3. Regions managing industrial transitions and disruptive innovation

This chapter takes a brief look back across the first three waves of industrial transitions to draw lessons on how regions and cities can ride the current fourth wave. It discusses key elements of the regional innovation system that support a successful transition, as well as different development paths including specialisation and diversification of economic activity. The chapter concludes with a more general discussion of disruptive innovations and how regions and cities can prepare to benefit from their impact.

Transitions of the industrial structure in regional and urban economies happen gradually and often imperceptibly, formed by combinations of several innovations. Some of these transitions are “industrial revolutions” that radically alter the way economies function and interact. Many regions and cities contribute to innovations that support “industrial transitions”. No single place drives an industrial transition but all regions and cities have to adapt to them. This does not mean that paths are predetermined but rather requires active and anticipatory changes within regions and cities that ensure that all actors within the region are well placed to seize opportunities that industrial transitions and disruptive innovations can bring.

A combination of innovations can act as a catalyst for industrial transitions where methods of production and consumption change radically. Some regions may find new opportunities for growth but others may find it hard to change their economic model, especially when their industrial structure is too heavily concentrated in economic activities that become obsolete. Regions struggling to manage industrial transitions may require support to diversify their economies and find new paths of growth. Instead of supporting the transition process, policies often aim to retain existing structures, e.g. by subsidising traditional sectors. Replacing policies that aim to retain activity with narrow innovation policies is equally misplaced. Transitioning a regional or urban economy requires a concerted effort of both supply- and demand-side instruments that support the transition of the current workforce and looks forward towards preparing the next generation of workers.

Some authors argue that during the third industrial revolution, European policymakers favoured protecting the stock of existing jobs instead of encouraging innovation and industrial transition. When compared with Europe, the United States took the lead in the third industrial revolution, with the most successful players being US firms (Bloom, Sadun and Reenen, 2012[1]). Decompositions of productivity growth in the United States show that a large fraction of this advantage occurred in sectors that produce information technologies (IT) or use them intensively, while in Europe the disadvantage comes mostly from the lack of IT usage in non-IT sectors (van Ark, O’Mahony and Timmer, 2008[2]). The growing gap arose despite comparably high levels of human capital, talent and research infrastructures in Europe and the United Starts. Part of the explanation can be that Europe focused more on incumbency, helping regions avoiding downward spirals from deindustrialisation (which happened massively in the United States rustbelt). However, by prioritising incumbency, radical innovators can be penalised. As argued in Phelps (2003[3]) and Gordon (2004[4]) European institutions were more prone to protect incumbency and inhibit new entry partly explaining why Europe lagged behind the United States during the third industrial transition.

Industrial revolutions often lead to a displacement of workers or the reduction of the importance of certain infrastructures. Artisans who produced goods from start to finish became workers specialising in tasks along an assembly line, who then were replaced by robots that took over routine tasks whilst workers monitor and maintain the system. Similarly, waterways gave way to railroads, which in turn were superseded by motorways. These changes disrupt the lives of people and whole regions but they also produce huge gains as more can be produced with fewer resources and more places gain access to the knowledge and capacities that leading places within and across countries have.

Disrupting the way economies function might be more important now than it has ever been before. Disruptive innovations might be the only way to tackle “grand” societal challenges OECD countries are facing. Without significant changes to transport, energy production and a move towards less wasteful consumption, climate mitigation efforts and the transition towards carbon-neutral economies will fail. In many areas, innovations are becoming increasingly disruptive, completely moving markets away from existing practices introducing new paradigms and opening up avenues for further developments.

Whether through the effect of a combination of different innovations or individual disruptive innovations, new opportunities come along with the displacement of existing industries, workers and respective institutions. Innovation can have very different regional impacts. It can disrupt incumbent industries in all types of regions but the most developed regions in the innovation frontier are more likely to create (and benefit the most from) disruptive technologies, finding new sources of jobs and growth paths. If regions behind the frontier cannot benefit from new opportunities related to industrial transitions and disruptive technologies, they can face prolonged unemployment due to automation.

This chapter first considers the impact of industrial revolutions on regions and identifies levers that regions can and have used to manage transitions of their economies. It then outlines the notion of “disruptive technologies” and describes strategies that regions can use to prepare for and manage their potential challenges.

This chapter and the full report draw from a series of expert workshops on “What works in innovation policy? New insights for regions and cities” organised by the OECD and the European Commission (EC). For each workshop, experts provided background papers that, together with the discussion during the workshop, form the basis for this report:

Fostering innovation in less-developed regions, with papers by Slavo Radošević (2018[5]) and Lena Tsipouri (2018[6]).

Building, embedding and reshaping global value chains (GVCs), with papers by Riccardo Crescenzi and Oliver Harman (2018[7]) and Sandrine Labory and Patrizio Bianchi (2018[8]).

Developing strategies for industrial transition, with papers by David Audretsch (2018[9]) and Charles Wessner and Thomas Howell (2018[10]).

Managing disruptive technologies, with papers by Pantelis Koutroumpis and François Lafond (2018[11]) and Jennifer Clark (2018[12]).

Experimental governance with papers, by Kevin Morgan (2018[13]) and David Wolfe (2018[14]).

Innovation and innovation policy are central to ensure that regions transition from their current strengths towards new opportunities. The lessons from past industrial revolutions show that transitions are no mean feat. Even today, many European and OECD regions appear to be stuck in a “middle-income trap” (EC, 2017[15]; OECD, 2018[16]). These regions were once drivers of growth in their countries but lost momentum through the changing nature of manufacturing, the shift in mining production out of more affluent OECD regions and the rise of new (tradeable) service sectors.

Managing industrial transitions requires identifying and exploring areas of economic potential to generate new sources of regional growth. The identification of domains of competitive advantage should not be limited to the public sector. It requires engaging with the private sector, academia, as well as relevant actors from civil society. This “quadruple helix” approach is not new: the triple helix of government, private sector and academia was formalised in the early 1990s (Etzkowitz and Leydesdorff, 1995[17]) and even the addition of civil society as a fourth helix has been discussed for over 15 years (Liljemark, 2004[18]). There is, however, no consensus on how the approach can be operationalised in different regional contexts (e.g. for regions where governmental capacity is low), across levels of government or how continuous learning and improvement can be embedded in the process (see Chapter 5).

There is no unique path to success when it comes to economic transitions. Policy can build on a growing body of evidence that considers a wide range of regional settings. The applicability still requires a thorough assessment of the local assets in a region. The central question for economic transition is “where to?”. Diverging success stories of Los Angeles and San Francisco (see also Chapter 5) and industrial policies that aimed at “picking winners” but failed to stir innovation (Dutz et al., 2014[19]) show how difficult it is for policy to set the right objectives and incentives.

The core question is whether it is better to specialise in those areas where a region is already strong or whether it is better to diversify. More specialised regions tend to be richer (in term of per capita gross domestic product [GDP]) but more diversified regions grew faster during the 2008-14 period (OECD, 2018[16]). Even if regions aim to diversify, the identification of suitable sectors and strategies to develop activity within these sectors is far from straightforward. In places with a well-diversified and vibrant economy, gaps might be easier to identify. The city of New York, for example, identified a lack of capacity in training engineers, in particular relative to tech-hubs around Boston and San Francisco, as a barrier to diversifying its economy. The result was the creation of a new graduate university “Cornell Tech” with a campus on Roosevelt Island (Katz and Bradley, 2013[20]). In places with a less diversified economic base and production that is focused on the extraction of raw materials, agriculture or low-tech manufacturing, the potential for diversification is much greater; but that also means it is harder to develop a concrete strategy (Balland et al., 2019[21]).

