Chapter 10. Business uptake, entrepreneurship and digital content

Most of the value of the Internet and the underlying infrastructure lies in the adoption and use of ICTs. This chapter describes how the Internet and ICTs support businesses, entrepreneurship and the development and distribution of local content. It examines the situation in the region and further presents a set of policy instruments that governments can use to promote ICT adoption, digital entrepreneurship and the production of local content. Overall, while some countries now have systematically included demand-side policies in their national digital agenda, more needs to be done to increase ICT adoption among firms, especially among small companies. This includes fostering entrepreneurial skills in LAC countries and promoting the development of content in the region that serves their needs.

Most of the value of the Internet and the underlying infrastructure lies in the adoption and use of information and communication technologies (ICTs). For this reason, this Toolkit has placed emphasis on broadband demand as well as supply. The uptake of the opportunities enabled by broadband is essential for achieving economic and social benefits (OECD 2015a), and for encouraging inclusive development in the Latin American and Caribbean (LAC) region.

Global value chains (GVCs) are increasingly managed digitally. Firms that are not connected to the Internet and do not use ICTs risk being excluded. This is why many countries are devoting increasing attention to demand-side policies. This means addressing the question of how to increase ICT adoption among companies and also, how to create digital content that serves the needs of firms operating in these countries, as well as the needs of citizens (OECD 2015a).

In the past, LAC countries have largely focused on supply-side policies and the deployment of broadband infrastructure, which is a necessary condition for the adoption and use of ICTs. More recently, however, several Latin American countries, such as Colombia, Brazil and Mexico, have increasingly focused on demand-side policies in their national digital strategies. At this stage, the region has overall lower ICT usage rates than the OECD area.

The objective of this chapter is to describe how the Internet and ICTs supports businesses, business development and entrepreneurship and to present a set of policy instruments that governments can use to promote ICT adoption and use. In particular, the chapter discusses:

-

ICT adoption by companies

-

Internet and ICT-based entrepreneurship

-

development of digital content, including local content.

An introduction to each topic is provided, before policy objectives and potential measurement tools are presented. An overview of policies in the LAC region follows, as well as a list of good practices.

Key policy objectives for the LAC region

ICT adoption by companies

Being connected to the Internet and using ICTs in daily operations offers companies many benefits. The Internet and related ICTs connect businesses to digitally managed global value chains and offer an important platform for selling to customers world wide. This allows firms of all sizes to scale up quickly and compete with other firms not only on the national but on the global level. In areas where access to knowledge faces certain obstacles – as is often the case in rural areas in Latin America – the Internet is an important source of information supporting business innovation and knowledge accumulation. ICT applications, ranging from basic accounting or inventory applications for smaller companies, to more complex services such as customer relationship management software or enterprise resource planning systems, for larger companies, render business processes more efficient. Overall, the Internet and ICTs drive firm productivity and reduce barriers to market entry.

Several studies have analysed the link between ICT adoption, firm performance and contribution to economic growth and have been able to show the positive effects of increased ICT adoption on firms’ productivity, performance and the economy as a whole (e.g. Gaggle and Wright, 2014; Grazzi and Jung, 2016; Haller and Siedschlag, 2011; OECD, 2012).

Grazzi and Jung (2016) especially analyse the effects of broadband and ICT adoption in Latin American firms and the effect on firm performance. They analyse several determinants of ICT adoption in Latin America and find that bigger firms, firms that are more exposed to foreign markets and firms that are located in a capital or big city have a higher likelihood of having a broadband connection and a website. Moreover, they show that the skill level in a company is an important determinant of ICT adoption. This confirms results of previous studies and underlines the importance of education and training (see also Chapter 9 on education and skills for the digital economy). In addition, firms that are operating in an environment where many firms have already adopted ICTs have a higher probability of getting connected.

Grazzi and Jung (2016) are also able to demonstrate the positive effect of ICT adoption and firm performance. Firms that adopted broadband are more likely to innovate. In addition, they also found evidence that ICT adoption leads to productivity growth in Latin American firms.

The findings above provide the evidence base for policy makers that increased ICT adoption by companies leads to better firm performance, higher productivity and thus to economic benefits. Since low levels of productivity are of particular concern in many Latin American countries, policy makers should work on the elaboration and implementation of policies aiming to increase ICT adoption.

The key policy objectives for increasing ICT adoption (discussed in detail in the good practices section) include:

-

Foster good Internet connectivity and ensure an open Internet so that firms can benefit from the full breadth of digital services and applications (see Chapters 4 on competition and infrastructure bottlenecks, Chapter 5 on extending broadband access and services and Chapter 7 on convergence for further details).

-

Develop policies to increase ICT adoption in firms, with a focus on small and young firms. These measures are discussed further in this chapter and include such policies as targeting large companies that have extensive business relations with a high number of SMEs, seconding ICT experts to companies that are lagging behind or encouraging the development of applications and services targeted to the needs of emerging economies. Governments can also use e-government services to provide incentives for companies to use the Internet and ICTs (see also Chapter 12).

-

Develop a measurement agenda to monitor the use of ICTs in businesses. One of the major challenges in Latin America is monitoring firms’ actual use of ICTs. Only limited data are available on ICT adoption in Latin America, beyond data on the number of firms with a website or using e-mail for business. Governments have an important part to play in extending the measurement of ICT adoption.

-

Promote e-commerce. Promoting e-commerce in Latin America requires countries to educate firms on the possibilities of electronic commerce and its potential to increase business performance, but also to review legacy regulations and to reduce barriers to foreign markets.

-

Promote the development of digital skills with a focus on ICT usage (see also Chapter 9 on education and skills for the digital economy).

-

Promote the use of ICTs through e-procurement and e-government policies (see Chapter 12 on digital government for information and recommendations).

Promote ICT and digital entrepreneurship

Another important area for policy makers is how to foster entrepreneurship using the Internet and ICTs, especially in the area of digital entrepreneurship. Entrepreneurs and young firms are an important part of the dynamic economic environment in which inefficient companies are replaced by younger, more productive companies. They thus ensure that economic resources are used more efficiently. In addition, entrepreneurs increase the available choice in the market, and are often more responsive to market needs and more innovative.

In terms of entrepreneurs’ role in the labour market, young businesses significantly contribute to job creation. According to a recent OECD study that analysed the effect of young firms in 15 countries from 2001 to 2011, young firms created about 50% of all new jobs and were more resilient to the financial crisis, with a positive net job growth during this period (OECD, 2013a). Finally, several studies have shown that a greater number of entrepreneurs and start-ups contribute to more rapid economic growth (e.g. Arzeni et al., 2012; OECD, 2010).

Given the key role of entrepreneurs, encouraging entrepreneurship in Latin America is an important area of work for policy makers. This section will mainly focus on digital entrepreneurship, which can be defined as “a subset of overall entrepreneurship that can be distinguished by links to the digital economy”. Encouraging digital entrepreneurship in a country is a challenging and time-consuming task, since different policy areas are involved. However, a number of policies can help reach this goal:

-

Strengthen entrepreneurial capabilities. A lack of skills is holding back digital entrepreneurship in Latin America, both in terms of managerial and ICT-related skills, such as programming and coding. Governments help strengthen entrepreneurial capabilities by promoting and/or establishing training programmes for entrepreneurs and to remedy this.

-

Foster an entrepreneurial culture with the private sector and, in particular, successful entrepreneurs. Fostering a digital entrepreneurial culture could include facilitating the exchange among entrepreneurs, establishing mentoring programmes between established firms of the private sector and start-ups, and organising hackathons and trade shows.

-

Review regulatory barriers to entrepreneurship. In many LAC countries, setting up a company is complex and burdensome. Labour market and bankruptcy regulations can also render entrepreneurship difficult. Regulations in LAC countries should be reviewed to identify the main obstacles and make it easier to create start-up firms in the region.

-

Improve access to finance. Access to finance is often difficult for entrepreneurs, especially in an environment with few organisations to provide seed capital and venture capital, as is the case for many LAC countries. Ways should be found to ease the access to finance for entrepreneurs, including reviewing the possibilities offered by the digital economy, such as crowd funding and online micro-credits.

-

Promote the use of cloud computing in Latin America. Cloud computing provides flexible and scalable access to software (e.g. customer-relationship management, or CRM, software), applications and computing power in general. The services can be easily scaled up or down, used on demand, and are typically paid by capacity used. For small companies and start-ups, cloud computing can provide easy access to ICTs, requiring no large capital investment. Starting with low amounts of capacity, new firms can and rapidly scale up computing resources as necessary.

