Australia

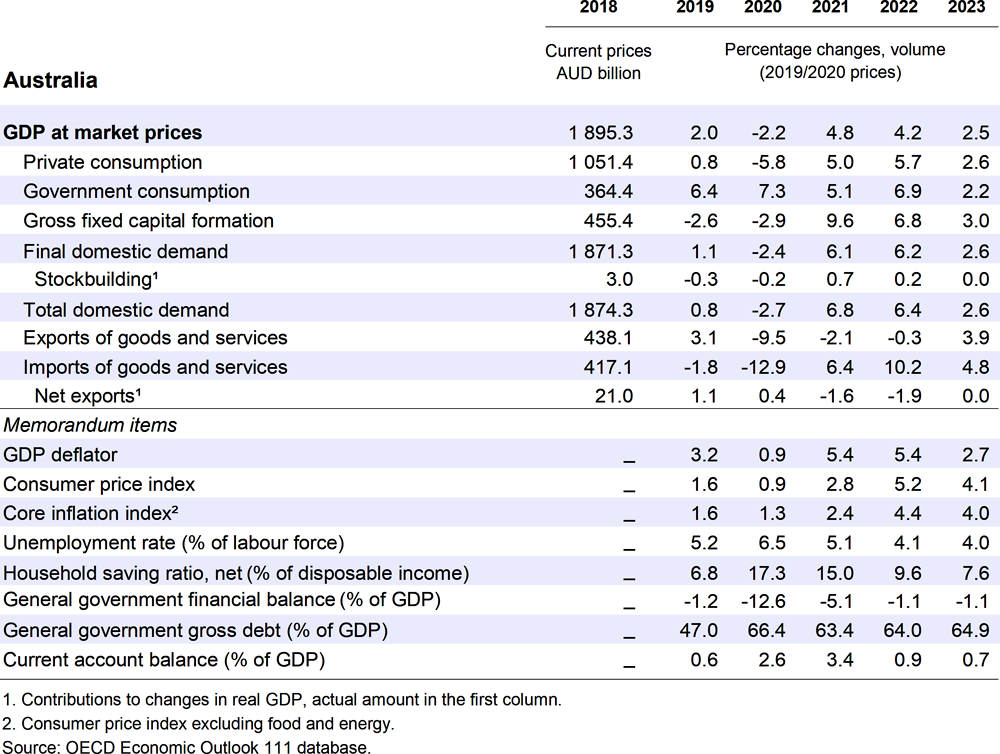

Real GDP is projected to grow by 4.2% in 2022 and 2.5% in 2023. The Australian economy is set to continue its solid recovery from the pandemic after having withstood the recent resurgence of COVID-19 cases as well as severe flooding in the states of Queensland and New South Wales. Wage and price pressures will rise given the already tight labour market and the strains on global supply chains, before moderating in 2023.

Monetary policy has started normalising, with the Reserve Bank of Australia raising its cash interest rate in May for the first time in a decade. Further tightening will be necessary in order to contain rising price pressures and bring inflation back to target. The temporary reduction in the fuel excise tax, prompted by concerns for cost-of-living pressures, is legislated to end on 28 September 2022. The global energy security risks posed by the war in Ukraine highlight the need to continue the transition towards greater renewable energy generation. In the medium-term, tax reform to reduce Australia’s heavy reliance on taxation of personal incomes would help decrease the vulnerability of public finances to an ageing population.