Specialisation and diversification of regional economies

The sectors and types of regional entrepreneurial activity will determine regional innovation paths. Three common pathways for regions’ innovation development include: i) regional specialisation in a particular technology domain; ii) regional diversification in related technological domains; or iii) regional diversification in unrelated technological domains (Table 3.1). The common factor to each innovation path is the need for entrepreneurship discovering and exploiting opportunities to create value within each path, whether improving existing products or services, or creating new ones (related or unrelated with the regions’ technological base).

Regional specialisation or regional diversification?

Specialisation of regional economies in certain sectors points towards comparative advantages. Strong sectors are the result of some form of local advantage, albeit this advantage might have eroded over time. Further developing the area of specialisation comes with concrete advantages. The skillset of the local workforce remains relevant, firms can incrementally move towards new fields without major disruptions and the risk of engaging in related activities is relatively limited. Once a competitive advantage is found, new opportunities emerge for local firms to further improve that field of knowledge (Boschma, 2004[22]). Many regions specialise in particular sectors and successfully innovate and grow for long periods of time by incrementally improving within existing sectors. They are thereby “extending” or “upgrading” their industrial development path (Grillitsch, Asheim and Trippl, 2018[23]).

An economy is “specialised” if a small number of sectors account for a relatively large share of its GDP, whereas it is “diversified” if each of a relatively high number of sectors accounts for a small share of GDP. Two examples for highly specialised (and successful) regional economies are the mid-sized cities of Erlangen and Wolfsburg in Germany. Volkswagen employed 60 000 workers at its seat in Wolfsburg, compared to a total working-age population in the municipality of 77 000. The “campus” of Siemens in Erlangen had about 25 000 employees compared to a total working-age population of about 71 000 (The Economist, 2016[24]). Examples are not limited to Germany but smaller cities and rural areas often have to rely on specialisation as they lack the critical mass to build strength in many sectors (OECD, 2016[25]).

A distinction is necessary between specialisation in growing and dynamic industries, and specialisation in mature and declining industries. Like Wolfsburg, the city of Detroit in the United States was heavily invested in its automobile industry, leading to its nickname “Motor City”. But the sector failed to sustain growth through the third industrial revolution. In the fourth industrial revolution, regions specialised in industries relying on routine tasks are likely to experience more disruption from automation. Too much specialisation in one or a few mature industries relevant in past industrial transitions can expose regions to negative shocks affecting those industries (Storper et al., 2016[26]). Regional specialisation affects the patterns of risk of automation among metropolitan areas in the United States. Between one-half and three-quarters of workers in metropolitan areas may face severe disruption in the near future (Frank et al., 2018[27]). The risk decreases with the size of the city, in part because larger cities have a higher share of employment in occupations whose tasks are more resilient to automation.

Excessive specialisation can affect regions’ innovation capacity negatively, since innovating within the same mature sector consists mostly of incremental innovations producing small improvements. This can lead to persistent economic slowdowns if regions find themselves incapable of adapting their industrial base to explore other opportunities, which is the case when the impact is a complete industrial transformation (Schoenmakers and Duysters, 2010[28]). But overcoming excessive specialisation can be difficult.

The mining industry in Pittsburgh (United States) was essential for the development of the city but contributed to crowd out entrepreneurship in the region (Chinitz, 1961[29]). Rochester (United States) provides another example of excessive specialisation. In 1879, when the emulsion-coating machine was invented in Rochester, the city of New York was the centre of the photographic industry. The Eastman Kodak Company in Rochester soon took over the market for photographic film and Rochester replaced New York City as the leading location in film production, becoming highly specialised in that sector. In the 1960s, Kodak was the largest employer in Rochester with over 60 000 employees. Yet, Kodak did not manage the disruption of digital technologies, nor did the region. When the company shut down its largest research and production facility, the population of Rochester witnessed a decline of the entire region. As Kodak’s workforce dropped by almost 80% between 1993 and 2006, the whole region rapidly lost population (citi, 2016[30]).

Linking existing strengths with new ones through “related varieties”

Instead of further specialising within existing sectors, regions can aim to diversify their economies and thereby “branch” onto new development paths. Regions with more diversified economies can be better positioned to enable the recombination of existing knowledge pieces to find new growth strategies. Knowledge spillovers between different sectors within a region are an important source of innovation. A diversified regional economy can be more likely to innovate and create new growth paths (Henderson, Kuncoro and Turner, 1995[31]; Rosenthal and Strange, 2004[32]). At the heart of such innovative capacity is the creation of inventions that introduce novel technological approaches, recombining technologies in new ways (Arthur, 2009[33]). Knowledge from multiple sectors can be exchanged more easily when the distance between sectors in a region is not too large. Sectors need to be related or complementary, presenting low co-ordination costs of combining different types of knowledge (Frenken, Van Oort and Verburg, 2007[34]).

A strategy to identify and foster new paths that link with existing assets is diversification into “related varieties”. The “related varieties” approach maps the presence of specific sectors or products (“varieties”) in different countries and regions. This mapping can then be used to identify varieties that tend to co-locate, i.e. “related” variety. The idea is that the local assets in existing sectors or capacities to produce current products are easier to bridge to those required for related varieties. A growing literature has shown that the probability that a region will start exporting a new product (Hidalgo et al., 2007[35]; Hausmann et al., 2014[36]) or start patenting in a new technology field (Boschma, Balland and Kogler, 2014[37]; Petralia, Balland and Morrison, 2017[38]) increases with the number of related activities present in that location. A positive link between related diversification and economic performance, in general, has been found in several empirical studies (Content and Frenken, 2016[39]).

The concept of “related variety” as regional development path is consistent with the reality at the firm level, where diversified firms providing a related variety of products tend to outperform specialised firms. For example, companies in the energy sector require a broad range of goods and services, so an intermediary firm can sell drilling equipment, well completion services or environmental management instruments, for example, through three separate but related business units. In a single visit, sales staff can offer multiple products and services to clients, yielding marketing economies of scope, with the potential to outperform competitors, which only offer a single product or service.

An additional example of firm-level activity benefitting from relatedness is research and development (R&D). If a firm has different, but related business units, all can potentially benefit from inventions resulting from R&D activities. Sharing common R&D activities and manufacturing facilities enables to distribute common fixed costs across more revenue streams (Palich, Cardinal and Miller, 2000[40]). Pursuing related-variety diversification strategies are limited by the co-ordination costs of combining multiple product lines. A study on US equipment manufacturers finds that producers favour related diversification in their products if the potential synergies (e.g. in terms of shared inputs) but that this positive effect is attenuated if existing products have complex value chains (Zhou, 2010[41]).

Related variety fulfils two needs at the same time: diversity and relatedness. Some degree of proximity in terms of common costs, technologies, skills and knowledge (that is, relatedness between sectors) is required to ensure that synergies, effective communication and interactive learning between sectors take place at low co-ordination costs. However, some degree of distance (that is, variety between sectors) is needed to avoid cognitive lock-in and to stimulate novelty. Boschma (2009[42]) provides the example of Emilia Romagna in Italy as a case of the branching process in related varieties. Many successful sectors in the region, such as ceramic tiles, the packaging industry and robotics, emerged out of a pervasive regional knowledge base in engineering. These sectors not only built and expanded on this extensive knowledge base, they also renewed and broadened the regional economy of Emilia Romagna.

The “related varieties” approach works best for regions that aim to follow established developments paths into new sectors. The identification of what sectors or products are related relies on precedents set in other places. This means that varieties might seem unrelated given the available data but might actually be closely related. This shortcoming is particularly important for innovation policy, where the explicit focus is on novel approaches. It might be the innovative activity itself that creates links between seemingly unrelated sectors or products.

