.

Source: Employment by activities and status (ALFS), a subset of the OECD Annual Labour Force Statistics (ALFS) Database, http://stats.oecd.org//Index.aspx?QueryId=81036 (accessed on 7 November 2017).

Some 5.6 million Koreans were self-employed in 2016 (4.0 million of them own-account workers and 1.6 million employers), accounting for 21.2% of total employment. The weighted share for the OECD as a whole was 13.3%. There were also 1.1 million contributing family workers in Korea in 2016, accounting for an additional 4.3% of total employment. The equivalent share in a majority of OECD countries is lower than 1%.2

Of Korea’s 19.6 million salaried workers in August 2016, 3.7 million were employed on a non-permanent basis; 2.5 million on a part-time basis (meaning they had fewer than 36 regular work-hours per week); and 2.2 million through non-typical work contracts (as, for example, daily workers, contractors, temporary agency workers or domestic workers) (Statistics Korea, 2017[5]). With some overlaps, these three groups – collectively called non-regular workers – accounted for 32.8% of all salaried employees in Korea.

While Korea discounts self-employed persons, contributing family workers and some non-regular employees from mandatory unemployment insurance coverage, a number of OECD countries have designed innovative rules to encompass them. The following sub-section reviews the coverage conditions other OECD countries apply, focusing on self-employed persons. With minor variations, many of the same solutions discussed can equally apply to contributing family workers and the categories of non-regular salaried employees currently omitted from the scope of EI’s coverage.

Extending coverage to self-employed persons

Countries exclude self-employed persons from the coverage of their unemployment insurance measures for a number of justifiable reasons. Income from self-employment can fluctuate much from month to month, making it difficult to establish usual earnings. The time devoted to self-employment and its tenure may be unclear, making it tricky to benchmark with salaried employment. Self-employed persons are self-accountable for maintaining their labour output, which introduces a moral hazard of defaulting on work in favour of benefits. Once a self-employed person starts claiming benefits, there might also be a temptation to carry out some own-account work covertly should the opportunity arise in parallel. In any case, it may be difficult to establish whether self-employment has fully stopped and to what extent unemployment is involuntary.

In light of these obstacles, a number of OECD countries opt to provide no unemployment insurance coverage at all for self-employed persons (although many do, however, routinely cover them for other contributory measures including national pensions, work-related injury, sickness and parental benefits). Under such circumstances, self-employed persons entering unemployment have to make do with what private support might be on offer or resort to lower-tier social assistance measures (typically pending a means test).3

Countries deviating from this approach either offer voluntary affiliation for self-employed persons on an opt-in basis or make coverage mandatory under similar conditions as for regular salaried workers (Table 3.1).

Voluntary unemployment insurance affiliation for self-employed persons is emerging in more and more OECD countries: Germany first introduced it in 2006; Austria in 2009; Spain in 2010; and Korea, under EI, in 2012. Denmark, Finland and Sweden provide unemployment insurance coverage on a voluntary basis to all workers, in any case, under their so-called “Ghent system” measures. Self-employed persons there are largely undistinguished from regular salaried workers, choosing in the same way whether or not to opt in for unemployment protection.

Voluntary affiliation is not always truly open insofar as some of the above-named countries restrict the option through certain key caveats. Germany, for example, limits affiliation only to former salaried employees who transition into self-employment and desire to maintain the regular coverage they had up until then. Germany’s option is thus more of a continuation of coverage than a true opt-in and, in any case, expires following one year of detachment from salaried employment (MISSOC, 2017[6]; Bäcker, 2017[7]). Austria limits the option of registering for coverage to a 12-month window occurring once every nine years: those who fail to register during their first year of self-employment must wait eight years before they can do so again; those failing in the ninth year must wait another eight years; and so on (ILO, 2013[8]; Lee et al., 2016[9]). Korea’s EI limits the option insofar as own-account workers may only opt in during their initial year of self-employment and employers with 50 workers or more are forbidden.

Voluntary affiliation may be worthwhile in allowing individuals to choose their own exposure to the risk of unemployment. In reality, however, the risk is not the same for everybody. Voluntary insurance measures of any kind embody a problem of “adverse selection”: the least successful entrepreneurs have the greatest incentive to opt in although they run the highest risk of becoming unemployed. In practice, moreover, numerous countries have found that voluntary affiliation results in extremely low levels of participation among self-employed individuals (European Commission, 2011[10]; Fondeville et al., 2015[11]; Lee et al., 2016[9]). Even in Finland, where all unemployment insurance participation is voluntary, survey findings reveal that only 21.4% of own-account workers and just 10.3% of employers opted in during 2015, compared with 85.9% among regular salaried employees (Kalliomaa-Puha and Kangas, 2017[12]).

Mandatory unemployment insurance affiliation offers less choice to self-employed persons but entails at least two key advantages over voluntary affiliation: it escapes the problem of adverse selection and it spreads the benefits of protection to a greater number within society. Seven OECD countries currently operate mandatory affiliation to unemployment insurance measures for all self-employed persons: the Czech Republic, Greece, Hungary, Iceland, Luxembourg, Poland and Slovenia (Table 3.1).

Most of these countries implemented mandatory coverage for self-employed persons at a nascent stage in the development of their measures. The Czech Republic, Hungary and Poland, for example, embraced mandatory coverage for self-employed persons when they first introduced insurance-based financing for unemployment benefits in the early-1990s (Dervis, 1994[13]; MISSOC, 2017[6]). Iceland and Luxembourg have implemented it since at least the 1980s (OECD, 2008[14]; MISSOC, 2017[6]). Slovenia previously had voluntary affiliation for self-employed persons but made it mandatory in 2011 under its Labour Market Regulation Act – primarily in response to a perceived coverage gap among “dependent” own-account workers (Ignjatović, 2013[15]). Greece introduced mandatory affiliation for most self-employed persons in 2011 as well – primarily in response to its unfolding economic and labour market crisis – although entitlement to the benefit is means-tested (OECD, 2013[16]; Theodoroulakis, Sakellis and Ziomas, 2017[17]).

Portugal represents something of a peculiar case among the OECD countries since four separate groups of self-employed persons there are subjected to very different kinds of coverage rules (MISSOC, 2017[6]; Perista and Baptista, 2017[18]). Employers all gain coverage on a mandatory basis in the same way the regular salaried workers they employ do. Own-account workers plus contributing family workers also gain mandatory coverage provided they meet two key conditions:

-

Their annual earnings are higher than six times the national Social Support Index (indexante dos apoios sociais; set at EUR 421.32 in 2017) – a threshold equivalent to roughly one seventh of Portugal’s average wage or a third of its statutory minimum wage.

-

They are in a situation of “dependent” self-employment – defined, in Portugal’s case, as gaining 80% or more of their earnings from an individual source.

Own-account workers who fail to meet only the first of these conditions can opt in for coverage voluntarily, if they so wish. Own-account workers who fail in the second condition, however, are excluded from unemployment insurance coverage altogether.

The result for Portugal is that all employers and virtually all persons in dependent self-employment (including contributing family workers) gain unemployment insurance coverage on a mandatory basis. Conversely, genuinely independent own-account workers – those with a more diverse client portfolio – gain no coverage opportunity at all.

Portugal introduced its instrument fairly recently under key reforms enacted in 2012 in response to a tangible rise in dependent self-employment, similar to Slovenia (Perista and Baptista, 2017[18]). Spain introduced a similar measure in 2010 – called the Régimen de Trabajadores Autónomos de la Seguridad Social (RETA) – although affiliation relating to unemployment protection is voluntary (Rodríguez-Cabrero et al., 2017[19]). Italy also introduced a similar measure in 2015 – called the Indennità di Disoccupazione per i Collaborator (DIS-COLL) – covering only non-typical workers under a particular type of work-contract (Iudicone and Arca Sedda, 2015[20]; Jessoula, Pavolini and Strati, 2017[21]).

Unlike regular salaried employment, self-employment gives rise to a number of idiosyncrasies among workers that result in a host of practical questions unemployment insurance measures must resolve: How precisely to define self-employment for social insurance purposes? How to assess earnings from self-employment? What insurance premium to adopt? And how to combat the moral hazards that might arise?

The remainder of this sub-section identifies some of the practical solutions selected OECD countries apply, taking each of the four questions in turn.

Defining self-employment

Countries may differ in the precise legal definitions they give to self-employment. In most cases, the distinction between regular salaried employment and self-employment is relatively clear: the former subordinates workers to a particular role within the employing organisation while the latter enables them a tangible degree of autonomy over executive business decisions around investment, hiring and other such matters. While this much may be clear in a majority of countries, many encounter a certain grey area when it comes to dependent self-employment (sometimes called “bogus”, “fake”, “quasi-” or “contingent” self-employment or, in certain modern contexts, “gig economy work”).

Dependent self-employment may satisfy neither the legal conditions of employment nor conform reasonably to a common understanding of what self-employment ought to look like. For social protection purposes, such grey areas can create loopholes for participation under which employers or individuals might renege on their social insurance duties by maintaining informal employment relationships or disguising otherwise regular ones as a form of self-employment.

Well-established legal definitions can go a long way towards tightening such loopholes and, at the very least, clarifying who is entitled to which protections and under what specific circumstances. In countries such as Korea where some social insurance measures cover self-employed persons while others do not, such clarity might be all the more necessary in enforcing existing rules and limiting abuse.

