3. Tax reforms before the COVID-19 crisis

This chapter provides an overview of the tax reforms adopted before the COVID-19 crisis in OECD countries as well as in Argentina, China, Indonesia and South Africa. It looks at the reforms coming into force or due to come into force in the second half of 2019 and 2020. It examines trends in each category of tax including personal income taxes and social security contributions, corporate income taxes and other corporate taxes, VAT/GST and other taxes on goods and services, environmentally related taxes and property taxes.

This chapter provides an overview of the tax reforms adopted before the COVID-19 crisis in OECD countries as well as in Argentina, China, Indonesia and South Africa. It looks at the reforms coming into force or due to come into force in the second half of 2019 and 2020. It examines trends in each category of tax including personal income taxes and social security contributions (Section 3.1), corporate income taxes and other corporate taxes (Section 3.2), VAT/GST and other taxes on goods and services (Section 3.3), environmentally related taxes (Section 3.4) and property taxes (Section 3.5). It should be noted that some of the reforms described in this chapter have been delayed in response to the crisis. More generally, the COVID-19 crisis should be seen as a significant intervening event and future reports will focus on the impact of the crisis on longer-term tax reforms.

The discussion in this chapter is primarily based on countries’ responses to the 2020 Annual Tax Policy Reform Questionnaire, which was completed by countries between January and February 2020. This annual questionnaire asks responding countries to describe their tax reforms as well as to provide details on their expected revenue effects and other relevant information, including the rationale for the tax measures (see Box 3.1).

At the Working Party No.2 on Tax Policy Analysis and Tax Statistics (WP2) meeting in November 2009, delegates from OECD countries agreed to start collecting more systematic information on the main tax measures adopted in each country. The motivation for this proposal was to provide consistent and comparative information on tax reforms to inform policy discussions in OECD and non-OECD countries.

At the November 2010 WP2 meeting, the following criteria were agreed for deciding whether a tax policy measure was sufficiently substantial to be reported in the questionnaire:

A significant change in a tax rate;

A change in the tax base that is expected to change revenue from that base by more than 5% or 0.1% of GDP; and

A politically important systemic reform.

Any central or sub-central tax policy measure that was implemented, legislated or announced in the previous calendar year which meets at least one of the criteria listed above must be reported in the questionnaire.

For each reform, the questionnaire requests information on the type of tax; the dates of entry into force, legislation or announcement; the direction of the rate and/or base change; and a detailed description of the reform. The questionnaire also asks for the rationale behind the reform and estimates of the revenue effects of the tax measures.

In the area of personal income tax (PIT), the report confirms that countries are continuing to lower the tax burden on personal income, with most of the countries that have introduced PIT reforms in 2020 opting to cut PIT rates and narrow PIT bases. The most common rationale for these reforms cited by countries is to support fairness, particularly for those on low and middle incomes. While this trend represents a broad continuation of PIT reforms in recent years, the focus on PIT rate cuts has intensified. PIT base narrowing measures have also been frequent and often targeted at families and low-income earners. Regarding the taxation of household capital income, limited changes have been introduced, involving both tax increases and decreases. These measures have included changes to the taxation of rental income as well as expanded tax reliefs to support small savers. Finally, the focus on SSC reforms has slowed compared with recent years, and most reforms have involved SSC reductions.

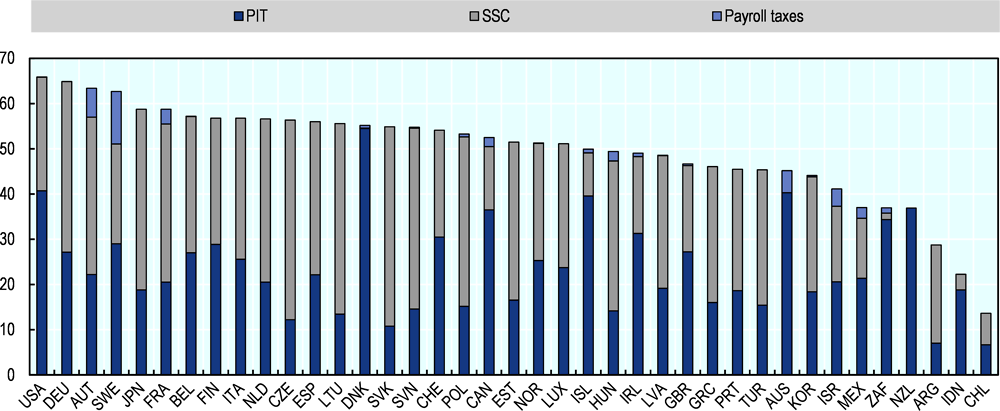

PIT and SSCs are major sources of tax revenues

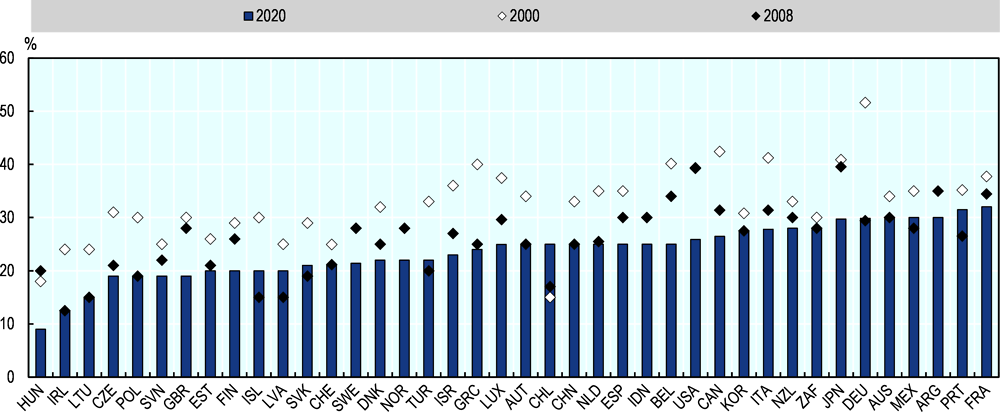

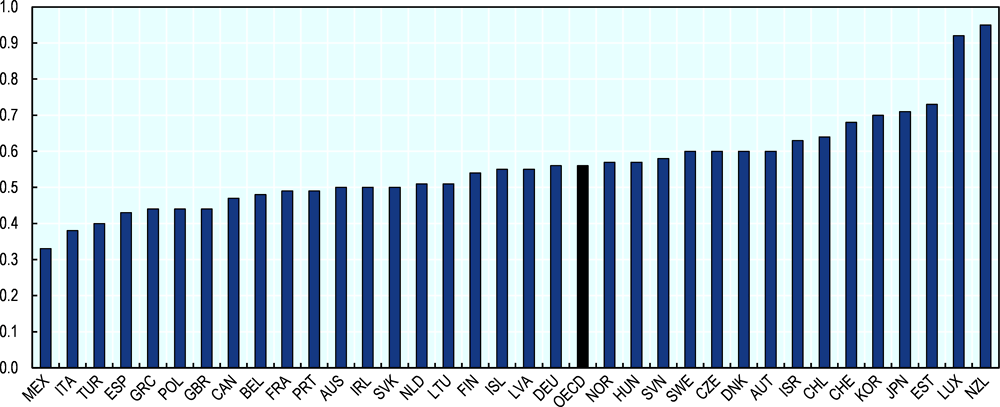

PIT and SSCs are particularly significant sources of tax revenues in most countries. Together, they account for half of tax revenues in OECD countries on average. PIT accounts for 24% of tax revenues in the OECD while SSCs account for 27%. As shown in Figure 3.1, in 2018, PIT, SSCs and payroll taxes accounted for over 60% of tax revenue in the United States and Germany and about 40% in Israel, New Zealand, South Africa and Mexico. In the Slovak Republic, the Czech Republic, Slovenia and Lithuania, SSCs alone accounted for at least 40% of total taxation. In Denmark, Australia and the United States, PIT alone accounted for about 40% or more of total tax revenues. PIT, SSCs and payroll taxes represent a much smaller share of tax revenues in Chile (14%), Indonesia (22%) and Argentina (29%).

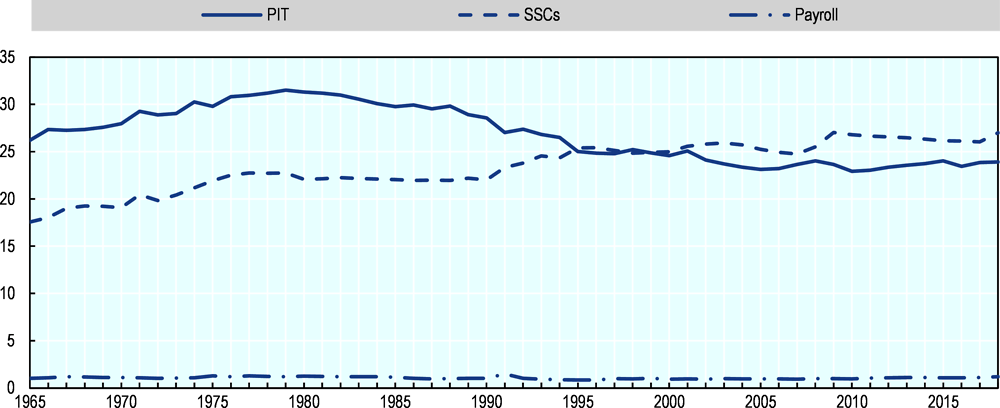

Over the past 50 years, SSCs have gradually overtaken PIT as the most important source of tax revenue in OECD countries. The sum of PIT and SSCs has remained relatively constant over time, at around half of tax revenue, but the mix has changed. PIT has gradually declined as a share of total revenue while SSCs have gradually increased (Figure 3.2). In 1965, SSCs comprised 17.6% of tax revenues on average while PIT accounted for 26.2% of total taxation. By 1995, they were about equal at approximately 25%. By 2018, SSCs represented 27.0% of total tax revenues on average, surpassing the PIT share of 23.9%.

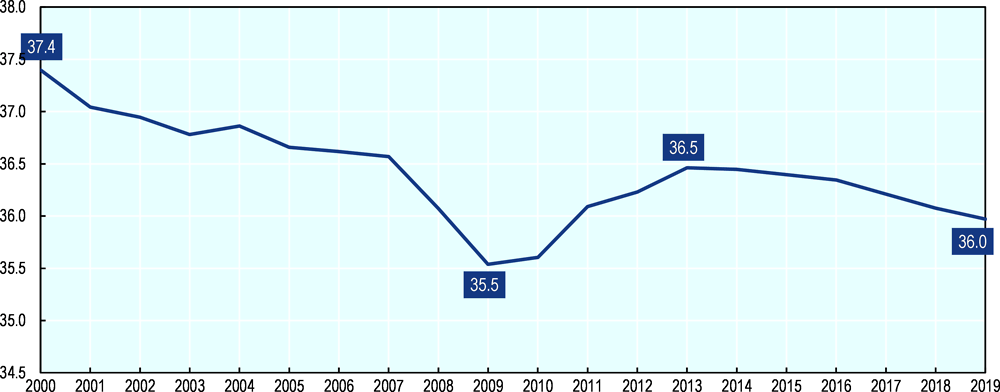

Taxes on labour income declined on average between 2013 and 2019, after a series of increases after the global financial crisis

The average tax burden on labour income has been declining slowly but consistently in recent years (Figure 3.3). Between 2009 and 2013, the OECD average tax wedge – the total tax payments on labour income as a percentage of total labour costs – for single workers earning the average wage increased by one percentage point, from 35.5% to 36.5%. This largely reflected countries’ fiscal consolidation efforts at that time. Since then, the OECD average tax wedge has been declining steadily but slowly reaching 36.0% in 2018.

