8. China

Support to agriculture

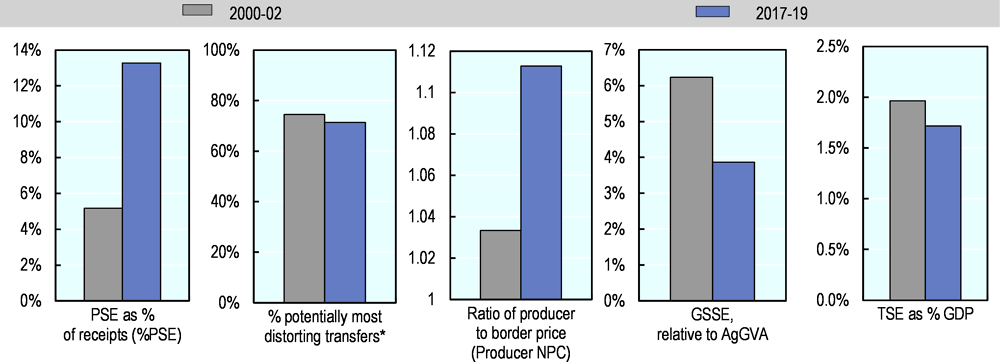

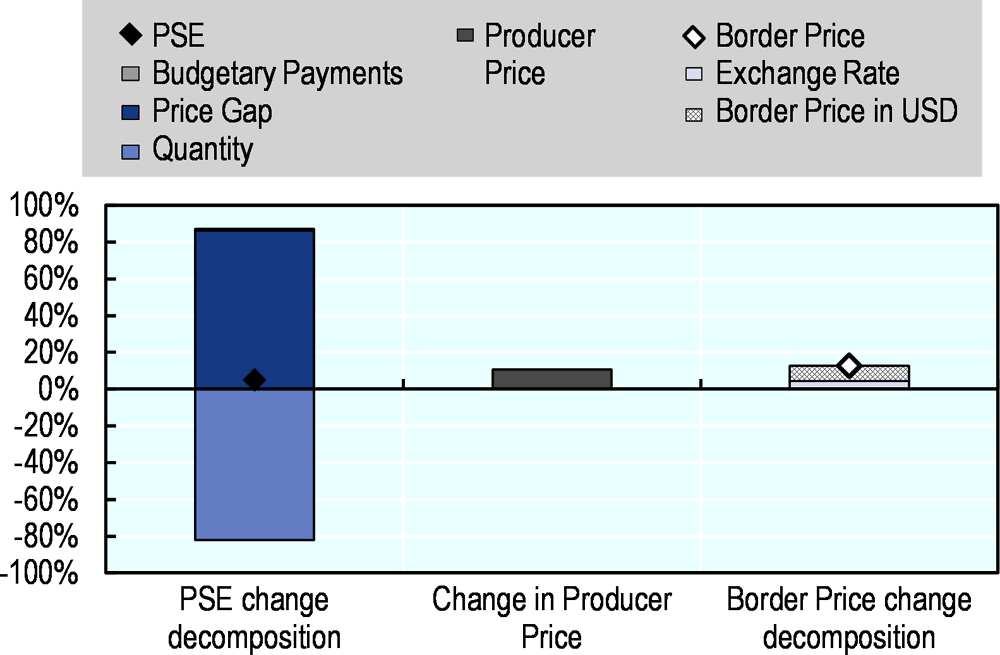

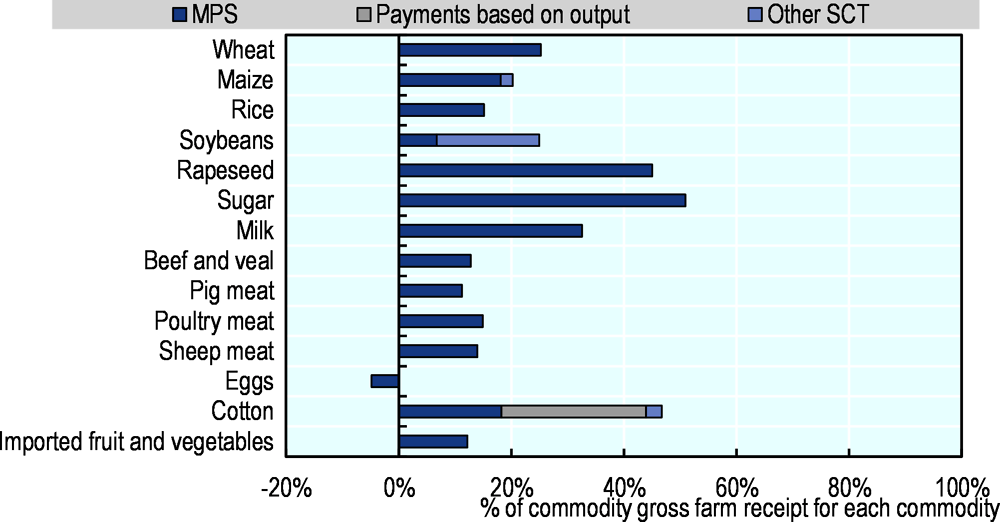

The share of support to agricultural producers in gross farm receipts (%PSE) in the People’s Republic of China (hereafter “China”) has been decreasing gradually since 2016 after two decades of steady growth. The %PSE averaged 13.3% in 2017-19, reflecting policy reforms undertaken with respect to the market intervention systems for soybeans, rapeseed, cotton, and maize, as well as to the minimum purchase price system for wheat and rice. The nominal depreciation of the CNY vis-à-vis the USD since 2014, after a long period of gradual appreciation, has been another factor influencing the evolution of price gaps and thus contributing to stabilising levels of Market Price Support (MPS) in recent years. Payments based on area planted have been consistently increasing since 2014 as a result of the recent reforms, but MPS remains the dominant part of total support, generated through both domestic price support policy and various border measures on imports. MPS levels differ across imported commodities, while prices of exported commodities are not supported. The higher domestic producer prices, on average, indicate an implicit tax imposed on consumers, with a percentage Consumer Support Estimate (%CSE) of -9.9% in 2017-19.

Within the General Services Support Estimate (GSSE), three categories attract the largest financial support: public stockholding, development and maintenance of infrastructure, and agricultural knowledge and innovation system. The GSSE corresponds however to only 15.9% of total support to agriculture in 2017-19.

Main policy changes

Ceilings on the volumes of grains procured at minimum purchase prices were fixed for the first time at 37 million tonnes for wheat and at 50 million tonnes for rice. Minimum purchase prices for early and mid-late indica rice were increased in February 2020 for the first time since 2014.

Central and provincial governments intensified policy responses to the African swine fever (ASF) outbreak, focusing on the compensation of producers affected, rebuilding the pig herd, and enhancing pig meat production. Specific measures included the strengthening of veterinary laboratories’ capacities and disease prevention, as well as support to the set up and extension of pig farms including through the relaxation of existing environmental regulations.

China lifted import bans on selected meat and related products for several countries and approved various facilities for importing in 2019.

The Soil Pollution Prevention and Control Law entered into force in 2019. The Ministry of Ecology and Environment together with the Ministry of Agriculture and Rural Affairs and the Ministry of Natural Resources are establishing a soil environmental monitoring system with regular soil examinations.

Assessment and recommendations

Recent reforms to replace intervention prices for key crops by direct payments based on area planted are a step in the direction of rebalancing the policy portfolio towards measures that reflect China’s policy orientation towards long-term productivity growth and sustainability. The most recent reform of the maize purchasing and storage system towards direct payments has eased the burden on the cost of public stockholding that still represents the largest expenditure share in general services support. Such reforms could be extended to gradually include rice and wheat. Should direct payments to farmers be maintained over a longer-term, the link between these and production decisions should be further loosened by providing payments on a historical area basis, for instance, and ‘greened’ by making them conditional on environmentally friendly production practices.

Public expenditure on general services has been increasing, but at a slower pace than support to individual producers. More efforts are thus needed to restructure agricultural support towards public investment in research and development, and agricultural infrastructure. Further investments in sanitary inspection and control services will be key to support the implementation of the Food Safety Law revised provisions and the recovery of the pig meat sector following the African swine fever outbreak. This restructuring of public expenditure can be achieved by scaling down input subsidies such as the subsidy to purchase farm machinery and ensuring that support through direct payments only has a transitory role in backing farmers’ adjustment to a new market environment.

Recent reforms in land transfer rules have contributed to the emergence of “new-style” farms, including large family farms, co-operative farms and farms run by agribusiness companies. For the reforms in land regulations to continue delivering expected outcomes, these need to be complemented by further investments in education and training and improved access to financial services.

To establish a solid framework for agri-environmental policies, China should define environmental targets well adapted to local ecological conditions and strengthen monitoring mechanisms for the enforcement of environmental regulations. In this sense, the soil environmental information platform and monitoring system with regular soil examinations – under the 2019 Soil Pollution Prevention and Control Law – need to be fully implemented and can set the stage for similar efforts relating to water use in agriculture. More specifically, under the current discussions on a law on groundwater pollution control and establishment of a national groundwater environmental monitoring system, a comprehensive review of water governance could help to better define responsibilities, remove conflicts, and ensure effective and efficient policy implementation.

China’s Nationally Determined Contributions (NDCs) distinguishes agriculture’s importance to its economy-wide emission reduction target, but no sector-specific targets have been set. Policy efforts for mitigating GHG emissions have focused on increased fertiliser efficiency, reduced emissions from rice cultivation, and agricultural biogas production. Several work plans have been recently put forward with the aim of strengthening policies supporting the sector’s adaptation to climate change. In this context, the Ministry of Ecology and Environment can mainstream adaptation policy objectives across current and planned programmes, including a better targeting of extension services for farmers. Prior to any extension of the insurance premium coverage, an evaluation of the performance of the subsidy to the agricultural insurance premium would allow assessing its cost-efficiency and impacts on adaptation.

