Spain

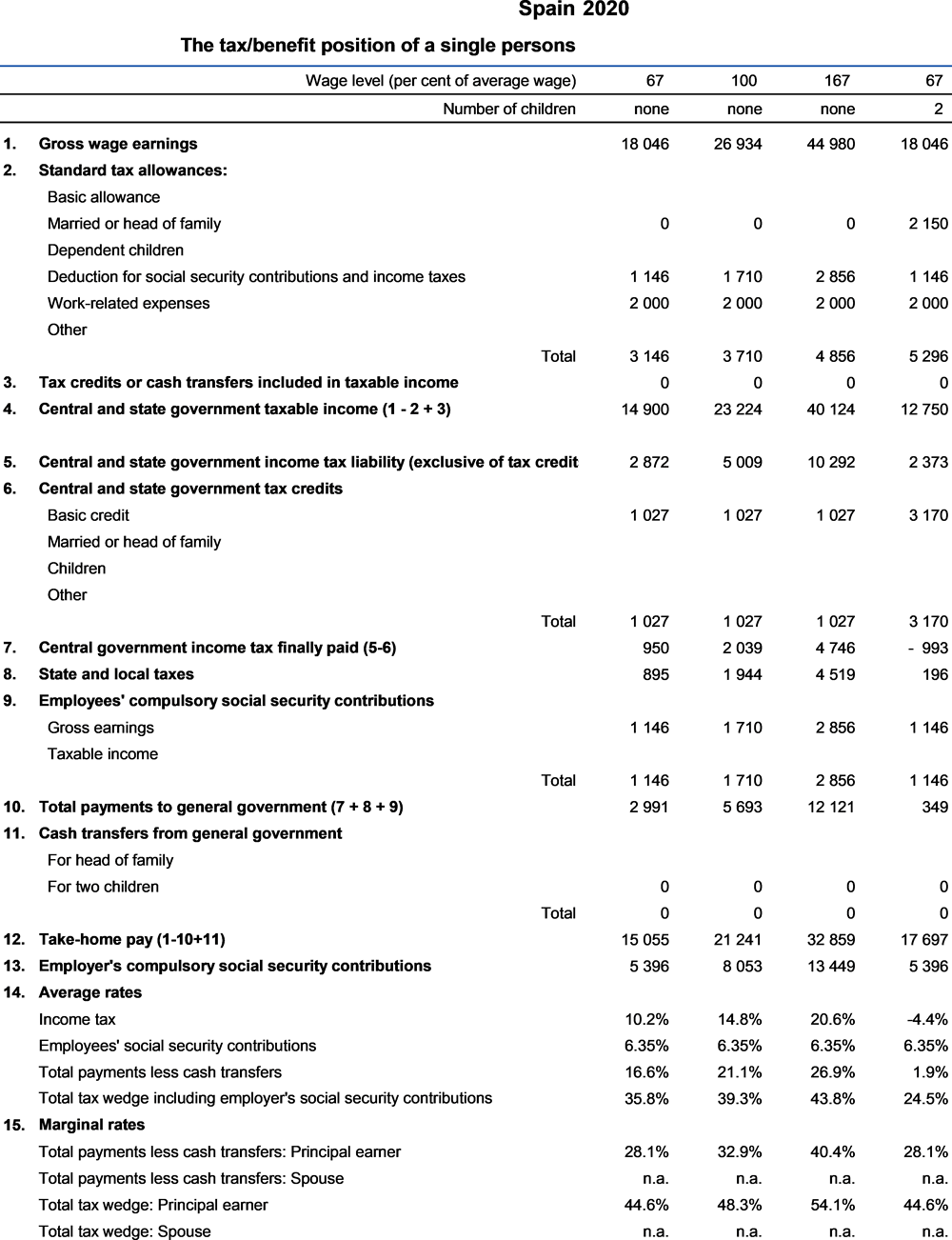

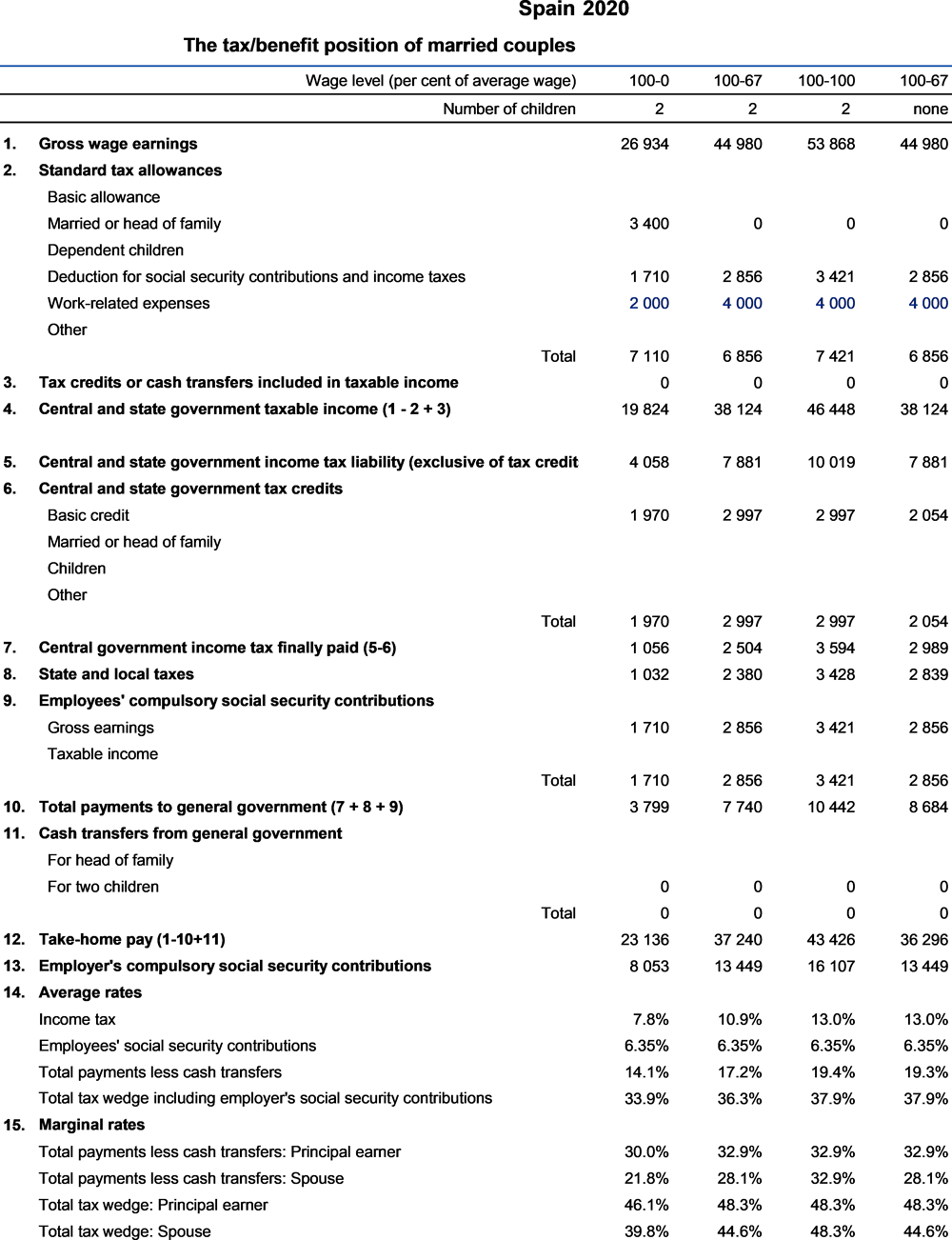

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Euro (EUR). In 2020, EUR 0.88 was equal to USD 1. In that year the average worker earned EUR 26 934 (Secretariat estimate).

1.1. Central government income tax

1.1.1. Tax unit

As a general rule, the tax unit is the individual. Nevertheless, families have the options of being taxed:

1.1.2. Tax allowances and tax credits

1.1.2.1. Standard reliefs

Basic reliefs: Married couples filing jointly may claim an allowance of EUR 3 400. This figure amounts to EUR 2 150 for heads of single-parent households.

Maternity tax credit: a non-wastable tax credit addressed to working females with children under 3 years of age up to EUR 1 200,which may be increased up to EUR 1 000 where the taxpayer has incurred qualifying expenses related to nursery schools/kindergartens

Large families (3 or more children) or dependent family members with disabilities tax credits: this additional non-wastable tax credit (up to EUR 1 200, in general, or EUR 2 400 for special large families, with 5 or more children) has been raised by EUR 600 for each child exceeding the minimum number of children required for both large families types listed above. It also may be claimed (within the Taxing Wages framework) by single-parent households with two children.

Relief for social security contributions: All social security payments are fully deductible.

Other expenses allowance: up to EUR 2 000, which may be increased by the same amount in case of an unemployed accepting a job in a different location implying a change of residence.

Employment related allowance: Net employment income (gross income - employee social security contributions) may be reduced according to the following rules:

Disabled workers allowance: an additional allowance of EUR 3 500 for disabled salary earners. Those with reduced mobility may claim an augmented allowance of EUR 7 750.

As a result of the application of the above rules, net income cannot become negative.

1.1.2.2. Main non-standard reliefs applicable to an average wage

Contributions to Pension Plans. Contributions made by each member of the household may reduce taxable income up to the lower of the following amounts:

Moreover, those households whose second earner has net labour income below EUR 8 000 may reduce taxable income up to a maximum of EUR 2 500 on a yearly basis if the principal earner contributes to a Pension Fund for the spouse.