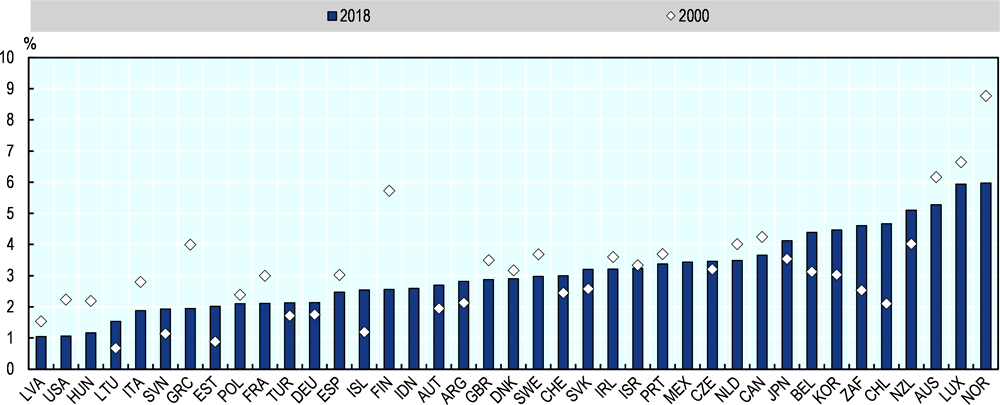

Over the past 20 years, tax burdens have declined, particularly for families with children. In the early 2000s, the tax burden declined across family types. Between 2009 and 2019, in the years following the global financial crisis, average tax wedges rose modestly for many family types, for example for one-earner married couples with children and single persons at 100% of average earnings with no children. However, tax wedges declined for single persons at 67% of the average wage with children. Overall, tax wedges remain lower than in 2000 across family types despite modest increases in the past decade (Figure 3.4).

PIT rate cuts have intensified

PIT reforms are important tools for governments to achieve different policy objectives, including raising tax revenues, stimulating economic growth or enhancing the redistributive impact of the tax system. These reforms involve the upward or downward adjustment of PIT rates and the broadening or narrowing of PIT bases. These policy choices often involve a trade-off between equity and efficiency. For instance, while PIT rate increases on the upper income brackets strengthen progressivity and fairness, they might also reduce economic incentives to work, save and invest. This section looks at the PIT reforms that were recently introduced in OECD countries, Argentina, China, Indonesia and South Africa, beginning with PIT rate reforms followed by PIT base changes.

Fewer countries have made changes to their top PIT rates compared to previous years

Of the countries undertaking top PIT rate reforms, three involved cuts while two involved increases (Table 3.1). This marks a decline in the number of top PIT rate changes compared to recent years. There are also fewer countries increasing their top PIT rates compared to previous years. For instance, in 2018, four countries reported top PIT rate increases, and in 2019, three countries raised their top PIT rates and Poland introduced a solidarity levy on taxpayers whose total income in the fiscal year exceeds PLN 1 million, levied at a rate of 4% on the excess of this amount.

Greece, the Netherlands and Sweden have lowered their top PIT rates. As part of its Annual Tax Plan 2020, the Netherlands is accelerating the introduction of its two bracket PIT (to replace the previous three bracket PIT rate schedule) by introducing it in 2020 rather than in 2021 as had previously been envisaged. As part of this reform, the rate of the top PIT bracket is decreased to 49.5% in 2020 from 51.75% in 2019. Sweden abolished its top PIT rate in 2020, which had previously added a 5% surtax on higher incomes above SEK 703 000. In Greece, the PIT rate on the highest income bracket for business, employment and farming income above EUR 40 001 is reduced modestly to 44% from 2020.

While several countries had increased top rates in recent years, only Chile and Turkey have done so in 2020, with both countries introducing a new highest income tax bracket with a PIT rate of 40%. In Chile, the previous highest tax rate was 35%. In Turkey, the new top PIT bracket applies to those earning over TRY 500 000 annually (the second highest bracket is 35%). The stated objective of both reforms is to raise revenues and enhance progressivity.

More countries are focusing on tax rate cuts targeted at low and middle-income earners

Similar to the top PIT rate reforms, non-top PIT rate reforms have involved more rate cuts than increases. Nine countries reported non-top PIT rate cuts and five reported non-top PIT rate increases in 2020. In 2019, there was a more even split between non-top PIT rate cuts and increases (four countries undertook non-top PIT rate cuts and three undertook increases). The current reforms are more closely aligned with 2017 and 2018 where most countries that undertook non-top PIT rate reforms introduced tax cuts targeted at low and middle-income earners (although these were small).

A few countries are increasing PIT rates on lower and middle-income brackets. Of the countries increasing non-top PIT rates, Lithuania increased the rate on its second PIT bracket from 27% to 32% in 2020. This PIT rate increase follows from a significant reform undertaken in Lithuania in 2019 when a new progressive PIT system was introduced to replace the previous flat-rate system. The Netherlands also increased its lowest rate modestly to 37.1% in 2020, up from 36.65% in 2019. In Iceland, it is proposed that the PIT rate on the middle bracket will be increased from 22.75% to 23.5% in 2021. In Greece, a number of previously proposed PIT reforms due to commence in 2020 were repealed including a previous proposal to cut the 22% PIT rate to 20% in January 2020. In Italy, the 20% substitute PIT rate for self-employed and entrepreneurs with incomes from EUR 65 000 to EUR 100 000 has been abolished. The regime, which had been due to come into force in 2020, allowed for the application of a different PIT rate than the ordinary progressive PIT rates.

Several countries are undertaking non-top PIT rate cuts to support low and middle-income earners. In Iceland, as part of the second phase of a three-phase PIT reform between 2019 and 2021, several non-top PIT rate changes are being introduced to reduce the tax burden on low and middle-income families. The lowest PIT rate bracket is reduced from 22.5% to 20.6% in January 2020; the middle-income bracket is 22.75% and the top bracket remains unchanged (although the threshold is adjusted for inflation). Furthermore, it is proposed that the lowest PIT rate will be further reduced to 17% in 2021. In Greece, non-top PIT rates are also being cut modestly in 2020 through several adjustments across the PIT rate schedule. A new lowest bracket is introduced with a PIT rate of 9% up to EUR 10 000 and the PIT rate has been reduced by one percentage point for incomes above EUR 10 000. Consequently, the new PIT rate schedule in Greece is as follows: 9% from EUR 0 – 10 000; 22% from EUR 10 001 – 20 000; 28% from EUR 20 001 – 30 000 and 36% from EUR 30 001 – 40 000 and 44% above EUR 40 001. In France, to support fairness, the first bracket of the PIT schedule is reduced from 14% to 11% from January 2020. Similarly, in Poland, as part of the Act on Personal Income Tax in mid-2019, the lowest PIT rate was reduced from 18% to 17% in October 2019. In Slovenia, the PIT rate is reduced modestly by one percentage point on both the second and third brackets to 26% and 33% respectively from 2020. In Germany, the solidarity charge, which amounts to 5.5% of the income tax, is proposed to be abolished for the majority of taxpayers and reduced for certain higher income earners from 2021. The rationale for the tax cut is to lower the tax on lower and middle incomes. In the Slovak Republic, for self-employed workers with incomes below EUR 100,000 per year, the PIT rate is reduced from 21% to 15%. In Denmark, the lowest PIT bracket is reduced slightly to 12.11% effective for 2020 and 2021. In Australia, a decrease in the 32.5% marginal tax rate to 30% in 2024/2025 was legislated.

PIT base narrowing reforms have continued

The trend among countries in recent years to narrow PIT bases has continued. A majority of PIT base reforms in 2020 have been aimed at supporting those on low incomes and families (Table 3.2). Overall, these measures are expected to reduce tax revenues. Of the countries undertaking PIT base reforms, 33 were base narrowing and three were base broadening. This policy preference for PIT base narrowing rather than base broadening follows the trend observed in recent years.

PIT base narrowing reforms have been aimed at supporting those on low incomes and families with children. Ten reforms involved increases in personal tax allowances, tax credits and tax brackets to support low-income earners and employment. Eight reforms were aimed at supporting children and other dependents. PIT base reforms targeted at supporting the elderly have been less frequent than in 2019. Four countries have expanded the scope of their earned income tax credits (EITCs) or other in-work benefits.

Personal tax allowances, tax credits and tax brackets

Many countries have increased the generosity of their general tax allowances and tax credits. These reforms, which are targeted at supporting low-income earners, are expected to increase after-tax incomes but also to reduce tax revenues.

In Australia, a number of significant reforms were introduced in mid-2019 to reduce PIT on individuals over the coming years. The stated objective of the reform is to make PIT lower, fairer and simpler. To increase tax relief for low incomes, a new ‘low and middle-income tax offset’ was introduced to provide tax relief of up to AUD 1 080 between 2018 and 2022. Entitlement to this new offset is in addition to the existing “low income tax offset”. From 2022, a new “low income tax offset” will replace both the current “low income tax offset” and the “low and middle-income tax offset”. This new “low income tax offset” will increase from AUD 445 to AUD 700. In addition, the top threshold of the 19% tax bracket will increase from AUD 37 000 to AUD 45 000 in 2022. Australia has also legislated an increase in the threshold at which the top marginal PIT rate is levied from AUD 180 000 to AUD 200 000 from the 2024–25 income year.

Five countries have increased their basic tax allowances. In Germany, the basic allowance has been increased modestly to EUR 9 408 in 2020 (it was EUR 9 168 in 2019 and EUR 9 000 in 2018). In Lithuania, with the similar objective of reducing the tax burden on low-income workers, the basic monthly tax allowance is increased to EUR 350 in 2020 and the authorities have proposed to increase it further to EUR 400 in 2021. Similarly, Slovenia increased the annual basic tax allowance from EUR 3 303 to EUR 3 500 in 2020. An additional tax allowance in Slovenia is also available for residents where taxable income does not exceed EUR 13 317 and the tax allowance for income from student work has been increased. In Finland, the basic allowance for earned income is increased to EUR 18 100 in 2020 from EUR 17 600 in 2019. In the Slovak Republic, the basic allowance for employees (and self-employed workers) is increased from 19.2 to 21 times the living minimum (of EUR 210) in 2020.

