4. Policies for a sustainable transport sector in Israel

This chapter discusses how Israel can both mitigate its (still increasing) emissions from the transport sector and improve its population’s well-being, notably by improving accessibility to opportunities (e.g., jobs, services, education, health facilities, etc.). After presenting the state of play, the chapter examines how improving taxation can limit emissions from private vehicles. It then highlights the need to improve road management: re-allocating and re-designing road space to promote accessibility and safety, and using tools (e.g. parking regulations, congestion charging) to use road space more efficiently. The chapter then examines how accessibility-based planning and appraisal frameworks can make public and active transport attractive alternatives to private cars and help fund infrastructure for these modes. It finally focuses on adapting governance and developing fully functional metropolitan transport authorities.

The transport sector is the second largest emitter of GHG emissions in Israel and its emissions have been increasing, driven by population growth and the expansion of car ownership within the population. Recommendations for climate mitigation policies in the transport sector in Israel are:

Align the taxation of private car use with its environmental damages and external costs

Fuel and car taxation are high in Israel relative to international standards. However, it can be better aligned with GHG emissions, environmental and social damage (air pollution, congestion, noise, road wear), without substantially increasing the tax burden. Three priorities are:

Align fuel taxation according to the environmental damage of combustion. Phase–out the tax benefits for diesel consumption (worth 0.28% of GDP in 2018).

Regularly update the car purchase tax (already aligned with external costs), to maintain environmental benefits and limit erosion of the tax base.

Consider the long-term replacement of fuel tax by distance and place based taxation, which can vary depending on vehicle characteristics.

Manage road space and prioritise public and active transport modes

Re-allocate and re-design roads to create a new user hierarchy where sustainable (i.e. low carbon, low space intensive modes) are prioritised over individual cars. Adopting a “Complete Streets” approach to road and project design that aims at safely balancing space between a diverse range of users and activities is also necessary.

A number of tools can help to improve the use and management of road space, but should be inscribed in the overall strategy to re-order user priorities and enhance accessibility:

Make use of parking fees and regulations which are aligned with the new user hierarchy (e.g. zoning indexed to public transport availability and city area). Liberated parking space can be used to promote active modes (e.g. with larger sidewalks and bicycle lanes).

Congestion charging can effectively reduce traffic in big cities. Distance and time differentiated schemes target more precisely the social costs of driving and are thus more effective, more efficient and bring better opportunities for the population to adapt. If adopted, general distance-based taxation would in the long-run incorporate congestion charges in place, as in this scheme driving through more central and congested areas could be taxed more severely.

In parallel, alternatives to private car journeys should be promoted and targeted compensatory measures should be considered for population disproportionally affected by new policies. A focus on revenue recycling can enhance public support for policy changes.

Focus on accessibility instead of mobility to unlock important opportunities

Use accessibility indicators to plan mobility systems and explicitly link land-use and housing decisions with transport accessibility criteria.

Develop appraisal methodologies that mainstream accessibility criteria. This will accelerate the implementation of the Strategic Plan for the Development of Public Transportation, allocating efficiently dedicated funds and steering more investment for public and active modes.

Widen financial capacity to ensure sustainable transport budgets

Fares need to help optimise public transport services and cover a substantial proportion of the system’s operational costs. The implementation of on-peak and off-peak tariffs can help limiting crowding in public transport.

Overall, a balance needs to be found between financial equilibrium and affordable transport. This can be done by keeping fares close to levels where operational costs are recouped and fares optimise usage. Targeted subsidies can then be modulated according to people’s family income in order to reduce vulnerabilities.

Funding sources for investment in transport can be enlarged by exploring land value capture mechanisms, levying new taxes on businesses, and channelling of charges on private vehicles, in addition to fare box revenue and general transfers from the central government. This can help ensure covering maintenance, expansion, improvement and regulation of transport, in addition to operational costs.

Devolve responsibility, develop capacity and improve coherence

The regulation of public transport in Israel is led by the central government. This presents shortcomings as local level governments tend to better placed to address local particular transport needs.

Shift capacity and responsibility to the local level within a framework that enables (or requires) the creation of Metropolitan Transport Authorities (MTAs) to provide responsiveness while avoiding over- fragmentation of responsibilities. It would also allow building planning and regulatory capacity inside the public sector (another limitation of the current model). This is particularly needed in the context of fast evolving transport services and the need to adopt a Mobility as a Service (MaaS) approach.

Develop fully functioning MTAs that have: defined responsibilities and formal authority with legal backing; secure financial and technical capacity; strategic level planning responsibilities; and predominant municipal representation in their governance structure (e.g. board of directors); and responsibilities beyond public transport (e.g. active modes, road management, safety).

Create a national policy for metropolitan and urban transport to: guide local policy and investment towards climate and well-being goals, standardise local planning tools, and bridge technical capacity gaps across territories.

4.1. Introduction

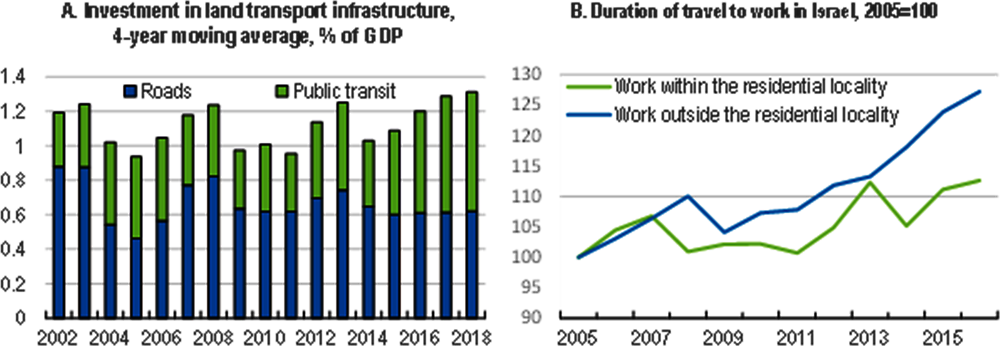

Making up 23% of GHG emissions in 2016 (the second emitter behind energy industries),1 the transport sector appears as a major challenge for climate change mitigation policies in Israel. The high increase in transport emissions (+12% between 2011 and 2016) is the result of deep societal changes, including rising living standards that increased investment in durable goods and more particularly to buy private vehicles. Slowing and reverting the growth of transport emissions entails structural changes, which include the development of palatable transport alternatives that would reduce people’s dependence on private vehicles and, when private cars are needed, the renewal of the private vehicle fleet.

The Israel government designed a National Plan for Transport in 2015, which is used as a basis to reach the Paris Agreement goals (a 26% reduction of GHG emissions per capita by 2030 relative to their level in 2005). This plan sets as an objective for 2030 a 20% reduction in vehicle-kilometres travelled, as compared to a business-as-usual (BAU) situation. However, such scenario does not entail a net decrease of the distance travelled by car relative to the current situation: the plan consists in limiting the increase of this value.2 The development of public transport in metropolitan areas and for intercity journeys is envisaged as the main driver that would allow reaching the car travel reduction objective. Beyond car travel reductions, in 2018, the Minister of Energy presented a plan which forecasted the ban of diesel and gasoline car imports in 2030, with the aim of shifting the transport sector towards technologies based on gas and alternative fuels (this plan has not yet been presented in Parliament).

Policies leveraging synergies between climate change mitigation and other well-being objectives have the potential to accelerate climate action. The performance of the transport sector should be assessed considering its capacity to reach the following goals: enhancing physical accessibility, ensuring affordable services, safety and security, reducing air pollution and noises, associated risks and habitat damages, and limiting climate change (OECD, 2019[1]).

This chapter argues that efficient climate policies in the transport sector should both reduce the need for journeys by private vehicles and the emissions from each vehicle when needed. Policies should focus on providing accessibility, which means easing the capacity to reach destinations for goods, services and opportunities instead of only enhancing physical mobility (Litman, 2019[2]). For instance, (Suhoy and Sofer, 2019[3]) measured relative accessibility via public transport to workplaces using detailed locality data in Israel. They identified notable gaps, as the number of job localities only accessible by private vehicles is by far higher than the number of job localities accessible by public transport.3 Developing sustainable transport modes such as cycling, walking and public transport is crucial for the transition to a low carbon economy. Shortening the distance between people and their needs (goods, services and job and leisure opportunities) would also allow to significantly reduce emissions from the transport sector. However, enhancing accessibility in order to reach transport objectives requires policies that go beyond the transport sector and also address the housing sector, spatial planning and labour policies (see also previous chapter).

