1. General assessment of the macroeconomic situation

The war in Ukraine has generated a major humanitarian crisis affecting millions of people. The associated economic shocks, and their impact on global commodity, trade and financial markets, will also have a material impact on economic outcomes and livelihoods. Prior to the outbreak of the war the outlook appeared broadly favourable over 2022-23, with growth and inflation returning to normality as the COVID-19 pandemic and supply-side constraints waned. The invasion of Ukraine, along with shutdowns in major cities and ports in China due to the zero-COVID policy, has generated a new set of adverse shocks. Global GDP growth is now projected to slow sharply this year to 3%, around 1½ percentage points weaker than projected in the December 2021 OECD Economic Outlook, and to remain at a similar subdued pace in 2023 (Table 1.1). In part, this reflects deep downturns in Russia and Ukraine, but growth is set to be considerably weaker than expected in most economies, especially in Europe, where an embargo on oil and coal imports from Russia is incorporated in the projections for 2023. Commodity prices have risen substantially, reflecting the importance of supply from Russia and Ukraine in many markets, adding to inflationary pressures and hitting real incomes and spending, particularly for the most vulnerable households. In many emerging-market economies the risks of food shortages are high given the reliance on agricultural exports from Russia and Ukraine. Supply-side pressures have also intensified as a result of the conflict, as well as the shutdowns in China. Consumer price inflation is projected to remain elevated, averaging around 5½ per cent in the major advanced economies in 2022, and 8½ per cent in the OECD as a whole, before receding in 2023 as supply-chain and commodity price pressures wane and the impact of tighter monetary conditions begins to be felt. Core inflation, though slowing, is nonetheless projected to remain at or above medium-term objectives in many major economies at the end of 2023.

The uncertainty around this outlook is high, and there are a number of prominent risks. The effects of the war in Ukraine may be even greater than assumed, for example because of an abrupt Europe-wide interruption of flows of gas from Russia, further increases in commodity prices, or stronger disruptions to global supply chains. Inflationary pressures could also prove stronger than expected, with risks that higher inflation expectations move away from central bank objectives and become reflected in faster wage growth amidst tight labour markets. Sharp increases in policy interest rates could also slow growth by more than projected. Financial markets have so far adjusted smoothly to tighter global financial conditions, but there are significant potential vulnerabilities from high debt levels and elevated asset prices. Challenges also remain for many emerging-market economies, from rising food and energy prices, the slow recovery from the pandemic, high debt, and the potential for capital outflows as interest rates rise in the advanced countries. Risks also remain from the evolution of the COVID-19 pandemic: new more aggressive or contagious variants may emerge, while the application of zero-COVID policies in large economies like China has the potential to sap global demand and disrupt supply for some time to come.

The substantial economic costs of the war, elevated uncertainty, and the forthcoming embargo on coal and seaborne oil imports from Russia in Europe add to the challenges already facing policymakers from rising inflationary pressures and the imbalanced recovery from the pandemic:

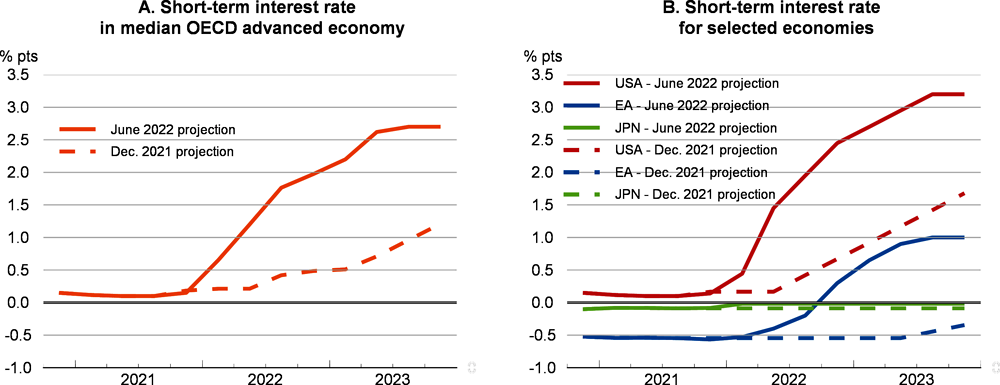

Faced with an adverse supply shock of uncertain duration and magnitude from higher commodity prices, monetary policy should remain focused on ensuring well-anchored inflation expectations. This calls for a differentiated response across the major advanced economies. The case for a relatively quick normalisation is particularly strong in the United States, Canada and many smaller European countries, where the recovery in demand from the pandemic is well advanced and broad-based inflation pressures were already apparent ahead of the recent commodity price surge. Removing accommodation more gradually is appropriate in economies where core inflation is lower, wage pressures remain modest and the impact of the conflict and the future embargo on growth is greatest. Further policy rate increases are likely to be needed in many emerging-market economies to help anchor inflation expectations and avoid destabilising capital outflows.

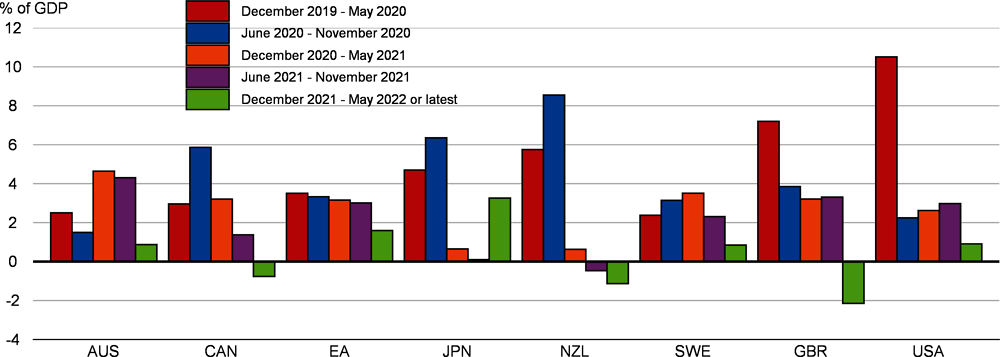

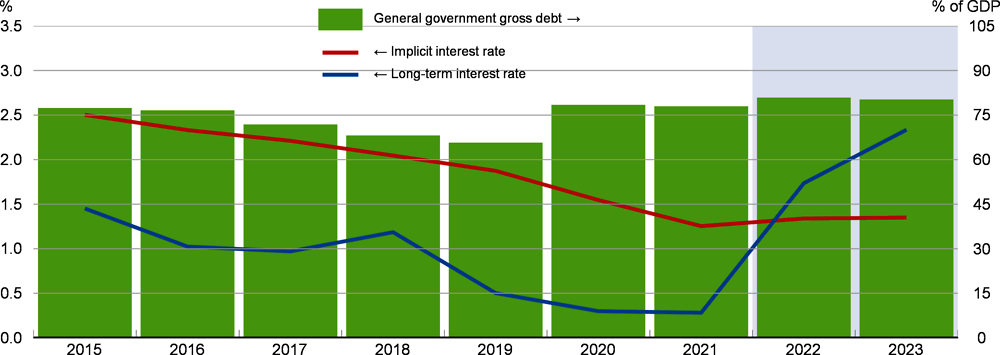

Temporary, timely and well-targeted fiscal measures, where feasible, provide the best policy option to cushion the immediate impact of the commodity and food price shocks on vulnerable households and companies and provide support for refugees from the war. Many countries have appropriately slowed plans for gradual fiscal consolidation in the aftermath of the pandemic, at least until 2023, but consolidation should not be delayed where demand pressures are clearly apparent in inflation. Over the medium and long term, the conflict in Ukraine is raising new fiscal priorities, including accelerated investment in clean energy and higher defence spending, reinforcing the need for a thorough reassessment of the composition of the public finances. Credible fiscal frameworks with strong national ownership can help to provide clear guidance about the medium-term trajectory of the public finances and mitigate concerns about debt sustainability.

The pandemic and the war in Ukraine have exposed many longstanding structural weaknesses, which have been felt unequally across households, firms and countries. Effective and well-targeted reforms are needed to boost resilience, revive productivity growth, address persisting inequality and accelerate reductions in carbon emissions. International co-operation will need to be preserved to improve prospects for sustainable and equitable longer-term growth by keeping markets open to trade, helping developing countries overcome the COVID-19 pandemic and reduce debt burdens, and enabling more ambitious and effective collective actions on climate change.

The war has underlined the vulnerability of energy and food security given the dependence of many countries on exports from Russia or Ukraine. Substantial, but not complete, diversification of energy sources can be achieved relatively quickly in some countries, as highlighted by the plans for oil and gas imports set out by the International Energy Agency. Providing regulatory and fiscal incentives to move towards alternative energy sources and invest in innovation and infrastructures are both important steps to help develop clean energy supply and spur energy efficiency. Some progress in this direction has been made in recent public investment plans but more needs to be done to meet the commitments made at COP26. Food security has also become a more pressing concern given the acute risk of economic crises in some developing economies and sharp increases in poverty and hunger. To monitor and mitigate such risks, all countries must provide the assistance necessary to facilitate the planting of new crops, including in Ukraine, tackle logistical barriers limiting the supply of food to countries most at risk, and refrain from export restrictions on food and other agricultural products.

The Russian invasion of Ukraine is a humanitarian crisis affecting millions of people. Beyond the tens of thousands of deaths and injuries, close to 7 million people have already been forced to flee Ukraine to other countries in Europe, and an even greater number have been displaced within the country. The war is also a severe economic shock, above all in Ukraine itself, but also in Russia, the neighbouring region, and even in more distant parts of the world (OECD, 2022a).

The effects of the war are being felt through many channels. Large output declines in Russia and Ukraine directly shrink global economic activity and reduce demand for output from other countries. This effect is relatively modest, given the limited direct role of Russia and Ukraine in global activity and trade, but could still reduce global growth this year by over ¼ percentage point at market prices and by close to ½ percentage point in PPP terms.1

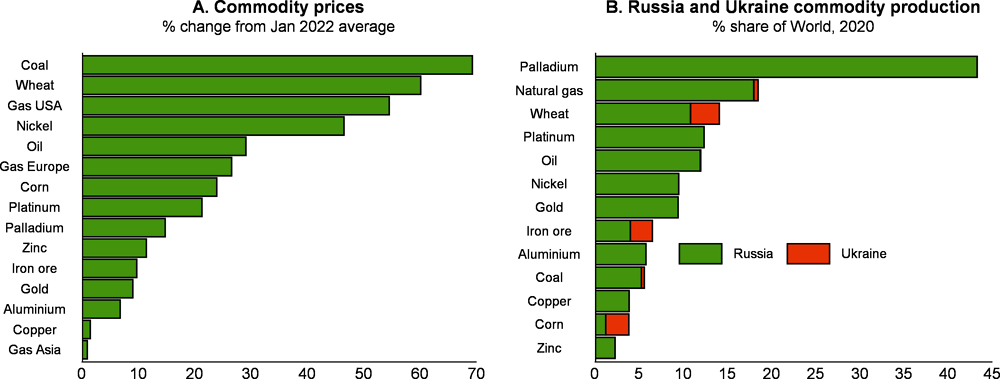

The major influence of Russia and Ukraine on the global economy is via their role as important suppliers in a number of commodity markets. Together they account for about 30% of global exports of wheat, 15% for corn, 20% for mineral fertilisers and natural gas, and 11% for oil. In addition, global supply chains are dependent on Russian and Ukrainian exports of metals (see below) and inert gases. The prices of many of these commodities increased sharply after the onset of the war, even in the immediate absence of any significant disruption to production or export volumes (Figure 1.1).

The surge in commodity prices and the possible disruptions to production will have significant consequences for many economies, particularly emerging-market and developing economies (Box 1.1). A particular concern is that a cessation of wheat exports from Russia and Ukraine could result in serious food shortages in many developing economies. There would be an acute risk not only of economic crises in some countries but also humanitarian disasters, with a sharp increase in poverty and hunger. The food supply shock could be compounded by fertiliser shortages and price rises, with Russia and Belarus major suppliers in many countries, putting agricultural output next year and perhaps beyond under stress.