Several countries have narrowed the PIT base through increased tax credits. In the Netherlands, the general tax credit will be increased gradually over two years by EUR 80 in total starting in 2020. This adds to increases in the general tax credit in 2019. In Italy, tax credits increased in 2020 to reduce PIT on labour income and encourage consumption. In Iceland, on the other hand, the personal tax credit is decreased to ISK 655,538 annually, based on an adjustment for inflation and taking account of the decrease in the bottom rate.

In some countries, tax brackets have been shifted upwards. In Slovenia, the threshold for the highest income bracket, which has a rate of 50%, has been raised to EUR 72 000. In Ireland, the income ceiling for the Universal Social Charge (USC) in the second tax bracket, which has a tax rate of 2%, has been raised from EUR 19 874 in 2019 to EUR 20 484 from February 2020. In Finland, the temporary highest income bracket of the progressive income tax schedule (the so-called ‘solidarity tax’) will remain in effect until the end of 2023.

Children and other dependents

Greece, Germany and Canada have introduced several PIT measures aimed at supporting families and children. In Greece, the tax credit for those earning employment, pension and farm income has been increased for married persons with dependents but decreased for those on higher incomes from January 2020. In addition, a cut in child tax credits to start from 2020 has been repealed. In Germany, a number of family benefits increased in January 2020. For example, the tax-free allowance for parents with children will increase to EUR 7 812 in 2020, up from EUR 7 620 in 2019. In addition, the child benefit was increased to EUR 204 per month in mid-2019 (the amount depends on the number of children). In Canada, a number of measures are being introduced to support families and children throughout 2019 and 2020. In British Columbia, a new child opportunity benefit is introduced in late 2020 to be combined with the existing childhood tax benefit. In Ontario, a new tax credit for childcare is introduced which provides families with an income-tested refundable tax credit of up to 75% of eligible childcare expenses.

Other countries have increased tax deductions and credits for children and other dependents. In Portugal, the draft budget proposes an increase in the tax credits from 2020 for households with small children to EUR 300 and an additional EUR 150 for the second child onwards when there are two or more children under three years of age. In Lithuania, the child benefit will also increase from EUR 50 to EUR 60 and from EUR 70 to EUR 100 for larger families. In the Slovak Republic, the child tax credit for children up to six years of age was increased to EUR 45.44 in mid-2019. In Japan, the deduction of JPY 350 000 for single parents with a dependent child was reviewed. The deduction now applies regardless of the marital status or gender of the parents. In addition, the deduction for widows and widowers with dependents other than a child is set to remain at JPY 270 000, for those with taxable income up to JPY 5 million. In Ireland, the home carer tax credit, where one spouse (or civil partner) works in the home caring for a dependent person, is increased to EUR 1 600 in 2020, up from EUR 1 500 in 2019 and EUR 1 200 in 2018.

EITCs and other in-work tax benefits

A number of changes to EITCs and other in-work benefits were introduced in the Netherlands, Ireland, Finland and Italy. When designed correctly, such measures have the potential to improve labour market participation and reduce poverty. The number of EITC reforms has declined compared to recent years. In the Netherlands, to support employment, the maximum of the income dependent EITC will be increased gradually over three years by a total of EUR 285 starting in 2020 (this follows a previous increase of EUR 150 in 2019). In Ireland, for self-employed workers, the EITC is increased by EUR 150 to EUR 1 500 in 2020. This adds to a consecutive set of increases in recent years including in 2019 (when it was EUR 1,350), 2018 (EUR 1 150) and 2017 (EUR 950). In Finland, for municipal taxation, the deduction for earned income has been increased to EUR 1 770 in 2020, up from EUR 1 630 in 2019 and EUR 1 540 in 2018. In Italy, the monthly tax credit is increased from EUR 80 to EUR 100 for employees with an income up to EUR 28 000 from July 2020 (the measure is only for employees with a tax liability). In addition, Italy introduced a temporary non-refundable tax credit of EUR 600 for employees with PIT income above EUR 28 000 from July 2020 and the amount of the tax credit is gradually decreased for higher incomes up to EUR 40 000. The tax credit is due to be phased out by December 2020.

Elderly and disabled

In 2020, PIT reforms to support the elderly have slowed. Supporting low-income older people continues to be an important policy rationale for age-related tax concessions (OECD, 2011[1]). A number of countries have undertaken PIT reforms to support low-income retirees in recent years. In 2020, two countries undertook such reforms. In Sweden, to reduce the tax burden on older workers, the basic personal allowance has been increased for people above 65 years of age from 2020. Finland is increasing the pension income deduction in both central and local government taxation in 2020 with the aim of reducing the tax burden on low-income taxpayers.

Two countries reported PIT measures to support the disabled. In Greece, taxpayers with certain disabilities are exempt from the solidarity surcharge from 2020. In Lithuania, the basic monthly tax allowance for disabled persons is increased to between EUR 600 and EUR 645, depending on the extent of disability from 2020.

Other employment and skills-related tax provisions

Several reforms were made to other tax provisions related to employment, skills and young workers. In Portugal, to support employment, the draft budget includes a partial exemption from PIT on employment income earned by certain young workers with income not exceeding EUR 25 000 from 2020 onwards. The PIT relief is applicable to a reducing fraction of taxable income in the first three years after completing education (30% in the first year, 20% in the second year and 10% in the third year). In Poland, PIT on employment income is exempt for those aged under 26 years age up to a limit of PLN 85 528 starting from August 2019. In Quebec in Canada, a tax credit for career extension is introduced to encourage experienced workers to remain in the labour market. In Estonia, to support employment, the compensation of employees’ public transport costs between home and work are not taxed as fringe benefits from 2020. In Turkey, non-taxable employer provided transport benefits have been expanded in 2020. In the Slovak Republic, certain daily allowances, such as business trips, are tax-exempt for employee salaries above 1.65 times the minimum wage from 2020, an increase from 1.3 times the minimum wage in 2019.

Tax reforms for the self-employed

Some countries reported PIT base reforms for the self-employed and unincorporated businesses. In the Netherlands, the allowance for the self-employed will be cut from EUR 7 280 in 2020 in consecutive annual steps until it reaches EUR 5 000 in 2028. In the Slovak Republic, to support the self-employed, the monthly exemption from PIT and SSCs for accommodation and transport costs are to be increased in 2020 and 2021 respectively. In addition in the Slovak Republic, a new category of taxpayers (‘micro-taxpayers’) will be introduced in 2021 under the Income Act, defined as individuals that generate income from business or self-employment activities not exceeding the threshold for VAT registration. These taxpayers will be entitled to several tax benefits including related to tax depreciation of movable property.

Other PIT deductions and credits

Regarding other types of PIT deductions and tax credits, a few base broadening measures were introduced. In the Netherlands, to simplify the tax system, the deductibility of education costs will be abolished from 2021 and replaced with a subsidy. The reform is expected to increase PIT revenues. In Finland, to increase tax revenues, the tax credit for domestic household expenses will be decreased in 2020. In Italy, the tax credit of 19% for certain personal expenses (such as expenses and mortgage interest on owner-occupied houses) is capped in 2020 at taxable incomes of EUR 120 000.

Changes to personal capital income taxation have been limited

Overall, changes to the taxation of household capital income have been limited. The two main rationales for the reforms to personal capital income cited by countries were to encourage savings on the one hand and to raise revenues on the other. Among others, reforms have included a mix of tax rate cuts and increases on rental income and expanded tax relief for financial income to support small savers.

Three countries have cut tax rates on personal capital income (Table 3.3). In Portugal, the tax rate on long-term housing rentals is reduced substantially from 28% to 10% starting January 2020. Similarly, in Italy, rental income is subject to a reduced 10% substitution rate from January 2020, under certain conditions (the rate had previously been proposed to be 15%). In Greece, to support investment, the tax rate on dividends is reduced from 10% to 5% for distributed dividends in 2020.

Two countries have increased tax rates on personal capital income. In Slovenia, the capital gains tax rate was increased from 25% to 27.5% for holding periods below five years. For holding periods greater than five years, the capital gains tax rate was increased to 20% between 5 and 10 years, to 15% between 10 and 15 years and to 10% between 15 and 20 years (for holding periods greater than 20 years, capital gains are exempt). In addition, in Slovenia, the tax rate on rental income was raised from 25% to 27.5%. In Chile, the increased 40% PIT rate (see above) is applicable to all types of ordinary income, including dividends and capital gains. In addition, dividends distributed to higher earners residents in Chile by companies under the Partial Imputation Regime are subject to an effective PIT rate of 44.45%. Finally, a new fixed 40% tax applies to disproportionate dividends (i.e. that do not correspond to the shareholder´s equity participation) that have no business or commercial justification and are distributed as a way to reduce the PIT burden of related-party shareholders (with family ties).

Some countries have introduced base narrowing measures (Table 3.4). In Argentina, the tax on certain financial income, including interest on fixed term deposits, government securities and corporate bonds, has been abolished from 2020. In Hungary, a tax exemption was introduced for interest income from retail treasury bonds to encourage households to buy these bonds. In Japan, the ’General NISA’ and ‘Installment-type NISA’ individual savings account programme, which provides certain tax-exempt benefits, was extended by five years. In Sweden, the coupon tax, which is withheld when a dividend is paid and no tax return is submitted, can be deferred in some cases under a new system introduced in 2020.

Two countries have reported measures broadening personal capital income tax bases. In Chile, a new one-year period limitation was introduced for the capital gains tax exemption on the sale of stocks or quotas in the capital market when the sale is made under a market maker agreement. In Finland, the deductibility of mortgage interest payments will be limited from 25% to 15% in 2020 and then further until it reaches zero in 2023.

SSC reforms have slowed compared with recent years

There have been fewer SSC reforms compared to previous years, and they have almost all involved SSC reductions, both through rate cuts and base narrowing. Overall, however, SSC reforms have been modest and SSCs remain high in many countries. In some countries, high SSCs have distortive effects and more comprehensive tax reforms will be needed to rebalance the tax mix towards less distortive and potentially more progressive taxes.

Changes to SSC rates have been limited

Three countries undertook SSC rate cuts in 2020, and one reported rate increases (Table 3.5). In Estonia, the rate of employer SSCs was cut from 33% to 20% for recipients of the parental allowance and disabled workers. In Hungary, employer SSCs were cut from 19.5% to 17.5% in mid-2019. In addition, with the stated objective of simplifying the tax system, employee SSCs, which currently consist of four separate items, will be integrated into a single SSC in mid-2020. In Sweden, a number of SSC reforms have been introduced with the aim of supporting employment and skills. For example, SSC contributions for new entrants to the labour market and younger workers have been reduced. Germany has undertaken a reform involving a mix of SSC rate increases and cuts. These reforms are introduced across the four types of social insurance in Germany: pension, unemployment, health and long-term care. The rationale for the reform is to reduce the tax burden on labour but also to address demographic requirements, for instance through the financing long-term care. Argentina was the only country to report an increase in SSC rates: a proposed SSC employer rate of 19.5% has been abolished and replaced with new SSC employer rates ranging from 18% to 20.4%, depending on the type of employer, with the objective of raising revenues.

