copy the linklink copied!5.6. Earmarked funds

Budget earmarks set aside a percentage of government funds for specific sectors, which can be estimated as a share of GDP; and are established by the constitution, or by primary or secondary legislation.

Earmarks cause budget rigidities because of the inability to fund programmes that are in line with new policy priorities, as opposed to pre-existing ones. This, in turn, can contribute to lack of accountability and inefficient use of resources by perpetuating programmes or initiatives that are no longer necessary or that do not perform as expected, which, in turn, may be captured by interest groups and hamper the development of new and strategic initiatives. In cases of sudden macroeconomic shocks, excessive earmarks compromise macroeconomic stability by reducing the room for manoeuvre to adjust fiscal aggregates to changing macroeconomic perspectives, leading to further indebtedness. Finally, when calculated as a share of GDP, earmarks contribute to pro-cyclical spending by increasing expenditures when the overall economy is growing, and decreasing them in times of crisis.

From the point of view of line ministries, budget earmarks increase the predictability of resources in the medium- and long-term, giving them greater flexibility to plan annual and multi-annual operations. Earmarks also protect important social programmes from short-term fluctuations in funding that may hinder long-term national objectives.

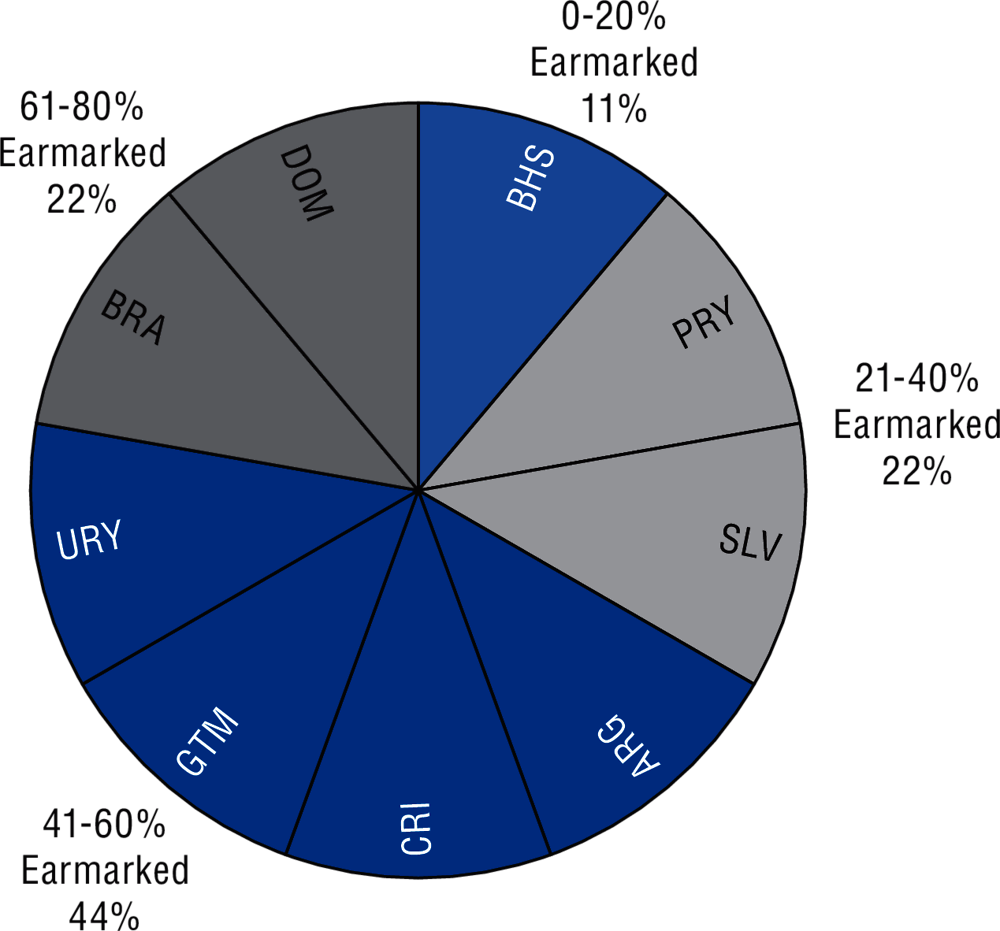

In 2018, all surveyed Latin American and Caribbean countries had earmarked funds. In Brazil and the Dominican Republic they represent 61-80% of all expenditures; in Argentina, Costa Rica, Guatemala and Uruguay they represent between 41-60%; in El Salvador and Paraguay 21-40% are earmarked; and in the Bahamas only 0-20%.

In terms of sectors, in 2018, seven countries (Argentina, Brazil, Costa Rica, Dominican Republic, Panama, Paraguay and Peru) have earmarked budget for education. In the Dominican Republic several laws allocate resources to specific sectors. For example, the Education Law indicates that expenditure to education should be the highest between 16% of total expenditure or 4% of GDP. Another law allocates 5% of total expenditure to tertiary education. In Peru, the National Agreement establishes that investment in education should reach 6% of GDP; however, in practice and despite recent increases, it is still below this level and funding varies depending on macroeconomic conditions and resources available. Five countries (Argentina, Brazil, Costa Rica, El Salvador and Uruguay) had earmarks for health. In El Salvador, the “Fondo Solidario para la Salud”, established in 2004 and modified in 2019, earmarks all resources collected from taxes on harmful products (e.g. tobacco) for funding the health system.

Six countries also have earmarked transfers to subnational governments, including Argentina, Brazil, Costa Rica, the Dominican Republic, El Salvador and Peru. In Costa Rica, the law on transfer of competencies to the regions has earmarked resources for the regions since 2016. For instance, subnational governments are entitled to at least 1.5% of government budget for building and maintaining the road network that connects the cantons.

In 2018, seven countries (Brazil, Costa Rica, El Salvador, Panama, Paraguay, Peru and Uruguay) reported having earmarked funds set in the constitution. For example, in Costa Rica, the constitution mandates that the budget for education must be at least 8% of GDP and that at least 10% of tax revenues must be transferred to subnational governments. Primary legislation was the legal basis in seven countries, including Argentina, Brazil, Costa Rica, the Dominican Republic, El Salvador, Peru and Uruguay. Secondary legislation provides the basis for earmarks in Dominican Republic and Panama.

Data come from the 2018 OECD/IDB Survey of Budget Practices and Procedures, to which 11 LAC countries responded. Respondents were predominantly senior budget officials in LAC countries. Responses represent the countries’ self-assessments of current practices and procedures. Data refer only to central/federal governments and exclude the sub-national level.

A budget earmark is defined as a pre-assigned fund. It is a line item established by law, decree or constitutional mandate, and is independent of the executive. It corresponds to revenues from a specific source or other transfers. Earmarks do not correspond to those expenditures stemming from operational concepts such as payroll value or debt service.

Further Reading

Pessino, C., Izquierdo, A. and Vuletin, G. (2018) Better Spending for Better Lives: How Latin America and the Caribbean Can Do More with Less. IDB Publications, Inter-American Development Bank, Washington D.C.

Figure notes

Data for Chile and Mexico for 2018 are not available.

5.14 Data for Panama are not available. Peru has earmarked funds that vary depending on the performance of macroeconomic variables, hence not included in the graph.

5.15 and 5.16. Data for Bahamas are not available. Data for Guatemala for 2018 are not available. Data for Dominican Republic and Uruguay for 2013 are not available.

Metadata, Legal and Rights

https://doi.org/10.1787/13130fbb-en

© OECD 2020

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.