Policy responses in relation to the COVID-19 outbreak

Agricultural policies

A statement by the State Council on 28 February 2020 encourages farmers to adopt double cropping of rice1 – in areas where planting conditions are favourable – with the objective to avoid potential grain supply disruptions for the 2020-21 marketing year (Xinhua, 2020[1]). The National Development and Reform Commission (NDRC) also raised by 0.8% the minimum purchase price for indica rice for 2020-21, the first time since 2014: reaching RMB 2 420 (USD 343) per tonne for early indica rice and RMB 2 540 (USD 361) per tonne for mid-late indica rice (State Council, 2020[2]) (Teller Report, 2020[3]).

With rice procurement being slowed following the COVID-19 outbreak, in February 2020 the National Administration of Grain and Commodity Reserves extended the procurement of rice at minimum prices in North-eastern provinces until the end of March2 (State Council, 2020[4]). The state-owned China Grain Reserves Group (CGRG) also released an estimated 10 million tonnes of grains from stocks between 20 January and 31 March 2020 to stabilise market supply (XInhua, 2020[5]) (China.org, 2020[6]).

In March 2020, several guidelines were issued with the view to avoiding disruptions in spring planting and ensuring the continuation of farm operations. This includes the 26 March 2020 joint circular by the Ministry of Agriculture and Rural Affairs (MARA) and the Ministry of Human Resources and Social Security on an “Implementation Plan for Enlarging the Scale of Local Employment for Returning Rural Migrant Workers” which contributes to ensuring that migrant workers can swiftly retake farming operations under the lead of farmer co-operatives following the relaxation of confinement measures (SNSJ Agri China, 2020[7]).

MARA signed co-operation agreements with the China United Insurance Group and with the Agricultural Bank of China to ensure the availability of financial services for farmers and agribusinesses (SNSJ Agri China, 2020[8]) (SNSJ Agri China, 2020[9]).

The fiscal support policies put in place for small and medium-sized enterprises (SMEs) in February and March 2020 also cover agribusinesses. Measures include, among others: deferred tax payment; extended loans repayment periods; tax and social contributions exemptions for SMEs in difficulty (China Briefing, 2020[10]) (China Banking and Insurance Regulatory Commission, 2020[11]) (MOFCOM, 2020[12]).

China temporarily reduced import tariffs on certain products, including for instance medical supplies, raw materials, agricultural products, and meat (International Trade Centre, 2020[13]).

Agro-food supply chain policies

Several policies address input constraints. On 6 February 2020, the CGRC supplied over 8 000 tonnes of soybean meal to poultry farms at below market prices in the Hubei province in order to address animal feed shortages (China Daily, 2020[14]). On 15 February 2020, MARA issued together with the NDRC and the Ministry of Transport an “Urgent notice on addressing practical difficulties for resuming production in poultry and other livestock sectors”. The notice specifically supports the creation of domestic “green channels” for transporting feed from feed producers to livestock farmers facing logistical bottlenecks due to the COVID-19 quarantine restrictions (MARA, 2020[15]). MARA and the NDRC issued a 27 March 2020 notice prioritising the supply of water, electricity and gas to animal feed and poultry meat producers, as well as slaughtering and processing facilities (SNSJ Agri China, 2020[16]).

A central government Notice of 20 February 2020 addresses disruptions in access to fertilisers for crop farmers and to raw materials for fertiliser producers. China’s energy companies were requested to prioritise coal and gas supplies to fertiliser production, while several producers of potash fertiliser were requested to build up domestic stocks of those (Argus Media, 2020[17]).

Central and local governments have also supported e-commerce as an alternative channel for the purchase and distribution of agricultural inputs. Platforms such as Pinduoduo or Alibaba’s Taobao marketplace have been facilitating this for seeds, fertilisers, sprinklers, and other agricultural machinery (Reuters, 2020[18]).

On 31 January 2020, MARA released the “Initiative to the National Farmers Cooperatives” outlining the role of farmers co-operatives in the collection of real-time information both on the supply of agricultural products such as vegetables or meat and on the operation of transportation channels linking farmers to main wholesale markets. Under existing limits on the mobility of people, farmer co-operatives also have to supervise the quality and food safety requirements within supply chains (MARA, 2020[19]).

In February 2020, China introduced a ban on the transportation of live poultry, considered a factor of potential risk in the transmission of the virus, as well as a permanent ban on the trade and consumption of wildlife as food (IFPRI, 2020[20]).

“Green lanes” were also set up at major ports starting February 2020 to provide 24/7 clearance for agro-food goods. Imported agro-food products have been given priority in inspection over other goods to the extent possible (General Administration of Customs China, 2020[21]).

Consumer policies

MARA issued a notice at the end of January 2020 urging related departments to co-ordinate to maintain ample supplies of vegetables and stable prices. State-owned companies COFCO and Sinograin stepped up supplies of rice, meat and cooking oil to Hubei province in January 2020 also through the operation of specific “green channels” for food distribution (Japan Times, 2020[22]). About 44 600 food emergency supply outlets were established throughout the country (State Council, 2020[2]).

On 24 February 2020, the Wuhan Municipal Bureau of Commerce launched the “special vegetable package”, selling 4.5 kg of vegetables at the price of CNY 10 (USD 1.4) until 15 March 2020 (Teller Report, 2020[23]).

Support to producers (%PSE) had steadily increased from 2000-02 to 2016 before stabilising at 13.3% of gross farm receipts in 2017-19, below the OECD average. More than two-thirds of support to producers are in the form of potentially most distorting transfers, a consistent pattern since 2000-02. Prices received by farmers were on average 11% higher than world prices in 2017-19 (Figure 8.1). The absolute level of producer support remained stable year-on-year, with relatively steady budgetary payments, but increasing price gaps in pig meat and other livestock commodities following the African swine fever outbreak (Figure 8.2). With the exception of eggs, peanuts, and fruit and vegetables that are exported, producers are benefiting from high transfers accounting for between 11% and 51% of commodity receipts in 2017-19 (Figure 8.3). At 3.9% in 2017-19, expenditure for general services (GSSE) relative to agriculture value added is lower than the OECD average of 5.7%. Total support to agriculture as a share of GDP (%TSE) has remained relatively stable since 2000-02. At 1.7% in 2017-19, %TSE is nevertheless one of the highest among the countries covered, almost three times higher than the OECD average.

Contextual information

China has the world’s largest population and the second largest land area. It is an upper-middle income economy, with a GDP per capita – adjusted by PPP – close to 76% of the average of countries covered by this report (Table 8.2). However, while counting almost 20% of the world’s population, it has only 7% of the world’s potable water and 10% of the world’s agricultural land. China is thus a resource scarce country, which results in severe competition between agriculture and other users of land and water resources.

Agriculture still accounts for 26.8% of employment, but its 8.2% share in GDP indicates that labour productivity is significantly lower than in the rest of the economy. Even if rural incomes are growing at high rates, they remain at around one-third of those in urban areas.

Crop production represents 68% of total agricultural output and its composition has changed significantly over the last decades, driven by the shift towards higher value-added agricultural products such as fruit and vegetables. While the average farm size remains less than one hectare, large-scale production has been developing rapidly, including co-operative and corporate farms. North and northeast provinces have seen more rapid farm consolidation than other regions, as increased labour mobility and transfer of land among farmers over the past three decades have led to adjustments in the farm structure Livestock production originates mostly from larger-scale commercial units (OECD, 2018[24]).

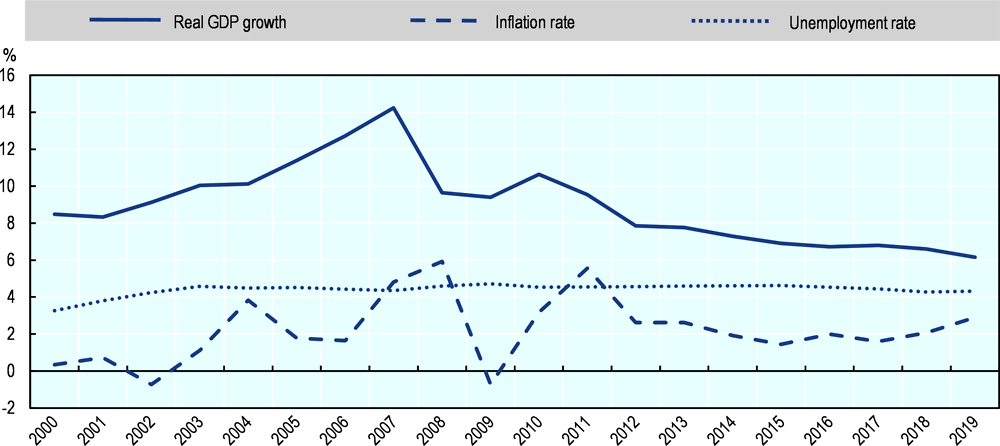

With real GDP growth averaging 6.5% in 2017-19, China continued to experience a gradual slowdown in economic growth. Its growth trajectory is not only increasingly dependent on the pace and nature of structural reforms, but is also under severe uncertainty in the aftermath of the COVID-19 outbreak. Unemployment nevertheless remained stable at 4.4% over the same period. The inflation rate increased to 3% in 2019, with food inflation largely driven by higher pig meat prices following the African swine fever outbreak (Figure 8.4).

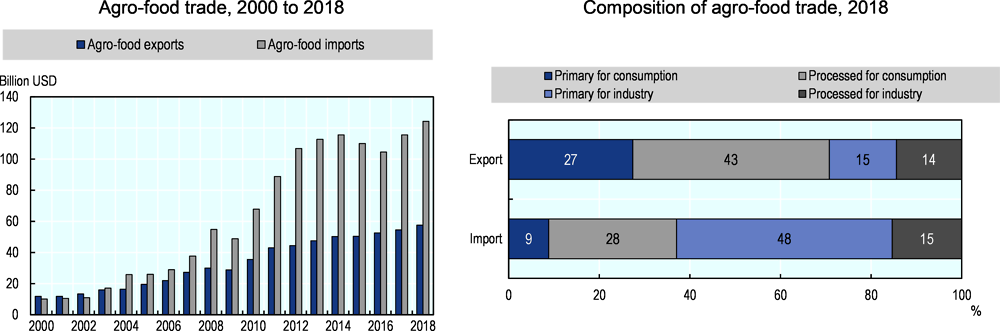

China has consistently been a net agro-food importer since 2003, but agro-food exports have been steadily growing over the last two decades. Primary products used as inputs in the domestic food industry dominate China’s agro-food imports, representing around half of the total in 2018. In turn, primary and processed products for final consumption are key export categories, accounting for 70% of total agro-food exports (Figure 8.5).

