42. Sweden

Nearly 99% of limited liability companies with employees are SMEs. In 2019, they accounted for 60% of total employment and 47% of GDP (non-employer firms excluded).

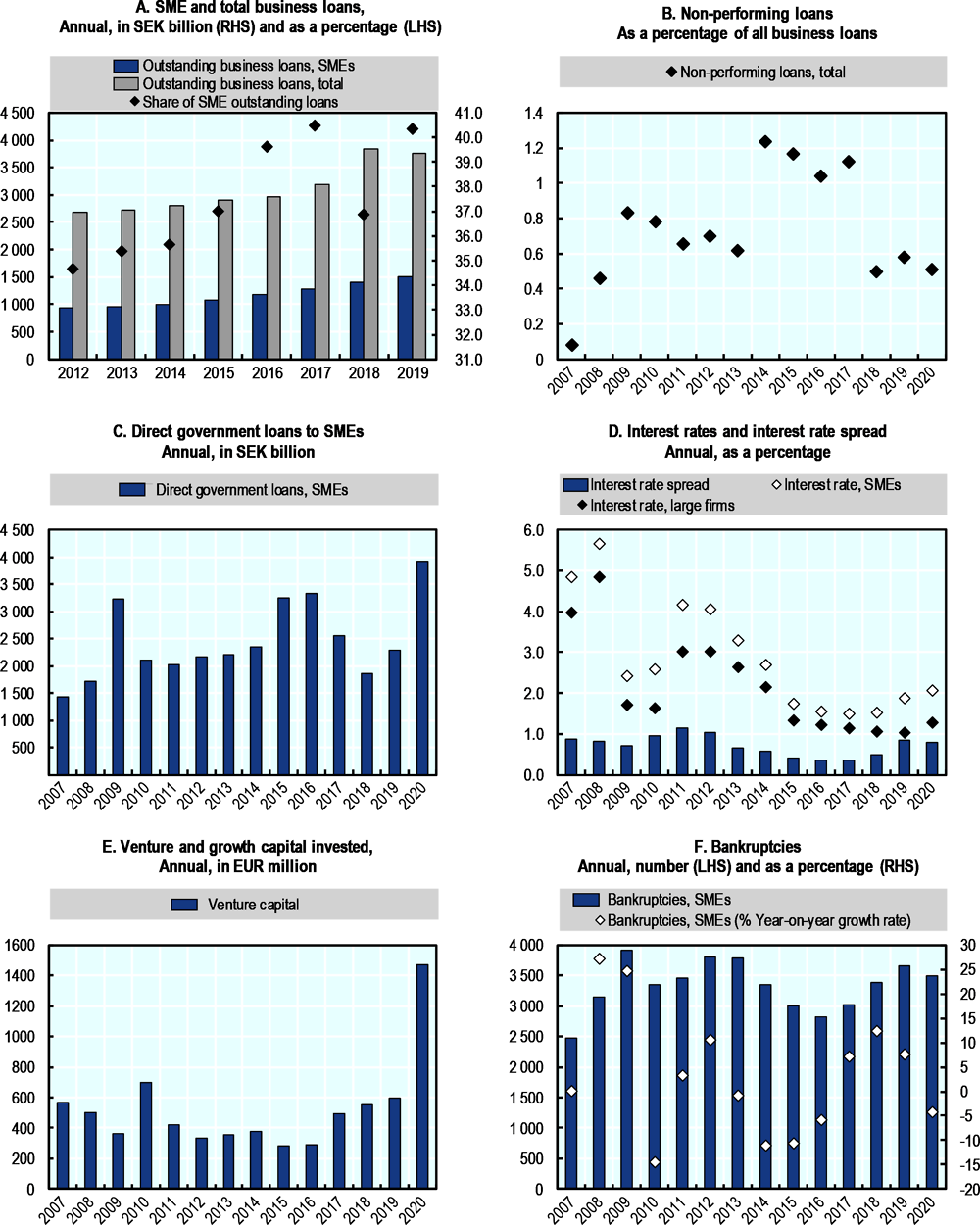

The stock of SME debts (long and short term) was in total SEK 1 514 billion in 2019, up by 7% from 2018. SME debt as a share of total outstanding debt was 40%.

