Türkiye

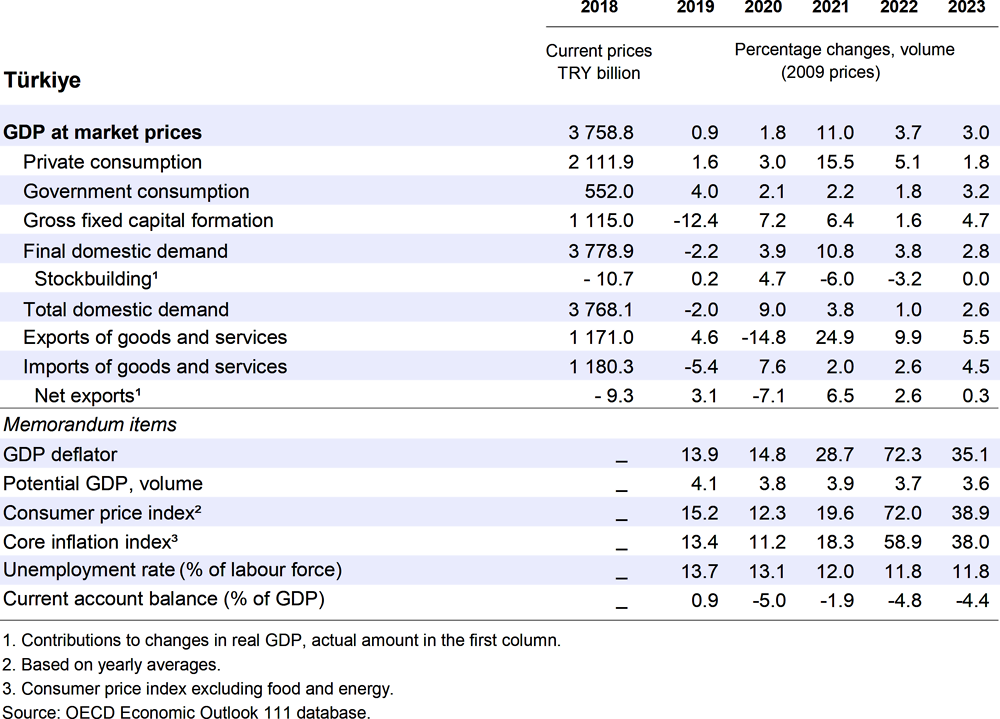

After a strong recovery in 2021, growth will moderate over the projection period. Very high inflation and declining consumer confidence will limit consumer spending. Investment will be held back by uncertainty about geopolitical factors and financial conditions. While exports will continue to benefit from the reallocation of global supply chains, the war in Ukraine will adversely affect external demand and commodity prices. Accommodative monetary policy coupled with high commodity and food prices will keep consumer inflation above 70% in 2022.

Strengthening the independence of the central bank and tightening monetary policy will be key to shore up confidence and anchor inflation expectations. Fiscal policy is expected to remain supportive over the projection period, including support to lower-income households that are facing high commodity prices. Structural reforms to enhance skills and the quality of training for workers and the unemployed are key to facilitate a move to higher paying jobs. Given its heavy dependence on oil and gas imports, Türkiye should continue to diversify supply sources and improve energy efficiency.

