Germany

The economy is projected to grow by 1.9% in 2022 and 1.7% in 2023, with the recovery hampered by the war in Ukraine, and an embargo on Russian oil. Rising inflation is reducing household purchasing power, damping the rebound of private consumption. Investor and consumer confidence have collapsed and supply chain bottlenecks have worsened, postponing the recovery of industrial production and exports towards the end of 2022, despite a large order backlog. The recovery could be further derailed by a sudden stop of gas imports from Russia or more persistent lockdowns in China.

Fiscal support programmes to mitigate the effects of rising energy and food prices need to be well targeted to vulnerable households and firms. Boosting infrastructure investment and improving planning and approval procedures and capacity, particularly at the municipal level, would accelerate digitalisation and the energy transition, which is crucial to lower dependency on energy imports. Skilled labour shortages will need to be addressed by raising the labour supply of women, elderly and low-skilled workers, improving training and adult learning, and lowering occupational licensing requirements to ease transitions to jobs in high demand. This should be complemented by facilitating the recognition of the qualifications of migrants and refugees.

Uncertainty, supply chain bottlenecks and high inflation weigh on the economy

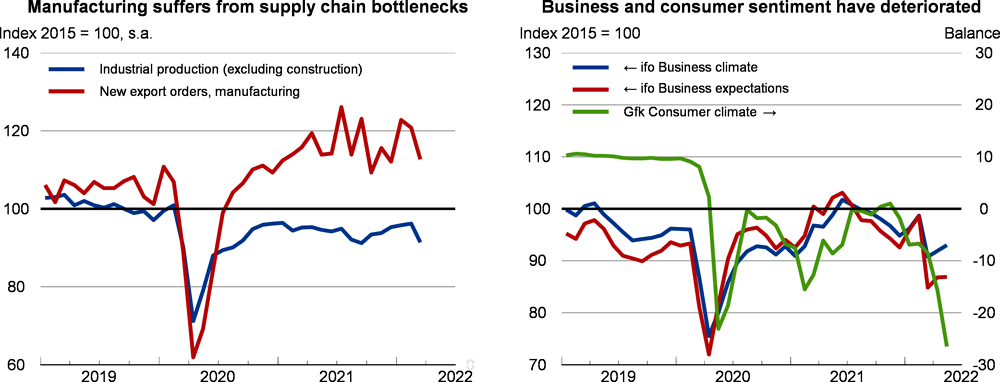

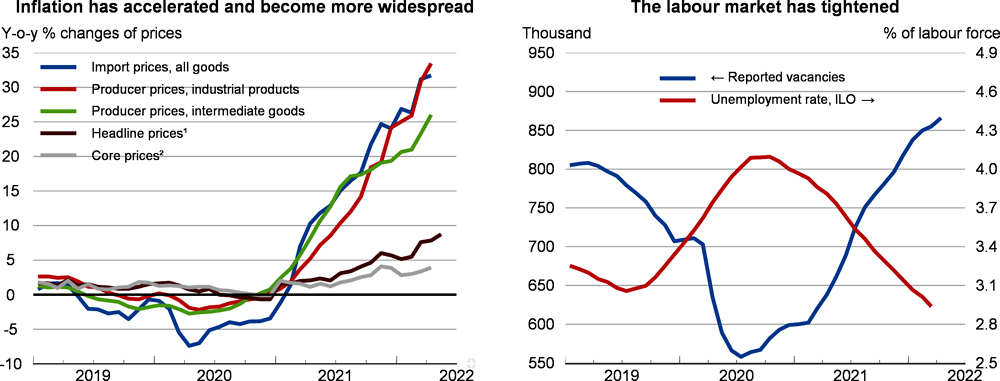

In the first quarter of 2022, real GDP grew by 0.2% (seasonally adjusted quarterly rate). In January and February, the easing of supply chain bottlenecks and mild weather conditions led to a rebound in manufacturing and construction, private investment and exports. Retail and hospitality spending started to recover due to high excess savings and the lifting of containment measures from March. However, the war has changed this positive outlook. High inflation and plummeting consumer confidence hit private consumption. Heightened uncertainty, a surge in energy prices and new material shortages hurt manufacturing and construction, private investment and exports. The ifo business climate plunged in March by more than 13%, but stabilised in April and May. Industrial production and goods exports decreased by 3.9% and 3.3% (month-on-month), respectively, in March. Moreover, the annual rate of headline inflation rose to 8.7% in May, with more than 40% of the price increase resulting from non-energy components following the pass through of high producer prices, which rose by 33.5% over the year to April. Wholesale prices have increased by 23.8% over the year to April, and by 2.1% compared to March 2022. With employment growth of 0.2%, the labour market remained robust in March amid intensifying labour shortages. After moderate wage growth during the pandemic, negotiated pay rose firmly at 4% (year-on-year) in the first quarter of 2022.