Promoting the creation and distribution of digital content and applications, including local content

Digital content, and especially local content, and applications are crucial in increasing ICT adoption. They are not only an important source of information, but render businesses and administrative processes more efficient. A developed content market is also beneficial for the development of network infrastructure. A joint report prepared by the OECD, the internet Society (ISOC) and the United Nations Educational, Scientific and Cultural Organisation (UNESCO) found that more developed local markets tend to lead to lower international prices for bandwidth and that conversely, markets with more intense international traffic tend to report lower local prices for Internet access, particularly in emerging countries (OECD/ISOC/UNESCO, 2013).

Different cultures have a rich heritage of content in local languages. Most of this content, however, remains inaccessible, sometimes even locally. The Internet makes digital content widely available and can empower users to create local content. As a major content distribution platform, including crowd-sourced platforms, it facilitates dissemination of content and can be a repository to store content.

For policy makers in the LAC area, encouraging digital content and applications that serve the needs of businesses and society can increase overall ICT adoption and advance inclusive development.

In Latin America and the Caribbean, policy makers face two important challenges. First, the majority of content available online is in English, across many content aggregation platforms. Content in languages other than Spanish and Portuguese, such as Quechua, is only just emerging. The content and applications currently available do not always serve the needs of people and businesses in emerging countries, especially those at the bottom of the pyramid. There is thus a need to foster the development of content and applications tailored to the region.

The main policy objectives in this area include:

-

Foster the creation of digital content, including local content, and in particular content and applications that address the needs of the region. This includes directly encouraging content production, for example in specialised IT centres, but also indirect measures such as improving basic literacy and digital literacy.

-

Foster multilingualism on the web. Foster the creation of content in Spanish, Portuguese and other regional and local languages of the region through, for instance, governmental funding of educational and cultural content in indigenous languages.

-

Access to hardware and software. This includes measures such as educating content creators on the availability of open and free online tools, and facilitating access to hardware and software (e.g. by lifting trade barriers or taxes).

-

Promote local hosting services so content providers can host content within the country, rather than buy hosting capacity overseas (see Chapter 8 on regional integration for information on IXPs, global interconnection and hosting).

-

Open up government data and public sector information. By making data and information available, easily accessible and reusable, digital government lets governments collaborate with citizens on innovation that can create public value. In turn, non-institutional actors, whether individuals, the private sector or civil society, can help develop content based on the cultural and local content already developed by the public sector (see also Chapter 12 on digital government).

Tools for and measurement and analysis in the LAC region

To assess the state of ICT adoption in Latin America and the Caribbean, policy makers need a holistic set of measures and surveys. Measurement is further discussed in the good practices section of this report, and Annex 10.A1 contains a comprehensive set of indicators for measuring ICT adoption used by OECD countries (OECD, 2015b). Measures and indicators policy makers are advised to collect include:

-

connectivity: indicators to measure, for example, broadband access (e.g. the proportion of businesses with a broadband connection (by speed tiers, fixed/mobile) and the proportion of employees using ICTs such as computers and/or Internet-enabled portable devices

-

Internet use: indicators to measure the use of the Internet, including the proportion of businesses i) using a website: ii) having a website equipped for online ordering; and iii) online marketing activities

-

information management tools in companies: proportion of businesses using enterprise resource planning (ERP) software, customer relationship management (CRM) software, electronic data interchange (EDI), radio-frequency identification (RFID) and cloud computing, as well as the proportion of businesses sharing supply chain management (SCM) information electronically

-

e-commerce: proportion of businesses receiving orders online, via EDI messages, making sales through the Internet, as well as the proportion of turnover received through computer networks

-

e-government and the availability of open government data (see Chapter 12 on digital government for more information)

-

ICT skills: indicator to measure, for instance, the proportion of employees with digital literacy or the proportion of businesses offering ICT specialist positions

-

social media activities: indicators such as the proportion of businesses using social networks or blogs

-

local content: indicators to measure the penetration of applications and services available in local languages, as well as applications adapted to local needs

-

digital entrepreneurship: indicators that include the number of digital entrepreneurs in a country, the number of young firms, the number of citizens trained in entrepreneurship through public initiatives or the amount of venture capital investments.

Overview of the situation in the region

In the past, LAC governments have focused on supply-side policies and the deployment of broadband infrastructure. This is a necessary first step before countries can move on to strengthen ICT adoption. More recently, however, several countries in the region, such as Brazil (TI Maior Programme), Colombia (Vive Digital strategy), Mexico (Prosoft 3.0 agenda) (OECD, 2015a) or Uruguay (Agenda Digital Uruguay) (AGESIC, 2016) have a broader focus on demand-side policies in their national digital strategies.

This trend can also be seen in regional LAC fora. eLAC, for instance, just published its new “Agenda Regional Digital 2018” (CEPAL, 2015a). One of the five key areas of the agenda consists in the “development of the digital economy, innovation and competition” (Area 2). In addition, one sub-goal of Area 1, on access and infrastructure, relates to encouraging content production, especially for vulnerable groups (see Box 10.1).

Access and infrastructure

The Latin America and the Caribbean digital agenda objective in this area is:

-

Objective 1: Scale up and provide affordable, universal access to digital services, taking advantage of the opportunities created by technological convergence and mobile technologies.

Digital economy, competitiveness and innovation

In this area, the Latin America and the Caribbean digital agenda objectives (eLAC2018) are the following:

-

Objective 6: Develop and promote both the traditional ICT industry and emerging sectors, for the production of digital content, goods and services; and promote digital economy ecosystems and public-private co-ordination, with an emphasis on generating greater value-added, increasing skilled work and training human resources.

-

Objective 7: Increase the productivity, growth and innovation in the productive sectors through the use of ICTs and propel the digital transformation of micro-enterprises and small and medium-sized enterprises (SMEs), taking into account technological and productive trajectories, innovative financing and revenue models, and capacity-building.

-

Objective 8: Strengthen e-commerce at the national and regional levels, adapting consumer protection regulations to the digital environment and co-ordinating aspects related to taxes, logistics and transportation, electronic payment mechanisms, systems for international settlement and personal data protection.

-

Objective 9: Incentivise the adoption and development of new technology trends in the public and private sectors, promoting in particular big data analytics, capacity-building and access options.

Source: CEPAL (2015a), Agenda Digital para América Latina (eLAC2018), http://conferenciaelac.cepal.org/es/documentos/agenda-digital-para-america-latina-y-el-caribe-elac2018.

As for the general implementation of demand-side policies, especially increasing ICT adoption among businesses, the general finding based on the analysis of the questionnaire is that some LAC countries have developed holistic demand-side policies in the past few years. The first positive results can now be seen in the increasing rates of ICT adoption among households and companies, including micro-companies (see Box 10.3).

However, a significant number of countries have not developed demand-side policies to increase ICT adoption by firms or to foster the production of local content. While noting this weakness, it must also be acknowledged that some countries in the LAC region still face major obstacles, such as lack of electricity (see also Chapter 1).

The state of ICT adoption in business

Assessing the state of ICT adoption for the LAC region is a difficult task. Few data are available comparing the state of ICT adoption across countries of the region. However, measuring and being able to show accurate uptake levels among companies of different sizes is key to designing effective policies to increase the level of ICT adoption. The Partnership on Measuring ICT for Development (ITU, 2010) proposes a set of key indicators, but this must be implemented at the regional level. An important recommendation discussed in the section on good practices is to increase the regional effort to collect data on firms’ ICT adoption.

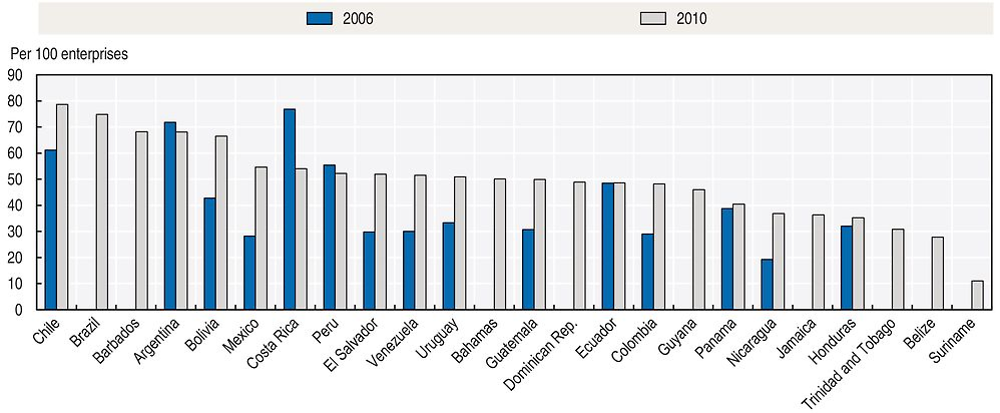

Data that are currently available to compare ICT adoption in the LAC include World Bank data on the use of websites and emails in companies, and data on the use of the Internet at work collected through the household survey conducted by the Comisión Economica para Latina América (CEPAL, or ECLAC) (CEPAL, 2015b).The 2010 World Bank Enterprise Survey, based on interviews conducted with firms in LAC countries, shows major differences in the percentage of enterprises with their own webpage, from 11% in Suriname to over 70% in Chile and Brazil (Figure 10.1). The average for the region was about 60%, below the 2010 OECD average of 71%.