The European Union’s European Working Conditions Survey provides a statistical definition of dependent self-employment as encompassing own-account workers who satisfy two or more of three conditions: they have only a single employer or client; they cannot hire employees, even if their workload is heavy; and they cannot autonomously take important decisions regarding their business (Oostveen et al., 2013[22]). While statistical definitions of this kind are useful, they can be cumbersome to establish for legal purposes. Efforts may be complicated further by the sheer diversity of work arrangements modern labour markets encompass, with grey areas not only around own-account work but also non-typical salaried work that can include daily workers, contractors, temporary agency workers, domestic workers, plus a whole range of private individuals earning their income through technologically-driven on-demand services delivery platforms.

In light of such challenges, OECD countries that offer unemployment insurance coverage to workers in dependent self-employment tend to opt for more pragmatic definitions. One key difference is between definitions founded on a relative threshold or an absolute one:

-

Some OECD countries have recently introduced definitions of dependent self-employment based on how concentrated an own-account or non-typical worker’s earnings might be on their biggest client, relative to the rest of their income. For Portugal and Slovenia, the line is drawn at 80% of the worker’s total earnings; Spain uses 75% (Perista and Baptista, 2017[18]; Stropnik, Majcen and Prevolnik Rupel, 2017[23]; Rodríguez-Cabrero et al., 2017[19]). Regardless of how much an individual might earn in total, any instance where their total earnings are concentrated on a single employer in excess of the threshold amount constitutes a relationship of dependent self-employment. This typically covers workers engaged on non-typical contracts; those subcontracted as own-account workers; and, in some cases, contributing family workers. In all three countries, the definition underpins a range of labour rights and labour market regulations applicable – not least of which regard who can (or must) be covered for which branches of social insurance.

-

Other OECD countries define own-account workers’ dependence through absolute threshold values such as a nominal amount of income a worker may gain at one time from a particular client or the time they might devote to such work. The Czech Republic, for example, identifies dependent self-employment when the commitment a non-typical workers devotes exceeds either an income threshold of CZK 10 000 per month (about KRW 520 000 per month) for a specific output (or one quarter of that if the work is of a more general nature) or a time threshold of 300 hours per year for a specific output (or 20 hours per week for work of a more general nature) (Sirovátka, Jahoda and Malý, 2017[24]). Other countries rely on similar absolute thresholds of this nature (MISSOC, 2017[6]).

Transparent formulas of either of these kinds engender a legal definition of dependent self-employment that can underpin the rights and obligations such workers (and their clients) must adhere to around social insurance. Once dependent self-employment is identified in one such clear way, it becomes easier to design appropriate coverage rules.

Assessing earnings from self-employment

Social insurance measures assess people’s usual earnings for two elementary purposes: as a basis for the premiums they charge and as a function of which the income support they could receive is calculated (except in the case of flat-rate benefits). A higher assessment of earnings may thus be a drawback for participants in terms of costlier social contributions but an advantage in terms of higher-value benefits.

The earnings regular salaried employees make are relatively easy to assess: they tend to be more-or-less uniform across the year; received at timely intervals; and transparently documented by the employer. The earnings self-employed persons make, on the other hand, are often none of these things, raising questions over how to assess them. Moreover, the taxable income self-employed persons gain from their work is justifiably a mix of two separate things – earnings (related to what labour the individual expends through their self-employment) and profits (related to their overall business performance, investments and holdings) – that might be difficult to separate out.

Countries that provide some social insurance to self-employed persons overcome these issues in a large variety of ways. Some take a fixed, formulaic approach while others offer more flexibility for individuals to draw their own line between earnings and profits.

The Czech Republic, Luxembourg, the Slovak Republic, Slovenia and Sweden exemplify the most rudimentary formulaic approaches conceivable: all of them assess self-employed participants’ earnings on the basis of a simple ratio that determines how much of their taxable income (i.e. their total revenues minus business expenses) should be taxed as earnings and how much as profits – the former being subject to social contributions and the latter not. In the Czech Republic, social contributions are charged on only half a self-employed person’s taxable income (Sirovátka, Jahoda and Malý, 2017[24]); in the Slovak Republic on roughly two thirds (Gerbery and Bednárik, 2017[25]); in Slovenia, on three quarters (Stropnik, Majcen and Prevolnik Rupel, 2017[23]); and in Luxembourg and Sweden, on all of it (Pacolet and Op de Beeck, 2017[26]; Nelson et al., 2017[27]).

The ease with which such rules can be administered represents a key advantage over other approaches. Nevertheless, it might be unsatisfactory to apply the same rigid, simplistic and, ultimately, rather arbitrary formula to all participants alike.

Iceland has a formulaic approach as well, though one that is significantly more nuanced. Each year, the government issues a centralised list of reference earnings for every occupational category, representing the amount of money a self-employed person could expect to earn carrying out the same work in a regular salaried position (Ríkisskattstjóri, 2017[28]). These so-called “presumptive” earnings (reiknað endurgjald) establish the sole basis on which self-employed persons in Iceland make social contributions: regardless of their actual earnings, it is solely the presumptive amount for each occupation that sets the basis for social insurance (Ólafsson, 2017[29]; KPMG, 2017[30]). Deviations from this benchmark are only possible under extenuating circumstances and, in any case, require approval from the Directorate on Internal Revenue (Ólafsson, 2017[29]). Presumptive earnings likewise underpin the way all contributing family workers in Iceland make social contributions.

Iceland’s unique approach offers an intuitive formula for establishing the earnings of self-employed persons. Those with incomes above the presumptive amount gain the full benefits of social protection alongside the profits they keep. Those with income far below the presumptive amount ultimately pay a disproportionate amount for social insurance and may well feel encouraged to opt for a salaried position instead.

Most other OECD countries take a more flexible approach, though not without certain boundaries. Korea, Portugal and Spain, for example, allow self-employed individuals a considerable degree of freedom in assessing their own earnings (MISSOC, 2017[6]). In Korea, self-employed persons volunteering for EI coverage unilaterally choose one of seven separate earnings assessment levels defined, in 2016, between thresholds of KRW 1 540 000 and KRW 2 690 000 per month. Portugal and Spain likewise allow participants to choose their own protection level, constrained by two such threshold amounts (SSA and ISSA, 2016[31]). Hungary and Poland offer a similar choice, constrained only by a minimum threshold amount: fixed at 150% of the statutory minimum wage in Hungary (Albert and Gal, 2017[32]) and at 60% of the previous year’s national average wage in Poland (Chłoń-Domińczak, Sowa and Topińska, 2017[33]). Austria, finally, allows self-employed persons to declare their covered earnings freely but, as a constraint, fixes the level they choose so it cannot be altered except once during every eight-year period (Lee et al., 2016[9]).

The flexible choice approach is worthwhile insofar as it allows individuals a significant freedom over the degree of support to insure for, within certain bounds. It amounts, in practice, to choosing one’s own exposure to the risk of unemployment. The main drawback, however, is that individuals largely tend to take a somewhat short-sighted approach by opting for the lowest amount of coverage possible: this has been the experience in Hungary, Poland and elsewhere, where a majority of self-employed persons simply opt for the minimum possible earnings assessment (Albert and Gal, 2017[32]; Chłoń-Domińczak, Sowa and Topińska, 2017[33]). While this thus results in relatively low levels of income support, it helps to maximise entitlement to employment support.

Setting insurance premiums for self-employed persons

Regular salaried employees in most OECD countries gain their social insurance coverage based on two separate payments: an employee’s contribution is deducted along with other taxes from their regular earnings (usually at the end of each month) and an employer’s contribution is made by the employing institution, as a compulsory part of their broader legal labour costs. Self-employed persons eligible for social insurance benefits usually make payments equivalent to the employee’s and employer’s contribution combined. This is the case, for example, in Hungary, Iceland and Slovenia.

Under Korea’s EI, regular salaried workers currently contribute a premium worth 0.7% of their earnings to the measure, while employers’ pay an additional 0.9-1.5%, depending on their size. Self-employed persons opting in for EI affiliation pay a premium of 2.3%.

Other OECD countries collect smaller-value social contributions from self-employed persons. Spain, for example, collects a voluntary premium of 2.2% to cover the risk of unemployment under RETA, compared to the 1.6% and 5.5% premiums a regular salaried employee and their employer pay under the general scheme (Rodríguez-Cabrero et al., 2017[19]). Germany and Poland both have a phased-in approach whereby self-employed persons are insured for only half of their reference earnings during the first two years of voluntary coverage and the full amount thereafter (SSA and ISSA, 2016[31]). Greece collects a flat-rate contribution of EUR 10 per month from the self-employed persons it covers on a mandatory basis, although entitlement to the benefit is means-tested (Theodoroulakis, Sakellis and Ziomas, 2017[17]).

Reducing the premium for self-employed persons might offer an incentive for more to opt in (Davies, 2013[34]; Hombert et al., 2017[35]). But preferential treatment for self-employed persons might also distort labour market incentives towards self-employment, potentially encouraging tax evasion and bogus self-employment (OECD, 2008[36]).

Addressing potential moral hazards

The economic activity of self-employed persons might be more difficult to monitor or account for, given its overall independent nature. While this may not present a problem among most beneficiaries, it does highlight some potential moral hazards for misusing unemployment benefits that measures covering self-employed persons should take care to guard against. One moral hazard for self-employed persons might be to default on work during a quiet period in the business cycle, in favour of claiming benefits. Another might be to carry on with self-employment despite claiming unemployment benefits.

