5. Improving FDI impacts on carbon emissions

This chapter discusses Jordan’s key challenges related to energy security and resulting implications for carbon emissions and private investment. It assesses the current contribution of FDI to diversifying energy sources, reducing carbon emissions and supporting the low-carbon transition, including through potential spillovers to domestic firms. It then considers the institutional and policy frameworks that influence the impact of FDI on carbon emissions, and identifies policy opportunities for improving these impacts. The chapter applies the forthcoming OECD FDI Qualities Policy Toolkit.

Water, food and energy security are among the greatest challenges to achieving sustainable development in Jordan and have serious implications for Jordan’s carbon emissions and its ability to meet its climate objectives. Carbon emissions in Jordan continue to rise, albeit at a diminishing rate, driven predominantly by the largely oil-fuelled energy and transport sectors. As the technological barriers to further electrification and decarbonisation of these sectors are falling rapidly, the private sector, and foreign investors specifically, can profitably cater to these investment needs. Over the last decade, foreign investment projects have been negligible in the transport sector, and largely dominated by fossil fuels in the energy sector. More recently, FDI has started to shift away from fossil fuels and into clean energy sources. Accelerating this shift is critical for diversifying energy sources, reducing reliance on fossil fuel imports and improving energy security, and will at the same time help advance Jordan’s low-carbon transition.

The low-carbon transition requires greening of investments beyond the energy sector. There is evidence that foreign firms may be responsible for over 50% of oil consumed in manufacturing. Moreover, according to the FDI Qualities Indicators, foreign investors in Jordan underperform in terms of green business practices, particularly when it comes to tracking energy use and emissions, and implementing measures to reduce emissions. This suggests that there may be little scope for positive spillovers from foreign to domestic firms, when it comes to greening business practices and improving the climate impacts of private investment. Even if foreign firms were to outperform domestic firms in terms of climate impacts (which there is currently no evidence of), the opportunities for influencing the business practices of domestic suppliers is somewhat limited, given to the limited extent of local supply chain linkages.

Since 2017, the Government of Jordan has made green growth a top national priority, and demonstrated its commitment to transition towards a green economy through various multi-year strategies and plans, resulting in a series of reforms and proactive policies to support decarbonisation. Two key reforms have been the unbundling of the power sector, which has opened up power generation to private investment, and the phasing out of energy subsidies, which as removed price distortions that resulted in over-investment in carbon intensive activities. While these reforms and programmes can influence the FDI entering the country, greater efforts could be made align the green growth framework with the investment promotion strategy and to clarify the role of private investors in advancing low-carbon targets more explicitly and specifically. This chapter provides an overview of national strategies, institutional arrangements and policies at the intersection of investment and climate policy and evaluates to what extent they are conducive improving the climate impacts of investment. Key policy considerations are summarised below.

Ensure high-level alignment and co-ordination across investment and climate policymakers. Jordan has made a visible effort to consolidate its many national strategies and action plans relating to climate change into a single cross-sectoral framework for green growth under the oversight of a cross-ministerial steering committee. The steering committee’s direct link to the Prime Ministry should ensure alignment with the Investment Council’s priorities. Given that renewable energy investments are a key priorities of the Investment Council, there may be scope for involvement within the Investment Council of the Ministry of Energy and Mineral Resources, in order to ensure greater strategic alignment.

Align the national green growth framework with the investment promotion strategy and clarify the role of private investors in achieving green growth outcomes. References to the role of private investment in Jordan’s green growth framework are general and rarely linked to specific priority actions outlined by the national plans. Greater efforts could be made to clarify where private investment will be most crucial, and link the identified green growth priority projects to private investment opportunities identified and promoted by the Ministry of Investment (MoI). An updated investment promotion strategy should ensure that investment opportunities in renewables are considered on a proactive rather than reactive basis by the MoI, in line with the multitude of green growth priority projects designed to accelerate private investment in renewable energy.

Streamline and unify licensing and registration procedures for renewable projects under one authority. Several institutions are involved in the administrative and licensing procedures for renewable-energy investments: the MoI’s one-stop shop facilitates licensing procedures for all types of investment; the MoI provides licences to free zone investors, some of which target renewable power generation; however, the main licence that a renewable project developer must obtain is a power-generation licence delivered by the electricity regulator (EMRC). Streamlining and unifying these licensing procedures under one authority can help decrease the transaction costs associated with renewable energy investments.

Consider replacing local content requirements on solar and wind components, with targeted incentives for industrial development. While electricity generation is relatively open to foreign investments, other discriminatory measures persist and may inhibit foreign investments in renewable technologies. The local content requirements on solar photovoltaics and wind turbines are at odds with Jordan’s relatively limited manufacturing capacity of related components. Such discriminatory measures are likely to discourage foreign investments in downstream solar and wind power generation. Instead, the government could provide targeted incentives for specific solar and wind components that are not yet manufactured locally.

Consider transitioning from a single buyer electricity model to a well-designed wholesale market for electricity. Competition policy may be especially important for supporting decarbonisation of the power sector. The current single buyer model can limit the penetration of renewable energy in the electricity sector, by reducing the attractiveness of Jordan’s electricity market to potential foreign investors. The government should consider enabling the three main electricity distributors to purchase electricity directly from the producers at market prices, in order to level the playing field for foreign investors. Gradually transitioning to a well-designed wholesale market for electricity could further enhance the ability of the power sector to accommodate high shares of renewable energy, and accelerate Jordan’s energy transition.

Streamline the land acquisition and land lease process. Accessing land suitable for renewable project development is one of the major challenges faced by investors in renewable power generation. Policymakers could create a database of government lands available for renewable projects, and facilitate land acquisition procedures through a central office to reduce transaction costs for investors. The government could further identify available private lands, and provide lenders with a mechanism to ensure that leases of land with multiple private owners can be efficiently concluded.

Link investment promotion efforts to low-carbon objectives. The role of the MoI in the implementation of policies to promote low-carbon investments remains limited to the provision of information related to investment opportunities in the energy and transport sectors. the MoI could consider further tailoring its investment promotion material and activities to target low-carbon investors, within and beyond these sectors. More emphasis could be given to investment opportunities related to electrification of road transport, and energy saving opportunities in tourism and industry. Given the relatively poor performance of foreign investors in Jordan with respect to green business practices, there may be scope for linking investment promotion efforts to incentives or requirements related to monitoring and reporting of energy use, both to reward energy saving efforts of domestic peers and to reduce the energy intensity of FDI.

Water, food and energy security are among the greatest challenges to achieving sustainable development in Jordan and have serious implications for Jordan’s carbon emissions and its ability to meet its climate objectives. Water scarcity and high energy costs are also crucial barriers to private sector growth and productivity (see Chapter 2). Jordan is one of the most water scarce countries in the world, and climate change is projected to exacerbate this scarcity. Jordan’s geographical conditions are such that high energy inputs are required to filter and transport water over long distances and wide elevational differences. Rising energy costs driven by the increased demands of a larger population have further intensified water scarcity in Jordan in recent years. Agriculture is responsible for 60% of total water use and 14% of electricity use, but provides only 19% of the country’s food requirements (EBRD, 2020[1]).

Jordan’s energy sector has also faced significant challenges over the past decade. Generation capacity in Jordan is overwhelmingly fossil-fuelled, but with few fossil-fuel resources of its own, Jordan imports 90% of its energy supply, particularly crude oil and oil products from neighbouring Saudi Arabia and Iraq; natural gas from Iraq, Egypt and Qatar; and electricity from Egypt and Syria (IEA, 2021[2]). Energy demand grew rapidly over 2012 to 2017 as a result of structural shifts in demand, compounded by the regional refugee crisis, although this trend is showing a reversal since 2018. During the same period, Jordan experienced disruptions in the flow of low-cost pipeline gas from Egypt, forcing the state-owned single wholesale buyer and seller of power, the National Electric Power Company (NEPCO), to import expensive diesel oil products, and to incur significant losses. Subsequent fuel and electricity subsidy reforms greatly alleviated the resulting fiscal pressures.

Thanks to its location, Jordan has a strong potential for the deployment of renewable power technologies, especially in solar and wind energy. In recent years, the Jordanian government succeeded in establishing a transparent and stable regulatory framework for the development of renewable energy and attracting international private capital and expertise. Jordan met its 10% renewable targets for 2020 ahead of schedule and now targets as much as 31% of its electricity generation from renewables by 2030 (Ministry of Environment, 2020[3]). As the Jordanian energy system transitions to accommodate larger shares of intermittent and decentralised renewable energy, challenges associated with the energy system’s increasing complexity are set to grow.

The quality of transport infrastructure is mixed, with major regional disparities. Jordan is one of the countries with the least developed rail infrastructure in the Southern Mediterranean region, and is characterised by high urbanisation and increasing congestion, with road traffic growth outpacing GDP growth. Public transport is dominated by low-capacity vehicles (i.e. taxis), exacerbating congestion, limiting mobility of the poor, and hampering private sector operation and development.

Foreign direct investment (FDI) is an important source of capital and driver of growth in Jordan – the FDI stock-to-GDP ratio exceeded 80% in 2020, which is high relative to other emerging economies (OECD, 2021). Less is known about how FDI affects green growth, and in particular Jordan’s climate change mitigation efforts and low-carbon transition. Evidence from other countries suggests that FDI can help diffuse cleaner or energy-saving technologies, and that the share of FDI captured by renewables, for example, has more than doubled relative to FDI in fossil fuels in the last decade in regions across the world (OECD, 2021[4]). This section examines the impact of FDI on carbon emissions and green growth in Jordan based on the FDI Qualities Policy Toolkit (Box 5.1).