The war and the sanctions on Russia are also causing disruptions through financial and business linkages.2 Sanctions placed on Russia have targeted selected individuals and banks, reduced access to foreign capital and frozen access to the foreign exchange reserves held by the Central Bank of Russia (CBR) in Western economies. Bans have also been imposed on some exports to Russia. As a result, the CBR has tightened monetary policy and imposed capital controls, and risk premia on Russian sovereign debt have widened. Selective export bans and delays and difficulties in making international payments are disrupting trade – Russian imports have plummeted since the start of the war – and could result in formal defaults on dollar-denominated Russian debts, with US banks now prohibited from handling US dollar payments from Russia. Financial market conditions around the world have also tightened, including in many economies in Central and Eastern Europe with relatively strong business ties with Russia. Air and sea traffic have been disrupted (see below) and many multinational companies have suspended operations in Russia.

The refugee flows caused by the war will result in additional public expenditure in the short term in host countries, although this will be offset over time as refugees enter the labour force, helping to alleviate some labour market pressures. The number of people who have already fled Ukraine since the start of the war is several times greater than the annual flow of asylum-seekers into Europe at the height of the Syrian refugee crisis in 2015-16. Supporting the refugees from Ukraine involves upfront spending on housing, food, medical assistance and childcare and schooling, along with assistance to help those who stay to enter the labour market. The scale of the spending challenge is difficult to predict due to uncertainty about the number of refugees, the length of time they will stay, and which country they may move to. An illustrative estimate, using current support for refugees, points to a minimum expenditure in European Union (EU) countries of around 0.2% of EU GDP (Box 1.2). This spending could be covered by the resources already made available in various EU funds.

Energy imports by the European economies from Russia are set to fall sharply in 2023. The EU has agreed an embargo on coal imports from Russia, to take effect in August, and an embargo on seaborne oil imports from Russia to begin in 2023. In addition, some countries have, or will, bilaterally end imports of gas and pipeline imports of oil from Russia this year, and Russia has halted gas exports to a few EU member states. These changes are incorporated in the baseline projections. A Europe-wide end to most oil imports from Russia brings challenges, with petroleum products (including crude oil) accounting for over one-third of total energy use in the EU. Even if alternative supplies can be found on world markets at higher prices and shortages avoided, as assumed in the baseline projections, the embargo is projected to push up inflation and weaken growth, particularly in Europe. The challenges in adjusting to the embargo, the risks of possible adverse supply-side effects and the impact of an additional EU embargo on gas imports from Russia are discussed further below.

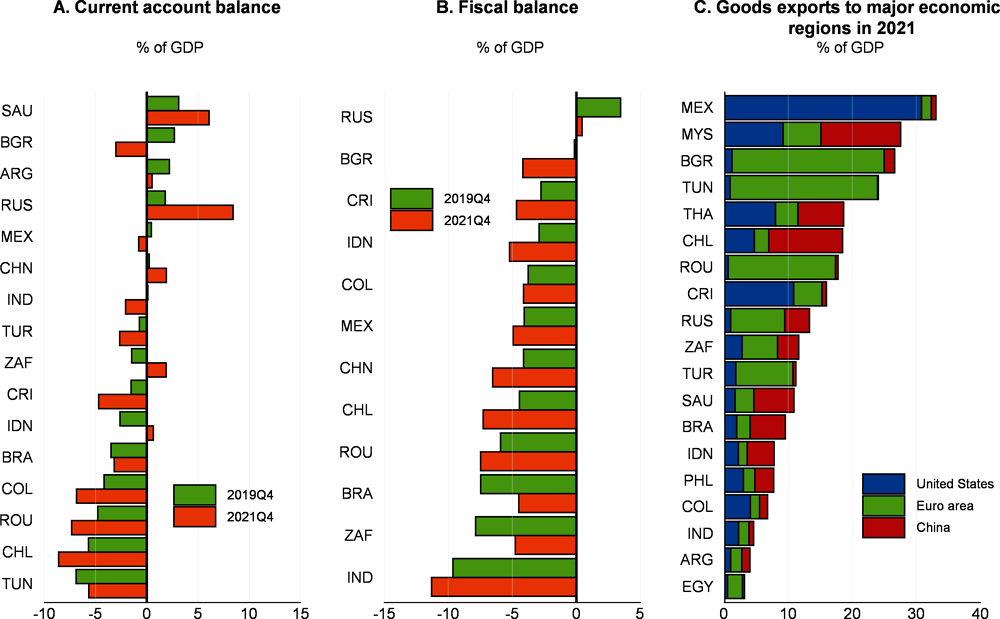

The disruptions in commodity markets brought about by the war in Ukraine will likely have strong economic and social impacts on emerging-market economies. Current accounts, and through them the income of the private and public sectors, are being affected by soaring commodity prices, to the benefit of net commodity exporters and the detriment of net importers. In addition, the available quantities of certain commodities are also under strain. Agricultural commodities are of particular concern on this count, since Russia and Ukraine are two major suppliers of cereals and fertilisers.

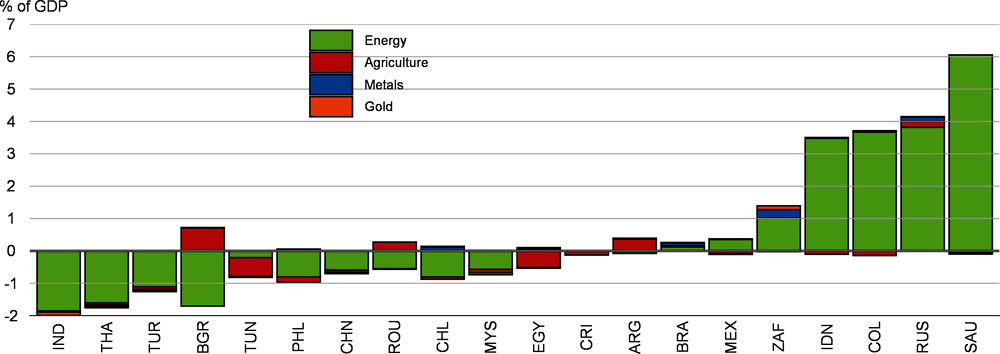

Current account effects

The current account effects of the commodity price shock depend on countries’ net export positions and the size of the price shocks for individual commodities. Both aspects – variation in net exports and the magnitude of the price shock – tend to be larger for energy commodities than for food or metals. An illustrative estimate of the potential annual gains (or losses) from the abrupt price changes that have been observed since the outbreak of the war in Ukraine is shown in Figure 1.2. For each country and commodity, the average net exports-to-GDP ratio over 2015-19 is multiplied by the respective price shock since the invasion of Ukraine, with the effects aggregated by broad commodity categories.1 The use of a five-year period helps to minimise the potential sensitivity of the results to exceptional events, such as droughts or strikes.2 These calculations isolate the impact of trade of selected commodities and do not incorporate possible changes in consumption patterns in response to price changes, or in non-commodity trade that could affect aggregate saving-investment balances. Hence, the depicted gains or losses should not be regarded as estimates of expected changes in overall current account balances.

Colombia, Indonesia, Russia and Saudi Arabia, all large energy exporters, gain from improvements in their terms of trade. In contrast, Bulgaria, India, Thailand and Türkiye could suffer significant losses.3 Bulgaria and Romania benefit from the sharp rise in wheat and maize prices, and Chile from higher metals prices, but these fall short of the costs from rising energy prices. Rising food prices are likely to yield moderate gains to Argentina, but sizeable income losses in Egypt and Tunisia.

Emerging-market economies face risks of significant disruptions in agricultural trade

In addition to price effects, the war can also reduce the quantities available on world markets. Russia and Ukraine are two major suppliers of agricultural commodities, especially cereals and fertilisers. Highly disaggregated customs data, covering nearly 5 000 distinct products, help to show which particular markets are most at risk of disruption, and which customers are most exposed to a reduction in production in Russia and Ukraine.

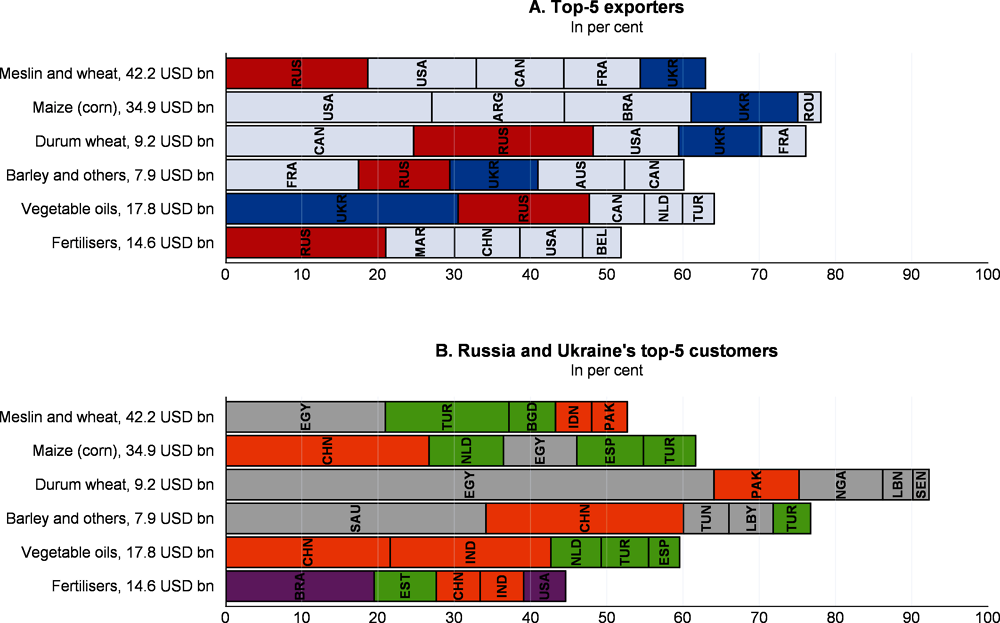

War-related disruptions are particularly likely for cereals and vegetable oils. Russia and Ukraine accounted for about 30% of global exports of durum wheat and meslin and wheat in 2020, 15% of maize, and one-quarter of barley and other cereals (Figure 1.3). Ukraine is also the world’s biggest exporter of vegetable oils (sunflower seed and safflower) and, together with Russia, supplies half of the global market. Overall, the supply of these agricultural commodities is remarkably concentrated, with the five biggest suppliers covering more than half of the world export market, and almost to 80% in some cases. Such a high degree of concentration limits the scope for substitution to other producers in the short run, making these products particularly vulnerable to shocks.

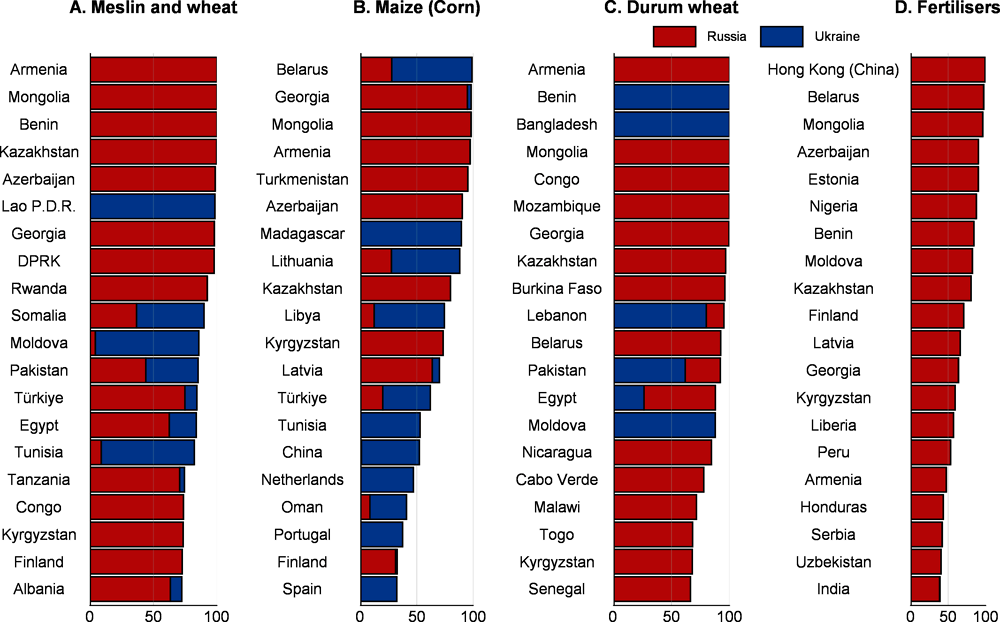

Some countries in Africa and the Middle East, and Central Asia are relatively exposed, particularly if they have low domestic production. Egypt buys two-thirds of the durum wheat exported by Russia and Ukraine, Türkiye one-fifth of the meslin and Saudi Arabia one-third of barley and other cereals. Lower-income countries that are the most dependent on Russian and Ukrainian supply will be the hardest hit and disruptions could threaten food security in those countries (Figure 1.4).