Countries have continued to narrow employer SSC bases, but reforms have been limited

All SSC base reforms, with one exception, involved SSC reductions, generally focused on employer SSCs (Table 3.6). In Sweden, to support research and development (R&D), the tax relief on the total SSCs paid by companies for individuals who work in R&D was increased from 10% to 20% in 2020. In Slovenia, the holiday allowance, which is paid by employers to employees, will be exempt from SSC contributions up to 100% of the average monthly minimum wage. In Argentina, the monthly deductible amount for employers from the employer contribution base is increased to ARS 12 000 per employee in some sectors and will remain in place until 2022. In Lithuania, the SSC ceiling is reduced to 84 times the average monthly salary from 2020. In addition, Lithuania’s tax-free salary threshold is increased from 1.3 to 1.65 minimum wages from January 2020. In Ireland, the weekly income threshold for the higher rate of employers pay related social insurance (PRSI) is increased to EUR 395 in 2020 (previously it was EUR 386 in 2019 and EUR 276 in 2018). Base narrowing measures related to employees and self-employed SSCs and payroll taxes were also introduced. In Austria, where certain SSCs can be partly reimbursed, the maximum SSC reimbursement for low-income earners is increased from EUR 400 to EUR 700 annually. The maximum SSC reimbursement for retirees is also increased from EUR 110 to EUR 300. In Poland, to reduce the tax burden on micro-entrepreneurs whose income in the previous calendar year was less than PLN 120 000, the minimum monthly SSC base has been set at 30% of the minimum monthly salary (MMS, equal to PLN 2 600 in January 2020), compared to the standard minimum of 60% of the MMS. In Quebec in Canada, to encourage the employment and retention of older workers, payroll taxes are reduced for SMEs that employ older workers through a tax credit (by 50% for workers aged 60 to 64 and 75% for workers aged 65 and over).

Only one country broadened its SSC base, which represents a marked decline compared with recent years. In France, employers benefit from a general reduction in employer SSCs due on the remuneration of their employees earning less than 1.6 times the minimum wage. As of January 1, 2020, the parameters for calculating this SSC reduction have been modified and is now capped for employees benefiting from a specific flat-rate deduction for professional expenses.

The downward trend in statutory corporate income tax (CIT) rates is continuing. The most significant CIT rate reductions have generally been introduced in countries with higher initial CIT rates, leading to further convergence in CIT rates across countries. Many countries have also reinforced the generosity of their corporate tax incentives to stimulate investment and innovation. With regard to international taxation, efforts to protect CIT bases against corporate tax avoidance have continued with the adoption of significant reforms in line with the OECD/G20 Base Erosion and Profit Shifting (BEPS) project. The tax challenges arising from the increasing digitalisation of the economy are another major concern for many countries. Efforts to achieve a consensus-based multilateral solution to address those challenges are ongoing, but some countries have announced or implemented interim measures to tax certain revenues from digital services in the meantime.

Trends in CIT revenues have varied across countries

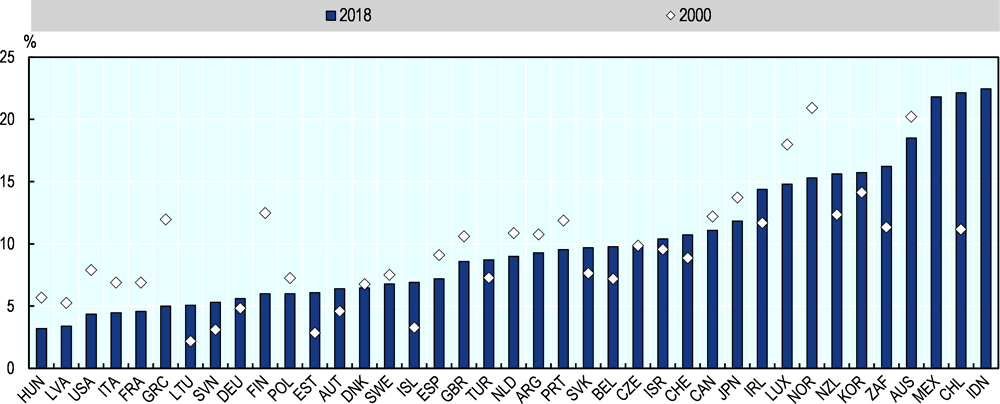

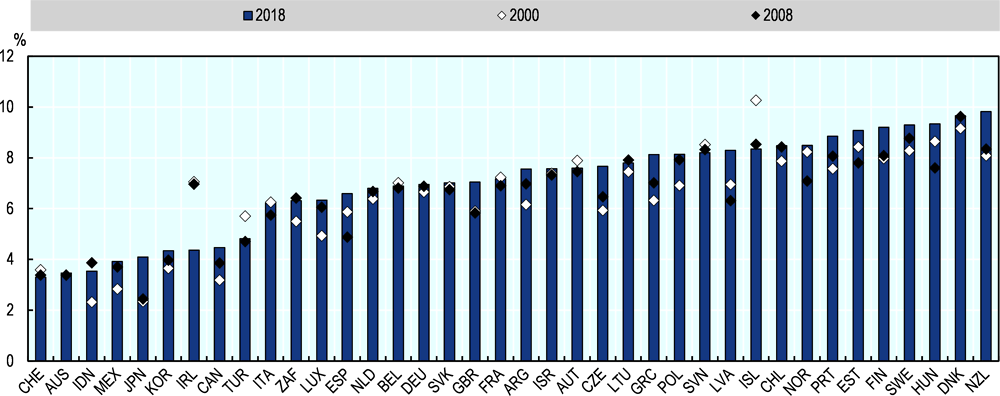

The CIT to GDP ratio and CIT revenues as a share of total tax revenues vary across countries. CIT revenues ranged from 1.0% of GDP in Latvia1 to 6.0% of GDP in Norway in 2018 (Figure 3.5). As a share of total tax revenues, CIT ranged from 3.2% of total taxation in Hungary to 22.5% of total tax revenues in Indonesia (Figure 3.6). Multiple factors can explain differences in revenues from CIT including statutory CIT rates, the breadth of the CIT base, the degree to which firms are incorporated, the phase in the economic cycle and the degree of cyclicality of the corporate tax system, as well as countries’ reliance on other taxes. These factors may have also contributed to the large differences in revenues between 2000 and 2018 observed in several countries including Chile, Greece and Finland. Figure 3.6 shows that CIT tends to represent a larger share of revenue in countries with significant natural resources and in emerging and developing economies. In the case of emerging and developing economies, total tax revenues are generally lower as a percentage of GDP and personal income tax revenues tend to play a smaller role than the CIT.

On average, CIT revenues have held up as a share of GDP over the last two decades. Across OECD countries, after a peak in 2007 and a subsequent fall following the global financial crisis, CIT revenues have remained relatively stable since 2009 on average, slightly picking up from 2015 onwards. Average CIT revenues as a share of GDP are now back to a level slightly below their 2000 level (Figure 3.7). They seem to have been relatively unaffected by the progressive decline in statutory CIT rates, which is also shown in Figure 3.7, and discussed in the following section. Various factors may have contributed to this apparent paradox between declining CIT rates and relatively stable CIT revenues, including the rise in corporate profits, the broadening of CIT bases, the incorporation of businesses, and the decline in borrowing costs as a result of low interest rates.