Economic activity is moderating after the strong recovery in 2021

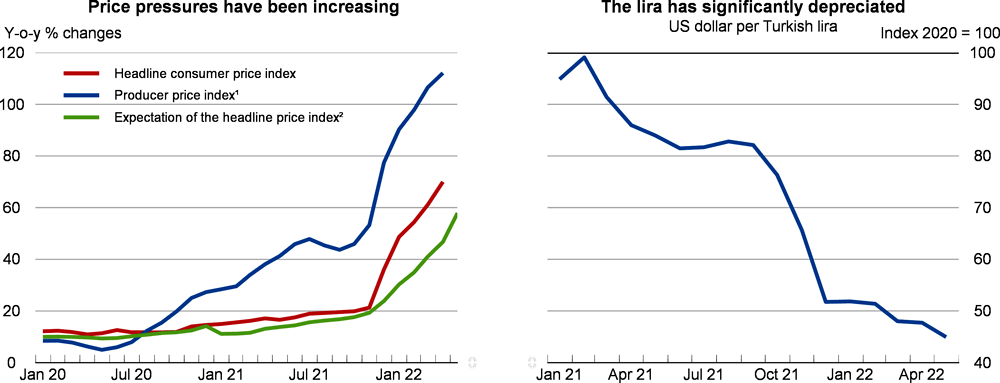

The economy grew by 11% in 2021, boosted by strong exports and high consumer spending. Exports of goods reached a record high in 2021 supported by strong external demand, with Türkiye benefitting from supply chain disruption in Asia and the lira depreciation. Domestic demand has been supported by strong credit growth and facilitated by expansionary monetary policy, in spite of high inflation. Employment has recovered to pre-pandemic levels, helped by the rebound in economic activity, and income has been boosted by a minimum wage increase of 50%. However, leading indicators – such as consumer confidence and the PMI – signal a gradual moderation of economic momentum. At the same time, prices are increasing significantly further, due to accommodative monetary policy, higher commodity prices and the exchange rate depreciation, and have begun to erode real incomes and limit consumer spending.

The war in Ukraine has been reflected in soaring commodity prices. This has added to cost and price increases, given Türkiye’s heavy dependence on imported oil and gas. Gas imports from Russia account to almost half of all gas imports while oil imports are around 30%. More than 70% of imported grains come from Russia and Ukraine. Moreover, Russian and Ukrainian tourists are important for Turkish hospitality sectors, accounting for about 15% of the overall tourism revenues.

Monetary and fiscal policy will remain supportive

The central bank has reduced its base rate by 5 percentage points since September 2021 and is expected to hold its policy rate at 14% over the projection period. Negative real interest rates have weighed on investors’ confidence and resulted in a large depreciation of the lira. This has prompted the population to protect their savings by changing lira deposits into dollars and other hard currency. As a result, bond yields have risen sharply and inflationary pressures have increased further. Central bank interventions and administrative measures, including obligations for exporters to convert 40% of their foreign currency revenue into lira and an exchange-rate protection for lira-denominated bank deposits introduced at the end of 2021, have helped to stabilise the exchange rate during the opening months of 2022, but has weakened again in May. Fiscal policy will remain supportive over the projection period, with increases in public sector wages and support for energy consumers. To mitigate higher energy prices, the government has reduced the value-added tax on electricity used in residences and agricultural irrigation and has granted subsidies to 4 million households.

Economic growth will slow

Economic growth will moderate over the next two years. The reopening of the economy after the pandemic and expansionary monetary and fiscal policy will support economic activity. However, persistent very high inflation will limit the purchasing power of households and uncertainty will moderate investment. Exports will remain solid as the relocation of global supply chains from Asia will help absorb some downward pressures from weaker global demand growth. The EU embargo of Russian oil will keep oil prices at high levels adding to high consumer price inflation, which will remain significantly elevated over the projection period.

The risks are on the downside as the adverse effects from the war could become much larger, particularly via commodity prices. A complete cessation of energy exports from Russia to Europe, stronger costs arising from shortages of critical raw materials, or further disruptions to transportation and trade could have sizable negative effects on the economy. Further pressures on the Lira could turn the exchange rate protection on deposits into an additional liability for public finances, with adverse effects on inflation and confidence. These risks are aggravated by the increase in contingent liabilities accumulated over the past years, despite the relatively low public debt-to-GDP ratio compared to other OECD countries and a sound banking sector.

The macroeconomic policy framework should be strengthened

Strengthening the credibility of monetary policy and increasing the policy rate will be key to ensure well-anchored inflation expectations and shore up confidence. Fiscal policy should tackle the adverse distributional impacts of higher energy prices. In order to avoid weakening price signals and keep fiscal costs manageable, the measures should be well targeted and temporary. Besides the stabilisation of the macroeconomic framework, a new reform package will be needed to make the economy more inclusive and resilient to future shocks. Labour market reforms that encourage more formal job creation, promote women's labour force participation, reduce employment costs and encourage more flexible employment forms are vital to promote social cohesion. Given its heavy dependence on oil and gas imports, Türkiye should continue with efforts to boost domestic oil and gas exploration, diversify supply sources and improve energy efficiency.