Big push towards “unrelated varieties”?

In some regions, the transition towards new sectors constitutes a more radical shift. Conceptually these regions move towards “unrelated varieties”, i.e. sectors or products that are not typically associated with the industrial structure of the region. The move from agricultural to industry-based economies is one such move that many regions have successfully taken. Radical innovations have the potential to connect previously unrelated knowledge bases and create new industries connected in a “related variety” fashion. For example, in the 19th century, the invention of synthetic dyestuffs gave birth to new related industries, as pharmaceutics, explosives, plastics, synthetic fibres and photography, all centred on the same new core technology (Malerba and Orsenigo, 2006[43]).

North Carolina in the United States is a successful example of branching through unrelated varieties. During the second industrial transition, North Carolina ranked as the poorest state in the United States (Link, 1995[44]), with its three main sectors being textiles, furniture and tobacco. However, during the third industrial transition, the region became one of the most innovative and prosperous regions in the world. North Carolina successfully branched into new high-growth sectors: IT, pharmaceuticals, banking, food processing and vehicle parts (Walden, 2008[45]). At the centre of this success was an innovation policy creating North Carolina’s Research Triangle between the counties of Chapel Hill, Durham and Raleigh and their universities campuses. Within the Research Triangle lies one of the most prominent science and technology parks, the Research Triangle Park, that played a key role in the transformation (see also Box 3.7).

The growth “miracle” of South Korea that took the country from “developing country” status in the early 1960s into the group of “high-income countries” in mere decades,1 is another dominant example of a “big push” towards new sectors. Targeted interventions by the central government promoted the development of competitive export-oriented sectors and those newly developing sectors that the government deemed worthy of promotion (Pack and Westphal, 1986[46]). As in the example of North Carolina, the knowledge base – here in the form of a well-educated labour force relative to the capital endowment in Korea – played an essential role in complementing the industrial policy and accompanying reforms (Rodrik, Grossman and Norman, 1995[47]). The Korean strategy is not without risk. Today, the legacy of the past interventionist policies impede progress towards fully transitioning the Korean economy (OECD, 2018[48]).

To adapt its economy to the fourth industrial revolution, Korea has changed its strategy. In 2014, the Centers for Creative Economy and Innovation (CCEIs) were created. In each of the 17 regions that house a CCEI, the centres link with existing strengths and the corporate fabric to push the local economy to the next stage. The approach focuses on linking research centres with entrepreneurship (Box 3.1). Having a dynamic regional entrepreneurial ecosystem contributes to the development of disruptive innovations because young firms are more likely to introduce disruptions. Large corporations can utilise this model for open innovation through CCEIs. Open innovation for those large incumbents will be crucial for success.

The most radical technological and scientific discoveries tend to combine knowledge pieces that were never combined before. Firms and inventors in regions that are diversified in unrelated sectors can find more opportunities to innovate by recombining unrelated pieces of knowledge. Such regions are likely to be in the scientific and technological frontier, with high innovation capacity for technological experimentation. Additionally, such knowledge pieces are more unrelated or distant, being more difficult to combine (Uzzi et al., 2013[49]; Wang, Veugelers and Stephan, 2017[50]). The recombination of unrelated knowledge pieces is also riskier: some generate the most impactful breakthroughs but many tend to fail. In addition to being riskier, these radical technological and scientific discoveries can also be costlier, requiring a longer time to develop commercial applications.

CCEIs in Korea were established in 2014 with the objective of supporting the creation of new industries and markets, functioning as a pivot for start-up incubation, small business innovation and regionally specialised programmes. The CCEI has 19 field offices covering 18 Korean regions and each focuses on promoting local entrepreneurship in line with regional industry characteristics and competencies of large regional corporations, fostering complementarities between incumbents and potential start-ups.

The centres promote partnerships and knowledge transfer between large Korean corporations and young firms. Additional services are provided, such as specialised consulting, according to the opportunities and challenges of each region. Consulting goes beyond technological considerations, covering strategic management skills, finance, marketing or R&D procedures for example. By providing specialised consulting along with facilitating partnerships with larger corporations, the CCEI supports young firms to start-up and scale-up using the networks of established corporations in order to grow faster and achieve global scale.

Source: CCEI (n.d.[51]), Introduction of Innovation Center, https://ccei.creativekorea.or.kr/eng/center/info.do.

Relatedness is more important for innovation in regions with a weaker innovation capacity. Xiao, Boschma and Andersson (2018[52]) find the effect of relatedness to decrease as regional innovation capacity increases. By focusing on exports, Saviotti and Frenken (2008[53]) find a related export variety to be linked with short-term gains in regional GDP per capita growth and productivity, while unrelated export variety promotes growth with a considerable time lag. They argue that related variety means knowledge is easily recombined in new products, causing direct growth effects, while unrelated variety, though harder to recombine, can, if successful, lead to completely new industries sustaining long-term growth.

Drawing on knowledge and resources residing in other regions can facilitate new growth paths through new and unrelated knowledge combinations, Multinationals, immigrant entrepreneurs and mobile scientists are examples of potential sources of external knowledge (Neffke et al., 2018[54]). In the context of the fourth industrial revolution, technologies such as artificial intelligence (AI) and machine learning can facilitate integration across a broad range of industries and types of economic activity. Thus, regions with a wide sectoral diversification can be better positioned to explore synergies and innovate across the fringes of different technologies and industries.

Often the gradual pace of substantial industrial change is misinterpreted as a temporary loss of competitiveness. The decline, for example, of Pittsburgh’s steel industry or Acron’s tire manufacturing (in the United States) was more than that. They were a symptom of a substantial change in the way industries are structured and production processes are functioning. Since the onset of modern production – the first industrial revolution – economies have undergone two further major revolutions and are currently taking the first steps in what will be the fourth industrial revolution.

Four industrial revolutions

The first industrial revolution started in Great Britain in the late 18th century with the mechanisation of the textile industry and the introduction and spread of the steam engine, which in turn facilitated the development of manufacturing in factories. In the following decades, the use of machines to manufacture goods, instead of crafting them by hand, spread around the world.

By the mid-19th century, the second industrial revolution began with a broad range of technological inventions that gave rise to assembly line manufacturing, enabling mass production. Along with the emergence of large-scale manufacturing also came a deskilling of labour, as tasks became routinised and simplified. The enhanced specialisation made a greater division-of-labour and greater focus of each specific task on the assembly line possible.

The third industrial revolution came with the introduction, development and diffusion of the computer. The key inventions, beginning around 1970 and continuing through the remainder of the century, were also the personal computer, semiconductor, Internet and Web 2.0. Like its two earlier predecessors, the third industrial transition had a large impact on virtually all aspects of society. It led to a massive shift in the occupational structure of the labour force, resulting in individual winners and losers based on occupations, and had strong impacts on the prosperity of cities and regions.

The fourth industrial revolution is being fostered by a new wave of innovations and technological advances, with AI and connectivity at the heart of this new wave of technological change. Digitisation in manufacturing is having a disruptive effect in every industry, such as office equipment, telecommunications, photography, music, publishing and films. The effects will not be confined to large manufacturers, as these technological advancements are empowering small- and medium-sized enterprises (SMEs) and individual entrepreneurs.