Possible disruptions in the supply of fertilisers could add further pressures (Figure 1.4, Panel D). Russia is a major supplier of fertilisers, as natural gas is a key input in this industry, and accounted for 20% of world exports for some fertilisers in 2020, with a global trade market of USD 15 billion.4 Russia is also one of the five biggest exporters of ammonia and natural calcium phosphates, two components mainly used in the production of fertilisers. Many countries from Central Asia as well as some advanced economies in Northern Europe, are among those most reliant on Russia for their imports of fertilisers. A few African countries are also highly exposed. Shortages of crops and fertilisers would put serious strain on agriculture worldwide.

← 1. Potential shifts in countries’ net exporting positions at the level of each commodity in response to the price shock or to changes in external demand could alter these illustrative results, but are not taken into account. For natural gas, the prices in the region a country belongs to are used to compute the effects on the current account balance.

← 2. More recent years have not been considered due to the impact of the pandemic (2020-21) or incomplete data (2021).

← 3. The estimated current account gains for Russia should be regarded as an upper bound as Russian oil has been traded at a discount – implied by the positive spread between Brent and Urals spot prices for oil – since the outbreak of the war.

← 4. The group of fertilisers plotted on Figure 1.4 aggregates five separate categories of fertilisers.

There has been an unprecedented outflow of refugees from Ukraine

The war in Ukraine has generated a historic outflow of people fleeing the conflict, unseen in Europe since World War II. The Syrian conflict raged for two years before the number of refugees abroad reached three million in 2015-16, whilst this number was reached in less than 3 weeks for the war in Ukraine. By May 18, according to data from the UNHCR, more than 6.2 million people had fled Ukraine and an additional estimated 8 million were internally displaced. About 5.3 million Ukrainian refugees have reached the European Union. Close to 3.4 million Ukrainians crossed into Poland, almost 930 000 into Romania, 615 000 into Hungary and 427 000 into the Slovak Republic.

This humanitarian crisis cannot be compared easily with previous ones, notably the 2015-16 humanitarian crisis in Europe. Key differences include the large pre-conflict Ukrainian diaspora and its role in the immediate reception of Ukrainian refugees; the pre-existing visa facilitations for Ukrainian nationals in Europe which greatly expedite orderly cross border movements; and the different socio-demographic characteristics of the current refugee inflow, which overwhelmingly consists of children and women with relatively high formal education levels. There has also been an exceptional mobilisation of institutions and host communities in OECD countries.

Daily outflows from Ukraine increased rapidly in the first days of the conflict, peaking at 200 000 in early March, but have now stabilised at around 50 thousand per day. The State Border Guard Service of Ukraine has reported that more than 1.8 million Ukrainians have returned to the country since the start of the war, although this figure may include short-term cross-border movements.

A growing number of refugees are now moving to other OECD countries. OECD estimates suggest that, by May 13, EU countries not bordering Ukraine have already received more than 2 million Ukrainians since February 24. In particular, Germany registered about 610 000 Ukrainians, the Czech Republic 335 000, Spain 135 000 and Italy 113 000. Beyond Europe, more than 28 000 Ukrainians arrived in Israel, 25 000 in Canada and about 37 000 in the United States.

The general mobilisation in Ukraine prevents most men aged 18 to 60 from leaving the country. As a result, very few working age men have left the country so far. Available data for Poland, according to the Office of Foreigners, show for example that out of the one million registrations by end-April, 48% of arrivals were minor children and 92% of the adults were women. Similar numbers are observed in Lithuania. Countries further from the Ukrainian border report a slightly lower share of children, between 32% (France and Greece) and 40% (the Czech Republic and Belgium).

Available information from host countries suggests that a relatively high share of Ukrainian refugees are tertiary educated, in contrast to other refugee groups. Overall, they also have higher levels of education than the general Ukrainian active population (34% of whom were tertiary educated in 2019). In Spain for example, 60% of registered Ukrainians above 16 years old have a tertiary diploma, 25% have a professional qualification, 11% have upper secondary education, and less than 1% are without any education.

A first assessment of the labour market impact of the Ukrainian refugee inflow in Europe

The Ukrainian refugees may make a sizeable contribution to the EU labour market. Their socio-demographic profile, the support they are receiving from the Ukrainian diaspora and host communities and the relatively modest monthly income support available in most countries (see below) all encourage labour force participation. The EU has also provided Ukrainian refugees with immediate and unrestricted access to the labour market.

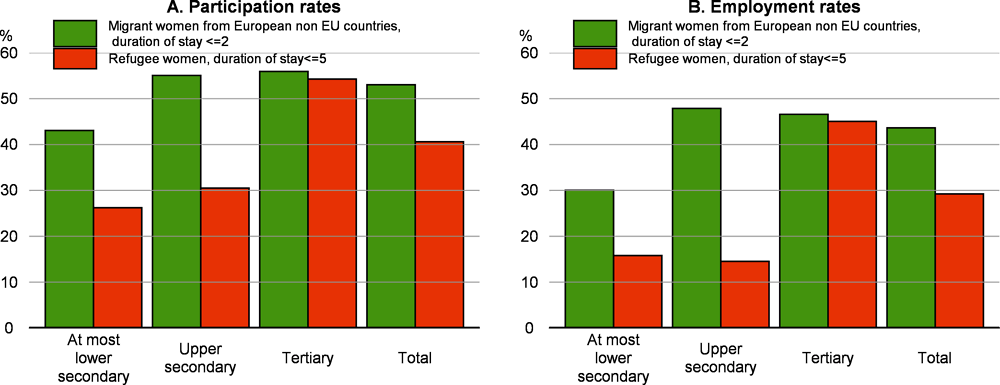

OECD estimates suggest that as of end-April, there could be 2.3 million Ukrainian refugees aged 20 to 64 in Europe.1 Estimates of possible employment and participation rates by the end of 2022 can be derived using the educational structure observed in Spain, and observed employment and participation rates for refugee women in Europe with less than 5 years of duration of stay, or European third-country migrant women with less than 2 years of duration of stay (Figure 1.5). These point to between 850 thousand and 1.1 million entries to the EU labour market of Ukrainian migrant women aged 20-64, with between 602 and 917 thousand in employment.

These numbers may seem large but should be put in the perspective of the size of the EU labour market (327 million working age population and 240 million employed workers) as well as of regular permanent migration flows (1.3 million new permanent immigrants from non-EU countries in 2019). They can also be compared to temporary migration flows from third countries. For instance, before the COVID-19 pandemic, Poland alone was receiving annually more than one million seasonal and temporary foreign workers, most of whom were from Ukraine. Much of this annual flow will probably be replaced by Ukrainian refugees.

The labour market integration of Ukrainian women may be slower than anticipated due to language barriers, uncertainty about their length of stay and delays in integrating Ukrainian children in the education system. Currently, many children are maintaining some links with the Ukrainian education system via online solutions. This may prevent their single mothers or guardians from immediately seeking work.

How much might the reception of Ukrainian refugees cost in Europe?

All EU countries provide financial support to beneficiaries of temporary protection to cover basic needs, but levels and mechanisms vary widely across countries. Monthly financial allowances also vary within countries, depending on whether refugees are hosted in a reception centre or not, whether they have access to food on site or not and, most importantly, depending on the family composition of the household. Differences in the monthly allocation for single refugees in accommodation provide an indication of the scope of cross-country differences (Figure 1.6). The total per capita cost might also be lower than in 2015-16 because there are no costs from asylum applications, because Ukrainian refugees are mostly concentrated in host countries with a cost of living below the EU average, because access to integration services is more limited and because of the higher proportion of minor children.

A provisional calculation based on the refugee population from Ukraine at the end of April, indicates that the cost for the direct financial support provided to Ukrainian refugees in the EU, including for housing, could be around EUR 17 billion in 2022. This does not include the broader costs for education, health and integration measures. Based on the age structure of the refugee population, these could collectively be just over an additional EUR 9 billion in the ten months of 2022. The reception cost can be compared to the funds made available by the decision of the EU Council in early April. This made it possible for Member States to redirect up to EUR 17 billion from European Structural and Investment Funds (ESIF), the Fund for European Aid for the Most Deprived (FEAD) and the 2022 tranche of the EU recovery plan (EU-REACT) to assist the refugees.

← 1. These calculations assume that only one third of the re-entries in Ukraine are durable returns, that the demographic composition of the refugee population varies slightly between bordering countries (50% children) and the rest of the EU (33% children) and that 94% of the adult refugee population is working age.

Activity indicators have moderated and confidence has been hit

Most economies experienced strong economic growth in 2021, as rising vaccination coverage and improved treatments mitigated the severity of the pandemic, and policy support and favourable financial conditions helped demand to rebound. Labour market slack was steadily reduced in all the major OECD economies, in some cases taking employment rates above pre-pandemic peaks. The economic disruptions from the wave of infections brought by the Omicron variant in late 2021 and the early months of 2022 generally proved mild in most countries, but global GDP growth more than halved in the first quarter of 2022, with output declining in several advanced economies.

High-frequency data are now showing some of the adverse effects of the war on activity and prices. Global mobility has continued to improve, but global industrial production, retail sales and car sales all declined in March and April (Figure 1.7, Panels A and B). Survey evidence also suggests that the war and the health-related restrictions in China are having a sizeable impact on business activity and confidence (Figure 1.7, Panels C and D). Indicators of business confidence and output have fallen sharply in China, reflecting the lockdowns in many cities and ports, and declines have also occurred in Russia and a number of major European economies, including Germany. Consumer confidence indicators had already begun to weaken ahead of the war, especially in the United States, but tumbled further in March, particularly in Europe, and declined further in April and May. In Russia, air traffic has slowed considerably, with around one-third fewer commercial flights from major airports since the war began, and prices have risen sharply. By late April, consumer prices were around 11% higher than at the start of February. Taken together, these indicators suggest that global GDP growth could be very weak in the second quarter of 2022.

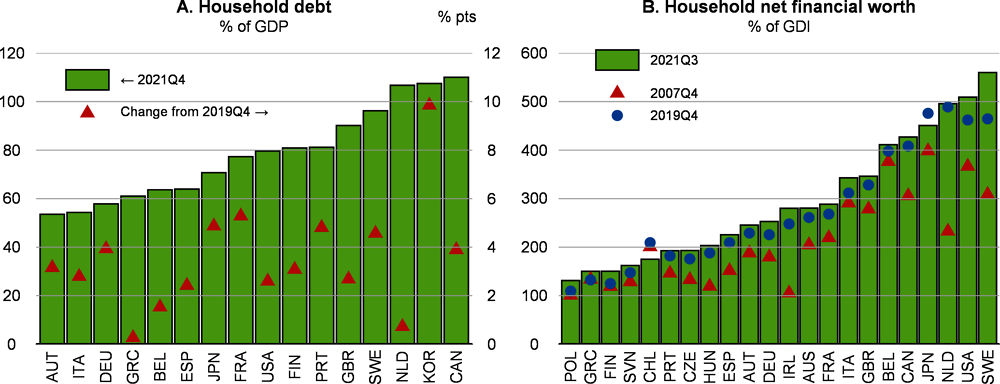

The downturn in consumer confidence is likely to be related to the squeeze on real household incomes coming from the acceleration in inflation as well as higher uncertainty. In most OECD economies, real household disposable income was already declining on a year-on-year basis in the last quarter of 2021, despite strong employment growth, and in many that decline is estimated to have continued in the first quarter of 2022. This partly reflects the phasing out of transfers associated with the pandemic, especially in countries like the United States and Canada where such payments were large, as well as the erosion of real wages. Economy-wide real hourly wage growth is now negative in most OECD economies (Figure 1.8).3 The additional increases in energy prices seen since the start of the war in Ukraine are pushing headline year-on-year inflation well ahead of the inflation rates expected at the time of collective bargaining to set wage rates in 2022.