This chapter examines how the transport sector can contribute to Israel’s climate change mitigation objectives for 2025 and 2030. It focuses on surface transport and the need to reduce reliance on private vehicles, which account for 90% of all the distance travelled by motorised modes in Israel (OECD, 2016[4]) and more than half of emissions (Tamir et al., 2015[5]). Section 4.2 introduces the general context of the transport sector in Israel. Section 4.3 points out the necessity of aligning taxes on fuels and vehicles to external costs in order to reduce transport emissions. Section 4.4 explores the opportunities provided by a better management of road space that prioritises public and active transport modes as opposed to private cars. Section 4.5 shows that these measures need to go hand in hand with strong investment on public and active transport to make it more attractive. It highlights the need for developing appraisal methodologies that incorporate accessibility as a central criteria to investment decisions, and make in this way a strong case for public and active transport modes. It also emphasises the need to increase the funding sources for transport. Finally, it also discusses the need to adapt the governance for transport, increasing the role of local authorities, while setting up metropolitan transport authorities and developing a national policy for urban and metropolitan transport. It also emphasises the need for improved regulation and integrated spatial planning, that goes beyond the transport system, can help scale up climate ambition in the transport sector.

4.2. Context: road transport in Israel

Emissions from transport have been steadily rising in Israel for more than a decade, increasing by 12% over the five-year period 2011-2016 and by 24% between 2006 and 2016.4 This has been mainly driven by the large population growth occurring in the same periods (over 10% and 21% respectively), but also by the increasing share of car ownership. Although the number of private cars per person is low relative to other OECD countries (311 passenger cars per 1000 inhabitants in 2015, according to the OECD-ITF, compared to 463 in average in OECD countries)5, this share increased in Israel by 30% between 2010 and 2015.6 Cars are also used intensively and Israel has one of the highest number of kilometres per vehicle in the OECD due to an increased dependence on private car journey in many Israelis’ daily life.7

Private cars are crucial for the mobility of passengers in Israel, notably because of the poor state of the public transport, which only account for 22% of commuting (Bleikh, 2018[6]). A high and increasing share of workers are commuting outside their areas of residence, up by 10 percentage points between 1990 and 2016 (from 43.9% to 53.9%). Moreover, an increasing share of these workers are using their private cars, which accounted for 60% of journeys to the workplace (Bleikh, 2018[6]).

Local spatial planning is also partly responsible for high transport emissions. In Netanya, for instance the city fabric is discontinuous, due to new neighbourhoods being built far from the city centre and commercial areas, increasing the dependence on private vehicles. The situation is likely to be worsened by new urban developments if not carefully designed (also see chapter 3 on the residential sector).

The rapidly growing demand for housing, mainly due to high population growth of over 1.96% per year between 2009 and 2018,8 has led to an increasing number of new housing projects. The government will build 1.5 million homes by 2040. As the development of large housing projects is easier in peripheral areas (because the land is state-owned) and makes it easier to keep pace with the growing housing demand, there is a risk that, without legal requirement to make employment and services accessible from housing developments by public transport, the city will continue to expand in a way that fosters car dependency. This importantly hinders all climate change mitigation efforts in the transport sector.

Perhaps even more significant than its climate effects, transport in Israel has many other detrimental effects on well-being. As transport infrastructures did not adapt to the upsurge of car ownership, congestion and air pollution stand as major issues in Israel. In 2015, PM2.5 caused the death of more than 2 000 people, according to the Global Burden of Disease database, and the number of people exposed to this pollution have been increasing (Environment and Health Fund and Ministry of Health, 2017[7]). A government-commissioned experts estimated that the total cost of car use to the Israeli economy up to 6% of its GDP (Israeli Tax Authority et al., 2008[8]), including 2% due to the damages of air pollution to health and ecosystem and 2% due to congestion cost (this number was confirmed by (Trajtenberg et al., 2018[9])).9 This figure, relatively high in international standards, is due to the fact that Israel has the highest road traffic density per network length in the OECD by far (3.5 time the OECD average). Other externalities (accidents due to traffic, noise, the occupation of public space by free parking places for private vehicles and infrastructure building and maintenance costs) add up to the cost of private vehicle use in Israel and account in total to 2% of GDP, according to the Israeli Tax Authority. As a comparison, the external costs of road transport in EU countries in 2016 amount for 4% of their GDP, with accidents being the highest external cost (European Commission, 2019[10]).

Pricing policies for transport (i.e. fuel and car purchase taxes), which reflect the external costs of private car use, can contribute to a reduction of GHG emissions. In the case of Israel, where alternatives to private cars are often limited and tax rates are already high, relative to international standards, a strong increase of the average taxation would probably hurt households’ purchase power without decreasing significantly car use. In the longer-run, shifting the car purchase tax towards a distance-based taxation would allow more accurate pricing of external costs and thus would be economically more efficient. In the short-run, in addition to adjusting the existing taxes, implementing congestion charges in big cities has the potential to both mitigate GHG emissions and improve air quality; the social outcomes should be carefully assessed and anticipated in order to gain public acceptability. The deployment of public transport and facilities for active transport modes (cycling and walking) would allow for much stronger decrease of GHG emissions, and government needs to scale up Israel’s transport plans. Finally, the impact of transport policies on climate and well-being can be enhanced if they are implemented in parallel with an integrated spatial planning that enforces accessibility to goods, services and opportunities.

4.3. Limiting private cars’ emissions through a consistent pricing policy on fuels and vehicles

Taxes on fuels and vehicles in Israel are already high relative to other countries but do not properly reflect the external costs of vehicle use on climate, environment, health and, more generally well-being. An appropriate tax policy on fuels and vehicles has the potential to reduce emissions from the most emitting vehicles without increasing the average fiscal burden on citizens.

4.3.1. Israel has high effective carbon rates but the prices across different fuels are misaligned with climate and other well-being objectives

Israel taxation on fossil fuels for road transport is high relative to other OECD countries. The OECD report “Taxing Energy Use” (OECD, 2019[11]) shows that Israel has the highest effective carbon price on road emissions among 44 OECD and G20 countries (more than EUR 280/tCO2, while the median rate is around EUR 160/tCO2). As Israel does not have an explicit carbon tax, this high price is due to high excise taxes on fuels for transport. The level of taxation is also higher than the highest estimates, in other countries, of the full range of external costs, including GHG emissions, congestion, noise, accidents and local air pollution. While the excise tax amounts to NIS 2.4 per litre for diesel and NIS 3.1 per litre for gasoline (see Table 4.1), the highest estimates of marginal costs in France and the United Kingdom do not exceed ILS 1.37 per litre (equivalent EUR 0.35 per litre)10 (OECD, 2019[11]).

Whatever the level, the price differential between fuels however, should be aligned with their different social costs, including their related GHG emissions. Policies need to give incentives to drivers to choose greener vehicles and to reduce journeys in vehicles running on fossil fuels. Putting the right price signal on fossil fuels in the transport sector would reduce the use of the most emitting vehicles; for the owners of those vehicles, it would limit unnecessary journeys and foster car-sharing and public transport use, which only accounts for 20% of daily journeys so far (Trajtenberg et al., 2018[9]) This could also create new options for new transport alternatives such as shared mobility services and car-pooling.

Although the average taxation rate on fuels is high, the different excise tax rates between fuels do not provide the right price signals on their external costs on climate and air pollution. As a consequence, drivers’ choices of vehicles will not be steered towards greener vehicles. Table 4.1 shows the different excise tax tariffs for each fuel as well as their estimated emissions of GHG. A striking example of this misalignment is the higher tax rate on gasoline relative to diesel, although it emits less CO2 per volume consumed (OECD, 2016[4]). The lower tax rate for diesel fuel is even less justified when pollutants other than GHG are taken into consideration, since diesel vehicles tend to emit much more particulate matter and nitrogen oxides (OECD, 2016[4]). Finally, there is no argument, from an environmental point of view, for applying a much lower rate on the local production of biodiesel than on imported biodiesel.

LPG and natural gas taxation is also particularly low relative to other fuels. It is taxed about 30 times less than gasoline although it emits two thirds of the CO2 equivalent from petrol. Natural gas that can be used for transport, and more particularly trucks (CNG and LNG) has an excise tax of ILS 17 per ton, which is equivalent of EUR 1.90 per ton of CO2eq (with the perspective of increasing the excise rate to 1,400 per ton within a period of eight years). The share of vehicles running with alternative fuels (gas and electricity) only amounted to 0.8% of the car fleet in 2015, but the discovery of a new source of gas by Israel will lead to the development of gas-powered vehicles. Although it is not carbon neutral, LPG and natural gas can be considered a useful transition fuel to go towards the low-carbon economy, as other modes (and more particular EVs) require heavy investment that are hard to implement fully in the short term. However, policies enhancing the use of LPG and natural gas in transport should be made on a clear assessment of the costs and benefits, including for public health and climate, as a recent study showed that gas-motored trucks emit much more NOx than diesel (Vermeulen, 2019[12]).

