2. Developing countries and the ocean economy: Key trends

This chapter provides an overview of selected trends in the ocean economy in developing countries, based in part on new OECD experimental ocean-based industries datasets. The following sectors of particular interest to developing countries are introduced and include marine fishing and aquaculture, coastal and marine tourism, extractive industries (e.g. oil and gas, sea-bed mining), transport and logistics industries (freight and passenger transport), shipbuilding industries, renewable energy and marine biotechnologies. All these economic activities bring long-term sustainability challenges. In view of the COVID-19 crisis’ enduring economic impacts on the ocean economy, the evidence provided here should contribute to providing a useful baseline for purposes of tracking the positioning of some countries and planning for recovery and new developments. As OECD measurement activities continue in partnership with the international community and ocean industry players, additional and improved economic evidence will be developed.

Not all developing countries have the same connections to the ocean. Geography, history, culture and economic development are all crucial elements that determine the links between countries and the ocean economy. While coastal states and small island developing states (SIDS) have embraced artisanal fisheries for centuries, the development of commercial ports activities in some of these same countries may be relatively recent and driven by changes in regional and international trade. Still, the ocean economy is already important for many countries around the world in terms of jobs and revenues, and particularly so for the many developing countries where a larger proportion of economic activity stems from ocean resources and their use. Measuring the value of ocean activities is therefore important to inform policy- and decision-makers in the public and private sectors, so as to foster improved ocean governance, and enhance sustainable practices.

The economic value of ocean-based industries

The OECD (2016[1]) report, The Ocean Economy in 2030, focussed on the task of measuring the economic contribution of ocean-based industries worldwide, providing for the first time a broad definition of the ocean economy based on the interactions among economic activities and the marine environment (Chapter 1). As a starting point, it estimated that in 2010, ten ocean-based industries produced value added equivalent to 2.5% of global gross domestic product (GDP), a total of USD 1.5 trillion, and full-time employment for approximately 30 million people. Offshore oil and gas accounted for about one third of total value added of the ocean-based industries, followed by maritime and coastal tourism (26%), ports (13%), and maritime equipment (11%). The other industries accounted for shares of 5% or less (industrial fish processing, shipping, shipbuilding and repair, industrial capture fisheries, aquaculture, and offshore wind). Industrial capture fisheries were one of the smallest in value added, although the available data did not take into account the importance of artisanal fisheries. In terms of employment, the ocean-based industries contributed some 31 million direct, full-time jobs in 2010, (roughly equal to France’s entire labour force that year). The largest employers (not including all artisanal fisheries) were industrial capture fisheries and maritime and coastal tourism.

Projecting to 2030, the report estimated that these ten ocean-based industries would reach, conservatively, a gross value added of about USD 3 trillion (roughly equivalent to the size of the German economy in 2010). Before the impacts of the COVID-19 pandemic began to spread, tourism development, including the cruise industry, was expected to make up the largest share (26%), followed by offshore oil and gas exploration and production (21%), port activities (16%), marine equipment (10%), fish processing (10%), and offshore wind (8%). The other industries were below 5%. Notable were the high rates of growth expected in some of the sectors (e.g. marine aquaculture, offshore wind and port activities). A majority of the workforce was expected to be working in the industrial capture fisheries sector and the maritime and coastal tourism industry. As noted, these are very conservative estimates, not least because several important activities in the ocean economy (e.g. marine business and finance, ocean surveillance, and marine biotechnology) were not included due to lack of data.

Since this initial assessment in 2016, developments in tourism and offshore oil and gas exploration, in particular, have accelerated, as discussed in more detail in the sector-specific sections of this report. The OECD, in co-operation with many countries, has also been undertaking further statistical analysis of ocean-based industries (Table 2.1) including original work on satellite accounts for the ocean economy (OECD, 2019[2]). Six ocean-based industries were the first focus of this analysis, starting in 2019, to produce long-term, experimental time series of value added and employment as a subset of the ocean economy. The six industries – marine fishing, marine aquaculture, marine fish processing, shipbuilding, maritime passenger transport and maritime freight transport – were selected based on the availability of datasets that could be populated for the period 2000-15 using official and internationally comparable sources. Many of these are of particular relevance for developing countries, and they interestingly differ in terms of their industrial structure, infrastructure needed and levels of qualification in human resources. The six ocean-based industries represented a total of approximately USD 376 billion in value added in 2015. Other ocean-based industries will be examined over the course of 2020 and into the future. A new OECD (forthcoming[3]) report on ocean economy measurement presents additional results and conceptual and methodological details.

The COVID-19 pandemic is having major economic impacts on countries around the world. Many ocean activities, especially those at the heart of global trade such as shipping as well as leisure activities such as coastal tourism, have been affected by measures undertaken to control the spread of the disease. The associated economic effects are considerable. Exactly how this disruption will impact the future of the ocean economy and the marine environment is not, as yet, clear. However, economic activity has slowed down markedly, and some time may pass before pre-crisis activity levels are reached again.

The looming, global economic downturn provoked by the pandemic has created a pervasive sense of uncertainty that may well persist in the short to medium term. Nonetheless, it will be important for countries to not lose sight of the longer-term opportunities that a sustainable ocean economy can offer. Recovery plans should especially anticipate and identify changes to demand and supply over the long run and consider how these changes might affect existing pressures on ocean ecosystems.

The next subsections look at the value added generated in six selected ocean-based industries and compares these across different country income groupings (Annex 2.A) and across different regions. They also look at evidence from the new datasets to highlight trends pertaining to the ocean economy and developing countries. Two overarching trends transpire: First, lower income groups rely extensively on their natural assets to develop their ocean-based industries, and in some cases important shares of their GDP depend on these industries. And second, ocean-based industries’ importance varies widely across different regions of the world, with some more advanced than others. Further insights in other sectors of the ocean economy are provided in the subsequent sections.

Lower income countries rely extensively on their natural assets to develop their ocean-based industries, and important shares of their GDP depend on these industries

A first focus on six ocean-based industries and comparable data on their value added provide some insights about the ocean economy and developing countries, as these industries constitute a subset of the ocean economy. Based on the new datasets, the economic positioning of developing countries varies widely across ocean-based industries. The six ocean-based industries include marine fishing, marine aquaculture, marine fish processing, shipbuilding, maritime passenger transport and maritime freight transport.

As shown in Figure 2.1, lower middle-income countries overall have a greater value added in marine fishing and fish processing, while high-income and upper middle-income countries generate the greatest value added in manufacturing and the transport sectors of shipbuilding, maritime freight transport and passenger transport.

The six ocean-based industries’ share of GDP also varies across country income groups. In high-income and upper middle-income countries, they represent less than 2% in 2015. They represent much larger shares in 2015 in lower middle-income countries (more than 11%) and in low-income countries (just under 6%). While these averages mask hide large differences from country to country, this analysis highlights the relative importance of ocean-based industries, particularly marine fishing, in the economies of developing countries.