There are countless examples among the OECD countries of potential ways to mitigate this problem. Some compelling illustrative examples may be grouped as follows:

-

Stricter entitlement conditions for self-employed claimants to fulfil before being able to claim benefits can offer an effective tool against possible misuse. Contribution conditions exceeding 12 months, for example, can prevent short-term defaults into unemployment during the business cycle. Several countries impose longer contribution conditions for self-employment. Finland, for example, requires self-employed participants to collect at least 15 months of social contributions within a four-year period, compared with just 6 months within a 28-month period for regular salaried employees (Kalliomaa-Puha and Kangas, 2017[12]). Portugal requires a minimum of 720 days within a 4-year period, compared with only 369 days within a two-year period for regular salaried workers (Perista and Baptista, 2017[18]). Luxembourg, finally, requires at least two years of social contributions, compared with just 26 weeks out of one year for regular salaried workers (Pacolet and Op de Beeck, 2017[26]).

-

Minimum earnings thresholds may be used in a similar way to discount self-employed persons with limited commitment or little success in their business. The Czech Republic, for example, has an earnings threshold for self-employed persons equivalent to 25% of the national average wage (or 10% if they work part-time) but imposes no such threshold on regular salaried workers (SSA and ISSA, 2016[31]). Spain, likewise, sets its minimum earnings threshold roughly one sixth higher for self-employed persons than it does for regular salaried workers (SSA and ISSA, 2016[31]).

-

Activation measures can be used to channel formerly self-employed jobseekers exclusively into regular salaried employment to avert potential flip-flopping in and out of self-employment. Luxembourg, for example, grants unemployment benefits to formerly self-employed claimants exclusively on the behavioural condition that they seek salaried employment. Reactivation into self-employment is therefore not an option (MISSOC, 2017[6]).

-

Delaying the start of the benefit period might also be effective for discouraging voluntary unemployment. Poland, for example, imposes a waiting period of 90 days on all formerly self-employed jobseekers starting on the day they register as unemployed (Chłoń-Domińczak, Sowa and Topińska, 2017[33]).

-

Mandating evidence of cessation of business operations can be an effective way to ensure benefit claimants do not undertake self-employment activity covertly. Most OECD countries with coverage for self-employer persons thus place at least some formal burden of evidence on jobseekers to certify that they are no longer active in their self-employment. Iceland, for example, mandates a double layer of evidence from any self-employed person registering as unemployed: a written declaration stating that all business operations have been discontinued, giving the reasons; and a formal letter from the Directorate of Internal Revenue certifying the claimant’s business has been removed from the employers’ register or their name deleted from a register of own-account taxpayers (Ólafsson, 2017[29]). Sweden requires a similar burden of proof but goes one step further to impose a strict ban from unemployment benefits for a period of five years on anyone found abusing the system or guilty of fraud (Nelson et al., 2017[27]).

What may or may not work, in any case, will be the result of various social and cultural factors plus how well-equipped public employment services may be at spotting potential wrong-doers. Given this complexity, a solution developed in one country might not work in another. The right mix of conditions, penalties and other countervailing measures can probably only be achieved through an extended period of experimentation.

Entitlement conditions for unemployment insurance benefits

Unemployment insurance measures in every country limit their coverage further through an additional set of entitlement conditions. Three kinds of conditions are in particularly common use among the OECD countries:

-

Minimum contribution conditions set a threshold of insurance affiliation or employment below which eligible workers are not entitled to claim benefits. Such conditions exist under every unemployment insurance measure and are virtually always expressed as a function of time: a set number of hours, days, weeks or months of prior work that entitle jobseekers to a given contributory benefit.4

-

Maximum cut-off conditions establish an expiry date at which past contributions effectively cease to count. Such conditions are usually expressed as the timeframe within which a worker must complete their minimum contribution condition: for example, 180 days of contributions within the past 18 months (as under Korea’s EI). Conditions of this kind effectively amount to a maximum period of time a worker can disengage from the labour market before forfeiting their entitlement to unemployment benefits. They thus inhibit long periods of inactivity.

-

Conditions on the nature of unemployment are commonly imposed as penalties for jobseekers leaving their previous employment under circumstances that were, in some way, reasonably avoidable or of their own choosing. Virtually all OECD countries have some legal criteria or an official guideline to differentiate “involuntary” unemployment situations from “voluntary” ones and, hence, to permit or restrict jobseekers’ entitlement to unemployment benefits.5

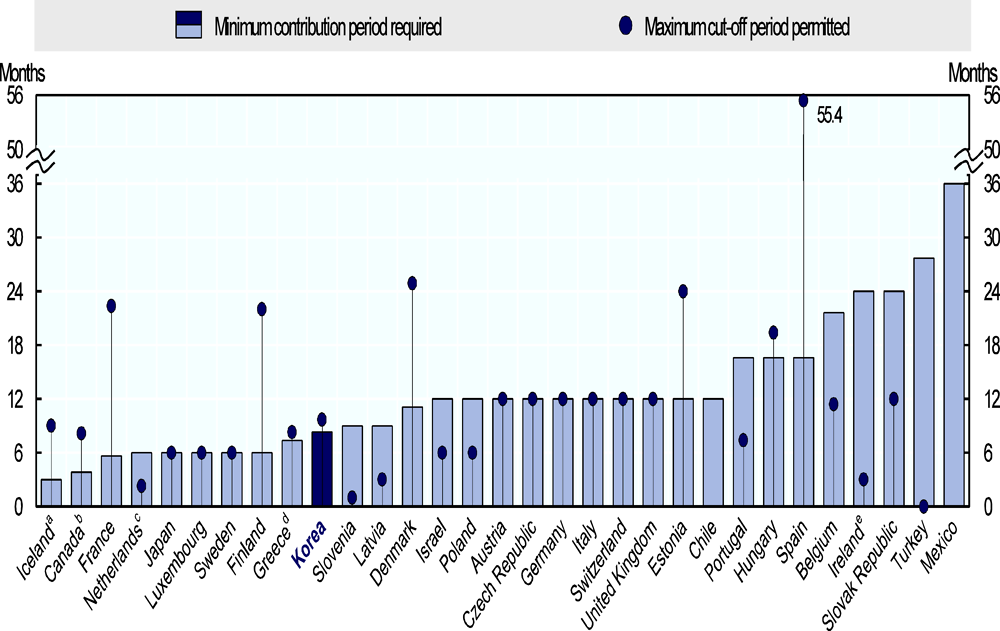

Figure 3.2 shows the minimum contribution and maximum cut-off conditions applied to unemployment insurance measures across the OECD. The periods of time under both conditions differ considerably from one country to another.

Minimum contribution conditions range from less than six months in Canada, Iceland and France to two years or more in Ireland, Mexico, the Slovak Republic, Slovenia and Turkey. The median and mode contribution periods among the OECD countries are both 12 months. Korea’s minimum contribution period of 180 days – roughly 8½ months (calculated as 180 ÷ 5 ÷ 52 x 12) – is slightly lower than in most OECD countries.

Maximum cut-off conditions differ more significantly. Turkey requires jobseekers to have worked continuously during the entire 24 weeks prior to the start of their benefit claim, resulting in an effective maximum cut-off period of zero. Spain, at the opposite extreme, requires only 360 days of contribution within a 6-year period, resulting in a potential cut-off period of over 4½ years. The median and mode cut-off periods among the OECD countries are both 12 months. Korea’s maximum cut-off period of 9½ months (18 months minus the roughly 8½ months required to fulfil 180 working days) is broadly in line with the OECD median.

Regarding voluntary unemployment, countries generally enforce one of three types of penalties on such jobseekers: a suspension, a sanction or a disqualification. Suspensions impose a fixed-term waiting period on the claimant, simply delaying the start of their benefit claim. Sanctions also impose a fixed-term waiting period but subtract from the overall entitlement period (effectively consuming the benefit, instead of just delaying it). Disqualifications, finally, eliminate the claimant’s entitlement to benefits altogether, thus excluding them for the entire duration of unemployment (Langenbucher, 2015[37]).

Table 3.2 summarises the types and scope of the penalties applied under the unemployment insurance measures found in OECD countries (plus the unemployment assistance measures of Australia and New Zealand, which make up their primary tier of income support for jobseekers in both countries).

Among the OECD countries, only Hungary and the Slovak Republic decline to impose any kind of a formal penalty on voluntary jobseekers for unemployment insurance benefits (though they penalise those fired for misconduct under certain circumstances).

for entitlement to unemployment insurance benefits

for entitlement to unemployment insurance benefits in OECD countries, 2016

Note: Where variable conditions apply, data assume the jobseeker is 40-years-old, single and without any dependents. Conditions defined in days were converted into months assuming a 5-day working week, with 52 weeks divisible into 12 equal months for every year. Conditions defined in hours were converted in the same way, assuming a 40-hour working week. Australia and New Zealand are not shown since they have no statutory unemployment insurance benefits. Norway is not shown since the minimum period of contribution for unemployment insurance is calculated from cumulative earnings. Mexico does not define a maximum cut-off condition (entitlement is conditioned by cumulative insurance contributions).

a. The minimum contribution period shown (10 weeks in the preceding year) enables entitlement for some benefits. Full entitlement requires 12 months out of the preceding year.

b. The minimum contribution period is lower in provinces with higher levels of unemployment. The figure presented assumes an unemployment rate of 6-7%.

c. The minimum contribution period shown (26 weeks in the preceding 36 weeks) applies to the short-term benefit. Longer-term benefits require affiliation during 4 of the preceding 5 years.

d. The minimum contribution period shown (80 days per year in each of the previous 2 years) is for first-time claimants. Those claiming unemployment insurance benefits for a second time or more must either contribute for 125 days in the previous 14 months or 200 days in the previous 24 months.

e. There are two minimum contribution conditions – first, to have made at least 104 weekly contributions at any point in time and, second, to have made at least 39 weekly contributions within the preceding calendar year or 26 within each of the previous 2 years. The periods shown represent both.

