United States

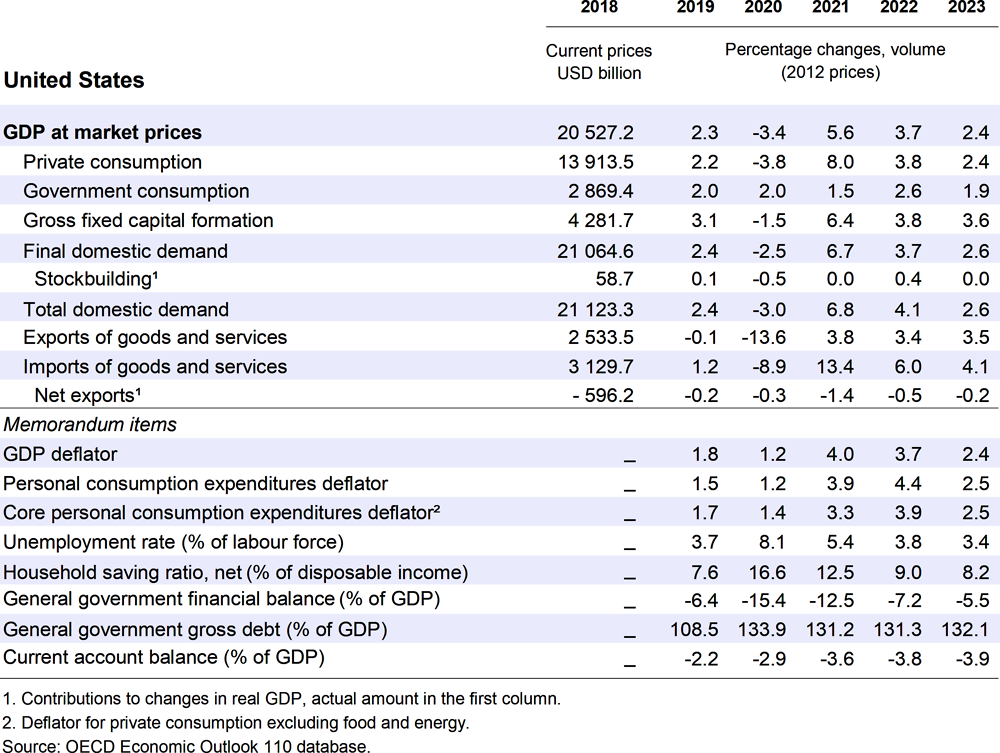

Real GDP is anticipated to grow by 5.6% in 2021, before rising by 3.7% and 2.4% in 2022 and 2023 respectively. Supply disruptions will gradually ease, facilitating a rebuild of business inventories and stronger consumption growth in the near-term. With the continued recovery in the labour market, nominal wage growth will pick up further. While price inflation is projected to moderate in some sectors as supply disruptions abate, higher wages, along with recent increases in housing rents and shipping rates, will lead to stronger overall consumer price growth than prior to the pandemic.

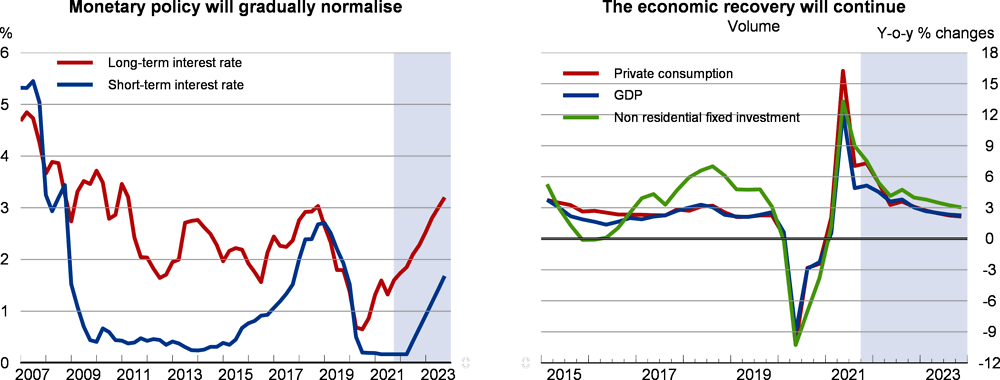

Monetary policy remains highly accommodative, but the announced tapering of government bond purchases is appropriate as the recovery becomes more firmly entrenched. Sustained price pressures will prompt a gradual increase in the federal funds rate starting in mid-2022. The ongoing withdrawal of fiscal support is now having a dampening impact on economic growth. Nevertheless, accumulated excess savings from earlier stimulus measures and lockdowns will continue to underpin household consumption and business investment over the coming quarters. In plotting a path to achieving net zero emissions by 2050, further investment in clean and resilient infrastructure, as well as enhanced pricing of environmental externalities, will be important.

Economic activity is reaccelerating and inflationary pressures have become more pronounced

After a surge in COVID-19 cases and supply disruptions caused growth to moderate in the third quarter, recent monthly data suggest a subsequent reacceleration of activity. For instance, indicators of consumer spending and industrial production picked up notably in October. The proportion of the total population fully vaccinated continues to rise steadily, but at around 60%, it is below that in most other OECD countries.

