Poland

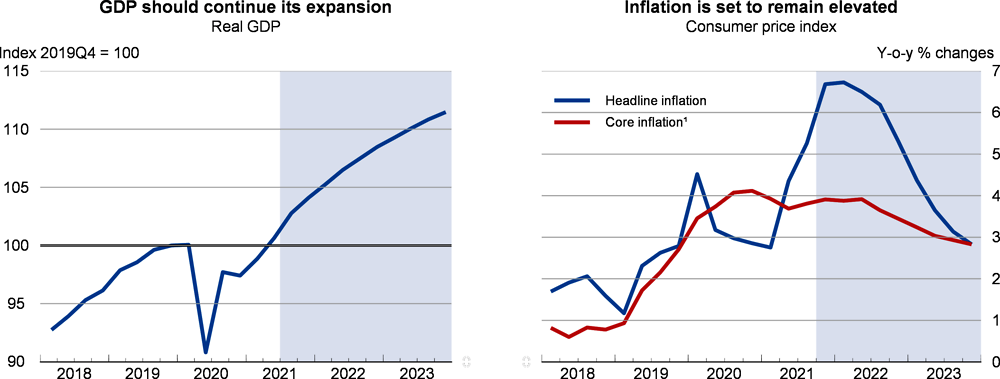

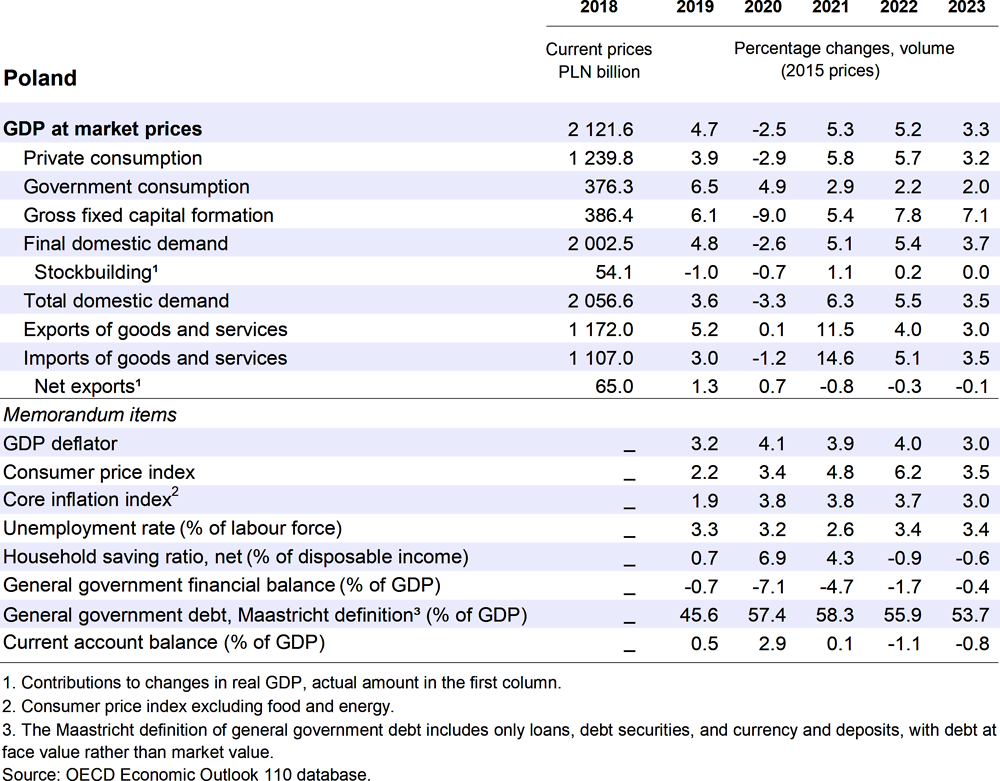

After a strong rebound during the first half of the year, GDP has surpassed its pre-pandemic level and is expected to grow by 5.3% in 2021. This momentum should continue with GDP growth projected to reach 5.2% in 2022, before easing to 3.3% in 2023. Consumption and investment will drive the recovery, with a sustained withdrawal of savings and the disbursement of EU funds significantly contributing to growth. However, an expanding economy and a tighter labour market will result in diminishing spare capacity, leading existing inflationary pressure to increase further.