Source: Compiled using OECD (2017), “Benefits and Wages: Country Specific Information”, www.oecd.org/els/soc/benefits-and-wages-country-specific-information.htm (accessed on 3 November 2017).

Most countries apply a suspensions or sanction period of some set length. These are enforced by the public employment services, in each case, based on either a pre-defined guideline or a discretionary approach. Suspension and sanction periods vary in duration from between three and four weeks in Austria and Denmark to upwards of three months in Finland, France, Israel, Japan and Poland.

Korea’s EI penalises voluntary jobseekers through disqualification. Thirteen other OECD countries take the same approach including Canada, Italy, Spain and the United States.

Penalties are usually justified on the grounds that they discourage workers from defaulting on employment in favour of benefits, thereby strengthening labour market outcomes and combatting a moral hazard among some to misuse the system. In practice, however, such a strict penalty as disqualification can encourage a different kind of moral hazard – for employers and employees to negotiate the terms of their dismissals to ensure the worker will retain their unemployment benefit entitlements. Such practices are apparently widespread in a number of countries (OECD, 2016[38]).

Somewhat lighter penalties might therefore be preferable. Most OECD countries see benefit sanctions or suspensions of a certain period as a viable enough solution for encouraging job mobility (and, thus, labour market dynamism) while ensuring income and employment support reached those who may need it.

Entitlement conditions for unemployment assistance benefits

Unemployment assistance benefits usually entail entitlement conditions distinct from those applied under contributory measures. Where unemployment assistance benefits are the secondary tier of income support for jobseekers, alternative entitlement rules can help to maximise the overall coverage. For example, unemployment assistance measures can provide employment support and help to activate new labour market entrants in a way that insurance-type measures inherently cannot. Such measures may therefore be of specific benefit to school-leavers who might otherwise fall into a so-called “NEET” situation (being neither in employment, education, or training). Unemployment assistance measures can also ensure that employment support reaches the poorest, most vulnerable or hardest-to-place jobseekers in a way insurance-type measures seldom do. This may be of particular use in activating those who might otherwise exit the labour market.

The coverage of unemployment assistance measures is usually restricted via three separate sets of entitlement conditions: those related to a jobseeker’s age; those related to the means that they possess (including individual or household income, savings, assets and so on); and those related, in some way, to their recent labour market activity.

Table 3.3, below, details the entitlement conditions that apply under 15 unemployment assistance measures identified among the OECD countries, including Korea’s ESPP.6

Entitlement conditions related to age typically span the entire working-age population. Most unemployment assistance measures welcome participants from early adulthood – starting at ages 15-20 – up to the legal retirement age – around age 65. Only Chile and New Zealand appear not to have a legal maximum age: entitlement to unemployment benefits ends, instead, upon the formal start of an individual’s retirement.

Entitlement conditions related to means testing are applied under virtually all unemployment assistance measures. Among the OECD countries, only Chile and Sweden are exceptions to this rule: neither of their unemployment assistance measures involves a means test, though both offer only relatively low-value benefits and over a limited period of time.7 Finland’s flat-rate unemployment assistance benefit is generally means-tested, though not for jobseekers aged 55 and above. Korea’s ESPP is also generally means-tested, though not for young participants (aged 18-34) plus certain categories of jobseekers deemed as “vulnerable”.8

Means-test waivers of the kind used in Finland and Korea offer an effective way to ensure that employment support, training and other activation-oriented services reach particular groups that might require them more. Reducing means-testing requirements can also simplify the application procedure for support and may reduce administrative costs.

Entitlement conditions related to jobseekers’ recent labour market activity vary the most significantly across the OECD countries. Several of them include no such particular conditions: entitlement to unemployment assistance benefits is determined independently of previous labour market activity and, instead, may solely rely on the age restrictions imposed; a means test (if one is applied); and any additional behavioural conditions that may apply afterwards. This is the case for Korea’s ESPP and under the unemployment assistance measures applied in Australia, Germany, Ireland, New Zealand and the United Kingdom. These countries’ measures embrace new labour market entrants.

Other countries set specific conditions on previous labour market activity, usually expressed as a minimum length of employment within a recent period of time. Such conditions usually exclude new labour market entrants but may offer special conditions for them. Finland’s unemployment assistance measure, for example, exempts new labour market entrants aged 17-24 from its labour market activity condition (of having at least six months of employment within the preceding 28 months) provided they complete a programme of vocational training or, otherwise, undergo a five-month “qualifying period” during which the benefit is suspended.

Unemployment assistance measures in Estonia and Sweden take an alternative approach: both have labour market activity conditions but include, under this, not only employment and self-employment but also periods of time spent in full-time education, caring for children, sickness, military service, imprisonment and other such justified activities.

Conditions like these open up the possibility of participation for new labour market entrants (and returners) as a crucial step towards activation. Young people, inactive housewives, those regaining their work capacity after sickness, and ex-prisoners might all be in need of the additional help and support unemployment assistance measures can offer. The alternative, for many, might otherwise be a default to inactivity. In the same spirit, the vulnerable groups exempted from means testing under Korea’s ESPP offer an exemplary policy for others to follow.9

Behavioural conditions and activation

Unemployment benefit measures can encourage activation by restricting the income support they offer to ensure it is tangibly less than work. Another way is to impose a maximum duration on benefits, beyond which they are “exhausted” and cease to be paid. Perhaps the main way that unemployment benefit measures ensure activation, however, is through the behavioural conditions they enforce. Such conditions may variously require beneficiaries of unemployment protection measures to register as unemployed; to consult with public employment services for advice and oversight at regular intervals; to ensure they are readily contactable; to ensure they are capable of work; to ensure they are available for work (sometimes imminently); to actively search for work and provide evidence of this; to accept any reasonable job offer the public employment service might identify; and to accept participation in any active labour market programme or training the public employment service might deem necessary, among other such conditions.

Behavioural conditions play an important role in the activation of jobseekers, once a benefit claim is underway, apportioning penalties on those who do not comply.

