1. Recent trends in SME and entrepreneurship financing

This chapter reports on trends and conditions in SME access to finance. It analyses the impact of the COVID-19 pandemic on SME and entrepreneurship financing in 2020 and 2021 based on national data and demand-side surveys. It first provides a brief overview of macroeconomic conditions and the business environment since 2020. It then analyses the provision of SME financing through different instruments, as well as trends in credit conditions, bankruptcies, payment delays and non-performing loans. It concludes with an overview of recent trends in SME finance support policies.

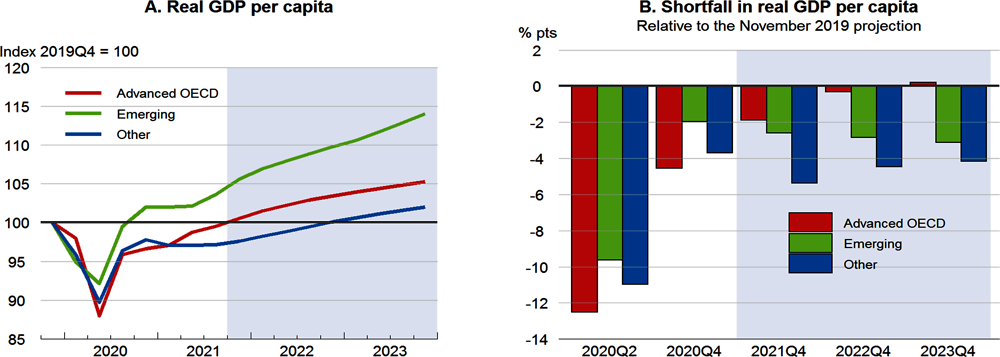

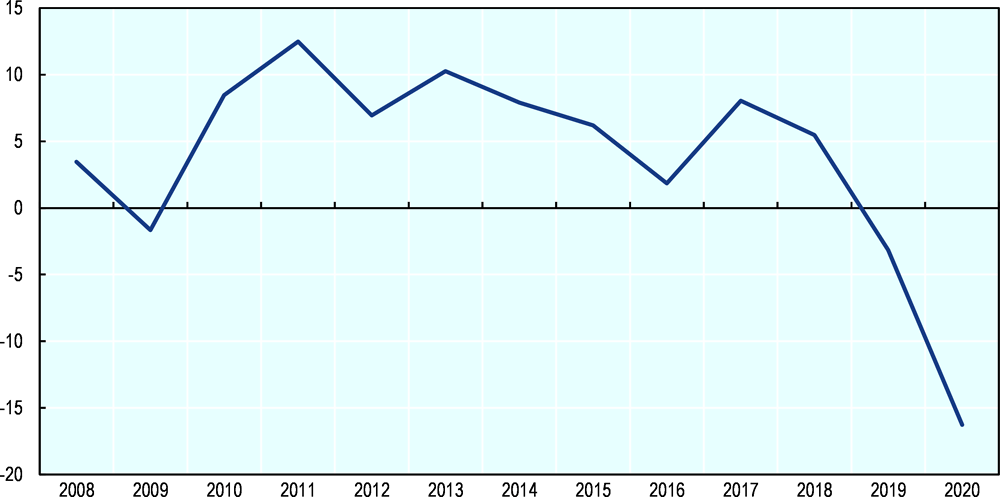

The COVID-19 pandemic has had a significant economic impact. Global GDP declined by 3.5% in 2020 as a result of confinement-related shutdowns, depressed demand and disruptions in value chains. (OECD, 2021[1]). In contrast to the great financial crisis, the economic contraction provoked by the COVID-19 pandemic hit developed and developing countries alike, with almost all economies reporting negative growth in 2020 (OECD, 2021[2]). Despite global GDP rebounding to 5.6% in 2021, the recovery differs significantly across countries and is projected to continue to diverge. Most advanced economies and emerging economies have already reached pre-crisis real GDP per capita levels, while other developing countries are expected to reach these levels by 2022 (Figure 1.1, left panel). However, the shortfalls relative to the November 2019 projections for real GDP per capita remain relatively high in emerging and developing economies, reflecting largely the relatively lower speed of vaccine rollouts as well as the relatively lower levels of fiscal support that can be deployed to support the recovery efforts (Figure 1.1, right panel).

However, these projections have been impacted by the war in Ukraine. While the most important consequences have been the lives lost and the humanitarian crisis associated with the huge numbers of besieged and displaced people, there are also significant economic implications. The economic impact of the conflict is highly uncertain, but as of March 2022, it is estimated that it could reduce global growth projections by 1% in the first full year after the start of the conflict, while global inflation could rise by close to 2½ percentage points (OECD, 2022[3]).

The pandemic has had a particularly strong impact on SMEs. At the height of the crisis, over 50% of SMEs reported a strong drop in revenue and were at risk of being put out of business in less than three months, according to more than 40 business surveys conducted in 2020 around the world. Micro and small enterprises were particularly hard hit, with nearly two thirds of these firms reporting significant impacts from the crisis, compared to about 40% of large enterprises (International Trade Centre, 2020[5]). SMEs in developing countries were even more affected due to the limited scale of government support1 or to the allocation of resources to large companies (World Bank, 2021[6]).Informal SMEs have also been greatly affected (ILO, 2020[7]).

The pandemic significantly disrupted world trade, which was already under considerable strain over the previous decade. In 2020, global trade registered an 8.5% decline in real terms (OECD, 2021[1]). In 2021, it rebounded, increasing 9.3% with respect to 2020 (OECD, 2021[4]). However, trade in services was particularly impacted by the crisis, declining by 21% in 2021 on account of a sharp decline in travel (-81% y-o-y in Q2 2020 and -68% y-o-y in Q3 and Q4 of 2020) and transport services (-20% y-o-y in Q2 and -14% y-o-y in Q3 of 2020) (WTO, 2021[8]). Trade in goods also contracted, though by a more moderate 5.8%, having rebounded following a 25% y-o-y decline in second quarter of 2020 (WTO, 2021[9]).

SMEs were impacted strongly by trade disruptions along the value chain. The biggest disruptions occurred in Q2 of 2020, with strict lockdown measures in many economies, but frictions have persisted through 2020 and into 2021. In China, exports fell about 21% in February 2020 compared to the same period in 2019, before beginning to recover (International Trade Centre, 2020[5]). In the last quarter of 2020, 69% of SMEs in Europe reported having difficulties in importing materials, goods and services, and 46% reported specifically facing disruptions to supply chains, which led to shortages of goods. SMEs also incurred additional financial costs due to these disruptions, with 26% reporting paying higher prices, and 39% facing late payments compared to the same period in 2019 (European Commission, 2021[10]). In 2022, SMEs in some sectors are encountering challenges as a result of increased volatility and price increases in commodity markets. Russia and Ukraine together account for about 30% of global exports of wheat, 20% of corn, mineral fertilisers and natural gas, and 11% of oil. (OECD, 2022[3]). SMEs that rely on these inputs, particularly European SMEs, are likely to be affected.

Supply chain disruptions persisted in 2021 and early 2022. The sharp rise in the demand for goods, in combination with the re-introduction of pandemic restrictions including China’s zero-COVID policy, has congested the world busiest ports and exhausted shipping capacity. With important ports closing, and the restriction on movement causing significant shortage of workers and drivers, in October 2021, the global delivery time index registered the worst month on record. This has impacted inventories, causing shortages and affecting manufacturers worldwide (Reuters, 2022[11]). As a result global shipping costs have soared, increasing by 343% y-o-y as October 2021 according to the Freghtos Baltic Index (CFR, 2021[12]).

The strong financial impact on enterprises, as well as the uncertainty that gripped the world in the midst of the pandemic, also had a strong impact on investment. Measured as gross fixed value formation, investment declined sharply in Q2 of 2020 (-11.5% y-o-y in OECD countries), but it has rebounded since in most advanced economies and emerging markets. (OECD, 2021[13]) (OECD, 2021[4]). According to surveys, SME fixed investment has followed the same trend (ECB, 2021[14]). Meanwhile, foreign direct investment (FDI) was particularly strongly hit, declining by 42% in 2020 (UNCTAD, 2021[15]). In the first half of 2021 however, global FDI rebounded strongly, with inflows in the first two quarters of 2021 recovering more than 70% of 2020 losses (UNCTAD, 2021[16]).

Financial conditions did not deteriorate significantly in 2020 and 2021, in large part due to swift and strong action of governments and monetary authorities around the world. Almost all central banks implemented monetary easing to swiftly inject liquidity into the economy. In high income countries with already record low interest rates, central banks took unconventional measures such as large emergency purchases of securities, and easing of collateral standards and capital requirements for financial institutions to prevent a credit crunch (Federal Reserve Bank of New York, 2020[17]) (ECB, 2020[18]). In many economies, these measures were accompanied by temporary regulatory easing for commercial banks as well as moratoria on principal and/or interest payments for enterprises. Complementary fiscal measures, including credit guarantee schemes, subsidised lending, tax deferrals, etc., were also introduced to keep credit flowing and stave off a potential solvency crisis (see more under Government Policy Responses section).

In 2022, conditions are tightening in financial markets around the world, reflecting greater risk aversion and uncertainty. A tighter monetary policy stance to counter inflation is leading to higher interest rates, which are likely to impact the conditions for SME borrowing (OECD, 2022[3]).

The COVID-19 crisis and related policy interventions had a significant impact on the dynamics of lending to SMEs in 2020. At the beginning of the crisis, SME liquidity needs soared due to significant revenue shortfalls. While some of these shortfalls were offset by lower expenses due to temporary closures, as well as relief measures such as tax deferrals, wage subsidies and moratoria on debt repayments, remaining gaps had to be filled with new financing. Moreover, many SMEs sought to build up precautionary liquidity buffers in light of the uncertain evolution of the pandemic. (Falagiarda, Prapiestis and Rancoita, 2020[19]).

