copy the linklink copied!39. Serbia

copy the linklink copied!Key facts on SME financing

SMEs dominate the Serbian business economy, accounting for 99% of all enterprises. In 2018, SMEs employed more than 65% of the labour force and accounted for 57.4% of total gross value added and for 37% of total exports. Sector-specific data indicates that most SMEs belonged to the trade sector (26.0%), followed by the manufacturing sector (15.4%), professional, scientific and innovative activities (12.8%), and transportation and storage (10.0%).

Results from the 2018 SME lending conditions survey conducted by the National Bank of Serbia indicate that SME financing conditions continued to improve, prolonging a trend that started in 2014. These improvements are linked to the country’s achievement and maintenance of a more macro-economically stable environment, as well as to the Central Bank’s relaxation of monetary policy and successful work on resolutions for dealing with NPLs, which have lowered the country’s risk premium.

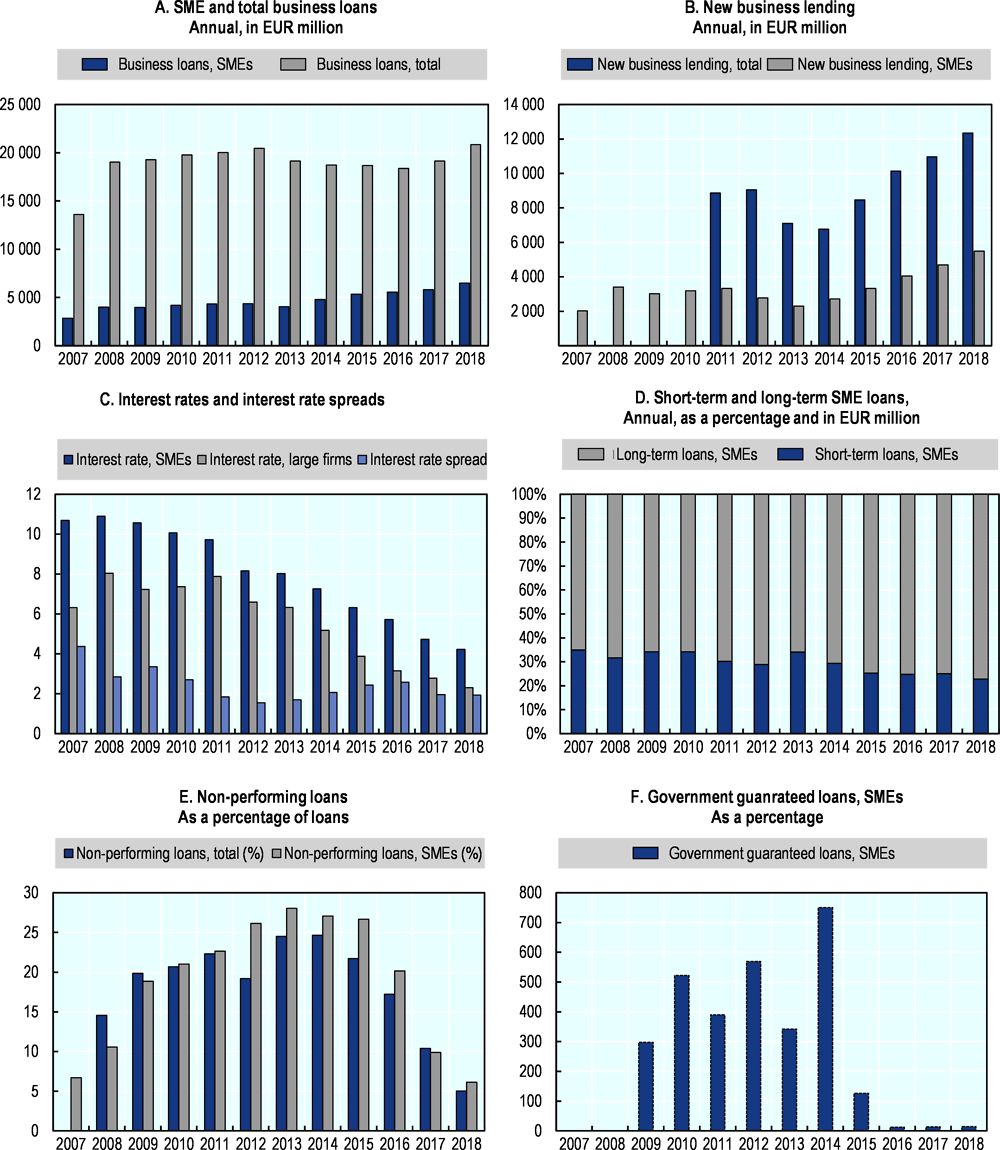

In 2018, new bank lending to SMEs increased by 17.2% year-on-year. The share of new SMEs loans among total corporate loans likewise increased by 1.8 percentage points to 44.5% in 2018. The stock of SMEs loans in 2018 increased by 12% year-on-year to EUR 6.5 billion. As a result, the share of outstanding SME loans in total corporate loans stood at 31.2%. Long-term loans amounted to 77.2% of total SMEs loans.

Lending conditions as captured by interest rate levels continue to improve. Interest rates for SME loans in or indexed to foreign currencies decreased to 4.2% in 2018 (from 4.6% in 2017 and 5.7% in 2016), however the interest rate spread between large companies and SMEs increased slightly to 1.9 percentage points (from 1.8 percentage points in 2017). On the Serbian dinar-denominated loans side, interest rates on loans to large companies decreased faster than interest rates on SME loans, thus the interest rate spread on RSD-denominated loans increased to 2.4 percentage points (from 1.9 percentage points in 2017). More specifically, interest rates on RSD-denominated loans to SMEs declined from 6.9% in 2017 to 6.3% in 2018.

The rejection rate (that is, the percentage of SME loan applications that are rejected) decreased to 17.1% in 2018 (from 28.3% in 2017), while the utilisation rate (the percentage of used SME loans among all SME loans that were approved) increased to 95% in 2018 (from 90.6% in 2017). At the same time, the share of loans requiring collaterals (excluding bills of exchange) decreased to 53.1% in 2018 (from 53.8% in 2017).

