Chapter 4. Oilseeds and oilseed products

This chapter describes the market situation and highlights the medium-term projections for world oilseed markets for the period 2019-28. Price, production, consumption and trade developments for soybean, other oilseeds, protein meal and vegetable oil are discussed. The chapter concludes with a discussion of important risks and uncertainties affecting world oilseed markets during the coming ten years.

4.1. Market situation

The downward trend in vegetable oil prices continued in 2018, with average prices reaching a ten-year low. For oil meals and seeds, however, prices peaked in the first half of 2018, but have since experienced a similar, although less dramatic, decline. The high levels of stocks among major exporters, coupled with market uncertainties related to trade talks between the United States and People’s Republic of China (hereafter “China”), have influenced these price trends.

Global soybean production increased in 2018, with the United States and Brazil recording bumper crops, contributing to inventory build-ups. Demand for protein meals has tapered off given China’s imposition of additional tariffs on US soybean exports and subsequent moves to lower the share of protein meal in feed rations. African swine fever continued to affect China’s livestock sector, curbing feed demand. The government recently also supported to decrease the minimum share of protein in feed rations, which was first proposed by a major industry association.

The vegetable oil sector was characterised by a slowdown in global trade, largely reflecting a decrease in edible oil imports by India in 2018. This resulted from an expansion in domestic oilseeds production, combined with increased import tariffs. Several countries also expanded their crushing capacity, thus increasing their seed imports at the expense of oil and meal purchases. Accordingly, exports by the main suppliers of vegetable oil, such as Indonesia and Malaysia, expanded less than average, leading to rising stocks and lower prices. The combination of these factors led to the introduction of higher biodiesel mandates in Indonesia, which drove domestic take up of palm oil for biodiesel production from 3.5 million litres in 2017 to 5.1 million litres in 2018.

4.2. Projection highlights

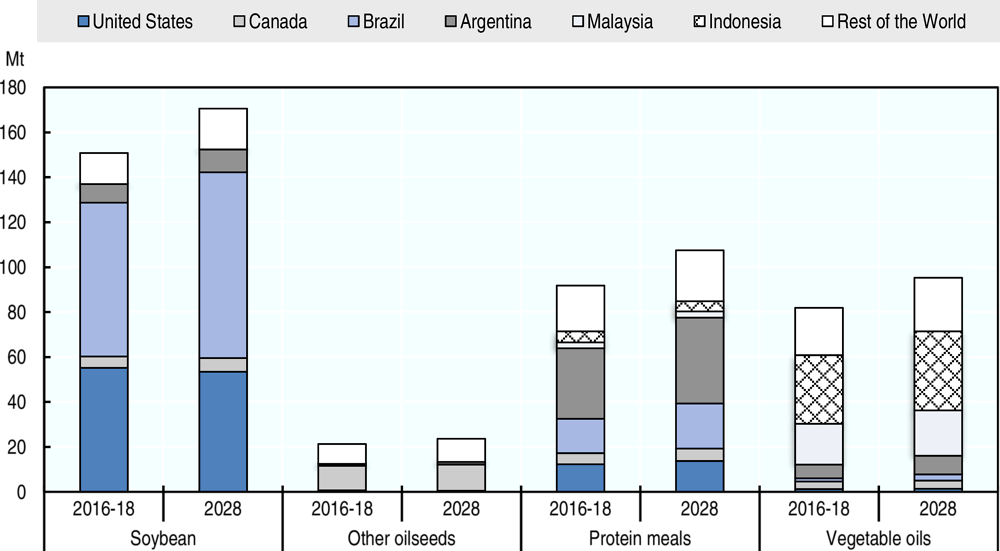

During the outlook period, global soybean production is projected to continue to expand at 1.6% p.a., with the expansion of area harvested accounting for 53% of global output growth. With its domestic output reaching 144 Mt by 2028, Brazil will become the world’s largest producer, overtaking the United States, for which output is projected to be 121 Mt by 2028. Production of other oilseeds will increase by 1.4% p.a. over the next decade, reflecting slower growth relative to the last ten years, due in part to curbed demand for rapeseed oil as a feedstock in European biodiesel production. Crushing of soybeans and other oilseeds into meal (cake) and oil will continue to dominate usage and increase faster than other uses, such as direct food/feed consumption of soybeans, groundnuts and sunflower seeds. Overall, 91% of world soybean output and 87% of world production of other oilseeds are projected to be crushed in 2028.

