copy the linklink copied!Latvia

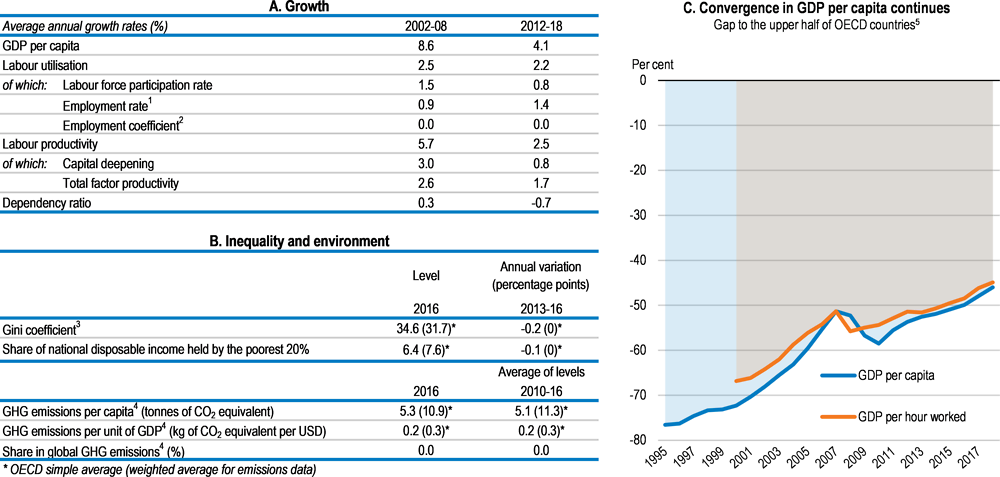

GDP per capita is significantly lower than the upper half of OECD countries due to relatively low productivity. Catch up to high-productivity countries continues, although at a slower pace than before 2008.

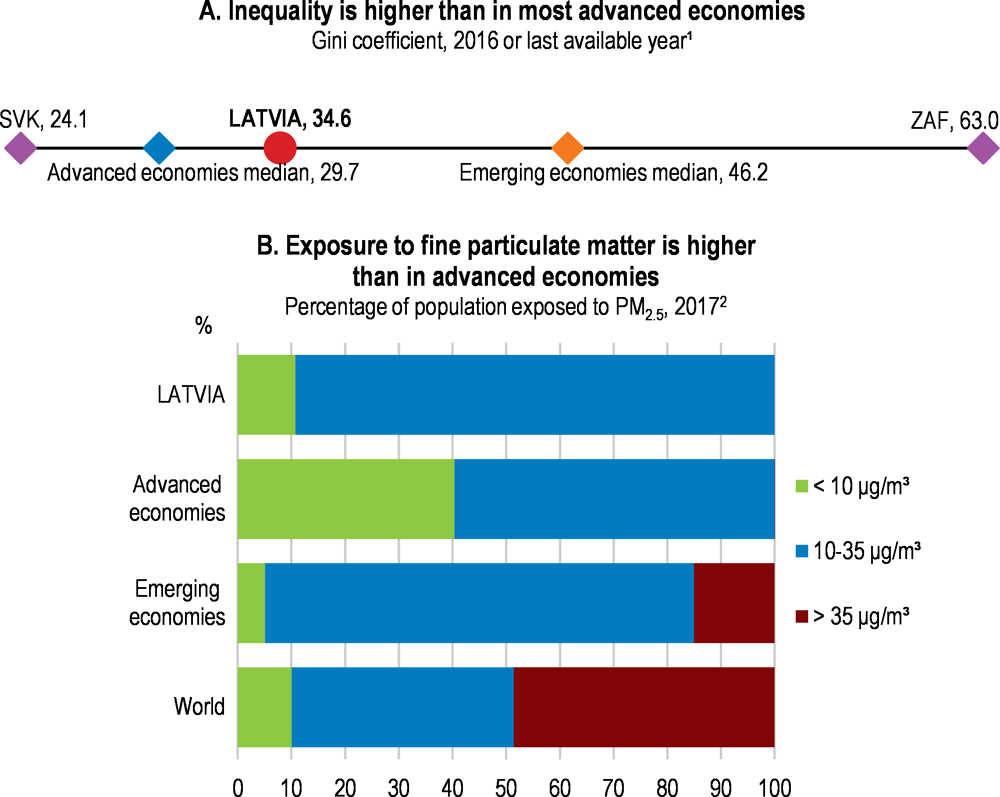

Income inequality has declined somewhat, but remains higher than the average of OECD countries. The income share of the poor remains low. Greenhouse gas emissions per capita are below the OECD average, owing to the high share of renewable energy, but have been stable over the past two decades.

The government introduced several measures to reduce regulatory burdens to business, namely the “Consult first” initiative where authorities first provide advice on compliance, before sanctioning businesses. It also passed several laws to promote e-government services and a one-stop shop for administrative procedure for starting a business. The personal income tax system was made more progressive by lowering the rate on low and medium incomes and introducing a higher, income-dependent tax allowance. Public health expenditure is being increased from a low level to improve access to services. The labour market relevance of vocational education has been increased and modular courses were introduced, facilitating access for adult learners. Integration of the electricity and railway networks with EU neighbours is ongoing.

Reducing labour taxes on low wages, strengthening minimum income support and financial assistance for low-income students would strengthen formal employment and productivity, while lowering poverty. Improving access to housing and investing in low-emission transport and energy efficiency would strengthen internal mobility, equality of opportunity and environmental outcomes.

Latvia: Going for Growth 2019 priorities

Strengthen vocational education. Skill shortages constrain formal employment, productivity growth and inclusiveness.

-

Actions taken: In cooperation with social partners the government modernised curricula, defined new training programmes and developed modular courses, with implementation starting in the 2017/18 school year. It invested heavily in the modernisation of school infrastructure. The government together with social partners is rolling out an adult education plan until 2020.

-

Recommendations: Provide more generous grants for students attending vocational schools who are from low-income families and strengthen work-based training. Make it more attractive for vocational schools to offer adult training by lifting limits on own earnings and improve awareness of low-income workers regarding adult learning offers.

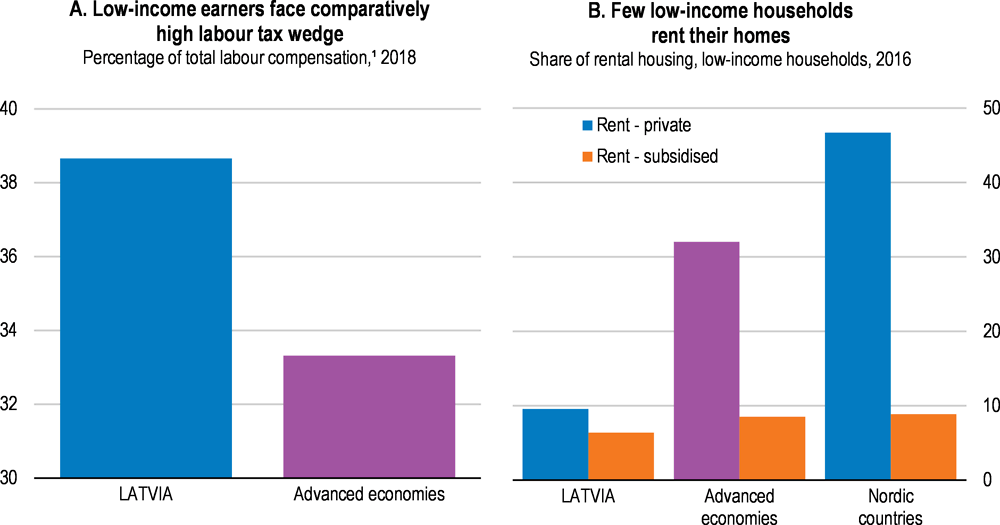

Lower labour taxes, increase property and green taxes and strengthen the tax administration. High taxes on low wage incomes contribute to informality, high unemployment and poverty. Better tax compliance would help finance minimum income support and other social policies.

-

Actions taken: The government lowered labour taxes on medium and low incomes and increased the income-dependent tax allowance in 2018. However, a new social contribution for health expenditure increases labour taxes on low-wage earners. The revenue loss is partly compensated by stricter VAT administration and increases in excise taxes.

-

Recommendations: Reduce the labour tax wedge on low earnings. Raise more revenues from the taxation of real estate and energy. Make better use of information and communication technology for tax law enforcement.

Strengthen social protection. Social benefits are low and not targeted to the poor. High out-of-pocket payments limit access to healthcare especially for the poor.

-

Actions taken: The government increased the Guaranteed Minimum Income by 6% in 2018 and took some measures to increase pension adequacy. Healthcare spending is being increased from a low level.

-

Recommendations: Implement the minimum income reform abandoned in 2017. Reduce out-of-pocket payments especially for the low-income population. Develop key service quality and performance indicators for health care providers to improve efficiency.

1Strengthen access to housing. Access to affordable decent housing is poor, especially in the Riga region with the best employment opportunities.

-

Recommendations: Improve legal certainty in rental regulation and encourage out-of-court procedures. Simplify the administrative process for obtaining a building permit. Provide more funding for low-cost rented housing in areas of expanding employment. Expand the mobility programme, which provides temporary support for relocation and transport.

Strengthen infrastructure. Energy and transport infrastructure are underdeveloped, isolating Latvia from the EU electricity markets and constraining productivity growth and regional development.

-

Actions taken: In 2017, the Intergovernmental agreement on the creation of the Rail Baltica, a EUR 6 billion railway transport project which aims to integrate the Baltic countries within the European railway network, was signed and ratified. In 2018, Latvia signed with other Baltic countries the Political Roadmap which aims at the synchronisation of the electricity networks with the Continental European Network by 2025.

-

Recommendations: Further increase the connectivity to EU electric networks. Enhance the quality of transport infrastructure, especially on roads. Make use of the latest technologies to favour demand-responsive collective road transport services tailored to the needs of customers in rural areas.

Note

← 1. New policy priorities identified in Going for Growth 2019 (with respect to Going for Growth 2017). No action can be reported for new priorities.

Metadata, Legal and Rights

https://doi.org/10.1787/aec5b059-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.