FDI generates emissions from production processes and energy use, as well as all other emissions associated with any intermediate goods, transport of goods to market, emissions in end use and disposal of products produced. These emissions are influenced by investor-specific attributes (e.g. technology, motive). Foreign investors can also generate spillovers arising from (1) their supply chain relationships with domestic firms; (2) market interactions through competition and imitation effects; (3) and labour mobility of workers between foreign and domestic firms.

The premise behind FDI spillovers is that foreign firms have access to superior technology, skills and capital, as a result of their ties to the parent company, and that this advantage can allow knowledge to spill over to domestic firms. This has important implications for the broader uptake of low-carbon technologies in the host country beyond the foreign firm. The spillover potential varies across technology and spillover channel. FDI spillovers on carbon emissions need not be positive, if, for instance, foreign investors are attracted by weaker environmental regulation (i.e. the ‘pollution haven hypothesis) and they induce a race to the bottom with respect to environmental standards.

The motivation behind the FDI Qualities Policy Toolkit is that, under certain circumstances, FDI can contribute the needed financial and technological resources to advance the low-carbon transition. Resulting benefits for host countries include: improving energy security, diversifying energy sources, reducing reliance on energy imports and electrifying remote rural areas; fostering innovation, creating new industries and jobs related to low-carbon technologies, and gaining an edge over competitors and attendant export opportunities in key industries; and the localised benefits of mitigating climate change, reducing environmental degradation, and improving air quality and associated health impacts.

The extent to which FDI can play a role in de-carbonising economies depends on a number of contextual factors that are the focus of this chapter, including FDI characteristics and spillover potential, market and regulatory environments of home and host countries and the international frameworks that link them. Targeted policy interventions can create incentives for foreign investors to actively contribute to low-carbon objectives, and influence the spillover potential of their investments.

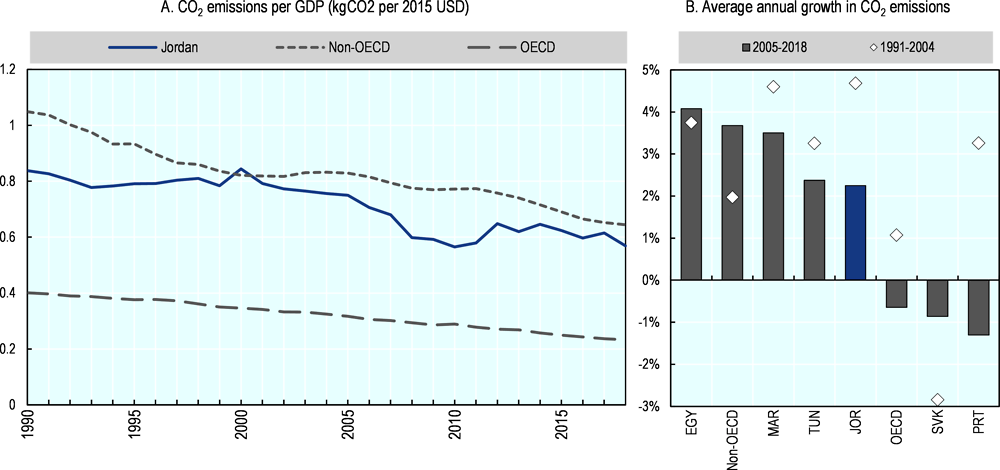

Carbon emissions per unit of output declined steadily in Jordan over the last decades at a rate that is similar to OECD countries, on average, while their level remains substantially higher and close to the average for non-OECD countries (Figure 5.2, Panel A). Although the growth rate in emissions has more than halved over the last fifteen years, and is substantially lower than that of the average non-OECD country, in absolute terms, Jordan’s carbon emissions continue to rise (Figure 5.2, Panel B). In contrast, emissions generated by OECD countries are declining both in absolute terms and as a share of GDP.

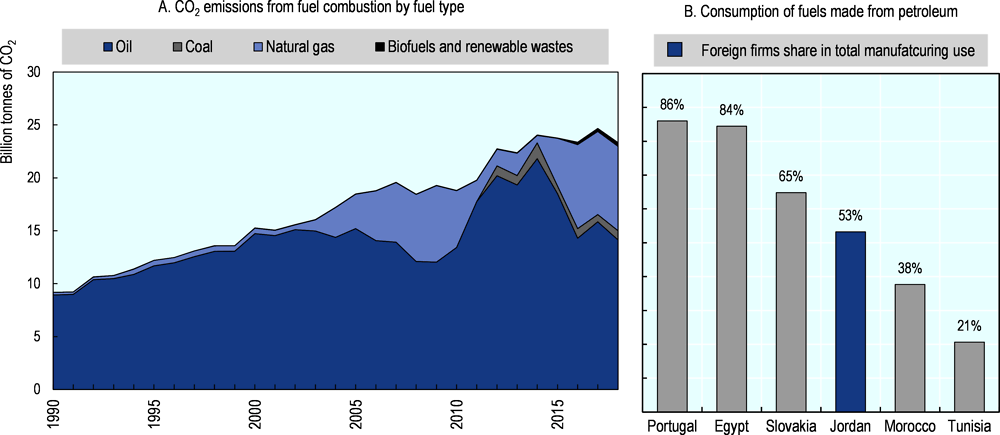

Combustion of oil products is responsible for over 80% of carbon emissions generated in Jordan over the last three decades, followed by natural gas, whose contribution has risen sharply since the early 2000s (Figure 5.3, Panel A). According to estimates based on the latest World Bank Enterprise Surveys, in 2019 foreign firms may have been responsible for over 50% of total consumption of oil-based fuels by manufacturing firms in Jordan (Figure 5.3, Panel B).1 This share is substantially lower than in Portugal (86%) and Egypt (84%), but still considerable compared to Morocco (38%) and Tunisia (21%). Overall, manufacturing accounts for 14% of oil-based energy consumption according to recent estimates, while transport and households are responsible for the bulk of oil consumption (Ministry of Energy and Mineral Resources, 2018[6]). Nevertheless, there remains significant potential to reduce FDI’s carbon footprint in manufacturing activities, and thereby reduce emissions in general.

5.3.1. FDI in renewable energy can significantly accelerate the low-carbon transition

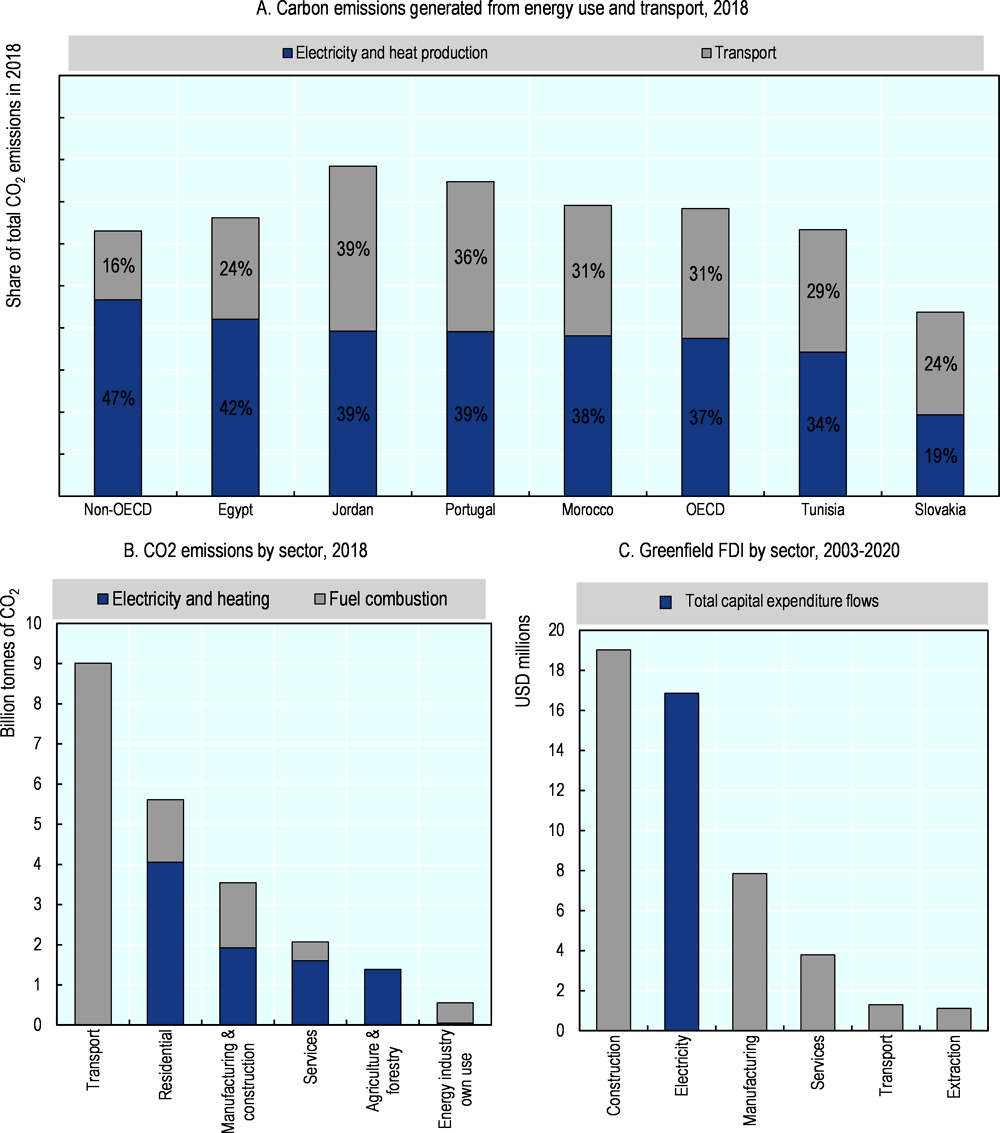

From a sectoral perspective, fuel combustion related to energy and transport accounted for close to 80% of Jordan’s carbon emissions in 2018 (Figure 5.4, Panel A). The transport sector’s contribution to emissions is the highest across comparator countries, and the energy sector is second only to Egypt. When broken down across consuming industries (Figure 5.4, Panel B), the residential sector accounts for the bulk of emissions from electricity use (45%), followed by roughly similar shares for manufacturing and construction (21%), services (18%), and agriculture and forestry (15%). By comparison, emissions associated with industrial activities and processes that do not originate from electricity use play a relatively minor role. This implies that a combination of increasing reliance on clean energy sources and electrifying the transport sector can result in vast emissions reductions. Given the rapidly declining costs associated with these technologies, the private sector, and foreign investors specifically, can profitably cater to these investment needs. Electricity generation also accounted for a substantial share of foreign greenfield investment flows over 2003 to 2020 (34%), second only to construction (38%) (Figure 5.4, Panel C). Given how polluting the energy sector is, the question of whether foreign investments are exacerbating this trend or supporting a shift to renewables naturally follows.