Aligning the excise tax rates to carbon emissions would be a first step towards a greener taxation of fuels. However it is important that, this alignment is not made by simply reducing the gasoline tax rate. This would be counterproductive concerning the wider objective of reducing fuel combustion since it entails a decrease in fuel prices for 96% of private vehicles. An alternative, more palatable from an environmental point of view, is to make the alignment upward, increasing diesel and biodiesel taxation. This increase in diesel prices would affect mostly users of taxis, buses and trucks, since 67% of their fleet consists of diesel-fuelled vehicles. Increased resort to the existing supports for the renewal of these vehicles might therefore be needed and should be anticipated in budget. Distributional and sectoral effects of this policy should also be assessed in order to calibrate other enabling and compensating measures.

Another way to make fuel taxation more efficient would be to phase out tax advantages linked to diesel consumption. The Excise Tax on Fuel Order instituted in 2005 tax rebates on diesel for buses, taxis, fishing boats and working vehicles (like tractors for agriculture). In 2018, these tax expenditures amounted to ILS 3.6 billion (0.28% of GDP) and accounted for the bulk of support to fossil fuels in Israel (OECD, 2018[14]). Phasing out such support to working vehicles would reduce the incentives for wasted consumption of diesel, which causes serious pollution. It would also increase incentives for fleet renewal and penetration of cleaner technologies in these segment of the vehicle fleet. While this also holds in the case of vehicles dedicated to public transport services, detrimental effects on different population groups (due to likely fare increases) should be assessed and where necessary compensated (e.g. via targeted subsidies-see below). Putting incentives for cleaner public transport or conditioning tender for public transport to environmental conditions can also be considered.

Phasing out this support to fuel consumption would create fiscal space to reduce the public debt or increase other subsidies or expenses; it would also increase the incentives to invest in less fuel-intensive vehicles. Government could use a part of the savings on fossil fuel subsidies to curb its potential detrimental effect by redistributing revenues to the sectors concerned. More particularly, it could be used to implement measures that would enable and facilitate the transition of the sector towards more sustainable modes of transport and production. In the transport sector, further support to the renewal of the bus and taxi fleets is an option, as they account for a substantial share of GHG emissions in the transport sector (around 15% in 2015 according to (Tamir et al., 2015[5])). Channelling new resources to public transport investment is also an option. For instance, Ile-de-France Mobilités, the metropolitan transport authority in charge of the Paris Region has been granted since 2016 a percentage of the revenue that comes from the internal tax on energy products (petrol and diesel) that are sold in the Paris region; this percentage, is used for improving the public transport network (ITF, 2018[15]).

In the longer-run, fuel taxation could be gradually substituted by a distance-based tax (see section 0).

4.3.2. Making the car fleet more sustainable: finding the right policy mix

Israel is putting the most polluting vehicles out of the market with standards and regulations

Most of the policies aiming at reducing emissions from private vehicles in Israel are focused on controlling the car fleet quality with standards and regulations, which forbid the sale or circulation of vehicles emitting the most GHGs, and pollutant gases by kilometre travelled. Standards and regulations for improving vehicle technology have been the cornerstone of environmental policies in the transport sector for a long time. Israel has been following European standards (Euro 4, 5 and 6 standards) since the mid-1990s and, since March 2006, gasoline motored vehicles have been required to undergo stringent emission checks. In 2012, standards were reinforced and roadside spot checks were implemented in 2013. If a vehicle fails to pass the roadside test, the owner has to pay a fine or make the required reparation. Failure to pass the annual emission check also prevents the renewal of the car licence.

Moreover, in October 2018, the Ministry of Energy presented a plan against pollution which included the phasing out of fossil fuels in the transport sector and the deployment of electric vehicles and trucks powered by gas (Compressed Natural Gas). A ban against the import of vehicles powered by diesel or gasoline will also be implemented in 2030 according to the plan, while the deployment of electric vehicles will be gradual (27,000 vehicles are expected to be sold in 2022, 177,000 by 2025, 665,000 in 2028 and 1.4 million by 2030). This plan has not been presented to Knesset yet.

Several Israeli cities also implemented Low Emission Zones (LEZ) to limit air pollution, particularly from diesel cars. One was initiated in 2018 in Haifa. In a first phase heavy diesel vehicles were banned from the area. The prohibition was then extended to light commercial vehicles; another LEZ was introduced in January 2020 in Jerusalem. Past experiments in other cities, like in Berlin, London or Copenhagen show that such policies have been effective in reducing the number of older and more polluting vehicles, incentivising the purchase of vehicles that are cleaner. The LEZs in Haifa is expected to reduce vehicular emissions by 20%, while the LEZ in Jerusalem is expected to reduce vehicle related CO2 emissions by 8%, NOx emissions by 55% and PM by 30%.11

LEZ in Israel have been implemented gradually, providing a clear signal easy to anticipate. However, it is important that they do not have detrimental impacts on vulnerable population’s well-being, as those might have some difficulties switching for compliant vehicles, more particularly when light vehicles would be covered. Coping with these issues would entail improving public transport service and infrastructure for walking and cycling, as well as a communication strategy for vulnerable groups, as suggested by consultation groups working on the ultra-low emission zone in London.12

Regulation (car standards and LEZ) have been efficient in renewing and greening the car fleet and providing a clear signal for people and car constructors. It succeeded at institutionalising basic standards and it contributed to the improvement of air quality in city centres: between 2000 and 2017, NOx concentration in the commercial centre of Tel Aviv was reduced by 63%, SO2 concentration by 79% and CO concentration by 84%.13

In theory, this type of regulation is not as efficient as emission taxation. First, it has no effect on the use of vehicles that comply with standards outside use in the given area where the LEZ is established.. Israel has the second highest mileage per vehicle in OECD countries so it is important to implement tools that directly tackle excessive use. Moreover, it does not spur innovation for building vehicles that are more efficient than required by the standards used to restrict access to the area where the LEZ is implemented, as opposed to an emission tax. Nonetheless, LEZs have proven to provide a very visible incentive to comply with environmental standards, as they are generally set in areas that are of particular interest for passenger or freight vehicles to travel to or through. This can help reinforce signals provided by fuel taxation, which while in theory more efficient might be more diluted as benefits are distributed through time. In addition LEZs target pollution, which depend on concentration and exposure (which fuel taxes do not account for). It is important though to regularly update standards used to restrict access to the selected area. As congestion charges are increasingly considered in Israel (see Section 4.4.2), existing LEZ could be integrated to such scheme and transformed into charging zones with minimum standards (i.e. that do not allow the most polluting vehicles but levy a congestion charge on all other vehicles). This is the case of the “Area C” scheme in Milan (ITF-OECD, 2017[16]).

The car purchase tax can be improved to better reflect external costs of car use

The past reform of the car purchase tax contributed to a greener tax fleet, but also to an increase of overall emissions

The car purchase tax in Israel has historically been high: in 2009, it amounted to 95% of the purchase value for private cars (nearly doubling the price paid by consumers) and to 75% for commercial vehicles. It is therefore one of the highest among the OECD countries. As a result, private car ownership is relatively low among the population (319 passenger cars for 1.000 residents in 2016 compared to 417 in the United States, 478 in Greece and 548 in Germany). In 2005, the car purchase tax rate was decreased permanently for light-duty vehicles with the aim of incentivising the renewal of the fleet.

In 2009, Israel initiated a Green Tax Reform that consisted in a modulation (based on 15 grade standards) of the car purchase tax according to the externalities of vehicles use (OECD, 2016[4]). The Israeli government assembled an inter-ministerial commission that estimated the external effects of different ranges of vehicles on: air and water pollution, congestion, accidents, global warming, noise, infrastructure and land use. Car models were classified in 15 different categories, all of them with a specific car purchase tax rate. At the end, the effective purchase tax rate amounted to a rate between 10% and 83% in 2014, with an average at 60.6% and most of the car sales having a rate between 54% and 67%. The Green Tax Reform therefore decreased substantially the average car purchase tax (from 95% in 2009 to 60.6% in 2014).

