13. Finland

The Finnish economy had seen five years of continuous growth before the COVID-19 pandemic. The COVID-19 pandemic and the uncertainty in the global economy resulted in a recession in Finland as GDP declined 2.9% in 2020. The Finnish Government supported companies, investments and the availability of financing during the pandemic.

About 99.1% of all employer firms are SMEs in Finland (79 435 companies), employing 57% of the labour force. The SME share in employment goes up to 64% if non-employers are also included in the count. The vast majority of SMEs (76.3%) are micro-enterprises with less than 10 employees. The decline in the number of employer firms has continued in recent years, while the number of the self-employed has increased.

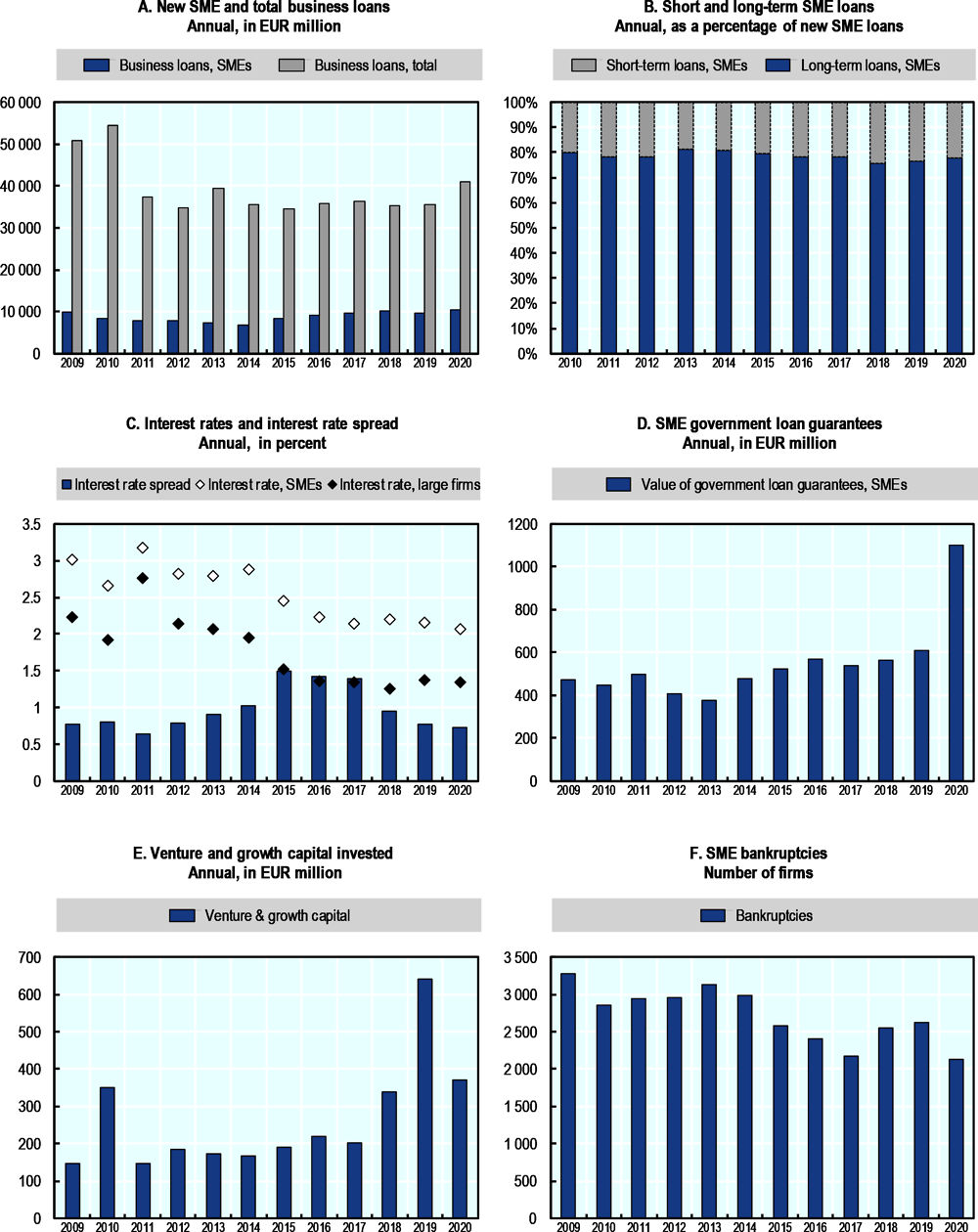

The volume of new lending to SMEs increased in 2020, almost approaching its pre-financial crisis (2008) level. New business lending to SMEs grew by 11.2% in 2020 in comparison to the previous year. Total new lending to all enterprises increased 14.8%. SMEs’ strong demand for loans was supported by COVID-19 economic measures to prevent bankruptcies, because restrictions on mobility and business activity affected demand in Finland in 2020.

