copy the linklink copied!Slovenia

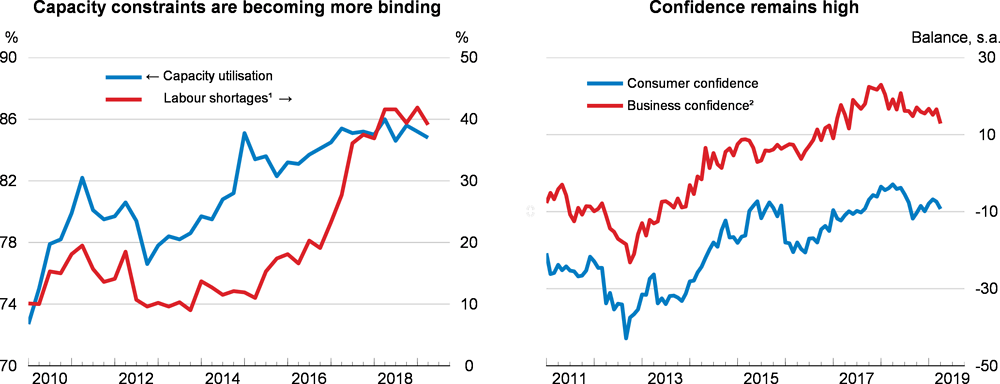

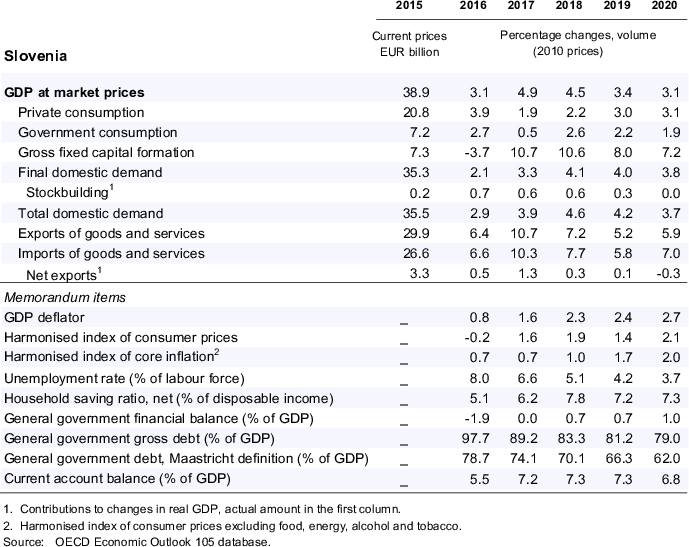

Economic growth is projected to slow to around 3½ per cent this year and just over 3% in 2020. Private consumption will be supported by continued income gains from real wage and employment growth, while private investments will be underpinned by the business sector’s need to expand capacity and favourable financing conditions. The maturing of the recovery is reflected in increasing labour shortages and tightening capacity constraints, leading demand to be increasingly satisfied through higher imports.

The fiscal stance is expansionary in 2019 and neutral the following year. As monetary conditions remain extremely accommodative, a tighter of the fiscal stance is needed to contain inflationary pressures and secure fiscal sustainability. Measures, such as restricting pathways to early retirement and accelerating the privatisation process, would contribute to mobilising under-utilised labour resources and free up workers to faster growing industries.

The recovery is maturing

Economic growth remains strong, underpinned by solid domestic demand. Private consumption is supported by improving labour market conditions, higher real wage growth and upbeat consumer confidence. Strong investment growth is sustained by EU structural funds, the need to expand production capacity, and favourable financing conditions. Export growth is moderating along with slower foreign demand. Until now, wage growth has picked up only moderately. Consumer price inflation dipped to 1.6% in early 2019, under the influence of lower energy prices, and core inflation has remained stable.

Employment continues to rise and unemployment is falling further, inducing higher labour force participation and the hiring of foreign nationals. Nonetheless, labour shortages and capacity utilisation remain at their highest level in a decade. Despite that, confidence remains high. Wage growth is set to rise, as the government and social partners agreed to increase minimum wages by 10% by end-2020 and public sector wages by about 4% in 2019.

Fiscal tightening would limit the risk of overheating

Financing conditions remain favourable with the highly accommodative ECB monetary policy, and long-term interest rates continue to fluctuate slightly below 1%. At the same time, the quality of banks’ assets is improving, contributing to stronger financial resilience. Fiscal policy continues to be expansionary with increases in social transfers and public sector wages. A tighter stance is required to limit the risks of overheating and to improve fiscal sustainability.

To address increasing labour shortages, better training and activation policies are needed to mobilise under-utilised labour resources, such as low-skilled workers and the long-term unemployed. Restricting pathways to early retirement for older workers and strengthening re-training opportunities could also help relieve skill shortages. Further privatisation efforts are required to free up resources for sectors with high growth potential. This should be combined with measures to improve the functioning of the housing rental market to enable workers to move to locations with strong job growth.

Growth will slow

GDP growth is projected to slow over the forecast period. Due to domestic capacity constraints, robust private consumption and investment growth will increasingly be satisfied through higher imports. Export growth will ease in the face of weaker global demand growth and rising unit labour costs. The unemployment rate will fall further below its natural rate, leading to accelerating wage growth over the projection period, feeding into price inflation. The main upside risk is a lower-than-expected household saving rate, which would lead to stronger private consumption growth. Downside risks stem primarily from lower-than-expected productivity gains from the expansion of the capital stock, leading to a deterioration in external competitiveness and export performance. As house prices have increased substantially in the last year, an abrupt correction in the real estate market could also have negative repercussions on demand and growth.

Metadata, Legal and Rights

https://doi.org/10.1787/b2e897b0-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.