In parallel with these changes, Israel implemented in 2007 a scrapping scheme that offered ILS 3 000 (EUR 550 in 2007) for the disposal of vehicles older than 20 years (3% of the fleet in 2007). This scheme was renewed in 2013 and had a huge unexpected success. As ILS 5 million was allocated yearly to this scheme for the 2013-2017 period, the whole budget for 2013 was spent in less than a day.

Overall, the combination of a more stringent regulation on vehicle emissions (higher standards, implementation of low-emission zones in metropolis, more stringent performance tests for vehicles –see previous section), the scrapping scheme and the Green Tax Reform allowed for a strong renewal of the car fleet. The introduction of new vehicles compliant with more stringent environmental standards and with better safety equipment, resulted in a safer and less emitting fleet. Casualties from traffic accidents decreased between 2005 and 2017 by 39% in Haifa, by 34% in Tel Aviv and by 22% in Jerusalem.14 In particular, the sales of vehicles with smaller engines, which are in general the less emitting, increased. While vehicles with engines below 1300 cubic centimetres (cc) amounted to less than 5% of imports in 2010, they made up to 25% of car sales in 2014 (OECD, 2016[4]).

As this reform resulted in a decrease of the car purchase tax for most car models, it had a mixed aggregate effect on environmental outcomes. On the one hand, it improved cars environmental performance and led to a long term decrease of the average pollution per vehicle. Integrating the many different pollutants in the tax basis allowed to decrease the CO2 emissions per car without increasing air pollutants like NOx and PM, unlike reforms in other countries such as Ireland, which reform fostered the sale of diesel cars (Ryan et al., 2018[17]). On the other hand by decreasing the final prices of cars, the reform contributed to an increase in car ownership in Israel, exacerbating related issues like congestion or infrastructure erosion. The net effect of the reform was also an increase in total emissions, including GHG emissions (OECD, 2016[4]): even though the average vehicle emitted less pollutants per kilometre, more cars on the market increased the total number of kilometres driven, which largely offset positive effects on climate. The reform also had detrimental effects on other well-being dimensions. The increase of the number of cars due to the reform exacerbated congestion and its related nuisance (time loss, noise, pollution). The number of vehicles increased by 17% between 2013 and 2016.15

The increased number of cleaner vehicles may also reduce government revenue. As people bought less vehicles at higher rate of taxation (i.e. the most polluting ones), the total tax revenues decreased.16 A frequent revision of grade standards that are used to set the tax rate should therefore avoid a decrease of average tax rates and the relating tax revenue. It would also improve the fleet in a dynamic way that takes into account technological progress.

Improving the current car purchase tax

Even when the Green tax reform in Israel may have had some detrimental effects (see previous section), the car purchase tax has many benefits. Israel was the first country that fully integrated the different externalities of cars into its car taxation and succeeded to reduce the emissions per car (OECD, 2016[4]). Moreover, the tax rates are high and this has contributed to maintaining a car ownership rate that is low relative to other countries. Phasing-out the car purchase tax without compensating with the increase of other types or car taxation would have the direct effect of incentivising car use and worsen the detrimental effects described above. Finally, a car purchase tax can be useful to price the external costs of resource use for car construction, in case it cannot be done upstream in the supply chain. This possibility could be explored by the Israeli authorities.

In the short term, the car purchase tax can be improved so that, together with fuel taxation, it builds a system that provides a good price signal on both the purchase and the use of cars. As fuel taxation, aligned with carbon emissions (as described in Section 4.3.1) would price the climate effect due to car use, the car purchase tax would shift consumption choices towards greener vehicles. Their interactions should be carefully assessed in order to provide a consistent price signal.

In order to maintain its environmental benefits, it is important that the car purchase tax is regularly updated. If categories and rates are not revised, regular technology would be priced at the same level as cutting-edge technology and there is a risk that a boost of car ownership would lock-in people in a car-driven system. It would also limit the erosion of the tax base due to the increased acquisition of greener vehicles. Moreover, the car purchase tax should not lose its environmental objectives at the expense of other social objectives. A recent project to increase electric vehicle taxation from 10% to 30%17 was announced by the tax authority to fight deficit. Such reform would blur the tax signal that favours the acquisition of less polluting vehicles.18 Other types of tax reforms, based on increasing income tax more that consumption taxes, would be both more efficient from an environmental point of view and better targeted from a distributional point of view.

In the longer term, a distance-based taxation (see Section 0) could be implemented. This would mainly replace fuel taxation but could, in the same way as a fuel tax, support the price signals provided by the differentiation of the purchase tax on cars during a transition period until the fleet is entirely or in its majority electric. Such a scheme would price at a higher rate kilometres driven by more polluting vehicles, in addition to differentiating rates based on time and place (depending on the intensity and saturation of road space). In this way it could reinforce the purchasing tax effect on the choice of cleaner vehicles. The rates can be defined following the same evaluation grid used for the car purchase tax. As a distance-based taxation is gradually phased-in, the car purchase tax can be gradually revised to find the optimal combination between a price signal at the moment of the car purchase and one throughout its use. As the fleet becomes increasingly electric, the transition towards distance-based taxation can ensure that other externalities (e.g. space consumption, infrastructure damage) are accounted for-since in any case GHG and pollution emissions will be progressively reduced as an external cost-, while also allowing maintenance of stable tax revenues.

Subsidies to public servants’ car fleet should be phased out

The public sector in Israel had more than 800.000 employees in 2018.19 Most of them, due to wage agreements, benefited from special treatment for their vehicles. This encourages the use of private cars, covering a large part of their car expenses and including free parking, even though it is for private use.

The National Plan to Reduce Air pollution considers a bulk of policies aiming at shifting private car use towards greener transportation like public transport or biking. Phasing-out the specific benefits for car use in the public sector would undoubtedly be a first step. However, the distributive impact of such measures should be carefully assessed, as the latter should not result in a decrease of purchasing power for public servants that would make useful professions less attractive. Instead, the government revenue once used for subsidising the car fleet could be recycled into public sector wages, and a part could be used to encourage greener transport when it is a feasible option (specific subsidies for employees that use public transport, for instance). This would also facilitate negotiations with workers’ representative and make the phasing-out of car use subsidies more acceptable.

Subsidising less polluting vehicles like EVs is not the right answer to improve overall transport and well-being conditions in Israel

If well-designed, the combination of a fuel tax and a car purchase tax reflecting the externalities of car use should provide the appropriate signal in favour of EVs, and there is no need for adding another instrument to incentivise their purchase. It is important to carefully assess the potential reduction of taxation for greener vehicles like electric or hydrogen vehicles, as it may accelerate the increase of car ownership in Israel, worsening congestion and still causing emissions (e.g. electricity production, tyre and break wear) which are not always accounted for. Yet, EVs can also be a major (low-cost) source of flexibility, improving the integration of renewables and the efficiency of the power system (Chapter 2). Overall, if well designed, the modulation of the car purchase tax and the fuel tax should provide enough a signal to stir transport choices and adding a tool could only blur this signal.

Several experiences show how subsidies or preferential tax treatment might increase car ownership and their amenities, and more specifically congestion, which is already a major issue in Israel. Norway has been encouraging EVs since the 1990s by providing registration tax exemption, free public parking, a reduction in the annual circulation tax, a reduction of company car tax and a road toll and a ferry charge exemptions; moreover, EVs have been authorised on bus lanes since 2005. This policy package was successful in increasing the share of electric vehicles, in 2018, Norway was by far the first market for electric cars, which accounted for 46% of all new car sales (IEA, 2019[18]). However, this also resulted in an increased congestion for buses that might have discouraged the use of public transport.

The environmental effects of such policy is also questionable. France introduced a “feebate” policy, including fees and rebates, for car purchase in 2008, which consisted in a rebate for low-emitting cars and a fee for high-emitting cars. This measure finally resulted in an increased number of car sales and a negative environmental outcome (D’haultfoeuille, Givord and Boutin, 2013[19]).

There might also be mitigated effects on air quality. Although the electrification of private vehicles would limit exhaust emissions of particulate matters and NOx, EVs may have less impact that expected on air quality, as they weight much more, and hence emit more particulate matters outside the exhaust system than internal combustion engine vehicles, accounting non-exhaust emissions such as tyre wear, brake wear, road surface wear and resuspension of road dust (that altogether make up 85% of PM2.5 and 90% of PM10 emissions from traffic) (Timmers and Achten, 2016[20]). This makes the case for more stringent regulation for these particular emissions, which have not decreased in Israel since 2000 at least.