Source: OECD, based on World Bank (2016), World Bank Enterprise Surveys (WBES), www.enterprisesurveys.org/.

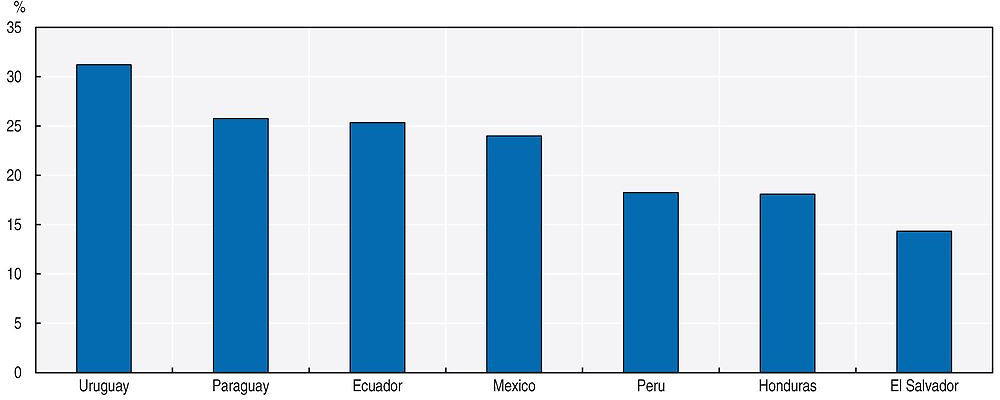

Data from ECLAC provides the users’ perspective and are collected through household surveys in the different countries. Data are only available for selected countries, and the methodology for 2010 is based on the recommendations of the Partnership on Measuring ICT for Development, Core ICT Indicators 2010 (ITU, 2010). In this survey, users indicated whether they used the Internet at work in 2010. Usage rates reported ranged from 14.3% in El Salvador to 31% in Uruguay, leaving room for further progress (Figure 10.2). Taking the two indicators together, many countries in the region should increase efforts to foster ICT adoption within firms.

These statistics only show basic ICT usage patterns, and more work needs to be done on collecting comprehensive data at the regional level. In the OECD/Inter-American Development Bank (IDB) questionnaires conducted for this Toolkit, ten countries reported that they conduct national surveys for the use of ICTs by firms. This is a good start for working towards a regional measurement agenda including metrics that go beyond those already collected by the World Bank and the Economic Commission for Latin America and the Caribbean (CEPAL).

Source: OECD, based on the CEPAL ICT database.

When countries were asked in the OECD/IDB questionnaire what main current barriers they face for increasing their use of the Internet, the main reported barriers included i) insufficient broadband infrastructure; ii) firms’ belief that they do not need the Internet and ICTs for their business; iii) the cost of ICT equipment; iv) a lack of ICT skills and talent; v) difficult access to finance; vi) a lack of confidence in online transactions.

When Colombia launched its strategy in 2010, it conducted a broad survey of firms on why they had decided not to use the Internet and ICTs. The main barrier reported was the belief that there was no need to be connected to the Internet to conduct business. The government consequently set up a series of programmes that focused on clearly demonstrating the economic benefits for businesses (see Box 10.3).

Other measures put in place by different LAC countries include providing training and website assistance, trade fairs, joint activities with industry associations, the provision of public funding for i) increasing ICT adoption by firms; ii) financial inclusion and loans for SMEs and micro-companies; as well as iii) establishing incubators.

Promote ICT and Internet-based entrepreneurship

Start-ups face more challenges obtaining access to finance in LAC than the overall OECD area. Financial markets tend to be less mature and banks less willing to provide financing to start-ups: “In the United States, for instance, bank loans provide 15%-30% of the initial finance of high-growth start-ups, well above the figure in Latin America (7% in Brazil and close to zero in Chile and Mexico). Similarly, in the United States, start-ups obtain 20%-47% of their finance from venture-capital funds and angel investors, compared to 23% in Brazil, 17% in Chile and 5% in Mexico.” (OECD, 2013b). This finding was mirrored by the replies to the OECD/IDB questionnaire on the question of the current obstacles to entrepreneurship in the region. The main reported barriers for Internet-based start-ups included: i) difficult access to finance, especially to seed capital; ii) lack of public support; iii) lack of (ICT) skills; iv) lack of online payment systems; v) a lack of entrepreneurship culture; vi) lack of electricity; vii) the fact that the ICT sector is a “new industry sector”; and viii) the cost of Internet access. In addition, administrative and regulatory burdens for start-ups tend to be higher in the LAC area than for most OECD countries, such as in Brazil, Chile and Mexico (Figure 10.3).

Notes: For the People’s Republic of China (hereafter “China”), data are based on preliminary estimates, as some of the underlying data has not been validated with national authorities. Subsequent data validation may lead to revisions to the indicators for this country. For Indonesia, data refer to 2009. For the United States, data refer to 2007.

Source: OECD (2015c), OECD Science, Technology and Industry Scoreboard 2015, https://doi.org/10.1787/sti_scoreboard-2015-en, based on OECD (2014c), OECD Product Market Regulation Database, www.oecd.org/economy/pmr.

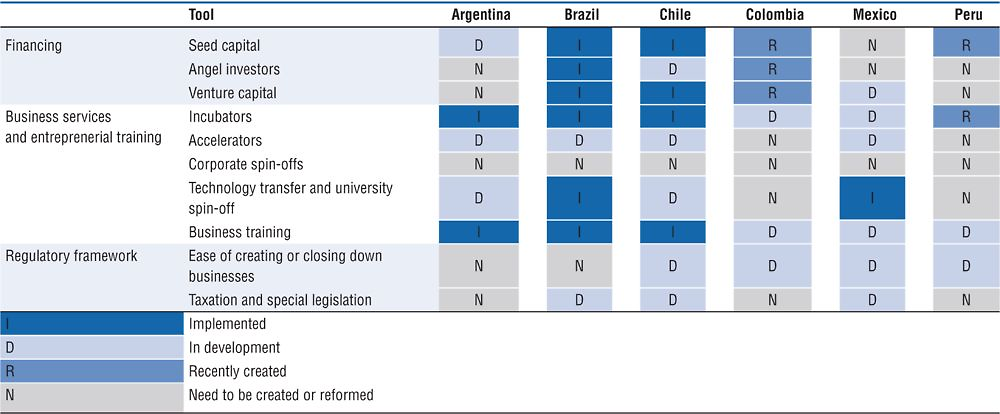

Although LAC countries lag behind OECD countries in establishing policies to encourage entrepreneurship, many countries in the region acknowledge the important role of entrepreneurs for their economy. Replies to the questionnaire show that existing policies include (holistic) entrepreneurship training programmes, tax incentives, incubators, programmes designed to develop software, financial support for entrepreneurs, and efforts to develop an entrepreneurship culture. An overview of policy tools used in selected LAC countries in 2012 is provided below (Table 10.1).