New SME loans

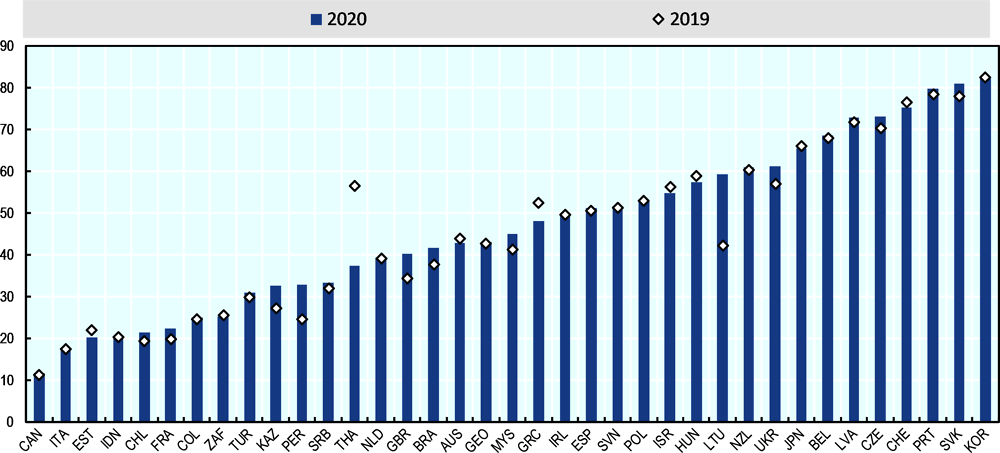

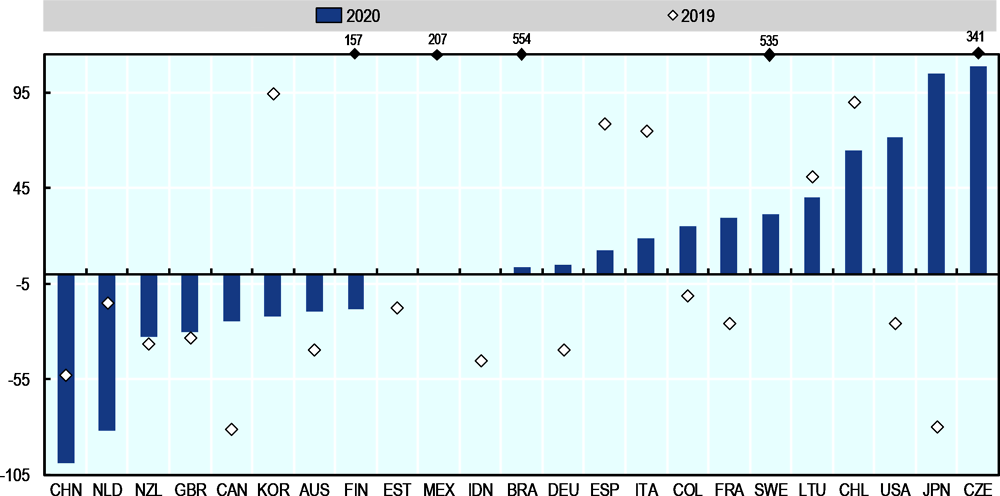

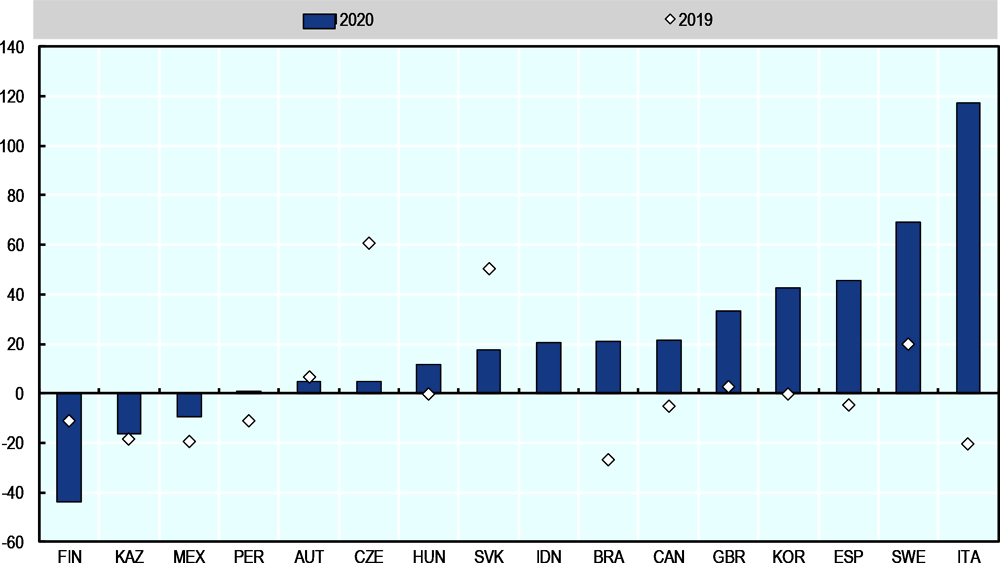

Many economies recorded an increase in new SME lending in 2020, supported by accommodative monetary policy and government support measures, including credit guarantees, direct lending through public banks, and other instruments (see Section 0 Government policy responses in 2019-20).

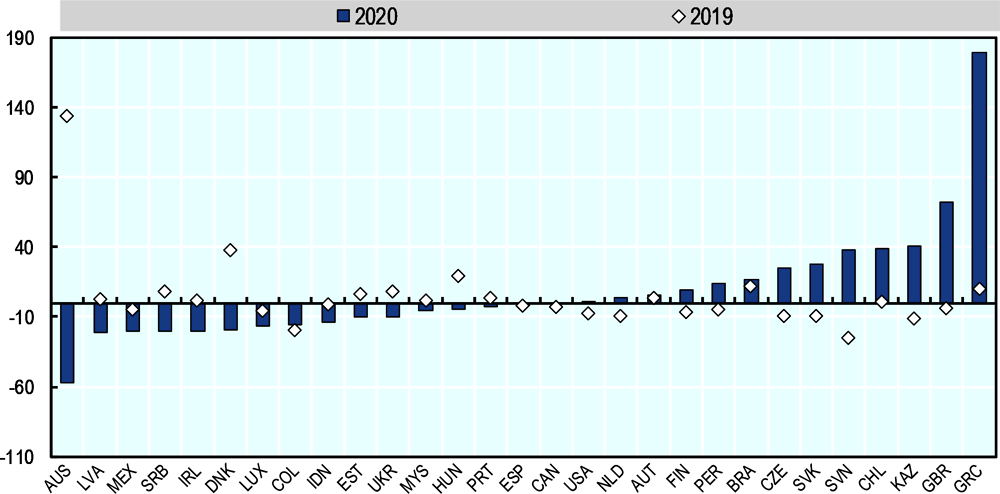

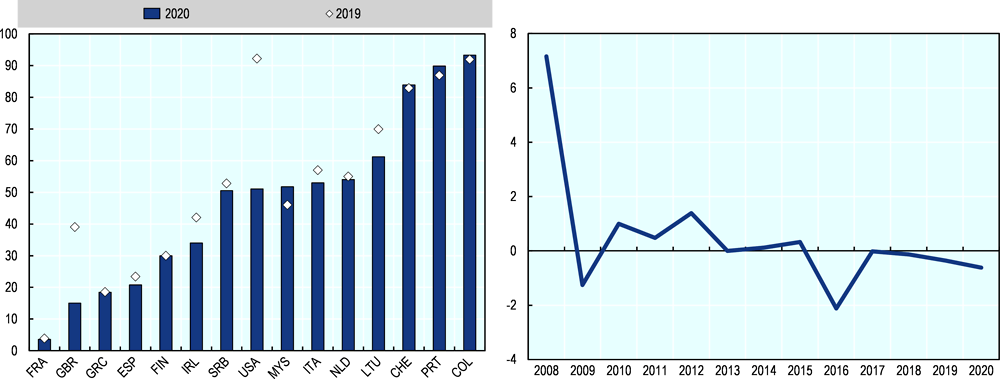

In a few economies, new lending surged in 2020: Greece (+179.5%), United Kingdom (+72.44%), Kazakhstan (+41%), Chile (+38%), Slovenia (38%), the Slovak Republic (+27.6%) and the Czech Republic (+24.7%) (Figure 1.2). In these economies, strong demand from liquidity-constrained SMEs - many operating in highly impacted sectors such as tourism, wholesale and retail trade, transport, etc. - was met with the expansion of existing SME-related government support programmes2 and the introduction of new crisis-related measures (see Government policy responses). The increase in lending also reflected an increase in precautionary borrowing spurred by favourable credit conditions and relatively faster and easier access to bank loans. Last but not least, in some economies, the significant restructuring and renegotiation of loans introduced under the COVID-related debt moratoria contributed to the increase in new loans (see Box 1.1 and Section on Government policy responses in 2019-20).

On the other hand, in many other Scoreboard economies, new lending was either subdued or declined despite significant liquidity support provided by monetary and fiscal authorities (Figure 1.2). This did not necessarily mean that liquidity needs of SMEs went unmet. As noted earlier, lower demand for new loans can also explain the observed decline in new lending. Lower investment needs, recourse to public financing schemes (direct lending, grants, equity, etc.) and reliance on alternative liquidity support measures (deferrals, wage subsidies, debt moratoria, etc.) limited SMEs’ need for bank credit (see Box 1.1). This was especially the case in more advanced economies where ample fiscal and monetary support was provided to avoid a credit crunch3 (Falagiarda, Prapiestis and Rancoita, 2020[19]) (see Box 1.1).

That said, SME surveys also pointed to supply-side constraints in the banking sector as well. For example, in Australia, which registered the highest decline in new lending across the Scoreboard countries, a study covering 1 750 Australian SMEs found that the SME financing gap widened considerably between 2019 and 2021, increasing by AUS 4.6 billion to AUS 94.3 billion. The survey found that 1 in 4 SMEs, most of which bank with the four largest banks in Australia, were not able to secure a loan in 2020 (Judo Bank, 2021[20]) In Denmark, too, credit declined despite increased demand for new loans among SMEs (see Denmark country profile). In Serbia, new lending to SMEs fell considerably despite the introduction of a new credit guarantee scheme. The sharp rise in rejection rates further suggests that the increased demand for new lending among Serbian enterprises might not have been fully met by the banking system (see section on Rejection rates).

In Chile, the high growth in new lending reflects the significant boost of funding (USD 3 billion) and lower access requirements to the Small Business Guarantee Fund (FOGAPE)’s through the newly established COVID-19 scheme. The sharp increase also reflects a relatively low base: SMEs account for just 21% total outstanding business loans (see Chile country profile).

In Greece, the sharp rise in lending also reflected the relatively low base of lending prior to the crisis. New SME lending (as all other enterprise lending) had been on a downward trend since the start of the global financial crisis, constrained by a weak post-recession recovery and a high and rising share of SME non-performing loans (NPLs) (36% of total loans in 2019). Thus, at EUR 3.5 billion, new SME loans in 2020 still accounted for just above a quarter of the value of new SME loans in 2008 (EUR 12.5 billion). The surge in new demand for loans in Greece likely also reflected the relatively high share of SMEs in sectors strongly affected by the crisis, such as tourism (see Greece country profile).

In Slovenia, 2020 saw an increase in precautionary borrowing as evidenced by the value of approved credit lines which have largely remained undrawn. New lending was further boosted by renegotiated and restructured loans under the legislative moratoria related to Covid-19, which are classified as new loans under the methodology of the Bank of Slovenia. This explains in part the divergence between the strong increase in new lending (23% y-o-y, inflation adjusted) and the decline in the outstanding stock of SME loans (see section below on Outstanding stock of SME loans; Slovenia country profile).

In the United Kingdom, the high spike in new lending to SME reflects significant precautionary borrowing by SMEs against 100% government guarantees in the Bounce Back Loan scheme (BBLS) to build up liquidity buffers: 23% of applicants in the scheme had used none of the facilities (Klahr et al., 2021[21]). Similarly, the provision of BBLS loans with broad eligibility criteria, a swift application process (loans approved within 24 to 72 hours), a long grace period and a 100% government guarantee may have contributed to a larger number of SMEs receiving loans compared to other Scoreboard economies (National Audit Office, 2020[22]).

In the United States, unprecedented financial support was provided to SMEs through the Paycheck Protection Programme (PPP) (USD 525 billion through 5,460 lenders) and other programmes. However the lending provided through the programme was subject to forgiveness upon proof of retained employment which resulted in most financial support (over USD 600 billion) being eventually extended in grant form (see United States country profile). This accounts for the relatively limited growth in new lending in 2020.

Source: Scoreboard country profiles.

Most upper middle income economies recorded a decline in new SME lending – with the median lending rate declining by 5.47% (Figure 1.3).This likely reflected the more limited government support relative to advanced economies and/or more limited transmission of the support measures. For example, advanced economies spent 8.4 % of GDP on average on stimulus measures, compared to 6.4% of GDP in middle income economies (UNCTAD, 2020[23]). Some middle-income countries also had limited scope for loosening monetary policy given inflationary pressures, potential capital outflows and upward pressures on exchange rates (OECD, 2020[24]), which had implications for interest rates and credit growth. Furthermore, in middle-income economies, the risks associated with lending to SMEs and enterprises in general are comparatively higher and banks can be less incentivised to lend, especially in a crisis situation. Therefore, even if instruments were deployed by governments to enhance new lending for SMEs, this lending did not always materialise at the expected rate unless credit guarantee schemes fully transferred the risks of new lending from banks to the government, which was not the case in all Scoreboard upper-middle income countries. Finally, the lower increase in new lending may also be attributable to lower demand for loans due to shorter and less strict lockdowns in some of these economies, as well as the availability of alternative sources of liquidity support (i.e. deferrals, subsidies and grants etc.) (Figure 1.2) (ECB, 2020[25]).

Outstanding stock of SME loans

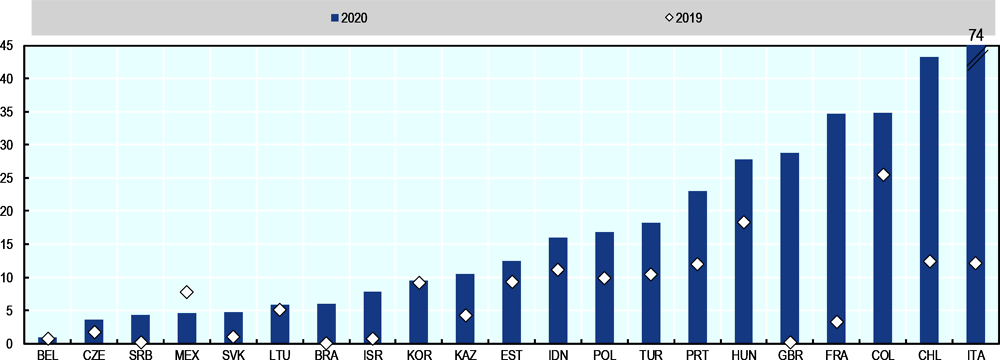

In most Scoreboard countries (27 out of 41 countries that provided data for this indicator), the stock of outstanding SME loans increased in 2020 (Figure 1.4). In many economies, such as France, Kazakhstan, Turkey and the United Kingdom, this reflects the significant growth in new SME lending, as discussed the previous section. However, changes in outstanding SME loans also reflect other dynamics that were impacted by the pandemic and related measures, including the pace of loan repayments and changes in the maturity of loans. The large use of debt moratoria, for example, affected the pace of loan repayments across most Scoreboard economies (29 out of 46 countries), and the extensions of loan maturities as part of debt restructuring schemes resulted in many SME loans remaining on bank balance sheets longer than they would have otherwise (OECD, 2021[2]).

In 2020, many countries (14 out of 41 countries that provided data for this indicator) recorded a decline in the stock of loans. Contributing factors include sluggish growth or declines in new lending due to limited investment opportunities and/or recourse to public crisis-related financing schemes, coupled with (accelerated) debt repayment. In some countries, the decline also reflected continued deleveraging of the private sector following the global financial crisis, and the sale and/or restructuring of NPLs and other loans (the latter as part of the debt moratoria schemes) (see Box 1.2).

In France, the stock of SME loans rose sharply on account of a strong increase in new lending through government-supported programmes and debt moratoria. French SMEs had increased their equity and had deleveraged significantly prior to the crisis, which enabled them to take on more debt in 2020. Data from the Bank of France show that the share of equity in total financial resources had risen from 37.8% in 2007 to 44% in 2019. This gave SMEs greater borrowing capacity to increase their liquidity in the midst of the crisis. The Bank of France shows that indeed in 2020, SMEs requested state-guaranteed loans worth EUR 95 billion, representing 75% of loans approved as of December 2020 (Banque de France, 2021[26]).

In Greece, the stock of SME loans declined despite a strong increase in new lending (170%, inflation adjusted). This was mainly the result of significant removal of NPLs from Greek banks’ balance sheets (from 36.1% of total loans in 2019 to 28.5% of total loans in 2020) through the introduction in late 2019 of the “Hercules” asset-protection scheme. The scheme, which was extended in mid-2021, enabled the sale of NPLs to a private securitisation vehicle that could subsequently sell more senior securities backed by these assets and guaranteed by the state (see Greece country profile).

In Ireland, the decline in new SME lending and the stock of outstanding loans in 2020 represented a continuation of a long-term deleveraging trend following the global financial crisis. According to the SME Credit Demand Survey, SMEs’ demand for loans declined in 2020, dampened by prolonged closures and the availability of alternative Government support that helped businesses reduce their expenditures (direct grants and payments to closed or impacted businesses, tax warehousing, support for wage payments). Data from the Central Bank of Ireland showed a significant increase in the deposits of private enterprises, including SMEs, which further confirms that the most likely reason SMEs did not access credit was the sufficient availability of internal funds.

In Italy, the State guarantee system was boosted by giving SACE, the Italian export credit agency whose tasks were redefined, the role of providing public guarantees to large firms. The initiative was also extended to SMEs that had exhausted their ability to access the Central Guarantee Fund. This, in combination with other provisions, such as the roll-out of a debt moratorium to help firms cope with temporary liquidity shortages, dampened the demand for bank credit. Italy thus saw only a modest increase in the outstanding stock of SME loans.

In Korea, the stock of SME lending rose by 10.6% compared to 2019. The increase is explained by government support measures, including the extension of loan maturities as well as debt moratoria of principal and interest of loans (worth KRW 209.7 trillion – from April 2020 to July 2021) provided to SMEs affected by the COVID-19 crisis. The deferral of principal payment was further extended with KRW 12.1 trillion, and the deferment of interest payments with KRW 209.7 billion.

In Peru new SME lending increased by 13.8% in real terms, and the outstanding stock of SME loans grew by a remarkable 60% in real terms. This marked a notable change in a multi-year trend of relatively subdued or negative growth in the stock of loans. The government support programmes Reactiva Peru and Fondo de Apoyo Empresarial- FAE-MYPE) gave a significant boost to new SME lending. The stock of loans was further boosted by the introduction of alternative liquidity support measures, such as a credit rescheduling programme, which was implemented to limit the risks of default, but also enabled loans to remain on banks’ balance sheets longer.

In Poland, bank surveys indicated that there is limited demand for new lending due to the use of government support programmes. This was accompanied by high debt repayment rates (94.5% of companies declared timely settlement of credit liabilities), which resulted in a net decline in the stock of loans.

Source: Country profiles.

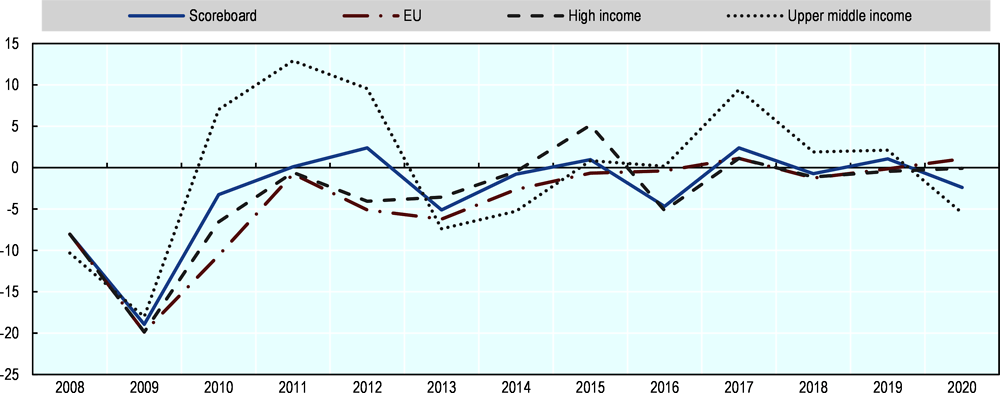

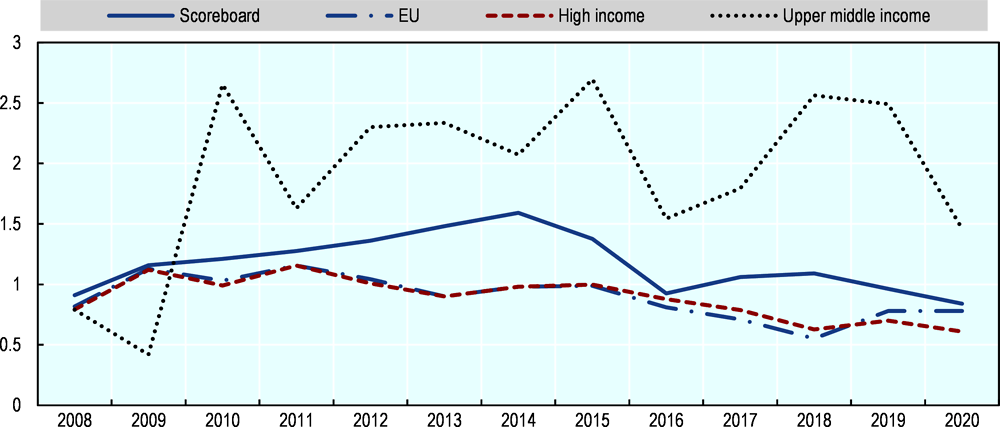

All of these factors contributed to a notable increase in the stock of outstanding SME loans: the median year-on-year growth for all Scoreboard countries rose to 4.94%, the highest in the Scoreboard’s history. The largest increase was registered in upper middle-income countries (12.7% increase in the group median), which marked a sharp reversal of the pre-crisis trend of declining outstanding stock of loans. The European Union experienced the smallest increase among all groups, at 0.97%, though the positive growth represented a reversal of a three-year trend of declining stock of outstanding SME loans (Figure 1.5).

SME loan shares

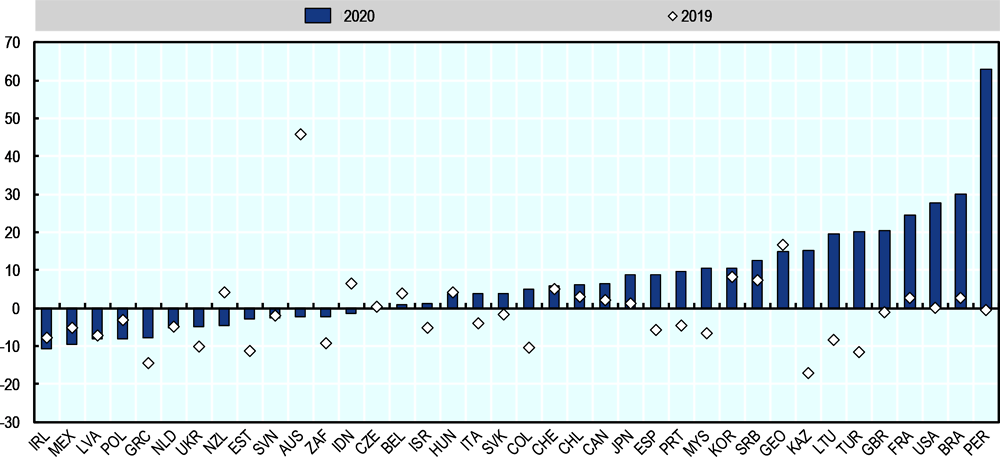

The composition of enterprise lending between SMEs and large enterprises did not change significantly in 2020 in most Scoreboard countries (Figure 1.6). This means that, contrary to what might have been expected, the COVID-19 crisis did not shift lending away from riskier clients like SMEs and toward larger enterprises. This also suggests that the strong policy response and focus on SME support in COVID-19 rescue packages likely shifted the balance in favour of SMEs, especially in the provision of liquidity support, if not financing for investment (see Chapter 2). A BIS study found that measures that strengthen bank’s lending capacity by encouraging flexibility in loss accounting and by preserving their capital, contributed to lending growth, with SMEs being the main beneficiaries. Likewise, increases in the coverage of guarantee programmes was associated with banks reporting accommodative lending standards and high lending to SMEs (BIS, 2021[27]).

In countries that saw the share of SME lending increase in 2020 (Figure 1.6), the driving factors differed. In Lithuania, for example, the share of SME loans increased by 17.1 percentage points in 2020, but this was mainly on account of large enterprises’ lower demand for loans tempered by postponed investments, reserved sales and alternative state support (e.g. tax deferrals) (see Lithuania country profile). In other countries, like Brazil and Peru, new lending to SMEs, which was largely government provided or backed, accounted for most of the increase in the relative share of SME loans in 2020 (see Brazil and Peru country profiles). In Peru, for example, 98.6% of the beneficiaries of the Reactiva Peru programme were SMEs (see Peru country profile).

In 2020, the share of outstanding SME business loans ranged from around 20% or less in Canada, Italy, Estonia, Indonesia, Chile and France, to more than 70% in Latvia, the Czech Republic, Switzerland, Portugal, the Slovak Republic and Korea (Figure 1.6). Interestingly, it is in the first group of countries (where the proportion of SME lending is lower compared to large firms) that there is less variation of the group median between 2019 and 2020, when compared to the second group of countries. This can be explained by the structure of the corporate sector in such economies where the presence of large firms is stronger (OECD, 2020[28]), and thus cyclical disruptions do not have a large impact on lending rates.

SME loan shares generally remain lower in developing and middle-income countries (Figure 1.6). This reflects, among other factors, higher levels of informality. In Colombia and South Africa, for example, an estimated 60% and 58% of businesses respectively operate informally (see country profiles). This high prevalence of informality also contributes to the lack of access to finance, as the benefits of formalisation are not well known and understood by business owners. Informality also contributes to financial exclusion from formal financial services: in South Africa, for example, about 28% of enterprises are informally served, while 15% are financially excluded (see South Africa country profile). The COVID-19 pandemic is likely to have exacerbated the challenges of informality, as a large share of formal businesses closed during the pandemic but many of these likely continued to operate informally (see more in Section 1.6.2 on Bankruptcies).

The relatively lower share of SME loans in developing and emerging countries can also be explained by the large proportion of SME owners that request credit on their personal accounts, to be used for business purposes. In South Africa, only 34% of businesses use formal financial accounts in the business’ name. This not only increases the risk of excessive personal indebtedness and affects the owners’ credit profile and history, but it also means that these businesses do not benefit from access to adequate financial products. This also impedes banks’ adequate monitoring of corporate credit (see South Africa country profile).

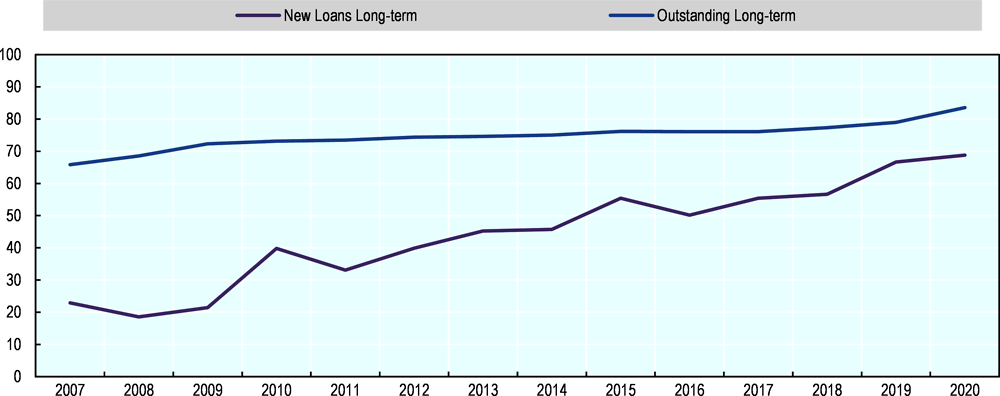

Short-term versus long-term lending

Short-term loans are defined as loans with maturities of less than a year, and are often used to provide working capital. Long-term loans, meanwhile, are more often used to finance investments, but can also indicate a strategy used by SMEs to lock in lower interest rates (Banque de France, 2018[29]). As documented by previous editions of the SME financing Scoreboard, there has been a progressive shift in the SME loan portfolio from short-term loans to loans with longer maturity periods, and 2020 data show a continuation of this trend (OECD, 2020[28]). Nearly seven out of ten new loans for SMEs in 2020 were long-term loans (Figure 1.7). This trend is likely to continue as COVID-19 debt restructuring schemes tend to extend loan maturities to loans provided in 2020 as a way to give SMEs the time to recover (OECD, 2021[2]).

This section describes credit conditions for SMEs and entrepreneurs based on the data on the cost of bank finance, collateral requirements and rejection rates. It also draws on findings from supply-side and demand-side surveys.

Interest rates

Interest rates continue to vary across Scoreboard countries, with upper middle-income economies demanding relatively higher borrowing costs for SMEs compared to advanced economies. In seven economies, SME interest rates exceeded 10%. The high interest rates reflect in some cases, the banks’ significantly higher operating costs and credit risk associated with SME operations. SMEs tend to have a low degree of organisation, operate in the local market and lack financial information regarding their activities. In Peru, for example, around 57.9% of SMEs do not keep a record of their cash flows and 80% do not prepare a financing plan for their activities (see Peru country profile). In other countries, like Kazakhstan, interest rates are high for both SMEs and large enterprises, reflecting broader macroeconomic conditions (see Kazakhstan country profile).

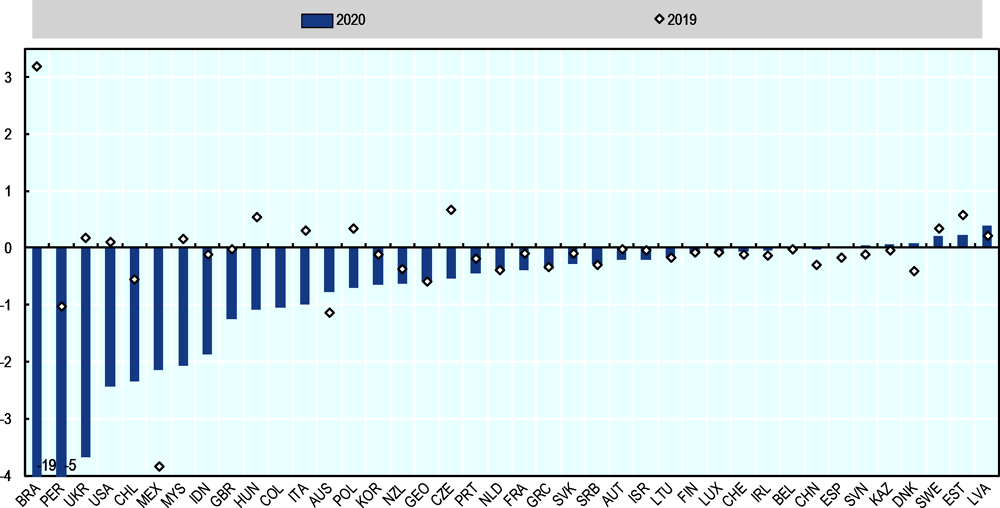

When looking at the changes in SME interest rates in 2020 compared to the previous year, it is apparent that central banks made use of this monetary policy tool to swiftly reduce the cost of credit as a response to the COVID-19 restrictions. Interest rates declined in almost all reporting economies (34 out of 42), and in the others, they increased only marginally (less than 1% in all remaining countries) (Figure 1.9). Inflationary pressures and concerns about potential capital outflows brought on by the crisis likely limited interest rate decreases in some countries (OECD, 2020[24]).

The decline in interest rates is also explained by significant recourse to public lending or guarantee schemes. For example, the Brazilian National Program to Support Micro and Small Enterprises – Pronampe – programme provided financing for SMEs at significantly lower rates compared to the otherwise double-digit market lending rates (see Brazil country profile). In Chile, likewise, the FOGAPE lending scheme established a cap on interest rates for covered credit operations (they could not exceed the monetary policy rate by more than 3% in nominal terms) (see Chile country profile). These schemes resulted in some of the largest declines in interest rates ever recorded in the Scoreboard history (Figure 1.9).

The median SME interest rate for the Scoreboard countries declined by 0.4 percentage points in 2020, the largest drop recorded in the Scoreboard for this indicator since 2009. Upper middle-income economies registered the largest decline, with 1.47 percentage points, albeit from a higher base. High-income countries, many of which already had record low interest rates prior to this crisis, registered a smaller decline in the median rate of 0.2 percentage points (Figure 1.9).

The interest rate spread between loans to SMEs and large companies offers additional insights regarding SME credit conditions. Given the inherently riskier profiles that SMEs have as borrowers, they are usually charged higher interest rates compared to large enterprises. As such, a narrowing interest rate spread generally indicates more favourable lending conditions for SMEs, while a widening spread indicates tighter lending conditions (OECD, 2012[30]).

The 2020 data on interest rate spreads show that SME credit conditions were overall more favourable compared to the run-up to the crisis: spreads were narrower in 27 countries out of 40 providing data for this indicator (Figure 1.10).

In 2020, Latin American countries registered the largest declines in interest rate spreads (Figure 1.10). This reflects a sharp drop in lending rates to SMEs that otherwise face very high market rates.

The trend of the median value of interest rate spreads by income group offers further insights into SME credit conditions in 2020. Narrower spreads were registered in almost all groups of countries. Upper middle-income countries registered the strongest decline with 1.03 percentage points and the lowest median value since 2009 (0.42). This continues the pre-crisis trend of narrowing spreads in these economies. High-income countries also registered a decline of 0.09 percentage points and a median value 0.61 percentage points. In contrast, European Union countries’ median value stood unchanged compared to 2019, at 0.78 percentage points (Figure 1.11).

Collateral requirements

Data on collateral requirements come from demand-side surveys, whose methodology, sample and questions asked differ from one country to the other. Cross-country comparisons should, therefore, be made with caution, and reporting improvements are needed to better assess the evolution in SME financing conditions in this respect.

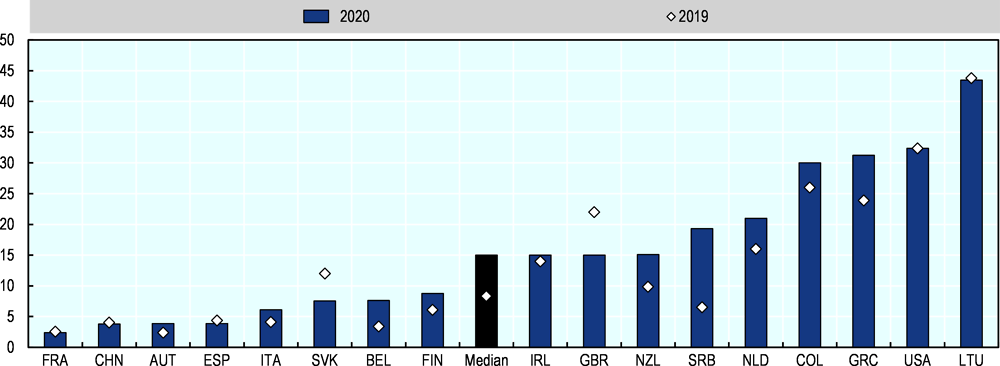

Evidence from 15 Scoreboard countries that provide data on this indicator shows that collateral requirements, expressed as a percentage of SMEs requiring collateral to access bank credit, declined significantly in 2020. Ten out of the 15 countries registered a fall in collateral requirements (Figure 1.12, left panel) The decrease was strongest in the United States (-41.10 percentage points), followed by the United Kingdom (-24 percentage points). Other high-income countries also registered a decline in collateral requirements, but to a lesser extent (Figure 1.12, left panel).

The decline likely reflects the increased use of credit guarantee schemes in response to the COVID-19 pandemic. For instance, as of February 2021, 46 out of 55 countries applied credit guarantees to respond to the COVID-19 crisis (OECD, 2021[2]).

The evolution of the median value for this indicators shows that the 2020 decline in collateral requirements was a continuation of the pre-crisis trend. However, the median share of loans requiring collateral in 2020 declined considerably more compared to the trend in the run-up to the crisis, reflecting the importance of the government support schemes. (Figure 1.12, right panel)

SME loan applications

Similar to data on collateral, data on application rates are usually gathered from demand-side surveys, with limited comparability across countries.

Despite the pandemic, new loans applications did not increase significantly in many countries: the 2020 median value of SME loan applications was 31%, only 6 percentage points higher than the 2019 median (Figure 1.13). As discussed in Section 1.1 on new SME loans, despite the liquidity constraints imposed by the crisis, demand for new loans in many countries was dampened by postponed investments as well as the introduction of additional support measures like tax deferrals, debt moratoria, employment retention schemes, etc. Use of public financing schemes was another factor that negatively impacted the demand for bank credit. (ECB, 2020[31]).

On the other hand, in countries that did register an increase in SME loan applications, the growth rates were unprecedented. This is the case of Austria (+13.48 percentage points), Colombia (+10 percentage points), Spain (+8.57 percentage points), Greece (+7.34 percentage points) and the United Kingdom (+5 percentage points) (Figure 1.13). In Austria, for example, the big rise in SME loan applications reflected a sharp increase in the need for new financing compared to the previous years which were marked by a reported negative financing gap (i.e. the available finance was higher than the financing needs of SMEs) (ECB, 2019[32]).

Rejection rates

Data on rejection rates are usually collected from demand-side surveys for which comparability across countries is often limited. Nevertheless, this indicator helps shed light on the supply of credit to SMEs and provides evidence on the overall financing conditions they face. Higher rates of rejection are indicative of constraints in the credit supply. A high number of loan application rejections thus illustrates that loan demand is not being met, either because the terms and conditions of the loan offers are deemed unacceptable, the average creditworthiness of loan applications has deteriorated, or banks are rationing credit (OECD, 2012[30]).

Credit standards (bank loan approval criteria) tightened in most countries in the context of the COVID-19 crisis, even if the tightening was relatively smaller compared to the global financial crisis, in part due to the significant fiscal and monetary support measures implemented in response to the crisis (ECB, 2020[31]). This resulted in an increase in rejection rates across over half the countries that provided data for this indicator (10 out of 17), while in the others rejection rates remained unchanged compared to 2019. The median value of the 17 countries showed an increase of 6.67 percentage points, reversing the trend seen in 2019 when the median rejection rates decreased 0.7 percentage points. This indicator remains high and with low variation between 2019 and 2020 in Lithuania and the United States, with 43.5% and 32.4% of SMEs being rejected respectively, and increased considerably in Serbia (+12.78), Greece (+7.34), and New Zealand (+5.24) (Figure 1.14).

The United Kingdom and in the Slovak Republic were the only two countries that reported a decline in rejection rates in 2020 compared to 2019. In the United Kingdom this was likely driven by the Bounce Back Loan Scheme (BBLS) (Figure 1.14). The scheme provided a 100% credit guarantee against the outstanding balance (capital and interest) on small business loans extended through the scheme, which significantly reduced the risk of lending to SMEs (see United Kingdom country profile). In the Slovak Republic, two guarantee schemes were implemented: “SIHAZ 1”, with a 80% coverage of individual credits from 50 % of the portfolio, and “SIHAZ 2a”, with a 90% coverage of all new credits (see Slovak Republic country profile).

In countries with stable low rejection rates, public interventions such as credit mediation can explain continued low levels in 2020. In France for example, the credit mediation scheme ensures that banks reconsider the rejection of loans and ease the provision of financing to companies facing temporary difficulties (European Monitoring Centre on Change, 2020[33]). In 2020, 14 147 French firms asked for credit mediation support, a figure that is 14 times higher than in 2019. According to the Bank of France, the scheme unblocked a total of EUR 2.98 billion of credit and preserved an estimated 77 815 jobs in 2020 (see France country profile).

Additional evidence on credit conditions from survey data

Survey data further illustrates that in 2020, debt finance remained relatively affordable and available, no doubt as a result of the strong policy response to tackle the COVID-19 crisis. Interest rates declined to record lows, and loan guarantees expanded significantly in European countries, Japan, the United Kingdom, and the United States. Although these surveys provide important insights on the conditions of the supply and/or demand of credit, the comparability across surveys is limited.

Euro area

The European Central Bank Survey on SME access to finance in euro area countries (SAFE Survey), undertaken twice a year, provides insights into how credit conditions are perceived by SMEs in the region. The survey, that covered the period of April to September 2020, indicates that access to finance remained among the least important concerns in the euro area as a whole, with some country heterogeneity, however. SMEs in Greece and Italy reported that the lack of finance continued to have a strong impact on them (ECB, 2021[14]). The survey covering the same period in 2021 showed that across the Euro area, the share of SMEs reporting access to finance as a major concern declined further and stood at 7% (ECB, 2021[34]).

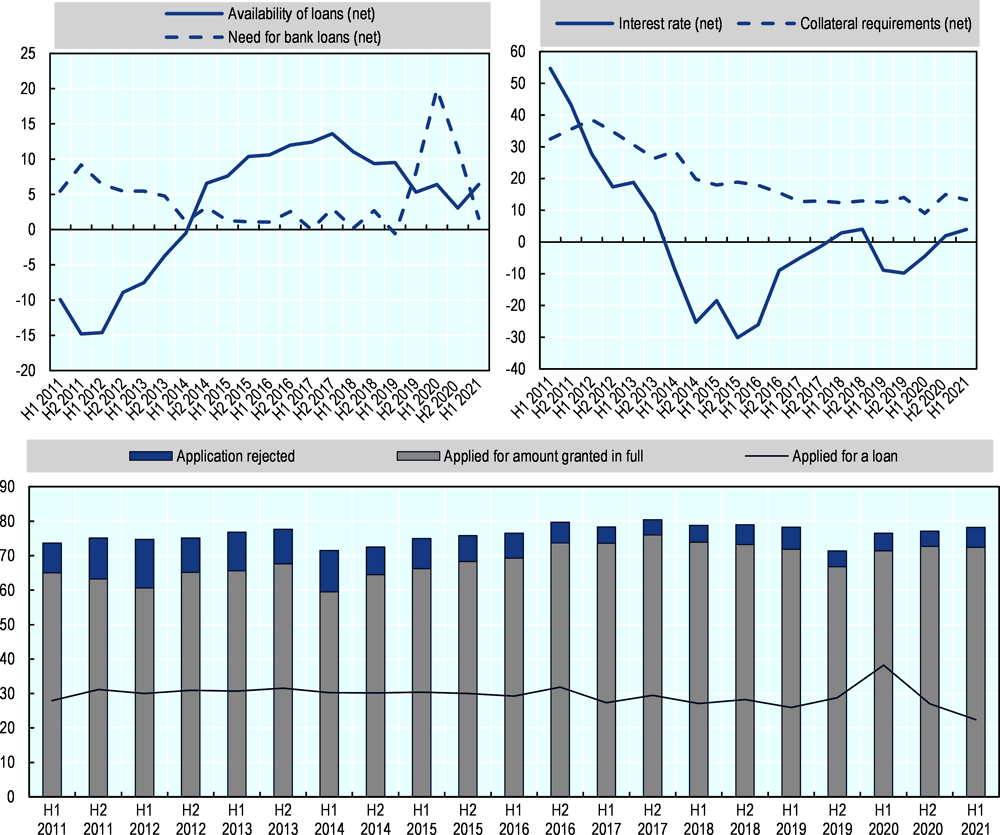

As illustrated in Figure 1.15, the demand for bank loans increased significantly in H1 2020 (20% from 8%), but decreased to 12% in H2 2020 and to 1.6% in H1 of 2021, explained by the large availability of non-debt public support schemes. The availability of bank loans showed some fluctuation in 2020: while the first half saw a slight increase in available bank loans by 6%, the second half saw a decline by 3%. Notably, while large companies signalled a return to pre-COVID-19 levels, micro firms indicated a decline in availability of bank loans. In contrast, in H1 2021, the availability of bank loans increased 6.4%, with almost all firm sizes (except medium-sized companies) reporting a return to pre-pandemic levels of loan availability (ECB, 2021[34]). Looking by country, SMEs in Belgium reported reduce availability of bank loans (ECB, 2021[14]).

The price, terms and conditions for bank financing reported in general an increase. The only exception is a decrease in interest rates in the first half of 2020, in line with the results of the Scoreboard. However, in the second half of 2020 and the first half of 2021, SMEs reported an increase in interest rates. Other financing costs, such as charges, fees and commissions reported an increase throughout the year (ECB, 2021[14]).

The survey data also shows a slight decrease in SMEs applying for a loan in H1 2021 at 22%, down from 27% from H2 2020. The share of loan applications granted in full in 2021 maintained the same levels registered in the previous round at 72.4% , while rejection rates increased to 6% (from 4% in H2 2020) (ECB, 2020[35]).

United States

Survey data from The Senior Loan Officer Survey captures the opinion of senior bank officials on lending practices in the United States. The data captured in Q3 2021 show looser standards in the terms of corporate loans for all firm sizes, which contrasts to survey results from the same period in 2020, where standards were significantly tighter. In Q3 2021, most banks reported easing loan rates for all firm sizes. For SMEs specifically, easing requirements were related to reducing the cost of loans and increasing the maximum size of credit lines. Demand for loans fluctuated between 2020 and 2021. While in 2020 bank officials reported a weaker demand for corporate credit, in Q3 2021 the demand for loans rebounded; however demand from SMEs remained unchanged (Federal Reserve Bank, 2020[36]) (Federal Reserve Bank, 2021[37]).

The Small Business Lending Survey, conducted quarterly, captures the perception of commercial banks of their small business lending activities in the United States. Survey responses captured in the third quarter of 2021 indicate an ease in credit standards, although with mixed loan terms, evidenced by tightened interest rate floors but an ease in spreads of loan rates and maximum maturity of credit lines (Federal Reserve Bank of Kansas City, 2021[38]). This behaviour contrasts with survey results from the same period in 2020, where credit standards and all loan terms were significantly tighter (Federal Reserve Bank of Kansas City, 2020[39]).

Japan

In Japan, the TANKAN survey, a quarterly poll on business confidence conducted by the Bank of Japan, shows that in the first two quarters of 2020 financing conditions for small firms and for large firms diverged. While lending attitudes for small businesses loosened slightly, for large business they tightened strongly, particularly in the first quarter of 2020 (Figure 1.16). In contrast, in 2021 lending attitudes for SMEs and for large firms started to converge, with the index value for both size classes being the closest in the last quarter of 2021. It is also noteworthy that the lending attitudes towards medium-sized enterprises replicate to a certain extent the attitude towards large enterprises; however it did not tighten at the same rate, remaining closer to the small firms index value in the last quarter of 2020 and through 2021 (Bank of Japan, 2021[40]).

United Kingdom

The Credit Conditions Survey of the Bank of England documents the opinion of bank officials regarding capital availability for loans and overall credit conditions on a quarterly basis. According to the survey data, availability of credit to the corporate sector increased for all firm sizes in 2020. In 2021 the availability of credit remained stable for SMEs, but increased slightly for large firms in the first three quarters. On the other hand, the demand for loans from SMEs in 2020 fluctuated. As expected, considering the impact of the pandemic, demand for loans from all business sizes increased in the second quarter of 2020, and only in Q4 did SME demand for credit decline (Bank of England, 2020[41]). In 2021, demand for credit from small businesses declined, while demand from large businesses increased. Demand from medium-sized companies was broadly stable in 2021, with the exception of Q2 and Q3 where demand decreased slightly (Bank of England, 2021[42]).

Leasing and hire purchases

Leasing and hire purchases activity declined in 2020, reversing the positive trend seen in previous years. This decline can be explained by the weaker demand for new leasing services (ECB, 2020[35]) as well as by lower payment capacity on leases (BDO, 2020[43]) both impacted by the lower economic activity in the context of the pandemic. Data from Leaseurope, a sector organisation, show a decline in leasing activity in the first half of 2020 compared to the same period in 2019, and the information captured from the individual country profiles confirms this negative trend in 2020 for 11 out of 19 countries in the Scoreboard that reported this data (Figure 1.17). The United Kingdom shows one of the largest declines, reflecting a significant contraction in business investment in the midst of pandemic and following the exit from the European Union, as well as by a potential replacement of the use of asset-based finance by government guarantee lending (see United Kingdom’s country profile). In Estonia, leasing and hire purchases in 2020 represented only 75% of the 2019 volumes, the lowest volume in the last 5 years, reflecting a significant decline in new leases (EESTI LIISINGUHINGUTEV LIIT, 2021[44]).

On the other hand, a few countries saw an increase in leasing activity in 2020. Most notably, Kazakhstan registered an increase of 33%, which continues a trend of strong growth in the leasing finance segment over the past decade (eight-fold since 2010) (Figure 1.17).

The SME Access to Finance of Enterprises (SAFE) Survey reported the evolution of leasing activities through 2020 and 2021 in the European Union. While in 2020 across the EU member states, the growth in leasing needs significantly surpassed the growth in the availability of such financing, in 2021 leasing activities return to positive growth (European Commision, 2020[45]). In the first quarter of 2021, the percentage of SMEs that indicated higher availability of leasing increased (to 6% from 3%). However, this positive growth did not reach pre-crisis levels of leasing activity (15% in 2019). In the second and third quarters, the likelihood of use of leasing was correlated with firm size, with 42% of large firms using leasing compared to 20% of SMEs in the Euro area (ECB, 2021[34]).

Factoring

Scoreboard data on factoring volumes is complemented with data from Factors Chain International (FCI), a sector organisation. In 2020, factoring activities saw an unprecedented decline, with the Scoreboard median declining by 16.27% (Figure 1.18). In Europe, the largest contributor to factoring activities, which represents 68% of the market, factoring turnover declined by 5.4%. This was the first decrease in 11 years and mirrored the decline in GDP (-6.4%). The largest declines experienced in the region were registered in the Slovak Republic (-21%), Slovenia (-12%), Italy (-10%) and France (-8%). Likewise, in the United States, factoring declined by 23.4% in 2020 compared to 4.6% in 2019 (FCI, 2021[46]).

Data from the Scoreboard country profiles, sourced from national accounts provided by country experts as a complement to the above-mentioned data from FCI, show that 11 out of 14 countries that provided data for this indicator documented a decline in factoring activities between 2019 and 2020. The largest declines from this data source were seen in Lithuania (-51%), Portugal (-41%) and the United Kingdom (-36.6%). On the other hand, there was a modest increase in Turkey (14%) and China (6%) (Figure 1.19).

In 2020, the negative performance in factoring activities reflects significant reduction in economic output and trade as a result of COVID-19 related restrictions (FCI, 2021[46]). This represents a continuation of the pre-crisis trend of a slowdown in factoring activity (since 2017) further accelerated by the crisis. The broad trend has reflected the rising trade tensions between the United States and China as well as the uncertainty accompanying the United Kingdom’s exit from the European Union. In many economies, sector-specific aspects also explain this trend. For example, factoring remains the preferred method of short-term financing in the automotive industry, which was strongly impacted by the pandemic in 2020 (OECD, 2015[47]).

Country-specific reforms accounted for the growth observed in factoring in some countries. For example, in Ukraine, factoring activity increased by 37% in 2020 on account of the creation of the so-called Factoring Hub, an online platform that facilitates the electronic application for factoring to SMEs so they can have quick working capital to fulfil government orders: with the Factoring Hub SMEs are able to obtain finance within two days and with a minimal request of financial documents (SCM, 2020[48]). The increase in Turkey is a product of a favourable regulatory environment that strengthened the sector since 2013 (see Turkey’s country profile). Similarly, in China, the increase can also be explained by the enhancement of the legal system though the National Civil Code and regulatory changes of the China Banking and Insurance Regulatory Commission, where despite a reduction in the number of factoring companies and branches, the factoring volume increased exceeding EUR 433.2 billion (see China’s country profile).

European survey data from 2021 show that factoring has not yet rebounded, with only 2% of SMEs using it and 8% considering it a relevant source of finance as of Q3 2021 (ECB, 2021[34]).

Venture capital

Trends in venture capital financing diverged across countries and stages in the Scoreboard in 2020 and 2021. In half of the countries providing data on this indicator, VC investment declined. On the other hand, 2020 VC investments grew strongly in a number of countries in the Scoreboard, including Turkey (+428 percentage points), Mexico (+199 percentage points) and Ireland (+110 percentage points) (Figure 1.20). In viewing these growth rates, it is important to keep in mind that data on VC investments are highly volatile, especially in smaller economies and countries with relatively underdeveloped VC markets, where a large single deal can impact overall volumes considerably.

In regions with significant VC market shares, data generally show a resilient VC sector despite the pandemic. In Europe, for example, VC saw an increase of 15% year on year, reaching a total deal value of EUR 42.8 billion. Similarly, in the United States, the sector saw in 2020 an increase of 13% year on year reaching a new record in total deal value of USD 156.2 billion, and a decline of 10% in the total number of deals, however (National Venture Capital Association - Pitchbook, 2020[49]) (Centre for Entrepreneurs, 2021[50]).

The marked growth in the European region can be explained by the acceleration of the growth of the digital economy, propelled by lockdown measures in 2020, as well as highly digitalised companies that offered online services taking advantage of the upsurge of demand. This is particularly the case for companies closing deals with sizes of over EUR 25 million (Pitchbook, 2020[51]). Government intervention also played an important role in supporting the dynamism of venture capital markets. For example, in Hungary, Hiventures, a state owned venture capital fund, set up the start-up rescue programme with a budget of HUF 41 billion (Hiventures Venture Capital Fund, 2020[52]). France and Germany, as part of their policy responses, included the establishment of a start-up fund of respectively EUR 4 billion and EUR 2 billion (with additional resources from public venture capital investors) (OECD, 2021[2]). Supranational financial institutions have also played an important role in supporting the VC sector during the pandemic. For example, the European Investment Fund mobilised up to EUR 5 billion, modified terms and conditions and included a EUR 100 million window for ease SME to access equity financing during the pandemic (EIF, 2021[53]).

In median terms, venture capital experienced weak but positive growth in 2020 compared to previous years (Figure 1.20). However, 2021 saw a strong rebound in VC funding, which increased by 92% y-o-y (totalling USD 643 billion in 2021 compared to USD 335 billion in 2020) (Crunchbase, 2021[54]) Looking at the development by stages in 2020, the crisis took a heavier toll on seed and early stage funding than investments in later stage funding. While seed funding closed the year with a decline of 27% y-o-y, and early stage funding declined by 11% y-o-y, later stages closed with an increase of 4% y-o-y (Crunchbase, 2021[55]). In 2021, early stage funding also experienced a sharp increase, rising by 100% y-o-y. On the other hand, seed funding experienced weaker growth increasing 56% y-o-y (Crunchbase, 2021[54]).

In the Netherlands, for example, the average funding round in 2020 was 1.5 times higher in 2020 compared to 2019 and this trend has continued into 2021. However, this growth has been observed mainly in the later stage venture companies, with early stage and seed capital declining during this period (see Netherlands country profile).

In the United States in 2020, in terms of number of deals seed and angel funding declined by 10% and early stage VC declined 20%, as opposed to late stage which registered growth of 4% (see United States country profile). This slight decline is likely driven by lower start-up rates at the beginning of the pandemic, as well as the inherently riskier profile of such investments (National Venture Capital Association - Pitchbook, 2020[49]).By the third quarter of 2021, global early stage venture capital started experiencing a recovery registering a growth of 104% in terms of volume raised (Crunchbase, 2021[56]).

Online alternative finance is a means of soliciting funds from the public for a project / firm through an intermediate platform, usually through the Internet. The online alternative finance ecosystem comprises debt, equity and non-investment models that allow entities to raise funds through an online digital market place. Debt-based models cover P2P / marketplace lending, and include both secured and unsecured loans, bonds and debtor notes. Equity-based models, including equity-based crowdfunding, relate to activities where businesses, particularly start-ups, raise capital by issuing unlisted shares or securities. Non-investment based models are models in which individuals or firms raise capital but they are not obliged to provide a monetary return to the individuals or institutions that funded the project. They include reward-based and donation-based crowdfunding (Cambridge Centre for Alternative Finance, 2021[57]).

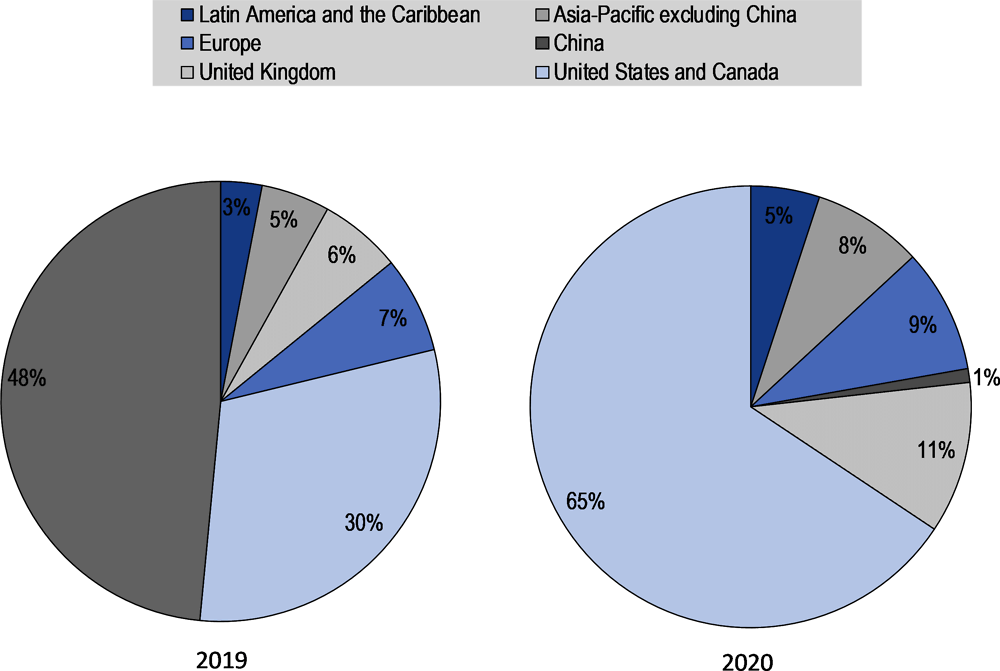

In 2020, there were significant changes in the volumes of online alternative finance transactions compared to previous years. In terms of total volume, the United States’ alternative finance market grew by 71.7% from USD 48.9 billion in 2019 to USD 84 billion in 2020. The Czech Republic and Japan registered the largest increases in volumes transacted compared to 2019 with a rise of 108% and 105% respectively, although from a lower base. Also, in Japan, the sharp increase reflects in large part an rise from low volumes in alternative finance prior to the crisis, as it had declined by more than 100% between 2018 and2019. In Chile, which accounts for 15% of all Latin American activity in this market, online alternative finance volumes increased by 64% (Figure 1.21). In France, funds raised by crowdfunding platforms soared in the 2018-2020 period, from EUR 402 million to EUR 1 020 million. In 2020, the funds raised allowed for the financing of 13 796 SMEs (see France country profile).

On the other hand, China’s market has declined significantly in recent years, from USD 177 billion in 2018, to USD 84.3 billion in 2019, to just USD 1.15 billion in 2020 (Figure 1.21). The dramatic decline in the volume and market share of China’s alternative finance relates to significant changes in local regulations as a result of fraud complaints and defaults of improperly licenced platforms (FCI, 2021[46]). The Chinese authorities implemented a long-term supervision mechanism of internet finance to mitigate future internet financial risks. As a result, by June 2020 the number of online lending platforms declined from 5000 to just 29 (See China’s country profile). Consequently, the United States’ and Canada’s overall market share grew dramatically (Figure 1.22). Other declines were witnessed in the Netherlands and New Zealand (by 82% and 33% respectively) (Cambridge Centre for Alternative Finance, 2021[58]). The decline in these countries can be in part explained by the lower volumes in alternative models of lending associated with the uncertainty of the pandemic.