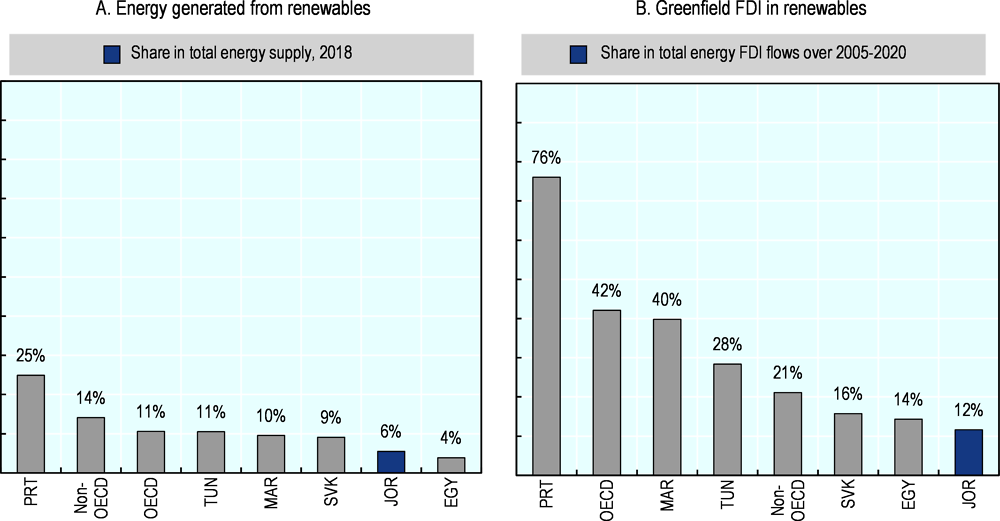

A closer look at Jordan’s energy sector shows that, only 6% of its annual energy supply was generated from renewable sources in 2018, compared to 14% in non-OECD countries, on average, and the second lowest across comparator countries. Studies have shown that multinational investors can play a critical role in diversifying energy sources and deploying renewable energy technologies and infrastructure, particularly in developing countries, thanks to their technological and financial advantages relative to domestic firms (OECD, 2019[9]). In Jordan, renewables accounted for only 10% of the value of greenfield FDI flows in the energy sector over 2003 to 2018, while fossil fuels and nuclear accounted for 90%. This share is less than half of the share for non-OECD countries on average, and less than a quarter of the share for OECD countries. However, when considering the number of investments, renewable energy accounts for 78% of projects, almost all of which were announced in 2014 or later. In contrast, only one of the 6 greenfield projects in non-renewable power date to after 2016. In other words, although there’s still a long way to go, FDI has started to shift away from fossil and into clean energy sources. Accelerating this shift is critical for diversifying energy sources, reducing reliance on fossil fuel imports and improving energy security, and will at the same time help advance Jordan’s low-carbon transition.

5.3.2. Foreign investors in Jordan perform poorly in terms of green business practices

The low-carbon transition requires greening of investments beyond the energy sector. In some cases foreign investors support this transition through their relatively more climate-friendly business practices, potentially as a result of more stringent international environmental standards that they are measured against. Conversely, foreign firms can also deteriorate environmental outcomes by outsourcing highly polluting activities to developing countries with less stringent environmental standards. The OECD FDI Qualities Indicators can help shed light on the extent of positive or negative contributions of FDI to carbon emissions across several dimensions. In particular, the indicators consider firm practices in terms of (1) environmental strategy and management, (2) monitoring and targeting of energy consumption, (3) and implementation of measures to reduce carbon impacts.

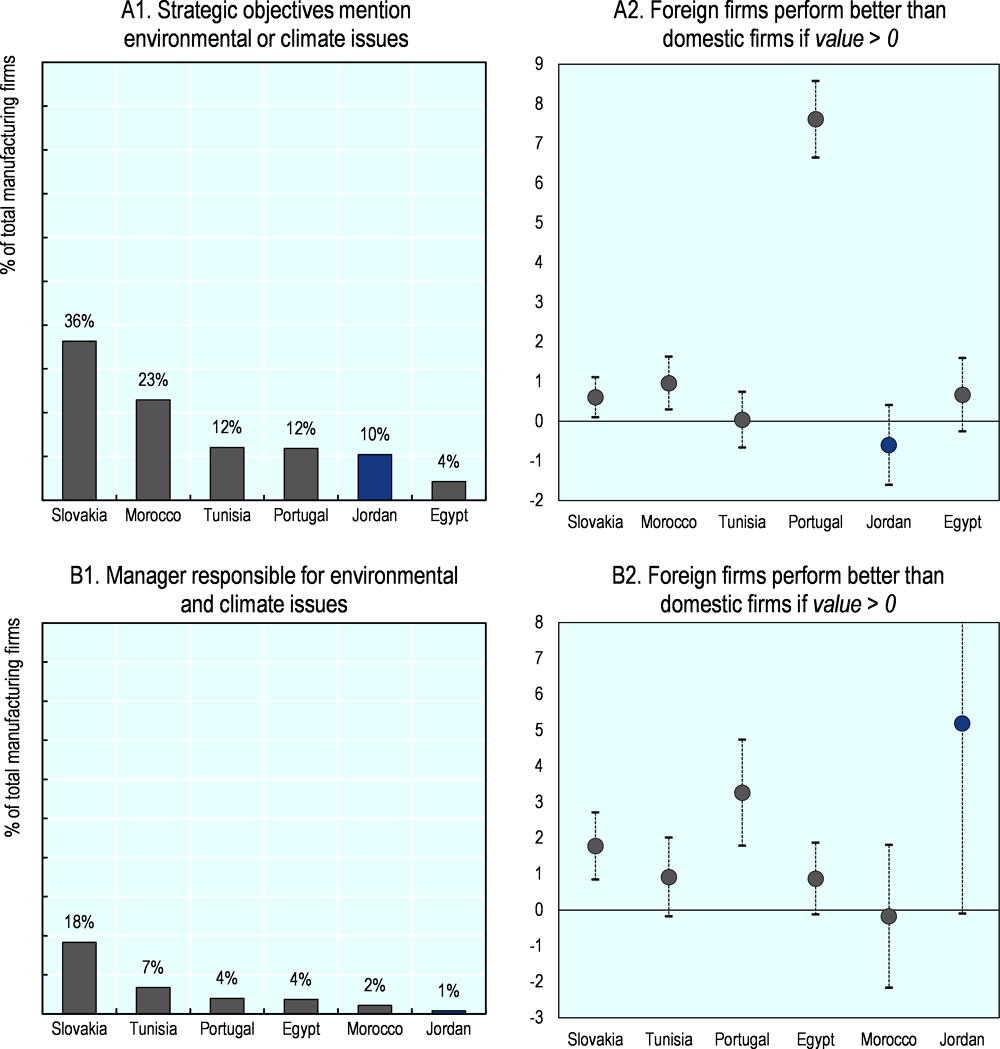

Among the countries considered, a minority of firms incorporate environmental or climate change issues into their strategic objectives, and even fewer employ a manager responsible for environmental and climate change issues (Figure 5.6, Panels A1 and B1). The shares are particularly low for Jordan (10% and 1%, respectively), while Slovakia is the top performing comparator country (36% and 18%, respectively). Moreover, foreign firms in other countries perform at least as well as domestic firms in terms of incorporating environmental strategic objectives, but there is no evidence of this in Jordan (Figure 5.6, Panel A2); and while foreign firms in Jordan are more likely to employ a manager responsible for environmental impacts than their domestic peers, given the low baseline and high variance, this evidence remains somewhat weak (Figure 5.6, Panel B2).