Policy should support stable and sustainable growth. Monetary policy has already begun tightening and additional interest rate increases, clearly communicated, might be necessary should inflationary pressures continue to mount. Fiscal support should be withdrawn at a faster pace than currently planned. In the medium-term, labour market policies should support upgrading skills to adapt to the post-pandemic economy. Public investment should focus on developing infrastructure and, in energy in particular, the move towards a greener economy.

The public health environment has improved but remains challenging

After an intense second wave at the beginning of the year, the public health situation has improved significantly, but it continues to remain challenging. Having peaked in March, new infections dropped and then stabilised during summer. The pace of vaccinations picked up from mid-April and around half of the total population has now been fully vaccinated. Poland has started a booster vaccination programme for its older citizens. However, the public health environment has deteriorated since early October amid a resurgence in infections.

The economy has bounced back strongly from the pandemic

Despite epidemiological challenges, the economy has rebounded strongly and above expectations as GDP expanded by 3.3% during the first half of 2021. This was mostly driven by a recovery in consumption as consumer confidence improved amid an improving health outlook, loosening restrictions and falling uncertainty. The labour market tightened further as vacancies grew strongly and wages increased across all sectors of the economy. Since then, consumer confidence and retail sales surveys have pointed to continued consumption growth while industrial production indicators suggest that output has increased further. Quarterly GDP growth is estimated to have been 2.1% in the third quarter of 2021. Surging global energy prices and supply bottlenecks resulted in mounting inflationary pressure. Headline harmonised consumer price inflation reached 6.4% in October, well above the central bank’s upper-range target. Core inflation has also remained elevated throughout most of 2021.

Policy has acted to stabilise the economy

Monetary and financial conditions tightened in response to rising inflation. The National Bank of Poland raised the key short-term interest rate from 0.1% to 0.5% in October and increased bank reserve requirements from 0.5% to 2% to contain inflation and prevent inflation expectations from de-anchoring. In November, the key short-term interest was raised further to 1.25%. Fiscal policy remained supportive in the first half of 2021. A second wave of ‘Anti-Crisis Shield’ fiscal measures provided more targeted support to the economy until the end of June but has now expired.

The economy is set to expand further in 2022 and 2023

The positive momentum should continue, with Polish GDP projected to expand by 5.3% in 2021. Looking ahead, GDP growth should reach 5.2% in 2022 before easing to 3.3% in 2023. Widespread vaccination should allow economic activity to resume largely as normal, which will support solid growth in private consumption as savings accumulated during the pandemic are spent. As uncertainty declines, investment will also support growth until 2023, boosted by just under half of the EUR 36bn of EU’s Recovery and Resilience Facility (RRF) funds allocated to Poland. The labour market is expected to become increasingly tight, leading to higher wage growth. In an economy above its pre-pandemic level, diminishing spare capacity should exert upward pressure on inflation. While higher energy prices and supply bottlenecks should push up annual headline inflation in 2022 before fading, underlying inflationary pressures are expected to persist and core inflation should remain elevated throughout 2023. With the aim of bringing inflation back to target, monetary policy should tighten further, with key policy interest rates increasing to 2.25%, and soften growth in 2023. The Polish New Deal, a fiscal package focused on lowering taxes for the middle-class and increasing health spending, should boost the economy from 2022 onwards. On balance, fiscal policy is foreseen to be gradually reduced by 2023, on the back of stronger growth and lower-than-expected COVID-19 related social spending, but further fiscal tightening may be necessary to stabilise the economy.

The outlook is uncertain and the risks are broadly balanced. On the upside, rising consumer confidence and higher wage growth could lead to stronger consumption growth and higher inflation. On the downside, a worsening of the pandemic could weaken confidence, leading to a loss of momentum and softer growth. Continued tensions with the European Commission and uncertainty around the disbursement of EU RRF funds could also drag on the recovery.

Policies must ensure a sustainable and green recovery

A focus on labour market reforms, productivity-friendly investments and decarbonisation would support a more sustainable and green recovery. Labour market programmes to improve relatively low basic skills, especially among older adults, should be strengthened and limited lifelong training opportunities for the unemployed and the low-skilled should be broadened in order to develop the skills necessary for a more digital and green economy. Helping displaced workers with job placement and reforming pensions to encourage greater labour market participation, especially among older workers, should support labour supply and underpin growth. Public investment that develops Poland’s infrastructure, particularly in transport, energy and digital technologies, should help smaller firms better access foreign markets. Within the energy sector, a focus on low-carbon and renewable energy would facilitate the move toward a greener economy.