Chapter 5. Innovation, applications and transformation1

Digital innovation drives the development of the digital economy and society, enables applications in many areas, and leads to transformations. This chapter first examines recent trends and evolutions in digital innovation, business models and markets, focusing on information and communication technology investment, business dynamism, data-driven innovation, and online platform markets, then presents expanding digital applications and services in selected areas – sciences, healthcare, agriculture, governments, and cities – and finally discusses the ongoing digital transformations of jobs and trade. Policy and regulation related to digital innovation, applications and transformation are discussed in Chapter 2.

Introduction

Digital innovation creates opportunities for new business models and markets, enables applications and services in different sectors and areas, and drives transformation across the economy and society, including of jobs and of trade. This chapter provides an overview of recent developments in digital innovation, applications and transformation.

Underpinned by information and communication technology (ICT) investment, business dynamism, entrepreneurship and data-driven innovation (DDI), traditional goods and services are increasingly enhanced by digital technology, new digital products and business models emerge, and more and more services are being traded or delivered over online platforms. For example, what used to be a simple tractor has become a data-intensive product that is able to monitor soil conditions, send data to its proprietor, and plough and plant with unseen precision. Such a tractor is not sold as a simple physical good anymore, but as a key component of a larger service package within which the proprietor plays a role after sales. Another example is the rise of online platforms, which create new markets or move existing ones partly or fully online. Beyond facilitating e-commerce trade of goods and enabling online search, social networks and digital media, platforms have entered service markets, e.g. for accommodation and transport as well as for any type of service that can be delivered over the Internet.

Digital innovation enables applications and services in a wide range of sectors, including in science, healthcare, agriculture, government and cities. For example, scientific research is being affected by the growing amount of data being collected and analysed throughout scientific processes as well as by the diffusion of results via online platforms that shape open access publishing and enable new modes of peer review. In healthcare, the use of mobile health applications (apps) and of electronic health records enables new care models and provides the foundation greater co-ordination and improved clinical management. Governments are promoting e-government services to individuals and firms, are providing open access to public sector information (PSI), and are increasingly communicating directly to citizens via social networks. Not least, cities are seizing the benefits of digital applications, for example in urban transport, energy, and water and waste systems, and are exploring the potential of DDI to improve urban operations and decision making.

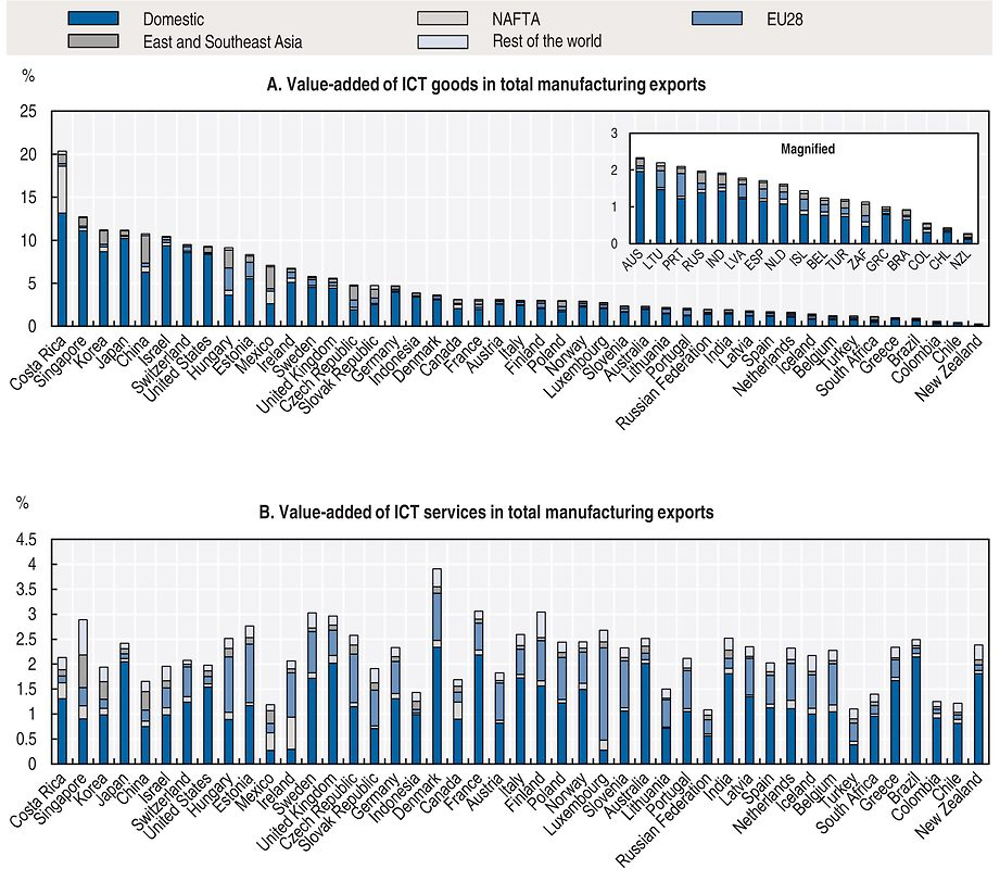

Digital innovation and applications transform not only products, business models and markets, but also jobs and trade. In some sectors ICT investment has led to job losses while in others it has led to job creation. For example, in most countries, labour demand decreases as a result of ICT investment in manufacturing, business services and trade, transport and accommodation, while it increases in culture, recreation and other services, construction and, to a lesser extent, in government, health and personal care, energy, and agriculture. Further, the use of digital technologies affects the nature of work in some areas. For example, services traded over online platforms, including accommodation and transport, are increasingly provided by individuals that tend to carry out flexible, temporary and part-time work in such jobs. Digitalisation is also reshaping the trade landscape, particularly for services. While ICT services help boost productivity, trade and competitiveness across the economy, in some countries trade is limited by restrictions on telecommunication and computer services.

Key findings in this chapter are that investments in ICT goods and services and business dynamism have fallen short of their potential in recent years, but data has become a core driver of digital innovation. DDI, new business models, and digital applications are changing the workings of science, governments, cities, and many sectors including health and agriculture. Effects of the digital transformation are likely to include job destruction in some and job creation in other sectors, new forms of work, and a reshaping of the trade landscape, in particular for services.

Digital innovation in business models and markets

This section examines developments in the conditions that underpin digital innovation, concerning the drivers that affect digital business models, and in new markets that are created by online platforms. Investment in ICT goods and services and entrepreneurship are important conditions for digital innovation, while data are becoming a driver and resource for it. New opportunities for business models are being created, for example, by digitisation, datafication, the Internet of Things (IoT), codification, automation, data trading, data analytics and artificial intelligence. Among the most successful digital businesses that have emerged over the last 15 years are online platforms, which have created exponentially growing online markets for a range of products, from information to goods and, more recently, services.

Investment in ICT goods and services underpins digital innovation and growth

Investment in ICT goods and services is an important condition for digital innovation and a driver of growth (Spiezia, 2011). ICTs have the potential to increase innovation by speeding up the diffusion of information, favouring networking among firms, enabling closer links between businesses and customers, reducing geographic limitations, and increasing efficiency in communication. In addition, the spillover effects from ICT usage, such as network economies, can be sources of productivity gains. ICTs can also be seen as a source of innovation because they enable closer links between businesses, their suppliers, customers, competitors and collaborative partners, thus making businesses more responsive to innovation opportunities and providing significant efficiency gains.

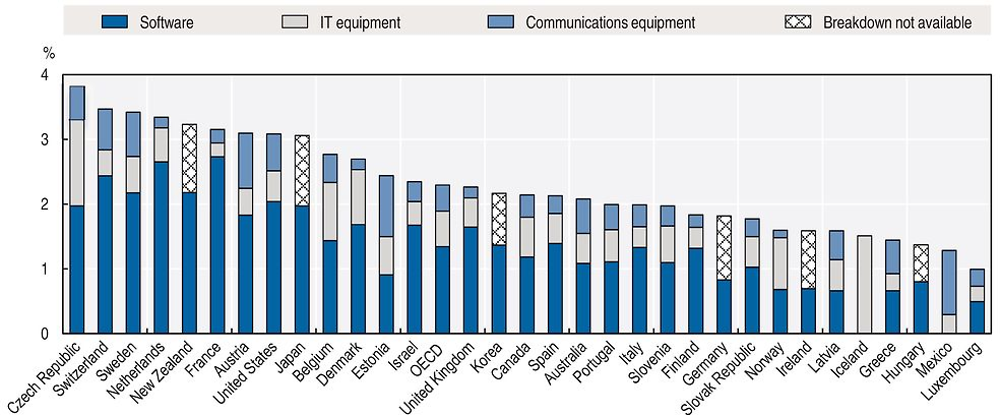

In 2015, ICT investment in the OECD area represented 11% of total fixed investment and 2.3% of gross domestic product (GDP). Almost 60% of ICT investment was devoted to computer software and databases. ICT investment across OECD countries varied from 3.8% in the Czech Republic to less than 1.5% of GDP in Greece, Luxemburg and Hungary. These differences tend to reflect differences in each country’s specialisation and its position in the business cycle (Figure 5.1).