Structural change in the industrial fabric happens gradually and often imperceptibly. It is often only recognised as a major event after reaching a critical level. Change in the structure of a region’s core companies affects employment in their sector. As these firms are connected to other firms in the region through supply and demand links and often constitute a key pillar of the regional innovation system, many (if not all) other firms in a region are affected by major changes. Examples in Europe that underwent a strong decline due to industrial structural change include regions such as the Ruhr area (steel, mining, machines) in Germany, or Newcastle upon Tyne (mining, steel, shipbuilding) in the United Kingdom. Emblematic examples in the United States include the decline of Kodak and its impact on the region of Rochester and the decline of Detroit’s automobile industry in Michigan. These major events are caused by a latent industrial structural change and have strong spatial repercussions, especially when regions are too reliant on those industrial sectors.

Source: Adapted from Audretsch, D. (2018[9]), “Developing strategies for industrial transition”, Background Report for an OECD/EC Workshop Series on Broadening Innovation Policy: New Insights for Regions and Cities, OECD, 15 October 2018, Paris.

The catalyst for each industrial revolution was a decidedly different and unique set of technologies. Ranging from steam in the first industrial revolution to transportation technologies and electricity in the second industrial revolution, computers, semiconductors and the Internet in the third. Finally, the current, fourth industrial revolution, is likely driven by the digitalisation of services and the development of AI and machine learning supported by automated exchanges between machines, the Internet of Things (IoT) (Box 3.2).

Economic history is replete with dramatic changes in economic structures at the regional, national and international levels. In the last two centuries, techno-industrial leadership shifted from Great Britain to Germany and the United States, and some countries in Southeast Asia have joined the ranks of leading industrial countries. Regions are subject to similar shifts, as the cases of Belgium, Germany and Great Britain demonstrate. Their core industrial areas have lost their economic dominance and have been replaced by a set of new growth regions in South East England, Flanders and the South of Germany respectively (Boschma, 2009[42]). In order to sustain long-term regional development, regions must constantly transform and renew their economic base (Martin and Sunley, 2008[55]).

The catalyst for the first two industrial revolutions were inventions that fundamentally changed the capacity to combine new tools and machines with natural resources that led to an unprecedented gain in productivity. Much more could be produced and distributed within a shorter period of time and significantly less need for human labour. The locational advantage of regions that helped attract capital investment was typically linked to an abundance of key natural resources. Investment was the main driver for economic performance.

At the beginning of the third industrial revolution, established manufacturing companies tried to adapt their traditional production formulas. The “just in time” production principle was the result. With the rise of the computer era, the key factors and resources that facilitated growth shifted from physical capital to knowledge, ideas, creativity, skills and human capital. This was partly due to the high component of human capital in the production or development of computers within the industry. The computer industry ranks among the most intensive users of human capital and R&D. Beyond the production of computers, the main beneficiaries of using computers at work were also workers with higher levels of education and “human capital”. Economists refer to “skill-biased technological change” that summarises the complementarity between human capital and using computerised technologies.

The first two industrial revolutions raised the demand for workers with low levels of skills, while in the third, the complementarities between computers and human capital resulted in an increased demand for human capital (Acemoglu, 2003[56]; Autor, Levy and Murnane, 2003[57]). The fourth industrial revolution is likely to continue to rely on similar factors and resources as the third but the relevance of these factors is likely to increase the importance of human capital (Frey and Osborne, 2017[58]). Box 3.3 defines the key elements typically associated with the fourth industrial transition.

The fourth industrial revolution is still ongoing and its defining characteristics will only become evident after its resolution. There are, however, some elements that appear to drive current radical change. For this industrial revolution, it is the integration of the physical and digital worlds. The digitalisation of manufacturing transforms conventional manufacturing into “smart factories”. A key salient feature of the transition is machine communication, not just between humans and machines but also machine-to-machine. With extensions into artificial intelligence (AI), connectivity through IoT and flexible automation enabled by combining the two (WEF, 2018[59]).

The first set of enabling factors of the current industrial revolution is the combination of advances in computing power and the availability of big data, which are allowing AI algorithms to excel. AI is enabling event recognition and the translation of such recognition for automated decision-making. Speech and image recognition have already reached the accuracy of the human brain. AI is becoming the key enabling feature of progress, from self-driving cars and drones to virtual assistants and translation software. R&D have made impressive progress, from software used to discover new drugs to algorithms that predict tastes and cultural interests (Schwab, 2017[60]). AI can also contribute to the creation of entirely new industries, based on scientific breakthroughs in the same way as the discovery of recombinant DNA technology led to a revolution in industrial biotechnology and the creation of vast economic value (OECD, 2018[61]).

A second enabling factor of the current industrial revolution involves the level of connectivity enabled by IoT. The miniaturisation of computers enables them to be attached to individual machines and then connected to the Internet. Sensors detect and report information online about machine operations. One example involves farm production, where sensors for temperature, water content and soil quality relay instantaneous information and feedback to the tractor operator about how to optimally adjust the planting procedure. Each sensor connects not just with each other but also larger systems in what constitutes IoT (EC, 2017[62]).

The combination of AI and connectivity can enhance productivity in factories. AI helps minimise interfaces with humans and, instead, production relies on the feedback and reactions that follow optimisation based on autonomous machine learning. For example, in aerospace, Airbus deployed AI to identify patterns in production problems when building its new A350 aircraft. A worker might encounter a difficulty that has not been seen before but the AI, analysing a mass of contextual information, might recognise a similar problem from other shifts or processes. Because AI immediately recommends how to solve production problems, the time required to address disruptions has been cut by one-third (Ransbotham et al., 2017[63]). More data from sensors and systems based on the IoT enhances the ability to make smarter decisions and ultimately boost both machine and system efficiency.

Source: WEF (2018[59]), “The next economic growth engine: Scaling fourth industrial revolution technologies in production”, White Papers, World Economic Forum, https://www.weforum.org/whitepapers/the-next-economic-growth-engine-scaling-fourth-industrial-revolution-technologies-in-production (accessed on 20 November 2018); Schwab, K. (2017[60]), The Fourth Industrial Revolution, Crown Publishing, New York; OECD (2018[61]), OECD Science, Technology and Innovation Outlook 2018: Adapting to Technological and Societal Disruption, https://dx.doi.org/10.1787/sti_in_outlook-2018-en: EC (2017[62]), “Industry 4.0 in agriculture: Focus on IoT aspects”, https://ec.europa.eu/growth/tools-databases/dem/monitor/sites/default/files/DTM_Agriculture%204.0%20IoT%20v1.pdf (accessed on 27 November 2018); Ransbotham, S. et al. (2017[63]), “Reshaping business with artificial intelligence: Closing the gap between ambition and action”, https://sloanreview.mit.edu/projects/reshaping-business-with-artificial-intelligence/ (accessed on 21 November 2018).

Disruptive innovation

Not all disruptive innovations trigger an industrial revolution but they disrupt part of the economic fabric in countries and their regions. Industrial revolutions are driven by a combination of several technological developments that affect regions through a continued period but a single disruptive innovation has the potential to disrupt regions immediately. Today, disruptive innovations are increasingly of larger scope, scale and faster speed, in large part due to the development of digital technologies.

Defining disruption

A possible framework to characterise innovations is in terms of their level of performance improvement compared to established solutions and in terms of their impact on incumbent players in the industry. Radical innovations are those that lead to larger performance improvement, and disruptive innovation those that have high levels of impact on incumbent agents. Disruptive innovations create entirely new markets and displace existing ones while sustaining innovations improve existing markets developing current products or services (Christensen, 1997[64]).