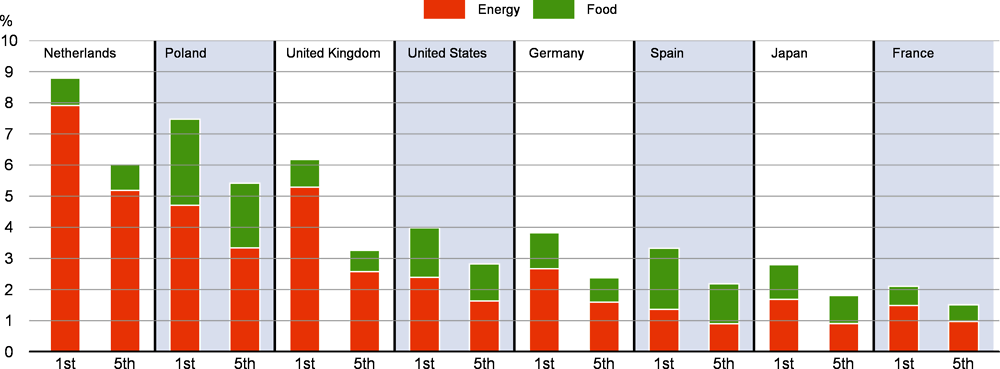

The impact of rising inflation on real incomes has not been uniform across households (Brainard, 2022).4 The increase in expenditure resulting from recent food and energy price changes represents a larger proportion of total spending for lower-income households (Figure 1.9), and those households have limited scope to offset this by drawing on savings or reducing discretionary expenditures.5 This is one reason why governments in many OECD countries have taken action to cushion recent rises in energy prices (see below).

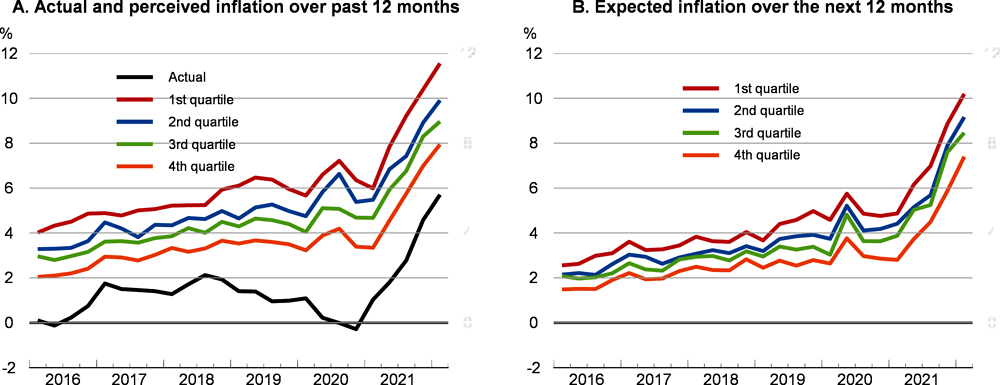

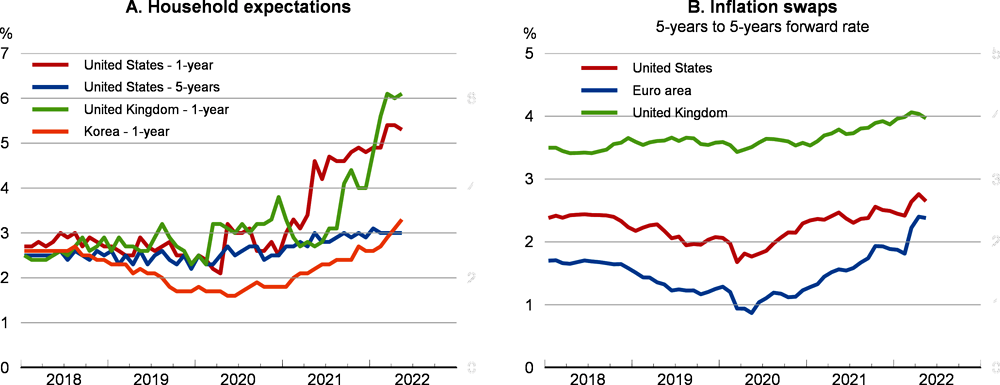

The difference between the degree of inflation experienced by many households and the official measure may be one explanation for the persistent difference between household survey measures of inflation and actual inflation in the euro area (Figure 1.10), with perceived and expected inflation highest amongst the lowest income quartile. Over and above the actual budget shares of different items, perceived inflation is also influenced by those prices which are most salient for consumers, such as electricity bills in Europe, gasoline in the United States, or common food items (Georganas et al., 2014; D’Acunto et al., 2021). These items are encountered regularly, relatively homogeneous (facilitating price comparisons over time) and make up a significant share of household expenditure. With such prices being among those registering the largest increases over the past eighteen months, perceptions of inflation have risen sharply since 2020 and run ahead of the measured rate for many people. This increase could place upward pressure on wage bargains over the coming year.

The COVID-19 pandemic has complicated the interpretation of labour market conditions, but it has become increasingly clear that labour markets in most OECD economies are now relatively tight. The OECD-wide unemployment rate is back to the lowest level in the past two decades and nominal wage growth has picked up in the United States and a few other countries to levels that are high by pre-pandemic standards. Most OECD economies are now experiencing labour shortages (Causa et al., 2022), with sharp increases in vacancies even in countries that favoured job retention schemes (Figure 1.11). Large declines in international migration since the onset of the pandemic have also contributed to labour shortages in some countries.

Financial market conditions have tightened significantly

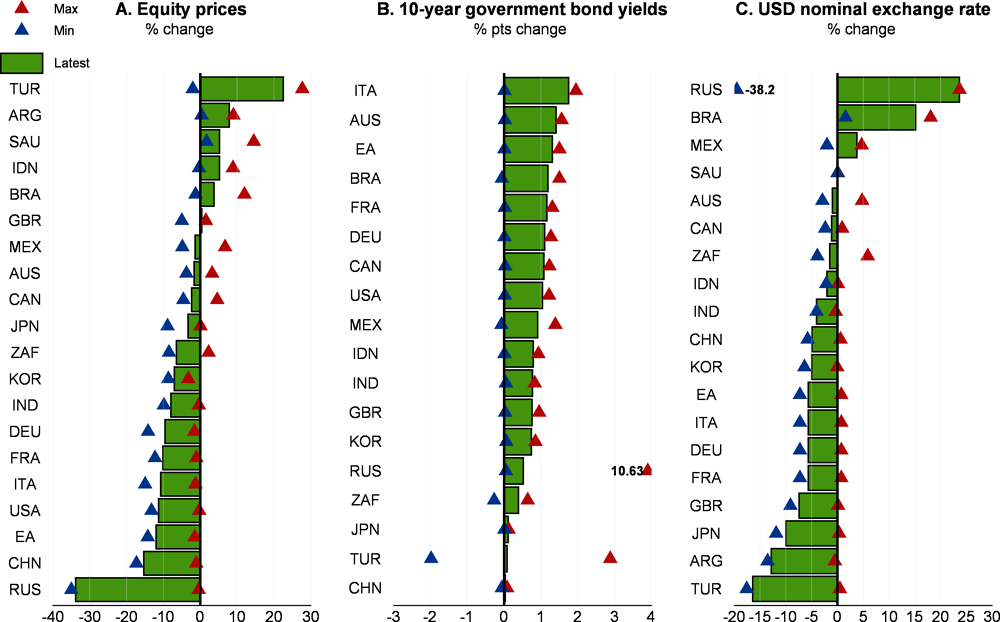

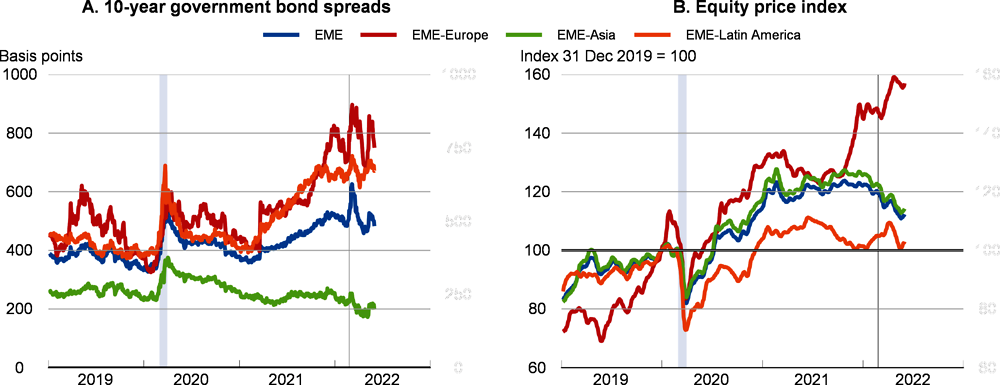

Faster and more extensive policy interest rate rises in advanced and emerging-market economies and the war in Ukraine have led to a substantial tightening of global financial conditions. In particular, volatility has increased significantly in equity, bond and foreign exchange markets (Figure 1.12), equity prices have declined, government bond yields have risen and most currencies have depreciated against the US dollar.

Weaker growth prospects and higher bond yields have weighed on equity markets in most advanced countries, including the United States. Strong exposure to the conflict region has added to downward repricing in the euro area and most Eastern European economies (Figure 1.13, Panel A). Equity prices have risen in a few commodity-exporting economies, as well as in Türkiye, but recent COVID-19 outbreaks and continuing vulnerabilities of highly leveraged real estate companies have hit equity markets in China.

Government bond yields have increased in most countries since January (Figure 1.13, Panel B). In the United States, the yields on 10-year nominal and inflation-adjusted government bonds have risen by around 1 percentage point over this period. The rise in 10-year nominal yields has been somewhat higher in the euro area, and sovereign bond spreads have widened within the area. Nominal yields have also risen in the major emerging-market economies.6 In contrast, yields have hardly increased in Japan, reflecting lower inflationary pressures, yield curve control and no immediate sign of policy tightening.

Corporate bond spreads (relative to government benchmark bonds) have increased since early 2022 but remain moderate by historical standards in the major advanced economies, reflecting generally healthy corporate balance sheets. However, bank credit default swap spreads have risen markedly, likely reflecting concerns about weakening growth prospects.

The US dollar has appreciated since the onset of the war in Ukraine, partly reflecting the faster anticipated pace of policy interest rate increases in the United States relative to most other advanced economies, especially Japan (Figure 1.13, Panel C). With a few exceptions due to idiosyncratic factors, such as Argentina, the currencies of most major commodity-producing emerging-market economies have either appreciated or depreciated only slightly against the US dollar since January.

Trade momentum is easing and supply chain pressures remain acute

Global merchandise trade, container port traffic and air freight traffic indicators were all expanding in early 2022 (Figure 1.14, Panel A), prior to the war. International travel was also gradually recovering, other than in the Asia Pacific region where widespread border closures and restrictions remained. War-related disruptions curbed this trend in March, with a particularly sharp downturn for air freight. Global new export orders have also weakened, with declines in China, the euro area and Japan (Figure 1.14, Panel B).

Bottlenecks in international freight remain high, and are being accentuated by the Ukraine war and the shutdowns in China. Supplier delivery times rose in many countries in March and April but eased slightly in May. Indicators of freight waiting times and shortages of intermediate goods have also increased (Figures 1.15 and 1.16). The easing of pandemic lockdowns and sanitary restrictions, combined with the normalisation of demand in many regions, is helping to reduce demand-supply mismatch in maritime transport, with shipping costs down from their peaks in late-2021. However, the war has resulted in the diversion of freight from routes that have become non-viable towards others which are already over-stretched and very expensive. With parts of the Black Sea and Sea of Azov unpassable, maritime companies have closed lanes and suspended shipping services. Rail and airspace over Ukraine and Russia have also been shut off, limiting capacity. Commercial air travel and freight traffic by air and sea are being rerouted to avoid Russian air space and ports, becoming more expensive (due to higher insurance rates and longer routes) or ceasing altogether. Container loads in major Russian ports have also declined by 50% compared to a year ago and have stopped in the Ukrainian port of Odessa since early March. The war also risks exacerbating crew shortages, as nearly 15% of international freight crews in 2021 were Russian or Ukrainian.