The average interest rate on small loans of up to EUR 1 million, which is used as proxy for the interest rate on loans to SMEs, decreased between 2011 and 2020. The average interest rate was 2.0% in 2020. The average interest rate charged on loans over EUR 1 million has remained at around 1.3% for two consecutive years. The credit spread between small and large business loans indicates a loosening of credit terms for SMEs compared to large enterprises. The interest rate spread was 0.69% in 2020, while it was 0.97% in 2018.

According to the Finnish Venture Capital Association (FVCA), a record-high figure of EUR 951 million was invested in start-ups and early-stage growth companies in Finland in 2020. The growth is seen as a continuation of long-term efforts which have led to increasingly high quality start-ups and stronger VC industry in Finland. Of the total sum, foreign investments accounted for EUR 543 million. Finnish Venture Capital (VC) funds invested EUR 223 million and business angels invested EUR 36 million. Finland had the most Venture Capital investments per GDP in 2018, 2019 and 2020.

Average payment delays surged to 17 days in 2020. There was a significant increase in payment delays following the COVID-19 pandemic and during the economic downturn in Finland.

Due to the COVID-19 pandemic, Business Finland and the Centres for Economic Development, Transport and the Environment (ELY Centres) distributed coronavirus subsidies to companies (including SMEs) for development activities. With these subsidies, companies were able to explore their development needs and implement their development projects. For example, companies have used the support for digitalisation.

In addition, the government also provided liquidity support to businesses. The business cost support is intended for firms whose turnover has fallen significantly (-30%) as a result of the COVID-19 pandemic. The third application round for business cost support took place from 27 April to 23 June 2021, which is used to cover firm’s fixed costs and wages. The aim of the cost support is to help businesses to withstand the challenges caused by the COVID-19 pandemic and to reduce the number of bankruptcies. SMEs can receive support even if they were in difficulties1 before January 2020. However, they are granted support if the company is not in bankruptcy or reorganization proceedings at the time the support is granted and has not received rescue or restructuring aid. The fourth application round for business cost support took place from 17 August to 30 September 2021.

The number of bankruptcies decreased markedly by 19% in 2020 from the previous year. A part of the decline is explained by temporary amendment of the bankruptcy law (May 1st 2020), which prevented bankruptcies of those enterprises whose financial difficulties would most likely be temporary due the COVID-19 pandemic restrictions.

In Finland, 99.1% of all employer firms were SMEs in 2019 (79 435 SMEs), employing 57% of the labour force. The share is 64% if all firms (0-249 employees, but excluding primary production sector) are included. The vast majority of SMEs (76.3%) were micro-enterprises with less than 10 employees. The decline in the number of employer firms have continued, whereas the number of self-employed has been increasing in recent years.

The volume of new lending to SMEs increased in 2020, almost approaching its pre-crisis (financial crisis 2008) level. New business lending to SMEs grew by 11.2% in 2020 in comparison to the previous year. Total new lending to all enterprises increased 14.8%. SMEs’ strong demand for loans was supported by COVID-19 economic measures to prevent bankruptcies, because restrictions on mobility and business activity affected demand in Finland in 2020.

Total new business lending and SME lending have followed inverse trends since the slump that followed the financial crisis. SME lending plummeted in 2013 and 2014 due to the economic downturn. New SME lending has increased by 44% since, whereas the total new business lending has grown only by 0.5% from 2014 to 20192. However total business lending increased 14.8% in 2020 in comparison to the previous year.

Between 2019 and 2020, the share of short-term loans in new SME lending decreased by one percentage point reaching 23.6% from previous year. The decrease in the share of short-term loans suggests that there wasn’t a huge need for working capital financing for SMEs due to the COVID-19 pandemic. COVID-19 business grants have reduced the need of loans.

Ample availability of bank financing lowered the demand for public sector financing from Finnvera. The volume of direct government loans to SMEs has decreased yearly since 2015 from EUR 385 million to EUR 105 million in 2020. Moreover, the introduction of EU guarantee programmes targeted at SMEs has increased availability of SME loans intermediated by banks and reduced the demand for loans provided by Finnvera.

The average interest rate on small loans of up to EUR 1 million, which is used as an interest rate proxy for loans to SME, has been decreasing from 2011 to 2020. The average interest rate was 2.0% in 2020. The average interest rate charged on loans over EUR 1 million has remained at around 1.3% for two consecutive years. The credit spread between small and large business loans indicates a loosening of credit terms for SMEs compared to large enterprises. The interest rate spread was 0.69% in 2020, while it was 0.97% in 2018.

According to the latest SME-barometer (1/2021), 50% of respondents consider that credit conditions have tightened. The share of Finnish SMEs that view credit conditions as having tightened increased to 50% from 46% in 2019 (1/2019). SMEs’ payment difficulties in the last 3 months have been relatively stable during COVID-19 pandemic.

Overall, however, access to finance was not the most pressing problem for Finnish SMEs before COVID-19 pandemic. According to SME-barometer in the second half of 2019, the current economic conditions was by far the most frequently mentioned barrier to SMEs’ development. Access to finance appears only as the sixth most pressing problem. The share of rejected loan applications was about 6% in Finland in 2019, but it increased by more than two percentage points in 2020.

According to SME-barometer in the first half of 2021, the COVID-19 pandemic has changed SMEs view for the future and 37% of the SMEs have developed new products and services. Also a third of the SMEs have changed their operating practices.

According to the Finnish Venture Capital Association (FVCA), a record-high figure of EUR 951 million was invested into start-ups and early stage growth companies in Finland in 2020. Of the total sum, foreign investments accounted for EUR 543 million. Finnish Venture Capital (VC) funds invested EUR 223 million and Finnish business angels invested EUR 36 million. Finnish Venture Capital (VC) investments doubled from previous year. Foreign VC funds allocated EUR 272 million of direct investments into Finnish companies. The amounts of investments from both Finnish and foreign VC funds has grown significantly from the previous year. New venture capital fund managers have emerged and new funds in the seed and start-up stage have been established in recent years.

According to Invest Europe, Finland had the most Venture Capital investments per GDP in 2018, 2019 and 2020.

The average seed and start-up investment was EUR 2.8 million and the average later stage investment was EUR 11.5 million in 2020 according to the FVCA statistics. The average investment amount has been on the increase in recent years. Foreign investors have been increasingly turning to Finnish growth companies and private equity funds, which may facilitate a rise in the availability of growth funding in the long run.

According to Bank of Finland, the volume of funding mediated through crowdfunding and peer-to-peer lending markets declined in Finland in 2020. Funding mediated to Finnish applicants decreased 17% from the previous year due to a reduction in P2P lending and loan-based crowdfunding. In 2020, the total volume of funding mediated through P2P lending and crowdfunding markets amounted to EUR 282 million. Crowdfunding is marginal as a corporate financing source in comparison to bank lending.

Average payment delays have surged to 17 days in 2020. There was a significant increase in payment delays following the COVID-19 pandemic and during the economic downturn in Finland, but the delays should decrease as the economic conditions improve after pandemic. Finnish businesses have been among the fastest in Europe to pay their invoices before COVID-19 pandemic, according to the statistics collected by Intrum for the European Payment Report 2018 and 2019. The share of businesses that have accepted excessively long payment terms is significantly higher in Finland at 81%, compared to the European average of 69%. Moreover, intentional late payments is a rather frequent cause of late payment in Finland. These observations suggest that some businesses are able to utilize cash planning for their advantage, but that some of their creditors, particularly SMEs, may become financially strained.

The number of bankruptcies decreased markedly by 19% in 2020 from the previous year. The total number of firms in bankruptcy proceedings was 2135 in 2020, and this figure covers all enterprises, as a statistics on SME bankruptcies is not available. A part of the decline is explained by temporary amendment of the bankruptcy law (May 1st 2020), which prevented bankruptcies of those enterprises whose financial difficulties would most likely be temporary due the COVID-19 pandemic restrictions. More recent data from the first half of 2021 indicate that the number bankruptcies will not surge significantly in the future.

There are four financing companies owned by the Government of Finland providing financing to SMEs. While Finnvera Plc and Business Finland provide unsecured loans, guarantees and grants, both Finnish Industry Investment Ltd and Business Finland Venture Capital Ltd operate in venture capital (incl. private equity) markets. Due to COVID-19 pandemic Business Finland and the Centres for Economic Development, Transport and the Environment (ELY Centres) distributed coronavirus subsidies to companies (including SMEs) for development activities. With these subsidies, companies were able to explore their development needs and implement their development projects. For example, companies have used the support for digitalisation. There has not been a need for a “furlough scheme” used in Sweden or Denmark, because it was possible to make the Finnish lay-off system very flexible with minor legislative amendments. In practice, “wage subsidies” have been replaced by earnings-related unemployment benefits in Finland.

The business cost support is intended for firms whose turnover has fallen significantly (-30%) as a result of the COVID-19 pandemic. The third application round for business cost support will take place from 27 April to 23 June 2021, which is used to cover firm’s fixed costs and wages. The aim of the cost support is to support businesses in the difficult situation caused by the COVID-19 pandemic and to reduce the number of companies going bankrupt by giving companies more time to adjust their activities and costs once the COVID-19 crisis persists.

At the end of 2020, Finnvera had 26 500 customers, of which 87% were micro-enterprises and 13% other SMEs and midcap enterprises. The Parliament of Finland raised Finnvera’s domestic credit and guarantee authorisation from the maximum of EUR 4.2 billion to EUR 12 billion by amendment in May 2020. This constituted a significant boost to Finnvera’s opportunities to grant COVID-19 financing. Finnvera gave a signal to markets that guarantees and loans are available when needed. The State raised the credit and guarantee loss compensation paid to Finnvera from 50% to 80%. Finnvera has shifted its focus to guarantees as loan stock has decreased in past few years. The main SME product is the Start Guarantee, with which an enterprise can get bank financing for its various investment and working capital needs. In 2020, Finnvera granted EUR 57 million in Start Guarantees.

Since the European Fund for Strategic Investments (EFSI) was set up by the European Commission in 2015, various EU guarantee and funding arrangements have become available in Finland. SME InnovFin and SME Initiative guarantee instruments are among the most relevant of these EU financial instruments. These loans are granted by private Finnish banks and one insurance company.

Finnvera can grant 80% coverage SME guarantee for a loan of a maximum of EUR 120 000 at one time. A new SME Guarantee may be granted at least two months after the previous SME guarantee decision. The total sum of SME Guarantees granted to one enterprise may be up to EUR 240 000. SME Guarantee does not require collateral.

Tesi (Finnish Industry Investment Ltd) manages KRR funds-of-funds (“growth fund of funds”), in which both Tesi and Finnish insurance and pension companies invest. KRR funds invest in venture capital and growth funds operating in Finland that invest in Finnish growth companies. Since the launch of the first KRR fund more than ten years ago, the programme has played an important role in encouraging large pension funds to get familiar with and invest in Finnish VC and buyout funds. The next KRR (IV) will continue the successful investment activities of its predecessors. The fund-of-fund’s capital is EUR 175 million. It targets to invest in 10-14 Finnish venture capital and private equity funds during 2020-2025.

Business Finland Venture Capital Ltd (BFVC) invests in venture capital funds, which invest in companies in their early stages of development. The purpose of the company is to develop Finland’s venture capital market. The programme has had a great impact on encouraging different groups of investors to participate in the fund raising of smaller first time VC funds. Their due diligence work has been especially appreciated by the co-investors in the funds. So far Business Finland Venture Capital Ltd has invested in 13 funds that have collected funs in total amount of 194 million euros. Both programmes, KRR and BFVC, are bridging the funding gaps by investing in private sector funds.

The Finnish Climate Fund is a Finnish state-owned special-assignment company. In 2020, the Finnish Government announced the Climate Fund and its operations focus on combating climate change, boosting low-carbon industry and promoting digitalisation. The Climate Fund’s primary investment targets are industrial scale-ups of climate solutions: the first verification of a new technology and/or its business model at an industrial or commercial scale. The other investment category of the Climate Fund includes physical or digital platforms enabling emissions reductions. Depending on the financing category and target, the financing by the Climate Fund can vary between EUR 1 and 20 million. The annual financing volume is approximately EUR 80 million.

The headquarters of Nordea bank were moved to Finland in 2018. This had an effect on some of the indicators. The total amount of non-performing loans (the rate and the amount in EUR) are derived from the Financial Supervisory Authority, which collects its statistics at the bank group level and not separated for business areas (Finland operations of Nordea).

Some of the revisions are due to an update about a month ago (5/2021). The removal of non-recourse factoring from business loan volumes and average interest rates from March 2014 onwards reduced average business loan interest rates and reduced new loan volumes. Source: Bank of Finland.

Notes

← 1. A company in difficulty refers to a company in accordance with Article 2(18) of the General Block Exemption Regulation of the EU.

← 2. The low cumulative growth is explained by the removal of non-recourse factoring from business loan volumes and average interest rates from March 2014 onwards reducing average business loan interest rates and reducing new loan volumes.