Disruptive innovation describes a process in which new entrants challenge incumbent firms, often despite inferior resources. This may happen in two ways: i) entrants may target over-looked segments of the market with a product considered inferior by incumbent’s customers and later move upmarket as their product improves; and ii) they may create entirely new markets turning non-consumers into consumers. Often incumbents fail to identify new opportunities or do not have incentives to explore them as they can cannibalise existing products or services. Incumbent firms are better placed than young firms to pursue sustaining innovations (in contrast to disruptive). Sustaining innovations enable incumbents to reach higher profit margins with their existing products or services. Incumbents have high incentives to compete for sustaining innovations and they have larger resources to win.

Disruptive innovation is a different concept from radical innovation, i.e. the degree to which the innovation differs from existing practices, goods or services. Innovations can be both disruptive and radical (see Table 3.2 for examples). Being able to distinguish radicality and disruption is important in order for regions to better manage different types of innovations as the local economy needs to adapt differently to each type. In particular, the degree to which incumbents are affected differs by the degree of disruption, even when innovation is incremental.

Radical innovations are not instant. They result from cumulative processes of multiple inventions and innovations, and their diffusion and adaptation to different circumstances (Warnke et al., 2019[70]). Radical innovations are disruptive when they represent a technological leapfrog that disrupts incumbents or creates entirely new markets (Hopp et al., 2018[71]). Innovation is both radical and “sustaining” when it is a remarkable improvement in existing markets that does not disrupt incumbents. Incremental innovations, in contrast to radical, only represent small improvements. Incremental innovations can be disruptive when small improvements severely disrupt incumbents or sustaining when they just provide minor developments of existing products or services.

Identifying disruptive innovations

Based on the market-related definition, disruptions are only identifiable “post mortem”, when the adverse effects on incumbents are already evident. A consistent framework to identify potential for disruption ex ante can help regional policymakers prepare for the challenges of disruption as well as explore potential opportunities.

Technological foresight exercises are therefore important for regions, as they create absorptive capacity by increasing local understanding and awareness about possible challenges and opportunities arising from future technological developments. Different technologies have heterogeneous impacts on regions; thus, equipping local agents with the tools that help them predict how specific technologies can affect them is particularly important since there is no one size fit all prescription for successful prediction.

Perhaps the earliest tool of quantitative technology forecasting is trend extrapolation, which consists of expecting new technologies to follow the same behaviour in terms of growth as previous technologies. However, trend extrapolation has major drawbacks. They rely heavily on the continuation of existing trends and, as a result, may not always be appropriate when attempting to construct scenarios for the very long run about technological disruption. For radical and disruptive technologies, especially digital technologies, there also appears to be a “holy cow” moment where progress is made at an exponential pace after a long run-up of slow progress (Baldwin, 2019[72]). Machine learning is an example of a technology where decades worth of theoretical work are resulting in massive payoffs in terms of practical progress within a few years.

A complementary approach that has been historically popular is to leverage experts’ opinions. One such approach is the Delphi method, originally developed by the RAND Corporation in the 1950s.2 The method follows an iterative approach that asks experts to forecast events and to update their forecasts after receiving the aggregate results of all experts’ views from the previous round. Delphi aims to use the wisdom of crowds in repeated interactions while avoiding bias from concerns about a reputational effect. Advances in behavioural economics and psychology are providing further was of “debiasing” expert opinions (Koutroumpis and Lafond, 2018[11]).3 Questions remain whether expert opinion actually outperforms the predictions by a random group of individuals, e.g. experts’ fame has been found to be negatively associated with the accuracy of their predictions in political science. Selecting the right experts is, therefore, a critical and difficult part of the process as well (Tetlock and Gardner, 2016[73]).

“Prediction markets” use pecuniary incentives to elicit (informed) views from many forecasters. They allow individuals to trade on future events, i.e. to “put their money where their mouth is”. The difficulty with implementing such markets is to delineate between gambling (and accordingly gambling regulation) and prediction markets. The quality of the information that prediction markets provide is still a matter of research as well and subject to a complex interaction between the availability of external information and the experience of participating individuals (Brown, Reade and Vaughan Williams, 2019[74]).

The combination of machine learning techniques and “big data” opens up new avenues for forecasting. Patent data has been used in some recent applications, to map patent data as innovation networks for predictive purposes for example (Acemoglu, Akcigit and Kerr, 2016[75]). The network is constructed using citation data and the results show that levels of patenting activity predicted using activity in an upstream (cited) category is correlated with actual patenting in the future. A second approach starts from the idea that innovation networks are in a sense too static because the number of nodes (technological domains) is given, whereas it seems important to try to predict radically new domains. This approach considers new technological categories in patents and aims to identify patterns to predict their emergence (Koutroumpis and Lafond, 2018[11]).

Big bang disruptions

Developments in digital technologies are enabling a new form of extreme disruption. Disruptors are typically considered as new entrants, spotting opportunities in lower ends of traditional market spaces or addressing types of demand ignored by incumbents, and disrupting thereafter by upgrading their value proposition (Christensen, 1997[64]). “Big Bang Disruption” – a concept proposed by Downes and Nunes (2013[76]) – is a new kind of disruptive innovation. “Big Bang Disruptors” provide better and cheaper products or services at a global scale from the moment of creation, instead of entering a market with an inferior product than those of established incumbents.

Disruptions can severely hit regions due to their level and speed of impact on incumbent firms and the speed of such impact. Big Bang Disruptors can destabilise mature industries in record time, in great part enabled by digital technologies such as broadband networks, cloud-based computing and increasingly powerful and ubiquitous mobile devices. The accelerating pace of Big Bang Disruption is driven by core technologies that became better and cheaper. The most familiar of these exponential technologies is the computer processor that has continually become faster, cheaper and smaller. A new generation of exponential technologies is emerging in fields such as chemistry, optics, materials and energy, promising to destabilise mature industries and their regions (Accenture, 2013[77]).

Developments in digital technologies are reducing barriers to entry by driving down entry costs for new entrepreneurs. Digital technologies are driving down the core costs of developing new products and services, such as the cost of innovation activities, of accessing information and of experimentation (Downes and Nunes, 2013[76]). These three driving forces are further explained:

Declining cost of creation: Steep declines in the cost of key input materials, including computer hardware and software, along with increasingly efficient supply chains, enables innovators to provide new or better solutions than existing ones. Products and services can begin life with higher quality, at a lower price and more easily customised than those of traditional competitors.

Declining cost of information: As social networks, microblogging and independent review services proliferate, consumers have easy access to more market information. Customers can discover and adopt new successful products and services much more rapidly across every traditional segment. Innovators no longer need to cultivate “early adopters” to establish new markets.

Declining cost of experimentation: Due to global broadband networks and ubiquitous computing devices, innovators and users are increasingly connected in an environment optimised for collaboration. New products and services often begin life as simple combinations of existing components, tested with little cost or risk directly on the market with real consumers.

An example of digital disruption with a large regional component is the blockchain. The technology is a database that allows the transfer of value within computer networks, facilitating the shared understanding of value attached to specific data and thus allows for transactions to be carried out (see Box 3.4).

The blockchain is a distributed database that acts as an open, shared and trusted public ledger that nobody can tamper with and that everyone can inspect. This technology may disrupt several markets by ensuring trustworthy transactions without the necessity of a third party.

Applications range from the administration of financial transactions to the creation and maintenance of trustworthy registries, or conditional transfers (smart contracts) relying on data that specify certain rules must be met before a transaction takes place. The technology can be of immense value in regions with lower institutional capacity because it provides an unfalsifiable record of transactions and ownership. Thus, it can generate improvements in transparency, efficiency and trust. Indeed, the blockchain can be a cheap platform for more efficient public services and trust in contracts. Possible uses include the registration and proof of ownership of land, business transactions, birth records, titles or pensions. A blockchain acts in this sense as a verification system of authenticity, creating permanent and secure records which cannot be distorted by corrupted activities.