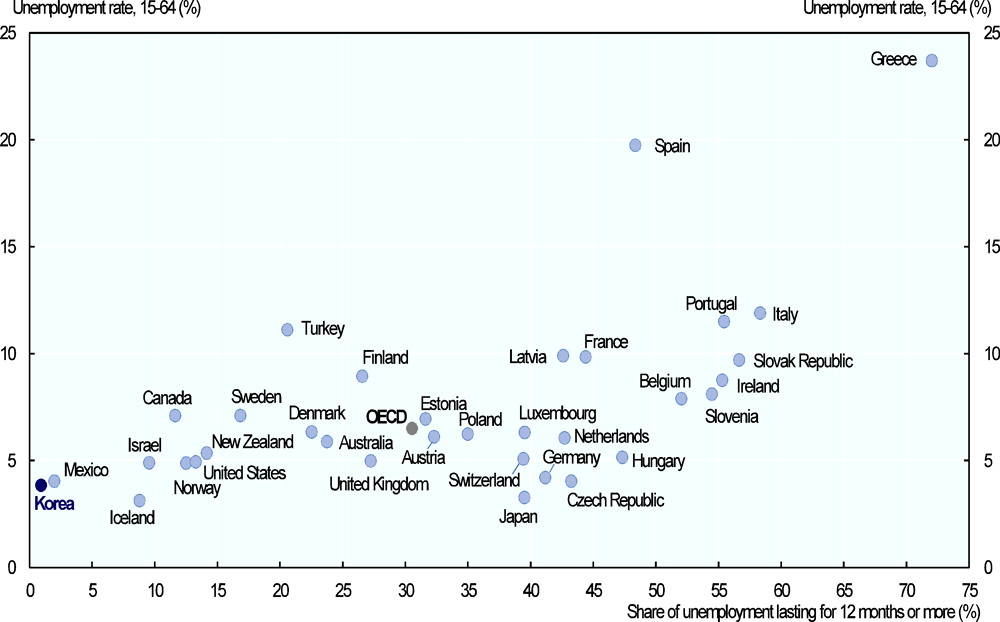

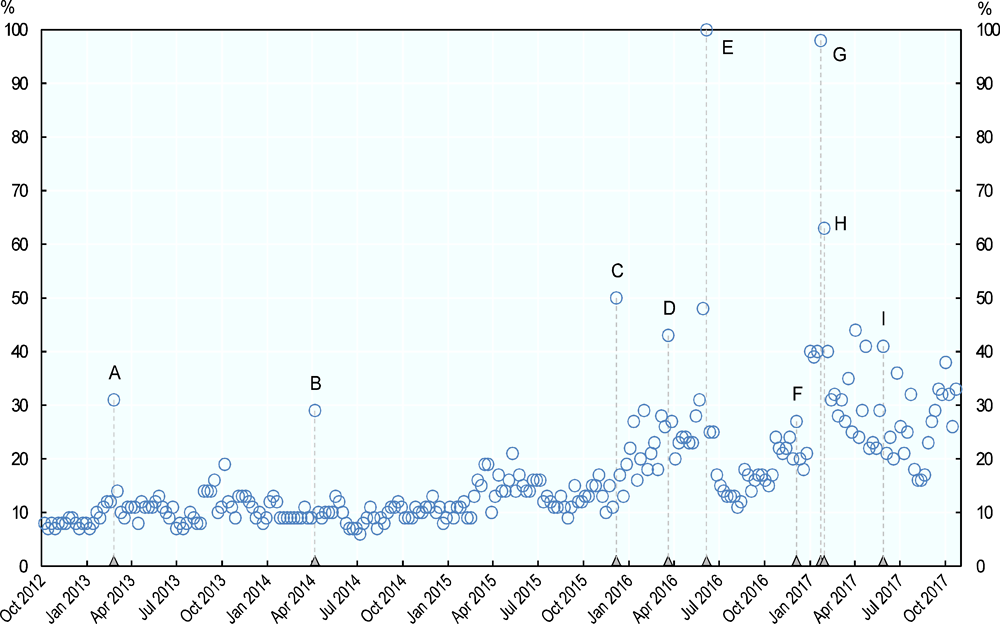

Shortcomings around activation are generally evidenced by high rates of unemployment and, in particular, long-term unemployment. Korea, on the other hand, has among the lowest rates of both among the OECD countries (Figure 3.3).

Korea’s formal unemployment rate was 3.8% in 2016. The share of those unemployed for 12 months or more was a mere 0.9% among the total unemployed – the lowest of any OECD country. The Czech Republic, Germany, Hungary, Japan and Switzerland had similarly low unemployment rates as Korea but significantly higher shares of long-term unemployment of some 40% or more. Greece, Italy, Portugal and Spain currently perform outstandingly poorly on both variables. For the OECD as a whole, unemployment stood at 6.5% and long-term unemployment at 30.5% in 2016.

The time it takes from becoming a jobseeker to exiting unemployment was just 3.0 months in Korea in 2016, according to the Economically Active Population Survey (Statistics Korea, 2017[5]). Comparable data for other OECD countries from 2014-15 show significantly longer durations: 4.6 months in Canada; 6-7 months in Norway and the United States; 10-12 months in Australia, Finland and Poland; 16½ months in Switzerland; and upwards of 18 months in the Czech Republic, Hungary and the Slovak Republic (OECD, 2017[39]).

Assuming that the majority of unemployed people genuinely find work under such circumstances – and are not merely exiting the labour force in large numbers – the indicators noted above signal a healthy (and even exemplary) activation climate in Korea.

Note: Data include all persons aged 15-64. Unemployment duration is based on ongoing (incomplete) spells. The figure ncludes all OECD countries except Chile, for which comparable data were unavailable.

Source: OECD Employment Database, www.oecd.org/employment/database (accessed on 4 May 2017).

Duration and value of income support

The income support unemployment benefit measures offer differs much among the OECD countries. This can be said of both the maximum duration benefit claims can last for and of the value of the income support they offer. Table 3.4 pinpoints these two features for the various unemployment insurance and unemployment assistance measures implemented among the OECD countries.

In terms of the duration, income support under Korea’s EI can last for a maximum of 90-240 days, depending on the jobseeker’s total contribution period and their age.10 This is relatively short compared with most other OECD countries’ unemployment insurance measures, among which the median and mode duration are both 12 months. In some countries, the duration can last for considerably longer still: upwards of three years for some workers in France, Iceland and the Netherlands and for a potentially unlimited time in Belgium (though the benefit amount gradually declines towards a flat rate over time). Unemployment assistance benefits, on the other hand, can potentially be claimed for much longer durations since most are unlimited, in principle, or renewable for most participants.

In terms of the value, income support under Korea’s EI is technically supposed to replace 50% of jobseekers’ previous gross earnings although is more resembles a “flat-rate” benefit, in practice, given its very narrow range between a minimum benefit value of KRW 46 584 and a maximum of KRW 50 000 per day, as of April 2017.

Genuine flat-rate unemployment insurance measures transfer the same benefit amount to all entitled claimants, regardless of their previous earnings. Such benefits are paid for the entire claim period in Greece, Ireland, Poland and the United Kingdom and in the later stages of those in Belgium and Iceland. Unemployment assistance benefits also virtually always take on a flat-rate value.

Variable-rate unemployment insurance benefits, on the other hand, retain a close link with beneficiaries’ previous earnings. During the initial stage of the claim period, such benefits replace up to 80% of previous earnings in Israel, Japan, Luxembourg, Slovenia and Sweden; 90% in Denmark; and even 100% in Mexico.

In practice, even variable-rate unemployment benefits are “flattened”, to some degree, at either extreme of the earnings distribution by “floor” and “ceiling” amounts that define the range of benefit values any measure can deliver. Benefit floor and ceiling amounts can be defined in various ways, including both explicit and de facto thresholds:

-

Explicit benefit thresholds are set at a particular value, defined by policy makers, and typically adjusted over time. Some are officially pegged to certain labour market variables like the statutory minimum wage or the national average wage or simply set to change in line with inflation. The explicit floor for Korea’s EI is officially capped at 90% of the daily minimum wage. Estonia has an explicit floor-cap of 50% of the previous year’s full-time minimum wage. In Hungary and Turkey, the benefit ceiling is pegged to the full-time minimum wage: at 100% and 80% of its level, respectively. In Luxembourg, the floor and ceiling amounts are both pegged at 80% and 250% of the minimum wage, respectively. In Israel, the ceiling amount is fixed at 100% of the national average wage.

-

De facto benefit thresholds operate somewhat differently and can supplant explicit thresholds under certain circumstances. The standard formula replacement rate for a minimum wage earner, for example, can function as a de facto floor amount: a benefit that reimburses, say, 60% of usual earnings cannot fall below a value of 60% of the minimum wage for any entitled jobseeker leaving a formal full-time job. The standard replacement rate for the minimum wage may thus count as a de facto floor for unemployment benefits – at least for formal, full-time workers. De facto ceiling amounts may exist where the covered earnings used to calculate social contributions are capped at some maximum threshold. Such thresholds effectively set a de facto ceiling on the benefit amount a jobseeker can receive, since only their covered earnings count towards insurance. Many countries employ such caps including Canada, France, Germany, Norway and Switzerland.