Vegetable oil includes oil obtained from the crushing of soybeans and other oilseeds (about 55% of world vegetable oil production), palm oil (35%), as well as palm kernel, coconut and cottonseed oils. Despite a slowdown in the expansion of the mature oil palm area, significant production growth is projected in Indonesia (4.6 Mt) and Malaysia (2.3 Mt). However, the rise in Indonesia’s domestic biodiesel requirement will place pressure on vegetable oil supplies in the medium term. Global demand for vegetable oil will expand by +28 Mt by 2028, which is likely to draw down high inventories and support vegetable oil prices over the outlook period.

Soybean meal dominates protein meal production and consumption. Compared to the past decade, the expansion of protein meal utilisation (1.5% p.a. vs. 4.1% p.a.) will be constrained by slower growth in global production of pork and poultry, and by efforts in China to adopt a lower protein meal share in livestock feed rations. As a result, Chinese protein meal use is projected to grow slightly slower than animal production.

Vegetable oil has one of the highest trade shares (40%) of production of all agricultural commodities. Indonesia and Malaysia, the world’s two main suppliers of palm oil – the greatest single component of vegetable oil – will continue to dominate vegetable oil trade (Figure 4.1), exporting over 70% of their combined production and jointly accounting for nearly 60% of global exports.

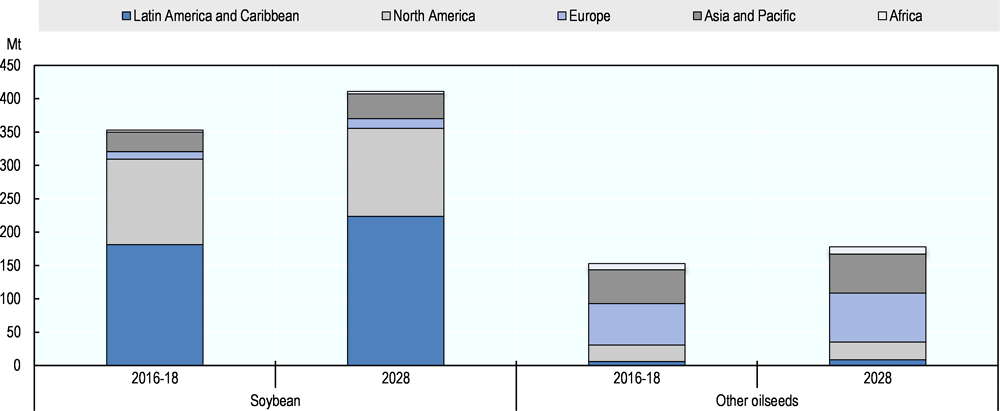

Growth in world trade of soybeans, dominated by the Americas, is expected to slow considerably in the next decade, a development directly linked to the projected slower growth in the crushing of imported soybeans in China. In parallel, Brazil will consolidate its position as the world’s largest exporter of soybean.

The expansion of soybean production and exports by the United States and Brazil will be subject to the outcome of the ongoing trade negotiations between China and the United States. The scope to increase palm oil output in Indonesia and Malaysia will increasingly depend on replanting activities and accompanying yield improvements (as opposed to area expansion), which in recent years have been sluggish given the low profitability of the sector, the limited scale of public replanting programmes in Indonesia, and rising labour costs in Malaysia. Sustainability concerns also influence the expansion of palm oil output as demand in developed countries favours oils not associated with deforestation and seeks sustainability certifications for vegetable oil used as biodiesel feedstock and, increasingly, for vegetable oils entering the food chain.

