Chapter 4. Country tables, 1997-2015 – Tax revenues

|

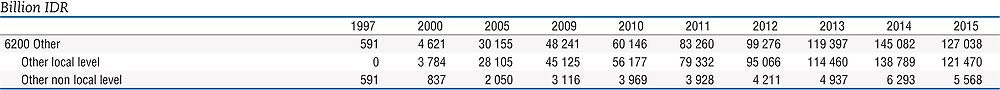

Table 4.1. Indonesia

|

|---|

|

|

|

Note: Year ending 31st December. The data are on a cash basis. The figures for social security contributions (heading 2000) are not available but they are thought to be negligible as they relate only to the “Asuransi Kesehatan” - a health insurance programme for employees in for-profit state-owned enterprises. |

|

Source: Ministry of Finance of the Republic of Indonesia. |

|

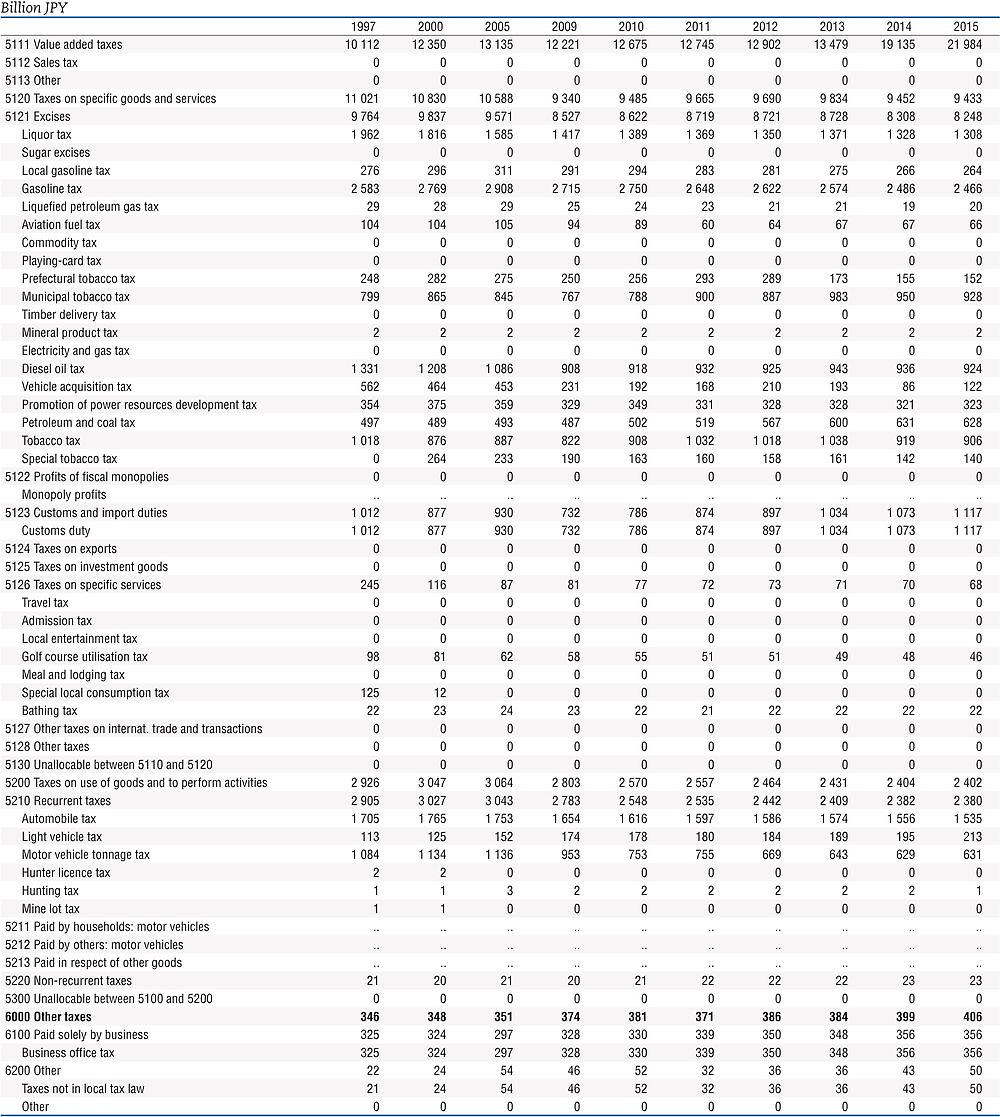

Table 4.2. Japan

|

|---|

|

|

|

Note: Figures are taken from OECD (2016), Revenue Statistics 2016, https://doi.org/10.1787/rev_stats-2016-en-fr, and are preliminary for 2015. Data are on a fiscal year basis beginning 1st April. From 1990, data are on an accrual basis. The figures for different groups of taxes are reported on different reporting bases, namely: Social security contributions (heading 2000): in principle accrual basis, Central government taxes: accrual basis (revenues accrued during the fiscal year plus cash receipts collected before the end of May (the end of April until 1977), Local government taxes: accrual basis (due to be paid during the fiscal year and cash receipts collected before the end of May). The Japanese authorities take the view that the Enterprise tax (classified in 1100 and 1200) and the Mineral product tax (classified in 5121) should be classified in heading 6000 since under articles 72 and 519 of the Local Tax Law these taxes are regarded as levies on the business or mining activity itself. Heading 2000: Includes some unidentifiable voluntary contributions. Preliminary data for 2015 were not available at the time OECD (2016), Revenue Statistics 2016 was prepared. Heading 2300: Includes contributions to the National pension, National Health