Additional disruptions have arisen as a result of the impact of the strict zero-COVID strategy in China. Though air and ocean ports are being kept operational (with workers often remaining on site), lockdowns in Shanghai and other big cities have created labour shortages that affect truck companies, reduce ground handling capacities, and ultimately slow operations in ports. Air traffic has also declined sharply.

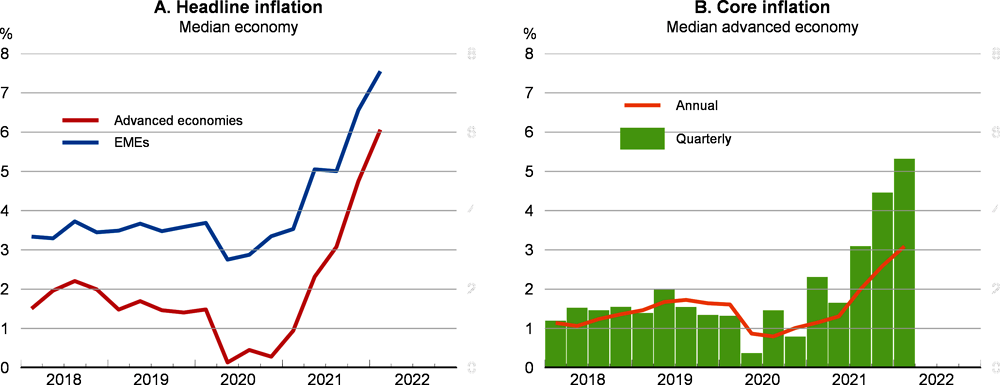

Inflation pressures have broadened further

Inflation has been increasing worldwide for more than a year (Figure 1.17, Panel A), with the headline measure of inflation currently above central bank objectives in most economies, particularly outside Asia. Apart from special cases of very high inflation, such as Türkiye and Argentina, headline inflation has increased particularly rapidly in Central and Eastern Europe, Latin America, the United States and the United Kingdom.

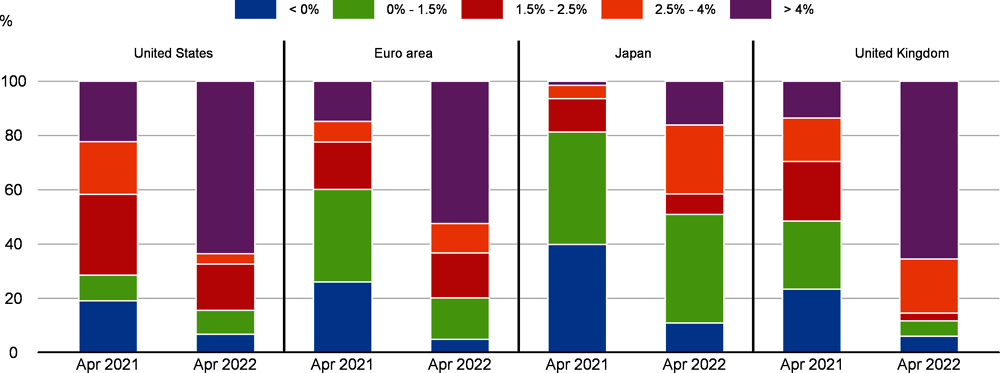

Large increases in food and energy prices since mid-2020 have pushed up headline inflation in all economies, even though the increases have not been uniform.7 More recently, the increase in inflation has gone well beyond energy and food in most countries. Core inflation (excluding food and energy) has increased in almost all advanced economies (Figure 1.17, Panel B), even where the recovery from the pandemic is not complete. As with headline inflation, core inflation has increased particularly sharply in Central and Eastern Europe. The distribution of price changes has also shifted considerably. In the United States, the euro area and the United Kingdom, the prices of at least half the items in the inflation basket rose at annual rates above 4% over the year to April (Figure 1.18).

Differences in the severity of the pandemic, the structure of economic activity, the extent of labour shortages and policy responses to the pandemic all help to account for cross-country differences in inflation. Particularly strong fiscal measures in response to the pandemic in the United States helped produce a strong cyclical recovery by pushing household incomes well above their pre-pandemic level. With expenditure on some services constrained by the pandemic and the associated restrictions, more of the rebound in consumption was directed to goods, where supply-chain constraints have been strongest, and was reflected in rapidly rising goods prices (OECD, 2021a; Boone, 2022; Jordà et al., 2022). In contrast, policies in many European economies focused on job preservation, with disposable incomes largely kept at their pre-pandemic level. This led to a slower recovery in consumption with smaller differences between goods and services spending. In Japan, large reductions in mobile phone price plans have helped to keep inflation low.

The patterns of price increases over the past two years suggest that pandemic-related effects account for a sizeable share of the recent increase in headline inflation (Figure 1.19). Prices declined in some of the service sectors most impacted by public health containment measures in the first phase of the pandemic, followed by large price increases as economies reopened. Similarly, the deep recessions in the spring of 2020 triggered sharp falls in the prices of oil and gas, which led many producers to shut down production and curb exploration. The rapid rebound in economic activity thus quickly met supply constraints in energy, contributing to the sharp increases in energy prices since that time.8 A variety of supply constraints associated with the pandemic also meant that goods production could not keep pace with the rebound in demand for goods. As a result, inflation for goods excluding food and energy was generally weak in the first half of 2020 but unusually strong over the past 18 months. In contrast to energy, goods and COVID-affected services, categories of services like financial services or communications, less obviously directly affected by the pandemic, have experienced relatively stable rates of inflation, but with some upward drift, especially in North America (Figure 1.19).

There have been several significant changes in the global economic environment in recent months, including the worldwide spread of the Omicron variant of the SARS-COV2 virus and the greater-than-expected persistence of inflationary pressures, entailing a faster adjustment of monetary policy in a number of major economies than previously expected. The single greatest change, however, is the economic impact of the war in Ukraine.

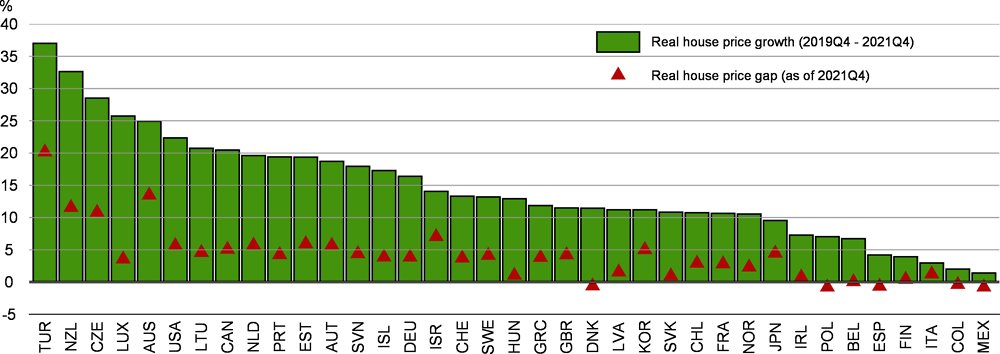

The Ukraine conflict is a significant negative shock to the global economy, although the impact on growth this year and next is partially mitigated by some of the factors already expected to support the recovery. In particular, the impact of the pandemic on economic activity is still assumed to wane through 2022, and household saving ratios, which in many countries surged in the first phase of the pandemic, are assumed to continue to decline, helping to offset much of the drag on real disposable incomes from elevated inflation (Figure 1.20). On the other hand, global financial conditions have tightened and fiscal consolidation is continuing in most OECD economies during 2022-23, though at a somewhat slower pace than previously expected, especially in Europe this year. Higher spending to offset the impact of higher energy prices on households and firms and to provide humanitarian assistance to refugees are among the reasons for this.

The war in Ukraine has quashed hopes that the inflationary surge experienced in much of the global economy in 2021 and early 2022 would subside quickly. The additional impetus to food and energy prices, and the aggravation of supply-chain issues, imply that consumer price inflation will peak later and at higher levels than previously foreseen. As this additional negative supply shock was not anticipated, household incomes are rising more slowly than prices, worsening the deterioration in real household disposable incomes that was already underway in many OECD economies. The forthcoming EU embargoes on coal and seaborne oil imports from Russia are likely to push up global energy prices further over the next year, keeping headline inflation higher for longer.

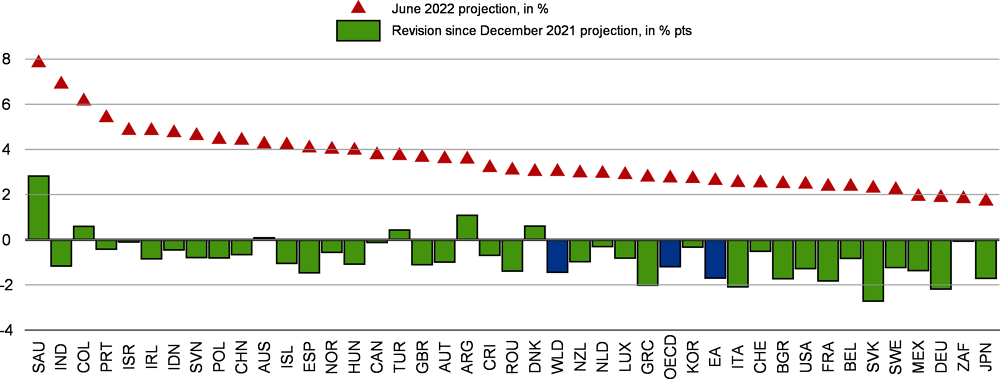

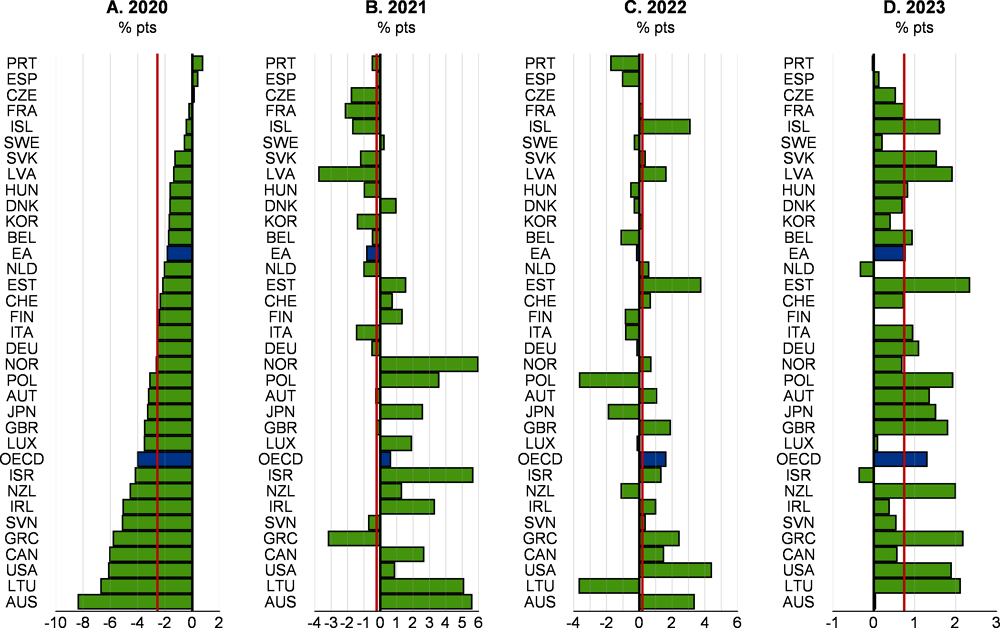

Consumer price inflation in the G20 economies is now projected to peak at 7.6% in 2022, before slowing to around 6¼ per cent in 2023 (Table 1.1). Inflation is still projected to moderate next year in most countries, provided that the peak in global energy prices is passed, as assumed, in early 2023 (Annex 1.A.) and supply-chain constraints wane gradually. Moderating demand growth will also help to ease inflation pressures. Even so, headline and core inflation are projected to remain higher in 2023 than previously foreseen, and in many cases above central bank policy objectives (Figure 1.21). With inflation now seen as staying higher for longer in most OECD economies, many central banks are now expected to raise interest rates more quickly than previously assumed. On average across the OECD, policy interest rates are projected to be around 2½ percentage points higher in 2023 than in 2021; the impact of this on the growth outlook is expected to take effect gradually through the projection period.