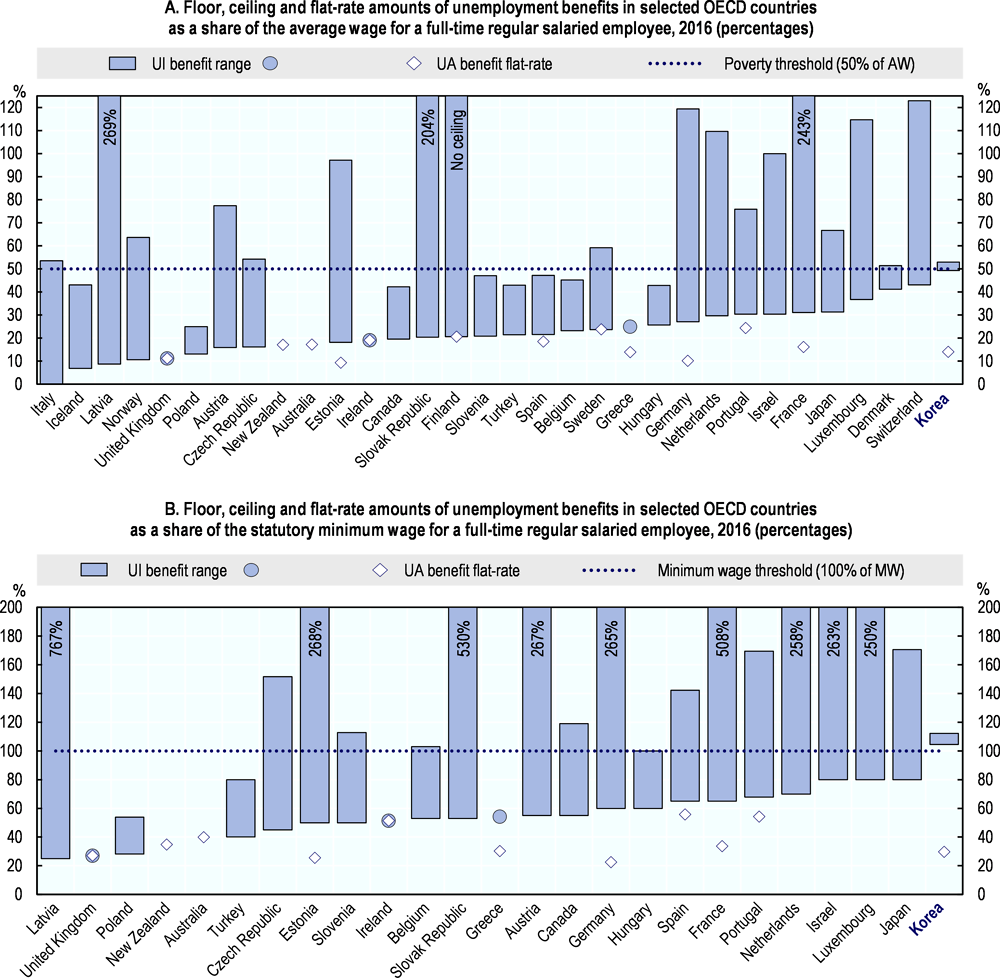

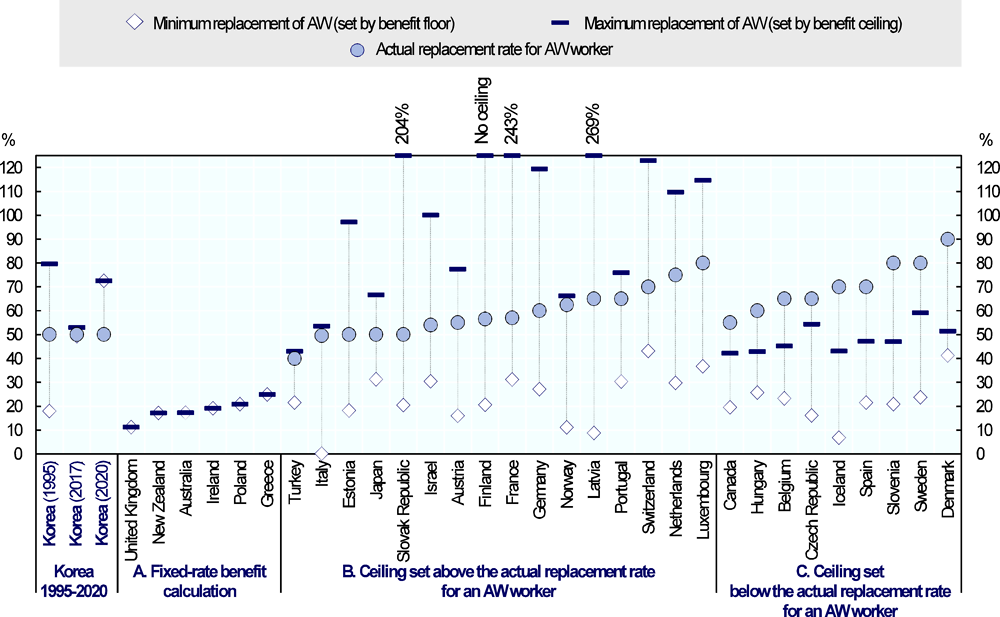

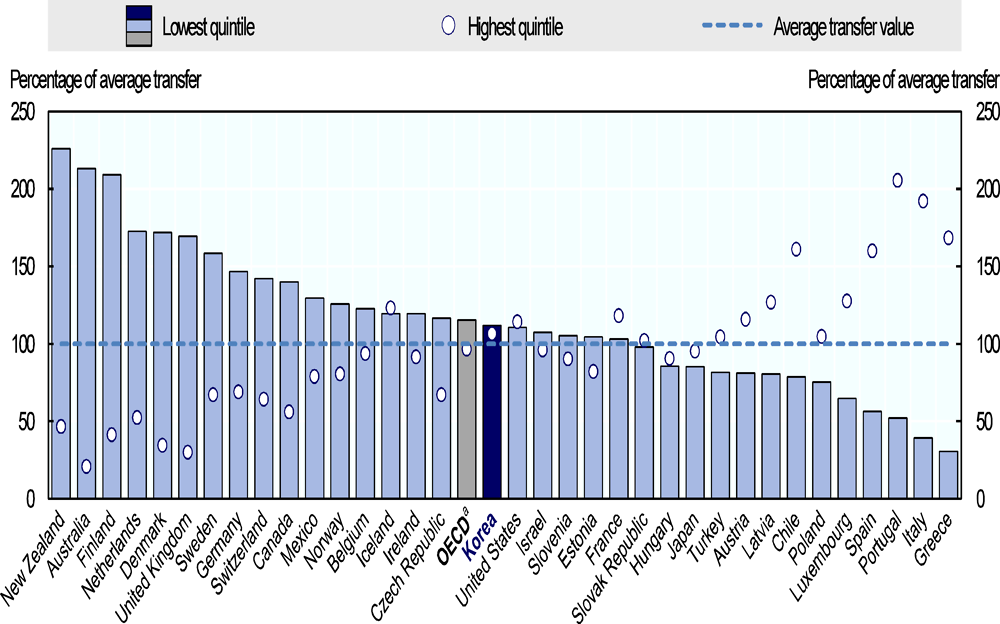

Putting together the information on all such thresholds, it is possible to compare OECD countries’ unemployment benefit measures regarding the range of values their income support can offer. Figure 3.4 shows the range of possible values for both unemployment insurance and unemployment assistance measures in OECD countries relative to the average wage (Panel A) and (where applicable) the statutory minimum wage (Panel B).11

Based on this analysis, Korea emerges as an outlier among the OECD countries in two main ways. First, the tight margin between EI’s explicit floor and ceiling amounts represent the smallest range of any OECD country (apart from those with explicitly flat-rate benefits). EI thus effectively functions more like a flat-rate benefit than any other countries’ measures do. Second, EI’s floor is especially high compared with other countries’ measures. Such a high floor makes Korea the only OECD country that brings all primary-tier unemployment benefit recipients above the relative poverty threshold of 50% of the average wage (albeit for only the relatively short duration of 90-240 days that EI benefits can last) (Figure 3.4, Panel A). EI’s high explicit floor also makes Korea the only OECD country where all such beneficiaries gain more than the minimum wage (Figure 3.4, Panel B). Although the EI floor is officially capped at 90% of Korea’s daily minimum wage, the minimum amount a claimant can receive is actually greater than the minimum wage, in practice, since the benefit is claimed on seven days per week.12

EI’s explicit ceiling is less of an outlier: broadly equivalent to those established in Denmark, Italy and Sweden (relative to their average wages) or Belgium, Canada and Spain (relative to their statutory minimum wages) but significantly lower than those of Finland, France, Germany, Latvia, Luxembourg, the Netherlands, the Slovak Republic and Switzerland, for example, where benefits may far exceed 100% of the average wage and 250% of the statutory minimum wage (Figure 3.4).

relative to their average wage and (where applicable) statutory minimum wage

Note: UA: Unemployment assistance benefits; UI: Unemployment insurance benefits; AW: Full-time average wage of a regular employee, estimated by dividing the national-accounts-based total wage bill by the average number of employees in the total economy and multiplying by the ratio of average usual weekly hours per full-time employee to average usual weekly hours for all employees; MW: Statutory minimum wages.

Information on benefit amounts is valid for circa 2015-16 and information on average wages and minimum wages for 2016, except for Korea, whose data have been updated using the latest parameters, valid for 2017. Benefit amounts are relevant for jobseekers who meet all applicable eligibility, entitlement and behavioural conditions; are aged 40; and are single and without dependents. Floor amounts shown are whichever is highest between: i) the explicit minimum benefit amount, and ii) the de facto minimum benefit amount a jobseeker would gain after stopping full-time employment in which they earned the minimum wage. Original amounts stated in annual, weekly, daily or hourly terms were converted to monthly figures assuming either a 40-hour or a 5-day working week, with 52 weeks divisible into 12 equal months in every year. Chile, Mexico and the United States are not included due to insufficient data.

Source: Average wages and statutory minimum wages data are from the OECD Employment Database, www.oecd.org/employment/database (accessed on 04 May 2017), series on “average annual wages” and “minimum wages at current prices in NCU”; benefit ranges compiled using OECD (2017), “Benefits and Wages: Country Specific Information”, www.oecd.org/els/soc/benefits-and-wages-country-specific-information.htm, cross-checked and updated using SSA and ISSA (2016, 2017), Social Security Programs throughout the World.

Under Korea’s ESPP, the maximum transfer of KRW 400 000 per month under stage 2 (including a training allowance of up to KRW 284 000 plus a training incentive of KRW 116 000) is currently equivalent to 14.0% of the monthly average wage. This is broadly in line with the flat-rate amounts paid by secondary-tier unemployment benefits in France, Greece and the United Kingdom. It is rather lower, however, than the amounts provided in Finland, Portugal and Sweden, where the equivalent is 20-25% of the average wage (Figure 3.4).

Figure 3.5, below, shows the floor and ceiling amounts for primary-tier unemployment benefits in OECD countries relative to their standard formula replacement rate: the share of an entitled jobseeker’s previous earnings that unemployment benefits compensate. The formula replacement rate is calculated for the first month of the unemployment claim (though it may reduce in subsequent months), as specified in Table 3.4 above.

Based on this analysis, most OECD countries fall into one of three general groups:

A. Some determine benefit amounts according to the same fixed-rate benefit for all jobseekers. In practice, such measures replace relatively low amounts of around 10-25% of the average wage. Countries with such measures include Australia, Greece, Ireland, New Zealand, Poland and the United Kingdom.

B. Some set the benefit range above and below the average formula replacement rate. Floors and ceilings defined in this way limit extreme benefit outcomes at either end of the income distribution while retaining the formula replacement rate for jobseekers with previously average earnings. This group of countries includes Japan, France, Germany and others.