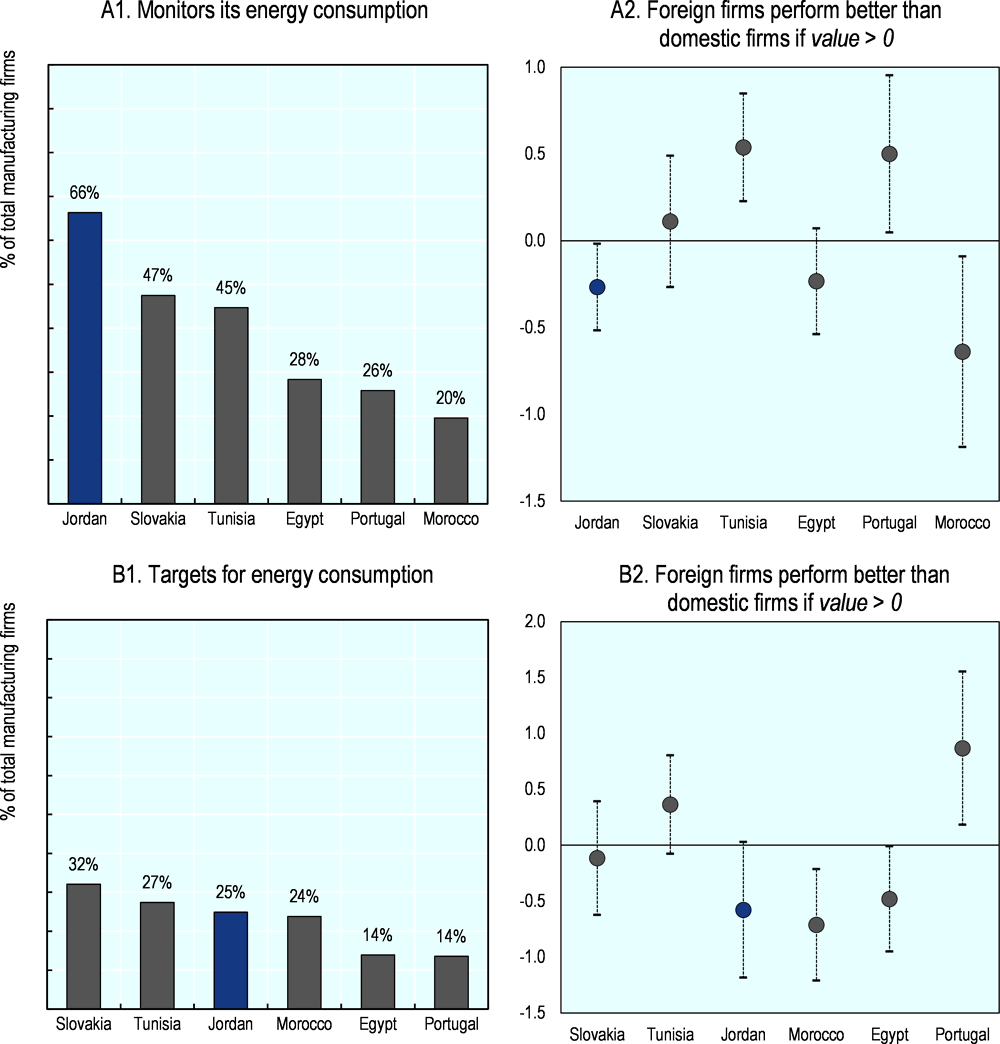

Companies in Jordan perform significantly better in terms of tracking their energy consumption, perhaps in response to Jordan’s high energy costs and resulting competitiveness implications for manufacturing firms (see Chapter 2). Two thirds of firms report that they monitor energy consumption, the highest share among the countries considered, and a quarter set targets for energy consumption, in line with the other top performers in the group (Figure 5.7, Panels A1 and B1). However, foreign firms in Jordan underperform relative to domestic firms (Figure 5.7, Panels A2 and B2). In other words, they are less likely to set targets for and monitor their energy use, while the opposite is true in Tunisia and Portugal. This is consistent with the evidence of a relatively large contribution of foreign manufacturing firms to oil-based fuel consumption in Jordan (Figure 5.3), and may warrant linking investment promotion efforts to incentives or requirements related to monitoring and reporting of energy use, both to reward energy saving efforts of domestic peers and to reduce the energy intensity of FDI.

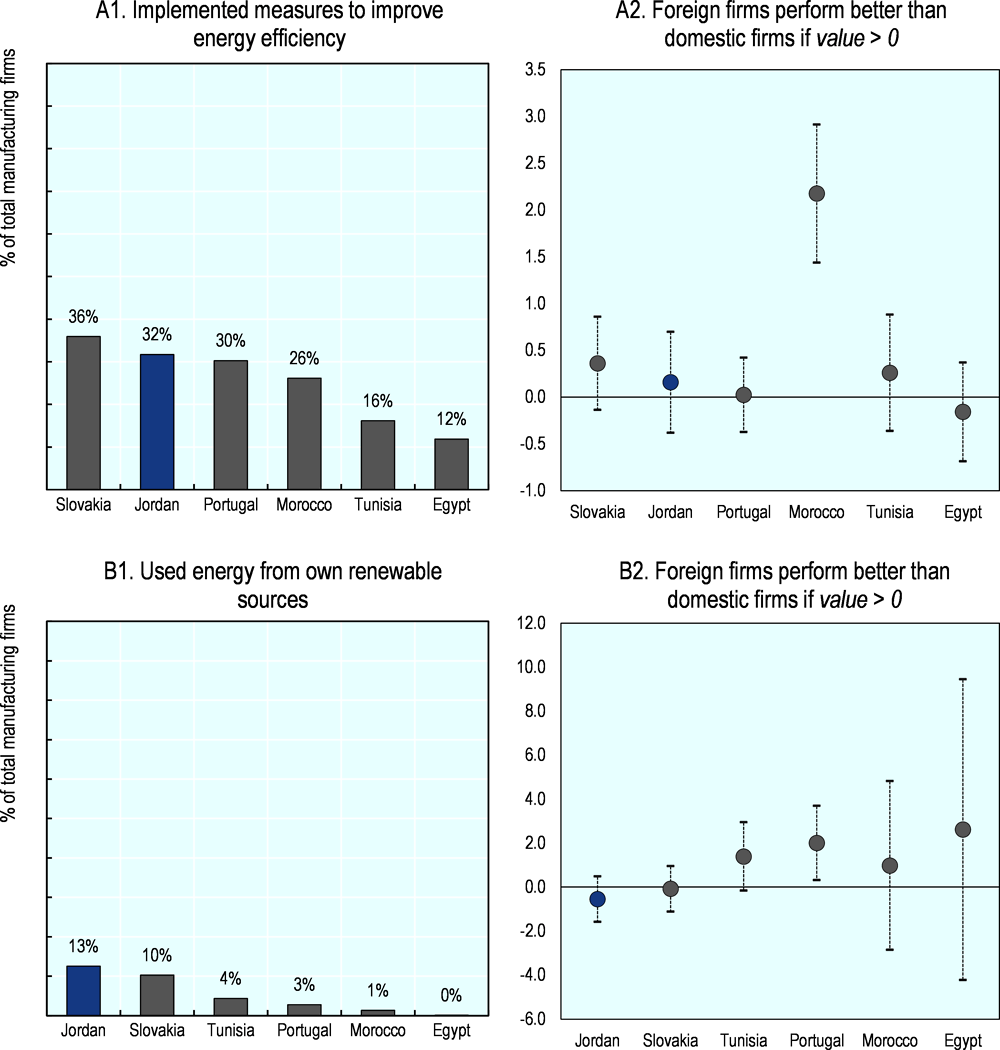

Companies in Jordan perform relatively well also in terms of implementing measures to reduce their emissions (Figure 5.8, Panels A1 and B1). A third of surveyed companies implemented measures to improve energy efficiency over the last three years, second only to Slovakia (36%), and 13% of surveyed companies use energy generated from their own renewable sources, the highest among the group of countries. According to the FDI Qualities Indicators, there is no significant difference across domestic and foreign firms in Jordan in their likelihood of implementing such measures (Figure 5.8, Panels A2 and B2). While this is not a negative result in itself, it suggests that there may be little scope for domestic firms to acquire new knowledge from their foreign counterparts, either through supply chain linkages or through market interactions, when it comes to implementing measures to reduce climate impacts. More generally, there appears to be relatively little potential for FDI-induced spillovers to domestic firms related to greener business practices.

5.3.3. There is limited evidence of FDI spillovers on carbon emissions

A number of factors can help shed further light on the potential for FDI spillovers, positive or negative, related to carbon emissions. One of the most important channels for such spillovers is through supply chain relationships with domestic suppliers, partners and buyers. Foreign firms can for instance influence the practices and resulting emissions of their suppliers by requiring environmental certifications or adherence to certain standards as a precondition for doing business. Foreign firms may also share knowledge and technologies with their suppliers that help reduce carbon emissions associated with their economic activities. Therefore, the existence of such supply chain relationships is a necessary condition for the materialisation of FDI-induced spillovers on emissions.

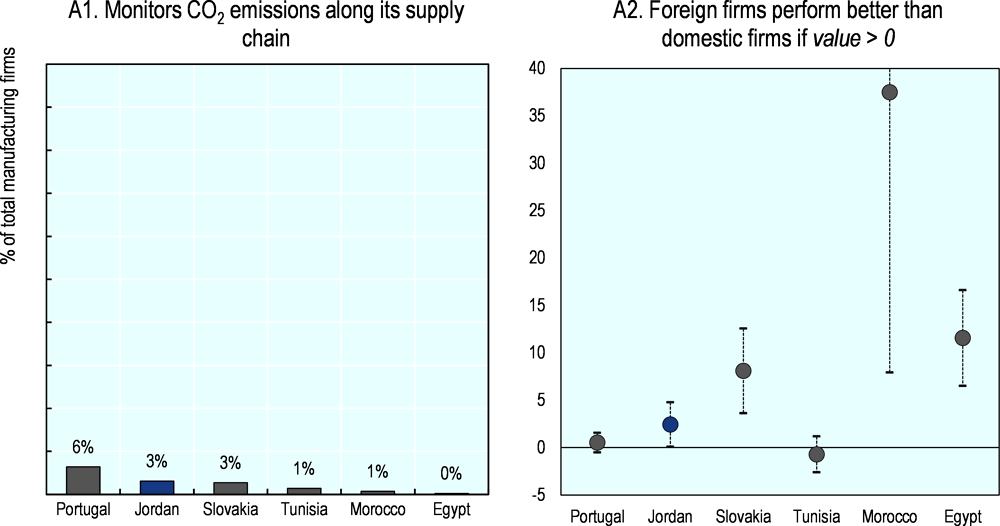

In Jordan, foreign manufacturing firms buy around a third of their intermediate inputs from local suppliers (see Chapter 2), the second lowest share across the countries considered, and well below the average for non-OECD countries (61%). Thus, even if foreign firms were to outperform domestic firms in terms of climate impacts (which there is currently no evidence of), the opportunities for influencing the business practices of domestic suppliers is somewhat limited. This evidence is further corroborated by the fact that only 3% of firms in Jordan report that they monitor emissions along their supply chain, a share that is nevertheless in line with other countries considered, and in fact the second highest in the group (Figure 5.9, Panel A). Similarly, few firms in Jordan (11%) report that their customers require environmental certifications or adherence to certain environmental standards as a condition to do business with them, although the share is in line with the other countries considered (Figure 5.10).