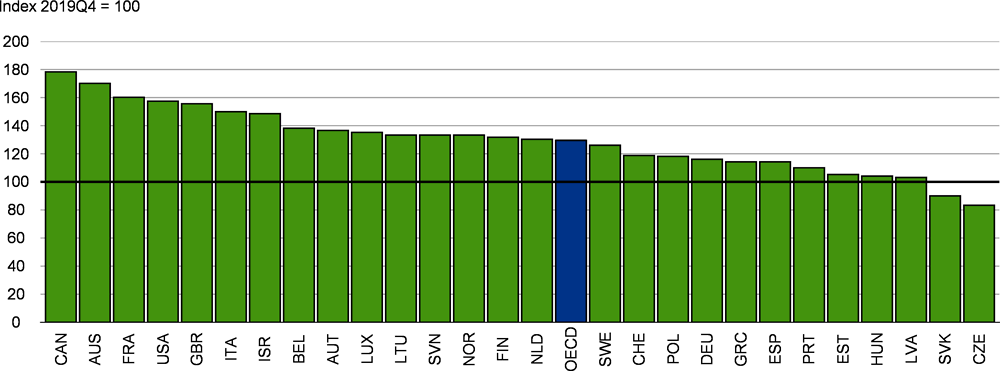

Global GDP growth is now projected to slow to 3% in 2022 and between 2¾-3 per cent in 2023, with output rising by only around 2% over the year to the fourth quarter of 2022. In the OECD economies, growth is now projected to moderate to 2.7% in 2022 and 1.6% in 2023, with the level of output in 2023 around 2% weaker than previously projected. Almost all countries are now expected to grow more slowly in 2022-23 than was foreseen before the war (Figure 1.22). Business investment and private consumption growth have both been revised down. OECD-wide private consumption is however still projected to rise on average by between 2¼-2½ per cent over 2022-23, with lower saving ratios and solid, albeit slowing, employment growth offsetting the drag from real wage declines in many countries. In many countries, GDP growth over the two years is still projected to be fast enough to allow the output gap to narrow, although in some economies, including the United States and the United Kingdom, growth is projected to drop below potential rates in 2023.

European economies, particularly those bordering Russia or Ukraine, are expected to be the hardest hit by recent developments. This reflects larger gas price rises in Europe than elsewhere and stronger pre-war business and energy linkages with Russia. In 2023, the oil embargo is likely to further weaken growth and prolong upward pressures on inflation in Europe, with adverse effects also being felt elsewhere. Advanced economies in the Asia-Pacific region and the Americas have weaker trade and investment links with Russia, and some are commodity producers who benefit from higher commodity prices. Even so, growth in these cases is still hit by weaker global demand and the impact of higher energy prices on household incomes and spending. Growth outcomes in the emerging-market economies reflect a balance between positive effects for some commodity-producing economies, particularly the major oil-producing economies other than Russia, and negative ones in the major commodity-importing economies.

Prospects in the major economies are as follows (Table 1.1):

In the United States, GDP growth is anticipated to weaken from 5.7% in 2021 to 2.5% in 2022 and 1.2% in 2023. Supply shortages, exacerbated by the war in Ukraine and COVID-related lockdowns in China, higher oil prices and a faster pace of monetary policy normalisation will hold back growth to a greater extent than previously foreseen. The expiry of pandemic-related fiscal measures will result in a marked fiscal consolidation this year, exerting a drag on growth, though this is expected to be partially mitigated by the lagged effects of past government spending. Growth will also be supported by continued employment gains this year and rising real wages in 2023. Labour markets remain tight, although unemployment is projected to bottom out in late 2022 and begin to edge up during 2023. Annual inflation (as measured by the personal consumption expenditures price index) is projected to decline from a peak of 6.3% in the second quarter of 2022 to 2.8% by the last quarter of 2023 – both the headline and core measures of inflation would remain above the Federal Reserve’s 2% target at end-2023.

Near-term growth in Japan has been dented by the Omicron wave, with public health restrictions applied to much of the country in early 2022, as well as by weak external demand and the increase in the prices of key commodity imports. Helped by a bounce-back in private consumption following the lifting of confinement measures, GDP growth is projected to pick up through 2022 to be 1.7% for the year as a whole, and 1.8% in 2023. Higher commodity prices will push headline inflation up to nearly 2½ per cent by late 2022, tempered by government subsidies to mute surging fuel prices, but core inflation is projected to remain low, partly reflecting weak wage growth.

In the euro area, the war in Ukraine and the lockdowns in China add to supply-side bottlenecks giving additional impetus to inflationary pressures and further denting real household incomes and business sentiment. The slowdown in growth, while sharp, is being cushioned by tight labour market conditions, the implementation of the Next Generation EU recovery plan and fiscal support for households and firms affected by higher energy costs. GDP growth is projected to slow from 5.3% in 2021 to 2.6% in 2022 and 1.6% in 2023. Headline inflation is projected to reach 7% in 2022 before falling to 4.6% in 2023 – annual inflation at the end of 2023, at 3.9% for the headline measure and 3.7% excluding food and energy, would still be well above the central bank’s objective.

After a fast recovery from the first wave of COVID-19, China’s economy has cooled, partly reflecting the stringent measures that remain in place to eradicate the spread of the virus as well as weak real estate investment due to tighter regulations and the failure of some major developers. However, additional monetary policy easing and fiscal support worth up to 2% of GDP this year should help to stabilise demand: GDP growth is projected to slip to 4.4% in 2022 before rebounding to 4.9% in 2023. China is potentially exposed to significant upward price pressures coming from energy and food, but large reserves are likely to contain these pressures. Headline inflation is projected to be 2% in 2022 and 3% in 2023.

India recorded the strongest rebound from the COVID-related downturn of any G20 economy, but momentum is dissipating owing to weaker external conditions, rising global food and energy prices and the tightening of monetary policy. As an importer of energy, fertilisers and edible oils, India is adversely affected by the war in Ukraine. GDP growth, which reached 8.7% in FY 2021, is projected to slow to 6.9% in FY 2022 and 6.2% in FY 2023, with weaker external demand growth and tighter monetary conditions being mitigated by strong government spending and an ambitious set of measures to simplify the business environment. Headline inflation is projected to ease gradually, though remaining above the central bank’s upper tolerance limit of 6% throughout 2022 and 2023.

A range of factors, including rising inflation, the war in Ukraine, unfavourable weather conditions, political uncertainty and the spread of the Omicron variant in early 2022 have eroded sentiment and dented growth in Brazil. Commodity exports are likely to strengthen, but higher inflation is expected to hit households’ purchasing power and hinder consumption growth, as well as triggering additional monetary policy tightening. GDP growth is projected to slow sharply to 0.6% in 2022 before picking up to 1.2% in 2023. Inflation is seen as remaining high in 2022, averaging 9.7%, before declining to 5.3% in 2023 as the impact of monetary policy tightening and currency appreciation is felt.

The normalisation of labour markets is projected to continue during 2022-23, despite the new negative shock of the war in Ukraine. As the public health situation improves further, based on rising vaccination rates and improved COVID-19 treatments, labour force participation is projected to increase in almost all economies. Stronger international migration flows and the gradual entry of Ukrainian refugees into host country labour markets should also help to ease some labour shortages. OECD-wide employment growth is projected to slow from around 2¾ per cent this year to under 1% in 2023, with unemployment rates starting to rise slightly in some countries. In most OECD economies, real wage growth over 2022-23 as a whole is projected to be negative, and for the OECD as a whole the pace of wage increases in nominal terms is projected to decline from around 4¾ per cent in 2022 to close to 4% in 2023.

The conjunction of soaring energy prices and growing worries about a sharp slowdown in growth has spurred talk of the global economy experiencing a new period of stagflation, a term redolent of the oil shocks of the 1970s. While there are indeed increasing similarities between the current situation and the mid-1970s after the first major oil price shock late in 1973, there are also differences that could mean that growth is more resilient now than on that occasion, and that inflationary pressures wane more quickly and durably (Box 1.3; Igan et al., 2022). Nonetheless, as discussed in the next section, there are clear risks that growth could slow more sharply than expected and inflationary pressures could intensify further.

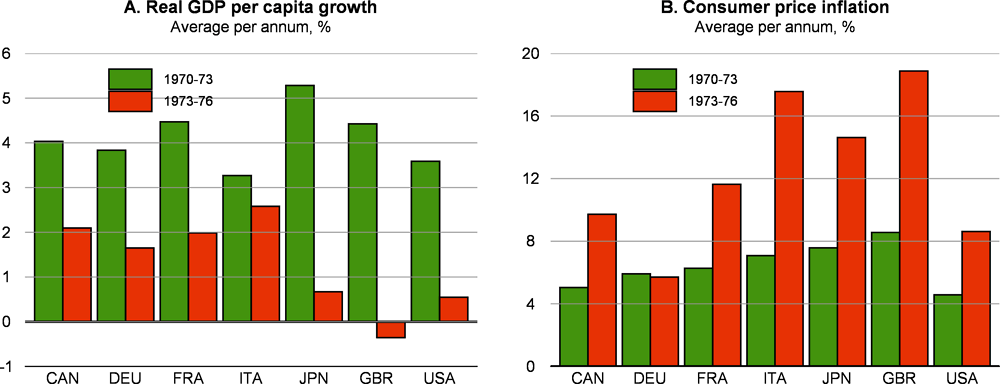

The combination of rapidly rising prices and slowing economic growth has given rise to fears that the global economy may be entering a period of stagflation. There is no single definition of stagflation but it is generally understood to denote a combination of slow or zero growth and high inflation. The turbulence experienced after the global oil price shock in late 1973 – with oil prices tripling over the year to the first quarter of 1974 – is widely seen as a period of stagflation, with inflation and unemployment rates rising steadily in the aftermath of the oil price increase, and real income growth slowing sharply (Figure 1.23). In late 1974 and early 1975, GDP per capita declined in all G7 economies and labour market conditions deteriorated: the average unemployment rate in the G7 economies over 1974-76 was 1 percentage point higher than over 1971-73, and 1.8 percentage points higher in the United States.

There were some other features of this episode also seen in the current economic situation. World food prices rose sharply, with the FAO food price index doubling between 1972 and 1974, and labour markets were generally tight ahead of the increase in oil and food prices, with strong wage growth. OECD potential output estimates suggest that the major advanced economies generally had large positive output gaps when the oil price shock hit in 1973, after a period of rapid growth. Cost-push inflation took root following the energy price shock, with successive wage rounds trying to restore real incomes, and inflation expectations rose over time. Ex-post real interest rates also turned negative, with monetary policy placing too much emphasis on maintaining low unemployment and too little on addressing rising inflation expectations (Meltzer, 2005; Powell, 2018).

Although the current situation shares some similarities with that in the early 1970s, economic policy frameworks are very different, and structural changes have reduced the impact of commodity price shocks on economic activity and wage growth. Thus, a negative supply shock induced by oil prices should have less of a stagflationary impact than in the mid-1970s:

The advanced economies have become far less energy-intensive after the big oil-price shocks of the 1970s and early 1980s, potentially reducing the impact of an oil shock by half in the United States (Blinder and Rudd, 2008). The share of industrial output in total economic activity has also declined. To some extent this is offset by the increasing importance of less energy-efficient emerging-market economies in global economic activity, but global oil and energy intensity has also declined (Rühl and Erker, 2021).