Insurance and the Farmer’s pension fund. Contributions to the Farmer’s pension fund are not available for the years before 1999. Heading 4100: Municipal property tax, includes Prefectural property tax from 1990 to 1994 because data are not available to provide a breakdown. Heading 5121: Municipal tobacco tax, includes Prefectural tobacco tax from 1990 to 1994 because data are not available to provide a breakdown. Heading 5121: In sub-item Petroleum and coal tax, the data before 2003 refer to petroleum tax. |

|

Source: Tax Bureau, Ministry of Finance. |

|

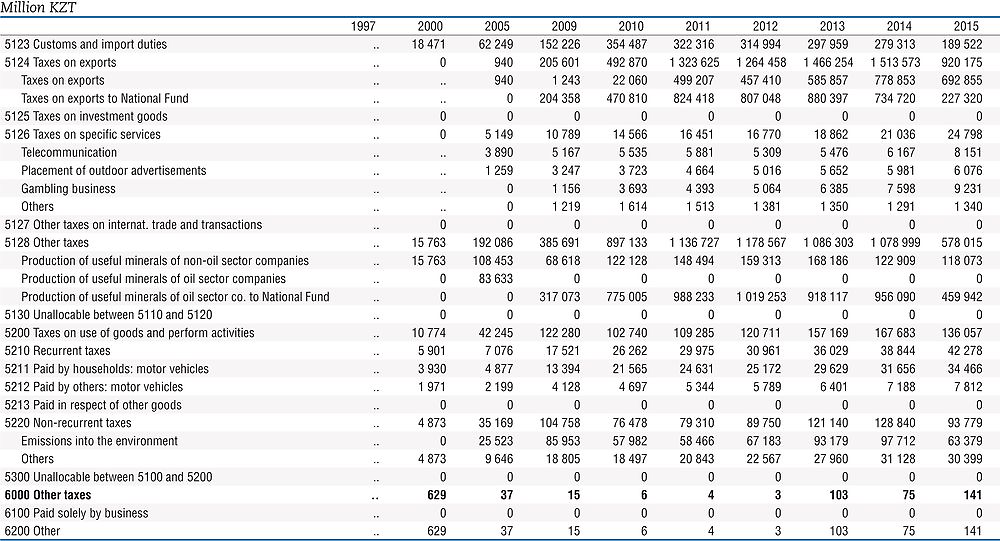

Table 4.3. Kazakhstan

|

|---|

|

|

|

Note: Year ending 31st December. Data are on a cash basis. The share of the Republic of Kazakhstan under production sharing contracts of oil companies, the bonuses of oil and non-oil sector companies, the levy for the use of the radio-frequency spectrum, the payment to compensate for historic costs as well as certain other items are classified as non-tax revenues according to the OECD Interpretative Guide, but are considered as tax revenues in Kazakhstan. Headings 1210, 5124 and 5128: These categories includes revenues that are paid to the National Fund of the Republic of Kazakhstan. This fund was created in 2000 as a stabilisation fund and includes revenues levied from oil and gas companies. Heading 2000: Social security contribution revenues are not considered as tax revenues in Kazakhstan, but are considered as tax revenues under the OECD Interpretative Guide, subject to certain criteria. Heading 4120: The uniform land tax is a presumptive tax for farmers and peasants’ households. Such payers are not obliged to pay personal income tax, land tax, environmental fees, transport tax, property tax and other mandatory payments to the budget. The uniform land tax is levied on the value of land in use. |