There has been a steady and widespread decline in corporate income tax rates

Standard CIT rates

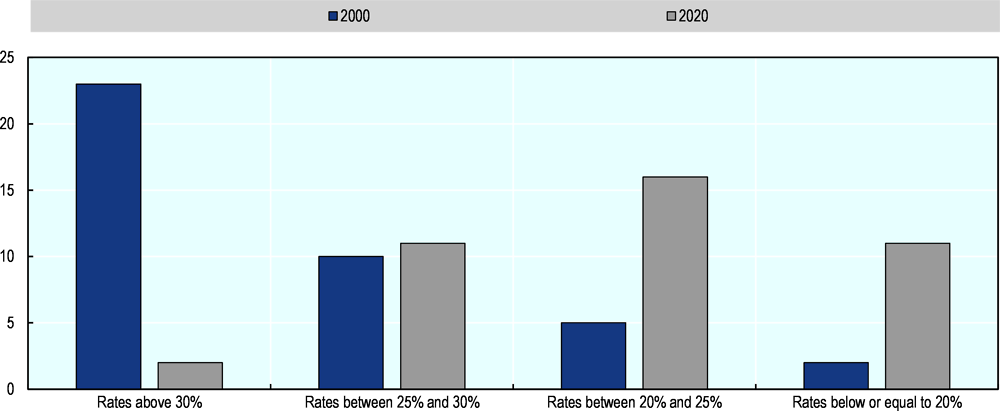

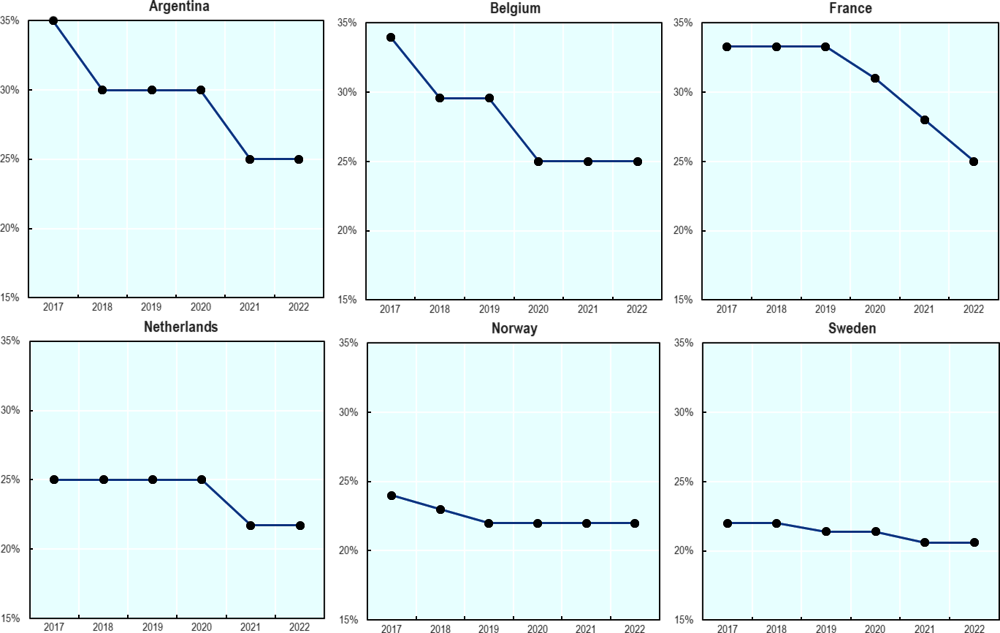

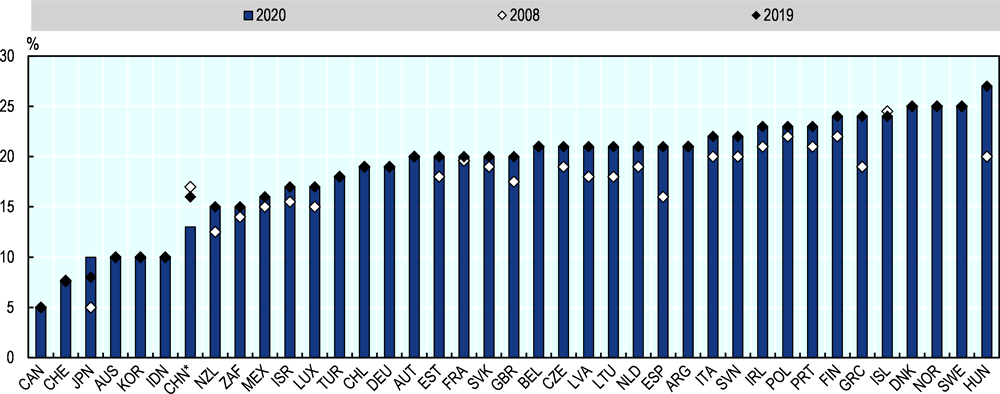

The decline in CIT rates has been a steady and widespread trend. Figure 3.8 shows the changes in the distribution of CIT rates between 2000 and 2020 across the countries covered in the report and highlights major shifts in the CIT landscape. In 2020, there were only two countries with CIT rates above 30%, against 23 in 2000. Meanwhile, the number of countries with CIT rates below 20% increased from two in 2000 to 11 in 2020. Overall, in the OECD, the average combined (central and sub-central) CIT rate has declined from 32.2% in 2000 to 23.5% in 2020 and OECD countries’ CIT rates have become slightly less dispersed (Figure 3.9).

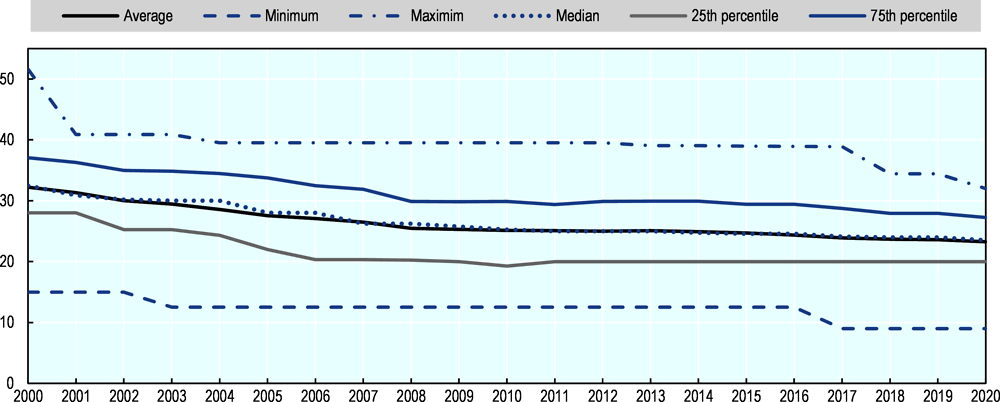

From 2015 onwards, the decline in average CIT rates has been driven by high-tax countries. In Figure 3.9, three main phases in the decline of OECD statutory CIT rates can be distinguished. First, there was a rapid decline in the OECD average CIT rate from 2000 to 2008 from 32.2% to 25.4%, driven by decreases in countries with both high and low CIT rates. This decline was followed by a more stable phase where the average CIT rate remained relatively stable, at around 25%. Finally, starting in 2015, the decline in the average CIT rate started accelerating again, declining from 24.9% in 2014 to 23.2% in 2020. This decline has been driven by a decrease in countries with relatively high tax rates as indicated by the evolution of the 75th percentile, which dropped from 29.9% in 2014 to 27.2% in 2020. In the same period, countries with relatively low CIT rates remained constant in the majority of cases, with the 25th percentile remaining at 20%. The only exception was Hungary where the CIT rate was cut to 9% in 2017.

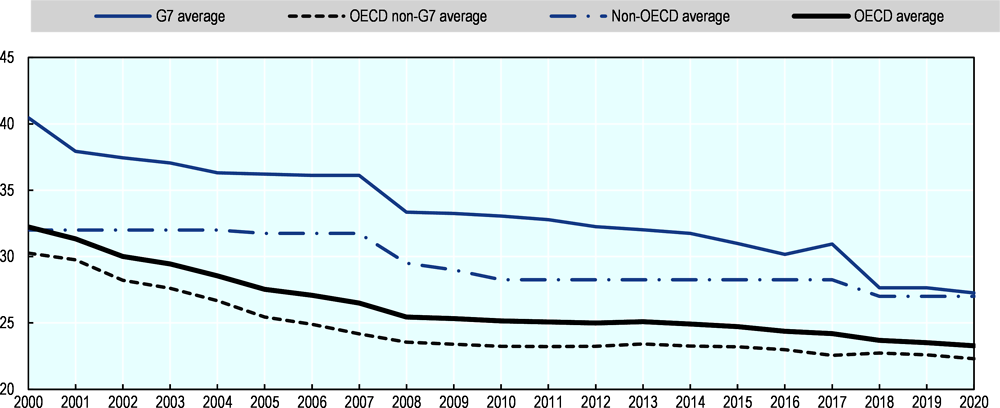

CIT rate reductions have been particularly pronounced in G7 countries. G7 countries had significantly higher CIT rates than other countries in the early 2000s and, on average, experienced the strongest average CIT rate reduction between 2000 and 2020, amounting to 13.2 percentage points. In comparison, the average decline for OECD countries that are not G7 members was about 8.0 percentage points (Figure 3.10). With the exception of the United Kingdom, the combined statutory CIT rates of G7 members remain among the highest in the OECD (Figure 3.11). The non-OECD countries covered in the report (Argentina, China, Indonesia and South Africa) have also seen a decline in their CIT rates, but not to the same extent as OECD countries, and their CIT rates remain higher than the OECD average (Figure 3.10).

In 2020, reductions in standard CIT rates were introduced in Belgium, Canada (Alberta), France, Greece and Indonesia (Table 3.7). In Belgium, the standard CIT rate was lowered to 25% as part of the Corporate Income Tax Reform Act of 2017. In France, the standard CIT rate was lowered to 31% (except for companies with an annual turnover exceeding EUR 250 million), as part of a previously legislated CIT rate reduction, which is expected to progressively bring the CIT rate down to 25% by 2022. In Canada, the region of Alberta implemented the Job Creation Tax Cut, which provides for reductions in the general CIT rate from 12% to 8% over four years. The rate was reduced from 12% to 11% on 1 July 2019 and will be reduced by one percentage point on 1 January of each year until it reaches 8% in 2022. In Greece, from tax year 2019 onwards, the CIT rate has been reduced from 28% to 24%. Indonesia has accelerated the decrease in its statutory CIT rate, initially planned to start in 2021. Indonesia’s CIT rate is now lowered from 25% to 22% in 2020 and 2021, and will be further decreased to 20% in 2022. Overall, the CIT rate cuts introduced in 2020 have been more sizeable than in 2019, with an average combined CIT rate reduction across the countries that introduced CIT rate cuts of around 3 percentage points, compared to an average decrease of around 1 percentage point in 2019.

Standard CIT rate reductions are also set to come into force in 2021. In the Netherlands, the originally planned reduction of the CIT rate applying to income exceeding EUR 200 000, was partly reversed; the CIT rate was not decreased to 22.55% in 2020 as originally planned; instead it remains at 25% in 2020 and will be lowered to 21.7% instead of 20.50% in 2021. Argentina also revised its scheduled CIT rate reduction: the planned reduction of its CIT rate from 30% to 25% in 2020 has been postponed until 2021 (Figure 3.12). Argentina’s distributed dividend tax will also increase from 7% to 13% in 2021. In Sweden, the statutory CIT rate remains at 21.4% in 2020 and will be cut to 20.6% in 2021.

SME CIT rates

Reduced CIT rates for SMEs are common across OECD countries. A number of countries provide reduced CIT rates for SMEs, although the design of these reduced tax rates varies significantly. Some countries apply lower tax rates on the first tranche(s) of profits, regardless of total income levels; some have reduced CIT rates for corporations with income below a certain level; and others determine eligibility for small business tax rates based on non-income criteria (e.g. turnover or assets) instead of or in addition to income criteria.

A few countries have reduced their SME CIT rates. In the Netherlands, as planned, the lower CIT rate that applies to taxable income up to EUR 200,000 was cut from 19% to 16.5% in 2020 and will be further reduced to 15% in 2021. To simplify its tax system and reduce the tax burden on SMEs, Hungary abolished the Simplified Business Tax (EVA) while reducing the rate of small business tax (KIVA) by 1 percentage point from 13% to 12%. The Slovak Republic has lowered the CIT rate from 21% to 15% for all corporations with a turnover below EUR 100 000 per year. In Portugal, the taxable income subject to the reduced CIT rate of 17% has been increased from EUR 15 000 to EUR 25 000 and, in the case of SMEs that carry out their activities in inland regions, the taxable income subject to the reduced CIT rate of 12.5% has also been raised from EUR 15 000 to EUR 25 000. In Poland, the definition of "small taxpayer" for CIT and PIT purposes was increased to include companies with revenues not exceeding the equivalent of EUR 2 million in the previous tax year (until 2019 this threshold was equal to EUR 1.2 million). This measure is aimed at bringing more companies into the SME regime.

Taxes on the financial sector

A few countries are introducing changes to financial sector taxes. Taxes on the financial sector gained attention in the aftermath of the global financial crisis. They are generally collected on top of ordinary corporate taxes and can be applied on different bases (e.g. bank deposits, capital assets, risk-weighted assets). The Slovak Republic first introduced a bank levy in 2012. The tax was initially introduced for a limited period and was expected to be repealed by 2020. However, the government approved its extension in November 2019, doubling the tax rate from 0.2% to 0.4% of banks’ liabilities net of equity. In Iceland, a bank levy was introduced in 2011 at a rate of 0.041% on financial institutions’ debt. In 2014, the rate was raised to 0.376% to finance the government’s household debt relief programme. This tax is scheduled to be lowered in four steps to reach 0.145% by 2023. In Sweden, a tax on the financial sector, which is scheduled to take effect in 2022, has been announced. Lithuania has introduced an additional CIT rate of 5% on top of the standard rate of 15% on the taxable profits of credit institutions.