Notes: Data for Latvia, Norway, Portugal and Spain are 2014 instead of 2015. Data for Korea are OECD estimates based on national Input-Output tables and OECD SNA08. Data for Iceland and Mexico were incomplete and only represent the asset for which data were available. The series “breakdown not available” represents in all cases the combination of IT and communication equipment. GDP = gross domestic product; IT = information technology.

Sources: OECD, National Accounts Statistics (SNA) (database), www.oecd-ilibrary.org/economics/data/oecd-national-accounts-statistics_na-data-en; OECD Productivity Database, www.oecd-ilibrary.org/employment/data/oecd-productivity-statistics_pdtvy-data-en; Eurostat, National Accounts (including GDP) Statistics (database), http://ec.europa.eu/eurostat/web/national-accounts/data/database; national sources (accessed July 2017).

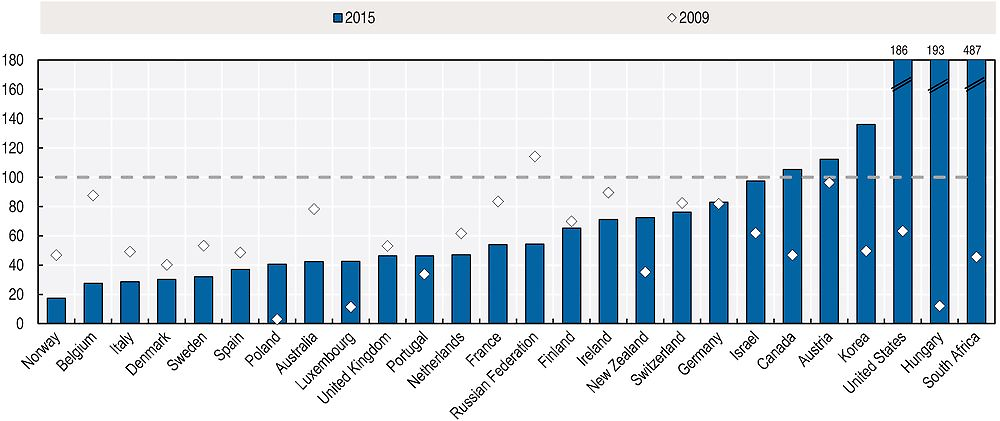

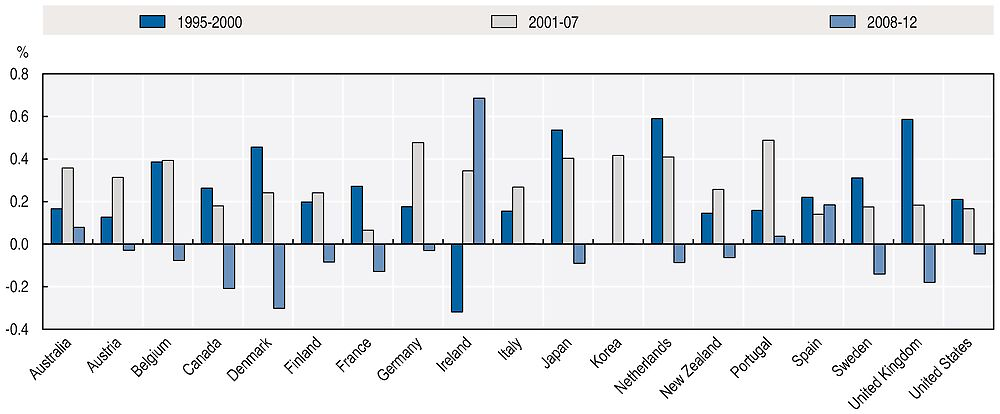

In most OECD countries, investments in ICTs in the aftermath of the 2007 crisis have been more resilient than total investments. As a result, the share of ICT investment in total investment was higher in 2015 than in 2007. In some countries, however, the crisis has resulted in a sharper slowdown in ICT investments. This is the case of Australia, Canada, Germany, Japan, Luxembourg, Norway, and Sweden, where the share of ICT investment in 2015 was lower than in 2007 and 2000 (Figure 5.2). Other factors may also have affected the observed changes in ICT investments, in particular increasing expenditures for cloud services, which firms use as a substitute for ICT investment. It is a matter of current debate (Byrne and Corrado, 2016) whether these services are properly measured in the System of National Accounts (SNA).

Notes: Data for Latvia, Norway, Portugal and Spain are 2014 instead of 2015. Data for Korea are OECD estimates based on national Input-Output tables and OECD SNA08.

Sources: OECD, National Accounts Statistics (SNA) (database), www.oecd-ilibrary.org/economics/data/oecd-national-accounts-statistics_na-data-en; OECD Productivity Database, www.oecd-ilibrary.org/employment/data/oecd-productivity-statistics_pdtvy-data-en; Eurostat, National Accounts (including GDP) Statistics (database), http://ec.europa.eu/eurostat/web/national-accounts/data/database; national sources (accessed July 2017).

Available evidence strongly suggests that investing in ICTs alone is not enough, as it is mainly the effective use of ICTs that generates positive productivity effects. And the degree of effectiveness in ICT use typically depends on complementary investments in knowledge-based capital (KBC), in particular firm-specific skills and know-how, and organisational change, including new business processes and business models (OECD, 2016a).

Indeed, investment in KBC has been rising, and in some countries is larger as a share of GDP than investment in physical capital. Unlike physical capital, investments in many forms of KBC – research and development, organisational change, design – yield knowledge that can spill over to other parts of the economy. That is, firms that do not invest in KBC can only be partially excluded from benefits created by firms that do. In addition, KBC can spur growth because the initial cost incurred in developing some types of knowledge does not need to be incurred again when that knowledge is used again in production. Indeed, once created, some forms of KBC – such as software and some designs – can be replicated at almost no cost and can be used simultaneously by many users. This can lead to increasing returns to scale in production and in positive network externalities, e.g. the value of a platform increases with the number of users of the platform (OECD, 2013a).

Business dynamism and entrepreneurship are falling short of their potential

Despite digital opportunities, there are signs that business dynamism is decreasing

Digital technologies can affect businesses’ dynamism, which supports the emergence and growth of firms. The Internet lowers barriers to entrepreneurship and makes it easier to start, grow and manage a business. It also supports “lean start-ups” that leverage the Internet to lower fixed costs and outsource many aspects of the business to stay agile and responsive to the market. The Internet further affects the broader business environment by lowering transaction costs, increasing price transparency and improving competition. It is now easier for businesses to communicate with suppliers, customers and employees using Internet-based tools. Improved communication is also leading to the emergence of new and transformed business models.

Evidence indicates that despite the new opportunities linked to digitalisation, there has been a general decrease in business dynamism across countries. This decline in business dynamism markedly accelerated during the crisis, and the recovery since has only been partial, with broadly similar trends observed for manufacturing and services. More specifically, entry rates appear to have steadily declined over the period, while churning rates and growth dispersion – more stable before the crisis – have dropped considerably since 2009, especially in non-financial business services (Blanchenay et al., forthcoming).

This decline in dynamism across countries is particularly marked in ICT-producing and ICT-using sectors. Figure 5.3 illustrates a strong decline in entry rates (number of entering units over number of entering and incumbent units) for ICT-producing manufacturing and service sectors between 2001 and 2015, with some recovery immediately before the crisis. This is mirrored in the ICT-using sectors, which also exhibit a pronounced decline in dynamism over the same period, especially when looking at manufacturing. However, the remaining sectors of the economy are characterised by a more modest decrease in entry rates, occurring mostly after the crisis.

Notes: ICT-producing sectors are defined as “computer, electronic and optical products” from the manufacturing sector and “IT and other information services” and “telecommunications” from the services sector. ICT-using sectors are defined as “electrical equipment”, “machinery and equipment” and “chemicals and chemical products” from the manufacturing sector and “publishing, audiovisual and broadcasting activities”, “legal and accounting activities” and “scientific research and development” from the services sector. Figures report three-year moving averages, conditional on the availability of data. Owing to methodological differences, figures may deviate from officially published national statistics. Data for all countries covered are still preliminary. ICT = information and communication technology.

Source: OECD, DynEmp3 Database, http://oe.cd/dynemp (accessed July 2017).

There are several potential mechanisms by which digital technologies influence business dynamism that may provide insights into the declining dynamism found across countries over time. The nature of new digital technologies may favour large firms at the expense of dynamism – reducing the entry and growth potential of new firms. Digital technologies may also trigger dynamics that benefit a minority of leading frontier firms (Brynjolfsson et al., 2008). For example, advances in digital technologies have enabled large multinationals to co-ordinate and profit from complex and fragmented production networks (OECD and World Bank, 2015). In some sectors, such as ICT-providing services and other ICT-using services, the significantly decreased marginal cost of both production (provision) and transport (communication) of digital goods (services) have been associated with easier scalability (Brynjolfsson and McAfee, 2011).