Over the last decade, the Government of Jordan has demonstrated its commitment to transition towards a green economy, viewing it not only as a choice but as the only way forward. The government supports this ambition with various multi-year strategies and plans, overseen by dedicated councils and committees, ministries and implementing agencies. This section provides an overview of government strategies and the institutional setup at the intersection of investment and climate policy.

5.4.1. Jordan has a coherent framework of national strategies to address climate change

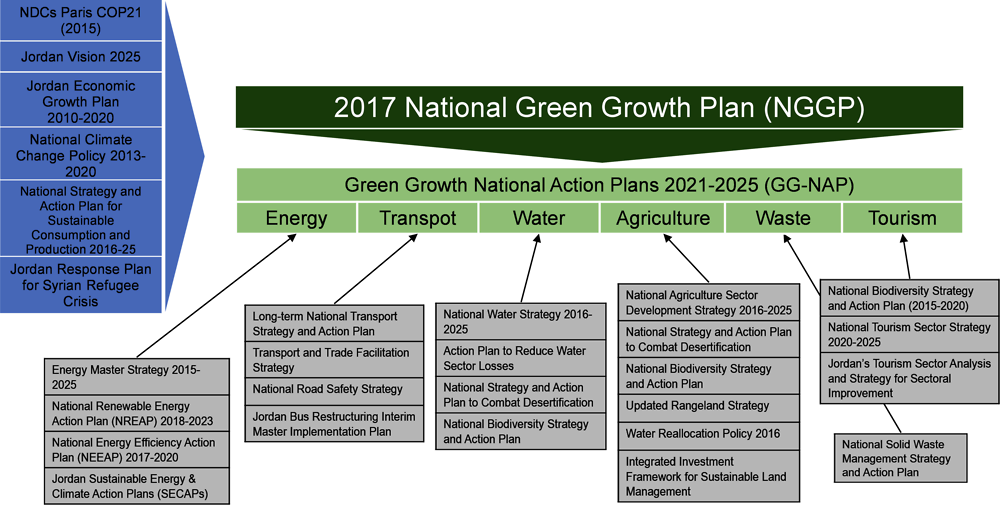

Since 2017, Jordan has made green growth a top national priority (Ministry of Environment, 2017[10]), and made an effort to align and consolidate its many national strategies and action plans relating to climate change and sustainable development under the National Green Growth Plan (NGGP). This Plan was designed to mainstream green growth, climate change, and sustainable development objectives into sectoral strategic frameworks, and strengthen cross-sectoral alignment and collaboration. Its first objective was to build a business case for green growth, then to understand what was preventing Jordan from achieving its green growth objectives, and finally, to offer guidance in the context of green growth and, ultimately to support implementation of Jordan's development strategy Vision 2025 (Figure 5.11).

This NGGP focuses on six priority sectors that provide coverage of key green growth issues and opportunities for Jordan: namely, agriculture, energy, tourism, transport, waste and water. These green economy sectors combine high-potential growth areas (e.g. tourism) and sectors that threaten to inhibit Jordan’s development if not properly managed (e.g. water), and are generally consistent with the MoI’s investment promotion focus, as defined by the 2014 Investment Law. As part of the implementation of the NGGP’s recommendations, sector-specific Green Growth National Action Plans 2021-2025 (GG-NAP) were developed by the Ministry of Environment in collaboration with the relevant sector line ministries, so as to ensure cross-sectoral alignment and collaboration, and to consolidate pre-existing sector-specific strategies and plans.

Each of the sectoral GG-NAPs builds on existing sector-specific strategies, policies and plans, as well cross-sectoral climate strategies and identifies a set of priority policy actions to achieve green growth, estimating their expected costs of implementation, and emphasising the need for public and private investment, as well as donor support for their implementation. Each action is linked to one or more of the five desired outcomes of green growth – namely, (1) enhanced natural capital; (2) sustained economic growth; (3) social development and poverty reduction; (4) resource efficiency; and (5) climate change adaptation and mitigation. Together these plans identify 86 priority policy actions and projects, and offer a full implementation framework for green growth in Jordan that can be benchmarked for the next national development planning process (Ministry of Environment, 2017[10]).

While there is mention in the NGGP and across the sector GG-NAPs about the importance of stimulating private sector investment in new and adaptive technologies to achieve the desired green growth outcomes, the references are somewhat general and rarely linked to specific priority actions or projects. Greater efforts could be made to clarify the role of private investors more explicitly and specifically. In addition, while the 2014 Investment Law identifies renewable energy as a priority sector for investment attraction, the Investment Promotion Strategy 2016-2019 considers that there are currently limited private investment opportunities in renewable energy (assigned a Tier 3 priority level). This means that, according to the strategy, investment opportunities in renewables will be considered on a reactive rather than proactive basis by the investment promotion agency. This is somewhat at odds with the National Green Growth framework and its key focus on decarbonising the energy sector. Nevertheless, this is subject to review after the three-year planning cycle, and may currently be under review.

5.4.2. The institutional setting governing FDI impacts on carbon emissions is complex

A complex system of institutions design and implement investment, climate and energy policies in Jordan, and it is important for coordination mechanisms to be in place to ensure their coherence and consistency, and achieve desired outcomes related to FDI and carbon emissions (Figure 5.12). Oversight of this framework is the responsibility of two high-level inter-ministerial councils:

The Investment Council overseas the development and implementation of investment policies. The Investment Council is headed by the Prime Minister and brings together several ministers (e.g. Minister of Industry and Trade and Supply and Minister of Planning and International Cooperation), the Chairman of the Jordan Investment Ministry, and the Governor of the Central Bank, chambers of commerce and industry and other representatives from the private sector. Members submit recommendations on investment strategies, policies and reforms directly to the Council. One of the priority sectors identified by the 2014 Investment Law is renewable energy; however, the Council does not include the Minister of Energy and Mineral Resources, or the Minister of Environment, responsible for the broader green growth strategy.

The Higher Steering Committee for Green Economy (HSCGE) oversees green growth policies across all relevant sectors of the economy. The HSCGE is chaired by the Minister of the Environment and composed of the Secretaries General of each of the line ministries responsible for the six green economy sectors (Energy, Transport, Water, Agriculture, Waste, Tourism), as well as the Ministry of Finance and the Ministry of Planning and International Cooperation (MoPIC). The HSCGE reports directly to the Prime Ministry, who chairs the Investment Council, suggesting that the latter holds the ultimate authority overseeing the framework for investment in green growth. The HSCGE does not directly include private sector representatives, but engages with them through its operational arm, the Green Economy Unit of the Ministry of Environment.

Implementation of investment, climate and energy policies is the responsibility of three main agencies with clear but in some cases overlapping mandates:

The HSCGE directly oversees the Green Economy Unit within the Ministry of the Environment, the leading operational actor responsible for delivering green growth in Jordan. Integrated into the Green Economy Unit is an advisory board with technical experts to ensure that long-term national goals are linked to green growth objectives. The unit gathers information related to the implementation of green growth policies from a range of stakeholders, including the Technical Committees from the Ministries covering six green economy sectors, international and national funds (e.g. JREEEF), international donors, and the private sector. The PPP Unit and the Green Economy Unit coordinate their support for green project implementation.