Inflation has been close to the Swedish central bank´s (“Riksbanken”) target of 2% since the start of 2017. Riksbanken assesses that conditions are good for inflation to remain close to the target going forward. Therefore, in line with the assessment in October, Riksbanken decided to raise the repo rate from -0.25% to 0.00%.

Private equity fund investments in Swedish companies in the venture and growth stages were EUR 1 467 million in 2020, an increase of almost 250% on the previous year.

Almi is a state-owned corporation with the mission to complement the private market and ensure that services are accessible nationwide. Almi offers loans to companies with growth potential and assists them in their business development. This applies to businesses in the start-up phase as well as established companies. Almi Invest provides venture capital for early-stage, emerging companies with high growth potential and a scalable business concept. Although Almi is not limited by strict eligibility requirements in favour of certain sectors or business phases, its focus is on SMEs with high growth potential. Almi’s lending was SEK 2 292 million in 2019 and increased to SEK 3 930 million in 2020.

The Swedish National Export Credits Guarantee Board issued guarantees totalling SEK 2.9 billion to SMEs in 2020, an increase of 7.4% compared to the previous year.

In 2020, bankruptcies among SMEs totalled 3 494, a decrease by 4.3% from the previous year.

The Swedish parliament adopted a proposal to address the structure of public financing for innovation and sustainable growth in June 2016. The aim was to clarify and simplify the system for state venture capital (VC) financing, but also to improve the efficiency of public resources and contribute to the development and renewal of Swedish industries. A key feature was the establishment of a new joint stock company, Saminvest AB, a fund that invests in privately managed VC firms focusing on development-stage companies. In 2018, Saminvest AB invested in 6 VC funds, which in turn made 56 investments in growth-oriented firms.

Nearly 99% of limited liability companies with employees are SMEs. In 2019, they accounted for 60% of total employment and 47% of GDP (non-employer firms excluded).

The stock of SME debts (long and short term) was in total SEK 1 514 billion, up by 7% from 2018. SME debt as a share of total business debt increased from 35 to 40% over the period 2012-2018. SME debt increased by 35% while large enterprises debt increased by 18% over the same period1.

Inflation has been close to the Swedish central bank´s (Sw: Riksbanken) target of 2% since the start of 2017. Riksbanken assesses that the conditions are good for inflation to remain close to the target going forward. Therefore, in line with the assessment in October, Riksbanken decided to raise the repo rate from –0.25% to 0%. The forecast for the repo rate is unchanged, and the repo rate is expected to remain at 0% in the coming years2.

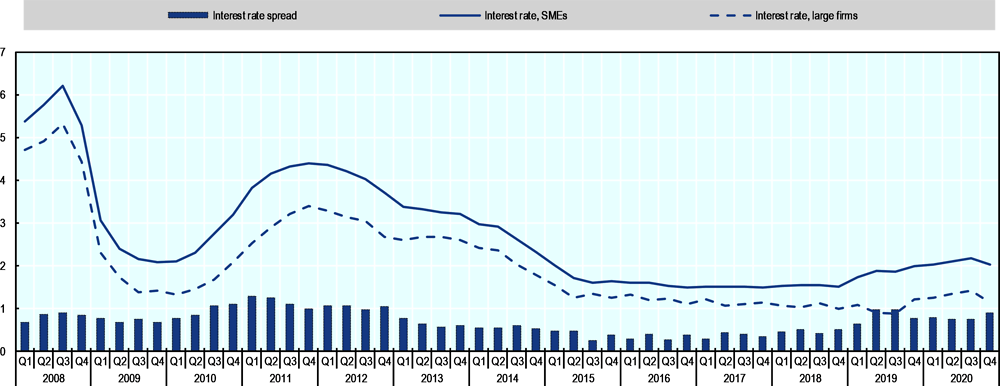

The Central Bank continuously increased the repo rate until the eve of the financial crisis. The rate was increased to 4.8% just a week before the fall of Lehman Brothers in September 2008. As the crisis hit, the rate was lowered gradually until it reached a low of 0.25%. The Central Bank began increasing the repo rate at the end of 2010 and the repo rate reached 2% in mid-2011. A negative growth shock – GDP contracted 1.1% in the fourth quarter 2011 – started the Central bank on a policy of low interest rates that persists. The repo rate went below zero in February 2015 and remained negative until the beginning of 2020.