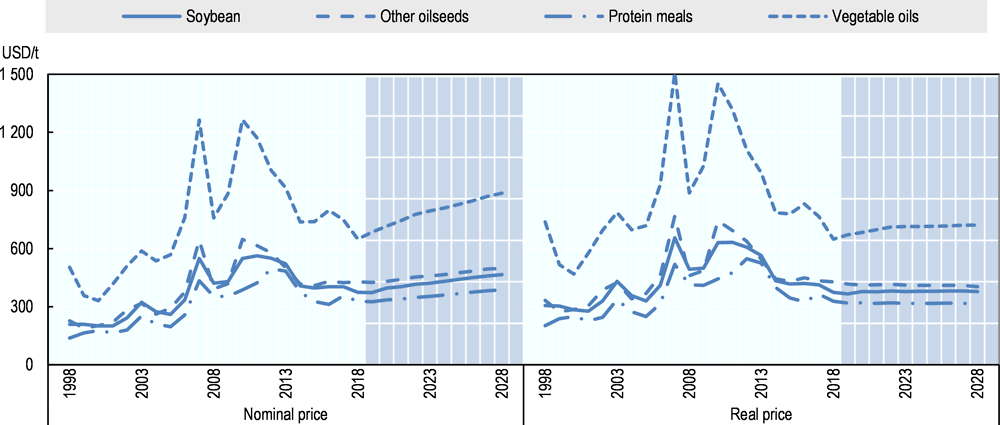

4.3. Prices

Vegetable oil prices, which stand at a thirteen-year low in real terms, are expected to begin an upward trend. Prices are set to recover as the ongoing global expansion of food and oleo-chemical demand for vegetable oil coupled with new domestic demand for vegetable oil as a biodiesel feedstock in selected countries, notably Indonesia will bring down its stocks, which currently stand at a ten-year high level. At the same time, production constraints in major palm oil-producing countries will hamper any major expansion of supplies over the next decade, thus consolidating the upward trend of real vegetable oil prices.

Real prices for soybean, other oilseed and protein meals will decline slightly as demand growth is expected to expand slightly slower than global supplies. Real prices will nonetheless remain above historical troughs (Figure 4.2). In nominal terms, prices of oilseeds and oilseed products are expected to rise over the medium term, although they are not expected to attain previous highs.

4.4. Oilseed production

The production of soybeans is projected to grow by 1.6% p.a., compared to 4.4% p.a. over the last decade. The production of other oilseeds (rapeseed, sunflower seed, and groundnuts) will grow slower than the production of soybeans, at 1.4% p.a. compared to 3.1% p.a. over the past ten years. Growth in other oilseeds is dominated by yield increases, which will account for 64% of production growth, compared to 46% of overall production growth derived from yields in the case of soybeans.

Brazil and the United States are currently producing similar amounts of soybeans (around 120 Mt in 2016-18), but over the next decade, the projected growth in Brazil (1.8% p.a.) should be stronger than in the United States (1.2% p.a.), mainly due to the possibility to expand area planted, mainly through crop intensification by double cropping soybean with maize. In addition, assuming that the additional tariffs China recently introduced on United States soybeans remain in place, Brazilian soybeans will enjoy a competitive advantage in the world’s largest import market. Overall, the production of soybeans will continue to grow strongly in Latin America, with Argentina and Paraguay producing 62 Mt and 13 Mt by 2028 (Figure 4.3). In China, soybean production is expected to resume growth after decreases over the past decade due partly to reduced policy support for the cultivation of cereals. Soybean production is also expected to grow in India, the Russian Federation, Ukraine, and Canada.

China (which produces mainly rapeseed and groundnuts) and the European Union (a major producer of rapeseed and sunflower seed) are the most important producers of other oilseeds, with projected output of 32 Mt and 30 Mt in 2028. However, limited growth in output is projected for both regions (China 1.0% p.a. and European Union 0.6% p.a.) as competitive prices for cereals will generate strong competition for constant to declining arable land. Canada, another major producer and the largest exporter of rapeseed, is projected to increase its production by 1.2% p.a. By contrast, faster growth in other oilseed production is projected for Ukraine and the Russian Federation, in line with the ongoing expansion of the agricultural sector in the Black Sea region. In India, other oilseeds production will expand faster over the next ten years as the government continues to support production in order to respond to domestic demand for vegetable oils and protein meal.

Soybean stocks are expected to remain unchanged, which implies that the world stock-to-use ratio would decline from 12.3% in 2016-18 to 10.7% in 2028. Given the global trend to gradually concentrate oilseed production in a few major producing countries, the declining stock-to-use ratio could result in increased price volatility.

4.5. Oilseed crush and production of vegetable oils and protein meal

Globally, the crushing of soybeans and other oilseeds into meal (cake) and oil dominates total usage. The demand for crush will increase faster than other uses, notably direct food consumption of soybeans, groundnuts and sunflower seeds, as well as direct feeding of soybeans. Overall, 90% of world soybean production and 86% of world production of other oilseeds will be crushed in 2028. The crush location depends on many factors, including transport costs, trade policies, acceptance of genetically modified crops, processing costs (e.g. labour and energy), and infrastructure (e.g. ports and roads).

In absolute terms, soybean crush expands by 61 Mt over the outlook period, well below the 111 Mt expansion of the previous decade. Chinese soybean crush is expected to increase by 19 Mt, accounting for about 31% of the world’s additional soybean crush, the bulk of which will utilise imported soybeans. The growth in China although large is projected to be considerably lower than in the previous decade. Crush of other oilseeds is expected to grow in line with production and its location closer to production compared to soybeans. This implies a much lower trade share for other oilseeds than for soybeans.

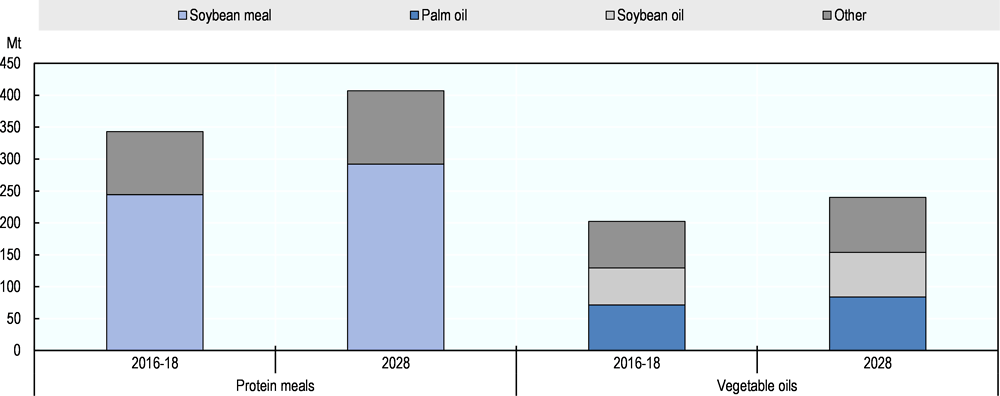

Global vegetable oil production depends on both the crush of oilseeds and the production of perennial tropical oil plants, especially oil palm. Global palm oil output has outpaced the production of other vegetable oils in the past decade. However, the position of palm oil is expected to weaken slightly over the projection period (Figure 4.4). Production of palm oil is concentrated in Indonesia and Malaysia, which together account for more than one third of world vegetable oil production.

Palm oil production in Indonesia is expected to grow by 1.8% p.a. over the projection period compared with 6.9% p.a. in the previous decade. Increasingly stringent environmental policies from the major importers of palm oil and sustainable agricultural norms (e.g. in the context of the 2030 Agenda for Sustainable Development) are expected to slow the expansion of the oil palm area in Malaysia and Indonesia. This implies that growth in production will be increasingly sourced from productivity improvements, including an acceleration in replanting activities. Palm oil production in other countries is expected to expand more rapidly from a low base, mainly for domestic and regional markets. For example, Thailand is projected to produce 2.9 Mt by 2028, Colombia 2.0 Mt, and Nigeria 1.2 Mt. In certain countries of Central America, niche palm oil production is developing from the outset with global sustainability certifications in place, positioning the region for eventually reaching broader export markets. At the global level, palm oil supplies are projected to expand at an annual rate of 1.8%.

In addition to palm oil and oil extracted from the crush of oilseeds analysed above, palm kernel, coconut and cottonseed oil complete the vegetable oil aggregate. Palm kernel oil is produced alongside palm oil and follows the trend of the latter. Coconut oil is mainly produced in the Philippines, Indonesia, and Oceanic islands. Palm kernel oil and coconut oil have important industrial uses, and dominance has shifted towards palm kernel oil along the growing production of palm oil. Cottonseed oil is a by-product of cotton, with global production concentrated largely in India, the United States, Pakistan, and China. Overall, vegetable oil production is expected to increase globally by 1.7% p.a., a higher rate than most agricultural commodities covered in this Outlook.

Global protein meal output is projected to expand by 1.6% p.a., reaching 400 Mt by 2028. World production of protein meals is dominated by soybean meal which accounts for more than two-thirds of world protein meal production (Figure 4.4). Production is concentrated in a small group of countries. Argentina, Brazil, China, the European Union, India, and the United States are projected to account for 75% of global production by 2028. In China and the European Union, most protein meal production comes from crushing of imported oilseeds, primarily soybeans from Brazil and the United States.

4.6. Vegetable oil consumption

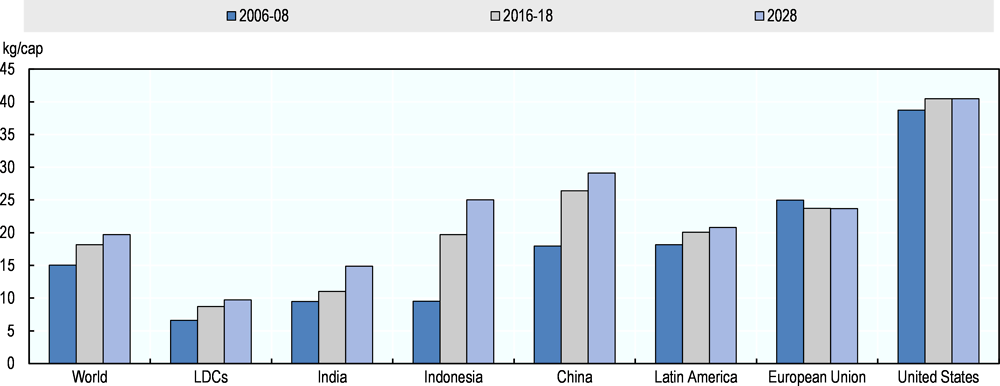

Per capita consumption of vegetable oil for food is projected to grow by 0.9% p.a., which is considerably less than the 2.0% p.a. increase observed during 2009-18. In China (30 kg per capita) and Brazil (24 kg per capita), the per capita level of vegetable oil food availability is set to reach levels comparable to those of developed countries, for which growth in vegetable oil food consumption will level off at 27 kg per capita, growing at 0.4% p.a. (Figure 4.5).

India, the second largest consumer and number one importer of vegetable oil in the world, is projected to maintain a high per capita consumption growth of 3.1% p.a. and to reach 15 kg per capita in 2028. This substantial growth will be the result of both expansion of its domestic production, sourced in the intensification of oilseed cultivation, and a further increase in imports of mainly palm oil from Indonesia and Malaysia. For LDCs, the per capita availability of vegetable oil is projected to increase by 1.2% p.a. to reach 10 kg per capita in 2028.

