copy the linklink copied!Basic, targeted and minimum pensions

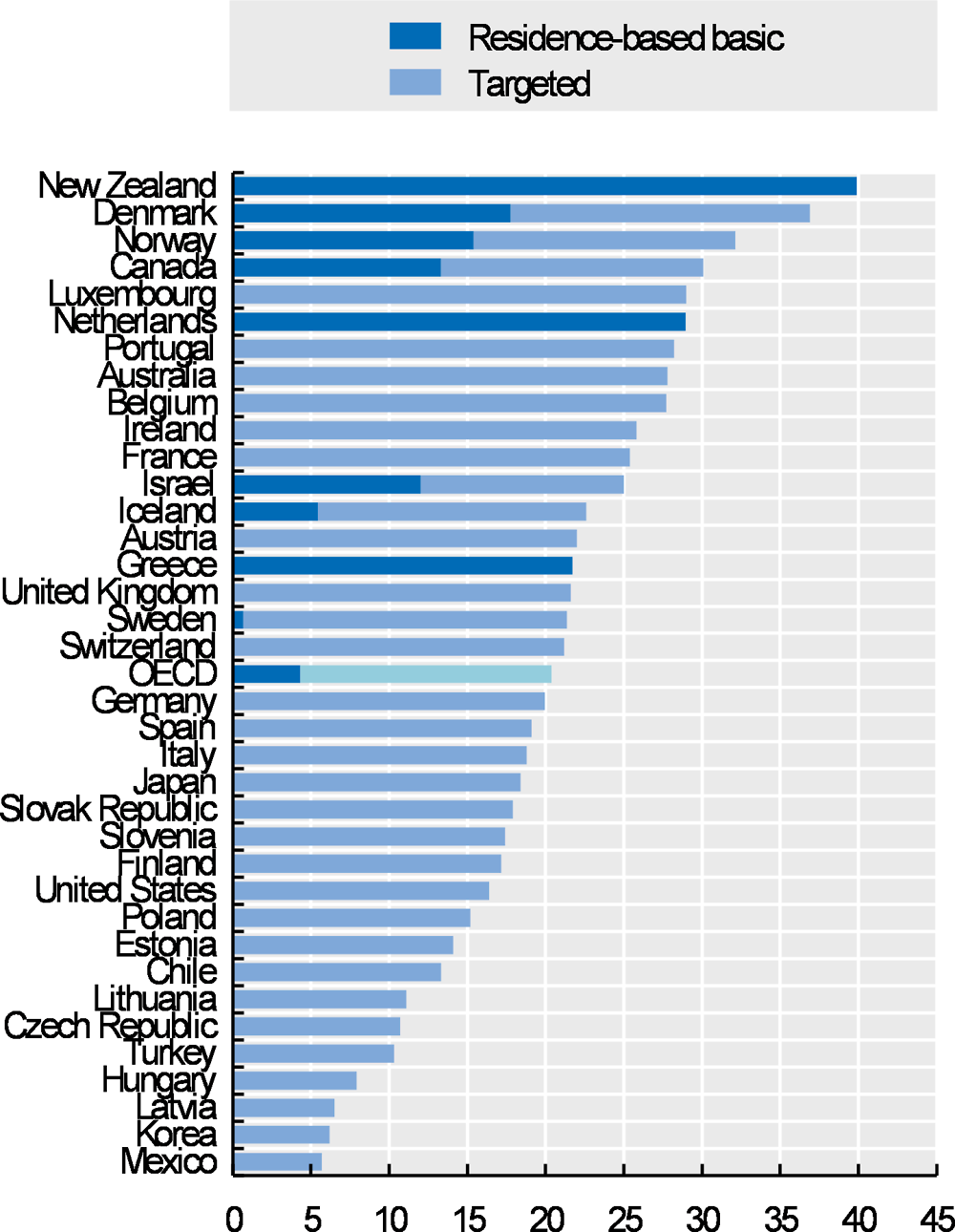

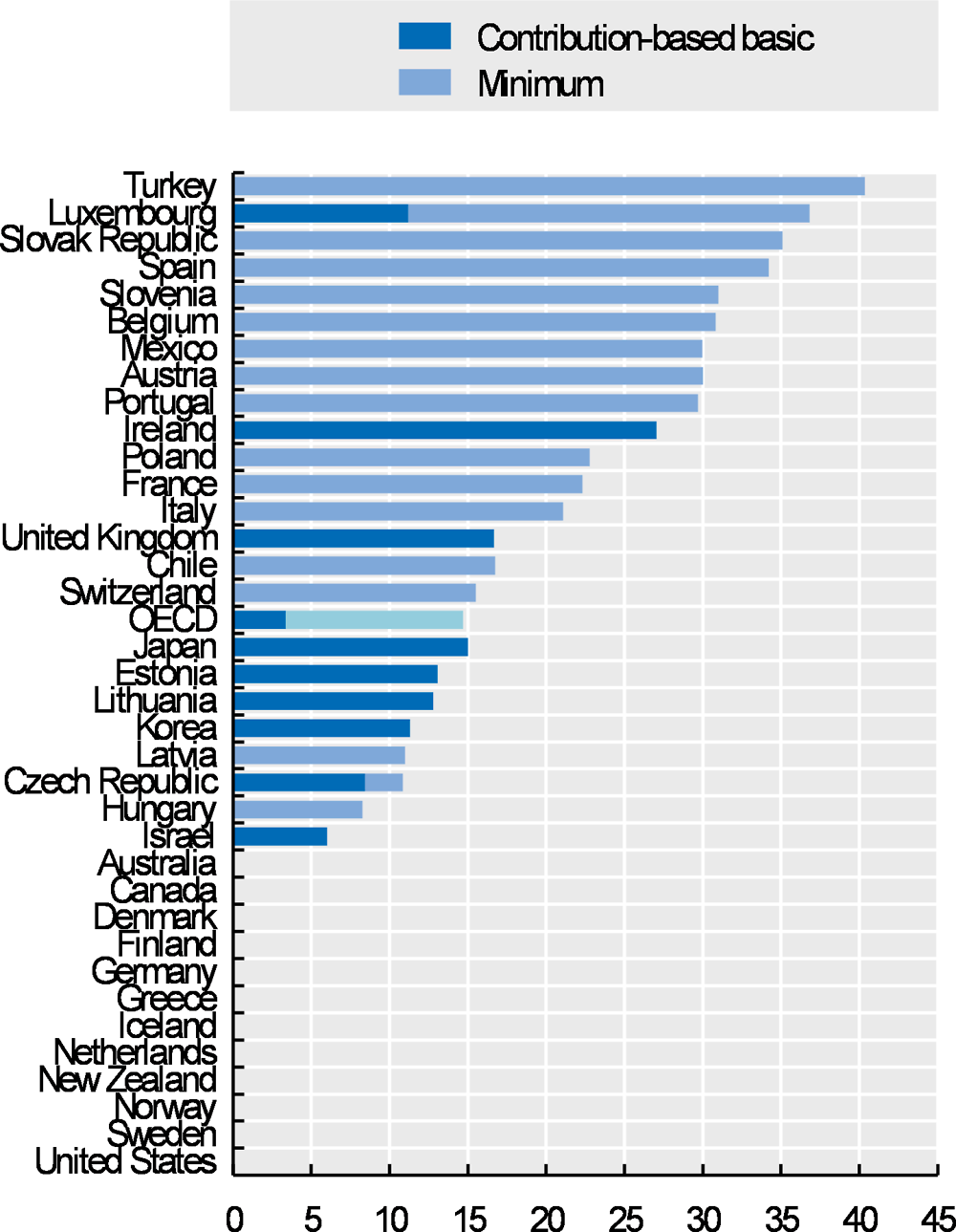

Residence-based basic pensions exist in nine OECD countries and are, on average, worth 17% of the gross average wage. Almost all OECD countries provide targeted benefits like guarantee pensions and social assistance for their residents. On average in the OECD, people without a contributory record could receive 16% of average earnings from targeted schemes, subject to a means test, and 20% when including residence-based basic pensions. Nine OECD countries provide contribution-based basic pensions, with the full benefit being equal to 14% of the gross average wage on average across these countries. Almost half of OECD countries provide a minimum pension benefit within their contributory scheme, most often above the basic or social assistance level and, on average, at 25% of average earnings for the full benefit.