|

Source: Ministry of Finance of the Republic of Kazakhstan. |

|

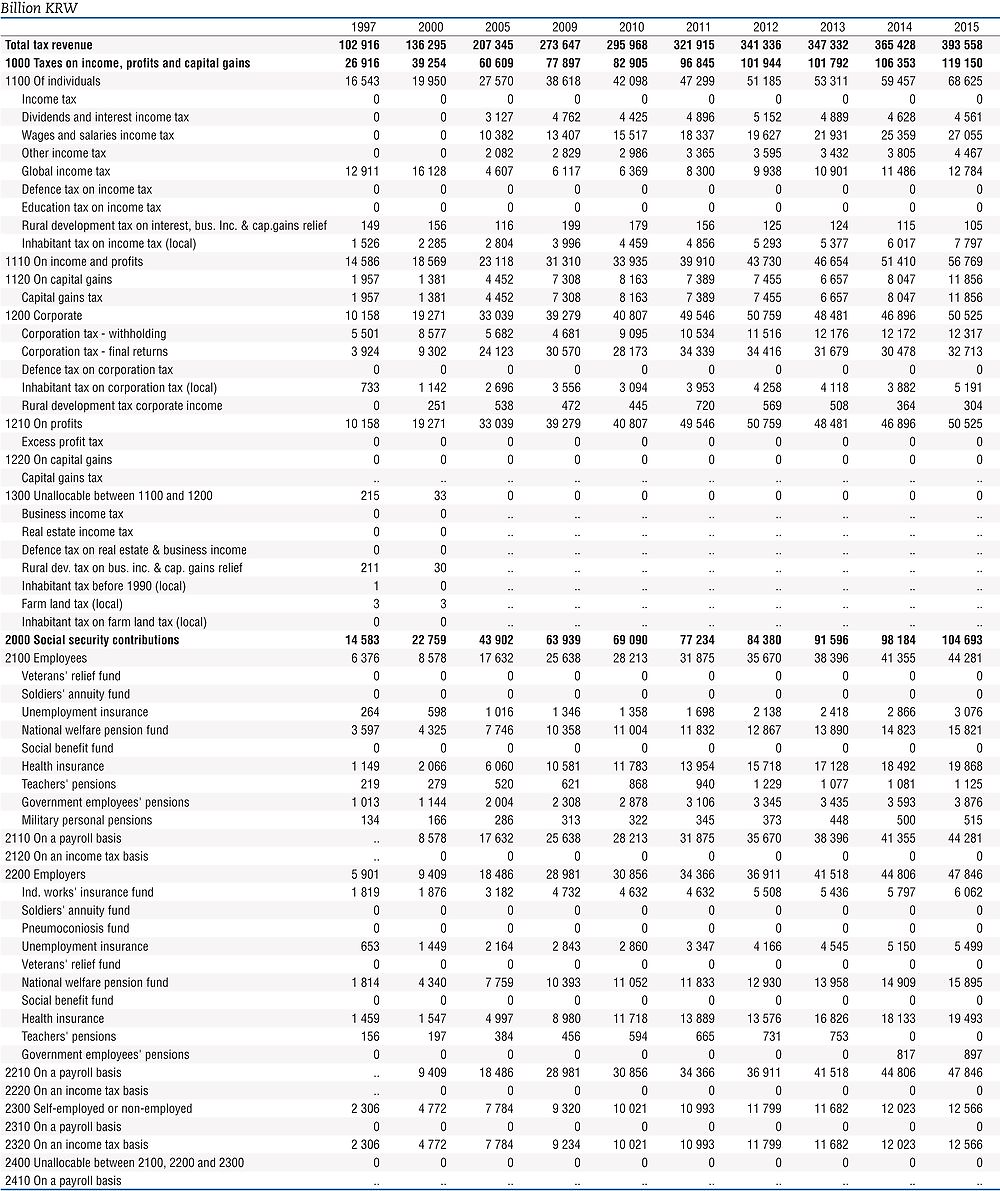

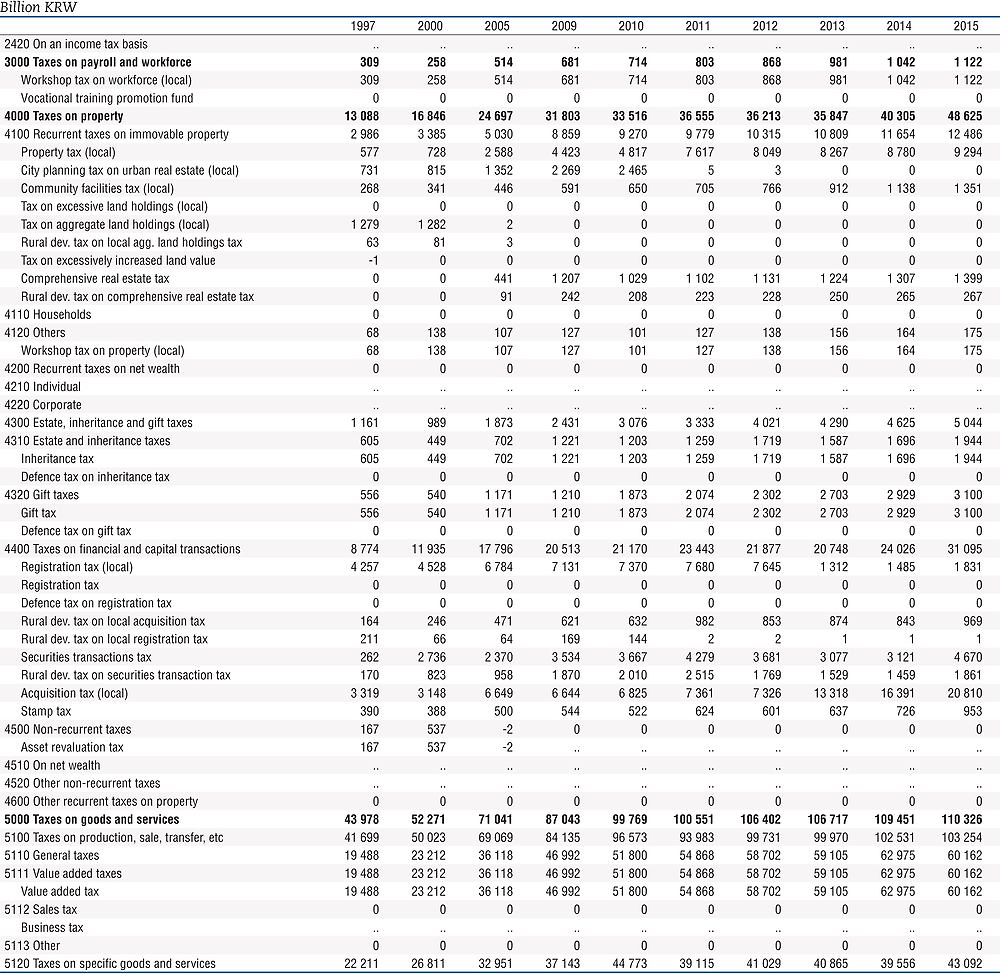

Table 4.4. Korea

|

|---|

|

|

|

Note: Figures are taken from OECD (2016), Revenue Statistics 2016, https://doi.org/10.1787/rev_stats-2016-en-fr, and are preliminary for 2015. Year ending 31st December. Data are on a cash basis. Heading 2000: From 1997 the contributions to the three funds (civil servant pension fund, private school teachers’ pension fund and medical insurance fund) are classified as security social contributions. The reasons for the change are that the contributions either became mandatory or the fund started to be managed by public authorities in that year, thereby meeting the OECD definition of social security contributions. Heading 2200: From 2007, this includes long-term care insurance. |