The potential of start-ups is hampered by a lack of access to finance and administrative burdens

A growing number of successful business cases show that small start-ups are better placed to seize the new opportunities offered by digital technologies (CB insights, 2015; The Economist, 2014). However, a combination of market and regulatory factors act as an obstacle to the creation of small young firms.

The first obstacle is financing. Debt finance is ill-suited for newer, small and innovative companies, which have a higher risk-return profile and often rely on firm-specific intangibles that are not always suitable as collateral.

Private equity investments, particularly venture capital (VC) and angel investing, provide new financing opportunities for innovative start-ups, mainly in high-tech fields. In 2016, over 70% of VC in the United States went to the ICT sector (see Chapter 3). In most countries, however, VC represents a very small percentage of GDP, often less than 0.05%. The two major exceptions are Israel and the United States, where the VC industry is more mature, representing in 2015 0.38% and 0.33% of GDP, respectively.

VC investments collapsed in nearly all countries at the height of the crisis and remain below pre-crisis levels in most countries (Figure 5.4). By contrast, in Hungary, South Africa and the United States, the recovery has been strong, with 2015 levels nearly twice those of 2007.

Note: Data for Israel and South Africa refer to 2014.

Source: OECD (2016b), Entrepreneurship at a Glance 2016, https://doi.org/10.1787/entrepreneur_aag-2016-en.

Despite its potential, the share of small firm financing provided through capital markets remains low. High monitoring costs, low liquidity, red tape and reporting requirements, as well as cultural factors and management practices are obstacles to its development.

ICTs themselves are creating new tools to overcome some of these obstacles. Crowdfunding platforms may provide new sources of finance for small start-ups. Peer-to-peer lending can be attractive for small businesses that lack collateral or a credit history to access traditional bank lending. Equity crowdfunding can provide a complement or substitute for seed financing for entrepreneurial ventures and start-ups that have difficulties in raising capital from traditional sources. Although crowdfunding has grown rapidly since the mid-2000s, it still represents a very minor share of financing for businesses. Donations, rewards and pre-selling are still dominant forms of crowdfunding, although regulation has limited its diffusion, especially for securities-based crowdfunding, which is not legal in some countries (OECD, 2014a).

The Internet can also help to bring together small young firms and potential investors by reducing information asymmetries and increasing transparency. For instance, data warehouses with loan-level information can help investors to better assess risks in small firms and identify investment opportunities. More reliable information about risk may also help to reduce the financing costs, which are typically higher for small firms than for large ones. Start-ups with a public listing on dedicated platforms can increase their visibility and facilitate match-making with investors. In addition, online platforms can provide training, mentoring and coaching for potential entrepreneurs and help them to improve the quality of their business plans and investment projects.

Regulation appears to be the other major obstacle to small start-ups, at least in countries with high administrative burdens on start-ups (Figure 5.5). While advances in ICTs have significantly lowered the cost of experimentation for frontier firms, in many countries regulation tends to favour incumbents and does not always enable the necessary experimentation with new ideas, technologies and business models that underpins the success of young firms. Chapter 2 provides further discussion on policy and regulation that affect start-ups and digital innovation.

Notes: For the People’s Republic of China (“China” in the figure), data are based on preliminary estimates. For Indonesia, data refer to 2009. For the United States, data refer to 2007.

Source: OECD, Product Market Regulation Database, www.oecd.org/economy/pmr (accessed December 2016).

Data are becoming a core driver of digital innovation

More data are being generated every week than in the last millennia. With the accelerating digitalisation of social and economic activities, the flows of data – the equivalent of around 50 000 years of DVD-quality video every single day – are such that the implications for the economy and society are colossal (OECD, 2015a). The huge volume, velocity (the speed at which they are generated, accessed, processed and analysed) and variety (such as unstructured and structured data) of data is today referred to as “big data”.2

The use of big data promises to significantly improve products, processes, organisational methods and markets, a phenomenon referred to as DDI (OECD, 2015a). In manufacturing, data obtained through sensors are used to monitor and analyse the efficiency of machines to optimise their operations and to provide after-sale services, including preventive maintenance. The data are sometimes also used to work with suppliers, and are, in some cases, even commercialised in the form of new services (for example, to optimise production control). In agriculture, geocoded maps of fields and real-time monitoring of every agricultural activity, from seeding to harvesting, are used to increase agricultural productivity (see the following section). The same sensor data can then be reused and linked with historical and real-time data on weather patterns, soil conditions, fertiliser usage and crop features to optimise and predict agricultural production. Traditional cultivation methods can be improved and the know-how of skilled farmers formalised and made widely available.

There is still little macroeconomic evidence on the effects of DDI, but available firm-level studies suggest that using DDI raises labour productivity faster than in non-using firms by approximately 5% to 10% (OECD, 2015a). Brynjolfsson, Hitt and Kim (2011) estimate that in the United States, output and productivity in firms that adopt data-driven decision making are 5% to 6% higher than what would be expected given their other investments in, and use of, ICTs. These firms also perform better in terms of asset utilisation, return on equity and market value. A study of 500 firms in the United Kingdom found that firms in the top quartile of online data use are 13% more productive than those in the bottom quartile (Bakhshi, Bravo-Biosca and Mateos-Garcia, 2014). Barua, Mani and Mukherjee (2013) suggest that improving data quality and access by 10% – presenting data more concisely and consistently across platforms and allowing it to be more easily manipulated – would increase labour productivity by 14% on average, but with significant cross-industry variations.3 Nevertheless, big data are still mainly used in the ICT sector, particularly by Internet services firms. According to Tambe (2014), for example, only 30% of Hadoop investments come from non-ICT sectors, including, in particular, in finance, transport, utilities, retail, healthcare, pharmaceuticals and biotechnology firms. Manufacturing is becoming increasingly data-intensive (see Manyika et al., 2011).

As goods become commodities with low profit margins, many manufacturing firms are developing new complementary services that extend their current business propositions. Rolls-Royce, for instance, shifted its business from a product, time and service solution to a service model trademarked as “Power by the Hour” (OECD, 2017a). Digitalisation has been a key enabler for this transformation towards higher value-added (complementary) services.

Historically, the digital transformation of business models was first enabled by the formalisation and codification of business-related activities, which led to the computerisation of business processes via software. This has “enabled firms to more rapidly replicate improved business processes throughout an organisation, thereby not only increasing productivity but also market share and market value”. Brynjolfsson et al. (2008) have referred to this phenomenon as scaling without mass. Internet firms pushed the digital transformation to a new level. This enabled them to scale without mass better than the rest of the economy.4

The business models of the most successful Internet firms today go beyond the formalisation and codification of processes via software, and now involve the collection and analysis of large streams of data (OECD, 2015a). By collecting and analysing big data, a large share of which is provided by Internet users (consumers), Internet companies are able to automate their processes and to experiment with, and foster, new products and business models at a much faster rate than the rest of industry. Instead of relying on the (explicit) formulation and codification of business processes, these firms use big data to “train” artificial intelligence (AI) algorithms to perform more complex business processes without human intervention. Innovation enabled by AI is now used to transform business processes across the economy. Thanks to the convergence of ICTs with other technologies (owing in particular to embedded software and the IoT), the digital transformation has the potential to affect even traditional sectors such as manufacturing and agriculture.