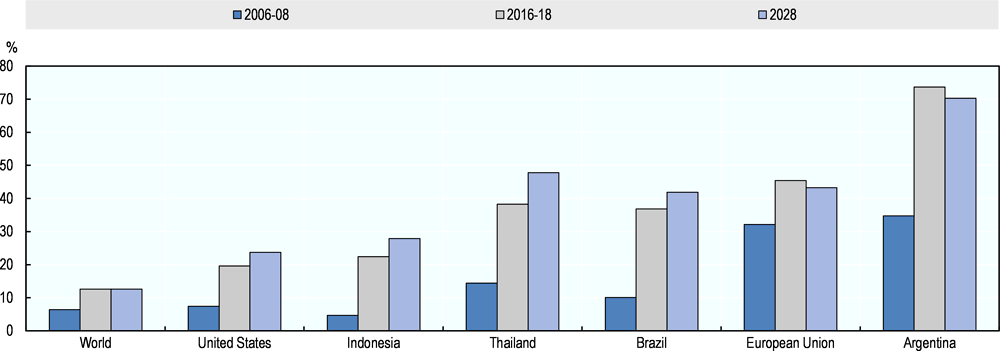

The uptake of vegetable oil as feedstock for biodiesel will remain unchanged over the next ten years, as compared to the 8.5% p.a. increase recorded over the previous decade when biofuel support policies were taking effect. In general, national targets for mandatory biodiesel consumption are expected to increase less than in previous years. In addition, used oils, tallow, and other feedstocks are increasing their share in the production of biodiesel largely due to specific policies (see Chapter 9 for more details on biofuels). Argentina is expected to maintain an export-oriented biodiesel industry (more than half of produced biodiesel is exported). Vegetable oil uptake by Argentina’s biodiesel industry is projected to be 3.2 Mt by 2028, equivalent to 75% of domestic vegetable oil consumption (Figure 4.6). Indonesia, Brazil, and Thailand recorded strong growth in biodiesel production over the last decade, but this is expected to taper off in the coming decade but expected to exceed overall food demand growth for vegetable oil, in part underpinned by support measures to stimulate domestic biodiesel consumption.

4.7. Protein meal consumption

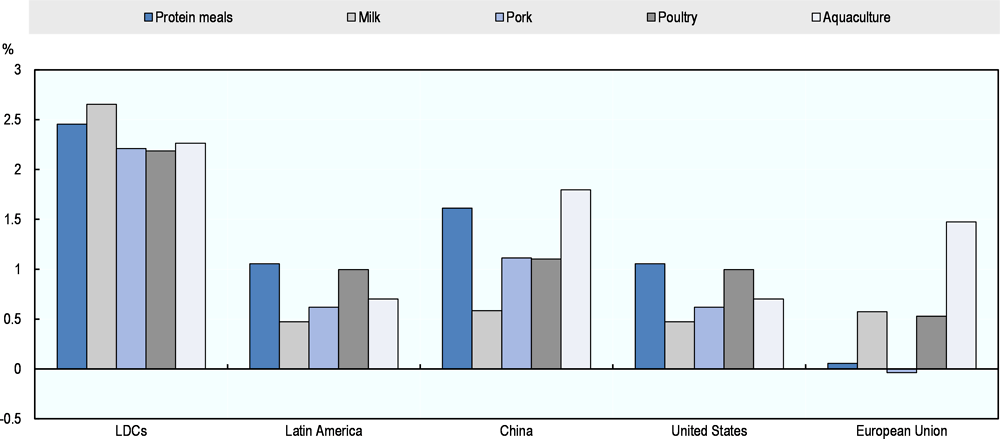

Protein meal consumption is expected to continue to grow at 1.6% p.a., considerably below the last decade’s growth rate of 4.2% p.a. The growth in protein meal consumption is closely linked to the development of feed demand, as protein meal is exclusively used as feed. The link between animal production and protein meal consumption is associated with a country’s degree of economic development, with backyard production characterising lower income producers and industrial production the norm in higher income economies (Figure 4.7).

