copy the linklink copied! Budget transparency

Budget transparency refers to the full disclosure of all relevant fiscal information in a timely and systematic manner. It is a multi-dimensional concept addressing the clarity, comprehensiveness, reliability, timeliness, accessibility and usability of public reporting on public finances, as well as citizen engagement in the budget process. Some of the most important benefits of budget transparency include enhanced accountability, legitimacy, integrity, inclusiveness and quality of budget decisions all of which could ultimately develop trust between governments and citizens. Beyond the disclosure of key budgetary information, budget transparency also encompasses public participation in the budget process (OECD, 2017, 2019). The OECD actively promotes and guides the adoption of practices aimed at increasing budget transparency as reflected in the OECD Best Practices for Budget Transparency (2001), its Recommendation of the Council on Budgetary Governance (2015), and the OECD Budget Transparency Toolkit (2017).

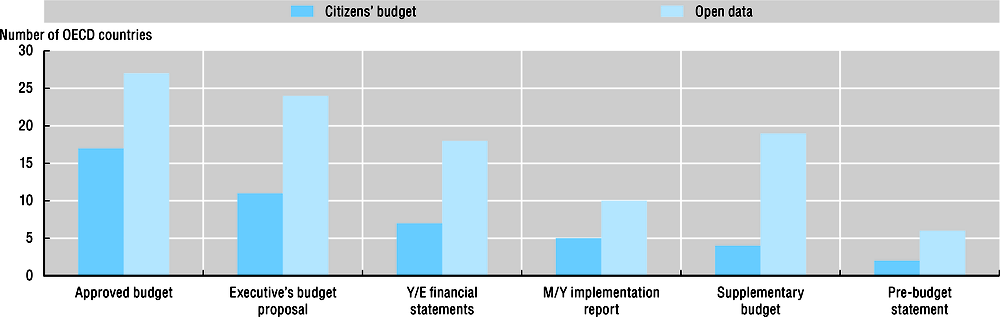

As a general trend, budget transparency has improved in recent years across OECD countries, driven mainly by the availability of core budget reports. All OECD countries with available information now publish a draft budget and the approved budget (34 countries), with a majority of countries also making available the underlying datasets of these documents in a machine-readable format (e.g. open data), (respectively 24 and 27 countries). A similar trend is observed with the publication of citizens’ guides to these key budget documents, which are short, easy-to-understand documents aimed at presenting budget decisions simply and clearly. While in 2012, citizens’ guides to the budget were produced in 14 OECD countries (42%), they are now produced in 23 (68% of surveyed countries). The nine countries that have started producing citizens’ guides to the budget since 2012 include the Czech Republic, Denmark, France, Hungary, Portugal, Slovenia, Spain, Turkey and the United Kingdom. In 2018, citizens’ guides were most often published for the approved budget (17 countries) and the executive budget proposal (11 countries) and were less likely to be published for the wider range of budget documents, although these documents and their underlying datasets remain widely available.