C. Some set the entire benefit range below the average formula replacement rate. Floors and ceilings defined in this way result in relatively low-cost unemployment benefit measures and reduce, in any case, the value of entitlements for jobseekers around the middle of the income distribution. This group of countries includes Canada, Spain, Sweden and others.

Korea’s EI does not conform neatly to any of these three models.

When EI was first established in 1995, the benefit floor and ceiling amounts closely resembled those of present-day Austria, Estonia or Japan: a relatively modest formula replacement rate of 50% of usual earnings was contained, on either side, by floor and ceiling amounts equivalent to 17.9% and 79.6% of the average wage.13 At EI’s inception, Korea would thus have neatly fit in among the group-B countries shown in Figure 3.5.

As Korea’s benefit floor increased from 70% to 90% of the minimum wage after 1999; and as the minimum wage itself increased rapidly over time; the EI floor converged closer to the formula replacement rate and to the ceiling amount. Between 2011 and 2016, the EI ceiling was slightly lower than the formula replacement rate of the average wage, thus resembling the group-C countries’ measures shown in Figure 3.5.14

By 2017, the EI benefit range has become so narrow it is virtually a flat-rate benefit. Korea today thus resembles the group-A countries shown in Figure 3.5, except that the implied replacement rate – at around 50% of the average wage – is much higher than the 10-25% provided by the genuine flat-rate unemployment insurance measures like those of Ireland, Poland or the United Kingdom.

relative to their formula replacement rate

for a full-time, average-wage employee within the first month of unemployment, 2016 (percentages)

Note: AW refers to the full-time average wage of a regular employee, estimated by dividing the national-accounts-based total wage bill by the average number of employees in the total economy and multiplying by the ratio of average usual weekly hours per full-time employee to average usual weekly hours for all employees. Information on benefit amounts is valid for circa 2015-16 and information on average wages for 2016, unless stated otherwise. Benefit amounts are relevant for jobseekers who meet all applicable eligibility, entitlement and behavioural conditions; are aged 40; and are single and without dependents. Floor amounts shown are whichever is highest between: a) the explicit minimum benefit amount, and b) the de facto minimum benefit amount a jobseeker would gain after stopping formal full-time employment in which they earned the minimum wage.

Source: Average wages data obtained from the OECD Employment Database, www.oecd.org/employment/database (accessed on 04 May 2017), series on “average annual wages”; benefit ranges compiled using OECD (2017), “Benefits and Wages: Country Specific Information”, www.oecd.org/els/soc/benefits-and-wages-country-specific-information.htm; cross-checked and updated using SSA and ISSA (2016, 2017) Social Security Programs throughout the World.

Looking ahead, political leaders in Korea have announced a goal to increase the statutory minimum wage to KRW 10 000 per hour, perhaps by the year 2020. The current EI floor of 90% of the minimum wage would thus result in a minimum benefit of KRW 72 000 – roughly equivalent to 72.6% of what the average wage might be by then.15

Korea already has the highest unemployment benefit floor of any OECD country, relative to its average wage. Maintaining the current EI floor at 90% of the minimum wage by 2020 would make Korea the only OECD country whose floor amount is greater than the formula replacement rate for an average worker. Even the already confirmed increase of the minimum wage to KRW 7 530 per hour from January 2018 implies an EI benefit floor of KRW 54 216 per day (calculated as 7 530 x 8 x 0.9), which will replace 56.5% of the average daily wage by then – a much higher floor than anywhere else in the OECD.

To restore a balance to this situation, policy makers should ultimately decide what kind of an EI Korea wants. There are several potential avenues forward:

-

Korea could decisively merge the EI floor and ceiling amounts together to offer a genuine flat-rate benefit like those of the group-A countries, mentioned above.16

-

Korea could reduce the EI floor amount to a lower share of the minimum wage (such as, for example, the 70% it originally was before 1999 or to something lower like the 40% currently set in Turkey or the 50% in Estonia) and raise the ceiling (to, e.g. Luxembourg’s 250% of the minimum wage or Israel’s 100% of the average wage) to resemble more the group-B countries, mentioned above.

-

Korea could maintain its current floor and ceiling amounts as they are but offer EI benefits on five days per week (as both Finland and Sweden do), instead of on seven, within the current total maximum total claim period of 90-240 benefit-days. This would effectively lower the weekly and monthly floor and ceiling amounts EI claimants can receive by 28.6% (calculated as 2 ÷ 7) without, on the face of it, affecting the total amounts jobseekers are entitled to nor, necessarily, the insurance premiums required to finance such an EI. This approach offers perhaps the quickest and simplest solution for EI to resemble more the group-C countries’ measures, mentioned above.

-

Finally, Korea could maintain its current floor amount as it is but raise the formula replacement rate from its current 50% of usual earnings to 80% (as in Luxembourg, Slovenia and Sweden) or 90% (as in Denmark) and increase the ceiling accordingly. This would somewhat rationalise the uncommonly high floor amount EI currently has but result in more costly transfers.

Providing a detailed costing for these different options is, unfortunately, beyond the scope of this report. Any adjustments, however, should certainly be careful to consider their fiscal impacts on the sustainability of EI plus any knock-on effects on work-incentives.

In any case, returning EI to the relative floor and ceiling levels it originally launched with in 1995 (i.e. those equivalent to roughly 18% and 80% of the average wage, respectively, as shown in Figure 3.5) would today require a floor amount of KRW 16 900 per day – roughly 33% of today’s daily minimum wage – and a ceiling of KRW 75 100 – roughly 150% of the current ceiling level.

Choosing a slightly narrower range like that of Japan’s current unemployment insurance measure (with thresholds of roughly 30% and 65% of the average wage, as shown in Figure 3.5) would require an EI floor amount of KRW 28 300 per day – roughly 55% of today’s daily minimum wage – and a ceiling of KRW 61 400 – roughly 125% of the current ceiling level.

All of these options are within the scope of what policy makers can achieve. Maintaining the current high floor and tight ceiling amounts of EI deviates from its original design and almost completely eliminates the link between the benefit amount and regular earnings.

Protections for sickness in OECD countries

Common support measures

The majority of OECD countries implement income support measures for employees undergoing temporary absences from work. Such benefits commonly seek to compensate workers whose capacity to perform their work (and, thus, to earn an income) is restricted in some justifiable way over a limited period of time.

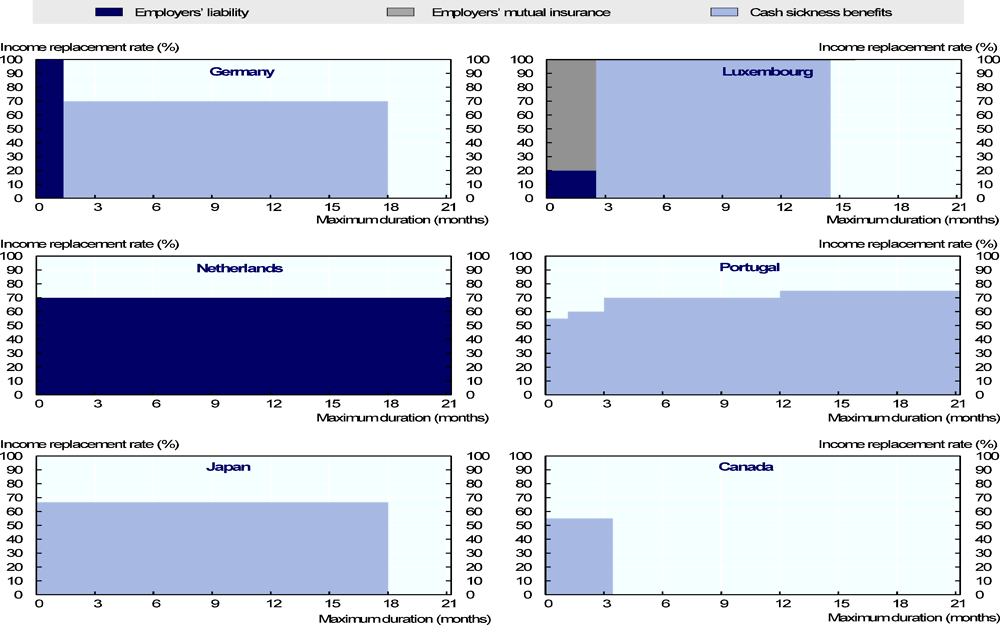

Temporary work incapacity can commonly arise from sickness or an injury. Two key types of policy measures are commonly applied under such circumstances:

-

Employers’ liability for sickness places a burden of duty on employers to provide for eligible workers during a period of ill-health. Employers may thus be obliged to pay part (or all) their worker’s salary, over a period of their absence. In some cases, employers must also rehabilitate the worker within a separate role or secure for them a different job elsewhere. In Korea, employers face no such liabilities for their workers at the statutory level.17

-

Cash sickness benefits can provide more extensive income support for workers in case of sickness beyond a period of employers’ liability. Most such benefits operate as contributory measures though some countries complement them with assistance-type benefits. Korea has neither, beyond the limited scope of support that delaying EI entitlement can offer to workers who relinquish their jobs.