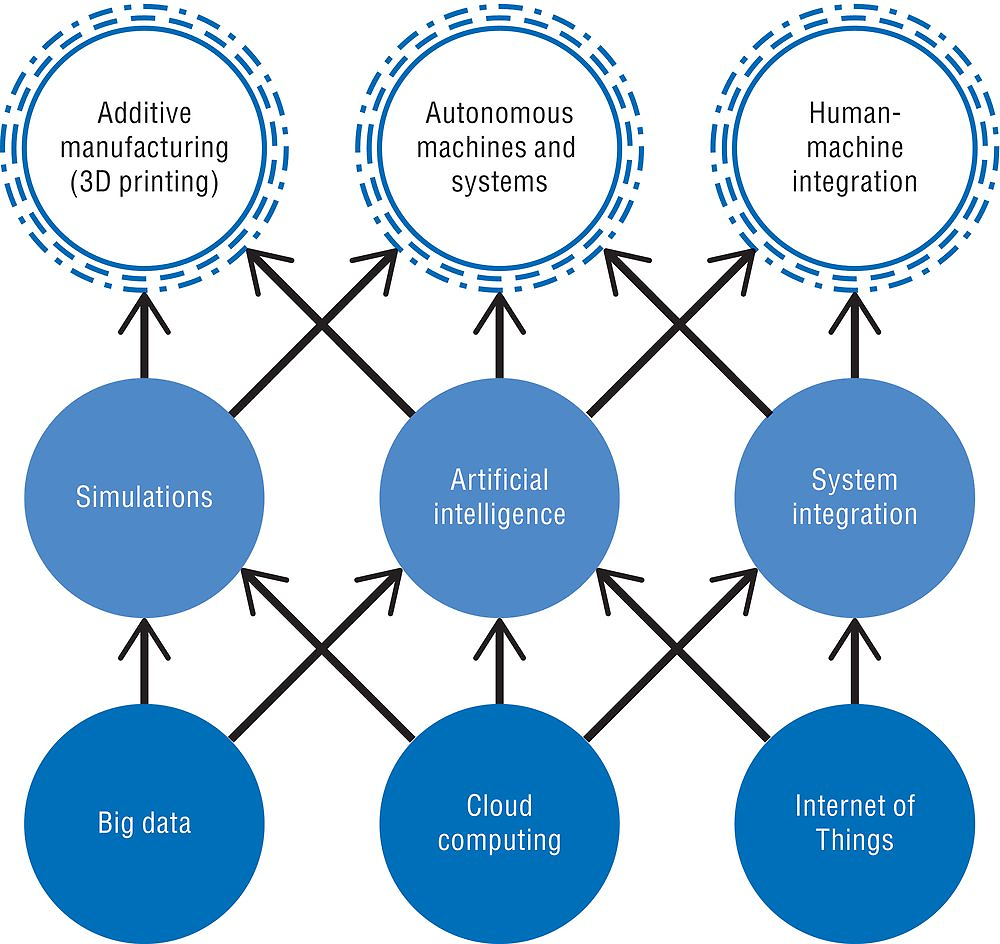

Two major trends make digital technologies transformational for production: the reduction of the cost of these technologies, which enables their wider diffusion, including to small and medium-sized enterprises (SMEs); and, most importantly, the combination of digital technologies, which enables new types of applications. Figure 5.6 depicts the key ICTs which are enabling the digital transformation of industrial production. The technologies at the bottom of the figure enable those at the top, as indicated by the arrows. The technologies at the top (in white), which include additive manufacturing (i.e. 3D printing), autonomous machines and systems, and human-machine integration, are the applications through which the main productivity effects in industry are likely to unfold. In combination, these technologies could one day lead to fully automated production processes, from design to delivery.

Note: This figure is highly stylised and does not show many of the complex relationships and feedback loops between these technologies.

Source: OECD (2017a), The Next Production Revolution: Implications for Governments and Business, https://doi.org/10.1787/9789264271036-en.

The analysis of successful digital business models suggests that actions that take advantage of the applications mentioned above can digitally transform traditional businesses. These actions include:

-

The digitisation of physical assets, which refers to the process of encoding information into binary digits (i.e. bits) so that it can be processed by computers (OECD, 2015a). This is one of the most straightforward steps to digitally transform businesses. An early example is the entertainment and content industry, where books, music and videos were digitised to be provided over formats such as CD and DVD, and the Internet. Thanks to the deployment of 3D scanners and 3D printing, digitisation is no longer limited to content, but can now include real-life objects. 3D printing promises, for instance, to shorten industrial design processes, owing to rapid prototyping, and in some cases to raise productivity by reducing material waste. Boeing, for instance, has already replaced machining with 3D printing for over 20 000 units of 300 distinct parts (Davidson, 2012).

-

The “datafication” of business-relevant processes, which refers to data generation, not only through the digitisation of content, but through the monitoring of activities, including real-world (offline) activities and phenomena through sensors. “Datafication” is a portmanteau word for “data” and “quantification” and should not be confused with “digitisation”, which is just the conversion of analogue source material into a numerical format (OECD, 2015a).5 Datafication is used by many platforms which monitor the activities of their users. And with the IoT, this approach is no longer limited to Internet firms. For example, data collected on agricultural machines, such as those made by Monsanto, John Deere and DuPont Pioneer, are being used as an important data source for optimising the distribution and genetic modification of crops (see the following section on how digitalisation affects traditional sectors and in particular Boxs 5.1 and 5.2).

-

The interconnection of physical objects via the IoT enables product and process innovation. Scania AB, a major Swedish manufacturer of commercial vehicles, now generates one-sixth of its revenues through new services enabled by the wireless communication built into its vehicles. This allows the company to transition towards a firm increasingly specialised in logistics, repair and other services. For instance, with the interconnection of its vehicles, Scania can better offer fleet management services. The interconnection of physical objects also enables the generation and analysis of big data, which can be used for the creation of more services: for example, Scania offers a set of services to increase driving (and therefore resource) efficiency, such as data-based driver coaches.

-

The codification and automation of business-relevant processes via software and AI: software has enabled and incentivised businesses to standardise their processes, and where processes are not central to the business model, to sell the codified processes via software to other businesses. An example is IBM’s Global Expenses Reporting Solutions, which were originally developed to automate the company’s internal travel-related reporting. IBM turned the in-house system into a service, which it has sold globally (Parmar et al., 2014). Another example is Google’s Gmail. This was originally an in-house e-mail system before it was announced to the public as a limited beta release in April 2004 (McCracken, 2014).

-

The trading of data (as a service) is made possible as soon as physical assets have been digitised or processes datafied (see bullet above on datafication). Data generated as a by-product of doing business can have huge value for other businesses (including in other sectors). The French mobile communication services firm, Orange, uses its floating mobile data technology to collect mobile telephone traffic data that are anonymised and sold to third parties, including government agencies and traffic information service providers. In addition, businesses can take advantage of the non-rivalrous nature of data to create multi-sided markets (inside an organisation), where activities on one side of the market go hand-in-hand with the collection of data, which is exploited and reused on the other side of the market. Very often, however, it is difficult to anticipate the value that data will bring to third parties. This has encouraged some businesses to move more towards open data under certain conditions (see OECD, 2015a).6

-

The (re-)use and linkage of data within and across industries (i.e. data mashups) has become a business opportunity for firms that play a central role in their supply chain. Walmart and Dell have successfully integrated data across their supply chains. But as manufacturing becomes smarter, thanks to the IoT and data analytics, this approach is becoming attractive to manufacturing companies as well. Sensor data, for instance, can be used to monitor and analyse the efficiency of products, to optimise operations at a system-wide level, and for after-sale services, including preventive maintenance operations.

Precision agriculture provides farmers with near real-time analysis of key data about their fields. John Deere entered this business initially with yield mapping and simple variable rate controls, and later with automated guidance technology (AutoTrac1). Those early products have since been enhanced by creating automated farm vehicles that communicate with each other. From the beginning, John Deere built on Global Positioning System (GPS) location data. It then developed initial “wired” capabilities to connect farm machines to each other and to the MyJohnDeere Operations Center, which is described by the company as “a set of online tools that provides information about a farm, when and where farmers need it” (Arthur, 2016).

To support vehicles in the field, John Deere developed remote wireless management for farm equipment. It used interconnected satellite and cellular ground-based communications networks, proprietary radio and Wi-Fi. This helped the company reduce the time to harvest crops or complete other tasks. For example, its self-propelled, programmable vehicles could plant or harvest 500 to 600 acres per day when used in groups of two or more vehicles, rather than the usual 100 to 150 acres that a single farmer can do alone. One enhancement John Deere introduced for planting was to use its Exact-Emerge planter and AutoTrac to expand the number of acres that could be planted under optimal conditions. With the enhanced planter and tracking system, the number of acres planted could increase from 600 to more than 800 per day. For harvesting, operations would also be much more efficient if the vehicles used incorporated AutoTrac.

Using a combination of sensors and GPS, Deere’s tractors not only drive themselves, they also use analytic systems. These systems permit vehicles to plant, water and harvest with an accuracy of 2 centimetres. These systems can also communicate with each other. Deere has estimated that it has more than 100 000 connected machines around the world. Tractor cabs also offer Wi-Fi communication with mobile and other on-board sensor systems, as well as other radios for mobile communications with other vehicles. This helps farmers synchronise operations and share data with other farmers.

Using the interconnected devices and smart sensors in this communications network, John Deere combined basic and performance data from its machines with in-field, geo-referenced data to enhance data analytics. Once systems capture these combined data and send them to Deere’s Operations Center, they are incorporated into a more extensive database that also includes environmental information. Deere can combine information from the farmer with data about the environmental conditions (including weather and climate data and data about the soil quality) as well as data about real yields. This helps farmers identify the sections of their land that are more productive. John Deere’s use of data analytics helps farmers optimise crop yield, because “farmers can use the data to decide what and where each piece of equipment will plant, fertilize, spray and harvest […] for an area as small as one by three meters” (Jahangir Mohammed, 2014).

In 2011, John Deere cemented its long-term strategy to focus on integrated data-driven products. The new focus also emphasised an increase in research and development (R&D) investments to 5.5% of net sales, compared to its competitors’ R&D investments of 4% to 5%. The focus on innovation helped Deere continue the 5% compound annual growth rate for employee productivity (measured by sales per employee) achieved over the past 30 years (John Deere, 2016). To buttress its capabilities in this area, John Deere also acquired a number of companies that have pioneered precision agriculture, such as Precision Planting (Agweb, 2015), a leading planting technology firm that also supplies hardware and sensors, and Monosem, a French-based planter equipment manufacturer. John Deere is also hiring data scientists to improve its ability to analyse big data. These professionals will: 1) identify relevant data, sources and applications; 2) utilise big data mining techniques such as pattern detection, graph analysis and statistical analyses to “discover hidden insights”;2 3) implement collection processes as well as develop infrastructure and frameworks to support analyses; and 4) use parallel computation languages to implement applications.

