Out-of-work benefits

Cash transfers for working-age people provide a major income safety net in case of unemployment. In most countries, two layers of support can be distinguished: primary unemployment insurance benefits and secondary benefits (such as unemployment assistance or guaranteed minimum-income benefits) for those who are not or no longer entitled to insurance benefits. These guaranteed minimum-income benefits (GMI) provide financial support for low-income families to ensure an acceptable standard of living and play a crucial role as last-resort safety nets for long-term unemployed people.

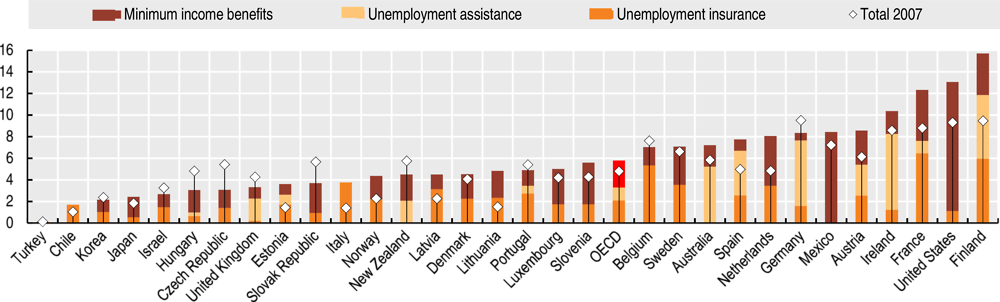

In 2016, the shares of working-age individuals receiving out-of-work benefits were highest in France, Finland, Ireland and the United States, with rates above 10% (Figure 6.7). At the other end of the spectrum, in Chile, Israel, Japan, Korea and Turkey, less than 4% of the working-age population received at least one of these payments. These differences in the number of recipients reflect not only differences in employment rates, but also differences in benefit entitlement rules. In countries with the highest levels of receipt, entitlement to GMI benefits extends to low-income working families. In some countries (including France and Ireland), earnings from work can be combined with unemployment insurance payments under certain conditions.

On average, 5.8% of the working-age population received out-of-work benefits in the OECD in 2016. The rate was still above pre-crisis levels in many countries, especially those countries where unemployment remained elevated in 2016 (including Ireland, Lithuania and Spain) and in countries with a higher number of recipients of means-tested benefits (Finland, France, the Netherlands and the United States). In other countries (Czech Republic, Hungary, New Zealand and Slovak Republic), levels of benefit recipiency fell. This drop partly reflects a fall in benefit coverage among the unemployed as a result of either policy changes that have tightened eligibility conditions or changes in the composition of the unemployed that have led to fewer people meeting these conditions (OECD, 2018[1]).

In a large majority of OECD countries, the levels of primary unemployment insurance benefits are typically significantly higher than those of GMI benefits (Figure 6.8). On average across the OECD, 58% of net income in work is maintained in the initial phase of an unemployment spell for a single person without children with previous earnings at the average wage, but this falls to 31% once they become long-term unemployed.

GMI benefits are sometimes significantly lower than commonly used poverty thresholds (Figure 6.9). Indeed, in a few countries, a single person without children who has exhausted unemployment benefit entitlement receives no cash support at all: Turkey has no GMI benefit and in the United States support takes the form of “food stamps” from the Supplementary Nutrition Assistance Programme. For those living in rented accommodation, housing-related benefits like rent allowances can provide significant further income assistance, bringing overall incomes close to or somewhat above the poverty line (Denmark, Finland, Iceland, Ireland, Japan, the Netherlands and the United Kingdom). However, in all countries GMI benefits alone are insufficient to escape poverty. Family incomes in these cases depend strongly on the type of housing and family arrangements.

Figure 6.7 shows the number of recipients as shares of working-age individuals. Benefits that are awarded at family level (e.g. social assistance) are only counted once per family. Data are based on the OECD Social Benefit Recipients Database (SOCR), which covers all main income replacement benefits in 40 EU and OECD countries. Depending on the data made available by countries, SOCR includes caseloads, flows and average amounts of benefits, and currently covers eight years (2007-14). Primary out-of-work benefits are typically received during an initial phase of unemployment (unemployment insurance in most countries). Some countries that have no unemployment insurance instead operate means-tested unemployment assistance as the primary benefit.

The net replacement rate (NRR) measures the fraction of net income in work that is maintained when unemployed. It is defined as the ratio of net income while out of work divided by net income while in work. The NRR presented here corresponds to a 40 year-old single person without children who earns 100% of the average wage. Initial phase of unemployment refers to the second month of benefit following any waiting period, and long-term unemployment refers to the 60th month of benefit receipt. Family incomes are simulated using the OECD Tax-Benefit Model (www.oecd. org/social/benefits-and-wages.htm).

One way of looking at how countries’ social protection systems perform is to show how the level of net minimum cash income benefits (including housing assistance) compares to relative poverty thresholds of 50% or 60% of median household incomes. These income levels account for all cash benefit entitlements of a family with a working-age head, with no other income sources and no entitlements to primary benefits such as unemployment insurance. They are net of any income taxes and social contributions. Median disposable incomes (before housing costs) come from the OECD Income Distribution Database (www.oecd.org/social/income-distribution-database.htm).

Further reading

Immervoll, H. and C. Knotz (2018), “How demanding are activation requirements for jobseekers”, OECD Social, Employment and Migration Working Papers, No. 215, OECD Publishing, Paris, https://dx.doi.org/10.1787/2bdfecca-en.

OECD (2018), “Unemployment-benefit coverage: Recent trends and their drivers”, in OECD Employment Outlook 2018, OECD Publishing, Paris, https://doi.org/10.1787/empl_outlook-2018-9-en.

Figure notes

Figure 6.7: Recipients caseloads are missing or incomplete for Greece. For comparability reasons, Canada, Iceland, Poland and Switzerland are also excluded.

Figure 6.8 and Figure 6.9: No data for Chile and Mexico.