The discussion below elaborates on the many ways in which OECD countries currently apply such measures, elaborating on the potential best practices for Korea.18

Employers’ liability for sickness

Employers in most OECD countries are liable for at least part of the risk associated with their employees’ absences in case of sickness. Most OECD countries mandate employers to continue paying an absent worker (in full or in part) over a period of 5-15 working days. In several cases, employers’ liability covers a much longer potential period of time: extending to around six weeks in Germany and Poland; 11-12 weeks in Austria and Luxembourg; 18 weeks for some workers in France; 36 weeks in Italy; and up to two years in the Netherlands (Spasova, Bouget and Vanhercke, 2016[40]).19

Employers in Korea have no such statutory obligations. Among the OECD countries, this is likewise the case in Canada, Denmark, Greece, Ireland, Japan, Portugal and the United States. Under such circumstances, it is predominantly at employers’ own discretion to decide what support to offer a worker. In practice, this can lead to a polarisation in the support different groups within the labour market might receive, potentially excluding many elderly workers; workers with pre-existing health conditions; non-regular workers; and employees in smaller firms. It also enables discrimination.

Employers in some countries may be bound to equivalent obligations under the terms of their workers’ employment contracts or via a collective agreement. Indeed, collective agreements sometimes set the norm for determining sickness pay and leave allowances. Switzerland, for example, regulates sickness protection predominantly through collective agreements, linking the employers’ liability very closely to workers’ tenure (lasting three weeks for new staff and upwards of six months for decades-tenured employees) (OECD, 2014[41]). Israel, likewise, determines sickness protection predominantly on the basis of collective agreements (SSA and ISSA, 2017[42]). Finland has statutory provisions for employers covering nine days of a worker’s absence due to sickness, while collective agreements increase it to 30 days for most manual workers and upwards of 90 days for professional and government employees (Spasova, Bouget and Vanhercke, 2016[40]). In France, most collective agreements oblige employers to make up the difference between cash sickness benefits and their workers’ full usual earnings over a period of several weeks (Spasova, Bouget and Vanhercke, 2016[40]).

Collective agreements offer a purposeful alternative to statutory provisions but may leave out large segments of the workforce. Statutory employers’ liability distributes the risks associated with sickness more equitably by holding all employers to a common standard of protection. Statutory employers’ liability also ensures that a minimum baseline of coverage is provided for all employees alike – indiscriminately of their sector, age or working time – thus helping to reduce the associated duality in support that can arise among different groups within a labour market.

Coverage of cash sickness benefits

Almost all OECD countries implement some social protection measure providing income support to workers under a period of temporary work incapacity. Such measures usually extend far beyond the limited provisions of employers’ liability for sickness.

Table 3.5 gives an overview of the coverage entailed by cash sickness benefits in OECD countries. Most provide income support through contributory measures. Australia, Finland, New Zealand and the United Kingdom also provide non-contributory income support, pending a means test. Korea has no equivalent measure in place.

In Korea, EI benefits may offer limited support to workers undergoing sickness under two specific sets of circumstances: those who are employed at the time they fall ill and forced to leave their jobs may choose to postpone the start of their EI benefit claim until they regain the capacity to seek work up to a maximum period of four years (though they gain no income support during this time); and those who are unemployed and already claiming EI benefits at the time they fall ill are exempted from behavioural conditions during what remains of their regular entitlement period (of 90-240 days). In either case, however, anyone still formally attached to an employer is ineligible for income support.

Given this circumstance, the best option for many workers undergoing sickness in Korea is simply to be fired. Such outcomes lead to indefinite breaks in employment relationships that are inefficient for workers and employers alike. Such outcomes also remove all liability from employers, opening the way for discrimination and potentially prolonging workers’ rehabilitation. Such outcomes, finally, can increase social exclusion for those who do not find their way easily back into work.

While EI may thus offer a limited degree of support for unemployed persons following a period of sickness, cash sickness benefit measures in other countries support existing employees during an absence from work due to sickness. The difference is crucial since one central goal among the latter kinds of measures is ultimately to preserve the employment relationship – something altogether neglected in Korea. Meeting this goal strengthens the positive role employers can play in their workers’ recovery and can significantly ease transitions back to work. Failing to meet this goal may add to the burdens workers face, resulting in longer periods of time spent on social benefits.

Among the remaining OECD countries, only Israel, Switzerland and the United States likewise have no statutory cash sickness benefit measures in place. Nevertheless, workers in Israel and Switzerland are generally relatively well protected: those in Israel through extensive sickness provisions common to practically all collective agreements and those in Switzerland through far-reaching employers’ liability laws. Only Korea and some parts of the United Sates thus have no equivalent policy in place.

Scope of income support for sickness

Beyond coverage, three key dimensions determine the scope of the income support cash sickness benefits may provide:

-

The maximum duration of cash sickness benefits differs greatly across countries. Some offer support for relatively limited periods of time (such as 15 weeks in Canada and 22 weeks in Denmark), while others do so for up to 18 months or longer (such as Germany, Japan, Portugal, Sweden and elsewhere) or for theoretically indefinite periods of time in case a recovery is expected (as in Slovenia, Turkey and the United Kingdom) (SSA and ISSA, 2016[31]).

-

The value of the income support cash sickness benefits provide also varies much across countries. As with unemployment benefits, most cash sickness benefits are calculated as a share of the claimants’ usual work-related income. Cash sickness benefits commonly compensate anything from 50-55% of this amount (as in Canada, Greece and the Slovak Republic) to all of it (as in Denmark, Ireland and Norway), subject to floor and ceiling amounts (SSA and ISSA, 2016[31]).

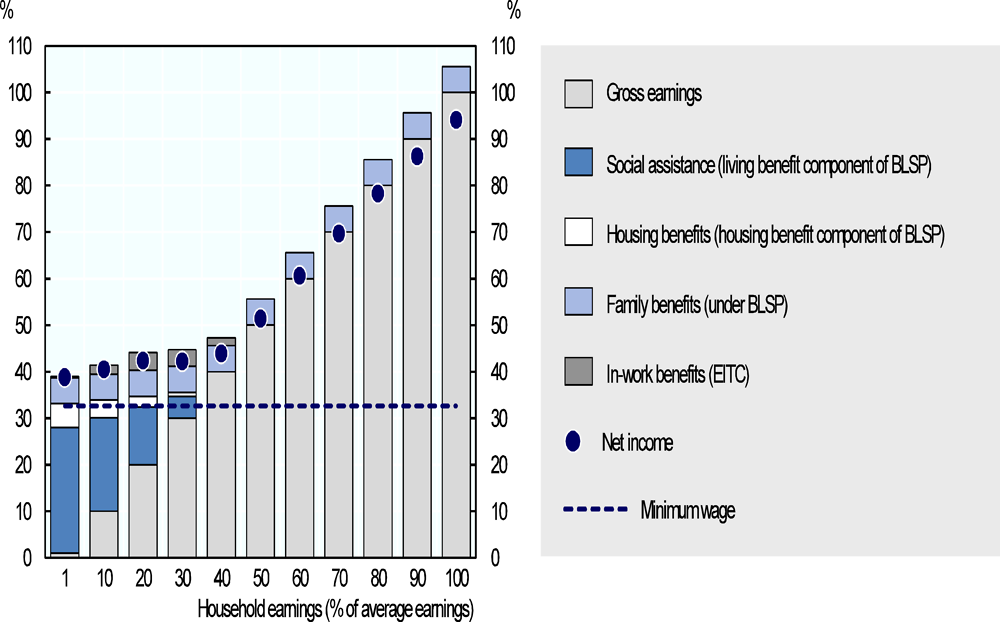

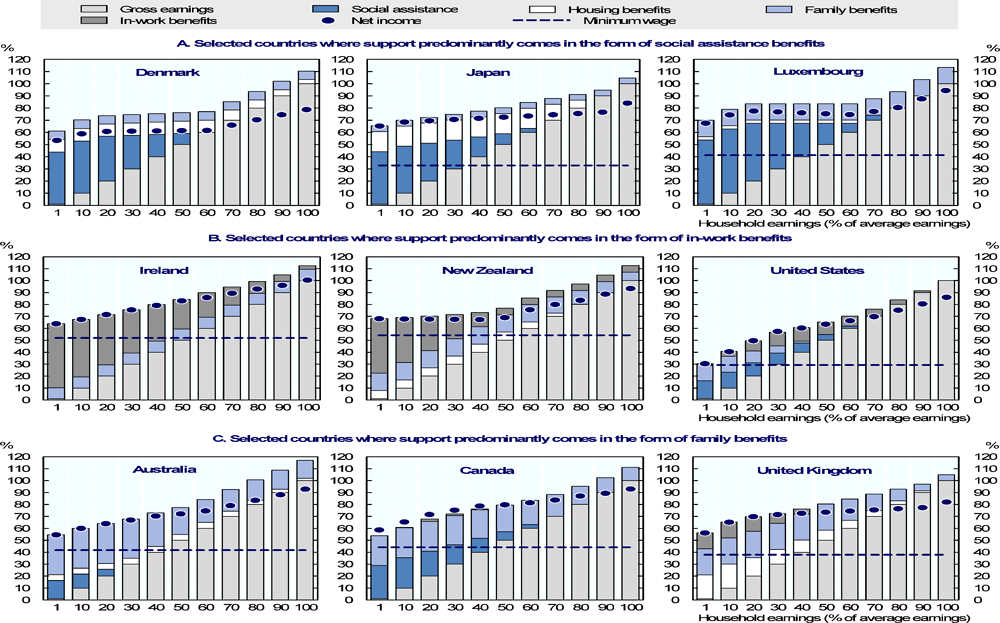

-