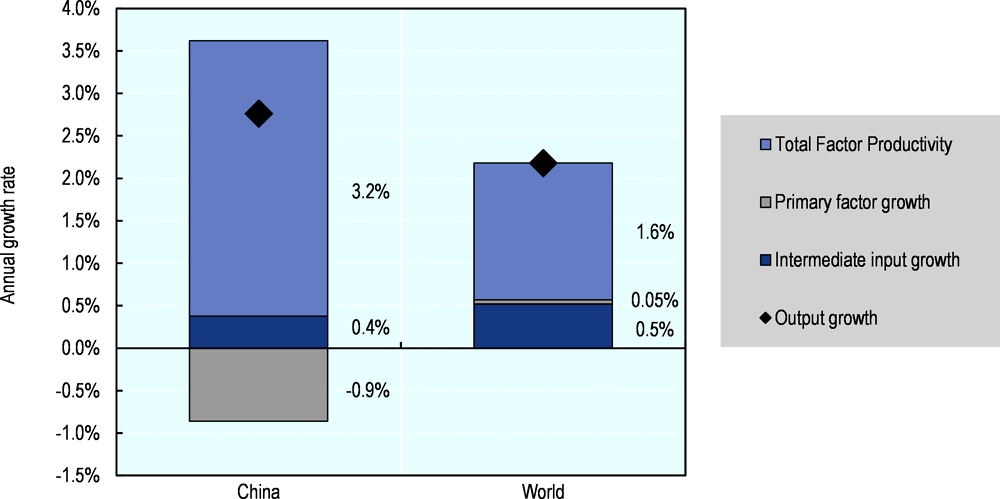

Agricultural output growth in China averaged 2.8% in 2007-16, almost one-third above the world average (Figure 8.6). This has been driven by strong growth in total factor productivity (TFP) at 3.2% per year, twice the global average. TFP growth can be largely attributed to farm consolidation and increased mechanisation of production.

However, the rapid and sustained growth in agricultural output has been exerting mounting pressures on natural resources, most notably on land and water. This is reflected in the high nutrient surplus intensities for nitrogen and phosphorus (Table 8.3). Agriculture remains the key user of water, accounting for 61.4% of total water consumption, well above the OECD average (Table 8.3). Water stress is twice as high as the OECD average.

Description of policy developments

Main policy instruments

The 13th Five-Year Plan sets out the key orientations of agricultural policy for 2016-20. The 2016-20 Plan focuses on “agricultural modernisation” across several dimensions, including: improving the quality and safety of agricultural products; supporting the development of new types of agribusiness; and strengthening the adoption and use of information technologies. Policy frameworks and specific areas for action are further developed in the annual “Policy Document No.1”, which for the last 17 years has set agriculture and rural development as top priority.

The ambition for self-sufficiency in key grains has been an important driver behind China’s agricultural policies over the past two decades. However, the scope of grains covered has evolved since the mid-1990s. The most recent editions of “Policy Document No.1” stress the importance of developing a competitive and sustainable agricultural sector and of continuing supply-side reforms, while reiterating the importance of guaranteeing the necessary grains production for food security purposes (mainly wheat and rice).

Market price support is the main channel for providing support to Chinese farmers. It is provided through both domestic policies – such as the minimum purchase prices for rice and wheat – and trade policies, including tariffs, tariff rate quotas (TRQ) and state trading.

The minimum purchase prices for wheat and rice are set every year by the National Development and Reform Commission (NDRC) in consultation with the Ministry of Agriculture and Rural Affairs (MARA) and other government institutions. Their application is limited to major wheat and rice producing provinces. They differ by type of grain, are announced before sowing seasons, and only apply for a fixed period limited to several months after the harvest. The central government mandates the state-owned China Grain Reserves Corporation (Sinograin) and other state-owned companies to undertake intervention purchases in the case market prices fall below the respective minimum prices. Only grain of national grade 33 or higher can be purchased at minimum prices since 2018. However, in situations with large volumes of grain below grade 3, such as in cases of extreme weather events, provincial authorities can purchase these under “temporary reserves”. In addition, minimum price procurement can begin only when the market price has fallen below the minimum price announced by the government for three days in a row and must be suspended when the market price rises above the minimum for three days.

The government-led temporary purchase and storage policy at pre-determined prices – mostly intended to stabilise market prices and to ensure adequate supplies – was discontinued in 2014-15 for cotton, soybeans, and rapeseed, and in 2016 for maize. For cotton, this was replaced by compensation payments covering the difference between pre-determined target prices and actual market prices. For soybeans and maize, it was replaced by direct payments based on area planted.

Budgetary transfers to producers have increased consistently since the end of the 1990s. Most of these are provided through four key programmes: (i) the “agricultural support and protection subsidy”, combining direct payments for grain producers, subsidies for agricultural inputs, and subsidies for improved seed variety, all paid on per unit of land basis; (ii) subsidies for purchases of agricultural machinery; (iii) subsidies for land consolidation; and (iv) subsidies for farmland irrigation construction. Subsidised agricultural insurance schemes have also grown in importance in recent years. The geographic coverage of payments destined to return farmland to forests and to exclude degraded grassland from grazing has been gradually extended, reflecting increasing environmental concerns.

Public stockholding of grains and programmes supporting the development of agricultural infrastructure – including irrigation and drainage facilities – represent the most important categories of general services. Expenditures related to agricultural knowledge and innovation are also sizable.

In the Adjusted Scenario of the Outline of the National Overall Planning on Land Use 2006-20, issued in 2016, a “red line” on arable land was set at no less than 124.3 million hectares. The conversion of farmland for non-agricultural use is strictly controlled. With about 40% of land suffering from various forms of degradation, the Outline calls for the prevention of land degradation and for the treatment of affected land.

China ratified the Paris Agreement on Climate Change on 3 September 2016. Its Nationally Determined Contributions (NDCs) include several commitments, such as: to peak CO2 emissions by 2030 at the latest; to lower the carbon intensity of GDP by 60-65% below 2005 levels by 2030; to increase the share of non-fossil energy carriers of the total primary energy supply to around 20% by 2030; and to increase its forest stock volume by 4.5 billion m3 compared to 2005 levels. While the NDC explicitly mentions agriculture, land-use change and forestry, among other sectors, no specific net-emission target has yet been set for the agricultural sector. The only specific quantitative target set for agriculture relates to achieving zero growth in fertiliser and pesticide utilisation by 2020, which MARA reported as already achieved in April 2018. Other broad objectives concern controlling methane emissions from rice fields and nitrous oxide emissions from farmland, promoting comprehensive utilisation of straw or reutilisation of agricultural waste (UNFCC, 2015[25]; Climate Action Tracker, 2018[26]).

The National Agricultural Sustainable Development Plan (2015-2030) sets the goals and paths for China’s sustainable agricultural development in terms of natural resources protection, improved farming practices that are protective of the environment, and a focus on quality and efficiency of production. It sets targeted priorities for different areas by taking into account the capacity of agricultural production, resource endowments, ecological characteristics and other factors (MOA, 2015[27]).

The State Council released its 13th Five-Year Work Plan to Control GHG Emissions in October 2016, looking to strengthen policies controlling for GHG emissions beyond CO2, such as methane and hydrofluorocarbons (HFCs). The plan includes mentions of reducing methane emissions in the agricultural sector and in municipal waste and sewage treatment (NDRC, 2017[28]).

Domestic policy developments in 2019-20

Developments in the policy and legal frameworks

In October 2019, the State Council issued a white paper on food security (“Food Security in China”). The document stresses the importance for China to remain self-sufficient in grains by ensuring domestic production capacity while allowing for “moderate” imports that would support the “need for variety” (without quantifying those imports, however). The white paper also emphasises the need to continue the reform of the grain purchase and storage system while adapting to WTO rules and preventing low grain prices from affecting farmers. An additional Notice by the State Council released on 16 October 2019 reinforces the objectives in the white paper on promoting the development of the food industry within the global agro-food landscape (State Council Information Office, 2019[29]; Xinhua, 2019[30]; State Council, 2019[31]).

According to the 2019 Urbanisation Plan issued on 8 April 2019 by the National Development and Reform Commission (NDRC), China aims to increase urbanisation by relaxing hukou (household registration) residency restrictions in big cities with a population between 1 and 3 million as well as in all small and medium-sized sized cities (China Briefing, 2019[32]). An amended Land Administration Law – adopted on 26 August 2019 – took effect in 2020. The amendments focus on speeding up rural revitalisation and enhancing urban-rural integrated development through more transparent and efficient land transactions. Land auctions, tenders, and listings are now executed through the recently launched online Public Resources Transactions Platform, which is yet to incorporate rural land contracts (MARA, 2019[33]; International Monetary Fund, 2019[34]).

The Central Committee of the Communist Party of China (CPC) and the State Council, in November 2019, issued guidelines to maintain rural land contracts across the country “stable and unchanged on a long-term basis”. As a result, once the current arrangements expire, the existing round of contracts will be extended for a further 30 years4 (CGTN, 2019[35]; CGTN, 2019[36]).