The potential benefits of the blockchain are also fostering the development of innovative regulatory frameworks that enable countries and regions to fully benefit from this technology by providing a safe and transparent environment. An example of regional regulatory framework development is the "Crypto Valley" in the small Canton of Zug outside of Zurich (Switzerland). Zug put in place clear guidance as to how it would treat (blockchain-based) cryptocurrency companies and those that dealt with its assets. The new rules helped attract Ethereum, the second-biggest cryptocurrency by value, and that triggered the set-up of a new ecosystem, including law firms, tax, accounting, smart contract evolvement firms, start-ups and universities for example.

Source: OECD (n.d.[78]), OECD Blockchain Primer, http://www.oecd.org/finance/OECD-Blockchain-Primer.pdf (accessed 21 August 2019); Berryhill, J., T. Bourgery and A. Hanson (2018[79]), “Blockchains Unchained: Blockchain Technology and its Use in the Public Sector”, https://dx.doi.org/10.1787/3c32c429-en.

Leveraging disruptive innovation in regions

Drivers and regional impacts of disruptive innovations change over time and space and from one technological domain to another. Regional characteristics interact with those of the disruptive innovation to determine how different technologies affect specific regions and what opportunities regions can derive. Broadly, there are three groups of characteristics. The first is regional assets and networks that are determined by policy and the legacy of past development. The second consists of spatial and geographical characteristics of the region and the third is the local workforce, population and prevailing culture. The list does not attempt to be comprehensive, as technologies and academic research develop the characteristics and their importance change as well.4 For example, with constant improvements in virtual meeting technologies and progress in increasing speed and reliance of broadband Internet access, the promise of a “death of distance” allowing the replacement of face-to-face interaction and thereby reduces one of the advantages of large cities is again under discussion (Baldwin, 2016[80]).

Disruptive innovations are often seen as new products but many disruptive technologies take the form of innovative services with a strong local dimension. Health services or services related to the “sharing” economy are critical fields of disruption and very much embedded in the local area. Some technologies can be more “material” than others in their inputs and the degree to which a technology relies on tangible or intangible capital. Concretely, a new start-up in micromobility that rolls out a fleet of electric scooters in a city has the scooter as a physical component that is locally bound, but supporting services and the IT infrastructure (and algorithms) that manage the fleet are not bound to a place. The degree to which disruptive innovations are “material” in turn determines their off-shorability or territorial embeddedness. Some innovations can enable the development of an ecosystem of supporting services, or services that are themselves supported by technology. These services can represent a great share of jobs, value-added and can be knowledge-intensive and non-offshorable. While it seems difficult for policy, for instance, to change a product innovation into a service innovation, encouraging the development of associated supporting services that operate locally may sometimes be possible. In particular, the advances of AI raises concerns about the ability of regions to retain jobs and high value-added activities (OECD, 2019[81]; 2018[82]).

Some technologies cannot be implemented in the same way everywhere. Agricultural technologies are a good example of this issue, with tools, livestock and plant varieties requiring important modifications to suit local conditions. In comparison, digital technologies require little adaptation apart from language or cultural factors. Technologies that require local adaptation often diffuse and progress less fast – precisely because experience cannot be shared – but also offer more promise for regions lagging behind the frontier to engage in “technological dialogue” and develop specific capabilities to meet their own demand. The need for local adaptation is not a technological trait that can be easily influenced by policy.

Changing benefits from the agglomeration of economic activity

The share of the global population that lives in cities has continuously increased over the last centuries. In 2015, nearly two-thirds of the people living in OECD countries lived in a functional urban area (a city and its commuting zone) with 250 000 or more inhabitants. The majority of these live in large metropolitan areas with 1.5 million or more inhabitants (39% of the total population).5 Large cities clearly provide some benefits that attract people and outweighs the “cost” of living in big cities, such as congestion, noise, pollution and the high cost of housing that means people live in (much) smaller apartments in large cities than in rural areas (OECD, 2015[83]).

Larger cities provide a greater variety in consumption and leisure activities than smaller places. They also provide greater earnings potential for their residents. The density of cities allows workers to specialise and thereby raise their productivity and income. Density allows firms to tap into a larger and more varied pool of workers, making it easier to find the right “match” for the vacancy they want to fill. Density also allows knowledge and information to flow more easily as people can meet and exchange both formally and informally, which again raises productivity and wages. All of these factors are summarised by economists as “agglomeration economies”, i.e. the pecuniary benefits that larger cities provide to their firms and residents (Duranton and Puga, 2004[84]).

The geographical concentration of innovative activities has been a common element of all first three industrial transitions. Prior to the first industrial transition, most of the population in the developed countries resided in rural regions and small towns. The inventions driving the first industrial transition facilitated the development of urban density and the emergence of cities on an unprecedented scale. From the mid-18th century onwards, thousands of people moved to the rapidly growing industrial cities of northern England, such as Leeds and Manchester, to take advantage of the opportunities that new factories and textile mills provided. The combination of job opportunities and the provision of improved infrastructure (including the Underground) allowed London to grow from 1 million inhabitants in 1800 to 3 million in 1860 and by 1900 had reached 6.5 million inhabitants (White, 2008[85]).

The English experience is not unique. In the United States, the industrial centres developed in Midwestern cities such as Detroit and Akron or Pittsburgh. In general, as countries develop and income levels rise, people flock to cities. There are no countries where increased income levels (measures in per capita GDP) have not been accompanied by a rise in urbanisation. The opposite is, however, not the case as urbanisation has not provided higher income in all countries (OECD, 2015[83]). Especially, developing countries are struggling with the move towards higher income levels despite increasing urbanisation. The difference might be linked with the drivers of income growth. Resource-intensive production in developing countries leads to urbanisation in “consumption cities” that focus on the provision of non-tradeable services to the local population, rather than “production cities” that are the hallmark of industry-led attraction of people to cities (Gollin, Jedwab and Vollrath, 2016[86]).

Cities continued to grow in the main capitalist countries over the twentieth century on the basis of manufacturing but, starting in the 1970s, many of them went through a period of deindustrialisation as jobs dispersed to low-wage regions and countries, leading in many cases to severe crisis conditions in the core. After a transitional period of slow growth in the 1970s and early 1980s, large cities in the core again experienced a strong resurgence as the 1980s passed by. Cities now found themselves at the focal point of a new “post-Fordist” economy, characterised by a decisive shift away from materials-intensive manufacturing to various kinds of high technology, management, logistical, service, design and cultural sectors (Scott and Storper, 2014[87]). Many cities have not transitioned from the manufacturing era associated with the previous industrial revolutions to the knowledge area associated with the third. As the fourth industrial revolution unfolds, such cities face the risk of a double industrial transition shock.

Geographic proximity to natural resources was a key driver of location choice in past industrial revolutions. As transport cost declined and the cost of extraction rose in developed countries, the need for colocation of resources and production disappeared. Some resources still favour local economic development. Stable and vibration-free ground soil in Wales supports the development of a cluster for the production of compound semiconductors and advanced optical instruments (OECD, 2018[16]). An abundance of cheap and “green” electricity is an important asset for heavy industrial production. More than 75% of Iceland’s annual energy production is used for the production of raw aluminium.6 Energy is the main contribution of Iceland to the production process as raw material (aluminium oxide) is imported. The sector is critical for Iceland’s exports. More than one-third of the value of exports comes from raw aluminium.7

Whether sectors solely use the available resource for production or become part of a wider regional development strategy depends on policy choices, especially innovation policy. Iceland’s cheap energy (and cold climate) have attracted a large number of data centres. Their total electricity consumption remains below the needs of the aluminium sector but is rapidly expanding. In 2013, data centres consumed 5 kWh, less than 3% of the 218 kWh used by the sector in 2016.8 Estimates suggest further rapid expansion with 90% of the sector’s electricity use driven by data centres specialising in the “mining” of cryptocurrencies (KPMG, 2018[88]). The link with other sectors is limited, as it is for the aluminium smelters that drive exports in Island. Norrbotten in Sweden has taken a different route. Using its arctic climate as a resource, the region has attracted data centres as well. The region went beyond the provision of data storage and computation services by developing itself as a testbed for machinery, construction and military equipment in cold climates through the Swedish Proving Ground Association. It also leveraged its position as an established base for satellite launching and development. The local University of Technology, based in Luleå, played a proactive and important role in promoting innovation to diversify the economic base of the region (OECD, 2017[89]).