The share of NPLs in total SMEs loans continued to improve in 2018 and stood at 6.1% (compared to 9.9% in 2017). This is a strong signal supporting the successful implementation of the NPL Resolution Strategy, which affected not only the SME segment but the whole corporate sector, whose NPL share decreased to 5% in 2018 from 10.4% in 2017.

copy the linklink copied!SMEs in the national economy

SMEs dominate the Serbian business economy, accounting for 99% of all enterprises, the majority of them (96.2%) being companies with less than 10 employees.

In 2018, SMEs employed more than 65% of the labour force and accounted for 57.4% of total gross value added and for 37% of total exports. Sector-specific data indicates that most SMEs belonged to the trade sector (26.0%), followed by the manufacturing sector (15.4%), professional, scientific and innovative activities (12.8%), and transportation and storage (10.0%).

copy the linklink copied!SME lending

The National Bank of Serbia conducts an annual survey on SME lending conditions among commercial banks established in Serbia. Data covers financial loans provided by these banks to SMEs as well as cross-border loans.

Preliminary results show that SME lending conditions continued to improve in 2018, for the fifth year in a row. Positive trends in SMEs lending, which started in 2014 and extended throughout 2015-17, continued in 2018. These improvements are linked to the country’s achievement and maintenance of a more macro-economically stable environment, as well as to the Central Bank’s relaxation of monetary policy and successful work on resolutions for dealing with NPLs, which have lowered the country’s risk premium.

The stock of SMEs loans in 2018 increased by 12% year-on-year to EUR 6.5 billion. In 2018, new bank lending to SMEs increased by 17.2% year-on-year. The share of new SMEs loans among total corporate loans likewise increased by 1.8 percentage points to 44.5% in 2018. As a result, the share of outstanding SME loans in total corporate loans was 31.2%. Long-term loans accounted for 77.2% of total SMEs loans.

copy the linklink copied!Credit conditions

Lending conditions as captured by interest rate levels continue to improve. Interest rates for SME loans in or indexed to foreign currencies decreased to 4.2% in 2018 (from 4.6% in 2017 and 5.7% in 2016). The interest rate spread between large companies and SMEs increased slightly to 1.9 percentage points (from 1.8 percentage points in 2017). On the RSD-denominated loans side, interest rates on loans to large companies decreased faster than interest rates on SME loans. Thus, the interest rate spread on RSD-denominated loans increased to 2.4 percentage points (from 1.9 percentage points in 2017). More specifically, interest rates on RSD-denominated loans to SMEs declined from 6.9% in 2017 to 6.3% in 2018.