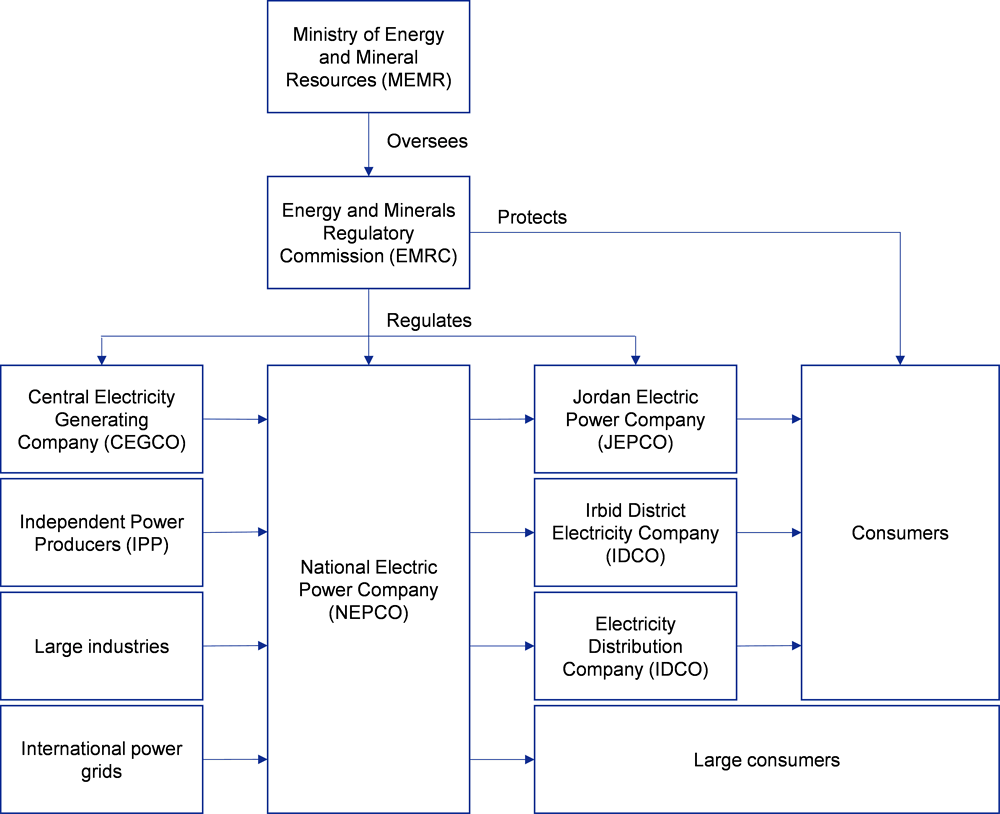

The Ministry of Energy and Mineral Resources (MEMR), which sits in the HSCGE, oversees the Energy and Minerals Regulatory Commission (EMRC), the country’s electricity regulator. The EMRC is an independent government authority in charge of issuing licences for power generation, establishing the methodological processes for computing energy tariffs, and drafting by-laws for the energy sector. It aims to improve economic feasibility and efficiency of the energy sector and ensures that the projects operating in the sector comply with environmental standards. It has issued several by-laws and regulations related to investment incentives and financing schemes for renewable energy, and is responsible for licensing renewable power projects.

The Jordan Investment Commission (JIC), hosted within the newly established Ministry of Investment, is responsible for investment promotion and facilitation. The JIC is part of the Investment Council and oversees Free Zones, Development Zones, and Special Economic Zones, and, through its one-stop-shop, facilitates licensing procedures for all types of investment. However, most renewable projects (larger than 1MW) are licensed by the EMRC, with the exception of Zone projects that are regulated by JIC. This can create potential confusion for private, and particularly foreign investors in renewable power generation.2

Other stakeholders that provide key inputs for the design and implementation of green growth policies include a variety of research centres, funds, and business associations:

The National Energy Research Center (NERC) is a specialised centre within the Royal Scientific Society, an independent non-governmental and non-for-profit multi-disciplinary science institution established by Royal Charter. The NERC undertakes specialised and accredited testing, research work with local industries and universities, and provides technical advice related to energy efficiency and renewable energy to the private and public sectors.

The Jordan Renewable Energy and Energy Efficiency Fund (JREEEF) was established in 2012 by the MEMR under the Renewable Energy and Energy Efficiency Law to facilitate the scaling-up of renewable energy and energy efficiency in order to meet the energy needs of Jordan, in accordance with the National Energy Strategy and National Energy Efficiency Action Plan. JREEEF is governed by a management committee chaired by the Minister of MEMR and is comprised of six members from the private and the public sector. JREEEF provides financial and technical assistance to project developers, targeting small-scale solar projects by households, SMEs, the tourism sector, the health sector, public buildings, and facilities such as schools.

The Jordan Environment Fund (JEF) was established by the Ministry of Environment in 2006 to provide financial support for projects in the context of environmental protection and preservation. It focused on different environmental areas, including renewable energy, municipal works, agriculture and waste management. The Fund is managed by a board of directors, headed by the Minister of Environment, and with the participation of 5 public and 5 private sector entities.

The Association for Energy, Water and the Environment (EDAMA) is a Jordanian business association established in 2009 to find innovative business solutions for energy and water independence and for environmental conservation. Its members comprise almost all energy services providers in Jordan.

The Renewable Energy Establishments Society (REES) is a business association established in 2014 to represent all renewable energy services and energy management companies, with the purpose of defending their interests and improving market conditions in the sector. Over 40 companies are members of JRES as of September 2020.

5.4.3. Implementation agencies have overlapping responsibilities when it comes to renewables

Following the recommendations of the NGGP, the HSCGG was created to oversee policies and institutions affecting green growth across all sectors and line ministries, under the leadership of the Ministry of Economy. While there are no explicit mechanisms in Jordan that are dedicated to horizontal policy co-ordination across ministries dealing with green growth and those responsible for investment, the HSCGG reports directly to the Prime Minister, who chairs the Investment Council. This should ensure that the green growth strategy and framework are aligned with the Investment Council’s investment priorities and policies.

At the same time, both the Minister of Environment, responsible for the overall green growth agenda, and the Minister of Energy and Mineral Resources, responsible for the energy strategy and related renewable energy regulation and policies, are not included in the Investment Council. This may not be necessary, and indeed the governing boards of many investment promotion agencies do not include representatives of the ministries in charge of environmental policy, although somewhat more frequently they include ministries in charge of energy policy (OECD-IDB, 2019[11]). However, one of the key priorities of the Investment Council, as stated by the 2014 Investment Law, is to attract investment in renewable energy. As MEMR is responsible for the national energy strategy, including renewable energy, there may be scope for involvement of the ministry in the Investment Council.

While it is challenging to assess the extent of inter-agency coordination, in the case of renewable energy there is some overlap in mandates and responsibilities across different implementing agencies, which may create unnecessary administrative burdens for investors. Several governmental institutions are involved in setting administrative and licensing procedures for renewable-energy projects. The one-stop-shop (OSS) Investment Window within the MoI was established to facilitate licensing procedures for all types of investment. The MoI also provides licences to free zone and SEZ investors, some of which target renewable power generation. However the main licence that a renewable project developer must obtain (for projects larger than 1MW) is a power-generation licence delivered by the electricity regulator, the EMRC. Streamlining and unifying licensing and registration procedures under one authority for all renewables projects could help decrease transaction costs for investors and project developers.

Improving the investment climate and stimulating private investment has long been a priority for the government of Jordan. Creating an enabling environment for green investment has gained traction with the government more recently. To this end, the government is advancing an ambitious programme of reforms to stimulate green investment. This section reviews policies and programmes in Jordan designed to attract green investment, including wider market regulations and targeted financial, technical and information support. The section also reviews Jordan’s international commitments and agreements and how they affect environmental standards and impacts of businesses.

5.5.1. FDI restrictions affect sectors that are critical for the low-carbon transition

Jordan’s overall scoring under the OECD FDI Regulatory Restrictiveness Index is significantly higher than the average of OECD and non-OECD economies covered by this index (see Chapter 2). This suggests that there are outstanding regulatory barriers to FDI in Jordan. The main sectors behind Jordan’s relatively high regulatory restrictiveness index include a number of sectors critical for the low-carbon transition (Figure 5.13).

Transport, for instance, is the most polluting sector in terms of CO2 emissions in the country and one of the priority sectors identified by the government for green growth. One of the national green growth objectives outlined in the sectoral 2021-2025 GG-NAP is to increase private sector participation in transport sector investments (Ministry of Environment, 2020[12]). There remain however, equity restrictions on foreign investments in all forms of transport, as well as other operational restrictions that discriminate against foreign investors. The transport sector is also among the sectors that has attracted the least foreign greenfield investments over the last decade, suggesting that these regulatory barriers deter to some extent foreign investments. Foreign ownership in engineering and construction services, as well as in wholesale and retail trade (including in energy services), is limited to 50%. Restrictions on FDI in these sectors are likely to result in sub-optimal flows of investment, limit the transfer of know-how and may hamper the deployment of low-carbon technologies.

While electricity generation is relatively open to foreign investments, presenting fewer restrictions than in the average OECD country, other discriminatory measures persist and may inhibit foreign investments in renewable technologies in Jordan. For instance, the local content requirements on solar photovoltaics and wind turbines (of 35% and 20%, respectively) are misaligned and at odds with Jordan’s relatively limited manufacturing capacity of related components. Currently, there is only one domestic assembler of solar panels in Jordan (Philadelphia Solar), two manufacturers of solar water heaters (Hanania Solar and Nur Solar Systems), and no manufacturer of photovoltaics or wind turbines components. Such strict local content requirements are likely to discourage foreign investments in downstream solar and wind power generation. Instead, the government could promote development of local industry in the manufacturing of specific solar and wind components by providing targeted investment incentives.

5.5.2. Increasing competition in the power sector can help attract clean energy investment

Competitive pressure is a powerful incentive to use scarce resources efficiently. By helping to achieve efficient and competitive market outcomes, competition policy contributes to the effectiveness of climate policies. Competition policy may be especially important for supporting decarbonisation of the power sector, which is traditionally characterised by vertically integrated monopolies. Unbundling the power sector by separating power generation, transmission and distribution functions can help create more space for private investment. Moreover, by opening competition in power generation, unbundling provides more space for clean energy technologies to enter the market and can therefore stimulate changes in the national energy mix. The decentralised nature and the smaller generation capacity of clean energy projects compared to their fossil fuel counterparts, makes independent power production well-suited for mainstreaming clean energy technologies. In the areas of transmission and distribution, increased competition can also render the national energy network more flexible, increasing its capacity to accommodate both on- and off-grid renewable energy (OECD, 2015[14]).

Jordan is the only country in the MENA region that has implemented structural separation of electricity generation, transmission, and distribution, by adopting a ‘single buyer’ model under the 2003 General Electricity Law (Figure 5.14). The state-owned utility, NEPCO, overseen by the electricity regulator (EMRC), owns and operates transmission lines and acts as the single buyer, purchasing electricity from different generators and selling it to distribution companies. The government privatised several power generation and distribution companies to open the power sector to foreign and domestic investors. The General Electricity Law guarantees non-discriminatory access to the transmission lines. In addition, the Renewable Energy and Energy Efficiency Law requires NEPCO to purchase electricity from renewable-power projects that are awarded power purchase agreements, either through competitive tendering or direct proposal submissions. This is a crucial first step to create an investment environment that is attracted to foreign renewable power producers.

The current single buyer model can nevertheless limit the penetration of renewable energy in the electricity sector, by reducing the bargaining power of independent renewable power producers (IPPs), and reduce the attractiveness of Jordan’s electricity market to potential foreign investors. As IPPs are not free to engage in power purchasing agreements with other potentially interested buyers, this can lead to economic inefficiency and increases the risk of abuse of market power by the single buyer. The government could consider enabling the three main electricity distributors to purchase electricity directly from the producers at market prices reflecting supply and demand, in order to level the playing field for foreign investors in renewable power. Gradually transitioning from power purchase agreements to a well-designed wholesale market for electricity could further enhance the ability of the power sector to accommodate high shares of renewable energy. While renewable-energy-based electricity generation is subject to fluctuations, demand must always be satisfied. Wholesale markets increase the flexibility of the electricity network and allow for a more cost-efficient allocation of power generation.

5.5.3. Access to land can hinder renewable-power projects

Access to land is an important consideration for all investors but may be critical for clean energy investors. In fact, one of the major challenges for renewables investment in Jordan is accessing lands suitable for renewable-project development. Most renewable energy plants demand more surface per megawatt installed than their fossil-fuel counterparts. As a result, renewable energy plants often require the company leading the project to engage with more than one landowner. Thus, inadequate property registration systems can substantially raise the transaction costs associated with clean energy investments (OECD, 2015[14]).

One of the main procurement methods for renewable power in Jordan is direct proposal submissions scheme, whereby independent power producers (i.e. the investors) are responsible for acquiring the development assets by themselves and are guaranteed a tariff for the power they produce (OECD, 2016[15]). Under this scheme, investors that submit successful proposals are responsible for acquiring permits and undertaking necessary assessments. As the MEMR does not acquire and lease land for renewable energy projects, this can create additional burdens and transaction costs for investors. Recent evidence suggests that independent power producers must undertake lengthy negotiations with landowners and contend with land speculation, resulting in higher project costs (OECD, 2016[15]). The lack of transparency on available lands suitable for development of renewable facilities is also a constraint for small-scale renewable investments developed under the wheeling scheme.

In order to reduce transaction costs associated with securing land, policymakers could create a database of available public land for renewable projects and potentially facilitate land acquisition procedures through a centralised office. The government could further identify available private lands, and provide lenders with a mechanism to ensure that leases of land with multiple private owners can be efficiently concluded. Jordan could also map the geographical distribution of renewable-energy resources to improve co-ordination between land use planning and renewable-power infrastructure development. Geographical mapping of resources would help identify which areas may require land-use adjustments to allow for deployment of renewable-power projects.

5.5.4. Jordan has made significant strides in reforming energy subsidies

While the regulatory framework is important to create an enabling environment for low-carbon investments, targeted measures are necessary to remove price distortions that result in over-investment in carbon-intensive activities. One such measure is to phase out inefficient energy and fossil fuel subsidies. Fossil fuel subsidies impose a huge cost on public budgets and expose national budgets to energy price fluctuations. For net energy importers like Jordan, fossil fuel subsidies exacerbate import dependence. Phasing out such subsidies can make private investors more inclined to invest in alternative energy sources and better technologies, increasing the energy efficiency and decreasing the energy intensity of these economies.

The government initiated substantial petroleum subsidy reforms in 2012, successfully phasing them out by 2014 and greatly reducing the total cost of energy subsidies. Electricity subsidies persisted in an effort to shield poorer consumers from prohibitively high energy prices, resulting in energy subsidies of over USD 1 billion in 2017, the highest across the group of comparator countries (Figure 5.15). Fuel price shocks and the resulting high electricity costs that were not passed on to consumers placed an enormous fiscal burden on the government. In 2017, the EMRC adopted an Automatic Electricity Tariff Adjustment Mechanism, which ensures that increases (or decreases) in global oil prices are reflected in consumer tariffs on a monthly basis (taking into consideration consumer affordability), and has since allowed the electricity sector to remain broadly at the cost-recovery levels since (World Bank, 2018[16]). Allowing for greater flexibility in electricity prices is an important first step to create incentives for private investments in energy efficiency and in alternative energy sources.

5.5.5. Targeted financial, technical and information support focus on expanding renewable energy capacity

The key institution responsible for developing, implementing and financing proactive policies and programmes to decarbonise the economy, including attracting private investment in support of decarbonisation, is the Ministry of Energy and Mineral Resources (MEMR). Indeed, perhaps as a result of Jordan’s energy-related challenges, the majority of these policies seek to expand renewable energy generation capacity and are implemented by the MEMR, the electricity regulator (EMRC) or the Jordan Renewable Energy and Energy Efficiency Fund (JREEEF), both of which are also under the oversight of the MEMR (Figure 5.16, Panel A). The second most frequent policy objective is to promote energy savings and increase energy efficiency of economic activities, while only one policy intervention targets low-carbon innovation, perhaps as a result of Jordan’s still limited capabilities in developing new low-carbon technologies. The preferred policy instruments to achieve renewable energy (RE) and energy efficiency (EE) targets are a variety of financial and fiscal incentives for related investments, as set out in several regulations and by-laws established by the MEMR and its implementing bodies (Figure 5.16, Panel B). Such policies are designed to influence the energy characteristics of investment entering the country, and their resulting direct impact on emissions. This impact can be quite large insofar as foreign investors expand the clean energy options available to domestic investors.

The key legislation that has supported the expansion of such investments is the 2012 Renewable Energy and Energy Efficiency Law (REEEL), which regulates the public procurement procedure for the development of RE projects (i.e. competitive tenders and direct proposal submission), establishes a fixed price (feed-in-tariff) guaranteed to energy generated from renewables, and sets up the JREEEF. The REEEL also establishes net-metering and wheeling schemes, which essentially incentivise industrial or commercial investors to produce their own renewable energy and sell any excess energy at a fixed price. The 2013 by-law on Tax Exemption for RE and EE further stipulates exemptions from customs duties and sales tax for RE equipment and related parts and components. These financial and fiscal incentives provided to RE investors are not advertised on MoI’s website, which raises questions as to whether foreign investors are aware of them. Greater coordination with the MoI to ensure that available financial incentives are included in promotional material published by the IPA may raise the effectiveness of these instruments in attracting low-carbon energy investments internationally. Evidence from an OECD mapping of 10 countries, including Jordan, suggests that financial support for renewable energy technologies should be time-limited and regularly reviewed, and should decrease as the technology matures (Box 5.2).

The JREEEF has implemented various programmes targeting specific sectors (e.g. industry, tourism). These programs often involve free energy audits, and technical and financial support for implementing the RE and EE measures identified by the energy audits (e.g. installing solar water heaters). The JREEEF actively collaborates with local commercial banks, international donors and the Jordan Chamber of Industry in the delivery of these programmes, which can significantly contribute to emissions reductions and greening of existing investments, including foreign investments. The JREEEF and several non-governmental organisations, including the Renewable Energy Establishments Society and the Royal Scientific Society have also financed and implemented information campaigns to raise awareness about energy savings and renewable energy opportunities targeting consumers and small businesses. The Coalition of Energy Services Associations set up a voluntary accreditation programme for energy suppliers to increase the visibility and competitiveness of top low-carbon providers. These types of programmes influence not only the characteristics of investments and resulting direct impacts on emissions, but also their potential for spillovers through competition and imitation by domestic businesses. By increasing awareness among consumers about the energy and emissions characteristics of energy companies and products, they can enhance the attractiveness of low-carbon investments, and induce domestic competitors to replicate their low-carbon business models.

The extent and type of financial support provided to expand renewable energy generation capacity varies across countries, often as a function of the extent of penetration of renewable energy technologies. Climate leaders like Sweden and Costa Rica, which rely overwhelmingly on renewable energy, tend to offer little or no government support for renewable energy generation in the form of tax incentives, grants or subsidies (aside from subsidies for micro-production by households and non-energy enterprises). Sweden rather adopts market-based support measures, like tradable electricity certificates. Costa Rica focuses on developing domestic supply chains to produce renewable energy equipment locally.

Countries that still depend heavily on fossil fuels but where renewable capacity is rising rapidly, like Thailand, Morocco and Jordan, tend to offer a mix of investment incentives on renewable energy equipment, fixed feed-in-tariffs (FiTs) for renewable electricity fed into the grid, and public tenders for new installations of renewable energy infrastructure. Studies provide some evidence that price-based support schemes such as FiTs and premiums are more positively correlated with investors’ ability to raise private finance than quota-based schemes, and therefore may be more appropriate for countries at an earlier stage of the energy transition (Table 5.1).

Countries with still limited renewable energy capacity like Tunisia and Uzbekistan primarily employ a combination of public tenders, corporate tax holidays and import duties exemptions on machinery and equipment.

Three programmes provide training to promote career opportunities related to low-carbon technologies. In particular, the MEMR provides access to a professional certification programme for energy managers tailored to the Arab region; the Vocational Training Corporation offers technical training and certification on skills related to renewable energy and energy efficiency; and NEPCO offers an apprenticeship programme targeting young professionals in the energy sector. Such programmes enhance the attractiveness of Jordan as a destination for low-carbon investments (i.e. direct impact), and additionally help develop the capabilities necessary for knowledge to spill over from foreign to domestic firms.