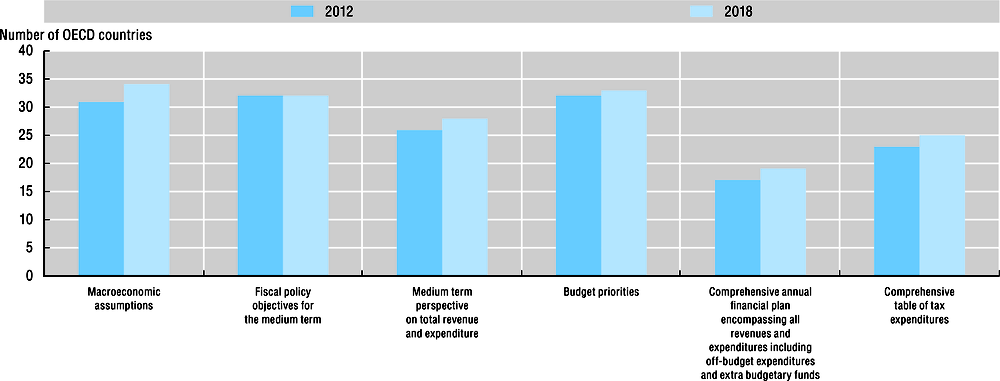

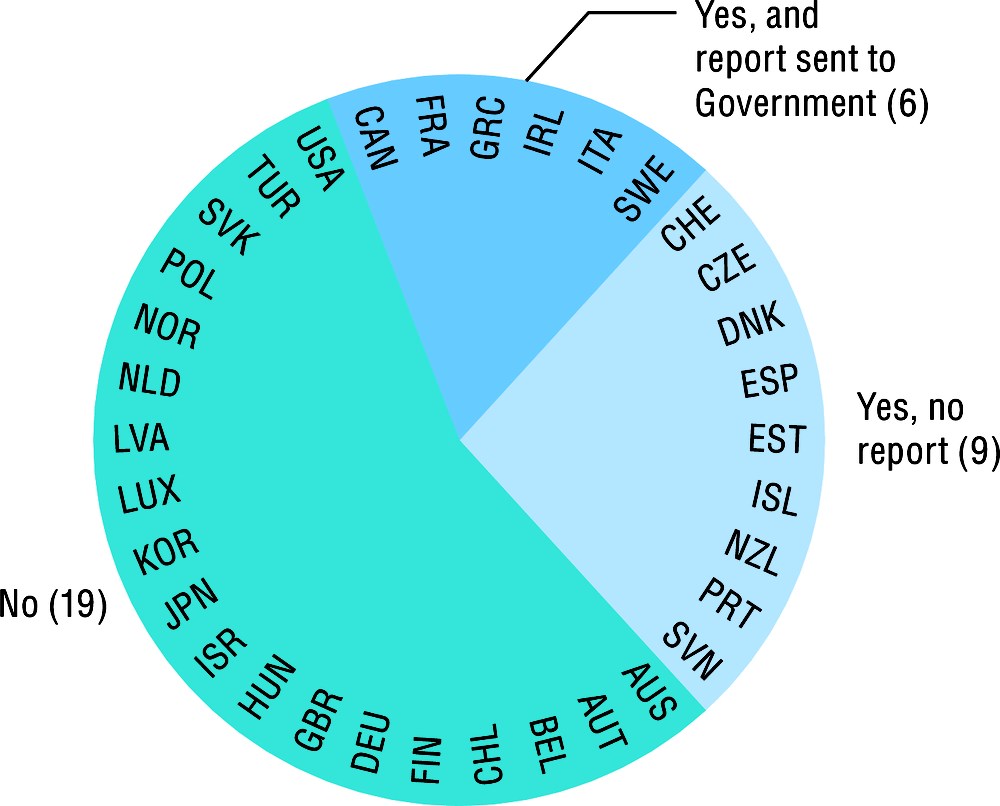

Parliaments are responsible for approving the executive budget proposal and ensuring that the budget reflects citizens’ preferences while being aligned with fiscal constraints. For all countries with available information, the breadth of budget documents provided to parliament by OECD countries has increased since 2012, signalling countries’ efforts to promote transparency and encourage improved budget oversight. In 2018, all surveyed OECD countries presented macroeconomic assumptions to the legislature, 97% presented budget priorities, and 82% presented a medium-term perspective on total revenue and expenditure. A further trend in relation to budget oversight is the growing role of OECD country parliaments at the ex ante phase of the budget process. The number of countries reporting that the government submits a pre-budget report to the legislature increased from 19 in 2012 to 22 in 2018. While in 2012 only 3 OECD countries reported that the legislature held a pre-budget debate, this figure increased to 15 in 2018. Of these, more than half send the results of the pre-budget debate as a report to the government, including Canada, France, Greece, Ireland, Italy and Sweden.

Data are derived from the 2012 and 2018 OECD Budget Practices and Procedures Surveys, as well as the 2018 OECD Parliamentary Budget Officials (PBO) Network Survey on Parliamentary Budgeting Practices. Respondents to the 2012 and 2018 OECD Budget Practices and Procedures Surveys were predominantly senior budget officials in the central/federal ministry of finance. For the 2012 survey, data comprises all 34 OECD countries at the time. For the 2018 Survey, data are available for all OECD countries except the United States. Respondents to the 2018 OECD Parliamentary Budgeting Practices Survey were predominantly parliamentary budget officials in OECD countries. Responses represent the country’s own assessment of current practices and procedures.

Open data refers to digital data that are made available with the technical and legal characteristics necessary for it to be freely used, re-used and redistributed by anyone, anytime, anywhere.

A citizens’ guide is an easy-to-understand summary of the main features of the annual budget or other budget-related documents. It is a user-friendly summary that helps the general reader to make sense of the technical information and avoids technical language.

Further reading

OCDE (2019), Budgeting and Public Expenditures in OECD Countries 2019, OECD Publishing, Paris, https://doi.org/10.1787/9789264307957-en.

OECD (2017), OECD Budget Transparency Toolkit: Practical Steps for Supporting Openness, Integrity and Accountability in Public Financial Management, OECD Publishing, Paris, https://doi.org/10.1787/9789264282070-en.

OECD (2015), Recommendation of the Council on Budgetary Governance, https://legalinstruments.oecd.org/en/instruments/OECD-LEGAL-0410.

Figures notes

On data for Israel, see https://doi.org/10.1787/888932315602.

5.9 and 5.10. Data for the United States are not available.

5.11. Data for Mexico are not available.

Metadata, Legal and Rights

https://doi.org/10.1787/8ccf5c38-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.