Promoting the creation of digital content and applications, including local content

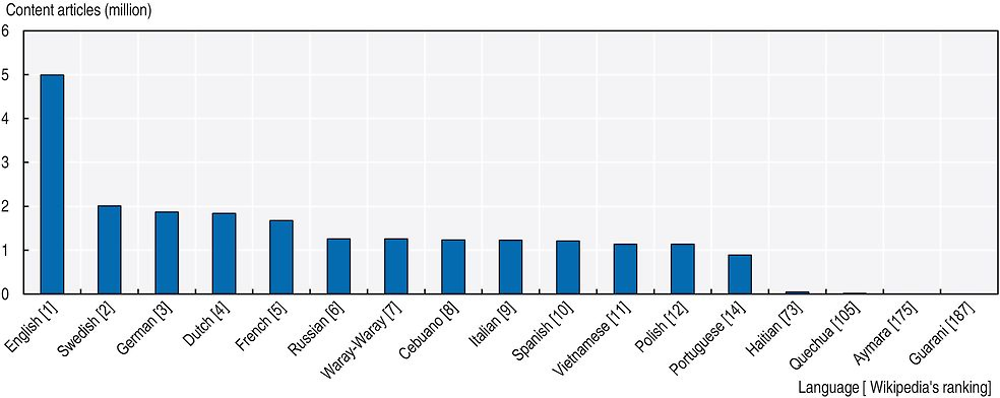

While much of the content available online is in English, the volume of content in Spanish, Portuguese and other regional languages has increased. The ranking of languages on Wikipedia, measured by the total number of content pages by language, is shown in Figure 10.4. All languages with more than a million content pages, and statistics for the languages with Wikipedia content pages that are spoken in the region. Spanish and Portuguese are ranked 10th and 14th, with 1.2 million and 890 000 content pages respectively (see Table 10.2 for more statistics on Spanish and Portuguese content on Wikipedia).

Besides content in these two languages, Wikipedia also lists pages in four other languages of the region: Haitian (Haiti’s official language, and a recognised minority language in Cuba), Quechua (official language in the Plurinational State of Bolivia [herafter “Bolivia”], Ecuador and Peru), Aymara (official language in Bolivia) and Guarani (official language in Paraguay). The total number of pages in these languages, however, is low. Figures for other indigenous languages in the region are not listed on the Wikipedia site. While this is only one indicator of local content made available online, Wikipedia plays an important role as a dictionary as well as for knowledge diffusion and knowledge storage. Content production on this site should thus be encouraged.

Source: OECD based on Wikipedia (2015), Wikipedia Statistics, https://en.wikipedia.org/wiki/Wikipedia:Statistics.

Another important form of digital content, especially for education, are so called “massive open online courses” (MOOCs) (see also Chapter 9 on education and skills for the digital economy), university courses for which people can enrol online, free of charge. Platforms such as EdX, Coursera, Udacity and Miriada X provide courses from different universities. The website Class Central tracks the global course offerings from different platforms and publishes statistics on the number of courses available online. According to the site, MOOCs are currently available in 16 languages (see Figure 10.5). The large majority of courses, 75%, are taught in English. Spanish is the language with the second-highest number of offerings (9%), which is mainly due to the platform Miriada X, which includes a consortium of close to 30 universities in the LAC region and Spain (Shah, 2014). This platform is a good example of encouraging the creation and distribution of educational content relevant to the region.

Source: OECD, based on Class Central (2015), “Languages”, https://www.class-central.com/languages.

The majority of countries that responded to the OECD/IDB questionnaire report that the government fosters the creation, distribution and access to digital content, including local content. Through the development of digital, and especially local, content, LAC countries are striving to make the Internet and ICTs more attractive to low-income groups and people in remote and rural areas, and to provide social services in areas such as education, health and public services. In addition, countries aim at developing content and applications for micro-companies and SMEs. The number of apps that have been developed for SMEs in the region is, however, harder to measure at this stage, as only information of use cases is available.

Several countries, such as Honduras, Colombia and Mexico, also reported that they promote the development of content in indigenous languages and/or about indigenous cultures. A number of countries in the region also plan to develop educational content. Countries in the region also promote the use of public sector data for further use and reuse. A majority of the LAC countries that responded to the OECD/IDB questionnaire reported having set up an Open Government Data Strategy, and by December 2014, six LAC countries had also dedicated national open data portals: Brazil, Chile, Colombia, Costa Rica, Mexico and Uruguay (see also Chapter 12).

Good practices for the LAC region

The previous sections have indicated that policy makers in the LAC region have an important task in increasing ICT adoption, especially within firms. The next section presents good practices from the LAC and other regions.

Increase ICT adoption by companies

The first step towards an increase in ICT adoption among firms is to develop a measurement agenda, ideally harmonised across countries. A major challenge in the LAC region is measuring the actual use of ICTs in companies, not simply whether firms have a website or use emails.

A good starting point is the list of indicators drawn up by the Partnership on Measuring ICT for Development in 2010 (Table 10.3). In addition, LAC countries should engage in a regional approach to discussing additional indicators to include in business surveys to reflect recent developments. For example, a significant number of young companies use cloud services, which are not yet part of the list of indicators of the Partnership on Measuring ICT for Development. Some LAC countries, such as Costa Rica, already try to reflect these new developments in their measurement approaches, but more remains to be done.

The OECD has developed an extensive list of indicators on ICT usage of businesses (Annex 10.A1). Some LAC countries, including Chile, Brazil, Colombia and Mexico, already participate in this survey, which is conducted every two to three years. LAC countries could use this extensive list of indicators and experience to jointly identify other key indicators for measuring ICT adoption by firms in the region, in addition to those recommended by the Partnership on Measuring ICT for Development. Using indicators developed for this survey would also allow direct comparisons with ICT adoption in OECD countries.

In addition to developing this measurement framework in the regional context, countries should also ensure that the business surveys they conduct are truly representative, not always an easy task. Reliable business registers are not always available, and developing such registers should be the first step. Countries should also make sure that the informal sector is duly represented. Otherwise, results will not reflect the business uptake in the region. In general, for all surveys, countries should carefully report sample statistics and the concrete methodology used.

The second step should be to develop policies to increase ICT adoption in firms. One of the most important challenges for policy makers is how to directly increase the adoption of ICTs among companies and how to connect these companies to the applications and services in use in the supply chains they are part of. In the LAC area, micro-companies and SMEs should receive special attention, since these firms represent a significant majority in these countries, and because small players often struggle the most to adopt ICTs.

One policy approach that has proved to work well is to target big companies in supply chains and connect small companies through this entry point, since they are often either suppliers to or buyers from larger companies. Colombia offers an illustration of this policy approach (Box 10.2). From 2010 to 2014, Colombia managed to increase ICT adoption among micro-companies and SMEs from 7% to 70%.

The Colombian ICT Ministry (MinTIC), together with Innpulsa (a government programme to foster private sector development) set up the “Mipyme” policy programme to i) increase ICT adoption by micro-companies and SMEs; and ii) develop applications and services that fit specific sector needs across entire supply chains.

The programme addressed the fact that only 7% of all micro-, small and medium companies (“mipymes”) were connected to the Internet in 2010. Larger companies can put forward proposals through public tenders on how they connect SMEs via Internet applications in their supply chains, in order to increase the productivity of small firms and to digitise the entire supply chain. Only companies with existing relationships with SMEs that are able to demonstrate that the programme will benefit at least 200 SMEs (not so far connected to the Internet) can apply. Companies with the most promising proposal, showing they can connect a large number of SMEs, win the tenders. Funds provided by the programme do not need to be reimbursed and amount to a maximum of 65% of the total project value and up to COP 2000 million (USD 765 000). The targets of the programme are to:

-

connect 70% of micro-companies and SMEs to the Internet by 2018

-

increase the number of “mipymes” using e-commerce from 2% to 30% by 2018

-

increase the number of “mipymes” with their own website to 63% by 2018

-

increase the number of “mipymes” with a social media presence to 54% in 2018.

Projects have been launched in different sectors, such as agriculture, tourism, construction, telecommunications, transport and the energy sector. SMEs in the construction sector reported that they could increase their revenues by 20%. Taxi drivers connected via apps and tablets reported that they could increase profitability by up to 70%, since they could add seven or eight trips to their daily total, because they spent significantly less time finding customers.

From 2010 to 2014, the number of connected micro-companies and SMEs was increased from 7% to 70% and 32 000 SMEs benefitted from the programme. To accompany the programme, the government launched application development competitions, SME ICT trainings and certifications, and “EXPO mipyme” fairs.

Source: MinTIC (2015), “MiPyme Vive Digital”, www.mintic.gov.co/portal/vivedigital/612/w3-propertyvalue-7235.html.

Peru is connecting small and medium firms in remote locations through a national fibre backbone network, to provide these businesses with access to the Internet and thus the opportunity to use e-commerce and other digital tools for running their enterprises.

Another policy measure successfully used in several countries, not only in increasing R&D activities, but increasing ICT adoption, is facilitating the secondment of ICT experts, also known as “expert transfer”. Seconded ICT experts can be sent by the private sector or public research and education institutes. Arrangements should be found to combine public and private funding. For example, experts can be sent for a fixed period and employment costs shared. If companies’ business models could be significantly enhanced through the use of ICTs, other solutions worth considering include encouraging longer-term transfers of groups of experts to support firms moving into new activities.