Central banks’ monetary policy frameworks have evolved and become more robust, with a stronger focus and understanding of the importance of maintaining well-anchored inflation expectations than was the case in the 1970s. Most central banks are now independent, and they have an explicit focus on price stability and an inflation target, even in countries in which they formally retain a dual mandate.

The advanced economies are more flexible, and hence better able to handle oil shocks, than they were in the 1970s. Changes in labour market institutions since the 1970s have reduced the risk that an oil price shock (or other negative supply shock) results in a wage-price spiral. The coverage of collective bargaining agreements has declined, many automatic wage indexation mechanisms have been removed, and lower union membership has reduced employees’ bargaining power (OECD, 2021a).

There are particular circumstances at the current juncture that may buffer some of the potential adverse effects of higher energy prices. For instance, many consumers have excess savings accumulated during the pandemic that can be used to offset income shortfalls, some spare capacity still exists on OECD estimates in many countries, and supply shortage pressures should moderate as borders reopen and more people join the labour force.

The Ukraine war is primarily a negative global supply shock, reducing output and raising prices relative to what might otherwise have been expected. In this sense, it is qualitatively similar to the effects of the oil shocks in the 1970s and shares some characteristics with periods of stagflation. However, the current baseline projections are for continued, but mild growth in most economies, with inflationary pressures that are projected to moderate slowly over the coming year and a half. Downside risks remain of more severe effects that would further harm growth prospects and add to inflation, such as an abrupt shut-off of gas imports from Russia to Europe. Nonetheless, sustained high inflation for several years could still be avoided provided monetary policy acts to maintain well anchored long-term inflation expectations close to central bank objectives.

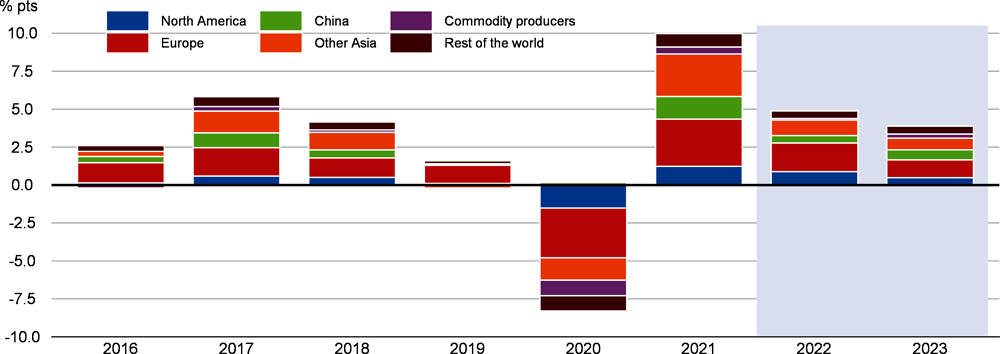

Global trade prospects have weakened. The surge in trade at the end of 2021 has strong positive carryover effects for annual growth this year, but on a quarterly basis trade growth is projected to be weaker than previously thought over 2022. World trade growth is projected to moderate from 10% in 2021 to about 5% in 2022 and 4% in 2023 (Figure 1.24). Key factors slowing trade growth in 2022 include prolonged regional lockdowns in China, weaker demand in Europe due to the Russia-Ukraine war and the transition of US consumer demand from goods to services. The recent rise in prices and tensions across commodity markets are projected to lower the trade growth of commodity exporters this year, with Russian trade expected to contract by over one-quarter in 2022 and 9% in 2023. In Europe, the slowdown in import growth is particularly pronounced in the Baltic and the East European economies, where supply-chain linkages with Russia and Ukraine are constraining key economic sectors.

The adverse effects from the war could be much larger

A key potential risk to the projections is that all energy exports from Russia to Europe could cease completely. The impact of such a shock is difficult to quantify, but could be severe if it were to occur through a sudden stop in imports from Russia at a time when stock levels had yet to be rebuilt and there were limited possibilities to switch quickly to alternative sources of supply. The forthcoming EU embargos on imports of coal and seaborne oil from Russia also raise challenges, and could be more disruptive than projected if there are prolonged supply shortages.

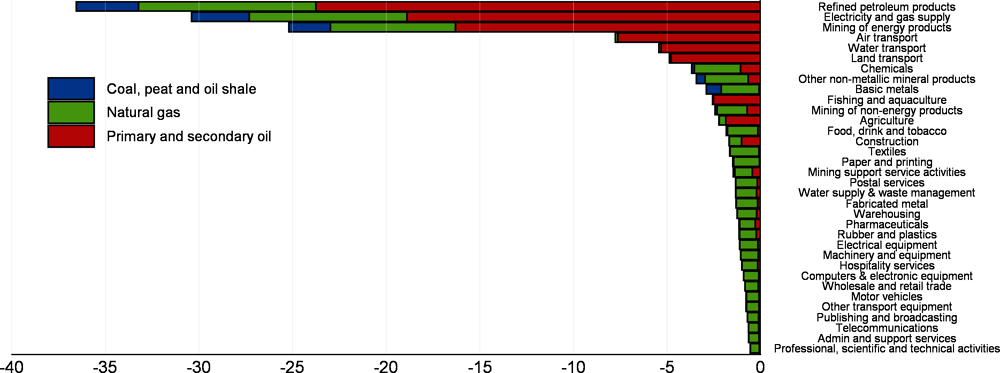

Oil and gas represent sizeable shares of EU total energy use.9 A Europe-wide embargo, or a sudden stop to exports by Russia, thus brings a sizeable risk of energy supply disruption as well as rising prices.10 There are large differences across member states, both in terms of the energy mix and the share of energy inputs that originate in Russia. An end to imports of Russian energy is likely to affect sectors in different ways according to their dependency on energy imports from Russia and scope to obtain alternative energy supplies or reduce demand. As energy is a critical input across several industries, the short-run impact on output could be amplified by cascading effects propagating along international and domestic input-output linkages. At the same time, sharp rises in energy prices might also have hefty repercussions on household incomes and demand.

Illustrative assessments of the direct effects on output in manufacturing and market services sectors that might result from an embargo of all of energy products from Russia can be made by combining input-output tables with information on energy use in 2019 from the International Energy Agency (IEA).11 The IEA data provide economy-wide dependency ratios on Russian imports for each of the three different fossil fuels (coal, gas and petroleum products). These can be used to calculate the dependence on Russian energy imports in each sector by using the consumption shares of each respective fuel product in different sectors and assuming that the share of each fuel product imported from Russia is the same across all sectors. The impact on gross output from an energy embargo on Russia is then derived by applying input-output multipliers of energy-related industries.12 After taking into account all direct and indirect linkages, the input-output multipliers quantify the change in each sector’s output that results from the complete cut in Russian energy inputs in trade partners’ industries and domestic sectors.

This approach, based on the pattern of energy use seen prior to the pandemic, suggests that a sudden stop in all imports of fossil fuels from Russia would affect all sectors of the economy, particularly energy-producing sectors, transport, minerals and metals manufacturing (Figure 1.25). Aggregating across sectors, the estimates imply a reduction in European output in manufacturing and market service sectors of between 2¾-3 per cent, if not offset by drawing down stocks or by substituting other energy inputs. Around one-half of this output decline would be due to shortfalls of petroleum and petroleum products, with the majority of the remainder from shortfalls of natural gas. These estimates highlight the risks of possible supply disruptions following an oil embargo, and the additional potential risks of a gas embargo.

These illustrative input-output estimates are highly uncertain, particularly given ongoing efforts to diversify sources of energy supply in Europe. The output effects could easily be understated, as supply disruptions could force companies to shut down production completely rather than reduce it proportionally. The near-term impact of a simultaneous sharp contraction in production across many sectors and countries is also likely to be larger than if only one country is affected. On the other hand, the input-output structure used cannot account for possible substitution effects with foregone Russian imports replaced by imports from elsewhere, or by drawing down reserves, using additional domestic supplies from alternative energy sources, such as nuclear energy or renewables, or improved energy efficiency. Such adjustments would mitigate the output costs.

A few similar studies report comparable output costs for Germany of between 0.3 and 2.2% (depending on the scenario considered) and slightly lower costs for France (Baqaee et al., 2022; Bachmann et al., 2022). Earlier estimates using input-output linkages also pointed to relatively small output costs in Europe if imports of natural gas from Russia were ended (Bouwmeester and Oosterhaven, 2017). In contrast, estimates by Holtemöller et al. (2022) and Deutsche Bundesbank (2022) for Germany highlight the risk of a large and immediate drop in output in the event of a sudden stop in energy imports from Russia.13

The extent to which the loss of imported fossil fuels from Russia can be offset will depend in part on the timing and circumstances of such a change.

Strong drives to reduce Europe’s dependency on Russia over the course of this year have already begun. In early March, the IEA set out a plan to reduce use of gas from Russia by at least one-third in 2022. Shortly thereafter, the European Commission released its RePower EU plan, raising the ambition to a two-thirds cut within a year. Plans include improved storage levels ahead of the winter season, joint purchases from alternative suppliers, greater use of renewables and other existing domestic energy sources, and improved energy-saving measures (such as lower residential heating temperatures).

There has already been a substantial shift in the composition of European gas imports this year. In the first 21 weeks of 2022, EU imports of Russian gas via pipeline were down by more than 30% compared to the corresponding period in 2021, and more than offset by a 54% increase in liquefied natural gas (LNG) imports from other sources. As a result, the share of Russian gas in total gas imports fell from 35% on average in the first 21 weeks of 2020 and 2021 to 24% in the same period of 2022 (Figure 1.26).

The IEA has also produced a 10-point plan to reduce oil use. In addition to finding alternative suppliers, a key need is to change behaviour and reduce demand. Actions to lower the amount of oil consumed by cars are particularly important. These changes will take time to put into full effect, raising potential risks to the projections of a sudden stop in oil supplies in the absence of adequate storage levels.

More generally, global energy markets are tight, although there is scope to obtain additional oil output from some OPEC and non-OPEC producers and further coordinated inventory releases by IEA members. Increased LNG deliveries can also help to mitigate any potential supply disruptions of pipeline gas to European markets, although additional investment in this sector will be necessary (G7, 2022). Significant logistical challenges also need to be overcome, including the transportation by sea of fuels from more distant non-European suppliers, the specialised platforms needed to store LNG offshore, and the infrastructure required to ensure that additional supplies can be moved within Europe to inland markets previously supplied by gas pipelines from Russia. Refineries currently designed to process oil from Russia also need to be reconfigured, unless a close substitute can be found. The difficulties that Russia would face in diverting all of its energy exports to Europe to non-European markets, particularly gas, would also be likely to hit global energy supply, at least in the short term. Strong additional competition from Europe for scarce energy supplies would therefore be likely to drive up prices in global markets.

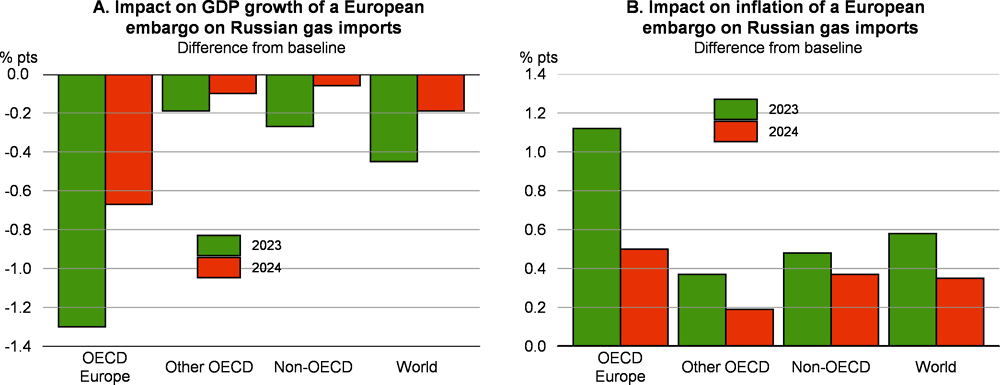

Illustrative simulations, using the NiGEM global macroeconomic model, highlight the risk of potential adverse effects from an end to Russian gas imports in the European economies. A full gas embargo is modelled as a negative supply shock, with potential output in the average European economy lowered by close to 1½ per cent via a combination of reduced technical efficiency and a fall in average hours worked. The embargo is also assumed to push up global gas prices by 50%, reflecting the need for the European economies to source additional supplies on world markets and reduced supply from Russia.14 Higher gas prices are expected to also push up fertiliser prices, which are assumed to rise by 25%, and increased demand for energy supplies is expected to spill over into oil markets, with oil prices assumed to rise by 10%. Given the uncertainty that is likely to accompany energy supply disruptions, additional effects are likely to arise in the European economies from a decline in confidence and higher financing costs for companies. These effects are modelled by an ex-ante increase of 1 percentage point in the household saving rate and a 1 percentage point rise in the user cost of capital. The commodity price shocks are assumed to last for at least one full calendar year, before fading slowly as markets start to adjust. All other shocks are assumed to persist for three years before fading. Policy interest rates are endogenous and adjust according to the balance of the shocks to growth and consumer price inflation.15

Taken together, these shocks could reduce growth in the European economies by over 1¼ percentage points in 2023, relative to baseline, and raise inflation by over 1 percentage point (Figure 1.27). A growth decline of this magnitude could potentially leave many countries close to, or in, recession in 2023. Growth would also be weakened in 2024 if the shocks persist, with demand gradually being brought into line with the reduction in supply. Real household disposable incomes would be hard hit, declining by more than 2% in the euro area economies, reflecting the drag exerted by higher prices and lower hours worked. Business investment would also be severely affected, with lower potential output, higher gas costs and the higher user cost of capital leading to declines of around 5% or more in many European economies in 2023.