The 2020 Policy Document No. 15 – issued in February 2020 – stresses the fight against poverty as the top rural policy priority for 2020 in order to achieve building a “moderately prosperous society in all respects”. In this sense, the Document underlines the improvement in public services delivery in rural areas – through better rural infrastructure and water supply, sanitation and housing, education, health care and social insurance – as key towards eliminating poverty. Other priorities concern the stability of grains supply, increasing farmers’ incomes (including through the improvement of the minimum price policy for rice and wheat), strengthening governance in rural areas, and restoring pig meat production to the same levels prior to the African swine fever outbreak in 2018. It also emphasises the importance of promoting agro-food entrepreneurship and marketing through e-commerce (CGTN, 2020[37]).

Domestic price support policies

In April 2019, the Guangxi provincial government discontinued its sugar cane purchase floor price by mills (RMB 490 (USD 73) per tonne in 2019). This implies that farmers and sugar mills in Guangxi province now have the opportunity to freely establish contract parameters such as prices or volumes (Agriculture Strategies, 2019[38]; Caixin, 2019[39]; GAIN-CH0132, 2019[40]).

Stockholding policies

On 12 October 2019, the NDRC fixed for the first time a ceiling on the volume of wheat procured at the minimum purchase price at 37 million tonnes for 2020,6 estimated to be about 65% higher than wheat procurement in 2019. However, procurement has been increasing in recent years due to higher supplies meeting minimum grading standards (Cngrain, 2019[41]; GAIN-CH0179, 2019[42]).

On 28 February 2020, the National Food and Strategic Reserves Administration (NFSRA) introduced a ceiling on the volume of rice procured at the minimum purchase price at 50 million tonnes7 (more specifically, 20 million tonnes for indica rice and 30 million tonnes for japonica rice) (NFSRA, 2020[43]). This is estimated to be more than three times higher than rice procured in 2019.

The destocking of grains from central reserves slowed in 2019 due to a good harvest, weak demand and downward pressure on farm gate prices. The minimum purchase price programme for wheat and rice was activated in 2019 slightly later than in previous years to provide more time for private sector entities to purchase grains, but the degree of market intervention appears to have remained significant. Overall, available estimates indicate that the central government purchased 22.3 million tonnes of wheat and 15.2 million tonnes of rice at minimum prices, in total 41% higher than in 2018 (Cngrain, 2020[44]). This translated into higher grains marketing financing provided through loans from the Agricultural Development Bank of China8 (Agricultural Development Bank of China, 2019[45]).

In May 2019, the National Grain Trade Centre started auction sales of state-owned wheat inventories at an average reserve price of RMB 2 290 (USD 341) per tonne, about RMB 60 to RMB 120 (USD 9 to USD 18) lower than 2018 with pricing determined by the production year of the wheat auctioned. Overall, available estimates indicate that about 2.6 million tonnes of wheat held in reserves were sold through actions in 2019 (Cngrain, 2019[41]; GAIN-CH19060, 2019[46]; GAIN-CH19036, 2019[47]).

During 2019, China continued auctions of older crop rice reserves. Auction lots from the 2013-14 and 2014-15 marketing years are estimated at about 12.5 million tonnes (Cngrain, 2020[44]; GAIN-CH19060, 2019[46]).

Maize auctions slowed in 2019 and are estimated to have decreased by more than 78% in 2019 compared to 2018 (22 million tonnes in 2019 from 101 million tonnes in 2018). This was primarily motivated by food security concerns following a sharp decrease in stocks in previous years driven by the removal of the minimum purchase price for maize in 2016. Additional market and structural drivers for the slower maize auctions include lower domestic feed demand in the context of the African swine fever (ASF) outbreak and concerns over the quality of reserves. Concerns around food security would also explain why there was no announcement to continue the maize processor subsidies in 2019, which the provincial governments of Heilongjiang, Jilin, Liaoning and Inner Mongolia had been providing since 2018 to feed millers and industrial processors to promote the use of maize from state reserves. In parallel, maize stocks are estimated to have increased by 12 million tonnes in 2018-19, backed by a larger domestic output. Provincial procurement programmes also remained active (for instance, Heilongjiang province is estimated to have purchased 0.3 million tonnes of maize for provincial reserves) (Cngrain, 2020[44]; GAIN-CH19022, 2019[48]; GAIN-CH19060, 2019[46]).

Driven by the ongoing concerns over the quality of grains in state-owned inventories, a national grain quality and safety inspection and monitoring network was established in 2019. This is composed of 6 national-level, 32 provincial-level, 305 municipal-level and 960 county-level quality inspection institutions, with the key role of monitoring quality parameters for grain reserves stored in warehouses (State Council Information Office, 2019[29]).

In response to the decrease in pig meat supply and increasing consumer prices, the central government released frozen pig meat from state reserves, particularly to address shortages before the main holiday periods in January and October 2019. Provincial governments also tapped into local reserves at different moments throughout 2019, but estimates of quantities released at local or central level are not available (Reuters, 2019[49]).

Input subsidies

On 14 October 2019, a circular issued jointly by the Ministry of Finance (MOF), MARA, the Banking and Insurance Regulatory Commission and the National Forestry and Grassland Administration announced the expansion of insurance risk premium coverage for rice, wheat and maize to over 70% by 2022. The subsidy for agricultural insurance premiums launched in 2007 has become one of the key programmes to support producers in China. The central government currently subsidises insurance premiums for 15 products, including all the major crop and livestock commodities, at rates of 47.5% of the premium in central and western provinces and 42.5% in the eastern provinces (AMIS, 2019[50]; Xinhua, 2019[51]; OECD, 2018[24]).

Payments to producers

Payments to producers targeting the expansion of soybeans production continued to vary between provinces in 2019. In Heilongjiang these were up to RMB 255 per mu9 (USD 552 per ha), while in Jilin and Liaoning they were set up to RMB 265 per mu (USD 574 per ha) and RMB 276 per mu (USD 598 per ha), respectively (Heilongjiang Finance Department, 2019[52]; Jilin Finance Department, 2019[53]; Cheng, Zhu and Xiaohong, 2020[54]).

The Guangxi provincial government has introduced payments up to RMB 30 (USD 4.5) per tonne for sugar cane farmers planting designated varieties (GAIN-CH19006, 2019[55]).

Changes in the regulatory environment

On 1 April 2019, China lowered the value added tax (VAT) on sales (including imports) of agricultural products from 10% to 9%. This is the third consecutive cut since 2017 (when the VAT for agricultural products was 13%) (GAIN-CH0145, 2019[56]).

In July 2019, MARA issued Announcement No. 194 that calls for stopping the production, import, and inclusion of sub-therapeutic growth-promoting antibiotics in livestock feed in 2020. Production and import of such drugs is suspended as of 1 January 2020 and production of feed additive products containing growth-promoting antibiotics must stop by 1 July 2020. Feed products that have already been produced can be marketed until 31 December 2020. MARA is in the process of revising standards and designing a regulatory system with the objective of removing growth-promoting antibiotics from use in feed, while allowing antibiotics use for disease prevention (MARA, 2019[57]). The ban has been motivated by concerns about drug residues in animal-sourced food and bacteria resistance. Feed manufacturers anticipate an increase in feed costs once the ban takes effect, ranging around 1% to 3% for compound feed and less than 1% for feed additives (Feed Trade, 2019[58]).

On 15 August 2019, the National Health Commission, MARA and the State Administration of Market Regulation (SAMR) jointly released the National Food Safety Standard for Maximum Residue Limits for Pesticides in Foods to be implemented as of 15 February 2020. The standard sets 7 107 maximum limits of 483 pesticides in 256 categories of food products (GAIN-CH0170, 2019[59]).

On 30 August 2019, the SAMR and the Standardization Administration of China (SAC) introduced a national standard on organic products covering mandatory requirements for production, processing and labelling. These concern aspects of inputs processing and production, such as adding microbial preparations for the control and prevention of animal diseases, adding detergents and disinfectants in plant operations, adding requirements for packaging materials for feed products, or adjusting lists of food additives. The new standard and the accompanying certification regulations were classified as voluntary. However, for any products marketed in China as organic, compliance with this standard and accompanying regulations is mandatory (SAMR, 2019[60]).

The Regulation on the Implementation of the Food Safety Law published by the State Council entered into force on 1 December 2019. The regulation clarifies the responsibilities of producers and other businesses in the agro-food supply chain as regards food safety standards, storage and transportation, as well as exporting or importing. The regulation also underscores the need for tougher supervision, requiring local governments above county levels to establish a uniform and authoritative supervision mechanism and to enhance regulatory capacity building. It also establishes the penalties system for food safety violations (State Council, 2019[61]; Xinhua, 2019[62]).

On 21 January 2020, MARA issued the first biosafety certificates for domestically grown, genetically modified (GM) maize and soybean traits. These are the first GM crops to receive such certificates, which constitutes a first step towards commercialisation. The certificates will be valid for five years starting 2 December 2019 (CNBC, 2020[63]). So far, GM maize and soybeans have been allowed only as imported livestock feed.

Policy responses to animal and plant disease threats as well as to other outbreaks

African swine fever outbreak

MARA confirmed the first outbreak of the African swine fever (ASF) in Liaoning province in August 2018. The disease then spread to 32 provinces, reducing the pig herd inventory by 27.5% (or 310 million heads less) and the pig meat output by 21.3% in 2018-19, according to the China National Bureau of Statistics (NBS) January 2020 estimates10 (National Bureau of Statistics, 2020[64]). NBS also reported that pig meat retail prices doubled in December 2019 from the previous year, accounting for 2.3 percentage points of the 4.5% year-on-year increase in the Consumer Price Index. In this context, central and provincial government responses to the ASF outbreak focused on policy measures to contain and prevent the spread of the virus, to compensate producers as well as to rebuild the pig herd and enhance pig meat production.

In April 2019, MARA requested pig meat processors to test for the presence of ASF in raw meat handled, starting 1 May 2019. Processors require certificates confirming that purchased pig products, including imported meat, do not carry the virus (Reuters, 2019[65]).