Policy makers should also promote the development of digital skills. ICT adoption in companies can only be increased if employees have the skills to use ICTs, including generic and specific ICT skills to to adapt applications and services to their needs. Digital literacy is vital, and LAC policy makers should develop a comprehensive approach to expand ICT skills at different levels. This would include such measures as digital and online courses tailored to firms’ needs, with a focus on micro-companies and SMEs, working towards integrating courses on digital skills in training on the job, and vocational training and in integrating the teaching of ICT skills in early school education (see Chapter 9 on education and skills for the digital economy). Brazil, Colombia, Peru and Costa Rica already have such programmes. Peru is currently implementing its Competitiveness Agenda 2014-2018, one of whose goals is to enhance scientific-technological and business innovation capabilities to work towards a knowledge-based economy.

These actions should be undertaken in parallel with the promotion of e-commerce. E-commerce is an important tool for LAC firms, since it enlarges the market firms can reach, sometimes even to the global level. Compared to other regions, however, the uptake of e-commerce is still relatively low in Latin America and the Caribbean. Policy makers in the region can promote e-commerce in several ways. Many firms, particularly smaller ones, are not aware of the benefits e-commerce can bring to their businesses and how they can use e-commerce to increase their revenues. Educating firms about the benefits of e-commerce, providing insight into the tools they need, how to use online payment systems and how to secure their website is particularly important in this situation of low uptake. The Mexican Chamber of Electronic, Telecommunications and Information Technology Industry (CANIETI) and the Ministry of the Economy have developed an online Spanish tutorial that is easy to understand and provides a comprehensive overview of e-commerce (Box 10.3). This could be helpful in any Spanish-speaking country.

The Mexican Chamber of Electronic, Telecommunications and Information Technology Industry (CANIETI) and the Ministry of the Economy have developed an online course format to educate firms about e-commerce and its benefits, and how to set up an e-commerce business. The tutorial aims to provide an introduction to e-commerce, informing firms of different ways of doing e-commerce, to increase the overall uptake of e-commerce in the country.

The course consists of 18 video sessions. The videos are accompanied by exercises as well as additional material that can be downloaded. The topics include:

-

introduction to e-commerce

-

overview of different e-commerce business models

-

how to create a web presence, engage in online marketing and make use of social networks

-

overview of online payment methods

-

security

-

e-commerce law and ethics in Mexico.

Source: CANIETI/Secretaría de Economía (2015), “Introducción al Comercio Electrónico”, http://canieti.mayahii.com/CANIETI#!.

Countries should also review legacy regulations to examine whether they pose unnecessary barriers to e-commerce. When firms are unable to sell online in a domestic market, this could also limit their international competitiveness. Especially when firms introduce new products that either complement or compete with traditional, regulated sectors, problems might arise. Examples include companies selling travel and transport services online (e.g. Uber, Airbnb) or health and financial services. Chapter 13 on consumer protection and e-commerce provides additional insights from a general perspective.

Finally, countries should review their tax policy (Chapter 6 examines taxation and other government charges). Some LAC countries impose special taxes on telecommunications services that make adopting ICTs more expensive. They may deter small businesses from subscribing to telecommunications services, excluding them from the benefits of e-commerce. Taxes in this area should be reviewed and, if possible, abolished or replaced. A good practice introduced in Colombia is the abolition of the value-added tax on tablets and laptops for devices that cost below COP 2 million, resulting in lower prices. Colombia has also eliminated custom tariffs, and the government gives low-income population groups subsidies to purchase such devices.

Promote ICT and Internet-based entrepreneurship

Given the important role entrepreneurs play in economies, governments in LAC area should carefully assess how they can foster entrepreneurial capabilities and an entrepreneurship culture in their countries. Two important challenges experienced by entrepreneurs in the region and reported in the questionnaire were a lack of skills, both digital and managerial, and sometimes a lack of public support. Governments in the region should work towards strengthening entrepreneurial capabilities by promoting or establishing training programmes for entrepreneurs and addressing the lack of ICT skills.

Some countries in the region, such as Brazil, Chile, Colombia, Jamaica and Mexico, have established training programmes for digital entrepreneurs that address managerial and ICT skills. Colombia, for instance, set up a holistic programme that supports entrepreneurs in different phases of the business creation and business upscaling process. The programme includes courses to develop both managerial and ICT skills, depending on the skills level of the different entrepreneurs (Box 10.4).

Apps.co is the digital entrepreneurship initiative of the Ministry of Information and Communication Technologies in Colombia (MinTIC), which supports entrepreneurs in different phases of the business creation process. The programme is part of the Vive Digital strategy to promote economic and social development through the use of ICTs. Apps.co promotes the creation of ICT businesses, focusing on mobile/web applications and digital content. It supports entrepreneurs in different phases of the business creation process. The programme consists of the following elements:

-

Boot camps: Training courses in programming languages for developing web applications and platforms. They include a variety of courses for entrepreneurs who want to learn how to programme and for those who want to strengthen their knowledge in programming languages for platforms such as Android, Microsoft and iOS. The courses are open to entrepreneurs in any discipline, and are designed for entrepreneurs with basic and more advanced programming skills. This phase aims at capacity building for digital applications, to further develop the Colombian talent pool and to equip people with the skills to create job opportunities.

-

Business discovery: In this phase, entrepreneurs complete an eight-week programme in which they are encouraged to test their ideas in the market. Through a structured mentoring, training and advisory process, they develop an ICT-based business model. The programme follows lean start-up principles and provides entrepreneurial tools such as a business model canvas, allowing for continued testing, learning and implementing in the goal of getting start-ups ready for the market. After eight weeks, each start-up should have a working prototype of its solution and a business plan identifying potential clients, active users, target downloads and, ideally, sales estimates. This programme is offered in 17 cities to provide opportunities to all entrepreneurs nationwide to explore and support ICT solutions for Colombia.

-

Growth and consolidation: The growth and consolidation programme provides 20 weeks of intensive one-to-one mentorship and activities conducive to building a client pipeline for entrepreneurs. The overall objective is to strengthen the capabilities of all entrepreneurial teams, support refining the value proposition of the start-ups and develop their business models to the point where they can be brought to the market. Funding is viewed as a consequence of this process and not as a goal. Every team is encouraged to think globally from the start, while validating locally. Apps.co supports 234 projects, with revenues of USD 2.5 million.

Source: OECD (2014b), “Cloud Computing: The Concept, Impacts and the Role of Government Policy”, OECD Digital Economy Papers, No. 240, https://doi.org/10.1787/5jxzf4lcc7f5-en.

These programmes can also be used as a tool to increase entrepreneurial culture in LAC countries, although this is a complex task beyond the responsibilities of ICT ministries and regulators. Some countries are using their digital entrepreneurship programmes to systematically bring entrepreneurs together so that they can exchange views on their entrepreneurial experiences. In addition, a number of countries are organising “hackathons” or entrepreneurship fairs. The German National IT Summit, for example, which is held annually and brings together high-level business representatives and policy makers has reserved panels and sessions for entrepreneurs.1

The section on the situation in the LAC region has shown that regulatory and administrative barriers are comparatively high. As a consequence, entrepreneurs may be dissuaded from starting a company. Policy makers should carefully review potential regulatory barriers to entrepreneurship. Various ways to reduce the regulatory burden on companies have been identified. They include increasing labour flexibility for young firms. They also ensure that regulation allows for bankruptcy and does not hold entrepreneurs back from creating a new company after a first failed attempt, and they create one-stop online government portals for launching businesses.

One-stop government portals can significantly facilitate business creation. Entrepreneurs who want to start a business often need to collect information from and file registrations at various government agencies, entailing multiple, often time-consuming visits. Procedures at the different agencies are not uniform, and agencies often work on different timelines, which can make the overall business creation process lengthy and burdensome. Online one-stop portals that contain both the information for entrepreneurs with respect to the administrative processes they need to follow as well as online forms and communication tools are effective tools for facilitating and speeding up business creation. The EUGO portal of the European Union and the Korean Start Biz Online portal are good practices in this respect. The EUGO portal is an online single point of contact for creating businesses in EU countries, providing links to the different European Union countries, which contain information on regulation and procedures. In addition, entrepreneurs can complete procedures online (EC, 2016). The Korean portal Start Biz combines the registration procedures of five different agencies, allowing entrepreneurs to complete the entire process online. Mexico is currently also developing a one-stop portal and has a beta version online (www.gob.mx/).

Another key policy action for advancing entrepreneurship is by improving access to finance. Access to finance is a key condition for entrepreneurs, but is more challenging in Latin America than in OECD countries. The Internet, however, creates new ways to access funding sources and digital platforms to provide loans to entrepreneurs and small firms. This is an interesting opportunity, since it is more difficult for these firms to obtain loans from traditional banks.

The digital funding market is growing rapidly and has some potential to change the financial sector significantly, as it is in China. Different funding models have developed over recent years. The Chinese platform Alibaba, for instance, has several models to provide small and medium companies with loans. Its small loans programme, Micro Ant Credit, has provided credits worth USD 64 billion to 800 000 SMEs. In 2014, there were 1 575 digital lending platforms in China.

Amazon is also offering funding to selected small companies in seven countries through the Amazon lending programme (Moshinaly, 2015). Loans can reach a maximum of USD 600 000 at interest rates between 6% and 14%. Other online models match entrepreneurs and start-ups with investors or crowd (P2P lending), enabling entrepreneurs to finance new products and services through platforms such as AngelList or Kickstarter.2

Most of these are currently located in the United States, Europe and Asia. Latin American and Caribbean countries should explore the possibility of developing a digital funding platform tool for the region and of facilitating companies gaining access to already existing funding tools. In terms of attracting venture capital funds, progress has been made, and a number of important VC funds have started to invest in start-ups in Latin America (Table 10.4).

While P2P lending is a promising area for facilitating access to capital for entrepreneurs, many governments have been reluctant to review regulations so far. The United Kingdom is among the few countries to have taken a pro-active stance on regulating P2P lending platforms. Important issues covered in the United Kingdom regulatory framework on crowdfunding over the Internet include minimum capital requirements, dispute resolution rules, client money protection rules, disclosure and reporting rules, as well as successor loan servicing arrangements (OECD, 2015b). Besides encouraging new forms of financing, policy makers in the region should analyse how to adapt existing regulation of financial markets.

Furthermore, policy makers should promote the use of cloud computing in LAC. Cloud computing provides easy and flexible access to information technology (IT) resources. Users of cloud-computing infrastructure and services do not have to make upfront, capital-intensive investments in IT infrastructure and software but pay for computing resources in a pay-as-you go model, and can easily scale the capacity up or down (OECD, 2014b). This is especially interesting for entrepreneurs, who often lack the means of buying costly computing infrastructure when creating their business.

The benefits of cloud computing, however, can entail challenges. Challenges in the area of privacy and security–including cross-border issues related to privacy protection and data breaches– need to be addressed, as well as issues regarding the liability of service providers in current terms and conditions of standard cloud- computing contracts.

LAC policy makers have an important role to play in educating entrepreneurs about the benefits of cloud computing and issues that they have to consider when it comes to protecting privacy and signing contracts with big cloud computing providers. The German initiative “digital SMEs” has developed a guide “Cloud computing as an opportunity for companies”, which is tailored to the needs of small and medium companies (eBusinesslotse, 2014). It explains the concept and guides companies on how to implement and integrate cloud computing into their business processes. This guide can serve as a good reference.

In addition, policy makers in the LAC region should promote the establishment of data centres in the region that increase the availability of cloud-computing services and applications. Today, most providers and their data centres are located outside the region, requiring international bandwidth (see also Chapter 8 on regional integration).

Promoting the creation of digital content and applications, including local content

The availability of content and applications for businesses and society are an important factor in increasing ICT adoption. The majority of applications and content available are in English and not always appropriate for the needs in emerging countries. By developing and distributing digital content, and especially local content and applications, LAC policy makers can make the Internet and ICTs more attractive to businesses, low-income groups and firms and people in rural and remote areas. In turn, once the content and applications are available, the Internet can be an efficient tool for content dissemination.

It is crucial that policy makers in the LAC region promote the development of content and applications at the national strategy level. Colombia has designated as a strategic priority developing content and applications for emerging countries and low-income groups. One of the three pillars of its Vive Digital Strategy 2014-2018 is the development of content and applications with a focus on social applications, government applications, and developing skills for content production. The Start-Up Chile programme, sometimes known as “Chilecon Valley”, supports start-ups developing content and applications. Bolivia includes the development of local content and applications as a key objective of its national telecommunications programme for social inclusion. It focuses on content and application development in health, education and e-government. These national initiatives are the most strategic and systematic in fostering content production. They were launched recently, but they have already generated some social apps. Tracking the outcomes of these programmes will be important in the coming years.

Policy makers should make sure that developing local content and multilingualism is supported in initiatives to promote content development. Public initiatives to foster content development should be considered. One way of doing this is to create IT centres specialised in content production, such as Colombia’s ViveLabs (Box 10.5). Training and content development courses can also be offered in ICT centres, which are often set up in rural areas or schools that have been connected to the Internet.

ViveLab is a national Colombian programme to foster the development of digital content and applications throughout the country to drive digital entrepreneurship. Labs have been launched a number of cities, including Manizales, Pereira, Armenia, Cali, Popayán, Bogotá, Bucaramanga, Medellín, Barranquilla, Cartagena, Montería, Sincelejo, Boyacá, Pasto, Pitalito, Villavicencio and Yopal.

The centres provide free training courses as part of the Ministry of ICT’s strategy to offer courses on videogame design and creation, 2D and 3D animation, digital video, business models and entrepreneurship, web development, mobile development, special effects and digital advertising.

Source: OECD (2014a), OECD Reviews of Innovation Policy: Colombia 2014, https://doi.org/10.1787/9789264204638-en.

Another good practice for fostering local content production is to create platforms that serve not only as aggregators of local content but incentivise the creation of local content, including those in indigenous languages. The Memoria Chilena platform offers content from Chile’s National Library and other libraries, archives and museums to disseminate content central to Chile’s cultural identity.3 The Colombian projects En mi idioma and the Educatrachos project in Honduras focus on the development of content in indigenous languages.4

Besides the direct measures mentioned above, policy makers in the region also need to work on indirect measures to promote the development and distribution of digital content and applications. These include: i) improving basic literacy and digital literacy; ii) easing access to hard- and software; iii) promoting local hosting services; and iv) opening up government data (see Chapter 12 for more information on government data).

Developing digital content and applications requires a certain skills level, both in terms of general literacy skills such as language and drafting skills, and digital literacy (see Chapter 9 on digital skills). Governments of the region, and education ministries in particular, should evaluate skill levels and develop appropriate learning. This should both target the educational system and lifelong learning and training on the job (OECD, ISOC and UNESCO, 2013).

Besides the appropriate skills for developing digital content and applications, firms and individual content producers need ICT equipment, whether computers, smartphones or cameras. Policy makers should ensure that no additional luxury taxes or other levies are imposed on these devices, to make sure that they remain affordable (see Chapter 6 on affordability and government charges).

Finally, as noted above, it is recommended that policy makers in the LAC region promote the establishment of local hosting services to host the digital content produced in the region. This can both avoid routing traffic internationally and can stimulate content production in the region.

Conclusion

Since significant value of the Internet lies in its adoption and use, policy makers in the LAC region have an important task in fostering business uptake, ICT entrepreneurship and developing digital content. This is all the more important in the light of low uptake rates in several LAC countries.

In assessing business uptake in the region, policy makers should be able to rely on a sound measurement agenda, to track use and identify usage gaps. A second step involves the development of policies to increase ICT adoption in firms. This includes the promotion of digital skills. Promoting e-commerce is a third key area for expanding the markets of firms of all sizes.

Fostering digital entrepreneurship is another way of increasing ICT uptake and creating a digital culture. LAC policy makers could review potential regulatory barriers to entrepreneurship, improving access to finance and promote the use of cloud computing as a flexible way of accessing IT resources.

Finally, policy makers can focus on fostering the development of content in the LAC region that serves the needs of businesses and individuals in the regions. This includes promoting local and multilingual content.

References

AGESIC (2016), “Estrategia y Agenda Digital”, AGESIC Website, http://www.agesic.gub.uy/innovaportal/v/258/1/agesic/Agenda-Digital.html (accessed 1 April 2016).

Arzeni, A. et al. (2012), “SME and Entrepreneuship Policies after the Crisis”, in: Small Businesses in the Aftermath of the Crisis, Physica Verlag, Heidelberg, Germany, pp. 1-16.

CAF (2011), El uso de las TIC para la simplificación de barreras administrativas a la inversión, http://publicaciones.caf.com/media/11206/tic_2011_01.pdf (accessed 4 April 2016).

CANIETI/Secretaría de Economía (2015), “Introducción al Comercio Electrónico”, CANIETI Website, Mexico, http://canieti.mayahii.com/CANIETI#!/c/296.

CEPAL (2015a), Agenda Digital para América Latina (eLAC2018), Comisión Economica para Latina América/United Nations, Mexico City, http://conferenciaelac.cepal.org/es/documentos/agenda-digital-para-america-latina-y-el-caribe-elac2018.

CEPAL (2015b), Sistema de Información Estadístico de TIC, Comisión Economica para Latina América/United Nations, http://www.cepal.org/tic/flash/.

Class Central (2015), “Languages”, Class Central Website, https://www.class-central.com/languages.

eBusinesslotse (2014), “Cloud-Computing als Chance für Unternehmen”, MittleStand Digital, http://www.mittelstand-digital.de/MD/Redaktion/DE/PDF/cloud-computing-1,property=pdf,bereich=md,sprache=de,rwb=true.pdf

EC (2016), “Las Ventanillas Únicas”, European Commission Website, http://ec.europa.eu/internal_market/eu-go/index_es.htm.

Gaggle, Paul and Gregg C. Wright (2014), “A Short-Run View of What Computers Do: Evidence from a UK Tax Incentive”, Discussion Paper Series No. 752, July, University of Essex, Colchester, UK.

Grazzi, Matteo and Juan Jung (2016), “ICT, Innovation and Productivity: Evidence from Latin American Firms”, in: Grazzi, Matteo and C. Pietrobelli, Firms’ Innovation and Productivity in Latin America and the Caribbean: The Engine of Economic Development, Palgrave, New York.

Haller, Stefanie A. and Iulia Siedschlag (2011), “Determinants of ICT Adoption: Evidence from Firm-Level Data”, Applied Economics, Vol. 43, No. 26, pp. 3775-3788.

ITU (2010), Partnership on Measuring ICT for Development, Core ICT Indicators 2010, International Telecommunication Union, Geneva. http://new.unctad.org/upload/docs/ICT_CORE-2010.pdf (accessed 15 October 2015).

MinTIC (2015), “MiPyme Vive Digital”, MinTIC Website, Ministerio de Tecnologías de la Información y las Comunicaciones de Colombia, www.mintic.gov.co/portal/vivedigital/612/w3-propertyvalue-7235.html.

Moshinaly, H. (2015), “Amazon propose des prêts aux vendeurs de 7 pays, Actualité Houssenia Writing, https://actualite.housseniawriting.com/technologie/2015/06/29/amazon-propose-des-prets-aux-vendeurs-de-7-pays/5583/.

OECD (2015a), OECD Digital Economy Outlook 2015, OECD Publishing, Paris, https://doi.org/10.1787/9789264232440-en.

OECD (2015b), The OECD Model Survey on ICT Usage by Businesses, Second revision, OECD Publishing, Paris, https://www.oecd.org/sti/ieconomy/ICT-Model-Survey-Usage-Businesses.pdf.

OECD (2015c), OECD Science, Technology and Industry Scoreboard 2015: Innovation for growth and society, OECD Publishing, Paris, https://doi.org/10.1787/sti_scoreboard-2015-en.

OECD (2014a), OECD Reviews of Innovation Policy: Colombia 2014, OECD Publishing, Paris, https://doi.org/10.1787/9789264204638-en.

OECD (2014b), “Cloud Computing: The Concept, Impacts and the Role of Government Policy”, OECD Digital Economy Papers, No. 240, OECD Publishing, Paris, https://doi.org/10.1787/5jxzf4lcc7f5-en.

OECD (2014c), OECD Product Market Regulation Database, www.oecd.org/economy/pmr.

OECD (2013a), Entrepreneurship at a Glance, OECD Publishing, Paris, https://doi.org/10.1787/entrepreneur_aag-2013-en.

OECD (2013b), Start-up Latin America: Promoting Innovation in the Region, Development Centre Studies, OECD Publishing, Paris, https://doi.org/10.1787/9789264202306-en.

OECD (2012), Internet Economy Outlook, OECD Publishing, Paris, https://doi.org/10.1787/9789264086463-en.

OECD (2011), OECD Guide to Measuring the Information Society 2011, OECD Publishing, Paris, https://doi.org/10.1787/9789264113541-en.

OECD (2010), “SMEs, Entrepreneurship and Innovation”, OECD Studies on SMEs and Entrepreneurship, OECD Publishing, Paris, https://doi.org/10.1787/9789264080355-en.

OECD, ISOC and UNESCO (2013), “The Relationship between Local Content, Internet Development and Access Prices”, OECD Digital Economy Papers, No. 217, OECD Publishing, Paris, https://doi.org/10.1787/5k4c1rq2bqvk-en.

Shah, D. (2014), “MOOC in 214: Breaking Down the Numbers”, EdSurge, http://www.edsurge.com/news/2014-12-26-moocs-in-2014-breaking-down-the-numbers (accessed 11 August 2015).

Téllez, O. (2015), “Top VCs are Chasing Digital Companies in Latin America”, Techcrunch Website, http://techcrunch.com/2015/08/11/top-vcs-chasing-digital-companies-in-latin-america/.

Wikipedia (2015), Wikipedia Statistics, https://en.wikipedia.org/wiki/Wikipedia:Statistics.

World Bank (2016), World Bank Enterprise Surveys (WBES), www.enterprisesurveys.org/ (accessed 21 August 2015).

Further reading

BCIE (2010), Diagnóstico sobre la Situación del Empreendedurismo en Centroamérica, www.bcie.org/uploaded/content/category/1504679651.pdf (accessed 4 April 2016).

GSMA Intelligence (2016), Content in Latin America: Shift to local, shift to mobile, GSMA, London.

GSMA Intelligence (2014), Local World: Content for the Next Wave of Growth, GSMA, London.DB (2015), “ICTs in Latin American and the Caribbean Firms: Stylized Facts, Programs and Policies”, IDB Discussion Paper No. IDB-DP-394, Inter-American Development Bank, Washington D.C.

IDB (2011), “The Impact of Internet Banking on the Performance of Micro and Small Enterprises in Costa Rica: A Randomized Controlled Experiment”, IDB Working Paper Series No. IDB-WP-242, Inter-American Development Bank, Washington D.C.

IDB (2010a), “Innovation, R&D and Productivity in the Costa Rican ICT Sector: A case study”, IDB Working Paper Series, No. IDB-WP-189, Inter-American Development Bank, Washington D.C.

IDB (2010b), The Imperative of Innovation – Creating Prosperity in Latin America and the Caribbean, Inter-American Development Bank, Washington D.C.

Lim, Hank and Fukunari Kimura (2009), The Internationalisation of SMEs in Regional and Global Value Chains, Inter-American Development Bank, Washington D.C., http://publications.iadb.org/handle/11319/3402 (accessed 21 August 2015).

Monge-González, Ricardo and Sandro Zolezzi (2012), “Insertion of Costa Rica in Global Value Chains: A Case Study”, Inter-American Development Bank Working Paper Series, No. IDB-WP-373, Inter-American Development Bank, Washington D.C.

Navas-Alemán, L., C. Pietrobelli and M. Kamiya, “Inter-Firm Linkages and Finance in Value Chains (2012)”, Inter-American Development Bank Working Paper Series, No. IDB-WP-349, Inter-American Development Bank, Washington D.C.

OECD (2008), Recommendation of the Council for Enhanced Access and More Effective Use of Public Sector Information, OECD, Paris, www.oecd.org/sti/44384673.pdf (accessed 5 April 2016).

Reimers, Ricardo (2007), Programa de Desarrollo de Oportunidades de Comercio Electrónico para las PyMEs en la Región de Santa Cruz, http://publications.iadb.org/handle/11319/3001 (accessed 21 August 2015).

Salazar, Antonio (2007), E-commerce y su impacto en el modelo de negocios de las PyMEs: Una Interpretación desde la Experiencia con las PYMES Farmacia Independientes, Inter-American Development Bank, Washington D.C., http://publications.iadb.org/handle/11319/3015, (accessed 21 August 2015).

Talamanca, Carlo Figà (2005), ICT and SMEs: Experiences in Italy and in China, Inter-American Development Bank, Washington D.C., http://publications.iadb.org/handle/11319/3068 (accessed 21 August 2015).

UNCTAD (2011), ICTs as an Enabler for Private Sector Development, Information Economy Report, United Nations Conference on Trade and Development, Geneva.

UNCTAD (2010), ICTs: Enterprises and Poverty Alleviation, Information Economy Report, United Nations Conference on Trade and Development, Geneva.

WEF (2012), From Consumers to Creators: Empowering the Digital Generation, www3.weforum.org/docs/WEF_ITTC_ConsumersCreatorsEmpoweringDigitalGeneration_Report_2012.pdf (accessed 5 April 2016).

Zahler, Andrés et al. (2014), “Public-Private Collaboration on Productive Development in Chile”, Inter-American Development Bank Working Paper Series No. IDB-WP-502, Inter-American Development Bank, Washington D.C.

CORE MODULES

Module A: Connectivity

Computer use

Definitions

Information and Communication Technologies (ICT) consist of the hardware, software, networks and media for the collection, storage, processing, transmission and presentation of information (voice, data, text, images), as well as related services.

Computers include personal computers, portable computers, tablets, other portable devices.

Computers here do not include smart phones or any other device, although with embedded computing abilities, having a main function other than computing (e.g. MP3 and other media players, game consoles, electronic dictionaries, GPS navigation devices, e-book readers etc.).

Persons employed is the total number of persons who work in the observation unit (inclusive of working proprietors, partners working regularly in the unit and unpaid family workers), as well as persons who work outside the unit but belong to it and are paid by it (e.g. sales representatives, delivery personnel, repair and maintenance teams). It excludes manpower supplied by other enterprises, persons carrying out repair and maintenance work in the enquiry unit on behalf of other enterprises, as well as those on compulsory military service.

Broadband access

Definitions

Broadband subscriptions have an advertised download speed greater than 256 kbit/s.

-

Wired (fixed) broadband connections include xDSL, cable modem, optical fibre (e.g. FTTx), leased lines, Ethernet, PLC, BPL;

-

Fixed wireless connections include public-WIFI, satellite and terrestrial fixed wireless such as fixed WiMAX, LMDS and MMDS;

-

(Terrestrial wireless) Mobile broadband connections include technologies such as 3G/LTE/4G, UMTS, CDMA2000, and any other future technology.

Internet use

Module B: Website

Module C: Information Management Tools

Intranet and Extranet

Definitions

Intranet is an Internet-like system only operating within a single organisation.

Extranet is a linked network of intranets or part of a company’s intranet that is extended to users outside the company. They may be used to share securely part of a business’s information or operations with suppliers, vendors, partners or customers.

EDI, ERP, CRM and RFID

Definitions

-

Electronic Data Interchange (EDI) refers to applications allowing for automated exchange of messages between enterprises and organisations:

-

Sending and/or receiving of messages (e.g. payment transactions, tax declarations, orders, etc.) in an agreed or standard format suitable for automated processing, e.g. EDI, EDIFACT, XML, xCBL, cXML, ebXML, ODETTE, TRADACOMS;

-

Without the individual message being typed manually.

Enterprise Resource Planning (ERP) is a software package used to manage resources by sharing information among different functional areas (e.g. accounting, planning, production, marketing, etc.). ERP software can use EDI technology and be clubbed with or embed CRM (see below).

Customer Relationship Management (CRM) refers to any software application for managing information about business’ customers. CRM functions can also be embedded into ERP software.

Radio Frequency Identification (RFID) is an auto-identification technology (like barcodes), which allows contactless information transmission, integration with sensors and the modification of stored data based on radio waves. Information is contained in ‘RFID tags’ (transponders) applied or incorporated into products or objects. RFID technology has a growing range of applications, from logistics, to retail, to manufacturing and access control.

Sharing information electronically: Supply Chain Management (SCM) and internal integration of information

Definitions

-

Sharing information electronically on Supply Chain Management (SCM) means exchanging all types of information with suppliers and/or customers about the availability, production, development and distribution of goods or services.

-

This information may be exchanged via websites, networks or other means of electronic data transfer, but it excludes manually typed e-mail messages.

Electronic invoicing

Definitions

There are invoices in paper form and electronic form. Invoices in electronic form are of two types:

-

E-invoices in a standard structure suitable for automated processing (e.g. EDI, UBL, XML). E-invoices are exchanged either directly or via service operators or via an electronic banking system

-

Invoices in electronic form not suitable for automated processing (e.g. e-mails, e-mail attachment as pdf, images in TIF, JPEG or other format).

Module D: Electronic Commerce

Definitions

An electronic commerce (e-commerce) transaction is the sale or purchase of goods or services, conducted over computer networks by methods specifically designed for the purpose of receiving or placing of orders. The payment and the ultimate delivery of the goods or services do not have to be conducted online.

-

An e-commerce transaction can take place between enterprises, households, individuals, governments, and other public or private organisations. Enterprises’ e-commerce sales (E-sales) with reference to customers the acronyms B2B (Business to Business), B2C (– to Consumers), or B2G (– to Government).

-

To be included are orders made over the web, extranet or electronic data interchange. The type is defined by the method of placing the order. To be excluded are orders made by telephone calls, facsimile or manually typed e-mail.

-

EDI transactions take place in an agreed or standard format which allows their automatic processing (e.g. EDIFACT, UBL, XML) without the individual messages being typed manually.

-

Web transactions are made via an online store (web shop), web forms on a website or extranet. Manually typed e-mails are to be excluded.

Module E: Security and Privacy

Definitions

Management represent measures, controls and procedures applied on ICT systems to ensure integrity, authenticity, availability and confidentiality of data and systems.

Privacy risks refer to any danger that personal information stored by the enterprise be used for illegal purposes, or any other purpose not explicitly agreed by the interested party.

External attacks: can be determined by injection of malicious software or unauthorised access, pharming (redirection of traffic to a fraudulent website)

COMPLEMENTARY MODULES

Module F: E-Government

Definitions

Public authorities refer to both public services and administration activities such as tax, customs, business registration, social security, public health, environment or commune administrations.

Public authorities can be at local, regional or national/federal level.

Module G: Emerging uses of Information Technologies

This module refers to technologies that at present are used by relatively few enterprises (data analytics, and to a lesser extent Radio Frequency Identification - RFID), or whose linkages with economic outcomes are less straightforward (green ICT policies) or are not obvious to assess, and in coming years are likely to spread in a seamless fashion (cloud computing).

In view of the above, this module is considered as “non-core”. In addition, its sections will need to be revised in the future, with the possible inclusion or exclusion/displacement of some technologies and uses.

Use of Radio-frequency identification (RFID) technologies

ICT green policies

Use of cloud computing

Definition

Cloud computing refers to ICT services that are used over the Internet to access software, computing power, storage capacity etc., where the service:

-

Is delivered from servers of service providers;

-

Can be easily scaled up or down (e.g. number of users or change of storage capacity);

-

Can be used on-demand by the user, at least after the initial set up (without human interaction with the service provider);

-

Is paid for, either per user, by capacity used, or they are pre-paid.

Cloud computing may include as well connections via Virtual Private Networks (VPN).

Use of data analytics

Definitions

Data analytics here is intended as the treatment (analysis, modelling) of data concerning, for instance, customers and market behaviours and dynamics, to gain information supporting decisions (e.g. targeting products and marketing, and/or allocation of resources). Data and data analysis can be collected and/or performed by the enterprise itself or purchasing them and/or the service from external providers. The definition excludes the purchase of services where data analytics is not the main purpose of the transaction (such as online advertising, where ads are addressed to potential customers based on data analytics techniques).

Expenditure hereunder covers all types of expenditure made by the enterprise for data analytics purposes, including e.g. personnel costs, databases, third-party services, etc.

Module H: ICT Skills

Definitions

ICT specialists are employees for whom ICT is the main job. For example, to develop, operate or maintain ICT systems or applications.

ICT related functions encompass a wide variety of activities within the enterprise. ICTs are not the main job but a tool.

Module I: ICT expenditure and acquisition

Note: Indicators in this module can present some overlaps with indicators on ICT skills (e.g. expenditures for ICT functions) and on use of given applications (e.g. software as a service).

Module J: Open Source Software (OSS)

Definition

An Open Source Software (OSS) is software where the source code available without any copyright cost and which provides the possibility of modifying and/or (re)distributing it.

Module K: Use of social media

Definition

Use of social media refers to the enterprise’s use of applications based on Internet technology or communication platforms for connecting, creating and exchanging content online, with customers, suppliers, or partners, or within the enterprise.