The climate effect of putting incentives for EVs should be carefully assessed. There might be supplementary emissions by an increased energy consumption. The effect of an increased number of electric vehicles on climate depends on the energy sources of electricity generation. In Israel, electricity is mainly produced from natural gas (66% in 2018, according to IEA) and coal (30%), renewable energies making up less than 3% of total electricity generation (see the chapter on electricity). The share of natural gas is likely to grow to replace coal in the coming years, as both the Ministry of Environment Protection and the Ministry of Energy include a complete coal phase-out by 2030. Final government decision is still pending (EcoTraders, 2019[21]).

Finally, higher penetration of EVs without curbing the expansion of car ownership in Israel would not allow the country to reach its climate goals. A simulation shows that a policy that increases the share of low-emitting vehicles but fails to dampen the current increase of car ownership would fall short of climate objectives (see Box 4.2). It would certainly reduce emissions relative to the government’s BAU scenario but the achievement of objectives rely on a limited increase of cars. If car ownership follows the same pathway than the current one (around +5% per year according to the Statistical Yearbook of Israel), climate objectives are impossible to reach, even with 25% of modal shift towards public transport or active modes. Israel would also fail to significantly reduce private car mileage, which is the objective of the National Plan for Transport to reach for the Israeli contribution for the Paris Agreement. Taking this into account, is important when planning investments in supporting infrastructure for electrification (e.g. charging stations), since the location and type of infrastructure needed will be different if it is to be compatible with high shares of shared rather than private mobility (Goetz, 2017[22]).

As a conclusion, policies supporting low-emitting vehicles should be carefully designed to avoid off-setting efforts to control an increase in the stock of cars. Setting the right standards to support their uptake but regularly updating them is key to limit the increase of car sales to a level that does not undermine climate objectives or worsen congestion. Vehicles’ weight, a driver for non-exhaust emissions, should be integrated in policy design. As the increase of car ownership might be difficult to curb, measures that limit the use of individual cars (including by better managing road space), and foster shared trips and high-occupancy, in parallel to policies that fosters the penetration of cleaner vehicles (see Sections 4.4 and 4.5) are needed. Fostering high occupancy will also be particularly important to meeting climate goals in the light of potential penetration of automated vehicles, which will probably tend to be larger (Fulton et al., 2017[23]).

Comparing climate scenarios for emissions from passenger vehicles

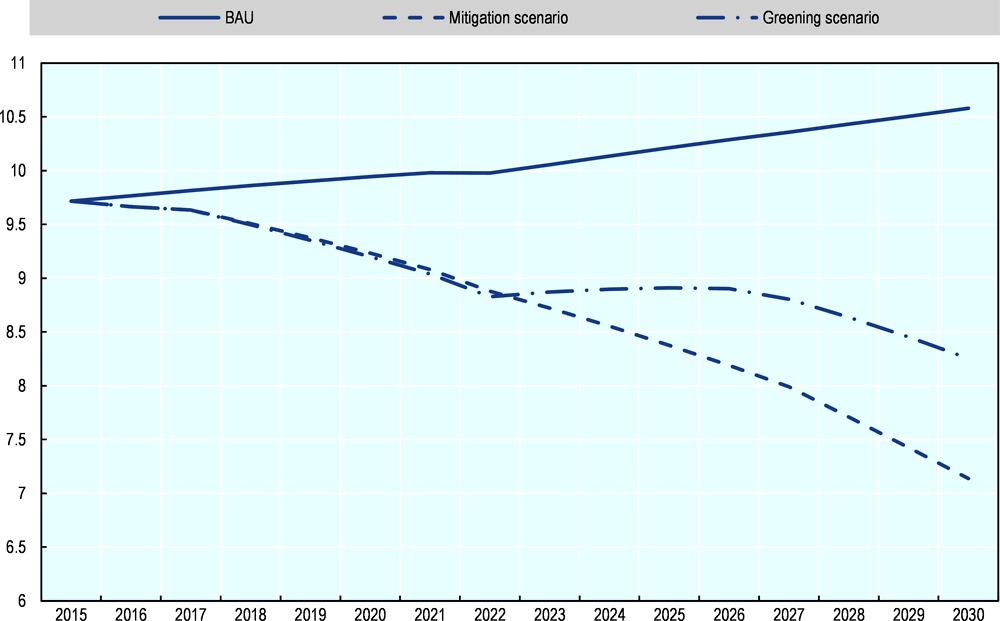

We are comparing different mitigation scenarios to asses, under certain assumptions, the impact of a subsidy to low and zero emission vehicle that would improve the car fleet, but also increase the total number of passenger vehicles.

This estimation compares different scenarios that were built in consistency with the hypothesis the Israeli Ministry took to assess the reduction potential of each sector in Israel in 2015 (Tamir et al., 2015[5]). As they do not aim to reflect directly reality, these scenarios provide a schematic assessment of what would happen if some policies were implemented in a certain context.

The BAU scenario, defined in (Tamir et al., 2015[5]), considers a scenario where the numbers of car increases by 2.38% each year and the share of petrol-motored vehicles slightly decreases (from 95% in 2013 to 77% in 2030), mostly at the benefits of diesel-motored vehicles (from 3.4% to 15% in the same period).

The mitigation scenario20 is based on the assumptions on mitigations measures made in (Tamir et al., 2015[5]), including major technological innovations and the penetration of more efficient vehicles and fuels. More importantly, this scenario assumes a modal shift from private cars to public transport, walking or cycling of 25%, meaning that 25% of the kilometres driven by private cars would be replaced by more sustainable transport modes. This is reflected in a decrease in the average mileage for each car, but not in the total number of cars, which follows the same path as the BAU scenario.21

The greening scenario has similar assumptions as the mitigation scenario and includes the same mitigation measures (technological innovation, same decrease of annual average mileage due to modal shift). It also adds-up a policy that increases the share of electric vehicles and LPG-motored vehicles (respectively 15% and 5% of the car fleet in 2030), but also the total car fleet. The car fleet increases by 2.38% per year between 2013 and 2020, following the same path as other scenarios, and by 5% per year between 2020 and 2030 due to the new policy. This latest figure was chosen in accordance with later trends in car ownership and should therefore be considered as a conservative hypothesis. The purpose of this scenario is to estimate the effect of a policy implemented in 2020 that would both reduce average emissions per vehicle and increase the car fleet.

The results, presented in Figure 4.1 and Figure 4.2, show that a greening scenario does not reach the same level of mitigation than a full mitigation scenario. This means that climate objectives are harder to reach if the deployment of low or zero emission vehicles increases the total number of vehicles. More specifically, the mitigation scenario would decrease CO2 emissions by 33% relative to a BAU scenario and a greening scenario would only reduce them by 22%.

More strikingly, the greening scenario falls short of the transport sector objective set in Israel NDCs which consisted in the decrease by 20% of car mileage relative to a BAU scenario. If the mitigation scenario succeeds at decreasing private car mileage by 25% (as initially considered), the greening scenario reduces total private car mileage by only 5%. The reduction is driven by a modal shift towards more sustainable transport that decreased the average mileage for each car. But this effect was largely offset by the increase of car ownership.

4.3.3. Considering a distance-based taxation in the long term

In the longer term, a distance-based taxation would efficiently replace the fuel tax, as well as congestion charges (see Section 4.4.2). The transition should be carefully monitored in order to avoid a shock on public finance.