On 4 December 2019, MARA issued a Notice outlining the “Three-year Action Plan to Accelerate the Recovery and Development of Pig Production” (MARA, 2019[66]). The Notice includes several areas for action as regards containment and prevention of the virus, requesting local administrations to:

encourage farmers in purchasing automated feeding and waste treatment equipment using the agricultural machinery and equipment subsidy programme;

encourage farmers to inspect animals and promptly report the presence of the disease;

punish concealment and intentional delays in reporting, or false reports;

set up province- and city-level animal disease administration, strengthen city and county veterinary laboratories capacity, carry out a special employment plan for disease prevention personnel;

create a system of collection points for the safe disposal of carcasses of pigs carrying the virus;

shift slaughter enterprises to major production regions in the northeast, the Huang-Huai region, and the south-central provinces to avoid the movement of animals, as well as to ensure that slaughter facilities have on-site veterinary inspectors;

strengthen research and development efforts for an ASF vaccine and enhance extension services to farmers.

On 21 August 2019, the central government confirmed that farmers would be provided a compensation of RMB 1 200 (USD 170) for every pig culled to stop the spread of the disease (Reuters, 2019[67]).

Several other measures were initiated with the objective of restoring the pig herd and further stabilising domestic pig meat supply. In September 2019, the NDRC and MARA announced one-off subsidies for large pig farms ranging between RMB 0.5 million and RMB 5 million (USD 70 570 and USD 0.7 million). The support should be used for the construction of facilities and relocation projects for farms and should not exceed 30% of the total project investment (Xinhua, 2019[68]). Recent estimates available highlight that China’s pig herd increased by 2.2% between November and December 2019, but efforts to rebuild the herd are currently being hampered by disruptions in supply chains linked to the Covid-19 outbreak (South China Morning Post, 2020[69]; Financial Times, 2020[70]).

The 4 December Notice by MARA foresees loosening bans on using certain farmland to build pig farms and simplifying approvals for setting up facilities. It also encourages local authorities to relax the application of local environmental bans on livestock farms. Farms of at least 5 000 pigs can start operating without having to wait for a final approval. Pig meat deficit cities and coastal regions are asked to form direct co-ordinated links with production regions in order to fill the deficits, as well as to use a pilot electronic system for transmitting animal inspection certificates and collecting statistics monitoring inter-province pig transportation (MARA, 2019[66]).

Almost all provincial-level administrative units also set up action plans at local levels to reinforce the application of measures designed at the central level. For instance, Guangdong and Tianjin provinces presented plans providing subsidies for breeding farms, low-interest loans and improved insurance policies (China Daily, 2019[71]).

Fall armyworm invasion

Fall armyworm was first detected in the South-western province of Yunnan in January 2019 and ultimately affected 16.9 million mu of farmland (1.1 million ha or 0.01% of China’s arable land area) in 26 provinces by the end of 2019. It mainly affected crops of maize, wheat, ginger, sugar cane and sorghum, but did not reach the North-eastern grain producing provinces. Central and provincial government responses to the fall armyworm invasion focused on policy measures to control and prevent its spread. At the end of 2019, the National Agriculture Technology Extension Service Centre (NATESC) in MARA averted that the fall armyworm could spread in the maize belt across north-eastern provinces in 2020 (Reuters, 2019[72]).

On 21 June 2019, MARA issued the 2019 Fall Armyworm Prevention and Control Plan, requesting as part of the measures crop rotation across more than 30% of the affected area. In addition, MARA and the Chinese Academy of Agricultural Sciences (CAAS) researchers collaborated with companies to revise labelling requirements for crop protection chemicals that proved to effectively control the fall armyworm spread by enabling farmers to access and comply more easily with China’s regulations for pesticide use (MARA, 2019[73]) (GAIN-CH19033, 2019[74]). In addition, on 5 June 2019, MARA recommended a list of 25 pesticides for emergency use against the fall armyworm until December 2020 (AMIS, 2019[75]).

On 21 February 2020, MARA issued the 2020 Fall Armyworm Prevention and Control Plan. Estimating that the fall armyworm would affect 100 million mu (7 million ha) in 2020, MARA plans to focus on upgrading the monitoring architecture by reinforcing county-level plant protection agencies and conducting systematic observations every three days in fields (MARA, 2020[76]).

Agri-environmental measures

The Soil Pollution Prevention and Control Law entered into force in January 2019. The Law establishes systems for agricultural land classification management according to pollution levels and identified risks. The primary responsibility for supervising and administering the actions against soil pollution lies with the MEE, with MARA and the Ministry of Natural Resources playing a supporting role. The Law requires them to establish a soil environmental information platform, to include soil pollution prevention and control in their economic development and environmental protection plans, and to establish a soil environmental monitoring system with regular soil examinations. The Law specifically grants local governments the enforcement responsibility in controlling and regulating soil pollution. Land use rights holders must investigate and assess soil conditions upon the transfer of management rights or in the incidence of a pollution event. However, when no party responsible for the pollution can be identified, central and provincial governments are to establish pollution clean-up funds (MEE, 2018[77]) (Global Compliance News, 2019[78]; Asia Society Policy Insitute, 2019[79]).

A first list of 40 national green agricultural development pilot zones was identified in 2019 under the National Agricultural Sustainable Development Plan 2015-20. In addition, a budget of RMB 1.7 billion (USD 0.25 billion) was allocated to reconvert 20 000 hectares of farmland into wetland (Ministry of Foreign Affairs, 2019[80]).

On 28 March 2019, the Ministry of Ecology and Environment (MEE) together with MARA, the Ministry of Natural Resources, the Ministry of Housing and Urban-Rural Development and the Ministry of Water Resources released jointly the Notice on “Issuing the Implementation Plan for Groundwater Pollution Prevention and Control”. The Notice established a roadmap for the implementation by the end of 2020 of a law on groundwater pollution control and a national groundwater environmental monitoring system (China Council for International Cooperation on Environment and Development, 2019[81]).

On 17 January 2020, the MEE announced that over the next five years it would restrict farming that encroaches on major rivers while accounting for food security concerns. MEE will set such areas under “ecological protection red lines” with the objective of contributing to the restoration of contaminated water supplies (Reuters, 2020[82]).

On 8 January 2020, the NDRC suspended its plan to implement this year a nationwide blending mandate of 10% ethanol (E10) in transportation. The motivation for this appears to have been twofold. First, maize stocks declined more sharply than anticipated between 2016 and 2018. Second, the production capacity of biofuels seems to remain limited in spite of the expansion in maize processing and ethanol operations in Jilin and Liaoning provinces initiated by the China National Cereals, Oils and Foodstuffs Corporation (COFCO) (China’s largest state-owned food processor) in 2018-19 (Reuters, 2020[83]; South China Morning Post, 2020[84]).11

Technology and digital in agriculture

Jiangsu province launched in June 2019 a traceability platform for agricultural products. Consumers can scan the QR codes on products using their mobile phones and obtain details on producers and the production process. More than 3 800 agro-food producers in the province registered with the platform in 2019 (Xinhua, 2019[85]).

Trade policy developments in 2019-20

Changes to import tariffs

On 23 December 2019, the State Council approved most favoured nation (MFN) tariff reductions for 850 products, which have been applied since 1 January 2020. This includes an MFN tariff reduction for frozen pig meat products from 12% to 8% and for avocados from 30% to 7% (South China Morning Post, 2019[86]).

The State Council Tariff Commission (SCTC) implemented additional retaliatory tariffs in 2019 on agricultural products from the United States, following the several rounds already imposed during 2018. On 13 May 2019, the SCTC first applied additional tariffs between 5% and 10% on wheat, maize and soybeans-related products from the United States (AMIS, 2019[87]). On 1 June 2019, the SCTC then levied an additional 25% tariff on other selected US goods, including dairy products and fresh fruit. Last, on 1 September, the SCTC introduced additional tariffs of 10% on US fresh fruit and of 5% on several cheeses (GAIN-CH19062, 2019[88]). The “Phase One Deal” Agreement concluded between China and the United States on 13 December 2019 does not foresee a timetable for their removal (see also section on Free Trade Agreements and other economic partnerships). However, in the context of supply chain disruptions caused by the coronavirus outbreak in January 2019, the SCTC halved, on 14 February 2020, the additional tariffs introduced on 1 September 2019 on US goods, including on certain fresh fruit and cheeses (Financial Times, 2020[89]).

There were also several tariff waivers and exclusions implemented by China on agricultural products originating in the United States. For instance, on 22 October 2019 – as part of the 2019 China-United States trade discussions – China waived the additional tariffs on imports for about 10 million tonnes of soybeans of US origin if imported by major processing operators (AMIS, 2019[50]).

On 15 April 2019, MOFCOM initiated a review of its anti-dumping tariffs on imports of distiller’s grains from the United States that it would complete within a year. From January 2017, the anti-dumping duties have been raised to between 42.2% and 53.7%, while anti-subsidy tariffs have ranged between 11.2% and 12% (AMIS, 2019[90]).

Import quotas

In May 2019, an additional import quota of 0.8 million tonnes was issued for cotton. Moreover, the central government implemented a more flexible application process for the annual WTO-required import quota of 894 000 tonnes (subject to 1% import duty). The application process for the 2020 quota was opened in late October 2019 to a widened pool of applicants (GAIN-CH0157, 2019[91]).

In August 2019, MOFCOM removed soybean oil, rapeseed oil and palm oil from its import tariff quota management (CGTN, 2019[92]).

Measures relating to sanitary and phytosanitary aspects

In March 2019, China lifted the import ban on poultry and related products from France, which had been in place since 2015 following an outbreak of avian influenza. Prior to the ban, France was a major supplier of breeding stock for China’s white-feathered broiler chicken producers who have faced challenges replenishing their stock in recent years due to bird flu-related bans on several countries (Reuters, 2019[93]). In November 2019, China lifted the ban on poultry imports from Spain and the Slovak Republic, which had been in place since 2016 (Reuters, 2019[94]). Also in November 2019, China lifted the restrictions on poultry imports from the United States. China had banned the import of poultry and related products from the United States after avian influenza outbreaks occurred in some parts of the United States in 2013-14 (China Daily, 2019[95]).