Intellectual property regimes

Intellectual property (IP) tax regimes allow income from the exploitation of IP to be taxed at a lower rate than other income. IP regimes have been introduced in an increasing number of countries, and these usually involve a significant reduction in the tax rate applicable to IP-related income compared to the tax rate that would otherwise apply (Figure 3.13).

A number of IP regimes were revised to comply with BEPS Action 5 and Poland introduced a new IP regime. Countries need to align their IP regimes with Action 5 of the OECD/G20 BEPS project, which aims at addressing harmful tax practices, including IP regimes where certain substance requirements are not met. In the past, IP regimes could be designed in a way that incentivised firms to locate their IP assets in a jurisdiction regardless of where the underlying R&D was undertaken. The modified nexus approach under Action 5 now requires that substantial economic activity is undertaken in the country offering the favourable tax regime and that the amount of income eligible for benefits in an IP regime is proportional to the amount of expenditures undertaken by the taxpayer to develop the IP. Action 5, which is a peer-reviewed minimum standard of the OECD/G20 BEPS package, has led many countries to align their IP regimes with these new requirements (see section 3.2.4). As noted in last year’s report, Poland introduced an IP regime for the first time, designed to be in line with the modified nexus approach. Starting from January 2019, under the Polish IP box regime, profits from qualifying IP are taxed at the preferential rate of 5%. Luxembourg replaced its previous IP regime, abolished in 2016, with a new one that is in line with the modified nexus approach. France also introduced a revised IP regime in line with the modified nexus approach as of 1 January 2019. The income benefitting from this regime is taxed at a 10% rate. In Switzerland, a significant tax reform, approved by Parliament and adopted after a referendum in May 2019, includes mandatory patent boxes at the cantonal level effective starting from January 2020 (Box 3.2).

In Switzerland, the Federal Act on Tax Reform and AHV (old age and survivors' insurance) Financing (TRAF) was approved in a referendum on 19 May 2019. The reform aims to maintain the competitiveness of Switzerland as a business location while securing jobs and tax receipts in the Confederation, cantons and communes. Mandatory measures of the TRAF entered into effect on 1 January 2020 at the federal level. Some of the cantonal measures are optional and cantons can tailor the majority of measures to their specific circumstances and needs within certain boundaries.

The tax reform brings the replacement of certain preferential tax regimes in line with a new set of internationally accepted measures. The central part of this package is the elimination of cantonal tax privileges for status companies (i.e. those that would benefit from the mixed, domiciliary, holding or principal company regimes, or the Swiss finance branch regime), which is compensated by the creation of patent boxes and the possibility for cantons to introduce additional deductions for R&D. Finally, it entails an increase in the cantonal share of federal direct tax revenues, a rebalancing of the national financial equalisation scheme, and increased AHV financing.

Abolition of cantonal tax privileges (mandatory)

The reform abolished the tax privilege of status companies that previously paid a reduced or null CIT at cantonal level. At the federal level, status companies continue to be subject to the regular CIT rate.

Patent box (mandatory)

The reform introduces a patent box regime intended to comply with OECD standards. Net profits from domestic and foreign patents and similar rights are to be taxed separately with a maximum reduction of 90% to be set at cantonal discretion.

Additional deductions for research and development (voluntary)

The cantons may give a higher weighting to R&D expenditure to promote research and development. The enhanced R&D deduction at the cantonal level can reach a maximum of 50% (on top of the 100% baseline tax deduction) of the effective qualifying expenses, at the discretion of cantons. The value of tax allowances will depend on the canton specific CIT rate.

Other business taxes

Poland has reduced the tax rate on the extraction of copper and silver by 15%. This measure aims to reduce the burden on businesses engaging in mining activities subject to the Law on Taxation of Extraction of Certain Metals introduced in 2012.

A new levy is charged on all Greek-owned fishing ships and boats, as well as tug boats, which operate in maritime transport or shipping services for a time period that does not exceed 50% of their total operating time. Lifeguard vessels that perform exclusively rescue and maritime relief operations are excluded. Depending on the type of boat, the duty is calculated based on the horsepower or length of the vessel.

Many countries have increased the generosity of their corporate tax incentives

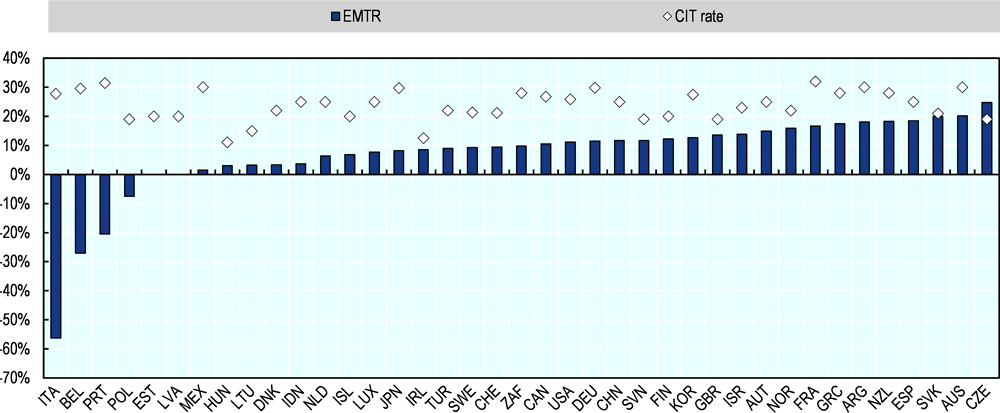

Most countries have CIT base narrowing provisions that lower companies’ effective tax burdens. Corporate tax systems differ across jurisdictions with regard to provisions that affect the tax base. Forward-looking effective tax rates (ETRs) capture information on corporate tax rates and bases as well as other relevant provisions within a single framework, providing a basis to compare corporate tax systems across jurisdictions. In particular, effective marginal tax rates (EMTRs) measure the extent to which taxation increases the pre-tax rate of return required by investors to break even. This indicator is used to analyse how taxes affect the incentive to expand existing investments given a fixed location.

EMTRs can diverge considerably from statutory tax rates. When fiscal depreciation is generous compared to true economic depreciation or if there are other significant base narrowing provisions, the EMTRs will be lower than the statutory tax rate. On the contrary, if tax depreciation does not cover the full effects of true economic depreciation, effective taxation will be higher. The EMTRs reported in Figure 3.14 show the effects of fiscal depreciation and other allowances and deductions (e.g., allowances for corporate equity, half-year conventions, inventory valuation methods). These CIT base narrowing provisions lower corporate EMTRs compared to statutory CIT rates in the majority of countries, reflecting their positive effects on businesses’ incentives to expand investments. Certain CIT base narrowing provisions, in particular allowances for corporate equity (in Italy, Belgium, Portugal and Poland in 2019) and generous accelerated depreciation rules considerably reduce EMTRs, which end up reaching negative values.

Countries have generally increased the generosity of their tax incentives through tax reforms affecting CIT bases. Several countries have increased the generosity of their CIT incentives to stimulate investment, innovation and environmental sustainability (Table 3.8). These measures will contribute to further reducing corporate EMTRs. Significant CIT base changes have also been introduced in Chile as part of its comprehensive 2020 tax reform (Box 3.3).

Chile’s Tax Modernisation Law (Nº 21.210) was approved by Congress on 29 January 2020. Its main provisions entered into effect retroactively on 1 January 2020. It is a comprehensive tax reform that aims to support investment and growth and to modernise the relationship between taxpayers and the tax authority, trough enhanced tax certainty and digitalisation. It also includes measures to strengthen the progressivity of the tax system.

Investment and growth

The reform implements the return to a single general Corporate Income Tax regime (which consists of a Partially Integrated System) and an enhanced fully integrated regime for SMEs. Under the Partially Integrated System, the CIT rate is 27% and shareholders receive a 65% tax credit for the underlying CIT paid. SMEs benefit from a reduced CIT rate of 25% and a full dividend imputation credit. The accruals based corporate tax regime has been abolished. Small businesses whose shareholders are liable to the PIT can now opt to be taxed under the PIT and no longer first under the CIT and then under the PIT. Given the implementation difficulties of the previous system, the 2020 tax reform reduces complexity and tax compliance costs and delivers greater tax certainty. Other measures supporting increased levels of capital investment are described in the Report (e.g., accelerated tax depreciation, faster reimbursement of VAT).

Enhanced tax certainty

The reform contains a range of measures intended to provide greater tax certainty to taxpayers. These include new transparency rules on administrative requests to the tax authority, new rules for the deductibility of business expenses and for the use of foreign tax credits. The reform also implements a domestic permanent establishment concept that is consistent with OECD standards. For the first time, a tax ombudsman is incorporated in Chile and an entirely new set of rules have been added to the taxpayers’ charter of rights. The taxable event of the Green Tax is amended, as the requirement of a minimum thermal power capacity of the polluting facilities is removed, focusing now on the volume of emissions (and new tax offsetting possibilities through effective mitigation measures are introduced).

Digitalisation

With the objective of facilitating and enhancing tax compliance, the tax reform further digitalises the relationship between taxpayers and the tax authority, including a new digital folder with historical taxpayer records and additional online filings for all types of taxes. It also implements mandatory electronic VAT receipts (in addition to the e-invoices established mandatorily in 2014), which are designed to simplify and modernise VAT procedures and further reduce VAT and income tax evasion. The reform also implements a new VAT simplified registration and compliance regime for non-resident suppliers to facilitate compliance on B2C digital transactions, in accordance with OECD Guidelines.

Strengthening the progressivity of the tax system

The reform will have the effect of modifying the Chilean tax structure. Once in full effect, the reform is projected to increase tax revenues by USD 2 204 million, of which more than 55% (USD 1 222 million) will be derived from high-income taxpayers. Many of these progressivity-enhancing measures are described in the Report (e.g. the new progressive property tax on high-value property added to the ordinary property tax; the highest income tax bracket with a top PIT rate of 40%). Additionally, the reform extended the residential property tax rebate for the elderly low-income taxpayers.

Increases in capital allowances

Several countries introduced (often temporary) measures increasing the generosity of their capital allowances. In Finland, new temporary measures were introduced to support investment in new machinery and equipment. For these assets, the rate of annual depreciation was increased from 25% to 50% until the end of 2023. Temporary measures were also introduced in Chile, where new or imported fixed assets acquired between October 2019 and December 2021 can be expensed for 50% of their value and depreciated at an accelerated rate the remaining part. More generous allowances were introduced in Araucania, a region in the south of Chile, where new and imported fixed assets can benefit from full expensing. In Australia, the threshold for the ‘instant’ asset write-off was temporarily increased from AUD 20 000 to AUD 30 000, and access was expanded to businesses with an annual turnover below AUD 50 million (up from AUD 10 million) prior to the COVID-19 pandemic. In Germany, the construction of new rented flats is encouraged through special temporary depreciation rules until the end of 2026. Immediate expensing was introduced in the Slovak Republic for micro taxpayer corporations (i.e. with yearly turnover below EUR 49 790). Under this provision, micro taxpayers can benefit from a 100% deduction of all tangible assets except cars costing more than EUR 48 000. Japan introduced a 30% depreciation (or, alternatively, a 15% tax credit) for investments in 5G-related equipment.