Because of a shift to more feed-intensive production systems in developing countries, growth in protein meal consumption tends to exceed growth in animal production. In LDCs, where the use of protein meals is very low, intensification in livestock production with more widespread use of commercial feed is expected to continue. The use of protein meal per unit of livestock production should increase considerably leading to fast growth in total demand in these countries. In countries such as the United States and in the European Union, where most animal production is compound feed-based, protein meal consumption are expected to grow at similar rates as for animal production.

Protein meal consumption growth in China is projected to decline from 6.3% p.a. in the last decade to 1.6% p.a. Growth in China’s compound feed demand is expected to shrink due to declining growth rates for animal production and the existing large share of compound feed-based production. Furthermore, the protein meal content in China’s compound feed surged in the last decade and considerably exceeds at present the levels found in the United States and European Union. To address this issue, the government of China recently supported a downward revision to the recommended protein content in feed rations which was originally proposed by a major industry association.

4.8. Trade

Over 40% of world soybean production is traded internationally, a high share compared to other agricultural commodities. Compared to the previous decade, the expansion in world soybean trade is expected to decelerate considerably during the outlook period. This development is directly linked to projected slower growth of the soybean crush in China.

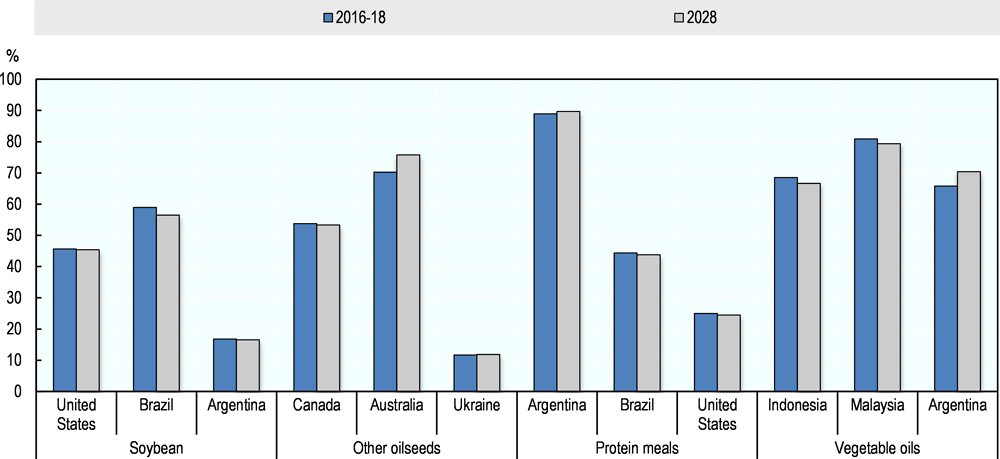

Chinese soybean imports are expected to grow by 1.5% p.a. to about 113 Mt in 2028, accounting for about two-thirds of world soybean imports. Exports of soybeans originate predominately from the Americas; the United States, Brazil and Argentina are projected to account for 87% of world soybean exports in 2028. Whereas the United States was historically the largest global exporter of soybeans, Brazil has taken that role with steady growth in its export capacity. By 2028, it is projected that Brazil will account for 42% of total global exports of soybean. This development is favoured by the additional 25% tariffs applied by China on soybean imported from the United States. It is assumed these tariffs will remain in place throughout the outlook period.

For other oilseeds, its share of global production trade is much lower than that for soybeans, at about 14% of world production. Important exporters are Canada, Australia, and Ukraine, which together are projected to account for more than 75% of world exports by 2028. In Canada and Australia, more than half of the other oilseed (rapeseed) production is exported (Figure 4.8).

Vegetable oil exports, which amount to 41% of global vegetable oil production, continue to be dominated by a few players. Indonesia and Malaysia will continue to account for almost two-thirds of total vegetable oil exports during the outlook period. Argentina is projected to become the third largest exporter (mainly of soybean oil), reaching about 7.9% of the world vegetable oil exports in 2028. In all three countries, it is expected that exports will account for more than two-thirds of the domestic production of vegetable oil. However, this share is projected to contract slightly in Indonesia and Malaysia as domestic demand for food, oleochemical and especially biodiesel uses is expected to grow more than exports. India is expected to continue its strong growth in imports at 3.7% p.a., reaching 22 Mt in 2028, or about a quarter of world vegetable oil imports.