In October 2019, China finalised the agreement with the United Kingdom lifting the twenty-year old import ban on beef imports, which had been removed through an initial protocol in June 2018. Through the finalised agreement, Chinese authorities cleared in 2019 four beef producing sites for export in a first instance, with further sites still under review. In addition, in 2019 China also approved beef imports from several meat processing plants in Argentina and Brazil (Global Meat News, 2019[96]).

Following the “Phase One Deal” Agreement with the United States (see section on Free Trade Agreements and other economic partnerships), China drew up in February 2020 food safety standards on residue limits of growth hormones in beef. Maximum residue limits (MRLs) for zearanol and trenbolone acetate in beef muscle are set at 2 micrograms per kg, while for melengestrol acetate at 1 microgram per kg. MRLs are in line with those used by Codex Alimentarius and will apply to all beef exporters to China (Reuters, 2020[97]). China also eliminated cattle age requirements for the importation of US beef and beef products. In March 2020, the USDA Animal and Plant Health Inspection Service signed with China a “poultry regionalisation agreement” allowing producers in areas of a country unaffected by a disease outbreak to continue to export even if avian diseases are detected in other parts of that country (Inside U.S. Trade, 2020[98]).

Restrictions on pig and beef meat imports from Canada were in place from June to November 2019 after Chinese border authorities reported the detection of residues from a restricted feed additive (ractopamine) in a batch of Canadian pig meat products as well as erroneous export certificates for Canadian pig and beef meat (Financial Times, 2019[99]).

In July 2019, the General Administration of China Customs (GACC) approved 24 dairy establishments from Brazil for exporting to China, covering dairy products such as milk powder, cheese, yoghurt, and cream products. This is the first time China has granted dairy market access to Brazil (GAIN-CH0127, 2019[100]).

In February 2019, China approved market access for maize and barley imported from Uruguay (GAIN-CH19022, 2019[48]). In July 2019, GACC also approved wheat imports from the Russian Federation region of Kurgan, as well as soybeans and barley imports from all regions of the Russian Federation (see also section on Free Trade Agreements and other economic partnerships) (Reuters, 2019[101]).

In March 2019, China suspended imports from certain Canadian rapeseed exporters after reports of border inspections detecting hazardous pests in several shipments. The exporters were removed from the GACC list of authorised shippers (World Grain, 2019[102]).

Free Trade Agreements and other economic partnerships

As part of the negotiations for Phase-II Protocol of the China-Pakistan Free Trade Agreement (FTA), which was concluded on 28 April 2020 and entered into force on 1 January 2020, China eliminated tariffs on a range of agricultural products, including selected fresh and frozen meat, fresh and dried fruit, groundnuts, and vegetable fats and oils (China Briefing, 2019[103]).

In November 2019, China and New Zealand concluded negotiations on upgrading the China-New Zealand FTA, which has been in force since 2008. The upgraded Agreement includes a number of provisions with a direct impact on agro-food products. This concerns areas such as certificates of origin (introducing the option for ‘approved exporters’ to self-declare the origin of their goods) as well as simplifying administrative processes and trade documentation for goods in transit. Further operational improvements cover expedited six-hour clearance times for perishable products, release of such goods outside normal business hours, and appropriate storage. The upgraded Agreement is foreseen to enter into force following its signature and ratification by parties in 2020, the exact timing of which is still to be defined (New Zealand Ministry of Foreign Affairs and Trade, 2019[104]).

On 6 November 2019, China and the European Union (EU) concluded negotiations on a China-EU Geographical Indications (GI) Agreement – China’s first comprehensive bilateral GI Agreement – with each party agreeing to protect 100 of the other’s GI products. The protected EU GIs include dairy products, beer, wine, and spirits, while the list of Chinese products includes Pixian bean paste, Anji white tea, Panjin rice and Anqiu ginger. After proceeding with internal procedures, China and the European Union should finalise and sign the Agreement before the end of 2020, with exact timelines still pending. The Agreement is subject to ratification by the two parties. Four years after the Agreement enters into force, it will be expanded to protect an additional 175 GIs from both sides, which will undergo the same registration procedure as for the first 200 protected GIs (European Commission, 2019[105]).

In June 2019, China signed a Memorandum of Understanding with Myanmar allowing the latter to export as much as 100 000 tonnes of rice during one year. In turn, Myanmar will import an equivalent value of rice milling and processing equipment from China (GAIN-CH19036, 2019[47]). Also in June 2019, China signed an agreement with Cambodia to enhance storage capacity in Cambodia for exports of paddy and milled rice to China (AMIS, 2019[75]).

In June 2019, China and the Russian Federation concluded a strategic partnership (“New Age Comprehensive Strategic Collaboration Partnership”) which includes a specific provision to promote soybeans production by the Russian Federation’s Far East and Baikal Regions and exports to China’s north-eastern provinces (Xinhua, 2019[106]).

On 13 December 2019, China and the United States reached a “Phase One Deal” Agreement (“Economic and Trade Agreement between the United States and the People’s Republic of China”), which includes several chapters with a direct link to agriculture. The Agreement was signed on 15 January 2020 and entered into force on 14 February 2020. Chapter 3 (“Trade in Food and Agricultural Products”) addresses non-tariff measures aspects for several agro-food products, including rice, horticultural products, animal feed and feed additives, meat products, dairy, infant formula, and products of agriculture biotechnology. China and the United States agreed to not implement food safety regulations – or require actions of each other’s regulatory authorities – that are not science- or risk-based and to apply regulations and require such actions only to the extent necessary to protect human life or health. In addition, the GACC will work with the US Department of Agriculture (USDA) to finalise the technical requirements for – and to implement – an electronic and automated system for China to access USDA Food Safety and Inspection Service (FSIS) export certificates accompanying US exports to China of meat and poultry products (USTR, 2020[107]).

The same Chapter 3 also covers issues with respect to the application of China’s TRQ system for wheat, rice and maize. The Agreement requires for TRQ eligibility, allocation, return, reallocation and penalties not to discriminate between State Trading Enterprises (STEs) and non-STEs. Section F in Chapter 1 (‘Intellectual Property’) of the Agreement covers ‘Geographical Indications’, while the ‘Expanding Trade’ Chapter 6 includes commitments from China to import various goods and services from the United States over the next two years by a minimum of USD 200 billion over China’s annual level of imports for those goods and services in 2017. For the agricultural goods identified in Annex 6.1 (oilseeds, meat, cereals, cotton, and other agricultural commodities12), the Agreement commits China to purchase and import no less than USD 12.5 billion in 2020 and no less than USD 19.5 billion in 2021 over its baseline purchases in 2017 (USTR, 2020[107]).13 In January 2020, MARA reported that China will not increase its annual low-tariff (1%) import quotas for rice, wheat and maize in order to accommodate some of these purchases (Caixin, 2020[108]).

Other trade-related developments

A WTO dispute panel circulated its report on 28 February 2019 in response to the request for consultations initiated by the United States on 13 September 2016 regarding certain measures of China’s support in favour of producers of wheat, rice and maize during 2012-15. The panel determined that in each of the years 2012-15, China exceeded its 8.5% de minimis level of support for rice and wheat. On that basis, the panel recommended for China to bring such measures into conformity with its obligations under the Agreement on Agriculture. On 10 June 2019, the United States and China informed the Dispute Settlement Body (DSB) they had agreed that the reasonable period of time for China to implement the DSB’s recommendations and rulings would be 11 months and 5 days (therefore, until 31 March 2020) (WTO, 2019[109]). Regarding the date by which China must implement the WTO ruling on its allocation of agricultural TRQs, the United States and China agreed in March 2020 to extend the date to 29 May 2020 (Inside U.S. Trade, 2020[98]).

References

[45] Agricultural Development Bank of China (2019), NDRC Strongly Supports Reform of the Food Distribution System to Ensure National Food Security, http://www.adbc.com.cn/n5/n15/c35963/content.html (accessed on 15 January 2020).

[38] Agriculture Strategies (2019), The Sugar Policy in China: the Sharing of Value at the Heart of the Device, http://www.agriculture-strategies.eu/en/2019/03/the-sugar-policy-in-china-the-sharing-of-value-at-the-heart-of-the-device/ (accessed on 10 January 2020).

[87] AMIS (2019), AMIS (2019), AMIS Market Monitor, No. 69, June 2019.

[90] AMIS (2019), AMIS Market Monitor, No. 68, May 2019.

[75] AMIS (2019), AMIS Market Monitor, No. 70, July 2019.

[50] AMIS (2019), AMIS Market Monitor, No. 73, November 2019.

[17] Argus Media (2020), China’s Government Moves to Ensure Fertilizer Supply, https://www.argusmedia.com/en/news/2074052-chinas-government-moves-to-ensure-fertilizer-supply (accessed on 10 April 2020).

[79] Asia Society Policy Insitute (2019), The China Dashboard: Environmental Policy Reform, https://chinadashboard.asiasociety.org/winter-2019/page/environment (accessed on 20 January 2020).

[108] Caixin (2020), China Will Not Raise Grain Import Quotas For U.S., Official Says, https://www.caixinglobal.com/2020-01-07/china-wont-raise-grain-import-quotas-for-us-official-says-101501928.html (accessed on 10 January 2020).

[39] Caixin (2019), Government Bows Out of Sugar Cane Price Setting, https://www.caixinglobal.com/2020-01-17/investors-cash-out-of-online-lender-qudians-after-guidance-withdrawal-101505295.html (accessed on 9 January 2020).

[37] CGTN (2020), China Unveils Key Policy Document on Agricultural, Rural Work in 2020, https://news.cgtn.com/news/2020-02-05/China-unveils-No-1-central-document-on-agricultural-issues-for-2020-NQ0THuzpzW/index.html (accessed on 28 February 2020).