A final focus on the least developed countries (LDCs) category, which includes low-income and some lower middle- income countries, shows that marine fisheries accounts for the biggest share of total value added of the six ocean-based industries, representing 76% of the total (Figure 2.3). It accounts as well for a sizable proportion of employment in LDCs. These countries are some of the world’s most vulnerable to economic and environmental shocks. Among the top ten LDCs in terms of total value added from the six ocean-based industries, Angola leads (Figure 2.3). This is due to the specificities of its marine fisheries and fish processing industries, which export high-value products (shrimp and fresh fish such as grouper and seabream) and import low-value fish for internal consumption (FAO, 2019[5]). The next highest are Bangladesh, Madagascar, Myanmar, Sierra Leone and Senegal.

The value added of ocean-based industries varies widely across different regions

Total value added from the subset of six ocean-based industries over 2005-15 is highest, at approximately USD 200 billion, in OECD countries as a group. Among regional groupings, these industries’ value added increased the most in East Asia and the Pacific, growing from USD 157 billion in 2010 to over USD 175 billion in 2015 in real terms, largely driven by China. The Association of Southeast Asian Nations (ASEAN) group (Brunei Darussalam, Cambodia, Indonesia, Lao People’s Democratic Republic, Malaysia, Myanmar, Philippines, Singapore, Thailand and Viet Nam) is close to reaching USD 50 billion in value added from the ocean economy. The six ocean-based industries represent approximately USD 19 billion in value added in both Latin America and the Caribbean and in South Asia (Figure 2.4). A comparison of value added of these industries at five-year intervals between 2005 and 2015 shows growth in all regions of the world except Europe and Central Asia. It should also be noted that for many of these regions, marine and costal tourism and the offshore extraction of crude petroleum and natural gas are important ocean economy sectors but these are not included in the datasets.

Although the global value added for these six ocean based industries is highest overall in the OECD area, employment in these industries is among the lowest of the regional and country groupings (Figure 2.5). This is likely due to higher productivity in the higher-income countries. The East Asia and Pacific region has the largest number of jobs in these industries (over 20 million). The number of jobs in these ocean-based industries is slowly rising in the ASEAN grouping, from 8.4 million in 2005 to 9 million in 2015. In sub-Saharan Africa, marine activities accounted for about 1.9 million jobs in 2015. Inland fishing and inland aquaculture are also employment-intensive in parts of Africa but are not counted in these figures. These estimates are conservative as they do not take into account significant subsistence activities. A study by de Graaf and Garibaldi (2014[6]) estimated the gross added value of the fisheries and aquaculture sector in Africa, including many inland activities not covered in this report, at USD 24 billion in 2011 (i.e. 1.6% of the GDP of all African countries) and that about 12.3 million people were employed in the sector.

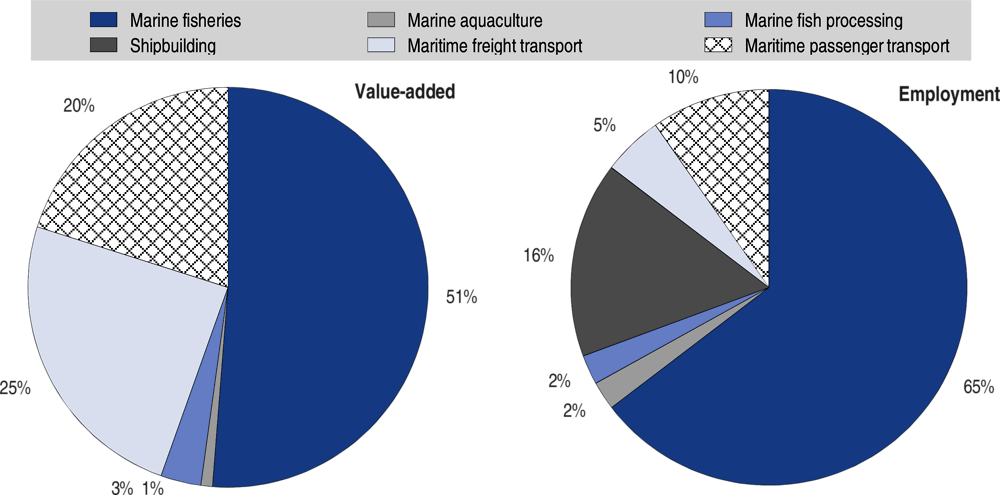

A more granular look at the role of the six ocean-based industries in the Caribbean region is illustrative. In terms of both value added and employment, marine fishing accounts for the largest share among the six industries (Figure 2.6). The region is also home to the manufacturing of small boats for local fishing industries or leisure pursuits and some ship repair. Shipbuilding accounts for 16% of the region’s employment, reflecting the importance of the cruise tourism industry in the Caribbean. At the same time, there are some important differences at national level among the countries of the region. The Dominican Republic has the largest value added in freight and passenger transport. It also the highest GDP in the region and fa relatively diversified economy based on agriculture, mining, services and tourism. Suriname, the Bahamas, Jamaica, Haiti and Belize have a larger value added in marine fisheries, although this sector is almost certainly dwarfed by tourism in each country.

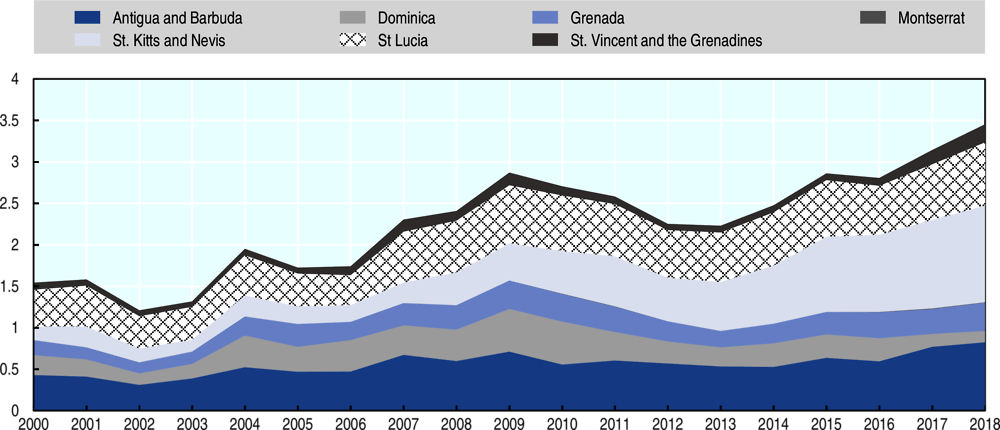

Many of the island countries are tourism-dependent economies, in particular Antigua and Barbuda, Dominica, Grenada, Grenadines, and Saint Vincent. Only a few Caribbean countries have diversified economies based on commodities, services and other natural resources. An example is Belize, which while highly dependent on tourism, also exports oil since 2005. One important factor for all Caribbean countries is their vulnerability to natural disasters and climate change. The island country of Dominica suffered damages estimated at 226% of its annual GDP during the 2017 hurricane season (World Bank, 2020[7]).

This section explores trends across developing countries in several specific ocean-based industries: seafood production (including fishing, aquaculture and fish processing); coastal and marine tourism (including the cruise industry); extractive industries (e.g. oil and gas and seabed mining); transport and logistics industries (including freight, passenger transport and ports); manufacturing, shipbuilding and repair industries; renewable energy; and bio-marine resources. As shown already in the previous section and in Table 2.2, some ocean-based sectors account for a considerable share of GDP in developing countries.

Seafood production: Fishing, aquaculture and fish processing

Capture fisheries and aquaculture are important sources of protein in human diets throughout the world (OECD/FAO, 2019[8]; FAO, 2020[9]). Small-scale fisheries remain the backbone of socio-economic well-being for many coastal communities and especially for developing countries in the tropics, where the majority of fish-dependent countries are located (Golden et al., 2016[10]). As noted in Table 2.2, value added from marine fisheries represents up to 6% of GDP for low-income countries and 8% of GDP for lower middle-income countries. Beyond providing sustenance for communities, capture fisheries and aquaculture are part of a complex seafood value chain that starts with catching or harvesting raw materials as input (e.g. fish, crustaceans), adding value to the raw materials through various processes, and marketing and selling finished products to customers. There are almost as many value chains as species, with very localised networks in the case of many small-scale fisheries and extensive global networks of supply and trade that connect production with consumers in multinational industrial fisheries (Rosales et al., 2017[11]). Fish is one of the most traded food commodities.

Fishing

According to OECD calculations, the value added from marine fishing alone is highest in the grouping of lower middle-income countries, at approximately USD 40 billion in 2015, followed by high-income countries (approximately USD 20 billion) and upper middle-income countries (USD 10 million) (Figure 2.8). The lower middle-income countries host largely coastal, artisanal fisheries, which represent very modest value added. The totals are still conservative, since approximations in many countries often do not take into account the informal, small-scale fisheries and subsistence sectors, which are often important in many developing countries. The lack of data on these fisheries is problematic for policy making at national and regional levels, with impacts on the effectiveness of development assistance and sustainable fisheries management efforts. Indeed, while it is often believed that large-scale fishing has the biggest impacts on fish stocks the most, in fact, the combined pressure of numerous small-scale and subsistence fishers also matters, especially in tropical countries where the abundance of stocks is relatively low. Collecting economic information on artisanal fisheries contributes to better target support policies, for example to identify those fisheries or fleet segments that may be most vulnerable to economic shocks (Delpeuch and Hutniczak, 2019[12]).

Employment data show the number of marine fishing jobs are highest in lower middle-income countries, with about 12 million people employed in this industry in 2014 (Figure 2.9). Upper middle-income countries have the next highest number of marine fishing jobs, with approximately 5 million people employed, followed by high-income countries (just over 500 000 people employed) and lower middle-income countries. While these are very conservative values, based mainly on industrial fishing and likely omitting some small-scale fisheries and family businesses, they highlight interesting distinctions between the different country income groups. For high-income countries, the rather low jobs numbers may be explained by various trends in the industry. The industrialisation of marine fishing and aquaculture activities has been accompanied by a decline in the number of actors in artisanal fisheries. These trends are not yet affecting lower middle-income countries, which account for much of the global employment in marine fishing and aquaculture. However, compliance with national and regional fishing quotas is on the rise and fishing vessel monitoring technologies to check on compliance are spreading. Some examples related to Indonesia in particular are discussed in this chapter. Employment in this industry in upper middle-income countries is starting to slowly decline.

As underscored in this report, policies to support the development of the ocean-based industries in a sustainable manner, combined with necessary marine conservation efforts, also need to be taken up in co-ordination with the local coastal populations to be effective. These issues will be revisited in Chapter 3.

Aquaculture

Aquaculture is considered to be one of the sectors with the largest potential for growth (FAO, 2018[13]) and has expanded substantially in recent years, driving up total fish production against a more stagnating trend for wild fish catch. In 2016, global aquaculture production, including both inland and marine production, was 110.2 million tonnes and was worth approximately USD 243.5 billion (FAO, 2018[13]). At least 64.2% of aquaculture production is inland and is dominated by freshwater fin fish such as carp species. Aquaculture in coastal areas includes both species farmed in saltwater ponds, such as shrimp, and species produced in cages and man-made structures either adjacent to or on the coast, such as seaweed and molluscs.

Developing marine aquaculture could be an opportunity for selected developing countries, although it should not come at the expense of coastal ecosystems. Aquaculture can provide an additional source of income for vulnerable coastal populations, who may otherwise rely on farming or fishing. Further, technical improvements in aquaculture systems have greatly increased the feed efficiency of aquaculture in recent years and many systems now achieve a feed conversion ratio similar to poultry systems, albeit with significant variation (Fry et al., 2018[14]). More complex and still at a demonstration stage, open ocean farming projects also have potential for more sustainable fish production (OECD, 2019[15]).

As shown in Figure 2.10 the top countries in seafood production, including both fisheries and aquaculture, have evolved somewhat between 2005 and 2015 in terms of live weight tonnes. China has remained the leader. Indonesia rose to second place in 2015, followed by the United States, Peru, the Russian Federation, India, Japan, Viet Nam, Norway and Chile. Crustaceans (e.g. shrimps and crabs) and molluscs in seafood production are increasingly important for many developing countries, not only for national consumption but as tradeable goods (OECD/FAO, 2019[8]).

Seafood processing

Millions of people and particularly women are involved in artisanal fish processing, making it another important ocean-based industry in developing countries but one that faces some common challenges. Post-harvest facilities such as drying equipment, ice plants and cold storage facilities are often lacking. Such installations are needed for adding value to the seafood product and obtaining better prices, but also to reduce post-harvest losses that occur in artisanal fisheries (Rosales et al., 2017[11]). When no storage facilities are available in the ports with no ice, the fishers sometimes tend to sell their unsold fish at cheaper price or face spoilage of their catches. The Food and Agriculture Organization estimates that approximately 35% of the global harvest is either lost or wasted every year (FAO, 2020[9]). Economic development across the entire fish production system is therefore highly dependent on enhancing post-harvest processing, as well as exploring further sustainable fishing practices (e.g. certifications and eco-labels), as is discussed further in Chapter 3).

Looking ahead, the impacts of overfishing, climate change, coastal pollution, biodiversity loss and illegal, unreported and unregulated fishing will take a toll on seafood production, as they add to the inherent challenges of artisanal fisheries. Some countries will increasingly need more effective strategies for marine conservation and sustainable fisheries management to rebuild stocks for nutritional security (Hicks et al., 2019[17]). The economic downturn provoked by the COVID-19 crisis will particularly impact fish trade1 and local economies that are reliant on exports.

Coastal and marine tourism including cruise shipping

Tourism is today one of the key sectors in the global economy. In 2019, tourism’s direct, indirect and induced impact represented 10.3% of the world’s GDP and accounted for approximately 330 million, or one in ten, jobs around the world (World Travel and Tourism Council, 2020[18]). Global tourism has grown significantly, with an estimated 1.5 billion international arrivals in 2019, an increase of 3.8% over the previous ten year increase and well beyond forecasts (World Tourism Organization, 2019[19]). Similarly, global expenditures on travel between 2000 and 2018 more than doubled, from USD 495 billion to USD 1.5 trillion, and now represent 7% of global exports in goods and services. The consumption patterns of the middle classes in OECD and emerging countries are driving the high demand for coastal tourism and cruise tourism, particularly in developing countries (OECD, 2016[1]). The COVID-19 crisis may have lasting effects on the tourism sector, however, with the international tourism economy projected to decline by as much as 70% in 2020 (OECD, 2020[20]).

There are major regional differences in countries’ reliance on tourism for their economies. The OECD (2018[21]) estimates that in 2016, tourism represented around 4% of GDP across OECD countries. In contrast, tourism is the main economic sector in several developing countries and an important source of foreign exchange, income and jobs. In Kenya for example, tourism is an important sector, representing 8.8% of GDP in 2018 and attracting up to two million foreign visitors a year, mainly in national parks and along the coast. In some years, coastal tourism can account for some 60% of the revenues. SIDS are also particularly dependent on the tourism sector: two out of three SIDS rely on tourism for 20% or more of their GDP (OECD, 2018[22]). As visitors are frequently concentrated along coastlines, some coastal areas generate up to 80% of total GDP in some countries (Tonazzini et al., 2019[23]). In the Maldives, for example, tourism contributes up to 40% of national GDP. The contribution of direct and indirect tourism to GDP is more than 50% in Cabo Verde, and more than 40% in Antigua and Barbuda, Belize, Saint Lucia, and Fiji It represents 65% of GDP in the Seychelles (Monnereau and Pierre, 2014[24]).

Marine and coastal tourism are highly dependent on the quality of natural ecosystems to attract visitors, as they rely on the recreational value of beaches and clean waters. Yet unmanaged tourism is contributing to ecosystem degradation and fragility, jeopardising it’s the sector’s own economic sustainability. Climate change vulnerability is also a risk for countries that rely on tourism, seen for instance in coral reefs bleaching events, with the greatest risk in small island states where tourism is also the largest sector of the national economy and the largest employer (Scott, Hall and Gössling, 2019[25]). Other challenges affecting the sector include beach degradation resulting from sand harvesting, mangroves deforestation and an ever-growing coastal population that pressures coastal ecosystems.

Cruise shipping is a major component of the tourism industry and has been growing globally. Small island countries are especially popular destinations for cruise ships Figure 2.11. For example, 825 420 cruise passengers visited Antiqua and Barbuda alone in 2018, a 92% increase since 2000 (Eastern Caribbean Central Bank, 2019[26]).

As noted elsewhere in this report, an increasingly trenchant issue for many developing countries is balancing the promotion of commercial activities that cater to foreign demand and the need to address environmental concerns. Global tourism is a case in point, as it is has significant adverse environmental impacts by placing pressures on domestic freshwater supplies, food systems and waste disposal systems in particular (OECD, 2018[21]). Chapters 3 and 4 present examples of policy solutions and practices to improve the sustainability of marine and coastal tourism and other ocean-based industries. Another issue is the impacts of the COVID-19 pandemic on the tourism industry and uncertainly over how long they might last. It is difficult to predict how the industry’s recovery will play out, given the extent of the economic damage, the reduced purchasing power of many potential travellers and the possibility that tourists may be reluctant to travel, especially to countries without well-developed health systems. Any mid- to long-term governmental support should ideally steer the industry to more sustainable practices, backed by efficient policy and economy instruments.

Extractive industries including oil and gas and seabed mining

Oil and gas

The offshore oil and natural gas industry represents the largest share of today’s ocean economy and contributes to many developing economies, particularly in Africa and Latin America, despite important environmental externalities (OECD, 2016[1]). Projects in Indonesia, Malaysia, Myanmar, Thailand and Viet Nam are also ongoing, with around 60% of current production in the Southeast Asia region coming from offshore fields located in shallow waters of less than 450 metres in water depth. Offshore projects generated nearly USD 90 billion of cash flow for publicly traded exploration and production companies in 2019, the third strongest year of the past decade in terms of revenues (Bousso, 2020[28]). The COVID-19 pandemic brought the industry to a sudden halt in early spring 2020 as demand collapsed at a time when supply, already overabundant, was still significantly increasing (IEA, 2020[29]). This will have strong economic impacts on many developing countries.

While Nigeria and Angola are Africa’s largest oil and gas producers, an unprecedented number of other African countries – among them Ghana, Mauritania, Mozambique, Senegal, Somalia and South Africa – are extending new exploration licenses to offshore companies (Beckman, 2019[30]). The oil and gas sector accounts for about 10% of Nigeria’s GDP and around 86% of its exports revenue, which represents 70% of total government revenue (OPEC, 2020[31]). In Angola, oil production and its supporting activities contribute around 50% of the country’s GDP and around 89% of exports. Box 2.1 gives an overview of extractive industries in Africa.

The momentum for new extraction licenses built on the results of recent oil and gas exploration programmes, particularly from the Atlantic coast. These include the discovery in West Africa of large deposits off the coasts of Senegal in the MSGBC basin (Mauritania, Senegal, Gambia, Guinea-Bissau and Equatorial Guinea), all since 2015. Several countries in the region have been working to grow and structure their local industry through training in particular, while also strengthening regulatory institutions to deal especially with the many environmental aspects of the developments. Given the uncertainty surround oil demand and price recoveries in the short to medium term, it is conceivable that investments in some offshore oil and gas projects will be delayed or cancelled due to low prices stemming from the reduced demand and oversupply.

Africa accounts for much of the exponential growth in the world’s population, and a quarter of the world’s population is expected to be African by 2050. Although Africa holds large natural resources and demonstrates economic dynamism, 46% of the population still live in extreme poverty (UNECA, 2016[32]). In this context, African countries with different connections to the ocean in view of their geography and history are seeking new sources of sustainable economic activities. About 70% of them (38 out of 55 countries) have a coastline including SIDS (Monnereau and Pierre, 2014[24]), and several of these coastal countries are in the process of developing ocean strategies to tap into their marine natural resources. Many of these countries are looking at the potential of ocean-based extractive industries to help manage population increase and tackle poverty.

Currently, extractive industries contribute significantly to public finance. Some African countries ’ public revenue is largely dependent on these industries, although revenues still tend to not directly benefit the majority of local communities (EITI, 2018[33]). Approximately 30% of all global mineral reserves are located in Africa. The continent’s proven reserves of oil and natural gas constitute 8 and 7%, respectively, of the world’s stocks. Minerals account for an average of 70% of total African exports and about 28% of GDP. Ghana, already the world’s 10th largest producer of gold, also , has a growing offshore oil sector and an increasing number of exploration activities (Arican Natural Resources Center, 2016[34]). Many African countries still face significant challenges in managing revenue from the oil and gas sector and being effective in improving transparency and accountability. Reliable data on how much oil, gas and mining companies produce are important to accurately calculate taxes and royalties that are based on production.

Seabed mining

Rising demand for minerals and metals, alongside the depletion of land-based resources, is stirring growing commercial interest in exploiting resources on the seabed in national waters and the high seas. Marine mining is already underway in various parts of the world and numerous projects are in operation, but these are located almost exclusively on continental shelves not far from the shore. While many developing countries, particularly SIDS, regard seabed mining as a promising opportunity, marine mining could have significant environmental impacts on coastlines and the high seas if it is managed incorrectly (Miller et al., 2018[35]).

To date, ongoing mining projects are targeted for the most part towards extracting diamonds, phosphates and seabed marine sulphide deposits, for example in Namibia and South Africa as well as China, Japan and Korea. On a global scale, these activities are still small and publicly available economic data on the operations are scarce. Nautilus Minerals, one of the world’s first seafloor miners, officially declared bankruptcy in late November 2019 as it was trying to develop a deep sea gold, copper and silver project off the coast of the Papua New Guinea. The project suffered from technical issues, financial setbacks and community opposition.

The International Seabed Authority is currently facilitating international negotiations on the drafting of technical and environmental rules as part of a possible International Mining Code for the high seas (International Seabed Authority, 2019[36]). The Authority has thus far signed 30 contracts for exploration, not exploitation, with contractors. The contractors, either government bodies or companies with sponsoring states, have the exclusive right to explore for their specified categories of resources for up to 15 years and to exploit an initial area of up to 150 000 km². Contractors may also apply more than once for extensions of up to an additional five years. Activities are currently taking place in the Clarion-Clipperton Fracture Zone (Pacific Ocean) and the Western Indian Ocean and on the Mid-Atlantic Ridge. As part of each exploration project, the contractors are required to propose a programme for the training of developing country nationals. As such, mineral extraction is now seen by several developing countries as a promising opportunity. As an illustration, the Seychelles and Mauritius have worked regionally to map their seafloor to delimit their continental shelf and extend their sovereignty rights. Chapter 3 describes this collaboration in greater detail.

At this stage, when it moves beyond exclusive economic zones and towards the high seas, mining remains an experimental industry with still-unknown impacts on the marine environment and biodiversity, particularly in areas where knowledge of the ocean floor and deep-water ecosystems is limited. Much science occurs though with the current deep-sea exploration phases. Scientific atlases of the many newly discovered megafauna, meiofauna and macrofauna species found in the abyss are already available on the International Seabed Authority (2020[37]) website, allowing researchers to access wealth of data. However, although deep sea science is progressing, much uncertainty still remains about any future operational seabed mining in the high seas. It could have a wide range of impacts on marine ecosystems that may be potentially widespread and long-lasting, with very slow recovery rates. Some impacts may also be theoretically irreversible for instance disturbance of the benthic community where nodules are removed; plumes impacting the near-surface biota and deep ocean; and deposition of suspended sediment on the sea-floor. In consequence, a few countries have called a precautionary approach and even a moratorium on seabed mining activities. For example, Fiji called on fellow Pacific Islands Forum countries to support a ten-year moratorium from 2020 to 2030 (Doyle, 2019[38]).

The COVID-19 pandemic is affecting short-term demand for minerals and metals, and this also may affect some ongoing plans. Nevertheless, looking forward, the commercial exploitation of resources will remain high on the agenda of many developed and developing countries. As countries continue their negotiations on the international regime for using commercially the high seas and the necessary preservation of biodiversity, future seabed mining operations should remain a key issue to tackle for policy-makers.

Shipping and passenger transport

Both shipping (i.e. maritime freight transport) and passenger transport have been growing steadily. International maritime trade has grown almost every year, with volume hitting an all-time high in 2018 of 11 billion tonnes loaded (UNCTAD, 2019[39]). The top five ship-owning regions –Greece, Japan, China, Singapore, and Hong Kong, China – account for more than 50% of the world’s dead weight tonnage. The main sub-sectors in maritime passenger transport also have been registering growth. Globally, ferries transport approximately two billion passengers a year, on a par with air passenger traffic, and the cruise industry carries some 26 million passengers annually (Cruise Market Watch, 2019[40]). In terms of domestic routes, it is often a challenge for developing countries, particularly SIDS and archipelagos, to link different regions via the sea. Indonesia is an example. While its policies target the development of the domestic freight and passenger transport sectors and the servicing of currently uneconomic supply routes, a 2005 regulation prevents international ships from servicing domestic routes and permits international ships to enter only a limited number of designated ports. The government also subsidises a small number of uneconomic goods shipment lines – sea toll routes – through either a state-owned shipping company or through tenders for any remaining capacity needs.

Overall, the maritime transport landscape has changed markedly in recent years, and the COVID-19 crisis is having significant impact (ITF, 2020[41]). Trade growth had been slowing before the pandemic as supply chains and trade patterns became increasingly regionalised, with some possible new gains for coastal lower middle-income countries. In parallel, technology and services have been playing an expanding role in logistics and services, and sustainability issues have been looming larger on the maritime transport industry agenda (ITF, 2019[42]). Additional challenges are likely to arise if the global economic downturn persists.

Shipbuilding

Shipbuilding, like other manufacturing activities, is influenced by a multitude of factors ranging from global trade, energy consumption and prices to changing cargo types and trade patterns, vessel age profiles, scrapping rates and replacement levels. Existing affects shipbuilding capacity also affects developments and has exceeded for some ship requirements for some time, notably due to market-distortive public support in some countries. There has also been a considerable build up of overcapacity in the shipping industry as growth of the global fleet outstripped that of world seaborne trade by a considerable margin (Gourdon, 2019[43]).

High-income and upper middle-income Asian countries are the dominant shipbuilding market leaders, with China, Japan and Korea together accounting for about 90% of global new-build deliveries in tonnage in commercial ships (UNCTAD, 2019[39]). Several European countries (e.g. Denmark, Finland, France, Germany and Italy) are producing highly specialised vessels such as ferries, offshore vessels, and large cruise ships. European countries also account for about a 50% global market share in the marine equipment industry.

In Indonesia, as in other developing countries, the shipbuilding industry is mainly focussed on supplying the domestic market. While the 2012-25 shipbuilding industry development roadmap aims to increase exports of whole ships, the Indonesian industry is constrained by poor access to finance, skilled labour shortages and a tax regime that incentivises the importation of whole ships rather than maritime parts for construction in domestic shipyards. At the end of the value chain, several low-income countries in South Asia (e.g. Bangladesh, India and Pakistan) are involved in the dismantling of the world’s ships (Gourdon, 2019[44]).

The COVID-19 pandemic has generated and is expected to generate many effects on the shipbuilding industry and its broader value chains. Ship demand is driven by global maritime activities that have been severely affected by the pandemic. On the supply side, many shipyards experienced production disruptions in 2020 as governments put in place lockdowns and quarantine measures. In addition, ship orders and ship deliveries have been delayed because it has been difficult for ship owners to meet with shipbuilders and conclude deals. The industry will need to adapt to recover.

Renewable energy

Electrification is a major challenge in many developing countries that remain dependent on imported fossil fuel for energy generation. The cost of fossil fuels is a burden on government budgets, business and households, and disproportionally affects people already struggling with poverty. This is especially the case for SIDS, where on average more than 30% of foreign exchange reserves are allocated each year to cover the cost of fossil fuel imports and where retail energy rates are three to seven times higher than in developed economies (OECD, 2018[22]). To lower the cost of energy and transition towards greener, low-emission development pathways, several renewable solutions are being tested thanks to recent innovations in offshore wind farms and solar and geothermal resources. These renewable energy are however often combined with diesel generators to function effectively in developing countries. The share of renewables in meeting global energy demand is expected to increase by a fifth over the period of 2018-23, reaching 12.4% (IEA, 2018[45]).

Offshore wind in particular is a rapidly growing sector (IEA, 2019[46]). It has expanded at an extraordinary rate over the last 20 years or so in developed and emerging countries, from almost zero to a total global capacity of 18 gigawatts (GW) in 2017. The cost of offshore wind generation has dropped progressively, and projections suggest that offshore wind could reach between 15 to 21 GW per year by 2025 to 2030 (GWEC, 2019[47]). This growth is expected not only in OECD countries and China, but also in several developing countries where offshore wind can expand electricity access and increase the share of renewable resources in the energy mix, thus contributing to the commitments made under the Paris Agreement on climate change. But the long-term impacts of large offshore wind farms on the ocean environment itself is slowly starting to be considered too. The offshore wind sector presents some opportunities but also many specific challenges for low-income countries. Technical difficulties can be vast due to geographic characteristics and remoteness, for SIDS in particular. Offshore wind farms still require rather large upfront investments. Chapter 4 presents examples of potential development financing.

Marine renewable energy – wave, current and tidal energy – is also considered an important potential source of power generation for the transition to a low-carbon future (IEA, 2019[46]). However, ocean energy technologies are for the most part still at the demonstration stage, with only a few prototypes moving towards the commercialisation phase. In many cases, the installation of wind turbines on land or as offshore platforms is not possible due to topographical constraints and competition for space with other ocean-based industries, typically coastal tourism. This is particularly the case for many SIDS that are considering these marine renewable energy options.

The use of geothermal resources can be explored for some tropical islands, particularly volcanic islands. Most geothermal technologies generate stable and carbon dioxide (CO2) emissions-free baseload power. The International Energy Agency, in 2018 forecasts for renewable energy to 2023, projected that growth in geothermal capacity as projects in nearly 30 countries come on line, with 70% of the growth in developing countries and emerging economies (IEA, 2018[45]). The Asia Pacific region (excluding China) has the largest growth (1.9 GW) over the forecast period. This is driven by Indonesia’s expansion, which is propelled by its abundant geothermal resource availability and a project pipeline in the construction phase supported by government policies. Kenya, the Philippines and Turkey follow in terms of capacity growth. Critical issues to resolve concern environmental impacts (e.g. seismicity, possible ground and water contamination, and air pollution) and economic and governance aspects (Table 2.3) (Meller et al., 2018[48]). In the French Caribbean department of Martinique, for example, the first large geothermal plant, named Nemo (New Energy for Martinique and Overseas), was launched in 2016 and then stopped due to technical difficulties and environmental risks linked to the use of ammonia in production. Although pre-development risks continue to pose an important barrier to securing financing for geothermal projects, exploration and construction of facilities in Latin American and Caribbean countries are expected to accelerate.

The policy responses to the COVID-19 crisis may potentially lead to further development in renewable energy systems, as investments in the energy infrastructure are re-evaluated in both developed and developing countries (Birol, 2020[49]).

Marine biotechnologies

To date, the potential of marine bio-resources remains largely untapped, although many developing countries have extensive and valuable marine resources such as corals, sponges and fish. As ocean processes become better known, many countries are developing strategies to foster marine biotechnology for future pharmaceutical drug development and cosmetic products for health and well-being as well as for food production using algae, biofuel, etc. (OECD, 2017[50]). Marine bio-resources research is already essential in many industries, for instance in the pharmaceutical sector for the development of new generations of antibiotics. Marine genetic resources could be at the core of new solutions to fight pandemics.

Already, an increasing number of developing countries have integrated this marine bio-resources dimension in their respective ocean economy strategies, among them the Seychelles, and more are doing the same. However, the gap between developed and developing countries on bioprospecting is growing, with ten developed countries accounting for more than 98% of the patents associated with a gene of marine origin (Blasiak et al., 2018[51]). Despite international conventions on the protection of biodiversity (e.g. the Convention on Biological Diversity and the Nagoya Protocol on Access to Genetic Resources and the Fair and Equitable Sharing of Benefits Arising from their Utilization), several multinationals are using patents to acquire genetic resources or traditional knowledge. A single corporation – BASF, headquartered in Germany and the world’s largest chemical manufacturer – registered 47% of all patent sequences based on genes of marine origin. The Yeda Research and Development Co. Ltd., the commercial arm of the Weizmann Institute of Science in Israel, registered more than half (56%) of all university patents, more than the combined claims of 77 other universities. At this stage, there are no internationally agreed definitions concerning the crucial marine genetic resources that are still being discovered. However, negotiations are ongoing for access to and benefit sharing of these resources.

As seen earlier, the impacts of the COVID-19 pandemic could have long-lasting effects on ocean-based industries in general. But they could also accelerate developments in specific emerging ocean-based sectors, for example marine biotechnologies for medical applications. For instance, the test being used to diagnose the novel coronavirus COVID-19 –and in other pandemics such as HIV/AIDS and SARS – was developed with the help of an enzyme isolated from a microbe found in marine hydrothermal vents (Hugus, 2020[52]).

Developing countries should consider exploring and potentially engaging in a sustainable way in these activities. An important first step to avoiding irreversible damage to fragile ecosystems may be linking with existing knowledge and innovation networks to form partnerships and base any future activities on scientific evidence. Chapter 3 highlights some collaborative approaches.

Some cross-sectoral perspectives

The objective of most private investment strategies is to achieve the highest possible return within reasonable risks, whether these are financial, technical or reputational risks. The broader environmental and social consequences of business operations have become an important focus for many ocean-based industries.

Since the UN Ocean Conference in New York in 2017, the importance of demonstrating sustainable practices is growing considerably in various ocean-based industries. The UN Global Compact, for instance, has developed a Sustainable Ocean Business Action Platform that convenes dozens of representatives of ocean-based industries to develop common principles and actions to advance progress towards the Sustainable Development Goals (UN Global Compact, 2019[53]). In 2019, the Compact developed Sustainable Ocean Principles that emphasise the responsibility of businesses to take necessary actions to secure a healthy and productive ocean. Although a strong policy and regulatory framework at national level is crucial to ensure sustainability across ocean-based industries (Chapter 3), more private actors are starting to align with the requirement for improved sustainability based on voluntary commitments.

Another cross-sectoral element concerns the importance of global value chains (GVCs) in ocean-based industries. All countries, including developing countries, aim to attract foreign investments and encourage their businesses to enter new markets. The general environment of the ocean economy is quite competitive including among developing countries, as illustrated in the competition to attract cruise ships in the Caribbean. Moreover, this environment is sensitive to even small changes in costs of doing business, production or trade. Many low-income countries thus face even more challenges and may need support to put in place some preconditions for integration into GVCs. The preconditions can include but are not restricted to open trade and investment regimes. Other important factors include the development of infrastructure and the readiness of institutions, supporting local human capital through education and training, improving the business climate, and the availability of capital (OECD, 2015[54]).

As the COVID-19 pandemic-induced crisis continues through 2020 and beyond, reduced activity in ocean-related sectors such as marine and coastal tourism will have an impact on developing countries’ socio-economic fabric. In view of the wider impacts on the world economy, the evidence developed for this report should eventually contribute to building a baseline to review the positioning of some countries in selected ocean-based industries and to plan for recovery and new developments as additional and better economic evidence is developed.

Despite uncertainties, many of the major trends associated with ocean-based industries will continue. For instance, longer-term demand for marine sources of food, energy, minerals and leisure pursuits is still likely to increase as the global population grows. Some untapped opportunities remain for developing countries to benefit from sustainable development pathways. Improving long-term sustainability should remain a core factor in decisions related to ocean-based industries, as policy makers consider strategies to stimulate their economies once it is safe to do so. The development of ocean-based industries should go hand in hand with preserving marine natural assets and ecosystem services.

Political will and public investment in ocean governance tools are needed to encourage and develop more sustainable practices in relation to the marine environment. Many policy instruments exist – ranging from regulatory command-and-control instruments to economic instruments and information and voluntary approaches – to create the right business environment to attract investments, protect the interest of fragile communities and make sure that any development is respectful of environmental laws. In other words, there is much that can be done to ensure that a sustainable ocean economy is sufficiently supported and that its benefits are shared as broadly as possible. Chapter 3 provides an overview of these instruments and practical examples for selected sectors.

References

[34] Arican Natural Resources Center (2016), Catalyzing Growth and Development Through Effective Natural Resources Management, African Development Bank Group, Abidjan, Côte d’Ivoire, https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/anrc/AfDB_ANRC_BROCHURE_en.pdf.

[30] Beckman, J. (2019), “Sub-Saharan Africa opening up to offshore investors”, Offshore, https://www.offshore-mag.com/drilling-completion/article/16763971/subsaharan-africa-opening-up-to-offshore-investors.

[49] Birol, F. (2020), “Put clean energy at the heart of stimulus plans to counter the coronavirus crisis”, IEA Commentaries, https://www.iea.org/commentaries/put-clean-energy-at-the-heart-of-stimulus-plans-to-counter-the-coronavirus-crisis.

[51] Blasiak, R. et al. (2018), “Corporate control and global governance of marine genetic resources”, Science Advances, Vol. 4/6, p. eaar5237, https://doi.org/10.1126/sciadv.aar5237.

[28] Bousso, R. (2020), Offshore oil and gas boom to continue, https://www.reuters.com/article/us-oil-offshore/offshore-oil-and-gas-boom-to-continue-rystad-idUSKBN1ZD1N6.

[40] Cruise Market Watch (2019), Statistics - 2018 Worldwide Cruise Line Market Share (webpage), https://cruisemarketwatch.com/market-share/ (accessed on 8 November 2019).

[6] de Graaf, S. and L. Garibaldi (2014), The Value of African Fisheries, Food and Agriculture Organization, Rome, http://www.fao.org/3/a-i3917e.pdf.

[12] Delpeuch, C. and B. Hutniczak (2019), “Encouraging policy change for sustainable and resilient fisheries”, OECD Food, Agriculture and Fisheries Papers, No. 127, OECD Publishing, Paris, https://dx.doi.org/10.1787/31f15060-en.

[38] Doyle, A. (2019), “Who is in charge of the high seas?”, Financial Times, https://www.ft.com/content/dcbc6e94-de26-11e9-b8e0-026e07cbe5b4.

[26] Eastern Caribbean Central Bank (2019), Tourism Annual 2018.

[27] Eastern Caribbean Central Bank (2019), Tourism Annual Report, https://www.eccb-centralbank.org/statistics/tourisms/comparative-report.

[33] EITI (2018), EITI in Africa, Extractive Industries Transparency Initiative (EITI) Oslo, https://eiti.org/sites/default/files/documents/eiti_africa_brief_en.pdf.

[9] FAO (2020), In Brief: The State of World Fisheries and Aquaculture 2020 - Sustainability in Action, Food and Agriculture Organization (FAO), Rome, https://doi.org/10.4060/ca9231en.

[16] FAO (2019), FAO Global production by production source 1950-2017, FAO Fisheries and Aquaculture - Statistics, August 2019., http://www.fao.org/fishery/statistics/en.

[5] FAO (2019), Fisheries and Aquaculture Country Profiles: The Republic of Angola, Food and Agriculture Organization (FAO), Rome, http://www.fao.org/fishery/facp/AGO/en#CountrySector-SectorSocioEcoContribution.

[13] FAO (2018), The State of World Fisheries and Aquaculture 2018, Food and Agriculture Organization (FAO), Rome, http://www.fao.org/3/I9540EN/i9540en.pdf.

[14] Fry, J. et al. (2018), “Feed conversion efficiency in aquaculture: Do we measure it correctly?”, Environmental Research Letters, Vol. 13/2, p. 024017, https://doi.org/10.1088/1748-9326/aaa273.

[10] Golden, C. et al. (2016), “Nutrition: Fall in fish catch threatens human health”, Nature, Vol. 534/7607, pp. 317-320, https://doi.org/10.1038/534317a.

[43] Gourdon, K. (2019), “An analysis of market-distorting factors in shipbuilding: The role of government interventions”, OECD Science, Technology and Industry Policy Papers, No. 67, OECD Publishing, Paris, https://dx.doi.org/10.1787/b39ade10-en.

[44] Gourdon, K. (2019), “Ship recycling: An overview”, OECD Science, Technology and Industry Policy Papers, No. 68, https://doi.org/10.1787/397de00c-en.

[47] GWEC (2019), Global Offshore Wind Report.

[17] Hicks, C. et al. (2019), “Harnessing global fisheries to tackle micronutrient deficiencies”, Nature, Vol. 574/7776, pp. 95-98, https://doi.org/10.1038/s41586-019-1592-6.

[52] Hugus, E. (2020), “Finding answers in the ocean: In times of uncertainty, the deep sea provides potential solutions”, Woods Hole Oceanographic Institution, https://www.whoi.edu/news-insights/content/finding-answers-in-the-ocean/.

[29] IEA (2020), Oil Market Report April 2020, International Energy Agency, Paris, https://www.iea.org/topics/oil-market-report.

[46] IEA (2019), Renewables 2019: Analysis and Forecast from 2019-2024, International Energy Agency, Paris, https://www.iea.org/renewables2019/ (accessed on 29 October 2019).

[45] IEA (2018), Renewables 2018: Analysis and Forecasts to 2023, International Energy Agency, Paris, https://www.iea.org/reports/renewables-2018 (accessed on 22 July 2019).

[37] International Seabed Authority (2020), Deep-Sea Taxonomic Atlases (webpage, https://www.isa.org.jm/vc/deep-sea-taxonomic-atlases (accessed on 5 May 2020).

[36] International Seabed Authority (2019), Exploration Contracts (webpage, https://www.isa.org.jm/deep-seabed-minerals-contractors (accessed on 22 July 2019).

[41] ITF (2020), COVID-19 Transportation Brief: How Badly Will the Coronavirus Crisis Hit Global Freight?, OECD Publishing, Paris, https://www.itf-oecd.org/sites/default/files/global-freight-covid-19.pdf.

[42] ITF (2019), “Maritime subsidies: Do they provide value for money?”, International Transport Forum Policy Papers, No. 70, OECD Publishing, Paris, https://www.itf-oecd.org/maritime-subsidies-do-they-provide-value-money.

[48] Meller, C. et al. (2018), “Acceptability of geothermal installations: A geoethical concept for GeoLaB”, Geothermics, Vol. 73, pp. 133-145, https://doi.org/10.1016/J.GEOTHERMICS.2017.07.008.

[35] Miller, K. et al. (2018), “An overview of seabed mining including the current state of development, environmental impacts, and knowledge gaps”, Frontiers in Marine Science, Vol. 4, p. 418, https://doi.org/10.3389/fmars.2017.00418.

[24] Monnereau, I. and P. Pierre (2014), Unlocking the Full Poential of the Blue Economy: Are African Small Island Developing States Ready to Embrace the Opportunities?, United Nations Economic Commission for Africa, Addis Ababa, https://doi.org/10.13140/RG.2.1.1928.6001.

[55] OECD (2020), A Blueprint for Improved Measurement of the International Ocean Economy, OECD Publishing, Paris.

[4] OECD (2020), Experimental Ocean-Based Industry Database, Directorate for Science, Technology and Innovation, OECD, Paris.

[20] OECD (2020), “Tourism polic responses to coronavirus (COVID-19)”, Tackling Coronavirus (COVID-19), https://read.oecd-ilibrary.org/view/?ref=124_124984-7uf8nm95se&title=Covid-19_Tourism_Policy_Responses.

[2] OECD (2019), “Innovative approaches to measuring the ocean economy”, in Rethinking Innovation for a Sustainable Ocean Economy, OECD Publishing, Paris, https://dx.doi.org/10.1787/d71e8b4d-en.

[15] OECD (2019), Rethinking Innovation for a Sustainable Ocean Economy, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264311053-en.

[22] OECD (2018), Making Development Co-operation Work for Small Island Developing States, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264287648-en.

[21] OECD (2018), OECD Tourism Trends and Policies 2018, OECD Publishing, Paris, https://dx.doi.org/10.1787/tour-2018-en.

[50] OECD (2017), “Marine biotechnology: Definitions, infrastructures and directions for innovation”, OECD Science, Technology and Industry Policy Papers, No. 43, OECD Publishing, Paris, https://dx.doi.org/10.1787/9d0e6611-en.

[1] OECD (2016), The Ocean Economy in 2030, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264251724-en.

[54] OECD (2015), “Participation of Developing Countries in Global Value Chains: Implications for Trade and Trade-Related Policies”, OECD Trade Policy Papers, No. 179, OECD Publishing, Paris, https://doi.org/10.1787/5js33lfw0xxn-en.

[3] OECD (forthcoming), A Blueprint for Improved Measurement of the International Ocean Economy, OECD Publishing, Paris.

[8] OECD/FAO (2019), OECD-FAO Agricultural Outlook 2019-2028, OECD Publishing, Paris/Food and Agriculture Organization of the United Nations, Rome, https://dx.doi.org/10.1787/agr_outlook-2019-en.

[31] OPEC (2020), About Us: Member Countries, Organization of the Petroleum Exporting Countries (OPEC), https://www.opec.org/opec_web/en/about_us/25.htm.

[11] Rosales, R. et al. (2017), “Value chain analysis and small-scale fisheries management”, Marine Policy, Vol. 83, pp. 11-21, https://doi.org/10.1016/j.marpol.2017.05.023.

[25] Scott, D., C. Hall and S. Gössling (2019), “Global tourism vulnerability to climate change”, Annals of Tourism Research, Vol. 77, pp. 49-61, https://doi.org/10.1016/j.annals.2019.05.007.

[23] Tonazzini, D. et al. (2019), Blue Tourism: The Transition Towards Sustainable Coastal and Maritime Tourism in World Marine Regions, Ecounion, Barcelona, http://www.ecounion.eu/wp-content/uploads/2019/06/BLUE-TOURISM-STUDY.pdf.

[53] UN Global Compact (2019), “30 companies and institutional investors commit to take action to secure a healthy and productive ocean”, https://www.unglobalcompact.org/news/4492-10-22-2019.

[39] UNCTAD (2019), Review of Maritime Transport 2019, United Nations Conference on Trade and Development (UNCTAD), Geneva, https://unctad.org/en/PublicationsLibrary/rmt2019_en.pdf.

[32] UNECA (2016), Africa’s Blue Economy: A Policy Handbook, United Nations Economic Commission for Africa (UNECA), Addis Ababa, https://www.uneca.org/publications/africas-blue-economy-policy-handbook.

[7] World Bank (2020), The World Bank in the Caribbean: Overview of the Caribbean (webpage), https://www.worldbank.org/en/country/caribbean/overview.

[19] World Tourism Organization (2019), International Tourism Highlights: 2019 Edition, https://doi.org/10.18111/9789284421152.

[18] World Travel and Tourism Council (2020), Economic Impact Reports, World Travel and Tourism Council (WTTC), https://wttc.org/Research/Economic-Impact.

Note

← 1. For more information on the impacts of COVID-19 on the fisheries sector please see: https://read.oecd-ilibrary.org/view/?ref=133_133642-r9ayjfw55e&title=Fisheries-aquaculture-and-COVID-19-Issues-and-Policy-Responses