The interest-rate spread between small and large enterprises (approximated by loans above and below EUR 1 million) stands at 0.89 percentage points in Q4 2020. The spread was at a high at 1.29 percentage points in the first quarter of 2011. The spread has decreased since then and was at an all-time low at 0.26 percentage points in Q3 2015. The interest rate spread has since increased, especially in the second and third quarter of 2019.

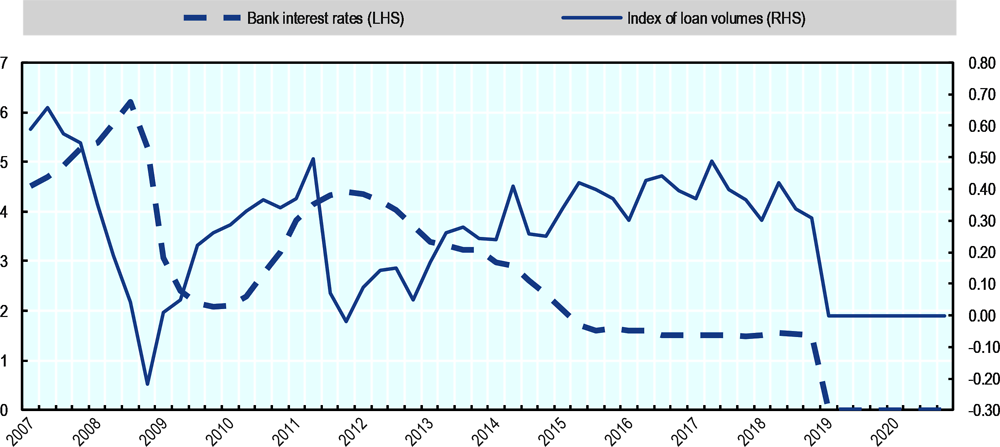

Almi, a state-owned corporation, performs quarterly surveys of bank managers’ views on business loan volumes. The survey is a relatively fast indicator of where the Swedish economy is heading. An index has been constructed to analyse the survey data3.

The most recent survey indicates that most bank managers estimate that loans to businesses have marginally changed in the last period. Only a minority of bank managers report decreased business lending. The index turned negative twice since 2007. The first time was in the last quarter of 2008, during the most critical time of the financial crisis, and the second was in the fourth quarter of 2011, when Swedish GDP decreased by 1.1% (Statistics Sweden (2012)). The index has remained positive since the first quarter of 2012. The increase in loans is concurrent with a low bank interest rate for business loans.

Private equity fund investments in Swedish companies in the venture and growth stages were EUR 1 467 million in 2020, a growth of almost 146% on the previous year.

Typically, investments in Swedish companies have been larger for companies in the venture phase than for companies in the growth phase4. Yet, in 2020, private equity investments in the venture stage were around EUR 461 million, while investments in companies in the growth stage was EUR 1006 million. Investments in the venture phase increased with 28% on the previous year, while investments in the growth phase increased by 440%.

According to Atradius (2019, 2020), the average payment delay for domestic B2B transactions was 14 days in 2018 and 15 days in 2019.

SMEs, defined as enterprises with 1-249 employees, account for more than 99.9% of recorded bankruptcies among employer enterprises. In the aftermath of the global financial crisis, the number of yearly SME bankruptcies increased from 2 469 in 2007 to 3 913 in 2009. In 2020, bankruptcies among SMEs totalled 3 494, a decrease by 4.3% from prior year (Swedish Agency for Growth Policy Analysis 2021).

Market-complementary financing through state actors aims to improve access to finance in business stages and segments where the private market is particularly thin. Market-complementary financing is currently provided by, among other institutions, the state-owned corporation Almi (which provides loans, and venture capital through its subsidiary Almi Invest), and the foundation “Industrifonden”.