The rejection rate (that is, the percentage of SME loan applications that are rejected) decreased to 17.1% in 2018 (from 28.3% in 2017), while the utilisation rate (the percentage of used SME loans among all SME loans that were approved) increased to 95% in 2018 (from 90.6% in 2017). Meanwhile, the number of loans requiring collateral (excluding bills of exchange) decreased to 53.1% in 2018 (from 53.8% in 2017).

copy the linklink copied!Alternative sources of SME financing

Non-bank sources of SME financing are still developing in Serbia, and the Government is working on setting up the legislative framework that will regulate this type of financing.

Currently, equity investment activity is dominated by the Western Balkans Enterprise Development and Innovation Facility (WB EDIF). As of today, WB EDIF has invested around EUR 75 million in 453 enterprises in Serbia. Funds are typically invested as part of two programmes:

-

The Enterprise Innovation Fund (ENIF) for the financing of innovative SMEs in their early stages of development, and;

-

The Enterprise Expansion Fund (ENEF), which finances established SMEs with high growth potential to support the development and expansion of their activities.

ENIF investments mostly targeted companies specialised in software or IT tools for different branches of activity, like the chemical industry, real estate or the tourism industry, but also companies that are developing online platforms for various services and aimed at lowering business costs.

ENEF mainly invested in manufacturing companies producing car parts.

In addition to these funds, WB EDIF also provides guarantees to banks that are lending to innovative SMEs, various technical support projects to improve the regulatory framework for innovative and fast-growing SMEs, as well as professional support.

copy the linklink copied!Other indicators

Cooperation between the Serbian government and the National Bank of Serbia aimed at lowering NPLs yielded conclusive results. The share of NPLs in total SME loans continued to improve in 2018 and stood at 6.1% (from 9.9% in 2017). This is a strong signal supporting the successful implementation of the NPL Resolution Strategy, which not only affected the SME segment but the whole corporate sector, whose NPL share decreased to 5% in 2018 from 10.4% in 2017.

copy the linklink copied!Government policy response

Development of SMEs was recognised by the Serbian government as one of the most important economic goals and in 2015, the Strategy for support in developing of SMEs and competitiveness (Strategy) was launched with the target of realising listed actions points during 2015-2020. The Strategy defined priorities and measures that should be implemented in the medium term. In 2016, a Year of Entrepreneurship was declared, and after successful actions made during 2016, it was decided in 2017 that the Year of Entrepreneurship be upscaled to the Decade of Entrepreneurship.

Under the Decade of Entrepreneurship programme, many government institutions, chambers of commerce, business associations, international organisations, donors, and NGOs are involved. Activities within this programme relate both to financial support (e.g. loans, subsidies, development of exports, support in entering supply chains, etc.) and non-financial support (such as education, requalification, professional and consulting assistance, etc.). Some of the projects that were announced in 2018 and 2019 are presented in the following paragraphs.

Financial support for Start Ups (active until the end of 2018)

The programme is implemented by the Ministry of Economy in cooperation with the Development Fund of the Republic of Serbia. The funds are designed to support newly established entrepreneurs, micro and small enterprises financially. Total available grants for the realisation of this programme amount to RSD 200 million.

Support includes a combination of 30% of grants and 70% of RS Development Fund loans, and in highly undeveloped municipalities (IV Development Group), 40% of grants and 60% of RS Development Fund loans.

Funds under this programme can be used for:

-

Upgrade/reconstruction

-

Purchase of equipment

-

Permanent working capital

This programme was closed in July 2019 as all funds were disbursed.

Programme for enhancing entrepreneurship through support investments

The programme is run by the Ministry of Economy in cooperation with the Development Fund of the Republic of Serbia. The funds defined by the programme are intended for:

-

Purchase, construction, upgrade, reconstruction, adaptation, rehabilitation, investment maintenance, production space or business premises, which is a part of the production area, or in which the production or storage of products is carried out;

-

Purchase of new or used production equipment (not older than five years), including delivery vehicles for the transport of own products and other means of transportation used in the production process;

-

Permanent working capital, which cannot constitute more than 20% of the total investment;

-

Purchase of software and other intangible assets.

Total available grants for the realisation of this programme amount to RSD 750 million. The programme was closed for medium-sized enterprises during 2019 as all funds were disbursed, but it is still open to small enterprises.

Digital transformation support programme

The programme is implemented by the Serbian Development Agency in cooperation with the Serbian Chamber of Commerce.

The goal of the Digital Transformation Support Programme is to create a clear infrastructure to support SMEs in the digital transformation process. Available funds are granted individually to the beneficiaries in the form of co-financing up to 50% of the eligible costs, excluding VAT, for each project activity, on the principle of reimbursement. The maximum amount of approved funds per beneficiary is RSD 600 000. The total budget of the programme is RSD 70 million.

Other Development Fund programmes:

-

Loans/guarantees for micro and small legal entities for maintenance of current liquidity;

-

Investment loans (for procurement of imported and domestic equipment, construction and upgrading of business facilities, etc.);

-

Short-term loans (to encourage the competitiveness and liquidity of the domestic economy).

Loans of the Agency for Insurance and Financing of Exports (AOFI)

The AOFI approves RSD loan arrangements with a repayment term of up to five years for exporters, both domestic legal entities and entrepreneurs. The AOFI also issues the following instruments:

-

Guarantees

-

Counter-guarantees

-

Basic lines for issuing guarantees

-

Guarantees for importation of equipment (for small and medium-sized export firms)

-

Other guarantees for export operations and investments abroad, as well as guarantees for exporters for domestic market operations.

Factoring of the Agency for Insurance and Financing of Exports

This is the financial instrument by which the factor (AOFI) finances the exporting enterprises on the basis of future (unexpired) receivables arising from the sale of goods or services. The total budget amounts to RSD 700 million.

Early Development Programme and Innovation Co-Financing Programme

The programmes are implemented by the Innovation Fund. The purpose of the programme is to provide direct financial assistance to small and medium-sized enterprises in Serbia for the development of innovative services, processes and products with market potential. Support can reach up to EUR 80 000 for the Early Development Programme, and up to EUR 300 000 for the Innovation Co-Financing Programme.

Early Development Programme is designed to support the survival of start-ups during the critical research and development phase and to enable business capacity development through which they can market their innovations. Applicants for this programme must be micro- or small enterprises no older than 3 years at the time of application to the programme. The support includes a combination of up to 85% of the grants provided by the Fund and a minimum of 15% of the self-financing provided by the beneficiary enterprise. The Fund may award a maximum of EUR 80 000 per project. Projects can take up to 12 months. EUR 4.5 million are dedicated to the implementation of this programme.

The Co-Financing Programme provides direct financial support for micro, small and medium-sized private enterprises in Serbia that want to engage in the development of innovative and commercially oriented products, services and technologies based on the creation of new intellectual property. The objective of the programme is to develop a high-value-added prototype or final innovative product, service or technology and to launch it internationally. The support includes a combination of up to 70% of the grants provided by the Fund and a minimum of 30% of the co-financing provided by the beneficiary enterprise. The Fund may award a maximum of EUR 300 000 per project. Projects can take up to 24 months.

Funds under these programmes can be used for:

-

Salaries;

-

Research and development equipment and supplies;

-

Lease of office space and business support;

-

Research and development services, subcontracting services;

-

Research and development experts/advisers;

-

Patent application and associated costs, product certification.

Science and economy collaboration programme

The programme is implemented by the Innovation Fund. The science and economy collaboration program is designed to encourage private sector enterprises and public research organisations to undertake joint research and development projects with the aim to create new products and services, that is, innovative technologies with market potential.

Amount of funding:

-

Up to EUR 300 000 or up to 70% of the total approved project budget for projects proposed by micro- and small enterprises, or up to 60% of the total approved project budget for projects proposed by medium-sized enterprises

-

At least 30% of the total approved budget for projects proposed by micro- and small enterprises, or at least 40% of the total approved budget for projects proposed by medium-sized enterprises, is provided by the applicant from other private sources independent of the Fund.

The project can be from any field of science and technology and any industrial sector.

The programme is funded by EU IPA 2013 funds (EUR 2.4 million) and the budget of the Republic of Serbia from the Ministry of Education, Science and Technology Development (EUR 1 million).

Innovation vouchers

The programme is implemented by the Innovation Fund. The aim of the Innovation Vouchers scheme is to financially incentivise SME to collaborate with R&D institutions, thereby engaging in innovation and making their products more competitive on the market. Privately owned micro-, small and medium-sized companies that are registered in Serbia may apply for innovation vouchers. The service provider is a public scientific research organisation or any other accredited scientific research organisation.

Up to RSD 800 000 are approved per innovation voucher, or 80% of total service costs, not including value added tax. At least 20% is provided by the applicant from other sources independently of the Fund. No more than two innovation vouchers may be granted to one applicant, for a maximum of RSD 1.2 million.

Funds under this programme may be used for the following services:

-

Development of new or improvement of existing products;

-

Feasibility study;

-

Production of a laboratory prototype;

-

Creation of demonstration prototypes;

-

Various types of testing (in the lab, at the pilot plant);

-

Technology verification;

-

Verification of new or improved products, processes or services;

-

Innovation advisory services;

-

Development and implementation of specific product- or process-related software (as part of product development);

-

Specific coaching in connection with the developed solution of the technical knowledge question.

Programme for the promotion of entrepreneurship and Self-employment programme

A Memorandum of Understanding between the Ministry of Economy, Public Investment Management Office and KfW was signed, establishing the Programme for the Promotion of Entrepreneurship and Self-Employment, which is intended for beginners in business, and which will provide various types of support: favourable loans, guarantees, grants and technical support programmes.

The total funds available for the implementation of this programme are RSD 300 million. Out of the mentioned funds, RSD 250 million are devoted for the implementation of the Programme, while RSD 50 million are devoted for the costs of engaging the Implementing Partner and the implementation of training and mentoring programmes.

Warranty scheme

The IPA project "EU for Serbia - financial resources for SMEs" is the implementation of a guarantee scheme and the improvement of the capacity of SMEs to access various forms of financing. The value of the project is EUR 20 million, and this guarantee scheme will enable new loans of at least EUR 180 million through the leverage effect. The objective of the scheme is to improve access to finance for SMEs by encouraging better lending conditions by financial intermediaries, such as:

-

More favourable maturities of loans;

-

Lower borrowing costs;

-

Reduction of the required stocks;

-

Extension of lending to risky SMEs (micro and early stage development companies - less than 3 years).

Although the funds are provided from the national IPA programmes, the enforcement mechanism will remain the same as for regional programmes under the Western Balkans Enterprise and Innovation Program (EDIF).

COSME

Serbia joined COSME at the end of 2015. COSME is the EU programme aimed at SMEs and running from 2014 to 2020. The programme’s general objective is to strengthen the competitiveness of SMEs, and thus decrease the unemployment in the county. The Ministry of Economy will be in charge of coordinating the activities of COSME.

The Programme consists of four components:

-

Facilitating access to finance – guarantees and venture capital;

-

Access to markets;

-

Creating an environment favourable to competitiveness;

-

Encouraging entrepreneurship.

The Programme beneficiaries are existing entrepreneurs and SMEs who will have facilitated access to finance aimed at enterprise development and growth, future entrepreneurs and SMEs via the start-up support, as well as national and local authorities through the transfer of best practice and financial support to test and scale up sustainable solutions for improving global competitiveness.

As of today, six Serbian commercial banks have signed loan guarantee agreements with the EIF, which will allow them to provide loans to SMEs of EUR 1 billion (in total) on more favourable terms.

The COSME programme also supports the continuation of the work of the European Enterprise Network in Serbia (EEN Network).

References

National Bank of Serbia (https://www.nbs.rs/internet/english/index.html)

Statistical Office of Republic of Serbia (http://www.stat.gov.rs/en-US/)

Ministry of Economy of Republic of Serbia (http://privreda.gov.rs/english/)

Metadata, Legal and Rights

https://doi.org/10.1787/061fe03d-en

© OECD 2020

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.