Substantial market growth is forecast for John Deere and similar firms offering farmers self-propelled vehicles and precision agriculture systems. Such forecasts predict that the global precision farming market will expand by USD 4.92 billion by 2020. This represents a compound annual growth rate of almost 12% between 2015 and 2020. At present, precision farming globally represents a USD 2.8 billion market (Mordor Intelligence, 2016). The US market accounts for roughly USD 1 billion to USD 1.2 billion of these sales annually. Using estimates for the large-row-crop farms, corn and soybean farms, where about two-thirds of acreage is subject to precision agriculture, it is conservatively estimated that John Deere’s sales of precision agriculture are about one-quarter of the US market total, or USD 250 million to USD 350 million.3

← 1. AutoTrac Vision uses a front-mounted camera to see early-season corn, soybeans and cotton. It helps farmers avoid damaging crops with sprayer wheels even if a planter is misaligned (John Deere, 2017).

← 2. This description is from a job posting by John Deere for a data scientist, from: https://www.glassdoor.com/Job/jobs.htm?suggestCount=0&suggestChosen=false&clickSource=searchBtn&typed.

← 3. According to a market forecast, this market would include a number of technologies that are integrated together, essentially guidance systems, remote sensing and variable rate technologies. The largest would be guidance systems with a GPS, a geographic information system (GIS) and the Global Navigation Satellite System (GNSS). The market forecast finds that various monitoring and mapping systems would be more important and that software applications – that is, those applications for crop, farm and weather management – would grow faster during the forecast period (see Mordor Intelligence [2016]).

Source: OECD (2017a), The Next Production Revolution: Implications for Governments and Business, https://doi.org/10.1787/9789264271036-en.

Online platforms have grown exponentially in markets for information, goods and services

The Internet has made it easier than ever before to match demand and supply in real time both locally and globally. Multiple online platforms are providing marketplaces for goods, services and information, delivered both physically and digitally. Many such platforms have emerged over the past 20 years and are run by fast-growing companies. A comparison between the top 15 Internet-based companies by market capitalisation in 1995 with those in 2017 shows that the main players used to be Internet service providers, media and hardware or software companies, whereas today most of them are online platforms (Table 5.1). The majority of these platforms either focus on matching demand and supply of information (e.g. search, social network) or provide e-commerce marketplaces (goods and/or services) or e-payment solutions. Somewhat exceptions to the 2017 list are Apple and Salesforce, which are not exclusively platforms, although Apple operates iTunes and App Store, two successful platforms that did not exist in 1995.

The high valuations and spectacular increase in the value of the companies listed in Table 5.1 can be explained by several factors, some of which are specific to online platforms. One reason is that many of these platforms have mainly digital products and can “scale without mass” (Brynjolfsson et al., 2008). Compared to firms that produce physical products with high fixed costs and marginal costs that decline with scale, firms selling digital products tend to have comparatively few tangible assets, such as buildings and employees, and low marginal costs. Furthermore, in contrast to traditional firms, the valuation of platforms does not only depend on sales and profit margins, but can significantly depend on the valuation of their user networks (individuals or firms) and the data generated by their users. In many cases platforms are multi-sided markets with often more than two networks. If a platform has amassed networks of a critical size, it can furthermore benefit from network effects, which can protect the platform and add to its value. For example, customers may stay with the large network of an established platform rather than switching to a competitor with smaller networks that would be unlikely to match the quality of service, the choice or the price of the larger platform.

Online platforms can affect entire markets by lowering transaction costs and by enabling new types of transactions. With his essays The Nature of the Firm (1937) and The Problem of Social Cost (1960), Ronald Coase was among the first economists who discussed the costs of market transactions, which he saw as one of the main reasons for firms to exist. The term “transaction costs” commonly refers to different types of costs occurring in markets, in addition to the production price of a good or service, notably the cost of: 1) finding reliable information on the desired product; 2) bargaining the price and contract; and 3) monitoring and enforcing transactions. By bundling complementary assets and activities, firms “supersede the price mechanism” of markets and create value (Coase, 1937). While firms therewith create firm-market boundaries, platforms can lower transaction costs in markets without (re-)creating firm-market boundaries and possibly contribute to dissolving the latter. Where a firm “rather makes than buys” when information and input prices are uncertain, platforms facilitate buying rather than making by providing more information, e.g. on price, products and providers, than was available in traditional markets. In their supply-side markets, platforms facilitate the entry of both firm and non-firm actors, including non-professional individuals or peers (Figure 5.7).

Note: P2P = peer-to-peer; B2C = business-to-consumer; B2B = business-to-business.

Source: OECD (2016c), “New forms of work in the digital economy”, https://doi.org/10.1787/5jlwnklt820x-en.

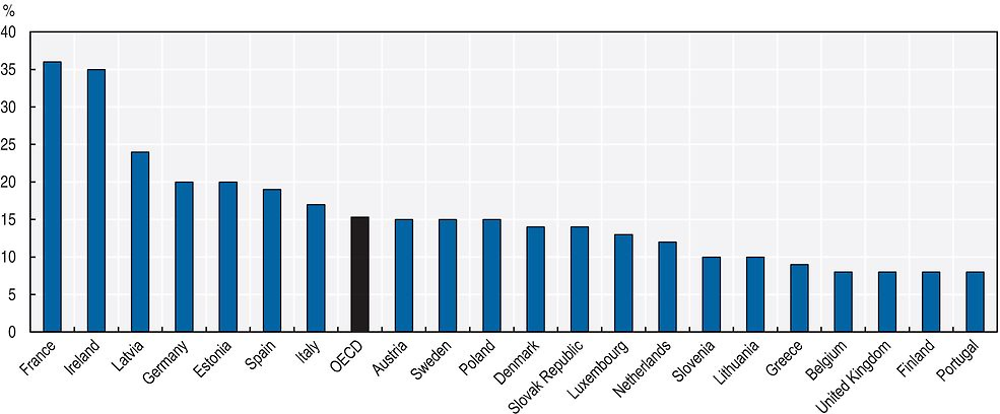

The uptake of online platforms has been fast but is not yet measured well in many cases. For some platforms the number of unique monthly visitors can indicate their uptake. For example, in early 2017, Google.com had over 6 billion monthly unique visitors, followed by Facebook.com with over 2 billion. The uptake of platforms that emerged more recently such as Uber and Airbnb was measured in a 2016 survey for European countries, where on average 15% of individuals had used an online platform for “collaborative economy” services (Figure 5.8). Younger, more educated users from small, medium or large towns were more likely to have used such platforms (31% versus 17% for all European countries). The two most frequently mentioned benefits of services delivered over such platforms, compared to traditional commerce, are the convenient access to and the cheaper price or free availability of such services. The two most frequently mentioned problems of such services, compared to traditional commerce, are that users often do not know who is responsible if a problem arises and that they may not trust Internet transactions more generally (Eurobarometer, 2016).

Note: The aggregate OECD only covers selected OECD European countries.

Source: Eurobarometer (2016), “Flash Eurobarometer 438: The use of collaborative platforms”, https://data.europa.eu/euodp/fr/data/dataset/S2112_438_ENG (accessed 13 April 2017).

Expanding digital applications and services

Digital innovation enables applications in many sectors, a selection of which is discussed in this section, focusing on science, healthcare, agriculture, governments and cities. In science, research is affected by the increasing amounts of data being collected and analysed and the diffusion of results by digital tools that shape open access publishing or enable new modes of peer review. Increasing use of mobile health applications and of electronic health records creates new opportunities for health by providing the foundation for higher functionalities that promise greater care co-ordination and improved clinical management. Even in agriculture, digital technologies enable, for example, precision farming and automation, which has the potential to profoundly affect traditional models. Also, governments are going digital by promoting e-government services to individuals and firms, by opening up PSI, and by communicating directly to citizens via social networks like Twitter. Not least, cities are seizing the benefits of digital applications, for example in transport, energy, water and waste systems, and are exploring the potential of DDI to improve their own operations and decision making.

Digital technologies are shaping the development of open science

Publically funded science generated the essential foundations for the digital revolution that is affecting all sectors of society and the economy today. For example, scientific research played a key role in the creation of the Internet and the worldwide web. Ongoing research in universities and public research institutions across the world in areas such as quantum computing, biological storage of digital data and human-computer interactions, will undoubtedly lead to new technological innovations with significant socio-economic impacts. Paradoxically, the practice of science itself is now also being radically altered by the digitalisation process that it triggered. This presents both exciting new opportunities and challenges.