[35] CGTN (2019), China Issues Guideline to Keep Land Contracting Practices “Unchanged”, https://news.cgtn.com/news/2019-11-26/China-proposes-to-keep-land-contract-relationship-stable-and-unchanged-LWd8lnQbXq/index.html (accessed on 10 December 2019).

[36] CGTN (2019), Chinese Rural Land Contracts Eextended for 30 Years, https://news.cgtn.com/news/2019-11-28/Chinese-rural-land-contracts-extended-for-30-years-LZL8NHr4be/index.html (accessed on 15 January 2020).

[92] CGTN (2019), MOFCOM to Remove Soybean Oil, Rapeseed Oil, Palm Oil Import Quotas, https://news.cgtn.com/news/2019-08-07/MOFCOM-to-remove-soybean-oil-rapeseed-oil-palm-oil-import-quotas-IXSohKp4wU/index.html (accessed on 10 December 2019).

[54] Cheng, G., M. Zhu and W. Xiaohong (2020), Background Information for 2020 China PSE Database.

[11] China Banking and Insurance Regulatory Commission (2020), Implementation of the Temporary Extension of Principal and Interest Repayment for Loans to SMEs, http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html?docId=892278&itemId=926 (accessed on 10 April 2020).

[10] China Briefing (2020), China’s Latest Regional Measures to Support SMEs during the Coronavirus Outbreak, https://www.china-briefing.com/news/chinas-latest-regional-measures-to-support-smes-during-coronavirus-outbreak/ (accessed on 10 April 2020).

[32] China Briefing (2019), China is Relaxing Hukou Restrictions in Small and Medium-Sized Cities, https://www.china-briefing.com/news/china-relaxing-hukou-restrictions-small-medium-sized-cities/ (accessed on 15 December 2019).

[103] China Briefing (2019), China-Pakistan FTA Phase-II: Reduced Tariffs, New Safeguard Measures, https://www.china-briefing.com/news/china-pakistan-fta-phase-2-reduced-tariffs-safeguard-measures-introduced/ (accessed on 10 December 2019).

[81] China Council for International Cooperation on Environment and Development (2019), Progress on Environment and Development Policies in China and Impact of CCICED’s Policy Recommendations (2018-19), https://www.iisd.org/sites/default/files/publications/cciced/agm/cciced-progress-report-2019-en.pdf (accessed on 20 December 2019).

[14] China Daily (2020), Feed Sent to Chickens in Need Amid Pandemic, https://www.chinadaily.com.cn/a/202002/06/WS5e3bbd1fa31012821727580f.html (accessed on 10 April 2020).

[95] China Daily (2019), China Lifts Restrictions on U.S. Poultry Imports, https://www.chinadaily.com.cn/a/201911/14/WS5dcd389aa310cf3e35577672.html (accessed on 15 December 2019).

[71] China Daily (2019), China Plans More Measures to Help Stabilize Pork Prices, https://www.chinadaily.com.cn/a/201911/15/WS5dce126ca310cf3e35577974.html (accessed on 15 December 2019).

[6] China.org (2020), China Increases State Rice Purchasing to Strengthen Grain Reserve, http://www.china.org.cn/business/2020-04/10/content_75915928.htm (accessed on 10 April 2020).

[26] Climate Action Tracker (2018), “Countries: China”, http://climateactiontracker.org/countries/china.html (accessed on 15 January 2019).

[63] CNBC (2020), China Issues Biosafety Certificates for Domestic GM Corn, Soybean Traits, https://www.cnbc.com/2020/01/21/reuters-america-update-1-china-issues-biosafety-certificates-for-domestic-gm-corn-soybean-traits.html (accessed on 22 January 2020).

[44] Cngrain (2020), Progress in Policy Destocking Declines Significantly in 2019, http://www.cngrain.com/Publish/1/663336.html (accessed on 21 January 2020).

[41] Cngrain (2019), Notice on Improving Relevant Policies for Minimum Wheat Purchase Price, (accessed on 3 November 2019).

[105] European Commission (2019), Landmark Agreement Will Protect 100 Geographical Indications in China, https://ec.europa.eu/commission/presscorner/detail/en/ip_19_6200 (accessed on 5 January 2020).

[58] Feed Trade (2019), 100 Feed Companies Surveyed, http://m.feedtrade.com.cn/article?classid=11246&id=2018073 (accessed on 10 January 2020).

[70] Financial Times (2020), Chinese Piglet Prices Jump on Supply Disruptions, https://www.ft.com/content/21ecc1a4-5ecd-11ea-b0ab-339c2307bcd4 (accessed on 6 March 2020).

[89] Financial Times (2020), Global Shares Rally After China Pledges Tariff Cuts on US Goods, https://www.ft.com/content/6e7113ac-489a-11ea-aeb3-955839e06441 (accessed on 6 February 2020).

[99] Financial Times (2019), China Lifts Ban on Canadian Beef and Pork Exports, https://www.ft.com/content/be42bd22-0010-11ea-b7bc-f3fa4e77dd47 (accessed on 10 December 2019).

[100] GAIN-CH0127 (2019), Dairy and Products Annual.

[40] GAIN-CH0132 (2019), Sugar Semi-annual.

[56] GAIN-CH0145 (2019), Fresh Deciduous Fruit Annual.

[91] GAIN-CH0157 (2019), Cotton and Products Update.

[59] GAIN-CH0170 (2019), National Food Safety Standard Maximum Residue Limits for Pesticides in Foods.

[42] GAIN-CH0179 (2019), China Announces 2020 Wheat Minimum Support Price at 2019 Level.

[55] GAIN-CH19006 (2019), Sugar Annual: Chinese Sugar Production Growth Expected to Slow, Prices Rise.

[48] GAIN-CH19022 (2019), Grain and Feed Annual.

[74] GAIN-CH19033 (2019), Fall Armyworm Now in 15 of China’s Provinces.

[47] GAIN-CH19036 (2019), Corn Prices Rise Amid Unprecedented Supply and Demand Shocks.

[46] GAIN-CH19060 (2019), Rice Auction Sales Boom.

[88] GAIN-CH19062 (2019), China Announces Increases to Additional Tariffs on U.S. Agricultural Products.

[21] General Administration of Customs China (2020), GACC Launches Facilitative Measures, http://english.customs.gov.cn/Statics/8f0f8824-eef2-492b-ace6-77d84bf12f1f.html (accessed on 15 April 2020).

[78] Global Compliance News (2019), China’s New Law on the Prevention and Control of Soil Pollution Imposes New Obligations, https://globalcompliancenews.com/china-new-law-prevention-control-soil-pollution-20181012/ (accessed on 16 December 2019).

[96] Global Meat News (2019), Britain and China Finalise Beef Trade Deal, https://www.globalmeatnews.com/Headlines/Industry-Markets/Britain-China-beef-trade-deal-finalised (accessed on 10 December 2019).

[52] Heilongjiang Finance Department (2019), Information on Payments to Soybeans Producers.

[20] IFPRI (2020), How China Can Address Threats to Food and Nutrition Security From the Coronavirus Outbreak, https://www.ifpri.org/blog/how-china-can-address-threats-food-and-nutrition-security-coronavirus-outbreak (accessed on 28 February 2020).

[98] Inside U.S. Trade (2020), “March 27 2020 Edition”, Vol. 18/13.

[34] International Monetary Fund (2019), IMF China Country Report No. 19/266, https://www.imf.org/en/Publications/CR/Issues/2019/08/08/Peoples-Republic-of-China-2019-Article-IV-Consultation-Press-Release-Staff-Report-Staff-48576 (accessed on 20 January 2020).

[13] International Trade Centre (2020), Market Access Map – COVID-19 Temporary Trade Measures, https://www.macmap.org/covid19.

[22] Japan Times (2020), China Steps Up ’Green Channel’ to Supply Food to Wuhan, https://www.japantimes.co.jp/news/2020/01/30/asia-pacific/science-health-asia-pacific/chinese-farmers-supermarkets-race-supply-food-locked-wuhan/#.XpNx2MgzY2w (accessed on 10 April 2020).

[53] Jilin Finance Department (2019), Information on Payments to Soybeans Producers.

[19] MARA (2020), Initiative for the National Farmers’ Cooperatives, http://www.moa.gov.cn/ztzl/kjxgfy/202002/t20200206_6336647.htm (accessed on 10 April 2020).

[76] MARA (2020), Notice of MARA on the Fall Armyworm Prevention and Control Plan in 2020, http://www.moa.gov.cn/gk/tzgg_1/tz/202002/t20200221_6337551.htm (accessed on 15 March 2020).

[15] MARA (2020), Urgent Notice on Addressing Practical Difficulties for Resuming Production in Poultry and Other Livestock Sectors, http://www.moa.gov.cn/xw/zwdt/202002/t20200215_6337140.htm (accessed on 30 March 2020).

[57] MARA (2019), Announcement No. 194, http://www.xmsyj.moa.gov.cn/zcjd/201907/t20190710_6320678.htm (accessed on 5 December 2019).

[33] MARA (2019), China’s New Land Administration Law Took Effect in 2020, http://english.agri.gov.cn/news/dqnf/201909/t20190921_296217.htm (accessed on 6 January 2020).

[73] MARA (2019), Notice of MARA on Fall Armyworm Prevention and Control Technology Plan, http://www.moa.gov.cn/govpublic/ZZYGLS/201906/t20190628_6319824.htm (accessed on 20 February 2020).

[66] MARA (2019), Notice of MARA on Issuing the Three-Year Action Plan to Accelerate the Recovery and Development of Pig Production, http://www.moa.gov.cn/gk/zcfg/qnhnzc/201912/t20191206_6332872.htm (accessed on 16 December 2019).

[77] MEE (2018), Law of the People’s Republic of China on Soil Pollution Control, http://www.mee.gov.cn/ywgz/fgbz/fl/201809/t20180907_549845.shtml (accessed on 20 February 2020).

[80] Ministry of Foreign Affairs (2019), China’s 2019 Progress Report on Implementation of the 2030 Agenda for Sustainable Development, https://www.fmprc.gov.cn/mfa_eng/topics_665678/2030kcxfzyc/P020190924780823323749.pdf (accessed on 15 January 2020).