A few countries introduced more generous depreciation schemes to encourage the transition to environmentally friendly vehicles. In Italy, the deductibility of company vehicle costs was tied to carbon emissions such that deductibility decreases as carbon emissions increase. The Slovak Republic introduced a shorter two-year depreciation period for battery and plug-in hybrid vehicles, as compared to the usual four-year depreciation period generally applied to motor vehicles. In Greece, a 130% super deduction was introduced for corporate passenger car expenses with low (up to 50 grams of CO2/km) or zero emissions and a maximum retail price before tax of EUR 40 000, for expenses incurred for public transportation tickets, and for expenses related to the installation and operation of charging points for low-emission cars. Finally, in Iceland, eco-friendly business vehicles can benefit from accelerated annual tax depreciation.

Increase in the generosity of R&D tax incentives

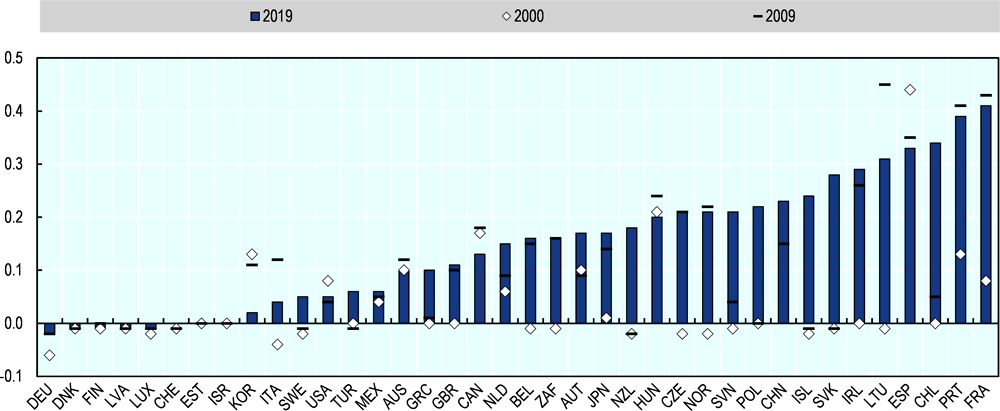

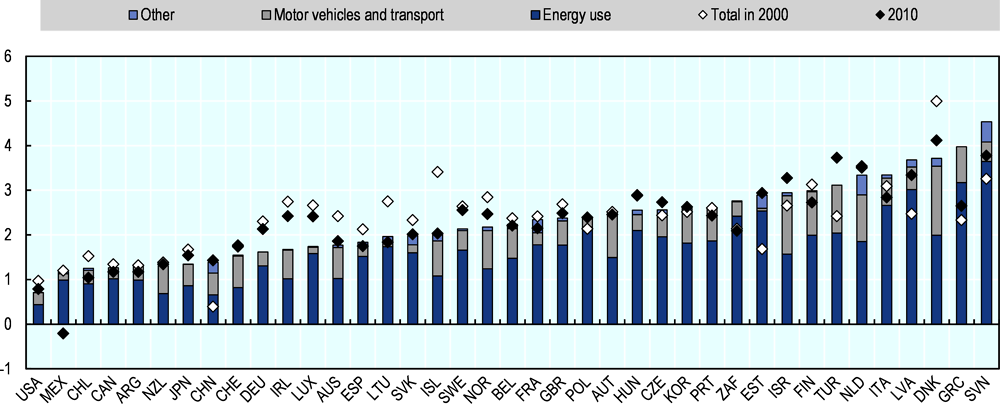

Many countries incentivise business investment in R&D through tax incentives.2 R&D tax incentives have become a widely used policy tool to promote business R&D. The number of OECD countries offering tax relief for R&D expenditures increased from 19 in 2000 to 30 in 2019, with the design and scale of R&D tax reliefs differing across countries.3 As shown in Figure 3.15, up until the onset of the global financial crisis, the marginal rate of R&D tax subsidy estimated for large profitable firms4 on average increased across OECD countries. This trend stabilised around 2014, with average implied subsidy rates remaining relatively constant thereafter. Figure 3.16 compares the implied tax subsidy rates on R&D expenditures for large profitable firms across countries and years (2000, 2009 and 2019). In 2019, R&D tax incentives were particularly generous for large profitable firms in France, Portugal, Chile and Spain, with the largest increases in generosity compared to 2000 being observed in Chile, France, and Lithuania. These changes reflect the introduction of new R&D tax incentives and the increasing generosity of existing R&D tax relief provisions.

Germany implemented a new R&D tax credit to complement its business R&D support policies. This new incentive, effective in January 2020, is made available for a broad range of R&D activities, complementing Germany’s direct support measures (e.g. R&D grants, government procurement of R&D services) targeting specific R&D investments. It consists of a 25% R&D tax credit, applicable to R&D salaries and eligible contract research expenses up to EUR 2 million, and entails a maximum level of R&D tax support of EUR 500 000 per year per company. Funding is open to activities carried out in-house or by an external R&D service provider.5 In the case of expenses incurred for contract R&D activities, 60% of the overall expenses that are paid for such activities are considered eligible expenses. The R&D tax credit itself is not subject to taxation and is refundable when it exceeds the taxpayer’s tax liability.

In Ireland, the current R&D tax credit is to be enhanced for micro and small companies, subject to state aid approval from the European Commission. For these companies, the rate of the tax credit will be increased from 25% to 30%. As was the case previously, the measure can also support loss-making companies, since unused tax credits in any year are payable6 or may alternatively be carried back to the previous accounting period or carried forward indefinitely. An additional feature allows micro and small companies to claim credits for qualifying pre-trading R&D expenditures. Before a company begins to trade, the credit may be offset against VAT and payroll taxes. Additional measures to enhance R&D incentives for all companies have been introduced. In particular, the amount of a company’s qualifying R&D expenditure that can be outsourced to third-level institutions was increased from 5% to 15% to increase collaboration between companies and the education sector.

Other countries have increased the generosity of their tax incentives for R&D and innovation. In the Slovak Republic, the amount of deductible costs has increased. For financial years starting on or after 1 January 2019, the volume-based and incremental rate of the R&D tax allowance was retrospectively increased from 100% to 150%, while for fiscal years starting on or after 1 January 2020, these rates have been increased to 200%. Finally, the new R&D tax credit announced in New Zealand in 2018 became effective in July 2019, providing a refundable tax credit7 of 15% of eligible R&D expenditures with a minimum R&D expense of NZD 50 000 and a ceiling on total eligible R&D expenditure of NZD 120 million.

In Italy, the R&D tax credit that was available in 2019 has been modified and extended to apply to expenses in the innovation and design fields. The R&D tax credit is computed by taking into account eligible expenses incurred in the fiscal year 2020 and depends on two factors that will need to be multiplied to compute the amount of the tax credit. These two factors are the type of expense incurred and the type of activity. For expenses such as research labour costs and contract R&D, up to 150% of the actual expenditure is considered. For costs such as materials, technical expertise and depreciation expenses, 20% to 30% of the incurred costs is considered. The factor depending on the type of activity ranges from 12% of eligible expenses for R&D activities to 6% for design activities. The tax relief ceiling was decreased from EUR 10 million in 2019 to EUR 3 million for R&D expenditures and EUR 1.5 million for the remaining activities.8

Other tax incentives

In the United States, several existing business tax credits were further extended, mainly to promote environmental sustainability. The existing tax credits for biodiesel and renewable diesel, electricity produced from certain renewable sources and alternative fuels were extended. Also, to boost economic growth and support investment, existing tax credits for new markets, work opportunities and railroad track maintenance were extended.

Incentives for investments in small enterprises were introduced in Hungary, Chile and Japan. In Hungary, the development tax incentive allows companies to deduct up to 80% of their CIT in the year of investment and over the following 12 years. The minimum present value of investments required to obtain the allowance will be reduced in the case of SMEs, which makes the tax incentive more widely available. Also, investments in start-ups are incentivised through an increase in the maximum limit of tax allowances related to angel investments. Chile enhanced profit reinvestment incentives for SMEs with the introduction of a measure allowing a tax base reduction of up to 50% of reinvested profits. The maximum deduction allowed is of UF 5 000 (approximately EUR 165 000). Japan introduced corporate income deductions equivalent to 25% of the investment carried out in innovative start-ups.

Temporary tax incentives to improve productivity were introduced in Korea. From January until December 2020, tax credits granted for investments made in qualifying facilities were increased from 1% to 2% for large companies, from 3% to 5% for medium-scale enterprises and from 7% to 10% for SMEs.

In Mexico, tax incentives to specific regions are being reoriented. The tax relief granted to the Special Economic Zones (SEZs)9 was repealed. Going forward, tax policies will focus on fundamental projects targeting southern regions (e.g. the Mayan Train and the Isthmus of Tehuantepec) and on tax benefits available for activities in the northern border area.

In Japan, eligibility conditions for tax credits and tax allowances were revised to encourage large enterprises to increase salaries and investments. More specifically, large corporations where the average salary does not exceed that of the previous year and the amount of domestic capital investment does not exceed 30% of the depreciation expenses in the current year, cannot benefit from R&D tax measures and other tax credits. In addition, large companies where the average wage growth was less than 3% or domestic capital investment was less than 95% of the depreciation costs incurred during the financial year cannot benefit from the tax credit equivalent to 15% of the wage increase.

Indonesia has expanded the scope of its tax allowance regime to encourage investment. Indonesia’s tax incentive schemes, which were kept unchanged, include additional deductions, the accelerated depreciation of fixed tangible assets, the accelerated amortisation of intangible assets, as well as enhanced loss carry forward provisions (from five to ten years). The new rules have expanded the number of sectors eligible for the incentives and have removed many of the existing geographical restrictions on eligible investments.

Deductions for reinvested earnings in Portugal

Portugal has broadened the deduction for the reinvestment of retained earnings. The reinvestment of retained earnings (“DLRR – Dedução por Lucros Retidos e Reinvestidos”) is a tax incentive for micro, small and medium-sized companies that provides the right to a CIT deduction equivalent to 10% of the retained and reinvested earnings used for the acquisition of relevant assets.10 In the 2020 State Budget Law, the reinvestment period for retained earnings was increased from three to four years and the maximum amount of retained earnings that can be reinvested was raised from EUR 10 million to EUR 12 million. Intangible assets are also eligible if they are eligible for amortisation for tax purposes and are not acquired from related parties.