The expected growth in world trade of protein meal is around 1.5% p.a. over the outlook period, down from 3.6% p.a. during the last decade, and will be characterised by a declining share of trade in global production. This shift is projected as the global expansion of meat production will be concentrated in the main oilseed-processing countries, where the use of locally-produced protein meal will increase, and thus trade will expand only slightly.

Argentina will remain the largest meal exporter because it is the only major protein meal producer with a clear export orientation. The largest importer is the European Union, with imports projected to remain almost unchanged at 28.1 Mt in 2028. More than half of the 18 Mt global import growth in protein meal will occur in Asia, especially in Viet Nam, Pakistan, and Thailand. Domestic crushing capacity in these countries are not expected to keep pace with protein meal demand, and expansion of the livestock sector will therefore require imported feed to meet production requirements.

4.9. Main issues and uncertainties

The uncertainties common to most commodities (e.g. macroeconomic environment, crude oil prices, and weather conditions) apply to oilseeds and products. Due to the concentration of production in a few regions of the world, the production impact of weather variations is more pronounced in the oilseeds and palm oil complex than in other major crop markets.

The expansion of soybean production in the United States and Brazil will be subject to the outcomes of the ongoing trade negotiations between China and the United States, which could result in an expansion of soybean cultivation in Brazil to respond to Chinese demand and the parallel conversion of soybean area to maize in the United States. The evolution of such negotiations could also influence demand for other oilseeds from other origins, replacement effects, and the volume of China’s imports of meals and oils.

Consumer concerns regarding soybeans stem from the high share of soybean production derived from genetically modified seeds. In the European Union in particular, certification schemes of animal products based on feed free of genetically modified products are gaining momentum and may shift feed demand to other protein sources. Environmental concerns are also on the rise, especially with respect to a potential link between deforestation and increasing soybean production in Brazil and Argentina. These concerns have motivated the private sector to incentivise the use of land already cleared for further area expansions. If successful, these voluntary initiatives should discourage further clearing of land by soybean producers.

The scope for increasing palm oil output in Indonesia and Malaysia will increasingly depend on replanting activities and accompanying yield improvements (as opposed to area expansion), which in recent years have been sluggish given the low profitability of the sector, the limited scale of public replanting programmes in Indonesia, and rising labour costs in Malaysia. Sustainability concerns also influence the expansion of palm oil output as demand in developed countries favours deforestation-free oils and seeks sustainability certifications for vegetable oil used as biodiesel feedstock and, increasingly, for vegetable oils entering the food chain.

Certification schemes, labelling, and environmental legislation might curb area expansion in key palm oil-producing countries and purchases by major importers, which would eventually affect supply growth. These concerns present specific constraints to the further expansion of oil palm plantations and their export for Malaysia and Indonesia.

The demand for vegetable oil as feedstock for biodiesel is levelling off after its rapid growth beginning in 2000 when domestic biofuel policies were first implemented in several countries. In the United States, the European Union, and Indonesia these policies remain a source of major uncertainty in the vegetable oil sector given that about 12% of global vegetable oil supplies go to biodiesel production. In the European Union, policy reforms and the emergence of second-generation biofuel technologies will likely prompt a shift away from crop-based feedstocks. In Indonesia, the attainability of the recently proposed 30% biodiesel mandate remains to be seen, in view of the fact that it may impose medium term supply constraints. The development of mineral oil prices, which affects the profitability of biodiesel production, also remains a major source of uncertainty in the vegetable oil sector.

Protein meals compete in part with other feed components in the production of compound feed and are thus reactive to any change in cereal prices. In addition, changing feeding habits, especially in the cattle sector, can alter the demand for protein meals. Ongoing adjustments in domestic cereal prices in China, for example, will affect the composition of its compound feeds, which currently contain a higher share of protein meal than in developed countries and other major emerging economies.