copy the linklink copied!Sweden

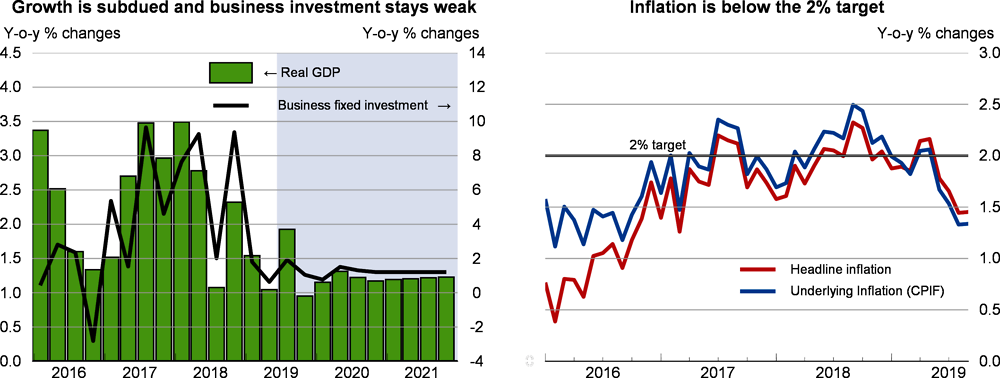

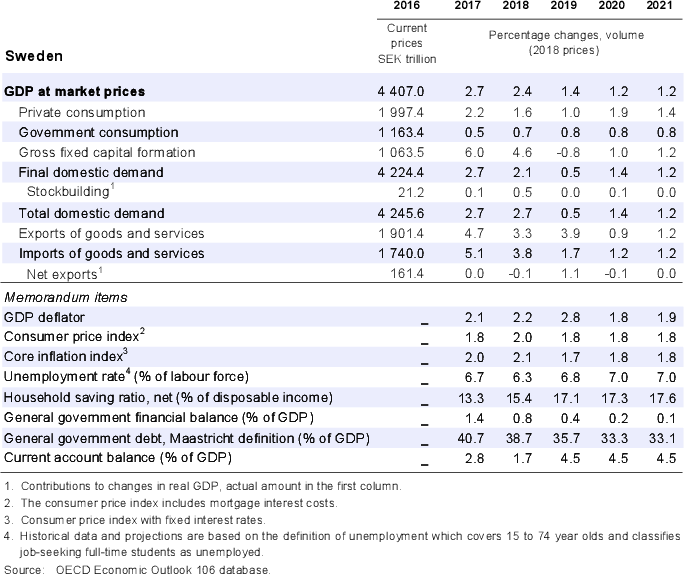

The long expansion is losing momentum. Export growth will decline sharply, reflecting the global slowdown. Heightened uncertainty will continue to weigh on business investment, while residential investment will bottom out. Households will continue to spend with caution, as unemployment is rising and wage gains remain moderate. Inflation will continue to undershoot the 2% target.

Monetary policy will likely remain accommodative until the economy shows clear signs of recovery and inflation moves clearly towards the target. Automatic stabilisers and discretionary fiscal measures will support the economy, but space for additional stimulus is available, should economic conditions deteriorate more than projected. Support for entry-level jobs and skills development, along with labour market reform, will be critical to contain the rise in unemployment.

Growth is slowing markedly and unemployment is rising

Weak exports and business investment, resulting from the global slowdown and higher uncertainty, are dragging down economic growth. Low consumer confidence and subdued wage growth are holding back private consumption. Residential investment continues to contract, but from a high level and at a slowing pace. Unemployment is rising, though most probably not as steeply as suggested by recent data. Sluggish activity, slower energy price increases and fading effects from the depreciation of the krona have pulled down inflation to below the 2% target.

Policies are cushioning the downturn and fiscal space is available

Monetary policy continues to support the economy, despite the expected December policy rate increase from -0.25% to 0%. Subdued growth, high uncertainty and below-target inflation are likely to delay any additional increase in the policy rate over the coming two years, as the benefits of expansionary policy outweigh potential adverse side effects on household debt and resource allocation. Scope for further monetary stimulus, should growth and inflation disappoint, is limited.

In addition to powerful automatic stabilisers, discretionary measures in the 2020 budget bill, amounting to 0.5% of GDP, will bolster activity. They include tax cuts for higher-income households and pensioners, and increased support for green investments, health care, schools and employment, as well as public investment, notably in road and rail maintenance. With a budget surplus and gross government debt close to 35% of GDP, there is room for additional fiscal stimulus if the economic situation deteriorates further.

Containing the rise in unemployment as the economy slows will be challenging. In particular, the tight labour market over recent years has facilitated the employment of low-skilled workers and newly-arrived immigrants, who are likely to face tougher prospects going forward. The government intends to introduce new measures, including entry agreements negotiated with the social partners, to help newly-arrived immigrants and long-term unemployed find jobs. A skills development programme will help workers adapt to evolving job requirements and the public employment service will be reformed, with increased involvement of private providers.

Growth will remain sluggish with downside risks

Weak global demand, notably for the intermediate and capital goods in which Sweden specialises, and global uncertainty will continue to weigh on exports and business investment. Residential investment will bottom out as inventories of unsold dwellings decline. However, even though house prices have stabilised and a general shortage of dwellings persists, no rapid rebound in construction is expected. Huge uncertainty surrounds the reaction of employment to the economic slowdown and the ability of the new labour market policies to counter the rise in unemployment. With the uncertainties surrounding the labour market and modest wage growth, households will remain cautious in spending, despite benefiting from tax cuts. Risks related to the global environment are tilted to the downside and lower global growth and intensified trade tensions could reduce Swedish exports and investment further. However, the strong fiscal position would allow more expansionary fiscal policy to damp the downturn.

Metadata, Legal and Rights

https://doi.org/10.1787/9b89401b-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.