Before the start of the war in Ukraine, Germany was highly dependent on Russian gas, oil and coal, with around one-third of primary energy supply coming from Russia. A rapid diversification of energy suppliers has led to a significant reduction in the share of Russian energy imports, with the oil import share from Russia falling from 35% to 12% and the coal import share from 50% to 8% by late April. Gas imports from Russia have only fallen from 55% to 35% of total gas supply, making the German economy highly vulnerable to a possible stop of gas imports. To prepare for such a scenario, the government has taken several measures, including filling up gas storage tanks, accelerating the construction of LNG terminals and negotiating trade deals with LNG exporters. Measures to raise energy savings could be further improved. Russia’s overall share in Germany’s foreign trade was only 2.3% in 2021. While imports from Russia fell by only 2.4% in March, exports to Russia fell sharply by 62%. So far, Germany has received 610 000 refugees from Ukraine (0.7% of the population), the largest inflow among the non-neighbouring countries.

Fiscal policy faces new challenges

The underlying budget deficit will remain higher than before the pandemic. Pandemic-related support programmes including short-term work and grants for firms are to be phased out at the end of June, but new measures to mitigate the energy price surge are included in the supplementary budget for 2022 (additional spending of EUR 39 billion or 1.1% of GDP). These comprise the permanent abolishment of the renewable energy surcharge from July, a three-month decrease in fuel taxes, an increase of the commuting subsidy, public transport subsidies, as well as several one-off cash transfers and income tax relief for households. While some of these measures are well targeted at vulnerable households, others disburse considerable amounts of scarce public resources to all households, reducing incentives to save energy and lower carbon emissions. The government is also providing liquidity support to firms severely impacted by the war in Ukraine through loan guarantees, credit lines, energy cost subsidies and equity. It is crucial that these programmes are well targeted and maintain strong incentives for capital and labour reallocation towards booming sectors with rising labour shortages. Additional social spending of EUR 4 billion (0.1% of GDP) is planned to manage the inflow of refugees from Ukraine.

To reach its ambitious climate targets, the government plans to invest around EUR 200 billion until 2026, with fiscal incentives to crowd in private investments playing a major role. It also envisions a significant increase in military spending of EUR 100 billion over the next years to upgrade military equipment. Most of these debt financed investments will be conducted using shadow budgets, the spending of which is excluded from the debt brake that will be reinstated from 2023. Exact spending plans for the shadow budgets are currently missing, but capacity constraints in the construction sector and long and complex planning and approval procedures will likely cause slow disbursement of funds this year.

A strong recovery is hampered by the war in Ukraine

Heightened uncertainty, a surge in energy prices and additional material shortages due to lock-down measures in China will hurt manufacturing and hold back private investment and exports despite a large order backlog, postponing the pickup of the recovery to the second half of this year. The easing of containment measures and accumulated excess savings will lead to a stronger recovery in services activity. However, falling consumer confidence due to the war and rising inflation rates will damp the recovery of private consumption. Fiscal policy will remain supportive. Inflation will stay high due to supply chain bottlenecks and high producer prices, which will be passed on to consumers during the coming months. Energy prices will further increase in 2023 due to the embargo on Russian oil. The depreciation of the euro and intensifying labour shortages will contribute to inflationary pressures. Wages will grow significantly due to a minimum wage increase from 48% to 60% of the median wage in October and pressure from unions to preserve the purchasing power of workers.

A severe downside risk to the projection arises from a potential stop of gas imports from Russia, which would hit the economy through higher import prices, heightened uncertainty and direct gas rationing. A worsening of the pandemic in China could exacerbate supply chain bottlenecks. On the upside, a quicker end of the war or faster substitution of energy imports from Russia would restore investor and consumer confidence. A stronger rise in tax revenues due to high inflation and repayments of pandemic related firm support could create additional fiscal space for public investments.

Expanding renewables to raise energy security

To expand renewable energy supply, it is crucial to continue accelerating complex planning and approval procedures at the municipal and Laender level. Speeding up the digitalisation of the economy requires more investments in digital infrastructure, a more rapid modernisation of the state and better coordination of policies and administrative procedures across levels of government. Increasing efficiency of public spending through effective use of spending reviews, reducing regressive and environmentally harmful subsidies and tax exemptions and improving tax enforcement could free up additional resources for necessary public investment. To address rising labour shortages, which also risk derailing private and public renewable energy investment, the labour market participation of women, low-skilled and elderly workers needs to be raised by setting the right tax incentives and improving training and adult learning policies. Boosting skilled migration and facilitating the labour market participation of Ukrainian refugees, such as through better supply of childcare facilities, is also key.