Colombia

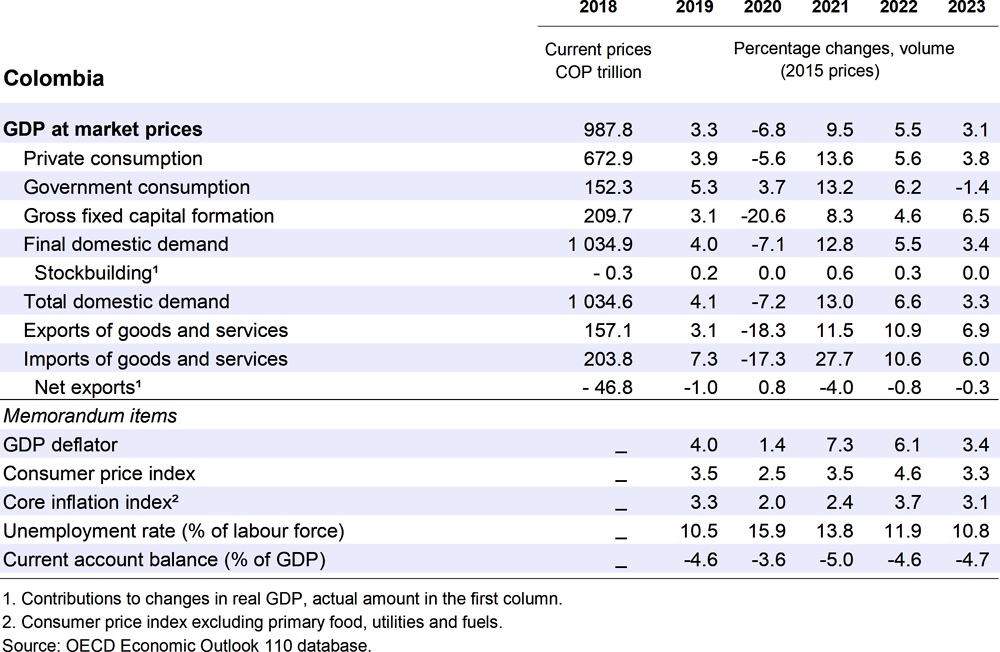

After surpassing its pre-crisis level in the third quarter of 2021, GDP is projected to grow by 5.5% in 2022 and 3.1% in 2023. Private consumption is the main driver of the recovery as employment picks up, although at a slower pace than economic activity. Vaccine coverage has made significant progress, but is trailing behind regional peers. Strong commodity prices and improving prospects in key trading partners will continue to underpin exports.

Fiscal policy will provide continuous support to vulnerable households during 2022, while spending reductions in other areas will usher in a gradual fiscal adjustment that is set to intensify in 2023. A recent fiscal reform has laid the ground for this adjustment, but stabilising public debt will require additional efforts. Addressing long-standing challenges like low tax revenues, low tax progressivity and low coverage of social benefits could ensure a more inclusive recovery. Amid rising inflation, monetary policy has appropriately started to withdraw some of the previous stimulus.