Throughout the financial crisis around 2008, the Swedish government engaged in several expansionary measures that included the fortification of banks’ capital basis, securing of bank lending and provision of tax credits, export credit facilitation and business development programmes. The largest government measure to increase access to finance for SMEs was a capital injection and a lowering the co-financing requirements that increased the Almi’s lending capacity.

In June 2016, the Swedish parliament (Sw: Riksdagen) adopted a proposal concerning the structure of public financing for innovation and sustainable growth (the government’s bill 2015/16:110). One aim of the revised structure is to clarify and simplify the current system of state VC-financing. The new structure also aims to better utilise public resources within the area and thereby contribute to the development and renewal of the Swedish industry. A primary feature of the new structure is the establishment of a new, joint stock company, Saminvest AB, a fund of funds which invests in privately managed VCs focuses on development-stage companies. Saminvest AB began operations in 2017. In 2018, Saminvest had invested in 6 VC funds, of which 3 were Micro funds. Micro funds are smaller structures for seed financing with strong regional ties.

Public venture capital (VC) efforts and instruments (such as Saminvest and Almi invest) in Sweden are typically not targeted to specific sectors but has focus on being supplementary to the Swedish VC-market. There is however one targeted initiative focusing on cleantech in the Swedish landscape of public financing. “The GreenTech VC Fund” run by Almi invest and co-funded by Almi Företagspartner, Almi Invest, the Energy Agency and the European Regional Development Fund. Investments will be made in areas such as renewable energy, recycling systems, energy, waste management, and combustion.

Almi loans

Almi is a state-owned corporation and the parent company of 16 regional subsidiaries. It has a broad mandate that include debt brokerage, equity investments, and the provision of advisory services to companies. The organisation’s mission is to complement the private market and ensure that services are accessible nationwide. Almi is not limited by strict eligibility requirements in favour of certain sectors or business phases. Its focus, however, is on small- and medium-sized enterprises with high growth potential.

Almi nearly doubled the amount of loans granted between 2008 and 2009, because of the policy response to the financial crisis. In 2015, lending again increased significantly, the result of “a conscious effort to increase funding in early stages, where the lack of private capital is the greatest” (Almi 2017). New lending decreased in 2017 (23%) and 2018 (27%) but increased in 2019 (23%) and 2020 (71%)5. Available capital was almost fully tied up in existing loans. To ensure a long-term sustainable level of new loans, Almi implemented measures to ensure a more balanced net lending and new loans picked up again in the fourth quarter of 2018 (Almi 2020b).

In Sweden, export credit guarantees are provided through the Swedish National Export Credits Guarantee Board (Sw. Exportkreditnämnden, EKN). 345 SMEs received guarantees totalling SEK 2.9 billion in 2020, an increase of 7.4% in comparison to the prior year (EKN 2020 p.20)6.

References

Almi (2021), Låneindikator Q2, 2021. Juni 2021.

Almi (2020a), Annual Report 2019, https://www.almi.se/nyheter/nationella/arsredovisning-2019/

Almi (2020b) Data produced by Almi specifically for the Scoreboard (not published).

Almi (2018b), Annual report 2017, https://www.almi.se/globalassets/almi/om-almi/finansiell-information/ar/almi-ar-2017web.pdf

Almi (2017), Annual report 2016, http://np.netpublicator.com/np/n36100118/Almi-%C3%85rsredovisning-2016.pdf

Atradius (2019), Atradius Payment Practices Barometer Sweden 2019

Atradius (2020), Atradius Payment Practices Barometer Sweden 2020

Cambridge Centre for Alternative Finance (2019), Shifting Paradigms – the 4th European Alternative Finance Industry Report. https://cdn.crowdfundinsider.com/wp-content/uploads/2019/04/CCAF-4th-european-alternative-finance-benchmarking-industry-report-shifting-paradigms-April-2019.pdf

EKN (2020), the Swedish National Export Credits Guarantee Board Annual Report 2020 https://www.ekn.se/globalassets/dokument/rapporter/arsredovisningar/en/ekn-annual-report-2020.pdf

European Central Bank (2020a), Bank interest rates - loans to corporations of up to EUR 1M with a floating rate and an IRF period of up to one year (new business) – Sweden http://sdw.ecb.europa.eu/quickview.do?SERIES_KEY=124.MIR.M.SE.B.A2A.F.R.0.2240.SEK.N