|

Source: Ministry of Finance and Economy, Ministry of Home Affairs. |

|

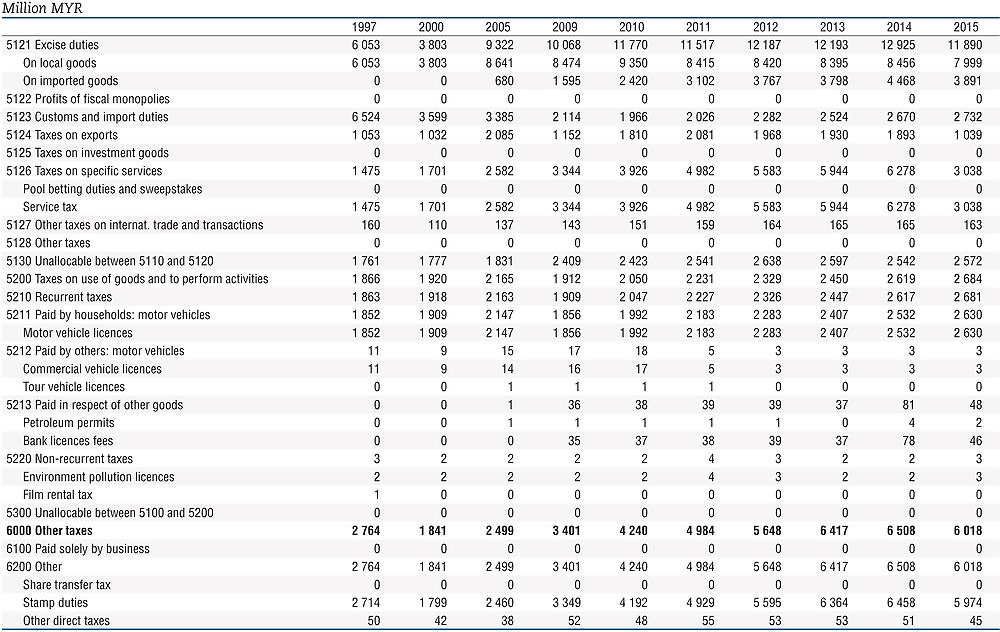

Table 4.5. Malaysia

|

|---|

|

|

|

Note: Year ending 31st December. The data are on a cash basis. Heading 2000: The data are estimated for 2015. An average annual growth rate for the period 2012-2014 was applied to the 2014 figure. Heading 4100: The data for the quit rent and the assessment tax are estimated for 2015. Heading 5111: The data for 2015 are sourced from the IMF’s Government Finance Statistics dataset. |

|

Source: Ministry of Finance of Malaysia, Social Security Organisation, State Government Financial Report and Local Government Financial Report. |