After a peak in COVID-19 infections in July, the recovery has gathered pace

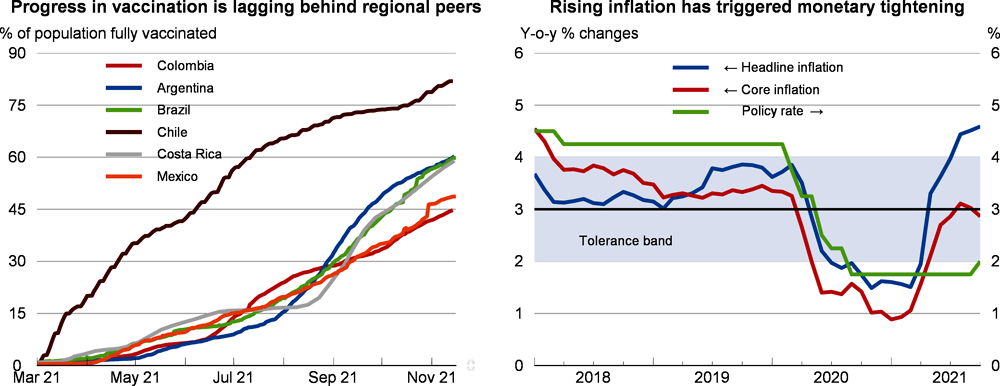

The most virulent infectious wave of COVID-19 hit Colombia in July 2021. Since then, case numbers have fallen massively and many distancing measures have been relaxed. Progress in vaccination has been steady, but is trailing behind regional peers. Following a temporary setback amid widespread social unrest in April and May of 2021, consumer confidence has picked up visibly in the second half of the year, while investment continues to be supported by infrastructure programmes. GDP expanded by 5.7% quarter-on-quarter in the third quarter of 2021. Employment has recently started to reflect improvements in activity and 95% of employment losses that occurred during the pandemic have now been recovered. Salaries in retail and manufacturing now exceed pre-pandemic levels. Commodity prices and external demand have been favourable, supporting exports, including beyond natural resources. Against this background, headline consumer price inflation has risen and exceeds the tolerance band around the 3% inflation target. Core consumer price inflation, by contrast, is below target and inflation expectations remain well anchored. Wage growth in the manufacturing and retail sectors has exceeded inflation.

Policy stimulus is gradually being withdrawn

Monetary policy has reacted to rising inflation and started to withdraw some of the significant stimulus provided since the outbreak of the pandemic. This gradual normalisation towards a neutral policy stance is projected to continue, with the policy interest rate rising to 4% by 2023, although this projection is conditioned on assumptions that are subject to substantial uncertainty. Similarly, fiscal policy will need to move from unprecedented support to a gradual adjustment as the recovery strengthens in 2022. In line with a recent fiscal reform approved in September 2021, exceptional income support to vulnerable households will be maintained during 2022, while other spending areas are seeing significant consolidation, including public investment and administrative expenses. A previously planned reduction of high corporate taxes has been withdrawn. Improving fiscal outcomes will shore up confidence, after gross public debt has risen to 62% of GDP in 2021, up from 50% in 2019.

Growth will remain solid while labour market improvements will be slower

The current strong pace of the recovery is projected to ease over 2022 and 2023. Private consumption and investment will be the main drivers of growth, buoyed by fiscal support in the near term and underpinned by continuous improvements in confidence. External demand and oil prices will remain supportive, but financing conditions are gradually becoming less favourable. The labour market is projected to recover at a considerably slower pace, with pre-pandemic employment levels regained only in mid-2023. Based on current assumptions, inflation will be above the 3% target in 2021 and 2022, before converging back to target in 2023. Besides a potential emergence of new virus variants, risks surround the adherence to fiscal plans, given that a significant part of the planned fiscal adjustment will have to be implemented by the next administration. Unexpected events on international capital markets, possibly related to changing financial conditions in advanced economies, could affect portfolio capital flows, which have been volatile in the recent past.

Addressing structural bottlenecks and improving equity will require deeper reforms

The pandemic has exacerbated previous challenges in poverty, inequality and labour market informality, while interrupting many children’s education for up to 18 months. Healing these scars will require additional spending in social protection, health and education, which can be financed only with additional public revenues. This provides an opportunity for a deeper reform of the tax system and its widespread exemptions and special rates, most of which favour the better off. It can also be used to bolster fiscal sustainability and ensure compliance with the modified fiscal rule, which now contains a debt anchor. A significant overhaul of the fragmented pension system could increase coverage and reduce old-age poverty, while fragmented cash benefit programmes could be merged into a universal social safety net, building on recent advances in social registries. Improving incentives for formal job creation together with measures to reduce trade barriers and strengthen competition could facilitate necessary reallocation processes, supporting both productivity and equity. Deforestation, a major source of greenhouse gas emissions, could be reined in with stronger enforcement efforts and an expansion of rural land registries.