European Central Bank (2021), Bank interest rates - loans to corporations of over EUR 1M with a floating rate and an IRF period of up to one year (new business) – Sweden http://sdw.ecb.europa.eu/quickview.do?SERIES_KEY=124.MIR.M.SE.B.A2A.F.R.1.2240.SEK.N

Government’s bill 2015/16:110 (Proposition 2015/16:110) – Staten och kapitalet - reformer för innovation och hållbar tillväxt, http://www.regeringen.se/rattsdokument/proposition/2016/03/prop.-201516110/

IMF (2019), Non-performing loans to total gross loans, per cent. http://data.imf.org/?sk=5ba7aeb2-c426-4b07-acae-ff4e5bbd461e&hide_uv=1

Invest Europe (2020), European Private Equity Activity Report and Data 2020, https://www.investeurope.eu/research/data-and-insight (membership wall)

Statistics Sweden (2012), Varuexporten tyngde BNP-utvecklingen, Statistiknyhet från SCB 2012-03-14, http://www.scb.se/sv_/Hitta-statistik/Statistik-efter-amne/Nationalrakenskaper/Amnesovergripande-statistik/Sveriges-ekonomi---statistiskt-perspektiv/197178/197186/Behallare-for-Press/Sveriges-ekonomi---statistiskt-perspektiv-4e-kvartalet-2011/

Statistics Sweden (2020a), Data ordered from Statistics Sweden specifically for the Scoreboard (not published). These data are based on enterprises yearly financial declarations to the Swedish Tax Agency.

Statistics Sweden (2020a), Swedish GDP at current prices, in millions of SEK http://www.statistikdatabasen.scb.se/sq/76199 (accessed 2020-06-18).

Statistics Sweden (2020b), Total Employment in Sweden, in thousands http://www.statistikdatabasen.scb.se/sq/76201 (accessed 2020-06-18).

Sveriges Riksbank (2020), Repo rate, table, https://www.riksbank.se/sv/statistik/sok-rantor--valutakurser/reporanta-in--och-utlaningsranta/ (Accessed 2020-06-09)

Sveriges Riksbank (2009), Ekonomiska Kommentarer nr 8, http://www.riksbank.se/Upload/Dokument_riksbank/Kat_publicerat/Ekonomiska%20kommentarer/2009/ek_kom_nr_8_sv.pdf

Swedish Agency for Growth Policy Analysis (Growth Analysis) (2020), Bankruptcies and hearings on compositions without bankruptcies 2019, https://www.tillvaxtanalys.se/publikationer/statistik/statistikserien/2021-03-24-konkurser-och-offentliga-ackord-2020.html

Notes

← 1. Long-term liabilities include: Bonds and debentures, convertible loans and the like; overdraft; building credit (Swedish: “byggnadskreditiv”) and other long-term liabilities to credit institutions. Short-term liabilities include: overdraft (short term) and other short-term liabilities to credit institutions.

← 2. Monetary policy report by the Swedish central bank (Riksbanken), December 2019: https://www.riksbank.se/en-gb/monetary-policy/monetary-policy-report/2019/monetary-policy-report-december-2019/

← 3. An index of 0 means that either all bank managers’ report unchanged lending compared to the last quarter or that equally many managers report increased lending as managers reporting decreased lending. An index of 1 (-1) means that all bank managers reported increased (decreased) lending compared to the last quarter

← 4. Venture investments include investments in the “Seed”, “Start-up”, and “Later stage venture” stages. (Invest Europe 2020)

← 5. Almi (2020b). Data in the scoreboard is produced with a method used previous years, to ensure comparability over time. This data is unpublished, because of a method change in the presentation of loan data (from loans granted to amount payed out) in the Annual Report 2018. Data is available on request from Almi.

← 6. SMEs are now defined in accordance with EU recommendation 2003/361. (Enterprises which employ fewer than 250 persons and which have an annual turnover not exceeding EUR 50 million, and/or an annual balance sheet total not exceeding EUR 43 million.) Data using the correct definition of SMEs is only available since 2014.