Notional interest deductions

The Italian allowance for corporate equity (ACE) was reintroduced. The Italian ACE consists of a notional interest deduction from the CIT base, equal to the net increase in new equity employed in the entity (i.e. the equity generated after 2010) multiplied by a rate determined every year. In its 2019 budget, the Italian government abolished the ACE, compensating its removal by introducing several measures aimed at supporting investment, including a reduced CIT rate for reinvested profits. With the elimination of the tax reduction for reinvested earnings, the ACE was reintroduced from 2019 and its notional return rate was decreased from 1.5% in 2018 to 1.3% in 2019.

Loss carryover provisions

Contrary to the trend observed in recent years, where countries were limiting loss carryover provisions, the Slovak Republic increased the generosity of its loss carry-forward provisions. The carry-forward period was extended from four to five years and the volume limit changed from 25% of accumulated losses to 50% of the tax base. For corporations in the category of micro-taxpayers (i.e. with turnover below EUR 49 790), a similar measure was introduced: the carry-forward period was extended from four to five years but no volume limits apply.

Fight against corporate tax avoidance

The past year has seen further progress on the implementation of the OECD/G20 BEPS package. The OECD/G20 BEPS package, which includes 15 Actions aimed at addressing tax planning strategies that artificially shift profits to low or no-tax jurisdictions, was delivered in October 2015. The BEPS package sets out a variety of measures, including four minimum standards (Actions 5, 6, 13 and 14), common approaches that will facilitate the convergence of national practices, and guidance drawing on best practices. Countries are carrying out the implementation of the BEPS package through the Inclusive Framework on BEPS, which brings together more than 135 jurisdictions.

As of March 2020, the provisions of the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent BEPS (MLI) had taken effect for about 300 tax agreements. The MLI, concluded by over 100 jurisdictions in November 2016, allows jurisdictions to swiftly implement measures to strengthen existing tax treaties and protect governments against tax avoidance strategies that inappropriately use tax treaties to artificially shift profits to low or no-tax jurisdictions. The MLI includes measures against hybrid mismatch arrangements (Action 2), treaty abuse (Action 6), a strengthened definition of permanent establishment (Action 7) and measures to make mutual agreement procedures (MAP) more effective (Action 14). The MLI entered into force on 1 July 2018 and its provisions started to take effect from 1 January 2019. As of 15 March 2020, the MLI covered 94 jurisdictions11 and 43 jurisdictions had deposited their instrument of ratification, acceptance or approval. Overall, it covers over 1650 tax agreements, which will be modified by the MLI once its provisions take effect for each of these agreements. More jurisdictions are expected to deposit their instrument of ratification, acceptance or approval of the MLI in 2020.

BEPS minimum standards

The MLI has allowed significant progress on the implementation of the Action 6 minimum standard on treaty shopping. Action 6 calls for the adoption of treaty provisions to prevent the granting of treaty benefits in inappropriate circumstances and to put an end to treaty shopping. The 2019 peer review report, which was approved by the BEPS Inclusive Framework at its January 2020 meeting and which covers all comprehensive tax agreements concluded by each of the 129 jurisdictions that were members of the Inclusive Framework as at June 2019, shows substantial progress in the implementation of the Action 6 minimum standard. The peer review also confirms the success of the MLI, which has been the preferred tool of jurisdictions for implementing Action 6.

Significant progress has also been made on Action 5 in addressing harmful tax practices. Since the start of the BEPS Project, the Forum on Harmful Tax Practices (FHTP) has reviewed a total of 287 preferential tax regimes against the standard for harmful tax regimes. The results to date show that all IP regimes have been, with one exception, either abolished or amended to comply with the modified nexus approach, which requires that substantial economic activity is undertaken in the country offering the favourable tax regime and that the amount of income that is eligible for benefits in an IP regime is proportional to the amount of expenditures undertaken by the taxpayer to develop the IP. Where necessary, other changes have been made to comply with the standard (e.g., removal of ring-fencing features designed to attract investment while protecting the domestic tax base).

In addition to the review of preferential tax regimes, there was a review of the substantial activities factor for “no or only nominal jurisdictions”. After agreeing the new substantial activities standard for “no or only nominal tax jurisdictions” in November 2018, the 12 “no or only nominal tax jurisdictions” identified by the FHTP introduced the necessary domestic legal framework to meet the standard. The standard requires that for certain highly mobile sectors of business activity, the core income generating activities must be conducted with qualified employees and operating expenditure in the jurisdiction. The FHTP has now reviewed the new domestic laws of the 12 no or only nominal tax jurisdictions. For 11 of these jurisdictions, the FHTP concluded that the domestic legal framework is in line with the standard and therefore “not harmful.” Regarding the remaining jurisdiction reviewed by the FHTP (United Arab Emirates), the FHTP concluded that the legal framework was in line with the standard but with one technical point outstanding, and the jurisdiction is now in the process of amending the relevant law.

On transparency in tax rulings, the second pillar of Action 5, progress has been achieved towards the compulsory spontaneous exchange of information on tax rulings. So far, almost 18 000 tax rulings have been identified and close to 30 000 exchanges of information have taken place. Eighty jurisdictions have now successfully implemented the standard and have not received any recommendations for improvement.

In line with Action 13, the first automatic exchanges of country-by-country (CbC) reports started in 2018. Action 13 requires the ultimate parent entity of an MNE group to file a CbC report in its jurisdiction, providing information (on turnover, profits, employees, taxes paid, etc.) for each of the jurisdictions in which it operates. The tax administration of the country where the ultimate parent entity is a tax resident will then exchange this data with the tax authorities of other countries. As of January 2020, there were over 2 400 bilateral exchange relationships activated with respect to jurisdictions committed to exchanging CbC reports. These include exchanges between the 84 signatories12 to the CbC Multilateral Competent Authority Agreement, between EU Member States under EU Council Directive 2016/881/EU and between signatories to bilateral competent authority agreements for exchanges under Double Tax Conventions or Tax Information Exchange Agreements, including 41 bilateral agreements with the United States. Jurisdictions continue to negotiate arrangements for the exchange of CbC reports.

Action 14, which deals with the improvement of mutual agreement procedures (MAP), has also seen significant progress. Action 14 aims at improving mechanisms to resolve tax treaty-related disputes to make them more effective. The MAP peer review process is conducted in two stages. Under Stage 1, the implementation of the Action 14 minimum standard is evaluated for Inclusive Framework members. Stage 2 focuses on monitoring the follow-up of any recommendations resulting from the Stage 1 peer reviews. As of October 2019, six rounds of Stage 1 peer review reports covering 45 jurisdictions had been released. The OECD will continue to publish Stage 1 peer review reports in batches in accordance with the Action 14 peer review assessment schedule.13 In addition, MAP country profiles for more than 80 countries have been published to increase transparency of the MAP processes.

BEPS beyond minimum standards

Beyond the BEPS minimum standards, BEPS Actions 2, 3 and 4 have been rapidly adopted by a large number of countries. These actions include common approaches to neutralising hybrid mismatches (Action 2) and to limiting excessive interest deductions (Action 4) as well as best practices in the design of effective controlled foreign company (CFC) rules (Action 3).

For EU countries, the adoption of the recommendations under BEPS Actions 2, 3 and 4 was agreed by the EU Council. The Council adopted the Anti-Tax Avoidance Directive (ATAD) as amended by ATAD II requiring Member States to implement domestic legislation in accordance with the provisions of ATAD for interest limitation and CFC rules with effect from 1 January 2019 and anti-hybrid rules with effect from 1 January 2020 (with the exception of the reverse hybrid mismatch rule, which will apply from 1 January 2022). In January 2020, the European Commission issued letters of formal notice to selected jurisdictions under Article 258 of the Treaty on the Functioning of the EU, where these letters serve as the first step in an infringement procedure. In the second stage of the procedure, the Commission may send a formal request to comply with EU law if it concludes that a member state is failing to fulfil its obligations under EU law.

Progress has also been made outside of the EU. In particular, Mexico adopted a reform that took effect in January 2020 to bring its tax legislation in line with recommendations from the OECD/G20 BEPS project (Box 3.4). Chile also adopted changes that took effect in January 2020, introducing a new special anti-avoidance rule that prevents the application of a reduced (4%) withholding tax on interest paid to a foreign financial institution if the lender institution is not the beneficial owner of the interest payments. In addition, Chile included new substance requirements for an entity to be qualified as a foreign financial institution and therefore be entitled to the reduced (4%) withholding tax on interest.

Actions 8 to 10 contain transfer pricing guidance to ensure that transfer pricing outcomes are in line with value creation in relation to intangibles and other high-risk transactions. Through this work, the OECD Transfer Pricing Guidelines have been modernised, and a new edition was published in July 2017. In June 2018, guidance on the application of the transactional profit split method and additional guidance addressed to tax administrations on the application of the approach on hard-to-value intangibles were approved, and have been incorporated into the OECD Transfer Pricing Guidelines. The implementation of Actions 8 to 10 has varied across countries. For a number of countries, changes to the OECD Transfer Pricing Guidelines resulted in domestic laws containing a direct reference to the Guidelines. In other countries, changes have consisted of clarifications, rather than substantive modifications to transfer pricing practices. Many other OECD and Inclusive Framework countries have introduced new legislation or regulations to implement domestically all or part of the guidance developed under BEPS Actions 8 to 10 (e.g. Argentina, Japan, Italy, Poland).

As recommended by BEPS Action 11, significant work has been undertaken to improve the quality of available corporate tax statistics, which is a critical step towards strengthening the Inclusive Framework’s ongoing efforts to measure and monitor BEPS and the impact of the BEPS package. New data collection processes and analytical tools have been developed. A new dataset – the OECD Corporate Tax Statistics Database – was released for the first time in January 2019, with the second edition published in July 2020. The second edition includes anonymised and aggregated CbC report statistics for 2016, to provide a more complete view of the largest MNEs’ global activities and improve the statistical and economic analysis of BEPS.

Finally, many countries have indicated that they plan to introduce or expand mandatory disclosure rules, in line with BEPS Action 12. BEPS Action 12 contains recommendations regarding the design of mandatory disclosure rules for aggressive tax planning schemes, taking into consideration the need to avoid disproportionate administrative and compliance costs and drawing on the experiences of the increasing number of countries that have such rules. EU countries are required to implement the rules as part of the EU Council Directive 2018/822 of 25 May 2018 (also known as DAC 6). While not all EU member states adhered to the implementation deadline of 31 December 2019, it is expected that DAC 6 will be transposed into the domestic laws of EU member states in 2020, with mandatory disclosure rules entering into force no later than 1 July 2020. Non-EU countries that have adopted mandatory disclosure rules include Canada, Israel, Mexico, Norway, Russia, South Africa, the United Kingdom and the United States.

In Mexico, a tax reform was approved by Congress on 30 October 2019 and entered into effect on 1 January 2020. This box provides an overview of the numerous changes intended to bring Mexico’s tax legislation in line with recommendations from the OECD/G20 BEPS project.

Anti-hybrid mismatch arrangements