Through the third industrial revolution, economic activity and – even more so frontier innovation – has concentrated in few metropolitan areas. In 2015, one-third of international patents were filed in only five TL2 regions.9 Most assets associated with the knowledge economy are more spatially concentrated than people or economic activity. R&D expenditure is highly concentrated in a small number of firms (see Chapter 2). Around one-third of tertiary-educated workers are concentrated in only 20% of OECD regions (Maguire and Weber, 2017[90]). The concentration is not just evident on a global scale but also within countries, e.g. patent filings are twice as concentrated as GDP. This is true for both low patenting-intensive countries of the OECD, such as Chile or Mexico, as well as higher patenting-intensive countries such as Germany, Japan and the Netherlands.

Prominent examples of geographical concentration of computer technologies are Silicon Valley in California, Austin in Texas, or the Research Triangle in North Carolina (United States), as well as Cambridge in the United Kingdom, Munich in Germany, or Stockholm in Sweden. Because they also draw heavily on knowledge and ideas, the economic activities associated with the fourth industrial transition are likely to present geographic concentration paths similar to the third transition.

Clusters can be an important facilitator for regional innovation diffusion and cross-regional links. Policies fostering cross-cluster collaborations can link local firms to interregional value chains with the potential to benefit all organisations in the clusters being linked (see also Chapter 4). The European Strategic Cluster Partnerships for Smart Specialisation Investments consists of leveraging existing clusters as accelerators for the promotion of cross-regional links that connect different clusters (Box 3.5).

The overall objective of European Strategic Cluster Partnerships is to boost industrial competitiveness and investment in the EU via cross-regional co-operation and networking. Partnerships aim at facilitating co-operation across different clusters in thematic areas related to regional smart specialisation strategies.

The programme provides incentives to the collaboration of firms, especially SMEs, across regional and sectoral silos towards generating joint investment projects. The type of targeted activities ranges from preparation to implementation and investment phases of joint innovation and investments projects. Supported projects include strategy-setting and road-mapping, matchmaking activities among partners, facilitating demonstration and pilot assignments.

In its first call (2016-17), 15 cross-cluster partnerships received funding and 10 additional partnerships were on the reserve list of the call accepted to keep working on a joint co-operation agenda without direct funding. In the second call (2018-19), 25 cross-cluster partnerships received funding.

Source: EC (2019[91]), EU Cluster Partnerships, https://www.clustercollaboration.eu/eu-cluster-partnerships (accessed on 30 January 2019).

Breaking sectoral and spatial divides

The fourth industrial revolution does not only change the speed of innovation but also the breadth of technologies involved. Innovations increasingly integrate technologies from different sectors. Digital general-purpose technologies are becoming a central element in many products and services. This means that the importance of tacit knowledge that helps link across different fields may have risen as the complexity of technologies has increased over time. It also means that the amount and sophistication of complementary investments required for technological adoption increases (Andrews, Criscuolo and Gal, 2016[92]).

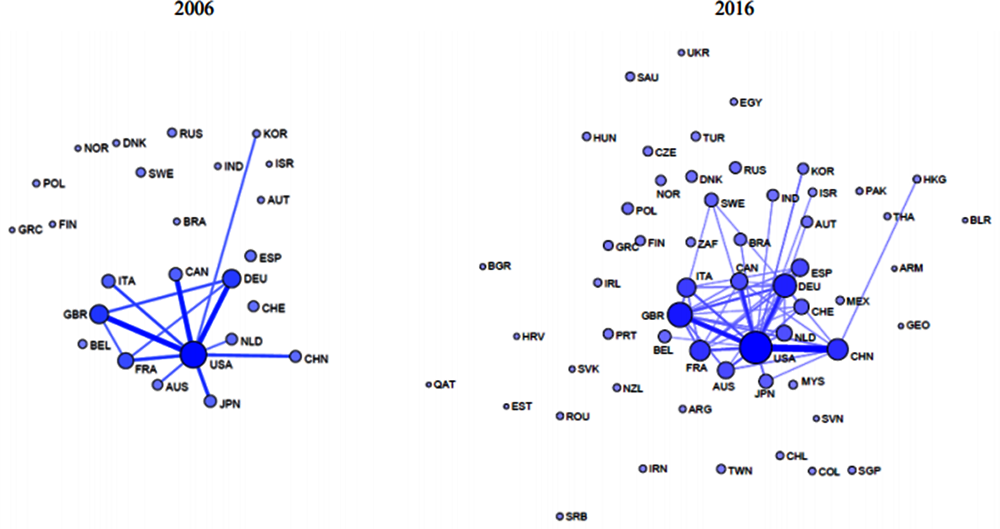

Complexity is accompanied by unprecedented access to information and ease to engage in international collaborations. Through the Internet, people can access learning opportunities provided by leading research institutions and even participate in degree courses. MIT OpenCourseWare, the online learning platform of the Massachusetts Institute of Technology in the United States, provides material for 2 400 different courses to a global audience. More than half of the approximately 1.6 million monthly visitors to the website come from outside North America.10 This growth in global reach is also evident in academic links. Compared to 2006, the number of countries with more than 10 000 academic publications has increased significantly. The number of co-authored papers, the global network of co-authors and the intensity of collaborations have increased as well (Figure 3.1).

Collaboration between larger companies and small (young) firms can help bridge sectoral divides and help manage the higher risks associated with the increasing speed of technological development. Young firms are more innovative and riskier, while established firms have deep-rooted processes, networks and larger financial capacities. Collaborative innovation partnerships enable exploiting these complementary capabilities, which have led to the advent of “project entrepreneurship” – where entrepreneurs and “intrapreneurs” create and develop new ideas inside large organisations. The speed at which firms pursue innovation activities is an important determinant for their survival (Ringel, Taylor and Zablit, 2016[93]). In a risky environment, collaborating with larger, established firms can be a valuable strategy in order to access a variety of financial and organisational resources. Similarly, established firms seeking to improve their external innovation capabilities can take advantage of the new radical ideas and energy of young firms (Box 3.6).

Innovation collaborations among young firms and larger established corporations

Young firms can benefit from collaborating with larger, established firms to access a variety of financial and organisational resources. Similarly, established firms seeking to improve their innovation capabilities can take advantage of the different approaches, risk outlooks and perspectives of smaller young firms. Young, dynamic firms are often structured around the development of novel and potentially disruptive products or services, while established firms have established processes and resources, and valuable networks. Collaborative innovation partnerships can exploit these complementary capabilities. This is not to say that potential benefits are not also balanced by obstacles that need to be overcome for collaboration to be effective (Table 3.3).

