Chapter 3. Foundations as innovators

Foundations are often seen as innovators. This chapter explores the meaning of innovation in the philanthropic sector – focusing on organisational innovation and process innovation– as well as why and how foundations have innovated, supported by OECD survey results. It highlights a confluence of factors – growth and professionalisation of the philanthropic sector, foundations´ inner drive for innovation and a generational shift – has led to foundations to innovate in the way that they work. It finds that, in terms of organisational innovation, foundations have moved towards more “strategic” philanthropy and, in terms of process innovation, foundations are using new financial tools and changing their internal processes due to technology and access to data. OECD survey results show while foundations are increasingly changing their practices and delivery methods, these innovations are still far from being the norm across philanthropies.

By their very nature, foundations are often considered to be potential incubators of innovation. However, foundations used to be relatively traditional and some still are. For this study, “traditional philanthropy” can be defined as practices encompassing the following (OECD netFWD, 2014[20]):

-

Short-term engagement (e.g. 1-2 years).

-

Untargeted giving: traditional foundations give out many grants, in many different sectoral and geographical areas with limited focus.

-

Project-based interventions: traditional foundations fund project by project, rather than an entire programme, and do not aim to achieve systemic change.

-

Reactive attitude: they let grantees come to them (by filling out an online form, for instance), and do not try to identify them in advance.

-

Input-focused: success is measured by spending their available budget entirely.

Against this background, this chapter will examine what innovation means, as well as why and how foundations have innovated.

The Oslo Manual, developed by the OECD and the European Commission (OECD and Eurostat, 2005[21]), offers the main international guidelines for the collection and use of data on innovation. It distinguishes four types of innovation: organisational, process, product and marketing. This chapter will focus on the first two as they are the most relevant for foundations.

Organisational innovation refers to the implementation of a new method in an organisation’s “business practices”. For foundations organisational innovation typically means transitioning out from traditional philanthropy and looking more strategically at how they can achieve more impact. The Shell Foundation, for instance, went through that process in the early 2000s. Ultimately, it developed a new strategy called the “enterprise-based” model.

Process innovation refers to implementation of a new delivery method. This includes significant changes in techniques, equipment and/or software. Applied to foundations, process innovation means developing and/or implementing new tools to achieve their goals, e.g. using innovative financial mechanisms and technology. The Shell Foundation, for example, used market-based solutions to social issues and worked mainly with social entrepreneurs to deliver its new strategy. Previously, it had supported exclusively non-governmental organisations (NGOs) for short-term projects (OECD and Eurostat, 2005[21]) (Shell Foundation, 2018[22]).

A convergence of factors has led foundations to innovate in the way they work. Three key factors, described in detail below, are growth and professionalisation of the philanthropic sector, an inner drive for innovation and a generational shift.

Professionalisation: as mentioned in Chapter 1, philanthropy has experienced a boom over the last 15 years, both in terms of financial resources available and number of foundations. For instance, in Kenya, over two thirds of foundations have been created since 2000 (OECD netFWD, 2017[23]). Alongside this growth, foundations – and the sector around them – have become more professional. They have built up their staff expertise by hiring professionals from development agencies, governments, and the non-profit or private sectors. Philanthropic infrastructure has also grown through the creation of thematic or regional networks of foundations and affinity groups. These include the Arab Foundations Forum, Asian Venture Philanthropy Network, European Foundation Centre, East Africa Philanthropy, Elevate Children Funders Group, Human Rights Funders Group, International Education Funders Group and the Network of Foundations Working for Development. These networks and groups aim to improve knowledge and grantmaking practice of their members through peer-learning, dialogue and research. This professionalisation has translated into efforts to be more strategic and outcome-focused, which led to organisational innovation (Section 3.1).

An inner drive: foundations have many characteristics that are conducive to innovation. They are smaller and more flexible than governments or multilateral organisations, which enables them to test new approaches, tools and initiatives. For instance, the Ayrton Senna Institute has been testing and progressively expanding a programme to teach social and emotional skills in the public education system across Brazil. Unlike governments and private companies, foundations are neither bound by electoral cycles nor to delivering immediate results to taxpayers or shareholders. Foundations look at the context in which they operate and try to identify the gaps (e.g. failures in the market or in policies) before coming up with new solutions. Some, such as the Rockefeller Foundation, invest a lot in foresight to detect early signs of major social issues and changes in order to target their activities better. Finally, foundations’ staff come from a broad range of sectors, including start-ups and small agile organisations where innovation is more critical to success than in larger corporations and institutions.

A generational shift: a new generation of philanthropists is disrupting the sector. They are often successful entrepreneurs who decide to devote part of their wealth to philanthropic causes, after making a fortune in business, especially in the tech sector (Bishop and Green, 2008[24]). They start their philanthropic ventures at a younger age than historical philanthropists (e.g. Andrew Carnegie, John D. Rockefeller, Henry Ford), and want to make an impact during their lifetime. They are often looking for ways to create value. Rather than funding long-standing institutions and giving out grants, they have come up with new approaches. Jeff Skoll, co-founder of Ebay, identifies high-potential social entrepreneurs. In another example, Azim Premji seeks to reform the education system in India by engaging teachers, school leaders, teacher educators and education officials. This new generation also tends to be more “hands on”, getting involved themselves and trying to get their peers to donate. However, some of these new approaches to addressing social issues have yet to be fully evaluated. Consequently, it is not clear whether they can create impact and, more importantly, replicated this at scale. The issue of data sharing also remains a hurdle. Some smaller organisations created by high-net-worth individuals are often reluctant to share information on their giving and the results achieved.

3.1. Organisational innovation

Philanthropy has undergone a paradigm shift in the last 15 years, embedded in the trend towards more “strategic” philanthropy. Traditional giving tends to focus on the importance of the cause and the giving/generosity element (the intention) rather than on its reach. More recently, founders or the chief executive officers of foundations themselves want to generate and measure their social or financial impact. Furthermore, these new “venture” philanthropists are trying to make strategic decisions grounded in evidence. This section explores three approaches underpinning these trends – venture philanthropy, systems change and big bet philanthropy – as well as a cross-cutting one, impact measurement.

3.1.1. Venture philanthropy: Spreading, but not yet widespread

The term “venture philanthropy” encompasses a broad range of practices. However, it can be defined as a high-engagement and long-term approach to generating social impact through tailored financing, organisational support, and impact measurement and management (EVPA, 2017[25]). Venture philanthropists view their grantees as partners and provide them with both financial and non-financial support, such as technical knowledge and capacity building. Instead of spreading their giving to a large number of projects, they make strategic and targeted “investment” choices to have the highest impact. These philanthropists are often not attached to working with a particular type of organisation, funding diverse social purpose groups that include for-profit enterprises, social enterprises and NGOs (OECD netFWD, 2014[20]).

This approach typically involves several phases, which enable foundations to test a model or an initiative and bring it to scale if it proves successful. For some foundations, the first phase often focuses on research and screening. Foundations assess needs and identify organisations already working on a social problem in a determined geographic area. The second phase includes developing a pilot initiative. This often involves blending several financial instruments (grants, loans, guarantees, etc.), and building partnerships with organisations able to deliver impact. These groups could include NGOs and social enterprises, but also the public and private sectors. Finally, if the pilot delivered satisfactory outcomes, foundations will seek to scale it up. To that end, they might further develop their emerging partnerships or expand the scope of outcomes, which could further involve governments.

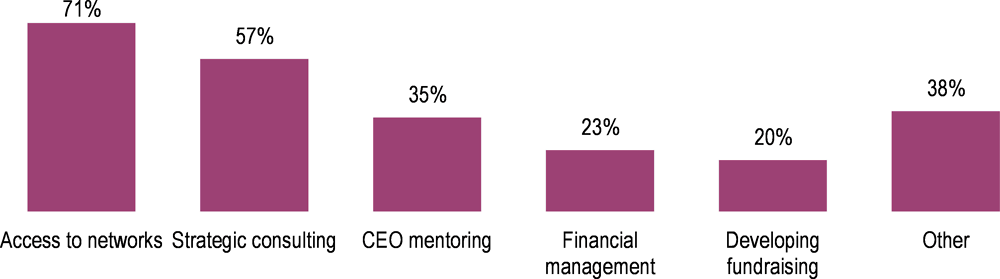

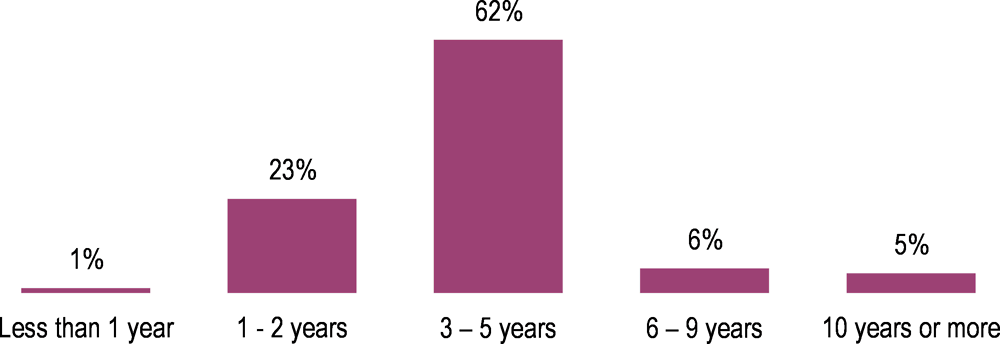

A growing number of foundations have been adopting such practices. The OECD survey highlights that almost half of foundations select their grantees proactively, and many provide them with non-financial support. For instance, 71% of foundations share their networks with their grantees, 57% offer strategic consulting and 35% provide mentoring for chief executive officers (Figure 3.1). This approach, however, is far from the norm. More than 20% of foundations surveyed focus on ten or more thematic areas, hence diluting their ability to work hand in hand with their partners. Only 26% target their action to between one and five thematic areas. Furthermore, long-term commitments are not yet the norm; 86% of foundations’ grants are for no longer than five years (Figure 3.2). This makes engagement over risky projects or support to social enterprises that are not yet viable more difficult. Short-term engagement also makes it more difficult to leave an impact on the enabling environment or a system change (see below).

3.1.2. Systems change philanthropy: The challenge of achieving large-scale impact from the start

Systems change is a recent approach favoured by some foundations, which can be defined as a change in the policies, processes, relationships, knowledge, power structures, values or norms of participants within a system that affects a social issue (Kramer, 2017[27]). Systems are understood to be made up of interconnected parts, both tangible and intangible. They include people, institutions and resources, as well as relationships, values and perceptions (Abercrombie, Harris and Wharton, 2015[28]).

While the objective is the same as venture philanthropy, i.e. achieving large-scale impact and addressing bold social issues, processes differ in systems change philanthropy. Unlike venture philanthropy, which tests its approaches through a pilot and a scale-up phase if successful, foundations adopting a systems change approach aim to achieve systemic change immediately. This requires a good understanding of the political economy of a context to influence it beyond the individual or organisational level. To do so, philanthropists often look at the context in an interdisciplinary and holistic way, considering all aspects of a social issue from the outset. They seek to leverage existing expertise and organisations, and build cross-sector coalitions across them, instead of creating new institutions (Walker, 2017[29]). A considerable investment of time is therefore needed to map an entire ecosystem and co-ordinate the large numbers of actors involved. Substantive funding (most often as part of a coalition) is also required.

Influencing an entire ecosystem can be a major challenge for foundations that remain relatively modest in size and budget compared to governments or multilateral organisations. Moreover, the philanthropic sector is extremely fragmented. Funders follow internally defined priorities, and do not seek alignment. Getting others to converge, align and support a systems change approach, then, is a tall order. Box 3.1 explores these issues and offers insights on how collaborative solutions can be further optimised.

Whether the intent is to improve educational outcomes for girls or access to clean water in informal urban settlements, complex challenges are informed by multiple factors. Solving any single one on its own will not solve the overall problem. Going beyond symptoms to create lasting change requires a systems approach:

-

Defining the boundaries of the system and understanding the problem in its context. For example: Is infant mortality a problem within the health system or does it need to be looked at in the context of urban planning and unhealthy living conditions?

-

Working with many actors that are part of the system, across private, public and civil sectors.

-

Identifying the levers that will alter the system, such as policy shifts, changes in public perception, behavioural changes, new data and insights and transformative technologies.

-

Using iterative monitoring and learning methods to establish quick feedback loops, instead of operating in a linear fashion.

Many foundations are applying a systems change mindset to their way of working. But much more could be done to implement this approach collectively, mainly by changing how and how much we collaborate. As funders we come together, but often in a decentralised way – by topic, approach or geography – and in alliances that focus on pooling financial support.

To achieve systems change, foundations could be more effectively brought together according to their expertise in using a specific lever for change as defined by Donella Meadows (Meadows, 2008[30]).

The prevention of pandemics can provide an example. Established funders such as the Wellcome Trust support the creation and dissemination of new insights and data on vaccines. Conversely, foundations dedicated to social justice, such as the Ford Foundation and Open Society Foundation, support shifting the rules of the system. Such a shift could involve enabling local communities and local governments to define how to reach the poorest of the poor in remote locations. Foundations experienced in setting up new institutions, such as the Rockefeller Foundation, focus on founding Centres for Disease Control and Disease Surveillance Networks. Venture philanthropy organisations like the Omidyar Network or the Draper Richards Kaplan Foundation help create and scale social enterprises to foster new business models and make preventative services and products available to more people. Tech foundations, like Google.org or the Cloudera Foundation, can be a partner in identifying and applying transformative technologies, e.g. to integrate live streams of global epidemic intelligence from worldwide infectious disease monitoring systems.

If all of these activities sound familiar it is because they already coexist. However, these and many other activities in support of systems change are often not linked up to function as a powerful philanthropic value chain. To optimise the ecosystem of change, foundations need a clearer understanding of their role in the system. They must know where their resources and expertise best fit local needs. And they should not expect their single approach to be sufficient to affect systems change.

Approaching systems change even more collaboratively would allow us to make every dollar count at a time where we are facing a USD 2.5 trillion gap per year to achieve the Sustainable Development Goals. Moreover, it would also more effectively draw on other assets that large and small foundations have at their disposal – expertise, in-kind contributions and the ability to convene across sectors.

Contributed by Claudia Juech, Cloudera Foundation

3.1.3. Big bets: High risk, high reward – but only for some

“Big bets” is another concept emerging in the philanthropic sector, especially popular among large US foundations. The big bet approach dedicates a significant philanthropic investment – USD 10 million or more – to solving a social problem in a limited timeframe, generally by supporting a single organisation. Like systems change, big bet philanthropy aims to create systemic change by targeting key levers in the ecosystem. Nonetheless, the approach is fundamentally different. Instead of considering all the main aspects of a social problem, funders “bet” on what they view as the main lever to unlock the problem. The Bill & Melinda Gates Foundation (BMGF) has often followed this approach. It made 19 of the 58 big bets identified by the Bridgespan Group in 2015 (Dolan, 2016[31]). For instance, the BMGF committed USD 1.55 billion to Gavi, the Vaccine Alliance in that year. This aimed to provide 300 million children with vaccines by 2020, and save up to 6 million lives by protecting them from diseases such as pneumonia, measles and severe diarrhoea (Bill & Melinda Gates Foundation, 2015[10]).

Big bets offer interesting opportunities, especially for grantees. From their point of view, receiving a large grant can help ensure financial sustainability for several years, and relieves them from the hassle of constant fundraising. In addition, big bets are usually issued as core contributions to an organisation (thus not earmarked). From a funders’ perspective, big bets can be particularly appealing due to the visibility they generate and the anticipated ability to solve an identified and quantifiable problem. Indeed, announcing a major investment attracts their peers, as well as the media’s attention to their philanthropic commitments.

However, this approach generates some concerns among practitioners. First, big bet philanthropy can be seen as favouring a siloed approach and result in over-simplifying development challenges, whereas they are complex and multi-faceted (Kramer, 2017[32]). Further, grantees may decide to change their course of action to better fit the funder’s strategy. The approach can also significantly influence the policy agenda, and end up taking over responsibilities that are normally the purview of governments (Jordan, 2017[33]). Indeed, large pledges by private donors to multilateral organisations that set global policy raise an important question. Is it legitimate for unelected and largely unaccountable organisations led by the wealthiest 1% to make decisions that have an impact on global public goods such as health? Finally, as shown in the OECD survey, big bets grants are likely to primarily benefit international NGOs and multilateral organisations. Such groups, including UNICEF, WHO or Save the Children, have all received multiple big bets grants between 2000 and 2012 (The Bridgespan Group et al., 2016[34]). Large grants (e.g. USD 10 million) are not typically directed at local organisations because they lack the capacity to handle such amounts and disburse them effectively.

3.1.4. Impact measurement: A cross-cutting trend and a common thread across innovations in philanthropy

Monitoring and evaluation (M&E) have become an integral part of the sector’s evolution, as illustrated by some new approaches in previous sections of this chapter. Philanthropists increasingly want decisions informed by evidence. They develop theories of change to frame their action and to track measurable outcomes. They ask for regular reporting based on key performance indicators from their grantees, as well as from end beneficiaries. Finally, they invest in thorough impact evaluations, such as randomised control trials, whereby a population control group enables the rigorous assessment of the effectiveness of a specific intervention.

To address this drive towards better and more measurement, innovative evaluation practices have emerged. The OECD netFWD, for example, has developed a methodology to assess the impact of multi-stakeholder partnerships. The methodology examines three dimensions: i) partnership design and functioning; ii) results yielded by the partnership; and iii) partnership value-added. The methodology is applied through a peer review, where other foundations working in the same area assess a foundation’s multi-stakeholder partnership in a policy area or sector. The first peer review on the quality of education, which began in September 2017 in Brazil, examined the partnership between Fundação Itaú Social and the Brazilian Ministry of Education. Their joint programme “Writing the Future” aims to improve the reading and writing skills of Brazilian students by providing training to public school teachers.

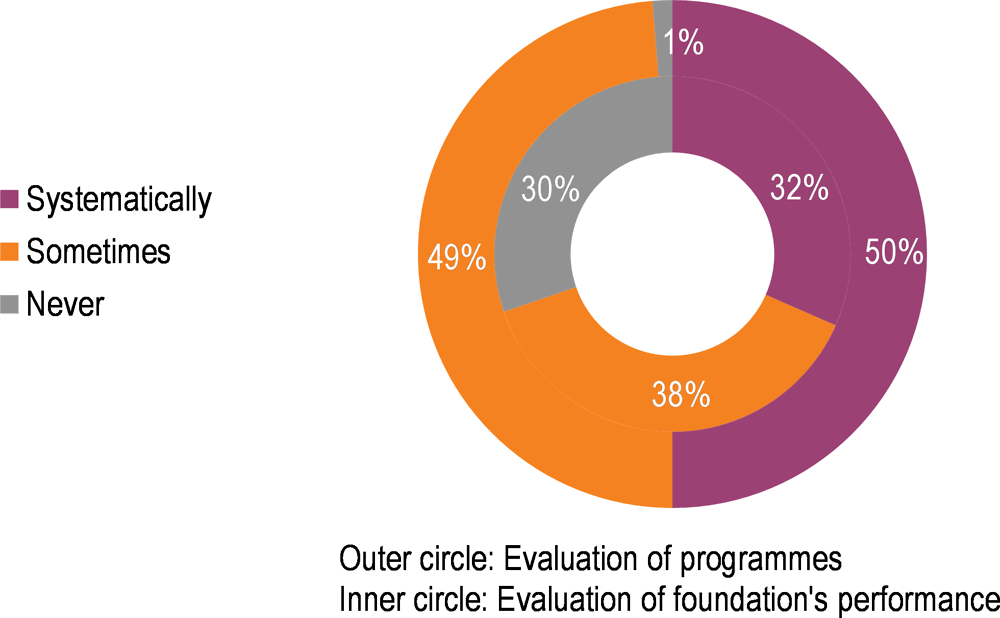

The OECD survey confirms the view that foundations are increasingly measuring impact. However, it also highlights significant gaps. Almost all foundations surveyed evaluate their programmes – half do it “sometimes” and half “systematically” (see Figure 3.3), which shows that foundations take impact measurement seriously. Yet measurement of institutional performance could still be improved. A third of surveyed foundations “never” evaluates its own impact as an organisation, while the remaining two-thirds are equally split between stating they “sometimes” and “systematically” evaluate.

Two main factors explain why foundations tend to be able to assess their programme performance more often than their own organisations’. First, institutional performance is hard to evaluate as it implies establishing cross-cutting indicators across foundations’ programmes. This adds to the difficulty foundations see in attributing outcomes to their specific intervention; all development actors face this dilemma when working on complex issues with a variety of actors. Second, while institutional performance evaluation must be done at the foundation level, the burden of programme evaluation is often shared with grantees, who are bound to report to funders.

Although impact measurement is widely praised and often seen as a must-have in philanthropy, it can also produce negative effects. By focusing too strongly on evidence and measurable outcomes, foundations can lose their appetite for risk. As a result, they may avoid projects that won’t necessarily yield results in the short term. This impact-centred approach encourages foundations to support more conventional or less risky programmes instead of experimenting with new ideas (Kasper and Marcoux, 2014[35]). It also pushes them to concentrate their activities in sectors where impact is easier to measure and becomes visible more quickly, such as the fields of health or entrepreneurship. As a result, areas where impact is hard to quantify, such as the fight against corruption or the defence of human rights, might seem less appealing to foundations. In addition, impact measurement generates heavy reporting burdens for grantees, thus increasing their administrative workload and overhead costs.

3.2. Process innovation

3.2.1. New financial tools for tailored support

Foundations are using new financial tools beyond traditional grantmaking. Some of these approaches, such as social impact investment, enable foundations to provide finance tailored to different grantees’ needs or to the level of risk at stake. Other tools, such as mission-related investments and development impact bonds, enable foundations to explore and test new ways and mechanisms of pursuing their organisational mission. A foundation focusing on fighting climate change, for instance, will give out grants to NGOs’ implementing recycling initiatives, and also invest its endowment in renewable energy companies or funds.

-

Social impact investing: Social impact investment can be defined as the provision of finance to organisations with the explicit expectation of both a measurable social and financial return (OECD, 2015[36]). Social impact investors include those willing to provide funding for organisations that are not able to generate market returns, such as foundations. But they also include more traditional investors with an interest in having a social impact.

Foundations have played a critical role in the evolution of the social impact investment market through market-building activities (research and knowledge exchange) and mission-related or programme-related investments (investments of their endowment into ventures that are related to their core mission). These investments may be made in parallel to the regular grantmaking of the foundation and typically take the form of loans, guarantees or equity investment; their repayments or returns are reinvested in new projects (Rangan, Appleby and Moon, 2012[37]). Grants, both public and private, continue to play an important role by providing “first loss” or “catalytic” funding. This means the grant provider is willing to bear the risk to attract additional funding (GIIN, 2013[38]). Grants and technical assistance are often needed before or alongside social impact investment to help social ventures addressing social challenges develop commercially viable solutions (Bridges Ventures, 2012[39]).

-

Mission-related investments (MRIs): Through MRIs, foundations no longer distinguish between investments to maintain and expand their endowment, and their grantmaking strategies. MRIs can be viewed as a type of social impact investment. They refer to market-rate investments that support the mission of a foundation by generating a positive social or environmental impact (Mission Investors Exchange,(n.d.)[40]). They are usually expected to generate competitive financial returns. Conversely, programme-related investments (PRIs) put more emphasis on achieving a social impact, and thus are often below-market rate.

Foundations use this approach for several reasons. First, it allows them to expand the resources available to advance their missions. Second, it helps attract mainstream investors to sustainable funds, i.e. funds that do not support economic activities harming social justice or the environment, such as oil and gas drilling.

In the United States, foundations are legally required to disburse 5% of their assets annually – called pay-out – to keep their tax exemptions. Grants and PRIs are typically counted in the pay-out, but MRIs are made directly from the endowment. MRIs therefore have the potential to leverage foundations’ 95% untapped capital. For example, in 2017, the Ford Foundation decided to devote USD 1 billion out of its USD 12-billion endowment to MRIs over the next ten years. This was the largest commitment to MRIs made by a foundation to date. The Ford Foundation aims to help build the market for MRIs by creating impact funds, and to encourage other foundations to follow their lead.

-

Development impact bonds (DIBs): Similarly to social impact bonds (SIBs), DIBs are a financial mechanism in which private investors provide up-front capital for social services. They are repaid by an outcome funder contingent on the achievement of agreed-upon outcomes (OECD, 2015[41]). There are two main differences between them. First, DIBs are implemented in low and middle-income countries. Second, in DIBs, the investors and/or the outcome funders are often bilateral donors or foundations. In fact, a recent study revealed that foundations of different scale are the predominant investors of DIBs (Gustafsson-Wright, Boggild-Jones and Segell, 2017[42]). For example, in India, the UBS Optimus Foundation (the investor) and CIFF (the outcome payer) are joining forces to enhance education outcomes for 18 000 children (Instiglio, 2018[43]). Most DIBs focus on health outcomes, such as the improvement of maternity and child care, HIV prevention or the treatment of cataracts. Conversely, SIBs primarily focus on employment. DIBs are spreading at a slow pace; to date, only 4 DIBs have been implemented and 25 are being designed (Instiglio, 2018[44]); 90 SIBs have been set up since the first one in 2010 in the United Kingdom.

In light of the ambitious Agenda 2030, development impact bonds (DIBs) could ensure efficient use of available funds and effective delivery of social services. With their ability to target hard-to-reach populations and to save public funds, DIBs may also help enhance accountability for funders and social service providers (both social enterprises and NGOs). In addition, DIBs could promote learning through evaluation and act as a compass for foundations to invest in what works. DIBs may allow governments to test innovative approaches of delivering social services. They may also allow governments to invest more on prevention, which can impact citizens’ well-being and yield long-term savings. Finally, DIBs could break silos, enhancing collaboration among relevant actors.

At the same time, DIBs have several shortcomings. First, as DIBs are implemented in low- and middle-income countries, they need serious risk management. Due to wider political or financial instability, stakeholders face greater uncertainty in terms of political commitment and financial returns, which are calculated based on future government savings. Second, although stakeholders may already have experience in results-based financing, DIBs remain costly and complex. They are based on tailored agreements that are hard to fully replicate, and which require patience and time to be carved out. Third, the lack of a clear regulatory framework may hinder development of DIBs. Fourth, DIBs may create the wrong kinds of incentives for measuring outcomes for social services providers. For instance, they could lead them to target the easiest results (cream-skimming). They could also lead them to leave aside the hardest-to-reach populations (cherry-picking) that could exaggerate success (gaming of results). Finally, some funders and particularly foundations used to hands-on grant-giving, may feel they have less control over their funding since DIBs empower social services providers to be more autonomous.

Source: Antonella Noya and Stellina Galitopoulou, OECD Centre for Entrepreneurship, SMEs, Local Development and Tourism

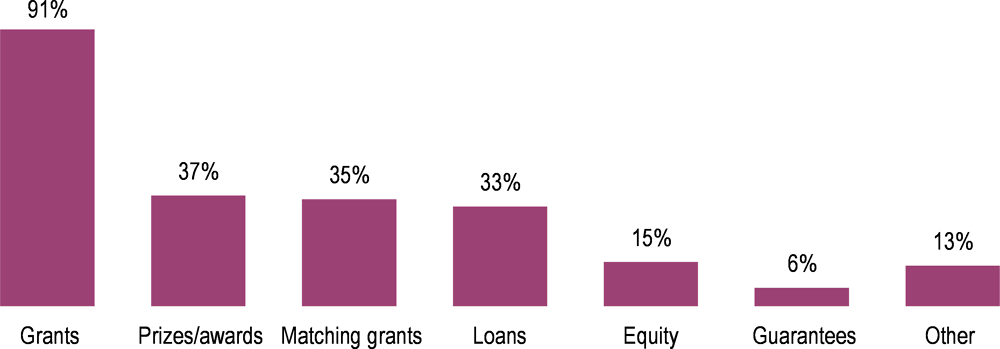

While these innovations generate interest and enthusiasm in the philanthropic sector, they are still far from the norm. To date, only the most cutting-edge foundations are pioneering DIBs. They are used mostly in the United States, but with notable exceptions elsewhere. The vast majority of foundations worldwide are much more traditional. The OECD survey results on financial support provide a telling example. As Figure 3.4 shows, 91% of foundations prefer grants as financial support. The predominance of grants is even more impressive when looking at volumes, as they represent (together with prizes and awards) about 99% of the total. A third of foundations offer loans and only 15% use equity. In terms of volumes, these two instruments represent less than 1%.

Foundations have relatively low levels of risk aversion and are willing to invest in innovative business concepts and financing models. Consequently, they are also becoming increasingly important players in the blended finance market. Whether a development finance provider uses concessional or non-concessional resources, they can help mobilise commercial capital to support development outcomes (OECD, 2018[45]).

3.2.2. Technology and access to data can enhance transparency, accountability and more direct giving

Technology and access to data are changing foundations’ internal processes. First, they change the way foundations allocate grants. Foundations increasingly digitalise their workflows, and thus save time Second, as more data on philanthropic giving are available online, foundations can learn from their own and others’ positive and negative experiences (Ricci, 2017[46]). For example, the Colombian Association of Family and Corporate Foundations (AFE) set up an online platform that provides detailed relevant information on their members’ projects. Increased knowledge sharing holds the potential to produce a global record system that could facilitate mappings, due diligence and impact assessments, and thus enhance transparency and accountability.

Technology also gives individual donors easier access to information on the interests and performance of organisations. Further, they can fund these organisations directly instead of through intermediaries such as foundations. Crowdfunding platforms also offer a wide number of projects, social enterprises, start-ups, etc. to choose from for whoever wants to give. Moreover, funders (individual and institutional alike) can now select their own beneficiaries through online platforms such as GiveDirectly. GiveDirectly enables anyone to provide direct cash transfers to the poor based on thorough due diligence and needs assessment.

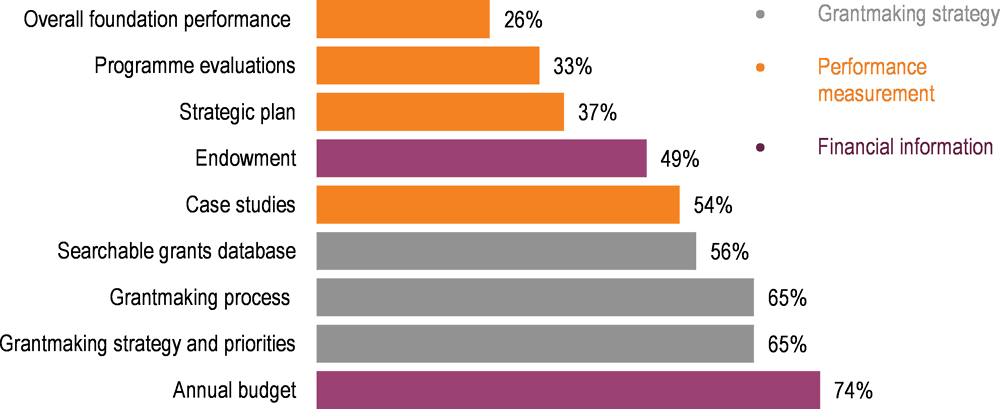

That said, transparency and accountability imply that foundations share data, a practice that is not yet widespread. Historically, foundations have been reluctant to make internal information publicly available. They argue the need to protect their grantees from governments’ scrutiny. In some cases, for example, they fund NGOs and other organisations that are part of the opposition under an autocratic regime. Although foundations have become more willing to share certain types of information, the OECD survey shows they carefully choose what they disclose. As presented in Figure 3.5, they make information about their inputs more easily available, e.g. budget (74%), strategy (65%), process (65%) and grantees (56%) than about their outcomes, e.g. programme evaluation (33%) and institutional performance (26%).

References

[28] Abercrombie, R., E. Harris and R. Wharton (2015), Systems Change: A guide to what it is and how to do it, New Philanthropy Capital, London, http://www.thinknpc.org/publications/ systems-change/.

[10] Bill & Melinda Gates Foundation (2015), Hundreds of millions more children to receive protection against deadly diseases, a chance at a healthy future, Press Release, 25 January 2015, (Webpage) https://www.gatesfoundation.org/Media-Center/Press-Releases/2015/01/GAVI-Replenishment-Conference.

[24] Bishop and Green (2008), Philanthrocapitalism: How giving can save the world, Bloomsbury Press, New York, https://www.bloomsbury.com/us/philanthrocapitalism-9781596913745/

[39] Bridges Ventures (2012), Sustainable and Impact Investment – How we define the market, Bridges Ventures, London, http://docplayer.net/17850360-Bridges-ventures-august-2012-sustainable-impact-investment-how-we-define-the-market.html.

[31] Dolan, K. (2016), Big Bet Philanthropy: How more givers are spending big and taking risks to solve society’s problems, Forbes blog, www.forbes.com/sites/kerryadolan/2016/11/30 /big-bet-philanthropy-solving-social-problems/#71f8c05179c5.

[25] EVPA (2017), Venture Philanthropy Glossary, European Venture Philanthropy Association, Brussels, https://evpa.eu.com/uploads/documents/Glossary-2017.pdf.

[38] GIIN (2013), Catalytic First-Loss Capital, Global Impact Investing Network, New York, https://thegiin.org/assets/documents/pub/CatalyticFirstLossCapital.pdf.

[42] Gustafsson-Wright, E., I. Boggild-Jones and D. Segell (2017), Impact Bonds in Developing Countries: Early learnings from the field, global economy and development programme, Brookings Institution, http://www.brookings.edu/wp-content/uploads/2017/09/impact-bonds-in-developing-countries_web.pdf.

[43] Instiglio (2018), Educate Girls Development Impact Bond,, http://instiglio.org/educategirlsdib/about-the-dib/ (accessed on 12 January 2018).

[44] Instiglio (2018), Impact Bonds Worldwide (database), www.instiglio.org/en/sibs-worldwide/ (accessed on 12 January 2018).

[33] Jordan, L. (2017), Keeping Faith with the Promise of a Private Foundation, Alliance, London, http://www.alliancemagazine.org/analysis/keeping-faith-promise-private-foundation/.

[35] Kasper, G. and J. Marcoux (2014), “The Re-Emerging Art of Funding Innovation”, Stanford Social Innovation Review, Spring 2014, https://ssir.org/articles/entry/the_re_emerging_art_of_funding_innovation.

[32] Kramer, L. (2017), “Against Big Bets”, Stanford Social Innovation Review Summer 2017, https://ssir.org/articles/entry/against_big_bets.

[27] Kramer, M. (2017), “Systems Change in a Polarized Country”, Stanford Social Innovation Review, April, 2017, https://ssir.org/articles/entry/systems_change_in_a_polarized_country.

Meadows D.H. (2008), Thinking in Systems: A primer, Chelsea Green Publishing Company, http://wtf.tw/ref/meadows.pdf.

[40] Mission Investors Exchange((n.d.)), What is Mission Investing? (webpage), http://web.cof.org/2013fall/docs/resources/Impact-Investing-Basics.pdf (accessed on 20 December 2017).

[20] OECD netFWD (2014), Venture Philanthropy for Development: Dynamics, Challenges and Lessons in the Search for Greater Impact, OECD Publishing, Paris, www.oecd.org/dev/ Venture%20Philanthropy%20in%20Development-BAT-24022014-indd5%2011%20mars.pdf.

[23] OECD netFWD (2017), Bringing Foundations and Governments Closer: Evidence from Kenya, OECD Development Centre, Paris www.oecd.org/site/netfwd /Kenya_EAAG_GEPE_Report_2017.pdf.

[21] OECD and Eurostat (2005), Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data,, OECD Publishing, Paris, www.oecd.org/sti/inno/ oslomanualguidelinesforcollectingandinterpretinginnovationdata3rdedition.htm.

[36] OECD (2015), Social Impact Investment: Building the Evidence Base, OECD Publishing, Paris, https://doi.org/10.1787/9789264233430-en.

[41] OECD (2015), “Understanding Social Impact Bonds”, OECD, Paris, www.oecd.org/cfe/leed/UnderstandingSIBsLux-WorkingPaper.pdf.

[45] OECD (2018), Making Blended Finance Work for the Sustainable Development Goals, OECD Publishing, Paris, https://doi.org/10.1787/9789264288768-en.

[26] OECD (2018), Survey on Private Philanthropy for Development 2013-2015: Qualitative questionnaire (internal database), www.oecd.org/site/netfwd/.

[37] Rangan, K., S. Appleby and L. Moon (2012), The Promise of Impact Investing. Background note, Harvard Business School, Boston, https://www.hbs.edu/faculty/Pages/item.aspx?num=41512.

[46] Ricci, J. (2017), The Future Tech Infrastructure for Philanthropy: 10 per cent Tech, 90 per cent Paradigm Shift,, http://www.alliancemagazine.org/blog/future-tech-infrastructure-philanthropy-10-per-cent-tech-90-per-cent-paradigm-shift/.

[22] Shell Foundation (2018), The Evolution of our Enterprise-Based Model (webpage), http://www.shellfoundation.org/our-approach.aspx (accessed on 01 February 2018).

[34] The Bridgespan Group, W. et al. (2016), “Making Big Bets for Social Change”, Stanford Social Innovation Review, Winter, http://ssir.org/articles/entry/making_big_bets_for_social_change.

[29] Walker, J. (2017), “Solving the World’s Biggest Problems: Better philanthropy through systems change”, Stanford Social Innovation Review April, https://ssir.org/articles/entry/ solving_the_worlds_biggest_problems_better_philanthropy_through_systems_cha.