There are four main ways in which OECD countries might provide retirement incomes to meet a minimum standard of living in old age (Table 4.2). The left-hand part of the table shows the value of benefits provided under these different types of schemes. Values are presented in relative terms – as a percentage of countries’ gross average wages – to facilitate comparisons between countries (See the “Average wage” indicator in Chapter 7). The right-hand part of the table shows the number of total recipients as a share of the population aged 65 and over.

Benefit level

Benefit values are shown for a single person. In some cases – in particular for minimum pensions – each partner in a couple can receive an individual entitlement. In other cases – especially for targeted schemes – the couple is treated as the unit of assessment and generally receives less than twice the entitlement of a single person.

Only four OECD countries have neither a basic nor a minimum pension: Australia, Finland, Germany and the United States. Moreover, almost all OECD countries provide targeted benefits that are subject to further means tests. The existence of multiple programmes in many countries complicates the analysis of effective benefit levels. In some cases, benefits under these schemes are additive. In others, there is a degree of substitution between them.

Figure 4.2 therefore summarises the level of non-contributory, residence-based benefits. Residence-based basic pensions are present in nine cases with an average benefit of 17% of the gross average wage and a maximum of 40% in New Zealand. Norway and Sweden are phasing them out. All OECD countries provide targeted benefits to their residents, but people in Greece, the Netherlands and New Zealand cannot receive such a benefit on top of a full residence-based basic pension. In Canada, Denmark and Iceland, residence-based basic pensions do not reduce the targeted benefit. On average in the OECD, 16% of gross average earnings can be received from targeted schemes subject to further means tests, and a total of 20% when including residence-based basic pensions.

As for the contributory components of first-tier pensions, one-third of OECD countries has neither contribution-based basic nor minimum pensions (Figure 4.3). One-quarter of the OECD countries provides contribution-based basic pensions, which lie on average at 14% of average earnings for the full benefit. They range from 6% of average earnings in Israel, where they are paid as a bonus to the residence-based basic pension, to 27% in Ireland. In almost half of OECD countries, low contributory pensions are topped up to a higher minimum pension level, up to 25% of average earnings on average. These minimum pensions vary between a low of about 10% of the average wage in the Czech Republic, Hungary and Latvia to a high of about 40% in Turkey.

Coverage

The importance of first-tier benefits varies enormously across OECD countries. The percentage of over-65s receiving such benefits is shown in the final four columns of Table 4.2. Different approaches of reporting the number of recipients, for example in case of benefits paid to couples or even households, may blur the data comparability across countries to some extent.

Naturally, residence-based basic pensions have on average the highest coverage. However, contribution-based basic pensions also have very high recipient numbers in most countries that have such a scheme. Sometimes recipient numbers exceed 100% of the population aged 65 and older hinting to recipients younger than 65 or living abroad.

The incidence of receiving a minimum pension is very diverse across countries and positively related to the level of the benefit. Minimum pensions are received by almost 40% of the over-65s in France and Portugal. In Belgium, Italy, Luxembourg and Spain around 30% of the over-65s receive a minimum pension while it is less than 10% in the Slovak Republic and at 2% or under in Hungary and Slovenia.

The range in targeted schemes is similarly big, with in particular Chile, Korea and Mexico showing high recipient numbers of more than every second person aged 65 or older.

Metadata, Legal and Rights

https://doi.org/10.1787/b6d3dcfc-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.