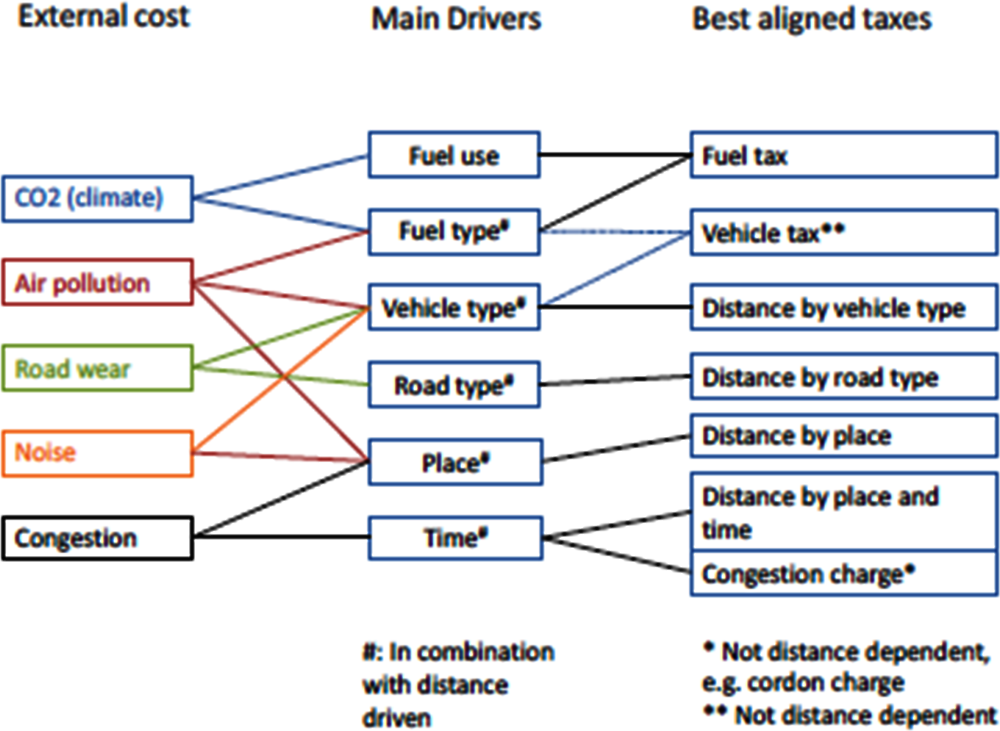

The externalities of transport use have many different drivers (see Figure 4.3). Some of them are dependent on fuel use and type (like GHG emissions), others on combined factors: the impact of driving on exhaust pollution, for instance, differs, according to the car quality, its use intensity and the place it is used (such as road and infrastructure wear, occupation of free parking) (van Dender, 2019[24]). As for the effect of vehicle use on congestion, which stands for 27% of estimated costs from transport usage according to (van Essen et al., 2019[25]), it depends on the size of the car and the timing of its use. The relations between externalities are therefore complex and taxing them appears as a challenge.

Existing taxes on transport in Israel fail to reflect correctly the different externalities of transport use. While fuel taxation can reflect the effect on climate, it fails to price precisely the effect that fuel combustion has on local air quality, as it strongly depends on the vehicle quality, but also, for instance, on the initial pollutant concentration, hence on other people’s use.

On the other hand, vehicle taxation, which is calibrated in order to reflect the average costs of car use does not account for the intensive use of each car. Reducing car use is a prominent lever for reducing GHG emissions from transport in Israel, as the country has the second highest mileage per car in the whole OECD (17,700 vehicle-km per road motor vehicles-see Figure 4.4) after the United States of America although population density is more than ten times lower in the latter.22 As car taxation fails to put a price on every kilometre driven, it does not reduce unnecessary trips and has a limited effect in reducing pollution. Nor does it foster car sharing, while 80% of Israelis drive alone (Trajtenberg et al., 2018[9]).

A tax proportional to the distance driven has the advantage of being suited to integrating many externalities linked to transport, such as noise, road wear, congestion and air pollution, which are often proportional to car use (Figure 4.3). Implementing such taxation, with a modulation by vehicle type that applies a higher rates for more polluting models, constitutes a good option to supplement fuel taxes.

This type of tax relates the price paid more closely to actual pollution than the car purchase tax by pricing both vehicle use and equipment choices. In order to reflect a broader range of externalities, congestion charges can be integrated by applying higher rates in case of congestion. As the purchase tax has however the advantage of providing an immediate price signal at the point of decision to purchase, the complete phase-out of this tax could result in accelerating car ownership, and deteriorating the tax base. Thus, an optimal combination of these taxes should be assessed.

The development in electronic metering technologies and its diffusion in the car fleet will probably reduce these costs of implementation. Finally, recent technology developments using GPS allow for a modulation of this tax according to the place and the moment of driving, and would then contribute to a broader internalisation of costs, including congestion (van Dender, 2019[24]).

Action in the short term would consist in implementing congestion charges in metropolis based on the distance driven. In the longer term, those schemes could be transformed into a national distance-based taxation by being expanded to the whole country and modulated according to vehicles characteristics (higher rates would be applied to more polluting vehicles) and to congestion.

Distributive effects of combining the car purchase tax with a distance-based taxation can be important. It would benefit households and firms that do not use much their vehicle or use it for short distances, and would negatively affect long commuters. Targeted compensatory measures can be considered but an efficient public transport network would be the best policy tool to smooth the transition (see section 4.5).

4.4. Improving road management and allocation will be key for lowering GHG emissions and enhancing life quality

4.4.1. Rethinking road management to increase the use of sustainable modes

Generating an efficient use of road space needs to be a priority for transport systems in Israel. Thus, transport modes that generate higher social benefits and lower GHG emissions and other social costs, relative to the road space they consume (e.g. walking, cycling, public transport and other forms of shared-trip services), need to be prioritised. Making an efficient use of road space will also require that the demand for the use of this infrastructure is managed to avoid congestion; which in addition to generating time and other economic losses exacerbates traffic noise and emissions of gaseous pollutants, greenhouse gases and particles (Crozet and Mercier, 2018[26]). Rethinking road allocation is also an opportunity to incorporate new transport modes (e.g. electric scooter often known as micro-mobility), which have a strong case in the light of road space allocation that prioritises low-carbon and space efficient modes (OECD, 2019[1]). Having dedicated road space and specific regulation could avoid the negative impacts (e.g. accidents) from the expansion of these modes.

The allocation of road space in cities in a way that is coherent with sustainable goals (including climate) is particularly important since public space (and road space as part of this) is scarce in these territories, especially as they grow. A number of cities worldwide, like Paris and Copenhagen, have for this reason engaged in plans and projects that reallocate road-space from cars to other users. Israel authorities could use international guidelines as a reference to rethink road allocation in existing urban areas as well as in new neighbourhoods being planned. For instance the Institute for Transportation and Development Policy (ITDP, 2016[27]) explicitly establishes the following hierarchy of users: 1) pedestrian access; 2) non-motorised vehicles movement and parking; 3) public transport; 4) non-motorised goods carriers; 5) freight movement; 6) taxi services/car-pooling/car-sharing; 7) private motor vehicle movement; 8) private motor vehicle parking.

A “Complete Streets” approach should also be adopted so that transport projects planned are embedded in a holistic strategy for reconfiguring street design and public space. Complete Streets refers to a design that aims at safely balancing space between a diverse range of users and activities, such as walking, cycling, public transport, private vehicles, commercial activities and residential areas (Litman, 2015[28]). Although there is no singular design prescription, main elements of this approach include prioritisation of space for the pedestrian environment (i.e. sidewalks, crosswalks), implementing traffic calming measures, bicycle accommodation (i.e. protected or dedicated bicycle lanes) and dedicated space for public transport (i.e. BRT, transit signal priority, bus shelters). The new approach to road design and allocation should also incorporate safety considerations and be aligned with a safe system approach, i.e. the principle that errors will happen but traffic fatalities and serious injuries should not be inevitable. Therefore the system of roads should be designed so that human error does not result in serious or fatal injuries (Lockard et al., 2018[29]), As put by (Lockard et al., 2018[29]) “[s]afety and the environment converge when it comes to land use”.

Introducing well-tailored parking policies will also be needed for efficiently managing road space. International evidence has demonstrated that the parking space required could be reduced by 10-30% with efficient parking policies, and these could also reduce general vehicle traffic (Litman, 2018[30]). Providing easy and cheap access to on-street parking incentivises car use and contributes additionally to congestion, since a part of the time of the travel is often dedicated to cruising for parking.

On-street parking is nearly free in Israel, thus there is wide room for manoeuvre in making use of parking fees and parking restrictions. The requirement for employers to provide free parking commodities to their employees in wage agreements could be reconsidered for instance. An option is to replace this advantage by an increase in wages, possibly with a bonus for employees using commuting modes other than private cars (e.g. public transport).

More generally, authorities could introduce different pricing zones to provide incentives to increase or decrease the availability and occupation of parking in diverse areas and for different time periods. In Lisbon, for example three parking pricing zones exist. Zoning is determined according to the availability of public transport services and to the density of parking sought for in the different areas. Red areas correspond to main transport corridors. In these areas relatively high parking prices and lower maximum parking duration limits (maximum 2 hours) are implemented. Contrastingly, in green zones, where there is relatively low public transport availability and where parking space is less scarce, parking prices are the lowest and time limits are larger (maximum 4 hours). Yellow areas are central areas of the cities that while not a transport corridor, have a relatively high availability of public transport. In these areas the price of parking is not as high as in red zones but still significantly higher than in green zones and the maximum time allowed for on-street parking is 4 hours (Lisboa, 2018[31]); (ELTIS, 2014[32]).