Digitalisation fundamentally affects how science is conducted and results are disseminated

ICTs – new data storage infrastructure, broadband Internet, high-speed computing and analytical software tools – are radically modifying the way science is conducted and the way the results of research are disseminated. A new paradigm of “open science” is emerging. This can encompass open access to scientific data, open access to scientific journals and greater engagement of civil society, including industry. In parallel, the availability and scale of data that are available for, and produced by, science has massively increased as has our ability to interrogate and analyse that data. Big data and data-driven research are now ubiquitous across all scientific disciplines and are opening up exciting new possibilities and the ability to link data from different sources and fields is providing new insights into complex global societal challenges. When coupled with AI, this potential is magnified even further.

In addition to enabling new scientific discoveries, there are a number of reasons why “open science” is being actively promoted in most OECD countries (OECD, 2015b). The traditional scientific journal publishing model and the rising costs of journal subscriptions can limit access to the outputs of publically funded scientific research. Open access publishing, which takes advantage of the very low costs of information dissemination on line, presents an attractive alternative. There have also been concerns about the rigour and reproducibility of published scientific results that can be at least partially addressed by ensuring open access on line to the underlying research data. Increased access to scientific information and data can make the research system more effective and efficient by reducing duplication; by allowing the same data to generate more research; and by multiplying opportunities for domestic and global participation in the research process. Open access to scientific results and data should increase the knowledge spillovers from public research and promote innovation. It can also play an important role in promoting citizens’ engagement and trust in science, making research more transparent and accountable and promoting citizen science.

Science is an important producer and user of big and open data

As in other areas of society and the economy, science is being dramatically altered by the online availability of new forms of data and big data. Indeed, it is fair to say that areas such as particle physics, astronomy, space science and genomics have driven the development of technologies and software to share and analyse large amounts of data. These scientific fields are still at the frontier in terms of big data generation and analysis. The Square Kilometre Array telescope, which is currently being built in South Africa and Australia, is expected to generate the data equivalent of twice the current total daily global Internet traffic when it comes on line in 2024. All areas of science are now being transformed by digitalisation and the increased availability of new forms of data and new analytical tools. For example, data from online transactions have the potential to transform social sciences and our understanding of human behaviours. Linking data from satellites with ground-based sensor data and environmental, behavioural and economic data is providing new insights into the complex societal challenges that are encapsulated in the global Sustainable Development Goals.

An essential pre-condition for making the most of the opportunities of this data revolution in science is that the data be findable, accessible, interoperable and reproducible. While the costs of data storage have decreased dramatically, the process of properly curating data and ensuring its long-term availability and usability is expensive and requires high-level expertise. New business models and new partnerships between different public and private actors need to be developed to support data repositories and associated services. A sustainable data infrastructure for science needs to be established at multiple scales, from local to global.

Perhaps the greatest potential for advancing research and society is in linking data from different areas. However, achieving interoperability is a major challenge because of technical, legal, ethical and social barriers. In particular, sharing and using personal data for scientific research raises a number of important issues related to the balance between individual privacy and societal benefits. While privacy and other aspects can legitimately prevent personal data from being freely shared, methods like anonymisation may be used in some cases to make personal data suitable for research.

The digitalisation of science requires scientists with new skills

The speed of change due to digitalisation raises important issues in relation to scientific skills. All scientists, in all disciplines, including social sciences and humanities, now need to be able to function effectively in a digital world. Although ICTs will not (at least for the foreseeable future) replace the dependence of science on individual creativity and invention, they will certainly supplement it. The future of research lies in effectively combining human and technological capacities. This will require new training and skills, from generic ICT skills to ICT specialist skills for advanced software development and data analytics. Big data will require the development and widespread adoption of new mathematical modelling and statistical approaches. Individual scientists, research teams and institutions will all have to acquire new capacities to function effectively in the digital world. There is considerable uncertainty as to how much these needs are already being addressed by the introduction of digital skills into the general education and training curricula and the development of specialised data science programmes.7

It is also unclear how much of the growing need for data curation and stewardship can be met by the evolution of traditional professions such as academic librarians or whether it will require a new cadre of data scientists who can work at the interface between science and data. What is clear is that the traditional discipline-based academic research workforce, with its associated career paths and reward systems, is entering a period of upheaval. This encompasses not only the need for new technical skills but also, and perhaps even more importantly, the need for “softer” brokering and team-working skills, which are not readily accommodated in many traditional academic settings (in contrast to industry).

Digital tools shape open access publishing and enable new modes of peer reviews

Many OECD countries are now mandating open access to scientific publications, which is viewed as a fundamental pillar of open science. Open access to science publications has been discussed extensively in OECD (2015b). In summary, there are currently two main approaches for publishers to providing access to science publications openly and free of charge at the point of delivery on line: the “green” route, which involves delaying open access for an initial period during which subscription-only access is provided; and the “gold” route, in which immediate open access is provided and the costs of publication are covered by mechanisms other than subscription. Hybrid models are also being tested and all of these different approaches have their advantages and inconveniences as well as their proponents and opponents. In addition, in some fields of science, pre-print deposition of articles and/or self-archiving of published articles by authors on open access servers are enabling more open access to scientific information.

Publication in scientific journals normally depends on prior approval by scientific peers. This peer review is often criticised for being too biased, too conservative or too unaccountable. The publication of a number of high-profile fraudulent publications has called into question the effectiveness of peer review as a “gatekeeper” for the dissemination of sound scientific findings. Digitalisation is opening up new possibilities for addressing some of the perceived weaknesses in current peer review processes. The use of pre-prints servers has become the norm in physics and mathematics and is spreading to other areas of science, allowing open online review of articles before they are submitted for publication. Other methods for open peer review, either prior to or following publication, are also being tested. In addition, digital publication enables supporting materials, including experimental data, to be made accessible alongside scientific articles, which can increase the transparency and reproducibility of the scientific process.

Despite the potential advantages and overall cost savings relative to traditional publishing practices, there is an urgent need for sustainable business models for new open access publishing and knowledge dissemination mechanisms. The whole area of the dissemination of scientific information is rapidly evolving and the role of formal peer-reviewed scientific publications is only one part of this dynamic landscape that increasingly encompasses the use of social media. It is essential, as new models and new actors find their places, that the long-term stewardship of the (past and future) scientific record is ensured.

Online platforms play an important role for scientific research

Digital tools, from individual electronic identifiers to electronic notebooks and online search tools, have rapidly infiltrated all steps in the scientific process, from research design through dissemination. Using “off-the-shelf” tools, it is increasingly easy to link and map the inputs and outputs of research to individuals and institutions. Digital tools are transforming not only the way scientific research is conducted, but also the way it is managed and assessed.

Many of these online tools are being integrated into digital platforms that provide value-added services on top of a mix of proprietary (e.g. bibliometric) and public (e.g. project grant information) data resources. Scientific research is increasingly dependent on these platforms, which are operated by a small number of private companies. For the time being, this appears to be working effectively, but in the longer term there are concerns that these companies may develop effective monopolies, which might interfere with the dynamics of science. It is important to ensure that the partnership between public and private actors in developing and using scientific tools and platforms is beneficial to both parties and ensures the public good properties of openness and accessibility of scientific knowledge.

Further developments in digital and open science depend on trust

The third main pillar of open science – in addition to open data and open access publications – is the open engagement of societal actors, including industry, in the scientific enterprise. Again, this encompasses all stages in the scientific process, from selecting research priorities to citizen science and knowledge transfer, and ICTs have enabled new and exciting opportunities for engagement across all these stages.

A critical pre-condition for an effective relationship between science and other sectors of civil society is trust. The digitalisation of science has the potential to both strengthen and undermine trust in science. There is huge potential to exploit new sources of online data and information to improve urban development, healthcare systems, agriculture and food systems, resource use and many other areas of societal need. However, much of these data concerns individuals. Therefore, new ethical frameworks and governance systems will be required to ensure an appropriate balance between individual privacy and societal benefit (OECD, 2016d). Trust in science will also depend on the integrity of the scientific enterprise – as science becomes more open and rapidly disseminated via social media, the distinction between good and bad science can easily become blurred. More than ever before the rigour of science will be under the spotlight. In particular, the quality assurance and (increasingly automated) analysis of big and complex data, including the development and use of new algorithms and mathematical models, will need to be done with vigilance and transparency.

Healthcare is evolving with the use of electronic health records and mobile health applications

Health sectors across countries are undergoing a profound transformation as they capitalise on the opportunities provided by ICTs. Key objectives shaping this transformation process include improved efficiency, productivity and quality of care. There is also growing evidence that ICTs are essential to improve access to health services, particularly in rural and remote areas where healthcare resources and expertise are often scarce or even non-existent, and to support the development of new, innovative models of care delivery (OECD and IDB, 2016).