|

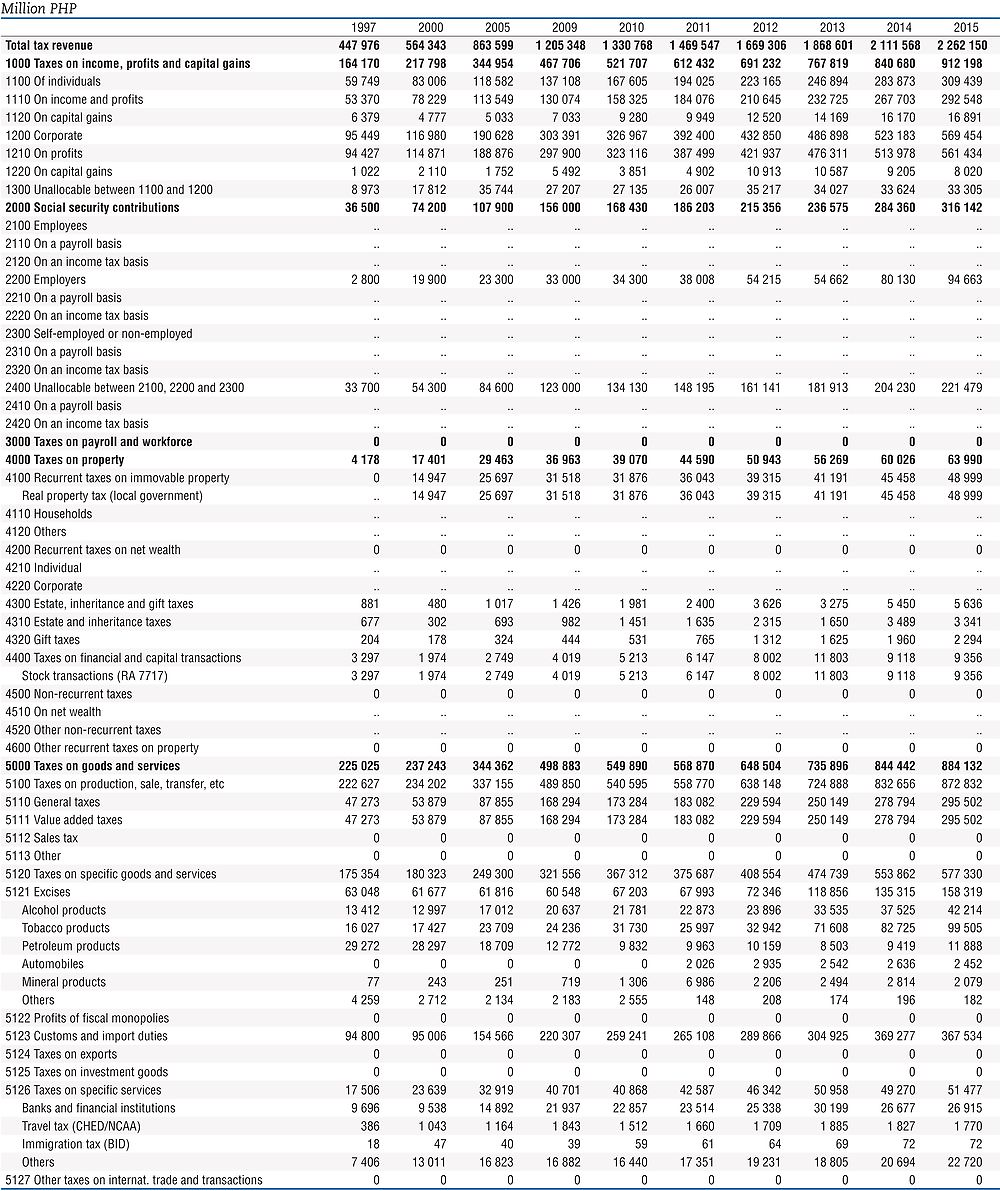

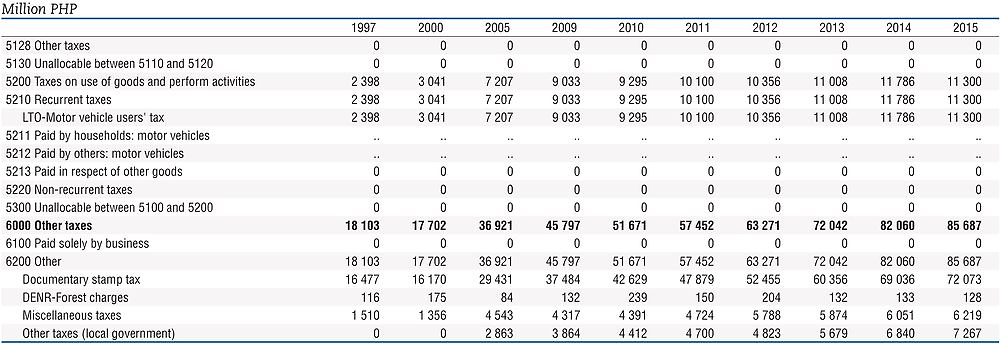

Table 4.6. Philippines

|

|---|

|

|

|

Note: Year ending 31st December. The data are on a cash basis. Heading 5123: This category includes VAT and excises levied on imports. |

|

Source: Department of Finance of the Philippines. |

|

Table 4.7. Singapore

|

|---|

|

Details of tax revenue

|

|

|

|

Note: Data are on a fiscal year basis ending 31st March. For example, the data for 2014 represent 1 April 2014 to 31 March 2015. The data are on a cash basis. Heading 2000: There are no social security contributions in Singapore. Heading 4100: Recurrent taxes on immovable property includes tax levied on all private properties, as well as properties owned by statutory boards. Heading 5121: Comprises excises, customs and import duties. |

|

Source: Source: Ministry of Finance of Singapore. |