Copenhagen also has a three zone parking scheme that has the objective of discouraging car usage while promoting active transport modes such as biking in the city centre; parking prices in peripheral areas of the city are lower (Kodransky and Hermann, 2011[33]). Similarly, in Strasbourg a concentric three-zones parking pricing scheme imposes higher parking prices as well as lesser parking times on the city centre, as compared to the peripheries of the city. This policy has gone in hand with a replacement of on-street parking spaces in the city centre for cycling lanes and tram ways. This policy bundle seeks to reduce car usage on the city centre, as well as to concentrate long-term parking needs to park-and ride and other off-street parking facilities in more residential areas on the outskirts of the city (Paul-Dubois-Taine, 2013[34]). Cities in Israel could create a similar dynamics as various public transport projects will be developed in the short term. Israel could also opt for introducing smart parking meters with real-time fare adjustments, which in San Francisco for instance, have increased the effectiveness of variable-rate on-street parking pricing (OECD, 2015[35]).

Governments can also promote a more efficient use of private cars through incentivising off-peak commuting and shared trips. In Israel, the Ministry of Finance and the Ministry of transport are driving together a pilot project to reduce the congestion in Tel Aviv and increase the vehicle occupancy rate (as 80% of Israelis drive alone (Trajtenberg et al., 2018[9])). This scheme includes compensation for 100,000 volunteers travelling off-peak hours and a joint work with employers to foster shared journeys or teleworking (EcoTraders, 2019[36]). Enlarging collaboration with employers to upscale these type of projects will be important. While public funds channelled to this type of programmes should be assessed in the wider context of potential alternative investment for expanding and improving the public and active transport infrastructure, it is important that active policy increases vehicle occupancy, especially in the light of the development of automated cars (which will tend to be larger) (as discussed in Section 4.3.2).

Policies that improve road management (see below) can be effective for incentivising walking and cycling. An OECD study shows that the implementation of a congestion charge in Milan increased daily bike-sharing use by 5.8%, and extending the charging system to early evening increased bike-sharing by 12% in this time window. The main driver of this shift to greener transport mode is the decline of road congestion, which created safer conditions for bike use (Cornago, Dimitropoulos and Oueslati, 2019[37]).

4.4.2. Implementing congestion charging schemes in the short term

Congestion in Israel is a central issue for people’s well-being and the country’s economy and is a prominent issue in all the country’s big cities. Israel has, by far, the highest driving distance per kilometre of network of all OECD countries (see Figure 4.5) (OECD, 2015[35]). Traffic congestion causes an average loss of 60 minutes per road-user per day (IMF, 2018[38]) and (Trajtenberg et al., 2018[9]) estimates that the costs for the Israeli economy account for 2% of GDP (including the cost of extra gasoline lost in traffic jams and the value of time lost due to congestion), in contrast with 1% of the GDP in the European Union (Casullo et al., 2019[39]). It also brings other nuisances for residents, like a concentration of air pollutants and noise.

With no specific measure taken to tackle congestion, this issue is likely to worsen as both car ownership and population grow. As stated above, the National Plan for Transport, a public transport plan designed by the government to reduce GHG emissions from transport and to reach the Paris Agreement goals, has the objective of limiting car mileage to 44.4 million vehicle-km, which is still higher than the 43.9 million vehicle-km in 2016. In this context, even compliance which such a plan will entail an increase in car use and thus very probably a further increase in congestion.

Further road expansion is unlikely to solve this issue, partly because there is a physical limit to expand roads. Adding road capacity also encourages movements by car, and, in the end, this induced demand might completely offset the congestion-reducing effect of a supplementary road capacity (see also Section 4.5.3) (IMF, 2018[38]) (Hymel, Small and Dender, 2010[40]).

Implementing congestion charging schemes in Israel’s big cities can be an effective solution in the short term. Congestion charging would have the advantage of pricing congestion explicitly and thus helping cope with a number of its negative externalities, reducing the numbers of vehicles that crowd the city centres. Past experiences in other metropoles have shown that the implementation of a charging toll immediately decreased traffic around the cordon by 20% in average and up to 60% in some arterial roads in the case of Stockholm (Eliasson, 2014[41]). The effect declines in the longer term but remains substantial (Börjesson and Kristoffersson, 2017[42]). For this reason, although road pricing schemes are not yet widely used, cities considering implementing such schemes are growing in number (ITF, 2019[43]). While using different types of pricing options, cities like London, Milan, Stockholm, and Singapore have congestion charging schemes that cover whole areas of their cities.

In Israel, the idea of implementing such scheme has been under examination since 2008. The Ministry of Finance brought for approval in the 2020 budget a congestion charge in the city of Tel Aviv, where 60% of the nation’s congestion costs are concentrated. The scheme is expected to become operational in 2021.In the longer-term, as discussed in the previous section, transitioning to a distance-based taxation scheme (differentiated by type of vehicle, time and space) would be most effective. In this case driving through more central and congested areas would already be taxed more severely, making a separate congestion charging scheme redundant.

There are several different ways to shape a congestion charge scheme, presented in Table 4.2. Ideally, the amount paid should reflect the external costs of congestion paid by the community and therefore, ideally, depend on the time and use of the car. London and Milan implemented an area charge, which is a charge for driving into or within an area, while the scheme for Stockholm has the characteristics of cordon charging, which is a charge for each crossing of a cordon (although there are a maximum number of times that a user can be charged per day). In the case of Singapore, the scheme is a combination of cordon charging and corridor charging (Charges for passing points along a corridor in a city), currently using electronic differentiated pricing. Other places like California, and Seoul, among others, apply road tolls to particular corridors only. (OECD/ITF, 2019[44]).

Cordon and area charges fail to effectively price the external costs of congestion. Contrastingly the ideal congestion charge scheme should be designed as a distance-based taxation i.e. modulated according to the real-time congestion pattern, hence the time and place of the driving (see supra). Founding taxation on the basis of crossing a line fails to mandate the right incentives to drivers who have no reason to limit their driving once the line is crossed. The potential mitigation effect is therefore weaker than in the case of a charging system based on the distance driven. It is even weaker in cases the charge is paid only once a day. Moreover, cordon and area charges should be carefully designed and regularly updated to avoid bottlenecks effects at the limit of the charged zone, as congestion can displace in another area.

As highlighted in Section 0, distance-based taxation is an efficient tool to capture a broad number of externalities from car use: congestion charges can approach such scheme, applying the concept to a certain zone. A distance-based charging rate depends on real-time congestion inside the city, as in Singapore, integrates most external costs of congestion and appears as the most efficient system. In addition it provides a larger scope for adapting behaviour (e.g. shifting to off-peak travel appears as an option in addition to modal shift). In this case, no trip would be left unpriced and short trips would not be overcharged because the driver crossed a certain line. This requires that few exemptions should be allowed for private vehicles (for residents or taxis for instance), even though they might improve public acceptance, in order to implement the proper incentives.

This rate can also depend on the vehicle size. A usual method to estimate the charging rate is to estimate and price the time loss in traffic and consider the marginal cost of a supplementary car in the traffic. The UK Department for transport, estimates the marginal external cost of congestion from GBP 0.01 per vehicle km in rural area motorways to GBP 0.692 in 2015 (2010 prices23), adding up costs of time loss in congestion as well as operating costs.24

Needless to say, some precision of the scheme can be forgone at the benefit of clarity, as a high degree of differentiation is not always readable for drivers and car owners. Unclear schemes would make users less reactive to the price signal and would increase oppositions to the scheme. The differentiation should thus be made simple and clear In the case of Stockholm, traffic volumes decreased by 20-25% during the trial period of a congestion charge and the system gathered general support in a referendum, with a simpler system based on a cordon charge. Peak and off-peak prices are nonetheless an important feature of the scheme.

Following track of vehicles moves in the concerned zones is necessary when implementing a congestion charge; modulating it according to time and place requires some higher level of technology. Using GPS technology seems feasible, as long as privacy issues are carefully managed. (OECD/ITF, 2019[44]).

4.4.3. Gaining public support

Policies aiming at better managing roads will change the relative prices for transport users, namely making car use more expensive (ideally where and when it causes the highest external costs). Gaining public acceptability is challenging but crucial to make these type of measures more perennial and less dependent on political cycles. Guaranteeing access through alternative modes of transport is an important part of gaining public acceptability. This is also necessary to make the policy cost-effective, since only in this way can the new pricing trigger behavioural change instead of only imposing economic burden on segments of the population. In any case, careful assessment of negative distributional impacts is necessary to ensure that no group is overburdened as well as to prevent relevant opposition.