The value of entrepreneurship

Entrepreneurship translates innovation into regional economic rejuvenation. The prevalence of start-ups is systematically and strongly related to local employment growth across and within regions (Glaeser, Pekkala Kerr and Kerr, 2015[97]). Small (and often young) firms have greater incentive to focus on market-changing “radical” innovations than large (established) firms. Conceptually, firms have to choose between investing in improving their existing products and developing new ones. For larger firms, this incentive favours existing products more than it does in small firms as innovation in new products will “cost” part their current revenue streams (Akcigit and Kerr, 2018[98]).

Young firms, in comparison with established firms, are more prone to develop products that are new to the market and have a larger share of sales associated with the introduction of such new products. In Spain, 62% of young firms (defined here as less than 10 years old) introduced products that are new to the market, compared with 56%-58% of established firms. New products or services account for 14% of young firms’ revenues, while for established firms they represent only 8%-10% (Coad, Segarra and Teruel, 2016[99]).

The growth phase of new sectors and industries is characterised by an increase in competition and innovation through new entrants. The life cycle of products and even industries exhibits typically four distinct phases – birth, growth, maturity and decline (Audretsch, 2018[9]). The birth phase characterises the development of a new market, often by few “first movers”, i.e. innovating firms that establish a new product or service. The following “growth phase” is the expansion of the sector through the entry of new competitors and continued growth of the initial innovator. Growth slows down through the maturity phase as processes become routinised and firms exit the market as cost reduction in production becomes increasingly important.

The German company SAP provides a prominent example of knowledge spillover through entrepreneurship. Five IBM engineers were involved in working on developing a new product: Scientific Data Systems (SDS)/SAPE software. The company, however, did not value the potential value of the product and decided to drop the project. Convinced of its potential value, the five engineers left IBM and instead started their own firm, System Analysis and Program Development, or SAP, which became Europe’s most prominent example of an entrepreneurial start-up that achieved global dominance. The investment in the new knowledge was made in one firm, IBM, but the actual innovations were realised in the context of a new entrepreneurial start-up, SAP (Audretsch and Lehmann, 2016[100])

High levels of entrepreneurial activity are also likely to characterise the fourth industrial revolution. However, the nature of entrepreneurship and the speed at which young firms can scale due to digital technologies is becoming faster. The pace of technological uptake is becoming increasingly fast: it took 30 years for electricity and 25 years for telephones to reach 10% adoption by households in the United States, but less than 5 years for tablet devices to achieve the same 10% rate. It took an additional 39 years for telephones to reach 40% penetration and further 15 before they became ubiquitous. Smartphones, on the other hand, accomplished a 40% penetration in just 10 years (DeGusta, 2012[101]). The higher speed of innovation came along with a higher risk of failure, with the examples of fast rise and fall of companies like Blackberry and Nokia being paradigmatic examples (Doz, 2017[102]; Inkpen and Himsel, 2017[103]).

The rise of digital platforms is a double-edged sword for regional development and regional innovation policies. Firms and entrepreneurs can access global knowledge and markets through digital platforms, providing opportunities to sell goods and services far beyond the local market. The small rural municipality of Fundão in Portugal decided to partner with a private company that provides intensive courses for software developers that were initially offered in Lisbon and Porto, Portugal’s largest cities. Underpinning the rationale for this initiative was the ability of graduates of the intensive course to live and work from Fundão by offering their services online through digital platforms. The municipality, supported by the Centro region in which it is located, used EU funds to complement the training with the development of a Business and Shared Services Centre that hosts 14 information and communication technology (ICT) for education businesses that have created over 500 jobs, hosted 70 start-ups and over 200 privately-funded innovative projects within the first 4 years of its inception in 2013.11 The advantage of accessing large markets through digital platforms are not limited to programmers that provide digital services but create new opportunities for a wide range of SMEs (OECD, 2019[104]).

Despite the opportunity for global access from all (connected) regions, entrepreneurial activities continue to concentrate in and around urban centres. In Europe, urban areas have an entrepreneurial advantage in terms of high-growth entrepreneurship (Bosma and Sternberg, 2014[105]). In the United States, innovative and entrepreneurial activities are typically urban-based. Technological innovation has been and remains concentrated in urban areas (Paunov et al., 2019[94]) and entrepreneurship (measured as start-up activity) has become even more concentrated in urban areas than innovation (Florida and Mellander, 2016[106]; Forman, Goldfarb and Greenstein, 2016[107]). For new start-ups, there are clusters in areas providing infrastructure (such as co-working spaces, incubators and labs) but other factors play a role for the location decision within cities as well, e.g. access to a pool of skilled workers, specialised finance and suppliers, as well as large multinationals for potential fruitful collaborations (Coll, Jové and Teruel, forthcoming). In Catalonia (Spain) the main hub for start-ups is Barcelona, with smaller cities attracting significantly fewer entrepreneurs. In Barcelona, start-ups cluster within a small number of neighbourhoods located along the east-west trunk road of the city. The same neighbourhoods also provide the highest density of local assets e.g. urban-cultural amenities, good transport accessibility, availability of talent, investors and incubators.

Another concern that is raised by the rise of digital platforms is the potential for platforms to become natural monopolies that stymy innovation. Digital platforms grow through network externalities: the more users a platform has the more interesting it is for providers and vice versa. In such a market, the platform provider can utilise their market power to extract rents that would otherwise support innovative activity. Antitrust tools and frameworks are still adapting to the new environment and might require a reassessment (OECD, 2018[108]).

Skills development was, is and will be crucial

The fourth industrial revolution has the potential to boost labour productivity but concerns abound regarding the potential impact of automation on technological unemployment and inequality. A common characteristic in all industrial transitions is that a broad range of activities that were initially labour intensive are simplified by new tools, machines or even completely replaced or automated. Technological progress and automation represent an opportunity to boost labour productivity – the key determinant of long-term economic and sustainable wage growth. However, automation displaces jobs in the short term, while new jobs enabled by the technological transition can take longer to be created and might not be created in the same place where jobs were initially displaced.

Previous waves of technological breakthroughs have shown that new technologies do not spread evenly across space and results in a variety of outcomes across regions. A common lesson is that high levels of “human capital” are a key element for regional resilience. Human capital is the summary term that economists attach to the knowledge, ability and skills that a person possesses. Equipping workers with the right human capital to give them the flexibility to exit from the industries where labour has been displaced by technology and capital and enter into industries where human skills are still needed is critical to make regions more resilient to industrial transitions (OECD, 2018[82]).

Regions with high levels of human capital are less affected by automation. With some exceptions, the risk of automation decreases as educational attainment required for the job increases. Thus, regions that have a highly educated workforce have a low share of jobs at risk of automation. The OECD (2018[82]) shows evidence of a negative relationship between the risk of automation and the share of workers with tertiary education. Regions that have the highest share of jobs at risk of automation also have the lowest share of workers with tertiary education. Reducing the risk of automation in those regions will therefore require efforts in training and education.

Human capital is more than formal education. Educational attainment alone fails to capture all aspects of knowledge, talent and skills that are critical for regions to manage the current industrial transition to an ever more intensive knowledge economy. Albeit higher levels of education are typically associated with stronger cognitive abilities. Areas with a higher share of jobs relying on routine tasks are likely to experience more disruption, whereas places where more jobs require tacit skills will face lower levels of risk. Tacit skills are based on experience and intuition instead of formal rules. Thus, they are more difficult to replicate through mechanical processes or standard algorithms. These jobs are in occupations such as engineering and sciences, but also those with a large component of social intelligence and creativity.

The skills that are becoming increasingly useful in the coming years are complementing formal education and training. Building on expert judgements, Frey and Osborne (2017[58]) estimate the likelihood that occupations can be automated, and the associated tasks and skills used in the occupations. Those skills that arise in the estimate with a lower risk of being automated are: