Czech Republic

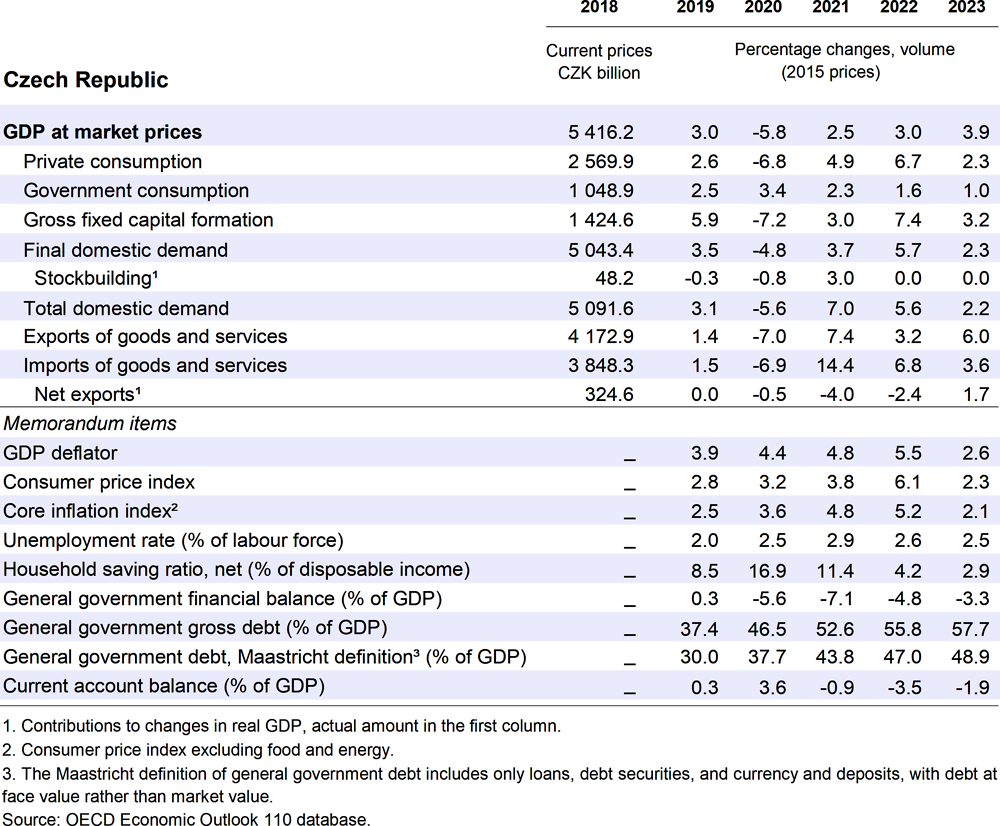

After contracting sharply in 2020, GDP is projected to grow by 2.5% and 3% in 2021 and 2022, respectively, and 3.9% in 2023. The removal of most containment measures amid steady progress with vaccinations will support a rebound in services and boost household consumption. Meanwhile, exports and manufacturing activity will face headwinds until mid-2022 due to supply bottlenecks. Unemployment will continue to fall and the labour market will tighten. Currently high inflation is expected to rise further in early 2022, but then subside toward the 2% target level by late 2023.

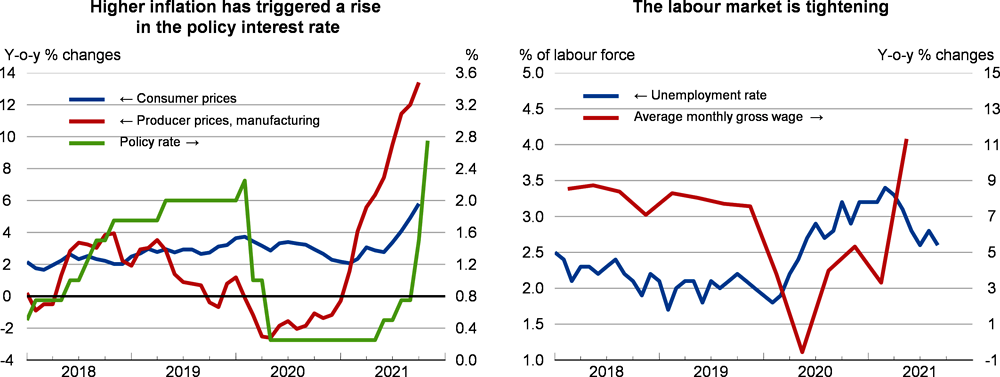

Faced with accelerating inflation and rising inflation expectations, the Czech National Bank began withdrawing monetary accommodation in June 2021. By end-November, it had raised the policy interest rate by 250 basis points in cumulative terms, to 2.75%. Rate rises are assumed to continue until the first quarter of 2022. The government deficit will rise further in 2021, due to the stimulus tax package and extended COVID-19 support. A gradual fiscal consolidation is planned thereafter. Bringing inactive people to work would ease emerging labour shortages and help the recovery.

The economy is recovering

The number of COVID-19 cases picked up rapidly in the autumn of 2021. 58% of the population had been fully vaccinated by mid-November, and progress with vaccination accelerated considerably after a marked slowdown over the summer. The removal of pandemic restrictions had boosted economic activity, notably in the services sector, but at the end of November 2021 some restrictions were introduced on the hospitality sector and gatherings. Household consumption growth is buoyed by recovering incomes. Meanwhile, the growth of manufacturing and exports has stalled due to bottlenecks in international supply chains. The latter, together with rapidly increasing demand, contributed to manufacturing producer prices growing 13.4% year-on-year in October 2021. Annual CPI inflation has risen markedly and stood at 5.8% in October, driven by rising costs of housing, transport, clothing and footwear and hospitality. Slowing activity and concerns about rising inflation have lowered economic sentiment. The unemployment rate has fallen from the peak of 3.3% in the first quarter of 2021, and average wage growth has picked up. There are signs that the Czech labour market is again facing labour shortages, most notably in construction but also in the reopened services sector and manufacturing.

The Czech National Bank has tightened monetary policy

Most emergency support measures introduced in 2020 were extended into 2021, and fiscal policy has continued to be expansionary. Gradual fiscal consolidation is planned (and incorporated in our projections) from 2022 onwards, at 0.5% of GDP annually in structural terms. The recovery will also be supported by spending and investment financed from the Recovery and Resilience Facility. Given accelerating inflation and signs of de-anchoring of inflation expectations, the Czech National Bank (CNB) has started withdrawing monetary accommodation. It raised the policy interest rate from 0.25 to 2.75% between June and November 2021 and signalled further rises in the near future. The projections assume that the policy interest rate will plateau at 3.75% in the first half of 2022. In addition, the CNB decided to increase the countercyclical capital buffer rate for exposures located in the Czech Republic in incremental steps from 0.5% to 1% (effective from 1 July 2022) and then 1.5% (effective from 1 October 2022) and 2% from January 2023. It has also reintroduced limits on new mortgage loans (based on debt-to-income and debt service-to-income ratios).

The economy will continue its recovery

GDP will grow moderately until mid-2022, facing headwinds from supply bottlenecks and negative net exports. Growth will pick up thereafter. Investment momentum should stay strong as sentiment improves and government investment grows, financed by Next Generation EU funds. Household consumption will be boosted by spending from accumulated household savings. This will raise imports. Unemployment will fall further. Inflation will continue rising until the first half of 2022, as administered prices rise significantly, but then subside towards the 2% target by end-2023. Uncertainty remains high. Inflation could rise even more rapidly if inflation expectations de-anchor or if the exchange rate depreciates markedly. Manufacturing could be disrupted further by distortions to global supply chains, adversely affecting activity and putting further pressures on prices. On the upside, the current substantial government support and public investment could have a stronger positive impact and households may reduce their currently high saving ratio by more than assumed.

Policy support should be withdrawn gradually

After a period of very accommodative monetary policy, the CNB appropriately reacted to the rapid pick-up in consumer prices and concerns about inflation expectations. Monetary policy tightening, together with the reduction of temporary pressures from global commodity prices and supply constraints, will help steer inflation back to target. Macroprudential tools should also be used further if needed to counter risks in the housing market and help restore adequate buffers. On the fiscal side, a gradual consolidation is appropriate if there are no further setbacks. Active labour market policies and reskilling programmes should be boosted and insolvency procedures accelerated to facilitate resource reallocation. Bringing inactive people to work, including mothers with young children, would help sustain growth. Investment support to strengthen the recovery is an opportunity to green the economy and boost R&D and innovation activity, as reflected in the National Reform Programme.