The electronic health record provides the foundation for more complex functionalities that promise greater care co-ordination and improved clinical management

A 2016 OECD survey of 30 OECD countries revealed that most countries are investing in the development of electronic health records (EHRs) (OECD, 2017b). Twenty-three countries reported that they are implementing a national-level EHR system. Eighteen reported comprehensive record-sharing within one “countrywide” system designed to support each patient having only one EHR. A few countries have one national EHR system, but within it some key aspects of record-sharing are subnational only, such as within provinces, states, regions or networks of healthcare organisations (Austria, Canada, Spain, Sweden and Switzerland). Among them, all but Canada have implemented or are implementing a national information exchange that enables key elements to be shared nationwide. Seven countries indicated that they are not aiming to implement a national-level EHR system at this time (Chile, Croatia, the Czech Republic, Denmark, Japan, Mexico and the United States). Croatia and Denmark report aspects of record-sharing that are comprehensive at the national level. In the other countries, sharing arrangements differ among healthcare organisations or regions.

There is robust evidence today to demonstrate that the introduction of EHRs can contribute in particular to the reduction of medication errors and better co-ordination of care. The implementation process is, however, a notoriously complex and expensive undertaking. Countries that are investing in developing their health information systems encounter numerous technical and financial challenges. Only a few countries have so far been able to achieve high-level integration and to capitalise on the possibility of data extraction from EHRs for research, statistics and other secondary uses. Healthcare systems still tend to capture data in silos and analyse them separately. Standards and interoperability are key challenges that must be addressed to realise the full potential of EHRs.

With an increasing number of individuals using smartphones and mobile devices, mobile health is by far the fastest growing segment of ICT-based healthcare delivery systems

Mobile technologies offer a wide range of smart modalities by which patients can interact with health professionals or systems. These technologies provide helpful real-time feedback along the care continuum, from prevention to diagnosis, treatment and monitoring. Since m-health services have low marginal costs and high availability, they have the potential to reach large numbers of patients between in-person clinical encounters. Low- and middle-income countries have perhaps the greatest potential to extend access to healthcare by using m-health to integrate rural and remote areas into the health system. Countries such as Ghana, Kenya, South Africa and Tanzania have successfully integrated the use of mobile phones as support mechanisms in community-based healthcare systems (Columbia University, 2011).

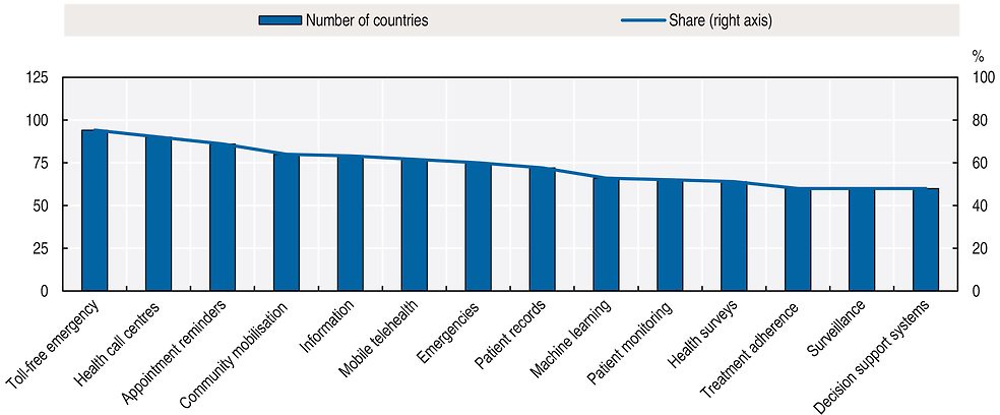

In 2015, the World Health Organization surveyed over 125 countries on e-health and m-health activities at the national level. Over 80% of these countries reported government-sponsored m-health programmes. M-health projects primarily extended existing health programmes and services at the national or local level (Figure 5.9).

Note: The results include responses from over 600 e-health experts in 125 countries worldwide.

Source: WHO (2016), Atlas of eHealth Country Profiles: The Use of eHealth in Support of Universal Health Coverage: Based on the Findings of the Third Global Survey on eHealth 2015, http://apps.who.int/iris/bitstream/10665/204523/1/9789241565219_eng.pdf?ua=1 (accessed 12 April 2017).

M-health is widely recognised as especially valuable for the management of non-communicable diseases such as diabetes and cardiac disease and other health conditions where continuous interaction is imperative. M-health services can also help address physical, sensory and cognitive impairments of older populations to allow continued aging in place and avoid hospital admissions.

The rapid proliferation of m-health pilots and the growth of health and wellness “apps” have emerged as significant challenges for policy makers

M-health is at a critical juncture in its evolution. First, many m-health projects and pilots were not designed to scale and were instead intended to demonstrate proof of concept. This has led to issues with fragmentation in financing, short-term partnerships and lack of integration into formal health systems. Early efforts saw many trials funded by operators, governments, non-governmental organisations and other interested bodies.

Second, health and wellness apps, unless classified as medical devices, are today largely unregulated, creating concerns about their safety and effectiveness. In addition, to function, health and wellness apps may require a vast trove of personal data, raising privacy and security concerns. Thus, although in many countries, like the United States, consumer protection laws would apply to protect consumers from deceptive or unfair practices related to health apps, data governance and associated m-health policies are currently high on the policy agenda of countries deciding how best to leverage m-health for improved health. A number of emerging initiatives aim to fill the evaluation gap. For example, medical app accreditation programmes, in which apps are subject to formal assessment or peer review, are a recent development that aims to provide clinical assurances about quality and safety, foster trust, and promote app adoption by patients and professionals. Voluntary codes of conduct or codes of practice are also being developed to promote private sector awareness and good practice.

In 2013, the Boston Consulting Group reported 500 m-health projects and in 2015 the number of patients using m-health applications was estimated at approximately 500 million globally. According to one estimate, more than 165 000 m-health apps (Apple and Android) were available in 2015, a figure that had doubled since 2013 (IMS Institute for Healthcare Informatics, 2015). The annual revenue of the health-related mobile apps market is projected to reach more than USD 26 billion by 2017 from its value of USD 2.4 billion in 2013 (research2guidance, 2014).

In 2014, a quarter of adults in the United States reported using one or more health tracking apps and a third of physicians had recommended an app to a patient in 2013 (Comstock, 2014). The combination of the rapidly evolving apps and app platforms and integration with other products introduces new opportunities as well as possible new risks. In particular there are persisting questions about:

-

clinical effectiveness and safety

-

privacy and security (many health and fitness apps have access to sensitive physiological data collected by sensors on a mobile phone, wearable or other device)

-

the high rate of app turnover (nearly 90% of apps are not used after six months; 80% are not generating revenue to support a business case).

Recent research also shows that while consumers have a wide choice of apps addressing a broad set of medical conditions, only a minority of these apps appear to address the needs of the patients who could benefit the most and to be clinically useful (Singh et al., 2016).

Digitalisation affects even traditional sectors such as agriculture

Industrial production is undergoing a transformation driven by the conjunction of the increasing interconnection of machines, inventories and goods delivered via the IoT; the capabilities of software embedded in machines; analysis of the large volumes of digital data (“big data”) generated by sensors; and the ubiquitous availability of computing power via cloud computing. The resulting transformation, which has been described by some as “Industrie 4.0” (Jasperneite, 2012), is not limited to manufacturing, but has already deeply affected even more traditional sectors such as agriculture. For instance, farmers today already generate large volumes of digital data which companies such as John Deere and DuPont Pioneer can exploit through new data-driven software services (Noyes, 2014). For example, sensors in John Deere’s latest equipment can help farmers manage their fleet, reduce tractor downtime and save resource consumption (Big Data Startups, 2013). It is estimated that “Industrie 4.0” could boost value added in German agriculture by an additional EUR 3 billion (1.17%) by 2025 (BITKOM and Fraunhofer, 2014).8

Precision agriculture has transformed farming thanks to big data analytics

Big data analytics has enabled precision agriculture, which provides productivity gains by optimising the use of agriculture-related resources. These include, but are not limited to, savings on seed, fertiliser and irrigation, as well as farmers’ time (Box 5.1). Estimates of the productivity effect depend on the types of savings considered. One estimate, for instance, suggests that precision agriculture could improve corn yields in the United States by five to ten bushels per acre, increasing profit by around USD 100 per acre (at a time when gross revenue minus non-land costs stood at about USD 350 per acre) (Noyes, 2014). Extrapolating, one could estimate economic benefits for the United States from precision agriculture to be around USD 12 billion annually. This represents about 7% of the total value added of USD 177 billion contributed by farms to the United States’ GDP.9 Studies that exclude farmers’ time savings estimate more modest benefits per acre from precision farming. Schimmelpfennig and Ebel (2016), for instance, estimated increased profits of USD 14.50 per acre. A similar study focused on the same sources of increased efficiency from precision agriculture for different size farms,10 in particular on precision agriculture’s “automatic row and section control, which uses GPS to prevent excess application of crop inputs, such as fertiliser and crop protection chemicals” (John Deere, 2015). Farmers’ cost savings for the corn fields, similar to the large-row-crop farms evaluated above, were estimated to be between USD 1 and USD 15 per acre.