Economic activity has been resilient but inflation has picked up

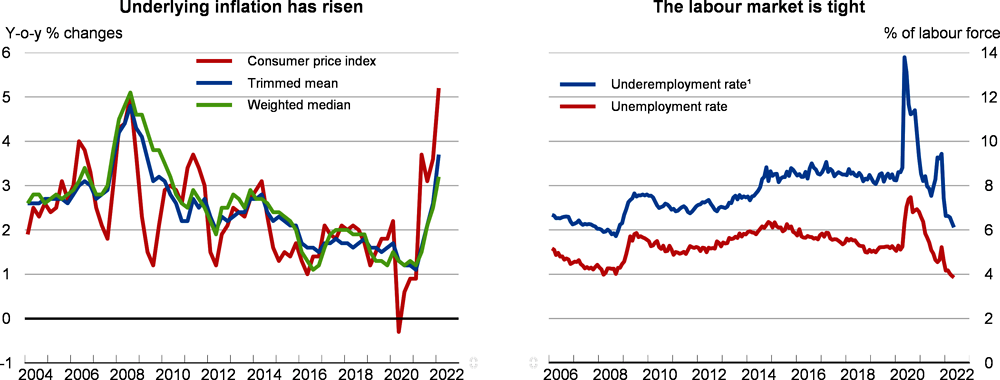

The recovery from the pandemic has continued despite the increase in COVID-19 cases in the first quarter of 2022 as well as the severe flooding that occurred in Queensland and New South Wales in February and March. Despite COVID-19 cases rising to levels not yet seen in Australia during the pandemic, indicators of private consumption and manufacturing activity have held up well over recent months. The labour market has tightened considerably, with the unemployment rate reaching 3.9% in April, its lowest level since 1974, reflecting the robust economic recovery and reduced immigration during the pandemic. In response, there are signs of wage growth picking up and inflation has risen, with the latter exacerbated by supply chain disruptions. Consumer prices rose by 5.1% year-on-year in the first quarter of 2022, with underlying inflation reaching 3.7%. This is the highest level since before the global financial crisis.

While the direct impact of the war in Ukraine on the Australian economy has been limited, both the war and the recent stringent lockdowns in China have exacerbated the supply-chain issues faced by Australia. High global energy prices have already affected Australian consumers and resulted in a rise in inflation, although inflation expectations remain at moderate levels. However, higher commodity prices have boosted Australia’s terms of trade, and strong global demand for grains will support exports following the war-related disruptions to output in Ukraine.

Monetary policy will tighten

In response to inflationary pressures, the Reserve Bank of Australia raised its cash target rate by 25 basis points to 0.35% in May, the first rate rise in over a decade. Further increases will be necessary to bring inflation back to the target range of 2-3%, with the OECD projections assuming that the cash rate will reach 2.5% by the end of 2023. The central bank has also ended its purchases of government bonds, which will lead to a significant but gradual decline of its balance sheet as bond holdings reach maturity. Pandemic-related fiscal support has largely unwound. However, this will be partly offset by a series of new spending measures announced with the Federal Budget following large revenue windfalls due to a stronger than anticipated recovery and high commodity prices. While windfalls will be partly used to reduce the federal deficit, the government also announced several measures aimed at easing cost of living pressures, including a cost of living tax offset and a temporary 6-month reduction in the fuel excise duty. Overall, the fiscal stance is assumed to be slightly contractionary in 2022 before being broadly neutral in 2023.

The economic recovery will continue amid rising inflation pressures

The economic recovery is projected to continue, with real GDP growth reaching 4.2% in 2022 and 2.5% in 2023. In the short run, growth will be supported by high commodity prices and improved terms of trade. Personal consumption growth will be supported by a strong labour market and a gradual decline in household saving rates. Inflation is projected to remain elevated in the near term as global supply chain issues, high energy prices and rising wages due to a tight labour market exert pressure on prices, before easing in 2023 as supply chain issues are gradually resolved and less accommodative monetary and fiscal policy weakens domestic demand. However, the recent embargo on Russian oil agreed by the European Union will exert upward pressure on inflation in 2023. Higher global oil prices will feed through to fuels and other items in the consumption basket, partially offsetting some of the easing in inflation that will result from waning supply chain issues. Skilled immigration will rise following the reopening of international borders in February, but is not expected to be sufficient to materially alleviate the tightness in the labour market. Strong global inflationary pressures and the tight labour market pose further upside risk to inflation in Australia, which could lead the Reserve Bank of Australia to tighten monetary policy more aggressively, with potential negative implications for consumption, investment and economic growth more generally. Finally, the pandemic also continues to pose a downside risk to the recovery as the emergence of a new, highly-infectious or virulent COVID-19 variant could prompt the re-imposition of restrictions, although it is unlikely that the country will return to restrictions as severe as those seen in 2020 and 2021.

Tax reform should be a medium-term priority

Significant further monetary policy tightening is needed in order to limit the rise in inflation. The reduction in the fuel excise duty is legislated to end on 28 September 2022. Any further cost of living support needed beyond this date should be better targeted to low income households and delivered in a way that does not distort price signals. Given the risks to energy security highlighted by the war in Ukraine, the transition towards renewable energy generation should be further encouraged, accompanied with further investments in the transmission network. The current recovery would also be a good time to reduce Australia’s heavy reliance on taxation of personal incomes, which adds to the vulnerability of public finances to an ageing population. Furthermore, consideration should be given to increasing or broadening the base of the Goods and Services Tax, reducing private pension tax breaks, reducing the capital gains tax discount and further replacing stamp duty with a recurrent land tax. Such reforms would result in a more sustainable tax base. As in other OECD countries, Australia would benefit from a review of its monetary policy framework. The review process should be transparent, involve consultation with relevant stakeholders, and should be broad in scope, potentially including a review of the central bank mandate, policy tools, methods of public communication, hiring processes and internal structures.