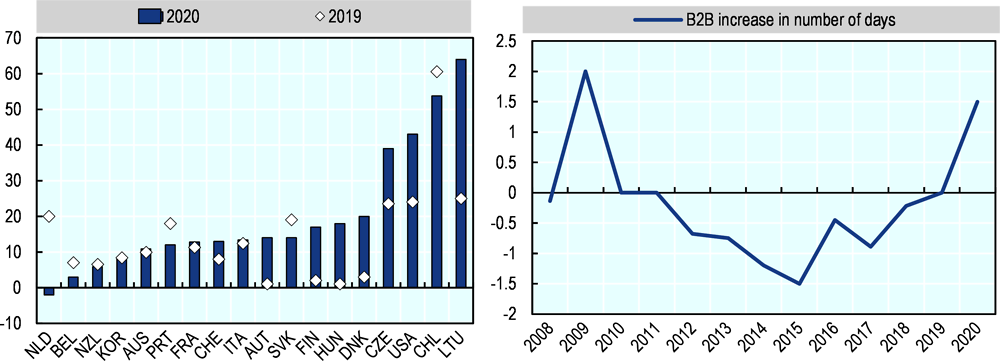

Payment delays

The COVID-19 pandemic brought about a large disruption in mobility and trade, affecting supply chains and payments. This strongly impacted SMEs, which generally have less bargaining power to enforce payment conditions compared to large firms and are often obliged to settle for unfavourable payment terms. 2020 saw a considerable variation in this indicator across countries. In 2020, 12 countries for which data are available reported an increase in payment delays, and 6 reported a decrease (Figure 1.23 left panel).

These delays likely compounded SMEs’ liquidity shortages when the pandemic hit. Survey data from Europe, for example, show that 69% of SMEs accepted unfavourable payment terms to protect their client relationships (Intrum, 2021[59]).

On the other hand, looking at the Scoreboard median value, aggregate payment delays did not increase significantly in 2020: the median value stood at 14 days compared to 12.4 days in 2019 (Figure 1.23 right panel). The decline in the payment gap4 in 2020 can be explained by the strong government support that eased SME liquidity constraints and allowed them to meet their payment obligations. However, as some of the public support measures are phased out, more SMEs foresee a higher risk of late or non-payments due to persistent debtors’ liquidity challenges. In Europe in particular, 65% of SMEs perceived this risk in 2021 versus 46% in 2020 (Intrum, 2021[59]) (Intrum, 2020[60]).

Bankruptcies

In 2020, the number of bankruptcies decreased in the majority of Scoreboard countries, despite the crisis. Of 32 countries that provided data for this indicator, 26 reported a decline in bankruptcies (Figure 1.24), and the median value registered a decline of 11.7%. This can be explained in part by the changes in bankruptcy procedures and requirements implemented by several governments that allowed insolvent SMEs to have more time to recover without having to file for bankruptcy (Bruegel, 2021[61]). For example, in Austria, which saw one of the highest declines in bankruptcy in 2020 (-40.7% y-o-y), the obligation to declare insolvency was temporarily suspended in 2020. In Italy, the decline in bankruptcies in 2020 was the highest recorded in more than a decade (-30.1%), partly explained by the moratorium on bankruptcies, in force from the beginning of March to the end of June, and the general slowdown in court activity due to the pandemic containment measures. In 2020, Japanese SMEs recorded the lowest number of bankruptcies in the past 30 years (see Japan country profile).

The decline in bankruptcy rates can also be explained by the unprecedented financial support provided to SMEs. No doubt, these measures also provided liquidity to some SMEs that in the absence of the pandemic would have ceased to exist in 2020, leading to a reduction in bankruptcy rates (Euler Hermes, 2020[62]). In Finland for example, even though government support was largely conditioned on enterprises not having been in financial distress at the end of 2019, this condition was waved for micro and small enterprises. These enterprises could be granted support if they were not in bankruptcy or reorganisation proceedings at the time the support was granted and had not received rescue or restructuring aid (see Finland country profile).

In light of the gradual phasing out of governmental support in some countries, it is likely that this indicator will rise going forward. In Israel, for example, the number of businesses that closed in 2021 increased by 84% y-o-y, after a 13.6% decline in 2020 attributed to the large government support (Israel Hayom, 2022[63]). However, in some countries, with the re-introduction of support measures to tackle the emergence of COVID-19 variants, bankruptcies continued to be lower compared to 2019 levels. For instance, in 2021 in France, bankruptcies were 12.7% lower than in 2020 and started to increase only in Q4 of 2021 (Banque de France, 2022[64]).

On the other hand, countries with a lower range and scope of governmental support generally reported an increase in bankruptcy rates in 2020. This includes mainly middle-income countries, including Peru, Kazakhstan, China and Colombia (Figure 1.24). In Peru, the number of SMEs declined by a remarkable 25% according to data from tax authorities. This reflects the seizing of operations of many enterprises that were strongly impacted by the strict lockdown measures, but likely also a notable share of enterprises that have continued their operations informally (see Peru country profile).

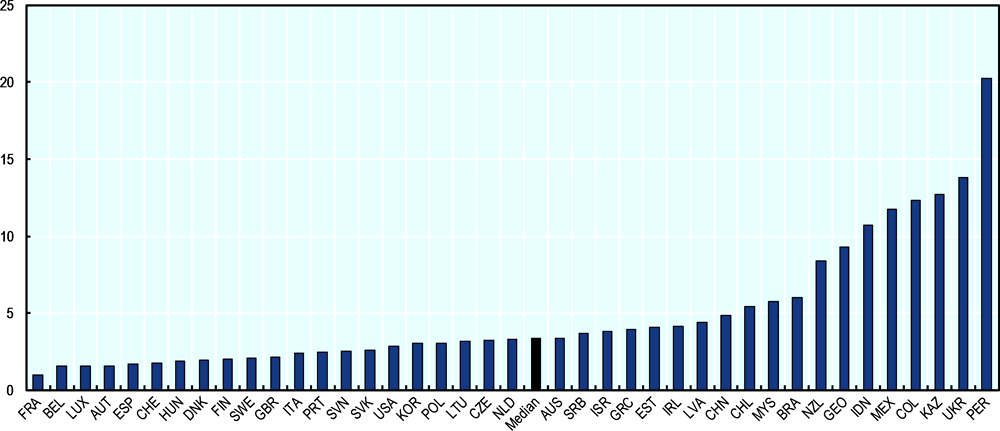

Non-performing loans (NPLs)

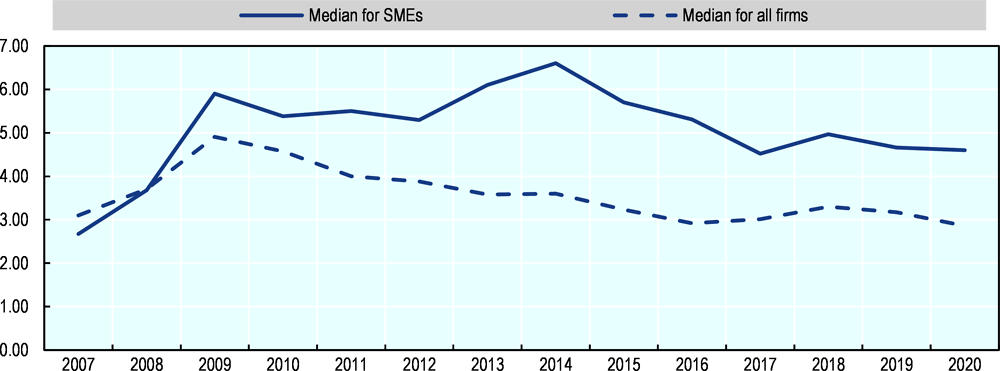

A temporal analysis of data on non-performing loans shows that they are generally more prevalent among SMEs than among the overall business population, with the median value of NPLs for SME lending systematically higher than the value for all corporate lending (Figure 1.25). The median rate shows that NPLs for all firms have generally declined since 2009, but SME NPLs are more volatile and do not exhibit a clear declining trend. In 2020, the divergence between NPLs for SMEs and for all firms was larger than the one recorded in 2019, which can also be attributed to the fact that SMEs were concentrated in the sectors that were most affected by the crisis (OECD, 2020[65]). In addition, the changes that some countries underwent in national insolvency regimes may have also contributed to the accumulation of non-performing loans (see Government policy responses in 2019-20).

Looking at the percentage of SME NPLs over all SME loans by country in 2020, there is no uniform trend: SME NPLs declined in 15 countries and increased in 11 other countries (Figure 1.26). Greece and Italy remained the countries with largest NPL ratios, a legacy from the global financial and Eurozone crises, but they recorded a notable decline in 2020. In both countries, large-scale sales of these assets accounted for their removal from banks’ balance sheets. On the other hand, NPLs increased in a number of countries, including Thailand (+2.34 percentage points), Ireland (+1.2 percentage points), Poland (+1.02 percentage points) (Figure 1.26). In Thailand, despite the requirement of not marking SMEs in debt rescheduling as NPLs (as was done prior to the crisis), non-performing exposures increased due to the expiration of most government support in Q3 2020, which prompted many companies in financial difficulty to file for restructuring and bankruptcy, increasing NPL levels (Thai Enquirer, 2021[66]). In Ireland, the increase in NPLs is to a large extent explained by the change in the definition of defaults, in combination with the pandemic’s impact on SMEs particularly in hospitality and retail. This was indicated by Ireland’s two largest banks that reported an increase in non-performing exposures in those portfolios (Fitch Ratings, 2021[67]).

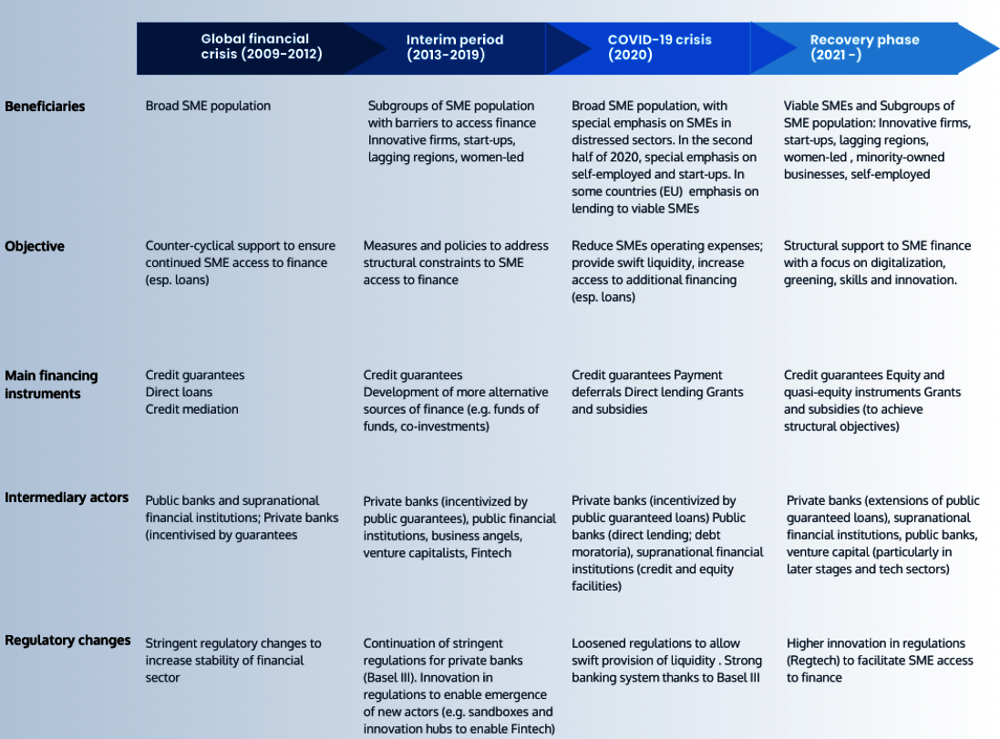

In 2020, the policy landscape for supporting SME access to finance evolved significantly in response to the COVID-19 pandemic. As with the global financial crisis, governments played a critical role in the crisis response by boosting direct financial support for SMEs, while simultaneously mobilising a strong increase in the financing channelled through private financial institutions, primarily banks. In doing so, governments increased the deployment of already existing policy instruments, which, in the pre-crisis period, had served to address structural constraints to SME finance. However, they also introduced new short-term measures to provide urgent liquidity support with a clear goal of phasing them out at the end of the crisis. This section examines policy responses during the pandemic and explores how they altered the pre-crisis SME finance policy landscape. Further information on policy responses can be found in Chapter 2, which assesses how recovery packages are being used to channel SME financing support.

In the run-up to the crisis, governments continued to make use of credit guarantee schemes and increasingly supported alternative finance instruments for SMEs

As noted in the 2020 edition of the financing SMEs and entrepreneurs Scoreboard, in the immediate aftermath of the global financial crisis, many governments set up or expanded guarantee schemes, direct lending, credit mediation and other measures to ease SME access to credit (OECD, 2020[28]). While these measures largely remained in place in later years, the emphasis of policies shifted as the recovery took hold. Equity instruments gained more traction as the crisis subsided, and credit measures (credit guarantees, direct loans) were increasingly targeted to specific subgroups of the SME population, including innovative firms, women entrepreneurs, start-ups, etc. (OECD, 2021[2]). This reflected the shift from counter-cyclical support during the crisis to addressing long-term structural constraints to SME access to finance in the aftermath (OECD, 2021[2]).

The response to the COVID-19 pandemic represented a return to primarily counter-cyclical support, but due to the nature and scale of the crisis, a significant range of new and short-term policy instruments were introduced to ease liquidity pressures on crisis-stricken SMEs (Figure 1.28) These measures included primarily the deferrals of payments (taxes, rents and utilities, pension and social security, etc.), which were used to reduce the operational expenses for the broad population of SMEs as well as larger enterprises. Subsidies and grants were also used to provide support for payments, employment retention, and to aid the self-employed (Figure 1.28).

In the first phase of the pandemic, alternative finance instruments were used to a lesser extent than the more traditional support channels. The urgent response to enterprises’ acute liquidity needs required swift action, and the use of traditional channels of support like direct lending or government-backed lending by private banks was often the fastest way to reach as many SMEs as possible. And while alternative finance had limited use as a counter-cyclical support instrument during the crisis (e.g. through quasi-equity instruments such as subordinated loans, convertible loans and debt and equity crowdfunding), it continued to be used primarily to provide structural support for innovative SMEs and start-ups. This type of support was further enhanced as the pandemic became more prolonged and more severe, particularly in H2 2020.

As Chapter 2 notes, the recovery phase has been marked by changes in the structural support to SMEs. Support is not only aimed at addressing traditional market failures that impact SMEs, but more emphasis is put also on financing SMEs’ contribution to “build back better.” Thus, significant new financing support is linked to investment in digitalisation, sustainability, skills and innovation. The challenges that policy makers face in the near term is how to balance the continuation of liquidity support and avoid a premature withdrawal, which risks harming viable SMEs, with enhanced structural support in order to ensure that SMEs take part in the digital and green transition.

Credit guarantees have remained the dominant form of support for SME access to finance through the COVID pandemic

Guarantees incentivise private bank lending to SMEs by transferring all or some of the credit risk from the private lenders to the government. Prior to the pandemic, the use of credit guarantee schemes was widespread in Scoreboard economies as a means of mobilising private debt financing for SMEs: more than half of the Scoreboard countries registered increases in guaranteed loans over 2009-19. In 2020-21, governments turned to credit guarantee schemes to provide swift access to external financing for liquidity-strapped SMEs. Government loan guarantees rose in all 27 countries providing this data in the Scoreboard, with a median increase of 110% between 2019 and 2020 (compared to an increase of 0.32% between 2018 and 2019). This marks an unprecedented increase in guaranteed lending since the start of the Scoreboard data collection (OECD, 2020[28])

However, unlike during the global financial crisis when credit guarantees were provided to a broad population of SMEs, guarantee schemes in the COVID-19 crisis in some countries, particularly in the EU, were more targeted to maximise benefits while minimising market distortions. Given the high level of coverage of the guarantee schemes - most offered guarantees of between 70% and 90% with some countries (e.g. Italy and Germany) offering up to 100% guarantees targeted mainly at SMEs and entrepreneurs – conditions on lenders and beneficiaries were introduced to minimise market distortions and fiscal risks. Some of these conditions included the provision of financing only to firms and entrepreneurs that had been strongly impacted by the crisis but which had not already been experiencing financial difficulties in 2019. In some countries, the guarantees also came with strict conditions for beneficiaries such as prohibition for distributing dividends, limits on the compensation of managers and employment retention commitments (OECD, 2020[65]).

There is evidence that the design of the schemes has contributed to limiting the distortive effects of this policy instrument. A recent empirical study of the credit guarantee schemes in EU member countries show that the credit guarantee schemes implemented in 2020 had significant positive impact by providing liquidity support to viable enterprises that were hit hard by the crisis, while minimising the support for unproductive firms. Notably, the study found that the schemes reduced the share of SMEs facing liquidity shortages by up to 8% from an estimated 32% in the absence of this policy intervention. Moreover, the schemes provided effective protection for productive firms; 40% of the SMEs facing liquidity shortages absent the credit guarantee schemes would have been firms with productivity levels higher than the median productivity level of liquid SMEs (Demmou, 2021[68]). Additional literature supports the finding that the schemes mainly supported viable firms (Laeven et al., 2020; Schivardi et al., 2020; ECB, 2021).

That said, in other high-income countries participating in the Scoreboard, notably the United Kingdom and the United States, the eligibility criteria for accessing these instruments remained relatively broad, allowing a large population of SMEs to gain access to finance. Many emerging markets in Latin America also loosened eligibility criteria for credit guarantee schemes to enable as many SMEs as possible to gain access to much needed working capital (see Country profiles).

Direct lending was also ramped up to support the SME crisis response

In addition to providing guarantees to commercial banks to support their SME lending, most governments also increased direct lending to SMEs. In 2020, the growth in direct loans was positive in 12 out of 14 countries that provided data for this indicator.

The approach to the provision of new lending during the crisis was different across the Scoreboard countries. In some countries (Australia, Canada, the United Kingdom and the United States), new loan instruments were set up targeting mainly highly impacted SMEs. In some (e.g. Austria, Colombia, Brazil, Spain), new lending schemes were introduced targeting the most vulnerable sectors. Countries also opened up existing instruments for disaster relief to SMEs affected by the COVID-19 crisis. They also expanded funds for direct lending through existing channels (e.g. Brazil, Japan, United States) or eased the accessibility of loan schemes through expansion of the group of potential beneficiaries, simplification and acceleration of loan procedures, and offer of more favourable terms and reduced interest rates (e.g. Canada) (OECD, 2020[29]).

Governments made significant use of temporary crisis measures, such as deferred payments and grants, to support the urgent liquidity needs of SMEs

In the immediate aftermath of the 2008 Great Financial crisis, deferred payments, grants and subsidies were commonly used short-term tools to provide liquidity to SMEs. Deferral of payments as well as tax reductions were used to prevent depletion of SMEs’ working capital. Similarly, grants and subsidies were used to help SMEs maintain investment levels. For instance, several countries introduced subsidies to industries that were affected by the economic crisis, but conditional on progress and clear production targets. Such subsidies were also restricted in size and their duration was limited to the crisis period (OECD, 2020[28]).

During the COVID-19 crisis, deferral measures allowed SMEs and entrepreneurs to postpone payments, thereby alleviating acute pressures on their liquidity. Deferrals on corporate and income tax were used in 90% of Scoreboard countries to relieve liquidity pressures for SMEs, especially at the time of the start of the crisis and the first lockdowns. A smaller share also included deferral of value added tax (47%), and social security and pension contributions (40%) (OECD, 2021[2]). In some countries, like France and the US, these measures were complemented with earlier repayments of tax refunds from the previous year. For enterprises providing goods and services to public institutions, measures were put in place to reduce payment times to get liquidity faster into SMEs’ accounts (OECD, 2020[69]). The scope of deferrals has also been gradually extended beyond tax and social security payments. For instance, financial institutions backed by governments introduced debt repayment and fee/interest moratoria. This instrument was used in about 60% of the Scoreboard countries.

In most countries, tax deferrals were extended to all companies regardless of size, and only some schemes specifically targeted SMEs. Likewise, most of these schemes did not target only viable firms: even companies that had faced financial distress prior to 2020 could benefit from support in the form of deferred payments. (OECD, 2020[69]). This is consistent with the finding that bankruptcies declined in most Scoreboard economies in 2020, with many economies recording record low bankruptcies in decades. And while insolvencies are on the rise in some countries, they have often not increased as much as expected given the severity of the crisis. That said, as a result of these interventions, insolvencies could be expected to rise in the near future.

Grants and subsidies were also used extensively to alleviate SME liquidity constraints and support the build up of cash buffers in the immediate aftermath of the COVID-19 crisis. As the pandemic developed, the provision of grants became even more widely used by governments, and its design varied considerably between countries (OECD, 2021[70]). Despite the large variation, at the beginning of the pandemic this type of support was generally used to relieve SMEs’ operating expenses and working capital needs. Grant schemes that aimed to target sectors in need (e.g. hospitality and cultural sector) were introduced in Greece, Belgium, Estonia (OECD, 2021[70]). In the Netherlands, schemes initially targeted micro and small enterprises in hard-hit sectors but gradually broadened the coverage to other sectors and company sizes (Government of the Netherlands, 2021[71]).

A key advantage of grant schemes is the broad range of beneficiaries that can be reached, as opposed to debt and equity finance where the provision is largely contingent on market-driven criteria. Grants have thus been mainly used to target microenterprises that are underserved through the traditional financing channels but were also in acute need of liquidity support. Microenterprise-targeting grant schemes were introduced in Chile, Germany, Ireland and the Netherlands (OECD, 2021[70]). In some emerging economies, grants schemes were also used to support informal SMEs given their limited access to bank finance and uncertain repayment capacity (Schwettmann, 2020[72]). Grants also have the benefit of providing relief without adding to SME debt.

As the pandemic evolved and governments started to introduce structural objectives in their policy support, grants and subsidies were also used as a tool to support the structural transition toward more digitalised, innovative and green economies (see Chapter 2). For example, vouchers were used to boost SMEs’ and access to consultancy services to innovate and diversify markets as well as to provide entrepreneurs with access to digital trainings in Ireland and New Zealand. In Germany, the KfW Climate action campaign introduced grants to incentivise investments in the manufacture and use of sustainable systems and products (OECD, 2020[65]).

Public support for equity financing in 2020 was strong, but not as strong as the support provided through other instruments

In the run-up to the COVID-19 crisis, there were significant improvements in the development and uptake of alternative sources of finance for SMEs. Government support played an important role in the development of the SME equity finance industry in the period after the great financial crisis and before the COVID-19 pandemic. In the case of venture capital, public funding in new investment funds contributed to mobilising private investors and boosting investment volumes (Helmut Kraemer-Eis, Simone Signore and Dario Prencipe, 2016[73]). Some of the measures implemented included the establishment of funds of funds, direct investment or co-investment, and the development of regulatory frameworks to enhance the industry (OECD, 2020[28]). Funds of funds, for example help distribute finance between large investors (which can include institutional investors) and firms that seek private equity, by grouping funds to invest in small VC funds rather than firms (OECD, 2020[28]). This strengthened the participation of smaller actors in the industry and helped in the diversification of asset allocation. Co-investment, on the other hand, helped mobilise private investment through risk-sharing (Group of Thirty, 2020[74]). A large number of countries implemented measures to strengthen the VC industry in 2019. For example, 40 out of 46 countries had policies that supported private equity financing for SMEs.