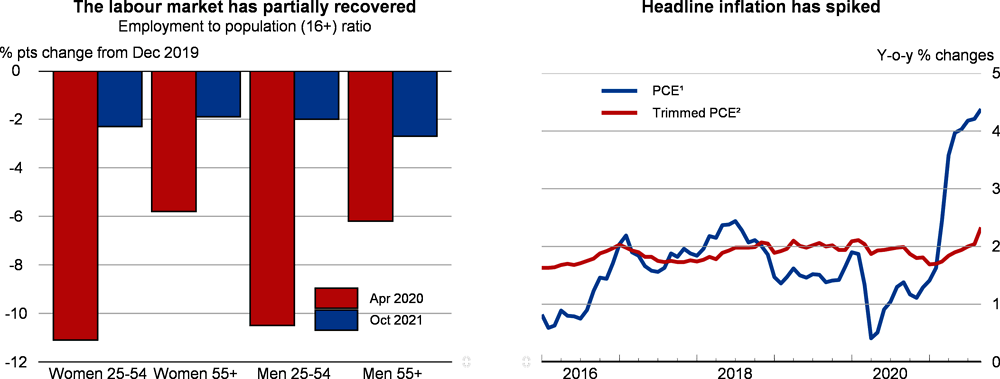

The labour market recovery continues to progress, although the employment to population ratio remains over 2 percentage points below pre-pandemic levels. Inflation has spiked, with particularly strong growth in components related to motor vehicles and energy. There are also signs of emerging inflationary pressures due to rising housing rents and wage pressures in some sectors. Notable wage increases have been observed in the leisure and hospitality sector, as well as in transport and warehousing. This partly reflects labour shortages, with the job openings rate in both sectors having risen in recent months. Even so, measures of underlying inflation, such as the trimmed-mean personal consumption expenditure deflator, are well below headline inflation. Long-term inflation expectations derived from both household surveys and financial markets also appear to have risen only modestly.

Pandemic-related fiscal policy support has been wound back

The pandemic-related fiscal measures announced in 2020 and early 2021 have now largely expired. Even so, earlier stimulus checks, supplementary unemployment benefit payments and expanded benefit coverage, have resulted in significant accumulated savings that will continue to support the economic recovery. The household saving rate increased by around 9 percentage points in 2020 and remained well above pre-pandemic levels in 2021. Longer-term public spending plans related to physical infrastructure are likely to start being implemented next year, with new funding for transport networks, broadband upgrades and improvements to power and water systems. There is also proposed additional public spending over the next decade on education, healthcare, childcare support and measures to reduce carbon emissions. However, these initiatives will provide only modest support to aggregate economic output within the projection period, as they are expected to be largely funded by new tax measures. Overall, the enactment of these long-term spending plans is assumed to add around 0.3% of GDP in net additional spending in both 2022 and 2023.

Monetary policy continues to provide substantial support to the economic recovery, both through the near-zero federal funds rate and central bank purchases of Treasury securities and agency mortgage backed securities. Monthly asset purchases will now be reduced, reflecting substantial progress in both returning the economy to maximum employment and inflation to above 2%. It is anticipated that asset purchases will gradually and predictably decline over the ensuing months. This will mark a slowing in the pace at which additional monetary policy accommodation is added. The Federal Open Market Committee has stressed that the decision to reduce asset purchases is distinct from any eventual decision to raise the federal funds rate from its current 0-¼ per cent range.

The economic recovery will continue

Real GDP growth is anticipated to strengthen through the end of 2021 and early 2022. Recent improvements in the public health situation will support increased services consumption and labour market participation through this period. Supply disruptions may take some time to fully ease, but will eventually allow stronger goods consumption by households and businesses to rebuild inventories. This will be accompanied by a recovery in trade growth. As the labour market further tightens, broadly-based wage pressures will become more pronounced. It is anticipated that inflation will recede somewhat from its current elevated level, with a gradual abatement of supply shortages related to motor vehicles and energy reducing price pressures in these components. Nonetheless, higher wages, along with recent increases in housing rents and shipping rates, will contribute to consumer price inflation remaining well above 2%. This is expected to prompt the Federal Reserve to begin raising the federal funds rate in mid-2022 and then announce further rate rises, reaching 1.5-1.75% by the end of 2023.

An upside risk to the projections is that the high levels of accumulated household savings fuel a stronger rebound in consumption than expected. In contrast, inflation could continue to surprise on the upside and a de-anchoring of longer-term inflation expectations could prompt tighter monetary and financial conditions starting in early 2022 that dent the recovery. A further resurgence in COVID-19 cases that restricts economic activity is also a downside risk, with those states with relatively low vaccination rates being particularly susceptible.

New infrastructure spending plans should be coupled with strong governance

Boosting public infrastructure investment can support the future prospects of the United States economy and the well-being of the population. However, an efficient selection of infrastructure projects is vital, utilising careful cost-benefit analysis that takes into account inter-jurisdictional spillovers of different projects and the structural shifts since the onset of the pandemic, such as more remote working. Infrastructure priorities also need to be carefully aligned with environmental and climate action plans. In plotting a path to net zero emissions by 2050, greater use of renewable sources in electricity generation will be required. Dramatic cost reductions in wind and solar power generation are underpinning their significant expansion. However, ongoing complementary investments to ensure good connections with electricity grids and energy storage capacity (given the intermittent nature of these renewable sources) are needed. More broadly, enhanced pricing of environmental externalities will further encourage emission abatement opportunities.