Outside Europe, the impact of the shocks would be smaller, especially in other gas-producing economies, but there would still be impacts from higher inflation on real incomes and weaker demand from Europe. For the world as a whole, inflation is pushed up by over ½ percentage point in 2023, with growth reduced by just under ½ percentage point.

Monetary policy reacts to the upturn in inflation, with policy interest rates initially raised by around 50 basis points in the euro area in the first year of the shock, and 25 basis points in many other advanced economies, before returning towards baseline as inflationary pressures subside.

In addition to energy, the risks of stronger costs from the war in Ukraine also arise from shortages of critical raw materials, and disruptions to transportation and trade finance.

As Russia and Ukraine are important suppliers of many critical raw materials, the risks of disruption are also high for some supply chains relying heavily on these inputs (e.g. automobile, aeronautics or electronics). Substituting towards alternative sources of supply is particularly difficult for some critical raw materials provided by Russia and Ukraine as these inputs are highly specialised and the market is very concentrated (Box 1.4; Grzegorczyk et al., 2022).

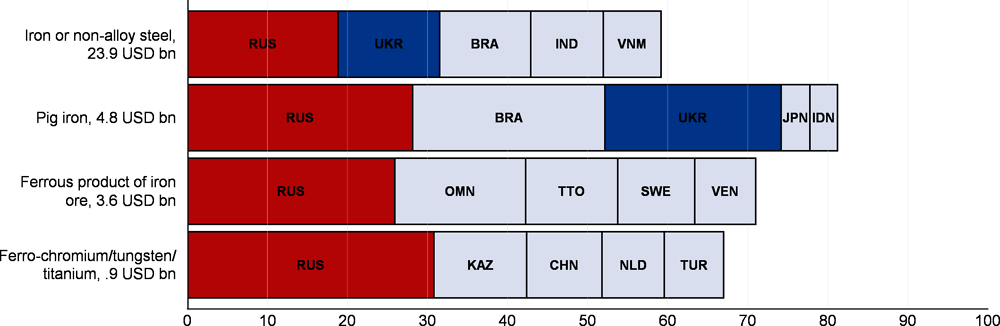

The products most at risk of disruptions in supply from Russia and Ukraine can be identified using granular customs data. For the purposes of this analysis, a traded good is characterised as vulnerable to disruption if Russia or Ukraine is one of the top five world exporters and if their combined market share represents at least 15% of the global export market. Out of more than 4500 products traded in 2020, 92 are identified as vulnerable on this basis. Collectively, they represent 2.7% of the total value of trade in 2020 (Table 1.2). The vulnerable products are concentrated in metals, chemicals, food and agriculture.

This snapshot of potential vulnerabilities suggests that beyond the impact on agriculture (Box 1.1) and energy, there are risks that the war hits trade in raw materials and triggers ripple effects in critical industries. European gross exports of basic metals and fabricated metal products contain almost 10% of value added from raw materials that originate from Russia. This high degree of backward integration to Russian metals makes production throughout Europe sensitive to disruptions.

Palladium and nickel matter for green technologies

Within metals products, Russia accounted for one-quarter of global palladium exports in 2020 (Figure 1.28, Panel A). This material is important for many green energy technologies. Its catalytic properties make palladium a central input for the production of emission-control systems in vehicles, with car manufacturers using it to remove toxic emissions from exhaust fumes. Global exports of nickel are also highly concentrated, and Russia together with Ukraine account for one-third of the world export market. Its uses include production of batteries powering electric vehicles. Ukraine is also a key exporter of neon gas, a by-product of steel manufacturing used in the lithography of semiconductors, which is sold to Korea, the United States, China and Chinese Taipei (Figure 1.28, Panel B). This collection of potential supply chain disruptions could pose significant risks for the vehicle industry, and especially the production of electric vehicles.

Steel value chains are also at risk, with potentially widespread downstream propagation

War-related disruptions could also weigh on iron and steel trade. Many products belonging to the broad iron and steel category are dependent on Russian and Ukrainian exports (Figure 1.29). Russia and Ukraine account for one-quarter of global exports of iron and non-alloy steel semi-finished products, and half of world exports of pig iron. While iron and steel are more easily substitutable than rare metals (such as palladium), their widespread use in multiple downstream industries could trigger cascading consequences in the event of supply disruptions.

Russia is also a major exporter of ferro-alloys, supplying 30% of the global export market for ferro-tungsten, ferro-chromium and ferro-titanium. Stainless steel makers use these ferro-alloys as a stabiliser in the production of low-carbon steels. Chromium and vanadium are also two important inputs in steel production: a small quantity is enough to harden steel and make it very resistant. The stainless steel is then used in construction or automotive industries. Stainless steel is also an input in transportation, including ship containers for the transportation of chemicals, liquids and food products. Many renewable energy technologies also use stainless steel components as they can withstand corrosive environments.

Disruptions to transportation could also have long-lasting and deeper costs, and increase congestion in international shipping. Regional blockages arising from Russia and Ukraine could also have stronger ripple effects on freight traffic than seen so far. European firms relying on manufacturing goods produced and assembled in Asia are particularly under pressure, since this merchandise is usually shipped through Russia. Bypassing Russian airspace or ports increases costs and the time taken for deliveries.

Financial sanctions on Russia could also magnify the trade fall by more than assumed in the projections, as has happened in the past. During the 2008-09 global financial crisis the collapse in exports in many countries was disproportionate to that of output, in part due to disruptions to trade credits. Exporting generally involves higher default risks and working capital requirements than domestic activity (Amiti and Weinstein, 2011), reducing the incentives of lenders to provide credit during crises. In the 2014 sanctions on Russia, the financial disruption to the provision of trade finance is also thought to have reduced trade (Crozet and Hinz, 2016).

Inflationary pressures could be stronger and longer lasting than expected

The prices of energy, metals and food commodities have relatively large weights in producer price indices (PPIs). As a result, across the OECD the PPI has risen much more sharply than consumer prices, although there is considerable cross-country variation (Figure 1.30). This is a common pattern, as the other cost components of consumer prices (especially labour costs) tend to be much less variable than commodity prices. Changes in producer selling prices are then passed through into retail prices, potentially with a lag, with the prices charged to consumers also reflecting distribution costs and retailers’ margins. Empirical estimates suggest that if PPIs were to continue rising in the coming months at a pace similar to that seen over the past year, consumer price inflation would be expected to rise further through 2022 in many economies (Box 1.5). Given the potential of the war in Ukraine to result in further upward pressure on a range of commodity prices, together with the possibility of additional supply chain disruptions arising from both the war and China’s zero-COVID policy, a continuation of inflationary pressure coming via producer prices is a clear risk.

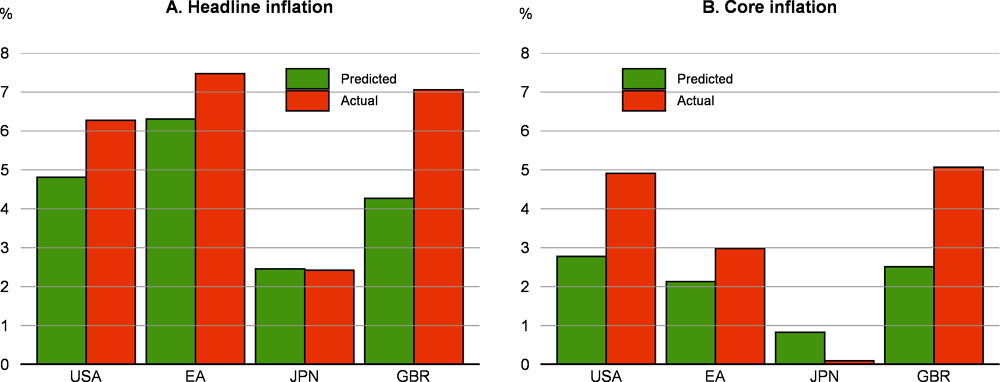

The rapid rise of producer prices, especially for energy, has opened up an unusually large gap between producer price inflation and consumer price inflation (Figure 1.30). A key question is whether this presages continued upward pressure on the latter. The analysis in this box (developed in more detail in Ollivaud, 2022) suggests that changes in producer price indices (PPIs) explain much of the recent annual increase in consumer prices. Different scenarios for how PPIs may evolve in the coming months suggest that if they continue to rise at a similar pace to the past year, headline consumer price inflation in advanced economies would be expected to continue rising through the end of 2022 (except in the United States, where it would remain broadly flat). If, however, the increases in the PPI were to decline and turn negative, as has been the case after past inflation spikes, there would be a quick slowdown in headline inflation.

Empirical estimates, using seasonally-adjusted monthly data, suggest that consumer price inflation has typically reacted relatively quickly to PPI inflation: nearly a third of the deflation/inflation that producers face is passed through in two months to consumers, with most of the change happening in the same month. The relationship between producer and consumer prices is less robust using core rather than headline consumer price inflation, i.e. excluding energy and food products. In the United States, the euro area and the United Kingdom producer prices are found to have a much smaller effect on core inflation than on the headline measure, with Japan a notable exception. This suggests that much of the association between the PPI and consumer prices comes from the impact of fluctuations in food and energy prices – which are typically reflected relatively quickly in both price series.

An assessment of the recent performance of the estimated equations suggests that consumer price inflation over the past year has typically been somewhat stronger than would have been predicted from producer prices alone (using actual PPI data) (Figure 1.31). The gaps between actual and predicted inflation over the past year are relatively small in Japan and the euro area, but larger for the United States and the United Kingdom. This suggests that additional factors have been important in the latter countries. This could be for instance an increase in employment costs or services prices, with broader consumer price pressures than just those reflected in producer prices.

The estimated equations can also be used to illustrate the possible outcomes for consumer price inflation depending on two different scenarios for near-term PPI developments. First, in a continued-high-inflation scenario, the average month-on-month increase in the PPI is assumed to be equal to the average seen over the past 12 months. This corresponds to an annualised month-on-month increase of 18.5%, 17.4%, 8.2% and 11.7% for the United States, the euro area, Japan and the United Kingdom, respectively. In an alternative scenario, it is assumed that PPI increases will slow and then turn quickly negative, as has been the case when prices have spiked in the past.

If producer prices continue to rise rapidly, as they have over the past year, the analysis suggests that in most cases headline consumer price inflation would continue its upward trend – towards 11½ per cent for the United Kingdom, 10¼ per cent for the euro area and 3½ per cent for Japan – though not in the United States, where it would hover around 6% (Figure 1.32, Panel A).

The alternative scenario where PPI inflation slows and then turns is characterised by a declining consumer price inflation rate (Figure 1.32, Panel B). Nonetheless, inflation would still remain above central bank target rates by the end of 2022, except in Japan.