Relief for subscriptions paid in respect of membership of a trade union and business or professional associations (last item is limited to mandatory membership) up to EUR 500.

Relief for expenses made for the legal defence of the taxpayer for labour-related conflicts up to a maximum limit of EUR 300.

Other non-standard reliefs provided as deductions are:

Investment in the acquisition and rehabilitation of own-housing: With effect from 1 January 2013, the tax credit has been abolished. Nevertheless, grandfathering rules apply for those taxpayers who before 1 January 2013 had acquired their main residence; had made some payments for it to be built; had made some payments for restoration/enlargement of their main residence or had made some payments to carry out the adaptation of the main residence of disabled people. However, in the latter two cases the works performed should be completed before 1 January 2017.

Gifts: 75% of the amounts (below EUR 150) donated to non-profit entities, public administration, public universities and other qualifying institutions. For larger gifts, 30% on the excess, which may be increased to 35% when meeting certain conditions (for fidelity cases) and 10% of the amount donated non-qualifying foundations or associations.

Investments and expenses in goods of cultural interest: 15% of the amounts granted to the importation, restoration, exhibition, etc., of certain goods listed in the General Register of Goods of Cultural Interest.

Each of these last two amounts cannot exceed 10% of taxable income.

1.1.2.3. Exempt Income

The base amount is EUR 5 550 per taxpayer. The same amount is granted for family units filing jointly. Taxpayers aged over 65 years may add EUR 1 150 to the former amount. Those aged over 75 years may claim additionally EUR 1 400.

Dependent children (under 25 years, in general; for each age, in case of disability): EUR 2 400 for the first dependent child; EUR 2 700 for the second one; EUR 4 000 for the third, and EUR 4 500 for any additional child.

Child care allowance: an additional allowance of EUR 2 800 for each of the above dependent children under 3 years of age.

In case of disabled workers and additional amount of EUR 3 000 also applies. In case of great disability prior amount reaches EUR 9 000.

Child allowances have to be shared equally between spouses when they file separately.

1.2. State and local income taxes

The Autonomous Communities (Regional Governments) are liable to set up their own personal income tax schedule to tax the general income tax base. For 2020, those tax rate schedules vary from five to ten brackets and their marginal rates from 9.0 to 25.5%. Up to 2009, the tax autonomous share (regional share of the tax) on the general tax base was determined by applying a progressive tax ladder with default values laid down by the Law regulating this tax, and fixed by Government. However, the Autonomous Communities (Regional Governments) were competent to modify these values under certain limitations. The complementary tax scale, fixed by the Central Government and applied in default as explained, was removed in 2010, which leaves a State-level ladder and each Autonomous Community determining their own tax scale, subject only to the progressivity requirement. From that moment on, by exercising their legislative competences, the Autonomous Community have been approving their tax scales that, although identical to the State-level tax scale in the beginning, as time elapsed they became increasingly different. These differences have grown since 2015, coinciding with the entry into force of the reform of this tax, up to the point that in 2016 and 2017 each Autonomous Community applies a different tax scale, with currently only one matching the Central Government tax scale.

Therefore, instead of taking into account a tax rate determined by an Autonomous Community equal to that applied by the Central Government, as past years, the new criteria followed since 2017 is to consider that of the Autonomous Community of Madrid (Madrid Region), which is thought as the most representative tax scale on different grounds, among which it is worth mentioning that this Autonomous Community comprises the Spain capital city and its relative significance as regards this tax, both in terms of number of taxpayers, income level and income tax roughly amounting to one quarter of the total revenues. All these make of it a potential stable criteria over time.

Now, there is not any local tax rate or schedule in the Spanish PIT. However, some Local Governments (the bigger and province capital cities) receive a fixed percentage of the PIT revenues.

Social Security contributions are assessed on the basis of employees’ gross earnings taking into account certain ceilings of gross employment income. In 2020, these ceilings are:

These ceilings are based on a full-time job. For part-time workers, ceilings are proportional to the real hours worked (the tax equations used for this Report do not take into account the lower ceiling).

3.2. Transfers for dependent children

EUR 341 for 1-child families with annual gross earnings below EUR 12 424.00; the child transfer decreases with income between EUR 12 424.00 and EUR 12 765.00; the value is 0 for gross earnings exceeding EUR 12 765.00. EUR 682 for families with 2 children with annual gross earnings below EUR 14 287.60; the child transfer decreases with income between EUR 14 287.60 and EUR 14 969.60; the value is 0 for gross earnings exceeding EUR 14 969.60.

5.1. Identification of an AW and calculation of earnings

Refer to the information provided in the Annex of this Report.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_sp” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_sp” values taken as 0.