Congestion charges for instance may have some distributional impacts that should not be overlooked, as they increase the cost of private transport and may therefore deteriorate households’ purchasing power. (OECD/ITF, 2019[44]) In Israel, total private vehicle expenses constitute 15% of income for households’ in the lowest decile, while only 9% of income of households in the highest decile.25 This means that the implementation of a new charge could potentially be regressive. Even though the modulation of the taxation by time or distance has the potential to alleviate this effect, this is far from certain and should be assessed, as this depends on the possibility for people to change their daily commute and other trips.

Beside, differentiating zones inside the city might have an impact on housing prices, especially for instance if charging zones coincide with places concentrating jobs and thus make living in the area even more advantageous (since one could walk or bike instead of commuting by car). This could push poorer households out of the city centres and benefit people owning real estate in the charging zones. This effect on property prices inside the zones would probably be exacerbated if residents are exempted from charges and enjoy free on-street parking. The negative impact on commuters from outside the centre can also be significantly alleviated if commuting from outside is made easier, by the presence of accessible and good quality public transport as well alternative transport modes (biking, walking) to car use.

Strategies and policies adopted in Israel to reach climate and other well-being goals by improving road management should be carefully assessed in order to anticipate potential problems and ways to compensate for this and improve the acceptability of measures. Mattioli et al. (2017[46]) proposes to build a vulnerability index assessing three dimensions of vulnerability (cost burden of energy expenditures, households’ sensitivity, defined with their income, and their adaptive capacity, defined as access to jobs and selected services). Results are used to identify vulnerability to increases in fuel prices spatially across London, but the index could be used to assess other policies such as road pricing. The vulnerability index takes into account for each neighbourhood the cost burden of a measure for the population (as a share of income), their adaptive capacity and the access to jobs and selected services. The result showed that, in London, while the urban core tends to be less vulnerable to increases in fuel prices according to the vulnerability index, there are pockets of the city where there is very high vulnerability. The findings underline the need to assess policy effects with the use of disaggregated information rather than focusing on average users. They also highlight the importance of going beyond analysis of vertical equity (i.e. distributional impacts across income groups) to account for the wider context (e.g. access to alternatives) that places, or not, different population in a situation of vulnerability regarding a certain policy.

There is a strong case for improving the taxation of transport in Israel, as heavy congestion in the bigger cities is a known problem. The reform proposed above (in Section 2) consists in improving the alignment of fuel taxes with their carbon contents, which would automatically raise diesel taxation (when 96% of vehicles are fuelled with petrol). It also recommends allowing the purchase tax to react more easily to technological change, which will probably not increase significantly the average cost for transport for households. However, the implementation of a congestion charge will probably increase transport costs more significantly, since it would put a price on what used to be free (i.e. the use of road space in congested areas). New fiscal measures may meet opposition. In October 2019, the Israeli Minister of Transport, M. Smotrich, publicly asserted his opposition to the congestion charge in Tel Aviv, following the steps of his predecessor.

A first option to gain public acceptance would be to recycle the revenues, so that the measure would not appear as a way for the government to levy revenues (OECD/ITF, 2019[44]). (Marten and van Dender, 2019[47]) identifies several options countries took to use their revenues from carbon pricing, such as using it to change the tax system (shifting from an labour income based taxation to a pollution-based one), for inter-governmental transfers, transport-related spending, green and energy-related spending and compensation to energy users. While that does not mean the tax income should be earmarked,26 a full disclosure of expenses allowed by the revenue could enhance the public acceptance for an increased tax burden.

In the case of Israel, there is a strong political case to recycle a large part of supplementary revenues in investments for transport (see section 4), even if the supplementary resources from congestion charges is likely to be low. A congestion charge entails heavy costs of monitoring and should not be expected to become a major source of revenue, nor should it be implemented with this objective as the main reason for doing so. For instance, the congestion charge and penalty charge notice fees (driving offences and parking fines) accounted for only 5% of TfL’s 2013 budget. (ITF, 2018[15]) Even so, transparent revenue recycling enhances public acceptance. In addition, recycling revenues can also be used in the case of charges other than congestion (e.g. parking charges, and fuel and purchase taxes). Investment in public transport and active modes would facilitate the reduction of car use by making households able to find alternatives to private cars, making the new charges both more acceptable and more efficient for climate.

Taking into consideration that the development of alternatives is key to making private transport taxation efficient and accepted by society, the timing of the development and improvement of alternatives is crucial. It seems more efficient to develop public transport before, or at the same time as, the fiscal measures are introduced. In the short term, buses can be developed and have their quality and regularity improved, all the more if a congestion charge improves traffic in the city centres. The Mayor of London took this option, improved bus routes and put additional buses into services by the time the congestion charge was introduced. As a result, the majority of the 30% of car trips foregone by cars were replaced by bus trips. More structural works (light trains, metro) can be initiated for the long term (Transport for London, 2004[48]).

Gaining public support for a supplementary tax on transport can be tricky, more particularly in Israel where transport charges are already high and public transport quality is subject to strong criticism. Initial support is key and can be reached by involving stakeholders, targeted consultation efforts and a strict timeline for engagement (OECD/ITF, 2019[44]). The State government of New York is planning to introduce congestion pricing for Manhattan’s central business district progressively, starting with taxis and for-hire vehicles. In Stockholm and Milan, the congestion charge was implemented after a referendum (in Stockholm, after an initial trial period) and the mayor of London had campaigned for it before being elected. However, experience showed that, once implemented, a congestion charge could reach a large political approval.

4.5. Public and active transport needs to be mainstreamed as an attractive alternative to private vehicles

In its National Transport Plan, designed in 2015, the Israeli government identified that modal shift from private car to sustainable transport modes presented the biggest mitigation potential in the transport sector. However, although the government has put a strong focus on public transport, further targeted efforts would scale up ambitions.

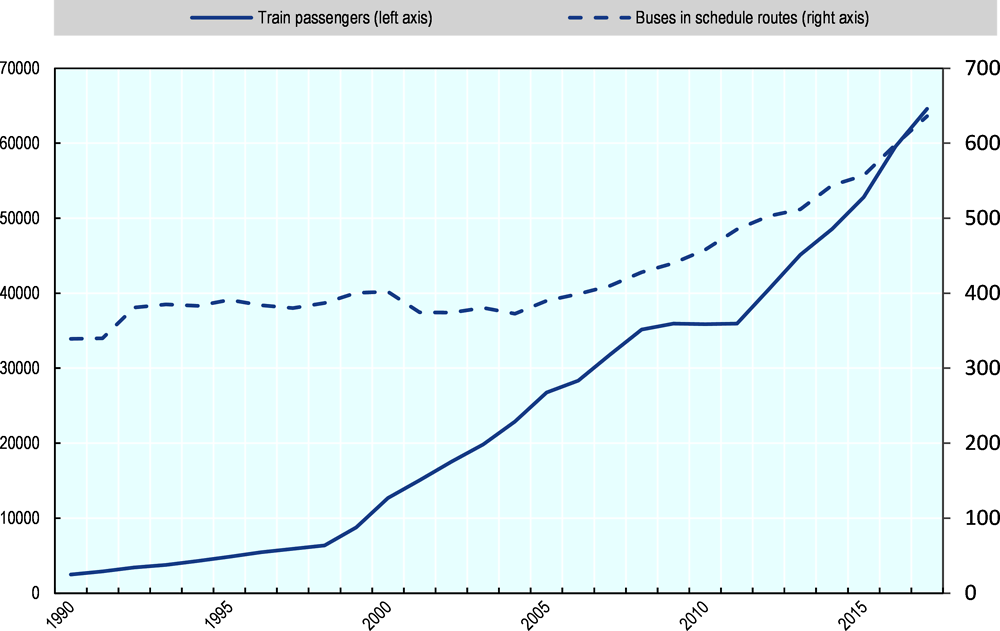

4.5.1. Israel made strong commitments to develop public transport

Public transport is key for Israel’s climate mitigation strategy in the transport sector. Assessing emission reduction potential in every sector in 2015, the government identified in a report that modal shift from private car to more sustainable transport alternatives (public transport and cycling) had the biggest mitigation potential in the transport sector. This report assessed that Israel could reduce its transport emissions by 21% by 2030, -12% could be reached by behavioural responses due to better public transport infrastructure, the rest being largely from technological improvement of vehicles. This scenario considers that the development of public transportation would reduce car uses by 25% relative to a business as usual scenario.

The Israeli government chose to take a more conservative option than its report and set the objective of a 20% reduction of private car kilometres travailed by 2030. This amounts to an emission reduction of 2.2 million tons of CO2eq relative to a business as usual scenario.