The role of the MoI in the design and implementation of policies to promote low-carbon investments remains limited to the provision of information related to low-carbon investment opportunities in key sectors such as energy and transport. JIC’s Energy Sector Profile, in particular, provides a detailed overview of clean energy investment opportunities and may be an effective tool to target foreign investments in the sector (JIC, 2018[17]). The Transport Sector Profile identifies investment opportunities to develop the national rail network, but fails to identify investment opportunities related to electrification of road transport, which is a key green growth priority identified in the Transport Sector GG-NAP 2021-2025 (JIC, 2017[18]). Moreover, in its informational and promotional material relating to other priority sectors such as tourism and industry, there is no mention of green investment opportunities, for instance relating to energy-saving or electrification opportunities in tourism and industry (JIC, 2017[19]; JIC, 2017[20]). This is a missed opportunity to link the national green growth agenda to the investment promotion agenda, and the MoI could consider further tailoring its investment promotion material and activities to target low-carbon investors.

5.5.6. Few of Jordan’s international investment agreements address climate concerns

Properly designed investment and trade agreements can play a constructive role in fostering international investment, including in low-carbon technology, services and infrastructure. Depending on the way in which international investment and trade agreements address environmental concerns, or fail to address them, these treaties may in some cases be perceived to conflict with climate objectives and with the measures taken by states to implement the Paris Agreement. Investment agreements may limit the ability of governments to restrict new fossil fuel investment projects, or phase out fossil-fuel-based infrastructure. Provisions that guarantee pre-establishment rights can limit the ability of developing countries to hold foreign investments to their home countries’ higher environmental standards in cases where domestic laws on environmental protection applicable to domestic companies are weak or missing. WTO rules may prevent states from regulating traded goods on the basis of the climate impacts of their production. States may also seek to protect low-carbon industries as a means of achieving long-term decarbonisation targets, and these trade protections may run contrary to free trade principles. States with both an interest in seeing robust climate action and a deep involvement in investment and trade negotiations are in an important position to ensure alignment and mutual reinforcement across climate, trade and investment regimes.

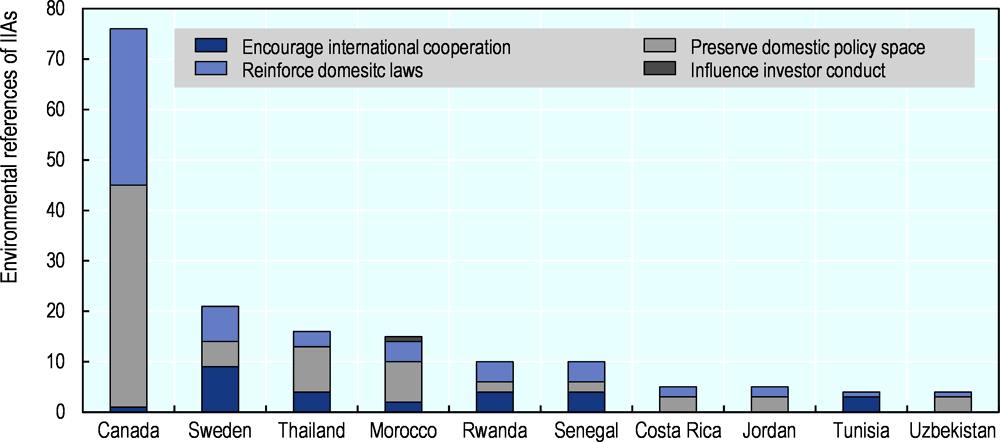

International investment agreements (IIAs) – including bilateral investment treaties (BITs) and regional trade agreements (RTAs) with investment chapters – can form part of wider policy efforts to create incentives for investments that help transition to low-carbon energy infrastructure, reform the current reliance on fossil fuels or correct regulations that weaken the business case for investment and innovation in low-carbon infrastructure. Newer BITs and RTAs, in particular, increasingly feature explicit language that reflects environmental concerns (Gordon and Pohl, 2011[21]; OECD, n.d.[22]).These references vary in specificity, objective and in their use across different types of agreements (Table 5.2).

According to the OECD FDI Qualities Mapping, there is wide variation across countries in the extent of referencing of environmental priorities in investment and trade agreements, and Jordan ranks among the countries with the fewest environmental references. Canada’s BITs and RTAs contain 75 explicit references to preserve domestic policy space for environmental regulation, or to prevent the lowering of environmental standards for the purpose of investment attraction, or both. Significantly fewer treaties present such safeguards in other countries covered by the mapping, with explicit environmental references ranging from 15-20 in Morocco, Thailand and Sweden, to 4-5 in Uzbekistan, Tunisia and Jordan. Specifically, in Jordan, three BITs contain provisions that preserve domestic policy space by excluding indirect expropriation from rom non-discriminatory measures to protect the environment; one RTA reaffirms Jordan’s right to regulate on environmental matter; and three BITs and one RTA contain provisions that mandate the non-lowering of standards for the purpose of investment attraction, thereby reinforcing domestic law. The relatively limited use of environmental provisions and safeguards may expose Jordan to litigation risks under older investment treaties and as the government endeavours to strengthen environmental regulation or expand policy support for low-carbon investments.

References

[1] EBRD (2020), Jordan Diagnostic, https://www.ebrd.com/publications/country-diagnostics.

[8] Financial Times (2021), FDI Markets: the in-depth crossborder investment monitor from the Financial Times, https://www.fdimarkets.com/.

[21] Gordon, K. and J. Pohl (2011), “Environmental Concerns in International Investment Agreements: A Survey”, OECD Working Papers on International Investment, No. 2011/1, OECD Publishing, Paris, https://doi.org/10.1787/5kg9mq7scrjh-en.

[2] IEA (2021), World Energy Statistics, https://www.iea.org/data-and-statistics/data-product/world-energy-statistics.

[17] JIC (2018), Sector Profile: Energy, https://www.jic.gov.jo/wp-content/uploads/2019/07/Energy-Sector-Profile-7-5.pdf.

[19] JIC (2017), Sector Profile: Industry, https://www.jic.gov.jo/wp-content/uploads/2018/07/Sector-Profile-Industry-Final-Mar-2018-JIC-1.pdf.

[20] JIC (2017), Sector Profile: Tourism, https://www.jic.gov.jo/wp-content/uploads/2018/07/Sector-Profile-Tourism-Final-Apr-2018-2.pdf.

[18] JIC (2017), Sector Profile: Transportation and Logistics, https://www.jic.gov.jo/wp-content/uploads/2018/07/Sector-Profile-Transportation-Logistics-Final-Mar-2018-JIC-1.pdf.

[6] Ministry of Energy and Mineral Resources (2018), Annual Report 2017, https://www.memr.gov.jo/ebv4.0/root_storage/en/eb_list_page/annual_report_2017.pdf.

[3] Ministry of Environment (2020), Energy Sector Green Growth National Action Plan 2021-2025, Amman, The Hashemite Kingdom of Jordan, http://www.moenv.gov.jo/ebv4.0/root_storage/ar/eb_list_page/20022_jordan_energy_v03_rc_web.pdf.

[12] Ministry of Environment (2020), Transport Sector Green Growth National Action Plan 2021-2025, Amman, The Hashemite Kingdom of Jordan, https://gggi.org/report/jordan-green-growth-national-action-plans-2021-2025-transport-sector/.

[10] Ministry of Environment (2017), A National Green Growth Plan for Jordan, Amman, Hashemite Kingdom of Jordan, https://www.greengrowthknowledge.org/sites/default/files/A%20National%20Green%20Growth%20Plan%20for%20Jordan.pdf.

[5] OECD (2022), FDI Qualities Policy Toolkit, OECD Publishing, Paris, https://doi.org/10.1787/7ba74100-en.

[13] OECD (2021), FDI Regulatory Restrictiveness Index, https://stats.oecd.org/Index.aspx?datasetcode=FDIINDEX#.

[4] OECD (2021), “Polices for improving the sustainable development impacts of investment”, Consultation Paper March 2021, https://www.oecd.org/daf/inv/investment-policy/FDI-Qualities-Policy-Toolkit-Consultation-Paper-2021.pdf.

[9] OECD (2019), FDI Qualities Indicators: Measuring the sustainable development, http://www.oecd.org/investment/FDI-Qualities-Indicators-Measuring-Sustainable-Development-Impacts.pdf.

[15] OECD (2016), OECD Clean Energy Investment Policy Review of Jordan, Green Finance and Investment, OECD Publishing, Paris, https://doi.org/10.1787/9789264266551-en.

[14] OECD (2015), Policy Guidance for Investment in Clean Energy Infrastructure: Expanding Access to Clean Energy for Green Growth and Development, OECD Publishing, Paris, https://doi.org/10.1787/9789264212664-en.

[22] OECD (n.d.), OECD Trade and Environment Working Papers, OECD Publishing, Paris, https://doi.org/10.1787/18166881.

[11] OECD-IDB (2019), OECD-IDB Survey of Investment Promotion Agencies 2018-19.

[7] World Bank (2021), Enterprise Surveys Indicators Data, https://www.enterprisesurveys.org/en/enterprisesurveys.

[16] World Bank (2018), Implementation Completion and Results Report, https://documents1.worldbank.org/curated/en/222301546546705732/pdf/icr00004657-12282018-636818041906584165.pdf.

Notes

← 1. These estimates should be interpreted with caution as they are based on relatively small sample sizes adjusted using the assigned World Bank Enterprise Survey population weights.

← 2. The Ministry of Investment was created during the time of drafting, and hosts the JIC, which previously reported directly to the Prime Minister. The new institutional relationships have yet to be determined.