Agriculture could be highly automated soon with the few human workers being integrated in automated processes

Autonomous machines are already intensively used in agriculture in some countries. In cattle farming in the United States, for instance, machines milk cows, distribute food and clean stables without any human intervention. The milking robot from Lely, for instance, autonomously adjusts the feeding and milking process to optimise milk production for each cow. Some studies have therefore suggested that it is only a matter of time before humans are removed altogether from agricultural farming.

A scenario might ensue in which farm enterprises become local caretakers of land, animals and data. They might monitor operations that are centred at the lower end of the value chain, much like the current concept of contract farming.11 Food producers, retailers or even end consumers could interact directly with the network around the farmer, including seed suppliers, smart (autonomous) machines, veterinarians, etc. In such a scenario, the job of the farmer would be more like a contractor making sure that the interactions between the supply and demand sides of the agricultural system work together properly. In an alternative scenario, farmers could become empowered by the data and intelligence provided by analytics, tailoring the processes to their knowledge of local and farm-specific idiosyncrasies.

As the IoT enables the integration of physical systems, it will also foster the integration of living systems – including plants, animals and humans – within physical systems.12 Such integration may further empower humans: augmented reality-based applications, for instance, could provide farmers with real-time information to improve decision making and work procedures. For example, instructions could be displayed directly in farmers’ field of sight using augmented reality glasses. And by using real-time information, farmers could organise shift scheduling. That said, as highlighted in OECD (2017a), there are also risks that such integration may lead to a dehumanisation of production, including in agriculture. In highly automated production processes, integration and interaction between humans and autonomous systems have already emerged, in particular for tasks for which human intelligence is still required and no cost-efficient algorithm exists, making human workers appear rather as servants than as users of IoT-enabled systems.

Obstacles to the reuse, sharing and linkage of data in agriculture remain

Obstacles to data reuse, sharing and linkage take various forms. These include technical barriers, such as constraints on the machine readability of data across platforms. Legal barriers can also prevent data reuse, sharing and linkage. For example, the “data hostage clauses” found in many terms of service agreements are an example of such legal barriers, in particular when this “provision may be used to extract additional fees from the customer or to prevent the customer from moving to another provider” (Becker, 2012).13 The issue is exacerbated by challenges linked to the concept of data ownership. In contrast to other intangibles, data typically involve complex assignments of different rights across different stakeholders. Where data are considered personal, the concept of ownership is problematic, since most privacy regimes grant explicit control rights to the data subject preventing the restriction their personal data by the data controller (see for example OECD [2013b]: paragraph 13). But even in cases where data are considered non-personal, controversies over data governance have emerged, such as in the case of a recent dispute between major providers of precision farming technologies (including John Deere, DuPont Pioneer and Monsanto) and farmers (Box 5.2).

Farming has become data-driven to such an extent that farmers’ ability to access and use agricultural data has become a determinant for success and failure. Major providers of precision farming technologies (agriculture technology providers [ATPs]), such as John Deere, DuPont Pioneer and Monsanto, recognised this trend when they started taking advantage of the Internet of Things by integrating sensors in their latest equipment. By doing so they have been able to generate large volumes of data, which are considered an important data source for biotech companies that optimise genetically modified crops, as well as for crop insurance companies and traders on commodity markets.

The control of agricultural data by the major ATPs has led to controversial discussions on the potential harm to farmers from discrimination and financial exploitation. For farmers, the benefits of data-intensive equipment also became less clear, and there was a sense that farmers would “degrade” to become local caretakers of land, animals and equipment, and act only as contractors making sure that the interactions between the supply and demand sides of the agricultural system work together properly. The role of farmers was blurred even more by uncertainties about the question of data ownership (Banham, 2014).

In April 2014, major providers of precision farming technologies met with the American Farm Bureau Federation to discuss the future of the governance of agricultural data. The question of data ownership was central to this discussion. The result was the Privacy and Security Principles for Farm Data, signed by 37 organisations (as of 3 March 2016). The following “principles” were relevant for the discussion on data governance:

-

Ownership: “We believe farmers own information generated on their farming operations. However, it is the responsibility of the farmer to agree upon data use and sharing with the other stakeholders with an economic interest, such as the tenant, landowner, cooperative, owner of the precision agriculture system hardware, and/or ATP, etc. The farmer contracting with the ATP is responsible for ensuring that only the data they own or have permission to use is included in the account with the ATP.”

-

Collection, access and control: “An ATP’s collection, access and use of farm data should be granted only with the affirmative and explicit consent of the farmer. This will be by contract agreements, whether signed or digital.”

-

Notice: “Farmers must be notified that their data is being collected and about how the farm data will be disclosed and used. This notice must be provided in an easily located and readily accessible format.”

-

Transparency and consistency: “ATPs shall notify farmers about the purposes for which they collect and use farm data. They should provide information about how farmers can contact the ATP with any inquiries or complaints, the types of third parties to which they disclose the data and the choices the ATP offers for limiting its use and disclosure.”

-

Portability: “Within the context of the agreement and retention policy, farmers should be able to retrieve their data for storage or use in other systems, with the exception of the data that has been made anonymous or aggregated and is no longer specifically identifiable. Non-anonymised or non-aggregated data should be easy for farmers to receive their data back at their discretion.”

-

Disclosure, use and sale limitation: “An ATP will not sell and/or disclose non-aggregated farm data to a third party without first securing a legally binding commitment to be bound by the same terms and conditions as the ATP has with the farmer. Farmers must be notified if such a sale is going to take place and have the option to opt out or have their data removed prior to that sale. […] If the agreement with the third party is not the same as the agreement with the ATP, farmers must be presented with the third party’s terms for agreement or rejection.”

-

Data retention and availability: “Each ATP should provide for the removal, secure destruction and return of original farm data from the farmer’s account upon the request of the farmer or after a pre-agreed period of time. The ATP should include a requirement that farmers have access to the data that an ATP holds during that data retention period. ATPs should document personally identifiable data retention and availability policies and disposal procedures, and specify requirements of data under policies and procedures.”

-

Unlawful or anticompetitive activities: “ATPs should not use the data for unlawful or anticompetitive activities, such as a prohibition on the use of farm data by the ATP to speculate in commodity markets.”

-

Liability and security safeguards: “The ATP should clearly define terms of liability. Farm data should be protected with reasonable security safeguards against risks such as loss or unauthorized access, destruction, use, modification or disclosure. Polices for notification and response in the event of a breach should be established.”

Sources: Banham, R. (2014), “Who owns farmers’ big data?”, www.forbes.com/sites/emc/2014/07/08/who-owns-farmers-big-data (accessed 4 May 2017); American Farm Bureau Federation (n.d.), “Privacy and Security Principles for Farm Data”, www.fb.org/issues/technology/data-privacy/privacy-and-security-principles-for-farm-data (accessed 21 June 2017).

Governments have identified digital opportunities, but can still make fuller use of them

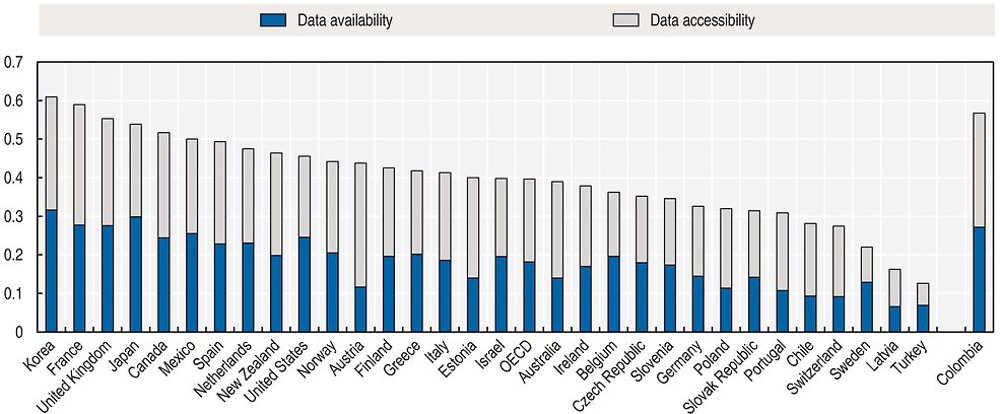

Digital technologies offer important potential for the public sector to improve service delivery and to create value for individuals and businesses. In 2017, the objective to “strengthen e-government services” ranked as the highest priority among 15 policy objectives for digital economy and society developments (see Table 1.1 in Chapter 1). This focus resonates with the potential that is left in many countries to improve e-government service delivery, as can be seen, for example, in the uptake of e-government services by individuals (Figure 5.10) and in the provision of openly accessible government data (Figure 5.11). While the term e-government is still used in many countries, OECD countries committed in 2014 to move from narrowly focusing on “e-government” to developing a broader agenda for “digital government” (Box 5.3).

Note: The latest available data for businesses are from 2013.

Sources: OECD, ICT Access and Usage by Businesses (database), http://oe.cd/bus; OECD, ICT Access and Usage by Households and Individuals (database), http://oe.cd/hhind (both accessed June 2017).