[27] MOA (2015), “National Agricultural Sustainable Development Plan (2015-2030)”, http://www.moa.gov.cn/zwllm/zwdt/201505/t20150527_4619961.htm (accessed on 10 January 2019, in Chinese).

[12] MOFCOM (2020), Guiding Opinions Responding to the Impact of the Epidemic, http://www.mofcom.gov.cn/article/h/redht/202003/20200302940639.shtml (accessed on 10 April 2020).

[64] National Bureau of Statistics (2020), In 2019, the Overall Stable Development of the National Economic Operation is Expected to Achieve the Main Goals, http://www.stats.gov.cn/tjsj/zxfb/202001/t20200117_1723383.html (accessed on 20 January 2020).

[28] NDRC (2017), “China’s Policies and Actions for Addressing Climate Change 2017”.

[104] New Zealand Ministry of Foreign Affairs and Trade (2019), Key Outcomes to the NZ-China Free Trade Agreement Upgrade, https://www.mfat.govt.nz/en/trade/free-trade-agreements/free-trade-agreements-concluded-but-not-in-force/nz-china-free-trade-agreement-upgrade/key-outcomes-to-the-nz-china-free-trade-agreement-upgrade/ (accessed on 20 January 2020).

[43] NFSRA (2020), Notice on Improving the Policies Regarding the Minimum Rice Purchase Price, http://www.lswz.gov.cn/html/lstk/2020-02/28/content_249501.shtml (accessed on 3 March 2020).

[24] OECD (2018), Innovation, Agricultural Productivity and Sustainability in China, OECD Food and Agricultural Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264085299-en.

[97] Reuters (2020), China Proposes Standards on Hormone Residues in Beef After U.S. Trade Deal, https://mobile.reuters.com/article/amp/idUSKBN20Z31W?__twitter_impression=true (accessed on 15 March 2020).

[83] Reuters (2020), China Suspends National Rollout of Ethanol Mandate, https://www.reuters.com/article/us-china-ethanol-policy-exclusive/exclusive-china-suspends-national-rollout-of-ethanol-mandate-sources-idUSKBN1Z71R8 (accessed on 13 January 2020).

[82] Reuters (2020), China to Curb Farming Near Rivers in Push to Reverse Water Pollution, https://www.reuters.com/article/us-china-environment-water/china-to-curb-farming-near-rivers-in-push-to-reverse-water-pollution-official-idUSKBN1ZG0EU (accessed on 20 January 2020).

[18] Reuters (2020), Chinese Farmers Dodge Coronavirus and Go Online for Spring Seeds and Supplies, https://fr.reuters.com/article/basicMaterialsSector/idUKL4N2AY2RF (accessed on 10 April 2020).

[101] Reuters (2019), China Approves Wheat Soy Imports from Russia, https://www.reuters.com/article/us-usa-trade-china-agriculture/china-approves-wheat-soy-imports-from-russia-idUSKCN1UL275 (accessed on 15 December 2019).

[93] Reuters (2019), China Lifts 2015 Ban on French Poultry Imports, https://www.reuters.com/article/us-china-france-poultry/china-lifts-2015-ban-on-french-poultry-imports-customs-idUSKCN1R80WO (accessed on 10 December 2019).

[94] Reuters (2019), China Lifts Ban on Poultry Imports from Spain, Slovakia, https://www.reuters.com/article/us-china-poultry-imports/china-lifts-ban-on-poultry-imports-from-spain-slovakia-customs-idUSKBN1XE0WD (accessed on 20 January 2020).

[49] Reuters (2019), China to Expand Pork Imports, Release Meat From Reserves to Boost Supplies, https://www.reuters.com/article/us-china-swinefever-meat/china-to-release-frozen-meat-from-reserves-to-boost-supplies-idUSKCN1VJ0PJ (accessed on 6 January 2020).

[65] Reuters (2019), China to Require Meat Processors to Test for African Swine Fever, https://in.reuters.com/article/china-swinefever-food/china-to-require-meat-processors-to-test-for-african-swine-fever-agriculture-ministry-idINKCN1RF101?il=0 (accessed on 16 December 2019).

[67] Reuters (2019), China to Speed Up Subsidies for Pigs Culled due to African Swine Fever, https://www.reuters.com/article/china-swinefever/update-1-china-to-speed-up-subsidies-for-pigs-culled-due-to-african-swine-fever-idUSL4N25H2C3 (accessed on 16 December 2019).

[110] Reuters (2019), China’s Hog Herds Plunge More Than 40%, But Worst May Be Over, https://www.bloomberg.com/news/articles/2019-11-29/china-s-hog-herds-extend-plunge-amid-signs-worst-may-be-over (accessed on 10 January 2020).

[72] Reuters (2019), China’s Northeast Cornbelt Likely to Be Hit by Fall Armyworm in 2020: Government Report, https://www.reuters.com/article/us-crops-armyworm-china/chinas-northeast-cornbelt-likely-to-be-hit-by-fall-armyworm-in-2020-government-report-idUSKBN1YU0DB (accessed on 20 January 2020).

[60] SAMR (2019), New Organic Standard, http://openstd.samr.gov.cn/bzgk/gb/newGbInfo?hcno=6C7830BA57AF12ACE93AF43B8CA7B315 (accessed on 10 December 2019).

[8] SNSJ Agri China (2020), MARA and and China United Insurance Group Sign a Strategic Cooperation Agreement, http://snsj.agri.cn/article-detail?id=3fee7dc4-6ff2-11ea-87c4-0242ac120002&route=cockpit-index (accessed on 10 April 2020).

[7] SNSJ Agri China (2020), MARA Circular on the Implementation Plan for Expanding the Scale of Local Employment of Migrant Workers Returning to Their Hometowns, http://snsj.agri.cn/article-detail?id=807802ce-7232-11ea-9765-0242ac120002&route=cockpit-index (accessed on 10 April 2020).

[9] SNSJ Agri China (2020), MARA Signed a Strategic Cooperation Agreement With the Agricultural Bank of China, http://snsj.agri.cn/article-detail?id=57294872-6fc8-11ea-8db2-0242ac120002&route=cockpit-index (accessed on 10 April 2020).

[16] SNSJ Agri China (2020), Solve the Problems of “Difficulty in Selling” and Product Backlog in Poultry and Aquaculture, http://snsj.agri.cn/article-detail?id=bfba73ec-6f0b-11ea-9eb3-0242ac120002&route=cockpit-index (accessed on 10 April 2020).

[84] South China Morning Post (2020), China Suspends Ethanol Mandate, https://www.scmp.com/economy/global-economy/article/3045270/china-suspends-national-roll-out-ethanol-mandate-which-will (accessed on 20 January 2020).

[69] South China Morning Post (2020), Lunar New Year in China Raises Risks of Worsening African Swine Fever Crisis, Minister Says, https://www.scmp.com/economy/china-economy/article/3045165/lunar-new-year-china-raises-risks-worsening-african-swine (accessed on 5 February 2020).

[86] South China Morning Post (2019), China to Reduce Import Tariffs on 850 Key Commodities, Including Frozen Pork, from January 1, http://scmp.com/economy/china-economy/article/3043181/china-reduce-import-tariffs-key-commodities-including-frozen (accessed on 8 January 2020).

[2] State Council (2020), Joint Defense and Control Mechanisms of the State Council Press Conference - 5 April 2020, http://www.gov.cn/xinwen/gwylflkjz81/index.htm (accessed on 14 April 2020).

[4] State Council (2020), Notice on Further Accomplishing the Autumn Grain Purchase in Northeast China, http://www.gov.cn/zhengce/zhengceku/2020-02/26/content_5483508.htm (accessed on 27 February 2020).

[61] State Council (2019), Regulations of the People’s Republic of China on Food Safety Law, http://www.gov.cn/zhengce/content/2019-10/31/content_5447142.htm (accessed on 10 December 2019).

[31] State Council (2019), Towards a Food Industry Powerhouse, http://www.gov.cn/xinwen/2019-10/16/content_5440369.htm (accessed on 15 December 2019).

[29] State Council Information Office (2019), Food Security in China, https://www.scio.gov.cn/zfbps/ndhf/39911/Document/1666230/1666230.htm (accessed on 3 November 2019).

[3] Teller Report (2020), 2020 Minimum Rice Purchase Price Announced, http://www.tellerreport.com/business/2020-02-28---2020-minimum-rice-purchase-price-announced--130-yuan-per-50-kg-of-japonica-rice-.HJMQTJcLEU.html (accessed on 2 March 2020).

[23] Teller Report (2020), Wuhan Special Vegetable Package, https://www.tellerreport.com/business/2020-03-17---wuhan--%22special-vegetable-package%22-expands-capacity-and-increases-investment-to-enrich-citizens-with-%22vegetable-baskets%22-.H1-IPE26BL.html (accessed on 10 April 2020).

[25] UNFCC (2015), “INDCs as communicated by Parties: China”, June, http://www4.unfccc.int/submissions/indc/Submission%20Pages/submissions.aspx.

[107] USTR (2020), Economic and Trade Agreement Between the Government of the United States and the Government of the People’s Republic of China, https://ustr.gov/about-us/policy-offices/press-office/press-releases/2020/january/economic-and-trade-agreement-between-government-united-states-and-government-peoples-republic-china (accessed on 15 January 2020).

[102] World Grain (2019), China’s Ban on Canadian Canola Widens, https://www.world-grain.com/articles/11830-chinas-ban-on-canadian-canola-widens (accessed on 20 November 2019).

[109] WTO (2019), DS511: China - Domestic Support for Agricultural Producers, https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds511_e.htm (accessed on 5 March 2020).

[5] XInhua (2020), China Increases State Rice Purchasing to Strengthen the Grain Reserve, http://www.xinhuanet.com/english/2020-04/09/c_138962183.htm (accessed on 15 April 2020).